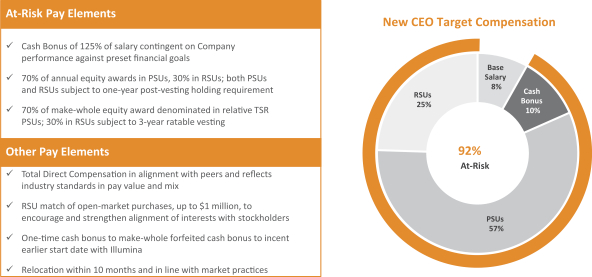

grant date value of $10,000,000, and with the 2024 grant consisting of 70% PSUs and 30% RSUs, with all such annual grants subject to a one-year post-vesting holding period (other than for shares necessary to satisfy tax obligations); and (iv) a fixed monthly cash stipend of $15,000 until the earlier of (1) Mr. Thaysen’s relocation to the San Diego area and (2) June 30, 2024 (intended to cover expenses incurred by Mr. Thaysen in connection with his travel to the San Diego area until his relocation).

In order to incentivize Mr. Thaysen to join Illumina, the Thaysen Offer Letter also provided for make-whole awards to replace compensation that Mr. Thaysen would forfeit with his prior employer, including the make-whole equity awards described above under “Make-Whole Awards and Matching RSUs”. Since Mr. Thaysen’s prior employer had a fiscal year ending October 31, 2023 and expected to pay annual bonuses in the fourth quarter of 2023, to induce Mr. Thaysen to commence employment with Illumina in September, we agreed to provide him with a $500,000 sign-on bonus to replace the value of his forfeited annual incentive award. In response to stockholder feedback and to prevent “pay for failure upon separation”, the sign-on bonus is subject to clawback if Mr. Thaysen’s employment terminates prior to the second anniversary of his start date, other than a termination by Illumina without “cause” or a termination that entitles Mr. Thaysen to change-in-control severance benefits as described above. In addition, the Thaysen Offer Letter also provides for the grant of matching RSUs described above under “Make-Whole Awards and Matching RSUs”.

Executive Transitions

In fiscal 2023 and early 2024, Mr. deSouza, Drs. Aravanis and Febbo, and Mses. Reeves and Tousi ceased employment with Illumina. In connection with their resignations, we did not enter into any termination or severance agreements with Mr. deSouza, Dr. Aravanis or Ms. Tousi. Mr. deSouza’s employment ended effective June 11, 2023, and he forfeited his FY23 VCP payout. Dr. Aravanis’ employment ended on August 18, 2023, and he received payout for FY23 1H VCP and forfeited his FY23 2H VCP payout. Ms. Tousi’s employment ended on January 5, 2024, and she received a payout for FY23 1H VCP and forfeited her FY23 2H VCP payout. All unvested equity awards were forfeited by these executives upon their departure.

As part of an organizational realignment, the Company entered into a Separation Agreement consistent with our current practice and in line with market benchmarks, dated as of September 5, 2023, pursuant to which Dr. Febbo received payments equal to (i) one year of his annual base salary ($600,000) and (ii) group health insurance premiums under COBRA for a period of 12 months. Dr. Febbo was also entitled to access certain executive physical benefits during the 2023 calendar year. While Dr. Febbo received a payout for FY23 1H VCP, he forfeited his FY23 2H VCP payout. All of Dr. Febbo’s unvested equity awards were forfeited upon his departure, which was effective August 7, 2023.

As part of an organizational realignment, the Company entered into a Separation Agreement consistent with our current practice and in line with market benchmarks, dated as of March 19, 2024, pursuant to which Ms. Reeves received payments equal to (i) one year of her annual base salary ($550,000), (ii) sixty days’ notice ($91,667), and (iii) group health insurance premiums under COBRA for a period of 12 months. Ms. Reeves received a payout for FY23 1H VCP and no payout for FY23 2H VCP as it was not achieved. All of Ms. Reeve’s unvested equity awards were forfeited upon her departure, which was effective March 22, 2024.

Other Benefits and Perquisites

We do not provide pension arrangements or post-retirement health coverage for our executives or employees, other than the change-in-control severance benefits discussed above. Our executive officers are eligible to participate in a Company-sponsored executive health screening program in addition to being offered medical

Illumina, Inc. 2024 Proxy Statement • 61