UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 31 , 2022

OR

For the transition period from ____________ to ____________

Commission file number 001-15827

(Exact name of registrant as specified in its charter)

| State of | |||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

Registrant’s telephone number, including area code: (800 )-VISTEON

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer," "accelerated filer,” "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☑ No

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2022 (the last business day of the most recently completed second fiscal quarter) was approximately $2.9 billion.

As of February 9, 2023, the registrant had outstanding 28,190,091 shares of common stock.

Document Incorporated by Reference

| Document | Where Incorporated | ||||

| 2023 Proxy Statement | Part III (Items 10, 11, 12, 13 and 14) | ||||

1

Visteon Corporation and Subsidiaries

Index

Part I | Page | |||||||

Item 1A. Risk Factors | ||||||||

Item 1B. Unresolved Staff Comments | ||||||||

Item 2. Properties | ||||||||

Part II | ||||||||

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | ||||||||

Item 9A. Controls and Procedures | ||||||||

Part III | ||||||||

Item 11. Executive Compensation | ||||||||

Part IV | ||||||||

Signatures | ||||||||

2

Part I

Item 1.Business

Description of Business

Visteon Corporation (the "Company" or "Visteon") is a global automotive technology company serving the mobility industry, dedicated to creating more enjoyable, connected, and safe driving experiences. The Company's platforms leverage proven, scalable hardware and software solutions that enable the digital, electric, and autonomous evolution of the Company's global automotive customers, including BMW, Ford, Geely, General Motors, Honda, Jaguar/Land Rover, Mahindra, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Renault, Stellantis, Tata, Toyota, and Volkswagen. Visteon products align with key industry trends and include digital instrument clusters, domain controllers with integrated advanced driver assistance systems ("ADAS"), displays, Android-based infotainment systems, and battery management systems. Visteon is headquartered in Van Buren Township, Michigan, and has an international network of manufacturing operations, technical centers, and joint venture operations dedicated to the design, development, manufacture, and support of its product offerings and its global customers. The Company's manufacturing and engineering footprint is primarily located in Brazil, China, India, Japan, Mexico, Portugal, and Slovakia.

The Company’s Industry

The Company operates in the automotive industry which is cyclical and highly sensitive to general economic conditions. The Company believes that future success in the automotive industry is, in part, dependent on alignment with customers to support their efforts to effectively meet the challenges associated with the following significant trends and developments in the global automotive industry:

•Electronic content and connectivity - The electronic content of vehicles continues to increase due to various regulatory requirements and consumer demand for increased vehicle performance and functionality. The use of electronic components can reduce weight, expedite assembly, enhance fuel economy, improve emissions, increase safety, and enhance vehicle performance. These benefits coincide with vehicles becoming more electric, connected, and automated. Additionally, digital and portable technologies have dramatically influenced the lifestyle of today’s consumers, who expect products that enable such a lifestyle. Consequently, the vehicle cockpit is transforming into a fully digital and connected environment with multi-display systems incorporating larger, curved, and more complex displays and the consolidation of discrete electronic control units into a multi-core domain controller.

•Electric vehicles – The trend towards electrification continues to accelerate, driven by government incentives and standards, announced restrictions of internal combustion engine vehicles in multiple cities and countries, and the significant increase of investment in electrification by Original Equipment Manufacturers ("OEMs"). The shift to electric vehicles increases the digital content of a vehicle as the majority of cockpit electronics will be all-digital to support the new electrical architecture. In addition, all battery electric vehicles will require a battery management system to manage the rechargeable battery pack.

•Advanced driver assistance systems and autonomous driving - The industry continues to advance toward semi-autonomous and autonomous vehicles. The Society of Automotive Engineers has defined five levels of autonomy ranging from levels one and two with driver-assist functions whereby the driver is responsible for monitoring the environment, to level five with full autonomy under all conditions. Levels one and two are already popular in the market. Levels three and above utilize a combination of sensors, radars, cameras and LiDARs, requiring sensor fusion and machine learning technologies, as the system assumes the role of monitoring the environment. Level three includes features such as highway pilot and parking assist technology, for which an increased market penetration rate is expected over the next several years.

•Safety and security - Governments continue to focus regulatory efforts on safer transportation. Accordingly, OEMs are working to improve occupant and pedestrian safety by incorporating more safety-oriented technology in their vehicles. Additionally, in-vehicle connectivity has increased the need for robust cybersecurity systems to protect data, applications, and associated infrastructure. Security features are evolving with advances in sensors and suppliers must enable the security/safety initiatives of their customers including the development of such new advances.

•Vehicle standardization - OEMs continue to standardize vehicle platforms on a global basis, resulting in a lower number of individual vehicle platforms, design cost savings, and further scale of economies through the production of a greater number of models from each platform. Having operations in the geographic markets in which OEMs produce global platforms enables suppliers to meet OEMs’ needs more economically and efficiently, thus making global coverage a source

3

of significant competitive advantage for suppliers with a diversified global footprint. Additionally, OEMs are looking to suppliers for increased collaboration to lower costs, reduce risks, and decrease overall time to market. Suppliers that can provide fully engineered systems and pre-assembled combinations of component parts are positioned to leverage the trend toward system sourcing. As vehicles become more connected and cockpits more digitized, suppliers that can deliver modular hardware architectures, “open” software architectures, and a software platform approach will be poised to help OEMs achieve greater reuse of validated hardware circuitry, design scalability, and faster development cycles.

The Company's Segment

The Company’s reportable segment is Electronics. The Electronics segment provides vehicle cockpit electronics products to customers, including digital instrument clusters, domain controllers with integrated advanced driver assistance systems ("ADAS"), displays, Android-based infotainment systems, and battery management systems. As the Company has one reportable segment, net sales, total assets, depreciation, amortization and capital expenditures are equal to consolidated results.

The Company’s Products

The Company designs and manufactures innovative automotive electronics and connected car solutions further described below:

Instrument Clusters

The Company offers a full line of instrument clusters, from standard analog gauge clusters to high-resolution, all-digital, fully reconfigurable, 2-D and 3-D display-based devices. The Company uses a platform approach to accelerate development and manage multiple vehicle variants. These clusters can use a wide range of display technologies, graphic capabilities, decorative elements, and free-form and curved displays. Premium clusters support complex graphics and feature embedded functionality such as driver monitoring, camera inputs, and ambient lighting.

Information Displays

The Company offers a range of information displays for various applications within the cockpit, incorporating a sleek profile, high perception quality displays and touch sensors designed to deliver high performance for the automotive market. These displays can integrate a range of user interface technologies and graphics management capabilities, such as active privacy, TrueColorTM enhancement, local dimming, cameras, optics, haptic feedback, and light effects. The Company offers a new generation of large, curved, complex multi-display modules with optical performance designed to be competitive with mobile devices. The Company's microZone™ display technology offers high contrast and brightness and a wide color gamut that enables automotive displays to cost-effectively achieve life-like imaging capability on par with consumer mobile devices, without sacrificing reliability or life span. The Company also developed the first bendable glass multi-display cockpit in the automotive industry.

Audio and Infotainment Systems

The Company offers a range of infotainment and connected car solutions, including scalable Android infotainment for seamless connectivity including integration with Android Auto and Apple CarPlay technology for wireless smartphone projection. The company offers a display audio and embedded infotainment platform that is based on Android automotive operating system, enabling third-party developers to create apps easily through a software development kit and software simulation of the target hardware system. Additionally, Visteon offers an onboard artificial intelligence ("AI")-based voice assistant with natural language understanding.

Battery Management Systems (“BMS”)

The Company offers configurable battery management systems that support both wired and wireless battery sensing and control. Visteon’s wireless BMS reliably and securely replaces wired communication between battery modules to improve the lifetime enterprise cost, battery weight, and packaging efficiency, and facilitates second-life battery repurposing. By providing a platform approach that can support multiple charging protocols and flexible battery pack architectures, Visteon provides a robust design-to-production strategy that enables advanced features that are fast-to-market.

High-Voltage Power Electronics

The Company offers integrated and scalable power electronics units that support conversion of grid-to-battery pack electric current. Visteon’s integrated power electronics solutions combine a bi-directional on-board charging module with a DC-to-DC

4

converter to ensure a systems approach that maximizes power conversion efficiency. Visteon’s solution is scalable to support between 400-volt to 800-volt systems with higher rate battery charging speeds. Visteon’s design provides a solution that allows for fast-charging and high-efficiency in a packaging that reduces weight and space to improve overall system cost.

Telematics Solutions

The Company provides a cost-optimized, high-speed telematics control unit to enable secure connected car services, software updates, and data. The Company’s telematics solution uses a single hardware and flexible software architecture to support regional telematics service providers and mobile networks. The Company’s wireless gateway platform is designed to meet future connectivity requirements.

SmartCore Cockpit Domain Controller

The Company offers SmartCore™, an automotive-grade, integrated domain controller approach, which can independently operate the infotainment system, instrument cluster, head-up display, rear-seat displays, and other features on a single, multi-core chip to improve efficiency, create a unified experience across products, and reduce power consumption and cost. The SmartCore domain controller includes: SmartCore Runtime, middleware enabling communication between domains and apps to be shown on any display; and SmartCore Studio, a PC-based configuration tool to generate hypervisor configurations. The SmartCore domain controller seamlessly connects the human machine interaction ("HMI") across an increasing number of display domains, such as surround view and in-cabin sensing of driver drowsiness, attentiveness, and facial recognition. The latest generation of SmartCore utilizes high performance computing technology and integrates processing of multiple camera inputs to deliver a set of advance driver assistance features. The latest generation of SmartCore is offered with a suite of connected services including over the air update solution and Automotive App Store.

Body Domain Controller

The Company offers a range of body domain modules which integrate several functions such as central gateway, body controls, comfort, and vehicle access solutions into one device. This computing module allows Visteon's customers to implement in-house applications software into body controls for brand and market differentiation.

The Company’s Customers

The Company's ultimate customers are global vehicle manufacturers including BMW, Ford, Geely, General Motors, Honda, Jaguar/Land Rover, Mahindra, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Renault, Stellantis, Tata, Toyota, and Volkswagen.

The following is a summary of customers representing greater than 10 percent of the Company's annual net sales:

| Percentage of Total Net Sales | ||||||||||||||||||||

| December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Ford | 22 | % | 22 | % | 22 | % | ||||||||||||||

The Company typically supplies products to OEM customers through purchase orders, which are usually governed by general terms and conditions established by each OEM. Although the terms and conditions vary from customer to customer, they typically contemplate a relationship under which customers place orders for their requirements of specific components supplied for particular vehicles but are not required to purchase any minimum quantities. Individual purchase orders can be cancelled for cause, non-performance, and, in most cases, insolvency or certain change in control events. Additionally, many of Visteon's OEM customers have the option to terminate contracts for convenience; this option permits the OEM customers to impose pressure on pricing during the life of the vehicle program or issue purchase orders for less than the duration of the vehicle program. This has the potential to reduce the Company’s profit margin and increases the risk of loss of future sales under those purchase contracts.

The Company manufactures and ships based on customer release schedules, normally provided on a weekly basis, which can vary based on OEM automotive production or dealer inventory levels. Although customer programs typically extend to future periods and although there is an expectation that the Company will supply certain levels of OEM production in those future periods, customer agreements (including the applicable terms and conditions) do not necessarily constitute firm orders.

The price related to these products are typically initially negotiated on an annual basis over the vehicle platform's life cycle. To the extent there are subsequent contractual price reductions, these reductions are intended to reflect the Company's ability to

5

reduce cost through such factors as manufacturing productivity enhancements, material cost reductions, and design-related cost improvements. Certain products may be excluded from such reductions or experience price increases due to shortages of material or other increases in supply chain or other related costs. The Company has an aggressive cost control program that focuses on reducing its total costs intended to offset customer price reductions or negotiating recoveries for increases. However, there can be no assurance that the Company’s cost reduction or recovery efforts will be sufficient to fully offset such price changes.

The terms and conditions generally require a warranty on products sold. In most cases, the warranty period is the same as the warranty offered by the OEM to the ultimate customer. The Company may also be required to share in all or part of recall costs if the OEM recalls vehicles for defects attributable to Visteon products.

The Company’s Competition

The automotive sector continues to remain highly competitive resulting from the ongoing industry consolidation. OEMs rigorously evaluate suppliers on the basis of financial viability, product quality, price competitiveness, technical expertise, development capability, new product innovation, reliability and timeliness of delivery, product design, manufacturing capability, flexibility, customer service, and overall management. The Company's primary independent competitors include, but are not limited to, Alpine Electronics, Aptiv PLC, Continental AG, Denso Corporation, Forvia, Harman International Industries, Incorporated (a subsidiary of Samsung Electronics Co. Ltd.), Hitachi Ltd., Hyundai Mobis, Innolux Corporation, Marelli Holdings Co., Ltd., Nippon Seiki, Panasonic Corporation, Preh GmbH, Robert Bosch GmbH, and Vitesco Technologies.

The Company’s Business Seasonality and Cyclicality

Historically, the Company’s business has been moderately seasonal because its largest North American customers typically cease production for approximately two weeks in July for model year changeovers and approximately one week in December during the winter holidays. Customers in Europe historically shut down vehicle production during a portion of August and one week in December. In China, customers typically shut down approximately one week in early October and one week in January or February. Additionally, third-quarter automotive production is traditionally lower as new vehicle models enter production. However, starting in 2020, the standard cyclicality of the business was altered due to the global COVID-19 pandemic and associated supply chain challenges creating rolling shutdowns amongst multiple customer production facilities.

Environmental, Social, and Governance

Attract and Retain

The Company’s ability to sustain and grow its business requires the recruitment, retention, and development of a highly skilled and diverse workforce. The Company’s Chief People Officer, reporting directly to Chief Executive Officer ("CEO"), oversees its global talent processes to attract, develop, and retain its employees. To attract the best talent, the Company offers market competitive compensation and benefits around the globe, annual and long-term incentive programs, and health and wellness benefits. The Company also provides a variety of resources to help its employees grow in their current roles and build new skills. Hundreds of online courses are available in the Company’s learning management system where individual development is emphasized as part of the annual goal setting process. The Company continues to build tools to be used by leaders to develop employees in their current role and create new opportunities within the organization to learn and grow. Because retention of the employee base is significant to its business strategy, executive management discusses it with the Board of Directors on a regular basis.

Workforce

Visteon’s strength comes from a workforce of approximately 10,000 employees operating in approximately 18 countries globally. The Company's workforce is globally distributed with 29% of employees located in the Americas, 31% in Europe, 14% in China, and 26% in the Asia Pacific region. Visteon believes that all employees are leaders and expects leaders to drive operational and financial results and build strong teams.

Many of the Company’s employees are members of industrial trade unions and confederations within their respective countries. Often these organizations operate under collectively bargained contracts that are not specific to any one employer. The Company constantly works to establish and maintain positive, cooperative relations with its unions and work representatives around the world.

Diversity and Inclusion

6

Diversity represents an environment where the contributions of all employees are encouraged and valued. As a global organization, the Company embraces human differences and harnesses the power of its employees’ varied backgrounds, cultures, and experiences because it is the right thing to do for its people and it creates a competitive business advantage. As of December 31, 2022, the percentage of Visteon's global workforce represented by females was approximately 39%.

The Company encourages many forms of communication such as global town hall employee meetings, informal small-group employee discussions, and an open-door policy so all employees have direct access to senior leadership and have the opportunity to ask questions, make suggestions, and provide input. As stated in one of the Company's four core beliefs and values, “We treat each other with respect and embrace our differences.”

Workplace Safety

The Company requires protective equipment, enforces comprehensive safety policies and procedures, and encourages its employees and leaders to continually look for ways to improve workplace safety. It has implemented and maintains a health and safety management system that is certified to the OHSAS 18001 or ISO 45001 standard. The Company provides regular health and safety reports to the Board of Directors including updates on the return to work health and safety protocols globally as a result of COVID-19.

Regulation

Visteon operates in a constantly evolving global regulatory environment and is subject to numerous and varying regulatory requirements for its product performance and material content. Visteon strives to identify potential regulatory and quality risks early in the design and development process and proactively manage them throughout the product lifecycle through the use of routine assessments, protocols, standards, performance measures, and audits. New regulations and changes to existing regulations are managed in collaboration with the OEM customers and implemented through Visteon’s global systems and procedures designed to ensure compliance with existing laws and regulations.

Visteon works collaboratively with a number of stakeholder groups including government agencies, customers, and suppliers to proactively engage in federal, state, and international public policy processes.

Environmental, Health, Safety, and Legal Matters

Visteon is involved in various lawsuits, claims and proceedings related to the operation of its businesses, including those pertaining to product liability, environmental, safety and health, intellectual property, employment, commercial and contractual matters, tax, and various other matters. Although the outcome of such lawsuits, claims and proceedings cannot be predicted with certainty and some may be disposed of unfavorably to Visteon, it is management's opinion that none of these will have a material adverse effect on Visteon's financial position, results of operations, or cash flows. Costs related to such matters were not material to the periods presented. Further details are provided in Part II, Item 8 of this Form 10-K in Note 18, "Commitments and Contingencies," of the notes to consolidated financial statements.

Board Oversight of Environmental, Social, and Governance Practices

The Company and its Board of Directors believe positive environmental, social, and governance-related business practices strengthens the Company, increases its connection with the stockholders, and helps it to better serve its customers and the communities in which it operates. The Company’s commitment to social responsibility extends to the environment, anti-corruption and trade compliance, responsible sourcing, human rights, labor practices, and worker health and safety. In light of the continued importance of these matters, the Board of Directors and management have developed a multi-year road map to enhance the Company’s environmental, social and governance-related programs and disclosures, including assessment of the potential risks associated with climate change. This road map includes near-term environmental targets for 2025 aimed at reducing energy consumption, solid waste, water and the reduction of scope 1 and scope 2 CO2 emissions through the use of renewable energy. The Company has also submitted its longer term greenhouse gas (GHG) emission reduction target for 2030 which includes scope 3 CO2 emissions to the science based targets initiative (SBTi) for validation. Management provides regular reports and presentations to the Corporate Sustainability and Governance Committee regarding progress toward achieving these targets, and the full Board of Directors has oversight of the Company’s environmental and social initiatives as part of its strategic review of the Company’s operations, products and technologies.

The Company’s Product Research and Development

7

The Company’s research and development efforts are intended to maintain leadership positions in core products and provide the Company with a competitive edge as it seeks additional business with new and existing customers. The Company also works with technology development partners, including customers, to develop technological capabilities and new products and applications.

The Company’s Intellectual Property

The Company owns significant intellectual property, including a number of patents, copyrights, proprietary tools and technologies, trade secrets, and numerous licensing arrangements. Although the Company’s intellectual property plays an important role in maintaining its competitive position, no single patent, copyright, proprietary tool or technology, trade secret or license, or group of related patents, copyrights, proprietary tools or technologies, trade secrets or licenses is of such value to the Company that its business would be materially affected by the expiration or termination thereof. The Company’s general policy is to apply for patents on an ongoing basis, in appropriate countries, on its patentable developments that are considered to have commercial significance. The Company also views its name and mark as significant to its business as a whole. In addition, the Company holds rights in a number of other trade names and marks applicable to certain of its businesses and products that it views as important to such businesses and products.

The Company’s International Operations

Financial information about sales and net property by major geographic region can be found in Note 19, "Revenue recognition and Geographical Information" to the Company's consolidated financial statements included in Part II, Item 8 of this Form 10-K.

The Company’s Raw Materials and Suppliers

Raw materials used by the Company in the manufacture of its products include electronics components, resins, and precious metals. While generally the supply of the materials used are available from numerous sources, semiconductor suppliers and silicon wafer production is concentrated. In general, the Company does not carry inventories of raw materials in excess of those reasonably required to meet production, shipping schedules, and customer safety stock requirements. The Company monitors its supply base and endeavors to work with suppliers and customers to mitigate the impact of potential material shortages and supply disruptions.

The Company, along with automotive companies around the world, has experienced a shortage in semiconductors as a result of suppliers inability to rapidly reallocate production to serve the automotive industry during a time of increased demand. The Company's semiconductor suppliers, along with most automotive component supply companies that use semiconductors, have been unable to fully meet the vehicle production demands of its customers due to events which are outside the Company's control, including but not limited to, the COVID-19 pandemic, the global semiconductor shortage, and other extraordinary events. The Company is working closely with suppliers and customers to attempt to minimize potential adverse impacts of these events.

The automotive supply industry is subject to inflationary pressures with respect to raw materials, labor, and associated freight costs, which can place operational and financial burdens on the entire supply chain. Accordingly, the Company continues to take actions with its customers and suppliers to mitigate the impact of these inflationary pressures in the future. Actions to mitigate inflationary pressures with customers include collaboration on alternative product designs and material specifications, contractual price escalation clauses, and negotiated customer recoveries. Actions to mitigate inflationary pressures with suppliers include aggregation of purchase requirements to achieve optimal volume benefits, negotiation of cost reductions, and identification of more cost competitive suppliers. While these actions are designed to offset the impact of inflationary pressures, the Company cannot provide assurance that it will be successful in fully offsetting increased costs resulting from inflationary pressures.

8

The Company’s Website and Access to Available Information

The Company’s current and periodic reports filed with the United States Securities and Exchange Commission (“SEC”), including amendments to those reports, may be obtained through its internet website at www.visteon.com free of charge as soon as reasonably practicable after the Company files these reports with the SEC. A copy of the Company’s code of business conduct and ethics for directors, officers and employees of Visteon and its subsidiaries, entitled “Ethics and Integrity Policy,” the Corporate Governance Guidelines adopted by the Company’s Board of Directors and the charters of each committee of the Board of Directors are also available on the Company’s website. A printed copy of the Company’s Ethics and Integrity Policy may be requested by contacting the Company’s Investor Relations department in writing at One Village Center Drive, Van Buren Township, MI 48111; by phone (734) 710-7893; or via email at investor@visteon.com.

Item 1A.Risk Factors

Set forth below are certain risks and uncertainties facing the Company. Additional risks and uncertainties, including those not presently known or that the Company believes to be immaterial, also may adversely affect the Company. Should any such risks and uncertainties develop into actual events, these developments could have material adverse effects on the Company’s business, operating results, financial condition, and cash flow.

Operations Related Risk Factors

The Company could be negatively impacted by shortages in deliveries from its supply base, other supplier distress, or suppliers demanding price increases

In an effort to manage and reduce the costs of purchased goods and services, the Company, like many automotive suppliers and automakers, has been consolidating its supply base. As a result, the Company is dependent on single or limited sources of supply for certain components used in the manufacture of its products including semiconductor chips, which are integral components of new vehicles and are embedded in multiple vehicle systems including automotive and cockpit electronics. In 2022, the Company continued to experience semiconductor shortages and once again expects such shortages to persist in 2023. If such shortages of semiconductors or other critical components from other suppliers continue longer than anticipated, or worsen, it could impact the Company's ability to meet its production schedules for some of its key products or to ship such products to its customers in a timely fashion. Furthermore, unfavorable economic or industry conditions could result in financial distress within the Company's supply base, thereby increasing the risk of supply disruption.

Such disruptions could be caused by any one of a myriad of potential problems, such as closures of one of the Company’s or its suppliers’ plants or critical manufacturing lines due to strikes, manufacturing quality issues, mechanical breakdowns, electrical outages, fires, explosions, or political upheaval, as well as logistical complications due to weather, global climate change, volcanic eruptions, or other natural or nuclear disasters, mechanical failures, delayed customs processing, the spread of an infectious disease, virus or other widespread illness and more. Additionally, as the Company grows in best cost countries, the risk for such disruptions is heightened. Similarly, a potential quality issue could force the Company to halt deliveries while it validates the products. Even where products are ready to be shipped, or have been shipped, delays may arise before they reach the customer. The Company’s customers may halt or delay production for the same reason if one of their other suppliers fails to deliver necessary components. This may cause the Company’s customers, in turn to suspend their orders, or instruct us to suspend delivery of Visteon's products, which may adversely affect the Company's financial performance.

The Company continues to work closely with its suppliers and customers to minimize any potential adverse impacts of the semiconductor supply shortage and monitor the availability of semiconductor microchips and other component parts and raw materials, customer vehicle production schedules, and any other supply chain inefficiencies that may arise, due to this or any other issue. However, if the Company is not able to mitigate the semiconductor shortage impact, any direct or indirect supply chain disruptions may have a material adverse impact on its business, operating results, financial condition, or cash flows.

If the Company were to fail to make timely deliveries in accordance with contractual obligations, the Company generally must absorb its own costs for identifying and solving the “root cause” problem as well as expeditiously producing replacement components or products. Generally, the Company must also absorb the costs associated with “catching up,” such as overtime and premium freight. Additionally, if the Company is the cause for a customer being forced to halt production the customer may seek to recoup all of its losses and expenses from the Company. Certain customers have communicated that they expect such reimbursement and are reserving their rights to claim damages arising from supply shortages. The Company believes it has a number of legal defenses to such claims and intends to defend any potential claims vigorously. Should the company be unsuccessful in their defense, these losses and expenses could be significant, and may include consequential losses such as lost profits. Any supply-chain disruption, however small, could cause the complete shutdown of an assembly line of one of the Company’s customers, and any such shutdown could lead to material claims for compensation.

9

The Company has experienced and may in the future experience supplier price increases that could negatively affect its operations and profitability. The price increases are often driven by raw material pricing and availability, component or part availability, manufacturing capacity, industry allocations, logistics capacity, natural disasters or pandemics, the effects of climate change, inflation, and significant changes in the financial or business condition of its suppliers

The Company’s business, operating results, financial condition, and cash flows have been, and may continue to be, adversely affected by the COVID-19 pandemic

The COVID-19 pandemic poses the risk that the Company or its affiliates and joint ventures, employees, suppliers, customers, and others may be restricted or prevented from conducting business activities for indefinite or intermittent periods of time, including as a result of employee health and safety concerns, shutdowns, shelter in place orders, travel restrictions, and other actions and restrictions that may be requested or mandated by governmental authorities. In addition, the Company has experienced, and may continue to experience, disruptions or delays in the supply chain as a result of such actions, which is likely to result in higher supply chain costs to us in order to maintain the supply of materials and components for Visteon's products. The Company cannot predict the degree to which, or the period over which, its financial condition and operations will be affected by this pandemic and related safety measures, the effects of which could have a material adverse impact on the Company’s business, financial condition and results of operations.

The Company’s substantial international operations make it vulnerable to risks associated with doing business in foreign countries

The Company has manufacturing and distribution facilities in many foreign locations. International operations are subject to certain risks inherent in doing business abroad, including, but not limited to:

•changes to international trade agreements;

•local economic conditions, expropriation and nationalization, foreign exchange rate fluctuations, and currency controls;

•withholding, border, and other taxes on remittances and other payments by subsidiaries;

•investment restrictions or requirements;

•export and import restrictions, including increases in border tariffs;

•the ability to effectively enforce intellectual property rights;

•new or additional governmental sanctions on doing business with or in certain countries or with certain persons; and

•increases in working capital requirements related to long supply chains.

Additionally, the Company’s global operations may also be adversely affected by political events, domestic or international terrorist events, and hostilities or complications due to natural or other disasters. These or any further political or governmental developments or health concerns in Mexico, China, or other countries in which the Company operates or where its suppliers are located could result in social, economic, and labor instability. These uncertainties could have a material adverse effect on the continuity of the Company’s business, results of operations, and financial condition.

Trade negotiations between the U.S. and Chinese governments, and between the U.S. and European governments, remain ongoing. However, given the uncertainty regarding the scope and duration of existing tariffs, as well as the potential for additional tariffs or trade barriers by or between the U.S., China, or other countries, the Company can provide no assurance that any strategies we implement to mitigate the impact of such tariffs or other trade actions will be successful.

The Company has invested significantly and is expected to continue to invest significantly in joint ventures with other parties to conduct business in China and elsewhere in Asia. These investments may include manufacturing operations, technical centers, and research and development activities, to support anticipated growth in the region. If the Company is not able to strengthen existing relationships, secure additional customers, and develop market-relevant electrification, advanced driver assistance, and semi-autonomous and autonomous vehicle technologies, it may fail to realize expected rates of return on these investments.

In addition, failure of the Company’s joint venture partners to comply with contractual commitments or to exert influence or pressure in China may impact the Company’s operations, financial condition and cash flow. For example, as previously disclosed, during the second quarter of 2022, the Company recorded a settlement charge related to a contract dispute with a joint venture partner in China and during the fourth quarter of 2022 the Company incurred approximately $19 million of program management costs and other charges with that joint venture partner. Although those disputes were resolved, the Company cannot predict the outcome of future interactions and it is possible that any future disputes and/or changes to the contractual obligations with the joint venture partner could have a material impact on the Company’s business, operating results, financial condition, and cash flow.

10

The Company’s ability to effectively operate could be hindered if it fails to attract and retain key personnel

The Company’s ability to operate its business and implement its strategies effectively depends, in part, on the efforts of its executive officers and other key employees. In addition, the Company’s future success will depend on, among other factors, the ability to attract and retain qualified personnel, particularly engineers and other employees with critical expertise and skills that support key customers and products or in emerging regions. The loss of the services of any key employees, and particularly the Company’s Chief Executive Officer, or the failure to attract or retain other qualified personnel could have a material adverse effect on the Company’s business, ability to secure future programs, operating results, financial condition, and cashflow.

Work stoppages and similar events could significantly disrupt the Company’s business

Because the automotive industry relies heavily on just-in-time delivery of components during the assembly and manufacture of vehicles, a work stoppage at one or more of the Company’s manufacturing and assembly facilities could have material adverse effects on the business. Similarly, if one or more of the Company’s customers were to experience a work stoppage, that customer would likely halt or limit purchases of the Company’s products, which could result in the shutdown of the related manufacturing facilities. A significant disruption in the supply of a key component due to a work stoppage at any of the Company’s suppliers or subsuppliers could have the same consequences, and accordingly, have a material adverse effect on the Company’s business, operating results, financial condition, and cash flow.

Industry and Competition Related Risk Factors

The Company may not realize sales represented by awarded business

The Company estimates awarded business using certain assumptions, including projected future sales volumes based on data from OEM customers and industry benchmarks. The OEM customers generally do not guarantee production volumes. In addition, awarded business may include business under arrangements that OEM customers have the right to terminate, at any time, without penalty. Therefore, the Company’s actual sales volumes, and thus the ultimate amount of revenue that it derives from such sales, are not guaranteed. If actual production orders from its customers are not consistent with the projections used by the Company in calculating the amount of its awarded business, the Company could realize substantially less revenue over the life of these projects than the projected estimate.

The Company must continue to develop, introduce, and achieve market acceptance of new and enhanced products in order to grow its sales in the future

The growth of the Company's business will be dependent on the demand for innovative automotive electronics products, including but not limited to electrification, advanced driver assistance, semi-autonomous and autonomous vehicle technologies. In order to increase sales in current markets and gain entry into new markets, the Company must innovate to maintain and improve existing products, including software, while successfully developing and introducing distinctive new and enhanced products that anticipate changing customer and consumer preferences and capitalize upon emerging software technologies. However, the Company may experience difficulties that delay or prevent the development, introduction, or market acceptance of its new or enhanced products. Furthermore, these new technologies have also attracted increased competition from outside the traditional automotive industry, and any of these competitors may develop and introduce technologies that gain greater customer or consumer acceptance, which could have a material adverse effect on the future growth of the Company.

The automotive industry is cyclical and significant declines in the production levels of the Company’s major customers could reduce the Company’s sales and harm its profitability

Demand for the Company’s products is directly related to the automotive vehicle production of the Company’s major customers. Automotive sales and production are cyclical and can be affected by general economic or industry conditions, labor relations issues, fuel prices, regulatory requirements, government initiatives, trade agreements, the cost and availability of credit, and other factors. Due to overall global economic conditions, including semiconductor shortages that continued in 2022, the automotive industry experienced constrained production schedules. Such shortages and constrained production schedules had and may in the future have a material adverse effect on the Company’s business, profitability, financial condition and results of operations.

The discontinuation or loss of business, or lack of commercial success, with respect to a particular product for which the Company is a significant supplier could reduce the Company’s sales and harm its profitability

Although the Company has purchase orders from many of its customers, these purchase orders generally provide for the supply of a customer’s annual requirements for a particular vehicle model and assembly plant, or in some cases, for the supply of a

11

customer’s requirements for the life of a particular vehicle model, rather than for the purchase of a specific quantity of products. In addition, certain customers have communicated an intent to manufacture components internally that are currently produced by outside suppliers, such as the Company. If the Company's OEM customers successfully insource products currently manufactured by the Company the discontinuation or loss of business for products which the Company is a significant supplier could reduce the Company’s sales and harm the Company’s profitability.

Price pressures from customers may adversely affect the Company’s business

Downward pricing pressures by automotive OEMs, while characteristic of the automotive industry, are increasing. Virtually all automakers have implemented aggressive price-reduction initiatives and objectives each year with their suppliers, and such actions are expected to continue in the future. In addition, estimating such amounts is subject to risk and uncertainties because any price reductions are a result of negotiations and other factors. Accordingly, suppliers must be able to reduce their operating costs in order to maintain profitability. Price reductions have impacted the Company’s sales and profit margins and are expected to continue to do so in the future. If the Company is unable to offset customer price reductions in the future through improved operating efficiencies, new manufacturing processes, sourcing alternatives, and other cost-reduction initiatives, the Company’s business, operating results, financial condition, and cash flow could be adversely affected.

The Company is highly dependent on Ford Motor Company and decreases in this customer’s vehicle production volumes would adversely affect the Company

Ford is one of the Company’s largest ultimate customers and accounted for 22% of sales for each of the years 2022, 2021 and 2020, respectively. Accordingly, any change in Ford's vehicle production volumes may have a significant impact on the Company’s sales volume and profitability.

The Company’s pension expense and funding levels of pension plans could materially deteriorate, or the Company may be unable to generate sufficient excess cash flow to meet increased pension benefit obligations

The Company’s assumptions used to calculate pension obligations as of the annual measurement date directly impact the expense to be recognized in future periods. While the Company’s management believes that these assumptions are appropriate, significant differences in actual experience or significant changes in these assumptions may materially affect the Company’s pension obligations and future expense. For more information on sensitivities to changing assumptions, please see “Critical Accounting Estimates” in Item 7 and Note 11, “Employee Benefit Plans” in Part II, Item 8 of this Form 10-K.

Product Related Risk Factors

The Company's inability to effectively manage the timing, quality, and costs of new program launches could adversely affect its financial performance

In connection with the award of new business, the Company often obligates itself to deliver new products and services that are subject to its customers’ timing, performance, and quality standards. Additionally, as a Tier 1 supplier, the Company must effectively coordinate the activities of numerous suppliers in order to launch programs successfully. Given the complexity of new program launches, especially involving new and innovative technologies, the Company may experience difficulties managing timeliness and detecting undiscovered software errors, bugs, and other defects in its products which may injure the Company's reputation. In addition, new program launches require a significant ramp up of costs; however, the sales related to these new programs generally are dependent upon the timing and success of the introduction of new vehicles by the Company's customers. The Company's inability to effectively manage the timing, quality, and costs of these new program launches could have a material adverse effect on its business, operating results, financial condition, and cash flow.

Warranty claims, product liability claims, and product recalls could adversely affect the Company

The Company faces the inherent business risk of exposure to warranty and product liability claims in the event that its products fail to perform as expected or such failure results, or is alleged to result, in bodily injury or property damage (or both). In addition, if any of the Company’s supplied products are defective or are alleged to be defective, the Company may be required to participate in a recall campaign. The Company’s products contain increasingly significant amounts of software and a successful cyberattack on such products could cause materially adverse effects on the Company’s business, operating results, financial condition, cash flow, and reputation. In addition, as the Company expands its electrification product offering, including its battery management systems, such products will present a different warranty and product liability risk profile. As suppliers become more integrally involved in the vehicle design process and assume more of the vehicle assembly functions, automakers are increasingly expecting them to warrant their products and are increasingly looking to suppliers for contributions when faced with product liability claims or recalls. A successful warranty or product liability claim against the Company, or a

12

requirement that the Company participate in a product recall campaign, could have materially adverse effects on the Company’s business, operating results, financial condition, and cash flow.

Developments or assertions by or against the Company relating to intellectual property rights could materially impact its business

The Company owns significant intellectual property, including a number of patents, trademarks, copyrights, and trade secrets and is involved in numerous licensing arrangements. The Company’s intellectual property plays an important role in maintaining its competitive position in a number of the markets served. The Company may utilize intellectual property in its products that requires a license from a third-party. While the Company believes that such licenses generally can be obtained, there is no assurance that the necessary licenses can be obtained on commercially acceptable terms or at all. Failure to obtain the right to use third-party intellectual property could preclude the Company from selling certain products, and developments or assertions by or against the Company relating to intellectual property rights, could have materially adverse effects on the Company’s business, operating results, financial condition, and cash flow.

The Company also derives significant revenue from countries outside the U.S. (including China) and significant intellectual property assets are licensed to joint ventures and customers in foreign jurisdictions. If a material intellectual property theft or forced transfer were to occur, it could materially and adversely affect the Company’s business, operating results, financial condition, and cash flow. In addition, the Company has continued to see an increase in patent claims related to connectivity-enabled products where other patent-holding companies are seeking royalties and often enter into litigation based on patent infringement allegations. Significant technological developments by others also could materially and adversely affect the Company’s business, operating results, financial condition, and cash flow.

Privacy and security concerns relating to the Company's current or future products and services could damage its reputation and deter current and potential users from using them

The Company may gain access to sensitive, confidential, or personal data or information that is subject to privacy and security laws, regulations, and customer-imposed controls. Concerns about the Company's practices with regard to the collection, use, disclosure, or security of personal information or other privacy related matters, even if unfounded, could damage its reputation and adversely affect its operating results.

Furthermore, regulatory authorities around the world are considering a number of legislative and regulatory proposals concerning cybersecurity and data protection. In addition, the interpretation and application of consumer and data protection laws in the U.S., Europe, and elsewhere are often uncertain and in flux. Complying with these various laws could cause the Company to incur substantial costs.

Tax Related Risk Factors

The Company’s expected annual effective tax rate could be volatile and could materially change as a result of changes in mix of earnings and other factors, including changes in tax laws and tax audits

We are subject to income taxes in the U.S. and various international jurisdictions. Changes in tax rates or tax laws by U.S. and international jurisdictions and tax audits could adversely impact Visteon’s financial results. The Company is in a position whereby losses incurred in certain tax jurisdictions generally provide no current financial statement benefit. In addition, certain jurisdictions have statutory rates greater than or less than the United States statutory rate. As such, changes in the mix and source of earnings between jurisdictions, including changes in tax rates in those jurisdictions, could have a significant impact on the Company’s overall effective tax rate in future periods. Additionally, in the ordinary course of business, we are subject to examinations by various tax authorities. Tax authorities in various jurisdictions could also open new examinations and expand existing examinations for which the outcomes cannot be predicted with certainty. Furthermore, changes in U.S. or foreign tax laws and regulations, or their interpretation and application, could also have a significant impact on the Company’s overall effective rate in future periods.

The Company may not be able to fully utilize its U.S. net operating losses and other tax attributes

The Company has net operating losses ("NOLs") and other tax attributes which could be limited if there is a subsequent change of ownership. If the Company were to have a change of ownership within the meaning of IRC Sections 382 and 383, its NOLs and other tax attributes could be limited to an amount equal to its market capitalization at the time of the ownership change multiplied by the federal long-term tax exempt rate. The Company cannot provide any assurance that such an ownership change will not occur, in which case the availability of the Company's NOLs and other tax attributes could be significantly limited or

13

possibly eliminated. Certain tax benefit preservation provisions of its corporate documents could delay or prevent a change of control, even if that change would be beneficial to stockholders.

Market Related Risk Factors

The Company is subject to significant foreign currency risks and foreign exchange exposure

As a result of Visteon's global presence, a significant portion of the Company's revenues and expenses are denominated in currencies other than the U.S. dollar. The Company is therefore subject to foreign currency risks and foreign exchange exposure. The Company's primary exposures are to the euro, Chinese renminbi, Brazilian real, Mexican peso, Thai bhat, Indian rupee, Japenese yen, and Bulgarian lev. Exchange rates are difficult to predict, and the Company’s financial instruments designed to hedge against foreign exchange exposure may not completely insulate the Company from those exposures. As a result, volatility in certain exchange rates could adversely impact Visteon financial results and comparability of results from period to period.

General Risk Factors

A disruption in the Company's information technology systems, including because of cyberattack, could adversely affect its business and financial performance

The Company relies on the accuracy, capacity, and security of its information technology systems as well as those of its customers, suppliers, partners, and service providers to conduct its business. Despite the security and risk-prevention measures the Company has implemented, the Company's systems could be breached, damaged, or otherwise interrupted by a system failure, cyberattack, malicious computer software (including malware or ransomware), unauthorized physical or electronic access, or other natural or man-made incidents or disasters. The Company is also susceptible to security breaches that may go undetected. Such a breach or interruption could result in business disruption, theft of the Company's intellectual property or trade secrets, and unauthorized access to personal information. To the extent that business is interrupted or data is lost, destroyed, or inappropriately used or disclosed, such disruptions could lead to legal claims against the Company and adversely affect the Company’s competitive position, reputation, relationships with customers, financial condition, operating results, and cash flows.

The Company is involved from time to time in legal proceedings and commercial or contractual disputes, which could have an adverse effect on the Company

The Company is involved in legal proceedings and commercial or contractual disputes that, from time to time, are significant. These are typically claims that arise in the normal course of business including, without limitation, commercial or contractual disputes (including disputes with suppliers), intellectual property matters, personal injury claims, and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s profitability and financial position.

Climate change, climate change regulations, and greenhouse gas effects could adversely impact the Company’s operations and markets

Increased attention to climate change and its association with greenhouse gas emissions, expectations for companies to establish short and long-term emissions reduction targets, and changes in consumer preferences may result in increased costs, reduced profits, risks associated with new regulatory requirements, and the potential for increased litigation and governmental investigations. The U.S. federal government, certain U.S. states, and certain other countries and regions have adopted or are considering legislation or regulation imposing overall caps or taxes on greenhouse gas emissions from certain sectors including automotive. Failure to comply with any legislation or regulation could result in substantial fines, criminal sanctions, or operational changes. Moreover, even without such legislation or regulation, increased awareness of, or any adverse publicity regarding, the effects of greenhouse gases could harm the Company’s reputation or reduce customer demand for its products and services.

Additionally, as severe weather events become increasingly common, operations of the Company, its customers, and/or suppliers may be disrupted, which could result in increased operational costs or reduced demand for products and services. Natural disasters could cause disruption to the Company’s ability to serve its customers and communities in times of need and extended periods of disruption could have an adverse effect on its results of operations.

14

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

The Company's principal executive offices are located in Van Buren Township, Michigan. At December 31, 2022, the Company and its consolidated subsidiaries owned or leased:

•30 corporate offices, technical and engineering centers and customer service centers in 13 countries around the world, all of which were leased.

•14 manufacturing and/or assembly facilities in Brazil, China, India, Japan, Mexico, Portugal, Slovakia, Tunisia, and Thailand, of which 11 were leased and 3 were owned.

In addition, the Company's non-consolidated affiliates operate 6 manufacturing and/or assembly locations, primarily in the Asia Pacific region. The Company considers its facilities to be adequate for its current uses.

Item 3.Legal Proceedings

Certain legal proceedings in which the Company is involved are discussed in Note 18, "Commitments and Contingencies" to the Company's consolidated financial statements included in Part II, Item 8 of this Form 10-K, "Financial Statements and Supplementary Data" and should be considered an integral part of Part I, Item 3, "Legal Proceedings."

Item 4.Mine Safety Disclosures

None

15

Item 4A. Executive Officers

The following table shows information about the executive officers of the Company as of February 1, 2023:

| Name | Age | Position | ||||||||||||

| Sachin S. Lawande | 55 | Director, President and Chief Executive Officer | ||||||||||||

| Jerome J. Rouquet | 55 | Senior Vice President and Chief Financial Officer | ||||||||||||

| Abigail S. Fleming | 41 | Vice President and Chief Accounting Officer | ||||||||||||

| Brett D. Pynnonen | 54 | Senior Vice President and Chief Legal Officer | ||||||||||||

| Joao Paulo Ribeiro | 53 | Senior Vice President, Manufacturing, Supply Chain, and Purchasing | ||||||||||||

| Kristin E. Trecker | 57 | Senior Vice President and Chief People Officer | ||||||||||||

| Robert R. Vallance | 62 | Senior Vice President, Global Customer Business Groups, New Technology Product Lines, and General Manager APAC Region | ||||||||||||

Sachin S. Lawande has been Visteon’s Chief Executive Officer, President, and a director of the Company since June 29, 2015. Before joining Visteon, Mr. Lawande served as Executive Vice President and President, Infotainment Division of Harman International Industries, Inc., an automotive supplier, from July 2013 to June 2015. From July 2011 to June 2013, he served as Executive Vice President and President of Harman’s Lifestyle Division, and from July 2010 to June 2011 as Executive Vice President and Co-President, Automotive Division. Prior to that he served as Harman’s Executive Vice President and Chief Technology Officer since February 2009. Mr. Lawande joined Harman International in 2006, following senior roles at QNX Software Systems and 3Com Corporation. He also serves on the board of directors of Cognex Corporation, a leading worldwide provider of machine vision products that are widely used in automotive, consumer electronics, life sciences, and logistics industries. Within the last five years, he also served on the board of directors of DXC Technology Company.

Jerome J. Rouquet has been Visteon’s Senior Vice President and Chief Financial Officer since February 2020 (after joining the Company as Senior Vice President, Finance in January 2020). Prior to that, he held leadership roles of increasing responsibility at Federal-Mogul, LLC (a global automotive supplier), including Senior Vice President and Chief Financial Officer from January 2016 to September 2018, Chief Accounting Officer and Controller from July 2010 to January 2016, and Finance Director from March 1999 to July 2010. Following the acquisition of Federal-Mogul by Tenneco, Inc., he most recently served as Senior Vice President Finance, Motorparts from October 2018 to December 2019. From 1990 to 1996, Mr. Rouquet served in various roles at Imaje SA, from Logistics Manager to Financial Controller.

Abigail S. Fleming has been Visteon’s Vice President and Chief Accounting Officer since joining the Company in August 2020. Prior to joining Visteon, Ms. Fleming was Executive Director and Assistant Controller of Tenneco Inc. (formerly Federal-Mogul, LLC), a global automotive supplier, from March 2017 to August 2020, and Director, Capital Markets and Accounting Advisory Services at PricewaterhouseCoopers LLP from March 2015 to March 2017. Ms. Fleming began her career at PricewaterhouseCoopers in August 2004 and is a certified public accountant.

Brett D. Pynnonen has been Visteon’s Senior Vice President and Chief Legal Officer since December 2016. Prior to that, he was Vice President and General Counsel since joining the Company in March 2016. Before joining Visteon he was Senior Vice President, General Counsel and Corporate Secretary of Federal-Mogul Holdings Corporation, a global automotive supplier, from November 2007 to March 2016. Prior to that, he was General Counsel and Secretary of Covansys Corporation, a technology services company, and an attorney at the law firm of Butzel Long.

Joao Paulo Ribeiro has been Visteon’s Senior Vice President, Manufacturing, Supply Chain and Purchasing since November 2021. Prior to that he was Vice President, Manufacturing and Supply Chain since March 2020, Vice President, Manufacturing Operations since March 2014, and Managing Director, European Operations from October 2010 to March 2014. During his career with Visteon and Ford Motor Company, he has held management positions of increasing responsibility in manufacturing and operations.

Kristin E. Trecker has been Visteon’s Senior Vice President and Chief People Officer since joining the Company in May 2018. Before joining Visteon, she served as Executive Vice President and Chief Human Resources Officer (“CHRO”) for Integer Holdings Corp. (formerly Greatbatch, Inc.), a medical device outsource manufacturer, from November 2015 to May 2017, and as Senior Vice President and CHRO of MTS Systems Corp., a global engineering firm, from February 2012 to October 2015. Prior to that Ms. Trecker spent 16 years with Lawson Software, Inc. in roles of increasing responsibility, ranging from Director of Compensation and Benefits to Senior Vice President of Human Resources.

16

Robert R. Vallance has been Visteon’s Senior Vice President, Global Customer Business Groups, New Technology Product Lines, and General Manager APAC Region since January 2022, and prior to that, he was Senior Vice President, Customer Business Groups since December 2016. He also served as Vice President, Customer Business Groups upon rejoining the Company in July 2014. From February 2008 to June 2014, he served as Vice President, Electronics Business Group of Johnson Controls, Inc., an automotive supplier. Prior to that, he spent 23 years at Ford Motor Company and Visteon in product development, program and commercial management, strategy and planning, product marketing, and manufacturing.

17

Part II

Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

As of February 9, 2023, the Company had 2,981 shareholders of record.

No dividends were paid by the Company on its common stock during the years ended December 31, 2022 and 2021. The Company’s Board evaluates the Company’s dividend policy based on all relevant factors. The Company’s credit agreements limit the amount of cash payments for dividends that may be made. Additionally, the ability of the Company’s subsidiaries to transfer dividends is subject to various restrictions, including regulatory requirements and governmental restraints.

No sales of the Company’s common stock were made by or on behalf of the Company or an affiliated purchaser during the fourth quarter of 2022.

The following information in Item 5 is not deemed to be “soliciting material” or be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (“Exchange Act”) or to the liabilities of Section 18 of the Exchange Act, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such a filing.

18

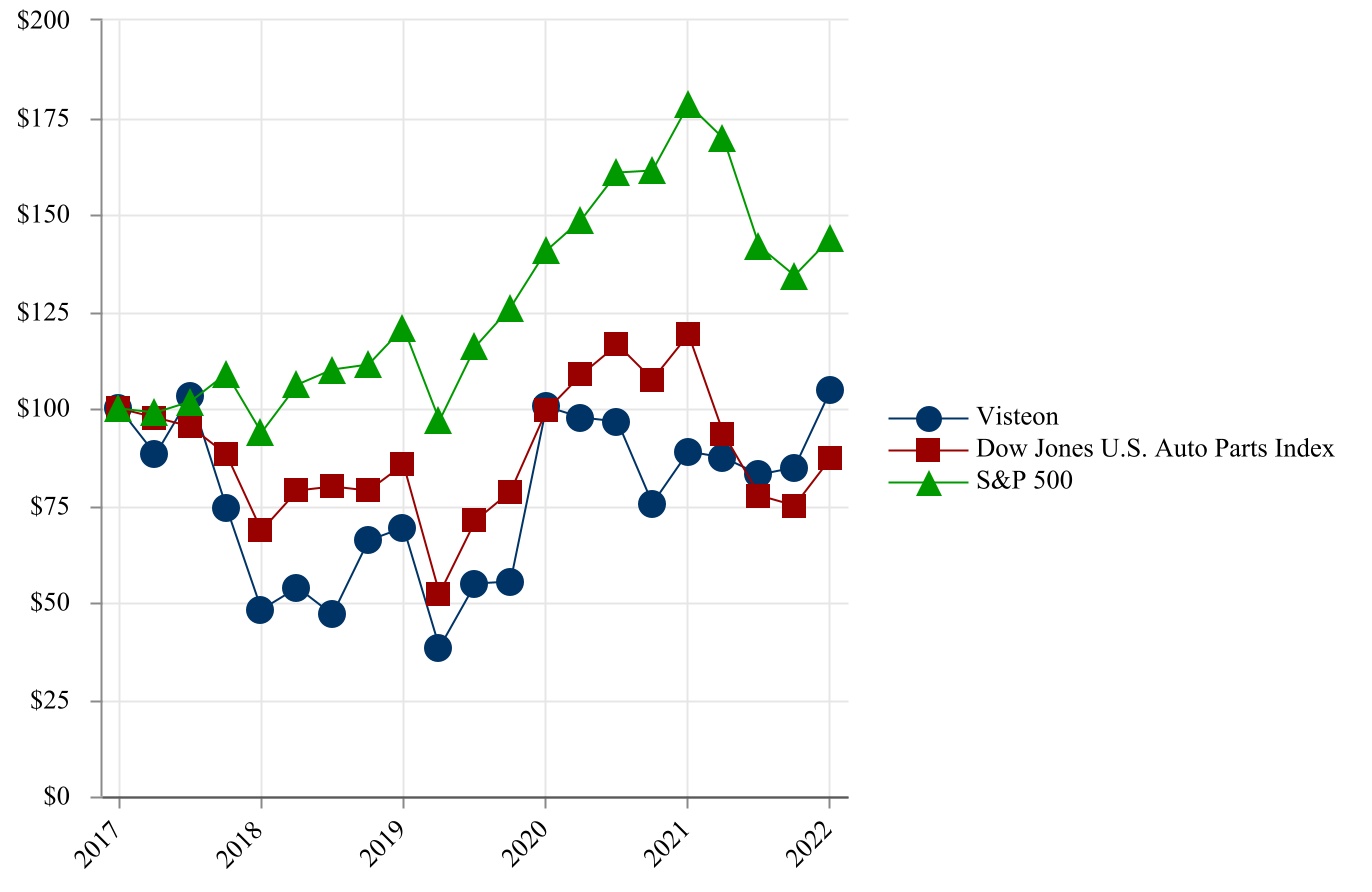

Performance Graph

The following graph compares the cumulative total stockholder return from December 31, 2017 through December 31, 2022, for Visteon's existing common stock, the S&P 500 Index and the Dow Jones U.S. Auto Parts Index. The graph below assumes that $100 was invested on December 31, 2017 in each of the Company's common stock, the stocks comprising the S&P 500 Index and the stocks comprising the Dow Jones U.S. Auto Parts Index, and that all dividends have been reinvested.

| December 31, 2017 | December 31, 2018 | December 31, 2019 | December 31, 2020 | December 31, 2021 | December 31, 2022 | |||||||||||||||

| Visteon Corporation | $100.00 | $48.17 | $69.19 | $100.30 | $88.81 | $104.55 | ||||||||||||||

| Dow Jones U.S. Auto Parts Index | $100.00 | $68.30 | $85.56 | $99.27 | $118.94 | $87.05 | ||||||||||||||

| S&P 500 | $100.00 | $93.76 | $120.84 | $140.49 | $178.27 | $143.61 | ||||||||||||||

The above comparisons are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of possible future performance of the Company's common stock or the referenced indices.

Item 6. Selected Financial Data

None

19

Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand the results of operations, financial condition, and cash flows of the Company. MD&A is provided as a supplement to, and should be read in conjunction with, the Company’s consolidated financial statements and related notes appearing in Item 8 of this Form 10-K “Financial Statements and Supplementary Data”.

Executive Summary

Strategic Priorities

Visteon is a global automotive technology company serving the mobility industry, dedicated to creating more enjoyable, connected, and safe driving experiences. The Company's platforms leverage proven, scalable hardware and software solutions that enable the digital, electric, and autonomous evolution of its global automotive customers. The automotive mobility market is expected to grow faster than underlying vehicle production volumes as the vehicle shifts from analog to digital and towards device and cloud connected, electric vehicles, and vehicles with more advanced safety features.

The Company has laid out the following strategic priorities:

•Technology Innovation - The Company is an established global leader in cockpit electronics and is positioned to provide solutions as the industry transitions to the next generation automotive cockpit experience. The cockpit is becoming fully digital, connected, automated, learning, and voice enabled. Visteon's broad portfolio of cockpit electronics technology, the industry's first wireless battery management system, and the development of safety technology integrated into its domain controllers positions Visteon to support these macro trends in the automotive industry.

•Long-Term Growth - The Company has continued to win business at a rate that exceeds current sales levels by demonstrating product quality, technical and development capability, new product innovation, reliability, timeliness, product design, manufacturing capability, and flexibility, as well as overall customer service.

•Enhance Shareholder Returns While Maintaining a Strong Balance Sheet - The Company has returned approximately $3.3 billion to shareholders since 2015. In addition, the Company has continued to maintain a strong balance sheet to withstand near-term industry volatility while providing a foundation for future growth and shareholder returns.

20

Financial Results

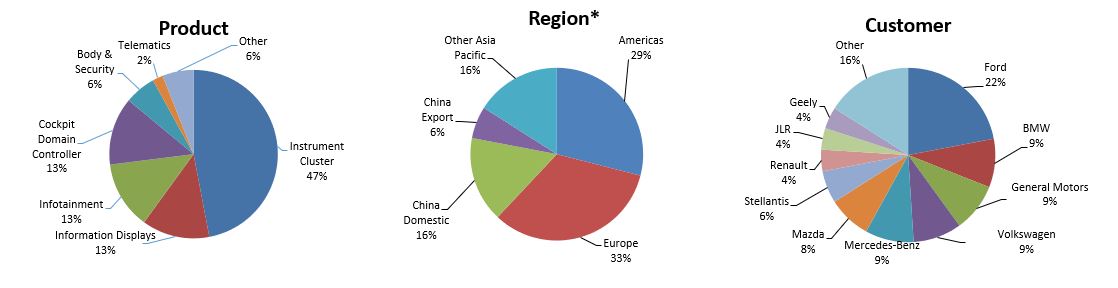

The pie charts below highlight the sales breakdown for Visteon for the year ended December 31, 2022.

*Regional sales are based on the geographic region where sale originates and not where customer is located (excludes inter-regional eliminations).

Global Automotive Market Conditions and Production Levels

The automotive industry has been negatively impacted by the COVID-19 pandemic and the ongoing semiconductor shortage. Industry vehicle volumes have increased in 2022 however remain near historically low levels despite strong consumer demand due to the ongoing semiconductor shortage. Visteon expects ongoing uncertainty and volatility as a result of the on-going shortages of semiconductors, geopolitical situation in Eastern Europe, uncertain global economy, and the COVID-19 related impacts in China and other countries. The magnitude of the impact on the financial statements, results of operations, and cash flows will depend on the evolution of the semiconductor supply shortage, plant production schedules, supply chain impacts, and global economic impacts.

Company Highlights

Visteon continued to focus on execution throughout 2022, building a foundation of sustainable growth, margin expansion, and cash flow generation. To address the near-term challenges created from the worldwide semiconductor and supply chain shortages, Visteon implemented a series of proactive initiatives aimed at increasing product availability for its customers while minimizing the impact of incremental costs to the business.

Early in 2021, Visteon set up a cross-functional task force which implemented several actions including the purchase of semiconductors through brokers and distributors, expedited logistics, and engineering redesigns while leading calls with customers and suppliers to minimizing manufacturing downtime. In addition, Visteon worked with its customers to pass along the elevated costs caused by semiconductor shortages.