UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the Month of November 2011

(Commission File. No 0-30718).

SIERRA WIRELESS, INC., A CANADIAN CORPORATION

(Translation of registrant’s name in English)

13811 Wireless Way

Richmond, British Columbia, Canada V6V 3A4

(Address of principal executive offices and zip code)

Registrant’s Telephone Number, including area code: 604-231-1100

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

|

|

Form 20-F |

o |

40-F |

x |

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

|

|

Yes: |

o |

No: |

x |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Sierra Wireless, Inc. | |

|

|

| |

|

|

|

|

|

|

By: |

/s/ David G. McLennan |

|

|

| |

|

|

David G. McLennan, Chief Financial Officer and Secretary | |

Date: November 8, 2011

Report to Shareholders

We were encouraged with the progress the company made in the third quarter of 2011. Profitability improved significantly compared to the previous two quarters driven by improvements in product costs and operating expenses, and we achieved these gains while successfully launching a number of important new 4G LTE products. Despite our third quarter revenue being slightly lower than our expectations, our development and launch execution was strong and the key drivers of our longer term strategy that position the company for sustainable, profitable growth remain intact.

Revenue in the third quarter 2011 was $146.8 million, representing sequential growth of 5% compared to the second quarter. Compared to the third quarter of 2010, revenue declined by 15% from $172.7 million. This year-over-year decline was principally driven by the loss of revenue from two large customers earlier this year, who together accounted for just over $30 million in revenue in third quarter of 2010. Excluding sales to these two customers, revenue in the third quarter increased 3% on a year-over-year basis, driven by steady year-over-year growth in our core M2M business of 15%, as well as significant growth in revenue from PC OEMs.

Non-GAAP gross margin improved to 29.6% in the third quarter compared to 28.0% in the second quarter of 2011. The sequential improvement in gross margins reflects continued ASP discipline, along with significant progress in product cost reductions. Non-GAAP operating expenses also improved significantly to $39.4 million — comparing well to $40.0 million in the second quarter of 2011. Our sequential reduction in operating expense was, like gross margin, better than expected, and was driven primarily by an intense focus on cost management, the deferral of certain launch related costs to the fourth quarter and a modest favorable impact of a stronger U.S. dollar. Improved gross margin, combined with lower operating expenses, led to significantly stronger than expected non-GAAP earnings from operations of $4.0 million.

Machine-to-Machine

In our M2M business, we had another strong quarter in Q3 and we continue to make solid progress on strategic initiatives: building on our leadership position and expanding our role in the value chain.

We are strong believers in the long term growth potential of M2M and the vision of a connected world. A recent report by Machina Research predicts that world-wide cellular connected devices will number over 2 billion by the year 2020; a stark comparison to the estimated 135 million connected devices that exist today. While our M2M success is broad based, we are particularly focused on three key segments that offer exciting prospects — Automotive, Energy and Networking.

In Automotive, we believe that the connected car has arrived and we are the market leader in this segment. We are deeply engaged in development activities with a number of car-makers and their Tier 1 suppliers and are focused on the emerging demand for solutions that support safety and emergency response, intelligent navigation, telematics and even streaming media.

In Energy, our focus is driven by the acceleration of smart metering and smart grid developments around the world that capture and monitor real-time data that enable demand management and other value added services.

In Networking, we are leveraging our deep 4G LTE expertise into solutions that, for the first time, enable a powerful alternative to wired networking; both as a backup to current wired systems and ultimately as a replacement.

Our 4G LTE embedded module development progressed well in the third quarter. Our AirPrime MC7700 and MC7750 embedded wireless modules were certified on the AT&T and Verizon networks respectively; an achievement that gives OEMs an opportunity to provide a choice of 4G LTE network services with their products.

Perhaps our most exciting opportunity in M2M is to leverage our leadership in the devices category to develop our vision of becoming the end-to-end platform of choice for OEM’s, integrators and operators around the world. Our AirVantage cloud platform is a key enabler of this vision. AirVantage integrates with all of our devices, seamlessly connects to global wireless networks, and provides essential features such as device, asset and subscription management, along with a powerful toolset to rapidly create and deploy applications. While we are early in the commercial development stage, we continue to make good progress and are now partnered with leading wireless operators such as AT&T, Verizon, Vodafone, Telstra, Orange, Telenor and KPN.

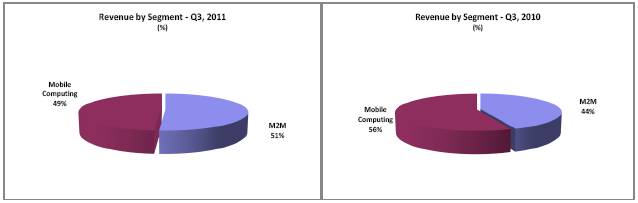

Sales in our M2M business were $75.3 million in the third quarter 2011, down modestly from the $76.1 million recorded in the third quarter of 2010, despite the absence of sales to a single large e-book reader customer that occurred in 2010. Excluding sales to this customer, our core M2M revenue grew by 15% year-over-year. M2M represented 51% of consolidated revenue in the quarter.

Mobile Computing

In our Mobile Computing business, we successfully executed the launch of our next generation 4G LTE AirCard products during the third quarter. The launches cover multiple products on multiple networks and early reviews of the products have been excellent. As a result of these product launches, we believe that we have strengthened our channel share at key operators and are in a good position to drive growth as our operator partners expand their 4G LTE networks.

At AT&T, we are the chosen launch partner for data devices on their new 4G LTE network which launched in September. AT&T is promoting our LTE hotspot, the Elevate 4G, along with our LTE USB modem, the USB Connect Momentum 4G across the US. The AT&T 4G LTE network is continuing to expand, with service in nine markets today, expanding to 15 by the end of the year, providing service to areas with population exceeding 70 million.

We also launched our first 4G LTE product on Telstra’s new network. The AirCard 320U is early in its distribution but is receiving a solid sales ramp. The launch of a 4G LTE hotspot for Telstra will not be far behind. And while the roll out of our new 4G LTE product progresses, sales of our existing Dual-Carrier, HSPA+ hotspot and USB modem were strong.

We leveraged our 4G LTE development investment into other markets as well. In Canada, we secured new channel positions with both Rogers and Bell; launching our AirCard 313U wireless modems on their growing LTE networks.

We continue to view embedded modules for the PC OEM segment as another growth opportunity in the mobile computing segment opportunity. While somewhat flat sequentially, Q3 revenue from this customer segment was up 61% on a year-over-year basis. We now have design wins with several market leaders such as Lenovo, HP, Fujitsu, Panasonic, Sony and others. During Q3, we launched our first LTE enabled notebook platform with Sony on the DoCoMo network in Japan.

Sales in our Mobile Computing business were $71.5 million in the third quarter of 2011, down 26% from $96.6 million in the third quarter of 2010. Almost $20 million of this reduction was due to the absence of revenue from one customer compared to the third quarter of 2010. Excluding the effects of this one customer, AirCard products were down 14% year-over-year, a result primarily of a slowing of orders from some operators as they work to tighten up inventory levels. The decline was partially offset by the continued ramp of sales to PC OEMs, which reached $9.8 million in the third quarter, up 61% year-over-year.

Outlook

While we made strong progress on strategy execution in the third quarter, our revenue performance was below our expectations as the sales ramp of our new 4G LTE AirCards is occurring more slowly than anticipated. However, in spite of these short-term challenges, we are continuing to drive our strategy forward. We are leveraging our advantages and differentiation to build a clear leadership position in the growing M2M market. Our investments in expanding our position in the M2M value chain are also yielding important results. Additionally, our leading edge 4G development efforts have resulted in important new products, launch commitments with strategic network operators, channel share gains and design wins with leading PC and Networking OEMs.

Overall, I continue to be excited about the prospects for Sierra Wireless and believe the company has the foundation necessary to drive sustainable, profitable growth. I thank you for your continued support and look forward to reporting to you on our achievements in the coming quarters.

Jason W. Cohenour

President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this letter constitute forward-looking statements or forward-looking information and, in this regard, you should read carefully the “Cautionary Note Regarding Forward-Looking Statements” in the attached Management’s Discussion & Analysis.

Table of Contents

|

|

Page |

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

1 |

|

|

|

|

Cautionary Note Regarding Forward Looking Statements |

2 |

|

|

|

|

Overview |

3 |

|

|

|

|

Consolidated Results of Operations |

5 |

|

|

|

|

Segmented Results |

10 |

|

|

|

|

Liquidity and Capital Resources |

13 |

|

|

|

|

Summary of Quarterly Results of Operations |

15 |

|

|

|

|

Non-GAAP Measures |

16 |

|

|

|

|

Critical Accounting Policies and Estimates |

17 |

|

|

|

|

Impact of Accounting Pronouncements Affecting Future Periods |

17 |

|

|

|

|

Internal Control Over Financial Reporting |

18 |

|

|

|

|

Legal Proceedings |

18 |

|

|

|

|

Risks and Uncertainties |

20 |

|

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS |

27 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) provides information for the three and nine months ended September 30, 2011, and up to and including November 7, 2011. This MD&A should be read together with our unaudited interim consolidated financial statements for the three and nine month periods ended September 30, 2011 and September 30, 2010, and our audited annual consolidated financial statements and the accompanying notes for the year ended December 31, 2010 (the “consolidated financial statements”). The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Except where otherwise specifically indicated, all amounts in this MD&A are expressed in United States dollars.

We have prepared this MD&A with reference to National Instrument 51-102 “Continuous Disclosure Obligations” of the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, we are permitted to prepare this MD&A in accordance with the disclosure requirements of Canada, which requirements are different than those of the United States.

Certain statements in this MD&A constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws. You should carefully read the cautionary note in this MD&A regarding forward-looking statements and should not place undue reliance on any such forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”.

Throughout this document, references are made to certain non-GAAP financial measures that are not measures of performance under U.S. GAAP. Management believes that these non-GAAP measures provide useful information to investors regarding the Company’s financial condition and results of operations as they provide additional measures of its performance. These non-GAAP measures do not have any standardized meaning prescribed by U.S. GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers. These non-GAAP measures are defined and reconciled to their nearest GAAP measure in “Non-GAAP Measures”.

Additional information about the Company, including our most recent consolidated financial statements and our Annual Information Form, is available on our website at www.sierrawireless.com, or on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Cautionary Note Regarding Forward-looking Statements

Certain statements and information in this MD&A are not based on historical facts and constitute forward-looking statements or forward-looking information within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities laws (“forward-looking statements”), including our business outlook for the short and longer term and our strategy, plans and future operating performance. Forward-looking statements are provided to help you understand our views of our short and longer term prospects. We caution you that forward-looking statements may not be appropriate for other purposes. We will not update or revise our forward-looking statements unless we are required to do so by securities laws. Forward-looking statements:

· Typically include words and phrases about the future such as “outlook”, “may”, “estimates”, “intends”, “believes”, “plans”, “anticipates” and “expects”;

· Are not promises or guarantees of future performance. They represent our current views and may change significantly;

· Are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect:

· Our ability to develop, manufacture and sell new products and services that meet the needs of our customers and gain commercial acceptance;

· Our ability to continue to sell our products and services in the expected quantities at the expected prices and expected times;

· Expected transition period to our 4G products;

· Expected cost of goods sold;

· Expected component supply constraints;

· Our ability to “win” new business;

· That wireless network operators will deploy next generation networks when expected;

· Our operations are not adversely disrupted by component shortages or other development, operating or regulatory risks; and

· Expected tax rates and foreign exchange rates.

· Are subject to substantial known and unknown material risks and uncertainties. Many factors could cause our actual results, achievements and developments in our business to differ significantly from those expressed or implied by our forward-looking statements, including, without limitation, the following factors, most of which are discussed in greater detail under “Risks and Uncertainties” and in our other regulatory filings with the U.S. Securities and Exchange Commission (the “SEC”) in the United States and the provincial securities commissions in Canada.

· Actual sales volumes or prices for our products and services may be lower than we expect for any reason including, without limitation, the continuing uncertain economic conditions, price and product competition, different product mix, the loss of any of our significant customers, or competition from new or established wireless communication companies;

· The cost of products sold may be higher than planned or necessary component supplies may not be available, are delayed or are not available on commercially reasonable terms;

· We may be unable to enforce our intellectual property rights or may be subject to litigation that has an adverse outcome;

· The development and timing of the introduction of our new products may be later than we expect or may be indefinitely delayed; and

· Transition periods associated with the migration to new technologies may be longer than we expect.

Investors are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results.

OVERVIEW

Business Overview

Sierra Wireless Inc. (“Sierra Wireless” or the “Company”) is a global leader in the development of wireless technologies and solutions. We focus on wireless devices and applications, offering a comprehensive portfolio of products and services that reduce complexity for our customers. With sales, engineering, and research and development teams located in offices around the world, we provide leading edge wireless solutions for the machine-to-machine (“M2M”) and mobile computing markets. We develop and market a range of products that include wireless modems for mobile computers, embedded modules and software for original equipment manufacturers (“OEMs”), intelligent wireless gateway solutions for industrial, commercial and public safety applications, and an innovative platform for delivering device management and end-to-end application services. We also offer professional services to OEM customers during their product development and launch process, leveraging our expertise in wireless design, software, integration and certification to provide built-in wireless connectivity for mobile computing devices and M2M solutions. Our products, services and solutions connect people, their mobile computers and machines to wireless voice and data networks around the world.

We believe that the markets for wireless solutions in mobile computing and M2M have strong growth prospects. We believe that the key growth enablers for these markets include the continued deployment and upgrade of wireless networks around the world, growth in the number and type of devices being wirelessly connected, a growing strategic focus on M2M services by wireless operators, and an expanding end customer awareness of the availability of such services and their benefits.

While the design and manufacture of mobile computing devices continues to be important to our business, our expansion by acquisition and organic development into M2M now makes us a global leader in this market, placing us in a strong position to benefit from the anticipated growth in both the wireless M2M and mobile computing markets. Our acquisitions have also diversified our revenue base, broadened our product offerings and increased our scale and capabilities throughout the world.

Our line-up of M2M wireless solutions is used by a wide range of OEMs and enterprises to wirelessly enable their products and solutions. Our M2M customers cover a broad range of industries, including automotive, networking equipment, energy, security, sales and payment, industrial control and monitoring, fleet management, field service, healthcare and consumer electronics. Our mobile computing products are used by businesses and consumers to enable mobile broadband access to the Internet, e-mail, remote databases and corporate and consumer applications.

We sell our products primarily through indirect channels including wireless operators, distributors and value-added resellers, as well as directly to OEMs and enterprises.

Key factors that we expect will affect our results in the near term are general economic conditions in the markets we serve, seasonality in demand, the relative competitive position of our products within sales channels in any given period, the relative competitive position of our customers versus their direct competitors, the availability of components from key suppliers, timing of deployment of mobile broadband networks by wireless operators, wireless technology transitions, the rate of adoption by end-users, the timely launch and ramp up of sales of our new products currently under development, the level of success our OEM customers achieve with sales of embedded solutions to end users and our ability to secure future design wins with both existing and new OEM customers. We expect that product and price competition from other wireless device manufacturers will continue to be intense. As a result of these factors, we may experience volatility in our results on a quarter to quarter basis.

Third Quarter Overview

Third quarter 2011 profitability improved compared to the prior quarter. Revenue improved as a result of new 4G AirCard® launches with leading mobile network operators, we experienced lower operating expenditures and gross margins improved largely due to product cost reductions.

Highlights for the third quarter:

· Revenue was $146.8 million, approximately 5% higher than the second quarter

· Gross margin increased to 29.5%, up from 28.0% in the second quarter

· Non-GAAP earnings from operations of $4.0 million and diluted earnings per share of $0.15 improved significantly from Non-GAAP loss of $0.8 million and diluted loss per share of $0.03 in the second quarter.

· Net loss was $1.0 million and diluted loss per share was $0.03, an improvement from net loss of $6.8 million and diluted loss per share of $0.22 in the second quarter.

· M2M represented 51% of sales and core M2M revenue grew 15% year-over-year

Selected financial information:

(in thousands of U.S. dollars, except where otherwise stated)

|

|

|

2011 |

|

2010 |

| ||||||||||||||

|

|

|

YTD |

|

Q3 |

|

Q2 |

|

YTD |

|

Q3 |

|

Q2 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Revenue (GAAP and Non-GAAP) |

|

$ |

430,990 |

|

$ |

146,827 |

|

$ |

139,888 |

|

$ |

483,165 |

|

$ |

172,732 |

|

$ |

159,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gross Margin |

|

$ |

121,898 |

|

$ |

43,334 |

|

$ |

39,100 |

|

$ |

141,498 |

|

$ |

48,954 |

|

$ |

46,210 |

|

|

- Non-GAAP (1) |

|

122,197 |

|

43,423 |

|

39,197 |

|

141,868 |

|

49,065 |

|

46,334 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gross Margin % |

|

28.3 |

% |

29.5 |

% |

28.0 |

% |

29.3 |

% |

28.3 |

% |

29.0 |

% | ||||||

|

- Non-GAAP (1) |

|

28.4 |

% |

29.6 |

% |

28.0 |

% |

29.4 |

% |

28.4 |

% |

29.1 |

% | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Earnings (loss) from operations |

|

$ |

(17,447 |

) |

$ |

(1,763 |

) |

$ |

(6,270 |

) |

$ |

(10,191 |

) |

$ |

(2,208 |

) |

$ |

(3,473 |

) |

|

- Non-GAAP (1) |

|

(451 |

) |

4,024 |

|

(846 |

) |

16,617 |

|

7,806 |

|

4,684 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Net loss |

|

$ |

(15,553 |

) |

$ |

(998 |

) |

$ |

(6,766 |

) |

$ |

(15,366 |

) |

$ |

710 |

|

$ |

(8,555 |

) |

|

- Non-GAAP (1) |

|

1,150 |

|

4,606 |

|

(1,025 |

) |

15,056 |

|

6,545 |

|

4,383 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Basic and diluted earnings (loss) per share (in dollars) |

|

$ |

(0.50 |

) |

$ |

(0.03 |

) |

$ |

(0.22 |

) |

$ |

(0.49 |

) |

$ |

0.02 |

|

$ |

(0.28 |

) |

|

- Non-GAAP (1) |

|

0.04 |

|

0.15 |

|

(0.03 |

) |

0.48 |

|

0.21 |

|

0.14 |

| ||||||

(1) Non-GAAP results exclude the impact of stock-based compensation expense, acquisition amortization, integration costs, restructuring costs, foreign exchange gains or losses on translation of balance sheet accounts, and certain tax adjustments. Refer to the section on “Non-GAAP measures” for additional details.

Outlook

In the fourth quarter of 2011, we expect revenue to be relatively unchanged from third quarter levels with both M2M and mobile computing being roughly flat compared to the third quarter. Our product mix in the fourth quarter is expected to be consistent with the third quarter and we expect gross margin percentage in the fourth quarter of 2011 to remain at levels consistent with the third quarter of 2011. Operating expenses are expected to be slightly above the third quarter levels.

Gross margin percentage may fluctuate from quarter to quarter depending on product mix, competitive selling prices and our ability to reduce product costs.

CONSOLIDATED RESULTS OF OPERATIONS

(in thousands of U.S. dollars)

|

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

| ||||||||||||||||

|

|

|

2011 |

|

% of |

|

2010 |

|

% of |

|

2011 |

|

% of |

|

2010 |

|

% of |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Revenue |

|

$ |

146,827 |

|

100.0 |

% |

$ |

172,732 |

|

100.0 |

% |

$ |

430,990 |

|

100.0 |

% |

$ |

483,165 |

|

100.0 |

% |

|

Cost of goods sold |

|

103,493 |

|

70.5 |

% |

123,778 |

|

71.7 |

% |

309,092 |

|

71.7 |

% |

341,667 |

|

70.7 |

% | ||||

|

Gross margin |

|

43,334 |

|

29.5 |

% |

48,954 |

|

28.3 |

% |

121,898 |

|

28.3 |

% |

141,498 |

|

29.3 |

% | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Sales and marketing |

|

11,158 |

|

7.6 |

% |

12,137 |

|

7.0 |

% |

34,752 |

|

8.1 |

% |

39,476 |

|

8.2 |

% | ||||

|

Research and development |

|

21,942 |

|

14.9 |

% |

22,178 |

|

12.9 |

% |

67,479 |

|

15.7 |

% |

64,253 |

|

13.3 |

% | ||||

|

Administration |

|

8,548 |

|

5.8 |

% |

8,865 |

|

5.1 |

% |

26,743 |

|

6.2 |

% |

27,284 |

|

5.6 |

% | ||||

|

Restructuring costs |

|

881 |

|

0.6 |

% |

4,316 |

|

2.5 |

% |

856 |

|

0.2 |

% |

7,508 |

|

1.5 |

% | ||||

|

Integration costs |

|

121 |

|

0.1 |

% |

727 |

|

0.4 |

% |

1,426 |

|

0.3 |

% |

4,204 |

|

0.9 |

% | ||||

|

Amortization |

|

2,447 |

|

1.7 |

% |

2,939 |

|

1.7 |

% |

8,089 |

|

1.9 |

% |

8,964 |

|

1.9 |

% | ||||

|

|

|

45,097 |

|

30.7 |

% |

51,162 |

|

29.6 |

% |

139,345 |

|

32.3 |

% |

151,689 |

|

31.4 |

% | ||||

|

Loss from operations |

|

(1,763 |

) |

-1.2 |

% |

(2,208 |

) |

-1.3 |

% |

(17,447 |

) |

-4.0 |

% |

(10,191 |

) |

-2.1 |

% | ||||

|

Foreign exchange gain (loss) |

|

(154 |

) |

|

|

2,359 |

|

|

|

47 |

|

|

|

(6,759 |

) |

|

| ||||

|

Other income (expense) |

|

68 |

|

|

|

12 |

|

|

|

15 |

|

|

|

(221 |

) |

|

| ||||

|

Earnings (loss) before income taxes |

|

(1,849 |

) |

|

|

163 |

|

|

|

(17,385 |

) |

|

|

(17,171 |

) |

|

| ||||

|

Income tax recovery |

|

(851 |

) |

|

|

(499 |

) |

|

|

(1,775 |

) |

|

|

(1,587 |

) |

|

| ||||

|

Net earnings (loss) before non-controlling interest |

|

(998 |

) |

|

|

662 |

|

|

|

(15,610 |

) |

|

|

(15,584 |

) |

|

| ||||

|

Less: non-controlling interest |

|

— |

|

|

|

(48 |

) |

|

|

(57 |

) |

|

|

(218 |

) |

|

| ||||

|

Net earnings (loss) attributable to the Company |

|

$ |

(998 |

) |

|

|

$ |

710 |

|

|

|

$ |

(15,553 |

) |

|

|

$ |

(15,366 |

) |

|

|

|

Basic and diluted net loss per share attributable to the Company |

|

$ |

(0.03 |

) |

|

|

$ |

0.02 |

|

|

|

$ |

(0.50 |

) |

|

|

$ |

(0.49 |

) |

|

|

Three Months Ended September 30, 2011 Compared to Three Months Ended September 30, 2010

Revenue

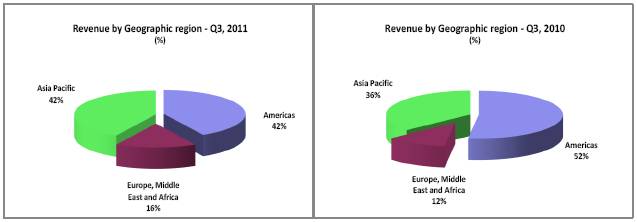

Revenue for the three months ended September 30, 2011 was $146.8 million, compared to $172.7 million in the same period of 2010, a decrease of 15%. The decrease in revenue was primarily related to the absence of embedded module revenue from Barnes & Noble for their e-book reader (nil for the three months ended September 30, 2011 compared to $10.5 million in the same period of 2010), loss of revenue from Clearwire (nil for the three months ended September 30, 2011 compared to $19.7 million in the same period of 2010), and lower sales to Sprint as it prepares to transition to new 4G LTE products and network. This was partially offset by increased revenue from higher sales of 4G LTE products to AT&T and Telstra and the continued growth in our core M2M business.

In the third quarter of 2011, AT&T, Telstra, and Sprint each accounted for more than 10% of our revenue, representing approximately 39% of our revenue in aggregate. In the third quarter of 2010, Sprint and Clearwire each accounted for more than 10% of our revenue, and in aggregate, these two customers represented approximately 31% of our revenue.

We continue to have a balanced mix of revenue between Mobile Computing and M2M. The product revenue mix for the three months ended September 30, 2011 and 2010 was as follows:

The geographic revenue mix for the three months ended September 30, 2011 and 2010 was as follows:

Gross margin

Gross margin amounted to $43.3 million for the three months ended September 30, 2011, or 29.5% of revenue, compared to $49.0 million, or 28.3% of revenue, in the same period of 2010. The increase in gross margin percentage was primarily driven by a higher proportion of higher margin M2M products and product cost reductions in the current period compared to the same period in 2010. Gross margin included $0.1 million of stock-based compensation expense in each of the third quarters of 2011 and 2010.

Sales and marketing

Sales and marketing expenses were $11.2 million, or 7.6% of revenue, for the three months ended September 30, 2011, compared to $12.1 million, or 7.0% of revenue, in the same period of 2010, a decrease of 8.1%. The decrease in sales and marketing costs was due primarily to cost reduction initiatives, including the final stages of integration of Sierra Wireless and Wavecom S.A. (“Wavecom”). Sales and marketing expenses included $0.3 million of stock-based compensation expense in the third quarter of 2011 compared to $0.4 million in the same period of 2010.

Research and development

Research and development expenses amounted to $21.9 million, or 14.9% of revenue, for the three months ended September 30, 2011, compared to $22.2 million, or 12.9% of revenue, in the same period of 2010, a decrease of 1.1%. The slight decrease was due primarily to cost reductions resulting from the final stages of integration of Sierra Wireless and Wavecom. Research and development expenses for the three months ended September 30, 2011 included stock-based compensation expense of $0.4 million and acquisition amortization of $1.8 million compared to stock-based compensation expense of $0.3 million and acquisition amortization of $1.6 million for the three months ended September 30, 2010.

Administration

Administration expenses amounted to $8.5 million, or 5.8% of revenue, for the three months ended September 30, 2011, compared to $8.9 million, or 5.1% of revenue, in the same period of 2010. Included in administration expenses was $0.8 million of stock-based compensation expense in the three months ended September 30, 2011. The same amount was expensed in the same period of 2010.

Restructuring

Restructuring costs were $0.9 million during the third quarter of 2011, compared to $4.3 million in the same period of 2010. Restructuring costs for the three months ended September 30, 2011 primarily represented the additional costs incurred for reductions in our workforce resulting from the implementation of the new organizational structure announced in September 2010. Restructuring costs in the third quarter of 2010 were related to reductions in our workforce resulting from the aforementioned organizational structure change.

Integration costs

Integration costs were $0.1 million for the three months ended September 30, 2011, compared to $0.7 million in the same period of 2010. Integration costs in the current period were primarily related to office space optimization in France. Integration costs in the third quarter of 2010 included costs for IT consultants for the integration of our Enterprise Resource Planning (“ERP”) system and employees retained for integration activities.

Amortization

Amortization expense was $2.4 million for the three months ended September 30, 2011, compared to $2.9 million in the same period of 2010. Amortization expense included $1.4 million of acquisition amortization for the three months ended September 30, 2011 compared to $1.8 million in the same period of 2010.

Foreign exchange gain (loss)

Foreign exchange loss was $0.2 million for the three months ended September 30, 2011, primarily related to foreign exchange loss on intercompany balances. For the three months ended September 30, 2010, we recorded a foreign exchange gain of $2.4 million, including a gain of $0.5 million on intercompany balances.

Foreign exchange rate changes also impact our Euro and Canadian dollar denominated operating expenses. However, the impact of changes in exchange rates between 2010 and 2011 was negligible in the third quarter of 2011.

Income tax recovery

Income tax recovery was $0.9 million for the three months ended September 30, 2011, compared to an income tax recovery of $0.5 million in the same period of 2010.

Non-controlling interest

Non-controlling interest was nil for the three-month period ended September 30, 2011 and less than $0.1 million for the three-month period ended September 30, 2010. The non-controlling interest represented the interest in Wavecom’s loss attributable to the 147,150 vested shares held by Wavecom employees under their long-term incentive plan. The vested shares were subject to a hold period for tax purposes that expired June 8, 2011. We have exercised our rights under a put/call agreement and purchased 140,150 vested shares at €8.50 per share. The obligation for the remaining 7,000 shares at €8.50 per share has been recorded as at September 30, 2011.

Net earnings (loss) attributable to the Company

Net loss attributable to the Company amounted to $1.0 million, or $0.03 per share, for the three months ended September 30, 2011, compared to net earnings of $0.7 million, or $0.02 per share, in the same period of 2010. Included in our net loss was $1.6 million of stock-based compensation expense in the three months ended September 30, 2011, compared to $2.1 million in the same period of 2010.

Weighted average number of shares

The weighted average diluted number of shares outstanding was 31.3 million for the three months ended September 30, 2011, compared to 31.2 million for the three months ended September 30, 2010. The number of shares outstanding was 31.3 million at September 30, 2011, compared to 31.1 million at September 30, 2010.

Nine Months Ended September 30, 2011 Compared to Nine Months Ended September 30, 2010

Revenue

Revenue for the nine months ended September 30, 2011 was $431.0 million, compared to $483.2 million in the same period of 2010, a decrease of 10.8%. The decrease in revenue was primarily due to a significant reduction in embedded module sales to Barnes & Noble for their e-book reader ($0.7 million for the nine months ended September 30, 2011 compared to $55.8 million in the same period of 2010), loss of revenue from Clearwire ($8.4 million for the nine months ended September 30, 2011 compared to $25.9 million in the same period of 2010), and decreased revenue from Sprint as they prepare to transition to new 4G LTE products and networks. Increased revenue from higher sales of 4G LTE products to Telstra and our core M2M embedded module products partially offset this negative impact.

In the nine months ended September 30, 2011, Sprint, AT&T, and Telstra each accounted for more than 10% of our revenue, representing approximately 34% of our revenue. In the nine months ended September 30, 2010, Sprint, AT&T, and Barnes and Noble each accounted for more than 10% of our revenue and, in the aggregate, these three customers represented approximately 39% of our revenue.

The product revenue mix for the nine months ended September 30, 2011 and 2010 was as follows:

The geographic revenue mix for the nine months ended September 30, 2011 and 2010 was as follows:

Gross margin

Gross margin amounted to $121.9 million for the nine months ended September 30, 2011, or 28.3% of revenue, compared to $141.5 million, or 29.3% of revenue, in the same period of 2010. The decrease in gross margin percentage resulted primarily from product mix. Gross margin included $0.3 million of stock-based compensation expense in the nine months ended September 30, 2011 compared to $0.4 million in the same period of 2010.

Sales and marketing

Sales and marketing expenses were $34.8 million, or 8.1% of revenue, for the nine months ended September 30, 2011, compared to $39.5 million, or 8.2% of revenue, in the same period of 2010, a decrease of 12.0%. The decrease in sales and marketing costs was due primarily to cost reduction initiatives, including the final stages of integration of Sierra Wireless and Wavecom. Sales and marketing expenses included $1.0 million of stock-based compensation expense in the nine months ended September 30, 2011 and $1.1 million in nine months ended September 30, 2010.

Research and development

Research and development expenses amounted to $67.5 million, or 15.7% of revenue, for the nine months ended September 30, 2011, compared to $64.3 million, or 13.3% of revenue, in the same period of 2010, an increase of 5.0%. The increase was largely due to additional investment during the first half of 2011 in new product development to support new product and technology transitions with some of our largest customers. Research and development expenses for the nine months ended September 30, 2011 included stock-based compensation expense of $1.2 million and acquisition amortization of $5.2 million compared to stock-based compensation expense of $1.0 million and acquisition amortization of $4.5 million for the nine months ended September 30, 2010.

Administration

Administration expenses amounted to $26.7 million, or 6.2% of revenue, for the nine months ended September 30, 2011, compared to $27.3 million, or 5.6% of revenue, in the same period of 2010. Included in administration expenses was $2.5 million of stock-based compensation expense in the nine months ended September 30, 2011. The same amount was expensed in the same period of 2010.

Restructuring costs

Restructuring costs were $0.9 million for the nine months ended September 30, 2011, compared to $7.5 million in the same period in 2010. Restructuring costs for the nine months ended September 30, 2011 primarily represented the additional costs incurred for reductions in our workforce resulting from the implementation of the new organizational structure announced in September 2010. Restructuring costs for the nine months ended September 30, 2010 were related to reductions in our workforce resulting from the aforementioned organizational structure change.

Integration costs

For the nine months ended September 30, 2011, integration costs related to the acquisition of Wavecom were $1.4 million, compared to $4.2 million in the same period of 2010. Integration costs in the current nine-month period were primarily costs related to office space optimization in France and for IT consultants retained to implement an integrated CRM system. Integration costs for the nine months ended September 30, 2010 included the cost for IT consultants for the integration of our ERP system, employees retained for integration activities and related travel expenses, and the impairment of an intangible asset.

Amortization

Amortization expense was $8.1 million for the nine months ended September 30, 2011, compared to $9.0 million in the same period of 2010. Amortization expense included $4.6 million of acquisition amortization for the nine months ended September 30, 2011 compared to $5.5 million in the same period of 2010.

Foreign exchange gain (loss)

Foreign exchange gain for the nine months ended September 30, 2011 was less than $0.1 million compared to a loss of $6.8 million in the same period of 2010. Our foreign exchange gain for the nine months ended September 30, 2011 included a net foreign exchange gain of $0.5 million on intercompany balances, compared to a net foreign exchange loss of $4.6 million in the same period of 2010.

Foreign exchange rates also impacted our Euro and Canadian dollar denominated operating expenses. We estimate that changes in exchange rates between 2010 and 2011 negatively impacted operating expenses by approximately $0.6 million in the nine months ended September 30, 2011.

Income tax recovery

Income tax recovery was $1.8 million for the nine months ended September 30, 2011, compared to $1.6 million in the same period of 2010.

Non-controlling interest

Non-controlling interest for the nine months ended September 30, 2011 was $0.1 million, compared to $0.2 million for the nine months ended September 30, 2010. The non-controlling interest represented the interest in Wavecom’s loss attributable to the 147,150 vested shares held by Wavecom employees under their long-term incentive plan. The vested shares were subject to a hold period for tax purposes that expired June 8, 2011. We have exercised our rights under a put/call agreement and purchased 140,150 vested shares at €8.50 per share. The obligation for the remaining 7,000 shares at €8.50 per share has been recorded as at September 30, 2011.

Net loss attributable to the Company

Net loss attributable to the Company amounted to $15.6 million, or $0.50 per share, for the nine months ended September 30, 2011, compared to a net loss of $15.4 million, or $0.49 per share, in the same period of 2010. Included in our net loss was $4.9 million of stock-based compensation expense for the nine months ended September 30, 2011, compared to $5.5 million for the nine months ended September 30, 2010.

Weighted average number of shares

The weighted average diluted number of shares outstanding was 31.3 million for the nine months ended September 30, 2011, compared to 31.1 million for the nine months ended September 30, 2010. The number of shares outstanding was 31.3 million at September 30, 2011, compared to 31.1 million at September 30, 2010.

SEGMENTED RESULTS

Revenue by segment for the three and nine months ended September 30, 2011 and 2010 was as follows:

(in thousands of U.S. dollars)

|

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

M2M |

|

|

|

|

|

|

|

|

| ||||

|

Revenue |

|

$ |

75,315 |

|

$ |

76,141 |

|

$ |

221,951 |

|

$ |

248,419 |

|

|

Cost of goods sold |

|

49,667 |

|

N/A |

|

149,732 |

|

N/A |

| ||||

|

Gross margin |

|

$ |

25,648 |

|

N/A |

|

$ |

72,219 |

|

N/A |

| ||

|

Gross margin % |

|

34.1 |

% |

N/A |

|

32.5 |

% |

N/A |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Mobile Computing |

|

|

|

|

|

|

|

|

| ||||

|

Revenue |

|

$ |

71,512 |

|

$ |

96,591 |

|

$ |

209,039 |

|

$ |

234,746 |

|

|

Cost of goods sold |

|

53,826 |

|

N/A |

|

159,360 |

|

N/A |

| ||||

|

Gross margin |

|

$ |

17,686 |

|

N/A |

|

$ |

49,679 |

|

N/A |

| ||

|

Gross margin % |

|

24.7 |

% |

N/A |

|

23.8 |

% |

N/A |

| ||||

Revenue by product line for the three and nine months ended September 30, 2011 and 2010 was as follows:

(in thousands of U.S. dollars)

|

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

M2M |

|

|

|

|

|

|

|

|

| ||||

|

AirPrime Embedded Wireless Modules (excludes PC OEMs) (1) |

|

$ |

63,635 |

|

$ |

60,889 |

|

$ |

186,089 |

|

$ |

206,095 |

|

|

AirLink Intelligent Gateways and Routers |

|

9,928 |

|

12,482 |

|

28,910 |

|

35,210 |

| ||||

|

AirVantage M2M Cloud Platform and Other |

|

1,752 |

|

2,770 |

|

6,952 |

|

7,114 |

| ||||

|

|

|

$ |

75,315 |

|

$ |

76,141 |

|

$ |

221,951 |

|

$ |

248,419 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Mobile Computing |

|

|

|

|

|

|

|

|

| ||||

|

AirCard Mobile Broadband Devices |

|

$ |

60,453 |

|

$ |

90,368 |

|

$ |

177,442 |

|

$ |

216,333 |

|

|

AirPrime Embedded Wireless Modules for PC OEMs |

|

9,771 |

|

6,054 |

|

28,375 |

|

16,154 |

| ||||

|

Other |

|

1,288 |

|

169 |

|

3,222 |

|

2,259 |

| ||||

|

|

|

$ |

71,512 |

|

$ |

96,591 |

|

$ |

209,039 |

|

$ |

234,746 |

|

(1) Barnes & Noble contributed nil million in M2M revenue in the three months ended September 30, 2011 compared to $10.5 million in the three months ended September 30, 2010. In the nine months ended September 30, 2011, Barnes & Noble contributed $0.7 million in M2M revenue compared to $55.8 million in the nine months ended September 30, 2010.

Machine-to-Machine

Our M2M business includes our AirPrime™ Embedded Wireless Modules (excluding embedded module sales to PC OEMs), AirLink™ Intelligent Gateways and Routers and our AirVantage™ M2M Cloud Platform. We believe that the market for our M2M products offers profitable growth opportunities. The M2M market is competitive and our future success will depend in part on our ability to continue to develop differentiated products and services that meet our customers’ evolving technology, design, schedule and price requirements.

Our M2M revenue was $75.3 million in the third quarter of 2011, compared to $76.1 million in the same period of 2010, a decrease of $0.8 million or 1.1%. For nine months ended September 30, 2011, our M2M revenue was $222.0 million compared to $248.4 million in the same period of 2010, a decrease of 10.7%. The decrease in revenue in both periods was primarily due to a significant reduction in embedded module sales to Barnes & Noble for their e-book reader partially offset by increased growth in our core M2M business.

Gross margin was $25.6 million for M2M, or 34.1% of M2M revenue in the third quarter of 2011. Comparative prior period information is not available as we started reporting segmented information in the first quarter 2011 following an organizational structure change that we implemented during the fourth quarter of 2010.

AirPrime™ Embedded Wireless Modules (excludes PC OEM embedded modules)

We believe that there are long-term profitable growth prospects in the embedded M2M market and we plan to continue to invest to expand our leadership position. Our expanded line-up of AirPrime Embedded Wireless Modules is used by a wide range of OEMs to wirelessly enable their products and solutions. Our M2M OEM customers cover a broad range of industries including automotive, networking equipment, energy, security, sales and payment, industrial control and monitoring, fleet management, field service, healthcare and consumer electronics.

In the third quarter of 2011, sales of our M2M embedded module products increased 4.5% to $63.6 million, compared to $60.9 million in the third quarter of 2010. This increase was largely driven by increased growth in our core M2M business. With the completion of embedded module shipments for Barnes & Noble’s first generation nook e-book reader, sales of embedded modules to Barnes and Noble in the third quarter of 2011 were nil compared to $10.5 million in the third quarter of 2010. Excluding sales to Barnes & Noble, our core M2M embedded module revenue grew 15% in the third quarter of 2011, compared to the same period in 2010.

During the third quarter of 2011, we announced an important milestone in our 4G LTE product development programs. Our AirPrime MC7700 embedded wireless module and AirPrime MC7750 embedded wireless module achieved full certification and technical approval for AT&T and Verizon, respectively, clearing the way for shipments to OEMs building products with integrated 4G connectivity on either of the U.S.-based LTE networks. OEMs working with our modules now have the opportunity to provide a choice of network services with their products, as the AirPrime MC7700 and AirPrime MC7750 share a common hardware and software interface. On October 4, 2011, we announced that Gorlitz AG, a leading manufacturer of advanced meter reading and energy information management systems, selected Sierra Wireless to provide the wireless connectivity solutions for its Ethernet/GPRS router. The router connects to energy meters, allowing utilities to remotely collect energy usage data. Our solution combines an AirPrime Q2686 embedded wireless module with our Open AT framework, which includes pre-packaged libraries that streamline development time and time to market.

AirLink™ Intelligent Gateways and Routers

Our AirLink Intelligent Gateways and Routers are sold to public safety, transportation, field service, energy, industrial, and financial organizations, and are among our highest gross margin products. We believe that there are profitable growth prospects for our AirLink intelligent gateway and router solutions and we intend to capture these opportunities through segment, product line and geographic expansion.

In the third quarter of 2011, revenue from AirLink Intelligent Gateways and Routers decreased 20.5% to $9.9 million compared to $12.5 million in the same period of 2010. The decrease was largely related to deferrals of orders by certain public service customers who were affected by budget constraints due to the weak U.S. economy, a temporary slowdown in orders as we introduced our new GX series of Intelligent Gateways, and technology transition as customers wait for solutions that support 4G.

AirVantage™ M2M Cloud Platform

Our AirVantage M2M Cloud Platform provides solutions and services that enable application providers, OEMs and mobile network operators to accelerate the deployment of complete M2M solutions for managing remote equipment and assets. These solutions are based on tools that facilitate the development and delivery of applications that are hosted on our AirVantage services platform. Our services platform is scalable, secure and compatible with a broad range of available wireless equipment.

Mobile Computing

Our mobile computing business includes our AirCard Mobile Broadband Devices and AirPrime wireless embedded modules for PC OEM customers.

Our mobile computing revenue was $71.5 million in the third quarter of 2011, compared to $96.6 million in the same period of 2010, a decrease of 26.0%. For the nine months ended September 30, 2011, our mobile computing revenue was $209.0 million compared to $234.7 million for same period of 2010, a decrease of 11.0%. The year-over-year decline in third quarter revenue was due to the loss of revenue from Clearwire and tightening inventory levels at some operators, partially offset by growth at AT&T and Telstra driven by the launch of new 4G products and growth in revenue from PCOEMs as a result of new design wins. For the nine-month period, the year-over-year decline in revenue was driven by a reduction in demand ahead of technology transitions, tightening inventory levels at some operators and a loss of revenue from Clearwire, partially offset by the launch of new 4G products, as well as an increase in revenue from PCOEMs.

Gross margin was $17.7 million for mobile computing, or 24.7% of mobile computing revenue, in the third quarter of 2011. Comparative period information is not available as we started reporting segmented information in the first quarter 2011 following an organizational structure change that we implemented during the fourth quarter of 2010.

AirCard® Mobile Broadband Devices

Our AirCard mobile broadband device family includes our AirCard branded PC cards, USB modems and mobile Wi-Fi hotspots. Our AirCards, sold to wireless operators around the world, provide a simple way to connect notebooks, netbooks and other electronic devices to the Internet, over 3G and 4G mobile broadband networks.

In the third quarter of 2011, sales of our AirCard products decreased by 33.1% to $60.5 million, compared to $90.4 million in the same period of 2010, primarily due to lower sales to Sprint who is preparing to transition from 3G to 4G products, along with a loss of revenue from Clearwire (nil in the three months ended September 30, 2011 compared to $19.7 million in the same period in 2010). This was partially offset by increased revenue from sales of 4G products to AT&T and Telstra.

During the third quarter of 2011, AT&T rolled out its first 4G LTE devices. The AT&T Mobile Hotspot Elevate 4G (a.k.a. Sierra Wireless AirCard 754S mobile hotspot) and the AT&T USBConnect Momentum 4G (a.k.a. Sierra Wireless AirCard 313U USB modem) enable mobile consumers and professionals to connect wirelessly from laptops, tablets, and other mobile devices at LTE speeds. The 4G LTE Sierra Wireless U313 switches seamlessly to the best available network technology when customers are outside of an LTE coverage area. Rogers Communications (“Rogers”) also launched its new LTE network in Canada during the quarter. Rogers’ first LTE-enabled mobile device is the LTE Rocket Stick USB modem (a.k.a the Sierra Wireless AirCard 313U). The launch began in Ottawa and Rogers has begun expanding its LTE services throughout Canada.

In September, 2011, we launched our 4G LTE U313 Turbo Stick (a.k.a. Sierra Wireless AirCard 313U) on Bell Mobility’s new LTE network. We also announced that the Telstra USB 4G mobile broadband modem (a.k.a. Sierra Wireless AirCard 320U) is now available to Telstra and BigPond customers, providing laptop users with access to the newly launched Telstra 4G LTE network.

We believe that the market for our AirCard products offers profitable opportunities. Competition in this market continues to be intense and our future success will depend in part on our ability to continue to develop differentiated products that meet our customers’ evolving technology, design, schedule and price requirements.

AirPrime™ Embedded Wireless Modules for PC OEMs

In the third quarter of 2011, revenue from sales of our AirPrime Wireless Embedded Modules to PC OEM customers increased 61.4% to $9.8 million from $6.1 million in the same period of 2010, primarily due to increased market demand from our existing PC OEM customers and initial shipments of modules in support of design wins with new customers secured in 2010.

Our ability to secure additional design wins in the PC OEM market will depend on our ability to successfully develop products and offer services that meet our customers’ technology, design, schedule and price requirements.

LIQUIDITY AND CAPITAL RESOURCES

Selected Financial Information

(in thousands of U.S. dollars, except where otherwise stated)

|

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

| ||||||||||||||

|

|

|

2011 |

|

2010 |

|

Change |

|

2011 |

|

2010 |

|

Change |

| ||||||

|

Cash flows provided (used) before changes in non-cash working capital: |

|

$ |

7,051 |

|

$ |

11,019 |

|

$ |

(3,968 |

) |

$ |

10,650 |

|

$ |

14,095 |

|

$ |

(3,445 |

) |

|

Changes in non-cash working capital |

|

(17,093 |

) |

(21,727 |

) |

4,634 |

|

(2,032 |

) |

(31,453 |

) |

29,421 |

| ||||||

|

Cash flows provided by (used in): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Operations |

|

(10,042 |

) |

(10,708 |

) |

666 |

|

8,618 |

|

(17,358 |

) |

25,976 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Investing activities |

|

12,580 |

|

8,293 |

|

4,287 |

|

9,505 |

|

12,499 |

|

(2,994 |

) | ||||||

|

Capital expenditures and intangibles |

|

(4,622 |

) |

(2,783 |

) |

(1,839 |

) |

(15,142 |

) |

(10,500 |

) |

(4,642 |

) | ||||||

|

Net change in short-term investments |

|

17,470 |

|

11,009 |

|

6,461 |

|

26,405 |

|

24,479 |

|

1,926 |

| ||||||

|

Purchase of Wavecom S.A. shares |

|

(282 |

) |

— |

|

(282 |

) |

(1,787 |

) |

(1,553 |

) |

(234 |

) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Financing activities |

|

(2,736 |

) |

9 |

|

(2,745 |

) |

(2,905 |

) |

(2,060 |

) |

(845 |

) | ||||||

Operating Activities

Cash used by operating activities was $10.0 million for the three months ended September 30, 2011, compared to $10.7 million in the same period of 2010. For the nine months ended September 30, 2011, cash provided from operating activities increased by $26.0 million to $8.6 million, compared to cash used by operating activities of $17.4 million for the same period of 2010. The increase in cash provided from operations in the nine-month comparative periods was primarily due to lower accumulations of working capital in 2011 compared to 2010.

Investing Activities

Cash provided by investing activities was $12.6 million in the three months ended September 30, 2011, compared to $8.3 million in the same period of 2010. The increase in the three-month comparative period was largely related to decrease in short-term investments to fund operating activities. For the nine months ended September 30, 2011, cash provided by investing activities was $9.5 million, compared to $12.5 million for the same period of 2010. The decrease in the nine-month period was primarily related to greater purchases of property, plant and equipment and intangible assets.

Cash used for the purchase of capital expenditures was primarily for production and tooling equipment, research and development equipment, computer equipment and software, while cash used for intangible assets was driven primarily by patent registration costs and software licenses.

Financing Activities

During the three months ended September 30, 2011, we used $2.7 million in financing activities, compared to nil in the same period in 2010. The use of cash in the three-month current period was primarily related to purchases on the TSX and NASDAQ, in the amount of $2.5 million, of the Company’s common shares for our RSU plan. For the nine months ended September 30, 2011, we used $2.9 million, compared to $2.1 million for the same period of 2010. In the current period, we used the funds primarily to purchase shares for our RSU plan. In 2010, we repaid certain of our long-term obligations.

Cash Requirements

Our near-term cash requirements are primarily related to funding our operations, capital expenditures, IP licenses, and other obligations discussed below. We believe our cash and cash equivalents balance of $100.7 million and cash generated from operations will be sufficient to fund our expected working capital requirements for at least the next twelve months based on current business plans. Our capital expenditures during the fourth quarter of 2011 are expected to be primarily for research and development equipment, tooling, leasehold improvements, software licenses and patents. However, we cannot assure you that our actual cash requirements will not be greater than we currently expect.

The following table quantifies our future contractual obligations as of September 30, 2011. The nature of the obligations have not changed materially since December 31, 2010.

(in millions of U.S. dollars)

|

2011 |

|

$ |

114.5 |

|

|

2012 |

|

5.7 |

| |

|

2013 |

|

4.8 |

| |

|

2014 |

|

4.9 |

| |

|

2015 |

|

3.7 |

| |

|

Thereafter |

|

5.9 |

| |

|

Total |

|

$ |

139.5 |

|

Capital Resources

(in thousands of dollars)

|

|

|

2011 |

|

2010 |

| |||||||||||||||||

|

|

|

30-Sep |

|

30-Jun |

|

31-Mar |

|

31-Dec |

|

30-Sep |

|

30-Jun |

|

31-Mar |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Cash and cash equivalents |

|

$ |

100,662 |

|

$ |

101,685 |

|

$ |

86,197 |

|

$ |

85,443 |

|

$ |

102,573 |

|

$ |

102,009 |

|

$ |

111,257 |

|

|

Short-term investments |

|

— |

|

17,470 |

|

24,559 |

|

26,405 |

|

2,413 |

|

13,428 |

|

11,099 |

| |||||||

|

|

|

100,662 |

|

119,155 |

|

110,756 |

|

111,848 |

|

104,986 |

|

115,437 |

|

122,356 |

| |||||||

|

Unused credit facilities (1) |

|

10,000 |

|

10,000 |

|

10,000 |

|

10,000 |

|

10,000 |

|

10,000 |

|

10,000 |

| |||||||

|

Total |

|

$ |

110,662 |

|

$ |

129,155 |

|

$ |

120,756 |

|

$ |

121,848 |

|

$ |

114,986 |

|

$ |

125,437 |

|

$ |

132,356 |

|

(1) Net of borrowings

Credit Facilities

On January 27, 2011, we signed an amended and restated credit agreement with The Toronto-Dominion Bank and Canadian Imperial Bank of Commerce, extending our revolving term, $10.0 million credit facility (the “Revolving Facility”) to January 28, 2013 at similar terms. The Revolving Facility is for working capital requirements and is secured by a pledge against all of our assets. At September 30, 2011, there were no borrowings under the Revolving Facility and we were in compliance with the covenants associated with the credit facility.

At September 30, 2011 we had $0.3 million (December 31, 2010 – $0.5 million) outstanding under a letter of credit, which approximates its fair value. The letter of credit scheduled to expire in September 2011 has been extended to expire in June 2012.

SUMMARY OF QUARTERLY RESULTS OF OPERATIONS

The following tables set forth certain unaudited consolidated statements of operations data for each of the eight most recent quarters that, in management’s opinion, have been prepared on a basis consistent with the audited consolidated financial statements for the year ended December 31, 2010. The unaudited consolidated statements of operations data presented below reflects all adjustments, consisting primarily of normal recurring adjustments, which are, in the opinion of management, necessary for a fair presentation of results for the interim periods. These operating results are not necessarily indicative of results for any future period. You should not rely on them to predict our future performance.

(in thousands of U.S. dollars, except per share amounts and number of shares)

|

|

|

2011 |

|

2010 |

|

2009 |

| ||||||||||||||||||

|

|

|

Q3 |

|

Q2 |

|

Q1 |

|

Q4 |

|

Q3 |

|

Q2 |

|

Q1 |

|

Q4 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Revenue |

|

$ |

146,827 |

|

$ |

139,888 |

|

$ |

144,275 |

|

$ |

167,176 |

|

$ |

172,732 |

|

$ |

159,116 |

|

$ |

151,317 |

|

$ |

143,952 |

|

|

Cost of goods sold |

|

103,493 |

|

100,788 |

|

104,811 |

|

118,309 |

|

123,778 |

|

112,906 |

|

104,983 |

|

95,223 |

| ||||||||

|

Gross margin |

|

43,334 |

|

39,100 |

|

39,464 |

|

48,867 |

|

48,954 |

|

46,210 |

|

46,334 |

|

48,729 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Sales and marketing |

|

11,158 |

|

11,326 |

|

12,268 |

|

12,123 |

|

12,137 |

|

13,183 |

|

14,156 |

|

15,191 |

| ||||||||

|

Research and development |

|

21,942 |

|

22,025 |

|

23,512 |

|

23,782 |

|

22,178 |

|

21,534 |

|

20,541 |

|

19,884 |

| ||||||||

|

Administration |

|

8,548 |

|

8,810 |

|

9,385 |

|

9,073 |

|

8,865 |

|

8,835 |

|

9,584 |

|

9,625 |

| ||||||||

|

Acquisition costs |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

95 |

| ||||||||

|

Restructuring costs |

|

881 |

|

(350 |

) |

325 |

|

132 |

|

4,316 |

|

1,581 |

|

1,611 |

|

4,678 |

| ||||||||

|

Integration costs |

|

121 |

|

765 |

|

540 |

|

906 |

|

727 |

|

1,631 |

|

1,846 |

|

1,337 |

| ||||||||

|

Amortization |

|

2,447 |

|

2,794 |

|

2,848 |

|

3,026 |

|

2,939 |

|

2,919 |

|

3,106 |

|

(997 |

) | ||||||||

|

|

|

45,097 |

|

45,370 |

|

48,878 |

|

49,042 |

|

51,162 |

|

49,683 |

|

50,844 |

|

49,813 |

| ||||||||

|

Loss from operations |

|

(1,763 |

) |

(6,270 |

) |

(9,414 |

) |

(175 |

) |

(2,208 |

) |

(3,473 |

) |

(4,510 |

) |

(1,084 |

) | ||||||||

|

Foreign exchange gain (loss) |

|

(154 |

) |

(221 |

) |

422 |

|

(241 |

) |

2,359 |

|

(5,460 |

) |

(3,658 |

) |

(1,754 |

) | ||||||||

|

Other income (expense) |

|

68 |

|

(13 |

) |

(40 |

) |

(20 |

) |

12 |

|

(103 |

) |

(130 |

) |

(279 |

) | ||||||||

|

Earnings (loss) before income taxes |

|

(1,849 |

) |

(6,504 |

) |

(9,032 |

) |

(436 |

) |

163 |

|

(9,036 |

) |

(8,298 |

) |

(3,117 |

) | ||||||||

|

Income tax expense (recovery) |

|

(851 |

) |

275 |

|

(1,199 |

) |

(1,221 |

) |

(499 |

) |

(399 |

) |

(689 |

) |

12 |

| ||||||||

|

Net earnings (loss) before non-controlling interest |

|

(998 |

) |

(6,779 |

) |

(7,833 |

) |

785 |

|

662 |

|

(8,637 |

) |

(7,609 |

) |

(3,129 |

) | ||||||||

|

Net loss attributable to non-controlling interest |

|

— |

|

(13 |

) |

(44 |

) |

(40 |

) |

(48 |

) |

(82 |

) |

(88 |

) |

(394 |

) | ||||||||

|

Net earnings (loss) attributable to the Company |

|

$ |

(998 |

) |

$ |

(6,766 |

) |

$ |

(7,789 |

) |

$ |

825 |

|

$ |

710 |

|

$ |

(8,555 |

) |

$ |

(7,521 |

) |

$ |

(2,735 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Basic |

|

$ |

(0.03 |

) |

$ |

(0.22 |

) |

$ |

(0.25 |

) |

$ |

0.03 |

|

$ |

0.02 |

|

$ |

(0.28 |

) |

$ |

(0.24 |

) |

$ |

(0.09 |

) |

|

Diluted |

|

$ |

(0.03 |

) |

$ |

(0.22 |

) |

$ |

(0.25 |

) |

$ |

0.03 |

|

$ |

0.02 |

|

$ |

(0.28 |

) |

$ |

(0.24 |

) |

$ |

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Weighted average number of shares (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Basic |

|

31,297 |

|

31,267 |

|

31,237 |

|

31,151 |

|

31,077 |

|

31,054 |

|

31,050 |

|

31,042 |

| ||||||||

|

Diluted |

|

31,297 |

|

31,267 |

|

31,237 |

|

31,493 |