J.P. Morgan Midwest Energy Infrastructure/MLP 1x1 Forum

September 21, 2016

Exhibit 99.1

Forward-Looking Statements

2

Statements contained in this presentation that state management’s expectations or predictions of the

future are forward-looking statements. While these forward-looking statements, and any assumptions

upon which they are based, are made in good faith and reflect our current judgment regarding the

direction of our business, actual results will almost always vary, sometimes materially, from any

estimates, predictions, projections, assumptions or other future performance suggested in this

presentation. These forward-looking statements can generally be identified by the words "anticipates,"

"believes," "expects," "plans," "intends," "estimates," "forecasts," "budgets," "projects," "could," "should,"

"may" and similar expressions. These statements reflect our current views with regard to future events

and are subject to various risks, uncertainties and assumptions.

We undertake no duty to update any forward-looking statement to conform the statement to actual

results or changes in the company’s expectations. For more information concerning factors that could

cause actual results to differ from those expressed or forecasted, see NuStar Energy L.P.’s annual report

on Form 10-K and quarterly reports on Form 10-Q, filed with the SEC and available on NuStar’s website at

www.nustarenergy.com.

We use financial measures in this presentation that are not calculated in accordance with generally

accepted accounting principles (“non-GAAP”) and our reconciliations of non-GAAP financial measures to

GAAP financial measures are located in the appendix to this presentation. These non-GAAP financial

measures should not be considered an alternative to GAAP financial measures.

NuStar Overview

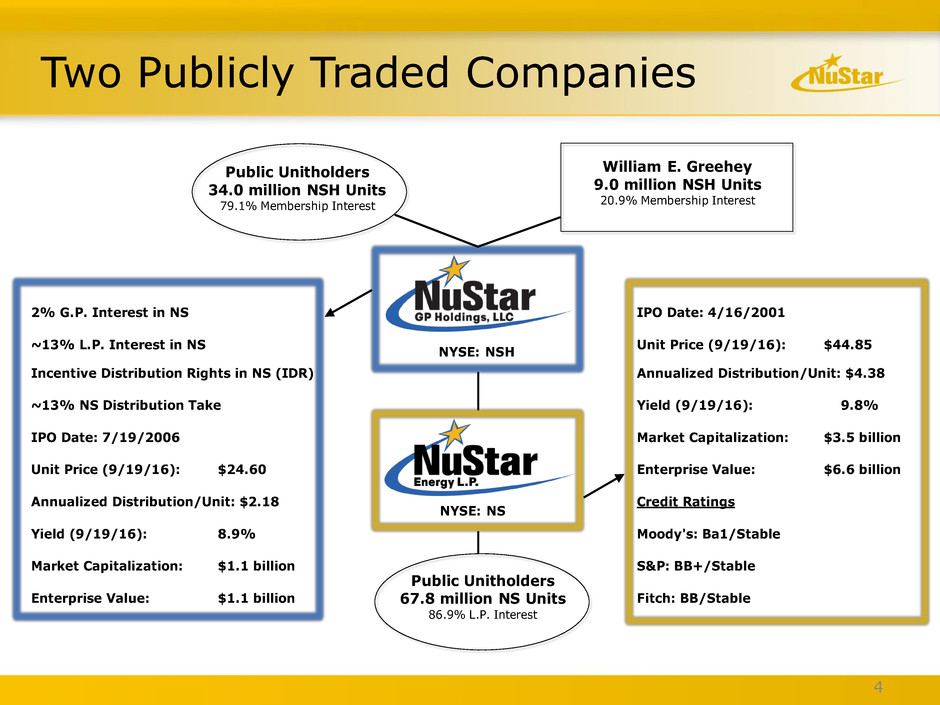

Two Publicly Traded Companies

4

2% G.P. Interest in NS IPO Date: 4/16/2001

~13% L.P. Interest in NS Unit Price (9/19/16): $44.85

Incentive Distribution Rights in NS (IDR) Annualized Distribution/Unit: $4.38

~13% NS Distribution Take Yield (9/19/16): 9.8%

IPO Date: 7/19/2006 Market Capitalization: $3.5 billion

Unit Price (9/19/16): $24.60 Enterprise Value: $6.6 billion

Annualized Distribution/Unit: $2.18 Credit Ratings

Yield (9/19/16): 8.9% Moody's: Ba1/Stable

Market Capitalization: $1.1 billion S&P: BB+/Stable

Enterprise Value: $1.1 billion Fitch: BB/Stable

NYSE: NSH

NYSE: NS

William E. Greehey

9.0 million NSH Units

20.9% Membership Interest

Public Unitholders

67.8 million NS Units

86.9% L.P. Interest

Public Unitholders

34.0 million NSH Units

79.1% Membership Interest

20

30

40

50

60

70

80

90

100

110

120

0.7

0.8

0.9

1

1.1

1.2

1.3

4/1/2014 11/1/2014 6/1/2015 1/1/2016

C

ru

d

e

P

ri

c

e

C

o

v

e

ra

g

e

R

a

ti

o

NS Coverage Ratio Price of Crude One-Times

Resilient and Strong Core Operations,

No Matter the Price of a Barrel of Crude

5

Although valuations of some MLPs have de-coupled from crude prices – we still believe that our

valuation does not yet reflect our solid financial results, stable cash flow and overall stability and

strength of our business

Total unitholder return since recent low on January 20, 2016 +83%2, however still down -23%2 from

last year’s high on April 30, 2015.

Coverage Ratio1 (Trailing Twelve Months) vs Price of Crude

(April 2014 – June 2016)

2 – Total unitholder returns as of September 19, 2016.

0.92x

0.98x

1.04x

1.12x 1.12x 1.11x

1.08x

1.12x

1.08x

2Q-14 3Q-14 4Q-14 1Q-15 2Q-15 3Q-15 4Q-15 1Q-16 2Q-16

1 – Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measure

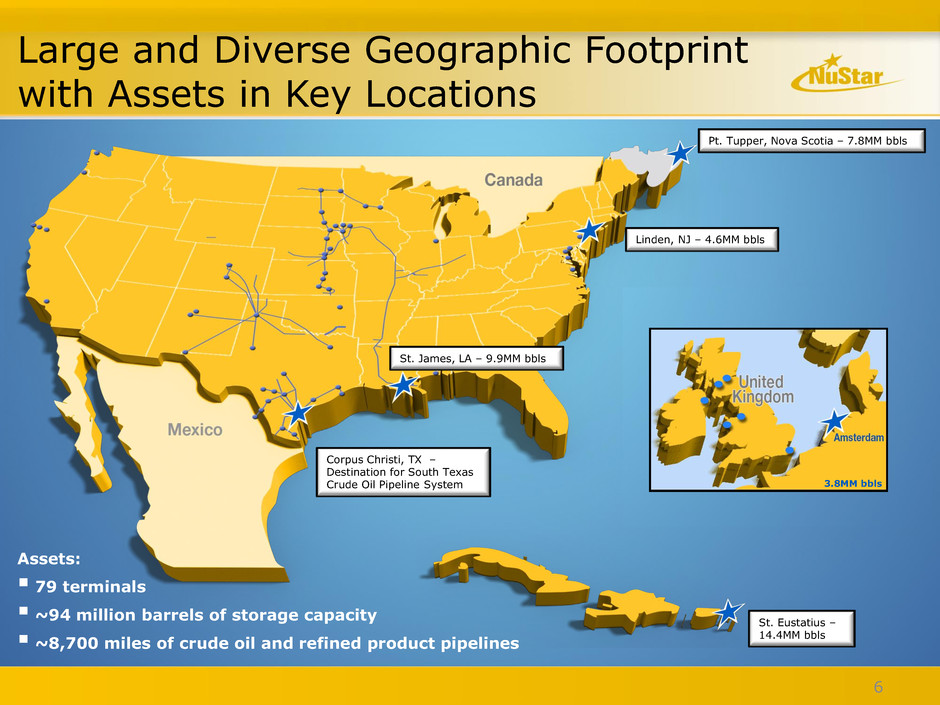

Large and Diverse Geographic Footprint

with Assets in Key Locations

Assets:

79 terminals

~94 million barrels of storage capacity

~8,700 miles of crude oil and refined product pipelines

Corpus Christi, TX –

Destination for South Texas

Crude Oil Pipeline System

St. James, LA – 9.9MM bbls

Pt. Tupper, Nova Scotia – 7.8MM bbls

Linden, NJ – 4.6MM bbls

St. Eustatius –

14.4MM bbls

3.8MM bbls

6

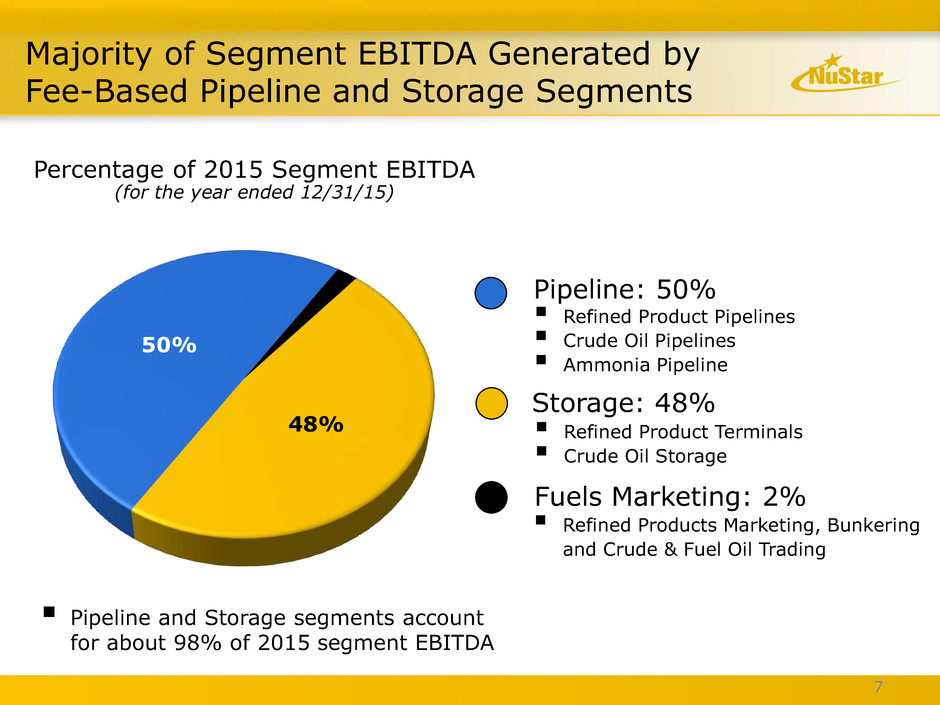

48%

50%

Percentage of 2015 Segment EBITDA

(for the year ended 12/31/15)

Refined Product Pipelines

Crude Oil Pipelines

Ammonia Pipeline

Refined Product Terminals

Crude Oil Storage

Fuels Marketing: 2%

Refined Products Marketing, Bunkering

and Crude & Fuel Oil Trading

Majority of Segment EBITDA Generated by

Fee-Based Pipeline and Storage Segments

Pipeline and Storage segments account

for about 98% of 2015 segment EBITDA

Storage: 48%

Pipeline: 50%

7

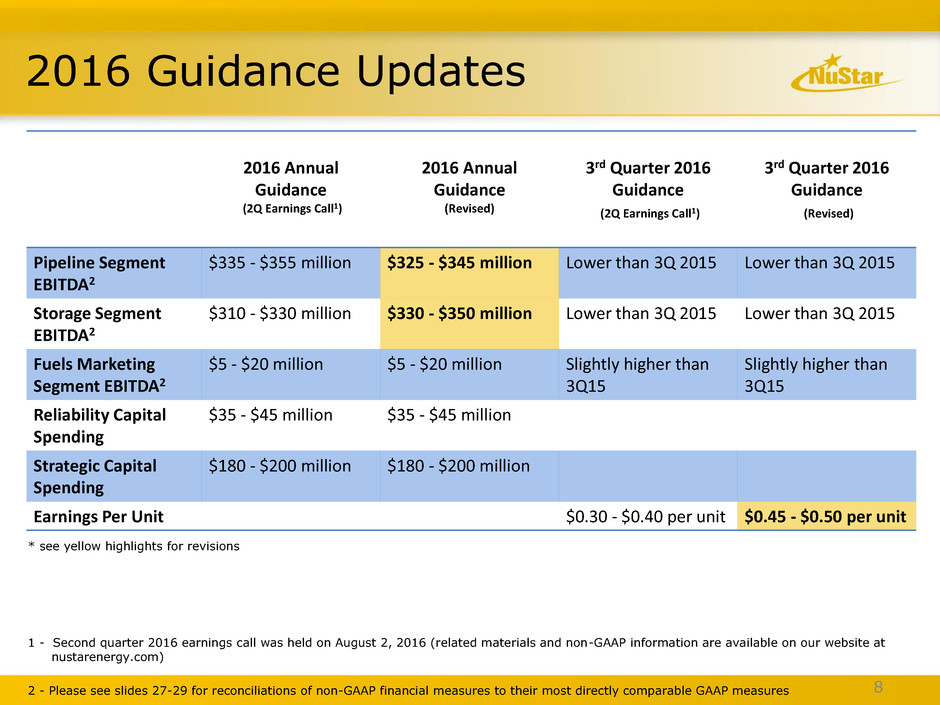

2016 Guidance Updates

8

2016 Annual

Guidance

(2Q Earnings Call1)

2016 Annual

Guidance

(Revised)

3rd Quarter 2016

Guidance

(2Q Earnings Call1)

3rd Quarter 2016

Guidance

(Revised)

Pipeline Segment

EBITDA2

$335 - $355 million $325 - $345 million

Lower than 3Q 2015 Lower than 3Q 2015

Storage Segment

EBITDA2

$310 - $330 million $330 - $350 million

Lower than 3Q 2015 Lower than 3Q 2015

Fuels Marketing

Segment EBITDA2

$5 - $20 million $5 - $20 million

Slightly higher than

3Q15

Slightly higher than

3Q15

Reliability Capital

Spending

$35 - $45 million $35 - $45 million

Strategic Capital

Spending

$180 - $200 million $180 - $200 million

Earnings Per Unit $0.30 - $0.40 per unit $0.45 - $0.50 per unit

1 - Second quarter 2016 earnings call was held on August 2, 2016 (related materials and non-GAAP information are available on our website at

nustarenergy.com)

2 - Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

* see yellow highlights for revisions

9

Building on Our Strengths - Stable, Diversified

Business Foundation for Future Growth

Contracted fee-based storage and pipeline assets provide stable cash flows

Storage terminals effectively full

~75% of pipeline revenues are demand-pull - based on refinery/fertilizer plant feedstock supply or

refinery production delivery

~25% of pipeline revenues are Eagle Ford volumes to area refineries or Corpus Christi, TX docks

~95% of tariffs are FERC-based, which are adjusted annually for inflation

Diverse and high-quality customer base composed of large integrated oil companies,

national oil companies and refiners

1 – 95% committed through take or pay contracts or through structural exclusivity (uncommitted lines serving refinery customers with no competition)

Storage Lease Utilization >90% Pipeline Revenue – Contract1 %

97% of

Leasable

Storage

Effectively

Full

95%

Committed1

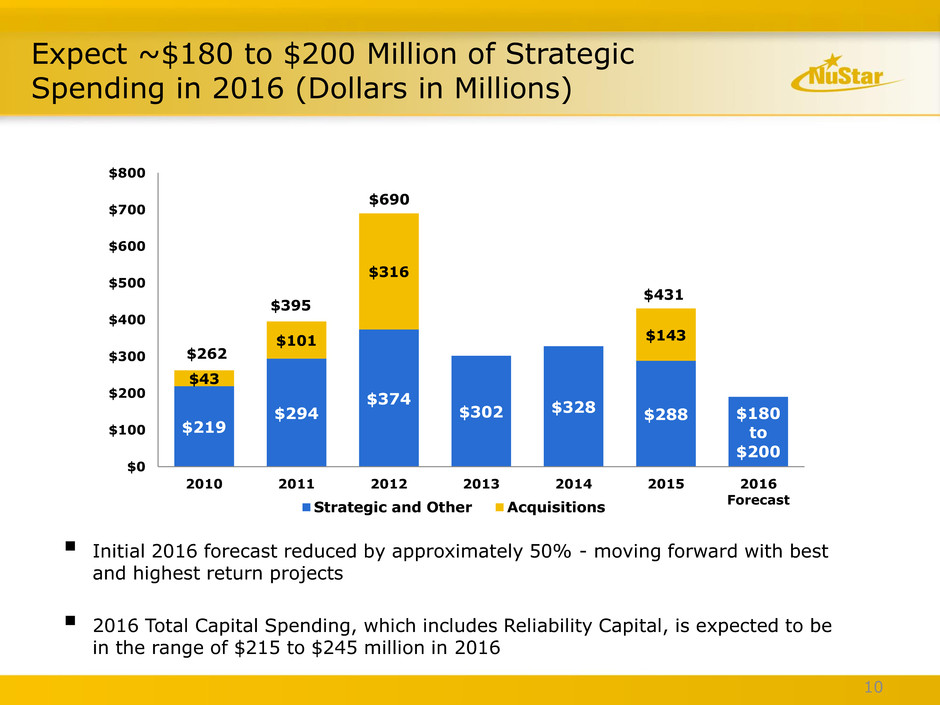

Expect ~$180 to $200 Million of Strategic

Spending in 2016 (Dollars in Millions)

Initial 2016 forecast reduced by approximately 50% - moving forward with best

and highest return projects

2016 Total Capital Spending, which includes Reliability Capital, is expected to be

in the range of $215 to $245 million in 2016

$219

$294

$374

$302 $328 $288 $180

to

$200

$43

$101

$316

$143

$0

$100

$200

$300

$400

$500

$600

$700

$800

2010 2011 2012 2013 2014 2015 2016

Forecast

Strategic and Other Acquisitions

$262

$395

$690

$431

10

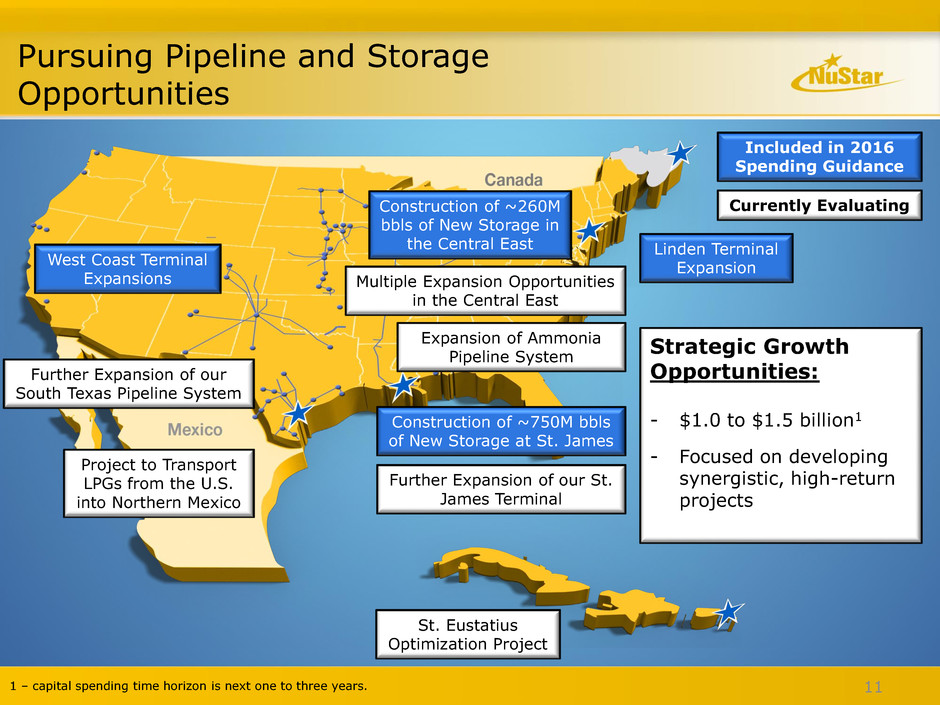

Pursuing Pipeline and Storage

Opportunities

3.8MM bbls

11

Expansion of Ammonia

Pipeline System

Included in 2016

Spending Guidance

Currently Evaluating

West Coast Terminal

Expansions

Construction of ~750M bbls

of New Storage at St. James

Linden Terminal

Expansion

Project to Transport

LPGs from the U.S.

into Northern Mexico

Further Expansion of our

South Texas Pipeline System

Strategic Growth

Opportunities:

- $1.0 to $1.5 billion1

- Focused on developing

synergistic, high-return

projects

1 – capital spending time horizon is next one to three years.

Construction of ~260M

bbls of New Storage in

the Central East

Further Expansion of our St.

James Terminal

Multiple Expansion Opportunities

in the Central East

St. Eustatius

Optimization Project

$1,031

$350

$450

$300 $250

$365

$403

$57

$0

$250

$500

$750

$1,000

$1,250

2015 2016 2017 2018 2019 2020 2021 2022 2038-

2041

Receivables Financing

Sub Notes

GO Zone Financing

Senior Unsecured Notes

Revolver

$810

No Debt Maturities until 2018

(LTD Maturity Profile as of June 30, 2016, Dollars in Millions)

Long-term Debt structure 55% fixed rate – 45% variable rate

Callable in 2018, but

final maturity in 2043

12

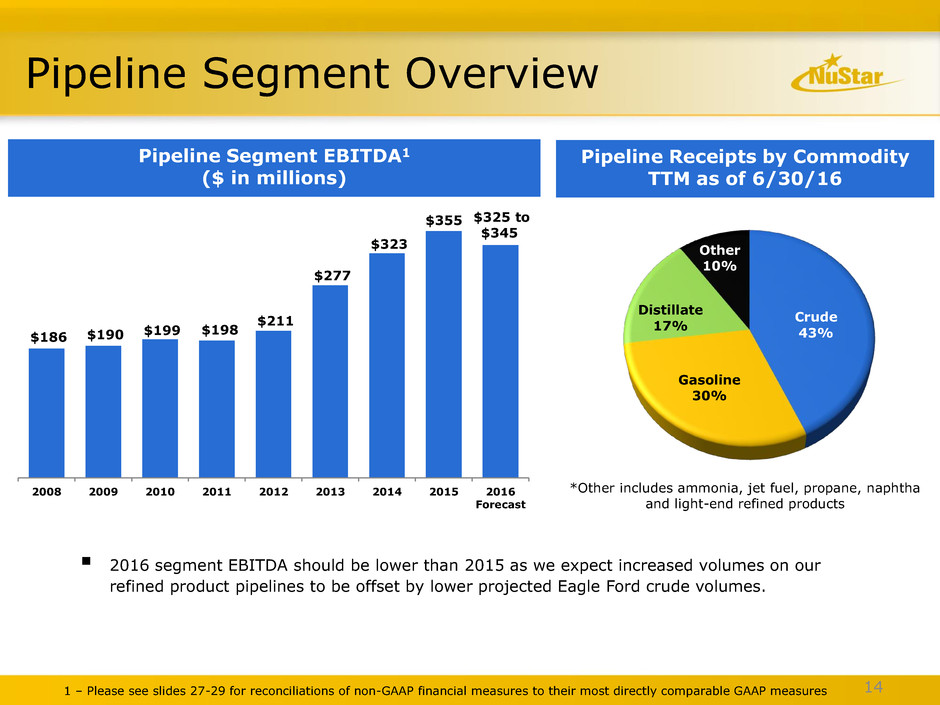

Pipeline Segment

14

2016 segment EBITDA should be lower than 2015 as we expect increased volumes on our

refined product pipelines to be offset by lower projected Eagle Ford crude volumes.

Pipeline Segment Overview

Pipeline Segment EBITDA1

($ in millions)

Pipeline Receipts by Commodity

TTM as of 6/30/16

*Other includes ammonia, jet fuel, propane, naphtha

and light-end refined products

1 – Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

Crude

43%

Gasoline

30%

Distillate

17%

Other

10%

$186 $190

$199 $198

$211

$277

$323

$355 $325 to

$345

2008 2009 2010 2011 2012 2013 2014 2015 2016

Forecast

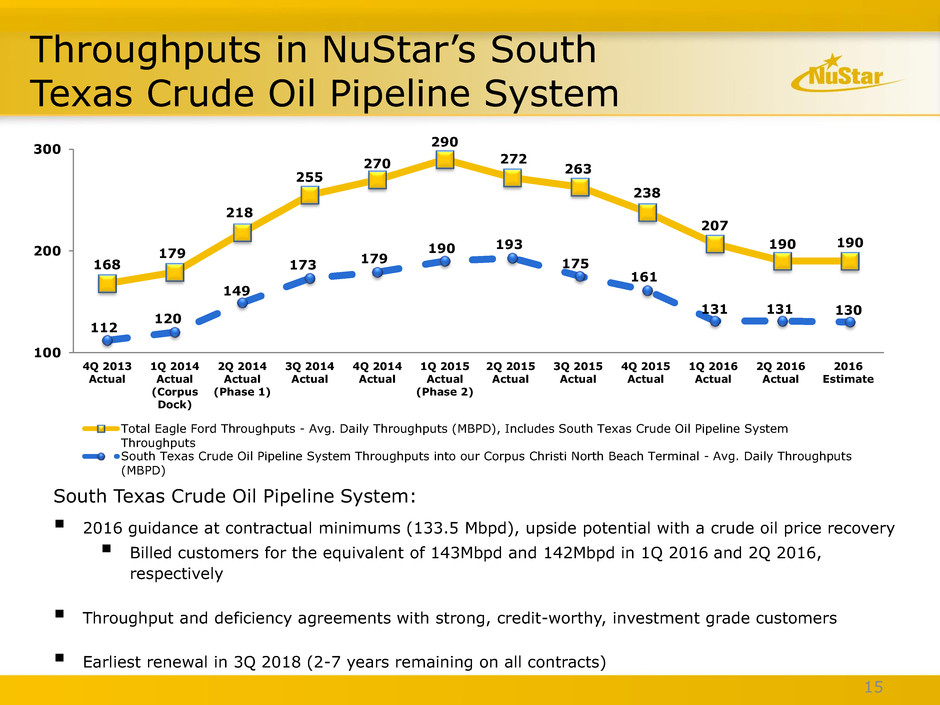

Throughputs in NuStar’s South

Texas Crude Oil Pipeline System

15

South Texas Crude Oil Pipeline System:

2016 guidance at contractual minimums (133.5 Mbpd), upside potential with a crude oil price recovery

Billed customers for the equivalent of 143Mbpd and 142Mbpd in 1Q 2016 and 2Q 2016,

respectively

Throughput and deficiency agreements with strong, credit-worthy, investment grade customers

Earliest renewal in 3Q 2018 (2-7 years remaining on all contracts)

168

179

218

255

270

290

272

263

238

207

190 190

112

120

149

173 179

190 193

175

161

131 131 130

100

200

300

4Q 2013

Actual

1Q 2014

Actual

(Corpus

Dock)

2Q 2014

Actual

(Phase 1)

3Q 2014

Actual

4Q 2014

Actual

1Q 2015

Actual

(Phase 2)

2Q 2015

Actual

3Q 2015

Actual

4Q 2015

Actual

1Q 2016

Actual

2Q 2016

Actual

2016

Estimate

Total Eagle Ford Throughputs - Avg. Daily Throughputs (MBPD), Includes South Texas Crude Oil Pipeline System

Throughputs

South Texas Crude Oil Pipeline System Throughputs into our Corpus Christi North Beach Terminal - Avg. Daily Throughputs

(MBPD)

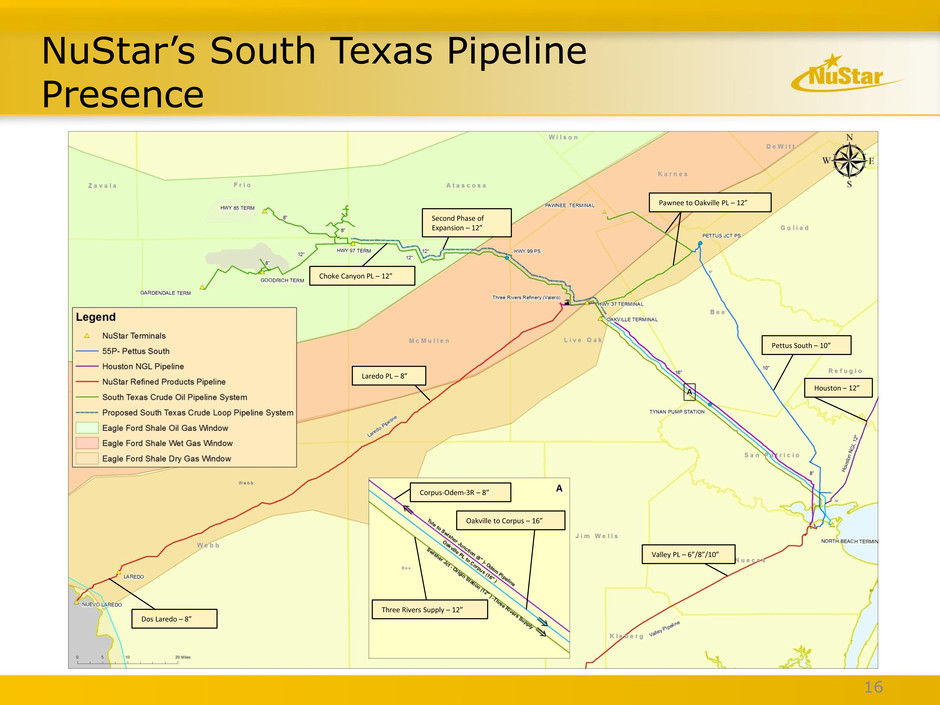

Choke Canyon PL – 12”

Laredo PL – 8”

Dos Laredo – 8”

Valley PL – 6”/8”/10”

Pettus South – 10”

Houston – 12”

Pawnee to Oakville PL – 12”

Three Rivers Supply – 12”

Corpus-Odem-3R – 8”

Oakville to Corpus – 16”

Second Phase of

Expansion – 12”

NuStar’s South Texas Pipeline

Presence

16

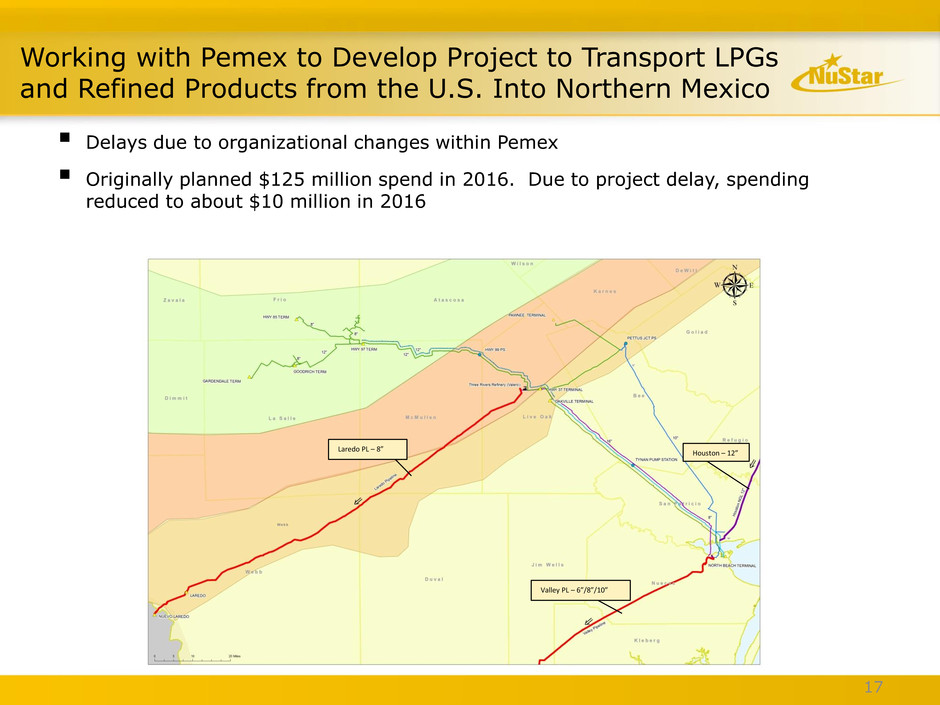

Working with Pemex to Develop Project to Transport LPGs

and Refined Products from the U.S. Into Northern Mexico

Laredo PL – 8”

Valley PL – 6”/8”/10”

Houston – 12”

17

Delays due to organizational changes within Pemex

Originally planned $125 million spend in 2016. Due to project delay, spending

reduced to about $10 million in 2016

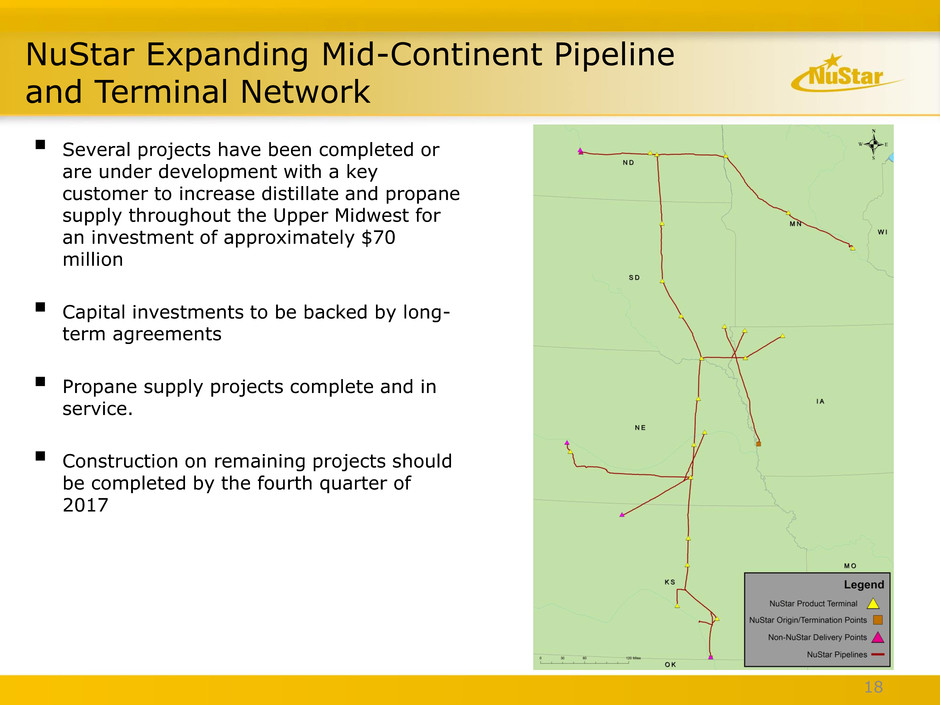

NuStar Expanding Mid-Continent Pipeline

and Terminal Network

Several projects have been completed or

are under development with a key

customer to increase distillate and propane

supply throughout the Upper Midwest for

an investment of approximately $70

million

Capital investments to be backed by long-

term agreements

Propane supply projects complete and in

service.

Construction on remaining projects should

be completed by the fourth quarter of

2017

18

Storage Segment

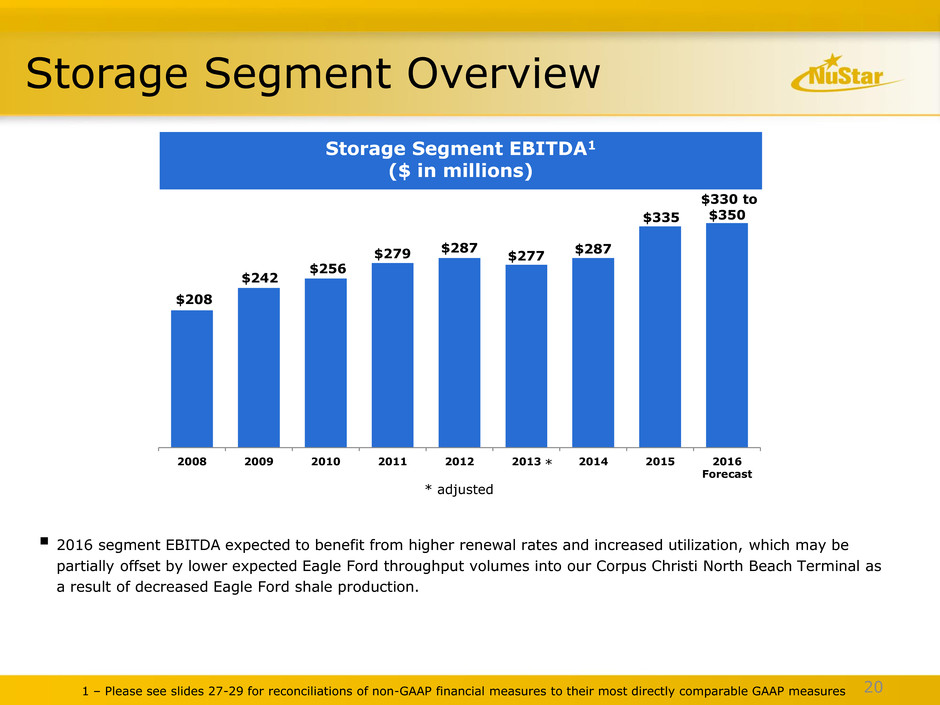

2016 segment EBITDA expected to benefit from higher renewal rates and increased utilization, which may be

partially offset by lower expected Eagle Ford throughput volumes into our Corpus Christi North Beach Terminal as

a result of decreased Eagle Ford shale production.

1 – Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

Storage Segment EBITDA1

($ in millions)

20

Storage Segment Overview

*

* adjusted

$208

$242

$256

$279 $287 $277

$287

$335

$330 to

$350

2008 2009 2010 2011 2012 2013 2014 2015 2016

Forecast

Piney Point Terminal

5.4 million-barrel storage facility located in Piney Point, Maryland, along the Potomac River

Primary storage capabilities include gasoline, distillates and other clean products

Reactivated due to favorable market economics

Recently signed up storage commitments for 1.8 million barrels

Contract allows customer to take advantage of the contango market structure

First delivery of 189,000 barrels of ULSD arrived on April 21, 2016

21

Piney Point Terminal Back in Service

22

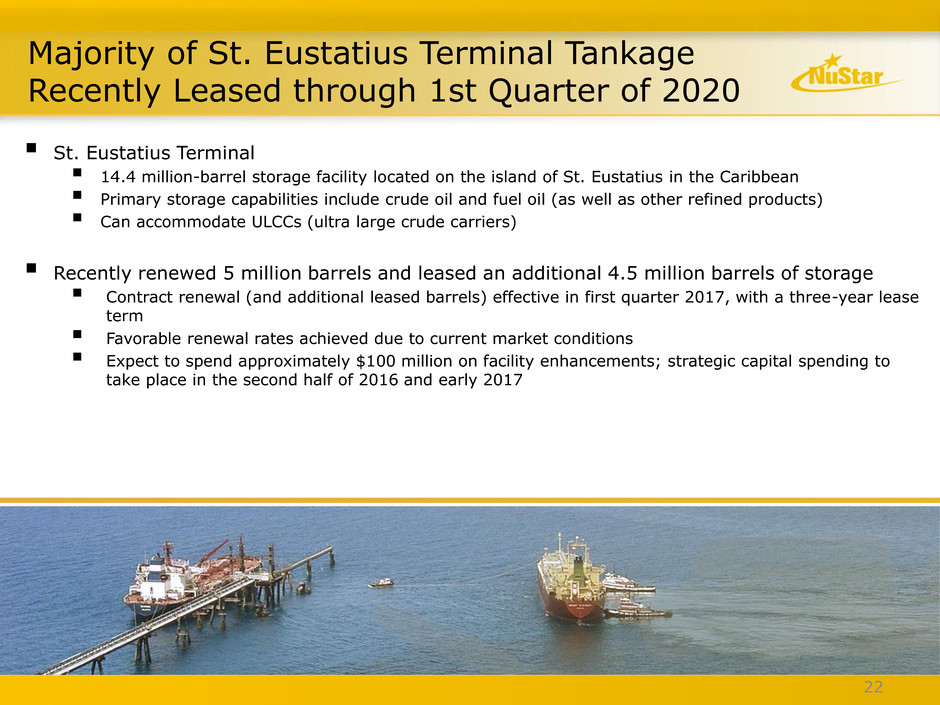

Majority of St. Eustatius Terminal Tankage

Recently Leased through 1st Quarter of 2020

St. Eustatius Terminal

14.4 million-barrel storage facility located on the island of St. Eustatius in the Caribbean

Primary storage capabilities include crude oil and fuel oil (as well as other refined products)

Can accommodate ULCCs (ultra large crude carriers)

Recently renewed 5 million barrels and leased an additional 4.5 million barrels of storage

Contract renewal (and additional leased barrels) effective in first quarter 2017, with a three-year lease

term

Favorable renewal rates achieved due to current market conditions

Expect to spend approximately $100 million on facility enhancements; strategic capital spending to

take place in the second half of 2016 and early 2017

22

Fuels Marketing Segment

Fuels Marketing Segment

Benefits Base Business

Segment is composed of:

Refined Products Marketing

Primarily butane blending, which is a consistent and low risk business

Bunkering

Crude & Fuel Oil Trading

Fuels Marketing Segment currently pays Storage Segment approximately $26 million

in annual storage fees

For storage otherwise idled or with challenging economics/locale

Represents around 4% of Storage Segment revenues

2016 EBITDA results for the segment are expected to be $5 to $20 million1

24 1 – Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

Appendix

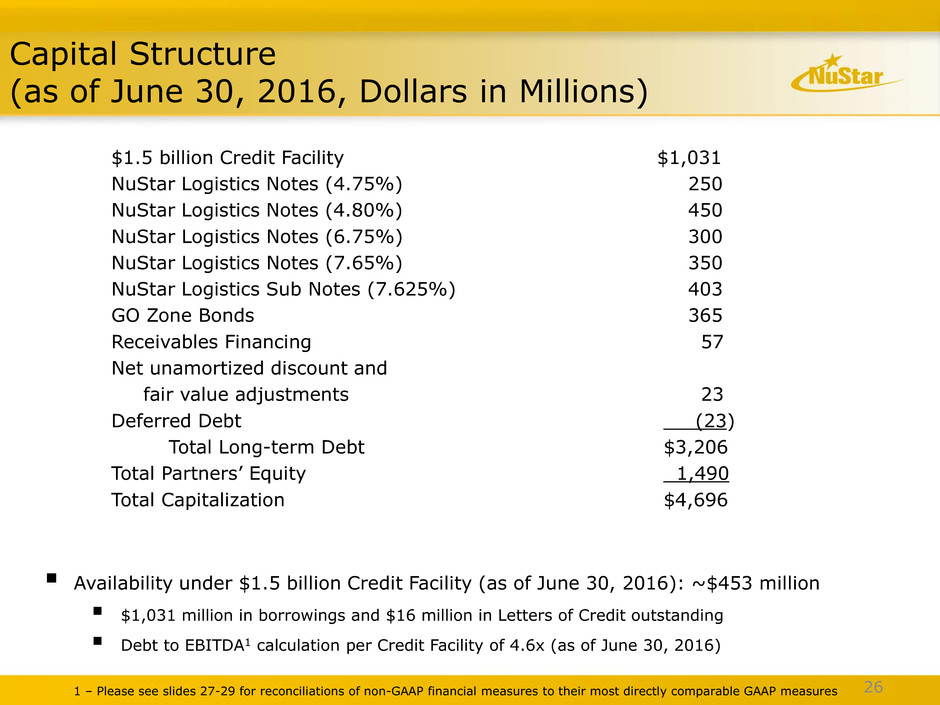

Capital Structure

(as of June 30, 2016, Dollars in Millions)

$1.5 billion Credit Facility $1,031

NuStar Logistics Notes (4.75%) 250

NuStar Logistics Notes (4.80%) 450

NuStar Logistics Notes (6.75%) 300

NuStar Logistics Notes (7.65%) 350

NuStar Logistics Sub Notes (7.625%) 403

GO Zone Bonds 365

Receivables Financing 57

Net unamortized discount and

fair value adjustments 23

Deferred Debt (23)

Total Long-term Debt $3,206

Total Partners’ Equity 1,490

Total Capitalization $4,696

Availability under $1.5 billion Credit Facility (as of June 30, 2016): ~$453 million

$1,031 million in borrowings and $16 million in Letters of Credit outstanding

Debt to EBITDA1 calculation per Credit Facility of 4.6x (as of June 30, 2016)

26 1 – Please see slides 27-29 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

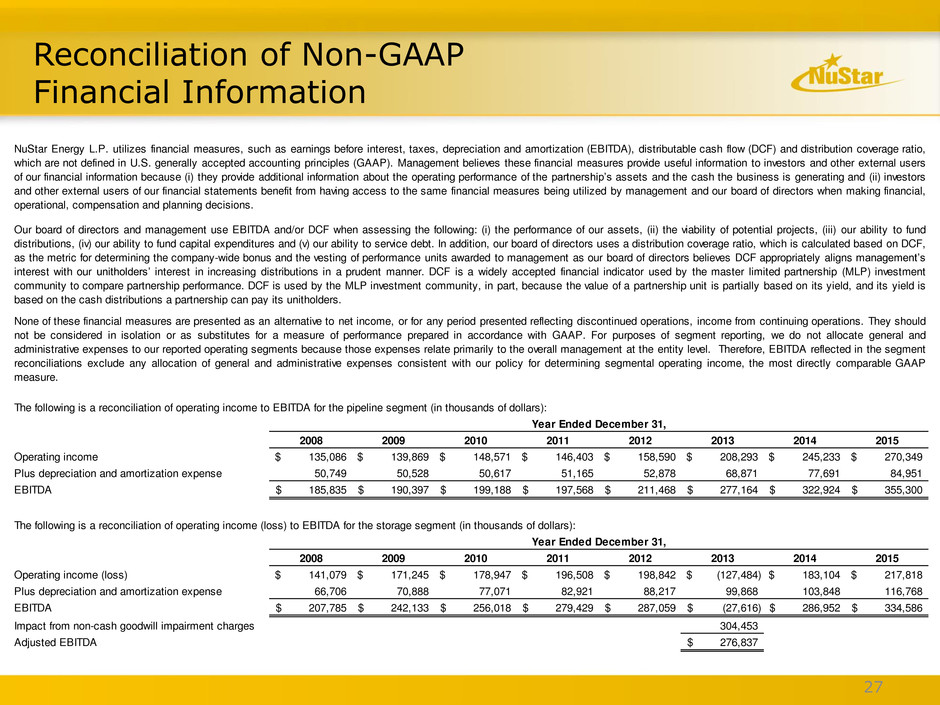

Reconciliation of Non-GAAP

Financial Information

27

2008 2009 2010 2011 2012 2013 2014 2015

Operating income 135,086$ 139,869$ 148,571$ 146,403$ 158,590$ 208,293$ 245,233$ 270,349$

Plus depreciation and amortization expense 50,749 50,528 50,617 51,165 52,878 68,871 77,691 84,951

EBITDA 185,835$ 190,397$ 199,188$ 197,568$ 211,468$ 277,164$ 322,924$ 355,300$

2008 2009 2010 2011 2012 2013 2014 2015

Operating income (loss) 141,079$ 171,245$ 178,947$ 196,508$ 198,842$ (127,484)$ 183,104$ 217,818$

Plus depreciation and amortization expense 66,706 70,888 77,071 82,921 88,217 99,868 103,848 116,768

EBITDA 207,785$ 242,133$ 256,018$ 279,429$ 287,059$ (27,616)$ 286,952$ 334,586$

Impact from non-cash goodwill impairment charges 304,453

Adjusted EBITDA 276,837$

Year Ended December 31,

Year Ended December 31,

The following is a reconciliation of operating income (loss) to EBITDA for the storage segment (in thousands of dollars):

NuStar Energy L.P. utilizes financial measures, such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF) and distribution coverage ratio,

which are not defined in U.S. generally accepted accounting principles (GAAP). Management believes these financial measures provide useful information to investors and other external users

of our financial information because (i) they provide additional information about the operating performance of the partnership’s assets and the cash the business is generating and (ii) investors

and other external users of our financial statements benefit from having access to the same financial measures being utilized by management and our board of directors when making financial,

operational, compensation and planning decisions.

The following is a reconciliation of operating income to EBITDA for the pipeline segment (in thousands of dollars):

Our board of directors and management use EBITDA and/or DCF when assessing the following: (i) the performance of our assets, (ii) the viability of potential projects, (iii) our ability to fund

distributions, (iv) our ability to fund capital expenditures and (v) our ability to service debt. In addition, our board of directors uses a distribution coverage ratio, which is calculated based on DCF,

as the metric for determining the company-wide bonus and the vesting of performance units awarded to management as our board of directors believes DCF appropriately aligns management’s

interest with our unitholders’ interest in increasing distributions in a prudent manner. DCF is a widely accepted financial indicator used by the master limited partnership (MLP) investment

community to compare partnership performance. DCF is used by the MLP investment community, in part, because the value of a partnership unit is partially based on its yield, and its yield is

based on the cash distributions a partnership can pay its unitholders.

None of these financial measures are presented as an alternative to net income, or for any period presented reflecting discontinued operations, income from continuing operations. They should

not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment reporting, we do not allocate general and

administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment

reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP

measure.

Reconciliation of Non-GAAP

Financial Information (continued)

28

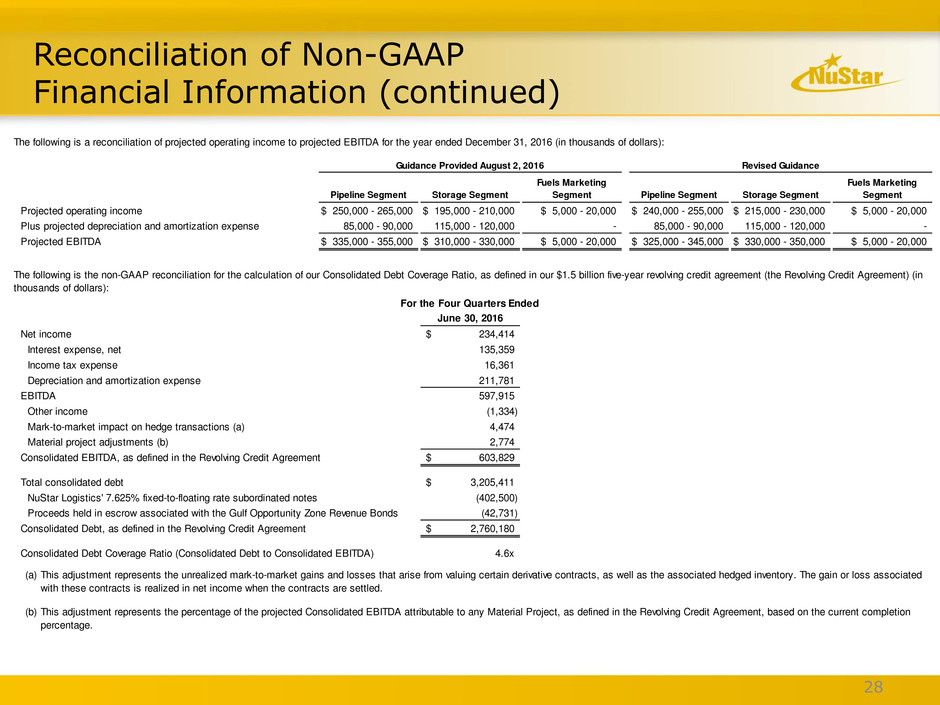

Pipeline Segment Storage Segment

Fuels Marketing

Segment Pipeline Segment Storage Segment

Fuels Marketing

Segment

Projected operating income $ 250,000 - 265,000 $ 195,000 - 210,000 $ 5,000 - 20,000 $ 240,000 - 255,000 $ 215,000 - 230,000 $ 5,000 - 20,000

Plus projected depreciation and amortization expense 85,000 - 90,000 115,000 - 120,000 - 85,000 - 90,000 115,000 - 120,000 -

Projected EBITDA $ 335,000 - 355,000 $ 310,000 - 330,000 $ 5,000 - 20,000 $ 325,000 - 345,000 $ 330,000 - 350,000 $ 5,000 - 20,000

June 30, 2016

Net income 234,414$

Interest expense, net 135,359

Income tax expense 16,361

Depreciation and amortization expense 211,781

EBITDA 597,915

Other income (1,334)

Mark-to-market impact on hedge transactions (a) 4,474

Material project adjustments (b) 2,774

Consolidated EBITDA, as defined in the Revolving Credit Agreement 603,829$

Total consolidated debt 3,205,411$

NuStar Logistics' 7.625% fixed-to-floating rate subordinated notes (402,500)

Proceeds held in escrow associated with the Gulf Opportunity Zone Revenue Bonds (42,731)

Consolidated Debt, as defined in the Revolving Credit Agreement 2,760,180$

C nsolidated Debt Coverage Ratio (Consolidated Debt to Consolidated EBITDA) 4.6x

(a)

(b)

This adjustment represents the unrealized mark-to-market gains and losses that arise from valuing certain derivative contracts, as well as the associated hedged inventory. The gain or loss associated

with these contracts is realized in net income when the contracts are settled.

This adjustment represents the percentage of the projected Consolidated EBITDA attributable to any Material Project, as defined in the Revolving Credit Agreement, based on the current completion

percentage.

The following is the non-GAAP reconciliation for the calculation of our Consolidated Debt Coverage Ratio, as defined in our $1.5 billion five-year revolving credit agreement (the Revolving Credit Agreement) (in

thousands of dollars):

The following is a reconciliation of projected operating income to projected EBITDA for the year ended December 31, 2016 (in thousands of dollars):

For the Four Quarters Ended

Guidance Provided August 2, 2016 Revised Guidance

Reconciliation of Non-GAAP

Financial Information (continued)

29

Jun. 30, 2014 Sept. 30, 2014 Dec. 31, 2014 Mar. 31, 2015 Jun. 30, 2015 Sept. 30, 2015 Dec. 31, 2015 Mar. 31, 2016 Jun. 30, 2016

Income from continuing operations (139,637)$ (116,202)$ 214,169$ 298,298$ 295,436$ 301,335$ 305,946$ 236,222$ 234,414$

Interest expense, net 128,196 132,208 131,226 129,901 129,603 130,044 131,868 133,954 135,359

Income tax expense 10,753 14,983 10,801 9,071 10,310 10,281 14,712 15,195 16,361

Depreciation and amortization expense 186,216 188,570 191,708 197,935 202,764 206,466 210,210 210,895 211,781

EBITDA from continuing operations 185,528$ 219,559$ 547,904$ 635,205$ 638,113$ 648,126$ 662,736$ 596,266$ 597,915$

Equity in (earnings) losses of joint ventures 19,711 11,604 (4,796) (9,102) (5,808) (3,059) - - -

Interest expense, net (128,196) (132,208) (131,226) (129,901) (129,603) (130,044) (131,868) (133,954) (135,359)

Reliability capital expenditures (35,473) (29,862) (28,635) (30,674) (29,464) (32,439) (40,002) (39,221) (44,497)

Income tax expense (10,753) (14,983) (10,801) (9,071) (10,310) (10,281) (14,712) (15,195) (16,361)

Distributions from joint venture 6,398 8,048 7,587 7,721 6,993 4,208 2,500 - -

Mark-to-market impact of hedge transactions (a) 7,200 (90) 6,125 4,991 (261) (132) (5,651) 152 4,474

Unit-based compensation (b) - - - - - - - 1,086 2,208

Other items (c) 322,044 323,764 19,732 (34,471) (36,351) (41,628) (44,032) 10,110 11,518

DCF from continuing operations 366,459$ 385,832$ 405,890$ 434,698$ 433,309$ 434,751$ 428,971$ 419,244$ 419,898$

Less DCF from continuing operations available

to general partner 51,064 51,064 51,064 51,064 51,064 51,064 51,064 51,064 51,064

DCF from continuing operations available

to limited partners 315,395$ 334,768$ 354,826$ 383,634$ 382,245$ 383,687$ 377,907$ 368,180$ 368,834$

Distributions applicable to limited partners 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$

Distribution coverage ratio (d) 0.92x 0.98x 1.04x 1.12x 1.12x 1.12x 1.11x 1.08x 1.08x

(a)

(b)

(c)

(d) Distribution coverage ratio is calculated by dividing DCF from continuing operations available to limited partners by distributions applicable to limited partners.

Other items mainly consist of (i) adjustments for throughput deficiency payments and construction reimbursements for all periods presented, (ii) a $56.3 million non-cash gain associated with the Linden

terminal acquisition on January 2, 2015 inlcuded in other income in our statements of income and (iii) a non-cash goodwill impairment charge totaling $304.5 million in the fourth quarter of 2013.

The following is a reconciliation of income from continuing operations to EBITDA from continuing operations and DCF from continuing operations (in thousands of dollars):

For the Twelve Months Ended

DCF from continuing operations excludes the impact of unrealized mark-to-market gains and losses that arise from valuing certain derivative contracts, as well as the associated hedged inventory. The

gain or loss associated with these contracts is realized in DCF from continuing operations when the contracts are settled.

In connection with the employee transfer from NuStar GP, LLC on March 1, 2016, we assumed obligations related to awards issued under a long-term incentive plan, and we intend to satisfy the

vestings of equity-based awards with the issuance of our units. As such, the expenses related to these awards are considered non-cash and added back to DCF. Certain awards include distribution

equivalent rights (DERs). Payments made in connection with DERs are deducted from DCF.