FY13 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 29, 2013

or

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to . |

Commission file number: 001-35406

Illumina, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 33-0804655 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

5200 Illumina Way San Diego, California | | 92122 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (858) 202-4500

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

| | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of January 31, 2014, there were 128.2 million shares (excluding 47.5 million shares held in treasury) of the Registrant’s Common Stock outstanding. The aggregate market value of the Common Stock held by non-affiliates of the Registrant as of June 30, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), based on the closing price for the Common Stock on The NASDAQ Global Select Market on June 28, 2013 (the last trading day before June 30, 2013), was $6.9 billion. This amount excludes an aggregate of approximately 33.3 million shares of Common Stock held by officers and directors and each person known by the registrant to own 10% or more of the outstanding Common Stock. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that the registrant is controlled by or under common control with such person.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2014 annual meeting of stockholders are incorporated by reference into Items 10 through 14 of Part III of this Report.

ILLUMINA, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 29, 2013

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

This annual report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements discuss our current expectations concerning future results or events, including our future financial performance. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. These statements include, among others:

| |

• | statements concerning our expectations as to our future financial performance, results of operations, or other operational results or metrics; |

| |

• | statements concerning the benefits that we expect will result from our business activities and certain transactions we have completed, such as product introductions, increased revenue, decreased expenses, and avoided expenses and expenditures; and |

| |

• | statements of our expectations, beliefs, future plans and strategies, anticipated developments (including new products and services), and other matters that are not historical facts. |

These statements may be made expressly in this document or may be incorporated by reference to other documents we have filed or will file with the Securities and Exchange Commission, or SEC. You can identify many of these statements by looking for words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology and similar references to future periods. These forward-looking statements are subject to numerous assumptions, risks, and uncertainties that may cause actual results or events to be materially different from any future results or events expressed or implied by us in those statements. Many of the factors that will determine or affect these results or events are beyond our ability to control or project. Specific factors that could cause actual results or events to differ from those in the forward-looking statements include:

| |

• | our ability to maintain our revenue levels and profitability during periods of research funding reduction or uncertainty and adverse economic and business conditions, including as a result of slowing or uncertain economic growth in the United States or worldwide; |

| |

• | our ability to further develop and commercialize our instruments and consumables and to deploy new products, services, and applications, and expand the markets, for our technology platforms; |

| |

• | our ability to manufacture robust instrumentation and consumables; |

| |

• | our ability to successfully identify and integrate acquired technologies, products, or businesses; |

| |

• | our expectations and beliefs regarding future prospects and growth of the business and the markets in which we operate; |

| |

• | the assumptions underlying our critical accounting policies and estimates; |

| |

• | our assessments and estimates that determine our effective tax rate; |

| |

• | our assessments and beliefs regarding the future outcome of pending legal proceedings and the liability, if any, that we may incur as a result of those proceedings; and |

| |

• | other factors detailed in our filings with the SEC, including the risks, uncertainties, and assumptions described in Item 1A “Risk Factors” below, or in information disclosed in public conference calls, the date and time of which are released beforehand. |

Our forward-looking statements speak only as of the date of this annual report. We undertake no obligation, and do not intend, to publicly update or revise forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of any current financial quarter, whether as a result of new information, future events, or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this annual report. Given these uncertainties, we caution investors not to unduly rely on our forward-looking statements.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on our website, www.illumina.com. The information on our website is not incorporated by reference into this report. Such reports are made available as soon as reasonably practicable after filing with, or furnishing to, the SEC. The SEC also maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that electronically file with the SEC. Copies of our annual report on Form 10-K will be made available, free of charge, upon written request.

_______________________________________

Illumina®, illuminaDx, BaseSpace®, BeadArray, BeadXpress®, BlueGnome®, cBot, CSPro®, DASL®, DesignStudio, Epicentre®, GAIIx, Genetic Energy, Genome Analyzer, GenomeStudio®, GoldenGate®, HiScan®, HiSeq®, HiSeq X, Infinium®, iSelect®, MiSeq®, MiSeqDx, NeoPrep, NextBio®, Nextera®, NextSeq, SeqMonitor, Solexa®, TruGenome, TruSeq®, TruSight, Understand Your Genome, UYG, VeraCode®, the pumpkin orange color, and the Genetic Energy streaming bases design are certain of our trademarks. This report also contains brand names, trademarks, or service marks of companies other than Illumina, and these brand names, trademarks, and service marks are the property of their respective holders.

_______________________________________

Unless the context requires otherwise, references in this annual report on Form 10-K to “Illumina,” the “Company,” “we,” “us,” and “our” refer to Illumina, Inc. and its subsidiaries.

PART I

ITEM 1. Business.

Overview

We are a leading developer, manufacturer, and marketer of life science tools and integrated systems for the analysis of genetic variation and function. We were incorporated in California in April 1998 and reincorporated in Delaware in July 2000. Our principal executive offices are located at 5200 Illumina Way, San Diego, California 92122. Our telephone number is (858) 202-4500.

Using our proprietary technologies, we provide innovative sequencing- and array-based solutions for genotyping, copy number variation analysis, methylation studies, and gene expression profiling of DNA and RNA. Our customers include leading genomic research centers, academic institutions, government laboratories, hospitals, and reference laboratories as well as pharmaceutical, biotechnology, agrigenomics, commercial molecular diagnostic, and consumer genomics companies.

Our broad portfolio of systems, consumables, and analysis tools are designed to accelerate and simplify genetic analysis. This portfolio addresses a range of genomic complexity, price points, and throughputs, enabling customers to select the best solution for their scientific challenge. Our leading edge sequencing instruments can be used to efficiently perform a range of nucleic acid (DNA, RNA) analyses on large numbers of samples. For more focused studies, our array-based solutions provide ideal tools to perform genome-wide association studies (GWAS) involving single-nucleotide polymorphism, genotyping and copy number variation analyses, as well as gene expression profiling, and other DNA and RNA studies.

To provide our customers with more comprehensive sample-to-answer workflow solutions, we acquired: NextBio, a leader in clinical and genomic informatics, in November 2013; Advanced Liquid Logic Inc., a leader in digital microfluidics and liquid handling solutions, in July 2013; and Epicentre Technologies Corporation, a leading provider of nucleic acid sample preparation reagents and specialty enzymes for sequencing and microarray applications, in 2011.

Over the last two years, we have taken significant steps to support our goal of becoming a leader in the reproductive health market by acquiring Verinata Health, Inc. (Verinata) in February 2013 and BlueGnome Ltd. (BlueGnome) in 2012. Our acquisition of Verinata further strengthened our focus on reproductive health by adding to our portfolio Verinata’s verifi® prenatal test, a comprehensive non-invasive prenatal test (NIPT) for high-risk pregnancies, and what we believe to be the most comprehensive intellectual property portfolio in the NIPT industry. Our acquisition of BlueGnome, a leading provider of genetic solutions for the screening of chromosomal abnormalities and genetic variations associated with developmental delay, cancer, and infertility, expanded our ability to establish integrated solutions in reproductive health and cancer.

Industry Background

Genetics Primer

The instruction set for all living cells is encoded in deoxyribonucleic acid, or DNA, with the complete set of DNA for any organism referred to as its genome. DNA contains small regions called genes, which comprise a string of nucleotide bases labeled A, C, G, and T, representing adenine, cytosine, guanine, and thymine, respectively. These nucleotide bases are present in a precise order known as the DNA sequence. When a gene is “expressed,” a partial copy of its DNA sequence - called messenger RNA (mRNA) - is used as a template to direct the synthesis of a particular protein. Proteins, in turn, direct all cellular function. The illustration below is a simplified gene expression schematic.

Variations among organisms are due, in large part, to differences in their DNA sequences. Changes caused by insertions, deletions, inversions, translocations, or duplications of nucleotide bases may result in certain genes becoming over-expressed (excessive protein production), under-expressed (reduced protein production), or silenced altogether, sometimes triggering changes in cellular function. These changes can be the result of heredity, but most often they occur at random. The most common form of variation in humans is called a single nucleotide polymorphism (SNP), which is a variation in a single position of a nucleotide base in a DNA sequence. Copy number variations (CNVs) occur when there are fewer or more copies of certain genes, segments of a gene, or stretches of DNA.

In humans, genetic variation accounts for many of the physical differences we see (e.g., height, hair, eye color, etc.). More importantly, these genetic variations can have medical consequences affecting disease susceptibility, including predisposition to complex genetic diseases such as cancer, diabetes, cardiovascular disease, and Alzheimer’s disease. They can also impact an individual’s response to certain drug treatments, causing them to respond well, not respond at all, or experience adverse side effects - an area of study known as pharmacogenomics.

Scientists are studying these variations and their consequences in humans, as well as a broad range of animals, plants, and microorganisms. Researchers investigating human, viral, and bacterial genetic variation are helping us to better understand the mechanisms of disease, and thereby develop more effective therapeutics and diagnostics. Greater insight into genetic variation in plants (e.g., food and biofuel crops) and animals (e.g., livestock and domestic animals) is enabling scientists to improve crop yields and animal breeding programs.

The methods for studying genetic variation and biological function include sequencing, SNP genotyping, CNV analysis, gene expression profiling, and gene regulation and epigenetic analysis, each of which is addressed by our breadth of products and services.

Life Sciences Research Primer

Life science research encompasses the study of all living things, from humans, animals, and plants, to viruses and bacteria. It is being performed in government, university, pharmaceutical, biotechnology, and agrigenomics laboratories around the world, where scientists are seeking to expand our knowledge of the biological functions essential for life. Beginning at the genetic level, where our tools are used to elucidate the correlation between gene sequence and biological processes, life science research expands to include the study of the cells, tissues, organs, systems, and other components that make up living organisms. This research supports development of new, more effective clinical diagnostics and medicines to improve human health, as well as advances in agriculture and animal husbandry to meet the world’s growing needs for food and energy.

Molecular Diagnostics Primer

Molecular diagnostic assays (or tests) are designed to identify the biological indicators linked with disease and drug response, providing physicians with information to more effectively diagnose, treat, and monitor both acute and chronic disease conditions. They are an integral part of personalized healthcare, where the unique makeup of each individual can be taken into account in diagnosing disease and managing treatment through the use of precision therapies. Biological indicators that can be measured by these assays include protein or gene expression, methylation levels, copy number variations, and the presence or absence of a specific gene or group of genes.

There are molecular diagnostics assays in development and on the market, including assays for infectious disease, cancer, and heart disease, as well as molecular-based drug metabolism and response assays to help physicians understand a patient’s disease risk profile or to select the most effective therapy with the fewest side effects. Our innovative technologies and products are contributing to the development of a wide range of genomic-based molecular diagnostics assays, including our own FDA-cleared MiSeqDx Cystic Fibrosis System, which offers a complete solution for accurate, comprehensive cystic fibrosis testing.

Increased public knowledge about ancestral and genealogical information derived from genomic data and the clinical relevance of genetic markers has prompted consumer interest in having personal genomes analyzed, sparking the development of the consumer genomics market. Several companies, including Illumina, now offer personal sequencing or genotyping services, working with physician groups and genetic counselors to interpret the results for consumers.

We believe the growth in consumer genomics and the use of genomic-based diagnostic assays will trigger a fundamental shift in the practice of medicine and the economics of the pharmaceutical industry and health care by facilitating an increased emphasis on preventative and predictive molecular medicine, ushering in the era of personalized healthcare.

Our Principal Markets

We believe that genomics will play an increasingly important role in molecular biology, and that by empowering genetic analysis, our tools will advance disease research, drug development, and the creation of molecular diagnostic tests. In addition to developing sequencing- and array-based solutions for life science, applied, and consumer genomics markets, we are facilitating the transition of sequencing to the clinic, by supporting and carrying out clinical trials to gather data for regulatory submissions in the United States and globally, and establishing infrastructure to offer products designed and manufactured in compliance with global quality standards for medical devices. Effective December 30, 2013, we realigned our business to target the markets and customers outlined below on a more comprehensive basis.

Life Sciences

Historically, our core business has been in the life sciences research market, which consists of laboratories generally associated with universities, medical research centers, and government institutions, as well as biotechnology and pharmaceutical companies. Researchers at these institutions are using our products and services in a broad spectrum of scientific activities, such as: next-generation sequencing, mid-to-high-complexity genotyping and gene expression (for whole-genome discovery and profiling), and low complexity genotyping and gene expression (for high-throughput targeted screening). Sequencing is growing the most rapidly among these three areas due to the improved performance of next generation sequencing technologies. It is fueled by private and public funding, new global initiatives to broadly characterize genetic variation, and the migration of legacy genetic applications to sequencing-based technologies.

We also provide products and services for other life sciences applied markets, such as the agricultural genomics market, where government and corporate researchers use our sequencing- and array-based tools to accelerate and enhance agricultural research to help identify desirable traits in plants and animals, leading to healthier and more productive crops and livestock.

Reproductive and Genetic Health

Our technologies and products provide reproductive health solutions ranging from preimplantation genetic screening (PGS), preimplantation genetic diagnosis (PGD), non-invasive prenatal testing (NIPT), as well as neonatal and genetic health testing. Our PGS solutions are used in connection with in-vitro fertilizations (IVF) to determine, before implantation, whether an embryo has an abnormal number of chromosomes, which is a major cause of IVF failure and miscarriages. In IVF cases where there is a family history of disease or when one or both parents are carriers for certain genetic conditions, our PGD solutions identify, before implantation, which embryos have genes associated with severe genetic disorders. Our NIPT solutions provide non-invasive tests for early identification of fetal chromosomal abnormalities by analyzing cell-free DNA in maternal blood, and our neonatal and carrier screening solutions provide early identification of genetic disorders in newborns as well as adults who are considering their reproductive options.

Oncology

Cancer is a disease of the genome, and the goal of cancer genomics is to identify genomic changes that transform a normal cell into a cancerous one. Understanding these genomic changes may lead to a more accurate diagnosis, a better understanding of the prognosis, and the selection of individually targeted therapies. Our sequencing- and array-based solutions provide researchers and clinicians in the research, translational, and clinical oncology markets with tools to identify the

molecular changes in a tumor, during all stages of tumor progression, transform discoveries into new treatments or therapies for cancer patients, and create diagnostic tests to identify patients most likely to be helped or harmed by a particular treatment or therapy.

Enterprise Informatics

Enterprise informatics solutions increase the utility of genomic data by providing tools that allow customers to analyze, archive, and share genomic data. The integration of our instruments with data analysis software solutions allow customers to go from raw genomic data to meaningful results. Our BaseSpace genomics analysis platform, which can be hosted onsite or in a cloud-based system, integrates directly with our sequencing instruments to streamline sequencing-data analysis, facilitate data sharing, provide data storage solutions, and provide access to a growing number of data analysis applications.

In 2013, we acquired NextBio, which provides a platform for aggregating and analyzing large quantities of genomic and phenotypic data for research and clinical applications. Ultimately, we believe that large-scale genomic databases containing both genomic and phenotypic information will enhance the value of human genome sequencing and accelerate the pace of discovery.

New and Emerging Markets

Our markets are characterized by rapid change and innovation brought about by next generation sequencing, and new applications and opportunities appear and evolve quickly. Through our new and emerging market business unit we assess new opportunities against our corporate strategies and consider whether there is a compelling unmet need and the opportunity to transform the market with our products and services. Some of the markets that provide immediate and near-term opportunities to expand the use of next generation sequencing include: transplant diagnostics, where sequencing is used to evaluate donor and patient compatibility; forensic genomics, where sequencing is used to investigate criminal cases; consumer genomics, where genotyping is primarily used to reveal ancestry and genealogical linkage information; and population sequencing, where sequencing is used to catalogue the complete spectrum of genetic variation in large populations.

Our Principal Technologies

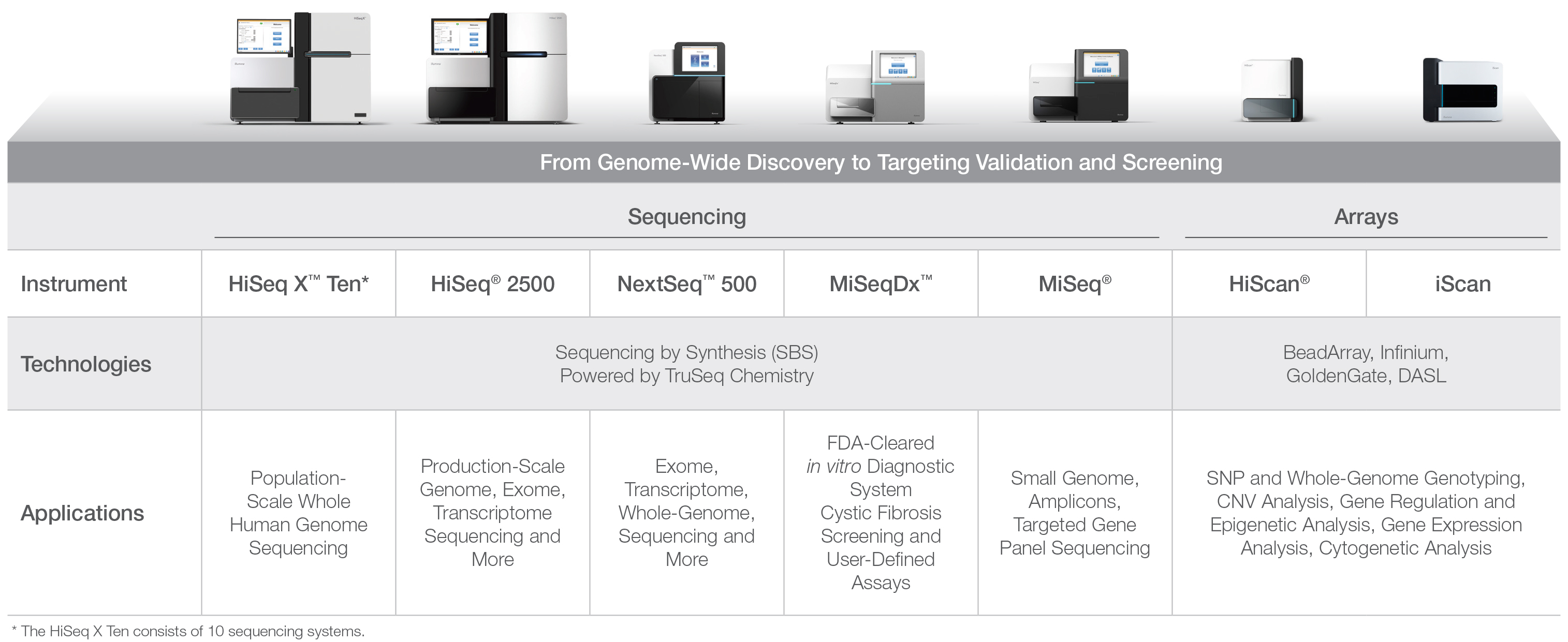

Our unique technology platforms enable the scale of experimentation necessary for population-scale studies, genome-wide discovery, target selection, and validation studies (see Figure 1 below). More than 10,000 customer-authored scientific papers have been published to date using these technologies, representing the efforts of a large and dynamic Illumina user community. Through rapid innovation, we are changing the economics of genetic research, enabling projects that were previously considered unapproachable.

Figure 1: Illumina Platform Overview:

Sequencing Technology

DNA sequencing is the process of determining the order of nucleotide bases (A, C, G, or T) in a DNA sample. Our portfolio of sequencing platforms represents a family of systems that we believe are setting the standard for productivity, cost-effectiveness, and accuracy among next-generation sequencing technologies. They are used by customers to perform whole-genome, de novo, exome, and targeted re-sequencing of genomes, and to analyze specific gene regions and genes.

Whole-genome sequencing determines an organism’s complete DNA sequence. In de novo sequencing, the goal is to sequence a representative sample from a species never before sequenced. In targeted re-sequencing, a sequence of nucleotide bases is compared to a standard or reference sequence from a previously sequenced species to identify changes that reflect genetic variation. Understanding the similarities and differences in DNA sequence between and within species furthers our understanding of the function of the structures encoded in the DNA.

Our DNA sequencing technology is based on our proprietary reversible terminator-based sequencing chemistry, referred to as sequencing by synthesis (SBS) biochemistry, and tracks the addition of labeled nucleotides as the DNA chain is copied - in a massively parallel fashion. Our SBS sequencing technology provides researchers with a broad range of applications and the ability to sequence even large mammalian genomes in days rather than weeks or years. Our highest throughput sequencing instrument, the HiSeq X, has the ability to generate up to 1.8 terabases (Tb) (16 human genomes) of DNA sequence in less than three days. Since the launch of our first sequencing system in 2007, our systems have reduced the cost of sequencing by more than a factor of 10,000 and decreased the sequencing time per gigabase (Gb) by nearly a factor of 2,000.

BeadArray Technology

Our BeadArray technology combines microscopic beads and a substrate in a proprietary manufacturing process to produce arrays that can perform many assays simultaneously, enabling large-scale analysis of genetic variation and biological function in a unique high-throughput, cost effective, and flexible manner. The arrays manufactured using BeadArray technology are imaged by our HiScan and iScan systems for a broad range of DNA and RNA analysis applications including SNP discovery, SNP genotyping, CNV analysis, gene expression analysis, and methylation analysis.

Our proprietary BeadArray technology consists of microscopic silica beads, with each bead covered with hundreds of thousands of copies of oligonucleotides, or oligos, that act as the capture sequences in one of our assays. We deploy our BeadArray technology on BeadChips - silicon wafers the size of a microscope slide, with varying numbers of sample sites per slide. BeadChips are chemically etched to create tens of millions of wells for each sample site.

Using our BeadArray technology, we achieve high-throughput analysis with a high density of test sites per array, and are able to format arrays in various configurations. We seek to maximize cost effectiveness by reducing use of expensive consumables and valuable samples, and through the low manufacturing costs associated with our technologies. Our ability to vary the size, shape, and format of the well patterns and to create specific bead pools for different applications provides the flexibility to address multiple markets and market segments.

Our Products

Our products give our customers the ability to analyze the genome at any level of complexity, from whole-genome sequencing to targeted panels, and enable us to serve a number of markets, including research, agriculture, reproductive and genetic health, oncology, pharmaceuticals, commercial molecular diagnostic, and consumer genomics companies.

The majority of our product sales consist of instruments and consumables (which include reagents, flow cells, and BeadChips) based on our proprietary technologies. For the fiscal years ended December 29, 2013, December 30, 2012, and January 1, 2012, instrument sales comprised 26%, 27%, and 35%, respectively, of total revenues, and consumable sales represented 62%, 64%, and 56%, respectively, of total revenues.

Sequencing Platforms

Based on our proprietary SBS technology, our next-generation sequencing platforms are designed to meet the workflow, output, and accuracy demands of a full range of sequencing applications. Our sequencing platforms can generate between 500 Mb and 1.8 Tb of genomic data, depending on the instrument and application, at different price points per Gb and for different applications ranging from small genome, amplicon, and targeted gene panel sequencing to population-scale whole human genome sequencing.

Array Platforms

The HiScan and iScan Systems are dedicated array scanners that support the rapid, sensitive, and accurate imaging of our array-based genetic analysis products. They incorporate high-performance lasers, optics, and detection systems, delivering sub-micron resolution and unmatched throughput rates. The HiScan and iScan support our Infinium, GoldenGate, DASL, gene expression, and methylation assays.

Consumables

We have developed a variety of sample preparation and sequencing kits to simplify workflows and accelerate analysis. Our sequencing applications include whole-genome sequencing kits, which enable sequencing of entire genomes of any size and complexity, and targeted resequencing kits, which enable sequencing of exomes, specific genes, or other genomic regions of interest. Our sequencing kits enable researchers to extend read lengths, achieve higher Gb of mappable data, and deliver the highest yield of perfect reads to maximize the ability to accurately characterize the target genome. Through our acquisition of Epicentre Technologies Corporation in 2011, we acquired the proprietary Nextera technology for next-generation sequencing library preparation. This technology has enabled us to offer sequencing library preparation kits with lower sample input requirements that greatly simplify genetic analysis workflows and significantly reduce the time from sample preparation to answer.

Our array-based genotyping consumables enable customers to perform a wide-range of analyses, including analyzing diversity across a species, disease-related mutations, and genetic characteristics associated with cancer. Customers may select from a range of human, animal, and agriculturally relevant genome panels or create their own custom arrays that can be used to investigate up to 1,000,000 genetic markers targeting any species.

Our Services

In addition to the products we supply to customers, we also provide genotyping and whole genome sequencing services through our CLIA-certified, CAP-accredited laboratory.

FastTrack Services

One of the ways in which we compete and extend the reach of our systems in the genetic analysis market is to deliver services that leverage our proprietary technologies and the expertise of our scientists to perform genotyping and sequencing services for our customers. We began offering genotyping services to academic institutions, biotechnology, and pharmaceutical customers in 2002, and we expanded to deliver sequencing services in 2007. Using our FastTrack services, customers can perform whole-genome sequencing projects (including phasing and long-read sequencing services) and microarray projects (including whole-genome association studies, DNA copy number studies, linkage analysis, fine mapping, and DNA methylation studies).

Service Partnership Programs

To complement our own service capabilities, we have developed partnered programs such as our Certified Service Providers (CSPro) and Illumina Genome Network (IGN), to create a world-wide network of Illumina technology-enabled service offerings that broaden our market reach. Illumina CSPro is a collaborative service partnership established between Illumina and leading genome centers and research laboratories to ensure the delivery of high-quality genetic analysis services. It provides a competitive advantage for service providers, while also ensuring that customers will receive Illumina data quality and service. To become a CSPro provider, participating laboratories must complete a three-phased Illumina certification process. There are more than 90 Illumina CSPro-certified organizations worldwide providing sequencing, genotyping, and gene expression services using our technologies and products.

Introduced in 2010, the IGN links researchers interested in conducting large whole genome sequencing projects with leading institutes worldwide that possess our next-generation sequencing technology. The IGN provides a cost-effective and dependable way to complete large sequencing projects. All IGN partners are experienced and well-published using Illumina technology, and each has completed Illumina’s Certified Service Provider (CSPro) certification. Each IGN partner possesses ten or more high-throughput Illumina sequencing systems, providing the scalability to handle even the largest sequencing projects with rapid completion times. Current members include: British Columbia Cancer Agency’s Genome Sciences Centre; Cold Spring Harbor Laboratory; HudsonAlpha Institute for Biotechnology; Macrogen; the Northwest Genomics Center at the University of Washington; the New York Genome Center; Takara Bio; and Illumina’s own FastTrack Services.

Individual Genome Sequencing

Since June 2009, Illumina's Clinical Services Laboratory has been offering personal genome sequencing from our CLIA-certified, CAP-accredited laboratory using Illumina next-generation sequencing technology. We offer a variety of individual sequencing options, including: the TruGenome Undiagnosed Disease Test, which aids in the diagnosis of inherited diseases of a single-gene; the TruGenome Predisposition Screen, which evaluates carrier status and enables patient-physician discussions about managing risk for a pre-defined set of adult-onset conditions; and TruGenome Technical Sequence Data, which provides whole-genome sequencing services for situations where the physician is able to analyze and interpret whole-genome sequencing data. For each service, individuals are required to follow our physician-mediated process, which involves pre-service consultation and informed consent that includes review of the information potentially to be learned in the report. The final genome data is returned to the physician who then meets with the patient and discusses implications and possible actions based on the results.

Intellectual Property

We have an extensive intellectual property portfolio, including, as of February 1, 2014, ownership of, or exclusive licenses to, 402 issued U.S. patents and 383 pending U.S. patent applications, including 22 allowed applications that have not yet issued as patents. Our issued patents include those directed to various aspects of our arrays, assays, oligo synthesis, sequencing technology, instruments, and chemical detection technologies, and have terms that expire between 2014 and 2032. We continue to file new patent applications to protect the full range of our technologies. We have filed or have been granted counterparts for many of these patents and applications in foreign countries.

We also rely upon trade secrets, know-how, copyright, and trademark protection, as well as continuing technological innovation and licensing opportunities to develop and maintain our competitive position. Our success will depend in part on our ability to obtain patent protection for our products and processes, to preserve our trade secrets, to enforce our patents, copyrights and trademarks, to operate without infringing the proprietary rights of third parties, and to acquire licenses related to enabling technology or products.

We are party to various exclusive and non-exclusive license agreements and other arrangements with third parties that grant us rights to use key aspects of our array and sequencing technologies, assay methods, chemical detection methods, reagent kits, and scanning equipment. Our exclusive licenses expire with the termination of the underlying patents, which will occur between 2014 and 2020. We have additional nonexclusive license agreements with various third parties for other components of our products. In most cases, the agreements remain in effect over the term of the underlying patents, may be terminated at our request without further obligation, and require that we pay customary royalties while the agreement is in effect.

Research and Development

We have made substantial investments in research and development since our inception. We have assembled a team of skilled scientists and engineers who are specialists in biology, chemistry, informatics, instrumentation, optical systems, software, manufacturing, and other related areas required to complete the development of our products. Our research and development efforts have focused primarily on the tasks required to optimize and support commercialization of the products and services derived from our technologies.

Our research and development expenses for fiscal 2013, 2012, and 2011 were $276.7 million, $231.0 million, and $196.9 million, respectively. We expect research and development expense to increase during 2014 to support the growth of our business and as we continue to expand our research and product development efforts.

Marketing and Distribution

Our current products address the genetic analysis portion of the life sciences market, in particular, experiments involving sequencing, SNP genotyping, and gene expression profiling. These experiments include many areas of biologic research, including basic human disease research, pharmaceutical drug discovery and development, pharmacogenomics, toxicogenomics, and animal and agricultural research. Our potential customers include leading genomic research centers, academic institutions, government laboratories, hospitals, reference laboratories, and clinical research organizations, as well as pharmaceutical, biotechnology, agrigenomics, commercial molecular diagnostic, and consumer genomics companies.

We market and distribute our products directly to customers in North America, Europe, Latin America, and the Asia-Pacific region. In each of these areas, we have dedicated sales, service, and application support personnel responsible for expanding and managing their respective customer bases. In addition, in certain markets within Europe, the Asia-Pacific

region, Latin America, the Middle East, and South Africa we sell our products and provide services to customers through distributors that specialize in life science products. We expect to continue to increase our sales and distribution resources during 2014 and beyond as we launch a number of new products and expand the number of customers that can use our products.

Manufacturing

We manufacture sequencing and array platforms, reagent kits, and scanning equipment. Our manufacturing capacity for consumables and instruments has grown during 2013 to support increased customer demand. We are exploring ways to increase the level of automation in the manufacturing process to continue to accelerate throughput and improve the quality and manufacturing yield as we increase the complexity of our products. We adhere to access and safety standards required by federal, state, and local health ordinances, such as standards for the use, handling, and disposal of hazardous substances. Our key manufacturing and distribution facilities operate under a quality management system certified to ISO 13485, which demonstrates the organization’s ability to provide medical devices and related services that consistently meet customer and applicable regulatory requirements.

Raw Materials

Our manufacturing operations require a wide variety of raw materials, electronic and mechanical components, chemical and biochemical materials, and other supplies. We have multiple commercial sources for many of our components and supplies; however, there are some raw materials and components that we obtain from single source suppliers. To mitigate potential risks arising from single source suppliers, we believe that we can redesign our products for alternative components or use alternative reagents, if required. In addition, while we generally attempt to keep our inventory at minimal levels, we purchase incremental inventory as circumstances warrant to protect our supply chain.

Competition

Although we believe that our products and services provide significant advantages over products and services currently available from other sources, we expect to continue to encounter intense competition from other companies that offer products and services for sequencing, SNP genotyping, gene expression, and molecular diagnostics markets. These include companies such as Affymetrix, Inc.; Agilent Technologies, Inc.; BGI; Luminex Corporation; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Roche Holding AG.; and Thermo Fisher Scientific, Inc., among others. Some of these companies have or will have substantially greater financial, technical, research, and other resources and larger, more established marketing, sales, distribution, and service organizations than we do. In addition, they may have greater name recognition than we do in the markets we address and in some cases a larger installed base of systems. Each of these markets is very competitive and we expect new competitors to emerge and the intensity of competition to increase. In order to effectively compete with these companies, we will need to demonstrate that our products have superior throughput, cost, and accuracy advantages over competing products.

Segment and Geographic Information

In accordance with the authoritative accounting guidance for segment reporting, we have determined that we have one operating segment for purposes of recording and reporting our financial results.

We currently sell our products to a number of customers outside the United States, including customers in other areas of North America, Latin America, Europe, and the Asia-Pacific region. Shipments to customers outside the United States totaled $706.5 million, or 50% of our total revenue, during fiscal 2013, compared to $580.1 million, or 51%, and $526.8 million, or 50%, in fiscal 2012 and 2011, respectively. The U.S. dollar has been determined to be the functional currency of the Company’s international operations due to the primary economic environment of our foreign subsidiaries. We expect that sales to international customers will continue to be an important and growing source of revenue. See note “13. Segment Information, Geographic Data, and Significant Customers” in Part II, Item 8 of this Form 10-K for further information concerning our foreign and domestic operations.

Backlog

Our backlog was approximately $330 million and $260 million at December 29, 2013 and December 30, 2012, respectively. Generally, our backlog consists of orders believed to be firm as of the balance sheet date; however, we may allow customers to make product substitutions as we launch new products. The timing of shipments depends on several factors, including agreed upon shipping schedules, which may span multiple quarters, and whether the product is catalog or custom.

We expect the majority of the backlog as of December 29, 2013, to be shipped within the fiscal year ending December 28, 2014. Although we generally recognize revenue upon the transfer of title to a customer, we may be required to defer the recognition of revenue even after title transfer depending on the specific arrangement with a customer and the applicable accounting treatment.

Seasonality

Historically, demand for our products is affected by a number of variables, namely spending associated with the end of the U.S. government fiscal year as well as the end of the calendar year, and lower consumable utilization during the summer vacation months in Europe. During 2013, we saw sequential revenue growth due to demand for our innovative products and a slight benefit from calendar year-end spending.

Environmental Matters

We are committed to the protection of our employees and the environment. Our operations require the use of hazardous materials that subject us to a variety of federal, state, and local environmental and safety laws and regulations. We believe we are in material compliance with current applicable laws and regulations; however, we could be held liable for damages and fines should contamination of the environment or individual exposures to hazardous substances occur. In addition, we cannot predict how changes in these laws and regulations, or the development of new laws and regulations, will affect our business operations or the cost of compliance.

Government Regulation

As we continue to expand our product lines to encompass products that are intended to be used for the diagnosis of disease, regulation by governmental authorities in the United States and other countries will be a significant factor in the development, testing, production, and marketing of such products. Products that we develop in the molecular diagnostic markets, depending on their intended use, will be regulated as medical devices by the FDA and comparable agencies of other countries and may require either receiving clearance following a pre-market notification process, also known as a 510(k) clearance, or premarket approval (PMA), from the FDA prior to marketing. Obtaining the requisite regulatory approvals can be expensive and may involve considerable delay.

The shorter 510(k) clearance process, which we utilized for our FDA-cleared MiSeqDx instrument, generally takes from three to six months after submission, but it can take significantly longer. The 510(k) submission process may be utilized if it is demonstrated that the new product is “substantially equivalent” to a similar product that has already been cleared by the FDA. The longer PMA process, which we intend to use for an IVD version of our HiSeq 2500 system, is much more costly, uncertain, and generally takes from nine months to one year after filing, but it can take significantly longer. Because we cannot be certain that any molecular diagnostic products that we develop will be subject to the shorter 510(k) clearance process, or will ultimately be approved at all, the regulatory approval process for such products may be significantly delayed and may be significantly more expensive than anticipated. If we fail to obtain, or experience significant delays in obtaining, regulatory approvals for molecular diagnostic products that we develop, we may not be able to launch or successfully commercialize such products in a timely manner, or at all.

Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time during the development or marketing of our products, which may negatively affect our ability to obtain or maintain FDA or comparable regulatory approval of our products, if required.

In addition, if our products labeled as “Research Use Only,” or RUO, are used, or could be used, for the diagnosis of disease, the regulatory requirements related to marketing, selling, and supporting such products could be uncertain, even if such use by our customers is without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

Employees

As of December 29, 2013, we had more than 3,000 employees. We consider our employee relations to be positive. Our success will depend in large part upon our ability to attract and retain employees. In addition, we employ a number of temporary and contract employees. We face competition in this regard from other companies, research and academic institutions, government entities, and other organizations.

Our business is subject to various risks, including those described below. In addition to the other information included in this Form 10-K, the following issues could adversely affect our operating results or our stock price.

If we do not successfully manage the development, manufacturing, and launch of new products or services, including product transitions, our financial results could be adversely affected.

We face risks associated with launching new products and pre-announcing products and services when the products or services have not been fully developed or tested. For instance, in January 2014 we announced significant additions to our instrument platforms, the HiSeq X Ten and the NextSeq 500, which include dramatic technology advances. If our products and services are not able to deliver the performance or results expected by our target markets or are not delivered on a timely basis, our reputation and credibility may suffer. If we encounter development challenges or discover errors in our products late in our development cycle, we may delay the product launch date. In addition, we may experience difficulty in managing or forecasting customer reactions, purchasing decisions, or transition requirements or programs (such as trade-in programs) with respect to newly launched products (or products in development) relative to our existing products, which could adversely affect sales of our existing products. The expenses or losses associated with unsuccessful product development or launch activities or lack of market acceptance of our new products could adversely affect our business, financial condition, or results of operations.

We face intense competition, which could render our products obsolete, result in significant price reductions, or substantially limit the volume of products that we sell.

We compete with life sciences companies that design, manufacture, and market products for analysis of genetic variation and biological function and other applications using a wide-range of competing technologies. We anticipate that we will continue to face increased competition as existing companies develop new or improved products and as new companies enter the market with new technologies. One or more of our competitors may render our technology obsolete or uneconomical. Some of our competitors have greater financial and personnel resources, broader product lines, a more established customer base, and more experience in research and development than we do. Furthermore, life sciences and pharmaceutical companies, which are our potential customers and strategic partners, could also develop competing products. We believe that customers in our markets display a significant amount of loyalty to their initial supplier of a particular product; therefore, it may be difficult to generate sales to potential customers who have purchased products from competitors. To the extent we are unable to be the first to develop or supply new products, our competitive position may suffer.

The market for molecular diagnostics products is currently limited and highly competitive, with several large companies already having significant market share, intellectual property portfolios, and regulatory expertise. Established diagnostic companies also have an installed base of instruments in several markets, including clinical and reference laboratories, which could deter acceptance of our products. In addition, some of these companies have formed alliances with genomics companies that provide them access to genetic information that may be incorporated into their diagnostic tests.

Our continued growth is dependent on continuously developing and commercializing new products.

Our target markets are characterized by rapid technological change, evolving industry standards, changes in customer needs, existing and emerging competition, strong price competition, and frequent new product introductions. Accordingly, our continued growth depends on continuously developing and commercializing new products and services, including improving our existing products and services, in order to address evolving market requirements on a timely basis. If we fail to innovate or adequately invest in new technologies, our products and services will become dated, and we could lose our competitive position in the markets that we serve as customers purchase new products offered by our competitors. We believe that successfully introducing new products and technologies in our target markets on a timely basis provides a significant competitive advantage because customers make an investment of time in selecting and learning to use a new product and may be reluctant to switch once that selection is made.

To the extent that we fail to introduce new and innovative products, or such products are not accepted in the market or suffer significant delays in development, we may lose market share to our competitors, which will be difficult or impossible to regain. An inability, for technological or other reasons, to develop successfully and timely introduce new products could reduce our growth rate or otherwise have an adverse effect on our business. In the past, we have experienced, and are likely to experience in the future, delays in the development and introduction of new products. There can be no assurance that we will keep pace with the rapid rate of change in our markets or that our new products will adequately meet the requirements of the marketplace, achieve market acceptance, or compete successfully with competing technologies. Some of the factors affecting market acceptance of new products and services include:

| |

• | availability, quality, and price relative to competing products and services; |

| |

• | the functionality and performance of new and existing products and services; |

| |

• | the timing of introduction of new products or services relative to competing products and services; |

| |

• | scientists’ and customers’ opinions of the utility of new products or services; |

| |

• | citation of new products or services in published research; |

| |

• | regulatory trends and approvals; and |

| |

• | general trends in life sciences research and applied markets. |

We may also have to write off excess or obsolete inventory if sales of our products are not consistent with our expectations or the market requirements for our products change due to technical innovations in the marketplace.

Our success depends upon the continued emergence and growth of markets for analysis of genetic variation and biological function.

We design our products primarily for applications in the life sciences, diagnostic, agricultural, and pharmaceutical industries. The usefulness of our technologies depends in part upon the availability of genetic data and its usefulness in identifying or treating disease. We are focusing on markets for analysis of genetic variation and biological function, namely sequencing, genotyping, and gene expression profiling. These markets are new and emerging, and they may not develop as quickly as we anticipate, or reach their full potential. Other methods of analysis of genetic variation and biological function may emerge and displace the methods we are developing. Also, researchers may not be able to successfully analyze raw genetic data or be able to convert raw genetic data into medically valuable information. For instance, demand for our microarray products may be adversely affected if researchers fail to find meaningful correlations between genetic variation, such as SNPs, and disease susceptibility through genome wide association studies. In addition, factors affecting research and development spending generally, such as changes in the regulatory environment affecting life sciences and pharmaceutical companies, and changes in government programs that provide funding to companies and research institutions, could harm our business. If useful genetic data is not available or if our target markets do not develop in a timely manner, demand for our products may grow at a slower rate than we expect, and we may not be able to sustain profitability.

Reduction or delay in research and development budgets and government funding may adversely affect our revenue.

A substantial portion of our revenue is derived from genomic research centers, academic institutions, government laboratories, and clinical research organizations, as well as pharmaceutical, biotechnology, agrigenomics, and consumer genomics companies, and their capital spending budgets can have a significant effect on the demand for our products and services. These budgets are based on a wide variety of factors, including the allocation of available resources to make purchases, funding from government sources, the spending priorities among various types of research equipment, and policies regarding capital expenditures during recessionary periods. Any decrease in capital spending or change in spending priorities of our customers could significantly reduce our revenue. Moreover, we have no control over the timing and amount of purchases by our customers, and, as a result, revenue from these sources may vary significantly due to factors that can be difficult to forecast. Any delay or reduction in purchases by our customers or our inability to forecast fluctuations in demand could harm our future operating results.

The timing and amount of revenues from customers that rely on government and academic research funding may vary significantly due to factors that can be difficult to forecast, and there remains significant uncertainty concerning government and academic research funding worldwide as governments in the United States and Europe, in particular, focus on reducing fiscal deficits while at the same time confronting uncertain economic growth. Funding for life science research has increased more slowly during the past several years compared to previous years and has declined in some countries. Government funding of research and development is subject to the political process, which is inherently fluid and unpredictable. Other programs, such as defense, entitlement programs, or general efforts to reduce budget deficits could be viewed by governments as a higher priority. These budgetary pressures may result in reduced allocations to government agencies that fund research and development activities, such as the U.S. National Institute of Health, or NIH. Past proposals to reduce budget deficits have included reduced NIH and other research and development allocations. Any shift away from the funding of life sciences research and development or delays surrounding the approval of government budget proposals may cause our customers to delay or forego purchases of our products, which could adversely affect our business, financial condition, or results of operations.

Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

As part of our strategy to develop and identify new products, services, and technologies, we have made, and may continue to make, acquisitions of technologies, products, or businesses. Acquisitions involve numerous risks and operational, financial, and managerial challenges, including the following, any of which could adversely affect our business, financial condition, or results of operations:

| |

• | difficulties in integrating new operations, technologies, products, and personnel; |

| |

• | lack of synergies or the inability to realize expected synergies and cost-savings; |

| |

• | difficulties in managing geographically dispersed operations; |

| |

• | underperformance of any acquired technology, product, or business relative to our expectations and the price we paid; |

| |

• | negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges; |

| |

• | the potential loss of key employees, customers, and strategic partners of acquired companies; |

| |

• | claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction; |

| |

• | the issuance of dilutive securities, assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash; |

| |

• | diversion of management’s attention and company resources from existing operations of the business; |

| |

• | inconsistencies in standards, controls, procedures, and policies; |

| |

• | the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies; and |

| |

• | assumption of, or exposure to, unknown contingent liabilities or liabilities that are difficult to identify or accurately quantify. |

In addition, the successful integration of acquired businesses requires significant efforts and expense across all operational areas, including sales and marketing, research and development, manufacturing, finance, legal, and information technologies. There can be no assurance that any of the acquisitions we make will be successful or will be, or will remain, profitable. Our failure to successfully address the above risks may prevent us from achieving the anticipated benefits from any acquisition in a reasonable time frame, or at all.

If the quality of our products does not meet our customers’ expectations, then our reputation could suffer and ultimately our sales and operating earnings could be negatively impacted.

In the course of conducting our business, we must adequately address quality issues associated with our products and services, including defects in our engineering, design, and manufacturing processes, as well as defects in third-party components included in our products. Because our instruments and consumables are highly complex, the occurrence of defects may increase as we continue to introduce new products and services and as we scale up manufacturing to meet increased demand for our products and services. Although we have established internal policies and procedures aligned to global quality standards to minimize risks that may arise from product quality issues, there can be no assurance that we will be able to eliminate or mitigate occurrences of these issues and associated liabilities. In addition, identifying the root cause of quality issues, particularly those affecting reagents and third-party components, may be difficult, which increases the time needed to address quality issues as they arise and increases the risk that similar problems could recur. Finding solutions to quality issues can be expensive, and we may incur significant costs or lost revenue in connection with, for example, shipment holds, product recalls, and warranty or other service obligations. In addition, quality issues can impair our relationships with new or existing customers and adversely affect our brand image, and our reputation as a producer of high quality products could suffer, which could adversely affect our business, financial condition, or results of operations.

Litigation, other proceedings, or third party claims of intellectual property infringement could require us to spend significant time and money and could prevent us from selling our products or services.

Our success depends in part on our non-infringement of the patents or proprietary rights of third parties. Third parties have asserted and may in the future assert that we are employing their proprietary technology without authorization. As we enter new markets or introduce new products, we expect that competitors will likely claim that our products infringe their intellectual property rights as part of a business strategy to impede our successful competition. In addition, third parties may have obtained and may in the future obtain patents allowing them to claim that the use of our technologies infringes these patents. We could incur substantial costs and divert the attention of our management and technical personnel in defending ourselves against any of these claims. Any adverse ruling or perception of an adverse ruling in defending ourselves against these claims could have an adverse impact on our stock price, which may be disproportionate to the actual import of the ruling itself. Furthermore, parties making claims against us may be able to obtain injunctive or other relief, which effectively could block our ability to develop further, commercialize, or sell products or services, and could result in the award of substantial damages against us. In the event of a successful infringement claim against us, we may be required to pay damages and obtain one or more licenses from third parties, or be prohibited from selling certain products or services. In addition, we may be unable to obtain these licenses at a reasonable cost, if at all. We could therefore incur substantial costs related to royalty payments for licenses obtained from third parties, which could negatively affect our gross margins and earnings per share. In addition, we could encounter delays in product introductions while we attempt to develop alternative methods or products. Defense of any lawsuit or failure to obtain any of these licenses on favorable terms could prevent us from commercializing products, and the prohibition of sale of any of our products or services could adversely affect our ability to grow or maintain profitability.

We depend on third-party manufacturers and suppliers for some of our products, or components and materials used in our products, and if shipments from these manufacturers or suppliers are delayed or interrupted, or if the quality of the products, components, or materials supplied do not meet our requirements, we may not be able to launch, manufacture, or ship our products in a timely manner, or at all.

The complex nature of our products requires customized, precision-manufactured components and materials that currently are available from a limited number of sources, and, in the case of some components and materials, from only a single source. If deliveries from these vendors are delayed or interrupted for any reason, or if we are otherwise unable to secure a sufficient supply, we may not be able to obtain these components or materials on a timely basis or in sufficient quantities or qualities, or at all, in order to meet demand for our products. We may need to enter into contractual relationships with manufacturers for commercial-scale production of some of our products, or develop these capabilities internally, and there can be no assurance that we will be able to do this on a timely basis, in sufficient quantities, or on commercially reasonable terms. In addition, the lead time needed to establish a relationship with a new supplier can be lengthy, and we may experience delays in meeting demand in the event we must switch to a new supplier. The time and effort required to qualify a new supplier could result in additional costs, diversion of resources, or reduced manufacturing yields, any of which would negatively impact our operating results. Accordingly, we may not be able to establish or maintain reliable, high-volume manufacturing at commercially reasonable costs or at all. In addition, the manufacture or shipment of our products may be delayed or interrupted if the quality of the products, components, or materials supplied by our vendors does not meet our requirements. Current or future social and environmental regulations or critical issues, such as those relating to the sourcing of conflict minerals from the Democratic Republic of the Congo or the need to eliminate environmentally sensitive materials from our products, could restrict the supply of components and materials used in production or increase our costs. Any delay or interruption to our manufacturing process or in shipping our products could result in lost revenue, which would adversely affect our business, financial condition, or results of operations.

If we are unable to increase our manufacturing capacity and develop and maintain operation of our manufacturing capability, we may not be able to launch or support our products in a timely manner, or at all.

We continue to rapidly increase our manufacturing capacity to meet the anticipated demand for our products. Although we have significantly increased our manufacturing capacity and we believe we have plans in place sufficient to ensure we have adequate capacity to meet our current business plans, there are uncertainties inherent in expanding our manufacturing capabilities, and we may not be able to sufficiently increase our capacity in a timely manner. For example, manufacturing and product quality issues may arise as we increase production rates at our manufacturing facilities and launch new products. Also, we may not manufacture the right product mix to meet customer demand, especially as we introduce new products. As a result, we may experience difficulties in meeting customer, collaborator, and internal demand, in which case we could lose customers or be required to delay new product introductions, and demand for our products could decline. Additionally, in the past, we have experienced variations in manufacturing conditions and quality control issues that have temporarily reduced or suspended production of certain products. Due to the intricate nature of manufacturing complex instruments, consumables, and products

that contain DNA, we may encounter similar or previously unknown manufacturing difficulties in the future that could significantly reduce production yields, impact our ability to launch or sell these products (or to produce them economically), prevent us from achieving expected performance levels, or cause us to set prices that hinder wide adoption by customers.

Additionally, we currently manufacture in a limited number of locations. Our manufacturing facilities are located in San Diego and the San Francisco Bay Area in California; Madison, Wisconsin; and Singapore. These areas are subject to natural disasters such as earthquakes, wildfires, or floods. If a natural disaster were to damage one of our facilities significantly or if other events were to cause our operations to fail, we may be unable to manufacture our products, provide our services, or develop new products.

Also, many of our manufacturing processes are automated and are controlled by our custom-designed laboratory information management system (LIMS). Additionally, the decoding process in our array manufacturing requires significant network and storage infrastructure. If either our LIMS system or our networks or storage infrastructure were to fail for an extended period of time, it may adversely impact our ability to manufacture our products on a timely basis and could prevent us from achieving our expected shipments in any given period.

If we lose our key personnel or are unable to attract and retain additional personnel, we may be unable to achieve our goals.

We are highly dependent on our management and scientific personnel, including Jay Flatley, our Chief Executive Officer. The loss of their services could adversely impact our ability to achieve our business objectives. In addition, the continued growth of our business depends on our ability to hire additional qualified personnel with expertise in molecular biology, chemistry, biological information processing, sales, marketing, and technical support. We compete for qualified management and scientific personnel with other life science companies, universities, and research institutions, particularly those focusing on genomics. Competition for these individuals, particularly in the San Diego and San Francisco area, is intense, and the turnover rate can be high. Failure to attract and retain management and scientific personnel would prevent us from pursuing collaborations or developing our products or technologies. Additionally, integration of acquired companies and businesses can be disruptive, causing key employees of the acquired business to leave. Further, we use share-based compensation, including restricted stock units and performance stock units to attract key personnel, incentivize them to remain with us, and align their interests with those of the Company by building long-term stockholder value. If our stock price decreases, the value of these equity awards decreases and therefore reduces a key employee’s incentive to stay.

Any inability to effectively protect our proprietary technologies could harm our competitive position.

Our success depends to a large extent on our ability to develop proprietary products and technologies and to obtain patents and maintain adequate protection of our intellectual property in the United States and other countries. If we do not protect our intellectual property adequately, competitors may be able to use our technologies and thereby erode our competitive advantage. The laws of some foreign countries do not protect proprietary rights to the same extent as the laws of the United States, and many companies have encountered significant challenges in establishing and enforcing their proprietary rights outside of the United States. These challenges can be caused by the absence of rules and methods for the establishment and enforcement of intellectual property rights outside of the United States.

The proprietary positions of companies developing tools for the life sciences, genomics, agricultural, and pharmaceutical industries, including our proprietary position, generally are uncertain and involve complex legal and factual questions. We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies are covered by valid and enforceable patents or are effectively maintained as trade secrets. We intend to apply for patents covering our technologies and products as we deem appropriate. However, our patent applications may be challenged and may not result in issued patents or may be invalidated or narrowed in scope after they are issued. Questions as to inventorship or ownership may also arise. Any finding that our patents or applications are unenforceable could harm our ability to prevent others from practicing the related technology, and a finding that others have inventorship or ownership rights to our patents and applications could require us to obtain certain rights to practice related technologies, which may not be available on favorable terms, if at all. Furthermore, as issued patents expire, we may lose some competitive advantage as others develop competing products, and, as a result, we may lose revenue.

In addition, our existing patents and any future patents we obtain may not be sufficiently broad to prevent others from practicing our technologies or from developing competing products and may therefore fail to provide us with any competitive advantage. We may need to initiate lawsuits to protect or enforce our patents, or litigate against third party claims, which would be expensive, and, if we lose, may cause us to lose some of our intellectual property rights and reduce our ability to compete in the marketplace. Furthermore, these lawsuits may divert the attention of our management and technical personnel.

There is also the risk that others may independently develop similar or alternative technologies or design around our patented technologies. In that regard, certain patent applications in the United States may be maintained in secrecy until the patents issue, and publication of discoveries in the scientific or patent literature tend to lag behind actual discoveries by several months.

We also rely upon trade secrets and proprietary know-how protection for our confidential and proprietary information, and we have taken security measures to protect this information. These measures, however, may not provide adequate protection for our trade secrets, know-how, or other confidential information. Among other things, we seek to protect our trade secrets and confidential information by entering into confidentiality agreements with employees, collaborators, and consultants. There can be no assurance that any confidentiality agreements that we have with our employees, collaborators, and consultants will provide meaningful protection for our trade secrets and confidential information or will provide adequate remedies in the event of unauthorized use or disclosure of such information. Accordingly, there also can be no assurance that our trade secrets will not otherwise become known or be independently developed by competitors.