PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION

[•], 2023

Notice of Annual Meeting and Proxy Statement

| Date: | [•], 2023 | |

| Time: | [•] (Pacific time) |

This year’s annual meeting will be a completely virtual meeting of stockholders.

|

To participate, vote, or submit questions 30 minutes before and during the annual meeting via live webcast, please visit: [•]. There will not be a physical location for the annual meeting.

|

The agenda for this year’s annual meeting includes the following items:

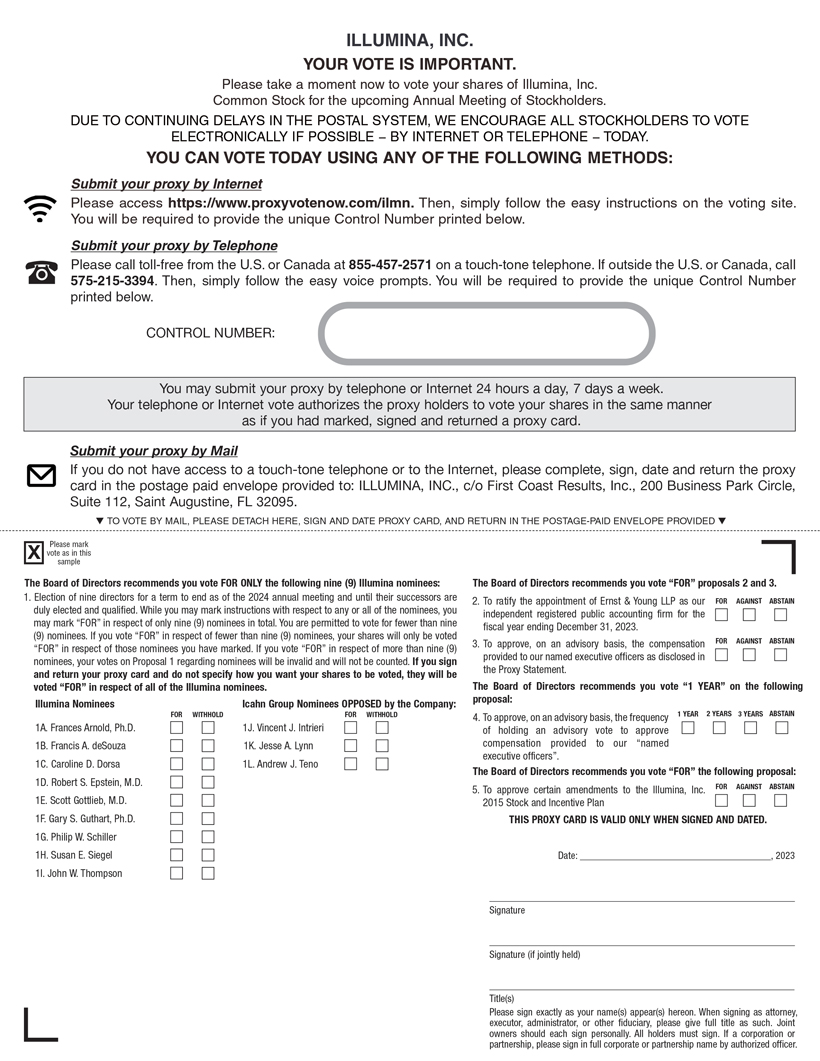

| 1. | Elect nine nominees to our Board of Directors; |

| 2. | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | Hold an advisory vote to approve the compensation provided to the “named executive officers” as disclosed in the proxy statement; |

| 4. | Hold an advisory vote on the frequency of holding an advisory vote to approve compensation provided to our “named executive officers”; |

| 5. | Hold a vote to approve certain amendments to the Illumina, Inc. 2015 Stock and Incentive Plan; and |

| 6. | Transact such other business as may properly come before the meeting and any adjournment or postponement. |

Please note that Icahn Partners LP, Icahn Partners Master Fund LP and Matsumura Fishworks LLC, along with other entities affiliated with Carl Icahn (collectively, the “Icahn Group”), have provided notice of their intent to nominate three nominees for election as directors at the annual meeting in opposition to the nominees recommended by the Board of Directors. You may receive solicitation materials from the Icahn Group, including proxy statements and [•] proxy cards. Illumina is not responsible for the accuracy or completeness of any information provided by or relating to the Icahn Group or its nominees contained in solicitation materials filed or disseminated by or on behalf of the Icahn Group or any other statements the Icahn Group may make.

The Board of Directors does not endorse the Icahn Group nominees, and unanimously recommends that you “WITHHOLD” your vote from the Icahn Group’s nominees.

The Board of Directors unanimously recommends that you vote “FOR” only the nominees proposed by the Board of Directors, “FOR” the other proposals recommended by the Board, and “AGAINST” the proposal made by a shareholder on the WHITE proxy card. The Board strongly urges you to discard and NOT to vote using any [•] proxy card sent to you by the Icahn Group. If you have already submitted a [•] proxy card, you can revoke that proxy and vote for your Board of Directors’ nominees and on the other matters to be voted on at the annual meeting by marking, signing and dating the enclosed WHITE proxy card and returning it in the enclosed postage-paid envelope or by voting via Internet by following the instructions on your WHITE proxy card or WHITE voting instruction form. Only your latest validly executed proxy will count and any proxy may be revoked at any time prior to its exercise at the annual meeting as described in the accompanying proxy statement.

Stockholders as of the record date of [•], 2023, are entitled to notice of and to vote on the matters listed in the proxy statement.

By Order of the Board of Directors,

CHARLES DADSWELL

General Counsel and Secretary