UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

None |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity, par value $0.01 per share, held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed fiscal year end, December 31, 2023, was $

There were

DOCUMENTS INCORPORATED BY REFERENCE

Listed below are documents incorporated herein by reference. None.

|

||

ITEM 1. |

4 |

|

ITEM 1A. |

7 |

|

ITEM 1B. |

7 |

|

ITEM 1C. |

7 |

|

ITEM 2. |

7 |

|

ITEM 3. |

20 |

|

ITEM 4. |

21 |

|

|

||

|

||

ITEM 5. |

22 |

|

ITEM 6. |

22 |

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

23 |

ITEM 7A. |

27 |

|

ITEM 8. |

28 |

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

60 |

ITEM 9A. |

60 |

|

ITEM 9B. |

60 |

|

ITEM 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

61 |

|

||

|

||

ITEM 10. |

62 |

|

ITEM 11. |

65 |

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

67 |

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

68 |

ITEM 14. |

69 |

|

|

||

|

||

ITEM 15. |

70 |

|

ITEM 16. |

72 |

|

|

73 |

|

|

||

EXHIBIT INDEX |

||

|

||

Exhibit 31.1 |

||

|

|

|

Exhibit 31.2 |

||

|

|

|

Exhibit 32.1 |

|

|

2

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This report contains numerous forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) relating to our mining business, including resource estimates, exploration efforts, results and expenditures, development initiatives at the San Jose de Gracia Project, estimated production and capacity, costs, capital expenditures, expenses, recoveries, gold prices, sufficiency of assets, ability to discharge liabilities, liquidity management, financing needs, environmental compliance expenditures, environmental, social and governance (“ESG”) and human capital management initiatives, risk management strategies, including capital resources and use, cash flow maximization, mine life and other strategic initiatives. Such forward-looking statements are identified by the use of words such as “believes,” “intends,” “expects,” “hopes,” “may,” “should,” “plan,” “projected,” “contemplates,” “anticipates” or similar words and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking information in this report includes, but is not limited to, statements regarding the beliefs, plans, expectations or intentions of management, as of the date of this presentation, regarding: (i) DynaResource, Inc.’s (the “Company”) ability to develop its exploration assets via operational cash flow from gold concentrate production; and (ii) the Company’s plans and expectations regarding its proposed 2024 exploration program for its San Jose de Gracia Project. Although the Company believes that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that these expectations and assumptions will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks related to: (1) fluctuations in commodity pricing, specifically gold and silver; (2) the Company’s ability to retain or engage qualified employees or contractors necessary to conduct mill operations at its San Jose de Gracia Facility; (3) a decreased demand for gold, silver and other minerals; (4) unexpected difficulties with the milling and the extraction of minerals from the Company’s projects; (5) unexpected interruptions and problems encountered in the operation of the San Jose de Gracia Facility; (6) factors that delay or cause difficulties in timing of shipments of concentrates by the Company; (7) potential negative financial impact from regulatory investigations, claims, lawsuits and other legal proceedings and challenges; (8) the possibility that the Company may not have sufficient capital to operate its San Jose de Gracia Facility or facilitate the further exploration of San Jose de Gracia; (9) inflationary pressures; (10) continued access to financing sources; (11) government orders that may require temporary suspension of operations or effects on our suppliers (12) the effects of environmental and other governmental regulations and government shut-downs; (13) the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries; and (14) our ability to raise additional financing necessary to conduct our business, make payments or refinance our debt and (15) other factors beyond the Company’s control.

There is a significant risk that such forward-looking statements will not prove to be accurate. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Given the current state of the global financial markets, global commodity markets, especially the recent volatility in gold and silver prices and current economic conditions, any forward-looking statements or projections may be impacted significantly. Consequently, there is no representation by the Company that actual results achieved will be the same as those forecast. You are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Mineral Reserves and Resources

We are subject to the reporting requirements of the Exchange Act, and as a result we report our mineral resources according to Item 1300 of Regulation S-K (“S-K 1300”), as issued by the SEC.

In our public filings in the U.S. and in certain other announcements not filed with the SEC, we disclose indicated and inferred mineral resources, each as defined in S-K 1300. We do not have proven and probable mineral reserves as defined in S-K 1300. The estimation of measured mineral resources and indicated mineral resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable mineral reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into S-K 1300 compliant reserves. The estimation of inferred mineral resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred mineral resources will ever be upgraded to a higher category. Therefore, investors are cautioned not to assume that all or any part of inferred mineral resources exist, or that they can be mined legally or economically.

3

Technical Report Summaries and Qualified Persons

The scientific and technical information concerning our mineral projects in this Form 10-K have been reviewed and approved by “qualified persons” under S-K 1300. For a description of the key assumptions, parameters and methods used to estimate mineral resources included in this Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are included as exhibits to, and incorporated by reference into, this Report.

PART I

ITEM 1. BUSINESS

History and Organization

The Company is a minerals investment, management, and exploration company, and currently conducting test mining and pilot milling activities through an operating subsidiary in México, with specific focus on precious and base metals in México. The Company was originally incorporated in the State of California on September 28, 1937, under the name West Coast Mines, Inc. In November 1998, the Company re-domiciled from California to Delaware and changed its name to DynaResource, Inc. (“DynaUSA”). Our common stock is traded on the OTCQX, the top tier of the OTC Markets Group under the symbol “DYNR”.

DynaUSA owns 100% of the outstanding shares of DynaResource de México, S.A. de C.V. which owns 100% of the mining concessions, equipment, camp and related facilities which comprise the San Jose de Gracia mining project. We have one wholly owned subsidiary in the USA, DynaMexico US Holding LLC (“US Holding”) and three in Mexico, DynaResource de Mexico S.A. de C.V. (“DynaMexico”), Mineras de DynaResource S.A. de C.V. (“DynaMineras”) and DynaResource Operaciones, S.A. de C.V. (“DynaOperaciones”) in Mexico, collectively referred to as “the Company”. Although we consider the three Mexican subsidiaries to be wholly owned, each has issued one qualifying share to a second shareholder as required under Mexican law, with such qualifying shares held by either US Holding or DynaUSA’s Chief Executive Officer. The Company currently conducts test mining and pilot milling operations, and other exploration activities of the San Jose de Gracía Property (“SJG”), in northern Sinaloa State, México.

Product

The end use product produced at our test mining and pilot milling operations at SJG is in the form of gold-silver concentrate. Gold-silver concentrate, or simply concentrate, is raw precious metals materials that has been crushed and ground finely to a sand-like product where gangue (waste) and non-precious metals are removed or reduced, thus concentrating the precious metals component. Concentrate processed and produced from San Jose de Gracía is transported to a third-party for processing.

During 2023, we reported the delivery and sale of 24,829 net ounces (Oz) gold (subject to final settlements) contained in concentrate. All gold concentrate originated from the San Jose de Gracía Property in México. Gold concentrates are sold at a small discount to the prevailing spot market price, based on the price per ounce of gold quoted at the London PM gold fix, with the actual net precious metals prices received depending on the sales contract. Concentrates are priced by the assay of the gold content in the concentrate deliveries and the final selling price and gold quantities are subject to final adjustments at the time of final purchase settlement. In the first three quarters of 2023, the final adjustments decreased initial reported delivered ounces by approximately 15%. Since and including the fourth quarter of 2023, there have been no material adjustments to the reported delivered ounces.

Metals Prices

The results of the Company are substantially dependent upon the market prices of gold and silver, which fluctuate widely. In the past, the Company has not entered into derivative contracts to protect the selling price for certain anticipated gold and silver production and to manage risks associated with foreign currencies.

Gold and Silver Pilot Processing Methods

Gold and silver are extracted from mined mineralized material, by crushing, grinding, milling, and further by simple gravity and flotation recoveries. The mineralized material is extracted by underground mining methods. The processing plant at the San José de Gracía mine site is composed of conventional crushing and grinding circuits, and with gravity and flotation recovery methods. The gravity and flotation concentrates are partially dewatered and transported to purchasers in armored and secured semi-trailer trucks.

4

Commodities

We purchase materials and supplies from third parties to conduct our business, including electricity, fuel, chemical reagents, explosives, steel and concrete. Prices for these commodities are volatile and can fluctuate due to conditions that are difficult to predict, including inflation, currency fluctuations, global competition for resources, consumer or industrial demand and other factors. For most of these commodities, we have existing alternate sources of supply or alternate sources of supply are readily available. We continuously monitor supply and cost trends for these items.

Exploration Stage

The Company is an exploration stage issuer as defined in Section 1300 of Regulation S-K.

Segment Information

The Company operates in one segment: test mining and milling gold-silver concentrate for sale from its location in Mexico.

General Government Regulations

México

In Mexico, we are subject to various governmental laws and regulations, including environmental regulations. Other than operating licenses for our mining and processing facilities and concessions granted under contracts with the host government, there are no third-party patents, licenses or franchises material to our business. The applicable laws and regulations applicable to us include but are not limited to:

Mineral Concession Rights. Exploration and exploitation of minerals in México may be carried out through Mexican companies incorporated under Mexican law by means of obtaining mining concessions. The Company’s mining concessions were granted by the Mexican government for a period of fifty years from the date of their recording in the Public Registry of Mining and are renewable for a further period of fifty years upon application within five years prior to the expiration of such concession in accordance with the Mining Law and its regulations at their issuance. These mining concessions are subject to annual work requirements and payment of annual surface taxes which are assessed and levied on a semi-annual basis. Such concessions may be transferred or assigned by their holders, but such transfers or assignments must be registered with the Public Registry of Mining in order to be valid against third parties. The holder of a concession must pay semi-annual duties in January and July of each year on a per hectare basis and in accordance with the amounts provided by the Federal Fees Law. During the month of May of each year, the concessionaire must file the work assessment reports made on each concession or group of concessions for the preceding calendar year with the General Bureau of Mines. The regulations of the Mining Law provide tables containing the minimum investment amounts that must be made on a concession. This amount is updated annually in accordance with the changes in the Consumer Price Index.

Surface Rights. In México, while mineral rights are administered by the federal government through federally issued mining concessions, Ejidos (communal owners of land recognized by the federal laws in México) control surface access rights to the land. An Ejido may sell or lease lands directly to a private entity. While the Company has agreements or is in the process of negotiating agreements with the Ejido that impact all of its projects in México, some of these agreements may be subject to renegotiation.

Mining Permits. The Secretariat of Environmental and Natural Resources, the Mexican Government environmental authority ("SEMARNAT"), is responsible for issuing environmental permits associated with mining. Three main permits required before construction can begin are: Environmental Impact Statement (known in México as Manifesto Impacto Ambiental) ("MIA"), Land Use Change (known in México as Estudio Justificativo Para Cambio Uso Sueldo) ("ETJ"), and Risk Analysis (known in México as Analisis de Riesgo) ("RA"). A construction permit is required from the local municipality and an archaeological release letter must be obtained from the National Institute of Anthropology and History (known as "INAH"). An explosives permit is required from the ministry of defense before construction can begin. The Environmental Impact Statement is required to be prepared by a third-party contractor and submitted to SEMARNAT and must include a detailed analysis of climate, air quality, water, soil, vegetation, wildlife, cultural resources and socio-economic impacts. The Risk Analysis study (which is included into the Environmental Impact Statement and submitted as one complete document) identifies potential environmental releases of hazardous substances and evaluates the risks in order to establish methods to prevent, respond to, and control environmental emergencies. The Land Use Change requires that an evaluation be made of the existing conditions of the land, including a plant and wildlife study, an evaluation of the current and proposed use of the land, impacts to naturally occurring resources, and an evaluation of reclamation/re-vegetation plans.

5

We believe we operate in compliance with all applicable governmental laws and regulations and the costs of compliance are paid for on an ongoing basis. Due to the nature of our permit, we have requirements for landscape restoration which are fulfilled on an ongoing basis. We are working under a permit which required a Forest Fund bond of approximately 134,487 pesos and does not require, other than the replanting of like vegetation material, any reclamation work since we are mining underground. We maintain a greenhouse of approximately 20,000 trees that are used in the replanting of vegetation material.

Customers

The Company sells its concentrates to the buyer who offers the best terms based upon price, treatment costs, refining costs, and other terms of payment. During the year ended December 31, 2023 and 2022, the Company sold gold-silver concentrates to one purchaser pursuant to an Advance Credit Line Facility (“ACL”) and a Revolving Credit Line Facility (the “RCL”) in accordance with the Commercial Offtake Agreement. As gold-silver concentrate can be sold through numerous gold and silver market traders worldwide, and the price paid to the Company under the ACL/RCL varies based on market conditions, the Company is effectively not economically dependent on a limited number of customers for the sale of its product.

Products and Raw Materials

Gold-silver concentrate is the only product we produce. Additionally, we have no major suppliers of raw materials as the ore we mine is the most important raw material we use. Supplementary supplies such as fuel and organic solutions are in ready supply from a number of vendors.

Competitive Business Conditions

We compete with many companies in the mining and mineral exploration and production industry, including large, established mining companies with substantial capabilities, personnel, and financial resources. There is a limited supply of desirable mineral lands available for claim-staking, lease, or acquisition in the United States, Canada, Mexico, Argentina, and other areas where we may conduct our mining or exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we compete with these entities, many of which have significantly greater financial resources and larger technical staffs than we do. From time to time, specific properties or areas that would otherwise be attractive to us for exploration or acquisition may be unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the industry is not limited to the acquisition of mineral properties, but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such exploration and development. Many competitors not only explore for and mine precious and base metals but conduct refining and marketing operations on a world-wide basis. Such competition may result in our company not only being unable to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources could have a material adverse effect on our results of operation, financial condition and cash flows.

Human Capital Resources

As of December 31, 2023, we had approximately 200 employees in Mexico and 6 in the United States. All our employees based in the United States work in an executive, technical or administrative position, while our employees in Mexico include management, laborers, craftsmen, mining, geologist environmental specialists, information technologists, accountants and various other support roles. We also frequently engage independent contractors in connection with certain administrative matters and the exploration of our properties, such as drillers, geophysicists, geologists, and other specialty technical disciplines. For the United States, we also engage independent contractors for technical and professional expertise. None of our employees in México are covered by union contracts and the Company believes we have good relations with our employees.

As part of our fundamental need to attract, reward and retain talent, we regularly evaluate our compensation, benefits and employee wellness offerings. We have determined that our compensation arrangements are competitive in the industry.

Responsibility

The San Jose de Gracia community is home to DynaMéxico activities. We’ve devoted significant capital and resources to ensuring our project is a good neighbor to SJG and the surrounding villages. We strive for best-in-class safety and environmental policies through an approach of responsible production, including the sole use of biodegradable and organic solvents and a focus on best safety practices.

6

DynaResource has constructed and donated a hospital to the SJG community and contributed funds for repairs and upgrades to the local church and school, and provided education and business training to adults, creating new opportunities for current residents. Additionally, we’ve funded and constructed roads within the community and improved a road from Sinaloa de Leyva to SJG, a distance of over 60 kilometers.

Available Information

We make available links on our website (http://www.dynaresource.com) to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements, as well as Forms 3, 4 and 5 with respect to our common stock, including any amendments to any of the foregoing, as soon as reasonably practicable after such reports are electronically filed with the U.S. Securities and Exchange Commission (“SEC”). These filings are also available at http://www.sec.gov.

Copies of our Code of Business Conduct and Ethics, applicable to the executive officers, are also available on our website. Information contained on our website is not a part of this report.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

The Company has adopted processes designed to assess, identify, and manage material risks from cybersecurity threats that are integrated into the Company’s overall risk management system. The Company’s cybersecurity risk management processes are managed by Tuearis Cyber (“Tuearis”) an outside contractor with significant experience and expertise in designing and implementing cybersecurity programs for corporate entities such as the Company.

During the year ended December 31, 2023, the Company did not experience any risks from cybersecurity threats that materially affected or were reasonably likely to materially affect the Company’s business strategy, results of operations, or financial condition.

The Company’s Board of Directors, through its Audit Committee (the “Committee”), working closely with the Company’s corporate governance consultant, provides oversight of risks from cybersecurity threats by monitoring incident-based reports from Tuearis as to the existence and severity of such risks. When risks are identified, the Committee works with the Company’s corporate governance consultant to develop appropriate responses, based on the recommendations of Tuearis. The Company does not have an employee with specific expertise in cybersecurity risk management but relies on Tuearis to provide that expertise. All material cybersecurity risks, incidents, and responses are reported to the Committee as a routine matter.

ITEM 2. PROPERTIES

Corporate Headquarters

The Company leases office space for its corporate headquarters in Las Colinas, Irving, Texas. In February 2023, the Company entered into a 52-month extension of the original lease from September 2017 and added additional office space. As part of the agreement the new lease term commenced and the Company received four months free rent upon completion of the finish out of the expansion space. The expansion was complete and the Company occupied the office space effective August 1, 2023. The Company makes tiered lease payments on the first of each month.

Administrative and Logistics Offices

DynaMexico maintains administrative and logistics offices in Guamuchil and Matazalan, Mexico, both of which are under month-to-month payment terms.

Mining Project Location

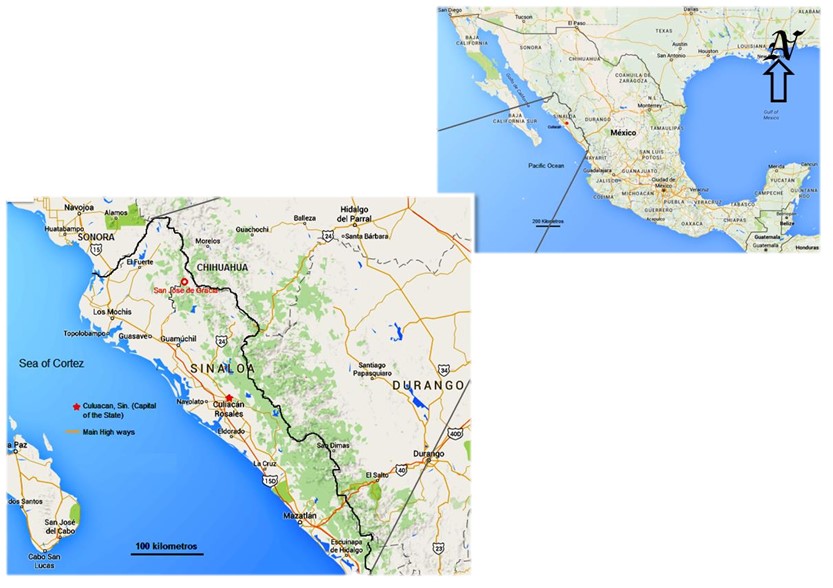

The San Jose de Gracia mining project (“SJG Project”) is located on map sheet G13-A81 in the Culiacan mining district of Sinaloa State, Mexico, at Latitude 26 ̊ , 9’ N, Longitude 107 ̊, 53’ W, approximately 120 kilometers east northeast of the coastal city of Los Mochis. The property on which the SJG Project resides, straddles the border separating the Mexican States of Sinaloa and

7

Chihuahua. The SJG Project is located in the south-western portion of the property, and is located entirely within the State of Sinaloa, as shown in the maps below.

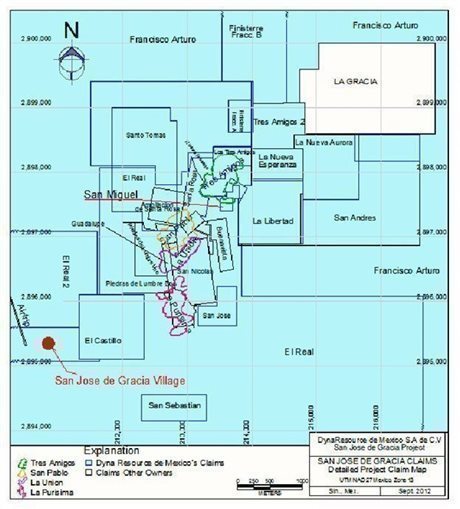

DynaMexico owns the San Jose de Gracia mineral concessions, which are comprised of 33 distinct concessions covering an aggregate of approximately 9,920 hectares. The concessions are held 100% by DynaMexico and there are no royalty or other interests.

The property on which the SJG Project resides is located in and around the village of San Jose de Gracia, approximately 100 km northeast of Guamuchil, on the west side of Mexico. The village of San Jose de Gracia has a small airstrip and can be accessed by a small airplane, or alternatively, by a dirt mountain road. There are roads providing access to the property on which the SJG Project resides. which are accessible throughout the year, with the possible exception of June and July when the rainy season sometimes causes flooding and runoff to make the roads too muddy to navigate.

Local Resources and Infrastructure

Accommodations

The Village of San Jose de Gracia maintains a few stores which offer essential goods and services. The camp site area, which is closer to the mining activities, maintains facilities of twelve rooms with additional lodging available in the village which can accommodate a total of about 225 persons.

8

Power

A power line to the San José de Gracia Project has been installed by the Comisión Federal de Electricidad, the only authorized power producer in Mexico. The power line was installed in March 2012 from the La Estancia area of the municipality of Sinaloa de Leyva, a distance of approximately 75 kilometers.

The power line is currently 220 volts maximum capacity, which supports domestic use only, including the office and camp facilities at SJG, such as water pump, air conditioning, refrigeration, lights, internet, and fans, as well as local residential use. The SJG Project produces its own diesel-generated power as a backup to the power grid.

Offices – Camp Facilities

The SJG Project sources many of its supplies from nearby towns, Guamuchil, Los Mochis and Culiacan. There is a satellite dish installed at the SJG Project providing communications from the SJG Project. At the SJG Project, DynaMexico maintains a camp staff, including geologists, field helpers, consultants, security, cooks and cleaners. Most of these employees come from the local community.

Mining Concessions

The San José de Gracia Property consists of the following 33 contiguous mining concessions which covers an area of approximately 9,920 hectares (24,513 acres):

Current Mining Concessions - San José de Gracia

Claim Name |

|

Claim Number |

|

Staking date |

|

Expiry |

|

Hectares |

|

|

|

AMPL. SAN NICOLAS |

|

183815 |

|

22/11/1988 |

|

21/11/2038 |

|

|

17.4234 |

|

|

AMPL. SANTA ROSA |

|

163592 |

|

30/10/1978 |

|

29/10/2028 |

|

|

25.0000 |

|

|

BUENA VISTA |

|

211087 |

|

31/03/2000 |

|

30/03/2050 |

|

|

17.9829 |

|

|

EL CASTILLO |

|

214519 |

|

02/10/2001 |

|

01/10/2051 |

|

|

100.0000 |

|

|

EL REAL |

|

212571 |

|

07/11/2000 |

|

07/11/2052 |

|

|

2038.0000 |

|

|

EL REAL 2 |

|

216301 |

|

30/04/2002 |

|

29/04/2052 |

|

|

280.1555 |

|

|

FINISTERRE FRACC. A |

|

219001 |

|

28/01/2003 |

|

27/01/2053 |

|

|

18.7856 |

|

|

FINISTERRE FRACC. B |

|

219002 |

|

28/01/2003 |

|

27/01/2053 |

|

|

174.2004 |

|

|

GUADALUPE |

|

189470 |

|

05/12/1990 |

|

04/12/2040 |

|

|

7.0000 |

|

|

LA GRACIA I |

|

215958 |

|

02/04/2002 |

|

01/04/2052 |

|

|

300.0000 |

|

|

LA GRACIA II |

|

215959 |

|

02/04/2002 |

|

01/04/2052 |

|

|

230.0000 |

|

|

LA LIBERTAD |

|

172433 |

|

15/12/1983 |

|

14/12/2033 |

|

|

97.0000 |

|

|

LA NUEVA AURORA |

|

215119 |

|

08/02/2002 |

|

07/02/2052 |

|

|

89.3021 |

|

|

LA NUEVA ESPERANZA |

|

226289 |

|

06/12/2005 |

|

05/12/2055 |

|

|

40.0000 |

|

|

LA UNION |

|

176214 |

|

26/08/1985 |

|

25/08/2035 |

|

|

4.1098 |

|

|

LOS TRES AMIGOS |

|

172216 |

|

27/10/1983 |

|

26/10/2033 |

|

|

23.0000 |

|

|

MINA GRANDE |

|

163578 |

|

10/10/1978 |

|

09/10/2028 |

|

|

6.6588 |

|

|

NUEVO ROSARIO |

|

184999 |

|

13/12/1989 |

|

12/12/2039 |

|

|

32.8781 |

|

|

PIEDRAS DE LUMBRE 2 |

|

215556 |

|

05/03/2002 |

|

04/03/2052 |

|

|

34.8493 |

|

|

PIEDRAS DE LUMBRE 3 |

|

218992 |

|

28/01/2003 |

|

27/01/2053 |

|

|

4.3098 |

|

|

PIEDRAS DE LUMBRE No.4 |

|

212349 |

|

29/09/2000 |

|

28/09/2050 |

|

|

0.2034 |

|

|

PIEDRAS DE LUMBRE UNO |

|

215555 |

|

05/03/2002 |

|

04/03/2052 |

|

|

40.2754 |

|

|

SAN ANDRES |

|

212143 |

|

31/08/2000 |

|

30/08/2050 |

|

|

385.0990 |

|

|

SAN JOSÉ |

|

208537 |

|

24/11/1998 |

|

23/11/2048 |

|

|

27.0000 |

|

|

SAN MIGUEL |

|

183504 |

|

26/10/1988 |

|

25/10/2038 |

|

|

7.0000 |

|

|

SAN NICOLAS |

|

163913 |

|

14/12/1978 |

|

13/12/2028 |

|

|

55.5490 |

|

|

SAN SEBASTIAN |

|

184473 |

|

08/11/1989 |

|

07/11/2039 |

|

|

40.0000 |

|

|

SANTA MARIA |

|

218769 |

|

17/01/2003 |

|

16/01/2053 |

|

|

4.2030 |

|

|

SANTA ROSA |

|

170557 |

|

13/05/1982 |

|

12/05/2032 |

|

|

31.4887 |

|

|

SANTO TOMAS |

|

187348 |

|

13/08/1986 |

|

12/08/2036 |

|

|

312.0000 |

|

|

TRES AMIGOS 2 |

|

212142 |

|

31/08/2000 |

|

30/08/2050 |

|

|

54.4672 |

|

|

FINISTERRE 4 |

|

231166 |

|

18/01/2008 |

|

17/01/2058 |

|

|

2,142.1302 |

|

|

FRANCISCO ARTURO |

|

230494 |

|

06/09/2007 |

|

27/03/2057 |

|

|

3,279.5600 |

|

|

TOTAL |

|

|

|

|

|

|

|

|

9,920.0000 |

|

|

9

Title to 32 of the 33 mining concessions is registered in the sole name of DynaMexico. The one exception is the San Miguel concession. For the San Miguel concession, DynaMexico has entered into transfer agreements with the registered owners of 50% of the concession title, and DynaMexico has also entered into promise to sell and purchase agreements with registered owners of the balance of the concession title. Under Mexican law, such agreements require the consent or relinquishment of first rights of refusal from the registered owners of 100% of the concession title, in order to have legal effect and be eligible for registration before the Mines Recorders’ Office.

Under amendments to the Mining Act of Mexico that came into effect in December 2006, the classifications of Mining Exploration Concessions and Mining Exploitation Concessions were replaced by a single classification of Mining Concessions valid for a renewable term of 50 years, commencing from the initial issuance date. To be converted into Mining Concessions at the time these amendments came into effect, former mining exploration and mining exploitation concessions had to be in good standing at the time of conversion.

All of the SJG concessions were in good standing and consequently were converted to 50-year Mining Concessions in December 2006, at the time the amendments to the Mining Act came into effect. To renew the 50-year term, Mining Concessions must be in good standing at the time an application for renewal is filed, and an application for renewal must be filed within 5 years prior to expiration of the term.

To maintain Mining Concessions in good standing, the registered owner must (a) pay bi-annual mining duties in advance, by January 31 and July 31 each year, (b) file assessment work reports by May 30 each year, for the preceding year (some exceptions apply), and (c) by January 31 each year, file statistical reports on exploration / exploitation work conducted for the preceding year. The Company believes it is in good standing regarding all above noted obligations.

Notice of Commencement of Production Activities and Annual Production Reports must be filed annually by January 31 each year for those concessions where mineral ore extraction is taking place. As a general provision, registered owners of Mining Concessions must follow environmental and labor laws and regulations in order to maintain their Mining Concessions in good standing.

The following claim location map shows the location of each of the concessions and the legend presents various areas of mining and drilling.

10

Surface Rights

In addition to the surface rights held by DynaMéxico pursuant to the Mining Act of México and its Regulations (Ley Minera y su Reglamento), the Company maintains access and surface rights for the SJG Project pursuant to a 20-year Land Lease Agreement. This lease agreement with the Santa Maria Ejido Community (the owners of the surface rights) is dated January 6, 2014 and continues through 2033. The lease agreement covers an area of 4,399 hectares surrounding the main mineral resource areas of SJG and provides for annual lease payments of $1,359,443 Pesos (adjusted for inflation). The 2023 payment was $4,414,124 pesos (approx. $249,000 USD).

The lease agreement provides the Company with surface access to the core resource areas of SJG (4,399 hectares), and allows for all permitted mining, pilot production and exploration activities.

Water Concession

The Company has secured the Water Rights Concession for the area surrounding SJG. The Director of Water Administration of the National Water Commission of México (CONAGUA) formally certified in writing the rights of DynaMéxico to legally “use”, exploit and extract 1,000,000 cubic meters of water per year from the DynaMéxico extraction infrastructure located within the perimeter of the mining concessions. CONAGUA determined that the DynaMéxico water rights are not subject to any water rights

11

concession or any other water extraction restriction. Water extracted by DynaMéxico will be subject to applicable levies imposed by the Mexican tax authorities in accordance with current Mexican tax laws. The water concession provides sufficient water for current operations, and for the anticipated future needs of the project. The Company recycles water from the tailings pond back through the test milling circuit, then back to the tailings pond.

Royalties, Encumbrances and Environmental Liabilities

The SJG Property is not subject to any royalties, encumbrances or environmental liabilities.

Required Permits for Exploration, Drilling and Mining

In respect of permit requirements for mineral exploration and mining in Mexico, the most relevant applicable laws, regulations and official technical norms are the Federal Mining Act (plus its regulations), the Federal Environmental Protection and Ecological Equilibrium Act (plus its regulations), the Federal Sustainable Forestry Development Act (plus its regulations), the Federal Explosives and Firearms Act, the National Waters Act and the Mexican Official Norm 120.

To carry out mineral exploration activities, holders of mining concessions in Mexico are required to file at the offices of the Federal Secretariat of the Environment and Natural Resources (“SEMARNAT”) a “Notice of Commencement of Exploration Activities” or “Preventive Exploration Notice” in accordance with the guidelines of the Mexican Official Norm 120 (“NOM- 120”).

If contemplated mineral exploration activities fall outside of the guidelines of the NOM-120 (e.g. exploration activities on rain forest areas), a “Change of Soil Use Permit Application” (“CSUP”) is required to be filed at SEMARNAT under the guidelines of the Federal Sustainable Forestry Development Act and its Regulations. To meet the requirements for issuance of a change of soil use permit, the applicant must file (together with the CSUP) a Technical Study (“Technical Justification Study”) to justify the change of soil use from forestry to mining, in order to demonstrate that biodiversity will not be compromised and that there will be no soil erosion or water quality deterioration on completion of the mineral exploration activities.

To carry out mining activities in Mexico, holders of mining concessions are required to file an “Environmental Impact Assessment Study” under the guidelines of the Federal Environmental Protection and Ecological Equilibrium Act and its Regulations, in order to evaluate the environmental impact of the contemplated mining activities.

If the use of explosives materials is required for execution of mineral exploration or mining activities, an Application for General Permit for Use, Consumption and Storage of Explosive (“GPCSE”) is required to be filed at the offices of the Secretariat of National Defense (“SEDENA”) under the guidelines of the Federal Explosives and Firearms Act. Under the Federal Mining Act, holders of mining concessions in Mexico have the right to the use of the water coming from the mining works. Certification of water rights and/or issuance of water rights concessions are required from the National Water Commission (“CONAGUA”) under the guidelines of the National Waters Act.

Fees or Bonding Requirements Necessary To Explore or Mine

As a pre-requisite for issuance of a CSUP, Article 118 of the Federal Sustainable Forestry Development Act provides the posting of a bond to the Mexican Forestry Fund for remediation, restoration and reforestation of the areas impacted by the mineral exploration activities.

As a pre-requisite for approval of Preventive Exploration Notice and Environmental Impact Assessment Study, the Federal Environmental Protection and Ecological Equilibrium Act and its Regulations require the posting of a bond to guarantee remediation and rehabilitation of the areas impacted by the mining activities.

Government Agencies Responsible For Any Applicable Permits

SEMARNAT is the office of the Federal Government of Mexico responsible for the review and issuance of a CSUP, the review of a Technical Justification Study and the filing of NOM-120. The Federal Attorney’s Office for the protection of the Environment is the enforcement branch of SEMARNAT responsible for the monitoring and enforcement of environmental laws and regulations. SEDENA is the office responsible for issuance of a GPCSE. CONAGUA is the office responsible for certification of water rights and issuance of water rights concessions.

12

Time Frame to Obtain Any Permit or Approval To Explore or Mine

NOM-120 is a notice to SEMARNAT only and has no prescribed processing time. Processing time for review and approval of a CSUP Application and Technical Justification Study varies depending on the workload of the SEMARNAT regional office where application is filed, but a processing time of four months is typical.

Processing time for review and approval of an Environmental Impact Assessment Study varies depending on workload of SEMARNAT regional office where application is filed, but a processing time of six months is typical. Processing time for issuance of a GPCSE by SEDENA is approximately six months. Processing time for issuance of a Water Rights Concession by CONAGUA is approximately six months.

DynaMexico Permits and Bonding Requirements

Exploration Permit: On June 28, 2010, DynaMexico filed a Preventive Exploration Notice (Preventive Exploration Notice) at the office of SEMARNAT in connection with contemplated mineral exploration activities at the La Prieta, San Pablo, La Purísima, La Unión, Tres Amigos and La Ceceña areas of the SJG Project. On July 21, 2010, SEMARNAT approved, for a term of 36 months, the execution of the mineral exploration activities at SJG set out in the Preventive Exploration Notice, as it determined that such activities fall within the framework of the NOM-120, subject to the following conditions: (a) filing and approval by SEMARNAT of a CSUP with respect to SJG (see below), and (b) posting of a bond in the amount of $134,487 Pesos to guarantee remediation and rehabilitation measures following the conclusion of the mineral exploration activities.

Change of Soil Use Permit

On August 9, 2010, DynaMexico filed at the offices of SEMARNAT a CSUP Application and Technical Justification Study to carry out certain mineral exploration activities set out in the Preventive Exploration Notice approved by SEMARNAT on July 21, 2010 (see above) at the La Prieta, San Pablo, La Purísima, La Unión, Tres Amigos and La Ceceña areas of SJG). On December 20, 2010, SEMARNAT approved the CSUP Application filed by DynaMexico with respect to SJG and authorized DynaMexico the execution of mineral exploration activities on 5.463 hectares of SJG for a term of 36 months, and it is continually renewed as required.

Water Rights Certification

On March 8, 2012 the Director of Water Administration of CONAGUA certified in writing the rights of DynaMexico to use, exploit and extract 1,000,000 cubic meters of water per year from the Company’s extraction infrastructure located in SJG. CONAGUA determined that DynaMexico’s water rights are not subject to any other water rights concession or any other water extraction restriction.

Bonding Requirements

Under the CSUP issued to DynaMexico on December 20, 2010, SEMARNAT imposed upon DynaMexico the obligation to post a bond in the amount of $116,911 Pesos for reforestation and remediation measures in SJG. The Company maintains a greenhouse of 20,000 trees which are used in the reforestation efforts as necessary.

Under Preventive Exploration Notice (Preventive Exploration Notice) approved by SEMARNAT on July 21, 2010, SEMARNAT imposed upon and DynaMexico complied, the obligation to post a bond in the amount of $134,487 Pesos, to guarantee remediation and rehabilitation measures following the conclusion of the mineral exploration activities. As required by US Generally Accepted Accounting Principles (“US GAAP”) the Company also has an asset retirement obligation recorded as of December 31, 2023 for the net present value of the cost to dismantle and dispose the plant and remove the tailings pond.

DynaMexico has sought and obtained all required environmental permits, temporary land occupation rights and consent letters from the regulatory agencies, local municipalities and the State of Sinaloa, in order to conduct its mining, production, exploration and drilling activities on the four main deposit areas at SJG. DynaMexico will be required to obtain further permits in order to conduct drilling in these four areas and the other areas, and in order to carry out future mining, milling, and production activities, and will timely obtain such permits, as and when required.

HISTORY OF SAN JOSE DE GRACIA

Production at San José de Gracia dates from the 1800’s and totals approximately one million ounces of gold mined from high-grade quartz veins. Large-scale mining in the camp began in 1870 and ended in 1910 with the onset of the Mexican Revolution. The majority of the production came from the Anglo, Rosario and La Cruz Mines on the Purisima Ridge trend, and from the La Prieta

13

Mine on the La Prieta trend (reference Fig. 2). The remainder of the production was derived from as many as 60 smaller mines throughout the 12 square kilometer area, including the Palos Chinos, San Pablo, Tres Amigos, La Ceceña, Los Hilos, Santa Rosa, Veta Tierra, La Union, Santa Eduwiges, La Mochomera and La Parilla Mines.

This table presents the historic reported gold production for San Jose de Gracia prior to 1970:

Area |

|

Gold |

|

|

Gold |

|

|

Mined |

||

Purisma Ridge Trend (includes the Anglo, Rosario, Jesus Maria and Laz Cruz Mines) |

|

|

471,000 |

|

|

|

67.0 |

|

|

Unknown |

La Prieta Trend (La Prieta Mine) |

|

|

215,000 |

|

|

|

28.0 |

|

|

1.5 – 3 m |

Other areas |

|

|

300,000 |

|

|

Unknown |

|

|

Unknown |

|

It was not until the 1970’s when mining could resume at San José de Gracia, when the first road to SJG was opened, allowing Compaňia Rosarito to begin producing gold from the Palos Chinos, San Pablo, Tres Amigos and La Union mines.

Recent Ownership of the Property

By 1977, the underlying owners of the mining concessions and subsequent vendors to Minera Finisterre SA de CV. (“Finesterre”) succeeded in acquiring control of most of the district, and installed a 70 ton per day flotation concentrator. Finisterre subsequently acquired the property through option agreements with the underlying vendors and continued some exploration work, although most of its financial resources were expended in erecting a larger, 200 ton per day concentrator.

Golden Hemlock Explorations Ltd., a Canadian company, obtained an option to acquire majority control of Finisterre and commenced work on the property in 1997. The actual exploration and development work was performed by Perforaciónes Quest de Mexico (“PQM”), which was under contract to Finesterre, and whose efforts consisted primarily of core drilling, trenching and mapping. PQM completed a 63-hole, 6,000-meter core drilling program in 1997.

In 1998-1999, Pamicon Developments Ltd., a Canadian company, examined the results of the 1997 drilling program, including PQM’s technical work, in order to calculate possible mineral reserves, and to review the general status of the property. Results of this examination were presented in a report dated September 1999.

During the first half of 1999, DynaResource, Inc. and its agents arranged to collect samples for metallurgical testing. In June of 2000, DynaResource formed its subsidiary DynaMexico, in order to acquire and consolidate ownership of the San Jose de Gracia Project. By December 2003, DynaMexico had completed the acquisition of and consolidation of 100% of the San Jose de Gracia Project from Golden Hemlock and Finisterre -- with the sole exception of the San Miguel mining concession.

Test Mining Operations

The Company has not determined mineral reserves and the test mining program is exploratory in nature. The Company has started extraction in identified areas after analysis of the results from the drilling program that was recommenced in 2021. All mines are underground and the ore is hard rock that needs to be blasted, removed from the mine and taken to the test mill to be crushed and ground before gold concentrate can be extracted.

Summary of Test Mining and Pilot Mill Operations for 2018 to 2023:

|

|

Estimated Total Tonnes |

|

|

Estimated Reported |

|

|

Estimated Reported |

|

|

Estimated Gross Gold |

|

|

Estimated Net Gold |

|

|||||

Year |

|

Processed |

|

|

(g/t Au) |

|

|

% |

|

|

(Au oz.) |

|

|

(Au oz.) |

|

|||||

2018 |

|

|

52,038 |

|

|

|

9.82 |

|

|

|

86.11 |

% |

|

|

14,147 |

|

|

|

13,418 |

|

2019 |

|

|

66,031 |

|

|

|

5.81 |

|

|

|

86.86 |

% |

|

|

10,646 |

|

|

|

9,713 |

|

2020 |

|

|

44,218 |

|

|

|

5.65 |

|

|

|

87.31 |

% |

|

|

7,001 |

|

|

|

5,828 |

|

2021 |

|

|

97,088 |

|

|

|

9.67 |

|

|

|

88.79 |

% |

|

|

26,728 |

|

|

|

22,566 |

|

2022 |

|

|

137,740 |

|

|

|

8.18 |

|

|

|

88.05 |

% |

|

|

31,905 |

|

|

|

25,554 |

|

2023 |

|

|

198,518 |

|

|

|

5.58 |

|

|

|

76.50 |

% |

|

|

27,252 |

|

|

|

24,829 |

|

14

Test pilot operations in 2023 yielded 198,518 tonnes of material, mined and processed from underground test mining activity and pilot milling operations. These test pilot operations also yielded approximately a reported 27,252 gross ounces of gold, and net of dry weight adjustments at the buyer’s facilities of approximately a reported 24,829 ounces of gold.

Infrastructure Improvements, Expansion and Increased Output (2017 To 2023)

As part of the Company’s test mining activities, the Company continues to upgrade the facilities and the pilot mill. Significant improvements have been made such that the condition of the equipment is new, relatively new or in good condition. The Company has three ball mills of which the two largest are currently running 800 tons per 24-hour day at the end of 2023. The third is currently being used as a regrind mill.

The Company continues its exploration at San Jose de Gracía, in order to increase production of gold ounces. Since January 2015 startup of the test mining and milling activities, the Company has increased daily output from an initial 75 tons per 24-hour operating day to a capacity of 800 tons per 24-hour operating day at the end of 2023.

Since January 2017, the Company has expended approximately $28.3 million USD in non-recurring costs, generally classified as project improvements and expansion costs which have been expensed in the Company’s financial statements. These funds have been provided primarily from cash flows from operations.

Of the approximately $28.3 million in non-recurring costs, the Company has spent the following on facilities expansion:

Mill Expansion |

|

$ |

7,893,000 |

|

Tailings Pond Expansion |

|

|

1,464,000 |

|

Machinery and Equipment |

|

|

3,165,000 |

|

Mining Camp Expansion |

|

|

272,000 |

|

Total |

|

$ |

12,794,000 |

|

The Company has spent the following amounts on mine development:

Mine Development - San Pablo |

|

$ |

4,968,000 |

|

Mine Expansion - San Pablo East |

|

|

915,000 |

|

Mine Expansion - Tres Amigos |

|

|

1,599,000 |

|

Exploration Drilling |

|

|

5,000,000 |

|

SJG Mining Concessions |

|

|

2,014,000 |

|

Surface Rights and Permitting |

|

|

1,042,000 |

|

Total |

|

$ |

15,538,000 |

|

The Company is currently reporting all costs of test mining operations, project improvements, and project expansion as expenses in accordance with the United States Securities & Exchange Commission requirements for an exploration stage company. The result of expensing all costs is that the Company has accumulated a net loss carry-forward from México operations of $22.0 million USD which is available to offset future taxable earnings.

The Company is performing exploration drilling to further define mineralization and in 2023 and 2022 expended $2,514,544 and $2,484,072, respectively, for this drilling.

The Company is currently an exploration stage issuer and is reporting all costs of mine operations, improvements, and expansion as expenses in accordance with Section 1300 of Regulation S-K and US GAAP requirements, and therefore the above costs are not reflected as capitalized assets on the Company’s balance sheet.

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

Topography, Physiography, and Vegetation

The topography of the San José de Gracia district is generally rugged with elevations varying from 400 meters in the valley bottoms to over 1600 meters in the higher Sierra. A network of small roads and tracks winds around areas nearer the old workings at San José de Gracia. Access to the remainder of the large property at the current stage of development is difficult without the use of horse or helicopter.

15

The SJG Project can be accessed by road, from either the City of Culiacan or the City of Guamuchil. Either route goes through the small town of Sinaloa de Leyva, then from Sinaloa de Leyva by gravel mountainous road to the village of San José de Gracia (population 750), which covers approximately 90 kilometers and is roughly a five-hour trip.

The SJG Project can also be accessed by air. A gravel airstrip is located adjacent to the San Jose de Gracia Village. The airstrip is suitable for light aircraft and charter flights of 45 minutes duration are available from the cities of Los Mochis or Culiacan. Much of the labor for mining and production activities of DynaMexico is provided by the local community of SJG.

Climate and Operating Season

The climate is semi-tropical with a rainy season dominating June and July. For some activities on the SJG project, operations may be suspended during the rainy season.

MINERAL PROCESSING AND METALLURGICAL TESTING

Bulk Sample, Hazen Process Development Metallurgical Report

Ore and existing mill tailings samples were collected prior to DynaMexico’s acquisition and consolidation of San Jose de Gracia. The ore samples consisted of a bulk (about 500 kg) of stockpiled ore from the lower adit of the Tres Amigos mine (intercept of the Tres Amigos and Orange Tree veins). In addition, approximately 100 kg of ore as a bulk sample was taken from the surface at the Gossan Cap area. Three additional ore samples (approximately 5-15 kg each) were assembled from splits of the cores from several of the 1997 drilling program core holes to develop samples representing different ore types for testing. These included: 1) composite drill cores from Palos Chinos, 2) massive sulfide from the Tres Amigos vein and 3) disseminated, nonsurprise mineralized zones at the bottom of several Tres Amigos core holes. The logic was that major exploratory test work to define a metallurgical process would be done on the bulk sample from the adit at Tres Amigos and the other samples would have limited testing done at the selected metallurgical process conditions to verify the performance of the selected metallurgical process circuit on other types of San José mineralization. Finally, several bulk samples (50-100 kg) of existing tailings from the Rosarito mill and the old Rosarito mill were collected and used to conduct flotation, gravity, and limited leachability test work on the tailings.” Samples were shipped to the laboratory of Carbonyx Carbon Technologies in Plano, Texas where in 2000 and 2001 two separate preliminary test programs were conducted, one for the tailings, and the other for a portion of the bulk Tres Amigos ore. The Company developed a concept for the metallurgical processing to produce both gravity and flotation concentrates (rougher and cleaner). The tests confirmed a metallurgical flow sheet to be utilized at San José to recover up to 90% of the feed gold into the concentrates. The above “in-house” testing established a preliminary flowsheet for a mill circuit for processing either primary ore or for reprocessing the existing tailings. Subsequently Hazen Research Laboratories of Golden, Colorado (“Hazen”) was engaged to provide independent verification of the in-house work and carry out additional optimization test work. Lockwood Greene/ Mr. Henderson prepared and verified completion of the scope of work.

In summary, various interim reports and the final metallurgical report, the Official Hazen Test Report, (“Hazen Report”)” provided results as follows:

A combination circuit of a gravity pre-concentration stage with flotation on the gravity tailings indicated the potential to recover > 90% of the feed gold into the gravity concentrate, the rougher flotation and the cleaner flotation concentrates while maintaining a 100 g Au/t grade in all of the concentrates.

EXPLORATION

DynaResource uses a multiple phase method of exploration. The initial activity consists of surface mapping and sampling to identify areas of interest. The next phase is detailed mapping and systematic sampling. Mapping and sampling of mine workings are also

16

performed to define potential areas for future work. Geological mapping and samples have been collected in the past and sent for laboratory analysis by the Company. The prospects are then catalogued and prioritized for drilling.

Since January 2021, seven areas have been drill-tested. They are: Tres Amigos, La Union, San Pablo, Tepehuaje, La Ceceña, Palos Chinos and La Mochomera. Since 2021, 241 holes for approximately 53,285 meters of diamond drilling has been completed and approximately 33,566 core samples were collected of which approximately 1,175 quality assurance/quality control (“QA/QC”) samples were shipped for laboratory analysis and verification.

Exploration and Drilling Protocol

The Company’s internal controls are designed to provide reasonable assurance that information and processes utilized in assessing its exploration results and resource estimates are reasonable and in line with industry best practices. These internal controls include QA/QC in the collection, analysis, verification, storage, reporting and use of drillhole, assay, metallurgical and other technical and scientific information, including the following internal control protocols in place for exploration data:

Mineral Resource Estimation

DynaResource has the following internal control protocols in place for mineral resource estimation:

Development of our mineral resource estimates use tools and processes such as mine design, scheduling and geostatistical tools that conform to industry best practices and are regularly reviewed and reconciled by internal and external parties. There are internal and external audit processes for mineral resource estimation.

Mineral resources are estimates that contain inherent risk and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable.

17

EXPLORATION PLANS FOR 2024

The Company plans to continue its exploration drilling program with two to six rigs on site. Management and geologists will make decisions based on capital available, the drill results, corporate strategies and market conditions, surface mapping, sampling and target generation. The Company has contracted with a "Qualified Person" within the meaning of subpart 1300 of Regulation S-K and Canadian Standard NI 43-101 to interpret the data collected for a formal Mineral Resource update in 2024.

TECHNICAL DISCLOSURE

All technical disclosures and resource estimate covering the Company's mineral property was prepared under the supervision of Mr. Francisco M Carranza Sr, CPG-11933, Consulting Geologist for the Company and a "Qualified Person" within the meaning of subpart 1300 of Regulation S-K.

The following is a summary and results of the data validation process of the 2023 and 2024 drilling campaigns, as well as an estimation of the resource potential, in the exploration area named La Mochomera, at the San Jose de Gracia Project of Dyna Resources Company.

Database

The drilling campaign consists of 100 drill holes with description, sampling, and dumped in an excel file, Dyna Resources delivered this information of drill cores, these files have information of geological description, sampling intervals, type of control sample (standard/blank), considering that this is the main source of more original data for the validation.

Bureau Veritas Laboratory provided us with access to the original certificates for both the 2023 and 2024 campaigns, the sum of these certificates is a total of 102 certificates, with Au, Ag, and ICP analysis.

Only 58 drill holes out of the 100 holes in the database are considered in the modeling of the area's resource potential. These generate continuities in geological and grade continuities. The orientation of the bodies are very similar to the other areas of the San Jose de Gracia district, bodies of mineralized veins, with variable thicknesses, with a general strike of 36° Az, and general strike of -30° of inclination to the NW.

La Mochomera has 11 zones of mineralization "veins" parallel, in a train of extension of little more than 400 meters, not all the veins present the same dimensions, but nevertheless it is possible to observe the orientations and similar inclinations.

Mineral Resource Estimate for the Mochomera area 2024.

Resource estimation was done in MineSight software using kriging with the omni-directional variogram used in the district due to similarity and prior knowledge of previous estimates.

To each of the structures was assigned a code, this code in turn was assigned to the blocks and composites belonging to these domains, so that the interpolation is controlled by domains and to control the interpolation Resources were estimated by kriging using data from 2024 and 2023 data. La Mochomera Resources was not classified.

Capping used was similar to the previous estimation, no variability was observed at the breakpoint of the probability plot.

Au Cut off g/t |

|

Tonnes |

|

|

Volume |

|

|

Au ppm |

|

|

Ag ppm |

|

|

Cu pct |

|

|

Pb pct |

|

|

Zn pct |

|

|

AuOz |

|

|

AgOz |

|

|

CuKg |

|

|

Pb Kg |

|

|

Zn Kg |

|

||||||||||||

0.2 |

|

|

4,150,533 |

|

|

|

1,660,213 |

|

|

|

1.11 |

|

|

|

2.51 |

|

|

|

0.04 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

148,138 |

|

|

|

334,979 |

|

|

|

2,019,676 |

|

|

|

415,053 |

|

|

|

830,107 |

|

0.4 |

|

|

2,309,195 |

|

|

|

923,678 |

|

|

|

1.78 |

|

|

|

3.47 |

|

|

|

0.06 |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

132,166 |

|

|

|

257,650 |

|

|

|

1,391,988 |

|

|

|

230,919 |

|

|

|

692,758 |

|

1 |

|

|

1,093,769 |

|

|

|

437,507 |

|

|

|

3.07 |

|

|

|

4.55 |

|

|

|

0.08 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

107,970 |

|

|

|

160,021 |

|

|

|

790,833 |

|

|

|

218,754 |

|

|

|

437,507 |

|

2 |

|

|

576,958 |

|

|

|

230,783 |

|

|

|

4.55 |

|

|

|

5.66 |

|

|

|

0.10 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

|

84,410 |

|

|

|

105,003 |

|

|

|

576,958 |

|

|

|

115,392 |

|

|

|

288,479 |

|

3 |

|

|

354,950 |

|

|

|

141,980 |

|

|

|

5.86 |

|

|

|

6.19 |

|

|

|

0.12 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

|

66,881 |

|

|

|

70,648 |

|

|

|

425,940 |

|

|

|

70,990 |

|

|

|

177,475 |

|

Resource Estimate as of December 31, 2022

The following resource information at Tres Amigos and San Pablo were classified as indicated as follows: block they are within 25 m of the nearest sample point and the block was estimated by at least 2 drill holes to be considered the indicated category. The remaining blocks that were interpolated are classified as inferred, La Purisima inferred estimate is provided by DynaResource de

18

Mexico SA de CV. However, for the purpose to elaborate for an official technical report with all the data process and verifications it is essential to validate the QA/QC protocols, field verification of drill sites, drill core, specific gravity procedures, rejects and pulps storage for re-assays if it is required.

The following table summarizes the estimated bulk tonnage resource at San Jose de Gracia after the drilling results in 2022:

Tres Amigos Indicated

Au Cut off g/t |

|

Tonnes |

|

|

Au g/t |

|

|

Au Oz |

|

|

Ag g/t |

|

|

Ag Oz |

|

|

Cu% |

|

|

CuKg |

|

|

Pb% |

|

|

PbKg |

|

|

Zn% |

|

|

Zn Kgs. |

|

|||||||||||

0.2 |

|

|

7,617,106 |

|

|

|

1.15 |

|

|

|

281,634 |

|

|

|

2.84 |

|

|

|

695,514 |

|

|

|

0.051 |

|

|

|

3,887,771 |

|

|

|

0.027 |

|

|

|

2,019,676 |

|

|

|

0.184 |

|

|

|

14,042,744 |

|

0.4 |

|

|

4,849,964 |

|

|

|

1.64 |

|

|

|

255,729 |

|

|

|

3.36 |

|

|

|

523,933 |

|

|

|

0.066 |

|

|

|

3,180,364 |

|

|

|

0.029 |

|

|

|

1,391,988 |

|

|

|

0.202 |

|

|

|

9,813,659 |

|

1 |

|

|

2,168,925 |

|

|

|

2.90 |

|

|

|

202,227 |

|

|

|

4.90 |

|

|

|

341,695 |

|

|

|

0.098 |

|

|

|

2,118,497 |

|

|

|

0.036 |

|

|

|

790,833 |

|

|

|

0.247 |

|

|

|

5,361,798 |

|

2 |

|

|

977,773 |

|

|

|

4.73 |

|

|

|

148,695 |

|

|

|

6.45 |

|

|

|

202,766 |

|

|

|

0.127 |

|

|

|

1,239,983 |

|

|

|

0.046 |

|

|

|

447,497 |

|

|

|

0.314 |

|

|

|

3,072,965 |

|

3 |

|

|

583,067 |

|

|

|

6.28 |

|

|

|

117,727 |

|

|

|

7.35 |

|

|

|

137,785 |

|

|

|

0.140 |

|

|

|

816,148 |

|

|

|

0.052 |

|

|

|

300,443 |

|

|

|

0.360 |

|

|

|

2,096,854 |

|

Tres Amigos Inferred

Au Cut off g/t |

|

Tonnes |

|

|

Au g/t |

|

|

Au Oz |

|

|

Ag g/t |

|

|

Ag Oz |

|

|

Cu% |

|

|

CuKg |

|

|

Pb% |

|

|

PbKg |

|

|

Zn% |

|

|

Zn Kgs. |

|

|||||||||||

0.2 |

|

|

2,049,678 |

|

|

|

1.22 |

|

|

|

80,398 |

|

|

|

3.85 |

|

|

|

253,714 |

|

|

|

0.070 |

|

|

|

1,443,732 |

|

|

|

0.027 |

|

|

|

560,280 |

|

|

|

0.207 |

|

|

|

4,249,372 |

|

0.4 |

|

|

1,241,112 |

|

|

|

1.83 |

|

|

|

73,023 |

|

|

|

4.76 |

|

|

|

189,940 |

|

|

|

0.095 |

|

|

|

1,174,340 |

|

|

|

0.034 |

|

|

|

417,336 |

|

|

|

0.245 |

|

|

|

3,042,028 |

|

1 |

|

|

630,208 |

|

|

|

3.00 |

|

|

|

69,786 |

|

|

|

6.81 |

|

|

|

137,984 |

|

|

|

0.140 |

|

|

|

880,118 |

|

|

|

0.049 |

|

|

|

311,329 |

|

|

|

0.360 |

|

|

|

2,265,719 |

|

2 |

|

|

321,043 |

|

|

|

4.54 |

|

|

|

46,862 |

|

|

|

8.87 |

|

|

|

91,555 |

|

|

|

0.184 |

|

|

|

589,470 |

|

|

|

0.048 |

|

|

|

155,115 |

|

|

|

0.475 |

|

|

|

1,526,115 |

|

3 |

|

|

187,049 |

|

|

|

6.05 |

|

|

|

36,384 |

|