Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

________________

FORM 10-Q

(Mark One)

| |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017,

OR

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 001-15827

VISTEON CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

State of Delaware | 38-3519512 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

One Village Center Drive, Van Buren Township, Michigan | 48111 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (800)-VISTEON

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No__

Indicate by check mark whether the registrant: has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer," "accelerated filer,” "smaller reporting company" and “emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ü Accelerated filer __ Non-accelerated filer __ Smaller reporting company __

Emerging growth company __

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. __

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No ü

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ü No__

As of April 20, 2017, the registrant had outstanding 31,765,589 shares of common stock.

Exhibit index located on page number 42.

Visteon Corporation and Subsidiaries

Index

Part I

Financial Information

| |

Item 1. | Consolidated Financial Statements |

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in Millions Except Per Share Amounts)

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31 |

| 2017 | | 2016 |

Sales | $ | 810 |

| | $ | 802 |

|

Cost of sales | 679 |

| | 681 |

|

Gross margin | 131 |

| | 121 |

|

Selling, general and administrative expenses | 51 |

| | 56 |

|

Restructuring expense | 1 |

| | 10 |

|

Interest expense | 6 |

| | 4 |

|

Interest income | 1 |

| | 2 |

|

Equity in net income of non-consolidated affiliates | 2 |

| | — |

|

Other expense, net | 1 |

| | 4 |

|

Income before income taxes | 75 |

| | 49 |

|

Provision for income taxes | 16 |

| | 13 |

|

Net income from continuing operations | 59 |

| | 36 |

|

Income (loss) from discontinued operations, net of tax | 8 |

| | (13 | ) |

Net income | 67 |

| | 23 |

|

Net income attributable to non-controlling interests | 4 |

| | 4 |

|

Net income attributable to Visteon Corporation | $ | 63 |

| | $ | 19 |

|

| | | |

Basic earnings (loss) per share: | | | |

Continuing operations | $ | 1.69 |

| | $ | 0.84 |

|

Discontinued operations | 0.25 |

| | (0.34 | ) |

Basic earnings per share attributable to Visteon Corporation | $ | 1.94 |

| | $ | 0.50 |

|

| | | |

Diluted earnings (loss) per share: | | | |

Continuing operations | $ | 1.67 |

| | $ | 0.83 |

|

Discontinued operations | 0.24 |

| | (0.34 | ) |

Diluted earnings per share attributable to Visteon Corporation | $ | 1.91 |

| | $ | 0.49 |

|

| | | |

Comprehensive income: | | | |

Comprehensive income | $ | 90 |

| | $ | 42 |

|

Comprehensive income attributable to Visteon Corporation | $ | 85 |

| | $ | 38 |

|

See accompanying notes to the consolidated financial statements.

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Millions)

|

| | | | | | | |

| (Unaudited) | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

ASSETS |

Cash and equivalents | $ | 688 |

| | $ | 878 |

|

Restricted cash | 4 |

| | 4 |

|

Accounts receivable, net | 552 |

| | 505 |

|

Inventories, net | 162 |

| | 151 |

|

Other current assets | 174 |

| | 170 |

|

Total current assets | 1,580 |

| | 1,708 |

|

| | | |

Property and equipment, net | 346 |

| | 345 |

|

Intangible assets, net | 128 |

| | 129 |

|

Investments in non-consolidated affiliates | 37 |

| | 45 |

|

Other non-current assets | 147 |

| | 146 |

|

Total assets | $ | 2,238 |

| | $ | 2,373 |

|

| | | |

LIABILITIES AND EQUITY |

Short-term debt, including current portion of long-term debt | 49 |

| | 36 |

|

Accounts payable | 463 |

| | 463 |

|

Accrued employee liabilities | 87 |

| | 103 |

|

Other current liabilities | 224 |

| | 309 |

|

Total current liabilities | 823 |

| | 911 |

|

| | | |

Long-term debt | 347 |

| | 346 |

|

Employee benefits | 302 |

| | 303 |

|

Deferred tax liabilities | 20 |

| | 20 |

|

Other non-current liabilities | 66 |

| | 69 |

|

| | | |

Stockholders’ equity: | | | |

Preferred stock (par value $0.01, 50 million shares authorized, none outstanding as of March 31, 2017 and December 31, 2016) | — |

| | — |

|

Common stock (par value $0.01, 250 million shares authorized, 55 million shares issued, 32 and 33 million shares outstanding as of March 31, 2017 and December 31, 2016, respectively) | 1 |

| | 1 |

|

Additional paid-in capital | 1,302 |

| | 1,327 |

|

Retained earnings | 1,332 |

| | 1,269 |

|

Accumulated other comprehensive loss | (211 | ) | | (233 | ) |

Treasury stock | (1,876 | ) | | (1,778 | ) |

Total Visteon Corporation stockholders’ equity | 548 |

| | 586 |

|

Non-controlling interests | 132 |

| | 138 |

|

Total equity | 680 |

| | 724 |

|

Total liabilities and equity | $ | 2,238 |

| | $ | 2,373 |

|

See accompanying notes to the consolidated financial statements.

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS1

(Dollars in Millions)

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31 |

| 2017 | | 2016 |

Operating Activities | | | |

Net income | $ | 67 |

| | $ | 23 |

|

Adjustments to reconcile net income to net cash provided from operating activities: | | | |

Depreciation and amortization | 19 |

| | 21 |

|

Equity in net income of non-consolidated affiliates, net of dividends remitted | (2 | ) | | — |

|

Non-cash stock-based compensation | 2 |

| | 2 |

|

Gain on India operations repurchase | (7 | ) | | — |

|

Losses on divestitures and impairments | 1 |

| | 1 |

|

Other non-cash items | 3 |

| | — |

|

Changes in assets and liabilities: | | | |

Accounts receivable | (39 | ) | | (24 | ) |

Inventories | (8 | ) | | 9 |

|

Accounts payable | 18 |

| | 4 |

|

Accrued income taxes | — |

| | (43 | ) |

Other assets and other liabilities | (64 | ) | | (51 | ) |

Net cash used by operating activities | (10 | ) | | (58 | ) |

Investing Activities | | | |

Capital expenditures | (32 | ) | | (25 | ) |

India operations repurchase | (47 | ) | | — |

|

Climate Transaction withholding tax refund | — |

| | 356 |

|

Short-term investments | — |

| | 47 |

|

Loans to non-consolidated affiliates, net of repayments | — |

| | (8 | ) |

Proceeds from asset sales and business divestitures | 10 |

| | 3 |

|

Net cash (used by) provided from investing activities | (69 | ) | | 373 |

|

Financing Activities | | | |

Short-term debt, net | 15 |

| | — |

|

Principal payments on debt | (2 | ) | | (1 | ) |

Distribution payments | (1 | ) | | (1,736 | ) |

Repurchase of common stock | (125 | ) | | (500 | ) |

Stock based compensation tax withholding payments | (1 | ) | | (11 | ) |

Other | (3 | ) | | — |

|

Net cash used by financing activities | (117 | ) | | (2,248 | ) |

Effect of exchange rate changes on cash and equivalents | 6 |

| | 7 |

|

Net decrease in cash and equivalents | (190 | ) | | (1,926 | ) |

Cash and equivalents at beginning of the period | 878 |

| | 2,729 |

|

Cash and equivalents at end of the period | $ | 688 |

| | $ | 803 |

|

1 The Company has combined cash flows from discontinued operations with cash flows from continuing operations within the operating, investing and financing categories.

See accompanying notes to the consolidated financial statements.

VISTEON CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. Description of Business

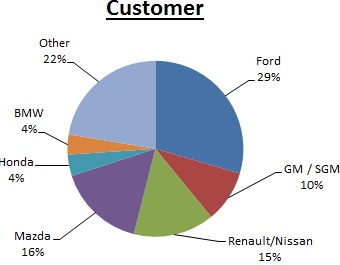

Visteon Corporation (the "Company" or "Visteon") is a global automotive supplier that designs, engineers and manufactures innovative electronics products for nearly every original equipment vehicle manufacturer ("OEM") worldwide including Ford, Mazda, Nissan/Renault, General Motors, Honda, BMW and Daimler. Visteon is headquartered in Van Buren Township, Michigan and has an international network of manufacturing operations, technical centers and joint venture operations, supported by approximately 10,000 employees, dedicated to the design, development, manufacture and support of its product offerings and its global customers. The Company's manufacturing and engineering footprint is principally located outside of the U.S., with a heavy concentration in low-cost geographic regions. Visteon delivers value for its customers and stockholders through its technology-focused core vehicle cockpit electronics business. The Company's cockpit electronics product portfolio includes instrument clusters, information displays, infotainment systems, audio systems, telematics solutions, and head up displays. The Company's vehicle cockpit electronics business is comprised of and reported under the Electronics segment. In addition to the Electronics segment, the Company had operations in South America and Europe associated with the former Interiors and Climate businesses, not subject to discontinued operations classification, that comprised Other, and were exited by December 31, 2016.

NOTE 2. Summary of Significant Accounting Policies

The unaudited consolidated financial statements of the Company have been prepared in accordance with the rules and regulations of the U.S. Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP") have been condensed or omitted pursuant to such rules and regulations. These interim consolidated financial statements include all adjustments (consisting of normal recurring adjustments, except as otherwise disclosed) that management believes are necessary for a fair presentation of the results of operations, financial position and cash flows of the Company for the interim periods presented. Interim results are not necessarily indicative of full-year results.

Reclassifications: Certain prior period amounts have been reclassified to conform to the current period presentation.

Other Expense, Net: Other expense, net includes the following:

|

| | | | | | | |

| Three Months Ended

March 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Transformation initiatives | $ | — |

| | $ | 3 |

|

Transaction exchange losses | — |

| | 1 |

|

Loss on non-consolidated affiliate transaction | 1 |

| | — |

|

| $ | 1 |

| | $ | 4 |

|

Transformation initiative costs include information technology separation costs, integration of acquired business, and financial and advisory services incurred in connection with the Company's transformation into a pure play cockpit electronics business.

Restricted Cash: Restricted cash represents amounts designated for uses other than current operations and includes $3 million related to the Letter of Credit Facility, and $1 million related to cash collateral for other corporate purposes as of March 31, 2017.

Recently Issued Accounting Pronouncements: In May 2014, the Financial Accounting Standards Board ("FASB") issued ASU No. 2014-9, "Revenue from Contracts with Customers," which is the new comprehensive revenue recognition standard that will supersede existing revenue recognition guidance under U.S. GAAP. The standard's core principle is that a company will recognize revenue when it transfers promised goods or services to a customer in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods and services. This ASU allows for both retrospective and prospective methods of adoption.

The Company has, with other industry leaders, interacted with the FASB on certain interpretation issues as well as interacted with non-authoritative industry groups with respect to the implementation of the standard. The Company will continue to monitor the interactions between its industry group and the standard setters with particular attention to the accounting for reimbursable tooling and engineering costs, currently accounted for as cost reductions. In addition, the Company will continue to evaluate its contracts with customers, analyzing the impact, if any, on parts production and reimbursements for engineering and tooling costs. Currently,

the Company does not expect the adoption of this standard to have a material impact on the its results of operations or financial position. The Company will adopt this standard January 1, 2018 and has not yet selected a transition method.

In February 2016, the FASB issued ASU 2016-02, "Leases (Topic 842)": The amendments supersede current lease requirements in Topic 840 which require lessees to recognize most leases on their balance sheets as lease liabilities with corresponding right-of-use assets. The objective of Topic 842 is to establish the principles that lessees and lessors shall apply to report useful information to users of financial statements about the amount, timing, and uncertainty of cash flows arising from a lease. This new guidance is effective for interim and annual reporting periods beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, "Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting." The ASU includes multiple provisions intended to simplify various aspects of the accounting for share-based payments. While aimed at reducing the cost and complexity of the accounting for share-based payments, these amendments are not expected to significantly impact net income, earnings per share, and the statement of cash flows. This new guidance is effective for interim and annual reporting periods beginning after December 15, 2016, with early adoption permitted. The Company's adoption of this standard did not have a material impact on its consolidated financial statements. The Company has adopted an entity-wide accounting policy election to account for forfeitures in compensation cost when they occur.

In August 2016, the FASB issued ASU 2016-15, "Statement of Cash Flows (Topic 230): Classification of certain cash receipts and cash payments." The ASU addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice in how certain transactions are classified in the statement of cash flows. The ASU will be applied using a retrospective transition method to each period presented. This new guidance is effective for interim and annual reporting periods beginning after December 15, 2017 with early adoption permitted. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

In March 2017, the FASB issued ASU 2017-07, “Compensation - Retirement Benefits (Topic 715): Improving the presentation of net periodic pension cost and net periodic postretirement benefit cost." The ASU requires entities to present the service cost component of the net periodic benefit cost in the same income statement line item(s) as other employee compensation costs arising from services rendered during the period. In addition, only the service cost component will be eligible for capitalization in assets. Entities will present the other components separately from the line item(s) that includes the service cost and outside of any subtotal of operating income, if one is presented, and disclose the line(s) used to present the other components of net periodic benefit cost, if the components are not presented separately in the income statement. The standard will be applied retrospectively for the presentation of the service cost component and the other components of net periodic pension cost and net periodic postretirement benefit cost in the income statement and prospectively, for the guidance limiting the capitalization of net periodic benefit cost in assets to the service cost. This new guidance is effective for interim and annual reporting periods beginning after December 15, 2017 and interim periods, with early adoption permitted. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

NOTE 3. Discontinued Operations

During 2014 and 2015, the Company divested the majority of its global Interiors business (the "Interiors Divestiture") and completed the sale of its Argentina and Brazil interiors operations on December 1, 2016. Separately, the Company completed the sale of the majority of its global Climate business (the "Climate Transaction") during 2015. As the operations subject to the Interiors Divestiture and Climate Transaction met conditions required to qualify for discontinued operations reporting, the results of operations for the Interiors and Climate businesses have been reclassified to income (loss) from discontinued operations, net of tax in the consolidated statements of comprehensive income for the three month periods ended March 31, 2017 and 2016.

Discontinued operations are summarized as follows:

|

| | | | | | | |

| Three Months Ended

March 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Sales | $ | — |

| | $ | 9 |

|

Cost of sales | — |

| | 13 |

|

Gross margin | — |

| | (4 | ) |

Gain on Climate Transaction | (7 | ) | | — |

|

Loss and impairment on Interiors Divestiture | — |

| | 1 |

|

Income (loss) from discontinued operations before income taxes | 7 |

| | (5 | ) |

(Benefit) provision for income taxes | (1 | ) | | 8 |

|

Net income (loss) from discontinued operations, net of tax, attributable to Visteon | $ | 8 |

| | $ | (13 | ) |

In connection with the Climate Transaction, the Company completed the repurchase of the electronics operations located in India during the first quarter of 2017 for $47 million, recognizing a $7 million gain on settlement of purchase commitment contingencies. The Company had previously consolidated the India operations based on the Company's controlling financial interest as a result of the repurchase obligation, operating control, and the obligation to fund losses or benefit from earnings. The Company continues to consolidate this entity based on the Company's voting control.

During the three months ended March 31, 2016, the Company recorded currency impacts of $8 million in connection with the Korean capital gains withholding tax recovered during the first quarter of 2016.

NOTE 4. Non-Consolidated Affiliates

Non-Consolidated Affiliate Transactions

Visteon and Yangfeng Visteon Automotive Trim Systems Co. Ltd. ("YFV") each own 50% of a joint venture under the name of Yanfeng Visteon Electronic (China) Investment Co., Ltd. ("YFVIC"). In October 2014, YFVIC completed the purchase of YFV’s 49% direct ownership in Yanfeng Visteon Automotive Electronics Co., Ltd ("YFVE") a consolidated joint venture of the Company. The purchase by YFVIC was financed through a shareholder loan from YFV and external borrowings which were guaranteed by Visteon, of which $18 million is outstanding as of March 31, 2017. The guarantee contains standard non-payment provisions to cover the borrowers in event of non-payment of principal, accrued interest, and other fees, and the loan is expected to be fully paid by September 2019.

In January 2017, the Company completed the sale of a 50% interest in an equity method investment for proceeds of $7 million, consistent with its carrying value.

In March 2017, the Company sold a cost method investment for proceeds of approximately $3 million. The Company recorded a pretax loss of $1 million during the three months ended March 31, 2017, classified as "Other expense, net."

Investments in Affiliates

The Company recorded equity in net income of affiliates of $2 million and a net loss of less than $1 million for the three month periods ended March 31, 2017 and 2016 respectively.

Investments in affiliates were $37 million and $45 million as of March 31, 2017 and December 31, 2016, respectively. As of March 31, 2017 and December 31, 2016, investments in affiliates accounted for under the equity method totaled $36 million and $40 million, respectively, while investments in affiliates accounted for under the cost method were $1 million as of March 31, 2017 and $5 million at December 31, 2016.

Variable Interest Entities

The Company determines whether joint ventures in which it has invested are Variable Interest Entities (“VIE”) at the start of each new venture and when a reconsideration event has occurred. An enterprise must consolidate a VIE if it is determined to be the primary beneficiary of the VIE. The primary beneficiary has both the power to direct the activities of the VIE that most significantly impact the entity’s economic performance and the obligation to absorb losses or the right to receive benefits from the VIE that could potentially be significant to the VIE.

The Company determined that YFVIC, is a VIE. The Company holds a variable interest in YFVIC primarily related to its ownership interests and subordinated financial support. The Company and YFV each own 50% of YFVIC and neither entity has the power to control the operations of YFVIC, therefore the Company is not the primary beneficiary of YFVIC and does not consolidate the joint venture.

A summary of the Company's investments in YFVIC is provided below.

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Payables due to YFVIC | $ | 7 |

| | $ | 14 |

|

Exposure to loss in YFVIC | | | |

Investment in YFVIC | $ | 24 |

| | $ | 22 |

|

Receivables due from YFVIC | 12 |

| | 15 |

|

Subordinated loan receivable | 22 |

| | 22 |

|

Loan guarantee | 18 |

| | 22 |

|

Maximum exposure to loss in YFVIC | $ | 76 |

| | $ | 81 |

|

NOTE 5. Restructuring Activities

Given the economically-sensitive and highly competitive nature of the automotive electronics industry, the Company continues to closely monitor current market factors and industry trends taking action as necessary, including restructuring actions. However, there can be no assurance that any such actions will be sufficient to fully offset the impact of adverse factors on the Company or its results of operations, financial position and cash flows. During the three months ended March 31, 2017 and 2016, the Company recorded $1 million and $10 million of restructuring expenses, net of reversals, respectively.

Electronics

During the fourth quarter of 2016, the Company announced a restructuring program impacting engineering and administrative functions to further align the Company's engineering and related administrative footprint with its core product technologies and customers. Through March 31, 2017, the Company has recorded approximately $28 million of restructuring expenses under this program, and expects to incur up to $45 million of restructuring costs associated with approximately 250 employees for this program. During the three months ended March 31, 2017, the Company has recorded approximately $1 million of restructuring expenses under this program, and $17 million remains accrued for the program as of March 31, 2017.The Company expects to record additional restructuring costs related to this program as the underlying plan is finalized.

During the first quarter of 2016, the Company announced a restructuring program to transform the Company's engineering organization and supporting functional areas to focus on execution and technology. The organization will be comprised of regional engineering, product management and advanced technologies, and global centers of competence. During the three months ended March 31, 2016, the Company recorded approximately $11 million of restructuring expenses under this program, associated with approximately 90 employees. As of March 31, 2017 $1 million remains accrued for this program and charges are considered substantially complete.

During 2015, the Company announced a restructuring program designed to reduce the workforce at a European Electronics facility, of which $5 million remains accrued as of March 31, 2017.

In connection with the acquisition of substantially all of the global automotive electronic business of Johnson Controls Inc. (the "Electronics Acquisition") in 2014, the Company commenced a restructuring program designed to achieve cost savings through transaction synergies. Charges for the program are considered substantially complete and approximately $2 million remains accrued as of March 31, 2017.

Other and Discontinued Operations

During 2016, the Company recorded restructuring expenses related to severance and termination benefits primarily related to the wind-down of certain operations in South America, of which $1 million remains accrued as of March 31, 2017.

As of March 31, 2017, the Company retained approximately $5 million of restructuring reserves as part of the Interiors Divestiture associated with previously announced programs for the fundamental reorganization of operations at facilities in Brazil and France.

Restructuring Reserves

Restructuring reserve balances of $32 million and $40 million as of March 31, 2017 and December 31, 2016, respectively, are classified as "Other current liabilities" on the consolidated balance sheets. The Company anticipates that the activities associated with the current restructuring reserve balance will be substantially complete within one year. The Company’s consolidated restructuring reserves and related activity are summarized below, including amounts associated with discontinued operations.

|

| | | | | | | | | | | |

| Electronics | | Other | | Total |

| (Dollars in Millions) |

December 31, 2016 | $ | 31 |

| | $ | 9 |

| | $ | 40 |

|

Expense | 1 |

| | — |

| | 1 |

|

Utilization | (8 | ) | | (1 | ) | | (9 | ) |

March 31, 2017 | $ | 24 |

| | $ | 8 |

| | $ | 32 |

|

NOTE 6. Inventories

Inventories consist of the following components:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Raw materials | $ | 83 |

| | $ | 83 |

|

Work-in-process | 49 |

| | 34 |

|

Finished products | 30 |

| | 34 |

|

| $ | 162 |

| | $ | 151 |

|

NOTE 7. Other Assets

Other current assets are comprised of the following components:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Recoverable taxes | $ | 71 |

| | $ | 60 |

|

Prepaid assets and deposits | 37 |

| | 35 |

|

Joint venture receivables | 32 |

| | 39 |

|

Notes receivable | 19 |

| | 18 |

|

Contractually reimbursable engineering costs | 6 |

| | 7 |

|

Foreign currency hedges | 6 |

| | 6 |

|

Other | 3 |

| | 5 |

|

| $ | 174 |

| | $ | 170 |

|

Notes receivable represent bank notes generally maturing within six months.

Other non-current assets are comprised of the following components:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Deferred tax assets | $ | 46 |

| | $ | 48 |

|

Recoverable taxes | 35 |

| | 34 |

|

Joint venture receivables | 26 |

| | 25 |

|

Long term notes receivable | 10 |

| | 10 |

|

Contractually reimbursable engineering costs | 10 |

| | 11 |

|

Other | 20 |

| | 18 |

|

| $ | 147 |

| | $ | 146 |

|

In accordance with the Interiors Divestiture, the Company entered into a three year term loan with the buyer for $10 million, which matures on December 1, 2019.

Current and non-current contractually reimbursable engineering costs of $6 million and $10 million, respectively, as of March 31, 2017 and $7 million and $11 million, respectively, as of December 31, 2016, are related to pre-production design and development costs incurred pursuant to long-term supply arrangements that are contractually guaranteed for reimbursement by customers. The Company expects to receive cash reimbursement payments of approximately $5 million during the remainder of 2017, $3 million in 2018, and $8 million in 2019 and thereafter.

NOTE 8. Intangible Assets, net

Intangible assets, net as of March 31, 2017 and December 31, 2016, are comprised of the following:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2017 | | December 31, 2016 |

| Estimated Weighted Average Useful Life (years) | | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value | | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| | | (Dollars in Millions) |

Definite-Lived: | | |

Developed technology | 10 | | $ | 41 |

| | $ | 26 |

| | $ | 15 |

| | $ | 40 |

| | $ | 25 |

| | $ | 15 |

|

Customer related | 9 | | 83 |

| | 27 |

| | 56 |

| | 83 |

| | 25 |

| | 58 |

|

Capitalized software development | 3 | | 5 |

| | — |

| | 5 |

| | 4 |

| | — |

| | 4 |

|

Other | 32 | | 8 |

| | 1 |

| | 7 |

| | 8 |

| | 1 |

| | 7 |

|

Subtotal | | | 137 |

| | 54 |

| | 83 |

| | 135 |

| | 51 |

| | 84 |

|

Indefinite-Lived: | | |

Goodwill | | | 45 |

| | — |

| | 45 |

| | 45 |

| | — |

| | 45 |

|

Total | | | $ | 182 |

| | $ | 54 |

| | $ | 128 |

| | $ | 180 |

| | $ | 51 |

| | $ | 129 |

|

The Company recorded approximately $3 million and $4 million of amortization expense related to definite-lived intangible assets for the three months ended March 31, 2017 and 2016, respectively. The Company currently estimates annual amortization expense to be $13 million for 2017, $14 million each year from 2018 through 2019, $11 million for 2020, and $10 million for 2021. Indefinite-lived intangible assets are not amortized but are tested for impairment at least annually, or earlier when events and circumstances indicate that it is more likely than not that such assets have been impaired. There were no indicators of potential impairment during the three months ended March 31, 2017.

A roll-forward of the carrying amounts of intangible assets is presented below:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Definite-lived intangibles | | Indefinite-lived intangibles | | |

| Developed Technology | | Customer Related | | Capitalized Software Development | | Other | | Goodwill | Total |

| (Dollars in Millions) |

December 31, 2016 | $ | 15 |

| | $ | 58 |

| | $ | 4 |

| | $ | 7 |

| | $ | 45 |

| | $ | 129 |

|

Additions | — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

Foreign currency | 1 |

| | — |

| | — |

| | — |

| | — |

| | 1 |

|

Amortization | (1 | ) | | (2 | ) | | — |

| | — |

| | — |

| | (3 | ) |

March 31, 2017 | $ | 15 |

| | $ | 56 |

| | $ | 5 |

| | $ | 7 |

| | $ | 45 |

| | $ | 128 |

|

NOTE 9. Other Liabilities

Other current liabilities are summarized as follows:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Product warranty and recall accruals | $ | 38 |

| | $ | 43 |

|

Restructuring reserves | 32 |

| | 40 |

|

Contribution payable | 32 |

| | 31 |

|

Rent and royalties | 20 |

| | 23 |

|

Income taxes payable | 18 |

| | 22 |

|

Dividends payable | 17 |

| | 5 |

|

Distribution payable | 14 |

| | 15 |

|

Joint venture payables | 10 |

| | 22 |

|

Deferred income | 10 |

| | 14 |

|

Non-income taxes payable | 5 |

| | 8 |

|

Foreign currency hedges | 2 |

| | 7 |

|

Electronics operations repurchase commitment | — |

| | 50 |

|

Information technology separation and service obligations | — |

| | 2 |

|

Other | 26 |

| | 27 |

|

| $ | 224 |

| | $ | 309 |

|

On December 1, 2015, Visteon completed the sale and transfer of its equity ownership in Visteon Deutschland GmbH, which operated the Berlin, Germany interiors plant ("Germany Interiors Divestiture"). The Company contributed cash, of approximately $141 million, assets of $27 million, and liabilities of $198 million including pension related liabilities. The Company will make a final contribution payment of approximately $32 million during the first half of 2017 upon fulfillment of buyer contractual commitments.

On January 22, 2016 the Company paid to shareholders a special distribution of $1.74 billion, and an additional $14 million will be paid over a two-year period upon vesting and settlement of restricted stock units and performance-based share units previously granted to the Company's employees. The special cash distribution was funded from the Climate Transaction proceeds.

Following the initial sale as part of the Climate Transaction, the Company repurchased an electronics operation located in India on March 27, 2017 as further described in Note 3, Discontinued Operations.

Other non-current liabilities are summarized as follows:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Deferred income | $ | 18 |

| | $ | 18 |

|

Product warranty and recall accruals | 14 |

| | 12 |

|

Income tax reserves | 13 |

| | 14 |

|

Non-income tax reserves | 7 |

| | 10 |

|

Other | 14 |

| | 15 |

|

| $ | 66 |

| | $ | 69 |

|

NOTE 10. Debt

The Company’s short and long-term debt consists of the following:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Short-Term Debt: | | | |

Current portion of long-term debt | $ | 1 |

| | $ | 3 |

|

Short-term borrowings | 48 |

| | 33 |

|

| $ | 49 |

| | $ | 36 |

|

Long-Term Debt: | | | |

Term debt facility | $ | 347 |

| | $ | 346 |

|

Short-Term Debt

Short-term borrowings are primarily related to the Company's non-U.S. consolidated joint ventures and are payable in USD, Chinese Renminbi and India Rupee. The Company had short-term borrowings of $48 million and $33 million as of March 31, 2017 and December 31, 2016, respectively. Short-term borrowings increased in Q1 2017 primarily due to changes in working capital needs.

Available borrowings on outstanding affiliate credit facilities as of March 31, 2017 are approximately $17 million and certain of these facilities have pledged assets as security.

Long-Term Debt

As of December 31, 2016, the Company had an amended credit agreement (the “Credit Agreement”) which included a $350 million Term Facility maturing April 9, 2021 and a Revolving Credit Facility with capacity of $200 million maturing April 9, 2019. Borrowings under the Term Loan accrued interest at the greater of LIBOR or 0.75%, plus 2.75%, with an option by the Company to specify the LIBOR tenor of either 1, 2, 3, or 6 months. Loans drawn under the Revolving Credit Facility had an interest rate equal to LIBOR plus a margin ranging from 2.00% to 2.75% as specified by a ratings grid contained in the Credit Agreement. As of December 31, 2016, borrowings under the Revolving Credit Facility would accrue interest at LIBOR plus 2.50%. There were no outstanding borrowings at year-end.

On March 24, 2017, the Company entered into a second amendment to the Credit Agreement to, among other things, extend the maturity dates of both facilities by three years and increase the Revolving Credit Facility capacity to $300 million. The amended Revolving Credit Facility will mature on March 24, 2022 and the amended Term Facility will mature on March 24, 2024. In addition, the amendment reduced the LIBOR spread applicable to each of the Revolving Credit Facility and the Term Facility by 0.50% and eliminated the 0.75% LIBOR floor. The $350 million of borrowings under the amended Term Loan Facility now accrue interest at a rate of LIBOR plus 2.25%. As the Company received a ratings upgrade by Standard & Poor’s during the refinancing, loans drawn under the Revolving Credit Facility would now accrue an interest rate of LIBOR plus 1.75%, if drawn.

The Revolver Credit Facility also provides up to $75 million availability for the issuance of letters of credit and a maximum of $20 million for swing line borrowing. Any amount of the facility utilized for letters of credit or swing line loans outstanding will reduce the amount available under the amended Revolving Facility. The Company may request increases in the limits under the amended Term Facility and the amended Revolving Facility and may request the addition of one or more term loan facilities under the Credit Agreement.

Outstanding borrowings may be prepaid without penalty (other than borrowings made for the purpose of reducing the effective interest rate margin or weighted average yield of the loans). There are mandatory prepayments of principal in connection with: (i) excess cash flow sweeps above certain leverage thresholds, (ii) certain asset sales or other dispositions, (iii) certain refinancing of indebtedness and (iv) over-advances under the Revolving Facility. No excess cash flow sweeps are required at the Company’s current leverage ratios.

The Credit Agreement requires the Company and its subsidiaries to comply with customary affirmative and negative covenants, and contains customary events of default. The Revolving Facility also requires that the Company maintain a total net leverage ratio no greater than 3.00:1.00. During any period when the Company’s corporate and family ratings meet investment grade

ratings, certain of the negative covenants shall be suspended. As of March 31, 2017, the Company was in compliance with all covenants.

All obligations under the Credit Agreement and obligations in respect of certain cash management services and swap agreements with the lenders and their affiliates are unconditionally guaranteed by certain of the Company’s subsidiaries. Under the terms of the Credit Agreement, all obligations under the Credit Agreement are secured by a first-priority perfected lien (subject to certain exceptions) on substantially all property of the Company and the subsidiaries party to the Security Agreement, subject to certain limitations.

During the three months ended March 31, 2017, the Company recorded $1 million of interest expense and deferred as a non-current asset $2 million of costs in connection with amending the Credit Facility. The deferred costs will be amortized over the term of the Credit Facility. As of March 31, 2017, the amended Term Facility remains at $350 million of aggregate principle and there were no outstanding borrowings under the amended Revolving Facility.

Other

The Company has a $15 million letter of credit facility whereby the Company must maintain a collateral account equal to 103% of the aggregate stated amount of issued letters of credit (or 110% for non-U.S. currencies) and must reimburse any amounts drawn under issued letters of credit. The Company had $3 million of outstanding letters of credit issued under this facility secured by restricted cash, as of March 31, 2017.

Additionally, the Company had $17 million of locally issued letters of credit as of March 31, 2017, to support various tax appeals, customs arrangements and other obligations at its local affiliates.

NOTE 11. Employee Benefit Plans

Defined Benefit Plans

The Company's net periodic benefit costs for all defined benefit plans for the three month periods ended March 31, 2017 and 2016 were as follows: |

| | | | | | | | | | | | | | | |

| U.S. Plans | | Non-U.S. Plans |

| 2017 | | 2016 | | 2017 | | 2016 |

| (Dollars in Millions) |

Costs Recognized in Income: | | | | | | | |

Service cost | $ | — |

| | $ | — |

| | $ | — |

| | $ | 1 |

|

Interest cost | 7 |

| | 7 |

| | 2 |

| | 2 |

|

Expected return on plan assets | (10 | ) | | (10 | ) | | (2 | ) | | (2 | ) |

Net pension (income) expense | $ | (3 | ) | | $ | (3 | ) | | $ | — |

| | $ | 1 |

|

During the three months ended March 31, 2017, cash contributions to the Company's defined benefit plans were less than $1 million for the U.S. plans and were $1 million for the non-U.S. plans. The Company expects to make cash contributions to its defined benefit pension plans of $7 million in 2017. The Company’s expected 2017 contributions may be revised.

NOTE 12. Income Taxes

During the three month period ended March 31, 2017, the Company recorded a provision for income tax on continuing operations of $16 million, which includes income tax expense in countries where the Company is profitable, withholding taxes, changes in uncertain tax benefits, and the inability to record a tax benefit for pretax losses and/or recognize tax expense for pretax income in certain jurisdictions (including the U.S.) due to valuation allowances. Pretax losses from continuing operations in jurisdictions where valuation allowances are maintained and no income tax benefits are recognized totaled $3 million and $7 million for the three months ended March 31, 2017 and March 31, 2016, respectively, resulting in an increase in the Company's effective tax rate in those years.

The Company provides for U.S. and non-U.S. income taxes and non-U.S. withholding taxes on the projected future repatriations of the earnings from its non-U.S. operations that are not considered permanently reinvested at each tier of the legal entity structure.

During the three month period ended March 31, 2017 and 2016, the Company recognized expense primarily related to non-U.S.

withholding taxes of $2 million in both years reflecting the Company's forecasts which contemplate numerous financial and operational considerations that impact future repatriations.

The Company's provision for income taxes in interim periods is computed by applying an estimated annual effective tax rate against income before income taxes, excluding equity in net income of non-consolidated affiliates for the period. Effective tax rates vary from period to period as separate calculations are performed for those countries where the Company's operations are profitable and whose results continue to be tax-effected and for those countries where full deferred tax valuation allowances exist and are maintained. In determining the estimated annual effective tax rate, the Company analyzes various factors, including but not limited to, forecasts of projected annual earnings, taxing jurisdictions in which the pretax income and/or pretax losses will be generated and available tax planning strategies. The Company’s estimated annual effective tax rate is updated each quarter and may be significantly impacted by changes to the mix of forecasted earnings by tax jurisdiction. The tax impact of adjustments to the estimated annual effective tax rate are recorded in the period such estimates are revised. The Company is also required to record the tax impact of certain other non-recurring tax items, including changes in judgment about valuation allowances and uncertain tax positions, and changes in tax laws or rates, in the interim period in which they occur, rather than included in the estimated annual effective tax rate.

The need to maintain valuation allowances against deferred tax assets in the U.S. and other affected countries will cause variability in the Company’s quarterly and annual effective tax rates. Full valuation allowances against deferred tax assets in the U.S. and applicable foreign countries will be maintained until sufficient positive evidence exists to reduce or eliminate them. The factors considered by management in its determination of the probability of the realization of the deferred tax assets include, but are not limited to, recent historical financial results, historical taxable income, projected future taxable income, the expected timing of the reversals of existing temporary differences and tax planning strategies. If, based upon the weight of available evidence, it is more likely than not the deferred tax assets will not be realized, a valuation allowance is recorded. The weight given to the positive and negative evidence is commensurate with the extent to which the evidence may be objectively verified. As such, it is generally difficult for positive evidence regarding projected future taxable income exclusive of reversing taxable temporary differences to outweigh objective negative evidence of recent financial reporting losses, in particular, when there is a cumulative loss incurred over a three-year period. In regards to the full valuation allowance recorded against the U.S. net deferred tax assets, the cumulative U.S. pretax book loss adjusted for significant permanent items incurred over the three-year period ended December 31, 2016 limits the ability to consider other subjective evidence such as the Company’s plans to improve U.S. profits, and as such, the Company continues to maintain a full valuation allowance against the U.S. net deferred tax assets. Based on the Company’s current assessment, it is possible that within the next 12 to 24 months, the existing valuation allowance against the U.S. net deferred tax assets could be partially released. Any such release is dependent upon the sustained improvement in U.S. operating results, and, if such a release of the valuation allowance were to occur, it could have a significant impact on net income in the quarter in which it is deemed appropriate to partially release the reserve.

Unrecognized Tax Benefits

Gross unrecognized tax benefits as of March 31, 2017 and December 31, 2016, including amounts attributable to discontinued operations, were $18 million and $35 million, respectively. Of these amounts approximately $10 million and $12 million as of March, 2017 and December 31, 2016, respectively, represent the amount of unrecognized benefits that, if recognized, would impact the effective tax rate. The gross unrecognized tax benefit differs from that which would impact the effective tax rate due to uncertain tax positions embedded in other deferred tax attributes carrying a full valuation allowance. Since the uncertainty is expected to be resolved while a full valuation allowance is maintained, these uncertain tax positions should not impact the effective tax rate in current or future periods. The Company records interest and penalties related to uncertain tax positions as a component of income tax expense and related amounts accrued at March 31, 2017 and December 31, 2016 were $4 million in both years.

During the first quarter of 2017, the IRS completed the audit of the Company's U.S. tax returns for the 2012 and 2013 tax years. The closing of the audit did not have a material impact on the Company's effective tax rate due to the valuation allowances maintained against the Company's U.S. tax attributes resulting in a decrease in unrecognized tax benefits of $16 million. Also during the first quarter of 2017, the Company settled tax assessments from the Mexican tax authorities in the amount of $2 million related to certain transfer pricing-related issues.

With few exceptions, the Company is no longer subject to U.S. federal tax examinations for years before 2014, or state, local or non-U.S. income tax examinations for years before 2003, although U.S. net operating losses carried forward into open tax years technically remain open to adjustment. Although it is not possible to predict the timing of the resolution of all ongoing tax audits with accuracy, it is reasonably possible that certain tax proceedings in Europe, Asia and Mexico could conclude within the next twelve months and result in a significant increase or decrease in the balance of gross unrecognized tax benefits. Given the number of years, jurisdictions and positions subject to examination, the Company is unable to estimate the full range of possible adjustments

to the balance of unrecognized tax benefits. The long-term portion of uncertain income tax positions (including interest) in the amount of $13 million is included in Other non-current liabilities on the consolidated balance sheet.

A reconciliation of the beginning and ending amount of unrecognized tax benefits including amounts attributable to discontinued operations is as follows:

|

| | | |

| Three Months Ended

March 31, 2017 |

| (Dollars in Millions) |

Beginning balance | $ | 35 |

|

Tax positions related to current period: | |

Additions | 1 |

|

Tax positions related to prior periods: | |

Reductions | (18 | ) |

Ending balance | $ | 18 |

|

During 2012, Brazil tax authorities issued tax assessment notices to Visteon Sistemas Automotivos (“Sistemas”) related to the sale of its chassis business to a third party, which required a deposit in the amount of $15 million during 2013 necessary to open a judicial proceeding against the government in order to suspend the debt and allow Sistemas to operate regularly before the tax authorities after attempts to reopen an appeal of the administrative decision failed. Adjusted for currency impacts and accrued interest, the deposit amount is approximately $16 million, as of March 31, 2017. The Company believes that the risk of a negative outcome is remote once the matter is fully litigated at the highest judicial level. These appeal payments, as well as income tax refund claims associated with other jurisdictions, total $19 million as of March 31, 2017, and are included in "Other non-current assets" on the consolidated balance sheet.

NOTE 13. Stockholders’ Equity and Non-controlling Interests

Changes in equity for the three months ended March 31, 2017 and 2016 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| 2017 | | 2016 |

| Visteon | | NCI | | Total | | Visteon | | NCI | | Total |

| (Dollars in Millions) |

Three Months Ended March 31 | | | | | | | | | | | |

Beginning balance | $ | 586 |

| | $ | 138 |

| | $ | 724 |

| | $ | 1,057 |

| | $ | 142 |

| | $ | 1,199 |

|

Net income from continuing operations | 55 |

| | 4 |

| | 59 |

| | 32 |

| | 4 |

| | 36 |

|

Net income (loss) from discontinued operations | 8 |

| | — |

| | 8 |

| | (13 | ) | | — |

| | (13 | ) |

Net income | 63 |

| | 4 |

| | 67 |

| | 19 |

| | 4 |

| | 23 |

|

Other comprehensive income (loss) | | | | | | | | | | | |

Foreign currency translation adjustments | 18 |

| | 1 |

| | 19 |

| | 23 |

| | — |

| | 23 |

|

Unrealized hedging gain (loss) | 4 |

| | — |

| | 4 |

| | (4 | ) | | — |

| | (4 | ) |

Total other comprehensive income (loss) | 22 |

| | 1 |

| | 23 |

| | 19 |

| | — |

| | 19 |

|

Stock-based compensation, net | 2 |

| | — |

| | 2 |

| | (9 | ) | | — |

| | (9 | ) |

Share repurchase | (125 | ) | | — |

| | (125 | ) | | (500 | ) | | — |

| | (500 | ) |

Dividends to non-controlling interests | — |

| | (11 | ) | | (11 | ) | | — |

| | — |

| | — |

|

Ending balance | $ | 548 |

| | $ | 132 |

| | $ | 680 |

| | $ | 586 |

| | $ | 146 |

| | $ | 732 |

|

Share Repurchase Program

During 2016, Visteon completed two stock buyback programs with a third-party financial institution to purchase shares of common stock for an aggregate purchase price of $500 million. Under these programs, Visteon purchased 7,190,506 shares at an average price of $69.48.

On January 10, 2017, the Company's board of directors authorized $400 million of share repurchase of its shares of common stock through March 30, 2018. On February 27, 2017 entered into an accelerated share buyback ("ASB") program with a third-party financial institution to purchase shares of common stock for an aggregate purchase price of $125 million. On March 2, 2017, the Company received an initial delivery of 1,062,022 shares of common stock using a reference price of $94.16. The ASB's first acceleration and scheduled termination dates are April 10, and May 8, 2017, respectively. The Company may purchase additional shares pursuant to the foregoing authorization.

Non-Controlling Interests

Non-controlling interests in the Visteon Corporation economic entity are as follows:

|

| | | | | | | |

| March 31 | | December 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Yanfeng Visteon Automotive Electronics Co., Ltd. | $ | 89 |

| | $ | 97 |

|

Shanghai Visteon Automotive Electronics, Co., Ltd. | 41 |

| | 39 |

|

Other | 2 |

| | 2 |

|

| $ | 132 |

| | $ | 138 |

|

Accumulated Other Comprehensive (Loss) Income

Changes in Accumulated other comprehensive (loss) income (“AOCI”) and reclassifications out of AOCI by component include: |

| | | | | | | |

| Three Months Ended

March 31 |

| 2017 | | 2016 |

| (Dollars in Millions) |

Changes in AOCI: | | | |

Beginning balance | $ | (233 | ) | | $ | (190 | ) |

Other comprehensive income (loss) before reclassification, net of tax | 20 |

| | 21 |

|

Amounts reclassified from AOCI | 2 |

| | (2 | ) |

Ending balance | $ | (211 | ) | | $ | (171 | ) |

Changes in AOCI by Component: | | |

Foreign currency translation adjustments | | | |

Beginning balance | $ | (163 | ) | | $ | (159 | ) |

Other comprehensive income before reclassification, net of tax (a) | 19 |

| | 29 |

|

Ending balance | (144 | ) | | (130 | ) |

Net investment hedge | | | |

Beginning balance | 10 |

| | 4 |

|

Other comprehensive loss before reclassification, net of tax (a) | (1 | ) | | (6 | ) |

Ending balance | 9 |

| | (2) |

|

Benefit plans | | | |

Beginning balance | (75 | ) | | (36 | ) |

Ending balance | (75 | ) | | (36 | ) |

Unrealized hedging (loss) gain | | | |

Beginning balance | (5 | ) | | 1 |

|

Other comprehensive income (loss) before reclassification, net of tax (b) | 2 |

| | (2 | ) |

Amounts reclassified from AOCI | 2 |

| | (2 | ) |

Ending balance | (1 | ) | | (3 | ) |

Total AOCI | $ | (211 | ) | | $ | (171 | ) |

(a) There were no income tax effects for the three month periods ending March 31, 2017 and 2016, due to the recording of valuation allowance.

(b) Net tax tax expense of $1 million and tax benefit of $1 million are related to unrealized hedging (loss) gain for both the three months ended March 31, 2017 and 2016, respectively.

NOTE 14. Earnings Per Share

Basic earnings per share is calculated by dividing net income attributable to Visteon by the weighted average number of shares of common stock outstanding. Diluted earnings per share is computed by dividing net income by the weighted average number of common and potentially dilutive common shares outstanding. Performance based share units are considered contingently issuable shares, and are included in the computation of diluted earnings per share based on the number of shares that would be issuable if the reporting date were the end of the contingency period and if the result would be dilutive.

The table below provides details underlying the calculations of basic and diluted earnings (loss) per share:

|

| | | | | | | |

| Three Months Ended

March 31 |

| 2017 | | 2016 |

| (In Millions, Except Per Share Amounts) |

Numerator: | | | |

Net income from continuing operations attributable to Visteon | $ | 55 |

| | $ | 32 |

|

Income (loss) from discontinued operations, net of tax | 8 |

| | (13 | ) |

Net income attributable to Visteon | $ | 63 |

| | $ | 19 |

|

Denominator: | | | |

Average common stock outstanding - basic | 32.5 |

| | 38.1 |

|

Dilutive effect of performance based share units and other | 0.5 |

| | 0.4 |

|

Diluted shares | 33.0 |

| | 38.5 |

|

| | | |

Basic and Diluted Per Share Data: | | | |

Basic earnings (loss) per share attributable to Visteon: | | | |

Continuing operations | $ | 1.69 |

| | $ | 0.84 |

|

Discontinued operations | 0.25 |

| | (0.34 | ) |

| $ | 1.94 |

| | $ | 0.50 |

|

Diluted earnings (loss) per share attributable to Visteon: | | | |

Continuing operations | $ | 1.67 |

| | $ | 0.83 |

|

Discontinued operations | 0.24 |

| | (0.34 | ) |

| $ | 1.91 |

| | $ | 0.49 |

|

NOTE 15. Fair Value Measurements and Financial Instruments

Fair Value Measurements

The Company uses a three-level fair value hierarchy that categorizes assets and liabilities measured at fair value based on the observability of the inputs utilized in the valuation. The fair value hierarchy gives the highest priority to the quoted prices in active markets for identical assets and liabilities and lowest priority to unobservable inputs.

| |

• | Level 1 – Financial assets and liabilities whose values are based on unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. |

| |

• | Level 2 – Financial assets and liabilities whose values are based on quoted prices in markets that are not active or model inputs that are observable for substantially the full term of the asset or liability. |

| |

• | Level 3 – Financial assets and liabilities whose values are based on prices or valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement. |

Items Measured at Fair Value on a Recurring Basis

Foreign currency hedge instruments are measured at fair value on a recurring basis under an income approach using industry-standard models that consider various assumptions, including time value, volatility factors, current market and contractual prices for the underlying and non-performance risk. Substantially all of these assumptions are observable in the marketplace throughout

the full term of the instrument, can be derived from observable data, or are supported by observable levels at which transactions are executed in the marketplace. Accordingly, the Company's foreign currency instruments are classified as Level 2, "Other Observable Inputs" in the fair value hierarchy.

Interest rate swaps are valued under an income approach using industry-standard models that consider various assumptions, including time value, volatility factors, current market and contractual prices for the underlying and non-performance risk. Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument, and can be derived from observable data or supported by observable levels at which transactions are executed in the marketplace. Accordingly, the Company's interest rate swaps are classified as Level 2, "Other Observable Inputs" in the fair value hierarchy.

Item Measured at Fair Value on a Nonrecurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring basis. The fair value measurements are generally determined using unobservable inputs and are classified within Level 3 of the fair value hierarchy. These assets include long-lived assets, intangible assets and investments in affiliates, which may be written down to fair value as a result of impairment.

Items Not Carried at Fair Value

The Company's fair value of debt was approximately $401 million and $389 million as of March 31, 2017 and December 31, 2016, respectively. Fair value estimates were based on the current rates offered to the Company for debt of the same remaining maturities. Accordingly, the Company's debt fair value disclosures are classified as Level 2, "Other Observable Inputs" in the fair value hierarchy.

Financial Instruments

The Company is exposed to various market risks including, but not limited to, changes in foreign currency exchange rates and market interest rates. The Company manages these risks, in part, through the use of derivative financial instruments. The maximum length of time over which the Company hedges the variability in the future cash flows for forecast transactions, excluding those forecast transactions related to the payment of variable interest on existing debt, is up to eighteen months from the date of the forecast transaction. The maximum length of time over which the Company hedges forecast transactions related to the payment of variable interest on existing debt is the term of the underlying debt. The use of derivative financial instruments creates exposure to credit loss in the event of nonperformance by the counter-party to the derivative financial instruments.

The Company presents its derivative positions and any related material collateral under master netting arrangements that provide for the net settlement of contracts, by counterparty, in the event of default or termination. Derivative financial instruments designated and non-designated as hedging instruments are included in the Company’s consolidated balance sheets. There is no cash collateral on any of these derivatives.

Foreign Exchange Risk: The Company’s net cash inflows and outflows exposed to the risk of changes in foreign currency exchange rates arise from the sale of products in countries other than the manufacturing source, foreign currency denominated supplier payments, debt and other payables, subsidiary dividends and investments in subsidiaries. The Company utilizes derivative financial instruments, including forward and option contracts, to protect the Company’s cash flow from changes in exchange rates. Foreign currency exposures are reviewed periodically and any natural offsets are considered prior to entering into a derivative financial instrument. The Company’s current primary hedged foreign currency exposures include the Euro, Japanese Yen and Mexican Peso. Where possible, the Company utilizes a strategy of partial coverage for transactions in these currencies.

As of March 31, 2017 and December 31, 2016, the Company had derivative instruments that consisted primarily of option and forward contracts to hedge changes in foreign currency exchange rates with notional amounts of approximately $153 million and $169 million, respectively. Fair value estimates of these contracts are based on quoted market prices and other observable inputs. As of March 31, 2017 and December 31, 2016, respectively, approximately $121 million and $138 million of the instruments have been designated as cash flow hedges with the effective portion of the gain or loss reported in the "Accumulated other comprehensive loss" component of Stockholders’ equity in the Company’s consolidated balance sheets. There was no ineffectiveness associated with such derivatives as of March 31, 2017 and December 31, 2016 and the fair value of these derivatives was a liability of $1 million and $6 million, respectively. The difference between the gross and net value of these derivatives after offset by counter party is not material. The estimated AOCI that is expected to be reclassified into earnings within the next 12 months is a $1 million loss.

During 2015, the Company entered into currency exchange derivatives with a notional amount of $150 million to manage foreign

currency exposure on certain non-U.S. denominated foreign entities. These derivatives have been designated as hedges of the Company's net investments in European affiliates with the effective portion of the gain or loss reported in the "Accumulated other comprehensive loss" component of Stockholder's equity in the Company's consolidated balance sheet. There was no ineffectiveness associated with such derivatives as of March 31, 2017 and December 31, 2016 and the fair value of these derivatives was an asset of $5 million and $6 million, respectively.

Interest Rate Risk: The Company is subject to interest rate risk principally in relation to variable-rate debt. The Company uses derivative financial instruments to manage exposure to fluctuations in interest rates in connection with its risk management policies. During 2015, the Company entered into interest rate swaps with a notional amount of $150 million that effectively convert designated cash flows associated with underlying interest payments on the Term Facility from a variable interest rate to a fixed interest rate, the maturities of these swaps will not exceed the underlying Term Facility. The instruments have been designated as cash flow hedges with the effective portion of the gain or loss reported in the "Accumulated other comprehensive loss" component of Stockholders' equity in the Company's consolidated balance sheets and such gains and losses will be reclassified at the time the underlying hedged transactions are realized. The ineffective portion of these swaps is assessed based on the hypothetical derivative method and is recorded as interest expense in the Company's consolidated statements of comprehensive income. As of March 31, 2017 and December 31, 2016 there was no ineffectiveness associated with these derivatives and the fair value was a liability of less than $1 million and $1 million, respectively. AOCI that is expected to be reclassified into earnings within the next 12 months is a $2 million loss.

Financial Statement Presentation

Gains and losses on derivative financial instruments for the three months ended March 31, 2017 and 2016 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Recorded (Loss) Income into AOCI, net of tax | | Reclassified from AOCI into (Income) Loss | | Recorded in (Income) Loss |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 |

| | (Dollars in Millions) |

Three Months Ended March 31 | | | | | | | | | | | | |

Foreign currency risk - Cost of sales | | | | | | | | | | | | |

Cash flow hedges | | $ | 2 |

| | $ | 1 |

| | $ | 2 |

| | $ | (2 | ) | | $ | — |

| | $ | — |

|

Net investment hedges | | (1 | ) | | (6 | ) | | — |

| | — |

| | — |

| | — |

|

Non-designated cash flow hedges | | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

|

Interest rate risk - Interest expense, net: | | | | | | | | | | | | |

Interest rate swap | | — |

| | (3 | ) | | — |

| | — |

| | — |

| | — |

|

| | $ | 1 |

| | $ | (8 | ) | | $ | 2 |

| | $ | (2 | ) | | $ | (1 | ) | | $ | — |

|

Concentrations of Credit Risk

Financial instruments including cash equivalents, derivative contracts, and accounts receivable, expose the Company to counter-party credit risk for non-performance. The Company’s counterparties for cash equivalents and derivative contracts are banks and financial institutions that meet the Company’s credit rating requirements. The Company’s counterparties for derivative contracts are substantial investment and commercial banks with significant experience using such derivatives. The Company manages its credit risk through policies requiring minimum credit standing and limiting credit exposure to any one counter-party and through monitoring counter-party credit risks.

The Company's credit risk with any individual customer does not exceed ten percent of total accounts receivable except for Ford and its affiliates which represents 16% of the balance as of March 31, 2017 and December 31, 2016, Mazda which represents less then 10% and 10% of the balance as of March 31, 2017 and December 31, 2016, respectively, and Nissan/Renault which represents 10% of the balance as of March 31, 2017 and December 31, 2016.

NOTE 16. Commitments and Contingencies

Litigation and Claims

In 2003, the Local Development Finance Authority of the Charter Township of Van Buren, Michigan (the “Township”) issued approximately $28 million in bonds finally maturing in 2032, the proceeds of which were used at least in part to assist in the development of the Company’s U.S. headquarters located in the Township. During January 2010, the Company and the Township entered into a settlement agreement (the “Settlement Agreement”) that, among other things, reduced the taxable value of the headquarters property to current market value and facilitated certain claims of the Township in the Company’s chapter 11 proceedings. The Settlement Agreement also provided that the Company would continue to negotiate in good faith with the Township in the event that property tax payments was inadequate to permit the Township to meet its payment obligations with respect to the bonds. In September 2013, the Township notified the Company in writing that it is estimating a shortfall in tax revenues of between $25 million and $36 million, which could render it unable to satisfy its payment obligations under the bonds. On May 12, 2015, the Township commenced a proceeding against the Company in the U. S. Bankruptcy Court for the District of Delaware in connection with the foregoing. Upon the Company’s motion to dismiss, the Township dismissed the proceeding before the Delaware Bankruptcy Court and re-commenced the proceeding against the Company in the Michigan Wayne County Circuit Court for the State of Michigan on July 2, 2015. The Township sought damages or, alternatively, declaratory judgment that, among other things, the Company is responsible under the Settlement Agreement for payment of any shortfall in the bond debt service payments. On February 2, 2016, the Wayne County Circuit Court dismissed the Township’s lawsuit without prejudice on the basis that the Township’s claims were not ripe for adjudication and the Township has appealed this decision to the Michigan Court of Appeals. The Company disputes the factual and legal assertions made by the Township and intends to vigorously defend the matter. The Company is not able to estimate the possible loss or range of loss in connection with this matter.

The Company is currently involved in disputes with its former President and Chief Executive Officer, Timothy D. Leuliette. Mr. Leuliette filed an arbitration demand against the Company with the American Arbitration Association, alleging claims relating to the cessation of his employment. The Company subsequently filed a complaint against Mr. Leuliette in the U.S. District Court for the Eastern District of Michigan, seeking to enjoin the arbitration and asserting additional claims. The federal litigation is currently stayed pending a ruling in the arbitration. The Company disputes the factual and legal assertions made by Mr. Leuliette, has asserted counterclaims against him in the arbitration, and, although there can be no assurances, the Company does not currently believe that the resolution of these disputes will have a material adverse impact on its results of operations or financial condition.

In November 2013, the Company and Halla Visteon Climate Control Corporation, a Korean corporation (“HVCC”), jointly filed an Initial Notice of Voluntary Self-Disclosure statement with the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”) regarding certain sales of automotive HVAC components by a minority-owned, Chinese joint venture of HVCC into Iran. The Company updated that notice in December 2013, and subsequently filed a voluntary self-disclosure regarding these sales with OFAC in March 2014. In May 2014, the Company voluntarily filed a supplementary self-disclosure identifying additional sales of automotive HVAC components by the Chinese joint venture, as well as similar sales involving an HVCC subsidiary in China, totaling approximately $12 million, and filed a final voluntary-self disclosure with OFAC on October 17, 2014. OFAC is currently reviewing the results of the Company’s investigation. Following that review, OFAC may conclude that the disclosed sales resulted in violations of U.S. economic sanctions laws and warrant the imposition of civil penalties, such as fines, limitations on the Company's ability to export products from the United States, and/or referral for further investigation by the U.S. Department of Justice. Any such fines or restrictions may be material to the Company’s financial results in the period in which they are imposed, but at this time is not able to estimate the possible loss or range of loss in connection with this matter. Additionally, disclosure of this conduct and any fines or other action relating to this conduct could harm the Company’s reputation and have a material adverse effect on our business, operating results and financial condition. The Company cannot predict when OFAC will conclude its own review of our voluntary self-disclosures or whether it may impose any of the potential penalties described above.

The Company's operations in Brazil and Argentina are subject to highly complex labor, tax, customs and other laws. While the Company believes that it is in compliance with such laws, it is periodically engaged in litigation regarding the application of these laws. As of March 31, 2017, the Company maintained accruals of approximately $10 million and $5 million for claims aggregating approximately $59 million and $34 million in Brazil and Argentina, respectively. The amounts accrued represent claims that are deemed probable of loss and are reasonably estimable based on the Company's assessment of the claims and prior experience with similar matters.

While the Company believes its accruals for litigation and claims are adequate, the final amounts required to resolve such matters could differ materially from recorded estimates and the Company's results of operations and cash flows could be materially affected.

Guarantees and Commitments

The Company provided a $18 million loan guarantee to YFVIC. The guarantee contains standard non-payment provisions to cover the borrowers in event of non-payment of principal, accrued interest, and other fees, and the loan is expected to be fully paid by September 2019.