Exhibit 99.2

Exhibit 99.2

Oromin Explorations Ltd.

Consolidated Financial Statements

February 29, 2012

Expressed in Canadian Dollars

INDEPENDENT AUDITORS' REPORT

To the Shareholders of

Oromin Explorations Ltd.

We have audited the accompanying consolidated financial statements of Oromin Explorations Ltd. which comprise the consolidated statements of financial position as at February 29, 2012, February 28, 2011 and March 1, 2010, and the consolidated statements of comprehensive loss, changes in equity and cash flows for the years ended February 29, 2012 and February 28, 2011, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of Oromin Explorations Ltd. as at February 29, 2012, February 28, 2011 and March 1, 2010 and its financial performance and its cash flows for the years ended February 29, 2012 and February 28, 2011 in accordance with International Financial Reporting Standards.

Emphasis of Matter

Without qualifying our opinion, we draw attention to Note 1 in the consolidated financial statements which describes conditions and matters that indicate the existence of a material uncertainty that may cast significant doubt about the ability of Oromin Explorations Ltd. to continue as a going concern.

“DAVIDSON & COMPANY LLP”

|

|

| Vancouver, Canada |

Chartered Accountants |

|

|

| May 28, 2012 |

|

OROMIN EXPLORATIONS LTD.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Expressed in Canadian Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

February 29, |

|

|

|

February 28, |

|

|

|

March 1, |

|

| |

|

2012 |

|

|

|

2011 |

|

|

|

2010 |

|

| |

|

|

|

|

|

(Note 19) |

|

|

|

(Note 19) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

$ |

3,927,251 |

|

|

$ |

16,230,612 |

|

|

$ |

10,003,721 |

|

|

Receivables (Note 3) |

|

101,475 |

|

|

|

303,078 |

|

|

|

166,345 |

|

|

Marketable securities (Note 4) |

|

41,927 |

|

|

|

89,843 |

|

|

|

89,843 |

|

|

Deposits and prepaid expenses |

|

280,442 |

|

|

|

791,843 |

|

|

|

58,675 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

4,351,095 |

|

|

|

17,415,376 |

|

|

|

10,318,584 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investment in Oromin Joint Venture Group Ltd. (Note 5) |

|

76,371,325 |

|

|

|

67,508,460 |

|

|

|

50,632,970 |

|

|

Exploration and evaluation assets (Note 7) |

|

- |

|

|

|

- |

|

|

|

1,103,033 |

|

|

Property, plant and equipment (Note 8) |

|

63,700 |

|

|

|

114,235 |

|

|

|

163,971 |

|

|

Advances to joint venture |

|

180,882 |

|

|

|

114,276 |

|

|

|

72,748 |

|

|

Performance bond – restricted cash |

|

- |

|

|

|

26,539 |

|

|

|

43,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

76,615,907 |

|

|

|

67,763,510 |

|

|

|

52,015,747 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

$ |

80,967,002 |

|

|

$ |

85,178,886 |

|

|

$ |

62,334,331 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Trade and other payables (Note 9) |

$ |

286,256 |

|

|

$ |

351,104 |

|

|

$ |

620,898 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Share capital (Note 10) |

|

112,455,628 |

|

|

|

111,298,040 |

|

|

|

82,876,200 |

|

|

Share-based payments reserve (Note 10) |

|

18,342,345 |

|

|

|

15,720,643 |

|

|

|

11,244,638 |

|

|

Investment revaluation reserve (Note 4) |

|

- |

|

|

|

(281,507 |

) |

|

|

(281,507 |

) |

|

Deficit |

|

(50,117,227 |

) |

|

|

(41,909,394 |

) |

|

|

(32,125,898 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

80,680,746 |

|

|

|

84,827,782 |

|

|

|

61,713,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

$ |

80,967,002 |

|

|

$ |

85,178,886 |

|

|

$ |

62,334,331 |

|

Nature and continuance of operations (Note 1)

Commitments (Note 13)

Contingency (Note 18)

The accompanying notes are an integral part of these consolidated financial statements.

These financial statements are authorized for issue by the Board of Directors on May 28, 2012.

OROMIN EXPLORATIONS LTD.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

For the years ended February 29, 2012 and February 28, 2011

(Expressed in Canadian Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

| |

|

2012 |

|

|

|

2011 |

|

| |

|

|

|

|

|

(Note 19) |

|

| |

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

Amortization |

$ |

50,535 |

|

|

$ |

50,535 |

|

|

Filing and transfer agent fees |

|

93,457 |

|

|

|

69,150 |

|

|

Office and rent |

|

482,840 |

|

|

|

352,214 |

|

|

Professional and consulting fees |

|

1,392,014 |

|

|

|

397,424 |

|

|

Salaries and benefits |

|

1,295,852 |

|

|

|

690,397 |

|

|

Share-based payments (Note 10) |

|

2,905,335 |

|

|

|

4,313,421 |

|

|

Travel and public relations |

|

294,233 |

|

|

|

272,588 |

|

| |

|

|

|

|

|

|

|

| |

|

(6,514,266 |

) |

|

|

(6,145,729 |

) |

| OTHER INCOME (LOSS) |

|

|

|

|

|

|

|

|

Corporate advisory fee (Note 6) |

|

(1,941,571 |

) |

|

|

(2,807,405 |

) |

|

Equity income (loss) from investment in Oromin Joint Venture Group Ltd. (Note 5) |

|

(109,917 |

) |

|

|

123,000 |

|

|

Foreign exchange loss |

|

(1,948 |

) |

|

|

(110,888 |

) |

|

Gain on sale of subsidiaries (Note 7) |

|

2,216 |

|

|

|

- |

|

|

Interest income |

|

105,565 |

|

|

|

105,234 |

|

|

Write-off of exploration and evaluation assets (Note 7) |

|

(83,112 |

) |

|

|

(1,443,355 |

) |

|

Write-down of investment revaluation reserve (Note 4) |

|

(329,423 |

) |

|

|

- |

|

|

Project administration cost recoveries |

|

664,623 |

|

|

|

495,647 |

|

| |

|

|

|

|

|

|

|

| |

|

(1,693,567 |

) |

|

|

(3,637,767 |

) |

| |

|

|

|

|

|

|

|

| Loss for the year |

|

(8,207,833 |

) |

|

|

(9,783,496 |

) |

| |

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

Unrealized loss on marketable securities (Note 4) |

|

(47,916 |

) |

|

|

- |

|

|

Write-down of investment revaluation reserve (Note 4) |

|

329,423 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| |

|

281,507 |

|

|

|

(9,783,496 |

) |

| |

|

|

|

|

|

|

|

| Total comprehensive loss of the year |

$ |

(7,926,326 |

) |

|

$ |

(9,783,496 |

) |

| |

|

|

|

|

|

|

|

| Basic and diluted loss per common share |

$ |

(0.06 |

) |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding |

|

135,716,443 |

|

|

|

117,491,838 |

|

The accompanying notes are an integral part of these consolidated financial statements.

OROMIN EXPLORATIONS LTD

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the years ended February 29, 2012 and February 28, 2011

(Expressed in Canadian Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

Share capital |

|

|

Reserves |

|

|

|

|

|

|

|

| |

Number of |

|

|

|

|

|

Share-based |

|

|

Investment |

|

|

|

|

|

|

|

| |

shares |

|

Amount |

|

|

|

payments |

|

|

revaluation |

|

|

Deficit |

|

|

Total equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 1, 2010 |

102,834,885 |

$ |

82,876,200 |

|

|

$ |

11,244,638 |

|

$ |

(281,507 |

) |

$ |

(32,125,898 |

) |

$ |

61,713,433 |

|

|

Shares issued on prospectus offering |

31,562,500 |

|

30,250,000 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

30,250,000 |

|

|

Shares issuance costs |

- |

|

(2,540,081 |

) |

|

|

- |

|

|

- |

|

|

- |

|

|

(2,540,081 |

) |

|

Shares issued on exercise of stock options |

651,000 |

|

403,200 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

403,200 |

|

|

Shares issued on exercise of warrants |

517,500 |

|

465,750 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

465,750 |

|

|

Shares issued for resource property services |

6,944 |

|

5,555 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

5,555 |

|

|

Share-based payments |

- |

|

- |

|

|

|

4,313,421 |

|

|

- |

|

|

- |

|

|

4,313,421 |

|

|

Fair value of stock options allocated to shares issued on exercise |

- |

|

285,267 |

|

|

|

(285,267 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Fair value of warrants allocated to shares issued on exercise |

- |

|

134,520 |

|

|

|

(134,520 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Warrants issued for underwriter’s compensation |

- |

|

(582,371 |

) |

|

|

582,371 |

|

|

- |

|

|

- |

|

|

- |

|

|

Loss for the year |

- |

|

- |

|

|

|

- |

|

|

- |

|

|

(9,783,496 |

) |

|

(9,783,496 |

) |

| Balance at February 28, 2011 |

135,572,829 |

$ |

111,298,040 |

|

|

$ |

15,720,643 |

|

$ |

(281,507 |

) |

$ |

(41,909,394 |

) |

$ |

84,827,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at February 28, 2011 |

135,572,829 |

$ |

111,298,040 |

|

|

$ |

15,720,643 |

|

$ |

(281,507 |

) |

$ |

(41,909,394 |

) |

$ |

84,827,782 |

|

|

Shares issued on exercise of stock options |

14,000 |

|

9,100 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

9,100 |

|

|

Shares issued on exercise of warrants |

976,389 |

|

864,855 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

864,855 |

|

|

Share-based payments (Note 10) |

- |

|

- |

|

|

|

2,905,335 |

|

|

- |

|

|

- |

|

|

2,905,335 |

|

|

Fair value of stock options allocated to shares issued on exercise |

- |

|

5,246 |

|

|

|

(5,246 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Fair value of warrants allocated to shares issued on exercise |

- |

|

278,387 |

|

|

|

(278,387 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Unrealized loss on marketable securities (Note 4) |

- |

|

- |

|

|

|

- |

|

|

(47,916 |

) |

|

- |

|

|

(47,916 |

) |

|

Write-down of investment revaluation reserve (Note 4) |

- |

|

- |

|

|

|

- |

|

|

329,423 |

|

|

- |

|

|

329,423 |

|

|

Loss for the year |

- |

|

- |

|

|

|

- |

|

|

- |

|

|

(8,207,833 |

) |

|

(8,207,833 |

) |

| Balance at February 29, 2012 |

136,563,218 |

$ |

112,455,628 |

|

|

$ |

18,342,345 |

|

$ |

- |

|

$ |

(50,117,227 |

) |

$ |

80,680,746 |

|

The accompanying notes are an integral part of these consolidated financial statements.

OROMIN EXPLORATIONS LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the years ended February 29, 2012 and February 28, 2011

(Expressed in Canadian Dollars, unless otherwise stated)

|

|

|

|

|

|

|

| |

2012 |

|

|

|

2011 |

|

| |

|

|

|

|

(Note 19) |

|

| |

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Loss for the year |

(8,207,833 |

) |

|

$ |

(9,783,496 |

) |

|

Items not affecting cash: |

|

|

|

|

|

|

|

Share-based payments |

2,905,335 |

|

|

|

4,313,421 |

|

|

Amortization |

50,535 |

|

|

|

50,535 |

|

|

Non-cash portion of foreign exchange loss |

13,496 |

|

|

|

- |

|

|

Write-down of investment revaluation reserve (Note 4) |

329,423 |

|

|

|

- |

|

|

Gain on sale of subsidiaries (Note 7) |

(2,216 |

) |

|

|

- |

|

|

Write-off of exploration and evaluation assets (Note 7) |

- |

|

|

|

1,443,355 |

|

|

Changes in non-cash working capital items: |

|

|

|

|

|

|

|

Receivables |

201,603 |

|

|

|

(136,733 |

) |

|

Deposits and prepaid expenses |

511,401 |

|

|

|

(733,168 |

) |

|

Trade and other payables |

(64,848 |

) |

|

|

(189,935 |

) |

| |

|

|

|

|

|

|

|

Net cash used in operating activities |

(4,263,104 |

) |

|

|

(5,036,021 |

) |

| |

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

Investment in Oromin Joint Venture Group Ltd., net of recoveries |

(8,862,865 |

) |

|

|

(16,980,459 |

) |

|

Advances to joint venture |

(66,606 |

) |

|

|

(41,528 |

) |

|

Proceeds from sale of subsidiaries, net (Note 7) |

2,216 |

|

|

|

- |

|

|

Exploration and evaluation assets |

- |

|

|

|

(309,657 |

) |

|

Purchase of property, plant and equipment |

- |

|

|

|

(799 |

) |

| |

|

|

|

|

|

|

|

Net cash used in investing activities |

(8,927,255 |

) |

|

|

(17,332,443 |

) |

| |

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

Common shares issued for cash |

873,955 |

|

|

|

31,118,950 |

|

|

Share issue costs |

- |

|

|

|

(2,540,081 |

) |

|

Proceeds from performance bond – restricted cash |

13,043 |

|

|

|

16,486 |

|

| |

|

|

|

|

|

|

|

Net cash provided by financing activities |

886,998 |

|

|

|

28,595,355 |

|

| |

|

|

|

|

|

|

| Change in cash |

(12,303,361 |

) |

|

|

6,226,891 |

|

| |

|

|

|

|

|

|

| Cash, beginning of year |

16,230,612 |

|

|

|

10,003,721 |

|

| |

|

|

|

|

|

|

| Cash, end of year |

3,927,251 |

|

|

|

16,230,612 |

|

Supplemental disclosure with respect to cash flows (Note 16)

The accompanying notes are an integral part of these consolidated financial statements.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 1. |

NATURE AND CONTINUANCE OF OPERATIONS |

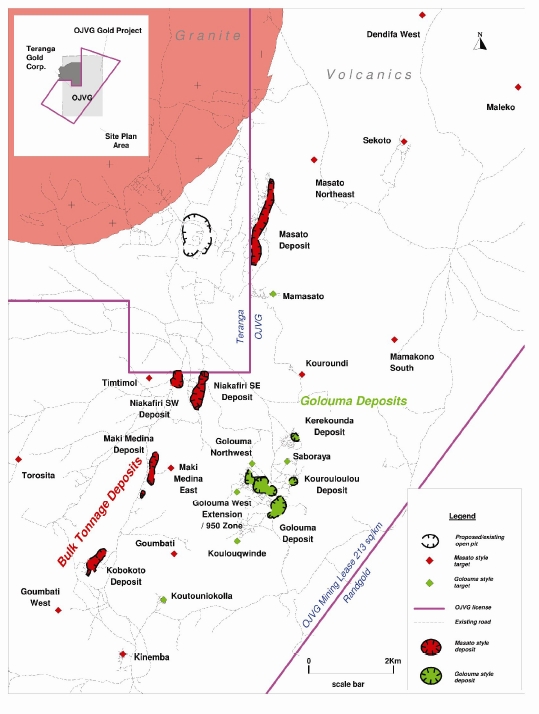

Oromin Explorations Ltd. (the “Company”) was incorporated on January 25, 1980 under the Company Act of British Columbia. The address of the Company’s registered office is 2000 - 1055 West Hastings Street, Vancouver, BC, Canada. The consolidated financial statements of the Company as at and for the year ended February 29, 2012 include the accounts of the Company, its subsidiary and the Company’s interest in a jointly controlled entity. The Company is the ultimate parent. The Company owns a 43.5% share in Oromin Joint Venture Group Ltd. ("OJVG") (note 5). OJVG owns the exploration concession and mining license in Senegal known as the "OJVG Project", OJVG’s sole mineral property interest.

On December 1, 2011, the Company sold the following subsidiaries in an arm’s length transaction (note 7): Exploraciones Oromin, S.A., which is incorporated under the laws of Argentina, and Irie Isle Limited and Cynthia Holdings Limited, both of which are incorporated under the laws of the British Virgin Islands. At the year ended February 29, 2012, the Company’s subsidiary includes Sabodala Holding Ltd.

The Company is in the business of exploring its resource properties and its current exploration activities are in the pre-production stage. Consequently, the Company defines itself to be in the exploration stage. The recoverability of the Company’s expenditures on resource properties is dependent upon the discovery of economically recoverable reserves, the ability of the Company to obtain necessary financing to complete the exploration and future profitable commercial production or proceeds from the disposition thereof.

These consolidated financial statements have been prepared with the assumption that the Company will be able to realize its assets and discharge its liabilities in the normal course of business rather than through a process of forced liquidation. However, the Company has sustained substantial losses from operations since inception and has no current source of revenue. Continued operations of the Company are dependent upon its ability to receive continued financial support, complete public or private equity financings, or generate profits from the operation or disposition of investments in the future. While management of the Company has been successful in completing equity financings in various conditions in the capital markets in the past, restrictions on the Company’s ability to finance in the future could have a material adverse effect on the Company.

These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES |

|

|

|

| |

A. |

Statement of compliance and conversion to International Financing Reporting Standards |

The consolidated financial statements have been prepared in accordance with International Accounting Standard 1, Presentation of Financial Statements (“IAS 1”) using accounting policies consistent with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”). These are the Company’s first consolidated annual financial statements prepared in accordance with IFRS and IFRS 1, First-time Adoption of International Financial Reporting Standards (“IFRS 1”), has been applied. Previously, the Company prepared its consolidated annual financial statements in accordance with Canadian generally accepted accounting principles (“GAAP”). Reconciliations between the Company's previously reported statement of financial position, statement of comprehensive loss and statement of cash flows under GAAP and those reported under IFRS are presented in note 19.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

These consolidated financial statements have been prepared on a historical cost basis except for financial instruments classified as financial assets or financial liabilities at fair value through profit and loss and available–for-sale financial assets, which are measured at fair value, as explained in the accounting policies note set out below. The comparative figures presented in the consolidated financial statements are in accordance with IFRS.

The policies applied in these consolidated financial statements are based on IFRS issued and outstanding as of the date the statements were issued.

The accounting policies set out below have been applied consistently to all periods presented in preparing the opening balance sheet at March 1, 2010 for purposes of transition to IFRS. The accounting policies have been applied consistently by the Company, its subsidiary and the Company’s interest in a jointly controlled entity.

|

|

|

| |

C. |

Basis of consolidation |

These consolidated financial statements include the accounts of the Company, its subsidiaries and the Company’s interest in a jointly controlled entity (note 5).

The Company has determined that its investment in OJVG, a company incorporated in the British Virgin Islands and owned 43.5% by Sabodala Holding Ltd., a company wholly-owned by the Company, 43.5% by Bendon International Ltd., an arm’s length private company incorporated in the British Virgin Islands, and 13% by Badr Investment & Finance Company, an arm’s length private company based in Saudi Arabia, qualifies as a jointly controlled entity since the Company has joint control, established by contractual agreements and requires majority consent for most strategic financial and operating decisions. The Company has elected to apply the equity method to account for its interest in OJVG (note 5). The investment is carried in the statement of financial position at cost and adjusted by post-acquisition changes in the Company’s share of the net assets of the joint venture, less any impairments.

Significant inter-company balances and transactions, including any unrealized income and expenses arising from inter-company transactions, are eliminated in preparing the consolidated financial statements. Unrealized gains arising from transactions with equity accounted investees are eliminated against the investment to the extent of the Company's interest in the investee. Unrealized losses are eliminated in the same way as unrealized gains, but only to the extent that there is no evidence of impairment.

Items included in the financial statements of each of the entities are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The functional and presentation currency of the Company, its subsidiary, and the Company’s interest in a jointly controlled entity is the Canadian dollar.

Transactions in foreign currencies are translated to the functional currency at exchange rates at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies at the reporting date are translated to the functional currency at the exchange rate at that date and non-monetary assets and liabilities are translated at historical rates. Foreign currency gains and losses arising from translation are included in profit or loss.

|

|

|

| |

E. |

Financial assets and liabilities |

The Company classifies its financial instruments in the following categories: financial assets at fair value through profit or loss, loans and receivables, available for sale financial assets, financial liabilities at fair value through profit or loss, and other financial liabilities at amortized cost. The classification depends on the purpose for which the financial instruments were acquired. Management determines the classification of its financial instruments at initial recognition.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

E. |

Financial assets and liabilities (continued) |

Financial assets at fair value through profit or loss (“FVTPL”)

The Company’s FVTPL comprise cash. A financial asset is classified at fair value through profit or loss if it is classified as held for trading or is designated as such upon initial recognition. Financial assets are designated as at FVTPL if the Company manages such investments and makes purchase and sale decisions based on their fair value in accordance with the Company’s risk management strategy. Attributable transaction costs are recognized in the statement of comprehensive loss when incurred. FVTPL are measured at fair value, and changes are recognized in the statement of comprehensive loss.

Available-for-sale financial assets

The Company’s investments in marketable securities are classified as available-for-sale financial assets. Subsequent to initial recognition, they are measured at fair value and changes therein, other than impairment losses and foreign currency differences, are recognized in other comprehensive income or loss and presented in the investment revaluation reserve in equity. Where the investment is disposed of or is determined to be impaired, the cumulative gain or loss previously recognized in the investment revaluation reserve is included in profit or loss.

Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for maturities greater than 12 months after the end of the reporting period. These are classified as non-current assets. The Company’s loans and receivables comprise receivables. Loans and receivables are measured at amortized cost using the effective interest method, less any impairment.

Financial liabilities at fair value through profit or loss

This category comprises of derivatives, or liabilities acquired or incurred principally for the purpose of selling or repurchasing it in the near term. They are carried in the statement of financial position at fair value with the changes in fair value recognized in the statement of comprehensive loss.

Other financial liabilities at amortized cost

The Company’s trade and other payables are classified as other financial liabilities at amortized cost and are initially measured at fair value and subsequently measured at amortized cost.

Transaction costs incurred upon the issuance of debt instruments or modification of a financial liability are deducted from the financial liability and are amortized using the effective interest method over the expected life of the related liability.

Impairment of financial instruments

Financial assets or a group of financial assets are assessed for indicators of impairment at each statement of financial position reporting date. Financial assets are impaired where there is objective evidence that, as a result of one or more events that occurred after the initial recognition of the financial asset, the estimated future cash flows of the investment have been impacted. Objective evidence of impairment could include:

-

significant financial difficulty of the issuer or counterparty; or

-

default or delinquency in interest or principal payments; or

-

it becoming probable that the borrower will enter bankruptcy or financial re-organization.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

E. |

Financial assets and liabilities (continued) |

For loans and receivables carried at amortized cost, the amount of the impairment is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the asset’s original effective interest rate. The carrying amount of the asset is reduced by the impairment loss through the use of a provision account. Subsequent recoveries of amounts previously written off are credited against the provision account. Changes in the carrying amount of the provision account are recognized in profit or loss.

With the exception of available-for-sale financial assets, if, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognized, the previously recognized impairment loss is reversed through profit or loss to the extent that the carrying amount of the investment at the date the impairment is reversed does not exceed what the amortized cost would have been had the impairment not been recognized. In respect of available-for-sale financial assets, impairment losses previously recognized through profit or loss are not reversed through profit or loss. Any increase in fair value subsequent to an impairment loss is recognized directly in equity.

The Company does not have any derivative financial instruments.

|

|

|

| |

F. |

Exploration and evaluation |

Oil and gas properties

The Company follows the full cost method of accounting for oil and gas properties whereby exploration and evaluation expenditures are capitalized and accumulated in cost centres. Such costs include lease acquisition costs, geological and geophysical expenses, lease rentals on undeveloped properties, costs of drilling both productive and non-productive wells, technical consulting costs directly related to exploration and development activities and capitalized financing costs. These costs do not include general prospecting or evaluation costs incurred prior to having obtained the legal rights to explore an area, which are expensed directly to the statement of comprehensive income or loss as they are incurred.

Depletion of exploration and evaluation expenditures and depreciation of production equipment are provided on the unit-of-production method based upon estimated proven oil and gas reserves before royalties in each cost centre, as determined by independent engineers. For purposes of this calculation, reserves and production of natural gas are converted to common units based on their approximate relative energy content. Undeveloped properties are excluded from the depletion calculation until the quantities of proven reserves can be determined.

Impairment of exploration and evaluation assets

Exploration and evaluation assets are assessed for impairment if (i) sufficient data exists to determine technical feasibility and commercial viability, and (ii) facts and circumstances suggest that the carrying amount exceeds the recoverable amount. The recoverable amount of the exploration and evaluation asset is estimated to determine the extent of the impairment loss (if any).

|

|

|

| |

G. |

Interest in joint ventures |

A joint venture is a contractual arrangement whereby the Company and other parties undertake an economic activity that is subject to joint control (i.e. when the strategic, financial, and operating policy decisions relating to the activities of the joint venture require the unanimous consent of the parties sharing control).

Joint venture arrangements that involve the establishment of a separate entity in which each venture has an interest are referred to as jointly controlled entities. The Company reports its interest in a jointly controlled entity (“JCE”), under the equity method of accounting. Under the equity method, an interest in a JCE is initially recorded at cost and adjusted thereafter for the post-acquisition change in the Company’s share of net assets of the JCE. The statement of comprehensive income or loss reflects the Company’s share of the results of operations of the joint venture.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

G. |

Interest in joint ventures (continued) |

When the Company transacts with a JCE of the Company, unrealized profit and losses are eliminated to the extent of the Company’s interest in the joint venture.

The financial statements of the JCEs are prepared for the same reporting period as the Company. Where necessary, adjustments are made to bring the accounting policies in line with those of the Company.

Reimbursement of the joint venture operator’s costs

When the Company, acting as an operator, receives reimbursement of direct costs recharged to the joint venture, such recharges represent reimbursements of costs that the operator incurred as an agent for the joint venture and therefore have no effect on the statement of comprehensive income or loss.

In many cases, the Company also incurs certain general overhead expenses in carrying out activities on behalf of the joint venture. As these costs can often not be specifically identified, joint venture agreements allow the operator to recover the general overhead expenses incurred by passing through its overhead costs incurred in the form of a project administration cost recovery. Although the purpose of this recharge is very similar to the reimbursement of direct costs, the Company is not acting as an agent in this case. Therefore, the general overhead expenses and the overhead fee are recognized in the statement of comprehensive income or loss as an expense and income respectively.

|

|

|

| |

H. |

Property, plant, and equipment |

Property, plant and equipment (“PPE”) are carried at cost, less accumulated depreciation and accumulated impairment losses. The cost of an item of PPE consists of the purchase price, any costs directly attributable to bringing the asset to the location and condition necessary for its intended use and an initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located.

When parts of an item of PPE have different useful lives, they are accounted for as separate items (major components) of PPE.

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably. All other repairs and maintenance are charged to the consolidated statement of comprehensive income or loss during the financial period in which they are incurred.

Depreciation is calculated at the following rates:

|

|

| Office furniture |

Straight line over five years |

| Computer equipment |

Straight line over five years |

| Leasehold improvements |

Straight line over the life of lease |

An item of PPE is derecognized upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the asset, determined as the difference between the net disposal proceeds and the carrying amount of the asset, is recognized in profit or loss in the consolidated statement of comprehensive income or loss.

|

|

|

| |

I. |

Trade and other payables |

Trade and other payables are obligations to pay for goods or services that have been acquired in the ordinary course of business. Trade and other payables are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities. Trade and other payables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

J. |

Restoration and rehabilitation provision |

A provision for restoration and rehabilitation is recognized when there is a present legal or constructive obligation, as a result of exploration, development, or production activities undertaken, it is probable that an outflow of economic benefits will be required to settle the obligation, and the amount of the provision can be measured reliably. The estimated future obligations include the costs of removing facilities, abandoning sites and restoring the affected areas. The restoration and rehabilitation provision is the best estimate of the present value of the expenditure required to settle the restoration obligation at the reporting date, based on current legal requirements. Future restoration costs are reviewed at least annually and any changes in the estimate are reflected in the present value of the restoration and rehabilitation provision at each reporting date. To date the Company does not have any significant restoration obligations.

At each financial position reporting date the carrying amounts of the Company’s assets are reviewed to determine whether there is any indication that those assets are impaired. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment, if any.

The recoverable amount is the higher of fair value less costs to sell and value in use. Fair value is determined as the amount that would be obtained from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. If the recoverable amount of an asset is estimated to be less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount and the impairment loss is recognized in the profit or loss for the period. For the purposes of impairment testing, each resource property is considered a cash-generating unit and assets are allocated to each cash-generating unit to which the exploration activity relates. For an asset that does not generate largely independent cash inflows, the recoverable amount is determined for the cash-generating unit to which the asset belongs.

Where an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in profit or loss.

|

|

|

|

L. |

Share-based payment transactions |

Share-based payments to employees are measured at the fair value of the instruments issued and each tranche is recognized on a straight-line basis over the vesting period. An individual is classified as an employee when the individual is an employee for legal or tax purposes (“direct employee”) or provides services similar to those performed by a direct employee. Share-based payments to non-employees are measured at the fair value of the goods or services received or the fair value of the equity instruments issued, if it is determined the fair value of the goods or services cannot be reliably measured, and are recorded at the date the goods or services are received. Fair value of the equity instruments issued is determined using the Black-Scholes option pricing model. The offset to the recorded cost is to share-based payments reserve. Consideration received on the exercise of stock options is recorded as share capital and the related share-based payments reserve is transferred to share capital. Upon expiry, the recorded value is transferred to deficit. The Company estimates the number of equity instruments that are expected to vest and then, at each reporting date, makes adjustments to the actual number that vests unless forfeitures are due to market-based conditions.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

M. |

Income taxes |

Income tax expenses comprises current and deferred tax. Current and deferred tax are recognized in net income except to the extent that it relates to a business combination or items recognized directly in equity or in other comprehensive loss/income.

Current income taxes are recognized for the estimated income taxes payable or receivable on taxable income or loss for the current year and any adjustment to income taxes payable in respect of previous years. Current income taxes are determined using tax rates and tax laws that have been enacted or substantively enacted by the year-end date.

Deferred tax is accounted for using the statement of financial position liability method, providing for temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred taxes are not recognized for temporary differences related to the initial recognition of assets or liabilities that affect neither accounting nor taxable profit nor investments in subsidiaries, associates and interests in joint ventures to the extent it is probable that they will not reverse in the foreseeable future. The amount of deferred tax provided is based on the expected manner and expected date of realization or settlement of the carrying amount of assets and liabilities, using tax rates enacted or substantively enacted at the statement of financial position date. A deferred tax asset is recognized only to the extent that it is probable that future taxable amounts will be available against which the asset can be utilized.

The Company uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on loss per share is recognized on the use of the proceeds that could be obtained upon exercise of options, warrants and similar instruments. It assumes that the proceeds would be used to purchase common shares at the average market price during the period. For the periods presented, this calculation proved to be anti-dilutive.

Basic and diluted loss per share is calculated using the weighted average number of common shares outstanding during the year.

The Company operates in a single reportable operating segment – the acquisition, exploration and development of mineral properties.

|

|

|

|

P. |

Use of Judgements and Estimates |

The preparation of consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amount of income and expenses during the reporting periods.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and further periods if the review affects both current and future periods.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

P. |

Use of Judgements and Estimates (continued) |

Critical judgments in applying accounting policies:

The following are critical judgements that management has made in the process of applying accounting policies and that have the most significant effect on the amounts recognized in the consolidated financial statements:

Determination of share-based payments:

The assumptions used in determining the fair value of share options granted include judgments in respect of length of service together with share price volatility, dividend, interest yields and exercise patterns. Also, the Company estimates the fair value using the Black-Scholes option pricing model but recognizes that other valuation models could provide differing results. Management believes that the current model provides a fair valuation measure.

|

|

|

|

Q. |

New Standards Not Yet Adopted |

|

|

IAS 1, Presentation of Financial Statements – The IASB has amended the disclosure requirement of items presented in other comprehensive income (“OCI”), including a requirement to separate items presented in OCI into two groups based on whether or not they may be recycled to profit or loss in the future. This amendment is effective for annual periods beginning on or after July 1, 2012. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

|

|

|

|

IFRS 7, Financial Instruments: Disclosures - In December 2011, the IASB amended IFRS 7 (Financial Instruments: Disclosures) requiring additional disclosures on offsetting of financial assets and financial liabilities. This amendment is effective for annual periods beginning on or after January 1, 2013. This standard also requires additional disclosures about the initial application of IFRS 9. This amendment is effective for annual periods beginning on or after January 1, 2015 (or otherwise when IFRS 9 is first applied). IAS 32, Financial Instruments: Presentation, was amended in December 2011 relating to application guidance on the offsetting of financial assets and financial liabilities. This standard is effective for annual periods beginning on or after January 1, 2014. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

|

|

|

|

IFRS 9, Financial Instruments - The IASB intends to replace IAS 39, Financial Instruments: Recognition and Measurement (“IAS 39”), in its entirety with IFRS 9, Financial Instruments (“IFRS 9”) in three main phases.

IFRS 9 will be the new standard for the financial reporting of financial instruments that is principles-based and less complex than IAS 39, and is effective for annual periods beginning on or after January 1, 2015, with earlier adoption permitted. IFRS 9 requires that all financial assets be classified as subsequently measured at amortized cost or at fair value based on the Company’s business model for managing financial assets and the contractual cash flow characteristics of the financial assets. Financial liabilities are classified as subsequently measured at amortized cost except for financial liabilities classified as at fair value through profit or loss, financial guarantees and certain other exceptions. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

|

|

|

|

IFRS 10, Consolidated Financial Statements – This standard establishes principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. This standard (i) requires a parent entity (an entity that controls one or more other entities) to present consolidated financial statements; (ii) defines the principle of control, and establishes control as the basis for consolidation; (iii) sets out how to apply the principle of control to identify whether an investor controls an investee and therefore must consolidate the investee; and (iv) sets out the accounting requirements for the preparation of consolidated financial statements. IFRS 10 supersedes IAS 27, Consolidated and Separate Financial Statements and SIC-12, Consolidation – Special Purpose Entities and is effective for annual periods beginning on or after January 1, 2013, with early application permitted. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

|

| 2. |

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

|

|

|

| |

Q. |

New Standards Not Yet Adopted (continued) |

|

|

|

|

|

IFRS 11, Joint Arrangements – This standard establishes the core principle that a party to a joint arrangement determines the type of joint arrangement in which it is involved by assessing its rights and obligations and accounts for those rights and obligations in accordance with that type of joint arrangement. This standard is effective for annual periods beginning on or after January 1, 2013, with early application permitted. The Company has early adopted this standard as set out in Note 2(G). |

|

|

|

|

|

IFRS 12, Disclosure of Involvement with Other Entities – This standard requires the disclosure of information that enables users of financial statements to evaluate the nature of, and risks associated with, its interests in other entities and the effects of those interests on its financial position, financial performance and cash flows.

This standard is effective for annual periods beginning on or after January 1, 2013, with early application permitted. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

|

|

|

|

IFRS 13, Fair Value Measurement – This standard defines fair value, sets out in a single IFRS a framework for measuring fair value and requires disclosures about fair value measurements. IFRS 13 applies when another IFRS requires or permits fair value measurements or disclosures about fair value measurements (and measurements, such as fair value less costs to sell, based on fair value or disclosures about those measurements), except for: share-based payment transactions within the scope of IFRS 2, Share-based Payment; leasing transactions within the scope of IAS 17, Leases; measurements that have some similarities to fair value but that are not fair value, such as net realizable value in IAS 2, Inventories or value in use in IAS 36, Impairment of Assets. This standard is effective for annual periods beginning on or after January 1, 2013, with early application permitted. The Company is currently evaluating the impact the final standard is expected to have on its consolidated financial statements. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 29, |

|

|

February 28, |

|

|

March 1, |

|

|

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

Accounts receivable |

$ |

2,564 |

|

$ |

45,805 |

|

$ |

79,976 |

|

|

Accrued interest receivable |

|

11,248 |

|

|

58,197 |

|

|

- |

|

|

HST receivable |

|

87,663 |

|

|

199,076 |

|

|

86,369 |

|

|

Receivables |

$ |

101,475 |

|

$ |

303,078 |

|

$ |

166,345 |

|

The Company’s investments consist of 1,197,906 shares of Lund Gold Ltd. (“Lund”) with a quoted market value at February 29, 2012 of $0.035 per share or $41,927 in the aggregate. The Company classifies these shares as available for sale financial assets, and accordingly any revaluation gains and losses in fair value are included in total comprehensive income or loss in investment revaluation reserve for the period until the asset is removed from the statement of financial position. During the year ended February 29, 2012, the Company recognized a loss in fair value attributable to the shares of Lund totaling $47,916 charged to other comprehensive loss in investment revaluation reserve. Also, based on the Company’s assessment of Lund’s estimated future value, an impairment charge of $329,423 has been recognized in the statement of comprehensive loss as at February 29, 2012 with an offsetting adjustment to investment revaluation reserve.

The Lund shares trade on the TSX Venture Exchange and fair values are readily determinable from this active public market. Lund is related to the Company, having a number of directors in common.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 5. |

INVESTMENT IN OROMIN JOINT VENTURE GROUP LTD. |

In October 2004 the Company was awarded an exploration concession in Sénégal known as the Sabodala Project (since renamed the “OJVG Project”), and the Company’s rights were formalized in a Mining Convention with the government of Sénégal dated February 17, 2005 and updated thereafter. The Mining Convention granted the Company the sole right to acquire a 100% interest in this project, subject to a 10% free carried interest, after repayment of capital and accrued interest thereon, held in favour of the government of Sénégal. The OJVG Project was subsequently transferred by the Company to Oromin Joint Venture Group Ltd. (“OJVG”), a company incorporated in the British Virgin Islands and owned 43.5% by Sabodala Holding Limited (“SHL”), a company wholly-owned by the Company, 43.5% by Bendon International Ltd. (“Bendon”), an arm’s length private company incorporated in the British Virgin Islands, and 13.0% by Badr Investment & Finance Company (“Badr”), an arm’s length private company based in Saudi Arabia. The Company provides exploration and management services to OJVG for which it may recover a portion of its administration costs. In order to acquire and maintain in good standing its interest in the OJVG Project, OJVG was obliged to spend at least US$32 million on exploration of the OJVG Project through December 2009 through a series of expenditure milestones, conditions which were met on schedule. Having met these milestone conditions, on January 26, 2010 OJVG was granted a mining licence for the OJVG Project for a term of fifteen years. This licence allows OJVG to carry out mining operations once feasibility is established. Under the Mining Code of Sénégal, the mining licence must be held by a Sénégalese company and accordingly OJVG is in the process of establishing an operating company under the laws of Sénégal. The operating company will be owned by OJVG as to 90% and by the Government of Sénégal as to 10%. The interest of the Government of Sénégal is fully carried, subject to the capital and accrued interest recoveries set out above, and the government is also entitled to a royalty equal to 3% of net smelter returns. Under the terms of the Mining Convention, OJVG is obliged to offer to Sénégalese nationals the right to purchase 25% of such operating company at a price determined by an independent valuator.

OJVG was incorporated in August 2006 in anticipation of the completion of an initial expenditure obligation, and in December 2006, SHL, Bendon and Badr completed a shareholders agreement governing the conduct of OJVG and the OJVG Project. Under the terms of a prior agreement which was superseded by the establishment of OJVG, Bendon provided an initial US$2.8 million in exploration expenditures with the Company providing the next US$5.2 million. Following the completion of the initial US$8 million obligation in October 2006, SHL and Bendon were required to fund and have been funding further exploration and related costs of the OJVG Project equally; Badr has a free carried interest through the commencement of production, subject to repayment of capital and accrued interest thereon.

Effective March 28, 2011, the Mining Convention in respect of the OJVG Project was altered by a rider agreement. Among other matters, this agreement: 1] committed the Company to invest USD $450,000 per year for the social development of local communities until the date of first commercial production, increasing to USD $800,000 per year from the date of first commercial production; 2] established the Company’s holiday from most forms of taxation in Sénégal to be eight years from the date of issue of its mining license, which is January 26, 2010; and 3] committed the Company to contribute up to USD $150,000 per year starting from the date of first commercial production for mining-related training of Sénégalese nationals.

The Company has determined that its investment in OJVG qualifies as an interest in a jointly controlled entity under IAS 31, Interests in Joint Ventures, and has elected to apply the equity method of accounting for its interest in OJVG. For accounting purposes, no recognition of Badr's interest in the equity of OJVG will be made until the commencement of production and the repayment of capital and accrued interest to Bendon and SHL and prior to that point each of Bendon and SHL are ascribed a 50 per cent interest in the equity of OJVG.

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 5. |

INVESTMENT IN OROMIN JOINT VENTURE GROUP LTD. (CONTINUED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment in Oromin Joint Venture Group Ltd. |

|

Year ended February |

|

|

Year ended February |

|

|

|

|

29, 2012 |

|

|

28, 2011 |

|

|

Balance, beginning of year |

$ |

67,508,460 |

|

$ |

50,632,970 |

|

|

Exploration and evaluation costs capitalized |

|

8,862,865 |

|

|

16,875,490 |

|

|

Balance, end of year |

$ |

76,371,325 |

|

$ |

67,508,460 |

|

Summary financial information for the equity accounted investee, OJVG, not adjusted for the percentage ownership held by the Company, is as follows as at:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 29, |

|

|

February 28, |

|

|

March 1, |

|

|

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

|

Cash |

$ |

237,371 |

|

$ |

4,556,596 |

|

$ |

6,202,494 |

|

|

Deposits and prepaid expenses |

|

29,572 |

|

|

23,837 |

|

|

189,964 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

266,943 |

|

|

4,580,433 |

|

|

6,392,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Current Assets |

|

|

|

|

|

|

|

|

|

|

Resource properties |

|

155,503,549 |

|

|

133,562,338 |

|

|

96,459,272 |

|

|

Contractor deposits |

|

- |

|

|

- |

|

|

368,410 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

155,503,549 |

|

|

133,562,338 |

|

|

96,827,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

155,770,492 |

|

$ |

138,142,771 |

|

$ |

103,220,140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Trade and other payables |

$ |

1,942,849 |

|

$ |

3,370,102 |

|

$ |

3,161,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Current liabilities |

|

|

|

|

|

|

|

|

|

|

Shareholder advances |

|

143,273,607 |

|

|

122,175,316 |

|

|

96,049,276 |

|

|

Accrued interest on shareholder advances |

|

34,209,145 |

|

|

22,623,819 |

|

|

15,078,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

177,482,752 |

|

|

144,799,135 |

|

|

111,127,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

Deficit |

|

(23,655,109 |

) |

|

(10,026,466 |

) |

|

(11,068,832 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

$ |

155,770,492 |

|

$ |

138,142,771 |

|

$ |

103,220,140 |

|

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 5. |

INVESTMENT IN OROMIN JOINT VENTURE GROUP LTD. (CONTINUED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended |

|

|

Year ended |

|

|

|

|

February 29, 2012 |

|

|

February 28, 2011 |

|

|

|

|

|

|

|

|

|

|

Income |

$ |

4,579 |

|

$ |

10,128,929 |

|

|

Expenses |

|

(13,633,222 |

) |

|

(9,086,563 |

) |

|

Net income (loss) |

|

(13,628,643 |

) |

|

1,042,366 |

|

|

Less: amounts related to shareholder advances |

|

13,408,809 |

|

|

(796,366 |

) |

|

|

|

(219,834 |

) |

|

246,000 |

|

|

The Company’s equity income from investment in OJVG at 50% |

$ |

(109,917 |

) |

$ |

123,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended |

|

|

Year ended |

|

|

|

|

February 29, 2012 |

|

|

February 28, 2011 |

|

|

|

|

|

|

|

|

|

|

Cash flows provided by (used in): |

|

|

|

|

|

|

|

Operating activities |

$ |

(158,963 |

) |

$ |

168,325 |

|

|

Financing activities |

$ |

19,274,808 |

|

$ |

34,714,852 |

|

|

Investing activities |

$ |

(23,435,070 |

) |

$ |

(36,529,075 |

) |

The reconciliation of OJVG’s equity to the Company’s net interest in the joint venture as at February 29, 2012, February 28, 2011 and March 1, 2010 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 29, |

|

|

February 28, |

|

|

March 1, |

|

|

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

OJVG’s equity |

$ |

(23,655,109 |

) |

$ |

(10,026,466 |

) |

$ |

(11,068,832 |

) |

|

Add: shareholder advances |

|

143,273,607 |

|

|

122,175,316 |

|

|

96,049,276 |

|

|

Add: accrued interest on shareholder advances |

|

34,209,145 |

|

|

22,623,819 |

|

|

15,078,081 |

|

|

Add: adjustment for difference in initial shareholder advances |

|

2,956,659 |

|

|

2,956,659 |

|

|

2,956,659 |

|

|

Add: other adjustments |

|

198,401 |

|

|

198,401 |

|

|

198,401 |

|

|

Less: accumulated project administration cost recovery |

|

(4,240,053 |

) |

|

(2,910,809 |

) |

|

(1,947,645 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

152,742,650 |

|

|

135,016,920 |

|

|

101,265,940 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company’s net interest in the joint venture at 50% |

$ |

76,371,325 |

|

$ |

67,508,461 |

|

$ |

50,632,970 |

|

|

| OROMIN EXPLORATIONS LTD. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| For the years ended February 29, 2012 and February 28, 2011 |

| (Expressed in Canadian Dollars, unless otherwise stated) |

| |

|

|

| 5. |

INVESTMENT IN OROMIN JOINT VENTURE GROUP LTD. (CONTINUED) |

Exploration and evaluation costs capitalized by OJVG are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

Balance, March 1, 2010 |

$ |

96,459,272 |