| OMB APPROVAL | ||||

| OMB Number: | 3235-0570 | |||

| Expires: | January 31, 2017 | |||

| Estimated average burden | ||||

| hours per response: | 20.6 | |||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09913

AIM Counselor Series Trust (Invesco Counselor Series Trust)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Philip A. Taylor 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 8/31

Date of reporting period: 8/31/15

Item 1. Report to Stockholders.

|

|

| |||

| Annual Report to Shareholders

|

August 31, 2015 | |||

|

Invesco American Franchise Fund | ||||

|

Nasdaq: A: VAFAX ¡ B: VAFBX ¡ C: VAFCX ¡ R: VAFRX ¡ Y: VAFIX ¡ R5: VAFNX ¡ R6: VAFFX | ||||

Letters to Shareholders

|

Philip Taylor |

Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. I hope you find this report of interest. The US economy expanded and unemployment declined throughout the reporting period. The sharp drop in oil prices that began in mid-2014 continued to benefit consumers, but a strong US dollar crimped corporate profits. The US Federal Reserve signaled that it was increasingly likely to raise interest rates, based on generally positive economic data, but uncertainty remained about when it would act. Overseas, the story was much different. Low energy prices hurt the economies of some oil-producing nations, such as Brazil and Russia. During the reporting period, the European Central Bank as well as central banks in China | |

| and Japan – among other countries – either instituted or maintained extraordinarily accommodative monetary policies in response to economic weakness. | ||

Investor uncertainty, such as we saw for much of the reporting period – and market volatility, such as we saw at the end of the reporting period – are unfortunate facts of life when it comes to investing. Some investors use these things as excuses to delay saving and investing for their long-term financial goals. That’s why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan – when times are good and when they’re uncertain. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Timely information when and where you want it

Invesco’s efforts to help investors achieve their financial objectives include providing individual investors and financial professionals with timely information about the markets, the economy and investing – whenever and wherever they want it.

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including prices, performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. Click on the “Need to register” link in the “Account Access” box on our homepage to get started.

Invesco’s mobile apps for iPhone® and iPad® (both available free from the App StoreSM) allow you to obtain the same detailed information, monitor your account and create customizable watch lists. Also, they allow you to access investment insights from our investment leaders, market strategists, economists and retirement experts. You can sign up to be alerted when new commentary is added, and you can watch portfolio manager videos and have instant access to Invesco news and updates wherever you may be.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, feel free to contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs for many years to come. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

iPhone and iPad are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

2 Invesco American Franchise Fund

|

Bruce Crockett |

Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: n Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. n Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

n Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus.

n Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive.

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper Inc., an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco American Franchise Fund

Management’s Discussion of Fund Performance

| 4 | Invesco American Franchise Fund |

5 Invesco American Franchise Fund

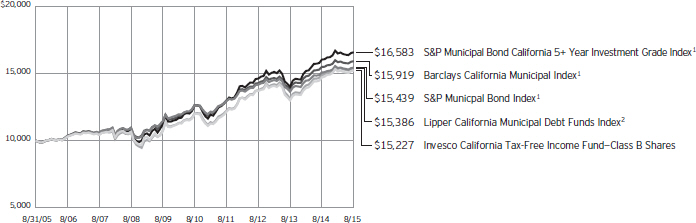

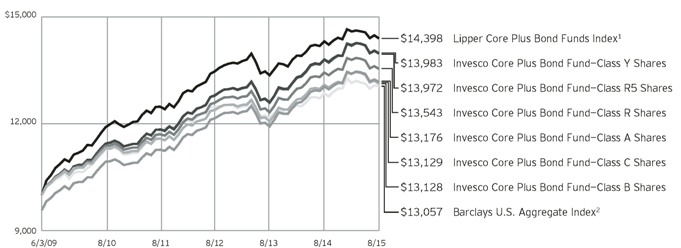

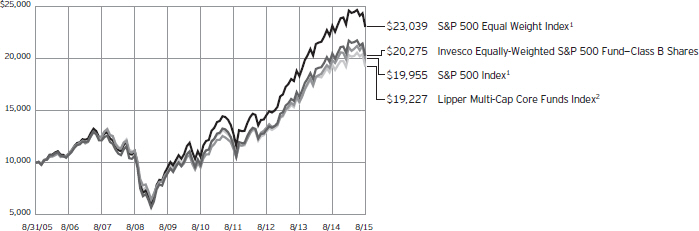

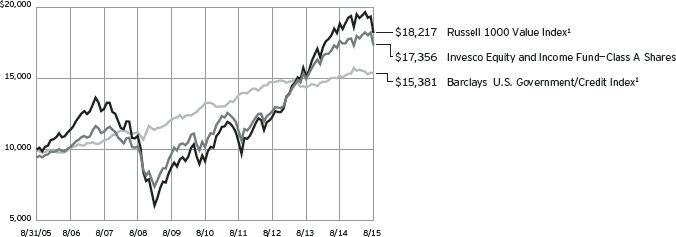

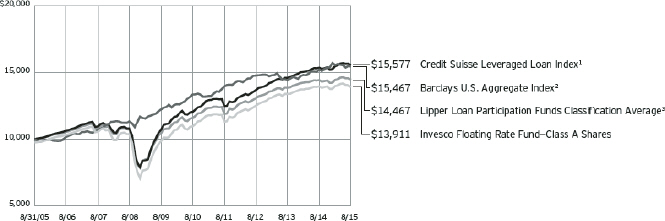

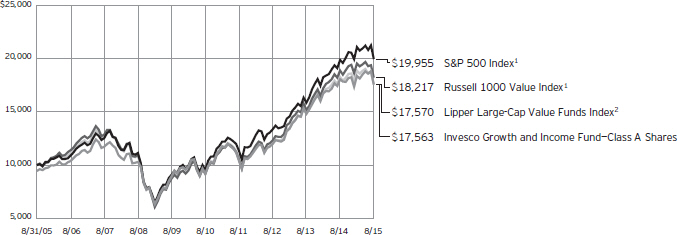

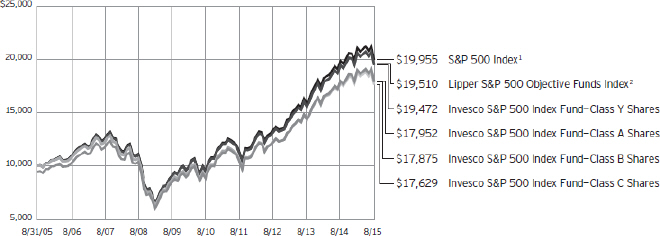

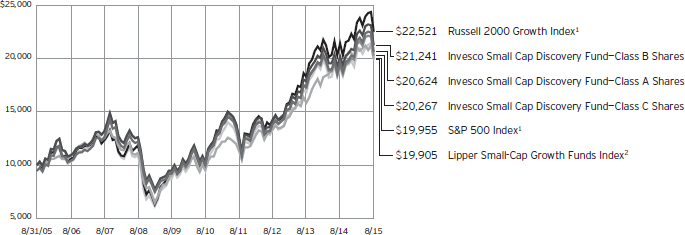

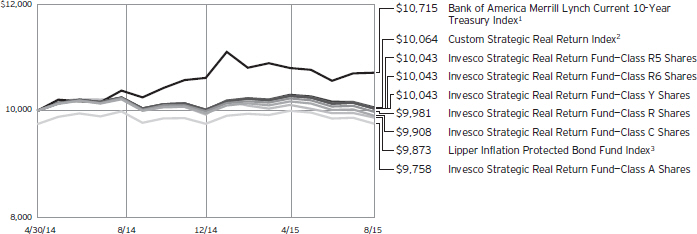

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 8/31/05

| 1 | Source: FactSet Research Systems Inc. |

| 2 | Source: Lipper Inc. |

6 Invesco American Franchise Fund

7 Invesco American Franchise Fund

Invesco American Franchise Fund’s investment objective is to seek long-term capital appreciation.

| n | Unless otherwise stated, information presented in this report is as of August 31, 2015, and is based on total net assets. |

| n | Unless otherwise noted, all data provided by Invesco. |

| n | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

8 Invesco American Franchise Fund

Schedule of Investments(a)

August 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco American Franchise Fund

Investment Abbreviations:

| ADR | – American Depositary Receipt | |

| REIT | – Real Estate Investment Trust |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at August 31, 2015. |

| (d) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of August 31, 2015. |

| (e) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. The following table presents the Fund’s gross and net amount of assets available for offset by the Fund as of August 31, 2015. |

| Counterparty | Gross Amount of Securities on Loan at Value |

Cash Collateral Received for Securities Loaned* |

Net Amount |

|||||||||

| State Street Bank and Trust Co. |

$ | 141,450,870 | $ | (141,450,870 | ) | $ | — | |||||

| * | Amount does not include excess collateral received. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco American Franchise Fund

Statement of Assets and Liabilities

August 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco American Franchise Fund

Statement of Operations

For the year ended August 31, 2015

| Investment income: |

| |||

| Dividends (net of foreign withholding taxes of $195,538) |

$ | 76,008,581 | ||

| Dividends from affiliated money market funds (includes securities lending income of $142,889) |

197,473 | |||

| Total investment income |

76,206,054 | |||

| Expenses: |

||||

| Advisory fees |

58,005,769 | |||

| Administrative services fees |

776,261 | |||

| Custodian fees |

202,396 | |||

| Distribution fees: |

||||

| Class A |

22,255,841 | |||

| Class B |

528,422 | |||

| Class C |

4,093,656 | |||

| Class R |

161,301 | |||

| Transfer agent fees — A, B, C, R and Y |

18,758,650 | |||

| Transfer agent fees — R5 |

49,075 | |||

| Transfer agent fees — R6 |

4,558 | |||

| Trustees’ and officers’ fees and benefits |

228,027 | |||

| Other |

1,135,993 | |||

| Total expenses |

106,199,949 | |||

| Less: Fees waived and expense offset arrangement(s) |

(189,769 | ) | ||

| Net expenses |

106,010,180 | |||

| Net investment income (loss) |

(29,804,126 | ) | ||

| Realized and unrealized gain (loss) from: |

||||

| Net realized gain from: |

||||

| Investment securities |

664,595,639 | |||

| Foreign currencies |

91,163 | |||

| 664,686,802 | ||||

| Change in net unrealized appreciation (depreciation) of: |

||||

| Investment securities |

(586,170,110 | ) | ||

| Foreign currencies |

(6,015 | ) | ||

| (586,176,125 | ) | |||

| Net realized and unrealized gain |

78,510,677 | |||

| Net increase in net assets resulting from operations |

$ | 48,706,551 | ||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco American Franchise Fund

Statement of Changes in Net Assets

For the years ended August 31, 2015 and 2014

| 2015 | 2014 | |||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ | (29,804,126 | ) | $ | (27,492,665 | ) | ||

| Net realized gain |

664,686,802 | 1,356,621,426 | ||||||

| Change in net unrealized appreciation (depreciation) |

(586,176,125 | ) | 853,805,517 | |||||

| Net increase in net assets resulting from operations |

48,706,551 | 2,182,934,278 | ||||||

| Distributions to shareholders from net investment income: |

||||||||

| Class A |

— | (8,146,047 | ) | |||||

| Class B |

— | (284,805 | ) | |||||

| Class Y |

— | (287,210 | ) | |||||

| Class R5 |

— | (126,411 | ) | |||||

| Class R6 |

— | (414,675 | ) | |||||

| Total distributions from net investment income |

— | (9,259,148 | ) | |||||

| Distributions to shareholders from net realized gains: |

||||||||

| Class A |

(784,832,614 | ) | (349,819,587 | ) | ||||

| Class B |

(20,473,568 | ) | (12,230,508 | ) | ||||

| Class C |

(37,732,374 | ) | (16,851,639 | ) | ||||

| Class R |

(2,796,858 | ) | (1,234,648 | ) | ||||

| Class Y |

(13,159,645 | ) | (4,914,966 | ) | ||||

| Class R5 |

(4,625,060 | ) | (1,888,689 | ) | ||||

| Class R6 |

(11,435,482 | ) | (5,092,450 | ) | ||||

| Total distributions from net realized gains |

(875,055,601 | ) | (392,032,487 | ) | ||||

| Share transactions–net: |

||||||||

| Class A |

29,568,935 | 2,022,415,364 | ||||||

| Class B |

(64,542,055 | ) | (32,429,104 | ) | ||||

| Class C |

2,440,937 | 74,675,675 | ||||||

| Class R |

1,750,654 | 6,673,587 | ||||||

| Class Y |

23,546,565 | 25,320,157 | ||||||

| Class R5 |

2,253,149 | (119,562,564 | ) | |||||

| Class R6 |

(43,605,157 | ) | (1,645,431 | ) | ||||

| Net increase (decrease) in net assets resulting from share transactions |

(48,586,972 | ) | 1,975,447,684 | |||||

| Net increase (decrease) in net assets |

(874,936,022 | ) | 3,757,090,327 | |||||

| Net assets: |

||||||||

| Beginning of year |

10,061,652,284 | 6,304,561,957 | ||||||

| End of year (includes undistributed net investment income (loss) of $(17,439,548) and $(23,695,349), respectively) |

$ | 9,186,716,262 | $ | 10,061,652,284 | ||||

Notes to Financial Statements

August 31, 2015

NOTE 1—Significant Accounting Policies

Invesco American Franchise Fund (the “Fund”) is a series portfolio of AIM Counselor Series Trust (Invesco Counselor Series Trust) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of thirteen separate portfolios, each authorized to issue an unlimited number of shares of beneficial interest. The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each portfolio or class will be voted on exclusively by the shareholders of such portfolio or class.

The Fund’s investment objective is to seek long-term capital appreciation.

The Fund currently consists of seven different classes of shares: Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Effective November 30, 2010, new or additional investments in Class B shares are no longer permitted. Existing shareholders of Class B shares may continue to reinvest dividends and capital gains distributions in Class B shares until they convert to Class A shares. Also, shareholders in Class B shares will be able to exchange those shares for Class B shares of other Invesco Funds offering such shares until they convert to Class A shares.

13 Invesco American Franchise Fund

Generally, Class B shares will automatically convert to Class A shares on or about the month-end, which is at least eight years after the date of purchase. Redemption of Class B shares prior to the conversion date will be subject to a CDSC.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

A. Security Valuations — Securities, including restricted securities, are valued according to the following policy.

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

14 Invesco American Franchise Fund

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions — Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses — Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated to each share class based on relative net assets. Sub-accounting fees attributable to Class R5 are charged to the operations of the class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending — The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated money market funds and is shown as such on the Schedule of Investments. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, is included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

| J. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

15 Invesco American Franchise Fund

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts — The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| Average Daily Net Assets | Rate | |||||

| First $250 million |

0 | .695% | ||||

| Next $250 million |

0 | .67% | ||||

| Next $500 million |

0 | .645% | ||||

| Next $550 million |

0 | .62% | ||||

| Next $3.45 billion |

0 | .60% | ||||

| Next $250 million |

0 | .595% | ||||

| Next $2.25 billion |

0 | .57% | ||||

| Next $2.5 billion |

0 | .545% | ||||

| Over $10 billion |

0 | .52% | ||||

For the year ended August 31, 2015, the effective advisory fees incurred by the Fund was 0.59%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, may pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2016, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6 shares to 2.00%, 2.75%, 2.75%, 2.25%, 1.75%, 1.75% and 1.75%, respectively, of average daily net assets. In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2016. The fee waiver agreement cannot be terminated during its term. The Adviser did not waive fees and/or reimburse expenses during the period under this expense limitation.

Further, the Adviser has contractually agreed, through at least June 30, 2017, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash (excluding investments of cash collateral from securities lending) in such affiliated money market funds.

For the year ended August 31, 2015, the Adviser waived advisory fees of $131,028.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended August 31, 2015, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. IIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. All fees payable by IIS to intermediaries that provide omnibus account services or sub-accounting are charged back to the Fund, subject to certain limitations approved by the Trust’s Board of Trustees. For the year ended August 31, 2015, expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

16 Invesco American Franchise Fund

Shares of the Fund are distributed by Invesco Distributors, Inc. (“IDI”). The Fund has adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act, and a service plan (collectively, the “Plans”) for Class A, Class B, Class C and Class R shares to compensate IDI for the sale, distribution, shareholder servicing and maintenance of shareholder accounts for these shares. Under the Plans, the Fund will incur annual fees of up to 0.25% of Class A average daily net assets, up to 1.00% each of Class B and Class C average daily net assets and up to 0.50% of Class R average daily net assets.

With respect to Class B and Class C shares, the Fund is authorized to reimburse in future years any distribution related expenses that exceed the maximum annual reimbursement rate for such class, so long as such reimbursement does not cause the Fund to exceed the Class B and Class C maximum annual reimbursement rate, respectively. With respect to Class A shares, distribution related expenses that exceed the maximum annual reimbursement rate for such class are not carried forward to future years and the Fund will not reimburse IDI for any such expenses.

Front-end sales commissions and CDSC (collectively, the “sales charges”) are not recorded as expenses of the Fund. Front-end sales commissions are deducted from proceeds from the sales of Fund shares prior to investment in Class A shares of the Fund. CDSC are deducted from redemption proceeds prior to remittance to the shareholder. During the year ended August 31, 2015, IDI advised the Fund that IDI retained $557,686 in front-end sales commissions from the sale of Class A shares and $7,150, $31,934 and $8,304 from Class A, Class B and Class C shares, respectively, for CDSC imposed on redemptions by shareholders.

For the year ended August 31, 2015, the Fund incurred $355,196 in brokerage commissions with Invesco Capital Markets, Inc., an affiliate of the Adviser and IDI, for portfolio transactions executed on behalf of the Fund.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

The following is a summary of the tiered valuation input levels, as of August 31, 2015. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Equity Securities |

$ | 9,192,021,311 | $ | 136,687,998 | $ | — | $ | 9,328,709,309 | ||||||||

NOTE 4—Expense Offset Arrangement(s)

The expense offset arrangement is comprised of transfer agency credits which result from balances in demand deposit accounts used by the transfer agent for clearing shareholder transactions. For the year ended August 31, 2015, the Fund received credits from this arrangement, which resulted in the reduction of the Fund’s total expenses of $58,741.

NOTE 5—Trustees’ and Officers’ Fees and Benefits

Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to pay remuneration to certain Trustees and Officers of the Fund. Trustees have the option to defer compensation payable by the Fund, and Trustees’ and Officers’ Fees and Benefits also include amounts accrued by the Fund to fund such deferred compensation amounts. Those Trustees who defer compensation have the option to select various Invesco Funds in which their deferral accounts shall be deemed to be invested. Finally, certain current Trustees were eligible to participate in a retirement plan that provided for benefits to be paid upon retirement to Trustees over a period of time based on the number of years of service. The Fund may have certain former Trustees who also participate in a retirement plan and receive benefits under such plan. Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to fund such retirement benefits. Obligations under the deferred compensation and retirement plans represent unsecured claims against the general assets of the Fund.

NOTE 6—Cash Balances

The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with State Street Bank and Trust Company, the custodian bank. Such balances, if any at period end, are shown in the Statement of Assets and Liabilities under the payable caption Amount due custodian. To compensate the custodian bank for such overdrafts, the overdrawn Fund may either (1) leave funds as a compensating balance in the account so the custodian bank can be compensated by earning the additional interest; or (2) compensate by paying the custodian bank at a rate agreed upon by the custodian bank and Invesco, not to exceed the contractually agreed upon rate.

17 Invesco American Franchise Fund

NOTE 7—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended August 31, 2015 and 2014:

| 2015 | 2014 | |||||||

| Ordinary income |

$ | — | $ | 9,609,951 | ||||

| Long-term capital gain |

875,055,601 | 391,681,684 | ||||||

| Total distributions |

$ | 875,055,601 | $ | 401,291,635 | ||||

Tax Components of Net Assets at Period-End:

| 2015 | ||||

| Undistributed long-term gain |

$ | 446,865,655 | ||

| Net unrealized appreciation — investments |

2,425,814,248 | |||

| Net unrealized appreciation (depreciation) — other investments |

(4,983 | ) | ||

| Temporary book/tax differences |

(2,837,745 | ) | ||

| Capital loss carryforward |

(188,402,611 | ) | ||

| Late-Year Ordinary Loss Deferral |

(14,601,802 | ) | ||

| Shares of beneficial interest |

6,519,883,500 | |||

| Total net assets |

$ | 9,186,716,262 | ||

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is due to differences in the timing of recognition of gains and losses on investments for tax and book purposes. The Fund’s net unrealized appreciation difference is attributable primarily to wash sales.

The temporary book/tax differences are a result of timing differences between book and tax recognition of income and/or expenses. The Fund’s temporary book/tax differences are the result of the trustee deferral of compensation and retirement plan benefits.

Capital loss carryforward is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforward actually available for the Fund to utilize. Capital losses generated in years beginning after December 22, 2010 can be carried forward for an unlimited period, whereas previous losses expire in eight tax years. Capital losses with an expiration period may not be used to offset capital gains until all net capital losses without an expiration date have been utilized. Capital loss carryforwards with no expiration date will retain their character as either short-term or long-term capital losses instead of as short-term capital losses as under prior law. The ability to utilize capital loss carryforwards in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.

The Fund has a capital loss carryforward as of August 31, 2015, which expires as follows:

| Capital Loss Carryforward* | ||||||||||||

| Expiration | Short-Term | Long-Term | Total | |||||||||

| August 31, 2017 |

$ | 188,402,611 | $ | — | $ | 188,402,611 | ||||||

| * | Capital loss carryforward as of the date listed above is reduced for limitations, if any, to the extent required by the Internal Revenue Code and may be further limited depending upon a variety of factors, including the realization of net unrealized gains or losses as of the date of any reorganization. |

NOTE 8—Investment Securities

The aggregate amount of investment securities (other than short-term securities, U.S. Treasury obligations and money market funds, if any) purchased and sold by the Fund during the year ended August 31, 2015 was $7,244,750,154 and $8,253,797,345, respectively. Cost of investments on a tax basis includes the adjustments for financial reporting purposes as of the most recently completed federal income tax reporting period-end.

| Unrealized Appreciation (Depreciation) of Investment Securities on a Tax Basis | ||||

| Aggregate unrealized appreciation of investment securities |

$ | 2,589,745,544 | ||

| Aggregate unrealized (depreciation) of investment securities |

(163,931,296 | ) | ||

| Net unrealized appreciation of investment securities |

$ | 2,425,814,248 | ||

Cost of investments for tax purposes is $6,902,895,061.

NOTE 9—Reclassification of Permanent Differences

Primarily as a result of differing book/tax treatment of net operating losses on August 31, 2015, undistributed net investment income (loss) was increased by $36,059,927, undistributed net realized gain was decreased by $1,097,821 and shares of beneficial interest was decreased by $34,962,106. This reclassification had no effect on the net assets of the Fund.

18 Invesco American Franchise Fund

NOTE 10—Share Information

| Summary of Share Activity | ||||||||||||||||

| Years ended August 31, | ||||||||||||||||

| 2015(a) | 2014 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold: |

||||||||||||||||

| Class A |

11,430,895 | $ | 198,025,073 | 13,434,382 | $ | 224,500,898 | ||||||||||

| Class B |

114,963 | 1,953,963 | 194,996 | 3,185,824 | ||||||||||||

| Class C |

1,474,703 | 24,315,642 | 1,375,112 | 22,116,190 | ||||||||||||

| Class R |

422,057 | 7,207,296 | 288,299 | 4,772,689 | ||||||||||||

| Class Y |

2,828,241 | 49,644,068 | 2,508,529 | 42,978,258 | ||||||||||||

| Class R5 |

925,325 | 16,123,386 | 772,745 | 13,042,930 | ||||||||||||

| Class R6 |

340,306 | 5,918,560 | 901,334 | 15,272,963 | ||||||||||||

| Issued as reinvestment of dividends: |

||||||||||||||||

| Class A |

45,566,849 | 740,461,291 | 20,978,874 | 337,759,873 | ||||||||||||

| Class B |

1,268,110 | 20,099,547 | 779,837 | 12,274,118 | ||||||||||||

| Class C |

2,276,570 | 35,286,826 | 1,015,415 | 15,779,551 | ||||||||||||

| Class R |

173,586 | 2,796,462 | 77,072 | 1,233,927 | ||||||||||||

| Class Y |

691,278 | 11,350,786 | 281,452 | 4,562,336 | ||||||||||||

| Class R5 |

281,944 | 4,623,889 | 124,583 | 2,014,511 | ||||||||||||

| Class R6 |

696,013 | 11,435,482 | 340,156 | 5,507,125 | ||||||||||||

| Issued in connection with acquisitions:(b) |

||||||||||||||||

| Class A |

— | — | 159,648,030 | 2,468,502,143 | ||||||||||||

| Class B |

— | — | 3,865,089 | 58,449,775 | ||||||||||||

| Class C |

— | — | 6,095,479 | 91,112,251 | ||||||||||||

| Class R |

— | — | 518,148 | 7,963,354 | ||||||||||||

| Class Y |

— | — | 969,446 | 15,095,293 | ||||||||||||

| Class R5 |

— | — | 189,764 | 2,949,334 | ||||||||||||

| Automatic conversion of Class B shares to Class A shares: |

||||||||||||||||

| Class A |

3,624,145 | 63,022,397 | 4,281,870 | 72,109,330 | ||||||||||||

| Class B |

(3,714,455 | ) | (63,022,397 | ) | (4,380,637 | ) | (72,109,330 | ) | ||||||||

| Reacquired: |

||||||||||||||||

| Class A |

(56,061,210 | ) | (971,939,826 | ) | (64,487,337 | ) | (1,080,456,880 | ) | ||||||||

| Class B |

(1,391,879 | ) | (23,573,168 | ) | (2,096,465 | ) | (34,229,491 | ) | ||||||||

| Class C |

(3,461,721 | ) | (57,161,531 | ) | (3,357,178 | ) | (54,332,317 | ) | ||||||||

| Class R |

(483,878 | ) | (8,253,104 | ) | (440,363 | ) | (7,296,383 | ) | ||||||||

| Class Y |

(2,143,896 | ) | (37,448,289 | ) | (2,205,531 | ) | (37,315,730 | ) | ||||||||

| Class R5 |

(1,073,189 | ) | (18,494,126 | ) | (8,388,466 | ) | (137,569,339 | ) | ||||||||

| Class R6 |

(3,413,210 | ) | (60,959,199 | ) | (1,334,727 | ) | (22,425,519 | ) | ||||||||

| Net increase (decrease) in share activity |

371,547 | $ | (48,586,972 | ) | 131,949,908 | $ | 1,975,447,684 | |||||||||

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 15% of the outstanding shares of the Fund. IDI has an agreement with these entities to sell Fund shares. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as securities brokerage, distribution, third party record keeping and account servicing. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

| (b) | As of the opening of business on September 16, 2013, the Fund acquired all the net assets of Invesco Constellation Fund (the “Target Fund”) pursuant to a plan of reorganization approved by the Trustees of the Fund on August 27, 2013. The acquisition was accomplished by a tax-free exchange of 171,285,956 shares of the Fund for 90,880,346 shares outstanding of the Target Fund as of the close of business on September 13, 2013. Shares of the Target Fund were exchanged for the like class of shares of the Fund, based on the relative net asset value of the Target Fund to the net asset value of the Fund on the close of business, September 13, 2013. The Target Fund’s net assets as of the close of business on September 13, 2013 of $2,644,072,150, including $725,175,144 of unrealized appreciation, were combined with those of the Fund. The net assets of the Fund immediately before the acquisition were $6,558,988,103 and $9,203,060,253 immediately after the acquisition. |

| The pro forma results of operations for the year ended August 31, 2014 assuming the reorganization had been completed on September 1, 2013, the beginning of the annual reporting period are as follows: |

| Net investment income (loss) |

$ | (28,410,833 | ) | |

| Net realized/unrealized gains |

4,238,871,492 | |||

| Change in net assets resulting from operations |

$ | 4,210,460,659 |

| As the combined investment portfolios have been managed as a single integrated portfolio since the acquisition was completed, it is not practicable to separate the amounts of revenue and earnings of the Target Fund that have been included in the Fund’s Statement of Operations since September 16, 2013. |

19 Invesco American Franchise Fund

NOTE 11—Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| Net asset value, beginning of period |

Net investment income (loss)(a) |

Net gains (losses) on securities (both realized and unrealized) |

Total from investment operations |

Dividends from net investment income |

Distributions from net realized gains |

Total distributions |

Net asset value, end of period |

Total return(b) |

Net assets, end of period (000’s omitted) |

Ratio of expenses to average net assets with fee waivers and/or expenses absorbed |

Ratio of expenses to average net assets without fee waivers and/or expenses absorbed |

Ratio of net investment income (loss) to average net assets |

Portfolio turnover(c) |

|||||||||||||||||||||||||||||||||||||||||||

| Class A |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

$ | 18.07 | $ | (0.05 | ) | $ | 0.08 | $ | 0.03 | $ | — | $ | (1.61 | ) | $ | (1.61 | ) | $ | 16.49 | 0.27 | % | $ | 8,320,796 | 1.05 | %(d) | 1.05 | %(d) | (0.28 | )%(d) | 74 | % | |||||||||||||||||||||||||

| Year ended 08/31/14 |

14.82 | (0.04 | ) | 3.99 | 3.95 | (0.02 | ) | (0.68 | ) | (0.70 | ) | 18.07 | 27.22 | 9,034,217 | 1.08 | 1.08 | (0.27 | ) | 77 | |||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.47 | 0.02 | 2.33 | 2.35 | (0.00 | ) | — | (0.00 | ) | 14.82 | 18.89 | 5,428,321 | 1.06 | 1.14 | 0.17 | 80 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.72 | (0.01 | ) | 0.88 | 0.87 | — | (0.12 | ) | (0.12 | ) | 12.47 | 7.55 | 4,728,364 | 1.05 | 1.18 | (0.05 | ) | 96 | ||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/11 |

9.79 | (0.05 | ) | 1.98 | 1.93 | — | — | — | 11.72 | 19.71 | 4,894,163 | 1.06 | 1.17 | (0.43 | ) | 179 | ||||||||||||||||||||||||||||||||||||||||

| Class B |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

17.66 | (0.05 | ) | 0.08 | 0.03 | — | (1.61 | ) | (1.61 | ) | 16.08 | 0.27 | (e) | 165,265 | 1.05 | (d)(e) | 1.05 | (d)(e) | (0.28 | )(d)(e) | 74 | |||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.50 | (0.04 | ) | 3.90 | 3.86 | (0.02 | ) | (0.68 | ) | (0.70 | ) | 17.66 | 27.20 | (e) | 247,220 | 1.08 | (e) | 1.08 | (e) | (0.27 | )(e) | 77 | ||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.20 | 0.02 | 2.28 | 2.30 | (0.00 | ) | — | (0.00 | ) | 14.50 | 18.90 | (e) | 226,796 | 1.06 | (e) | 1.14 | (e) | 0.17 | (e) | 80 | ||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.47 | (0.01 | ) | 0.86 | 0.85 | — | (0.12 | ) | (0.12 | ) | 12.20 | 7.54 | (e) | 273,177 | 1.05 | (e) | 1.18 | (e) | (0.05 | )(e) | 96 | |||||||||||||||||||||||||||||||||||

| Year ended 08/31/11 |

9.64 | (0.08 | ) | 1.91 | 1.83 | — | — | — | 11.47 | 18.98 | (e) | 373,157 | 1.28 | (e) | 1.65 | (e) | (0.64 | )(e) | 179 | |||||||||||||||||||||||||||||||||||||

| Class C |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

17.34 | (0.17 | ) | 0.08 | (0.09 | ) | — | (1.61 | ) | (1.61 | ) | 15.64 | (0.46 | ) | 381,264 | 1.80 | (d) | 1.80 | (d) | (1.03 | )(d) | 74 | ||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.34 | (0.16 | ) | 3.84 | 3.68 | — | (0.68 | ) | (0.68 | ) | 17.34 | 26.23 | 417,687 | 1.83 | 1.83 | (1.02 | ) | 77 | ||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.16 | (0.08 | ) | 2.26 | 2.18 | — | — | — | 14.34 | 17.93 | 271,960 | 1.81 | 1.89 | (0.58 | ) | 80 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.51 | (0.09 | ) | 0.86 | 0.77 | — | (0.12 | ) | (0.12 | ) | 12.16 | 6.82 | 252,685 | 1.80 | 1.93 | (0.80 | ) | 96 | ||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/11 |

9.68 | (0.11 | ) | 1.94 | 1.83 | — | — | — | 11.51 | 18.90 | (f) | 266,990 | 1.60 | (f) | 1.71 | (f) | (0.97 | )(f) | 179 | |||||||||||||||||||||||||||||||||||||

| Class R |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

17.93 | (0.09 | ) | 0.08 | (0.01 | ) | — | (1.61 | ) | (1.61 | ) | 16.31 | 0.03 | 30,716 | 1.30 | (d) | 1.30 | (d) | (0.53 | )(d) | 74 | |||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.74 | (0.09 | ) | 3.96 | 3.87 | — | (0.68 | ) | (0.68 | ) | 17.93 | 26.83 | 31,760 | 1.33 | 1.33 | (0.52 | ) | 77 | ||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.43 | (0.01 | ) | 2.32 | 2.31 | — | — | — | 14.74 | 18.58 | 19,576 | 1.31 | 1.39 | (0.08 | ) | 80 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.71 | (0.04 | ) | 0.88 | 0.84 | — | (0.12 | ) | (0.12 | ) | 12.43 | 7.30 | 18,746 | 1.30 | 1.43 | (0.30 | ) | 96 | ||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/11(g) |

12.81 | (0.02 | ) | (1.08 | ) | (1.10 | ) | — | — | — | 11.71 | (8.59 | ) | 17,698 | 1.30 | (h) | 1.42 | (h) | (0.66 | )(h) | 179 | |||||||||||||||||||||||||||||||||||

| Class Y |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

18.22 | (0.01 | ) | 0.09 | 0.08 | — | (1.61 | ) | (1.61 | ) | 16.69 | 0.56 | 152,179 | 0.80 | (d) | 0.80 | (d) | (0.03 | )(d) | 74 | ||||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.93 | (0.00 | ) | 4.01 | 4.01 | (0.04 | ) | (0.68 | ) | (0.72 | ) | 18.22 | 27.48 | 141,094 | 0.83 | 0.83 | (0.02 | ) | 77 | |||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.57 | 0.06 | 2.34 | 2.40 | (0.04 | ) | — | (0.04 | ) | 14.93 | 19.13 | 92,418 | 0.81 | 0.89 | 0.42 | 80 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.78 | 0.02 | 0.89 | 0.91 | — | (0.12 | ) | (0.12 | ) | 12.57 | 7.86 | 99,758 | 0.80 | 0.93 | 0.20 | 96 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/11 |

9.83 | (0.02 | ) | 1.97 | 1.95 | — | — | — | 11.78 | 19.84 | 117,471 | 0.81 | 0.92 | (0.18 | ) | 179 | ||||||||||||||||||||||||||||||||||||||||

| Class R5 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

18.20 | 0.01 | 0.08 | 0.09 | — | (1.61 | ) | (1.61 | ) | 16.68 | 0.62 | 50,052 | 0.71 | (d) | 0.71 | (d) | 0.06 | (d) | 74 | |||||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.90 | 0.02 | 4.01 | 4.03 | (0.05 | ) | (0.68 | ) | (0.73 | ) | 18.20 | 27.65 | 52,164 | 0.70 | 0.70 | 0.11 | 77 | |||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13 |

12.55 | 0.06 | 2.34 | 2.40 | (0.05 | ) | — | (0.05 | ) | 14.90 | 19.22 | 151,535 | 0.75 | 0.75 | 0.48 | 80 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/12 |

11.75 | 0.04 | 0.88 | 0.92 | — | (0.12 | ) | (0.12 | ) | 12.55 | 7.96 | 301,283 | 0.69 | 0.69 | 0.31 | 96 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/11(g) |

12.07 | (0.00 | ) | (0.32 | ) | (0.32 | ) | — | — | — | 11.75 | (2.65 | ) | 197,097 | 0.66 | (h) | 0.66 | (h) | (0.03 | )(h) | 179 | |||||||||||||||||||||||||||||||||||

| Class R6 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/15 |

18.22 | 0.03 | 0.08 | 0.11 | — | (1.61 | ) | (1.61 | ) | 16.72 | 0.73 | 86,444 | 0.62 | (d) | 0.62 | (d) | 0.15 | (d) | 74 | |||||||||||||||||||||||||||||||||||||

| Year ended 08/31/14 |

14.92 | 0.03 | 4.01 | 4.04 | (0.06 | ) | (0.68 | ) | (0.74 | ) | 18.22 | 27.69 | 137,509 | 0.63 | 0.63 | 0.18 | 77 | |||||||||||||||||||||||||||||||||||||||

| Year ended 08/31/13(g) |

13.03 | 0.07 | 1.87 | 1.94 | (0.05 | ) | — | (0.05 | ) | 14.92 | 14.98 | 113,955 | 0.65 | (h) | 0.65 | (h) | 0.58 | (h) | 80 | |||||||||||||||||||||||||||||||||||||

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. For the year ended August 31, 2014, the portfolio turnover calculation excludes the value of securities purchased of $1,921,954,452 and sales of $1,568,687,370 in the effort to realign the Fund’s portfolio holdings after the reorganization of Invesco Constellation Fund into the Fund. For the year ended August 31, 2013, the portfolio turnover calculation excludes the value of securities purchased of $279,161,573 and sales of $299,305,234 in the effort to realign the Fund’s portfolio holdings after the reorganization of Invesco Leisure Fund into the Fund. For the year ended August 31, 2011, the portfolio turnover calculation excludes the value of securities purchased of $4,947,460,310 and sales of $2,251,028,915 in the effort to realign the Fund’s portfolio holdings after the reorganization of Invesco Large Cap Growth Fund, Invesco Van Kampen Capital Growth Fund and Invesco Van Kampen Enterprise Fund into the Fund. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $8,902,336, $211,369, $409,366, $32,260, $154,896, $51,201 and $113,943 for Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

| (e) | The total return, ratio of expenses to average net assets and ratio of net investment income (loss) to average net assets reflect actual 12b-1 fees of 0.25%, 0.25%, 0.25%, 0.25% and 0.47% for the years ended August 31, 2015, 2014, 2013, 2012 and 2011, respectively. |

| (f) | The total return, ratio of expenses to average net assets and ratio of net investment income (loss) to average net assets reflect actual 12b-1 fees of 0.79% for the year ended August 31, 2011. |

| (g) | Commencement date of May 23, 2011 for Class R shares, December 22, 2010 for Class R5 shares and September 24, 2012 for Class R6 shares. |

| (h) | Annualized. |

20 Invesco American Franchise Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of AIM Counselor Series Trust (Invesco Counselor Series Trust)

and Shareholders of Invesco American Franchise Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Invesco American Franchise Fund (one of the funds constituting AIM Counselor Series Trust (Invesco Counselor Series Trust), hereafter referred to as the “Fund”) at August 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2015 by correspondence with the custodian and brokers, and the application of alternative auditing procedures where confirmations of security purchases have not been received, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

October 27, 2015

Houston, Texas

21 Invesco American Franchise Fund

Calculating your ongoing Fund expenses

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2015 through August 31, 2015.

Actual expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Class | Beginning Account Value (03/01/15) |

ACTUAL | HYPOTHETICAL (5% annual return before expenses) |

Annualized Expense Ratio |

||||||||||||||||||||

| Ending Account Value (08/31/15)1 |

Expenses Paid During Period2 |

Ending Account Value (08/31/15) |

Expenses Paid During Period2 |

|||||||||||||||||||||

| A | $ | 1,000.00 | $ | 940.70 | $ | 5.09 | $ | 1,019.96 | $ | 5.30 | 1.04 | % | ||||||||||||

| B | 1,000.00 | 940.90 | 5.09 | 1,019.96 | 5.30 | 1.04 | ||||||||||||||||||

| C | 1,000.00 | 937.10 | 8.74 | 1,016.18 | 9.10 | 1.79 | ||||||||||||||||||

| R | 1,000.00 | 939.00 | 6.30 | 1,018.70 | 6.56 | 1.29 | ||||||||||||||||||

| Y | 1,000.00 | 941.90 | 3.87 | 1,021.22 | 4.02 | 0.79 | ||||||||||||||||||

| R5 | 1,000.00 | 941.80 | 3.52 | 1,021.58 | 3.67 | 0.72 | ||||||||||||||||||

| R6 | 1,000.00 | 942.50 | 2.99 | 1,022.13 | 3.11 | 0.61 | ||||||||||||||||||

| 1 | The actual ending account value is based on the actual total return of the Fund for the period March 1, 2015 through August 31, 2015, after actual expenses and will differ from the hypothetical ending account value which is based on the Fund’s expense ratio and a hypothetical annual return of 5% before expenses. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half year. |

22 Invesco American Franchise Fund

Approval of Investment Advisory and Sub-Advisory Contracts

23 Invesco American Franchise Fund

24 Invesco American Franchise Fund

Tax Information

Form 1099-DIV, Form 1042-S and other year–end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

The following distribution information is being provided as required by the Internal Revenue Code or to meet a specific state’s requirement.

The Fund designates the following amounts or, if subsequently determined to be different, the maximum amount allowable for its fiscal year ended August 31, 2015:

| Federal and State Income Tax |

||||

| Long-Term Capital Gain Distributions |

$ | 875,055,601 | ||

| Qualified Dividend Income* |

0 | % | ||

| Corporate Dividends Received Deduction* |

0 | % | ||

| U.S. Treasury Obligations* |

0 | % | ||

| Tax-Exempt Interest Dividends* |

0 | % | ||

| * | The above percentages are based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

25 Invesco American Franchise Fund

Trustees and Officers

The address of each trustee and officer is AIM Counselor Series Trust (Invesco Counselor Series Trust) (the “Trust”), 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173. The trustees serve for the life of the Trust, subject to their earlier death, incapacitation, resignation, retirement or removal as more specifically provided in the Trust’s organizational documents. Each officer serves for a one year term or until their successors are elected and qualified. Column two below includes length of time served with predecessor entities, if any.

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During Past 5 Years | ||||

| Interested Persons | ||||||||

| Martin L. Flanagan1 — 1960 Trustee | 2007 | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Trustee, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU Cox School of Business

Formerly: Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, IVZ Inc. (holding company), INVESCO Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization). |

144 | None | ||||