SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than Registrant ¨

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material under §240.14a-12

|

|

GLOBALSCAPE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

|

Notice of 2014

|

|

Annual Meeting

|

|

of Stockholders

|

|

Proxy Statement

|

|

And

|

|

Form 10-K

|

|

For the year end December 31, 2013

|

| 4500 Lockhill-Selma, Suite 150 | San Antonio, TX 78249 |

|

To our Stockholders,

|

||

|

|

||

|

I am pleased to report that GlobalSCAPE achieved record revenues in 2013 for the | |

| fourth consecutive year and earnings per share that tied the highest in Company history. | ||

| These results allowed us to express our appreciation to our stockholders by paying a | ||

| special dividend for the second year in a row. While 2013 was a year of transition in | ||

| many ways, our employees continued our strategic mission that produced both increased | ||

| efficiency and the improved bottom-line results. | ||

| Since GlobalSCAPE’s founding in 1996, we have experienced a number of significant | ||

| organizational evolutions. Early days of the company focused on consumer innovation | ||

| and rapid product releases. This approach enabled us to achieve a great deal of brand | ||

| awareness and a very loyal following. We then added enterprise caliber products | ||

| that moved us into the realm of larger clients where security is more critical and | ||

| product quality must be more stringently monitored and delivered. This phase saw | ||

| GlobalSCAPE grow into a more mature organization with the people, processes, and | ||

| James Bindseil | technologies to meet the needs of these larger clients. We are now entering an era during | |

| (President and CEO) | which we believe it time to take GlobalSCAPE’s products and services to a new level. | |

| Moving into 2014, I look forward to a renewed dedication to the innovative spirit built by my predecessors. We have | ||

| new and exciting product development programs in place. We are broadening our sales and marketing activities to target | ||

| new customers through expanded partner alliances anddemand generation programs to supplement our established | ||

| in-house, direct sales team. We are redesigning internal processes to improve our expense control. | ||

| I am proud to serve as the President and CEO of GlobalSCAPE. I work with the finest group of people in the industry. | ||

| I look forward to making our award-winning solutions even better through innovation and leading GlobalSCAPE to | ||

| continually improving financial results. | ||

| Thank you for the support you continue to show GlobalSCAPE. I look forward to meeting you at the Annual Meeting | ||

| of Stockholders. | ||

| Sincerely, | ||

| James L. Bindseil | ||

| President and Chief Executive Officer | ||

GlobalSCAPE, Inc.

4500 Lockhill-Selma Rd, Suite 150

San Antonio, Texas 78249

(210) 308-8267

April 3, 2014

Dear Stockholders:

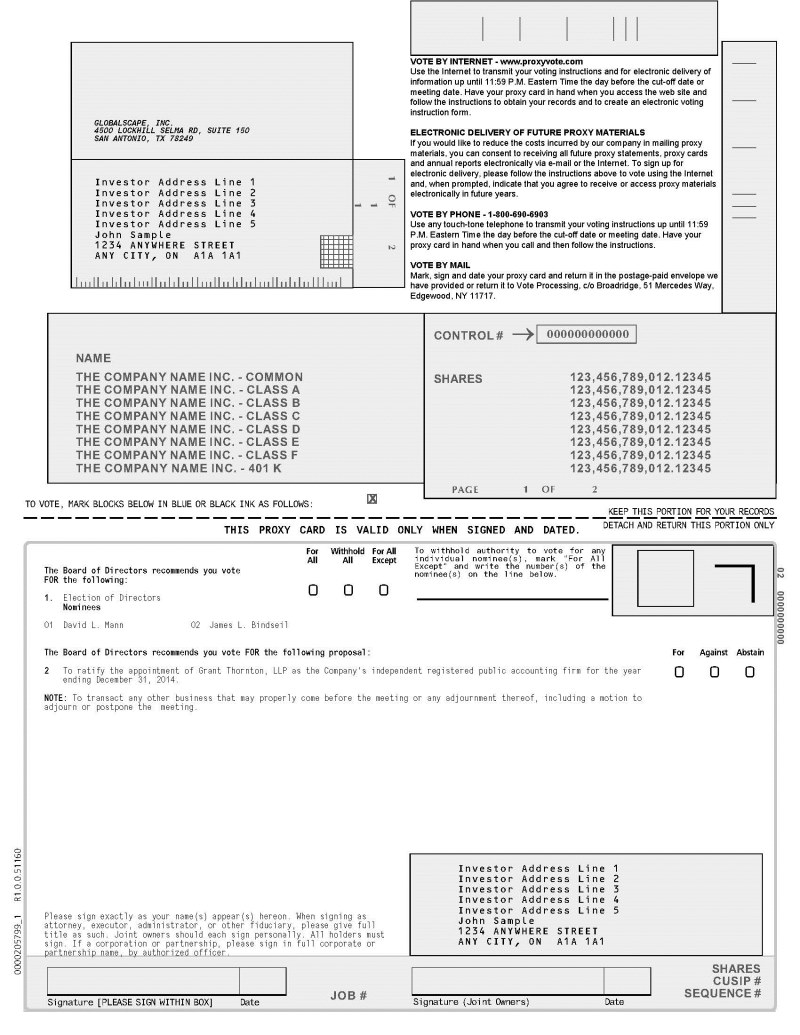

You are cordially invited to attend the 2014 Annual Meeting of Stockholders of GlobalSCAPE, Inc. to be held at GlobalSCAPE’s headquarters, 4500 Lockhill-Selma Road, Suite 150, San Antonio, TX 78249, on Wednesday, May 14, 2014 at 9:00 a.m. If you cannot attend the annual meeting, you may vote over the Internet or, if you received a paper copy of the proxy materials, you may follow the instructions on the proxy card.

The agenda for this year’s annual meeting includes:

|

·

|

The election of two directors each of whom will serve for a term of three years; and

|

|

·

|

Ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for 2014.

|

Please refer to the Proxy Statement for detailed information about each of the proposals and the annual meeting.

Every stockholder vote is important. Even if you do not plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote by signing your Proxy Card and mailing it in accordance with the instructions on the card. If you prefer, you may vote over the Internet or by telephone following the instructions on your Proxy Card. You may revoke your proxy at any time before it is voted. Of course, you may also vote in person at the stockholders meeting if you are the stockholder of record.

Sincerely,

James Bindseil

President and Chief Executive Officer

GlobalSCAPE, Inc.

4500 Lockhill-Selma Rd, Suite 150

San Antonio, Texas 78249

(210) 308-8267

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 14, 2014

To the Stockholders of GlobalSCAPE, Inc.:

The 2014 Annual Meeting of Stockholders of GlobalSCAPE, Inc. (the “Company”) will be held at the Company’s office located at 4500 Lockhill-Selma Road, Suite 150, San Antonio, Texas 78249, on May 14, 2014, at 9:00 a.m., local time, for the following purposes:

|

1.

|

To elect the following two directors to serve for a term of three years:

|

David L. Mann

James L. Bindseil

|

2.

|

To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2014; and

|

|

3.

|

To transact any other business that may properly come before the meeting or any adjournment thereof, including a motion to adjourn or postpone the meeting.

|

The foregoing items of business are described more fully in the Proxy Statement accompanying this notice.

The Company’s Board of Directors has fixed the close of business on March 21, 2014, as the record date for determining the stockholders entitled to receive notice of, and to vote at, the Annual Meeting and any adjournment thereof.

STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON.

April 3, 2014

San Antonio, Texas

By Order of the Board of Directors,

James Bindseil

President and Chief Executive Officer

Important Notice Regarding Availability of

Proxy Materials For Our Annual Meeting of Stockholders to be Held On May 14, 2014

This Proxy Statement, the form of proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, including financial statements, are available on the Internet at http://proxydocs.com/gsb.

GlobalSCAPE, Inc.

Proxy Statement

For

Annual Meeting of Stockholders

To Be Held Wednesday May 14, 2014

Table of Contents

|

Page

|

|

|

3

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

6

|

|

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

10

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

12

|

|

|

14

|

|

|

15

|

|

|

15

|

|

|

15

|

|

|

15

|

|

|

15

|

|

|

17

|

|

|

17

|

|

|

17

|

|

|

17

|

|

|

18

|

|

|

21

|

|

|

22

|

|

23

|

|

|

23

|

|

|

26

|

|

|

26

|

|

|

27

|

|

|

27

|

|

|

29

|

|

|

29

|

|

|

30

|

|

|

30

|

|

|

31

|

|

|

31

|

|

|

32

|

|

PROXY STATEMENT

|

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of GlobalSCAPE, Inc. (“GlobalSCAPE” or the “Company”) of proxies from the stockholders of GlobalSCAPE to be used at GlobalSCAPE’s 2014 Annual Meeting of Stockholders. In accordance with Securities and Exchange Commission rules, instead of mailing a printed copy of our Proxy Statement, annual report and other materials relating to the Annual Meeting to stockholders, we intend to mail a Notice of Internet Availability of Proxy Materials, which advises that the proxy materials are available on the Internet to stockholders. We intend to commence distribution of the Notice of Internet Availability on or about April 3, 2014. Stockholders receiving a Notice of Internet Availability by mail will not receive a printed copy of proxy materials unless they so request. Instead, the Notice of Internet Availability will instruct stockholders as to how they may access and review proxy materials on the Internet. Stockholders who receive a Notice of Internet Availability by mail who prefer to receive a printed copy of our proxy materials, including a proxy card or voting instruction card, should follow the instructions for requesting these materials included in the Notice of Internet Availability.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. If you previously elected to receive our proxy materials electronically, you will continue to receive these materials by e-mail unless you elect otherwise. However, if you prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

GlobalSCAPE’s 2014 Annual Meeting of Stockholders will be held at 9:00 a.m., Central Daylight Time, on May 14, 2014, at GlobalSCAPE’s office at 4500 Lockhill-Selma Road, Suite 150, San Antonio, Texas 78249. Please call us at (210) 308-8267, ext. 100, if you need assistance with directions to our office.

Record Date, Shares Entitled to Vote, Quorum

GlobalSCAPE’s Board of Directors has fixed the close of business on March 21, 2014 as the record date for GlobalSCAPE stockholders entitled to notice of and to vote at the annual meeting. As of the record date, there were 20,048,817 shares of GlobalSCAPE common stock outstanding, which were held by approximately 1,901 holders of record. Stockholders are entitled to one vote for each share of GlobalSCAPE common stock held as of the record date.

The holders of a majority of the outstanding shares of GlobalSCAPE common stock issued and entitled to vote at the annual meeting must be present in person or by proxy to establish a quorum for business to be conducted at the annual meeting. Whether you attend the meeting in person, sign and return the proxy card or vote via the Internet or telephone, your shares will be counted as present at the meeting. Abstentions and broker non-votes are included for purposes of determining whether a quorum is present at the annual meeting. If you own shares through a bank or broker in street name, you may instruct your bank or broker how to vote your shares. A “broker non-vote” occurs when you fail to provide your bank or broker with voting instructions and the bank or broker does not have the discretionary authority to vote your shares on a particular proposal because the proposal is not a routine matter under the New York Stock Exchange rules. Please consider the following voting matters specific to each proposal on the ballot:

|

·

|

Proposal 1 (election of directors) is not considered a routine matter under current New York Stock Exchange rules. Your bank or broker will not have discretionary authority to vote your shares held in street name on this item. A broker non-vote may also occur if your broker fails to vote your shares for any reason.

|

|

·

|

Proposal 2 (ratification of the appointment of our independent registered public accounting firm) is considered a routine matter under the New York Stock Exchange rules. Your bank or broker will have discretionary authority to vote your shares held in street name on that Proposal.

|

If sufficient votes for approval of the matters to be considered at the annual meeting have not been received prior to the meeting date, GlobalSCAPE may postpone or adjourn the annual meeting in order to solicit additional votes. The form of proxy being solicited by this Proxy Statement provides the authority for the proxy holders, in their discretion, to vote the stockholders’ shares with respect to a postponement or adjournment of the annual meeting. At any postponed or adjourned meeting, proxies received pursuant to this Proxy Statement will be voted in the same manner described in this Proxy Statement with respect to the original meeting.

Stockholders of Record and Beneficial Owners

Many of our stockholders hold their shares through a stockbroker, bank, or other agent rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

·

|

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC, you are considered the stockholder of record with respect to those shares. Access to our proxy materials is being provided directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the meeting.

|

|

·

|

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank, you are considered the beneficial owner of the shares held in “street name.” Access to these proxy materials is being provided by your broker who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the meeting. Your broker or nominee has enclosed a voting instruction card for your use.

|

Attendance and Voting by Proxy

If you are a stockholder whose shares are registered in your name, you may vote your shares by one of the following four methods:

|

·

|

Vote in person, by attending the Annual Meeting. We can give you a proxy card or a ballot when you arrive, if requested.

|

|

·

|

Vote by Internet, by going to the web address, http://www.proxypush.com/gsb, and following the instructions for Internet voting.

|

|

·

|

Vote by Telephone, by calling 866-390-5419

|

|

·

|

Vote by Mail, by completing, signing, dating, and mailing the proxy card mailed to you in the envelope provided. If you vote by Internet, please do not mail your proxy card.

|

The deadline for voting electronically on the Internet is 11:59 p.m., Eastern Time, on May 13, 2014. If you vote by mail, your signed proxy card must be received before the annual meeting to be counted at the annual meeting.

If your shares are held in “street name” (through a broker, bank, or other agent), you should have received a separate voting instruction form or you may vote by telephone or on the Internet as instructed by your broker or bank.

PLEASE NOTE THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER AGENT AND YOU WANT TO VOTE AT THE MEETING, YOU MUST FIRST OBTAIN A LEGAL PROXY ISSUED IN YOUR NAME FROM THE RECORD HOLDER. YOU WILL NOT BE PERMITTED TO VOTE IN PERSON AT THE MEETING WITHOUT THE LEGAL PROXY.

The proxies identified on the back of the proxy card will vote the shares of which you are stockholder of record in accordance with your instructions. If you sign and return your proxy card without giving specific voting instructions, the proxies will vote your shares as follows:

|

·

|

“FOR” the nominated slate of directors.

|

|

·

|

“FOR” the ratification of the selection of Grant Thornton LLP as GlobalSCAPE’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

|

The giving of a proxy will not affect your right to vote in person if you decide to attend the meeting.

If any matters other than those addressed on the proxy card are properly presented for action at the Annual Meeting, the persons named in the proxy card will have the discretion to vote on those matters in their best judgment unless authorization is withheld.

Revocation of Proxy

Whether you vote by Internet, by telephone, or by mail, you may change or revoke your proxy before it is voted at the meeting by:

|

·

|

Submitting a new proxy card bearing a later date.

|

|

·

|

Voting again by the Internet at a later time.

|

|

·

|

Giving written notice before the meeting to our Secretary at the address set forth on the cover of this Proxy Statement stating that you are revoking your proxy.

|

|

·

|

Attending the meeting and voting your shares in person.

|

Please note that your attendance at the meeting will not alone serve to revoke your proxy.

Quorum; Vote Requirements

Election of Directors

Directors are elected by a plurality of the votes of the holders of shares of common stock present in person or by proxy and entitled to vote on the election of directors. Under Delaware law, votes that are withheld from a director’s election will be counted toward a quorum but will not affect the outcome of the vote on the election of a director. Abstentions and broker non-votes will not be taken into account in determining the outcome of the election. Unless otherwise instructed or unless authority to vote is withheld, the proxy card accompanying these materials will be voted FOR election of each of the director nominees

Ratification of Appointment of Independent Registered Public Accounting Firm

With respect to Proposal Two, the ratification of the appointment of the Company’s independent registered public accounting firm, an abstention is treated as entitled to vote and, therefore, has the same effect as voting “against” the proposal. Since this proposal is considered a “routine” matter, brokers will be permitted to vote on behalf of their clients if no voting instructions are furnished. Unless otherwise instructed or unless authority to vote is withheld, the proxy card accompanying these materials will be voted FOR the ratification of Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal year 2014.

Other Matters

The required vote to approve any matter other than the election of directors is the affirmative vote by the holders of a majority of the total number of shares of common stock present in person or by proxy and entitled to vote on the matter.

Important Note Regarding NYSE Rules

If a broker does not receive instructions from the beneficial owner of shares held in street name for certain types of proposals, the broker must indicate on the proxy that it does not have authority to vote such shares (a “broker non-vote”) as to such proposals. Under the rules of the New York Stock Exchange, if your broker does not receive instructions from you, your broker will not be able to vote your shares in the election of directors. Therefore, it is important that you provide voting instructions to your broker.

Solicitation of Proxies

Proxies will be solicited by mail and the Internet. Proxies may also be solicited personally, or by telephone, fax, or other means by the directors, officers, and employees of GlobalSCAPE. Directors, officers, and employees soliciting proxies will receive no extra compensation but may be reimbursed for related out-of-pocket expenses. GlobalSCAPE will make arrangements with brokerage houses and other custodians, nominees, and fiduciaries to send the proxy materials to beneficial owners. GlobalSCAPE will, upon request, reimburse these brokerage houses, custodians, and other persons for their reasonable out-of-pocket expenses in doing so. GlobalSCAPE will pay the cost of solicitation of proxies.

PROPOSAL ONE

ELECTION OF DIRECTORS

GlobalSCAPE’s Articles of Incorporation divide the Board of Directors into three classes of directors serving staggered three-year terms, with one class to be elected at each annual meeting of stockholders. At this year’s meeting, two Class II directors are to be elected for a term of three years, to hold office until the expiration of their term in 2017, or until a successor shall have been elected and shall have qualified. The nominees are David L. Mann and James L. Bindseil. Mr. Mann and Mr. Bindseil are currently Class II directors. Mr. Mann is not an officer of GlobalSCAPE. Mr. Bindseil is President and Chief Executive Officer of GlobalSCAPE.

Assuming the presence of a quorum, the nominees for director who receive the most votes will be elected. The enclosed form of proxy provides a means for stockholders to vote for or to withhold authority to vote for the nominees for director. If a stockholder executes and returns a proxy, but does not specify how the shares represented by such stockholder’s proxy are to be voted, such shares will be voted FOR the election of the nominee for director. In determining whether this item has received the requisite number of affirmative votes, abstentions, and broker non-votes will not be counted and will have no effect.

The Board of Directors recommends a vote “FOR” the election of the nominees to the Board of Directors.

The following table sets forth the name and age of the nominee as of the mailing date of this Proxy Statement, the principal occupation of the nominee during at least the past five years, and the year each began serving as a director of GlobalSCAPE:

|

Name

|

Age

|

||

|

David L. Mann

|

64

|

Mr. Mann has been in the real estate development and home building business since his graduation from Southern Methodist University in 1975 where he earned a B.B.A. For the past twenty years, he has worked exclusively in the San Antonio, Texas market. Mr. Mann currently serves as a member of the Board of Directors of GlobalSCAPE and has served in such capacity since June 2002. Mr. Mann has broad business and finance experience and is our second largest stockholder. Mr. Mann’s term as a director of GlobalSCAPE expires in 2014.

|

|

|

James L. Bindseil

|

49

|

Mr. Bindseil was named to the Board of Directors in December 2013 to fill the vacancy left after the passing of Craig Robinson. His term as a director expires in 2014. For more information about Mr. Bindseil, see below under “Executive Officers.”

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE INDIVIDUALS NOMINATED ABOVE AS DIRECTORS.

Directors with Terms Expiring in 2015 and 2016

The following table sets forth the name and age of each director as of the mailing date of this Proxy Statement, the principal occupation of each director during at least the past five years and the year each began serving as a director of GlobalSCAPE.

|

Name

|

Age

|

||

|

Thomas W. Brown

|

70

|

Mr. Brown has been an independent stockbroker and investment advisor in San Antonio since 1995. He entered the securities brokerage business in 1967 after receiving an M.B.A. from Southern Methodist University. In recent years, he has also been involved in the real estate development business in San Antonio in addition to managing stock and bond investments. Mr. Brown currently serves as a member and Chairman of the Board of Directors of the Company and has served in such capacity since June 2002. Mr. Brown is an experienced investor and our largest stockholder. Mr. Brown’s term as a director of GlobalSCAPE expires in 2015.

|

|

|

Phillip M. Renfro

|

68

|

Mr. Renfro is a retired partner of the law firm of Fulbright and Jaworski, L.L.P., where from 1983 to 2005, he was division head of the Corporate, Business, and Banking Section in the firm’s San Antonio, Texas office. Prior to his career in corporate law, from 1980 to 1983, he was President and CEO of Resco International, Inc., an oil field service Company. From 2004 to 2009, Mr. Renfro served on the board of Enzon Pharmaceuticals, Inc., a publicly-traded biotech company, where he was also a member of the Audit Committee and the Governance and Nominating Committee. The Company believes that Mr. Renfro’s legal, financial and business experience, including a diversified background of managing and directing companies, give him the qualifications and skills to serve as a director. In addition, as a former member of Enzon’s audit committee and as a corporate and securities attorney, Mr. Renfro has extensive financial reporting and corporate governance experience. Mr. Renfro’s term as director of GlobalSCAPE expires in 2016.

|

|

|

Frank M. Morgan

|

65

|

Mr. Morgan is currently Executive Director, Cyber Security, for ManTech International’s MCTS Group. From 2005 to 2010, Mr. Morgan served as the Vice President and General Manager of the Information Systems Business Unit and Intelligence Solutions Division, of L-3 Communications Services Group, managing offices in Reston, Virginia, Colorado Springs, Colorado, and San Antonio, Texas. He held a similar position with Titan Corporation from 2001 to 2005 before its acquisition by L-3. From 1996 to 2001, Mr. Morgan worked for BTG, Inc. (acquired by Titan Corp.), a publicly traded software development Company and computer security product value-added reseller. As Vice President of federal sales, Mr. Morgan was responsible for marketing security products across the federal government. Mr. Morgan spent 30 years in the Air Force, retiring in 1996 as a Colonel. His assignments included three tours at the Pentagon in both operations and acquisitions. He holds a B.S. in Aeronautical Engineering from the Air Force Academy, a M.S. in Human Resources Management from the University of Utah, and a M.A. in National Security and Strategic Studies from the Naval War College. Mr. Morgan’s business experience, particularly his experience in the software industry and in government sales, provides valuable insight to our board. Mr. Morgan’s term as director of GlobalSCAPE expires in 2016.

|

Executive Officers

The following table sets forth the name, age, and position of each of our executive officers as of the mailing date of this Proxy Statement and the principal occupation of each executive officer during the past five years. Throughout this Proxy Statement, we refer to these persons collectively as our named executive officers, or NEOs.

|

Name

|

Age

|

Position

|

|

|

James L. Bindseil

|

49

|

President and Chief Executive Officer

|

Mr. Bindseil is GlobalSCAPE’s President and Chief Executive Officer. He became Interim President in September 2013 and was appointed to his current position in December 2013. He is responsible for integrating and enhancing GlobalSCAPE’s business and technical operations across all functions and markets.

Mr. Bindseil has more than 20 years of experience leading and delivering IT professional services and support for all sizes of both domestic and international businesses. Prior to joining GlobalSCAPE, from January 2009 to July 2010, Mr. Bindseil served as Vice President of Solutions Engineering and Marketing for Enterprise Business Services at Fujitsu America. Previously, from July 1999 to December 2008, he was Senior Global Technical Director for the Security Services line of business at Symantec. He also served honorably in the United States Marine Corps.

Mr. Bindseil graduated with honors from the University of Phoenix with a Bachelor of Arts degree in Management and has an Associate of Arts degree in Mathematics. He also has professional certifications from Hewlett Packard, Cisco Systems, and Microsoft, and is a Certified Information Systems Security Professional (CISSP).

|

|

James W. Albrecht, Jr.

|

59

|

Chief Financial Officer

|

Mr. Albrecht has served as GlobalSCAPE’s Chief Financial Officer since July 2012. He is responsible for our finance, accounting and treasury activities. Before joining GlobalSCAPE, from 2008 to 2012, Mr. Albrecht was Chief Executive Officer and Chief Financial Officer of Photoreflect.com, an Internet-based company that provided an online display and selling portal for professional photographers. From 1995 to 2008, Mr. Albrecht was Chief Financial Officer of Introgen Therapeutics, Inc., a biotechnology company developing gene therapies for the treatment of cancer, where he was part of the team that managed that company’s initial public offering in 2000 and subsequent trading and reporting as a public company listed on NASDAQ. He began his career at Arthur Andersen LLP where he served clients for eleven years. Mr. Albrecht regularly lectures as a faculty member at The University of Texas at Austin where he received a B.B.A. in Accounting.

|

|

Matthew C. Goulet

|

41

|

Vice President of Sales

|

Mr. Goulet has served as GlobalSCAPE’s Vice President of Sales since October 2013. He has more than 16 years of experience in the security, networking, and storage industries. From 2008 to September 2013, he was at Kaspersky Labs, an information technologies security company, most recently as the Vice President of SME sales and operations, where he helped build Kaspersky’s reseller channel.

|

Board Meetings and Attendance

During the fiscal year ended December 31, 2013, the Board of Directors held ten meetings. Separate from the full Board of Directors’ meetings, there were two Audit Committee meetings, one Compensation Committee meeting and two Nominating and Governance Committee meetings. During 2013, each director attended at least 75% of all Board and applicable Committee meetings. During 2013, our directors, received compensation for service to GlobalSCAPE as a director. See “Executive Compensation – Compensation of Directors.” GlobalSCAPE encourages, but does not require, directors to attend the annual meeting of stockholders. At GlobalSCAPE’s 2013 Annual Meeting, all members of the Board were present.

Board Leadership Structure

The Board believes it is in the best interests of the Company to separate the roles of Chief Executive Officer and Chairman of the Board. This structure ensures a greater role for the directors in the oversight of management and the Company and promotes active participation of the directors in setting meeting agendas and establishing Board priorities and procedures. Further, this structure permits the chief executive officer to focus on the management of the Company's day-to-day operations.

Board Independence

A majority of the Board has determined that Messrs. Mann, Morgan and Renfro are independent as determined in accordance with the listing standards of the NYSE MKT LLC and the Exchange Act3. All members of the Audit and Compensation Committees are “independent,” as currently defined by the Securities and Exchange Commission and the listing standards of the NYSE MKT LLC.

Committees of the Board of Directors

GlobalSCAPE has standing Audit and Compensation Committees. In 2014, GlobalSCAPE assigned the responsibilities of the Nominating and Governance Committee to the Board of Directors as a whole and disbanded that committee.

The Audit Committee is a separately-designated audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee consisted of Messrs. Mann, Morgan and Renfro in 2013 and Messrs. Mann and Morgan beginning in January 2014. Mr. Renfro served as the Audit Committee Chairman from 2006 to December 2013. Mr. Mann began service as Audit Committee Chairman in January 2014. This committee met two times during 2013. The Board has determined that Mr. Mann is an audit committee financial expert as defined by SEC rules. The Audit Committee aids management in the establishment and supervision of our financial controls, evaluates the scope of the annual audit, reviews audit results, makes recommendations to our Board regarding the selection of our independent registered public accounting firm, consults with management and our independent registered public accounting firm prior to the production of financial statements to stockholders and, as appropriate, initiates inquiries into aspects of our financial affairs. The Audit Committee Report, which appears in a subsequent section of this document, more fully describes the activities and responsibilities of the Audit Committee.

The Compensation Committee consisted of Messrs. Mann, Morgan and Renfro in 2013 and Messrs. Mann and Morgan beginning in January 2014. Mr. Morgan began service as Compensation Committee Chairman in January 2014. This committee met one time during 2013. The Compensation Committee’s role is to establish and oversee GlobalSCAPE’s compensation and benefit plans and policies, administer its stock option plans, and review and approve annually all compensation decisions relating to GlobalSCAPE’s executive officers. At least annually, our President and Chief Executive Officer submits to the Compensation Committee his recommendations as to base salary, bonus and equity incentives awards for each executive officer, except himself, for the following fiscal year based upon his subjective evaluation of their individual performance. The Compensation Committee reviews and discusses the recommendations and has the sole authority to determine the base salary, bonus, and equity incentives for the President and Chief Executive Officer.

The agenda for meetings of the Compensation Committee is determined by its Chairman. At each meeting, the Compensation Committee meets in executive session. The Compensation Committee’s Chairman reports the Committee’s recommendations on executive compensation to the Board. The Company’s personnel support the Compensation Committee in its duties and, along with the President and Chief Executive Officer, may be delegated authority to fulfill certain administrative duties regarding the compensation programs. The Compensation Committee has authority under its charter to retain, approve fees for and terminate advisors, consultants, and agents as it deems necessary to assist in the fulfillment of its responsibilities.

The Nominating and Governance Committee, which consisted of Messrs. Mann, Morgan, and Renfro met two times during 2013. The primary function of the Nominating and Governance Committee was to assist the Board in identifying, screening, and recruiting qualified individuals to become Board members and determining the composition of the Board and its committees, including recommending nominees for annual stockholders meetings or to fill vacancies on the Board. In January 2014, the Board of Directors determined that the activities and responsibilities of the Nominating and Governance Committee could be effectively executed and managed by the Board of Directors as a whole. Accordingly, the Nominating and Governance Committee was disbanded at that time.

Each of the Board’s committees has a written charter. Copies of the charters are available for review on the Company’s website at www.globalscape.com on the Investor Relations page.

Risk Management

The Company has a risk management program overseen by its president and chief executive officer and the chief financial officer. Material risks are identified and prioritized by management. Each prioritized risk is referred to a Board committee or the full Board for oversight.

The Board reviews information regarding the Company's credit, liquidity, and operations, as well as the risks associated with each. The Board also reviews and approves the annual operating budget of the Company. Because we rely on cash on hand and cash flows from operations to fund our operations, the Board as a whole devotes significant time to reviewing and approving our levels of indebtedness, contractual obligations and research and development spending. While each committee is responsible for specific risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. In addition, the Compensation Committee periodically reviews the most important risks to the Company to ensure that compensation programs do not encourage excessive risk taking.

Compensation Committee Interlocks and Insider Participation

Messrs. Mann, Morgan and Renfro served on the Compensation Committee during 2013. No member of the Compensation Committee was at any time during 2013, or any other time, an officer or employee of GlobalScape or had any relationship with GlobalScape requiring disclosure as a related-party transaction in the section “Certain Relationships and Related Transactions” of this proxy statement. No executive officer of GlobalScape has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Board of Directors or the Compensation Committee during 2013.

GlobalSCAPE has adopted a Code of Ethics that applies to all of its employees, including the president and chief executive officer and its chief financial officer. This Code is a statement of GlobalSCAPE’s high standards for ethical behavior, legal compliance, and financial disclosure. It is applicable to all directors, officers, and employees. A copy of the Code of Ethics can be found in its entirety on GlobalSCAPE’s website at www.globalscape.com. Should there be any changes to, or waivers from, GlobalSCAPE’s Code of Ethics, those changes or waivers will be posted immediately on our website at the address noted above.

Stockholder Communications with Board

The Board of Directors has a process by which stockholders may communicate with the Board of Directors. Any stockholder desiring to communicate with the Board of Directors may do so in writing by sending a letter addressed to The Board of Directors, c/o The Corporate Secretary. The Corporate Secretary has been instructed by the Board to promptly forward communications so received to the members of the Board of Directors.

Nominations

The Board of Directors is responsible for determining the slate of director nominees for election by stockholders. All director nominees are approved by the Board prior to annual proxy material preparation and are required to stand for election by stockholders at the next annual meeting. For positions on the Board created by a director’s leaving the Board prior to the expiration of his current term, whether due to death, resignation, or other inability to serve, Article III of the Company’s Amended and Restated Bylaws provides that a director elected by the Board to fill a vacancy shall be elected for the unexpired term of his predecessor in office. In December 2013, the Board elected Mr. Bindseil to fill the Board vacancy resulting from the untimely and unexpected death of Craig A. Robinson. Mr. Bindseil’s term on the Board expires in 2014.

The Board of Directors does not currently use any third-party search firm to assist in the identification or evaluation of Board member candidates. The Board of Directors may engage a third party to provide such services in the future, as it deems necessary or appropriate at the time in question.

The Board of Directors determines the required selection criteria and qualifications of director nominees based upon the needs of the Company at the time nominees are considered. A candidate must possess the ability to apply good business judgment and must be in a position to properly exercise his duties of loyalty and care. Candidates should also exhibit proven leadership capabilities, high integrity, experience with a high level of responsibility within their chosen fields, and have the ability to quickly understand complex principles of, but not limited to, business and finance. Candidates with potential conflicts of interest or who do not meet this criteria will be identified and disqualified. The Board of Directors will consider these criteria for nominees identified by the Board, by stockholders, or through some other source. When current Board members are considered for nomination for reelection, the Board of Directors also takes into consideration the member’s prior Board contributions, performance, and meeting attendance records.

The Board of Directors will consider qualified candidates for possible nomination that are recommended by stockholders, for possible nomination. Stockholders wishing to make such a recommendation may do so by sending the following information to the Board of Directors, c/o Corporate Secretary, at the address listed above: (1) name of the candidate with brief biographical information and résumé; (2) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and (3) a signed statement as to the submitting stockholder’s current status as a stockholder and the number of shares currently held. Any such nomination must comply with the advance notice provisions of our Amended and Restated Bylaws. These provisions are summarized under “Stockholder Proposals to be Presented at Next Annual Meeting” in a subsequent section of this document.

The Board of Directors conducts a process of making a preliminary assessment of each proposed nominee based upon the résumé and biographical information, an indication of the individual’s willingness to serve and other background information. This information is evaluated against the criteria set forth above as well as the specific needs of the Company at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet the needs of the Company may be invited to participate in a series of interviews, which are used for further evaluation. The Board of Directors uses the same process for evaluating all nominees, regardless of the original source of the information. The Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Board of Directors strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company's businesses.

No candidates for director nominations were submitted to the Board of Directors by any stockholder in connection with the 2014 Annual Meeting.

Composition of the Board of Directors

The Company believes that its Board as a whole should encompass a range of talent, skill, diversity, experience and expertise enabling it to provide sound guidance with respect to the Company’s operations and business goals. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of the Company. The Company’s policy is to have at least a majority of its directors qualify as “independent” as determined in accordance with the listing standards of the NYSE MKT LLC and Rule 10A-3 of the Exchange Act. The Board of Directors identifies candidates for election to the Board of Directors and reviews their skills, characteristics and experience.

The Board of Directors seeks directors with strong reputations, high integrity and experience in areas relevant to the strategy and operations of the Company, particularly in the high technology industry and complex business and financial dealings. The Board of Directors also believes that each nominee and current director has other key attributes that are important to an effective board including the ability to engage management in a constructive and collaborative fashion and a diversity of background, experience and thought.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

The following table sets forth certain information regarding ownership of our common stock as of March 21, 2014 by (i) each person known by GlobalSCAPE to be the beneficial owner of more than 5% of the outstanding shares of common stock, (ii) each director of GlobalSCAPE, (iii) the President and Chief Executive Officer, (iv) each of the named executive officers of GlobalSCAPE, and (v) all executive officers and directors of GlobalSCAPE as a group. Unless otherwise indicated in the footnotes below, each of the named persons has sole voting and investment power with respect to the shares shown as beneficially owned.

Applicable percentage ownership is based on 20,048,817 shares of common stock outstanding at March 21, 2014. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of common stock subject to options or restricted stock held by that person that are currently exercisable or will vest or are exercisable within 60 days of March 21, 2014.

The address of each beneficial owner listed in the table below is c/o GlobalSCAPE, Inc., 4500 Lockhill-Selma Rd, Suite 150, San Antonio, Texas, 78249.

|

Shares Beneficially Owned

|

|||||||||||||||||||||||||||

|

Additional

|

|||||||||||||||||||||||||||

|

Common Shares

|

Common Shares

|

||||||||||||||||||||||||||

|

Common

|

That May Be

|

That May Be

|

|||||||||||||||||||||||||

|

Shares

|

Acquired By

|

Acquired within

|

Total

|

||||||||||||||||||||||||

|

Currently

|

Exercise of

|

Total Common

|

60 Days of

|

Beneficial

|

Percentage

|

||||||||||||||||||||||

|

Owned

|

Stock Options

|

Shares Held

|

March 21, 2014

|

Ownership

|

of

|

||||||||||||||||||||||

|

Name of Beneficial Owner

|

(# of shares)

|

(# of shares)

|

(# of shares)

|

(# of shares)

|

(# of shares)

|

Class

|

|||||||||||||||||||||

|

Thomas W. Brown

|

5,748,103 | (1) (2) | 40,000 | 5,788,103 | - | 5,788,103 | 28.81 | % | |||||||||||||||||||

|

David L. Mann

|

1,797,243 | (2) | 40,000 | 1,837,243 | - | 1,837,243 | 9.15 | % | |||||||||||||||||||

|

Phillip M. Renfro

|

94,520 | (2) | 40,000 | 134,520 | - | 134,520 | 0.67 | % | |||||||||||||||||||

|

Frank M. Morgan

|

74,520 | (2) | 40,000 | 114,520 | - | 114,520 | 0.57 | % | |||||||||||||||||||

|

James L. Bindseil

|

- | 94,800 | 94,800 | - | 94,800 | 0.47 | % | ||||||||||||||||||||

|

James W. Albrecht, Jr.

|

- | 49,500 | 49,500 | - | 49,500 | 0.25 | % | ||||||||||||||||||||

|

Matthew C. Goulet

|

- | - | - | - | - | 0.00 | % | ||||||||||||||||||||

|

All directors and executive officers

as a group (6 persons) |

8,018,686 | - | 8,018,686 | 39.40 | % | ||||||||||||||||||||||

|

(1) Includes 650 shares owned by Mr. Brown’s spouse. Mr. Brown disclaims beneficial ownership of the shares owned by his spouse.

|

||||||||||||||||||||||||||||

|

(2) Includes 20,000 shares of restricted common stock.

|

||||||||||||||||||||||||||||

Equity Compensation Plan Information

The following table provides aggregate information regarding grants under all equity compensation plans of GlobalSCAPE through December 31, 2013.

|

Plan Category

|

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights

|

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

|

Number of Securities Available for Future Issuance under Equity Compensation Plans (Excluding securities Reflected in Column (A))

|

|||||||||

|

(A)

|

(B)

|

(C)

|

||||||||||

|

Equity compensation plans approved by security holders

|

3,117,745 | $ | 1.92 | 1,745,040 | ||||||||

Section 16(a) Beneficial Ownership Reporting Compliance

GlobalSCAPE believes, based solely on its review of the copies of Section 16(a) forms furnished to it and written representations from executive officers and directors (and its ten percent stockholders), that all Section 16(a) filing requirements were fulfilled on a timely basis except that Mr. Mann reported the sale under Rule 144 of 100,000 shares in December 2013 on a Form 5 filed on February 14, 2014 that should have been reported on a Form 4.

In making this disclosure, GlobalSCAPE has relied solely on written representations of its directors and executive officers (and its ten percent stockholders) and copies of the reports that they have filed with the SEC.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

Transactions in 2013

Robert Langenbahn, an Enterprise Sales Manager, earned $278,660 in base salary and commissions in 2013. Mr. Langenbahn is the son-in-law of Thomas W. Brown, our Chairman of the Board. Mr. Langenbahn’s compensation plan is comparable to and consistent with other GlobalSCAPE employees who hold a similar position.

Policy Related to Related-Person Transactions

Our Board of Directors has adopted a formal, written related-person transaction approval policy, setting forth GlobalSCAPE’s policies and procedures for the review, approval, or ratification of “related-person transactions.” For these purposes, a “related person” is a director, nominee for director, executive officer, or holder of more than 5% of our common stock, or any immediate family member of any of the foregoing. This policy applies to any financial transaction, arrangement, or relationship or any series of similar financial transactions, arrangements, or relationships in which GlobalSCAPE is a participant and in which a related person has a direct or indirect interest, other than the following:

|

·

|

Payment of compensation by GlobalSCAPE to a related person for the related person’s service in the capacity or capacities that give rise to the person’s status as a “related person”.

|

|

·

|

Transactions available to all employees or all stockholders on the same terms.

|

|

·

|

Purchases of supplies from GlobalSCAPE in the ordinary course of business at the same price and on the same terms as offered to our other customers, regardless of whether the transactions are required to be reported in GlobalSCAPE’s filings with the SEC.

|

|

·

|

Transactions, which when aggregated with the amount of all other transactions between the related person and GlobalSCAPE, involve less than $5,000 in a fiscal year.

|

Our Audit Committee is required to approve any related person transaction subject to this policy before commencement of the related-person transaction, provided that if the related person transaction is identified after it commences, it shall be brought to the Audit Committee for ratification, amendment, or rescission. The Chairman of our Audit Committee has the authority to approve or take other actions with respect to any related-person transaction that arises, or first becomes known, between meetings of the Audit Committee, provided that any action by the Chairman must be reported to our Audit Committee at its next regularly scheduled meeting.

Our Audit Committee will analyze the following factors, in addition to any other factors the members of the Audit Committee deem appropriate, in determining whether to approve a related-person transaction:

|

·

|

Whether the terms are fair to GlobalSCAPE.

|

|

·

|

Whether the transaction is material to GlobalSCAPE.

|

|

·

|

The role the related person has played in arranging the related-person transaction.

|

|

·

|

The structure of the related-person transaction.

|

|

·

|

The interest of all related persons in the related-person transaction.

|

Our Audit Committee may, in its sole discretion, approve or deny any related-person transaction. Approval of a related-person transaction may be conditioned upon GlobalSCAPE and the related person following certain procedures designated by the Audit Committee.

|

EXECUTIVE COMPENSATION

|

Compensation Discussion & Analysis

We compensate our management through a combination of base salary, incentive bonuses and long-term equity based awards in the form of stock options and stock awards. This compensation is designed to be competitive with those of a group of companies which we have selected for comparative purposes in order to attract and retain our executive officers while also creating incentives which will align executive performance with the long-term interests of our stockholders.

This section discusses the principles underlying our executive compensation policies and decisions and the most important factors relevant to an analysis of these policies and decisions. It provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our executive officers named in the Summary Compensation Table below, whom we sometimes refer to as our named executive officers, or NEOs, and places in perspective the data presented in the tables and narrative that follow.

Our Compensation Committee

Our Compensation Committee approves, implements, and monitors all compensation and awards to executive officers including the president and chief executive officer, chief financial officer, and the other NEOs. The Committee’s membership is determined by the Board of Directors and is composed of two non-management directors. The Committee has the authority to delegate any of its responsibilities to subcommittees as the Committee may deem appropriate in its sole discretion. During 2013, the Committee did not delegate any of its responsibilities.

The Committee periodically approves and adopts, or makes recommendations to the Board for, GlobalSCAPE’s compensation decisions (including the approval of grants of stock options to our NEOs). At least annually, our President and Chief Executive Officer submits to the Compensation Committee his recommendations as to base salary, bonus and equity incentive awards for each executive officer, except himself, for the following fiscal year based upon his subjective evaluation of their individual performance. The Compensation Committee reviews and discusses the recommendations and has the sole authority to determine the base salary, bonus, and equity incentives for the President and Chief Executive Officer.

The Compensation Committee reviewed all components of compensation for our executive officers, including salary, bonuses, long-term equity incentives, the dollar value to the executive, and cost to GlobalSCAPE of all perquisites and all severance and change of control arrangements. Based on this review, the Compensation Committee determined that the compensation paid to our executive officers reflected our compensation philosophy and objectives.

Compensation Philosophy and Objectives

Our underlying philosophy in the development and administration of GlobalSCAPE’s annual, incentive, and long-term compensation plans is that our compensation system should be designed to attract and retain talented executives while also creating incentives that reward performance and align the interests of our NEOs with those of GlobalSCAPE’s stockholders. Key elements of this philosophy are:

|

·

|

Establishing base salaries that are competitive with the companies in our comparative group, within GlobalSCAPE’s budgetary constraints and commensurate with GlobalSCAPE’s salary structure.

|

|

·

|

Rewarding our NEOs for outstanding Company-wide performance as reflected by financial measures, such as sales revenue or net income, or other goals, such as the consummation of an acquisition and product delivery as well as customer and employee satisfaction and compliance with regulatory requirements.

|

|

·

|

Providing equity-based incentives for our NEOs to ensure that they are motivated over the long term to respond to GlobalSCAPE’s business challenges and opportunities as owners rather than just as employees.

|

Attracting and Retaining Executive Talent.

As a small company, we recognize salary is one component in successfully attracting and retaining talented executives who will help the Company grow. Being mindful of our budgetary responsibilities, we generally set our base salaries at levels we believe are competitive relative to comparable companies in our industry that are in our general geographic area. We use third-party services that gather and report base salary, incentives, equity, and total compensation information for multiple companies. The services we use include Equilar Executive Compensation Survey, Salary.com Small Business Compensation Solutions and Kenexa CompAnalyst. We use these services because we believe they provide information relevant to the industry and geographic areas in which our personnel work. This comparison allows us to create competitive total compensation packages for our executive team. Annual adjustments are considered and based on the Company’s ability to achieve pre-established revenue and profitability goals.

Rewarding Performance.

We reward outstanding performance with cash bonuses that are based on financial measures, such as sales revenue or net income, or other goals, such as the consummation of an acquisition or product delivery. For more information on our bonus program, refer to “Elements of Executive Compensation—Incentive Compensation.”

Aligning Executive and Stockholder Interests.

We believe that equity-based compensation provides an incentive to our NEOs to build value for our Company over the long term and aligns the interests of our NEOs and stockholders. We use stock options because we believe such options will generate value to the recipient only if our stock price increases during the term of the option. The stock options granted to our NEOs vest solely based on the passage of time, other than in the event of a change of control. We believe that time-vested equity awards encourage long-term value creation and executive retention because executives can realize value from such rewards only if they remain employed by us until the awards vest.

Elements of Executive Compensation

The compensation currently paid to GlobalSCAPE’s executive officers consists of four core elements:

|

·

|

Base salary. |

|

·

|

Bonuses under a performance-based, non-equity incentive plan. |

|

·

|

Stock option awards granted pursuant to our 2010 Employee Long-Term Equity Incentive Plan, which we refer to as the 2010 Employee Plan.

|

|

·

|

Other employee benefits available to all employees of GlobalSCAPE.

|

We believe these elements support our underlying philosophy of attracting and retaining talented executives while remaining within our budgetary constraints, creating cash incentives that reward Company-wide and individual performance, and aligning the interests of our NEOs with those of GlobalSCAPE’s stockholders by providing the NEOs with equity-based incentives to ensure motivation over the long term. We view the four core elements of compensation as related but individually distinct. Although we review total compensation, we do not believe that significant compensation derived from one component should increase or reduce compensation from another component. We determine the appropriate level for each component of compensation separately. We have not adopted any formal or informal policies or guidelines for allocating compensation among long-term incentives and annual base salary and bonuses, between cash and non-cash compensation, or among different forms of non-cash compensation. We consider the experience, tenure, and seniority of each named executive officer in making compensation decisions.

GlobalSCAPE does not have any deferred compensation programs or supplemental executive retirement plans. No perquisites are provided to GlobalSCAPE’s executive officers that are not otherwise available to all employees of GlobalSCAPE. No perquisites are valued in excess of $10,000 per employee.

Base Salary. Being mindful of our budgetary responsibilities, the base salary for all GlobalSCAPE NEOs are targeted at levels we believe are competitive relative to a comparative group of the companies in our general industry and geographic region. This approach enables us to attract and retain the necessary talent a small competitive company needs to grow. This salary structure is reviewed at least annually, and more frequently if warranted, to ensure its competitiveness within our peer group. Adjustments are determined initially by our President and Chief Executive Officer with final approval by the Compensation Committee before being implemented. The composite average increase in base salaries for all Company employees, including NEOs, during 2013 was 3.0%.

Incentive Compensation. The Compensation Committee believes that paying incentive compensation in the form of bonuses or commissions helps create financial incentives for our NEOs that are tied directly to goals that best reflect their respective duties and responsibilities or the achievement of certain goals. The Compensation Committee approves the plans under which bonuses and commissions are paid and may, at its discretion, modify the goals and objectives upon which these payments are based, pay bonuses if such goals are not met, or increase or decrease the amounts paid..

If certain target levels of revenue and net income were achieved for 2013, Mr. Bindseil and Mr. Robinson’s estate were eligible for annual bonuses equal to 40% of their base salaries and Mr. Albrecht was eligible for an annual bonus equal to 35% of his base salary. If actual revenue and net income fall below the target levels, the base bonuses are reduced on a sliding scale by specified percentages to a point where if less than 85% of the target levels of revenue and net income are achieved, no bonus is earned. If actual revenue and net income exceed the target levels, the base bonuses are increased on a sliding scale by specified percentages of up to 200%. The bonus eligibility for Messrs. Robinson and Albrecht was specified in their employment agreements. The bonus for Mr. Bindseil was not specified in his employment agreements. The bonuses paid to Mr. Bindseil and Mr. Robinson’s estate were prorated in accordance with the respective period of time they served as our President and Chief Executive Officer. For 2013, the Company did not achieve 85% of the net income target and achieved 84.9% of the revenue target. In light of these results, the Compensation Committee exercised its discretion and made a bonus payment of $16,861 to Mr. Bindseil, $10,200 to Mr. Robinson’s estate and $16,861 to Mr. Albrecht.

Mr. Goulet is paid a sales commission each month at a base rate ranging from 1.1% to 1.4% of sales invoiced. These rates can increase or decrease based on actual sales results relative to stated sales quotas.

Long-Term Equity Incentive Plan. GlobalSCAPE’s 2010 Employee Long Term Equity Incentive Plan, or 2010 Employee Plan, was approved by our stockholders in 2010. This plan authorizes us to grant incentive stock options, non-qualified stock options, and shares of restricted stock to our NEOs, as well as to all employees of GlobalSCAPE. A total of 3,000,000 shares of common stock are reserved for issuance under this plan. We use stock options as a form of long-term compensation because we believe that stock options motivate our NEOs to exert their best efforts on behalf of our stockholders and align the interests of our NEOs with our stockholders. Vesting is accelerated in certain events described under “Employment Agreements and Potential Payments Upon Termination or Change in Control.”

The purpose of the 2010 Employee Plan is to employ and retain qualified and competent personnel and to promote the growth and success of GlobalSCAPE, which can be accomplished by aligning the long-term interests of the NEOs with those of the stockholders by providing the NEOs an opportunity to acquire an equity interest in GlobalSCAPE. All grants are made with an exercise price equal to the closing price of our common stock on the date of grant. On their date of hire and generally each year thereafter, our NEOs are granted options to purchase shares. These options generally vest ratably over three years from the option grant date. Options granted on the date of hire and each year thereafter generally may each be for the purchase of up to an additional 100,000 shares of our common stock with the exact number determined at the discretion of the Compensation Committee and Board of Directors based upon input from our President and Chief Executive Officer. We do not time stock option grants in coordination with the release of material non-public information.

Other Employee Benefits. GlobalSCAPE’s NEOs are eligible to participate in all of our employee benefit plans, such as medical, dental, group life, and long-term disability insurance on the same basis as other employees. GlobalSCAPE’s NEOs are eligible to participate in our 401(k) plan on the same basis as other employees. GlobalSCAPE’s Board of Directors, at its sole discretion, may authorize GlobalSCAPE to make matching cash contributions (in part or in whole) each year to the 401(k) on behalf of our employees.

Compensation Policies and Practices

The Compensation Committee has conducted an in-depth risk assessment of the Company’s compensation policies and practices in response to public and regulatory concerns about the link between incentive compensation and excessive risk taking by companies. The Compensation Committee concluded that our compensation policy does not motivate imprudent risk taking. In this regard, the Compensation Committee believes that:

|

·

|

The Company’s annual incentive compensation is based on performance metrics that promote a disciplined approach towards the long-term goals of the Company;

|

|

·

|

The Company does not offer significant short-term incentives that might drive high-risk investments at the expense of the long-term value of the Company;

|

|

·

|

The Company’s compensation programs are weighted towards offering long-term incentives that reward sustainable performance, especially when considering the company’s stock ownership guidelines for executive officers;

|

|

·

|

The Company’s compensation awards are capped at reasonable levels, as determined by a review of the Company’s financial position and prospects, as well as the compensation offered by companies in our industry; and

|

|

·

|

The Board’s high level of involvement in approving our operating budget, material investments and capital expenditures help avoid imprudent risk taking.

|

The Company’s compensation policies and practices were evaluated to ensure that they do not foster risk taking above the level of risk associated with the Company’s business. The Company and the Compensation Committee concluded that the Company has a balanced pay and performance program and that the risks arising from its compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Impact of Regulatory Requirements

Deductibility of Executive Compensation. Federal income tax laws limit the deductions a publicly-held company is allowed for compensation paid to the chief executive officer and to the four most highly compensated executive officers other than the chief executive officer. Generally, amounts paid in excess of $1.0 million to a covered executive, other than performance-based compensation, cannot be deducted. In order to constitute performance-based compensation for purposes of the tax law, stockholders must approve the performance measures. Since GlobalSCAPE does not anticipate that the compensation for any executive officer will exceed the $1.0 million threshold in the near term, stockholder approval necessary to maintain the tax deductibility of compensation at or above that level is not being requested. We will reconsider this matter if compensation levels approach this threshold in light of the tax laws then in effect. We will consider ways to maximize the deductibility of executive compensation, while retaining the discretion necessary to compensate executive officers in a manner commensurate with performance and the competitive environment for executive talent.

Policy on Recovery of Compensation. Our President and Chief Executive Officer and Chief Financial Officer are required to repay certain bonuses and stock-based compensation they receive if we are required to restate our financial statements as a result of misconduct as required by Section 304 of the Sarbanes-Oxley Act of 2002.

Risk Considerations in our Compensation Program

The Compensation Committee has reviewed the Company’s compensation policies and practices in response to current public and regulatory concern about the link between incentive compensation and excessive risk-taking by corporations. The Committee concluded that the Company’s compensation program does not motivate imprudent risk taking and that any risks taken resulting from compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. In reaching this conclusion, the Committee determined the following:

|

·

|

The Company’s annual incentive compensation is based on balanced performance metrics that promote progress towards longer-term Company goals.

|

|

·

|

The Company’s compensation programs are capped at reasonable levels, as determined by a review of the Company’s budgetary constraints, economic position and prospects, as well as the compensation offered by comparable companies.

|

|

·

|

The oversight of the Compensation Committee in the operation of incentive plans and the high level of board involvement in approving material use of Company resources adequately mitigates imprudent risk-taking.

|

Compensation Committee Report

The Compensation Committee of GlobalSCAPE reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Accordingly, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

This report is submitted by the members of the Compensation Committee, which consists of the following directors:

|

·

· |

Frank M. Morgan (Chairman of the Compensation Committee)

David L. Mann

|

Summary Compensation Table

The following table summarizes compensation that GlobalSCAPE paid to our Chief Executive Officers and the next two, most highly compensated NEOs for the fiscal years ended December 31, 2013 and 2012.

|

Name & Principal Position

|

Year

|

Salary

|

Bonus

|

Option Awards (1)

|

Non-Equity

Incentive Plan

Compensation

|

All Other

Compensation (4)

|

Total

|

|||||||||||||||||||

|

James Bindseil

|

2013

|

$ | 225,802 | $ | 16,861 | $ | 65,095 | $ | - | $ | 18,222 | $ | 325,980 | |||||||||||||

|

President and Chief Executive Officer (2)

|

2012

|

172,534 | 9,450 | 41,575 | 5,003 | 19,269 | 247,831 | |||||||||||||||||||

|

Craig Robinson

|

2013

|

212,826 | - | - | 10,200 | 85,002 | 308,028 | |||||||||||||||||||

|

Former President and Chief Executive Officer (2)

|

2012

|

250,000 | - | - | 36,300 | 24,986 | 311,286 | |||||||||||||||||||

|

James W. Albrecht, Jr. (3)

|

2013

|

224,269 | 16,861 | - | - | 15,341 | 256,471 | |||||||||||||||||||

|

Chief Financial Officer

|

2012

|

94,269 | - | 166,893 | 13,657 | 5,604 | 280,423 | |||||||||||||||||||

|

Doug Conyers

|

2013

|

179,230 | 25,200 | - | - | 188,860 | (5) | 393,290 | ||||||||||||||||||

|

Former Senior Vice President of Engineering

|

2012

|

170,000 | 23,800 | - | 12,599 | 15,824 | 222,223 | |||||||||||||||||||

|

Chris Hopen

|

2013

|

206,354 | - | - | - | 117,940 | (5) | 324,294 | ||||||||||||||||||

|

Former President, TappIn, Inc.

|

2012

|

200,000 | - | - | - | 17,101 | 217,101 | |||||||||||||||||||

|

(1)

|

These amounts represent the aggregate grant date fair value of stock option awards for fiscal years 2013 and 2012 calculated as described in our accounting policy for stock-based compensation in footnote 2 to our Consolidated Financial Statements included in our Form 10-K as of December 31, 2013, and for the year then ended filed with the Securities and Exchange Commission. These amounts do not necessarily represent the actual amounts paid to or realized by the named executive officer for these awards during fiscal years 2013 or 2012. These amounts are recognized as an expense in our financial statements over the period of service required for the grant to become vested which is generally three years.

|

|

(2)

|

Mr. Robinson was our President and Chief Operating Officer until January 2013 at which time our Board of Directors appointed him President and Chief Executive Officer, the position he held until his untimely and unexpected death in September 2013. Mr. Bindseil was appointed our President and Chief Executive Officer in October 2013.

|

|

(3)

|

Mr. Albrecht’s salary in 2012 is the amount he was paid from his July 10, 2012 date of hire.

|

|

(4)

|

Primarily 401k matching contributions and group health plan premiums.

|

|

(5)

|

For Messers Conyers and Hopen, all other compensation includes a severance payment made in connection with their separation of service from the Company.

|

Relationship of Salary and Annual Incentive Compensation to Total Compensation

The following table sets forth the relationship of salary and annual incentive compensation to total compensation for our NEOs for 2013.

|

Executive

|

Percentage of Salary to Total Compensation

|

Percentage of Annual Cash Incentive Payment to Total Compensation

|

||||||

|

James L. Bindseil

|

73.4 | % | 5.5 | % | ||||

|

Craig A. Robinson

|

72.8 | % | 3.5 | % | ||||

|

James W. Albrecht, Jr.

|

93.0 | % | 7.0 | % | ||||

|

Doug Conyers

|

46.6 | % | 6.6 | % | ||||

|

Chris Hopen

|

67.4 | % | 0.0 | % | ||||

Employment Agreements and Potential Payments Upon Termination or Change in Control