UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | þ | ||||

| Filed by a Party other than the Registrant | ¨ | ||||

| Check the appropriate box: | |||||

| ¨ | Preliminary Proxy Statement | ||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| þ | Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | ||||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | ||||

Basic Energy Services, Inc.

| (Name of the Registrant as Specified In Its Charter) | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| þ | No fee required. | |||||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| ¨ | Fee paid previously with preliminary materials: | |||||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

i

| NOTICE OF THE 2019 ANNUAL MEETING OF STOCKHOLDERS | ||||||||

The 2019 Annual Meeting of Stockholders of Basic Energy Services, Inc. will be held:

| When: | Where: | ||||||||||

| Tuesday, May 14, 2019, | The Fort Worth Club | ||||||||||

| at 10:00 a.m. local time | 306 W. 7th Street | ||||||||||

| Fort Worth, Texas 76102 | |||||||||||

The purpose of the meeting is to consider and vote on the following proposals:

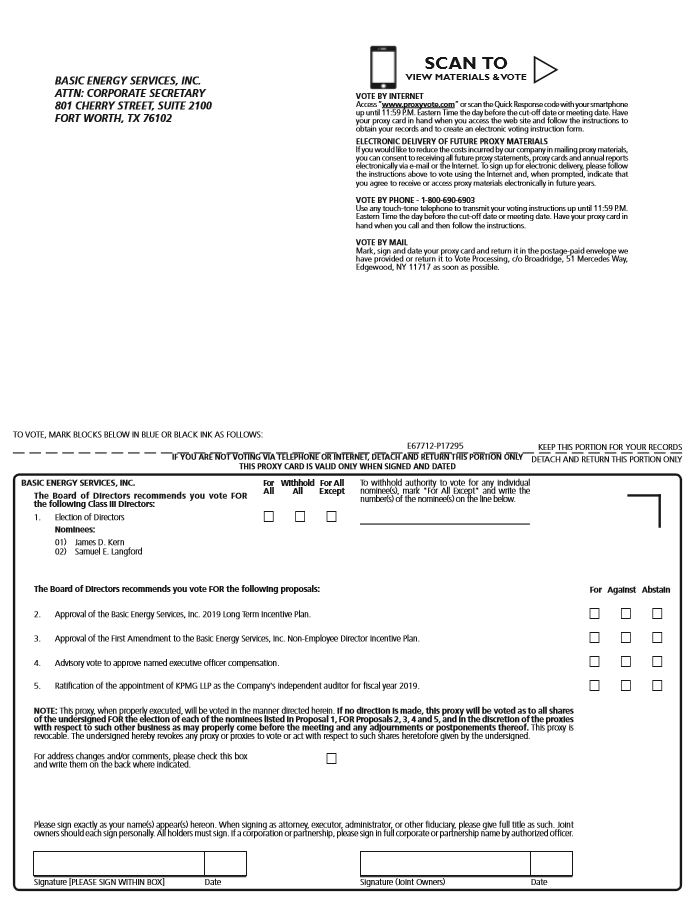

1.To elect two Class III directors to serve a three-year term;

2.To approve the Basic Energy Services, Inc. 2019 Long Term Incentive Plan;

3.To approve the First Amendment to the Basic Energy Services, Inc. Non-Employee Director Incentive Plan;

4.To approve, on a non-binding advisory basis, our named executive officer compensation;

5.To ratify the appointment of KPMG LLP as our independent auditor for fiscal year 2019; and

6.To transact such other business as may properly come before the meeting, or any adjournment of it.

Stockholders of record at the close of business on March 21, 2019 are entitled to vote at the meeting or any adjournment. A list of such stockholders will be available for examination by a stockholder for any purpose germane to the meeting during ordinary business hours at our offices at 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102 during the ten days prior to the meeting. Stockholders holding at least a majority of the outstanding shares of our common stock are required to be present or represented by proxy at the meeting to constitute a quorum.

Please note that space limitations make it necessary to limit attendance at the meeting to stockholders, though each stockholder may be accompanied by one guest. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 9:30 a.m., and seating will begin at 9:45 a.m. Each stockholder may be asked to present valid picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts must bring a copy of a brokerage statement reflecting stock ownership as of the record date. Cameras, recording devices and other electronic devices will not be permitted at the meeting. You may obtain directions to The Fort Worth Club by calling (817) 336-7211.

By Order of the Board of Directors,

David S. Schorlemer,

Secretary

Fort Worth, Texas

April 4, 2019

Important Notice Regarding the Availability of Proxy Materials for the 2019 Annual Meeting of Stockholders to Be Held on May 14, 2019: This notice, the proxy statement for the 2019 Annual Meeting of the Stockholders, the proxy card and our annual report on Form 10-K for the fiscal year ended December 31, 2018 are available at https://materials.proxyvote.com.

| PLEASE VOTE BY USING THE TELEPHONE OR INTERNET VOTING OPTIONS DESCRIBED IN THE ACCOMPANYING PROXY CARD OR, IF THE ATTACHED PROXY STATEMENT AND A PROXY CARD WERE MAILED TO YOU, PLEASE SIGN, DATE AND RETURN YOUR PROXY AS PROMPTLY AS POSSIBLE. AN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES, IS ENCLOSED FOR THIS PURPOSE. | ||

ii

| TABLE OF CONTENTS | ||||||||

GENERAL | ||||||||

VOTING PROCEDURES | ||||||||

| VOTING SECURITIES | ||||||||

| PROPOSAL 1: ELECTION OF DIRECTORS | ||||||||

| BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD | ||||||||

| Board of Directors | ||||||||

Committees of the Board | ||||||||

| CORPORATE GOVERNANCE GUIDELINES AND CODE OF ETHICS | ||||||||

| EXECUTIVE OFFICERS | ||||||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||||||

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | ||||||||

| EXECUTIVE COMPENSATION MATTERS | ||||||||

| What Guides Our Program | ||||||||

| Summary Compensation Table | ||||||||

| Outstanding Equity Awards at Fiscal Year-End | ||||||||

| Employment Agreements | ||||||||

| Director Compensation | ||||||||

| Transactions with Related Persons, Promoters and Certain Control Persons | ||||||||

| Compensation Committee Interlocks and Insider Participation | ||||||||

| Leadership Structure of the Company’s Board of Directors | ||||||||

| Board Role in Risk Oversight of the Company | ||||||||

| AUDIT RELATED MATTERS | ||||||||

| Audit Committee Report | ||||||||

| Independent Auditor and Fees | ||||||||

| Audit Committee Pre-Approved Policies and Procedures | ||||||||

| PROPOSAL 2: APPROVAL OF THE BASIC ENERGY SERVICES, INC 2019 LONG TERM INCENTIVE PLAN | ||||||||

| PROPOSAL 3: APPROVAL OF THE FIRST AMENDMENT TO THE BASIC ENERGY SERVICES, INC NON-EMPLOYEE DIRECTOR INCENTIVE PLAN | ||||||||

| PROPOSAL 4: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | ||||||||

| PROPOSAL 5: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR | ||||||||

| OTHER MATTERS | ||||||||

| PROPOSALS OF STOCKHOLDERS FOR 2020 ANNUAL MEETING | ||||||||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||||||||

| ADDITIONAL INFORMATION | ||||||||

| ANNEX A: BASIC ENERGY SERVICES, INC. 2019 LONG TERM INCENTIVE PLAN | A-1 | |||||||

| ANNEX B: BASIC ENERGY SERVICES, INC. NON_EMPLOYEE DIRECTOR INCENTIVE PLAN | B-1 | |||||||

| ANNEX C: FIRST AMENDMENT TO THE BASIC ENERGY SERVICES, INC. NON_EMPLOYEE DIRECTOR INCENTIVE PLAN | C-1 | |||||||

PROXY STATEMENT | ||

| FOR ANNUAL MEETING OF STOCKHOLDERS | ||

| MAY 14, 2019 | ||

| General | ||

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Basic Energy Services, Inc. a Delaware corporation (the “Company” or “Basic”) in connection with the 2019 Annual Meeting of Stockholders of the Company (the “2019 Annual Meeting”) to be held at The Fort Worth Club, located at 306 W 7th Street, Fort Worth, Texas 76102, on Tuesday, May 14, 2019, at 10:00 a.m. local time. Stockholders of record at the close of business on March 21, 2019 are entitled to notice of, and to vote at, the meeting and at any postponement or adjournment thereof.

When a properly executed proxy is received prior to the meeting, the shares represented will be voted at the meeting in accordance with the directions noted on the proxy. A proxy may be revoked at any time before it is exercised by submitting a written revocation or a later-dated proxy to the Secretary of the Company at the mailing address provided below or by attending the meeting in person and so notifying the inspector of elections.

Management does not intend to present any business for a vote at the 2019 Annual Meeting other than (i) the election of directors, (ii) the approval of the Company's 2019 Long Term Incentive Plan; (iii) the approval of the First Amendment to Company’s Non-Employee Director Incentive Plan, (iv) the approval, on a non-binding advisory basis, of our named executive officer compensation, and (v) the ratification of KPMG LLP as the Company’s independent auditor for fiscal year 2019. Unless stockholders specify otherwise in voting instructions to their broker, their shares (i) will not be voted in (a) the election of the director nominees listed in this proxy statement, (b) the approval of the Company's 2019 Long Term Incentive Plan, (c) the approval of the First Amendment to Company’s Non-Employee Director Incentive Plan, or (d) the advisory approval of our named executive officer compensation, and (ii) will be voted FOR the ratification of KPMG LLP as the Company’s independent auditor. If other matters requiring the vote of stockholders properly come before the meeting, it is the intention of the persons named in the enclosed proxy card to vote proxies held by them in accordance with their judgment.

The complete mailing address of the Company’s executive offices is 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102. A notice of the 2019 Annual Meeting, proxy statement and proxy card were made available on or about April 4, 2019, and if you are receiving this by mail, a proxy statement, proxy card, our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 are enclosed.

| Voting Procedures | ||

A majority of the outstanding shares of our common stock present in person or represented by proxy at the 2019 Annual Meeting will constitute a quorum for the transaction of business. Abstentions and broker non-votes will be included in determining whether a quorum is present at the 2019 Annual Meeting. Broadridge Financial Solutions, Inc. will tabulate all votes cast, in person or by submission of a properly executed proxy, before the closing of the polls at the meeting. The Company will appoint an inspector of elections at the meeting.

The affirmative vote of a plurality of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote is required for the election of each nominee for director. The affirmative vote of holders of a majority of our common stock present in person or represented by proxy at the meeting and

1 | Basic Energy Services Inc. 2019 Proxy Statement

entitled to vote is required for (i) the approval of the Company’s 2019 Long Term Incentive Plan, (ii) the approval of the First Amendment to Company’s Non-Employee Director Incentive Plan, (iii) the approval, on a non-binding advisory basis, of our named executive officer compensation, (iv) ratification of KPMG LLP as the Company’s independent auditor and (v) any other matters presented for a vote of stockholders. As an advisory vote, the proposal to approve our named executive officer compensation is not binding upon the Company. However, the Compensation Committee of our Board, which is responsible for overseeing our executive compensation program, values the opinions expressed by stockholders and will consider the outcomes of those votes when making future compensation decisions.

Abstentions will not count as votes cast for the election of directors or for any other proposal. As a result, abstentions will have no effect on Proposal 1 and will have the same practical effect as votes against Proposal 2, Proposal 3, Proposal 4 and Proposal 5. Brokers do not have discretionary voting authority with respect to the election of directors, the approval of the Company's Long Term Incentive Plan, the approval of the First Amendment to the Company's Non-Employee Director Incentive Plan, or the advisory approval of executive compensation. Accordingly, broker non-votes will not have any effect on Proposal 1, Proposal 2, Proposal 3 or Proposal 4. Because brokers generally have discretionary authority to vote on the ratification of our independent auditor, broker non-votes represented by submitted proxies will be taken into account in determining the outcome of Proposal 5.

Stockholders who submit proxies but attend the meeting in person may vote directly if they prefer and withdraw their proxies or may allow their proxies to be voted with the similar proxies submitted by other stockholders.

| Voting Securities | |||||||||||

On March 21, 2019, the record date, there were outstanding 26,957,350 shares of our common stock held of record by approximately 119 persons. Stockholders are entitled to one vote, exercisable in person or by proxy, for each share of our common stock held on the record date. Stockholders do not have cumulative voting rights.

2 | Basic Energy Services Inc. 2019 Proxy Statement

| PROPOSAL 1: ELECTION OF DIRECTORS | ||

The Board recommends a vote FOR each of the nominees named below. | ||

Board of Directors. The Company’s Second Amended and Restated Bylaws (the “Bylaws”) provide for the directors to serve in three classes having staggered terms of three years each. Two Class III directors will be elected at the 2019 Annual Meeting to serve for a three-year term expiring at the Annual Meeting of Stockholders in 2022. Pursuant to Delaware law, in the event of a vacancy on the Board, a majority of the remaining directors will be empowered to elect a successor, and the person so elected will hold office for the remainder of the full term of the director whose death, retirement, resignation, removal, disqualification or other cause created the vacancy and thereafter until the election of a successor director.

Recommendation; Proxies. The persons named in the enclosed proxy card will vote all shares over which they have discretionary authority FOR the election of the nominees named below. Although the Board does not anticipate that any of the nominees will be unable to serve, if such a situation should arise prior to the meeting, the appointed persons will use their discretionary authority pursuant to the proxy and vote in accordance with their best judgment.

Nominees. The following table sets forth information for each nominee. Each nominee has consented to be named in this proxy statement and to serve as a director, if elected.

| Name | Class | Age | Biography | ||||||||

| James D. Kern | III | 52 | Mr. Kern has served as Managing Partner of Majestic Ventures 1 LLC, a consulting and investment partnership focused on early stage growth companies since May 2014. In addition, Mr. Kern has served on the board of directors of PlaySight Interactive Ltd., a designer of consumer sports analytics systems, since May 2014 and currently serves as a director on the board of THL Credit, Inc. and Boart Longyear. From 2010 to mid-2014, Mr. Kern was a Managing Director at Nomura Securities, serving as Head of Global Finance FIG and Specialty Finance Investment Banking for the Americas. He previously served as a Managing Director at J.P. Morgan Securities within the FIG practice focused on Asset Management and Specialty Finance clients and, from 1994-2008, was a Senior Managing Director at Bear Stearns where he held several positions including Head of Strategic Finance-FIG, Head of Corporate Derivatives and was a founding member of the firm’s Structured Equity Products group. Mr. Kern has a Bachelor of Science degree from the Marshall School of Business at the University of Southern California. | ||||||||

| Independent Director since 2016 | |||||||||||

| Samuel E. Langford | III | 61 | Since January 2015, Mr. Langford has performed services as a consultant regarding upstream energy investments, strategies and management. Previously, Mr. Langford was employed by Newfield Exploration Co. as Senior Corporate Advisor-Corporate Office from March 2012 until December 2012, General Manager, Mid-Continent Business Unit from April 2011 until February 2012, and Vice President, Corporate Development from February 2009 until March 2011. Mr. Langford was retired from January 2013 until December 2014. In addition to Newfield, Mr. Langford has worked with Cockrell Oil & Gas, British Gas Exploration America, Tenneco Oil Company, Tenneco Inc and Exxon USA in various technical and managerial positions. Mr. Langford currently serves on the board of Chaparral Energy, Inc. Mr. Langford holds a Bachelor of Science degree in Mechanical Engineering from Auburn University. | ||||||||

| Independent Director since 2016 | |||||||||||

3 | Basic Energy Services Inc. 2019 Proxy Statement

Other Directors. The following table sets forth certain information for the Class I and Class II directors, whose terms will expire at the Annual Meetings of Stockholders in 2020 and 2021, respectively.

| Name | Class | Age | Principal Occupation | ||||||||

T. M. “Roe” Patterson | I | 44 | Mr. Patterson has 24 years of related industry experience. He was named our President and Chief Executive Officer and appointed as a Director in September 2013. From 2006 to September 2013, Mr. Patterson worked for Basic in positions of increasing responsibility: as our Senior Vice President and Chief Operating Officer from April 2011 until September 2013, as a Senior Vice President from September 2008 until April 2011 and as a Vice President from February 2006 until September 2008. Prior to joining Basic, he was President of TMP Companies, Inc. from 2000 to 2006. He was a Contracts/Sales Manager at Patterson Drilling Company from 1996 to 2000. From 1995 to 1996, he was employed as an Engine Sales Manager at West Texas Caterpillar. Mr. Patterson graduated with a Bachelor of Science degree in Biology from Texas Tech University. | ||||||||

| Director since 2013 | |||||||||||

| Julio M. Quintana | I | 59 | Mr. Quintana served as the President and Chief Executive Officer of Tesco Corporation, from 2005 until his retirement in January 2015 and was a member of the Tesco board from September 2004 to May 2015. Prior to the appointment as President and Chief Executive Officer, Mr. Quintana served as Executive Vice President and Chief Operating Officer at Tesco beginning in September 2004. Prior to his tenure at Tesco, Mr. Quintana worked for Schlumberger Corporation as Vice President of Integrated Project Management and Vice President of Marketing for The Americas from November 1999 to September 2004. Prior to Schlumberger, Mr. Quintana worked from June 1980 to November 1999 for Unocal Corporation, an integrated E&P company. Mr. Quintana held various operational and managerial roles in production, drilling and asset management. His last roles at Unocal were Asset Manager for the Mid Continent Region and Asset Manager for Deepwater Gulf of Mexico. Mr. Quintana brings 36 years of experience in various aspects of the oil and gas exploration and production industry, including strong experience in upstream operations, a deep understanding of drilling and asset management technologies, broad human resources management skills and experience. Mr. Quintana has a degree in Mechanical Engineering from The University of Southern California. He has been a member of the board of Directors of SM Energy since July 2006 and a member of the board of Newmont Mining since October 2015. | ||||||||

| Independent Director since 2016 | |||||||||||

| Anthony J. DiNello | I | 37 | Mr. DiNello joined Silver Point Capital, L.P. in January 2006, where he currently serves as a Senior Investment Analyst. Prior to joining Silver Point, Mr. DiNello worked in the Global Industrials & Services Group of Credit Suisse First Boston from July 2003 to December 2005. Mr. DiNello currently serves as a director of Healthsmart Holdings, Inc., Granite Broadcasting LLC., and BridgePoint Healthcare, LLC., is a member of the Supervisory Board of Novasep Holdings, S.A.S., and previously served on the board of Standard Register, Inc. Mr. DiNello received a Bachelor’s Degree in Business Administration from the University of Michigan Business School, with emphases in finance and accounting. Mr. DiNello has knowledge and expertise in a number of areas, and has extensive experience in the financial and credit analysis of numerous portfolio companies of Silver Point Capital, L.P. across a wide range of industries. | ||||||||

| Director since 2017 | |||||||||||

4 | Basic Energy Services Inc. 2019 Proxy Statement

| Name | Class | Age | Principal Occupation | ||||||||

| Timothy H. Day | II | 48 | Mr. Day is currently a private investor and director of several private companies. Prior to this, Mr. Day joined First Reserve in 2000 as a Vice President, served as Managing Director since 2007 and Co-Head of Buyout since 2012 until December 2015. Prior to joining First Reserve, Mr. Day was with SCF Partners, a private equity investment group specializing in the energy industry, as an Associate from 1995 to 1997 and as a Vice President from 1998 to 2000. Prior to that, he was an analyst with CS First Boston from 1993 to 1995, and prior to that he was an analyst with Salomon Brothers from 1992 to 1993. Mr. Day currently serves as a director on the board of Diamond S Shipping, TNT Crane & Rigging and TPC Group. Mr. Day previously served as a Director of PBF Energy Inc. He holds a Master of Business Administration degree from Harvard Business School and a Bachelor of Business Administration degree from the University of Texas. | ||||||||

| Independent Director since 2016 | |||||||||||

| John Jackson | II | 60 | Mr. Jackson has served as Chief Executive Officer of Spartan Energy Partners since March 2010. Prior to that, from January 2008 through October 2009, Mr. Jackson was the Chairman and Chief Executive Officer of Price Gregory Services, Inc., a leading energy infrastructure services provider specializing in pipeline construction. Prior to Price Gregory, from October 2004 to August 2007, Mr. Jackson served as President and Chief Executive Officer of Hanover Compressor, and from January 2002 to September 2004 as Hanover’s Chief Financial Officer. Prior to that, Mr. Jackson held several positions at Duke Energy Field Services, including Chief Financial Officer, and he also held various positions at Union Pacific Resources. Mr. Jackson currently sits on the board of directors of Seitel, Inc., Main Street Capital Corp. and Cone Midstream, in addition to his role with non-profits boards. He has previously served on the board of directors of Select Energy Services (2012 to 2015), RSH Energy (2013 to 2014), Encore Energy Partners (2009 to 2011) and Exterran Holdings, Inc. (2007 to 2009). John earned a Bachelor of Business Administration in Accounting from Baylor University. | ||||||||

| Independent Director since 2016 | |||||||||||

Director Experience, Qualifications, Attributes and Skills. The relevant experience, qualification, attributes and skills that our director nominees and directors bring to the Board include: for Mr. Kern, strategic finance, capital markets activities, derivative expertise, and audit committee experience; for Mr. Langford, executive and strategic planning, operational management, budget accountability and investment decision making; for Mr. Day, financial expertise and experience in the energy industry; for Mr. DiNello, corporate finance, mergers and acquisitions, capital markets activities and oil and gas drilling; for Mr. Jackson, chief executive officer in energy industry, finance and accounting; and for Mr. Quintana, engineering, finance, international, leadership, industry, public policy, technology. Only one of our directors, Mr. Patterson, is an officer of the Company. Mr. Patterson, our President and Chief Executive Officer, has over 24 years of experience in our industry.

5 | Basic Energy Services Inc. 2019 Proxy Statement

| BOARD OF DIRECTORS | ||

| Board of Directors | ||

Meetings. During fiscal 2018, the Board held 11 meetings of the full Board and 20 meetings of committees. The Nominating and Corporate Governance Committee held five meetings; the Compensation Committee held six meetings and the Audit Committee held nine meetings during fiscal 2018. In addition, the Company’s independent auditors and management meet with the Audit Committee Chairman prior to the issuance of earnings press releases, and the other members of the Audit Committee are invited to attend these meetings. While the Company does not have a specific policy about director attendance at annual meetings of stockholders, all directors are expected to attend meetings of the Board (and any committees thereof on which they serve) either in person or telephonically unless exigencies prevent them from attending. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the Board of Directors (held during the period for which he has been a director) and (2) the total number of meetings of committees of the Board on which he served (during the periods that he served). Our non-employee directors meet at regularly scheduled executive sessions presided over by our Chairman. Additionally, our independent directors meet at least once a year without members of management or non-independent directors present. All of our directors other than John Jackson attended our 2018 Annual Meeting of Stockholders.

Compensation. Directors who are our employees do not receive a retainer or fees for service on the Board or any committees. We pay non-employee directors for their service as directors. For 2018, directors who were not employees received an annual fee of $75,000 and our Chairman received an additional $25,000. In addition, the chairman of each committee received the following annual fees: Audit Committee — $15,000; Compensation Committee — $15,000; and Nominating and Corporate Governance Committee — $10,000. In addition, each of our non-employee directors received 7,800 shares of restricted stock with the exception of our Chairman who received 9,400 shares of restricted stock.

We granted each non-employee director $125,000 in targeted restricted stock awards (or $150,000 aggregate for our Chairman) under the Non-Employee Director Incentive Plan, which vested on December 23, 2018 (or the anniversary of the director hire date). Directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the Board or committees and for other reasonable expenses related to the performance of their duties as directors.

Independence. Our Board currently consists of seven members, including five members determined by our Board to be independent — Messrs. Day, Quintana, Jackson, Kern and Langford.

The Board has determined that Messrs. Day, Quintana, Jackson, Kern and Langford are independent as that term is defined by rules of the New York Stock Exchange (the “NYSE”) and, in the case of the Audit Committee, rules of the Securities and Exchange Commission (“SEC”) including Rule10A-3(b). In the case of the Compensation Committee, Mr. Day, Mr. Quintana and Mr. Jackson were determined to be independent for purposes of Rule 16b-3 and Section 162(m) of the Internal Revenue Code of 1986 as amended (the “Code”) for 2018. In determining that each of these directors is independent, the Board considered the role of Mr. Langford as a consultant to Silver Point Capital, L.P. (“Silver Point”), which became a 10% beneficial owner of the Company’s common stock as of the December 23, 2016. Based upon its review, the Board has affirmatively determined that each of these directors is independent and that none of these directors has a material relationship with the Company.

6 | Basic Energy Services Inc. 2019 Proxy Statement

Stockholder and Interested Party Communications with the Board. Stockholders and interested parties may communicate directly with the Board or a particular director by sending a letter to the attention of the Board or the particular director(s), as applicable, c/o Corporate Secretary, Basic Energy Services, Inc., 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102. Stockholder communications must contain a clear notation on the mailing envelope indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” Additionally, if the enclosed letter is from an interested party, the mailing envelope must contain a clear notation indicating that it is an “Interested Party-Board Communication” or an “Interested Party-Director Communication,” as applicable. All such letters must identify the author as a stockholder and/or interested party and clearly state whether the intended recipients are all members of the Board, certain specified individual directors or a group of directors, such as the non-management directors. The Secretary shall forward communications to the appropriate directors or the Board as a whole, as applicable, unless he reasonably determines in good faith that such communications relate to an improper or irrelevant topic.

| Committees of the Board | ||||||||||||||

Our Board has the following three standing committees, each with a written charter adopted by the Board and available on our website:

•Audit Committee;

•Nominating and Corporate Governance Committee; and

•Compensation Committee.

All of the directors on our Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee are currently independent in compliance with the requirements of the Sarbanes Oxley Act of 2002, the NYSE listing standards and SEC rules and regulations. The following table shows the committees on which each director serves:

| Nominating | |||||||||||

| and Corporate | |||||||||||

| Director | Audit | Governance | Compensation | ||||||||

| Timothy H. Day | X | X* | |||||||||

| T.M. “Roe” Patterson | |||||||||||

| Julio M. Quintana | X* | X | |||||||||

| Samuel E. Langford | X | ||||||||||

| James D. Kern | X | X | |||||||||

| John Jackson | X* | X | |||||||||

| Anthony J. DiNello | |||||||||||

*Chairperson

Audit Committee. The responsibilities of the Audit Committee, composed of Messrs. Jackson (Chairman), Day and Kern, include, among others:

• to appoint, engage and terminate our independent auditors;

• to approve fees paid to our independent auditors for audit and permissible non-audit services in advance;

• to evaluate, at least on an annual basis, the qualifications, independence and performance of our independent auditors;

• to review and discuss with our independent auditors reports provided by the independent auditors to the Audit Committee regarding financial reporting issues;

• to review and discuss with management and our independent auditors our quarterly and annual financial statements prior to our filing of periodic reports;

7 | Basic Energy Services Inc. 2019 Proxy Statement

• to establish and maintain procedures for the receipt, retention and treatment of complaints received by us and concerns of employees regarding accounting and auditing matters;

• to review our procedures for internal auditing and the adequacy of our disclosure controls and procedures and internal control over financial reporting; and

• to evaluate its own performance at least annually and deliver a report setting forth the results of such evaluation to the Board.

To promote the independence of the audit, the Audit Committee consults separately and jointly with the independent auditors, the internal auditors and management. The Board has determined that Mr. Jackson is an “audit committee financial expert” as that term is defined in Item 407(d)(5) of Regulation S-K The Board has adopted a written charter for the Audit Committee, a copy of which is available in the “Investor Relations — Corporate Governance” section of the Company’s website (www.basicenergyservices.com).

Nominating and Corporate Governance Committee. The responsibilities of the Nominating and Corporate Governance Committee, composed of Messrs. Quintana (Chairman), Kern and Langford, include, among others:

• to identify, recruit and evaluate candidates for membership on the Board and to develop processes for identifying and evaluating such candidates;

• to annually present to the Board a list of nominees recommended for election to the Board at the annual meeting of stockholders, and to present to the Board, as necessary, nominees to fill any vacancies that may occur on the Board;

• to adopt a policy regarding the consideration of any director candidates recommended by our stockholders and the procedures to be followed by such stockholders in making such recommendations;

• to adopt a process for our stockholders to send communications to the Board;

• to evaluate its own performance at least annually and deliver a report setting forth the results of such evaluation to the Board;

• to oversee our policies and procedures regarding compliance with applicable laws and regulations relating to the honest and ethical conduct of our directors, officers and employees;

• to have the sole responsibility for granting any waivers under our Code of Ethics and Corporate Governance Guidelines; and

• to evaluate annually, based on input from the entire Board, the performance of the Chief Executive Officer and report the results of such evaluation to the Compensation Committee of the Board.

The Board has adopted a written charter for the Nominating and Corporate Governance Committee, a copy of which is available in the “Investor Relations — Corporate Governance” section of the Company’s website (www.basicenergyservices.com).

The Nominating and Corporate Governance Committee has not established any minimum qualifications for non-employee director candidates that it recommends for nomination.

The Nominating and Corporate Governance Committee has established procedures for identifying and evaluating director nominees. Among the many factors considered in identifying and evaluating nominees, the Nominating and Corporate Governance Committee first considers the Board’s needs. Candidates will first be interviewed by the Nominating and Corporate Governance Committee. If approved by the Nominating and Corporate Governance Committee, candidates will then be interviewed by additional members of the Board. The full Board, with such interested directors recusing themselves as appropriate, will approve all final nominations after considering the recommendations of the Nominating and Corporate Governance Committee. The Chairman of the Board, acting on behalf of the other members of the Board, will extend the formal invitation to an approved candidate to stand for election to the Board.

8 | Basic Energy Services Inc. 2019 Proxy Statement

The Nominating and Corporate Governance Committee will continue to seek opportunities to enhance the diversity of directors serving on our Board. Although the Nominating and Corporate Governance Committee does not have specific requirements with regard to diversity in identifying director nominees, the Nominating and Corporate Governance Committee has historically considered, and will continue to consider, diversity a significant factor in evaluating the qualifications and experience of director nominees. In that regard, the Nominating and Corporate Governance Committee will endeavor to achieve an overall variety and mix of diversity in professional experiences, skills, perspective, culture, race and gender among the directors of our Board.

Stockholders may nominate director candidates in accordance with the Company’s Bylaws. Such nominations must be made in writing to the Company’s Secretary at the Company’s principal executive offices. The recommendation must set forth certain information about both the nominee and the nominating stockholder(s). The foregoing is a summary, and the specific requirements and procedures of the Bylaws, including timing of proposals, control.

The stockholder’s notice must set forth as to each nominee all information relating to the nominee that may be required under United States securities laws to be disclosed in solicitations of proxies for the election of directors, including the written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected. The stockholder’s notice must also set forth as to (i) the stockholder giving notice and (ii) if any, (A) the beneficial owner on whose behalf the nomination is made, (B) any affiliates or associates of such stockholder or any beneficial owner described in clause (A), and (C) each other person with whom any of the foregoing persons either is acting in concert with respect to the Company or has any agreement, arrangement or understanding (whether written or oral) for purpose of acquiring, holding, voting (except pursuant to a revocable proxy given in certain specified circumstances) or disposing of any capital stock of the Company or to cooperate in obtaining, changing or influencing the control of the Company (except independent financial, legal and other advisors acting in the ordinary course of their respective businesses) (each person in clauses (A), (B) and (C) is referred to as a “Stockholder Associated Person”): (1) a description of each agreement, arrangement or understanding with any Stockholder Associated Person; (2) the name and record address, as they appear on the Company’s books, of the stockholder proposing such business, such stockholder’s principal occupation and the name and address of any Stockholder Associated Person; (3) the class or series and number of equity and other securities of the Company which are, directly or indirectly, held of record or beneficially owned by such stockholder or by any Stockholder Associated Person, the dates on which such stockholder or any Stockholder Associated Person acquired such shares and documentary evidence of such record or beneficial ownership; (4) a list of all Derivative Interests (as defined in the Bylaws) held of record or beneficially owned by the stockholder or any Stockholder Associated Person; (5) the name of each person with whom the stockholder or any Stockholder Associated Person has a Voting Agreement (as defined in the Bylaws); (6) details of all other material interests of each stockholder or any Stockholder Associated Person in the proposal of the nominee or any security of the Company (collectively, “Other Interests”); (7) a description of all economic terms of all such Derivative Interests, Voting Agreements or Other Interests and copies of all agreements and other documents relating to each such Derivative Interest, Voting Agreement or Other Interest; and (8) a list of all transactions by such stockholder and any Stockholder Associated Person involving any securities of the Company or any Derivative Interests, Voting Agreements or Other Interests within the six-month period prior to the date of the notice.

To be timely, a stockholder’s notice given in the context of an annual meeting of stockholders shall be delivered to or mailed and received at the principal executive office of the Company not less than 90 days nor more than 120 days in advance of the first anniversary of the date of the Company’s previous year’s annual meeting of stockholders; provided, however, that if no annual meeting was held in the previous year or the date of the annual meeting of stockholders has been changed by more than 30 calendar days from the date of the previous year’s annual meeting, the notice must be received by the Company not less than 90 days nor more than 120 days prior to such annual meeting date or, if the first public announcement of such annual meeting is less than 100 days prior to the date of such annual meeting, the tenth (10th) day following the day on which the public announcement of the date of such meeting is first made by the Company.

If the information supplied by the stockholder is deficient in any material aspect or if the foregoing procedures are not followed, then the Board may determine that the stockholder’s nomination should not be brought before the meeting and that the nominee is ineligible for election as a director of the Company. The Nominating and

9 | Basic Energy Services Inc. 2019 Proxy Statement

Corporate Governance Committee will not alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder.

Compensation Committee. The responsibilities of the Compensation Committee, composed of Messrs. Day (Chairman), Jackson and Quintana, include, among others:

• to evaluate, develop and/or approve the compensation policies applicable to our executive officers and make recommendations to the Board or approve with respect to the compensation to be paid to our executive officers;

• to review, approve and evaluate on an annual basis the corporate goals and objectives with respect to compensation for our Chief Executive Officer and our other named executive officers (“NEOs”);

• to determine and approve our Chief Executive Officer’s compensation, including salary, bonus, incentive and equity compensation;

• to review and make recommendations regarding the compensation paid to non-employee directors;

• to review and approve, or make recommendations to the Board with respect to our incentive compensation plans and to assist the Board with the administration of such plans; and

• to evaluate its own performance at least annually and deliver a report setting forth the results of such evaluation to the Board.

The Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is available in the “Investor Relations — Corporate Governance” section of the Company’s website (www.basicenergyservices.com).

10 | Basic Energy Services Inc. 2019 Proxy Statement

CORPORATE GOVERNANCE GUIDELINES AND CODE OF ETHICS | ||

The Board has adopted Corporate Governance Guidelines, which present a flexible framework within which the Board, supported by its committees, directs the affairs of the Company. The Board has also adopted a Code of Ethics that applies to the Company’s directors and executive officers, including its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The Corporate Governance Guidelines and Code of Ethics are available in the “Investor Relations — Corporate Governance” section of the Company’s website (www.basicenergyservices.com).

If the Company amends or waives the Code of Ethics with respect to the principal executive officer, principal financial officer or principal accounting officer, it will post the amendment or waiver at this location on its website.

11 | Basic Energy Services Inc. 2019 Proxy Statement

| EXECUTIVE OFFICERS | ||||||||

The following table sets forth certain information with respect to our executive officers. Officers are elected annually by the Board and serve until their successors are duly elected and qualified or until their earlier death, resignation or removal. As of March 21, 2019, the respective ages and positions of our executive officers are as follows:

| Name | Age | Position | ||||||||||||

| T. M. “Roe” Patterson (1) | 44 | President, Chief Executive Officer and Director | ||||||||||||

| David S. Schorlemer | 52 | Senior Vice President, Chief Financial Officer, Treasurer and Secretary | ||||||||||||

| James F. Newman | 55 | Senior Vice President — Region Operations | ||||||||||||

| Adam L. Hurley | 37 | Vice President— Strategy & Business Development | ||||||||||||

| William T. Dame | 58 | Vice President — Pumping Services | ||||||||||||

| Douglas B. Rogers | 55 | Vice President — Marketing | ||||||||||||

| Eric Lannen | 53 | Vice President — Human Resources | ||||||||||||

| Lanny T. Poldrack | 51 | Vice President — Central Region and Tubular Division | ||||||||||||

| Brett J. Taylor | 46 | Vice President — Chief Technology Officer | ||||||||||||

| Richard S. Wegner | 35 | Vice President — Equipment, Quality Health, Safety and Environment | ||||||||||||

1.For biographical information on Mr. Patterson see “Election of Directors — Other Directors” beginning on page 4.

David S. Schorlemer (Senior Vice President, Chief Financial Officer, Treasurer and Secretary) has 30 years of related industry experience. He became our Senior Vice President, Chief Financial Officer, Treasurer and Secretary in August 2018. Mr. Schorlemer most recently served as the Chief Financial Officer of Gulf Island Fabrication, Inc., a Nasdaq-traded company that fabricates, maintains and services structures, facilities and vessels in the energy sector. Prior to that position, Mr. Schorlemer served as the Chief Financial Officer of GR Energy Services Management, LP, an oilfield services company delivering completion and production solutions to the United States and Latin America. Mr. Schorlemer also previously served as the Chief Financial Officer for Stallion Oilfield Holdings, Inc., an oilfield services company, helping the company to design and develop SEC financial reporting infrastructure, organization and policies. He earned a Bachelor of Business Administration degree in finance from The University of Texas, and a Master of Business Administration from Texas A&M University.

James F. Newman (Senior Vice President — Regional Operations) has 34 years of related industry experience and has been our Senior Vice President — Regional Operations since November 2013. He previously served as our Group Vice President - Permian Business Unit from April 2011 until September 2013 and has been a Group Vice President since September 2008. Prior to joining Basic, he co-founded Triple N Services in 1986 and served as its President through May 2008. He initially served Basic as an Area Manager in the plugging and abandonment operations. Mr. Newman is a registered Professional Engineer and is active in the Society of Petroleum Engineers. Mr. Newman graduated with a Bachelor of Science in Petroleum Engineering from Colorado School of Mines.

Adam Hurley (Vice President — Strategy and Business Development) has 14 years of related industry experience. He has been our Vice President of Strategy and Business Development since July 2018. Prior to joining Basic, he was an investment banker focused on oil and gas M&A advisory at Intrepid Partners, an energy-focused merchant bank, from 2016 to 2018 and Goldman Sachs from 2013 to 2016. Before that, Mr. Hurley was an officer in the U.S. Army for eight years, most notably as a Special Forces team leader and an infantry platoon leader. Mr. Hurley graduated with a Bachelor of Science degree from the United States Military Academy at West Point and a Master of Business Administration from Duke University.

12 | Basic Energy Services Inc. 2019 Proxy Statement

William T. Dame (Vice President — Pumping Services) has 38 years of related industry experience. Mr. Dame joined Basic in 2003 and has served as our Vice President — Pumping Services since 2006. He previously served as our Vice President - PPW and RAFT Divisions from 2005 to 2006 and as a regional vice president from 2004 through 2005. From 1997 to 2003, Mr. Dame worked in various operational management positions at Plains Energy, Precision Drilling and New Force Energy Services. He served as a vice president of Fleet Cementers, Inc. from 1987 to 1997. Mr. Dame began his career in 1981 with Halliburton. Mr. Dame attended Tarleton State University.

Douglas B. Rogers (Vice President — Marketing) has 36 years of related industry experience. He joined Basic in 2007 and serves as Vice President — Marketing after serving as Vice President-Contracts for the Drilling Division. Mr. Rogers was Vice President - Rocky Mountain Division for Patterson - UTI Drilling Company from March 2003 to June 2007. He also served as Western Division Sales Manager for Ambar Lonestar Fluid Services, a division of Patterson - UTI Drilling Company, from 1998 to 2003. He began his career in 1983 with Permian Servicing Company, where he managed well servicing operations. He continued in that capacity through Permian Servicing Company’s mergers with Xpert Well Service and Pride Petroleum Service until joining Zia Drill/Nova Mud in March 1997. Mr. Rogers graduated with a Bachelor of Arts degree from Eastern New Mexico University.

Eric Lannen (Vice President — Human Resources) has been a Vice President since August 2015. Eric Lannen has more than 27 years of Human Resources experience in the oil & gas, engineering & construction, defense & government services and the technology industries, as well as more than 16 years of experience in HR leadership roles. Prior to joining Basic, Mr. Lannen served as Senior Vice President, Human Resources for Dyncorp International and Vice President of Human Resources at McDermott International. Mr. Lannen’s prior experience includes: talent acquisition leader for IBM growth markets across five continents; leading Human Resources for the Government Services Division of Kellogg Brown & Root (KBR); and several HR positions at Halliburton Company. Mr. Lannen graduated from Texas A&M University with a Bachelor of Science degree.

Lanny T. Poldrack (Vice President — Central Region and Tubular Division) has 32 years of related industry experience and has served as our Vice President - Central Region and Tubular Division since October 2015. He previously served as our Vice President - Safety and Operations Support since April 2011. From April 2009 to April 2011, he served as a Corporate Marketing Representative based in Houston, Texas. Prior to joining Basic, he spent 13 years at Cudd Energy Services where he held various technical sales and sales management positions for both well intervention and live well service divisions, the last four years of which he served as Business Development Manager for Cudd Well Control for both domestic and international operations in U.S., Canadian, Latin America, European, Middle Eastern and South East Asian markets. He began his oilfield career in West Texas as a technical field representative for Weatherford International, specializing in fishing and rental tools and hydraulic BOP systems. Mr. Poldrack graduated with an applied science degree from Odessa Junior College.

Brett J. Taylor (Vice President — Chief Technology Officer) has 26 years of related industry experience and has been our Vice President – Chief Technology Officer since December 2018. Mr. Taylor previously served as our Vice President of Manufacturing and Equipment since June 2013. Prior to joining Basic, he was President of Taylor Industries, LLC in Tulsa, Oklahoma from 2010 to 2013. From 2009 to 2010, he served as Executive Vice President of Sales and Marketing at Serva Group Manufacturing. Before that, Mr. Taylor held positions of increasing responsibilities at Taylor Industries over an 11-year span. His tenure at Taylor included the role of Consultant, President of Sales from 2008 to 2009, President of Taylor from 2003 to 2008, General Manager & Vice President of Business Development from 2001 to 2003, and Sales and Marketing Manager from 1997 to 1999. Mr. Taylor graduated with a Bachelor of Business Administration degree from the University of Oklahoma.

Richard S. Wegner (Vice President — Quality, Health, Safety & Environment) has seven years of related industry experience. Mr. Wegner is responsible for the development, implementation, communication and coordination of all quality, health, safety and environmental programs for the Company including Department of Transportation compliance and safety training. Prior to his current role, Mr. Wegner held roles of increasing responsibility at Basic in the Finance and Safety functions including Director of Budget & Analysis and Director Safety & Compliance. Prior to joining Basic, Mr. Wegner served as an Infantry Officer in the United States Marine Corps. Mr. Wegner earned his Bachelor of Business Administration degree from Texas Tech University and his Master in Business Administration from Southern Methodist University.

13 | Basic Energy Services Inc. 2019 Proxy Statement

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||||||

The following table sets forth the number of shares of common stock beneficially owned as of March 21, 2019, by (1) all persons who beneficially own more than 5% of the outstanding voting securities of the Company, to the knowledge of the Company’s management, (2) each current director, (3) each named executive officer listed in the Summary Compensation Table and (4) all current directors and executive officers as a group.

0

| Amount and Nature | Percent of | ||||||||||

| of Beneficial | Shares | ||||||||||

| Name | Ownership | Outstanding | |||||||||

| Ascribe Capital LLC (1) | 4,165,238 | 15.5 | % | ||||||||

| Silver Point Capital, L.P. (2) | 3,268,151 | 12.1 | % | ||||||||

| CVI Opportunities Fund I, LLLP (3) | 2,402,820 | 8.9 | % | ||||||||

| Cetus Capital III, L.P. (4) | 2,197,058 | 8.2 | % | ||||||||

| Dimensional Fund Advisors LP (5) | 2,120,260 | 7.9 | % | ||||||||

| Prescott Group Capital Management, L.L.C. (6) | 1,686,791 | 6.3 | % | ||||||||

| Blackrock, Inc. (7) | 1,579,875 | 5.9 | % | ||||||||

| T.M. “Roe” Patterson (8) | 453,858 | 1.7 | % | ||||||||

| James F. Newman (9) | 153,825 | * | |||||||||

| Alan Krenek (10) | 131,711 | * | |||||||||

| Timothy H. Day | 71,600 | * | |||||||||

| William T. Dame (11) | 68,683 | * | |||||||||

| James D. Kern | 26,100 | * | |||||||||

| Samuel E. Langford | 16,600 | * | |||||||||

| Julio M. Quintana | 16,600 | * | |||||||||

| John Jackson | 16,100 | * | |||||||||

| Anthony J. DiNello (12) | 12,100 | * | |||||||||

| Directors and Executive Officers as a Group (16 persons) | 1,042,619 | 3.9 | % | ||||||||

* Less than one percent.

1.Based solely on information provided on Form 4 filed by Ascribe Capital LLC ("Ascribe Capital") with the SEC on December 18, 2018. Ascribe Capital reported shared voting power as to 4,165,238 shares and shared dispositive power as to all 4,165,238 shares. Ascribe Capital’s principal business address is 299 Park Avenue, New York, NY 10171.

2.Based solely on information provided on From 4 filed by Silver Point Capital, L.P. ("Silver Point") with the SEC on May 23, 2018. Silver Point reported shared voting power as to 3,268,151 shares and shared dispositive power as to all 3,268,151 shares. Silver Point’s principal business address is Two Greenwich Plaza, Greenwich, CT 06830.

3.Based solely on information provided on Schedule 13G filed by CVI Opportunities Fund I, LLLP (“CVI”) with the SEC on February 4, 2019. CVI reported shared voting power as to 2,402,820 shares and shared dispositive power as to all 2,402,820 shares. CVI’s principal business address is One Commerce Center, 1201 N. Orange Street, Wilmington, DE 19801. Susquehanna Advisors Group, Inc., which serves as the investment manager to CVI, may be deemed to be the beneficial owner of all shares owned by CVI.

4.Based solely on information provided on Schedule 13G filed by Cetus Capital III, L.P. (“Cetus”) with the SEC on February 8, 2019. Cetus reported shared voting power as to 856,009 shares and shared dispositive power as to all 856,009 shares. Cetus's principal business address is 30 Rockefeller Plaza, New York, NY 10112.

14 | Basic Energy Services Inc. 2019 Proxy Statement

5.Based solely on information provided on Schedule 13G filed by Dimensional Fund Advisors LP. (“Dimensional”) with the SEC on February 8, 2019. Dimensional reported sole voting power as to 2,120,260 shares and sole dispositive power as to all 2,207,229 shares. Dimensional’s principal business address is 6300 Bee Cave Road, Austin, TX 78746.

6.Based solely on information provided on Schedule 13G filed by Prescott Group Management, L.L.C. (“Prescott Capital”) with the SEC on February 11, 2019. Prescott Capital reported shared voting power as to 1,686,791 shares and shared dispositive power as to all 1,686,791 shares. Prescott Capital’s principal business address is 1924 South Utica, Tulsa, OK 74104.

7.Based solely on information provided on Schedule 13G filed by Blackrock, Inc. (“Blackrock”) with the SEC on February 11, 2019. Blackrock reported sole voting power as to 1,523,942 shares and sole dispositive power as to all 1,579,875 shares. Blackrock’s principal business address is 55 East 52nd Street, New York, NY 10055.

8.Includes 20,807 warrants to purchase the Company’s common stock on a one-for-one basis. Excludes 113,383 shares of issuable upon vesting RSUs and 66,912 shares issuable upon exercise of unvested stock options, which are subject to forfeiture and generally vest over the next three and one years, respectively.

9.Includes 6,313 warrants to purchase the Company’s common stock on a one-for-one basis. Excludes 40,318 shares of issuable upon vesting RSUs and 23,744 shares issuable upon exercise of unvested stock options, which are subject to forfeiture and generally vest over the next three and one years, respectively.

10.Includes 6,638 warrants to purchase the Company’s common stock on a one-for-one basis. Includes 99,600 shares owned subject to bank pledges.

11.Includes 4,461 warrants to purchase the Company’s common stock on a one-for-one basis. Excludes 23,660 shares of issuable upon vesting RSUs and 12,952 shares issuable upon exercise of unvested stock options, which are subject to forfeiture and generally vest over the next three and one years, respectively.

12.Mr. DiNello disclaims any beneficial ownership relating to shares owned by Silver Point.

15 | Basic Energy Services Inc. 2019 Proxy Statement

1.

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | ||

The following table provides information regarding options, warrants and rights authorized for issuance under our equity compensation plans as of December 31, 2018:

0

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (2) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (3) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding Securities Reflected in Column (4) | |||||||||||||||||||||||||||||||||||

Equity compensation plans approved by security holders (1) | 2,475,579 | $39.23 | 677,015 | |||||||||||||||||||||||||||||||||||

Equity compensation plans not approved by security holders | — | — | — | |||||||||||||||||||||||||||||||||||

Total | 2,475,579 | $39.23 | 677,015 | |||||||||||||||||||||||||||||||||||

1.Represents shares of common stock issuable under the Basic Energy Services, Inc. Management Incentive Plan, effective as of December 23, 2016 (the “MIP”), and the Basic Energy Services, Inc. Non-Employee Director Incentive Plan, effective as of May 25, 2017 (the “Director Incentive Plan”).

2.Includes 595,736 shares of common stock that may be issued upon the vesting of stock options and 1,879,843 shares of common stock that may be issued upon vesting of restricted stock units (“RSUs”), each under the MIP.

3.RSUs do not have an exercise price; accordingly, RSUs are excluded from the weighted average exercise price of outstanding awards.

4.Represents the number of shares of common stock remaining available for grant under the MIP and Director Incentive Plan as of December 31, 2018. If any common stock underlying an unvested award is canceled, forfeited or is otherwise terminated without delivery of shares, then such shares will again be available for issuance under the MIP, but not under the Director Incentive Plan.

16 | Basic Energy Services Inc. 2019 Proxy Statement

| EXECUTIVE COMPENSATION MATTERS | ||

| Overview | ||||||||||||||

We are currently considered a smaller reporting company for purposes of the SEC’s executive compensation disclosure rules. In accordance with such rules, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year-End Table, as well as limited narrative disclosures. Further, our reporting obligations extend only to the individuals serving as our chief executive officer, our two next most highly compensated executive officers and our retired Chief Financial Officer. We refer to the aforementioned individuals throughout this discussion as the “NEOs” and their names, titles and positions are as follows:

17 | Basic Energy Services Inc. 2019 Proxy Statement

| Name | Principal Position | ||||||||||||||||||||||||||||

| T. M. “Roe” Patterson | President and Chief Executive Officer | ||||||||||||||||||||||||||||

| Alan Krenek (Retired) | Former Senior Vice President and Chief Financial Officer, Treasurer and Secretary | ||||||||||||||||||||||||||||

| James F. Newman | Senior Vice President - Region Operations | ||||||||||||||||||||||||||||

| William T. Dame | Vice President - Pumping Services | ||||||||||||||||||||||||||||

| What Guides Our Program | ||||||||||||||

Our Compensation Philosophy & Objectives. Our historic compensation philosophy is driven by the following guiding principles that reinforce the critical connections between business performance, stockholder value creation and senior leadership:

•Compensation for performance: A substantial portion of our executive’s total compensation is variable and contingent upon the attainment of certain specific and measurable annual- and long-term business performance objectives.

•Stockholder alignment: Executives are compensated through compensation elements (base salaries, annual- and long-term incentives) designed to create long-term value for our stockholders, as well as foster a culture of ownership.

•Competitiveness: Target compensation is set at a level that is competitive with that being offered to individuals holding similar positions at other oil and gas companies with which we compete for business and talent.

•Attraction and retention: The executive compensation program enables the Company to retain superior executive talent, as well as attract additional top-tier leadership.

The Principal Elements of Compensation: Total Direct Compensation ("TDC"). Our compensation philosophy is supported by the following principal elements in our executive compensation program:

| Element | Form | Purpose | ||||||

| Base Salary | Cash (Fixed) | Provides a competitive rate relative to similar positions at the market median. This enables the Company to attract and retain critical executive talent. | ||||||

| Quarterly Incentive Bonus Plan* | Cash (Variable) | Ties the compensation of eligible executives in specific areas, regions and divisions directly to the achievement of financial return on assets employed, revenue growth and safety goals within their particular operations. | ||||||

| Annual Cash Bonus Plan | Cash (Variable) | Provides motivation toward, and reward for the achievement of, annual financial and strategic goals that drive long-term stockholder value. | ||||||

| Long-Term Incentives | Equity (Variable) | Provides incentives to execute on longer-term financial/strategic growth goals that drive stockholder value creation and support the Company’s retention strategy. | ||||||

18 | Basic Energy Services Inc. 2019 Proxy Statement

*The CEO, CFO, and Senior Vice President, Region Operations do not participate in this plan. Any bonus amounts awarded under this plan to the other NEOs are deducted from any bonus amounts received under the Annual Cash Bonus Plan.

Section 162(m). We consider objectives such as attracting, retaining and motivating leaders when we design our executive compensation programs. We also consider the tax-deductibility of compensation, but it is not our sole consideration. For federal income taxes, compensation is an expense that is fully tax-deductible for almost all our employees. Our NEOs are treated differently. Their pay above $1.0 million is non tax-deductible. The MIP permits the payment of qualified performance-based compensation, which, prior to 2018, was fully tax-deductible. As a result of the elimination of the performance-based compensation exception from the 162(m) limitation, the opportunity to design programs that are fully tax-deductible for our NEOs has effectively been eliminated. Therefore, we believe that tax-deductibility will have less of an impact on our program design in the future.

We believe that all the compensation we paid to our other NEOs in 2018 was tax-deductible except for the following:

•the value of the time-based RSUs vested in 2018; and

•certain prerequisites and other benefits.

Effective for tax years in 2018 or later, performance-based compensation exception to $1.0 million deduction limitation was repealed. In 2018 and future years, we expect that earnings from performance-based stock options and performance-based RSUs granted on or before November 2, 2017 and has not since been materially modified will continue to be tax-deductible pursuant to the MIP because they are considered grandfathered under the tax reform legislation, unless further tax reform guidance tells us otherwise. We expect the other compensation paid to our NEOs above $1.0 million will not be tax-deductible.

19 | Basic Energy Services Inc. 2019 Proxy Statement

| Summary Compensation Table | ||||||||||||||

The following information relates to compensation paid by the Company for the fiscal years ended 2018 and 2017 to the Company’s Chief Executive Officer, its retired Chief Financial Officer, and each of the other two most highly compensated executive officers:

| Name and Principal Position | Year | Salary ($)(1) | Bonus ($) | Stock Awards ($)(2) | Option Awards ($)(3) | Non-Equity Incentive Plan Compensation ($)(4) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)(5) | Total ($) | ||||||||||||||||||||

| T.M. “Roe” Patterson, | 2018 | 700,000 | — | 1,429,018 | — | 315,000 | — | — | 2,444,018 | ||||||||||||||||||||

President and Chief Executive Officer | 2017 | 658,269 | — | 9,115,924 | 1,641,017 | 630,000 | — | — | 12,045,210 | ||||||||||||||||||||

| Alan Krenek (Retired) | 2018 | 268,154 | — | 511,263 | — | 192,719 | — | 1,166,775 | 2,138,911 | ||||||||||||||||||||

Former Senior Vice President, Chief Financial Officer, Treasurer and Secretary | 2017 | 395,208 | — | 3,244,487 | 582,289 | 311,250 | — | 900 | 4,534,134 | ||||||||||||||||||||

| James F. Newman, | 2018 | 415,000 | — | 511,263 | — | 155,625 | — | 7,639 | 1,089,527 | ||||||||||||||||||||

Senior Vice President, Region Operations | 2017 | 395,208 | — | 3,244,487 | 582,289 | 311,250 | — | 6,616 | 4,539,850 | ||||||||||||||||||||

| William T. Dame, | 2018 | 311,692 | — | 359,024 | — | 75,000 | — | 19,044 | 764,760 | ||||||||||||||||||||

Vice President, Pumping Services | 2017 | 317,890 | — | 1,764,366 | 317,615 | 255,000 | — | 17,904 | 2,672,775 | ||||||||||||||||||||

______________

1.Under the terms of their employment agreements, Messrs. Patterson, Newman and Dame are entitled to the compensation described under “Employment Agreements” below.

2.This column represents the total grant date fair value of RSUs and performance-based RSUs granted to each of the applicable named executive officers. The fair value of performance-based RSUs granted in 2018, $14.72 was calculated in accordance with FASB ASC Topic 718, based on the fair value on the grant date, February 8, 2018. The value of time-based RSU was calculated based upon the closing market price of the stock on the grant date, February 8, 2018. The actual value that an executive officer will realize upon vesting of performance or time-based RSUs will depend upon the market price of the Company’s stock on the vesting date, so there is no assurance that the value realized by an executive officer will be at or near the value of the market price of the Company’s stock on the grant date. Refer to the Company's Annual Report on Form 10-K for the period ended December 31, 2018, filed with the SEC on March 5, 2019 for further discussion on our grant-date valuation of stock-based compensation.

3.The option awards vest in three equal installments beginning on February 8, 2018. Each option has an exercise price of $41.93. The fair value of the option awards included in this column represents the value of the award on the grant date, $16.35, which was determined in accordance with FASB ASC Topic 718, and excludes the effect of estimated forfeitures. Refer to the Company's Annual Report on Form 10-K for the period ended December 31, 2018, filed with the SEC on March 5, 2019 for further discussion on our grant-date valuation of stock-based compensation.

4.Reflects aggregate bonus payments made utilizing metrics under our annual cash bonus incentive compensation plan and division-level Quarterly Incentive Bonus Plan. In 2018, Messrs. Patterson, Krenek and Newman did not participate in the Quarterly Incentive Bonus Plan and received only an annual cash bonus for 2018 performance that was paid in early 2019. Mr. Dame participated in the Quarterly Incentive Bonus Plan in 2018.

5.Includes vehicle allowance for 2018 of $6,739 for Mr. Newman and $18,144 for Mr. Dame. Includes a cell phone allowance of $900 for Mr. Newman and Mr. Dame and $600 for Mr. Krenek in 2018. Messers. Krenek, Newman and Dame each received $900 of cellphone allowance in 2017 and Mr. Patterson did not participate in the cell phone allowance plan in 2018 and 2017. For 2018, all other compensation for Mr. Krenek also includes payments made in connection with his retirement for severance related payments of $1,166,175.

20 | Basic Energy Services Inc. 2019 Proxy Statement

| Outstanding Equity Awards at Fiscal Year-End | ||||||||||||||

The following table sets forth information concerning unexercised stock options and unvested RSUs of each of our named executive officers as of December 31, 2018:

| Option Awards | Stock Awards | ||||||||||||||||||||||||||||

| Equity Incentive | |||||||||||||||||||||||||||||

| Number of | Number of | Equity | Number of | Equity Incentive | Plan Awards: | ||||||||||||||||||||||||

| Securities | Securities | Incentive Plan | Shares | Plan Awards: | Market or Payout | ||||||||||||||||||||||||

| Underlying | Underlying | Awards: Number of | or Units of | Market Value of | Number of Unearned | Value of Unearned | |||||||||||||||||||||||

| Unexercised | Unexercised | Securities Underlying | Option | Stock That | Shares or Units of | Shares, Units or | Shares, Units or | ||||||||||||||||||||||

| Options | Options | Unexercised | Exercise | Option | Have Not | Stock That | Other Rights that | Other Rights That | |||||||||||||||||||||

| (#) | (#) | Unearned Options | Price | Expiration | Vested | Have Not Vested | Have Not Vested | Have Not Vested | |||||||||||||||||||||

| Name | Exercisable | Unexercisable | (#) | ($) | Date | (#) | ($) | (#) | ($) | ||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | ||||||||||||||||||||

| T.M. “Roe” Patterson | |||||||||||||||||||||||||||||

| 12/23/2016(1) | 66,912 | — | 33,456 | $36.55 | 12/23/2026 | — | — | — | — | ||||||||||||||||||||

| 2/22/2017(2) | — | — | — | — | — | 167,280 | $642,355 | — | — | ||||||||||||||||||||

| 2/22/2017(3) | 33,456 | — | 66,912 | $41.93 | 2/22/2027 | — | — | — | — | ||||||||||||||||||||

| 2/8/2018 (4) | — | — | — | — | — | 44,615 | $171,322 | — | — | ||||||||||||||||||||

| 2/8/2018 (5) | — | — | — | — | — | — | — | 44,615 | $171,322 | ||||||||||||||||||||

| Alan Krenek (Retired) (6) | |||||||||||||||||||||||||||||

| 12/23/2016(6) | 35,614 | — | — | $36.55 | 12/23/2026 | — | — | — | — | ||||||||||||||||||||

| 2/22/2017(6) | 35,614 | — | — | $41.93 | 2/22/2027 | — | — | — | — | ||||||||||||||||||||

| James F. Newman | |||||||||||||||||||||||||||||

| 12/23/2016(1) | 23,742 | — | 11,871 | $36.55 | 12/23/2026 | — | — | — | — | ||||||||||||||||||||

| 2/22/2017(2) | — | — | — | — | — | 59,357 | $227,931 | — | |||||||||||||||||||||

| 2/22/2017(3) | 11,872 | — | 23,742 | $41.93 | 2/22/2027 | — | — | — | — | ||||||||||||||||||||

| 2/8/2018 (4) | — | — | — | — | — | 15,962 | $61,294 | — | — | ||||||||||||||||||||

| 2/8/2018 (5) | — | — | — | — | — | — | — | 15,962 | $61,294 | ||||||||||||||||||||

| William T. Dame | |||||||||||||||||||||||||||||

| 12/23/2016(1) | 12,950 | — | 6,475 | $36.55 | 12/23/2026 | — | — | — | — | ||||||||||||||||||||

| 2/22/2017(2) | — | — | — | — | — | 32,376 | $124,324 | — | |||||||||||||||||||||

| 2/22/2017(3) | 6,476 | — | 12,950 | $41.93 | 2/22/2027 | — | — | — | — | ||||||||||||||||||||

| 2/8/2018 (4) | — | — | — | — | — | 11,209 | $43,043 | — | — | ||||||||||||||||||||

| 2/8/2018 (5) | — | — | — | — | — | — | — | 11,209 | $263,075 | ||||||||||||||||||||

(1) One third of the options vested on December 23, 2017 and another one third of the RSUs vested on December 23, 2018. The remainder will vest on December 23, 2019.

(2) Performance-based RSUs were granted by our Board, as recommended by the Compensation Committee, to certain of our employees, including our named executive officers, on February 22, 2017. Performance for the award was measured based on the Company's relative total stock return (“TSR”) compared to the TSR of a selected peer group of energy services companies. One third of the Performance-based RSUs vested on February 8, 2018. The remainder will vest in two equal annual installments on February 8, 2019 and 2020.

(3) One third of the options vested on February 8, 2018. The remainder will vest in two equal annual installments on February 8, 2019 and 2020.

(4) RSUs were granted by our Board, as recommended by the Compensation Committee, to certain of our employees, including our named executive officers, on February 8, 2018. RSUs begin to vest in three equal annual installments on March 15, 2019.

(5) Performance-based RSUs were granted by our Board, as recommended by the Compensation Committee, to certain of our employees, including our named executive officers, on February 8, 2018. Performance for the award will be measured based on the Company's relative TSR compared to the TSR of a selected peer group of energy services companies.

(6) Pursuant to the transition agreement entered April 3, 2018 with Mr. Krenek, all of Mr. Krenek's unvested equity compensation vested on August 15, 2018. Mr. Krenek's unexercised options had a six-month expiration date and expired on February 15, 2019.

21 | Basic Energy Services Inc. 2019 Proxy Statement

| Employment Agreements | ||||||||||||||

Pursuant to our employment agreement, effective May 2013, with T.M. “Roe” Patterson, our President and Chief Executive Officer, Mr. Patterson’s initial annual base salary was set at $650,000 and is subject to adjustment at least annually. Mr. Patterson is entitled to an annual performance bonus if certain performance criteria are met. In addition, Mr. Patterson is eligible from time to time to receive grants of stock options and other long-term equity incentive compensation under our MIP. If Mr. Patterson’s employment were to be terminated for certain reasons, he would be entitled to a lump sum severance payment equal to two times the sum of his annual base salary plus his current annual incentive target bonus for the full year in which the termination of employment occurred. Additionally, if Mr. Patterson’s employment were to be terminated for certain reasons within the six months preceding or the twelve months following a change in control of our Company, he would be entitled to a lump sum severance payment equal to three times the sum of his annual base salary plus the higher of (i) his current annual incentive target bonus for the full year in which the termination of employment occurred or (ii) the highest annual incentive bonus received by him for any of the last three fiscal years. Mr. Patterson’s employment agreement renews automatically each January 1st for a one-year period unless notice of termination is properly given by us or Mr. Patterson. In the event that Mr. Patterson’s employment agreement is not renewed by us for any reason other than cause and a new employment agreement has not been entered into prior to the expiration of the then-current term, Mr. Patterson will be entitled to the same severance benefits described above.

We entered into a transition services agreement with Alan Krenek, our former Senior Vice President and Chief Financial Officer, Treasurer and Secretary, effective April 3, 2018. Pursuant to this agreement, Mr. Krenek's employment agreement terminated on the severance date and Mr. Krenek was entitled to a lump sum severance payment along with a pro rata portion of the 2018 target bonus based on the number of days from January 1, 2018 through and including the Severance Date divided by 365. All of Mr. Krenek's outstanding unvested stock options, restricted stock, and restricted stock units (collectively, the "Equity Awards") fully vested on the severance date, with any applicable performance goals deemed met at target levels and settled in accordance with the terms of the applicable award agreement.