SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 000-30563

DELTA INTERNATIONAL OIL & GAS INC.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 14-1818394 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization) | Identification No.) | |

| 8655 East Via de Ventura, Suite F127, Scottsdale, AZ | 85258 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (480) 483-0420

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by checkmark if the registrant is not required to file reports to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. (Check One):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

(Do not check if a smaller reporting company) |

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $2,469,030.

Number of shares of Common Stock outstanding as of April 10, 2015: 32,338,826.

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors. | 9 |

| Item 1B. | Unresolved Staff Comments. | 13 |

| Item 2. | Properties. | 14 |

| Item 3. | Legal Proceedings. | 14 |

| Item 4. | Mine Safety Disclosures. | 14 |

| PART II | ||

| Item 5. | Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities. | 15 |

| Item 6. | Selected Financial Data. | 15 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 16 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 20 |

| Item 8. | Financial Statements and Supplementary Data. | 21 |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 22 |

| Item 9A. | Controls and Procedures. | 22 |

| Item 9B. | Other Information. | 22 |

| PART III | ||

| Item 10. | Directors, Executive Officers, and Corporate Governance. | 23 |

| Item 11. | Executive Compensation. | 25 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 27 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 28 |

| Item 14. | Principal Accountant Fees and Services | 29 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules. | 30 |

| ii |

PART I

NOTE REGARDING FORWARD LOOKING STATEMENTS

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report contains historical information as well as forward-looking statements. Statements looking forward in time are included in this Annual Report pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to be materially different from any future performance suggested herein. We wish to caution readers that in addition to the important factors described elsewhere in this Form 10-K, the following forward-looking statements, among others, sometimes have affected, and in the future could affect, our actual results and could cause our actual consolidated results during 2015, and beyond, to differ materially from those expressed in any forward-looking statements made by or on our behalf.

Item 1. Business.

Unless the context otherwise requires, the terms the “Company", “Delta”, "we," "our" and "us" refers to Delta International Oil & Gas Inc., and, as the context requires, its consolidated subsidiaries.

Background

Delta was incorporated in Delaware on November 17, 1999. Our name was changed from Delta Mutual Inc. to our present name on October 29, 2013, by the merger with a wholly-owned Delaware subsidiary, where the sole change resulting from the merger was the change of the Company’s name to Delta International Oil & Gas Inc.

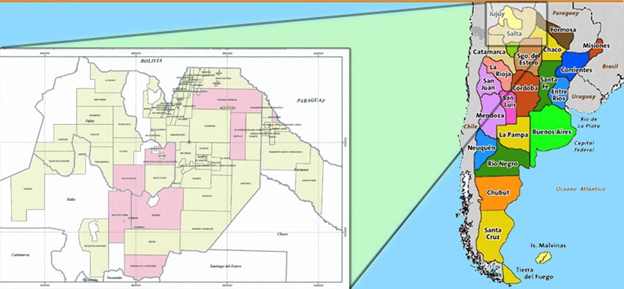

The primary focus of the Company’s business has been its South American Hedge Fund LLC (“SAHF”) subsidiary, which has investments in oil and gas concessions in Argentina. Dr. Daniel R. Peralta, who died in November 2012, was responsible for initiating our efforts to acquire and develop oil and gas concessions in Argentina as our President and Chief Executive Officer, director, and major stockholder.

Effective March 4, 2008, we acquired 100% of the issued and outstanding membership interests in SAHF. For accounting purposes, the transaction was treated as a recapitalization of the Company, as of March 4, 2008, with the parent of SAHF as the acquirer. Four oil and gas investments were contributed to the Company as part of this reverse merger transaction. SAHF maintains a branch office in Argentina, where it is engaged in oil and gas exploration and development activities. Given the current status of the Argentine economy, as well as the oil and gas industry, Delta is looking for opportunities in other industries.

Our principal offices are located at 8655 East Via de Ventura, Suite F127, Scottsdale, AZ 85258. Our telephone number is (480)483-0420. Our common stock is quoted on the Over-the-Counter Electronic Bulletin Board under the symbol "DLTZ".

General

We are an independent oil and gas company engaged in oil and gas concession investments and exploration activities in Argentina discussed below. In addition, we have ownership interests in certain mineral rights that are located in Argentina.

| 1 |

Business Strategy

As a result of the evaluation by our management team and our board of directors of the current business conditions in Argentina, the status of the global oil and gas industry, and the Company’s upcoming capital and operational requirements in Argentina, the Company has decided to shift its attention away from exclusively oil and gas investments and exploration in Argentina and to evaluate entry into another business sector.

During 2013, Delta evaluated several producing oil and gas projects in Argentina, as we acknowledged that the capabilities of Delta’s staff was better suited for producing properties than exploration properties. After evaluating a number of properties, Delta did not find a suitable, economically viable oil or gas producing project in Argentina.

During 2014, we continued to look for other producing opportunities in Argentina, and expanded our search to the United States. During the first half of the year, Argentina’s economic and political situation deteriorated. During the second half of the year, the oil price had dropped by about 50% and the natural gas price was already low. As the oil prices began dropping, our management team then decided that it would be in the best interest of the shareholders to explore options in other industries.

As of the date of this report, we are in discussions with another party for the potential sale of our stake in our properties in Argentina. No assurances can be provided that these negotiations will result in a definitive agreement leading to the sale of our Argentina oil and gas properties.

Our Oil and Gas Investments

SAHF has held interests in a total of ten oil and gas concessions in northern Argentina acquired in 2006, 2007, 2008, and 2011. Currently, SAHF holds interests in three concessions. The joint venture operators (of which SAHF is the operator of only Valle de Lerma) of the respective concessions have undergone all the required processes to obtain the necessary government and environmental operating permits for the commercial exploitation of these concessions. While we are not the operators of certain of these concessions, we generally have representation on the operating committees that are responsible for managing the business affairs of these concessions.

At December 31, 2014 the SAHF participations in the Argentina concessions are as follows:

| Block | Province | Status | Delta [SAHF] % | Partner(s) | ||||

| Tartagal | Salta | 2 Work over wells drilled; 2 exploratory wells to be drilled | 18% CO | New Times Energy (HK), Maxipetrol | ||||

| Morillo | Salta | 3D seismic interpretation; 2 exploratory wells to be drilled | 18% CO | New Times Energy (HK), Maxipetrol | ||||

| Valle de Lerma | Salta | Workover deemed undrillable | 60% | Remsa, PetroNexus, Grasta |

*CO means a carryover interest in the project.

** In the Tartagal and Morillo concessions the carry over mode relieved SAHF from the payment of canons, landlord fees of any kind or any other expense until production is realized. In the exploratory area Valle de Lerma, proportional exploratory canons were paid as explained in the financials.

| 2 |

Agreements with Principle Petroleum Limited

Effective March 30, 2012, we entered into an Asset Purchase and Cooperation Agreement (the “Cooperation Agreement”) with Principle Petroleum Limited (“PPL”), headquartered in the British Virgin Islands. Under the Cooperation Agreement, we agreed to sell to PPL, for a price of $7,000,000 certain exploration and exploitation rights to oil and gas deposits and certain bidding rights held by SAHF on the following areas: Valle de Lerma in the province of Salta; San Salvador de Jujuy; Libertador General San Martin in the province of Jujuy; and Selva Maria in the province of Formosa. The San Salvador, Libertador, and Selva Maria concessions have since been awarded by the government to another party. Pursuant to a separate Agreement dated March 31, 2012, we agreed with PPL to assign and transfer 50% of SAHF's current ownership of the Tartagal and Morillo (i.e., a 9% interest in the concession) to PPL for a purchase price of US$500,000. PPL had also agreed in an Undertaking to provide funds to the operating entity of Valle de Lerma (and the other concessions, if we had been successful in our bid) in the aggregate amount of up to US$10,000,000. PPL has paid US$4,300,000 towards the Cooperation Agreement and has defaulted on the balance of the payments. The interests in the Tartagal, Morillo, and Valle de Lerma concessions have not yet been transferred to PPL due to PPL’s payment default.

As of April 10, 2015, Delta was in the process of solidifying settlement terms for the Cooperation Agreement with PPL and a third party.

Jollin and Tonono Concessions

During 2014, SAHF exchanged its 10% ownership interest in the Jollin and Tonono oil and gas concessions located in the Province of Salta, Argentina for clearance documents from Maxipetrol for SAHF’s 18% ownership in Tartagal and Morillo. Jollin and Tonono were part of SAHF’s original investment in oil and gas in Argentina and after a series of purchases, sales, and transfers, SAHF has completely divested out of the properties after six years of inactivity in Jollin and Tonono. These assets have been removed from the balance sheet and written off (total write-off: US$328,953).

| 3 |

Tartagal and Morillo Concessions

Tartagal Oriental - The Tartagal Oriental (“Tartagal”) exploration license area, extended to February 2016, covers 7,065 square kilometers in Salta Province, located in the northern part of Argentina. Exploration dates back into the mid-20th century, and 22 wells, some oil producers, have been drilled in Tartagal Oriental since the 1960s. Of the 22 wells that have been drilled in Tartagal Oriental in the past decades, several were judged to be workover candidates by High Luck Group, the operator and majority owner. High Luck has invested approximately $60 million to date on: 1) geological studies, 2) 2D and 3D seismic surveys on both blocks, 3) two work-over drills, and 4)an exploratory well drill in Tartagal. Production from the two Campo Alcoba test wells commenced in 2011, continued into 2012, and then shut down due to large quantities of water in the oil. One more exploratory well is planned by the major partner.

Morillo - The Morillo exploration license area covers 3,518 square kilometers in Salta Province, contiguous with and south of the Tartagal Oriental license. Granted at the same time as Tartagal Oriental, the Morillo license was also extended to February 2016. In 2011, High Luck ordered a 274 square kilometer 3D seismic to be shot in the southwestern corner of the property because of a recent discovery made by Petrobras in an adjacent block. Once the data is processed, a decision will be made as to further drilling. SAHF had 9% ownership of the Tartagal and Morillo oil and gas concessions located in Salta Province, Argentina, at December 31, 2010. Subsequent to year end, our ownership interest was increased to 18% in March 2011, and we sold 50% of that interest to PPL in 2012. Because of PPL’s default on payments, SAHF has retained its full 18% interest in Tartagal and Morillo.

Terms of Carryover Arrangements- The Tartagal and Morillo interest was a carry-over interest from inception, May 15, 2007. The carrying party for Tartagal and Morillo concessions is currently High Luck Group.

Under the terms of the carry over, 50% of the production profits will be applied to the investment payment. The balance of the production profits (50%) will be distributed proportionally according to the percentage of each JV member. These terms only apply to the Tartagal and Morillo concessions.

Admission of SAHF to Joint Ventures Operating Oil Concessions- The approval for the Tartagal and Morillo Blocks application was filed in August 2010 and approved May 11, 2011. Prior to formal admittance into the joint ventures, SAHF’s 18% carry-over interest in the Tartagal and Morillo Concessions were assigned to and held in Trust for SAHF by Maxipetrol for the sole use and benefit of SAHF, including any proceeds from the sale of hydrocarbons or property interests. The Assignment Agreement did not affect the rights, privileges, obligations and liabilities of the parties to the agreement related to their respective interests in any way. This is a common practice in Argentina due to the lengthy period required for obtaining government approvals. In January, 2014, this trust agreement with Maxipetrol was canceled and SAHF’s ownership of that certain 18% interest was and is no longer bound by the trust agreement. SAHF has free and clear title to the property, subject to a possible sale.

Exploration Rights

Delta, through SAHF, does not have any ownership over the rights of the five exploration blocks originally purchased in 2008.

On February 6, 2008, SAHF purchased 40% of the oil and gas exploration rights to five geographically defined areas in the Salta Province of Northern Argentina for $697,000 through a trust agreement and subsequently sold 50% of it for the payments of canons.

Through 2012, the operators of four of the blocks (excluding Guemes) had not done anything with the properties so they gave two of concessions back to the province and two to YPF in order to protect the joint ventures from canon payments and work commitment obligations. These assets have been removed from the balance sheet and written off as a loss (total write-off: US$364,081).

| 4 |

Guemes Block

SAHF’s Argentine team, though not the operators, led exploratory drilling activities that commenced in April 2010 on the Guemes Block. In July 2010, SAHF found positive traces of the presence of natural gas and hydrocarbons of low-density quality through its analysis of core samples. The well was eventually deemed to not be commercially viable. After three years of non-activity, the operating company was sold and no further work was pursued. The Guemes block has been removed from the balance sheet and written off (total write-off: US$244,337)

Valle de Lerma Concession

On August 10, 2011, SAHF and its partners, Remsa, PetroNexus, and Grasta SA, won the bid to explore and produce hydrocarbons in the block known as “Valle de Lerma” in the province of Salta, Argentina.

The Valle de Lerma block is located in the province of Salta in the northwestern region of Argentina and has an area of 5259 km2. SAHF has done the measurement and survey study and filed an environmental impact study, which was approved. Upon completion of the study, it was determined that the actual well site was within the boundaries of the City of Salta, where government restrictions do not allow oil to be produced from this site. There is an additional commitment of 231 work units in Valle de Lerma outstanding.

SAHF holds a majority of the license interest and is the responsible operator. The exploration terms are four years for the first period, three years for the second and two years for the last period.

SAHF currently owns 60% of the rights to explore Valle de Lerma; Grasta owns 5%; PetroNEXUS owns 30%; and Remsa owns 5%. 29.4% of the rights are tied to the PPL Agreement, but still remain under SAHF’s control until full payment or a settlement is made. Delta is currently finalizing the terms to sell its full stake in Valle de Lerma to a third party. While Delta believes that the sale will be successful, there is uncertainty regarding its time frame.

Caimancito Refinery

On January 13, 2012, we, through our wholly-owned subsidiary, SAHF, signed a three-way purchase option agreement with Cruz Norte, SA and Grasta SA to purchase 66.66% (33.33% for SAHF; 33.33% for Grasta) of the Caimancito Refinery, located in the Jujuy Province, Argentina. In March, 2012, SAHF transferred the equivalent of US$150,000 as an initial payment for its 33.33% of the outstanding shares of Caimancito Refinery; the purchase price was paid in full, but the agreement required another US$1,500,000 in refurbishing costs to be paid by Grasta SA and SAHF. Grasta never paid its initial US$150,000 and backed out of the agreement. After thorough review, SAHF decided that it would not invest the remaining US$1,500,000 and its shares were revoked. The investment in the Caimancito Refinery has been removed from the balance sheet and declared as a loss (total write-off: US$87,740).

The Caimancito plant is the only refining plant in Jujuy and is not in operation.

Lithium Project

On March 1, 2010, we purchased control of 51% of approximately 143,000 hectares with 29 mines located in the Northwest part of Argentina, south of the border with Bolivia, with high lithium and borates brines concentration. This property is held under a concession for a period of 20 years that provides for the following rights: to explore, evaluate, develop, produce and arrange mineral resources on the property. Subject to the terms and conditions of this agreement, SAHF has been appointed as Chief Operating Officer (COO) of the project. The project involves the exploration and eventual exploitation of 29 mines in one block of a salt plateau located in Jujuy Province, Argentina. None of the 29 mines is being actively mined. We have performed sampling and geological analyses with a local geological company to determine value to the property. The condition to retain the claims is payment of the annual fee renewal and the approval of the Operation Plan and Environmental Impact Report by government authorities before any major drilling. We are seeking a buyer to take over the development of this property. Delta is not expecting a sale of the lithium property within the next year due to 1) the current price of lithium, 2) lithium’s abundance in the surrounding area, and 3) Delta’s primary focus on other projects.

| 5 |

Cachi

In the fourth quarter of 2010, SAHF signed a purchase option agreement with Minera Ansotana, SA to explore and develop columbite-tantalite (coltan) from a set of mines in Cachi, Salta. Some of the key mines in Cachi are El Quemado, Penas Blancas and Tres Tetas, which were used for mining in the 1950's by German immigrants. The Company reviewed various reports detailing the potential of these mines and began sampling the property. In the fourth quarter of 2011, the Company received very promising results from the Tres Tetas mines from samples that were taken throughout 2011 by a team of local geologists and engineers. The samples were originally analyzed in labs at a local Salta University, and then exported to Chile and Australia for further analysis.

Because of the location, altitude, and access, SAHF looked for partners to help exploit the mine. As of December 2014, SAHF’s ownership option had been revoked and it had been written off the balance sheet (total write-off: US$36,304 per MD&A).

Development Activities

Development projects on the concessions in which we have investments include accessing additional productive formations in existing well bores, formation stimulation, infill drilling on closer well spacing, and retrofitting or reworking existing wells.

Reserve Reports for the Properties

The Company worked with NSAI and some of its partners to attain an updated prospective resources report for Tartagal and Morillo, and a contingent resources report for the well “La Troja” in Valle de Lerma. Both of these reports are available, however, they are not considered to be Reserve Reports, they are an indication of the potential resources that could be in the concessions.

Customers

Petroleum and natural gas in the Northwest Basin of Argentina are traded freely and on a transaction by transaction basis. There are no long term contracts due to the supply deficit in this area. The buyers are the local refineries, and deliveries are made by pipelines or by truck in remote sites. Refineries pay for the transportation cost.

Title to Properties

We believe we have satisfactory title in all of our properties; and we investigate title and title opinions from counsel only when we acquire properties or before commencement of drilling operations. All of our current properties have been acquired directly from the government. As all of our current property titles are issued by the Argentine government (Department of Energy), we believe that we are in full compliance with the title requirements for each of our properties.

| 6 |

Competition

Our ability to acquire additional prospects and to find and develop reserves in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. Also, there is substantial competition for capital available for investment in the oil and gas industry.

Governmental Regulation

The key points of the statutory and regulatory regime in respect of oil and gas operations in Argentina are as follows:

The Company’s operations in Argentina are subject to various laws, taxes and regulations governing the oil and gas industry. SAHF is registered in the Public Registry of Commerce, and the conduct and dealing of SAHF are governed by the commercial code and supplementary laws and regulations. Taxes generally include income taxes, value added taxes, export taxes, and other production taxes such as provincial production taxes and turnover taxes. Labor laws and provincial environmental regulations are also in place.

According to the Argentinean Hydrocarbons Law, number 6747 and Decrees 3560/95 and 2219/96, an Oil Operator License is needed to work in exploration and Exploitation of Hydrocarbons in the country. The Company has a Federal Operator License issued by the Federal Secretary of Energy and a Salta Province Producer License issued by the Salta Secretary of Energy.

Oil Concessions

Our right to conduct exploration activities in Argentina is derived from participation in concessions and exploration permits granted by the Argentine federal government and provincial governments that control sub-surface minerals. In general, provincial governments have had full jurisdiction over concession contracts since 2006, when the Argentine federal government transferred to the provincial government’s full ownership and administration rights over all hydrocarbon deposits located within the respective territories of the provinces, including all exploration permits and exploitation concessions originally granted by the federal government.

A concession granted by the government gives the concession holders, or the joint venture partners, ownership of hydrocarbons at the moment they are produced through the wellhead. Under this arrangement, the concession holders have the right to freely sell produced hydrocarbons, and have authority over operations including exploration and development plans. The production concessions have a term of 25 years which can be extended for 10 years with the consent of the government. Throughout the term of their concessions, the partners are subject to provincial production taxes, turnover taxes, and federal income taxes. These tax rates are fixed by law and are currently 12% to 18.5%, two percent, and 35 percent, respectively. Subsequent to the transfer of ownership and administrative rights over hydrocarbon deposits to the provinces, provincial governments have sometimes required higher provincial production tax rates in blocks awarded by the provinces or in concessions that have been granted the 10 year extension.

In Argentina, material mining regulations are promulgated by the Federal Congress and have been contained since 1884 as a part of the Mining Code. On the other hand, original domain of mining natural resources belongs to the provinces. Thus, provinces (i) appoint concession authorities and (ii) provide procedural mining regulations that individuals and legal entities must follow in order to be awarded mining rights and property. Exploration concessions granted are subject to specific terms, but resulting exploitation concessions––provided that certain requirements are met–– are perpetual.

Mining prospecting and exploration rights are easements which title can be granted to individuals or legal entities through administrative or judicial concessions ("exploration concessions"). Any mineral discovery made either by the concessionaire or third parties, provided they take place in the area and term of the concession, grants the concessionaire the right to turn such discovery into a mine.

| 7 |

The term of exploration concessions depends on the size of the granted concession area. The basic 500 hectares concession lasts for 150 days and each surface unit added to such basic concession increases the term in 50 additional days. Therefore, the largest possible concession will last for a 1,100 days term. In addition, there is an area limit of 200,000 hectares per area and a maximum of 20 areas that can be owned by a single entity.

Provincial governments in Argentina recently have established production floors and conditions for producing concessions, designed to force companies to increase production or else face a revocation in their concessions.

SAHF received its producing license for oil and gas on April 29, 2011. Our partners in the joint ventures that SAHF is involved in have all the other required licenses and permits to commercially produce oil and gas.

In the lithium (North Guayatayoc) property, licenses have not yet been pursued because SAHF is focused on the possibility of selling the concession. SAHF has no intention on acquiring mining-related licenses.

The main effects of government regulations on the Company are that it will take a longer amount of time for properties to start producing commercially and that it will cost more capital. The longer time frame from acquisition of the property to their commercial production stage can be attributed to the higher amount of time and focus that has to be put on paperwork and legal work. Because all of our contracts and corporate documents are written in English in the U.S, they need to be translated and notarized with an apostille to be valid in Argentina, which can cause delays in the applications for permits and licenses in Argentina. The higher expected cost can be attributed to the legal fees incurred to comply with the government regulations, along with the royalties, canons, and landowner fees that are particular to each concession.

On October 29, 2014, the Argentine Congress approved an amendment to the Federal Hydrocarbons Law which will improve investment conditions in the Argentine oil and gas industry (the “Amendment”). The Amendment is intended to improve investment conditions for the Argentine oil industry in a number of ways, including: (i) extending exploration and production terms, (ii) creating a special type of concession for unconventional hydrocarbon projects with longer terms and lower royalties, (iii) capping royalties and bonus fees, (iv) reducing Government-take in certain types of projects, and (v) reinstating the right to export a percentage of oil and gas production while maintaining abroad the export proceeds. The benefits introduced by the Amendment are available to both new entrants and existing players.

A substantial change introduced by the Amendment is that the privilege that State-owned entities currently have to access hydrocarbon blocks without competing with private companies is eliminated.

Exchange Controls

As a result of the devaluation of the Argentine peso at the beginning of 2002, several foreign exchange regulations were issued to limit the transfer of money abroad.

On October 13, 2011, the Argentine government launched a series of regulations in order to control the sale of foreign currency. The measures were aimed at slowing the rise in value of the North American dollar, of which the Argentine Central Bank has had to reduce its reserves in order to avoid the continuing devaluation of the Argentine peso against the dollar.

In January 2014, the government devalued the Argentine peso to the greatest extent since 2002, the year the government abandoned a one-to-one peg with the U.S. dollar following a record $95 billion default. Exchange control restrictions were eased following the January 2014 devaluation.

There are no restrictions for the payment abroad of interest, dividends or profits, royalties and other commercial payments duly supported by the corresponding documentation. There are presently no restrictions on foreign investment in the capital of local corporations. However, pursuant to a 2005 rule issued by the central bank, any transfer of funds into Argentina as a result of a financial debt is subject to a compulsory one-year temporary and non-interest bearing deposit equivalent to 30% of the funds transferred into Argentina. Investments in mining projects or to increase the capital requirement of a company's branch(es) in Argentina are exempt from this deposit rule.

| 8 |

Research and Development

We do not anticipate performing any significant product research and development under our plan of operation.

Employees

Currently, we have two management employees in Delta: Santiago L. Peralta, Interim President and Chief Executive Officer, and Pablo D. Peralta, SAHF Coordinator. In Delta’s subsidiary, SAHF, Alberto MacMullen is the manager of the SAHF’s Argentina branch. In the past, we have used temporary independent contractors while in oil drilling operations.

Available Information

We maintain a website at the address www.deltamutual.com. We are not including the information contained on our website as part of, or incorporating it by reference into, this report. We make available free of charge (other than an investor’s own Internet access charges) through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission.

Item 1A. Risk Factors.

General

Although our Board has determined to evaluate the acquisition of a public or private entity that operates outside of the oil and gas industry, we have no arrangements or understandings with respect to any such acquisition at this time.

We have no arrangement, agreement or understanding with respect to engaging in a merger with, joint venture with or acquisition of, a private or public entity outside the oil and gas industry. There can be no assurance that we will be successful in identifying and evaluating suitable business opportunities in another sector or in concluding a business combination. We cannot provide assurances that we will be able to negotiate such a business combination on terms favorable to us.

Risks Related to Our Oil and Gas Business

Our oil and gas investments made by our subsidiary SAHF may not be profitable.

The success of our investments in Argentina will depend to a great extent on the operations, financial condition and management of the oil and gas concession and exploration rights in which we have investments. Their success may depend upon management of the operations in which the investments were made and numerous other factors beyond our control.

International operations, and in particular in Argentina, expose us to political, economic and currency risks.

With regard to our investments in oil and gas concessions located in Argentina, we are subject to the risks of doing business abroad, including,

| ● | Currency fluctuations; | |

| ● | Changes in tariffs and taxes; and | |

| ● | Political and economic instability. |

| 9 |

Changes in currency exchange rates may affect the relative costs of operations in Argentina, and may affect the cost of certain items required in oil and gas processing, thus possibly adversely affecting our profitability.

Argentina has devalued its currency, the peso, in 2002 and in 2014. We believe that the effect on oil and gas production operations will be basically to increase an operator’s costs and thereby lower its profitability.

In addition, there are inherent risks for the foreseeable future of conducting business internationally. Language barriers, foreign laws and tariff and taxation issues all have a potential negative effect on our ability to transact business. Changes in tariffs or taxes applicable to investments in foreign operations may adversely affect our profitability. Political instability may increase the difficulties and costs of doing business. We may be subject to the jurisdiction of the government and/or private litigants in foreign countries where we transact business, and may be forced to expend funds to contest legal matters in those countries in disputes with those governments or with customers or suppliers.

Drilling for and producing oil and natural gas are high risk activities with many uncertainties.

Our future success will depend on the success of our exploration activities. Our oil and natural gas exploration and production activities are subject to numerous risks beyond our control, including the risk that drilling will not result in commercially viable oil or natural gas production. Our decisions to purchase, explore, develop or otherwise exploit prospects or properties will depend in part on the evaluation of data obtained through geophysical and geological analyses, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. Our cost of drilling, completing and operating wells is often uncertain before drilling commences. Overruns in budgeted expenditures are common risks that can make a particular project uneconomical. Further, many factors may curtail, delay or cancel drilling, including the following:

| ● | delays imposed by or resulting from compliance with regulatory requirements; | |

| ● | pressure or irregularities in geological formations; | |

| ● | shortages of or delays in obtaining qualified personnel or equipment, including drilling rigs and CO2; | |

| ● | equipment failures or accidents; and | |

| ● | adverse weather conditions, such as freezing temperatures, hurricanes and storms. |

The presence of one or a combination of these factors at our properties could adversely affect our business, financial condition or results of operations.

| 10 |

Prospects that we decide to drill may not yield oil or gas in commercially viable quantities.

A prospect is a property on which we have identified what our geoscientists believe, based on available seismic and geological information, to be indications of oil or gas. Our prospects are in various stages of evaluation, ranging from a prospect which is ready to drill to a prospect that will require substantial additional seismic data processing and interpretation. There is no way to predict in advance of drilling and testing whether any particular prospect will yield oil or gas in sufficient quantities to recover drilling or completion costs or to be economically viable. The use of seismic data and other technologies and the study of producing fields in the same area will not enable us to know conclusively prior to drilling whether oil or gas will be present or, if present, whether oil or gas will be present in commercial quantities. In addition, because of the wide variance that results from different equipment used to test the wells, initial flowrates may not be indicative of sufficient oil or gas quantities in a particular field. The analogies we draw from available data from other wells, from more fully explored prospects, or from producing fields may not be applicable to our drilling prospects. We may terminate our drilling program for a prospect if results do not merit further investment.

We are subject to complex laws that can affect the cost, manner or feasibility of doing business.

Exploration, development, production and sale of oil and natural gas are subject to extensive federal and state regulation in Argentina. We may be required to make large expenditures to comply with governmental regulations. Matters subject to regulation include:

| ● | the exploitation of our oil and gas concessions as governed by the terms of the concession agreements; | |

| ● | royalties, canons and landlord fees; | |

| ● | production permits; | |

| ● | discharge permits for drilling operations; | |

| ● | drilling bonds; | |

| ● | reports concerning operations; | |

| ● | the spacing of wells; | |

| ● | unitization and pooling of properties; and | |

| ● | taxation. |

Under these laws, we could be liable for personal injuries, property damage and other damages. Failure to comply with these laws also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws could change in ways that could substantially increase our costs. Any such liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations.

Our operations may incur substantial liabilities to comply with environmental laws and regulations.

Our oil and gas operations are subject to stringent federal and state laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations require an environmental impact study before drilling commences; and impose substantial liabilities for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of penalties or the incurrence of investigatory or remedial obligations.

Market conditions or operational impediments may hinder our access to oil and gas markets or delay our production.

In connection with our continued development of oil and gas properties, we may be disproportionately exposed to the impact of delays or interruptions of production from wells in these properties, caused by transportation capacity constraints, curtailment of production or the interruption of transporting oil and gas volumes produced. In addition, market conditions or a lack of satisfactory oil and gas transportation arrangements may hinder our access to oil and gas markets or delay our production. The availability of a ready market for our oil and natural gas production depends on a number of factors, including the demand for and supply of oil and natural gas and the proximity of reserves to pipelines and terminal facilities.

| 11 |

Crude oil and natural gas prices are volatile and a substantial reduction in these prices could adversely affect our results and the price of our common stock.

Our revenues, operating results and future rate of growth depend highly upon the prices we receive from crude oil and natural gas produced by the concession in which we have investments. Historically, the markets for crude oil and natural gas have been volatile and are likely to continue to be volatile in the future. The markets and prices for crude oil and natural gas depend on factors beyond our control. These factors include demand for crude oil and natural gas, which fluctuates with changes in market and economic conditions, and other factors, including:

| ● | worldwide and domestic supplies of crude oil and natural gas; | |

| ● | political conditions and events (including instability or armed conflict)in crude oil or natural gas producing regions; | |

| ● | the level of global crude oil and natural gas inventories; | |

| ● | the price and level of foreign imports; | |

| ● | the price and availability of alternative fuels; | |

| ● | the availability of pipeline capacity and infrastructure; | |

| ● | availability of crude oil transportation and refining capacity; | |

| ● | domestic and foreign governmental regulations and taxes; and | |

| ● | the overall economic environment. |

Significant declines in crude oil and natural gas prices for an extended period may have the following effects on our business:

| ● | limiting our financial condition, liquidity, and ability to finance planned capital expenditures and results of operations; | |

| ● | reducing the amount of crude oil and natural gas that can be produced economically; | |

| ● | causing us to delay or postpone some of our capital projects; | |

| ● | reducing our revenues, operating income and cash flows; | |

| ● | reducing the carrying value of our investments in crude oil and natural gas properties; or | |

| ● | limiting our access to sources of capital, such as equity and long-term debt. |

Our business involves many operating risks that may result in substantial losses for which insurance may be unavailable or inadequate.

Our oil and gas investments are subject to hazards and risks inherent in operating and restoring oil and gas wells, such as fires, natural disasters, explosions, casing collapses, surface cratering, pipeline ruptures or cement failures, and environmental hazards such as natural gas leaks, oil spills and discharges of toxic gases. Any of these risks can cause substantial losses resulting from injury or loss of life, damage to or destruction of property, natural resources and equipment, pollution and other environmental damages, regulatory investigations and penalties, suspension of our operations and repair and remediation costs. In addition, our liability for environmental hazards may include conditions created by the previous owners of properties in which we have investments or purchase or lease.

We do not believe that insurance coverage for all environmental damages that could occur is available at a reasonable cost. Losses could occur for uninsurable or uninsured risks. The occurrence of an event that is not fully covered by insurance could harm our financial condition and results of operations.

| 12 |

Competition in our industry is intense and many of our competitors have greater financial and technological resources.

We have investments in the competitive area of oil and gas exploration and production. Many competitors are large, well-established companies that have larger operating staffs and significantly greater capital resources.

Competition for experienced personnel may negatively impact our operations.

Our future profitability will depend on our ability to attract and retain qualified personnel. The loss of any key executives or other key personnel could have a material adverse effect on investments results and revenues. In particular, the loss of the services of our President, Dr. Daniel Peralta, could adversely affect our South American oil and gas investment results.

We are subject to changing governmental regulations concerning our oil and gas properties and with respect to investments.

Provincial governments in Argentina have established production floors and conditions for producing concessions that are required to be met by the companies holding the concessions. Our operations in Argentina may in the future be adversely impacted by these measures currently being taken by provincial governments.

Although, there are no restrictions for the payment abroad of interest, dividends or profits, royalties and other commercial payments duly supported by the corresponding documentation, exchange control regulations could be implemented to restrict transfers of funds from SAHF to the Company, which would limit our ability to pay dividends.

Historically we have not paid dividends.

We have never paid dividends on our common stock, and management does not anticipate payment of dividends until such time as our Board of Directors determines that our profitability warrants payment of dividends.

Item 1B. Unresolved Staff Comments.

Not applicable.

| 13 |

Item 2. Properties.

As of December 31, 2014, our principal assets included Partial Rights Ownership in three oil and gas properties.

| Block | Province | Status | Delta % | Partner(s) | ||||

| Tartagal | Salta | Drilling | 18% CO | New Times Energy (HK), Maxipetrol | ||||

| Morillo | Salta | Seismic | 18% CO | New Times Energy (HK), Maxipetrol | ||||

| Valle de Lerma | Salta | Seismic | 60% | Remsa, PetroNexus, Grasta, Maxipetrol |

*CO means a carryover interest in the project.

** In the Tartagal and Morillo concessions the carry over mode relieved SAHF from the payment of canons, landlord fees of any kind or any other expense until production is realized. In the exploratory area Valle de Lerma, proportional exploratory canons were paid as explained in the financials.

Executive Offices

Effective March 1, 2014, we entered into a two-year lease for our new executive offices, at a net monthly rental of $2,180, located at 8655 East Via de Ventura, Suite F127, Scottsdale, AZ 85258. We anticipate that this office space will accommodate our operations for the next several years.

Item 3. Legal Proceedings.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

| 14 |

PART II

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Our common stock has been quoted on the Over-the-Counter Bulletin Board operated by FINRA, and the OTCQB, since approximately February 1, 2001.

Our shares are listed under the symbol "DLTZ”. The quotations in the table below reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not represent actual transactions.

| High | Low | |||||||||

| 2013 | 1st Quarter | 0.25 | 0.20 | |||||||

| 2nd Quarter | 0.40 | 0.15 | ||||||||

| 3rd Quarter | 0.30 | 0.05 | ||||||||

| 4th Quarter | 0.28 | 0.20 | ||||||||

| 2014 | 1st Quarter | 0.28 | 0.10 | |||||||

| 2nd Quarter | 0.29 | 0.16 | ||||||||

| 3rd Quarter | 0.40 | 0.06 | ||||||||

| 4th Quarter | 0.11 | 0.04 | ||||||||

| 2015 | 1st Quarter | 0.25 | 0.06 | |||||||

During the last two fiscal years, no cash dividends have been declared on Delta's common stock and Company management does not anticipate that dividends will be paid in the foreseeable future. The payment of dividends is within the discretion of the board of directors and will depend on the Company's earnings, capital requirements, financial condition, and other relevant factors. There are no restrictions that currently limit the Company's ability to pay dividends on its common stock other than those generally imposed by applicable state law. As of April 13, 2015, there were approximately 94 record holders of our common stock.

The Company has no equity compensation plans in effect, or any securities outstanding under equity compensation plans, as of the date of this report.

Item 6. Selected Financial Data.

Disclosure under Item 7A is not required of smaller reporting companies.

| 15 |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our consolidated financial condition and results of operations should be read in conjunction with the consolidated financial statements and notes thereto and the other financial information included elsewhere in this report.

Certain statements contained in this report, including, without limitation, statements containing the words "believes," "anticipates," "expects" and words of similar import, constitute "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including our ability to create, sustain, manage or forecast our growth; our ability to attract and retain key personnel; changes in our business strategy or development plans; competition; business disruptions; adverse publicity; and international, national and local general economic and market conditions.

GENERAL

Delta International Oil & Gas Inc. (“Delta” or “the Company”) was incorporated in Delaware on November 17, 1999. Our name was changed from Delta Mutual Inc. to our present name on October 29, 2013. In 2003, we established business operations focused on providing environmental and construction technologies and services. Our operations in the Far East (Indonesia) and our construction operations in Puerto Rico were discontinued in 2008.

Effective March 4, 2008, we acquired 100% of the issued and outstanding membership interests in the parent of South American Hedge Fund LLC, a Delaware limited liability company (sometimes herein referred to as “SAHF”). For accounting purposes, the transaction was treated as a recapitalization of the Company, as of March 4, 2008, with the parent of SAHF as the acquirer. SAHF maintains a branch office in Argentina, where it is engaged in oil and gas exploration and development activities.

Overview

We are an independent oil and gas company, with the SIC Code classification 1311 (oil and gas production) for SEC filing purposes, engaged in oil and gas acquisition and exploration activities in Argentina. Our operating policies have been to secure oil and gas properties and concessions which are either producing economical quantities of oil and gas or which demonstrate favorable characteristics for well “workovers” with a history of excellent production.

The Company's business is subject to the risks of its oil and gas investments in South America. Our investments at this time are in the oil and gas sector in Argentina, where recently proposed legislation would change the respective roles of the federal and provincial governments in the award of and participation in oil and gas concessions. If enacted these changes could necessitate renegotiation of certain of the concessions in which we have interests, and affect the value of our investments. As of the close of 2014, Argentina was in technical default on its external debt and, although negotiations to remedy this default are in process, it is likely that this situation, however resolved, will lead the government to impose further restrictions on exports of capital from Argentina.

Our Oil and Gas Investments

As of December 31, 2014, the Company, through SAHF, retained 18% of the total concession in the carryover mode ("no cost obligations to SAHF") in the Tartagal and Morillo oil and gas concessions located in Northern Argentina. We do not operate the Tartagal and Morillo concession, and have a minority position in the joint venture. 9% of Tartagal and Morillo had been sold to PPL in March 2012, but due to payment defaults, the 9% were not transferred. We have, for nominal consideration, disposed of our 10% concession interest in the carryover mode in the Jollin and Tonono oil and gas concessions in Northern Argentina, and incurred an impairment charge for this concession interest of $328,953, resulting in a carrying value of $-0-, in the twelve months ended December 31, 2014.

We hold a 60% interest in the Valle de Lerma concession in Northern Argentina, where the joint venture partners are Grasta SA, PetroNEXUS and REMSA. 29.4% of Valle de Lerma had been sold to PPL via an agreement dating March 2012, but due to payment defaults, the Company has not transferred the 29.4% interest. The exploration terms are four years for the first period, three years for the second and two years for the last period. Currently our ability to reopen the existing well site is constrained by law, since the location of the well was within the city limits of Salta. Requests made for government approval to override the existing restrictions of the current policy have been rejected. The Company is looking to sell its full stake in Valle de Lerma. Currently, the Company is finalizing the terms of the sale; however, there is uncertainty regarding the time frame given the past experience with selling properties.

| 16 |

We have incurred an impairment charge of $608,418 and written down to $-0- the carrying amount as of December 31, 2014, of SAHF’s 20% ownership interest in the oil and gas exploration rights to five geographically defined areas in the Salta Province of Northern Argentina. Four of the blocks were given back to the government or other companies given the joint venture’s inability to fulfill its work unit commitments in the areas. SAHF led exploratory drilling activities in April 2010 on the Guemes Block and in July 2010, SAHF confirmed the existence of hydrocarbons in the well. In 2013, the initial majority working interest owner, Ketsal S.A., sold its share to another firm, which is evaluating whether to proceed further with investments in this concession. Given the circumstances of Guemes, SAHF did not complete its application for its participation in the joint venture and the required government decree.

The Company no longer intends to pursue any of its own operating activities on its oil and gas properties that are not in a carry-over mode.

Accordingly, a further impairment charge of $54,498 was incurred with respect to swabbing rig equipment and other miscellaneous equipment we had purchased, and the carrying value of the equipment was written down to $-0-, as of December 31, 2014.

As of December 31, 2014, SAHF’s 33.33% stake in the Caimancito Refinery in Jujuy was revoked by the majority owner. Due to the cost of required rehabilitation work, and a partner dropping part of the financing, SAHF decided that it would not further invest by itself in the refinery, leading to the revocation of SAHF’s interest. Currently this refinery is not being operated to produce gasoline or diesel fuel, and the owner has no plans to rehabilitate the facility. We have incurred an impairment charge of $87,740, and the carrying amount for this property was also written down to $-0- as of December 31, 2014.

Lithium and Coltan Mining Properties

On March 1, 2010, SAHF purchased control of 51% of the Guayatayoc project via a partnership agreement with Oscar Chedrese and Servicios Mineros SA. The project holds the concession for a period of 20 years for the mineral rights to 143,000 hectares with 29 mines located in the Northwest part of Argentina, south of the border with Bolivia, with high lithium and borates brines concentration. We have performed sampling in the property to determine the value of the property, but the results have been inconclusive. We are seeking a purchaser for our concession interest in this property. Delta is not expecting a sale of the lithium property within the next year due to 1) the current price of lithium, 2) lithium’s abundance in the surrounding area, and 3) Delta’s primary focus on other projects.

In the fourth quarter of 2010, SAHF entered a purchase option agreement with Minera Ansotana, SA to explore and develop columbite-tantalite (coltan) from a set of mines in Cachi, Salta. After reviewing various reports detailing the potential of these mines, the Company began sampling the property. After no further investment from SAHF due to the difficulty and cost of the project, Minera Ansotana cancelled SAHF’s agreement. We incurred a $36,304 impairment charge in connection with writing down the value of these properties to $-0- as of December 31, 2014.

| 17 |

RESULTS OF OPERATIONS

YEAR ENDED DECEMBER 31, 2014 COMPARED TO THE YEAR ENDED DECEMBER 31, 2013

During the year ended December 31, 2014, we had a net loss of approximately $4,702,198 as compared to a net loss of $87,107 for the year ended December 31, 2013.

During the year ended December 31, 2014 our loss from operations was approximately $5,089,658 compared to a net loss from operations of approximately $816,477 in 2013, due to an impairment charge of $1,119,913 and to an allowance for bad debt of $3,200,069. General and administrative expense was $769,676 in 2014, as compared to $816,477 in 2013.

LIQUIDITY

At December 31, 2014, we had a working capital surplus of approximately $1.1 million, compared with a working capital surplus of approximately $5.0 million at December 31, 2013.

At December 31, 2014, we had total assets of approximately $1.6 million compared to total assets of approximately $7.2 million at December 31, 2013. Net cash used in operating activities in the year ended December 31, 2014 was $1,068,571, as compared with $243,817 in 2013; and net cash generated from investing activities was approximately $293,000 in 2014, as compared with cash generated of approximately $385,000 in 2013. Net cash used by financing activities was approximately $150,000 in the year ended December 31, 2014, compared to approximately $563,000 in 2013.

Effective March 30, 2012, we entered into an Asset Purchase and Cooperation Agreement (the “Cooperation Agreement”) with Principle Petroleum Limited (“PPL”), headquartered in the British Virgin Islands. Under the Cooperation Agreement, we agreed to sell to PPL, for a price of $7,000,000 certain exploration and exploitation rights to oil and gas deposits and certain bidding rights held by SAHF on the following areas: Valle de Lerma in the province of Salta; San Salvador de Jujuy; Libertador General San Martin in the province of Jujuy; and Selva Maria in the province of Formosa. The San Salvador, Libertador, and Selva Maria concessions have since been awarded by the government to another party. Pursuant to a separate Agreement dated March 31, 2012, we agreed with PPL to assign and transfer 50% of SAHF's current ownership of the Tartagal and Morillo (i.e., a 9% interest in the concession) to PPL for a purchase price of US$500,000. PPL had also agreed in an Undertaking to provide funds to the operating entity of Valle de Lerma (and the other concessions, if our bid had been approved) in the aggregate amount of up to US$10,000,000.

As part of PPL’s obligations under the Cooperation Agreement, PPL made partial payments of $2,000,000 in our 2012 first fiscal quarter, $999,979 in the second quarter and $499,979 in the third quarter towards the full amount of $7,000,000 provided under the Cooperation Agreement. Both parties are working to execute the full amount of PPL’s payment obligations as agreed. Further payments of $500,000, $50,000, $150,000, and $99,973 were made in January 2013, July 2014, August 2014, and November 2014, respectively. The interests in the Tartagal, Morillo, and Valle de Lerma concessions have not yet been transferred to PPL due to PPL’s payment defaults in all agreements.

For the past year, we have been in talks with PPL and a third party to settle the Cooperation Agreement as well as potentially sell a larger stake in our properties. As of April 10, 2015, we were in the process of solidifying the terms of the contract.

Estimated 2015 Capital Requirements

In the case of the Tartagal and Morillo oil and gas properties, we have carried interests; therefore, no further capital expenditures are required on our part.

Valle de Lerma’s target well, “La Troja,” has been deemed inside the city limits, and, therefore, unable to be drilled. Given the concession’s limited number of other potential “workover” drills, and the Company’s strategy to not engage in any exploratory drilling, the cost of Valle de Lerma for 2015 is expected to be US$100,000 in canons and other obligations. The Company is currently looking for buyers for the property.

| 18 |

USE OF ESTIMATES

The preparation of the financial statements requires the Company to make estimates and judgments that affect the reported amount of assets, liabilities, and expenses, and related disclosures of contingent assets and liabilities. On an on-going basis, the Company evaluates its estimates, including those related to oil and gas properties, intangible assets, income taxes and contingencies and litigation. The Company bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. In the opinion of management, all normal recurring adjustments considered necessary for a fair presentation have been included in these financial statements. Certain amounts for prior periods have been reclassified to conform to the current presentation.

Management believes that it is reasonably possible that the following material estimates affecting the financial statements could happen in the coming two years:

| ● | Reserve reports in two of the properties; | |

| ● | Cash flow from exploratory drilling in two of the properties; and | |

| ● | Future exploration and development costs that are carried. |

NEW FINANCIAL ACCOUNTING STANDARDS

For a summary of new financial accounting standards applicable to the Company, please refer to the accompanying notes to the financial statements.

Critical Accounting Policies

The Securities and Exchange Commission recently issued “Financial Reporting Release No. 60 Cautionary Advice About Critical Accounting Policies” (“FRR 60”), suggesting companies provide additional disclosures, discussion and commentary on their accounting policies considered most critical to its business and financial reporting requirements. FRR 60 considers an accounting policy to be critical if it is important to the Company’s financial condition and results of operations, and requires significant judgment and estimates on the part of management in the application of the policy.

The Company assesses potential impairment of its long-lived assets, which include its property and equipment, investments, and its identifiable intangibles such as deferred charges under the guidance of SFAS 144 “Accounting for the Impairment or Disposal of Long-Lived Assets.” The Company must continually determine if a permanent impairment of its long-lived assets has occurred and write down the assets to their fair values and charge current operations for the measured impairment.

Investments in non-consolidated affiliates – These investments consist of the Company’s ownership interests in oil and gas development and exploration rights in Argentina, net of impairment losses if any.

We evaluate these investments for impairment when indicators of potential impairment are present. Indicators of impairment include, but are not limited to, levels of oil and gas reserves, availability of pipeline (or other transportation) capacity and infrastructure and management of the operations in which the investments were made.

| 19 |

The Company accounts for stock-based compensation to non-employees under ASC 718, "Compensation-Stock Compensation" ("ASC 718"). The compensation cost of the awards is based on the grant date fair-value of these awards and recognized over the requisite service period, which is typically the vesting period. The Company uses the Black-Scholes Option Pricing Model to determine the fair-value of stock options issued for compensation.

The Company accounts for non-employee share-based awards based upon ASC 505-50, “Equity-Based Payments to Non-Employees.” ASC 505-50 requires the costs of goods and services received in exchange for an award of equity instruments to be recognized using the fair value of the goods and services or the fair value of the equity award, whichever is more reliably measurable. The fair value of the equity award is determined on the measurement date, which is the earlier of the date that a performance commitment is reached or the date that performance is complete. Generally, our awards do not entail performance commitments. When an award vests over time such that performance occurs over multiple reporting periods, we estimate the fair value of the award as of the end of each reporting period and recognize an appropriate portion of the cost based on the fair value on that date. When the award vests, we adjust the cost previously recognized so that the cost ultimately recognized is equivalent to the fair value on the date the performance is complete.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Disclosure under Item 7A is not required of smaller reporting companies.

| 20 |

Item 8. Financial Statements and Supplementary Data.

DELTA INTERNATIONAL OIL AND GAS, INC. AND SUBSIDIARIES

INDEX TO FINANCIAL STATEMENTS

| Page | |

| Reports of Independent Registered Public Accounting Firms | F-1 |

| Consolidated Balance Sheets as of December 31, 2014 and 2013 | F-2 |

| Consolidated Statements of Operations for the Years Ended December 31, 2014 and 2013 | F-3 |

| Consolidated Statement of Comprehensive Income (Loss) for the Years Ended December 31, 2014 and 2013 | F-4 |

| Consolidated Statement of Stockholders’ Equity to December 31, 2014 | F-5 |

| Consolidated Statements of Cash Flows for the Years Ended December 31, 2014 and 2013 | F-6 |

| Notes to Consolidated Financial Statements | F-7 |

| 21 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Delta International Oil & Gas, Inc.

Scottsdale, Arizona

We have audited the accompanying consolidated balance sheets of Delta International Oil & Gas, Inc. and its subsidiaries (collectively the “Company”) as of December 31, 2014 and 2013, and the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity, and cash flows for each of the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Delta International Oil & Gas, Inc. and its subsidiaries as of December 31, 2014 and 2013 and the results of their operations and their cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

April 15, 2015

| F-1 |

| DELTA INTERNATIONAL OIL & GAS INC. AND SUBSIDIARIES | ||||||||

| CONSOLIDATED BALANCE SHEETS |

| December 31, | ||||||||

| 2014 | 2013 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 1,206,177 | $ | 1,833,407 | ||||

| Receivable from sale of bidding rights and oil and gas properties (net of allowance for doubtful accounts of $3,200,069 and -0- as of December 31, 2014 and 2013, respectively) | - | 3,500,042 | ||||||

| Total current assets | 1,206,177 | 5,333,449 | ||||||

| Investment in mineral properties | 55,023 | 117,351 | ||||||

| Investments in unproved oil and gas properties | 336,383 | 1,609,889 | ||||||

| Investment in oil refinery | - | 109,452 | ||||||

| Property and equipment (net of accumulated depreciation of $16,386 and $-0- as of December 31, 2014 and 2013, respectively) | - | 61,698 | ||||||

| Other assets | 6,368 | 8,234 | ||||||

| TOTAL ASSETS | $ | 1,603,951 | $ | 7,240,073 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 13,679 | $ | 1,744 | ||||

| Accrued expenses | 57,614 | 144,000 | ||||||

| Notes payable | 15,000 | 75,000 | ||||||

| Liabilities for uncertain tax positions | 27,549 | 75,228 | ||||||

| Total current liabilities | 113,842 | 295,972 | ||||||

| Long-term deferred tax liability | - | 633,590 | ||||||

| Long-term debt payable to related parties | - | 150,655 | ||||||

| Total liabilities | 113,842 | 1,080,217 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders' Equity: | ||||||||

| Preferred stock $0.0001 par value-authorized 10,000,000 shares; no shares issued and outstanding at December 31, 2014 and 2013, respectively | - | - | ||||||

| Common stock $0.0001 par value - authorized 250,000,000 shares; 32,338,826 shares issued and outstanding at December 31, 2014 and 2013, respectively | 3,233 | 3,233 | ||||||

| Additional paid-in capital | 7,118,982 | 7,021,482 | ||||||

| Accumulated deficit | (5,100,542 | ) | (398,344 | ) | ||||

| Accumulated other comprehensive loss | (531,564 | ) | (466,515 | ) | ||||

| Total stockholders' equity | 1,490,109 | 6,159,856 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,603,951 | $ | 7,240,073 | ||||

The accompanying notes are an integral part of the consolidated financial statements

| F-2 |

DELTA INTERNATIONAL OIL & GAS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| Years ending December 31, | ||||||||

| 2014 | 2013 | |||||||

| Costs and Expenses: | ||||||||

| Impairment charge | $ | 1,119,913 | $ | - | ||||

| Allowance for bad debt | 3,200,069 | - | ||||||

| General and administrative | 769,676 | 816,477 | ||||||

| 5,089,658 | 816,477 | |||||||

| Loss from operations | (5,089,658 | ) | (816,477 | ) | ||||

| Other Income (Expense): | ||||||||

| Foreign exchange gain (loss) | (309,517 | ) | (268,764 | ) | ||||

| Interest expense | (7,413 | ) | (41,431 | ) | ||||

| Forgiveness of Debt | 70,800 | - | ||||||

| Tax refund | - | 39,316 | ||||||

| Life insurance proceeds | - | 1,000,249 | ||||||

| Other Income (expense) | (246,130 | ) | 729,370 | |||||

| Income (loss) before income taxes | (5,335,788 | ) | (87,107 | ) | ||||

| Provision (benefit) for income taxes | (633,590 | ) | - | |||||

| Net Income (loss) | $ | (4,702,198 | ) | $ | (87,107 | ) | ||

| Net income (loss) per common share: | ||||||||

| Basic and Diluted | $ | (0.15 | ) | $ | (0.00 | ) | ||

| Weighted average common shares – Basic and Diluted | 32,338,826 | 32,147,344 | ||||||

The accompanying notes are an integral part of the consolidated financial statements

| F-3 |

DELTA INTERNATIONAL OIL & GAS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| Years ending December 31, | ||||||||

| 2014 | 2013 | |||||||

| Net income (loss) | $ | (4,702,198 | ) | $ | (87,107 | ) | ||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | (65,050 | ) | (263,592 | ) | ||||

| Net change in other comprehensive income (loss) | (65,050 | ) | (263,592 | ) | ||||

| Comprehensive income (loss) | $ | (4,767,248 | ) | $ | (350,699 | ) | ||

The accompanying notes are an integral part of the consolidated financial statements

| F-4 |

DELTA INTERNATIONAL OIL AND GAS, INC. AND SUBSIDIARIES

(FORMERLY DELTA MUTUAL INC. AND SUBSIDIARIES)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

From January 1, 2013 to December 31, 2014

| Number of | Accumulated Other | |||||||||||||||||||||||

| Common | Common | Paid in | Accumulated | Comprehensive | ||||||||||||||||||||

| Shares | Stock | Capital | Deficit | Income | Total | |||||||||||||||||||

| Balance January 1, 2013 | 32,010,826 | 3,201 | 6,900,096 | (311,237 | ) | (202,923 | ) | 6,389,137 | ||||||||||||||||

| Issuance of shares for investment in mineral property | 76,000 | 7 | (7 | ) | - | |||||||||||||||||||

| Sale of shares (valued at $0.24 per share) | 252,000 | 25 | 60,455 | 60,480 | ||||||||||||||||||||

| Warrants issued for services | 60,938 | 60,938 | ||||||||||||||||||||||

| Net loss | (87,107 | ) | (87,107 | ) | ||||||||||||||||||||

| Foreign Currency Adjustment | (263,592 | ) | (263,592 | ) | ||||||||||||||||||||

| Balance December 31, 2013 | 32,338,826 | $ | 3,233 | $ | 7,021,482 | $ | (398,344 | ) | $ | (466,515 | ) | $ | 6,159,856 | |||||||||||

| Warrants issued for services | 97,500 | 97,500 | ||||||||||||||||||||||

| Net loss | (4,702,198 | ) | (4,702,198 | ) | ||||||||||||||||||||

| Foreign Currency Adjustment | (65,049 | ) | (65,049 | ) | ||||||||||||||||||||

| Balance December 31, 2014 | 32,338,826 | $ | 3,233 | $ | 7,118,981 | $ | (5,100,542 | ) | $ | (531,563 | ) | $ | 1,490,109 | |||||||||||

The

accompanying notes are an integral part of the consolidated financial statements.

| F-5 |

DELTA INTERNATIONAL OIL & GAS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Years ending December 31, | ||||||||

| 2014 | 2013 | |||||||

| Cash flows from Operating Activities: | ||||||||

| Net income (loss) | $ | (4,702,198 | ) | $ | (87,107 | ) | ||

| Allowance for doubtful accounts | 3,200,069 | - | ||||||

| Warrants issued for services | 97,500 | 60,938 | ||||||

| Reserve for impairment | 1,119,913 | - | ||||||

| Depreciation | 16,386 | - | ||||||

| Forgiveness of debt | (70,800 | ) | - | |||||

| Deferred taxes | (633,590 | ) | - | |||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Changes in operating assets and liabilities | (95,851 | ) | (217,648 | ) | ||||

| Net cash used in operating activities | (1,068,571 | ) | (243,817 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Oil and gas properties exploration and development costs | - | (115,070 | ) | |||||