☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

☒ | No fee required. | |||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||

(1) | Title of each class of securities to which transaction applies: | |||||

(2) | Aggregate number of securities to which transaction applies: | |||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

(4) | Proposed maximum aggregate value of transaction: | |||||

(5) | Total fee paid: | |||||

☐ | Fee paid previously with preliminary materials. | |||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

(1) | Amount Previously Paid: | |||||

(2) | Form, Schedule or Registration Statement No.: | |||||

(3) | Filing Party: | |||||

(4) | Date Filed: | |||||

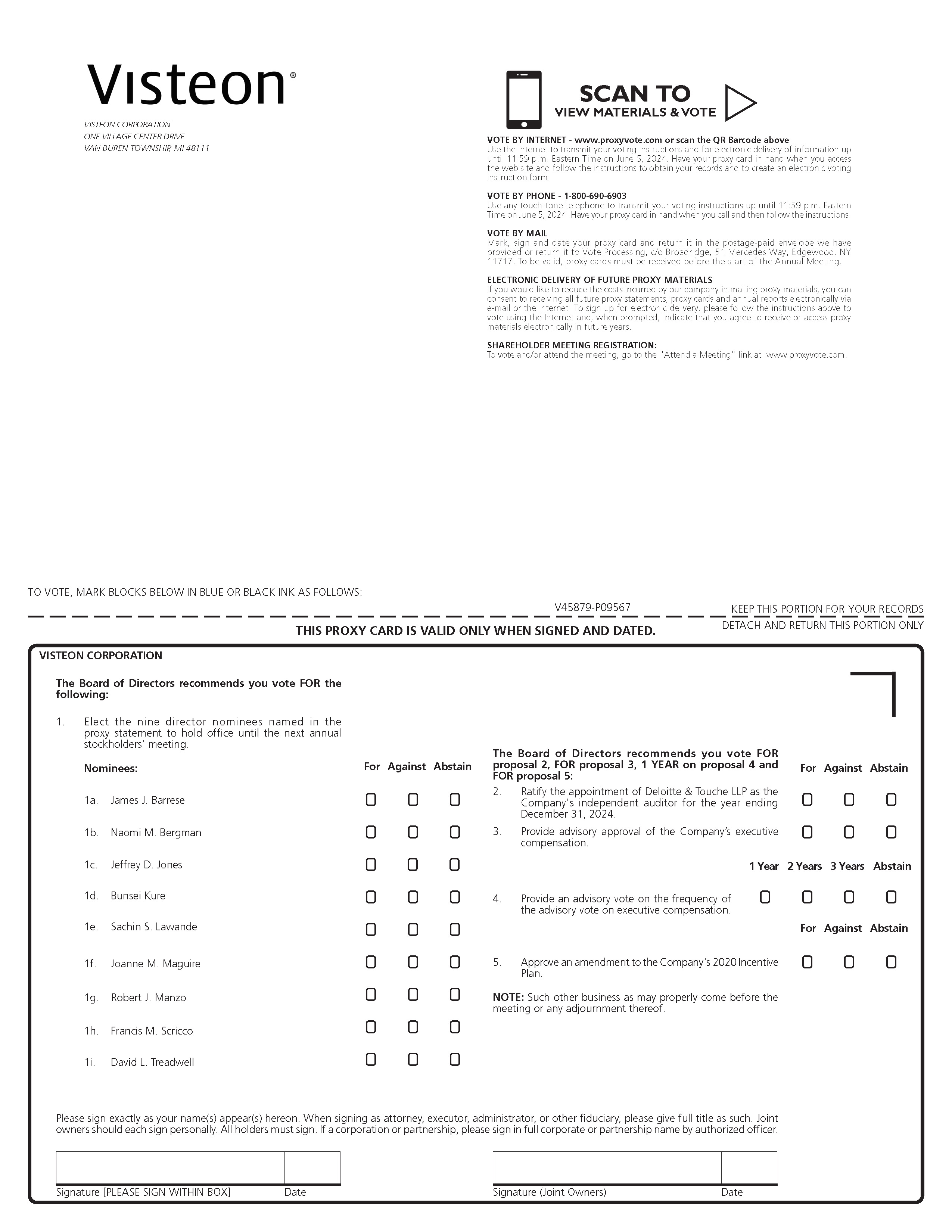

Notice of Annual Meeting of Stockholders To Visteon Stockholders, We invite you to attend our 2024 Annual Meeting of Stockholders at the Grace Lake Corporate Center. At this meeting you and the other stockholders will be able to vote on the following proposals, together with any other business that may properly come before the meeting. | Meeting Details:     Your vote is important. Even if you plan to attend the Annual Stockholders Meeting, we encourage you to vote your shares before the meeting to ensure they are counted. | ||||

1 | Elect the nine director nominees named in the proxy statement to hold office until the next annual stockholders' meeting. | ||||

2 | Ratify the appointment of Deloitte & Touche LLP as the Company's independent auditor for the year ending December 31, 2024. | ||||

3 | Provide advisory approval of the Company’s executive compensation. | ||||

4 | Provide an advisory vote on the frequency of the advisory vote on executive compensation. | ||||

5 | Approval of an amendment to the Company's 2020 Incentive Plan to increase the total number of shares of common stock authorized and available for issuance under the Plan. | ||||

You may vote on these proposals in person or by proxy. If you cannot attend the meeting we urge you to vote by proxy so that your shares will be represented and voted at the meeting in accordance with your instructions. Instructions on how to vote by proxy are contained in the proxy statement and in the Notice of Internet Availability of Proxy Materials. Only stockholders of record at the close of business on April 11, 2024 will be entitled to vote at the meeting or any adjournment thereof. If you wish to attend the meeting in person you will need to RSVP and print your admission ticket at www.proxyvote.com. An admission ticket together with photo identification must be presented in order to be admitted to the meeting. Please By order of the Board of Directors,  Heidi A. Sepanik Secretary The accompanying proxy statement dated April 25, 2024, together with the enclosed form of proxy card and Notice of Internet Availability of Proxy Material, is first being mailed to stockholders of Visteon on or about April 25, 2024. | |||||

2024 Proxy Statement | Visteon Corporation | i |

Table of Contents |

Sustainability | ||

Items to be Considered & Board Recommendations | ||

Director Nominations and Board Refreshment | ||

Highlights | ||

Corporate Governance Guidelines | ||

Board Leadership Structure | ||

Net Sales $3,954M 12% Y/Y Growth |  Adjusted EBITDA $434M 11.0% Margin |  Adjusted FCF $150M 35% Conversion |

DELIVERED ON CONTINUED GROWTH |  EXPANDING OUR PROFITABILITY |  EXECUTING ON PRODUCT LAUNCHES |  STRONG NEW BUSINESS WIN ACTIVITY |  RETURNING CAPITAL TO SHAREHOLDERS |

2024 Proxy Statement | Visteon Corporation | 1 |

2025 Environmental Goals | 2030 GHG Emissions Goals | |||||||||||

-6% Energy and Water Use |  -5% Waste Reduction |  -25% Scope 1 & 2 GHG Emissions | ||||||||||

1&2 -45% Direct & Indirect Operational Emissions | 3 -25% Other Indirect Emissions | |||||||||||

Delivering on short-term goals and committing to longer term greenhouse gas emissions reduction goals* | ||||||||||||

Company Overview |

2 | Visteon Corporation | 2024 Proxy Statement |

Proxy Summary This summary provides highlights of information contained in this proxy statement. It does not contain all of the information that you should consider before voting. We encourage you to read the entire proxy statement. For more complete information regarding the Company’s 2023 performance, please read our 2023 Annual Report on Form 10-K. | Meeting Details:     Ways to Vote:     Please vote your shares promptly, as this will save the expense of additional proxy solicitation. You may submit your vote by Internet, telephone, mail or in person. | |||||||

Items to be Considered & Board Recommendations | ||||||||

Item | Votes Required for Approval | Board's Voting Recommendation | Page Reference | |||||

1 | Elect directors | Majority of votes cast | FOR each nominee | |||||

2 | Ratify the appointment of Deloitte & Touche LLP as the Company's independent auditor for the year ending December 31, 2024 | Majority of votes present | FOR | |||||

3 | Advisory approval of the Company’s executive compensation | Majority of votes present The vote on this item is nonbinding, but the Board will consider the results of the vote in making future decisions. | FOR | |||||

4 | Advisory vote on the frequency of the advisory vote on executive compensation | Majority of votes present The vote on this item is nonbinding, but the Board will consider the results of the vote in making future decisions. | ONE YEAR | |||||

5 | Approval of an amendment to the Company's 2020 Incentive Plan | Majority of votes present | FOR | |||||

| Our Notice of Annual Meeting and Proxy Statement, Annual Report on Form 10- K, electronic proxy card and other Annual Meeting materials are available on the Internet at www.proxyvote.com, together with any amendments to any of these materials that are required to be furnished to stockholders. If you receive a Notice of Internet Availability of Proxy Materials, you will not receive a paper or email copy of the proxy materials unless you request one in the manner set forth in the Notice. | |||||||

2024 Proxy Statement | Visteon Corporation | 3 |

Name | Age | Director Since | Independent | Primary Occupation | Other Public Boards |

James J. Barrese | 55 | 2017 | • | SVP, FinTech Product Development of Intuit, Inc. | — |

Naomi M. Bergman | 60 | 2016 | • | Senior Executive of Advance | — |

Jeffrey D. Jones | 71 | 2010 | • | Attorney, Kim & Chang | 1 |

Bunsei Kure | 67 | 2022 | • | Former CEO Rensas Electronics | 1 |

Sachin S. Lawande | 56 | 2015 | CEO and President of Visteon Corporation | 1 | |

Joanne M. Maguire | 69 | 2015 | • | Former EVP of Lockheed Martin Corporation | 2 |

Robert J. Manzo | 66 | 2012 | • | Managing Member of RJM, LLC | 1 |

Francis M. Scricco | 74 | 2012 | • | Former SVP, Avaya, Inc. and former President and CEO of Arrow Electronics, Inc. | 1 |

David L. Treadwell | 69 | 2012 | • | Former CEO and President of EaglePicher Corporation | 1 |

Proxy Summary |

4 | Visteon Corporation | 2024 Proxy Statement |

Sachin S. Lawande Director, President and Chief Executive Officer |  Jerome J. Rouquet Senior Vice President and Chief Financial Officer |  Brett D. Pynnonen Senior Vice President and Chief Legal Officer |  Robert R. Vallance Senior Vice President, Customer Business Groups, New Technology Product Lines, and General Manager APAC Region |  Kristin E. Trecker Senior Vice President and Chief People Officer |

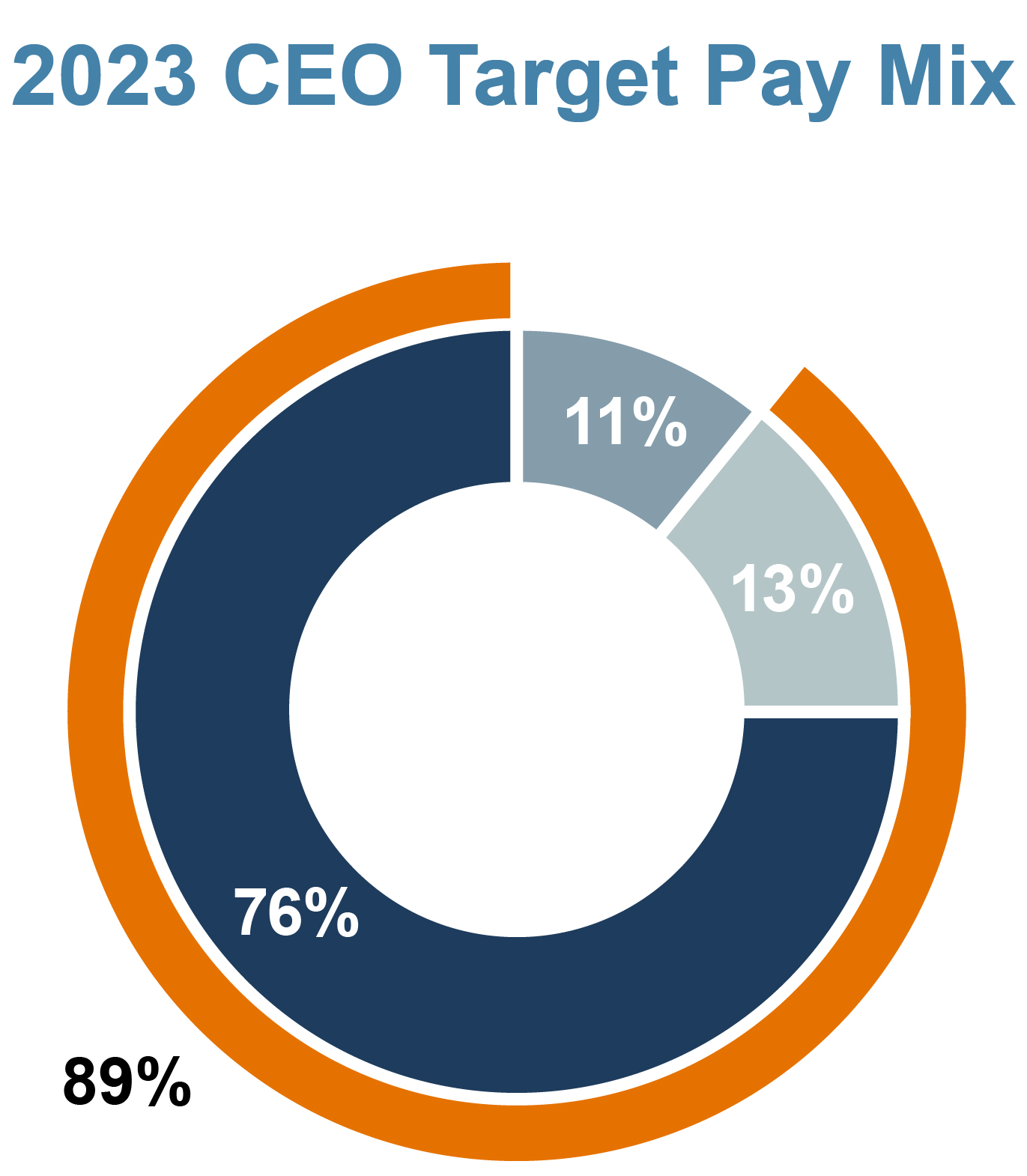

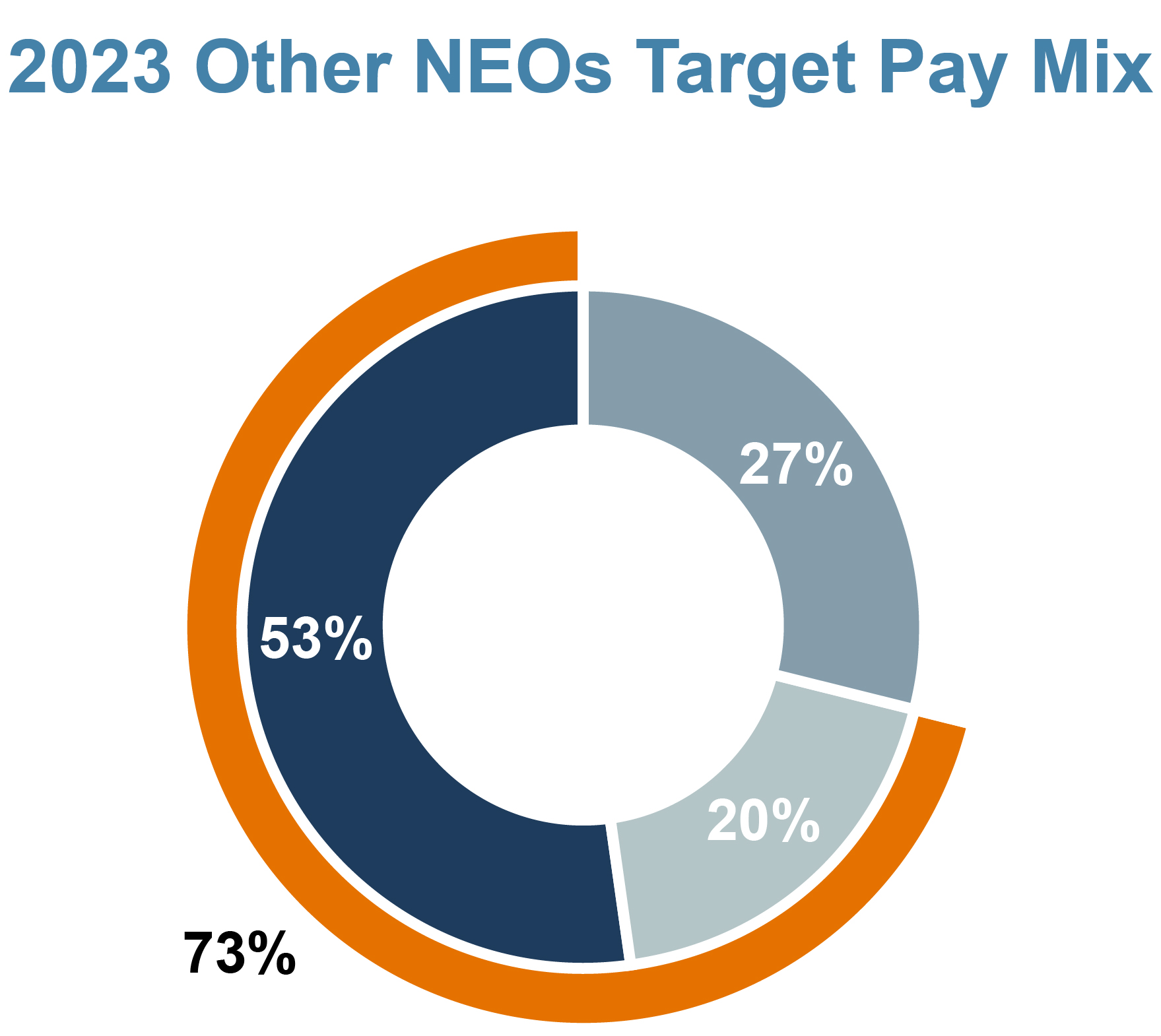

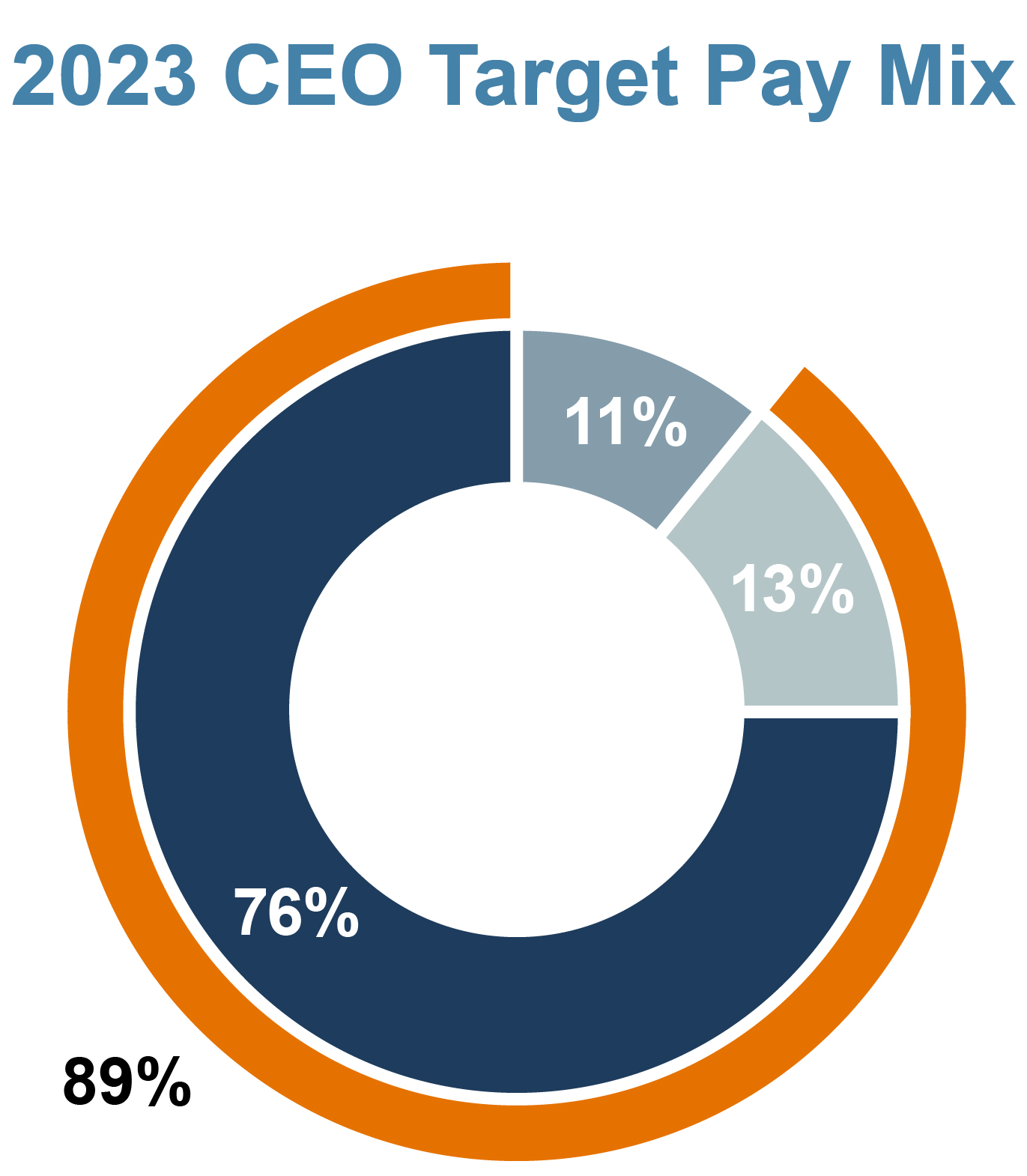

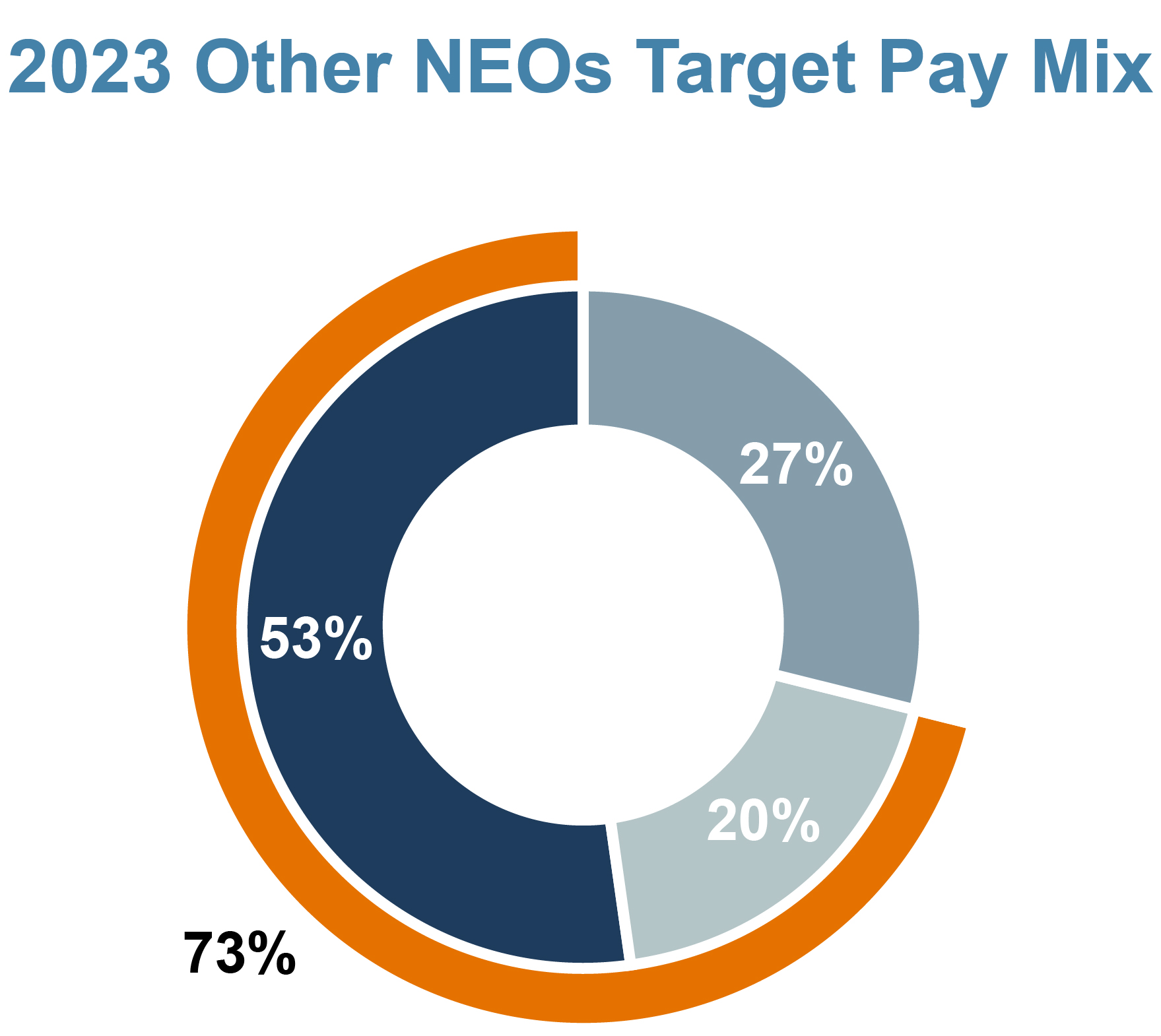

n Base Salary | n Annual Incentive | n Long-Term Incentive | n Variable (At Risk) |

Proxy Summary |

2024 Proxy Statement | Visteon Corporation | 5 |

Item One | |||||||||

Election of Directors The first proposal on the agenda for the Annual Meeting will be electing nine directors to hold office until the next Annual Meeting of Stockholders to be held in 2025. |  | ||||||||

We expect each nominee for election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of directors serving on the Board. The Company’s Bylaws provide that in any uncontested election (an election in which the number of nominees for director is not greater than the number to be elected), each director shall be elected if the number of votes cast “for” the nominee’s election exceed the number of votes cast “against” that nominee’s election. The Bylaws also provide that any nominee who does not receive more votes cast “for” the nominee’s election than the number of votes cast “against” that nominee in an uncontested election is expected to promptly tender his or her resignation to the Chairman of the Board, which resignation shall be promptly considered through a process managed by the Corporate Sustainability and Governance Committee, to determine if a compelling reason exists for concluding that it is in the best interests of the Company for such incumbent to remain a director. The Corporate Sustainability and Governance Committee shall provide its recommendation to the Board with respect to any tendered resignation within 14 days of the certification of the election voting results and such recommendation shall be acted on by the Board within 30 days of the certification of the voting results. If a resignation offer is not accepted by the Board, it will publicly disclose its decision, including a summary of reasons for not accepting the offer of resignation. In a contested election (an election in which the number of nominees for director is greater than the number to be elected), the directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. | James J. Barrese Naomi M. Bergman Jeffrey D. Jones Bunsei Kure Sachin S. Lawande Joanne M. Maguire Robert J. Manzo Francis M. Scricco David L. Treadwell  The Board of Directors recommends that you vote "FOR" each nominee. | ||||||||

6 | Visteon Corporation | 2024 Proxy Statement |

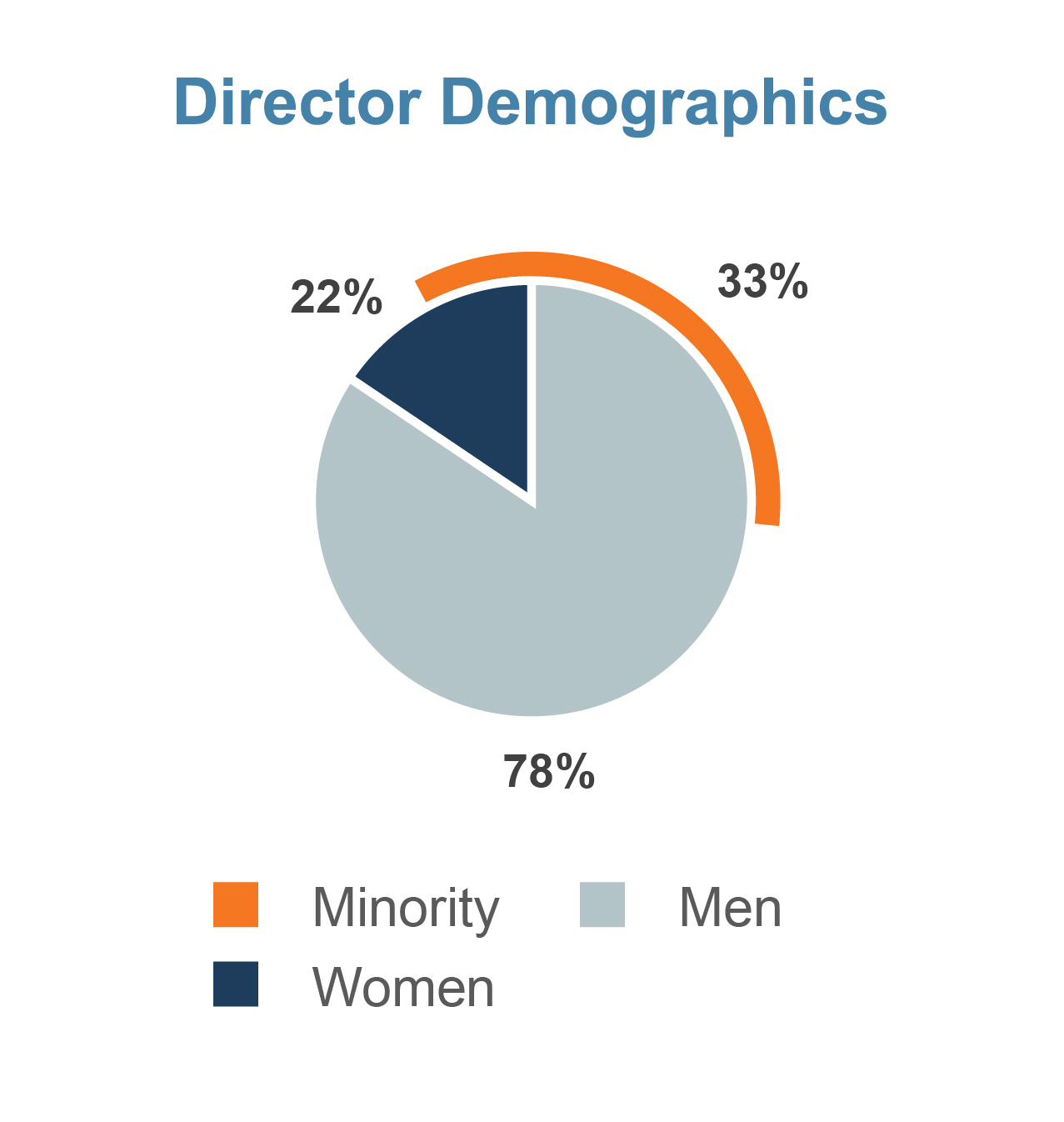

Board Diversity Matrix as of April 1, 2024 | ||||

Board Size: | ||||

Total Number of Directors | 9 | |||

Gender: | Male | Female | Non-binary | Gender Undisclosed |

Number of Directors Based on Gender Identity | 7 | 2 | — | — |

Number of Directors who Identify in any of the categories below: | ||||

African American or Black | — | — | — | — |

Alaska Native or American Indian | — | — | — | — |

Asian | 2 | — | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 5 | 2 | — | — |

Two or More Races or Ethnicities | — | — | — | |

LGBTQ+ | 1 | |||

Undisclosed | — | |||

Item One |

2024 Proxy Statement | Visteon Corporation | 7 |

Barrese | Bergman | Jones | Kure | Lawande | Maguire | Manzo | Scricco | Treadwell | ||

Skills & Experience | ||||||||||

| Senior Leadership Experience | • | • | • | • | • | • | • | • | • |

| Automotive Industry Experience | • | • | • | • | • | ||||

| International Business Experience | • | • | • | • | • | • | • | ||

| Financial Literacy | • | • | • | • | • | • | • | • | |

| Technology/Systems Expertise | • | • | • | • | |||||

| Marketing/Sales Experience | • | • | • | • | • | ||||

| Governance, Sustainability & Compliance Experience | • | • | • | • | • | • | • | • | • |

| Academic/Research Experience | • | • | |||||||

| Military Service | • | ||||||||

| Government/Public Policy Expertise | • | • | |||||||

| James J. Barrese | Director Since: 2017 | Age: 55 |

Mr. Barrese is the Senior Vice President, Fintech Product Development of Intuit, Inc., a financial services software company, a position he has held since September 2023. Prior to that he was the Senior Vice President, Technology and Engineering of Chime Inc., a mobile banking services company, from July 2021 to August 2023. He has also served as the Chief Technology Officer and Senior Vice President, Payment Services Business of Paypal, Inc., a digital and mobile payments company, a position he held from February 2015 to June 2016. Prior to that he was Paypal’s Chief Technology Officer from February 2012 to January 2015 and Vice President of Global Product Development from August 2011 to January 2012. Mr. Barrese spent nearly 10 years in executive technology roles at eBay, Inc., he served as Vice President of engineering at Charitableway.com, Inc., was a manager at Andersen Consulting, Inc. and a programmer in the Materials Science Department at Stanford University. He is also a veteran of the U.S. military and owner of the consulting company Altos Group. During the past five years, he also served on the boards of Idemia, Marin Software and Merrill Corporation. | |||

Mr. Barrese has a deep knowledge of digital transformation, technology strategy, architecture, analytics and cloud computing. | |||

Item One |

8 | Visteon Corporation | 2024 Proxy Statement |

| Naomi M. Bergman | Director Since: 2016 | Age: 60 |

Ms. Bergman is a senior executive of Advance, a private, family-held multimedia company, a position she has held since May 2016. Prior to that, she served as President of Bright House Networks, LLC, a cable service provider, from 2007 to 2016. Ms. Bergman currently serves on the boards of privately-held companies Black & Veatch Holding Company and HawkEye 360 Inc. Ms. Bergman also serves on the Federal Communications Commission Technical Advisory Committee, the Board of Trustees for the University of Rochester, and she is a board member of non-profit organizations Bridging Voice, The Cable Center, Adaptive Spirit, One Revolution and The Marconi Society. During the past five years, Ms. Bergman also served on the board of directors of Comcast Corporation. | |||

Ms. Bergman brings to the Board her experience and expertise in technology and operations from her experiences in the cable and telecommunications industry. | |||

| Jeffrey D. Jones | Director Since: 2010 | Age: 71 |

Mr. Jones is an attorney with Kim & Chang, a South Korea-based law firm, a position he has held since 1980. Mr. Jones serves as Chairman of the Board of Partners for Future Foundation and Ronald McDonald House Charities of Korea, both Korean non-profit foundations. He also serves on the board of SPC SAMLIP CO., LTD. | |||

Mr. Jones has over thirty years of international legal experience, with particular focus on Asia. He has served on the boards of multinational companies and has been active in civic and charitable activities. He has served as chairman of the American Chamber of Commerce in Korea, as an advisor to several organizations and government agencies in Korea, and as a recognized member of the Korean Regulatory Reform Commission. | |||

| Bunsei Kure | Director Since: 2022 | Age: 67 |

Mr. Kure is the former Chief Executive Officer of Renesas Electronics, a leading supplier of semiconductor solutions to the global automotive industry, a position he held from June 2016 until his retirement in June 2019. Prior to that he served as Executive Vice President and then as Chief Operating Officer of Nidec, the world’s largest electric motor company, from June 2013 to September 2015 and as the Chief Executive Officer of Calsonic Kansei, a large tier-1 supplier that is now part of Marelli, from June 2008 to March 2013. Mr. Kure also serves on the board of Nippon Avionics Co., Ltd. and privately-held OM Digital Solutions Corporation. | |||

Mr. Kure brings extensive experience in the global automotive and semiconductor industries, and knowledge of the Japanese automotive industry, including deep networks within Japanese OEMs and suppliers. | |||

Item One |

2024 Proxy Statement | Visteon Corporation | 9 |

| Sachin S. Lawande | Director Since: 2015 | Age: 56 |

Mr. Lawande has been Visteon's Chief Executive Officer, President and a Director of the Company since June 2015. Before joining Visteon, Mr. Lawande served as Executive Vice President and President, Infotainment Division of Harman International Industries, Inc., an automotive supplier, from July 2013 to June 2015. From July 2011 to June 2013, he served as Executive Vice President and President of Harman’s Lifestyle Division, and from July 2010 to June 2011 as Executive Vice President and Co-President, Automotive Division. Prior to that he served as Harman’s Executive Vice President and Chief Technology Officer since February 2009. Mr. Lawande joined Harman International in 2006, following senior roles at QNX Software Systems and 3Com Corporation. He also serves on the board of directors of Cognex Corporation, and within the last five years served on the board of directors of DXC Technology Company. | |||

Mr. Lawande has extensive experience in the automotive industry, including leadership roles with a global automotive components supplier. He also has deep experience with the technology sector. | |||

| Joanne M. Maguire | Director Since: 2015 | Age: 69 |

Ms. Maguire served as an Executive Vice President of Lockheed Martin Corporation and President of its Space Systems Company, a provider of advanced-technology systems for national security, civil and commercial customers, from July 2006 until she retired in May 2013. Ms. Maguire joined Lockheed Martin in 2003, following 28 years of employment at TRW’s Space & Electronics sector (now part of Nothrop Grumman). Throughout her career, she has held senior leadership roles in program management, engineering, advanced technology, manufacturing, and business development. Ms. Maguire also serves on the board of directors of CommScope Holdings Company, Inc. and Tetra Tech, Inc. | |||

Ms. Maguire has extensive experience in the technology sector, including senior leadership positions with a publicly traded company, executive responsibility for operations and profitability, and board service on multiple high tech corporations | |||

| Robert J. Manzo | Director Since: 2012 | Age: 66 |

Mr. Manzo is the founder and managing member of RJM, LLC, a provider of consulting services to troubled companies, a position he has held since 2005. From 2000 to 2005, Mr. Manzo was a senior managing director of FTI Consulting, Inc., a global business advisory firm. He also serves on the board of directors of Bristow Group Inc., and within the last five years served on the board of directors of ADVANZ PHARMA Corp. | |||

Mr. Manzo has extensive experience advising companies and management in the automotive and other industries, and as a non-practicing CPA, possesses financial and accounting expertise | |||

Item One |

10 | Visteon Corporation | 2024 Proxy Statement |

| Francis M. Scricco | Director Since: 2012 | Age: 74 |

Mr. Scricco is the former Senior Vice President, Manufacturing, Logistics and Procurement of Avaya, Inc., a global business communications provider, a position he held from February 2007 until his retirement in October 2008. Prior to that he was Avaya’s Senior Vice President, Global Services since March 2004. Prior to joining Avaya, Inc., Mr. Scricco was employed by Arrow Electronics as its Chief Operating Officer from 1997 to 2000, and as its President and Chief Executive Officer from 2000 to 2002. His first operating role was as a general manager for General Electric. Mr. Scricco began his career with the Boston Consulting Group in 1973. Mr. Scricco currently also serves on the board of Masonite International Corporation as well as Transportation Insight, LLC, a privately held company. | |||

Mr. Scricco has extensive global business leadership experience, including public company board service. Mr. Scricco has spent more than twenty-five years as a senior P&L manager in six different industries. His P&L experience ranges from CEO of a venture capital technology start-up to CEO of a $13 billion publicly traded Fortune 200 company. | |||

| David L. Treadwell | Director Since: 2012 | Age: 69 |

Mr. Treadwell is the former President and CEO of EP Management Corporation, formerly known as EaglePicher Corporation, a position he held from August 2006 to September 2011; and he served as their chief operating officer from June 2005 to July 2006. Prior to that, he served as Oxford Automotive’s CEO from 2004 to 2005. In addition to Visteon, Mr. Treadwell currently serves on the board of New York Community Bank. During the past five years, Mr. Treadwell has also served on the board of directors of AGY, LLC, FairPoint Communications Inc., Revere Industries, Sungard Availability Services Capital, Inc., Tweddle LLC, U.S. Well Services, Inc. and WinCup LLC. | |||

Mr. Treadwell has extensive experience advising and leading companies in the automotive and other industries. | |||

| The Board of Directors recommends that you vote "FOR" the election of James J. Barrese, Naomi M. Bergman, Jeffrey D. Jones, Bunsei Kure, Sachin S. Lawande, Joanne M. Maguire, Robert J. Manzo, Francis M. Scricco, and David L. Treadwell as directors. | ||

Item One |

2024 Proxy Statement | Visteon Corporation | 11 |

Corporate Governance Corporate Governance Guidelines The Board has adopted Corporate Governance Guidelines to define the role of the Board, its structure and composition, as well as set forth principles regarding director commitment expectations and compensation. The guidelines also limit the number of other boards a director may serve on and the maximum age of directors. A copy of the Corporate Governance Guidelines is available on our website at https://www.visteon.com/company/about-us/corporate-governance/. Board Leadership Structure Since September 2012, the Board has separated the positions of Chairman and Chief Executive Officer by appointing a non-executive Chairman. The non- executive Chairman serves in a lead capacity to coordinate the activities of the other outside directors and to perform the duties and responsibilities as the Board of Directors may determine from time to time. Currently, these responsibilities include: •Presiding at all meetings of stockholders; •Convening and presiding at all meetings of the Board, including executive sessions of the independent directors; •Developing, with the assistance of the Chief Executive Officer (the “CEO”), the agenda for all Board meetings; •Collaborating with the CEO, committee Chairs, and other directors to establish meeting schedules, agendas, and materials in order to ensure that all directors can perform their duties responsibly and that there is sufficient time for discussion of all agenda items; •Advising the CEO on the quantity, quality, and timeliness of information delivered by management to the Board and providing input so that directors can effectively and responsibly perform their duties; •Counseling the CEO on issues of interest or concern to directors and encouraging all directors to engage the CEO with their interests and concerns; •Serving as a liaison on Board-related issues between directors and the CEO and management although directors maintain the right to communicate directly with the CEO or any member of management on any matter; •Assisting the Board and the Company’s officers in assuring compliance with and implementation of the Company’s Corporate Governance Guidelines; •Working in conjunction with the Corporate Sustainability and Governance Committee to recommend revisions, as appropriate, to the Corporate Governance Guidelines; | Governance Highlights The Company believes good governance is a critical element to achieving shareholder value. We are committed to governance policies and practices that serve the long-term interests of the Company and its stockholders, employees and stakeholders. | ||||

| Annual election of all directors | ||||

| 89% of Board is independent | ||||

| Board Chair and Chief Executive Officer roles separated | ||||

| Proxy access right granted to stockholders | ||||

| Executive sessions of independent directors held at each regularly scheduled Board meeting | ||||

| Share ownership guidelines for directors and executives | ||||

| Majority voting for directors | ||||

| Independent Board Chair | ||||

| All Board Committees composed entirely of independent directors | ||||

| Annual Board and committee evaluations | ||||

| Commitment to corporate social responsibility | ||||

| Board considers diversity when evaluating prospective directors | ||||

12 | Visteon Corporation | 2024 Proxy Statement |

Corporate Governance |

2024 Proxy Statement | Visteon Corporation | 13 |

Audit Committee | |||

Members: Robert J. Manzo (Chair) Naomi M. Bergman David L. Treadwell Meetings in 2023: 6 | The duties of the Audit Committee are generally: •To select and evaluate the independent registered public accounting firm; •To approve all audit and non-audit engagement fees and terms; •To review the activities and the reports of the Company’s independent registered public accounting firm including the critical audit matters described in their annual report; •To review internal controls, accounting practices, financial structure and financial reporting, including the results of the annual audit and review of interim financial statements; •To review and monitor enterprise cybersecurity, information security and risk mitigation programs; •To review and monitor compliance procedures; and •To report the results of its review to the Board. The charter of the Audit Committee, as well as any future revisions to such charter, is available on the Company’s website at https://www.visteon.com/company/about-us/corporate- | ||

Corporate Governance |

14 | Visteon Corporation | 2024 Proxy Statement |

Corporate Sustainability and Governance Committee | |||

Members: Robert J. Manzo (Chair) James J. Barrese Bunsei Kure Jeffrey D. Jones Meetings in 2023: 5 | The duties of the Corporate Sustainability and Governance Committee are generally: •To develop corporate governance principles and monitor compliance therewith; •To review the performance of the Board as a whole; •To review and recommend to the Board compensation for outside directors; •To develop criteria for Board membership; •To identify, review and recommend director candidates; •To review and monitor environmental, safety and health matters; and •To oversee the Company’s sustainability initiatives including but not limited to environmental and social policies, programs and reporting. The charter of the Corporate Sustainability and Governance Committee, as well as any future revisions to such charter, is available on the Company’s website at https://www.visteon.com/ company/about-us/corporate-governance/. | ||

Organization and Compensation Committee | |||

Members: David L. Treadwell (Chair) Jeffrey D. Jones Bunsei Kure Joanne M. Maguire Meetings in 2023: 5 | The duties of the Organization and Compensation Committee are generally: •To review and approve corporate goals and objectives relative to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance and set the Chief Executive Officer’s compensation level based on this evaluation; •To review and approve executive compensation and incentive plans; •To approve the payment of cash performance bonuses and the granting of stock-based awards to the Company’s employees, including officers; and •To review and recommend management development and succession planning. The charter of the Organization and Compensation Committee, as well as any future revisions to such charter, is available on the Company’s website at https://www.visteon.com/company/ about-us/corporate-governance/. | ||

Corporate Governance |

2024 Proxy Statement | Visteon Corporation | 15 |

Technology Committee | |||

Members: Joanne M. Maguire (Chair) James J. Barrese Naomi M. Bergman Meetings in 2023: 3 | The duties of the Technology Committee generally are: •To review and comment on new product technology strategies as developed by the Company; •To review and make recommendations to the Board regarding the technology budget, assess major investments in new technology platforms, partnerships and alliances; •To monitor and evaluate existing and future trends in technology that may affect the Company’s strategic plans, including overall trends in the automotive industry; and •To review and monitor the Company's cybersecurity policies and practices relating to its products and technologies including risk mitigation. The charter of the Technology Committee, as well as any future revisions to such charter, is available on the Company’s website at https://www.visteon.com/company/about-us/corporate- governance/. | ||

Corporate Governance |

16 | Visteon Corporation | 2024 Proxy Statement |

Name | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | All Other Compensation ($) | Total ($) | |

James J. Barrese | 95,000 | 125,000 | — | 220,000 | |

Naomi M. Bergman | 105,000 | 125,000 | — | 230,000 | |

Jeffrey D. Jones | 95,000 | 125,000 | — | 220,000 | |

Bunsei Kure | 95,000 | 125,000 | — | 220,000 | |

Joanne M. Maguire | 110,000 | 125,000 | — | 235,000 | |

Robert J. Manzo | 140,000 | 125,000 | — | 265,000 | |

Francis M. Scricco(1) | 170,000 | 275,000 | — | 445,000 | |

David L. Treadwell | 120,000 | 125,000 | — | 245,000 |

2024 Proxy Statement | Visteon Corporation | 17 |

Common Stock Beneficially Owned | Stock Units(2)(3) | |||

Name | Number(1) | Percent of Outstanding | ||

Sachin S. Lawande | 454,030 | 1.6% | 52,379 | |

James J. Barrese | 2,192 | * | 6,871 | |

Naomi M. Bergman | 1,000 | * | 17,420 | |

Jeffery D. Jones | 2,192 | * | 10,817 | |

Bunsei Kure | 1,189 | * | 841 | |

Joanne M. Maguire | 2,192 | * | 9,336 | |

Robert J. Manzo | 7,192 | * | 10,817 | |

Francis M. Scricco | 6,542 | * | 23,959 | |

David L. Treadwell | 4,192 | * | 9,336 | |

Jerome J. Rouquet | 22,810 | * | 9,367 | |

Brett D. Pynnonen | 10,437 | * | 4,543 | |

Kristin E. Trecker | 10,643 | * | 4,230 | |

Robert R. Vallance | 24,189 | * | 4,415 | |

All executive officers and directors as a group (16 persons) | 568,563 | 2.0% | 171,615 | |

18 | Visteon Corporation | 2024 Proxy Statement |

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Ownership | Percent of Class |

Common Stock | BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | 3,901,454 total aggregate shares (3,770,517 shares held with sole voting power and 3,901,454 shares held with sole dispositive power) | 14.0% |

Common Stock | Wellington Management Group LLP 280 Congress Street Boston, Massachusetts 02210 | 2,942,002 total aggregate shares (2,561,045 shares with shared voting power and 2,942,002 shares held with shared dispositive power) | 10.6% |

Common Stock | The Vanguard Group 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 2,880,882 total aggregate shares (51,106 shares held with shared voting power; 2,799,762 shares held with sole dispositive power, and 81,120 shares held with shared dispositive power) | 10.4% |

Security Ownership |

2024 Proxy Statement | Visteon Corporation | 19 |

20 | Visteon Corporation | 2024 Proxy Statement |

Visteon's Leadership Principles | |

Lead from the front •Empowering their teams to create exceptional customer value •Being on the field and off the sidelines •Solving problems holistically •Demonstrating that the best decisions are those made by critically thinking problems all the way through •Doing what they say, and saying what they do | Build strong teams •Ensuring that every employee plays to their strengths and full potential •Giving employees a voice through opportunities for debate and ideation •Collaborating across boundaries to reduce unproductive friction and build bridges •Taking seriously their role in attracting and growing key talent |

Inspire change •Having a compelling vision backed up by plausible strategies and plans •Pursuing disruptive innovation and bringing others along with them •Communicating with authenticity and factual insights •Generating optimism about what’s possible •Being humble, real and open to feedback | Lead the market •Knowing the industry (its products, competitors, and trends) inside and out •Translating market and customer trends into business opportunities •Demonstrating the courage to ask tough and provoking questions that could change the game •Embracing a growth mindset to continuously anticipate and adapt to what’s next |

2024 Proxy Statement | Visteon Corporation | 21 |

TECHNOLOGY INNOVATION | LONG-TERM GROWTH | ENHANCE SHAREHOLDER RETURNS WHILE MAINTAINING A STRONG BALANCE SHEET | ||||||||

The Company is an established global leader in cockpit electronics and is positioned to provide solutions as the industry transitions to the next generation automotive cockpit experience. The cockpit is becoming fully digital, connected, automated, learning, and voice enabled. Visteon's broad portfolio of cockpit electronics technology, the industry's first wireless battery management system, and the development of safety technology integrated into its domain controllers positions Visteon to support these macro trends in the automotive industry. | The Company has continued to win business at a rate that exceeds current sales levels by demonstrating product quality, technical and development capability, new product innovation, reliability, timeliness, product design, manufacturing capability, and flexibility, as well as overall customer service. | The Company has continued to maintain a strong balance sheet to withstand industry volatility while providing a foundation for future growth and shareholder returns. In March 2023, the Company announced a $300 million share repurchase program maturing at the end of 2026. The Company repurchased $106 million of Company common stock during 2023 as part of this program. | ||||||||

Executive Compensation |

22 | Visteon Corporation | 2024 Proxy Statement |

n Base Salary | n Annual Incentive | n Long-Term Incentive | n Variable (At Risk) |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 23 |

< | Cash | < | Equity |

Year Granted | Applicable NEOs | Performance Period | Metric | Actual or Estimated Weighted Average Payout Percentage |

2023 | All NEOs | Mar 2023-Feb 2026 | Relative TSR | Estimated: 0% |

2022 | All NEOs | Jan 2022-Dec 2024 | Relative TSR | Estimated: 200% |

2021 | All NEOs | Jan 2021-Dec 2023 | Relative TSR | Actual: 100% |

Executive Compensation |

24 | Visteon Corporation | 2024 Proxy Statement |

What We Do |  | The Organization and Compensation Committee of the Board of Directors approves all aspects of executive officer pay |

| Target pay levels to be, on average, within a competitive range of the median of comparable companies, considering an individual’s responsibilities, business impact, performance and other factors | |

| Provide the majority of pay through performance-based annual and long-term incentive programs | |

| Balance short- and long-term incentives using multiple performance metrics, covering individual, financial and total shareholder return performance | |

| Cap incentive awards that are based on performance goals | |

| Have “double trigger” (qualifying termination of employment following a change in control) requirements for NEO severance payments and/or equity acceleration for all of the NEOs’ outstanding awards | |

| Maintain guidelines for robust stock ownership by our NEOs to ensure ongoing and meaningful alignment with shareholders | |

| Have a compensation recoupment (“clawback”) policy for executive officers covering incentive-based compensation (both cash and equity) in the event of a financial restatement | |

| Prohibit hedging transactions, purchasing the Company’s common stock on margin or pledging such shares | |

| Review key elements of the officer pay program annually, as conducted by the Committee, which also considers our business and talent needs, and market trends | |

| Use an independent compensation consultant to evaluate our executive compensation program relative to our peers, and outside legal counsel to draft our executive compensation plans and award agreements | |

What We Don't Do |  | Do not provide excise tax gross-ups |

| Do not have compensation practices that encourage unnecessary and excessive risk taking | |

| Do not reprice options, reload, exchange or grant stock options or stock appreciation rights below market value without shareholder approval | |

| Do not provide dividends or dividend equivalents on unearned PSUs unless and until the underlying PSU vests (and if such PSUs are forfeited, no dividend equivalents are paid out) | |

| Do not provide car allowances, club memberships or similar perquisites |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 25 |

Party: | Primary Roles: |

Organization and Compensation Committee (composed solely of independent directors) | •Oversee all aspects of the executive compensation program •Approve officer compensation levels, incentive plan performance goals and award payouts •Approve specific performance goals and objectives, as well as corresponding compensation for the CEO •Ensure the executive compensation program best achieves the Company’s objectives, considering the business strategy, talent needs and market trends |

Senior Management (CEO, CFO and CPO) | •Make recommendations regarding the potential structure of the executive compensation program, including input on key business strategies and objectives •Make recommendations regarding the pay levels of the officer team (excluding the CEO) •Provide any other information requested by the Committee |

Compensation Consultant (FW Cook) | •Advise the Committee on competitive market practices and trends •Provide proxy pay data for our compensation peer group •Present information and benchmarking regarding specific executive compensation matters, as requested by the Committee •Review management proposals and provide recommendations regarding CEO pay •Participate in Committee meetings as requested, including executive sessions of the Committee when management is not present, and communicate with the Committee Chair between meetings |

Executive Compensation |

26 | Visteon Corporation | 2024 Proxy Statement |

2023 Compensation Comparator Group | |||

American Axle & Manufacturing | Dana Inc. | LCI Industries | Sensata Technologies Holding PLC |

Ametek Inc. | Garmin Ltd. | Methode Electronics. | Spirit AeroSystems Holdings, Inc. |

Ansys | Gentex Corporation | Modine Manufacturing Co. | Trimble Inc. |

Cooper-Standard Holdings Inc. | Gentherm | Rockwell Automation Inc. | |

BASE SALARY | ANNUAL INCENTIVE | LONG-TERM INCENTIVE | ||

Fixed cash compensation based on the market-competitive value of the skills and knowledge required for each role. Reviewed and adjusted when appropriate to maintain market competitiveness. Increases are not automatic or guaranteed. | Designed to reward results of the prior year. Annual cash incentives are based on: •Company financial metrics chosen to drive our growth strategy •Strategic company objectives •Individual performance | Forward-looking equity awards intended to motivate and reward potential to drive future growth and align the interests of employees and shareholders. Grants awarded in the form of Performance and Restricted Stock Units. |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 27 |

2023 | Base Salary ($) | Annual Incentive ($) | Long-Term Incentive ($) | Total ($) | |

Sachin S. Lawande | 1,115,000 | 1,393,750 | 8,000,000 | 10,508,750 | |

Jerome J. Rouquet | 573,460 | 470,250 | 1,520,000 | 2,563,710 | |

Brett D. Pynnonen | 473,385 | 318,250 | 733,600 | 1,525,235 | |

Robert R. Vallance | 430,000 | 290,000 | 700,000 | 1,420,000 | |

Kristin E. Trecker | 417,360 | 280,250 | 700,000 | 1,397,610 | |

2022 | Base Salary ($) | Annual Incentive ($) | Long-Term Incentive ($) | Total ($) | |

Sachin S. Lawande | 1,060,000 | 1,325,000 | 7,000,000 | 9,385,000 | |

Jerome J. Rouquet | 541,000 | 351,000 | 1,320,000 | 2,212,000 | |

Brett D. Pynnonen | 453,000 | 295,000 | 655,000 | 1,403,000 | |

Robert R. Vallance | 417,000 | 271,000 | 694,000 | 1,382,000 | |

Kristin E. Trecker | 376,000 | 239,000 | 538,000 | 1,153,000 |

Management Business Objectives | ||

New Business Wins | New Product Market Introduction | Software Quality & Productivity |

Organization Effectiveness | Social & Environmental Sustainability | |

Executive Compensation |

28 | Visteon Corporation | 2024 Proxy Statement |

2023 Threshold | 2023 Target | 2023 Maximum | Actual Performance | Committee Assessed Performance | Weighted % Earned | |||

Measure ($ in millions) | 25% of Target Payout | 100% of Target Payout | 200% of Target Payout | |||||

Adjusted EBITDA(1) | $340 | $400 - $451 | $531 | $434 | $434 | 40% | ||

Adjusted Free Cash Flow(2) | $98 | $126 - $154 | $182 | $150 | $150 | 30% |

2023 Annual Incentive | Target ($) | Company Performance Factor (%) | Individual Performance Factor (%) | Amount Earned ($) | |

Sachin S. Lawande | 1,393,750 | 115% | 100% | 1,602,813 | |

Jerome J. Rouquet | 470,250 | 115% | 100% | 540,788 | |

Brett D. Pynnonen | 318,250 | 115% | 100% | 365,988 | |

Robert R. Vallance | 290,000 | 115% | 100% | 333,500 | |

Kristin E. Trecker | 280,250 | 115% | 100% | 322,288 |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 29 |

Award Type and Weighting | Primary Role | Design Features |

Performance Stock Units (60% of the total LTI value) | Reward the achievement of TSR results from 2023 through 2026 relative to returns of 17 similar companies | •PSUs provide executives with the opportunity to earn shares of the Company’s stock based on the Company’s three-year TSR relative to 17 automotive sector peer companies (listed below) •The awards have a single, three-year performance period with the earned awards paid at the end of the three-year cycle (paid in early 2026) •If the Company’s actual TSR is negative during the performance period, the award earned cannot exceed 100% of target (regardless of percentile rank within the peer group) •Awards can be earned up to 200% of the target award opportunity based on the Company’s TSR performance percentile ranking within the comparator group (Visteon plus the 17 TSR peer companies) •No award is earned if Visteon’s performance is below the 25th percentile •35% of target award earned at the 25th percentile, 100% at 55th percentile and 200% at 80th percentile •Award payouts for performance between the percentiles specified above is determined based on interpolation •TSR is calculated using the 20-trading day average closing price at the start and end of the performance period, adjusted for dividends |

Restricted Stock Units (40% of the total LTI value) | Facilitate retention and provide an ownership stake | •Vest one-third per year beginning one year after the date of grant |

2023-2026 Performance Stock Units Relative TSR Peer Group | ||

Adient, Inc. | Cooper Standard | LCI Industries |

American Axle & Mfg Holdings | Dana Incorporated | Lear Corporation |

Aptiv PLC | Denso | Magna International, Inc. |

Autoliv, Inc. | Forvia | Modine Manufacturing Company |

BorgWarner Inc. | Gentex Corporation | Valeo |

Continental | Gentherm Incorporated | |

Executive Compensation |

30 | Visteon Corporation | 2024 Proxy Statement |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 31 |

Executive Compensation |

32 | Visteon Corporation | 2024 Proxy Statement |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 33 |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Options Awards ($) | Non-Equity Incentive Plan Compensation ($)(2) | Change in Pension Value & Nonqualified Deferred Compensation Earnings ($)(3) | All Other Compensation ($)(4) | Total ($) | |

Sachin S. Lawande | 2023 | 1,101,250 | — | 9,794,540 | — | 1,602,813 | — | 651,887 | 13,150,490 | |

Director, President and Chief Executive Officer(5) | 2022 | 1,052,500 | — | 6,999,953 | — | 1,987,500 | — | 497,328 | 10,537,281 | |

2021 | 1,030,000 | — | 6,499,949 | — | 1,287,500 | — | 489,763 | 9,307,212 | ||

Jerome J. Rouquet | 2023 | 565,345 | — | 1,860,920 | — | 540,788 | — | 167,773 | 3,134,826 | |

Senior Vice President and Chief Financial Officer(6) | 2022 | 537,000 | — | 1,320,091 | — | 526,500 | — | 135,587 | 2,519,178 | |

2021 | 525,000 | — | 1,200,104 | — | 341,250 | — | 139,466 | 2,205,820 | ||

Brett D. Pynnonen | 2023 | 468,289 | — | 898,147 | — | 365,988 | — | 137,773 | 1,870,197 | |

Senior Vice President and Chief Legal Officer(7) | 2022 | 449,750 | — | 654,928 | — | 442,500 | — | 111,466 | 1,658,644 | |

2021 | 440,000 | — | 595,008 | — | 286,000 | — | 109,976 | 1,430,985 | ||

Robert R. Vallance | 2023 | 426,750 | — | 857,070 | — | 333,500 | — | 140,166 | 1,757,486 | |

Senior Vice President, Customer Business Groups, New Technology Product Lines, and General Manager APAC Region(8) | 2022 | 413,971 | — | 693,996 | — | 487,800 | — | 108,402 | 1,704,169 | |

2021 | 404,884 | — | 555,131 | — | 289,493 | — | 103,019 | 1,352,527 | ||

Kristin E. Trecker | 2023 | 407,020 | — | 857,070 | — | 322,288 | — | 116,670 | 1,703,048 | |

Senior Vice President and Chief People Officer(9) | 2022 | 373,250 | — | 537,941 | — | 358,500 | — | 92,455 | 1,362,146 | |

2021 | 361,250 | — | 429,890 | — | 232,000 | — | 82,044 | 1,105,184 | ||

Executive Compensation |

34 | Visteon Corporation | 2024 Proxy Statement |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 35 |

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | All Other Option Awards: Number of Securities Underlying Options (#)(3) | Exercise or Base Price of Option Awards ($ /Sh) | Grant Date Fair Value of Stock and Option Awards ($)(4) | |||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||

Sachin S. Lawande | ||||||||||||

Annual Cash Incentive(1) | — | 104,531 | 1,393,750 | 2,787,500 | — | — | — | — | — | — | — | |

Restricted Stock Units | 3/1/2023 | — | — | — | — | — | — | 18,861 | — | — | 3,199,957 | |

Performance Stock Units | 3/1/2023 | — | — | — | 9,902 | 28,292 | 56,584 | — | — | — | 6,594,582 | |

Jerome J. Rouquet | ||||||||||||

Annual Cash Incentive(1) | — | 35,269 | 470,250 | 940,500 | — | — | — | — | — | — | — | |

Restricted Stock Units | 3/1/2023 | — | — | — | — | — | — | 3,584 | — | — | 608,061 | |

Performance Stock Units | 3/1/2023 | — | — | — | 1,881 | 5,375 | 10,750 | — | — | — | 1,252,859 | |

Brett D. Pynnonen | ||||||||||||

Annual Cash Incentive(1) | — | 23,869 | 318,250 | 636,500 | — | — | — | — | — | — | — | |

Restricted Stock Units | 3/1/2023 | — | — | — | — | — | — | 1,730 | — | — | 293,512 | |

Performance Stock Units | 3/1/2023 | — | — | — | 908 | 2,594 | 5,188 | — | — | — | 604,635 | |

Robert R. Vallance | ||||||||||||

Annual Cash Incentive(1) | — | 21,750 | 290,000 | 580,000 | — | — | — | — | — | — | — | |

Restricted Stock Units | 3/1/2023 | — | — | — | — | — | — | 1,650 | — | — | 279,939 | |

Performance Stock Units | 3/1/2023 | — | — | — | 867 | 2,476 | 4,952 | — | — | — | 577,131 | |

Kristin E. Trecker | ||||||||||||

Annual Cash Incentive(1) | — | 21,019 | 280,250 | 560,500 | — | — | — | — | — | — | — | |

Restricted Stock Units | 3/1/2023 | — | — | — | — | — | — | 1,650 | — | — | 279,939 | |

Performance Stock Units | 3/1/2023 | — | — | — | 867 | 2,476 | 4,952 | — | — | — | 577,131 | |

Executive Compensation |

36 | Visteon Corporation | 2024 Proxy Statement |

Option Awards | Stock Awards | ||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($)(2) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(3) | |||

Sachin S. Lawande | 3/1/2018 | 47,036 | — | — | 124.34 | 2/28/2025 | — | — | — | — | |||

3/7/2019 | 63,748 | — | — | 80.97 | 3/6/2026 | — | — | — | — | ||||

3/4/2020 | 70,126 | — | — | 66.98 | 3/3/2027 | — | — | — | — | ||||

3/11/2021 | — | — | — | — | — | 6,780 | (4) | 846,822 | 26,111 | (7) | 3,261,264 | ||

3/1/2022 | — | — | — | — | — | 16,666 | (5) | 2,081,583 | 51,476 | (8) | 6,429,352 | ||

3/1/2023 | — | — | — | — | — | 18,861 | (6) | 2,355,739 | — | (9) | — | ||

Jerome J. Rouquet | 3/4/2020 | 4,675 | — | — | 66.98 | 3/3/2027 | — | — | — | — | |||

3/11/2021 | — | — | — | — | — | 1,252 | (4) | 156,375 | 4,821 | (7) | 602,143 | ||

3/1/2022 | — | — | — | — | — | 3,143 | (5) | 392,561 | 9,708 | (8) | 1,212,529 | ||

3/1/2023 | — | — | — | — | — | 3,584 | (6) | 447,642 | — | (9) | — | ||

Brett D. Pynnonen | 3/11/2021 | — | — | — | — | — | 621 | (4) | 77,563 | 2,390 | (7) | 298,511 | |

3/1/2022 | — | — | — | — | — | 1,560 | (5) | 194,844 | 4,816 | (8) | 601,518 | ||

3/1/2023 | — | — | — | — | — | 1,730 | (6) | 216,077 | — | (9) | — | ||

Robert R. Vallance | 3/11/2021 | — | — | — | — | — | 579 | (4) | 72,317 | 2,230 | (7) | 278,527 | |

3/1/2022 | — | — | — | — | — | 1,652 | (5) | 206,335 | 5,104 | (8) | 637,490 | ||

3/1/2023 | — | — | — | — | — | 1,650 | (6) | 206,085 | — | (9) | — | ||

Kristin E. Trecker | 5/7/2018 | 1,217 | — | — | 124.72 | 5/6/2025 | — | — | — | — | |||

3/4/2020 | 1,500 | — | — | 66.98 | 3/3/2027 | — | — | — | — | ||||

3/11/2021 | — | — | — | — | — | 449 | (4) | 56,080 | 1,727 | (7) | 215,702 | ||

3/1/2022 | — | — | — | — | — | 1,281 | (5) | 159,997 | 3,956 | (8) | 494,104 | ||

3/1/2023 | — | — | — | — | — | 1,650 | (6) | 206,085 | — | (9) | — | ||

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 37 |

Option Awards | Stock Awards | |||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) | Number of Shares Acquired on Vesting (#)(2) | Value Realized on Vesting ($)(2) | ||

Sachin S. Lawande | 47,187 | 2,549,090 | 93,786 | 14,635,824 | ||

Jerome J. Rouquet | 9,350 | 791,425 | 18,559 | 2,896,382 | ||

Brett D. Pynnonen | 8,403 | 495,901 | 7,694 | 1,200,548 | ||

Robert R. Vallance | 4,648 | 288,291 | 7,438 | 1,160,557 | ||

Kristin E. Trecker | 6,136 | 957,468 | ||||

Executive Compensation |

38 | Visteon Corporation | 2024 Proxy Statement |

Name | Executive Contributions in Last FY ($) | Registrant Contributions in Last FY ($)(3) | Aggregate Earnings in Last FY ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last FYE ($) | |

Sachin S. Lawande | ||||||

Savings Parity Plan(1) | — | 165,525 | 127,251 | — | 1,138,479 | |

DC SERP(2) | — | 447,869 | 460,140 | — | 3,507,647 | |

Jerome J. Rouquet | ||||||

Savings Parity Plan(1) | — | 45,711 | 8,773 | — | 121,373 | |

DC SERP(2) | — | 98,266 | 37,471 | — | 309,638 | |

Brett D. Pynnonen | ||||||

Savings Parity Plan(1) | — | 34,847 | 23,761 | — | 207,131 | |

DC SERP(2) | — | 81,971 | 80,161 | — | 581,474 | |

Robert R. Vallance | ||||||

Savings Parity Plan(1) | — | 35,073 | 96,974 | — | 351,231 | |

DC SERP(2) | — | 82,309 | 234,121 | — | 778,807 | |

Kristin E. Trecker | ||||||

Savings Parity Plan(1) | — | 26,131 | 5,665 | — | 73,598 | |

DC SERP(2) | — | 68,897 | 49,683 | — | 318,838 |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 39 |

Named Executive Officer | Involuntary Termination (w/o cause or for Good Reason) ($) | Change in Control ($) | Qualifying Termination after Change in Control ($) | |

Sachin S. Lawande | ||||

• Severance Payments | 3,763,125 | N/A | 5,017,500 | |

• Accelerated Stock Option Vesting(1) | — | — | — | |

• Accelerated Stock/Unit Awards Vesting(2) | 9,372,871 | — | 14,974,761 | |

• Deferred Compensation(3) | — | — | — | |

• Continuation of Health & Welfare Benefits(4) | 24,467 | N/A | 27,518 | |

• Outplacement Services(5) | 50,000 | N/A | 50,000 | |

Totals | 13,210,463 | — | 20,069,779 | |

Jerome J. Rouquet | ||||

• Severance Payments | 1,565,565 | N/A | 1,565,565 | |

• Accelerated Stock Option Vesting(1) | — | — | — | |

• Accelerated Stock/Unit Awards Vesting(6) | 1,753,471 | — | 2,811,249 | |

• Deferred Compensation(3) | — | — | 431,011 | |

• Continuation of Health & Welfare Benefits(4) | 32,248 | N/A | 33,817 | |

• Outplacement Services(5) | 50,000 | N/A | 50,000 | |

Totals | 3,401,284 | — | 4,891,642 | |

Brett D. Pynnonen | ||||

• Severance Payments | 1,187,453 | N/A | 1,187,453 | |

• Accelerated Stock Option Vesting(1) | — | — | — | |

• Accelerated Stock/Unit Awards Vesting(6) | 868,055 | — | 1,388,513 | |

• Deferred Compensation(3) | — | — | — | |

• Continuation of Health & Welfare Benefits(4) | — | N/A | 1,295 | |

• Outplacement Services(5) | 50,000 | N/A | 50,000 | |

Totals | 2,105,508 | — | 2,627,261 | |

Robert R. Vallance | ||||

• Severance Payments | 1,080,000 | N/A | 1,080,000 | |

• Accelerated Stock Option Vesting(1) | — | — | — | |

• Accelerated Stock/Unit Awards Vesting(6) | 1,140,837 | — | 1,400,754 | |

• Deferred Compensation(3) | — | — | — | |

• Continuation of Health & Welfare Benefits(4) | 32,248 | N/A | 33,424 | |

• Outplacement Services(5) | 50,000 | N/A | 50,000 | |

Totals | 2,303,085 | — | 2,564,178 |

Executive Compensation |

40 | Visteon Corporation | 2024 Proxy Statement |

Named Executive Officer | Involuntary Termination (w/o cause or for Good Reason) ($) | Change in Control ($) | Qualifying Termination after Change in Control ($) | |

Kristin E. Trecker | ||||

• Severance Payments | 1,046,415 | N/A | 1,046,415 | |

• Accelerated Stock Option Vesting(1) | — | — | — | |

• Accelerated Stock/Unit Awards Vesting(6) | 686,076 | — | 1,131,969 | |

• Deferred Compensation(3) | — | — | ||

• Continuation of Health & Welfare Benefits(4) | 24,467 | N/A | 25,609 | |

• Outplacement Services(5) | 50,000 | N/A | 50,000 | |

Totals | 1,806,958 | — | 2,253,993 |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 41 |

Executive Compensation |

42 | Visteon Corporation | 2024 Proxy Statement |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 43 |

Executive Compensation |

44 | Visteon Corporation | 2024 Proxy Statement |

Year (a) | Summary Compensation Table Total for PEO(¹) ($) (b) | Compensation Actually Paid to PEO($)(¹)˒(²)˒(³) (c) | Average Summary Compensation Table Total for Non-PEO NEOs(¹)($) (d) | Average Compensation Actually Paid to Non-PEO NEOs(¹)˒(²)˒(³) ($) (e) | Value of Initial Fixed $100 Investment based on:(4) | Net Income ($ Millions) (h) | Adjusted EBITDA(⁵) ($ Millions) (i) | |

TSR ($) (f) | Peer Group TSR ($) (g) | |||||||

2023 | ||||||||

2022 | ||||||||

2021 | ||||||||

2020 | ( | |||||||

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 45 |

2020 | 2021- 2023 |

Jerome J. Rouquet | Jerome J. Rouquet |

Brett D. Pynnonen | Robert R. Vallance |

Robert R. Vallance | Brett D. Pynnonen |

Matthew M. Cole | Kristin E. Trecker |

Sunil K. Bilolikar | |

William M. Robertson |

Year | Summary Compensation Table Total for PEO ($) | Exclusion of Change in Pension Value for PEO ($) | Exclusion of Stock Awards and Option Awards for PEO ($) | Inclusion of Pension Service Cost for PEO ($) | Inclusion of Equity Values for PEO ($) | Compensation Actually Paid to PEO ($) |

2023 | ( | |||||

2022 | ( | |||||

2021 | ( | |||||

2020 | ( |

Year | Average Summary Compensation Table Total for Non-PEO NEOs ($) | Average Exclusion of Change in Pension Value for Non-PEO NEOs ($) | Average Exclusion of Stock Awards and Option Awards for Non- PEO NEOs ($) | Average Inclusion of Pension Service Cost for Non- PEO NEOs ($) | Average Inclusion of Equity Values for Non-PEO NEOs ($) | Average Compensation Actually Paid to Non-PEO NEOs ($) |

2023 | ( | |||||

2022 | ( | |||||

2021 | ( | |||||

2020 | ( | ( |

Executive Compensation |

46 | Visteon Corporation | 2024 Proxy Statement |

Year | Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for PEO ($) | Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for PEO ($) | Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for PEO ($) | Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for PEO ($) | Total - Inclusion of Equity Values for PEO ($) |

2023 | ( | ||||

2022 | ( | ||||

2021 | ( | ||||

2020 | ( |

Year | Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs ($) | Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs ($) | Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non- PEO NEOs ($) | Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs ($) | Total - Average Inclusion of Equity Values for Non-PEO NEOs ($) |

2023 | ( | ||||

2022 | ( | ||||

2021 | ( | ||||

2020 | ( | ( |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 47 |

Executive Compensation |

48 | Visteon Corporation | 2024 Proxy Statement |

Most Important Performance Measures for 2023 |

Executive Compensation |

2024 Proxy Statement | Visteon Corporation | 49 |

Audit Committee Report The Audit Committee is composed of three directors, all of whom are considered independent under the rules and regulations of the Securities and Exchange Commission, the Nasdaq Stock Market listing standards and the Visteon Director Independence Guidelines, and operates under a written charter adopted by the Board of Directors. During 2023, the Audit Committee held six meetings. Visteon management has the primary responsibility for the Company’s internal controls and the financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America. The independent registered public accounting firm also expresses an opinion, based on an audit, on the effectiveness of Visteon’s internal control over financial reporting. The Audit Committee oversees and monitors these processes and reports to the Board of Directors on its findings. The Audit Committee of the Board of Directors selects and hires the independent registered public accounting firm. The Audit Committee considers the impact of changing auditors when assessing whether to retain the current external auditor, and regarding the mandated rotation, has had direct involvement in the selection process for the lead engagement partner for the Company’s audit. Deloitte & Touche LLP has served as Visteon’s external auditor since 2022. During the year, the Audit Committee met and held discussions with Visteon management and Deloitte & Touche LLP, the independent registered public accounting firm. The Audit Committee discussed with Deloitte & Touche LLP the overall scope and plans for their audit. The Audit Committee reviewed and discussed with Visteon management and Deloitte & Touche LLP the audited financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, including the critical audit matters addressed in the audit, as well as the Company’s internal control over financial reporting. The Audit Committee also discussed with Deloitte & Touche LLP the matters required to be discussed with the Audit Committee by Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees, the rules of the Securities and Exchange Commission, and other applicable regulations. Deloitte & Touche LLP submitted to the Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee discussed with Deloitte & Touche LLP the firm’s independence and considered whether the provision of non-audit services by Deloitte & Touche LLP to the Company is compatible with maintaining the independence of Deloitte & Touche LLP. The Audit Committee concluded that the independence of Deloitte & Touche LLP from Visteon and management is not compromised by the provision of such non-audit services. Based on these reviews and discussion, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and filed with the SEC. | ||||

Audit Committee •Robert J. Manzo (Chairman) •Naomi M. Bergman •David L. Treadwell | ||||

The Audit Committee reviews with management and the independent auditor the Company’s audited financial statements. |

50 | Visteon Corporation | 2024 Proxy Statement |

Year Ended December 31 | Audit Services Fees | Audit Related Fees | Tax Fees | All Other Fees | |

2023 | $2,640,500 | $86,000 | $807,200 | $75,000 | |

2022 | $2,384,000 | $70,000 | $1,125,100 | _ |

Audit Committee Report |

2024 Proxy Statement | Visteon Corporation | 51 |

Item Two | |||||

Approval of Independent Registered Public Accounting Firm | |||||

The next proposal on the agenda for the Annual Meeting will be ratifying the appointment of Deloitte & Touche LLP by the Audit Committee as the Company’s independent registered public accounting firm for fiscal year 2024. Deloitte & Touche LLP served in such capacity for fiscal year 2023. Representatives of Deloitte & Touche LLP, the Company’s independent registered public accounting firm, are expected to be present at the Annual Meeting. They will have the opportunity to make a statement at the meeting if they desire to do so and are expected to be available to respond to appropriate questions. For information regarding fees paid to Deloitte & Touche LLP, see “Audit Fees” above. | The Audit Committee believes that the choice of Deloitte & Touche LLP to serve as external auditor is in the best interests of the Company and its shareholders.  The Board of Directors Recommends that You Vote "FOR" the Ratification of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 2024. | ||||

52 | Visteon Corporation | 2024 Proxy Statement |

Our executive compensation provides strong alignment between executive pay and company performance. | |||||

Item Three | |||||

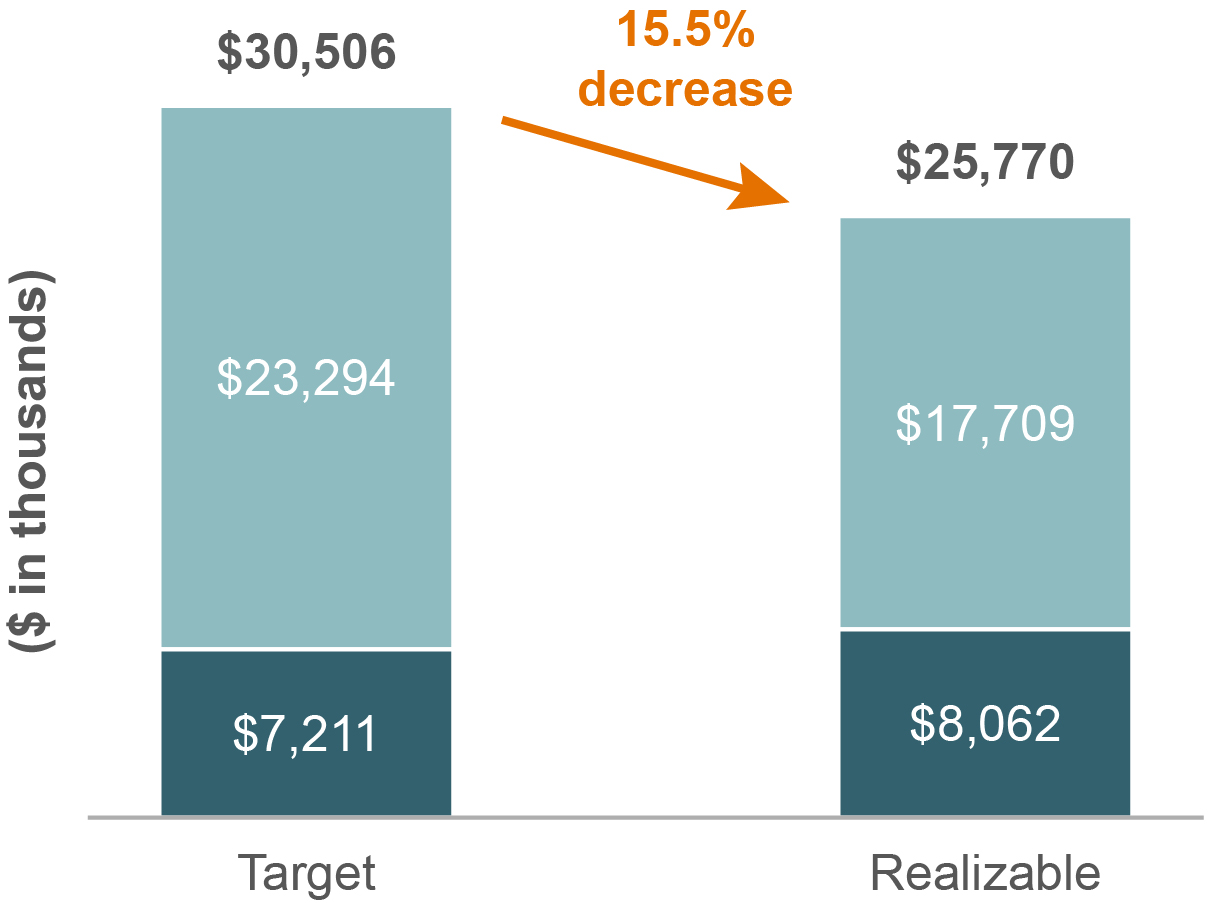

Provide an Advisory Vote Executive Compensation Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we are seeking stockholder approval of the Company’s executive compensation program and practices as disclosed in this proxy statement. While this vote is advisory, and not binding on the Board, it will provide information to the Board and the Organization and Compensation Committee regarding investor sentiment about our executive compensation programs and practices, which the Organization and Compensation Committee will carefully review when evaluating our executive compensation program. Stockholders are being asked to vote on the following advisory resolution: “RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s executive officers, as disclosed in the 2024 Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosures.” The Company is committed to maintaining executive compensation programs and practices that are aligned with the Company’s business strategy. As a result, the Company has a strong pay-for-performance philosophy that greatly impacts its decisions regarding executive compensation. Our executive compensation programs seek to align management’s interests with our stockholders’ interests to support long-term value creation and pay for performance. This philosophy and the compensation structure are essential to the Company’s ability to attract, retain and motivate individuals who can achieve superior financial results in the best interests of the Company and its stockholders. To that end, our program links pay to performance by delivering a significant majority of the total compensation opportunity of our Named Executive Officers in variable or performance-based compensation programs (annual and long-term incentive plans). Performance measures used in the Company’s annual and long-term incentive plans support the Company’s annual operating plan and longer term strategy and are tied to key Company measures of short and long-term performance. Our program also aligns the Named Executive Officers’ financial interest with those of our stockholders by delivering a substantial portion of their total compensation in the form of equity awards and other long-term incentive vehicles. We urge our stockholders to read “Compensation Discussion and Analysis” above, which describes in detail how our executive compensation program and practices operate and are designed to achieve our compensation objectives, as well as the accompanying compensation tables which provide detailed information on the compensation of our Named Executive Officers. | |||||

Performance-based annual and long-term programs | |||||

Robust stock ownership guidelines | |||||

Clawback policy for executive officers in the event of a financial restatement | |||||

Double trigger requirements for NEO severance payments | |||||

The Board of Directors Recommends that You Vote "FOR" the Approval of Executive Compensation set forth in this proxy statement. | |||||

2024 Proxy Statement | Visteon Corporation | 53 |

Item Four | |||||

Provide an Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation | |||||

Pursuant to Section 14A of the Exchange Act, we are asking stockholders to vote on whether future advisory votes on executive compensation of the nature reflected in Item 3 above should occur every year, every two years or every three years. This frequency vote is required to be held at least once every six years. At the 2018 Annual Meeting, stockholders approved the annual frequency option for the advisory vote on executive compensation and since 2018, the Company’s stockholders have provided the advisory vote on executive compensation on an annual basis. This advisory vote provides stockholders the ability to specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. The frequency alternative that receives the most votes will be considered the advisory choice of stockholders. Stockholders are not voting to approve or disapprove the Board’s recommendation. While this vote is advisory, and not binding on the Board, the Organization and Compensation Committee will carefully review the voting results. Notwithstanding the Board’s recommendation and the outcome of the stockholder vote, the Board may in the future decide to conduct advisory votes on a more or less frequent basis and may vary its practice based on factors such as discussions with stockholders and the adoption of material changes to compensation programs. After careful consideration, the Board has determined that holding an advisory vote on executive compensation every year is the most appropriate policy for the Company at this time, and recommends that stockholders vote for future advisory votes on executive compensation to occur every year. While the Company’s executive compensation programs are designed to promote a long-term connection between pay and performance, the Board recognizes that executive compensation decisions and disclosures are made annually. Holding an annual advisory vote on executive compensation provides the Company with more direct and immediate feedback on our compensation programs. We believe that an annual advisory vote on executive compensation is consistent with our practice of seeking input and engaging in dialogue with our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices. | Annual advisory votes provide direct and regular feedback on our compensation programs.  The Board of Directors Recommends that You Vote "FOR" the One Year Fequency Option for the Advisory Vote on Executive Compensation. | ||||

54 | Visteon Corporation | 2024 Proxy Statement |

Item Five | |||||

Approval of Amendment to the 2020 Incentive Plan The next proposal on the agenda for the Annual Meeting is the approval of an amendment to the Visteon Corporation 2020 Incentive Plan. The Amended 2020 Incentive Plan has already been approved and adopted by the Organization and Compensation Committee, pending approval by our stockholders. The proposed amendment seeks stockholder approval for an additional 1,330,000 shares to be authorized for issuance under the amended Incentive Plan becoming effective June 6, 2024. There are no other amendments being made to the 2020 Incentive Plan. We are requesting that our stockholders approve the Amended 2020 Incentive Plan which would add 1,330,000 shares available for issuance. As of April 1, 2024, we had 97,157 shares remaining available for issuance of future awards under the 2020 Incentive Plan. If this increase is approved then as of the effective date, we would have had 1,427,157 shares available for issuance for future awards under the Amended 2020 Incentive Plan. We believe that the adoption of the Amended 2020 Incentive Plan is necessary for maintaining our ability to utilize equity-based compensation effectively across our workforce, including employees, directors, officers, consultants, or advisors. The equity incentives serve to not only align the interests of recipients with our stockholders but also contribute significantly to our ability to attract and retain top talent, thereby ensuring the ongoing success of the Company. Furthermore, we believe that the additional shares proposed to be reserved under the amendment to the 2020 Incentive Plan are crucial for maintaining our commitment to emphasize on equity compensation and remaining competitive with industry standards in granting equity awards. Equity Usage In developing our share request for the Amended 2020 Incentive Plan and analyzing the impact of equity utilization on our stockholders, the Board considered our share usage and “overhang”. Equity usage provides a measure of the potential dilutive impact of our annual equity award program. The three-year average share usage rate of 1.06% is aligned with the industry thresholds established by certain major proxy advisory firms and institutional investors. The following table sets forth information regarding the share usage for each of the last three fiscal years under all awards reported in our Form 10-Ks for such fiscal years. | The Amended 2020 Incentive Plan aligns the interests of key personnel with our stockholders and incorporates the following best practices: | ||||

Minimum 1 year vesting requirement | |||||

No “liberal share recycling” of awards | |||||

Stock option repricing prohibited | |||||

No excise tax gross-ups | |||||

The Board of Directors Recommends that You Vote "FOR" the Approval of the Amendment to the Visteon Corporation 2020 Incentive Plan to increase the total number of shares of common stock authorized and available for issuance under the Plan. | |||||

2024 Proxy Statement | Visteon Corporation | 55 |

Stock Options/SARs Outstanding | 190,347 |

Weighted-Average Exercise Price of Outstanding Stock Options/SARs | $86.20 |

Weighted-Average Remaining Term of Outstanding Stock Options/SARS | 1.88 years |

Total Full Value Awards Outstanding | 836,171 |

Shares remaining available for issuance under 2020 Incentive Plan | 97,157 |

Basic common shares outstanding as of the record date (April 11, 2024) | 27,595,884 |

Item Five |

56 | Visteon Corporation | 2024 Proxy Statement |

2023 | 2022 | 2021 | 3-Year Average | |

Stock Options/Stock Appreciation Rights (SARs) Granted | — | — | — | |

Stock-Settled Time-Vested Restricted Shares/Units Granted | 221,000 | 276,000 | 110,000 | |

Stock-Settled Performance-Based Shares/Units Granted | 131,000 | 98,000 | 55,000 | |

Weighted-Average Basic Common Shares Outstanding | 28,100,000 | 28,100,000 | 28,000,000 | |

Share Usage Rate | 1.25% | 1.33% | 0.59% | 1.06% |

Item Five |

2024 Proxy Statement | Visteon Corporation | 57 |

Item Five |

58 | Visteon Corporation | 2024 Proxy Statement |

Item Five |

2024 Proxy Statement | Visteon Corporation | 59 |

Item Five |

60 | Visteon Corporation | 2024 Proxy Statement |

Item Five |

2024 Proxy Statement | Visteon Corporation | 61 |

Item Five |

62 | Visteon Corporation | 2024 Proxy Statement |

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a)(1) ($) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b)(1) ($) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column(a))(c) ($) | |

Equity compensation plans approved by security holders | 823,377 | 86.21 | 464,166 | |

Equity compensation plans not approved by security holders | — | — | — | |

Total | 823,377 | 86.21 | 464,166 |

Item Five |

2024 Proxy Statement | Visteon Corporation | 63 |

64 | Visteon Corporation | 2024 Proxy Statement |