UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 000-29961

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (615 ) 622-0000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of Class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| None | None | |||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| ☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12 (b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The number of units of limited partnership interest outstanding as of December 31, 2022 was 285,979,913 .

DOCUMENTS INCORPORATED BY REFERENCE

This Form 10-K does not incorporate any document by reference.

| Table of Contents | ||

| 2022 Annual Report | i | ||||

| Glossary of Certain Defined Terms | ||

| AB | AllianceBernstein L.P. (Delaware limited partnership formerly known as Alliance Capital Management L.P., “Alliance Capital”), the operating partnership, and its subsidiaries and, where appropriate, its predecessors, AB Holding and ACMC, Inc. and their respective subsidiaries. | ||||

| AB Holding | AllianceBernstein Holding L.P. (Delaware limited partnership). | ||||

| AB Holding Partnership Agreement | the Amended and Restated Agreement of Limited Partnership of AB Holding, dated as of October 29, 1999 and as amended February 24, 2006. | ||||

| AB Holding Units | units representing assignments of beneficial ownership of limited partnership interest in AB Holding. | ||||

| AB Partnership Agreement | the Amended and Restated Agreement of Limited Partnership of AB, dated as of October 29, 1999 and as amended February 24, 2006. | ||||

| AB Units | units of limited partnership interest in AB. | ||||

| AUM | AB's assets under management. | ||||

| Bernstein Transaction | AB's acquisition of the business and assets of SCB Inc., formerly known as Sanford C. Bernstein Inc., and the related assumption of the liabilities of that business, completed on October 2, 2000. | ||||

| Equitable America | Equitable Financial Insurance Company of America (f/k/a MONY Life Insurance Company of America, an Arizona corporation), a subsidiary of Equitable Holdings. | ||||

| Equitable Financial | Equitable Financial Life Insurance Company (New York stock life insurance company), a subsidiary of Equitable Holdings. | ||||

| Equitable Holdings or EQH | Equitable Holdings, Inc. (Delaware corporation) and its subsidiaries other than AB and its subsidiaries. | ||||

| Exchange Act | the Securities Exchange Act of 1934, as amended. | ||||

| ERISA | the Employee Retirement Income Security Act of 1974, as amended. | ||||

| GAAP | U.S. Generally Accepted Accounting Principles. | ||||

| General Partner | AllianceBernstein Corporation (Delaware corporation), the general partner of AB and AB Holding and a subsidiary of Equitable Holdings, and, where appropriate, ACMC, LLC, its predecessor. | ||||

| Investment Advisers Act | the Investment Advisers Act of 1940, as amended. | ||||

| Investment Company Act | the Investment Company Act of 1940, as amended. | ||||

| NYSE | the New York Stock Exchange, Inc. | ||||

| Partnerships | AB and AB Holding together. | ||||

| SEC | the United States Securities and Exchange Commission. | ||||

| Securities Act | the Securities Act of 1933, as amended. | ||||

ii | AllianceBernstein | ||||

| Part I | ||

Item 1. Business

The words “we” and “our” in this Form 10-K refer collectively to AB Holding and AB and its subsidiaries, or to their officers and employees. Similarly, the words “company” and “firm” refer to both AB Holding and AB. Where the context requires distinguishing between AB Holding and AB, we identify which company is being discussed. Cross-references are in italics.

We use “global” in this Form 10-K to refer to all nations, including the United States; we use “international” or “non-U.S.” to refer to nations other than the United States.

We use “emerging markets” in this Form 10-K to refer to countries included in the Morgan Stanley Capital International (“MSCI”) emerging markets index, which include, as of December 31, 2022: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

Clients

We provide diversified investment management, research and related services globally to a broad range of clients through our three buy-side distribution channels: Institutions, Retail and Private Wealth Management, and our sell-side business, Bernstein Research Services. See “Distribution Channels” in this Item 1 for additional information.

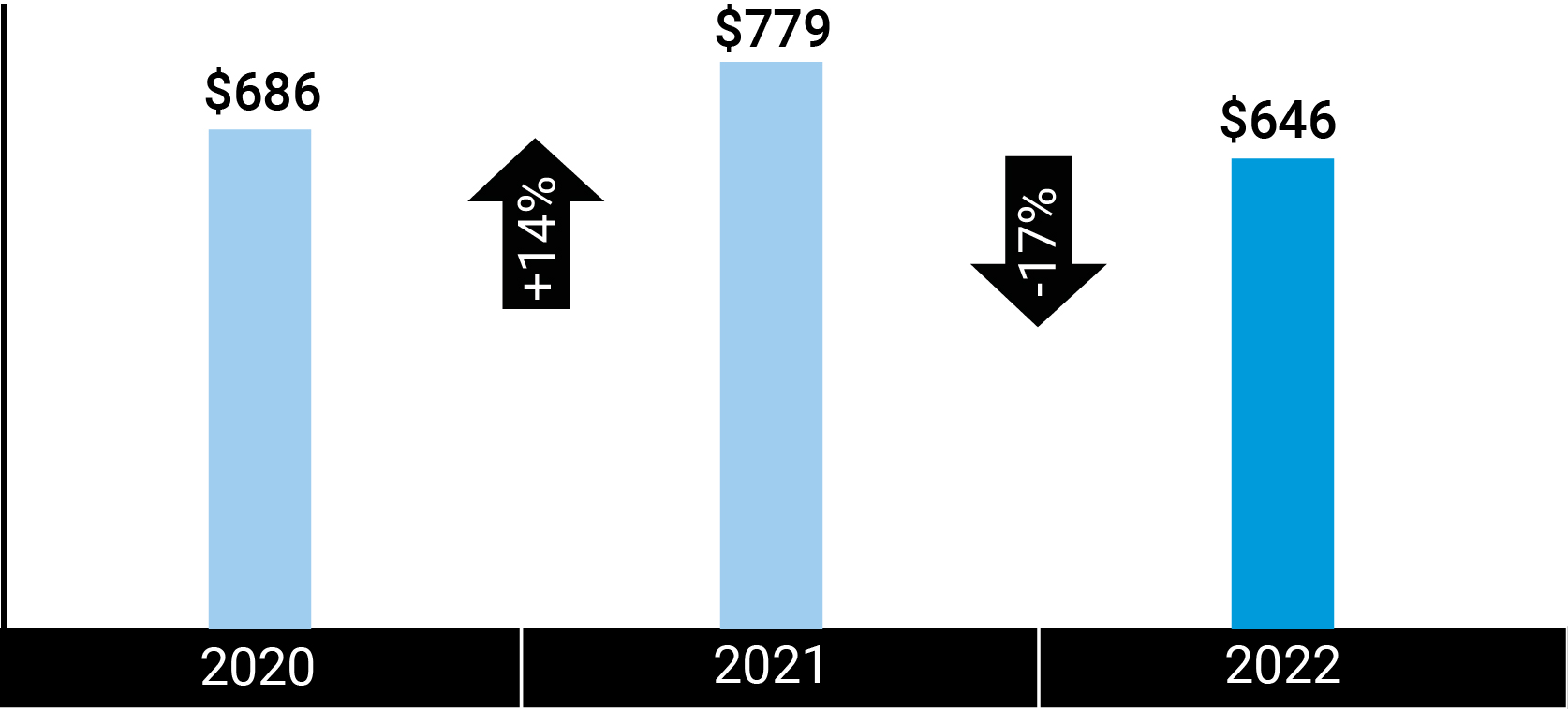

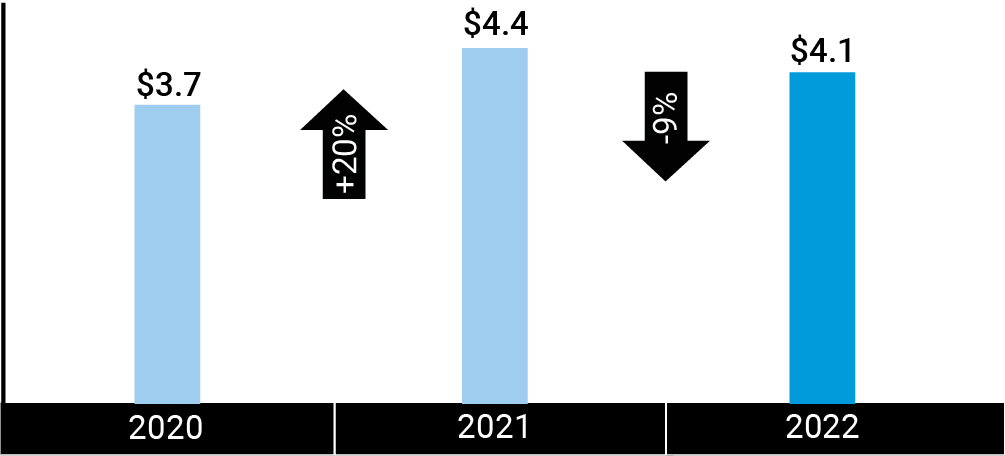

As of December 31, 2022, 2021 and 2020, our AUM were approximately $646 billion, $779 billion and $686 billion, respectively, and our net revenues were approximately $4.1 billion, $4.4 billion and $3.7 billion, respectively. EQH (our parent company) and its subsidiaries, whose AUM consist primarily of fixed income investments, is our largest client. Our EQH affiliates represented approximately 16%, 17% and 19% of our AUM as of December 31, 2022, 2021 and 2020, and we earned approximately 4% of our net revenues from services we provided to them in each of those years.

Assets Under Management (AUM) ($ billions) | Net Revenues ($ billions) | ||||

|  | ||||

See “Distribution Channels” below and “Assets Under Management” and “Net Revenues” in Item 7 for additional information regarding our AUM and net revenues.

Generally, we are compensated for our investment services on the basis of investment advisory and services fees calculated as a percentage of AUM. For additional information about our investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7.

Research

Our high-quality, in-depth research is the foundation of our asset management and private wealth management businesses. We believe that our global team of research professionals, whose disciplines include economic, fundamental equity, fixed income and quantitative research, gives us a competitive advantage in achieving investment success for our clients. We also have experts focused on multi-asset strategies, wealth management, environmental, social and governance (“ESG”), and alternative investments.

| 2022 Annual Report | 1 | ||||

Part I

Purpose, Values and Corporate Responsibility

At AB, we pursue insight that unlocks opportunity. This is our firm's purpose. Together with our firm's mission and values, which we have described below, our purpose forms the foundation of responsibility at AB.

AB's mission is to help our clients define and achieve their investment goals, explicitly stating what we do each day to unlock opportunity for our clients. As an active manager, our differentiated insights drive our ability to deliver alpha and design innovative investment solutions. ESG and climate issues are key elements in forming insights and in presenting potential risks and opportunities that can impact the performance of the companies and issuers in which we invest and the portfolios that we build.

Our values provide a framework for the behaviors and actions that deliver on our purpose and mission. Values align our actions. Each value emerges from our firm's character, yet also is aspirational, and each value challenges us to become a better, more responsible version of AB:

•We invest in each other, meaning that we have a strong organizational culture in which diversity is celebrated and mentorship is critical to our success.

•We strive for distinctive insight, meaning that we collaboratively identify creative solutions to clients' economic, ESG and climate-related investment challenges through our expertise in a wide range of investment disciplines.

•We speak with courage and conviction, which informs how we engage with our AB colleagues and issuers.

•We act with integrity, which is the bedrock of our relationships and drives us to avoid activities that could create potential conflicts of interest or distract us from our singular focus to provide asset management and research to our clients.

As noted above, we consistently challenge ourselves to become a better version of AB. We are committed to being a responsible firm and striving to model the behavior that we expect from the companies in which we invest. This means, in part, giving back to the communities in which we work through our firm-wide philanthropic initiative, AB Gives Back, and reducing our environmental footprint by increasing our use of “green buildings,” such as our new corporate headquarters in Nashville, Tennessee. Additionally, by promoting diversity, equity and inclusion, we are afforded different perspectives and ways of thinking, which can lead to better outcomes for our clients (See Diversity, Equity and Inclusion below in this Item 1).

Also, striving to be more responsible gives us a richer perspective for evaluating other companies. As longtime fundamental investors with a strong research heritage, we consider ESG factors in various processes. This helps us make fully informed risk/return assessments and draw insightful investment conclusions. Our investors — research analysts and portfolio managers — understand the companies and industries they cover in-depth. This positions them well to determine which ESG issues are material to particular companies, to determine the financial impact of an ESG issue and to incorporate that insight into their cash-flow, earnings and credit models. And, we continue to invest in technology and innovation to further enable our investment teams to formalize their ESG evaluations and share insights from our engagements with other companies.

Additionally, AB has prioritized our employees' health and welfare throughout the COVID-19 pandemic while ensuring that our firm has continued to meet our fiduciary obligations and provide exceptional client service and thoughtful investment advice. Furthermore, COVID-19 is a prominent theme in engagement: it not only impacts business models but also highlights corporate ESG practices. We are advocating that issuers be responsible corporate citizens, and we are working to better understand opportunities and threats, including supply chain disruptions and inflationary pressures, fueled by the pandemic.

We provide additional information in this regard in the AB Responsibility Report, which can be found under “Responsibility - Overview” on www.alliancebernstein.com. And, we have described our firm's governance structure, including our Board and its committees, in Item 10 of this Form 10-K.

2 | AllianceBernstein | ||||

Part I

Investment Philosophy

We believe that by using differentiated research insights and a disciplined process to build high-active-share portfolios, we can achieve strong investment results for our clients over time. Key to this philosophy is developing and integrating ESG and climate research, as well as our approach to engagement. Our global research network, intellectual curiosity and collaborative culture allow us to advance clients' investment objectives, whether our clients are seeking responsibility generated idiosyncratic alpha, total return, downside mitigation, or sustainability and impact-focused outcomes.

Our investment services include expertise in:

•Actively managed equity strategies across global and regional universes, as well as capitalization ranges, concentration ranges and investment strategies, including value, growth and core equities;

•Actively managed traditional and unconstrained fixed income strategies, including taxable and tax-exempt strategies;

•Actively managed alternative investments, including hedge funds, fund of funds and direct assets (e.g., direct lending, real estate and private equity);

•Portfolios with Purpose, including actively managed, impact-focused and Responsible+ (climate-conscious, ESG leaders, change catalysts) equity, fixed income and multi-asset strategies that address our clients' evolving need to invest their capital with purpose while pursuing strong investment returns;

•Multi-asset services and solutions, including dynamic asset allocation, customized target-date funds and target-risk funds; and

•Some passive management, including index, ESG index and enhanced index strategies.

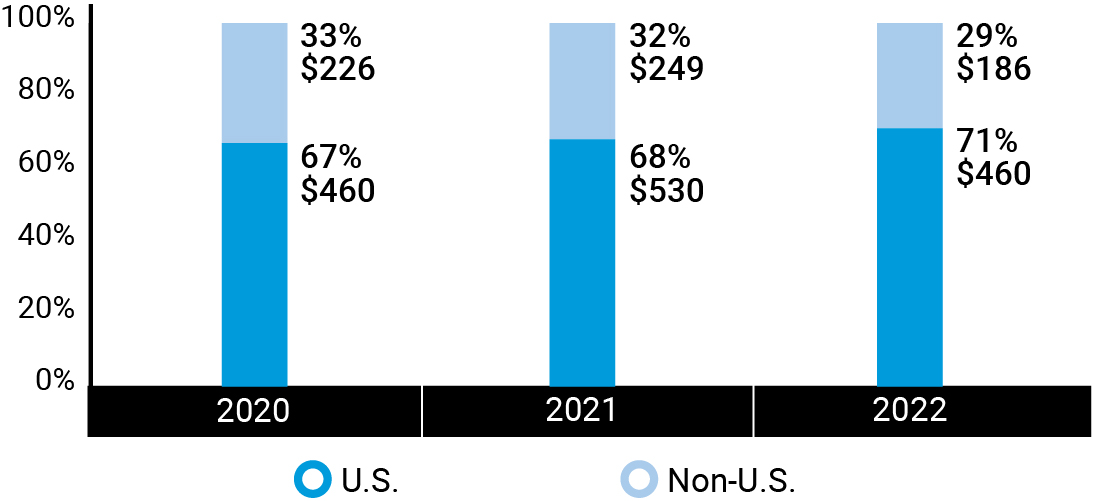

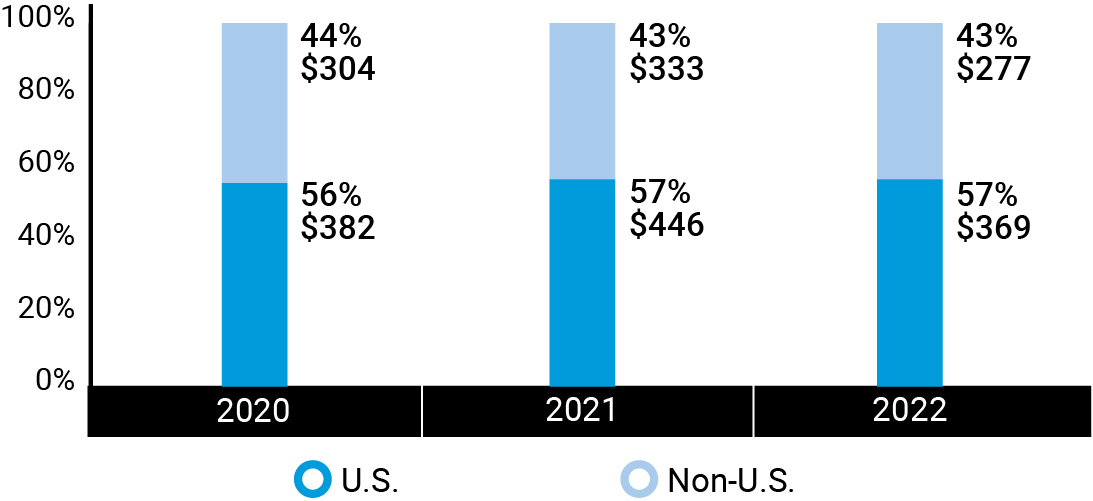

Our AUM by client domicile and investment service as of December 31, 2022, 2021 and 2020 are as follows:

AUM by Client Domicile ($ in billions) | AUM by Investment Service ($ in billions) | ||||

|  | ||||

| 2022 Annual Report | 3 | ||||

Part I

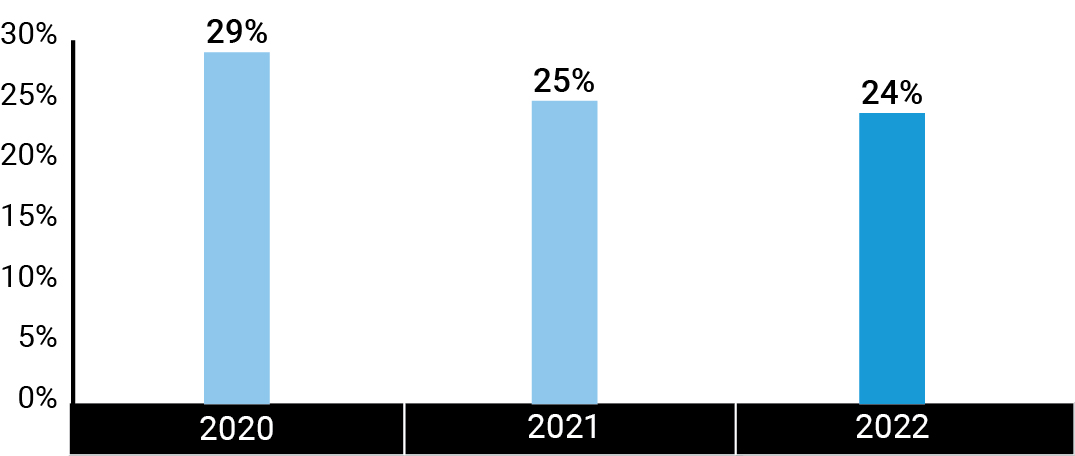

Distribution Channels Institutions We offer to our institutional clients, which include private and public pension plans, foundations and endowments, insurance companies, central banks and governments worldwide, and EQH and its subsidiaries, separately managed accounts, sub-advisory relationships, structured products, collective investment trusts, mutual funds, hedge funds and other investment vehicles (“Institutional Services”). We manage the assets of our institutional clients pursuant to written investment management agreements or other arrangements, which generally are terminable at any time or upon relatively short notice by either party. In general, our written investment management agreements may not be assigned without the client's consent. For information about our institutional investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7. EQH and its subsidiaries constitute our largest institutional client. EQH and its subsidiaries combined AUM accounted for approximately 24%, 25% and 29% of our institutional AUM as of December 31, 2022, 2021 and 2020, respectively, and approximately 19%, 18% and 18% of our institutional revenues for 2022, 2021 and 2020, respectively. No single institutional client other than EQH and its respective subsidiaries accounted for more than approximately 2% of our net revenues for the year ended December 31, 2022. | |||||||||||||||||

As of December 31, 2022, EQH and its subsidiaries combined AUM accounted for: | |||||||||||||||||

Approximately 24% of our institutional AUM. | |||||||||||||||||

Approximately 19% of our institutional revenues. | |||||||||||||||||

| EQH and Subsidiaries as a % of our Institutional AUM | EQH and Subsidiaries as a % of our Institutional Revenues | ||||

|  | ||||

4 | AllianceBernstein | ||||

Part I

As of December 31, 2022, 2021 and 2020, Institutional Services represented approximately 46%, 43% and 46%, respectively, of our AUM, and the fees we earned from providing these services represented approximately 16%, 13% and 14%, respectively, of our net revenues for each of those years. Our AUM and revenues are as follows:

Institutional Services Assets Under Management (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 55,731 | $ | 73,726 | $ | 60,067 | (24.4) | % | 22.7 | % | |||||||||||||||||||

Equity Passively Managed(1) | 21,062 | 28,995 | 27,873 | (27.4) | 4.0 | ||||||||||||||||||||||||

| Total Equity | 76,793 | 102,721 | 87,940 | (25.2) | 16.8 | ||||||||||||||||||||||||

| U.S. | 35,428 | 47,409 | 41,241 | (25.3) | 15.0 | ||||||||||||||||||||||||

| Global & Non-US | 41,365 | 55,312 | 46,699 | (25.2) | 18.4 | ||||||||||||||||||||||||

| Total Equity | 76,793 | 102,721 | 87,940 | (25.2) | 16.8 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 121,871 | 155,940 | 164,048 | (21.8) | (4.9) | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 849 | 1,108 | 1,271 | (23.4) | (12.8) | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 192 | 224 | 84 | (14.3) | 166.7 | ||||||||||||||||||||||||

| Total Fixed Income | 122,912 | 157,272 | 165,403 | (21.8) | (4.9) | ||||||||||||||||||||||||

| U.S. | 88,800 | 110,312 | 116,833 | (19.5) | (5.6) | ||||||||||||||||||||||||

| Global & Non-US | 34,112 | 46,960 | 48,570 | (27.4) | 26.1 | ||||||||||||||||||||||||

| Total Fixed Income | 122,912 | 157,272 | 165,403 | (21.8) | (4.9) | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(2): | |||||||||||||||||||||||||||||

| U.S. | 12,873 | 7,697 | 6,104 | 67.2 | 26.1 | ||||||||||||||||||||||||

| Global & Non-US | 84,703 | 69,390 | 56,151 | 22.1 | 23.6 | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 97,576 | 77,087 | 62,255 | 26.6 | 23.8 | ||||||||||||||||||||||||

| Total: | |||||||||||||||||||||||||||||

| U.S. | 137,101 | 165,418 | 164,178 | (17.1) | 0.8 | ||||||||||||||||||||||||

| Global & Non-US | 160,180 | 171,662 | 151,420 | (6.7) | 13.4 | ||||||||||||||||||||||||

| Total | $ | 297,281 | $ | 337,080 | $ | 315,598 | (11.8) | 6.8 | |||||||||||||||||||||

| Affiliated - EQH | 70,924 | 84,096 | 91,396 | (15.7) | (8.0) | ||||||||||||||||||||||||

| Non-affiliated | 226,357 | 252,984 | 224,202 | (10.5) | 12.8 | ||||||||||||||||||||||||

| Total | $ | 297,281 | $ | 337,080 | $ | 315,598 | (11.8) | 6.8 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Includes certain multi-asset solutions and services not included in equity or fixed income services.

| 2022 Annual Report | 5 | ||||

Part I

Revenues from Institutional Services (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 220,917 | $ | 240,049 | $ | 170,802 | (8.0) | % | 40.5 | % | |||||||||||||||||||

Equity Passively Managed(1) | 4,910 | 6,119 | 5,851 | (19.8) | 4.6 | ||||||||||||||||||||||||

| Total Equity | 225,827 | 246,168 | 176,653 | (8.3) | 39.4 | ||||||||||||||||||||||||

| U.S. | 80,908 | 97,522 | 69,795 | (17.0) | 39.7 | ||||||||||||||||||||||||

| Global & Non-US | 144,919 | 148,646 | 106,858 | (2.5) | 39.1 | ||||||||||||||||||||||||

| Total Equity | 225,827 | 246,168 | 176,653 | (8.3) | 39.4 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 189,679 | 199,866 | 194,026 | (5.1) | 3.0 | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 1,182 | 1,356 | 1,355 | (12.8) | 0.1 | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 425 | 105 | 82 | n/m | 28.0 | ||||||||||||||||||||||||

Fixed Income Servicing(2) | 15,991 | 14,738 | 14,108 | 8.5 | 4.5 | ||||||||||||||||||||||||

| Total Fixed Income | 207,277 | 216,065 | 209,571 | (4.1) | 3.1 | ||||||||||||||||||||||||

| U.S. | 128,392 | 124,004 | 118,924 | 3.5 | 4.3 | ||||||||||||||||||||||||

| Global & Non-US | 78,885 | 92,061 | 90,647 | (14.3) | 1.6 | ||||||||||||||||||||||||

| Total Fixed Income | 207,277 | 216,065 | 209,571 | (4.1) | 3.1 | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(3): | |||||||||||||||||||||||||||||

| U.S. | 114,982 | 64,646 | 52,222 | 77.9 | 23.8 | ||||||||||||||||||||||||

| Global & Non-US | 111,202 | 59,179 | 73,354 | 87.9 | (19.3) | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 226,184 | 123,825 | 125,576 | 82.7 | (1.4) | ||||||||||||||||||||||||

| Total Investment Advisory and Services Fees: | |||||||||||||||||||||||||||||

| U.S. | 324,282 | 286,172 | 240,941 | 13.3 | 18.8 | ||||||||||||||||||||||||

| Global & Non-US | 335,004 | 299,886 | 270,859 | 11.7 | 10.7 | ||||||||||||||||||||||||

| Total | 659,286 | 586,058 | 511,800 | 12.5 | 14.5 | ||||||||||||||||||||||||

| Distribution Revenues | 268 | 474 | 588 | (43.5) | (19.4) | ||||||||||||||||||||||||

| Shareholder Servicing Fees | 429 | 485 | 526 | (11.5) | (7.8) | ||||||||||||||||||||||||

| Total | $ | 659,983 | $ | 587,017 | $ | 512,914 | 12.4 | 14.4 | |||||||||||||||||||||

| Affiliated - EQH | 125,229 | 105,415 | 90,101 | 18.8 | 17.0 | ||||||||||||||||||||||||

| Non-affiliated | 534,754 | 481,602 | 422,813 | 11.0 | 13.9 | ||||||||||||||||||||||||

| Total | $ | 659,983 | $ | 587,017 | $ | 512,914 | 12.4 | 14.4 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Fixed Income Servicing includes advisory-related services fees that are not based on AUM, including derivative transaction fees, capital purchase program-related advisory services and other fixed income advisory services.

(3)Includes certain multi-asset solutions and services not included in equity or fixed income services.

6 | AllianceBernstein | ||||

Part I

Retail

We provide investment management and related services to a wide variety of individual retail investors globally through retail mutual funds we sponsor, mutual fund sub-advisory relationships, separately-managed account programs (see below), and other investment vehicles (“Retail Products and Services”).

We distribute our Retail Products and Services through financial intermediaries, including broker-dealers, insurance sales representatives, banks, registered investment advisers and financial planners. These products and services include open-end and closed-end funds that are either (i) registered as investment companies under the Investment Company Act (“U.S. Funds”), or (ii) not registered under the Investment Company Act and generally not offered to U.S. persons (“Non-U.S. Funds” and, collectively with the U.S. Funds, “AB Funds”). They also include separately-managed account programs, which are sponsored by financial intermediaries and generally charge an all-inclusive fee covering investment management, trade execution, asset allocation, and custodial and administrative services. In addition, we provide distribution, shareholder servicing, transfer agency services and administrative services for our Retail Products and Services. See “Net Revenues – Investment Advisory and Services Fees” in Item 7 for information about our retail investment advisory and services fees. See Note 2 to AB’s consolidated financial statements in Item 8 for a discussion of the commissions we pay to financial intermediaries in connection with the sale of open-end AB Funds.

Fees paid by the U.S. Funds are reflected in the applicable investment management agreement, which generally must be approved annually by the board of directors or trustees of those funds, by a majority vote of the independent directors or trustees. Increases in these fees must be approved by fund shareholders; decreases need not be, including any decreases implemented by a fund’s directors or trustees. In general, each investment management agreement with the U.S. Funds provides for termination by either party, at any time, upon 60 days’ notice.

Fees paid by Non-U.S. Funds are reflected in management agreements that continue until they are terminated. Increases in these fees generally must be approved by the relevant regulatory authority, depending on the domicile and structure of the fund, and Non-U.S. Fund shareholders must be given advance notice of any fee increases.

The mutual funds we sub-advise for EQH and its subsidiaries constitute our largest retail client. EQH and its subsidiaries accounted for approximately 14% of our retail AUM as of December 31, 2022, 2021 and 2020 and approximately 1% of our retail net revenues for the years ended December 31, 2022, 2021 and 2020.

Most open-end U.S. Funds have adopted a plan under Rule 12b-1 of the Investment Company Act that allows the fund to pay, out of assets of the fund, distribution and service fees for the distribution and sale of its shares. The open-end U.S. Funds have entered into such agreements with us, and we have entered into selling and distribution agreements pursuant to which we pay sales commissions to the financial intermediaries that distribute our open-end U.S. Funds. These agreements are terminable by either party upon notice (generally 30 days) and do not obligate the financial intermediary to sell any specific amount of fund shares.

As of December 31, 2022, retail U.S. Fund AUM were approximately $54 billion, or 22% of retail AUM, as compared to $73 billion, or 23%, as of December 31, 2021, and $62 billion, or 23%, as of December 31, 2020. Non-U.S. Fund AUM, as of December 31, 2022, totaled $96 billion, or 39% of retail AUM, as compared to $130 billion, or 41%, as of December 31, 2021, and $110 billion, or 41%, as of December 31, 2020.

| 2022 Annual Report | 7 | ||||

Part I

Our Retail Services represented approximately 38%, 41% and 39% of our AUM as of December 31, 2022, 2021 and 2020, respectively, and the fees we earned from providing these services represented approximately 49%, 50% and 49% of our net revenues for the years ended December 31, 2022, 2021 and 2020, respectively. Our AUM and revenues are as follows:

Retail Services Assets Under Management (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 116,235 | $ | 154,200 | $ | 106,866 | (24.6) | % | 44.3 | % | |||||||||||||||||||

Equity Passively Managed(1) | 30,445 | 40,821 | 35,995 | (25.4) | 13.4 | ||||||||||||||||||||||||

| Total Equity | 146,680 | 195,021 | 142,861 | (24.8) | 36.5 | ||||||||||||||||||||||||

| U.S. | 118,547 | 152,106 | 108,506 | (22.1) | 40.2 | ||||||||||||||||||||||||

| Global & Non-US | 28,133 | 42,915 | 34,355 | (34.4) | 24.9 | ||||||||||||||||||||||||

| Total Equity | 146,680 | 195,021 | 142,861 | (24.8) | 36.5 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 53,995 | 75,813 | 84,654 | (28.8) | (10.4) | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 26,714 | 29,009 | 23,202 | (7.9) | 25.0 | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 9,206 | 12,762 | 8,231 | (27.9) | 55.0 | ||||||||||||||||||||||||

| Total Fixed Income | 89,915 | 117,584 | 116,087 | (23.5) | 1.3 | ||||||||||||||||||||||||

| U.S. | 41,151 | 46,361 | 36,137 | (11.2) | 28.3 | ||||||||||||||||||||||||

| Global & Non-US | 48,764 | 71,223 | 79,950 | (31.5) | (10.9) | ||||||||||||||||||||||||

| Total Fixed Income | 89,915 | 117,584 | 116,087 | (23.5) | 1.3 | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(2): | |||||||||||||||||||||||||||||

| U.S. | 2,697 | 3,595 | 3,071 | (25.0) | 17.1 | ||||||||||||||||||||||||

| Global & Non-US | 3,594 | 3,718 | 3,321 | (3.3) | 12.0 | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 6,291 | 7,313 | 6,392 | (14.0) | 14.4 | ||||||||||||||||||||||||

| Total: | |||||||||||||||||||||||||||||

| U.S. | 162,395 | 202,062 | 147,714 | (19.6) | 36.8 | ||||||||||||||||||||||||

| Global & Non-US | 80,491 | 117,856 | 117,626 | (31.7) | 0.2 | ||||||||||||||||||||||||

| Total | $ | 242,886 | $ | 319,918 | $ | 265,340 | (24.1) | 20.6 | |||||||||||||||||||||

| Affiliated - EQH | 34,110 | 44,417 | 36,765 | (23.2) | 20.8 | ||||||||||||||||||||||||

| Non-affiliated | 208,776 | 275,501 | 228,575 | (24.2) | 20.5 | ||||||||||||||||||||||||

| Total | $ | 242,886 | $ | 319,918 | $ | 265,340 | (24.1) | 20.6 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Includes certain multi-asset solutions and services not included in equity or fixed income services

8 | AllianceBernstein | ||||

Part I

Revenues from Retail Services (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 746,889 | $ | 766,578 | $ | 508,973 | (2.6) | % | 50.6 | % | |||||||||||||||||||

Equity Passively Managed(1) | 12,870 | 14,773 | 14,347 | (12.9) | 3.0 | ||||||||||||||||||||||||

| Total Equity | 759,759 | 781,351 | 523,320 | (2.8) | 49.3 | ||||||||||||||||||||||||

| U.S. | 558,319 | 556,398 | 355,542 | 0.3 | 56.5 | ||||||||||||||||||||||||

| Global & Non-US | 201,440 | 224,953 | 167,778 | (10.5) | 34.1 | ||||||||||||||||||||||||

| Total Equity | 759,759 | 781,351 | 523,320 | (2.8) | 49.3 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 390,708 | 517,327 | 534,164 | (24.5) | (3.2) | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 89,450 | 84,945 | 70,734 | 5.3 | 20.1 | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 13,682 | 12,994 | 12,229 | 5.3 | 6.3 | ||||||||||||||||||||||||

| Total Fixed Income | 493,840 | 615,266 | 617,127 | (19.7) | (0.3) | ||||||||||||||||||||||||

| U.S. | 119,053 | 115,248 | 101,825 | 3.3 | 13.2 | ||||||||||||||||||||||||

| Global & Non-US | 374,787 | 500,018 | 515,302 | (25.0) | (3.0) | ||||||||||||||||||||||||

| Total Fixed Income | 493,840 | 615,266 | 617,127 | (19.7) | (0.3) | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(2): | |||||||||||||||||||||||||||||

| U.S. | 55,356 | 81,872 | 57,069 | (32.4) | 43.5 | ||||||||||||||||||||||||

| Global & Non-US | 13,484 | 13,117 | 12,723 | 2.8 | 3.1 | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 68,840 | 94,989 | 69,792 | (27.5) | 36.1 | ||||||||||||||||||||||||

| Total Investment Advisory and Services Fees: | |||||||||||||||||||||||||||||

| U.S. | 732,728 | 753,518 | 514,436 | (2.8) | 46.5 | ||||||||||||||||||||||||

| Global & Non-US | 589,711 | 738,086 | 695,803 | (20.1) | 6.1 | ||||||||||||||||||||||||

| Consolidated company-sponsored investment funds | 770 | 1,243 | 733 | (38.1) | 69.6 | ||||||||||||||||||||||||

| Total | 1,323,209 | 1,492,847 | 1,210,972 | (11.4) | 23.3 | ||||||||||||||||||||||||

| Distribution Revenues | 594,431 | 644,125 | 522,056 | (7.7) | 23.4 | ||||||||||||||||||||||||

| Shareholder Servicing Fees | 83,268 | 86,857 | 78,920 | (4.1) | 10.1 | ||||||||||||||||||||||||

| Total | $ | 2,000,908 | $ | 2,223,829 | $ | 1,811,948 | (10.0) | 22.7 | |||||||||||||||||||||

| Affiliated - EQH | 23,836 | 28,334 | 27,130 | (15.9) | 4.4 | ||||||||||||||||||||||||

| Non-affiliated | 1,977,072 | 2,195,495 | 1,784,818 | (9.9) | 23.0 | ||||||||||||||||||||||||

| Total | $ | 2,000,908 | $ | 2,223,829 | $ | 1,811,948 | (10.0) | 22.7 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Includes certain multi-asset solutions and services not included in equity or fixed income services.

| 2022 Annual Report | 9 | ||||

Part I

Private Wealth Management

We partner with our clients, embracing innovation and research to address increasingly complex challenges. Our clients include high-net-worth individuals and families who have created generational wealth as successful business owners, athletes, entertainers, corporate executives and private practice owners. We also provide investment and wealth advice to foundations and endowments, family offices and other entities. Our flexible and extensive investment platform offers a range of solutions, including separately-managed accounts, hedge funds, mutual funds and other investment vehicles, tailored to meet each distinct client's needs. Our investment platform is complimented with a wealth platform that includes complex tax and estate planning, pre-IPO and pre-transaction planning, multi-generational family engagement, and philanthropic advice in addition to tailored approaches to meeting the unique needs of emerging wealth and multi-cultural demographics ("Private Wealth Services").

We manage accounts pursuant to written investment advisory agreements, which generally are terminable at any time or upon relatively short notice by any authorized party, and may not be assigned without the client's consent. For information about our investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7.

Our Private Wealth Services represented approximately 16%, 16% and 15% of our AUM as of December 31, 2022, 2021 and 2020, respectively. The fees we earned from providing these services represented approximately 25%, 25% and 24% of our net revenues for 2022, 2021 and 2020, respectively. Our AUM and revenues are as follows:

Private Wealth Services Assets Under Management (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 45,977 | $ | 59,709 | $ | 50,854 | (23.0) | % | 17.4 | % | |||||||||||||||||||

Equity Passively Managed(1) | 2,304 | 1,764 | 666 | 30.6 | % | 164.9 | % | ||||||||||||||||||||||

| Total Equity | 48,281 | 61,473 | 51,520 | (21.5) | 19.3 | ||||||||||||||||||||||||

| U.S. | 28,014 | 35,014 | 28,776 | (20.0) | 21.7 | ||||||||||||||||||||||||

| Global & Non-US | 20,267 | 26,459 | 22,744 | (23.4) | 16.3 | ||||||||||||||||||||||||

| Total Equity | 48,281 | 61,473 | 51,520 | (21.5) | 19.3 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 14,391 | 14,567 | 14,515 | (1.2) | 0.4 | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 24,953 | 26,929 | 25,764 | (7.3) | 4.5 | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 2 | 230 | 195 | (99.1) | 17.9 | ||||||||||||||||||||||||

| Total Fixed Income | 39,346 | 41,726 | 40,474 | (5.7) | 3.1 | ||||||||||||||||||||||||

| U.S. | 34,764 | 36,166 | 35,042 | (3.9) | 3.2 | ||||||||||||||||||||||||

| Global & Non-US | 4,582 | 5,561 | 5,432 | (17.6) | 2.4 | ||||||||||||||||||||||||

| Total Fixed Income | 39,346 | 41,727 | 40,474 | (5.7) | 3.1 | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(2): | |||||||||||||||||||||||||||||

| U.S. | 6,607 | 6,926 | 5,927 | (4.6) | 16.9 | ||||||||||||||||||||||||

| Global & Non-US | 12,021 | 11,446 | 7,064 | 5.0 | 62.0 | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 18,628 | 18,372 | 12,991 | 1.4 | 41.4 | ||||||||||||||||||||||||

| Total: | |||||||||||||||||||||||||||||

| U.S. | 69,385 | 78,106 | 69,745 | (11.2) | 12.0 | ||||||||||||||||||||||||

| Global & Non-US | 36,870 | 43,466 | 35,240 | (15.2) | 23.3 | ||||||||||||||||||||||||

| Total | $ | 106,255 | $ | 121,572 | $ | 104,985 | (12.6) | 15.8 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Includes certain multi-asset solutions and services not included in equity or fixed income services.

10 | AllianceBernstein | ||||

Part I

Revenues from Private Wealth Services (by Investment Service) | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| Equity Actively Managed | $ | 521,155 | $ | 584,455 | $ | 487,899 | (10.8) | % | 19.8 | % | |||||||||||||||||||

Equity Passively Managed(1) | 8,700 | 4,780 | 1,113 | 82.0 | % | n/m | |||||||||||||||||||||||

| Total Equity | 529,855 | 589,235 | 489,012 | (10.1) | 20.5 | ||||||||||||||||||||||||

| U.S. | 295,235 | 325,154 | 263,938 | (9.2) | 23.2 | ||||||||||||||||||||||||

| Global & Non-US | 234,620 | 264,081 | 225,074 | (11.2) | 17.3 | ||||||||||||||||||||||||

| Total Equity | 529,855 | 589,235 | 489,012 | (10.1) | 20.5 | ||||||||||||||||||||||||

| Fixed Income: | |||||||||||||||||||||||||||||

| Fixed Income Taxable | 66,851 | 72,404 | 71,575 | (7.7) | 1.2 | ||||||||||||||||||||||||

| Fixed Income Tax-Exempt | 125,123 | 130,391 | 123,952 | (4.0) | 5.2 | ||||||||||||||||||||||||

Fixed Income Passively Managed(1) | 1,804 | 2,634 | 2,891 | (31.5) | (8.9) | ||||||||||||||||||||||||

| Total Fixed Income | 193,778 | 205,429 | 198,418 | (5.7) | 3.5 | ||||||||||||||||||||||||

| U.S. | 159,411 | 167,402 | 160,666 | (4.8) | 4.2 | ||||||||||||||||||||||||

| Global & Non-US | 34,367 | 38,027 | 37,752 | (9.6) | 0.7 | ||||||||||||||||||||||||

| Total Fixed Income | 193,778 | 205,429 | 198,418 | (5.7) | 3.5 | ||||||||||||||||||||||||

Alternatives/Multi-Asset Solutions(2): | |||||||||||||||||||||||||||||

| U.S. | 195,666 | 249,432 | 109,169 | (21.6) | 128.5 | ||||||||||||||||||||||||

| Global & Non-US | 69,245 | 71,524 | 76,065 | (3.2) | (6.0) | ||||||||||||||||||||||||

| Total Alternatives/Multi-Asset Solutions | 264,911 | 320,956 | 185,234 | (17.5) | 73.3 | ||||||||||||||||||||||||

| Total Investment Advisory and Services Fees: | |||||||||||||||||||||||||||||

| U.S. | 650,311 | 741,987 | 533,773 | (12.4) | 39.0 | ||||||||||||||||||||||||

| Global & Non-US | 338,232 | 373,632 | 338,891 | (9.5) | 10.3 | ||||||||||||||||||||||||

| Total | 988,543 | 1,115,619 | 872,664 | (11.4) | 27.8 | ||||||||||||||||||||||||

| Distribution Revenues | 12,496 | 7,641 | 7,137 | 63.5 | 7.1 | ||||||||||||||||||||||||

| Shareholder Servicing Fees | 2,964 | 2,882 | 2,871 | 2.8 | 0.4 | ||||||||||||||||||||||||

| Total | $ | 1,004,003 | $ | 1,126,142 | $ | 882,672 | (10.8) | 27.6 | |||||||||||||||||||||

(1)Includes index and enhanced index services.

(2)Includes certain multi-asset solutions and services not included in equity or fixed income services.

| 2022 Annual Report | 11 | ||||

Part I

Bernstein Research Services

We offer high-quality fundamental and quantitative research and trade execution services in equities and listed options to institutional investors, such as mutual fund and hedge fund managers, pension funds and other institutional investors ("Bernstein Research Services" or "BRS"). We serve our clients, which are based in major markets around the world, through our trading professionals, who are primarily based in New York, London and Hong Kong, and our research analysts, who provide fundamental company and industry research along with quantitative research into securities valuation and factors affecting stock-price movements.

Additionally, we occasionally provide equity capital markets services to issuers of publicly traded securities, such as initial public offerings and follow-on offerings, generally acting as co-manager in such offerings.

We earn revenues for providing investment research to, and executing brokerage transactions for, institutional clients. These clients compensate us principally by directing us to execute brokerage transactions on their behalf, for which we earn commissions, and to a lesser but increasing extent, by paying us directly for research through commission sharing agreements or cash payments. Bernstein Research Services accounted for approximately 10%, 10% and 12% of our net revenues for the years ended December 31, 2022, 2021 and 2020, respectively.

For information regarding trends in fee rates charged for brokerage transactions, see “Risk Factors” in Item 1A.

In the fourth quarter of 2022, AB and Société Générale (EURONEXT: SCGLY, “SocGen”), a leading European bank, announced plans to form a joint venture combining their respective cash equities and research businesses. As a result, the BRS business has been classified as held for sale. For further discussion, see Note 24 Acquisitions and Divestitures to AB's consolidated financial statements in Item 8.

Our Bernstein Research Services revenues are as follows:

| Revenues from Bernstein Research Services | ||

| Years Ended December 31 | % Change | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022-21 | 2021-20 | |||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||

| Bernstein Research Services | $ | 416,273 | $ | 452,017 | $ | 459,744 | (7.9) | % | (1.7) | % | |||||||||||||||||||

Custody

Our U.S. based broker-dealer subsidiary acts as custodian for the majority of our Private Wealth Management AUM and some of our Institutional AUM. Other custodian arrangements, directed by clients, include banks, trust companies, brokerage firms and other financial institutions.

People Management

As a leading global investment management and research firm, we bring together a wide range of insights, expertise and innovations to advance the interests of our clients around the world. The intellectual capital and distinctive knowledge of our employees are collectively the most important assets of our firm, so the long-term sustainability and success of our firm is heavily dependent on our people. In 2022, our human capital and administrative services teams became our "People" team, a key acknowledgement of the central role they play in supporting our employees and advancing their work experience. We are keenly focused on:

•fostering an inclusive culture by incorporating diversity, equity and inclusion in all levels of our business;

•encouraging innovation;

•developing, retaining and recruiting high quality talent; and

•aligning employees’ incentives and risk taking with those of the firm.

As a result, we have a strong firm culture that helps us maximize performance and drive excellence. Further, our firm’s role as a fiduciary is embedded in our culture. As a fiduciary, our firm’s primary objective is to act in our clients' best interests and help them reach their financial goals.

Also, our Board of Directors (the "Board") and committees of the Board, particularly our Compensation and Workplace Practices Committee, provide oversight into various matters affecting our people, including emerging people management risks and strategies to mitigate our exposure to those risks. Furthermore, our Board and Board committees evaluate the overall effectiveness of our social responsibility policies, goals and programs and recommend changes to management as necessary. These collaborative efforts contribute to the overall framework that guides how AB attracts, retains and develops a workforce that supports our values and strategic initiatives.

12 | AllianceBernstein | ||||

Part I

Talent Acquisition

AB seeks to achieve excellence in business and investment performance by recruiting and hiring a workforce with diversity of thought, backgrounds and experiences. We believe that diverse and inclusive teams generate better ideas and reach more balanced decisions. We seek to leverage the unique backgrounds of our employees to meet the needs of a broad range of clients and engage with the communities in which we operate. We engage several external organizations to assist in attracting and recruiting top talent at all levels, with a particular focus on attracting diverse talent. We have a sizable group of internal talent acquisition associates focused on recruiting, and we have implemented various people-related initiatives to develop and provide for a balanced workforce. Additionally, we offer internship programs for students to work in positions across functional areas of the firm, and an important part of our emerging talent and post-graduate recruitment strategy is to convert a high percentage of our interns into full-time employees.

Employee Engagement

We believe a workforce is most productive, effective and highly engaged when they feel connected to our business and culture. We seek to provide diverse work experiences, professional development opportunities, competitive compensation and benefits, an inclusive and diverse culture and social engagement projects to keep our employees motivated, connected to our firm and engaged throughout their careers. We strive to create a culture of intellectual curiosity and collaboration, creating an environment where our employees can thrive and do their best work. We foster growth and advancement through different training avenues to develop skill sets, create opportunities for networking, both internally and externally, and we encourage internal mobility as a part of our employees' career trajectory.

It is important that our employees are not only connected to our business but also to the communities in which we operate. As such, AB offers many opportunities for our employees to volunteer in the communities in which we serve, including our firm-wide philanthropic initiative, AB Gives Back. Other initiatives in support of these objectives include a five-year refresh award, whereby employees receive two additional weeks off for every five years of service. In addition, we utilize AB Voice, a periodic survey designed to measure employee satisfaction and engagement, allowing us to identify and address performance gaps.

Diversity, Equity and Inclusion

Our continued commitment to Diversity, Equity & Inclusion ("DEI") across all facets of our firm aligns with broader industry recognition of the workplace as both a working and learning community. We believe that our company plays a critical role in empowering our people though purpose and fostering an inclusive, collaborative environment and equitable culture that allows for connectivity, belonging and success at every level.

A key element of our ongoing journey has been to adapt as appropriate to evolving DEI industry trends. In 2022, we formally incorporated the concept of "equity" into our strategy and team name in an effort to more accurately reflect our current and anticipated approach.

Our firm's community engagement efforts have been further integrated under the DEI umbrella. To support our grantee and community partners, bolster our commitment to our non-profit clients, and add value for our current and future employees, our approach leverages four programs under the "AB Gives Back" brand: philanthropy, volunteering, board participation and gift matching. Some highlights include improved student attendance and financial literacy in inner city neighborhoods and over 3,000 employee volunteer hours completed in 2022.

We have enhanced our talent attraction and retention approach to position ourselves as an employer of choice and increase investment in our people. We have developed a diverse talent strategy with a goal of gaining a deeper understanding of the needs of diverse talent and also equipping managers with the necessary tools to effectively manage an increasingly diverse workforce. The strategy includes incorporating the concept of inclusive leadership into the firm-wide leadership development curriculum and providing opportunities to build relationships across the firm at all levels.

Finally, our people remain our top priority. Over the course of the last year, there has been a continued focus on education and deepening engagement across all pillars of our strategy to include Employee Resource Groups ("ERGs"), corporate partnerships, and the overall experience at AB. ERGs have been a major proponent of these efforts by cultivating spaces for courageous conversations, encouraging professional development and personal wellness, and raising awareness for various underrepresented communities.

| 2022 Annual Report | 13 | ||||

Part I

Compensation and Benefits

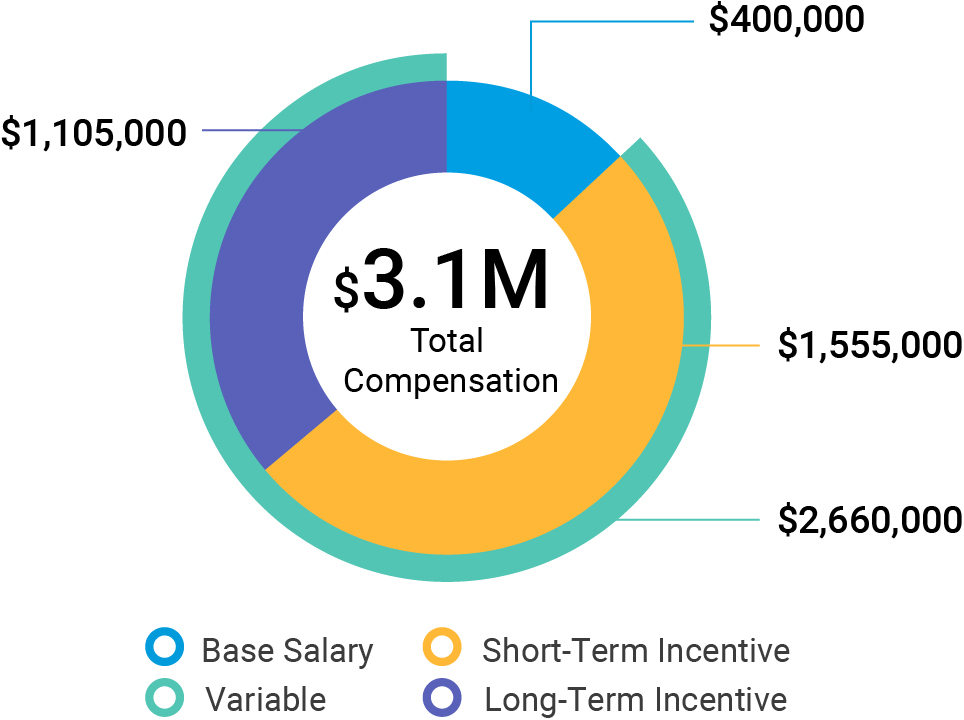

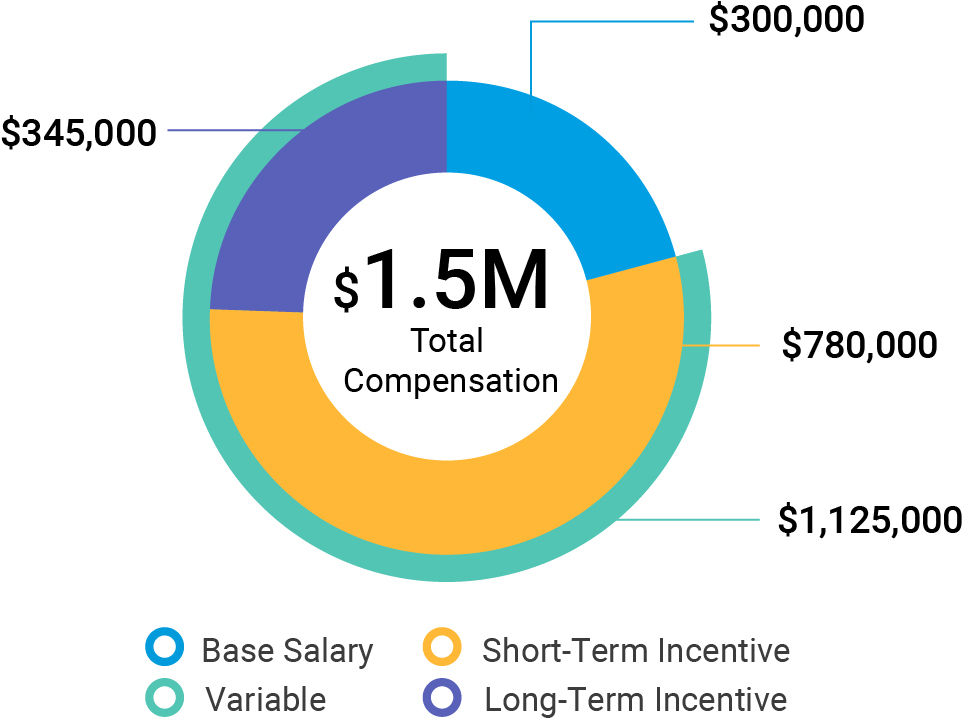

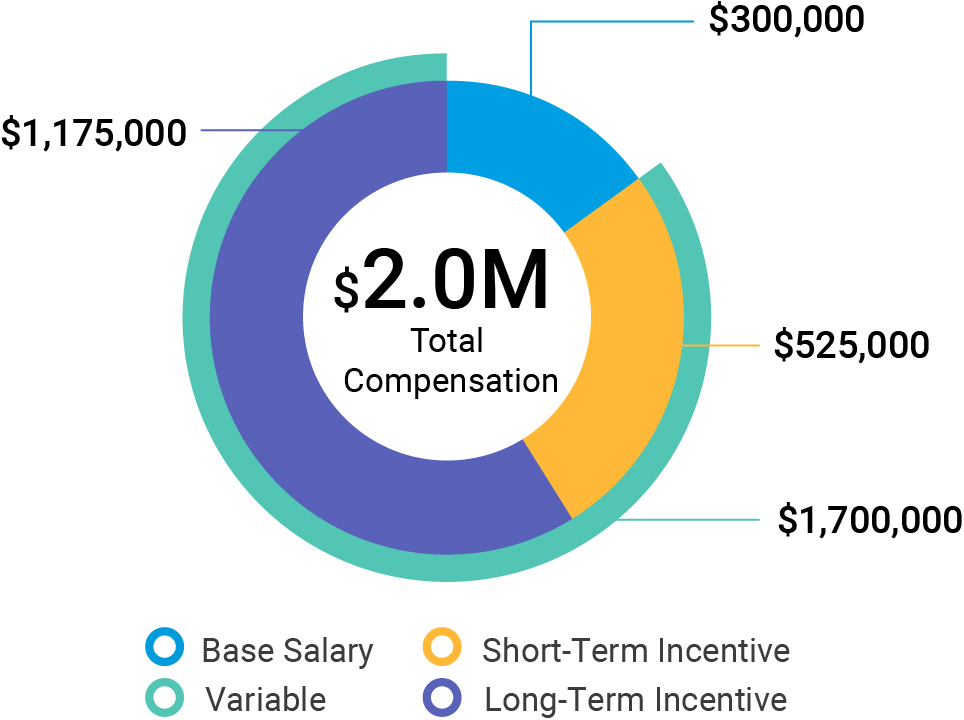

We consistently invest in our workforce by offering competitive compensation. We utilize a variety of compensation elements, including base salaries, annual short-term compensation awards (i.e., cash bonuses) and, for those of our employees who earn more than $300,000 annually, a long-term compensation award program. Long-term incentive compensation awards generally are denominated in restricted AB Holding Units. We utilize this structure to foster a stronger sense of ownership and align the interests of our employees directly with the interests of our Unitholders and indirectly with the interests of our clients, as strong performance for our clients generally contributes directly to increases in AUM and improved financial performance for the firm. Furthermore, in the U.S. (and elsewhere, although benefits may differ by jurisdiction):

•We provide employee wages that are competitive and consistent with employee positions, skill levels, performance, experience, knowledge and geographic location.

•We engage nationally recognized compensation and benefits consulting firms to independently evaluate the effectiveness of our executive compensation and benefit programs, as well as consulting services relating to the amount and form of compensation paid to employees other than executives, and to provide benchmarking against our industry peers; this process also includes engagement of outside counsel to conduct privileged pay equity reviews to ensure ongoing compliance with applicable laws and regulations.

•We provide merit-based and cost of living annual salary increases, as well as incentive compensation, which are communicated to employees at year-end and documented through our annual review procedures, upon internal transfer and/or promotion; and

•The firm makes benefits available to all eligible employees, including a flexible in-office work schedule that permits working remotely two days weekly, health and prescription insurance, paid and unpaid leaves, a retirement plan, and life and disability/accident coverage. We also offer a variety of voluntary benefits that allow employees to select the options that meet their needs, including flexible time-off, paid parental leave, adoption and surrogacy assistance, tuition reimbursement, and a health and financial wellness program.

Health, Safety and Flexibility for our Workforce

During 2020, at the onset of COVID, we mobilized to ensure the health and safety of our employees globally. We implemented business continuity measures, including travel restrictions and a work-from-home requirement for almost all personnel (other than a relatively small number of employees whose physical presence in our offices was considered critical), which lasted through the second quarter of 2021. Then, while continuing to closely monitor COVID-related conditions globally, we developed return-to-office programs tailored locally, so that employees could feel safe knowing that their health, and the health of their families, were a priority. This meant a staggered return to the office so that we could monitor data while complying with local ordinances.

Beginning in July 2021, in the U.S. we returned to the office three days a week, alternating weeks through the end of 2021. In early 2022, while most of our employees returned to the office full-time, we offered employees the ability to work remotely up to two days per week given the ability and diligence our employees demonstrated while working remotely. By the end of 2022, all employees had returned to the office utilizing a hybrid work schedule, including the flexibility to work remotely up to two days per week. We believe this approach allows our employees to maintain the important benefits of in-person collaboration while providing greater work-life balance.

Employees

As of December 31, 2022, our firm had 4,436 full-time employees, including 203 AB CarVal employees, compared to 4,118 full-time employees as of December 31, 2021, representing a 7.7% increase (a 2.8% increase excluding AB CarVal).

14 | AllianceBernstein | ||||

Part I

As of December 31, 2022, our employees reflected the following characteristics and locations:

| Region: | Female | % Female | Male | % Male | Grand Total | % of Total | ||||||||||||||

| Americas | 1,164 | 26 | % | 2,099 | 47 | % | 3,263 | 74 | % | |||||||||||

| Asia ex Japan | 234 | 5 | % | 227 | 5 | % | 461 | 10 | % | |||||||||||

| EMEA | 221 | 5 | % | 377 | 9 | % | 598 | 14 | % | |||||||||||

| Japan | 56 | 2 | % | 43 | 1 | % | 99 | 2 | % | |||||||||||

Grand Total(1) (2) | 1,675 | 38 | % | 2,746 | 62 | % | 4,421 | 100 | % | |||||||||||

(1)The table above only reflects employees who have self-reported as male or female and as such does not reconcile to our total of 4,436 full-time employees.

(2)The methodology utilized to populate the table above changed from the prior year. Specifically, while in 2021 we presented the total percentage of female and male full-time employees by region who self-reported, in the above table we present the total percentage of female and male full-time employees by region, as a percentage of total global full-time employees, who self-reported.

In connection with our establishing 1,250 roles in Nashville, Tennessee, we have relocated many of our employees from our New York City and White Plains, New York, locations. Employees whose roles are in-scope for the move, but who are not relocating, receive a separation package. We expect layoffs to continue on a rolling basis until all in-scope roles are filled in Nashville.

Information about our Executive Officers

Please refer to "Item 10. Directors, Executive Officers and Corporate Governance" below for information relating to our firm's executive officers.

Service Marks

We have registered a number of service marks with the U.S. Patent and Trademark Office and various foreign trademark offices, including the mark “AllianceBernstein.” The logo set forth below is a service mark of AB:

In 2015, we established a new brand identity by prominently incorporating “AB” into our brand architecture, while maintaining the legal names of our corporate entities. With this and other related refinements, our company, and our Institutional and Retail businesses, are referred to as “AllianceBernstein (AB)” or simply “AB.” Private Wealth Management and Bernstein Research Services are referred to as “AB Bernstein.” Also, we adopted the logo service mark described above.

In connection with the Bernstein Transaction, we acquired all of the rights in, and title to, the Bernstein service marks, including the mark “Bernstein.”

Service marks are generally valid and may be renewed indefinitely, as long as they are in use and/or their registrations are properly maintained.

Regulation

Virtually all aspects of our business are subject to various federal and state laws and regulations, rules of various securities regulators and exchanges, and laws in the foreign countries in which our subsidiaries conduct business. These laws and regulations primarily are intended to protect clients and fund shareholders and generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the carrying on of business for failure to comply with such laws and regulations. Possible sanctions that may be imposed on us include the suspension of individual employees, limitations on engaging in business for specific periods, the revocation of the registration as an investment adviser or broker-dealer, censures and fines.

| 2022 Annual Report | 15 | ||||

Part I

AB, AB Holding, the General Partner and six of our subsidiaries (Sanford C. Bernstein & Co., LLC (“SCB LLC”), AB Broadly Syndicated Loan Manager LLC, AB Custom Alternative Solutions LLC, AB Private Credit Investors LLC, AB CarVal Investors and W.P. Stewart Asset Management Ltd.) are registered with the SEC as investment advisers under the Investment Advisers Act. Additionally, AB Holding is an NYSE-listed company and, accordingly, is subject to applicable regulations promulgated by the NYSE. Also, AB, SCB LLC and AB Custom Alternative Solutions LLC are registered with the Commodity Futures Trading Commission (“CFTC”) as commodity pool operators and commodity trading advisers; SCB LLC also is registered with the CFTC as a commodities introducing broker.

Each U.S. Fund is registered with the SEC under the Investment Company Act and each Non-U.S. Fund is subject to the laws in the jurisdiction in which the fund is registered. For example, our platform of Luxembourg-based funds operates pursuant to Luxembourg laws and regulations, including Undertakings for the Collective Investment in Transferable Securities Directives, and is authorized and supervised by the Commission de Surveillance du Secteur Financier (“CSSF”), the primary regulator in Luxembourg. AllianceBernstein Investor Services, Inc., one of our subsidiaries, is registered with the SEC as a transfer and servicing agent.

SCB LLC and another of our subsidiaries, AllianceBernstein Investments, Inc., are registered with the SEC as broker-dealers, and both are members of the Financial Industry Regulatory Authority. In addition, SCB LLC is a member of the NYSE and other principal U.S. exchanges.

Many of our subsidiaries are subject to the oversight of regulatory authorities in the jurisdictions outside the United States in which they operate, including the Ontario Securities Commission, the Investment Industry Regulatory Organization of Canada, the European Securities and Markets Authority, the Financial Conduct Authority in the U.K., the CSSF in Luxembourg, the Financial Services Agency in Japan, the Securities & Futures Commission in Hong Kong, the Monetary Authority of Singapore, the Financial Services Commission in South Korea, the Financial Supervisory Commission in Taiwan and The Securities and Exchange Board of India. While these regulatory requirements often may be comparable to the requirements of the SEC and other U.S. regulators, they are sometimes more restrictive and may cause us to incur substantial expenditures of time and money related to our compliance efforts. For additional information relating to the regulations that impact our business, please refer to "Risk Factors" in Item 1A.

History and Structure

We have been in the investment research and management business for more than 50 years. Bernstein was founded in 1967. Alliance Capital was founded in 1971 when the investment management department of Donaldson, Lufkin & Jenrette, Inc. (since November 2000, a part of Credit Suisse Group) merged with the investment advisory business of Moody’s Investors Service, Inc.

In April 1988, AB Holding “went public” as a master limited partnership. AB Holding Units, which trade under the ticker symbol “AB,” have been listed on the NYSE since that time.

In October 1999, AB Holding reorganized by transferring its business and assets to AB, a newly-formed operating partnership, in exchange for all of the AB Units (the “Reorganization”). Since the date of the Reorganization, AB has conducted the business formerly conducted by AB Holding and AB Holding’s activities have consisted of owning AB Units and engaging in related activities. Unlike AB Holding Units, AB Units do not trade publicly and are subject to significant restrictions on transfer. The General Partner is the general partner of both AB and AB Holding.

In October 2000, our two legacy firms, Alliance Capital and Bernstein, combined, bringing together Alliance Capital’s expertise in growth equity and corporate fixed income investing and its family of retail mutual funds, with Bernstein’s expertise in value equity investing, tax-exempt fixed income management, and its Private Wealth Management and Bernstein Research Services businesses.

16 | AllianceBernstein | ||||

Part I

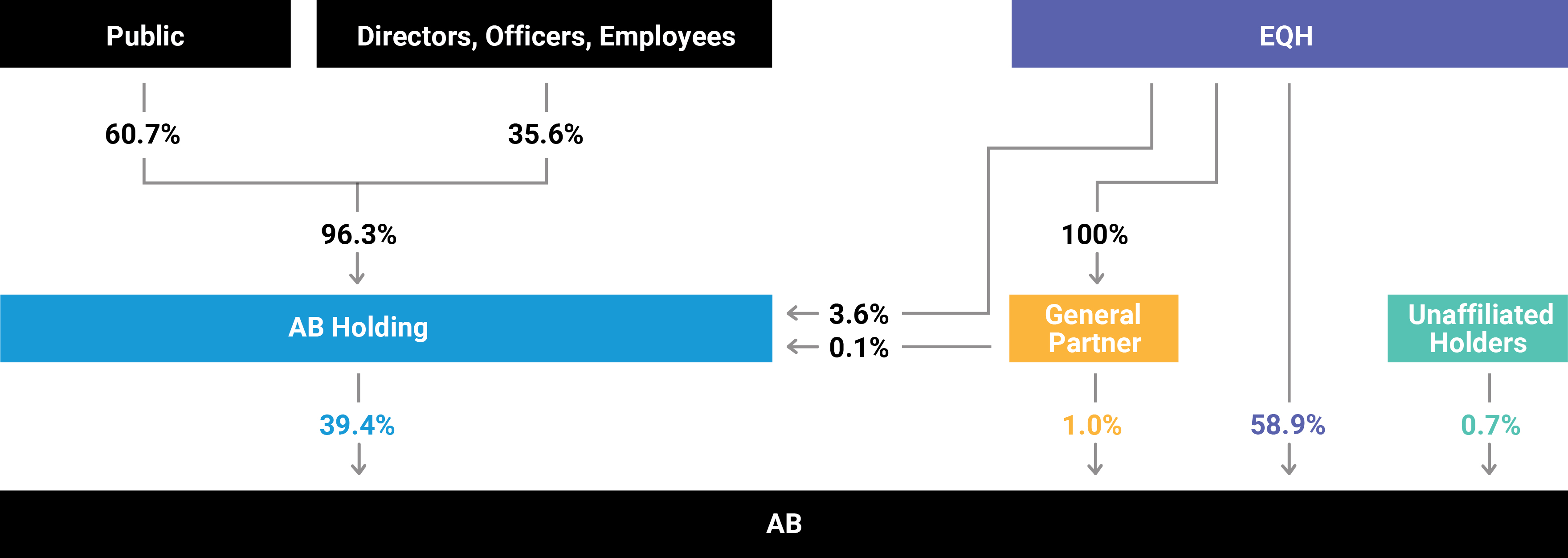

As of December 31, 2022, the condensed ownership structure of AB is as follows (for a more complete description of our ownership structure, see “Principal Security Holders” in Item 12):

The General Partner owns 100,000 general partnership units in AB Holding and a 1% general partnership interest in AB. Including these general partnership interests, EQH, directly and through certain of its subsidiaries (see “Principal Security Holders” in Item 12), had an approximate 61.3% economic interest in AB as of December 31, 2022.

Competition

We compete in all aspects of our business with numerous investment management firms, mutual fund sponsors, brokerage and investment banking firms, insurance companies, banks, savings and loan associations, and other financial institutions that often provide investment products with similar features and objectives as those we offer. Our competitors offer a wide range of financial services to the same customers that we seek to serve. Some of our competitors are larger, have a broader range of product choices and investment capabilities, conduct business in more markets, and have substantially greater resources than we do. These factors may place us at a competitive disadvantage, and we can give no assurance that our strategies and efforts to maintain and enhance our current client relationships, and create new ones, will be successful.

In addition, EQH and its subsidiaries provide financial services, some of which compete with those we offer. The AB Partnership Agreement specifically allows EQH and its subsidiaries (other than the General Partner) to compete with AB and to pursue opportunities that may be available to us. EQH and certain of its subsidiaries have substantially greater financial resources than we do and are not obligated to provide resources to us.

To grow our business, we believe we must be able to compete effectively for AUM. Key competitive factors include:

•our investment performance for clients;

•our commitment to place the interests of our clients first;

•the quality of our research;

•our ability to attract, motivate and retain highly skilled, and often highly specialized, personnel;

•the array of investment products we offer;

•the fees we charge;

•Morningstar/Lipper rankings for the AB Funds;

•our ability to sell our actively-managed investment services despite the fact that many investors favor passive services;

•our operational effectiveness;

•our ability to further develop and market our brand; and

•our global presence.

Competition is an important risk that our business faces and should be considered along with the other factors we discuss in “Risk Factors” in Item 1A.

| 2022 Annual Report | 17 | ||||

Part I

Available Information

AB and AB Holding file or furnish annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to such reports, and other reports (and amendments thereto) required to comply with federal securities laws, including Section 16 beneficial ownership reports on Forms 3, 4 and 5, registration statements and proxy statements. We maintain an Internet site (http://www.alliancebernstein.com) where the public can view these reports, free of charge, as soon as reasonably practicable after each report is filed with, or furnished to, the SEC. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Please consider this section along with the description of our business in Item 1, the competition section immediately above and AB’s financial information contained in Items 7 and 8. The majority of the risk factors discussed below directly affect AB. These risk factors also affect AB Holding because AB Holding’s principal source of income and cash flow is attributable to its investment in AB. See also “Cautions Regarding Forward-Looking Statements” in Item 7.

Business-related Risks

Our revenues and results of operations depend on the market value and composition of our AUM, which can fluctuate significantly based on various factors, including many factors outside of our control.

We derive most of our revenues from investment advisory and services fees, which typically are calculated as a percentage of the value of AUM as of a specified date, or as a percentage of the value of average AUM for the applicable billing period, and vary with the type of investment service, the size of the account and the total amount of assets we manage for a particular client. The value and composition of our AUM can be adversely affected by several factors, including:

•Market Factors. Our AUM remain sensitive to the volatility associated with global financial market conditions. For example, the dramatic securities market declines experienced during March 2020, which resulted from the global effects of COVID-19, caused a significant reduction in our AUM. Markets and AUM levels recovered to new highs in 2021 following unprecedented, coordinated monetary and fiscal policy support and the approval of vaccines to help remedy the global pandemic. However, significant supply chain challenges, energy shortages and labor shortages, brought about by COVID-19 and significantly exacerbated by the conflict in Ukraine, contributed to heightened global inflationary pressures, which resulted in sizable interest rate increases and associated market volatility in 2022. We recognize that, due to continued uncertainty associated with these circumstances, markets may remain volatile and, accordingly, there remains risk of a significant reduction in our revenues and net income in future periods. Global economies and financial markets are increasingly interconnected, which increases the probability that conditions in one country or region might adversely impact a different country or region. Conditions affecting the general economy, including political, social or economic instability at the local, regional or global level may also affect the market value of our AUM. Health crises, such as the COVID-19 pandemic, as well as other incidents that interrupt the expected course of events, such as natural disasters, war (such as the ongoing conflict in Ukraine) or civil disturbance, acts of terrorism (whether foreign or domestic), power outages and other unforeseeable and external events, and the public response to or fear of such diseases or events, have had and may in the future have a significant adverse effect on financial markets and our AUM, revenues and net income. Furthermore, the preventative and protective health-related actions, such as business activity suspensions and population lock-downs, that governments have taken, and may continue to take, in response to COVID-19 have resulted, and may continue to result, in periods of business interruption, inability to obtain raw materials, supplies and component parts, and reduced or disrupted operations. Also, significant market volatility and uncertainty, and reductions in the availability of margin financing, can significantly limit the liquidity of certain asset backed and other securities, making it at times impossible to sell these securities at prices reflecting their true economic value. While liquidity conditions were relatively stable in 2022 despite market volatility, we recognize the possibility that conditions could deteriorate in the future. Lack of liquidity makes it more difficult for our funds to meet redemption requests. If liquidity were to worsen, this may have a significant adverse effect on our AUM, revenues and net income in the future.

•Client Preferences. Generally, our clients may withdraw their assets at any time and on short notice. Also, changing market dynamics and investment trends, particularly with respect to sponsors of defined benefit plans choosing to invest in less risky investments and the ongoing shift to lower-fee passive services described below, may continue to reduce interest in some of the investment products we offer, and/or clients and prospects may continue to seek investment products that we may not currently offer. Loss of, or decreases in, AUM reduces our investment advisory and services fees and revenues.

18 | AllianceBernstein | ||||

Part I

•Our Investment Performance. Our ability to achieve investment returns for clients that meet or exceed investment returns for comparable asset classes and competing investment services is a key consideration when clients decide to keep their assets with us or invest additional assets, and when a prospective client is deciding whether to invest with us. Poor investment performance, both in absolute terms and/or relative to peers and stated benchmarks, may result in clients withdrawing assets and prospective clients choosing to invest with competitors.

•Investing Trends. Our fee rates can vary significantly among the various investment products and services we offer to our clients (see “Net Revenues” in Item 7 for additional information regarding our fee rates); our fee realization rate fluctuates as clients shift assets between accounts or products with different fee structures.

•Service Changes. We may be required to reduce our fee levels, restructure the fees we charge and/or adjust the services we offer to our clients because of, among other things, regulatory initiatives (whether industry-wide or specifically targeted), changing technology in the asset management business (including algorithmic strategies and emerging financial technology), court decisions and competitive considerations. A reduction in fee levels would reduce our revenues.

•Interest Rate Changes. Investor interest in and the valuation of our fixed income and multi-asset investment portfolios can be adversely affected by changes in interest rates, particularly if interest rates increase substantially and quickly.

A decrease in the value of our AUM, a decrease in the amount of AUM we manage, an adverse mix shift in our AUM and/or a reduction in the level of fees we charge would adversely affect our investment advisory fees and revenues. A reduction in revenues, without a commensurate reduction in expenses, adversely affects our results of operations.

The industry-wide shift from actively managed investment services to passive services has adversely affected our investment advisory and services fees, revenues and results of operations, and this trend may continue.

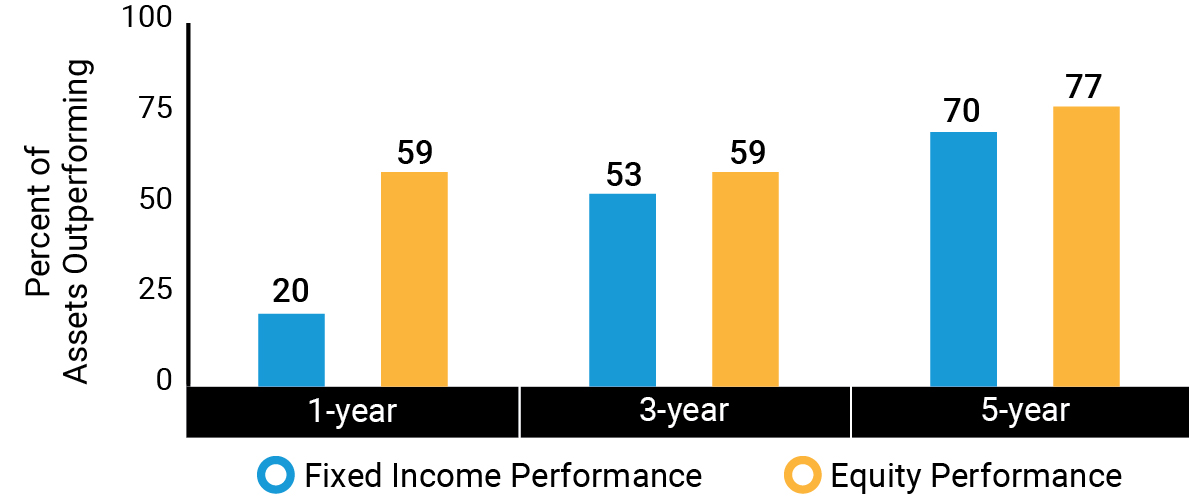

Our competitive environment has become increasingly difficult, as active managers, which invest based on individual security selection, have, on average, consistently underperformed passive services, which invest based on market indices. Active performance relative to benchmarks as of mid-2022 deteriorated from prior-year levels, with 40% of active managers outperforming their passive benchmarks for the 12 months ended June 30, 2022 (latest data available), compared to 47% for the prior 12-month period. U.S. stock active funds fared better than non-U.S. with 45% of U.S. active stock funds outperforming benchmarks, as compared with 23% for non-U.S. stock funds. Performance of actively managed bond funds decreased sharply in 2022, with just 29% outperforming benchmarks, representing a 44% decline compared to the prior-year period.

Flows into actively managed funds deteriorated industry-wide in 2022, with U.S. industry-wide active mutual fund outflows of $974 billion in 2022, contrasted with inflows of $148 billion in 2021. Active fixed income U.S. mutual funds experienced outflows of $482 billion in 2022, compared to inflows of $368 billion in 2021. Furthermore, active equity U.S. mutual fund outflows accelerated to $432 billion in 2022, compared to outflows of $191 billion in 2021. By contrast, demand for passive strategies in the U.S. continued to grow, though at a reduced rate from the prior year, as industry-wide total passive mutual fund net inflows of $518 billion in 2022 compared to $928 billion in 2021. Organic growth through net inflows continues to be difficult to achieve for active managers, such as AB, and requires taking market share from other active managers.

The significant shift from active services to passive services adversely affects Bernstein Research Services revenues as well. Institutional global market trading volumes continue to be pressured (notwithstanding the heightened market volatility and trading volume predominantly relating to COVID-19 in the first half of 2020) by persistent active equity outflows and passive equity inflows. As a result, portfolio turnover has declined and investors hold fewer shares that are actively traded by managers.

Our reputation could suffer if we are unable to deliver consistent, competitive investment performance.

Our business is based on the trust and confidence of our clients. Damage to our reputation, resulting from poor or inconsistent investment performance, among other factors, can reduce substantially our AUM and impair our ability to maintain or grow our business.

EQH and its subsidiaries provide a significant amount of our AUM and fund a significant portion of our seed investments, and if our agreements with them terminate or they withdraw capital support it could have a material adverse effect on our business, results of operations and/or financial condition.

EQH (our parent company) and its subsidiaries constitute our largest client. Our EQH affiliates represented approximately 16% of our AUM as of December 31, 2022, and we earned approximately 4% of our net revenues from services we provided to them. Our related investment management agreements are terminable at any time or on short notice by either party, and EQH is not under any obligation to maintain any level of AUM with us. A material adverse effect on our business, results of operations and/or financial condition could result if EQH were to terminate its investment management agreements with us.

| 2022 Annual Report | 19 | ||||

Part I

Our business is dependent on investment advisory agreements with clients, and selling and distribution agreements with various financial intermediaries and consultants, which generally are subject to termination or non-renewal on short notice.