| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) | |

(Address of principal executive offices) |

(Zip Code) | |

| Title of each class |

Trading Symbols(s) |

Name of each exchange on which registered | ||

| ☒ | Accelerated filer | ☐ | ||||

Non-accelerated filer |

☐ | Smaller reporting company | ||||

| Emerging growth company | ||||||

Page |

||||||

Part I |

||||||

| Item 1 | 3 | |||||

| Item 1A | 19 | |||||

| Item 1B | 37 | |||||

| Item 2 | 37 | |||||

| Item 3 | 39 | |||||

| Item 4 | 39 | |||||

Part II |

||||||

| Item 5 | 40 | |||||

| Item 6 | 41 | |||||

| Item 7 | 42 | |||||

| Item 7A | 56 | |||||

| Item 8 | 59 | |||||

| Item 9 | 115 | |||||

| Item 9A | 115 | |||||

| Item 9B | 116 | |||||

| Item 9C | 116 | |||||

Part III |

||||||

| Item 10 | 117 | |||||

| Item 11 | 117 | |||||

| Item 12 | 117 | |||||

| Item 13 | 117 | |||||

| Item 14 | 117 | |||||

Part IV |

||||||

| Item 15 | 118 | |||||

| Item 16 | 121 | |||||

| 122 | ||||||

ITEM 1 |

BUSINESS |

| • | NMR |

| • | EPR |

| • | MRI |

| • | MPI |

| • | PET |

| • | SPECT |

| • | CT |

| • | MALDI -TOF —Matrix-assisted laser desorption ionization time-of-flight time-of-flight (MALDI-TOF); |

| • | ESI -TOF time-of-flight ESI-quadrupole-TOF |

| • | MRMS (Q-q-MRMS); |

| • | ITMS |

| • | GC -MS chromatography-mass spectrometry systems utilizing triple-quadrupole time-of-flight |

| • | LC -MS chromatography-mass spectrometry systems utilizing triple-quadrupole time-of flight mass spectrometry; |

| • | FT -IR transform-infrared spectroscopy; |

| • | NIR —Near-infrared spectroscopy; and |

| • | Raman |

| • | XRD X-ray diffraction, often referred to as X-ray diffraction; |

| • | XRF —X-ray fluorescence, also called X-ray spectrometry, including handheld XRF systems; |

| • | SC -XRD— X-ray diffraction, often referred to as X-ray crystallography; |

| • | µ CT— X-ray micro computed tomography, X-ray microscopy; |

| • | EDS— X-ray spectroscopy on electron microscopes; |

| • | EBSD— |

| • | S -OES— |

| • | CS/ONH— |

| • | AFM |

| • | FM |

| • | SOM |

| • | TMT |

| • | NanoIR |

| • | Alicona non-contact dimensional metrology; and |

| • | Canopy |

Number of Employees |

||||||||

2021 |

2020 |

|||||||

| Production and distribution |

3,690 | 3,570 | ||||||

| Selling and marketing |

1,900 | 1,770 | ||||||

| General and administrative |

885 | 825 | ||||||

| Research and development |

1,290 | 1,235 | ||||||

| |

|

|

|

|||||

| Total |

7,765 | 7,400 | ||||||

| |

|

|

|

|||||

ITEM 1A |

RISK FACTORS |

| • | Our financial condition and results of operations for fiscal 2022 may continue to be adversely affected by the COVID-19 pandemic; |

| • | Supply chain issues, including increasing demand for certain components used in our products and production delays, has and could continue to result in significant additional costs and manufacturing inefficiencies, which could adversely impact our revenue, increase our manufacturing costs and have a material adverse effect on our operating results. |

| • | Unfavorable economic or political conditions in the countries in which we operate may have an adverse impact on our business results or financial condition; |

| • | We derive a significant portion of our revenue from international sales and are subject to the operational risks of doing business in foreign countries; |

| • | Adverse global economic conditions, geopolitical tensions and other conditions that impact our increasingly global operations could have a negative effect on our business, results of operations and financial condition and liquidity. |

| • | If our products fail to achieve and sustain sufficient market acceptance across their broad intended range of applications, we will not generate expected revenue; |

| • | Our products compete in markets that are subject to rapid technological change, and one or more of the technologies underlying our products could be made obsolete by new technology; |

| • | If investment in life and material science research spending declines, our ability to generate revenue may suffer; |

| • | Any reduction in the capital resources or government funding of our customers could reduce our sales and impede our ability to generate revenue; |

| • | Disruptions at any of our manufacturing facilities could adversely affect our business; |

| • | In addition to the risks applicable to our life science and materials analysis products, our CBRNE detection products are subject to a number of additional risks, including lengthy product development and contract negotiation periods and certain risks inherent in long-term government contracts; |

| • | Our debt may adversely affect our cash flow and may restrict our investment opportunities or limit our activities; |

| • | The transition away from LIBOR may adversely affect our cost to obtain financing; |

| • | If we lose our strategic partners, our marketing and sales efforts could be impaired; |

| • | We face risks related to sales through distributors and other third parties that we do not control, which could harm our business; |

| • | Our operations are dependent upon a limited number of suppliers and contract manufacturers; |

| • | Supply shortages and increasing prices of raw materials could adversely affect the gross profit of the Bruker BioSpin Group and the BEST Segment; |

| • | If we are unable to effectively protect our intellectual property, third parties may use our technology, which would impair our ability to compete in our markets; |

| • | We may be involved in lawsuits to protect or enforce our patents that are brought by us which could be expensive and time consuming and, if determined adversely, could adversely affect our patent position; |

| • | Our manufacture and sale of products could lead to product liability claims for which we could have substantial liability; |

| • | We are subject to environmental laws and regulations, which may impose significant compliance or other costs on us; and |

| • | We operate as an entrepreneurial, decentralized company, which presents both benefits and certain risks. In particular, significant growth in a decentralized operating model may put strain on certain business group resources and our corporate functions, which could materially and adversely affect our business, financial condition and results of operations. |

| • | changes in foreign currency translation rates; |

| • | changes in regulatory requirements; |

| • | legislation and regulation, including tariffs, relating to the import or export of high technology products, which legislation and regulation may conflict with U.S. law and may have an adverse impact on our business results; |

| • | the imposition of government controls; |

| • | political and economic instability, including the impact of COVID-19, the possibility of an economic recession in certain key markets such as Germany, international hostilities and resulting sanctions, acts of terrorism and governmental restrictions, inflation, trade relationships and military and political alliances; |

| • | costs and risks of deploying systems in foreign countries; |

| • | compliance with export laws and controls and trade embargoes in multiple jurisdictions, which may conflict with U.S. law and may have an adverse impact on our business results; |

| • | limited intellectual property rights; |

| • | the burden of complying with a wide variety of complex foreign laws and treaties, including unfavorable labor regulations, specifically those applicable to our European operations; and |

| • | compliance with U.S. and local laws affecting the activities of U.S. companies abroad, including the United States Foreign Corrupt Practices Act, or FCPA, and local anti-bribery laws. |

| • | the timing of sales of our products and services; |

| • | the timing of recognizing revenue and deferred revenue under U.S. GAAP; |

| • | changes in our pricing policies or the pricing policies of our competitors; |

| • | increases in sales and marketing, product development or administration expenses; |

| • | the mix of services provided by us and third-party contractors; |

| • | our ability to attain and maintain quality levels for our products; and |

| • | costs related to acquisitions of technology or businesses. |

| • | the timing of governmental stimulus programs and academic research budgets; |

| • | the time it takes between the date customer orders and deposits are received, systems are shipped and accepted by our customers and full payment is received; |

| • | foreign currency exchange rates; |

| • | the time it takes for us to receive critical materials to manufacture our products; |

| • | general economic conditions; |

| • | the time it takes to satisfy local customs requirements and other export/import requirements; |

| • | the time it takes for customers to construct or prepare their facilities for our products; and |

| • | the time required to obtain governmental licenses. |

| • | coordinating or consolidating geographically separate organizations and integrating personnel with different business backgrounds and corporate cultures; |

| • | integrating previously autonomous departments in sales and marketing, distribution, accounting and administrative functions; |

| • | integrating financial information and management systems; |

| • | the pace of our acquisition activity and the related diversion of already limited resources and management time; |

| • | disruption of our ongoing business; |

| • | potential impairment of relationships with customers as a result of changes in management or otherwise arising out of such transactions; and |

| • | retention of key employees of the acquired businesses within the first one to two years after the acquisition, including the risk that they may compete with us subsequently. |

| • | a staggered Board of Directors, where stockholders elect only a minority of the board each year; |

| • | advance notification procedures for matters to be brought before stockholder meetings; |

| • | a limitation on who may call stockholder meetings; and |

| • | the ability of our Board of Directors to issue up to 5,000,000 shares of preferred stock without a stockholder vote. |

ITEM 1B |

UNRESOLVED STAFF COMMENTS |

ITEM 2 |

PROPERTIES |

| Location |

Principal Use |

Approximate Square Feet |

Relationship |

|||||||

| Principal Facilities Used in Current Operations for Bruker BioSpin: |

||||||||||

| Ettlingen, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 360,000 | Owned | |||||||

| Faellanden, Switzerland |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | |

422,000 61,000 |

|

|

Owned Leased |

||||

| Wissembourg, France |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 189,000 | Owned | |||||||

| Principal Facilities Used in Current Operations for Bruker CALID: |

||||||||||

| Bremen, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 298,000 | Owned | |||||||

| Ettlingen, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 182,000 | Owned | |||||||

| Nehren, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 89,000 | |

Owned/ Leased |

| |||||

| Principal Facilities Used in Current Operations for BSI Nano: |

||||||||||

| Karlsruhe, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 145,000 | Owned | |||||||

| Berlin, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 243,000 | Owned | |||||||

| Santa Barbara, CA, U.S.A. |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 100,000 | Owned | |||||||

| Graz, Austria |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 30,000 | Leased | |||||||

| Location |

Principal Use |

Approximate Square Feet |

Relationship | |||||

| Penang, Malaysia |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 100,000 | Leased | |||||

| Migdal Ha’Emek, Israel |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 22,000 | Leased | |||||

| Principal Facilities Used in Current Operations for BEST: |

||||||||

| Perth, Scotland |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 47,000 | Owned | |||||

| Hanau, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 138,000 | Leased | |||||

| Bergisch Gladbach, Germany |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 134,000 | Leased | |||||

| Carteret, NJ, U.S.A. |

Manufacturing, Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 115,000 | Leased | |||||

| Shared Principal Facilities: |

||||||||

| Billerica, MA, U.S.A. |

Research and Development, Application and Demonstration, Marketing, Sales and Administrative | 200,000 | Owned | |||||

ITEM 3 |

LEGAL PROCEEDINGS |

ITEM 4 |

MINE SAFETY DISCLOSURES |

ITEM 5 |

MARKET FOR REGISTRANT ’ S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

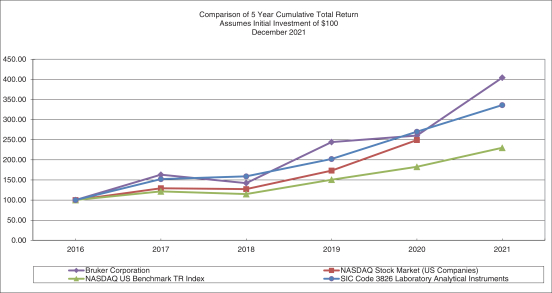

| Cumulative Total Return Index for: |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||

| Bruker Corporation |

$ | 100.0 | $ | 162.96 | $ | 142.07 | $ | 244.14 | $ | 260.20 | $ | 404.24 | ||||||||||||

| Nasdaq US Benchmark TR Index |

100.0 | 121.38 | 114.77 | 150.55 | 182.57 | 229.84 | ||||||||||||||||||

| Nasdaq Stock Market (US companies) |

100.0 | 129.30 | 127.19 | 173.11 | 249.17 | — | ||||||||||||||||||

| SIC Code 3826 Laboratory Analytical Instruments |

100.0 | 151.99 | 158.88 | 202.04 | 269.90 | 336.07 | ||||||||||||||||||

| Period |

Total Number of Shares Purchased (1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs (2) |

||||||||||||

| October 1—October 31, 2021 |

— | $ | — | — | $ | 463,380,168 | ||||||||||

| November 1—November 30, 2021 |

634,855 | $ | 82.32 | 634,855 | $ | 411,119,634 | ||||||||||

| December 1—December 31, 2021 |

371,659 | $ | 80.70 | 371,659 | $ | 381,127,281 | ||||||||||

| |

|

|

|

|||||||||||||

| 1,006,514 | $ | 81.72 | 1,006,514 | $ | 381,127,281 | |||||||||||

| |

|

|

|

|||||||||||||

| (1) | The Company purchased shares of common stock in accordance with its share repurchase program approved by the Board of Directors and announced on May 12, 2021 (the “2021 Repurchase Program”). The shares were purchased on the open market at prevailing prices. |

| (2) | The 2021 Repurchase Program authorizes the purchase of the Company’s common stock of up to $500.0 million from time to time over a two-year period, in amounts, at prices, and at such times as management deems appropriate, subject to market conditions, legal requirements and other considerations. At February 23, 2022, $374.9 million remains for future purchase under the 2021 Repurchase Program. |

ITEM 6 |

RESERVED |

ITEM 7 |

MANAGEMENT ’ S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| • | Non -GAAP Measures.Non-GAAP financial measures. |

| • | Overview |

| • | Results of Operations. |

| • | Liquidity and Capital Resources. |

| • | Critical Accounting Policies and Estimates. Form 10-K. |

| • | Recent Accounting Pronouncements. |

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Net cash provided by operating activities |

$ | 282.4 | $ | 332.2 | ||||

| Less: purchases of property, plant and equipment |

(92.0 | ) | (97.2 | ) | ||||

| |

|

|

|

|||||

| Free cash flow |

$ | 190.4 | $ | 235.0 | ||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||||||||||

2021 |

2020 |

|||||||||||||||

| Gross profit |

$ | 1,209.6 | 50.0 | % | $ | 939.8 | 47.3 | % | ||||||||

| Non-GAAP adjustments: |

||||||||||||||||

| Restructuring costs |

3.4 | 0.1 | % | 3.8 | 0.2 | % | ||||||||||

| Acquisition-related costs |

0.7 | — | 0.8 | — | ||||||||||||

| Purchased intangible amortization |

20.2 | 0.9 | % | 19.9 | 1.0 | % | ||||||||||

| Other costs |

1.1 | 0.1 | % | 3.7 | 0.2 | % | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-GAAP gross profit |

$ | 1,235.0 | 51.1 | % | $ | 968.0 | 48.7 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||||||||||

2021 |

2020 |

|||||||||||||||

| Operating income |

$ | 413.3 | 17.1 | % | $ | 248.3 | 12.5 | % | ||||||||

| Non-GAAP adjustments: |

||||||||||||||||

| Restructuring costs |

8.2 | 0.3 | % | 15.8 | 0.8 | % | ||||||||||

| Acquisition-related costs |

6.9 | 0.3 | % | 3.2 | 0.2 | % | ||||||||||

| Purchased intangible amortization |

37.4 | 1.5 | % | 35.7 | 1.8 | % | ||||||||||

| Other costs |

4.4 | 0.2 | % | 14.2 | 0.7 | % | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-GAAP operating income |

$ | 470.2 | 19.4 | % | $ | 317.2 | 16.0 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| • | the impact of the COVID-19 global pandemic on our customers, supply chain or manufacturing capabilities; |

| • | the impact of certain weather-related disruptions, such as the recent flooding in Germany and other parts of Europe; |

| • | the timing of governmental stimulus programs and academic research budgets; |

| • | the time it takes between the date customer orders and deposits are received, systems are shipped and accepted by our customers and full payment is received; |

| • | foreign currency exchange rates; |

| • | the time it takes for us to receive critical materials to manufacture our products; |

| • | general economic conditions, including the impact of COVID-19 or other factors on the global economy; |

| • | the time it takes to satisfy local customs requirements and other export/import requirements; |

| • | the time it takes for customers to construct or prepare their facilities for our products; and |

| • | the time required to obtain governmental licenses. |

Year Ended December 31, |

||||||||||||||||

2021 |

2020 |

Dollar Change |

Percentage Change |

|||||||||||||

| Product revenue |

$ | 2,017.3 | $ | 1,638.1 | $ | 379.2 | 23.1 | % | ||||||||

| Service revenue |

393.2 | 343.4 | 49.8 | 14.5 | % | |||||||||||

| Other revenue |

7.4 | 6.0 | 1.4 | 23.3 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenue |

2,417.9 | 1,987.5 | 430.4 | 21.7 | % | |||||||||||

| Cost of product revenue |

979.3 | 840.2 | 139.1 | 16.6 | % | |||||||||||

| Cost of service revenue |

228.2 | 206.5 | 21.7 | 10.5 | % | |||||||||||

| Cost of other revenue |

0.8 | 1.0 | (0.2 | ) | (20.0 | )% | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total cost of revenue |

1,208.3 | 1,047.7 | 160.6 | 15.3 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Gross profit |

1,209.6 | 939.8 | 269.8 | 28.7 | % | |||||||||||

Year Ended December 31, |

||||||||||||||||

2021 |

2020 |

Dollar Change |

Percentage Change |

|||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

561.2 | 468.6 | 92.6 | 19.8 | % | |||||||||||

| Research and development |

220.8 | 198.0 | 22.8 | 11.5 | % | |||||||||||

| Other charges, net |

14.3 | 24.9 | (10.6 | ) | (42.6 | )% | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total operating expenses |

796.3 | 691.5 | 104.8 | 15.2 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Operating income |

413.3 | 248.3 | 165.0 | 66.5 | % | |||||||||||

| Interest and other income (expense), net |

(19.7 | ) | (22.5 | ) | 2.8 | (12.4 | )% | |||||||||

| |

|

|

|

|

|

|||||||||||

| Income before income taxes and noncontrolling interest in consolidated subsidiaries |

393.6 | 225.8 | 167.8 | 74.3 | % | |||||||||||

| Income tax provision |

113.0 | 64.4 | 48.6 | 75.5 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Consolidated net income |

280.6 | 161.4 | 119.2 | 73.9 | % | |||||||||||

| Net income attributable to noncontrolling interests in consolidated subsidiaries |

3.5 | 3.6 | (0.1 | ) | (2.8 | )% | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Net income attributable to Bruker Corporation |

$ | 277.1 | $ | 157.8 | $ | 119.3 | 75.6 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

2021 |

2020 |

Dollar Change |

Percentage Change |

|||||||||||||

| BSI Life Science |

$ | 1,510.6 | $ | 1,253.9 | $ | 256.7 | 20.5 | % | ||||||||

| BSI Nano |

697.5 | 556.1 | 141.4 | 25.4 | % | |||||||||||

| BEST |

223.8 | 189.5 | 34.3 | 18.1 | % | |||||||||||

| Eliminations (a) |

(14.0 | ) | (12.0 | ) | (2.0 | ) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | 2,417.9 | $ | 1,987.5 | $ | 430.4 | 21.7 | % | |||||||||

| |

|

|

|

|

|

|||||||||||

| (a) | Represents product and service revenue between reportable segments. |

2021 |

2020 |

|||||||||||||||

Operating Income (Loss) |

Percentage of Segment Revenue |

Operating Income (Loss) |

Percentage of Segment Revenue |

|||||||||||||

| BSI Life Science |

$ | 385.4 | 25.5 | % | $ | 273.8 | 21.8 | % | ||||||||

| BSI Nano |

73.4 | 10.5 | % | 23.6 | 4.2 | % | ||||||||||

| BEST |

22.2 | 9.9 | % | 6.2 | 3.3 | % | ||||||||||

| Corporate, eliminations and other (a) |

(67.7 | ) | (55.3 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Total operating income |

$ | 413.3 | 17.1 | % | $ | 248.3 | 12.5 | % | ||||||||

| |

|

|

|

|||||||||||||

| (a) | Represents corporate costs and eliminations not allocated to the reportable segments. |

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Net cash provided by operating activities |

$ | 282.4 | $ | 332.2 | ||||

| Net cash used in investing activities |

(192.4 | ) | (192.7 | ) | ||||

| Net cash provided by (used in) financing activities |

318.7 | (161.6 | ) | |||||

| Effect of exchange rates on cash and cash equivalents and restricted cash |

(22.5 | ) | 25.7 | |||||

| |

|

|

|

|||||

| Total increase in cash and cash equivalents and restricted cash |

$ | 386.2 | $ | 3.6 | ||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

| EUR notes (in dollars) under the 2021 Note Purchase Agreement |

$ | 170.7 | $ | — | ||||

| CHF notes (in dollars) under the 2021 Note Purchase Agreement |

329.2 | — | ||||||

| CHF notes (in dollars) under the 2019 Note Purchase Agreement |

325.9 | 335.5 | ||||||

| U.S. Dollar notes under the 2019 Term Loan |

299.2 | 300.0 | ||||||

| U.S. Dollar notes under the 2012 Note Purchase Agreement |

205.0 | 205.0 | ||||||

| Unamortized debt issuance costs |

(2.0 | ) | (2.4 | ) | ||||

| Other loans |

1.9 | 3.0 | ||||||

| |

|

|

|

|||||

| Total notes and loans outstanding |

1,329.9 | 841.1 | ||||||

| Finance lease obligations |

4.3 | 3.4 | ||||||

| |

|

|

|

|||||

| Total debt |

1,334.2 | 844.5 | ||||||

| Current portion of long-term debt |

(112.4 | ) | (2.2 | ) | ||||

| |

|

|

|

|||||

| Total long-term debt, less current portion |

$ | 1,221.8 | $ | 842.3 | ||||

| |

|

|

|

|||||

| 2022 |

$ | 111.1 | ||

| 2023 |

15.8 | |||

| 2024 |

115.2 | |||

| 2025 |

15.5 | |||

| 2026 |

15.2 | |||

| Thereafter |

1,059.1 | |||

| |

|

|||

| Total |

$ | 1,331.9 | ||

| |

|

Weighted Average Interest Rate |

Total Amount Committed by Lenders |

Outstanding Borrowings |

Outstanding Letters of Credit |

Total Committed Amounts Available |

||||||||||||||||

| 2019 Credit Agreement |

1.3 | % | $ | 600.0 | $ | — | $ | 0.2 | $ | 599.8 | ||||||||||

| Bank guarantees and working capital line |

varies | 116.2 | — | 116.2 | — | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total revolving lines of credit |

$ | 716.2 | $ | — | $ | 116.4 | $ | 599.8 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

ITEM 7A |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

2021 |

2020 |

|||||||||||||||

Revenue |

Percentage of Revenue |

Revenue |

Percentage of Revenue |

|||||||||||||

| United States |

$ |

601.0 |

24.9 |

% |

$ |

455.9 |

22.9 |

% | ||||||||

| Europe |

920.7 |

38.1 |

764.7 |

38.5 |

||||||||||||

| Asia Pacific |

729.1 |

30.1 |

629.1 |

31.7 |

||||||||||||

| Rest of world |

167.1 |

6.9 |

137.8 |

6.9 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ |

2,417.9 |

100.0 |

% |

$ |

1,987.5 |

100.0 |

% | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

ITEM 8 |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Page |

||||

| 60 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

December 31, |

||||||||

2021 |

2020 |

|||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ |

$ |

||||||

| Short-term investments |

||||||||

| Accounts receivable, net |

||||||||

| Inventories |

||||||||

| Assets held for sale |

— |

|||||||

| Other current assets |

||||||||

| Total current assets |

||||||||

| Property, plant and equipment, net |

||||||||

| Goodwill |

||||||||

| Intangible assets, net |

||||||||

| Operating lease assets |

||||||||

| Deferred tax assets |

||||||||

| Other long-term assets |

||||||||

| |

|

|

|

|

|

|

|

|

| Total assets |

$ |

$ |

||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Current portion of long-term debt |

$ |

$ |

||||||

| Accounts payable |

||||||||

| Customer advances |

||||||||

| Other current liabilities |

||||||||

| |

|

|

|

|

|

|

|

|

| Total current liabilities |

||||||||

| Long-term debt |

||||||||

| Long-term deferred revenue |

||||||||

| Deferred tax liabilities |

||||||||

| Operating lease liabilities |

||||||||

| Accrued pension |

||||||||

| Other long-term liabilities |

||||||||

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies (Note 17) |

||||||||

| |

|

|

|

|

|

|

|

|

| Redeemable noncontrolling interest |

— |

|||||||

| Shareholders’ equity: |

||||||||

| Preferred stock, $ par value issued or outstanding at December 31, 2021 and 2020 |

||||||||

| Common stock, $ par value shares authorized, and shares issued and and outstanding at December 31, 2021 and 2020, respectively |

||||||||

| Treasury stock at cost, and shares at December 31, 2021 and 2020, respectively |

( |

) |

( |

) | ||||

| Additional paid-in capital |

||||||||

| Retained earnings |

||||||||

| Accumulated other comprehensive (loss) income |

( |

) |

||||||

| |

|

|

|

|

|

|

|

|

| Total shareholders’ equity attributable to Bruker Corporation |

||||||||

| Noncontrolling interest s in consolidated subsidiaries |

||||||||

| |

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

||||||||

| |

|

|

|

|

|

|

|

|

| Total liabilities, redeemable noncontrolling interest and shareholders’ equity |

$ |

$ |

||||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

Product revenue |

$ | $ | $ | |||||||||

Service revenue |

||||||||||||

Other revenue |

||||||||||||

Total revenue |

||||||||||||

Cost of product revenue |

||||||||||||

Cost of service revenue |

||||||||||||

Cost of other revenue |

||||||||||||

Total cost of revenue |

||||||||||||

Gross profit |

||||||||||||

Operating expenses: |

||||||||||||

Selling, general and administrative |

||||||||||||

Research and development |

||||||||||||

Other charges, net |

||||||||||||

Total operating expenses |

||||||||||||

Operating income |

||||||||||||

Interest and other income (expense), net |

( |

) | ( |

) | ( |

) | ||||||

Income before income taxes and noncontrolling interest s in consolidated subsidiaries |

||||||||||||

Income tax provision |

||||||||||||

Consolidated net income |

||||||||||||

Net income attributable to noncontrolling interest s in consolidated subsidiaries |

||||||||||||

Net income attributable to Bruker Corporation |

$ | $ | $ | |||||||||

Net income per common share attributable to Bruker Corporation shareholders: |

||||||||||||

Basic |

$ | $ | $ | |||||||||

Diluted |

$ | $ | $ | |||||||||

Weighted average common shares outstanding: |

||||||||||||

Basic |

||||||||||||

Diluted |

||||||||||||

Consolidated net income |

$ | $ | $ | |||||||||

Foreign currency translation (net of tax of $ |

( |

) | ( |

) | ||||||||

Derivatives designated as hedging instruments (net of tax of $ |

( |

) |

( |

) | ||||||||

Pension liability adjustments (net of tax of ($ ) million, ($ |

( |

) | ||||||||||

Net comprehensive income |

||||||||||||

Less: Comprehensive income attributable to noncontrolling interests |

||||||||||||

Less: Comprehensive loss attributable to redeemable noncontrolling interest |

( |

) | ( |

) | ( |

) | ||||||

Comprehensive income attributable to Bruker Corporation |

$ | $ | $ | |||||||||

Redeemable Noncontrolling Interest |

Common Shares |

Common Amount |

Treasury Shares |

Treasury Stock Amount |

Additional Paid-In Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Total Shareholders’ Equity Attributable to Bruker Corporation |

Noncontrolling Interests in Consolidated Subsidiaries |

Total Shareholders’ Equity |

||||||||||||||||||||||||||||||||||

| Balance at December 31, 2018 |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||||||||||||

| Stock options exercised |

— |

— |

— |

— |

— |

— |

— |

|||||||||||||||||||||||||||||||||||||

| Restricted stock units vested |

— |

— |

— |

— |

( |

) |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||||||||||||||

| Stock-based compensation |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Shares issued from 2017 acquisition |

— |

— |

( |

) |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Shares repurchased |

— |

( |

) |

— |

( |

) |

— |

— |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Treasury stock acquired |

— |

( |

) |

— |

( |

) |

— |

— |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Cash dividends paid to common stockholders ($ |

— |

— |

— |

— |

— |

— |

( |

) |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Consolidated net income |

( |

) |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

( |

) |

— |

— |

— |

— |

— |

— |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at December 31, 201 9 |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

|||||||||||||||||||||||||||||||

| Stock options exercised |

— |

— |

— |

— |

— |

— |

— |

|||||||||||||||||||||||||||||||||||||

| Restricted stock units vested |

— |

— |

— |

— |

( |

) |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||||||||||||||

| Stock-based compensation |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Shares repurchased |

— |

( |

) |

— |

( |

) |

— |

— |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Distributions to noncontrolling interests |

— |

— |

— |

— |

— |

— |

— |

— |

— |

( |

) |

( |

) | |||||||||||||||||||||||||||||||

| Acquired remaining |

( |

) |

— |

— |

— |

— |

— |

( |

) |

— |

( |

) |

— |

( |

) | |||||||||||||||||||||||||||||

| Cash dividends paid to common stockholders ($ |

— |

— |

— |

— |

— |

— |

( |

) |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Consolidated net income |

— |

— |

— |

— |

— |

— |

— |

|||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

( |

) |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at December 31, 2020 |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||||||||||||

| Stock options exercised |

— |

— |

— |

— |

— |

— |

— |

|||||||||||||||||||||||||||||||||||||

| Restricted stock units vested |

— |

— |

— |

— |

( |

) |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||||||||||||||

| Stock-based compensation |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Shares repurchased |

— |

( |

) |

— |

( |

) |

— |

— |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Cash dividends paid to common stockholders ($ per share) |

— |

— |

— |

— |

— |

— |

( |

) |

— |

( |

) |

— |

( |

) | ||||||||||||||||||||||||||||||

| Formation of Acuity Spatial Genomics, Inc. |

— |

— |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||

| Consolidated net income |

( |

) |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

— |

— |

— |

— |

— |

— |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at December 31, 2021 |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

( |

) |

$ |

$ |

$ |

|||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

Cash flows from operating activities: |

||||||||||||

Consolidated net income |

$ |

$ |

$ |

|||||||||

Adjustments to reconcile consolidated net income to cash flows from operating activities: |

||||||||||||

Depreciation and amortization |

||||||||||||

Stock-based compensation expense |

||||||||||||

Deferred income taxes |

( |

) |

( |

) |

( |

) | ||||||

Other non-cash expenses, net |

||||||||||||

Changes in operating assets and liabilities, net of acquisitions: |

||||||||||||

Accounts receivable |

( |

) |

( |

) | ||||||||

Inventories |

( |

) |

( |

) |

( |

) | ||||||

Accounts payable and accrued expenses |

( |

) |

||||||||||

Income taxes payable |

( |

) |

||||||||||

Deferred revenue |

||||||||||||

Customer advances |

||||||||||||

Other changes in operating assets and liabilities |

( |

) |

( |

) | ||||||||

Net cash provided by operating activities |

||||||||||||

Cash flows from investing activities: |

||||||||||||

Purchase of short-term investments |

( |

) |

( |

) |

( |

) | ||||||

Maturity of short-term investments |

— |

|||||||||||

Purchase of investments held to maturity |

( |

) |

( |

) |

— |

|||||||

Cash paid for acquisitions, net of cash acquired |

( |

) |

( |

) |

( |

) | ||||||

Purchases of property, plant and equipment |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from sales of property, plant and equipment |

||||||||||||

Net proceeds from cross-currency swap agreements |

— |

|||||||||||

Net cash used in investing activities |

( |

) |

( |

) |

( |

) | ||||||

Cash flows from financing activities: |

||||||||||||

Proceeds from issuance of long-term debt |

— |

|||||||||||

Repayment of long-term debt |

( |

) |

— |

( |

) | |||||||

Repayments of revolving lines of credit |

— |

( |

) |

( |

) | |||||||

Proceeds from revolving lines of credit |

— |

|||||||||||

Repayment of other debt, net |

( |

) |

( |

) |

( |

) | ||||||

Payment of deferred financing costs |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from issuance of common stock, net |

||||||||||||

Payment of contingent consideration |

( |

) |

( |

) |

( |

) | ||||||

Payment of dividends to common stockholders |

( |

) |

( |

) |

( |

) | ||||||

Repurchase of common stock |

( |

) |

( |

) |

( |

) | ||||||

Cash payments to noncontrolling interests |

— |

( |

) |

— |

||||||||

Net cash provided by (used in) financing activities |

( |

) |

||||||||||

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

( |

) |

||||||||||

Net change in cash, cash equivalents and restricted cash |

||||||||||||

Cash, cash equivalents and restricted cash at beginning of year |

||||||||||||

Cash, cash equivalents and restricted cash at end of year |

$ |

$ |

$ |

|||||||||

Supplemental cash flow information: |

||||||||||||

Cash paid for interest |

$ |

$ |

$ |

|||||||||

Cash paid for taxes |

$ |

$ |

$ |

|||||||||

Restricted cash period beginning balance |

$ |

$ |

$ |

|||||||||

Restricted cash period ending balance |

$ |

$ |

$ |

|||||||||

• |

Level 1: |

• |

Level 2: |

• |

Level 3: |

| Estimated Useful Life | ||

| Buildings |

||

| Machinery and equipment |

||

| Computer equipment and software |

||

| Furniture and fixtures |

||

| Leasehold improvements |

Lesser |

Estimated Useful Life |

||||

| Existing technology and related patents |

|

| ||

| Customer relationships |

|

| ||

| Trade names |

|

| ||

2021 |

2020 |

2019 |

||||||||||

Risk-free interest rates |

% | % | % | |||||||||

Expected life |

||||||||||||

Volatility |

% | % | % | |||||||||

Expected dividend yield |

% | % | % | |||||||||

Weighted-average fair value per share |

$ | $ | $ | |||||||||

(in millions) |

2021 |

2020 |

2019 |

|||||||||

| Revenue by Group: |

||||||||||||

| Bruker BioSpin |

$ | $ | $ | |||||||||

| Bruker CALID |

||||||||||||

| BSI N ano |

||||||||||||

| BEST |

||||||||||||

| Eliminations |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Total revenue |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

(in millions) |

2021 |

2020 |

2019 |

|||||||||

| Revenue recognized at a point in time |

$ | $ | $ | |||||||||

| Revenue recognized over time |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total revenue |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

SCI Instruments |

Molecubes NV |

|||||||

| Segment |

BSI Nano |

BSI Life Science |

||||||

| Consideration Transferred: |

||||||||

| Cash paid |

$ | $ | ||||||

| Fair value of contingent consideration |

||||||||

| Working capital adjustment |

( |

) | — | |||||

| |

|

|

|

|||||

| Total consideration transferred |

$ | $ | ||||||

| |

|

|

|

|||||

| Allocation of Consideration Transferred: |

||||||||

| Cash |

$ | — | $ | |||||

| Accounts receivable |

— | |||||||

| Inventories |

||||||||

| Other current assets |

— | |||||||

| Property, plant and equipment |

— | |||||||

| Intangible assets: |

||||||||

| Technology |

||||||||

| Customer relationships |

||||||||

| Trade name |

||||||||

| Backlog |

||||||||

| Goodwill |

||||||||

| Deferred taxes |

— | ( |

) | |||||

| Liabilities assumed |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total consideration allocated |

$ | $ | ||||||

| |

|

|

|

|||||

Name of Acquisition |

Date Acquired |

Segment |

Total Consideration |

Cash Consideration |

||||||||||||

Creative Instruments |

July 1, 2021 | BSI Life Science | $ | $ | ||||||||||||

SVXR, Inc |

September 9, 2021 | BSI Nano | ||||||||||||||

| $ | $ | |||||||||||||||

Name |

Acquisition / Investment |

Financial Statement Classification |

Date Acquired |

Segment |

Total Consideration |

Cash Consideration |

||||||||||||||||||

Glycopath Inc. |

Investment |

Other long-term |

February 18, 2021 |

BSI Life Science |

$ | $ | ||||||||||||||||||

IonPath Inc. |

Investment |

Other long-term |

March 18, 2021 |

BSI Life Science |

||||||||||||||||||||

Olaris, Inc. |

Investment |

Other long-term |

September 23, 2021 |

BSI Life Science |

||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||

Consideration Transferred: |

||||

Cash paid |

$ | |||

Contingent consideration |

||||

Cash acquired |

( |

) | ||

Working capital adjustment |

||||

Total consideration transferred |

$ | |||

Allocation of Consideration Transferred: |

||||

Inventories |

$ | |||

Accounts receivable |

||||

Other current and non-current assets |

||||

Property, plant and equipment |

||||

Operating lease assets |

||||

Intangible assets: |

||||

Technology |

||||

Customer relationships |

||||

Trade name |

||||

Backlog |

||||

Goodwill |

||||

Deferred taxes, net |

( |

) | ||

Liabilities assumed |

( |

) | ||

Total consideration allocated |

$ | |||

Name of Acquisition |

Date Acquired |

Segment |

Total Consideration |

Cash Consideration |

||||||||||||

SmartTip B.V. |

April 1, 2020 | BSI Nano | $ | $ | ||||||||||||

Integrated Proteomics Applications, Inc. |

August 7, 2020 | BSI Life Science | ||||||||||||||

| $ | $ | |||||||||||||||

| Balance at December 31, 2018 |

$ | |||

| Additions |

||||

| Deductions |

( |

) | ||

| |

|

|||

| Balance at December 31, 2019 |

||||

| Additions |

||||

| Deductions |

( |

) | ||

| |

|

|||

| Balance at December 31, 2020 |

||||

| Additions |

||||

| Deductions |

( |

) | ||

| |

|

|||

| Balance at December 31, 2021 |

$ | |||

| |

|

2021 |

2020 |

|||||||

| Raw materials |

$ | $ | ||||||

| Work-in-process |

||||||||

| Finished goods |

||||||||

| Demonstration units |

||||||||

| |

|

|

|

|||||

| Inventories |

$ | $ | ||||||

| |

|

|

|

|||||

8. |

Property, Plant and Equipment, Net |

2021 |

2020 |

|||||||

| Land |

$ | $ | ||||||

| Building and leasehold improvements |

||||||||

| Machinery, equipment, software and furniture and fixtures |

||||||||

| |

|

|

|

|||||

| Less accumulated depreciation and amortization |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Property, plant and equipment, net |

$ | $ | ||||||

| |

|

|

|

|||||

9. |

Goodwill and Intangible Assets |

BSI Life Science |

BSI Nano |

BEST |

Total |

|||||||||||||

| Balance at December 31, 2018 |

$ | $ | $ | — | $ | |||||||||||

| Current period additions/adjustments |

||||||||||||||||

| Foreign currency impact |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2019 |

||||||||||||||||

| Current period additions/adjustments |

— | — | ||||||||||||||

| Foreign currency impact |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2020 |

||||||||||||||||

| Current period additions/adjustments |

— | |||||||||||||||

| Foreign currency impact |

( |

) | ( |

) | — | ( |

) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2021 |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

2021 |

2020 |

|||||||||||||||||||||||

Gross |

Net |

Gross |

Net |

|||||||||||||||||||||

Carrying |

Accumulated |

Carrying |

Carrying |

Accumulated |

Carrying |

|||||||||||||||||||

Amount |

Amortization |

Amount |

Amount |

Amortization |

Amount |

|||||||||||||||||||

| Existing technology and related patents |

$ | $ | ( |

) | $ | $ | $ | ( |

) | $ | ||||||||||||||

| Customer relationships |

( |

) | ( |

) | ||||||||||||||||||||

| Trade names |

( |

) | ( |

) | ||||||||||||||||||||

| Other |

( |

) | ( |

) | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Intangible assets |

$ | $ | ( |

) | $ | $ | $ | ( |

) | $ | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 2022 |

$ | |||

| 2023 |

||||

| 2024 |

||||

| 2025 |

||||

| 2026 |

||||

| Thereafter |

||||

| |

|

|||

| Total |

$ | |||

| |

|

10. |

Other Current Liabilities |

2021 |

2020 |

|||||||

| Deferred revenue |

$ | $ | ||||||

| Accrued compensation |

||||||||

| Accrued warranty |

||||||||

| Contingent consideration |

||||||||

| Income taxes payable |

||||||||

| Other taxes payable |

||||||||

| Derivative liabilities |

||||||||

| Operating leases |

||||||||

| Legal and professional fees |

||||||||

| Other accrued expenses |

||||||||

| |

|

|

|

|||||

| Other current liabilities |

$ | $ | ||||||

| |

|

|

|

|||||

| Balance at December 31, 2018 |

$ | |||

| Accruals for warranties issued during the year |

||||

| Settlements of warranty claims |

( |

) | ||

| Foreign currency impact |

( |

) | ||

| |

|

|||

| Balance at December 31, 2019 |

||||

| Accruals for warranties issued during the year |

||||

| Settlements of warranty claims |

( |

) | ||

| Foreign currency impact |

||||

| |

|

|||

| Balance at December 31, 2020 |

||||

| Accruals for warranties issued during the year |

||||

| Settlements of warranty claims |

( |

) | ||

| Foreign currency impact |

( |

) | ||

| |

|

|||

| Balance at December 31, 2021 |

$ | |||

| |

|

11. |

Debt |

2021 |

2020 |

|||||||

| EUR notes (in dollars) under the 2021 Note Purchase Agreement |

$ |

$ |

||||||

| CHF notes (in dollars) under the 2021 Note Purchase Agreement |

||||||||

| CHF notes (in dollars) under the 2019 Note Purchase Agreement |

||||||||

| U.S. Dollar notes under the 2019 Term Loan |

||||||||

| U.S. Dollar notes under the 2012 Note Purchase Agreement |

||||||||

| Unamortized debt issuance costs |

( |

) |

( |

) | ||||

| Other loans |

||||||||

| Total notes and loans outstanding |

||||||||

| Finance lease obligations |

||||||||

| |

|

|

|

|||||

| Total debt |

||||||||

| Current portion of long-term debt |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Total long-term debt, less current portion |

$ |

$ |

||||||

| |

|

|

|

|||||

Weighted Average Interest Rate |

Total Amount Committed by Lenders |

Outstanding Borrowings |

Outstanding Letters of Credit |

Total Committed Amounts Available |

||||||||||||||||

| 2019 Credit Agreement |

% | $ | $ | — | $ | $ | ||||||||||||||

| Bank guarantees and working capital line |

varies |

— | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total revolving lines of credit |

$ | $ | — | $ | $ | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| • | $ |

| • | $ |

| • | $ |

| • | $ |

2022 |

$ | |||

2023 |

||||

2024 |

||||

2025 |

||||

2026 |

||||

Thereafter |

||||

Total |

$ | |||

12. |

Fair Value of Financial Instruments |

December 31, 2021 |

Total |

Quoted Prices in Active Markets Available (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

Assets: |

||||||||||||||||

Time deposits and money market funds |

$ | $ | — | $ | $ | — | ||||||||||

Short-term investments |

— | — | ||||||||||||||

Interest rate and cross currency swap agreements |

— | — | ||||||||||||||

Forward currency contracts |

— | — | ||||||||||||||

Embedded derivatives in purchase and delivery contracts |

— | — | ||||||||||||||

Fixed price commodity contracts |

— | — | ||||||||||||||

Debt securities available for sale |

— | — | ||||||||||||||

Total assets recorded at fair value |

$ | $ | — | $ | $ | |||||||||||

Liabilities: |

||||||||||||||||

Contingent consideration |

$ | $ | — | $ | — | $ | ||||||||||

Hybrid instrument liability |

— | — | ||||||||||||||

Forward currency contracts |

— |

— |

||||||||||||||

Interest rate and cross currency swap agreements |

— | — | ||||||||||||||

Long-term fixed interest rate debt |

— | — | ||||||||||||||

Total liabilities recorded at fair value |

$ | $ | — | $ | $ | |||||||||||

December 31, 2020 |

Total |

Quoted Prices in Active Markets Available (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

Assets: |

||||||||||||||||

Time deposits and money market funds |

$ |

$ |

— |

$ |

$ |

— |

||||||||||

Short-term investments |

— |

— |

||||||||||||||

Interest rate and cross currency swap agreements |

— |

— |

||||||||||||||

Foreign currency contracts |

— |

— |

||||||||||||||

Embedded derivatives in purchase and delivery contracts |

— |

— |

||||||||||||||

Fixed price commodity contracts |

— |

— |

||||||||||||||

Debt securities available for sale |

— |

|||||||||||||||

Total assets recorded at fair value |

$ |

$ |

— |

$ |

$ |

|||||||||||

Liabilities: |

||||||||||||||||

Contingent consideration |

$ |

$ |

— |

$ |

— |

$ |

||||||||||

Hybrid instrument liability |

— |

— |

||||||||||||||

Interest rate and cross currency swap agreements |

— |

— |

||||||||||||||

Forward currency contracts |

— |

— |

||||||||||||||

Long-term fixed interest rate debt |

— |

— |

||||||||||||||

Total liabilities recorded at fair value |

$ |

$ |

— |

$ |

$ |

|||||||||||

Balance at December 31, 2019 |

$ | |||

Current period additions |

||||

Current period adjustments |

( |

) | ||

Current period settlements |

( |

) | ||

Foreign currency effect |

||||

Balance at December 31, 2020 |

||||

Current period additions |

||||

Current period adjustments |

||||

Current period settlements |

( |

) | ||

Foreign currency effect |

( |

) | ||

Balance at December 31, 2021 |

$ | |||

Balance at December 31, 2019 |

$ | |||

Current period additions |

||||

Foreign currency effect |

||||

Balance at December 31, 2020 |

||||

Current period additions |

||||

Foreign currency effect |

( |

) | ||

Balance at December 31, 2021 |

$ | |||

13. |

Derivative Instruments and Hedging Activities |

Notional (in USD) |

December 31, 2021 |

Notional (in USD) |

December 31, 2020 |

|||||||||||||

| Derivatives designated as hedging instruments |

||||||||||||||||

| Interest rate cross-currency swap agreements |

||||||||||||||||

| Other current assets |

$ |

$ |

||||||||||||||

| Other current liabilities |

( |

) |

( |

) | ||||||||||||

| Other long-term liabilities |

( |

) |

( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

$ |

$ |

( |

) |

$ |

$ |

( |

) | |||||||||

| Long-term debt |

||||||||||||||||

| Long-term Debt |

( |

) |

( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total derivatives designated as hedging instruments |

$ |

$ |

( |

) |

$ |

$ |

( |

) | ||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derivatives not designated as hedging instruments |

||||||||||||||||

| Forward currency contracts |

||||||||||||||||

| Other current assets |

$ |

$ |

$ |

$ |

||||||||||||

| Other current liabilities |

( |

) |

( |

) | ||||||||||||

| Embedded derivatives in purchase and delivery contracts |

||||||||||||||||

| Other current assets |

||||||||||||||||

| Fixed price commodity contracts |

||||||||||||||||

| Other current assets |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total derivatives not designated as hedging instruments |

$ |

$ |

$ |

$ |

||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total derivatives |

$ |

$ |

( |

) |

$ |

$ |

( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||

| Financial Statement Classification |

2021 |

2020 |

2019 |

|||||||||||

| Derivatives not designated as hedging instruments |

||||||||||||||

| Forward currency contracts |

|

Interest and other income (expense), net |

$ | ( |

) | $ | $ | |||||||

| Embedded derivatives in purchase and delivery contracts |

|

Interest and other income |

|

|||||||||||

| |

|

|

|

|

|

|||||||||

| |

( |

) | ||||||||||||

| Derivatives designated as cash flow hedging instruments |

||||||||||||||

| Interest rate cross-currency swap agreements |

Interest and other income |

( |

) |

( |

) |

— |

||||||||

| |

|

|

|

|

|

|||||||||

| Derivatives designated as net investment hedging instruments |

||||||||||||||

| Interest rate cross-currency swap agreements |

Interest and other income (expense), net |

|||||||||||||

| |

|

|

|

|

|

|||||||||

| Total |

$ |

$ |

$ |

|||||||||||

| |

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||

| Financial Statement Classification |

2021 |

2020 |

2019 |

|||||||||||

| Derivatives designated as cash flow hedging instruments |

||||||||||||||

| Interest rate cross-currency swap agreements |

Accumulated other |

$ |

$ |

( |

) |

$ |

||||||||

| Derivatives designated as net investment hedging instruments |

||||||||||||||

| Interest rate cross-currency swap agreements |

Accumulated other |

( |

) |

( |

) | |||||||||

| Long-term debt |

Accumulated other |

( |

) | ( |

) | |||||||||

| |

|

|

|

|

|

|||||||||

( |

) |

( |

) | |||||||||||

| |

|

|

|

|

|

|||||||||

| Total |

$ |

$ |

( |

) |

$ |

( |

) | |||||||

| |

|

|

|

|

|

|||||||||

14. |

Income Taxes |

2021 |

2020 |

2019 |

||||||||||

| Domestic |

$ |

( |

) |

$ |

( |

) |

$ |

|||||

| Foreign |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total income before provision for income taxes |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Current income tax expense (benefit): |

||||||||||||

| Federal |

$ |

$ |

( |

) |

$ |

|||||||

| State |

( |

) |

||||||||||

| Foreign |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total current income tax expense |

||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred income tax expense (benefit): |

||||||||||||

| Federal |

( |

) |

( |

) |

( |

) | ||||||

| State |

( |

) |

( |

) |

||||||||

| Foreign |

( |

) |

( |

) | ||||||||

| |

|

|

|

|

|

|||||||

| Total deferred income tax benefit |

( |

) |

( |

) |

( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Income tax provision |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Statutory tax rate |

% | % | % | |||||||||

| Foreign tax rate differential |

||||||||||||

| Permanent differences |

||||||||||||

| U.S. tax on foreign earnings |

||||||||||||

| Stock compensation |

( |

) | ( |

) |

( |

) | ||||||

| Mandatory repatriation |

— | ( |

) | |||||||||

| Tax contingencies |

||||||||||||

| Change in tax rates |

( |

) | ||||||||||

| Withholding taxes |

( |

) | ( |

) | ||||||||

| Repatriation of foreign earnings |

( |

) | ||||||||||

| State income taxes, net of federal benefits |

( |

) | ( |

) | ||||||||

| Research and development credits |

( |

) | ( |

) | ( |

) | ||||||

| Other |

( |

) | — | |||||||||

| Change in valuation allowance for unbenefited losses |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| Effective tax rate |

% | % | % | |||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

|||||||

| Deferred tax assets: |

||||||||

| Accrued expenses |

$ | $ | ||||||

| Compensation |

||||||||

| Deferred revenue |

||||||||

| Disallowed interest carryforward |

||||||||

| Net operating loss carryforwards |

||||||||

| Foreign tax and other tax credit carryforwards |

||||||||

| Unrealized currency gain/loss |

||||||||

| Hedge unrealized FX gain/loss |

— | |||||||

| Lease obligations |

||||||||

| Other |

|

|

|

|

|

|

— |

|

| |

|

|

|

|||||

| Gross deferred tax assets |

||||||||

| Less valuation allowance |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total deferred tax assets |

||||||||

| |

|

|

|

|||||

| Deferred tax liabilities: |

||||||||

| Accounts receivable |

||||||||

| Inventory |

||||||||

| Fixed assets |

||||||||

| Foreign patent reserves |

||||||||

| Intangibles |

||||||||

| Accrued expenses |

||||||||

| Accrued withholding tax |

||||||||

| Right-of-use |

||||||||

| Other |

||||||||

| |

|

|

|

|||||

| Total deferred tax liabilities |

||||||||

| |

|

|

|

|||||

| Net deferred tax asset s |

$ | $ | ||||||

| |

|

|

|

|||||

| Balance at December 31, 2018 |

$ | |||

| Decreases recorded as a benefit to income tax provision |

( |

) | ||

| Balance at December 31, 2019 |

$ | |||

| Increases recorded as part of acquisition purchase accounting |

||||

| |

|

|||

| Balance at December 31, 2020 |

$ | |||

| Increases recorded as an expense to income tax provision |

||||

| |

|

|||

| Balance at December 31, 2021 |

$ | |||

| |

|

| Gross unrecognized tax benefits at December 31, 2018 |

$ | |||

| Gross increases—tax positions in prior periods |

||||

| Gross increases—current period tax positions |

||||

| Lapse of statutes |

( |

) | ||

| |

|

|||

| Gross unrecognized tax benefits at December 31, 2019 |

$ | |||

| Gross increases—tax positions in prior periods |

||||

| Gross increases—current period tax positions |

||||

| Gross unrecognized tax benefits at December 31, 2020 |

$ | |||

| Gross increases—tax positions in prior periods |

||||

| Gross increases—current period tax positions |

||||

| |

|

|||

| Gross unrecognized tax benefits at December 31, 2021 |

$ |

|||

| |

|

December 31, 2021. There was no benefit recognized during the year ended December 31, 2020.

15. |

Leases |

2021 |

2020 |

|

|

2019 |

| |||||||

| Amortization of right-of-use |

$ | $ | |

$ | |

| ||||||

| Interest on lease liabilities |

|

|

|

| ||||||||

| |

|

|

|

|

|

|

| |||||

| Total finance lease cost |

|

|

|

| ||||||||

| Operating lease cost |

|

|

|

| ||||||||

| Short term lease cost |

|

|

|

| ||||||||

| Variable lease cost |

|

|

|

| ||||||||

| Sublease income |

( |

) | ( |

) | |

|

( |

) | ||||

| |

|

|

|

|

|

|

| |||||

| Total lease cost |

$ | $ | |

$ |

|

| ||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

||||||||

2021 |

2020 |

|||||||

Operating leases |

||||||||

Operating lease assets, net |

$ | $ | ||||||

Other current liabilities |

||||||||

Operating lease liability—long term |

||||||||

December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

Weighted average remaining lease term |

||||||||||||

Weighted average discount rate |

% |

% |

% | |||||||||

December 31, |

||||||||

2021 |

2020 |

|||||||

Finance leases |

||||||||

$ |

$ |

|||||||

December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

Weighted average remaining lease term |

||||||||||||

Weighted average discount rate |

% |

% |

% | |||||||||

2021 |

2020 |

2019 |

||||||||||

Cash paid for amounts included in the measurement of lease liabilities |

||||||||||||

Operating cash flows from finance leases |

$ | $ | $ |

|||||||||

Operating cash flows from operating leases |

||||||||||||

Financing cash flows from finance leases |

||||||||||||

Right-of-use |

||||||||||||

Operating leases |

$ | $ | ||||||||||

Finance leases |

||||||||||||

Operating Leases |

Finance Leases |

|||||||

Twelve months ending December 31: |

||||||||

2022 |

$ | $ | ||||||

2023 |

||||||||

2024 |

||||||||

2025 |

||||||||

2026 |

||||||||

Thereafter |

— | |||||||

Total undiscounted lease payments |

||||||||

Less: imputed interest |

( |

) | ( |

) | ||||

| $ | $ | |||||||

16. |

Post Retirement Benefit Plans |

2021 |

2020 |

2019 |

||||||||||

Components of net periodic benefit costs: |

||||||||||||

Service cost |

$ | $ | $ | |||||||||

Interest cost |

||||||||||||

Expected return on plan assets |

( |

) | ( |

) | ( |

) | ||||||

Settlement loss recognized |

— | — | ||||||||||

Amortization of prior service (credit) cost |

||||||||||||

Amortization of actuarial (gains) losses |

||||||||||||

Net periodic benefit costs |

$ | $ | $ | |||||||||

2021 |

2020 |

|||||||

Change in benefit obligation: |

||||||||

Benefit obligation at beginning of year |

$ |

$ |

||||||

Service cost |

||||||||

Interest cost |

||||||||

Plan participant contributions |

||||||||

Plan amendments |

( |

) | ( |

) | ||||

Plan settlements |

( |

) |

— | |||||

Benefits paid |

( |

) | ( |

) | ||||

Actuarial loss (gain) |