UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

For the transition period from ________ to ________

COMMISSION FILE NUMBER

(Exact name of registrant as specified in its charter)

|

|

|

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

|

| (Address of principal executive offices) | (Zip Code) |

| ( |

|

| (Registrant's telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act: |

||

|

Title of each class |

Trading Symbol(s) |

Name of each Exchange on which registered |

|

NONE. |

N/A |

N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value Per Share.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

[__] Yes [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[__] Yes [X]

1

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (s. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

[ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [__] |

Accelerated filer [__] |

|

|

Smaller reporting company [ |

|

|

Emerging growth company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[__]

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public company accounting firm that prepared or issued its audit report.

[

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

[__] Yes [

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter:

$

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

As of April 21, 2023 the Registrant had

2

LIVE CURRENT MEDIA, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

3

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this registration statement constitute "forward-looking statements." These statements, identified by words such as "plan," "anticipate," "believe," "estimate," "should," "expect" and similar expressions include the Company's expectations and objectives regarding its future financial position, operating results and business strategy. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause its actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, general economic conditions particularly related to demand for the Company's products and services, changes in business strategy, competitive factors (including the introduction or enhancement of competitive services), pricing pressures, changes in operating expenses, fluctuation in foreign currency exchange rates, inability to attract or retain consulting, sales and/or development talent, changes in customer requirements, and/or evolving industry standards, as well as those factors discussed in "Part II, Item 1A. Risk Factors" of this annual report on Form 10-K.

Forward looking statements are based on a number of material factors and assumptions, including the availability and final receipt of required government licenses, that sufficient working capital is available to complete the proposed activities, that contracted parties provide goods and/or services on the agreed time frames. While the Company considers these assumptions may be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in "Part II, Item 1A. Risk Factors" of this annual report on Form 10-K.

The Company intends to discuss in its Quarterly Reports and Annual Reports any events or circumstances that occurred during the period to which such documents relate that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this registration statement. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on its business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forwarding looking statement.

As used in this registration statement, unless the context otherwise requires, "we," "us," "our," the "Company" and "Live Current" refers to Live Current Media, Inc. All dollar amounts in this registration statement are in U.S. dollars unless otherwise stated.

ITEM 1. BUSINESS

General

Live Current Media Inc. was incorporated under the laws of the State of Nevada on October 10, 1995. Live Current is a media technology company involved in the creator economy. The Company is bringing together a select group of companies and technologies to create a platform that powers the independent creator. The Company combines creation tools, community building applications, and monetization programs to help independent creators more efficiently create, grow, and monetize their creativity.

The Company acquires and integrates technologies that automate key processes in content and community creation, bringing together innovative businesses and technologies to provide an end-to-end resource for the hundreds of millions of creators who do not have a meaningful piece of the creator economy. Today, the Live Current Media Platform features a growing set of creative tools and community building technologies that power video community creation, AR/VR discovery, social media amplification, personal and business brand management and sponsorship and alternative revenue creation for the global creative community. Live Current Business Solutions provide community and experiential solutions for businesses who want to become more creative in the way they reach their customers and constituents. The Live Current ecosystem helps creators manage the four key pillars of independent creativity: Creation, Amplification, Participation and Monetization.

4

Material Developments - Acquisitions

Acquisition of Evasyst, Inc. (Kast)

On April 22, 2022, the Company acquired all of the outstanding shares of Evasyst, Inc. (doing business as "Kast")("Evasyst") by means of a reverse merger (the "Evasyst Merger"). In connection with the Evasyst Merger, the Company's wholly owned subsidiary formed for the purpose of completing the Evasyst Merger merged with and into Evasyst, with Evasyst continuing as the surviving entity as a wholly owned subsidiary of the Company. In consideration for all of the outstanding shares in the common stock of Evasyst, the Company issued to the former stockholders of Evasyst 125,000,000 shares in the Common Stock of the Company.

Prior to its acquisition of Evasyst, the Company was primarily involved in the development of two game apps, SPRT MTRX and Trivia Matrix. The development of SPRT MTRX and Trivia Matrix has been suspended as the Company is currently focusing its resources on the Creator Economy.

The acquisition of Evasyst was accounted for as a reverse acquisition, with Evasyst being treated as the acquiring entity for accounting and financial reporting purposes.

Acquisition of Guru Experience Co.

Effective November 23, 2022, the Company acquired all of the outstanding shares of Guru Experience, Co. (“Guru”). The Company acquired Guru to expand its business into cloud-based applications.

Concurrent with the acquisition, the Company entered into a note cancellation agreement with the holders of certain convertible promissory notes of Guru (the “Guru Notes”). The company agreed to issue 3,000,000 shares of the Company’s common stock as satisfaction in full of the amounts owing to the Guru note holders. The Guru note holders agreed not to sell or otherwise transfer the shares of the Company’s common stock issued to them for a period of six months following the completion of the acquisition. Other than the shares of common stock issued to Guru note holders for concellation of the Guru Notes, no additional consideratioin was paid for the shares of Guru.

Acquisition of PowerSpike Assets

On November 9, 2022, the Company issued a total of 1,106,639 shares of its common stock to PowerSpike, Inc. ("PowerSpike") for the acquisition of certain assets of PowerSpike, including all code to PowerSpike's influencer management software and all social media sites supporting the product.

5

Acquisition of Neverthink Assets

On June 7, 2022 the Company acquired the code and social media assets for the video meme platform Neverthink.TV for 11,000 Euros (approximately $11,800) in an all cash transaction.

Proposed Acquisition of Social Media Network

On March 12, 2023, the Company entered into a non-binding letter of intent to acquire a social media network. The Company is in the process of completing due diligence in respect of the proposed acquisition. If the proposed acquisition is consummated, the Company estimates that the proposed target will add close to $11M in additional annual revenue based on unaudited management prepared financial statements for the proposed target. The proposed acquisition price will involve a combination of cash and equity, with the final purchase price still to be determined. Subject to the satisfactory completion of the Company's due diligence investigations and the successful negotiation of a binding definitive agreement, the Company expects the transaction to complete some time in May 2023. There is no assurance that the proposed acquisition will complete as contemplated or within the time frame expected.

Amendment to Company Articles

Effective January 18, 2023, the Company amended its articles of incorporation by:

(a) increasing the number of authorized shares of common stock, par value $0.001 (the "Common Stock") from 500,000,000 shares of Common Stock to 850,000,000 shares of Common Stock; and

(b) creating a class of preferred stock, par value $0.001 (the "Preferred Stock") and authorizing the issuance of up to 100,000,000 shares of Preferred Stock.

The rights and restrictions attached to the Company's Common Stock remain unchanged.

The Preferred Stock provides the Company's board of directors (the "Board") with the discretion to establish one or more series of Preferred Stock, the number of shares constituting that series, and the rights, privileges and restrictions attached to each series so established. The rights, privileges and restrictions attached to any series of Preferred Stock established by our Board may be greater than those available to holders of the Company's Common Stock.

Products and Services

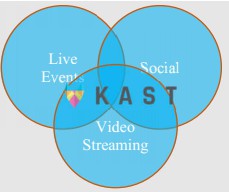

Kast

Kast is a social video application Kast that allows users to host public or private watch parties with friends on their PC, Mac, web and mobile. Kast's technology is unique to the creation of intimate private watch parties, aka spectate, that scales with millions of users. Kast is at the intersection of fast-growing markets in live events, social media and video streaming with its multi-channel watch party solution. During COVID19, Kast received fast user adoption and has had steady monthly recurring revenue since adding a premium subscription service in February 2020.

Kast is a virtual living room for all users to host public or private events, watch content together, or interact socially on a scalable platform on their computer or mobile. Users can elect to subscribe for premium features and better bandwidth or enjoy the free features provided. Kast's revenue model is considered to be "Freemium".

6

Kast is built on a number of cloud-based technologies that in concert perform the duties of relational data management, app communication, webRTC server provisioning and load balancing of those server resources in relation to active video parties.

Kast has client apps for desktop, web, iOS, Android platforms that communicate with the backend service-oriented architecture REST APIs to add, update and retrieve relational and status data. When a user enters a party, they are handed off to a webRTC server with a custom webSocket and its own REST API layer that handles most of the party status signaling and management.

Kast provides support for:

Social media platforms:

- Full text chat implementation (direct messages, group chat, emoticons, animated reactions)

- Connecting to friends

- Party / Virtual Room memberships

- Realtime presence

- Notifications

- 120 people in each party (20 can stream + 100 can watch/chat)

Video chat:

- Fully featured video chat based on WebRTC

- Real time bandwidth adaptation based on network condition

- 20 people supported in each party

Real-time content sharing:

- Synchronized video streaming

- VOD library that can be populated with any video content

- Integration with YouTube

- Ability to screenshare

- Real time transcoding of any source

- Proven scale to concurrent 100,000 users

Safety:

- Party moderation rights

- Banning, kicking and blocking

- Community reports linked to Slack

- A moderation platform for internal use

System monitoring:

- Grafana system monitoring and alerts

- Mixpanel metrics and behavioral data

7

Kast has a software as a service (SaaS) offering at a monthly charge or annual charge for premium subscribers. Currently Kast offers three tiers of membership:

| Free | Base | Premium | |

| Join parties | X | X | X |

| Invite Friends | X | X | X |

| Text chat | X | X | X |

| Voice chat | X | X | X |

| Video chat | X | X | X |

| Share free Kast TV | X | X | X |

| Share all Kast TV | X | X | |

| Share screen (standard) | X | X | |

| Premium reactions | X | X | |

| Share screen (HD) | X | ||

| No ads | X | ||

| Premium bitrate | X | ||

| Picture-in-picture | X |

Looking forward the Company believes that there are opportunities for Kast in business-to-business (B2B) and business-to-consumer fields:

- B2B: Professional virtual theater offerings with a focus on film festivals; private theaters; independent film makers.

- B2C: Watch parties as a service, "Powered by Kast" with a focus on TV manufacturers and over-the-top (OTT) media providers.

|

Kast sits at the intersection of three multi-billion dollar and growing markets: Live Events, Social, and Video Streaming. Live Events: $887B projected to reach $2,194B by 2028 with a 13.5% CAGR1 Video Streaming: $419B projected to reach $932B by 2028 with a 12.1% CAGR2 Social: $192.9B projected to reach $940B by 2026 with a 25.38% CAGR3 Kast intends to enter new markets during 2022/2023, including gaming. |

|

Guru Experience

Guru Experience Co. operates in the Virtual Reality Market. Guru offers museums and cultural sites a full-suite digital experience platform. Guru creates a bridge between cultural institutions and a 21st-century audience. Museums have connected people to art and culture for centuries. Guru works with museum, zoo, and aquarium partners to not only enhance the visitor experience but also provide digital strategies to meet the educational and financial goals of institutions.

_________________________________

1 https://www.prnewswire.com/news-releases/events-industry-market-size-worth--2-194-40-billion-globally-by-2028-at-13-48-cagr-verified-market-research-301455483.html

2 https://www.fortunebusinessinsights.com/video-streaming-market-103057

3 https://www.globenewswire.com/news-release/2021/08/27/2287644/28124/en/Global-Social-Networking-Platforms-Market-2021-to-2026-Featuring-Facebook-Pinterest-and-Twitter-Among-Others.html

8

Guru offers a user-friendly platform that makes creating, sharing, updating, and maintaining digital experiences fast and easy. These include audio tours, augmented reality, wayfinding, geolocated content, interactive maps, games, scavenger hunts, ticketing, and queuing.

Moving forward, the Company intends to integrate Guru into its creator ecosystem to provide business the necessary support to bring them into the digital world.

PowerSpike

The PowerSpike product is a comprehensive and extendable influencer management software platform that includes scalable data tracking and analysis tools, client facing reporting and monitoring applications with real-time chat processing and inference tools. More significantly, the tech stack has the ability to screen and source millions of social media handles, filtering for subject matters, number of followers, and other key characteristics. More than 70,000 creators have already signed up to use PowerSpike and the assets include a list of another 10,000,000 influencers in numerous niches.

Capitalizing on a growing demand for acquiring and analyzing data, the Company plans to expand and to monetize the new platform features by integrating and rolling out this unique platform across all other products within the Company's product portfolio and ecosystem.

Neverthink

Neverthink was a social platform for creating and sharing meme videos considered to be part of the creator economy. According to Crunchbase, 6.6M Euros were invested into the Neverthink platform through 2019 and the platform attracted fifteen million users, 85,000 creators, and 700 million total video views. However, in 2021, management and shareholders of Neverthink made the decision to shut the platform down.

The Company has revitalized key aspects of the Neverthink platform to offer to current users of the Kast social, video streaming platform in order to add user value to its current product range.

Gaming Products:

SPRT MTRX and Trivia MTRX are mobile games products that were part of Live Current Media in 2021 and 2022. The Company refreshed SPRT MTRX during 2nd half 2022 and after evaluation, the Company does not intend to continue developing SPRT MTRX or Trivia MTRX in its current form, and continues to focus on the strategy of supporting the Creator Economy through its other platforms.

Creator Economy

Market. The creator economy, valued at $104 Billion has traditionally been dominated by sponsorships for professional influencers4. However, according to Influencer Marketing Factory, the market is shifting towards new monetization methods such as merchandise, virtual tickets, digital gifting, and subscriptions5. There are over 250 million "Independent Creators" with less than 100,000 followers, comprising around 83% of creators worldwide, looking for a platform to grow and monetize their content6. The Company is committed to providing that home and community where they can thrive.

_________________________________

4 https://blog.adobe.com/en/publish/2023/03/17/is-social-media-content-creation-just-a-side-hustle#:~:text=As%20of%202021 %2C%20the%20creator,hobby%20or%20'side%2Dhustle

5 https://influencermarketinghub.com/income-disparity-creator-economy/

6 https://news.adobe.com/news/news-details/2022/Adobe-Future-of-Creativity-Study-165M-Creators-Joined-Creator-Economy-Since-2020/

9

Business Model. The Company monetizes creators and their communities through a combination of subscriptions, licensing agreements, and is in the process of integrating addition revenue streams including advertising, transaction fees, digital gifting, and revenue sharing on digital purchases.

Development. The Company will continue to integrate acquisitions, while developing its ecosystem, and creating additional streams of revenue. The Company is actively pursuing an intelligent acquisition strategy that enhances its platform, honing in on what it calls "Small Tech" leaders, i.e. companies that have extensive and passionate fan bases and highly evolved products but lack the proper funding or entered the market too early.

Competition

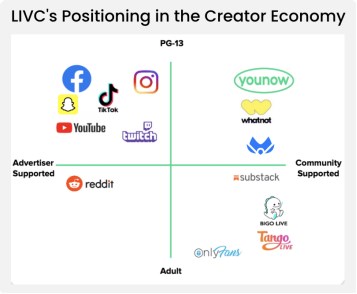

|

|

Live Current Media is a content-agnostic open platform focused on a community supported model, not reliant on advertising in this volatile macro-environment. This enables Live Current to compete against others in the market by generating multiple streams of revenue outside of advertising.

|

The Company is media technology company involved in the Creator Economy. The Company competes with video streaming services, social media providers and virtual reality platforms. These business areas are characterized by rapid technological change, frequent product innovation and the continuously evolving preferences and expectations of users, advertisers, content partners, platform partners and developers.

The market for social media platforms, video streaming services, virtual reality platforms and game development is characterized by rapid technological change, frequent product innovation, changing user preferences and expectations. The Company faces significant competition in every aspect of its business. Many of the Company's competitors are more established, have greater market share, greater user adoption and greater financial and other resources. In addition to competition for its products, the Company also competes to attract, engage and retain advertisers, content providers, platform partners and developers, employees, software engineers and designers and product managers.

Competitors of the Company include:

- Companies that offer products that enable people to create and share ideas, videos, and other content and information.

- Companies that offer advertising space and opportunities to advertisers.

- Companies that develop applications, particularly mobile applications, that create, syndicate and distribute content across different platforms.

- Traditional, online, and mobile businesses and media companies that enable people to consume content or marketers to reach their audiences and/or develop tools and systems for managing and optimizing advertising campaigns.

10

Some of these competing companies and their products include Discord, Amazon (Twitch), ByteDance (TikTok), Salesforce (Slack), Microsoft (Teams, Skype, LinkedIn), Twitter, Meta (Facebook, Instagram, WhatsApp), Alphabet (Google Chat, Google Meet, YouTube), and Snap (Snapchat).

If the Company is unable to compete effectively for users of its platform or apps, software engineers and developers, advertisers, or other resources, the Company's business and operating results could be harmed. See "Risk Factors".

Intellectual Property

To protect our intellectual property rights, we rely on a combination of patents, trade secrets and trademarks. We have 8 granted patents, 2 allowed and 1 pending, all related to video streaming and marketplace for video content.

In addition, we own a number of registered trademarks relating to our brand and business:

Evasyst™

Play Together. Watch Together. Be Together.™

as well as 2 trademark applications in process.

Government Regulation

The Company is subject to a number of U.S. federal and state and foreign laws and regulations that involve matters central to its business, including laws and regulations relating to privacy, data protection, cybersecurity, publication rights, content regulation, data localization, intellectual property, competition, protection of minors, consumer protection, credit card processing, taxation or other matters. Many of the laws and regulations impacting the Company's business, particularly in the area of privacy and data protection, are still evolving and could be developed, interpreted or applied in a manner that is inconsistent from region to region. The Company's current policies and practices may not be consistent with all of these laws and regulations or how those laws and regulations are interpreted, and as a result, the Company's business could be negatively impacted. People may also be restricted from accessing the Company's platforms or apps from or in certain countries.

See "Risk Factors".

Employees

Today, the Company has a total fifteen (15) employees (including subsidiaries). During 2022, the Company had a peak of twenty-six (26) employees (including subsidiaries).

Facilities

The Company does not currently own any real property. The Company currently leases its principal executive offices located at 10801 Thornmint Rd., Suite 200, San Diego, CA, 92127. The Company believes that its existing facilities are sufficient for its current needs. In the future, the Company may need to expand its offices or facilities. If that occurs, the Company believes that it will be able to do so on commercially reasonable terms.

11

ITEM 1A. RISK FACTORS

There is substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

An investment in the Company's common shares involves a high degree of risk. You should carefully consider the risks described below and the other information in this registration statement before investing in its common shares. If any of the following risks occur, the Company's business, operating results and financial condition could be seriously harmed. The trading price of its common shares could decline due to any of these risks, and you may lose all or part of your investment.

You should consider each of the following risk factors and the other information in this registration statement, including the Company's financial statements and the related notes, in evaluating its business and prospects. The risks and uncertainties described below are not the only ones that impact on the Company's business. Additional risks and uncertainties not presently known to the Company or that the Company currently consider immaterial may also impair its business operations. If any of the following risks do occur, its business and financial results could be harmed. In that case, the trading price of its common stock could decline.

Risks Related to the Company's Business

There is substantial doubt about our ability to continue as a going concern. The Company has not achieved profitable operations, has incurred recurring operating losses since inception. For the year ended December 31, 2022, the Company incurred a net loss of $15.1 million and used cash in operating activities of $3.4 million, and at December 31, 2022, the Company had a stockholders' deficit of $3.8 million. These factors raise substantial doubt about the Company's ability to continue as a going concern within one year of the date that the financial statements are issued. In addition, the Company's independent registered public accounting firm, in their report on the Company's December 31, 2022, audited financial statements, raised substantial doubt about the Company's ability to continue as a going concern.

No assurance can be given that any future financing, if needed, will be available or, if available, that it will be on terms that are satisfactory to the Company. Even if the Company is able to obtain additional financing, if needed, it may contain undue restrictions on its operations, in the case of debt financing, or cause substantial dilution for its stockholders, in the case of equity financing.

Our Efforts to Attract and Retain Users may not be Successful. We have experienced significant user growth over the past several years. Our ability to continue to attract users will depend in part on our ability to effectively market our service, consistently provide our users with compelling content choices, as well as a quality experience for selecting and viewing factual entertainment. Furthermore, the relative service levels, content offerings, pricing and related features of competitors to our service may adversely impact our ability to attract and retain users. Competitors include other entertainment video providers, such as Multichannel Video Programming Distributors (MVPDs) and Subscription Video on Demand (SvoD) services. If consumers do not perceive our service offering to be of value, including if we introduce new or adjust existing features, adjust pricing or service offerings or change the mix of content in a manner that is not favorably received by them, we may not be able to attract and retain users. In addition, we believe that many of our users rejoin our service or originate from word-of-mouth advertising from existing users. If our efforts to satisfy our existing users are not successful, we may not be able to attract users, and as a result, our ability to maintain and/or grow our business will be adversely affected. Users may cancel our service for many reasons, including: a perception that they do not use the service sufficiently, the need to cut household expenses, selection of content is unsatisfactory, competitive services provide a better value or experience and customer service issues are not satisfactorily resolved. Membership growth is also impacted by seasonality, with the first quarter historically representing our greatest growth, also affecting the timing of our content release schedules. We must continually add new users both to replace cancelled users and to grow our business beyond our current user base. If we do not grow as expected, we may not be able to adjust our expenditures or increase our per user revenues commensurate with the lowered growth rate, such that our margins, liquidity and results of operations may be adversely impacted, and our ability to operate may be strained. If we are unable to successfully compete with current and new competitors in both retaining our existing users and attracting new users, our business will be adversely affected. Further, if excessive numbers of users cancel our service, we may be required to incur significantly higher marketing expenditures than we currently anticipate to replace these users with new users.

12

Operating Results are Likely to Fluctuate Significantly. We expect our operating results to fluctuate significantly in the future based on a variety of factors, many of which are outside our control and difficult to predict. As a result, period-to-period comparisons of our operating results may not be a good indicator of our future or long-term performance. The following factors may affect us from period-to-period and may affect our long-term performance:

- our ability to maintain and develop new and existing revenue-generating relationships;

- our ability to improve or maintain gross margins in our business;

- the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure;

- our ability to significantly increase our subscriber base and retain customers;

- our ability to enforce our contracts and collect receivables from third parties;

- our ability to develop, acquire and maintain an adequate breadth and depth of content via original productions, co-productions, commissions and/or licenses;

- changes by our competitors to their product and service offerings;

- increased competition;

- our ability to detect and comply with data collection and privacy regulation and customer questions related thereto in every jurisdiction in which we operate;

- changes in promotional support or other aspects of our relationships with our partners through which we make our service available, including the MVPDs and/or the vMVPDs (virtual multichannel video programming distributors), through which we offer our content;

- our ability to effectively manage the development of new business segments and markets, and determine appropriate contract and licensing terms;

- our ability to maintain and develop new and existing marketing relationships;

- our ability to maintain, upgrade and develop our website, our applications through which we offer our service on our customers' devices and our internal computer systems;

- fluctuations in the use of the Internet for the purchase of consumer goods and services such as those offered by us;

- technical difficulties, system downtime or Internet disruptions;

- our ability to attract new and qualified personnel in a timely and effective manner and retain existing personnel;

- our ability to attract and retain sponsors and prove that our sponsorship offerings are effective enough to justify a pricing structure that is profitable for us;

- the success of our program sales to other media companies;

- our ability to successfully manage the integration of operations and technology resulting from possible future acquisitions;

- governmental regulation and taxation policies; and

- general economic conditions and economic conditions specific to the Internet, online commerce and the media industry.

Managing Growth. We launched our subscription service in March 2020 We anticipate that further expansion of our operations will be required to achieve significant growth in our products, lines of business and user base and to take advantage of favorable market opportunities. Any future expansion will likely place significant demands on our managerial, operational, administrative and financial resources. If we are not able to respond effectively to new or increased demands that arise because of our growth, or, if in responding, our management is materially distracted from our current operations, our business may be adversely affected. In addition, if we do not have sufficient breadth and depth of content necessary to satisfy increased demand arising from growth in our user base, our user satisfaction may be adversely affected.

13

We are continuing to expand our operations internationally, scaling our service to effectively and reliably handle anticipated growth in both users and features related to our service and ramping up our ability to produce original content. As our offerings evolve, we are managing and adjusting our business to address varied content offerings, consumer customs and practices, different technology infrastructure, different markets for factual video content, as well as differing legal and regulatory environments. As we scale our service, we are developing technology and utilizing third-party "cloud" computing services. As we ramp up our original content production, we are building out expertise in a number of disciplines, including creative, marketing, legal, finance, licensing and other resources related to the development and physical production of content. If we are not able to manage the growing complexity of our business, including improving, refining or revising our systems and operational practices related to our operations and original content, our business may be adversely affected.

Costs and Challenges Associated with Strategic Acquisitions and Investments. From time to time, we acquire or invest in businesses, content, and technologies that support our business. The risks associated with such acquisitions or investments include the difficulty of integrating solutions, operations, and personnel; inheriting liabilities and exposure to litigation; failure to realize anticipated benefits and expected synergies; and diversion of management's time and attention, among other acquisition-related risks. We may not be successful in overcoming such risks, and such acquisitions and investments may negatively impact our business.

In addition, a significant portion of the purchase price of companies we acquire may be allocated to acquire goodwill, which must be assessed for impairment at least annually. If our acquisitions do not yield expected returns, we may be required to take charges to our operating results based on this impairment assessment process. Acquisitions also could result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our operating results.

Furthermore, if we do not integrate an acquired business successfully and in a timely manner, we may not realize the benefits of the acquisition to the extent anticipated. If an acquired business fails to meet our expectations, our operating results, business and financial condition may suffer. Acquisitions and investments may contribute to fluctuations in our quarterly financial results. These fluctuations could arise from transaction-related costs and charges associated with eliminating redundant expenses or write-offs of impaired assets recorded in connection with acquisitions and investments, which could negatively impact our financial results.

Certain of Our Growth Strategies are Untested, Unproven or not yet fully Developed. We intend to increase our revenues through expanding our subscriber base by, among other things, continuing to expand into international markets, expanding into the mobile video market. There can be no assurance that these international partnerships will be successful or result in our meeting revenue targets.

If We Experience Excessive Rates of User Churn, Our Revenues and Business will be Harmed. In order to increase our revenues, we must minimize the rate of loss of existing users while adding new users to our Kast subscription service. Our experience during our operating history indicates that there are many variables that impact churn, including the type of plan selected, user engagement with the platform and length of a user's subscription to date. As a result, in periods of rapid user growth, we believe that our average churn is likely to increase as the average length of subscription to date decreases. Similarly, in periods of slow user growth, we believe that our average churn is likely to decrease since our average user duration is longer. However, these estimates are subject to change based on a number of factors, including the percentage of users selecting monthly vs. annual plans, increased rates of subscription cancellations and decreased rates of user acquisition. We cannot assure you that these estimates will be indicative of future performance or that the risks related to these estimates will not materialize. Users may cancel their subscription to our service for many reasons, including, among others, a perception that they do not use the service sufficiently, or the belief that the service is a poor value or that customer service issues are not satisfactorily resolved. We must continually add new users both to replace users who cancel and to continue to grow our business beyond our current user base. If too many of our users cancel our service, or if we are unable to attract new users in numbers sufficient to grow our business, our operating results will be adversely affected. Further, if excessive numbers of users cancel our service, we may be required to incur significantly higher marketing expenditures than we currently anticipate in order to replace these users with new users.

14

Risks Connected with Content We Acquire, Produce, License and/or Distribute, such as Unforeseen Costs and Potential Liability. As a producer and distributor of content, we face potential liability for negligence, copyright and trademark infringement, or other claims based on the nature and content of materials that we acquire, produce, license and/or distribute. We also may face potential liability for content used in promoting our service, including marketing materials. We are devoting more resources toward the development, production, marketing and distribution of original programming. We believe that original programming can help differentiate our service from other offerings, enhance our brand and otherwise attract and retain users. To the extent our original programming does not meet our expectations, in particular, in terms of costs, viewing and popularity, our business, including our brand and results of operations, may be adversely impacted. As we expand our original programming, we have become responsible for production costs and other expenses. We also take on risks associated with production, such as completion risk. To the extent we create and sell physical or digital merchandise relating to our original programming, and/or license such rights to third parties, we could become subject to product liability, intellectual property or other claims related to such products. We may decide to remove content from our service, not to place licensed or produced content on our service or discontinue or alter production of original content if we believe such content might not be well received by our users or could be damaging to our brand.

To the extent we do not accurately anticipate costs or mitigate risks, including for content that we obtain but ultimately does not appear on or is removed from our service, or if we become liable for content we acquire, produce, license and/or distribute, our business may suffer. Litigation to defend these claims could be costly and the expenses and damages arising from any liability or unforeseen production risks could harm our results of operations. We may not be indemnified against claims or costs of these types and we may not have insurance coverage for these types of claims.

Payment Processing Risks. Our users pay for our service using a variety of different payment methods, including credit and debit cards, gift cards, direct debit and online wallets. We rely on third parties to process payment. Acceptance and processing of these payment methods are subject to certain rules and regulations and require payment of interchange and other fees. To the extent there are disruptions in our payment processing systems, increases in payment processing fees, material changes in the payment ecosystem, such as large re-issuances of payment cards, delays in receiving payments from payment processors and/or changes to rules or regulations concerning payment processing, our revenue, operating expenses and results of operation could be adversely impacted. In addition, the recent military invasion of Ukraine by Russian forces and the economic sanctions imposed by the U.S. and other nations on Russia, Belarus and certain Russian organizations and individuals may disrupt payments we receive for distribution of our content in Russian territories. In certain instances, we leverage third parties such as our MVPDs and other partners to bill subscribers on our behalf. If these third parties become unwilling or unable to continue processing payments on our behalf, we would have to find alternative methods of collecting payments, which could adversely impact user acquisition and retention. In addition, from time to time, we encounter fraudulent use of payment methods, which could impact our results of operation and if not adequately controlled and managed could create negative perceptions of our service.

If We Fail to Maintain or, in Newer Markets Establish, a Positive Reputation with Consumers Concerning Our Service, Including the Content We Offer, We may not be Able to Attract or Retain Users, and Our Operating Results may be Adversely Affected. We believe that a positive reputation with consumers concerning our service is important in attracting and retaining users who have many choices when it comes to where to obtain video entertainment. To the extent our content is perceived as low quality, offensive or otherwise not compelling to consumers, our ability to establish and maintain a positive reputation may be adversely impacted. To the extent our content is deemed controversial or offensive by government regulators, we may face direct or indirect retaliatory action or behavior, including being required to remove such content from our service, and our entire service could be banned and/or become subject to heightened regulatory scrutiny across our business and operations. In light of the recent military invasion of Ukraine by Russian forces and the economic sanctions imposed by the U.S. and other nations on Russia, Belarus and certain Russian organizations and individuals, our contracts to sell and distribute our content to Russian distributors in Russian territories may cast us in a negative light with consumers, governmental authorities, business partners or other stakeholders and injure our reputation. Furthermore, to the extent our marketing, customer service and public relations efforts are not effective or result in negative consumer reaction, our ability to establish and maintain a positive reputation may likewise be adversely impacted. Lastly, to the extent we suffer any security vulnerabilities, bugs, errors or other performance failures, our ability to establish and maintain a positive reputation may be adversely impacted. With newer markets, we also need to establish our reputation with consumers and to the extent we are not successful in creating positive impressions, our business in these newer markets may be adversely impacted.

15

Government Licensing Requirements. Currently, other than business and operations licenses applicable to most commercial ventures, the Company is not required to obtain any governmental approval for its business operations. There can be no assurance, however, that governmental institutions will not, in the future, impose licensing or other requirements on the Company. Additionally, as noted below, there are a variety of laws and regulations that may, directly or indirectly, have an impact on the Company's business.

Privacy Legislation and Regulations. While the Company is not currently subject to licensing requirements, entities engaged in operations over the Internet, particularly relating to the collection of user information, are subject to limitations on their ability to utilize such information under federal and state legislation and regulation. In 2000, the Gramm-Leach-Bliley Act required that the collection of identifiable information regarding users of financial services be subject to stringent disclosure and "opt-out" provisions. While this law and the regulations enacted by the Federal Trade Commission and others relates primarily to information relating to financial transactions and financial institutions, the broad definitions of those terms may make the businesses entered into by the Company and its strategic partners subject to the provisions of the Act. This, in turn, may increase the cost of doing business and make it unattractive to collect and transfer information regarding users of services. This, in turn, may reduce the revenues of the Company and its strategic partners, thus reducing potential revenues and profitability. Similarly, the Children On-line Privacy and Protection Act ("COPPA") imposes strict limitations on the ability of Internet ventures to collect information from minors. The impact of COPPA may be to increase the cost of doing business on the Internet and reducing potential revenue sources. The Company may also be impacted by the US Patriot Act, which requires certain companies to collect and provide information to United States governmental authorities. A number of state governments have also proposed or enacted privacy legislation that reflects or, in some cases, extends the limitations imposed by the Gramm-Leach-Bliley Act and COPPA.

Advertising Regulations. In response to concerns regarding "spam" (unsolicited electronic messages), "pop-up" web pages and other Internet advertising, the federal government and a number of states have adopted or proposed laws and regulations which would limit the use of unsolicited Internet advertisements. While a number of factors may prevent the effectiveness of such laws and regulations, the cumulative effect may be to limit the attractiveness of effecting and promoting sales on the Internet.

There are currently few laws or regulations that specifically regulate communications or commerce on the Internet. However, laws and regulations may be adopted in the future that address issues such as user privacy, pricing and the characteristics and quality of products and services. For example, the Telecommunications Act of 1996 sought to prohibit transmitting various types of information and content over the Internet. Several telecommunications companies have petitioned the Federal Communications Commission to regulate Internet service providers and on-line service providers in a manner similar to long distance telephone carriers and to impose access fees on those companies. This could increase the cost of transmitting data over the Internet. Moreover, it may take years to determine the extent to which existing laws relating to issues such as intellectual property ownership, libel and personal privacy are applicable to the Internet. Any new laws or regulations relating to the Internet or any new interpretations of existing laws could have a negative impact on Live Current's business and add additional costs to doing business.

Competition. The Company competes with many companies possessing greater financial resources and technical facilities than itself. In addition, some of these competitors have been in business for longer than us and may have established more strategic partnerships and relationships than the Company.

Intellectual Property.

Significant impairments of our intellectual property rights, and limitations on our ability to assert our intellectual property rights against others, could harm our business and our ability to compete.

Intellectual property rights are important assets of our business and we seek protection for such rights as appropriate. To establish and protect our trade secrets, trademarks, copyrights, and patents as well as restrictions in confidentiality, license and intellectual property assignment agreements we enter into with our employees, consultants and third parties. Various circumstances and events outside of our control, however, pose threats to our intellectual property rights. We may fail to obtain effective intellectual property protection, effective intellectual property protection may not be available in every country in which our products and services are available, or such laws may provide only limited protection. Also, the efforts we have taken to protect our intellectual property rights may not be sufficient or effective, and any of our intellectual property rights may be challenged, circumvented, infringed or misappropriated which could result in them being narrowed in scope or declared invalid or unenforceable. There can be no assurance our intellectual property rights will be sufficient to protect against others offering products or services that are substantially similar to ours and compete with our business.

16

Effective protection of intellectual property rights is expensive and difficult to maintain, both in terms of application and registration costs as well as the costs of defending and enforcing those rights. We may be required to protect our rights in different countries, a process that is expensive and may not be successful or which we may not pursue in every country in which our products and services are distributed or made available.

We also seek to obtain patent protection for some of our technology. We may be unable to obtain patent protection for our technologies. Even if patents are issued from our patent applications, which is not certain, our existing patents, and any patents that may be issued in the future, may not provide us with competitive advantages or distinguish our products and services from those of our competitors. In addition, any patents may be contested, circumvented, or found unenforceable or invalid, and we may not be able to prevent third parties from infringing or otherwise violating them. Effective protection of patent rights is expensive and difficult to maintain, both in terms of application and maintenance costs, as well as the costs of defending and enforcing those rights.

While the Company believes that its products and operations will not violate the intellectual property rights of third parties, other parties could bring legal actions against the Company claiming damages and seeking to enjoin the marketing and sale of the Company's products for allegedly conflicting with patents held by them. Any such litigation could result in substantial cost to the Company and diversion of effort by its management and technical personnel. If any such actions are successful, in addition to any potential liability for damages, the Company could be required to obtain a license in order to continue to market the affected products. There can be no assurance that the Company would prevail in such action or that any license required under any such patent would be available on acceptable terms, if at all. Failure to obtain needed patents, licenses or proprietary information held by others may have material adverse effect on the Company's business. In addition, if the Company was to become involved in such litigation, it could consume a substantial portion of the Company's time and resources.

The Company will consider seeking further trademark protection for its online businesses, however, the Company may be unable to avail itself of trademark protection under United States laws. Consequently, the Company will seek trademark protection only where it has determined that the cost of obtaining protection, and the scope of protection provided, results in a meaningful benefit to the Company.

Dependence on One or a Few Major Customers. The Company does not currently depend on any single customer for a significant proportion of its business. However, as the Company enters into strategic transactions, the Company may choose to grant exclusive rights to a small number of parties or otherwise limit its activities that could, in turn, create such dependence. The Company, however, has no current plans to do so.

Risks Related to the Company's Securities

We have identified a material weakness in our internal control over financial reporting. If we are unable to remediate the material weakness and otherwise maintain an effective system of internal control over financial reporting, it could result in us not preventing or detecting on a timely basis a material misstatement of the Company's financial statements. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. As further disclosed in "Item 9A. Controls and Procedures" of this Annual Report on Form 10-K, management had identified material weaknesses specifically relating to deficiencies in its internal controls over (i) written documentation of our internal control policies and procedures, including written policies and procedures to ensure the correct application of accounting and financial reporting with respect to the current requirements of U.S. GAAP and SEC disclosure requirements; and (ii) ineffective controls over the financial reporting process and we had inadequate segregation of duties consistent with control objectives. The Company has taken actions to remediate the material weaknesses.

17

Although we are implementing plans to remediate this material weakness, we cannot be certain of the success of the plans. If our remedial measures are insufficient to address the material weakness, or if one or more additional material weaknesses or significant deficiencies in our internal control over financial reporting are discovered or occur in the future, or our disclosure controls and procedures or our internal controls over financial reporting are again determined to be ineffective, we may not be able to prevent or identify irregularities or ensure the fair and accurate presentation of our financial statements included in our periodic reports, which may have other consequences that could materially and adversely affect our business, including an adverse impact on the market price of our common stock, potential actions or investigations by the U.S. Securities and Exchange Commission or other regulatory authorities, shareholder lawsuits, a loss of investor confidence and damage to our reputation.

Additional financing will be required. The Company anticipates that it will require significant additional financing to fund its proposed business development plans. The costs of developing the Company's platforms are anticipated to be substantially greater than the Company's existing financial resources, and the Company anticipates that it will require substantial financing to develop and operate its businesses over the next 12 months.

If the Company is unable to obtain additional financing when needed, the Company may not be able to complete its business development plans or its business could fail. The Company will scale back its development plans depending upon its existing financial resources.

The Company's ability to obtain future financing will be subject to a number of factors, including the variability of the global economy, investor interest in our planned business projects, and the performance of equity markets in general. These factors may make the timing, amount, terms or conditions of additional financing unavailable to the Company. If the Company is not able to obtain financing when needed or in an amount sufficient to enable us to complete our programs, the Company may be required to scale back its business development plans.

Additional issuances of capital stock will dilute existing stockholders. The most likely source of future financing presently available to the Company is through the sale of shares of its common stock and/or preferred stock. Issuing shares of common stock or preferred stock, for financing purposes or otherwise, will dilute the interests of existing stockholders. The Company also expects to issue shares of its common stock or preferred stock as part of its ongoing acquisition strategy. Existing stockholders will have their interests diluted as a result of that strategy.

The Company's stock price is volatile. The stock markets in general, and the stock prices of Internet companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance of any specific public company. The market price of the Company's Common Stock is likely to fluctuate in the future, especially if the Company's Common Stock is thinly traded. Factors that may have a significant impact on the market price of the Company's Common Stock include:

(a) actual or anticipated variations in the Company's results of operations;

(b) the Company's ability or inability to generate new revenues;

(c) increased competition;

(d) government regulations, including Internet regulations;

(e) conditions and trends in the Internet industry;

(f) proprietary rights; or

(g) rumors or allegations regarding the Company's financial disclosures or practices.

The Company's stock price may be impacted by factors that are unrelated or disproportionate to its operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of the Company's Common Stock.

18

The Company does not expect to pay dividends in the foreseeable future. The Company has never paid cash dividends on its Common Stock and has no plans to do so in the foreseeable future. The Company intends to retain earnings, if any, to develop and expand its business.

"Penny Stock" rules may make buying or selling the Company's Common Stock difficult, and severely limit its market and liquidity. Trading in the Company's Common Stock is subject to certain regulations adopted by the SEC commonly known as the "penny stock" rules. The Company's Common Stock qualifies as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934, which imposes additional sales practice requirements on broker/dealers who sell the Common Stock in the aftermarket. The "penny stock" rules govern how broker-dealers can deal with their clients and "penny stocks". For sales of The Company's Common Stock, the broker/dealer must make a special suitability determination and receive from you a written agreement prior to making a sale to you. The additional burdens imposed upon broker-dealers by the "penny stock" rules may discourage broker-dealers from effecting transactions in The Company's Common Stock, which could severely limit their market price and liquidity of its Common Stock. This could prevent you from reselling your shares and may cause the price of the Common Stock to decline.

Lack of operating revenues. The Company has limited operating revenues and is expected to continue to do so for the foreseeable future. Management has assessed the Company's ability to continue as a going concern and the financial statements included with this registration statement includes disclosure that there is a substantial doubt as to the Company's ability to continue as a going concern. The audit report of the Company's principal independent accountants for the years ended December 31, 2021 and December 31, 2020 includes a statement regarding the uncertainty of the Company's ability to continue as a going concern. The Company's failure to achieve profitability and positive operating revenues could have a material adverse effect on its financial condition and results of operations and could cause the Company's business to fail.

No assurance that forward-looking assessments will be realized. The Company's ability to accomplish its objectives and whether or not we are financially successful is dependent upon numerous factors, each of which could have a material effect on the results obtained. Some of these factors are in the discretion and control of management and others are beyond management's control. The assumptions and hypotheses used in preparing any forward-looking assessments contained herein are considered reasonable by management. There can be no assurance, however, that any projections or assessments contained herein or otherwise made by management will be realized or achieved at any level.

Uncertainty due to Global Outbreak of COVID-19. In March of 2020, the World Health Organization declared an outbreak of COVID-19 to be a global pandemic. The COVID-19 has impacted a vast array of businesses through the restrictions put in place by most governments internationally, including the USA federal government as well as provincial and municipal governments, regarding travel, business operations and isolation/quarantine orders. At this time, it is unknown to what extent the impact of the COVID-19 outbreak may have on the Company as this will depend on future developments that are highly uncertain and that cannot be predicted with confidence. These uncertainties arise from the inability to predict the ultimate geographic spread of the disease, and the duration of the outbreak, including the duration of travel restrictions, business closures or disruptions, and quarantine/isolation measures that are currently, or may be put, in place world-wide to fight the virus. While the extent of the impact is unknown, the COVID-19 outbreak may hinder the Company's ability to raise financing for exploration or operating costs due to uncertain capital markets, supply chain disruptions, increased government regulations and other unanticipated factors, all of which may also negatively impact the Company's business and financial condition.

Uncertainty due to recent financial market events. Inflation poses risk to the economy overall and could indirectly pose challenges to our business. Elevated inflation can impact our business customers through loss of purchasing power, leading to lower sales. In addition, sustained inflationary pressure has led the Federal Reserve to raise interest rates several times during 2022. The failure of three regional banks in March 2023 and the resultant negative outlook on the banking sector has created concern regarding the exposure of banks to interest rate risk, and the exposure of banks to unrecognized investment losses due to investments classified as "held to maturity" on the balance sheet.

19

ITEM 2. PROPERTIES

The Company does not currently have any interests in any real property.

The Company and its subsidiaries operate from their principal office at 10801 Thornmint Road, Suite 200 San Diego, CA 92127.

ITEM 3. LEGAL PROCEEDINGS

Settlement with San Diego Innovation Center.

On April 30th, 2021, San Diego Innovation Center, commenced a legal action in the Superior Court of California, County of San Diego, Central Division against Evasyst for breach of lease. These proceedings related to a 5-year lease that Evasyst entered into in December 2019 prior to the COVID-19 pandemic and the stay at home order issued by the Governor of California in March 2020. San Diego Innovation Center relet the property in June 2021 and is now in mediation for a lease settlement. These proceedings were scheduled for trial in August 2022. The Company reached a settlement with the San Diego Innovation Center for $180,000, payable over 18 months, where as end of today $20,000 has been paid. The Company is seeking to reduce this amount through negotiation of faster payment schedule.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

20

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Holders of the Company's Shares

As of the date of this Annual Report, the Company had 293 registered shareholders. The number of registered shareholders does not include shareholders holding their shares on deposit with brokers or dealers and registered in the name of stock depositories.

Market Information

The Company's common shares trade over-the-counter in the United States on the OTCQB marketplace under the symbol "LIVC."

Quotations entered on the OTCQB marketplace reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

Dividend Rights

There are no provisions in the Company's articles of incorporation or bylaws restricting the Company's ability to pay dividends on our common stock. Chapter 78 of the Nevada Revised Statutes (the "NRS") does provide certain limitations on the Company's ability to declare and pay dividends. Section 78.288 of the NRS prohibits the Company from declaring dividends where, after giving effect to the distribution of the dividend:

(a) The Company would not be able to pay its debts as they become due in the usual course of business; or

(b) Except as allowed in the Company's articles of incorporation the Company's total assets would be less than the sum of the Company's total liabilities plus the amount that would be needed to satisfy any preferential rights.

The Company has never declared, nor paid, any dividend since their incorporation and they do not foresee paying any dividend in the near future since all available funds will be used to conduct the Company's business development activities. Any future payment of dividends will depend on its financing requirements and financial condition and other factors which the board of directors, in its sole discretion, may consider appropriate.

Recent Sales of Unregistered Securities

February 2022 Convertible Note Offering

On February 15, 2022 the Company completed a private placement offering (the "February 2022 Convertible Note Offering") of Original Issue Discount Senior Convertible Promissory Notes (the "February 2022 Convertible Notes") and warrants to purchase shares of the Company's common stock (the "February 2022 Warrants") with Mercer Street Global Opportunity Fund, LLC ("Mercer") pursuant to a securities purchase agreement between the Company and Mercer (the "February 2022 Securities Purchase Agreement"). Under the February 2022 Convertible Note Offering, for an aggregate purchase price of $1,500,000, the Company issued to Mercer a February 2022 Convertible Note having a face value of $1,620,000, and February 2022 Warrants to purchase a total of 3,573,529 shares of the Company's common stock. The February 2022 Securities Purchase Agreement originally provided for a second tranche of February 2022 Convertible Notes having a face value of $1,080,000 and February 2022 Warrants to purchase up to an additional 2,382,353 shares of the Company's common stock for gross proceeds of $1,000,000, issuable at the request of the Company. In October 2022, the terms of the February 2022 Securities Purchase Agreement to remove the second tranche.

21

The February 2022 Convertible Notes mature 24 months after issuance, bear interest at a rate of 4% per annum and are convertible into shares of the Company's common stock, originally at an initial conversion price of $0.34 per share, subject to adjustment for certain stock splits, stock combinations and dilutive share issuances. In October 2022, the Company and Mercer amended the terms of the February 2022 Convertible Notes whereby the conversion rate of the February 2022 Convertible Notes was changed from $0.34 to $0.18 per share. The Company may prepay the February 2022 Convertible Notes (i) at any time during the first 90 days following closing at the face value of the February 2022 Convertible Notes, (ii) at any time during the period from 91 to 180 days following closing at a premium of 110% of the face value of the February 2022 Convertible Notes, and (iii) thereafter at 120% of the face value of the February 2022 Convertible Notes. The February 2022 Convertible Notes contain a number of customary events of default. Additionally, the February 2022 Convertible Notes are secured by all of the assets of the Company, including a lien on and security interest in all of the issued and outstanding equity interests of the wholly-owned subsidiaries of the Company, pursuant to a security agreement that was entered into in connection with the issuance of the February 2022 Convertible Notes.

The February 2022 Warrants are exercisable at an initial exercise price of $0.60 per share for a term ending on the 5 year anniversary of the date of issuance. The exercise price of the February 2022 Warrants are subject to adjustment for certain stock splits, stock combinations and dilutive share issuances.

In addition to the forgoing, under the February 2022 Securities Purchase Agreement, until such time as there are no February 2022 Convertible Notes outstanding, if the Company proposes to offer and sell any securities of the Company in a subsequent financing, Mercer may elect to surrender its February 2022 Convertible Notes and February 2022 Warrants for securities of the same type offered in such subsequent financing on the same terms and conditions as that subsequent financing. Subject to certain stated exceptions, the Company is prohibited from incurring any debt, filing registration statements, entering into any variable rate transactions while the February 2022 Convertible Notes are outstanding, and until the earlier of 90 days following closing of the second tranche, or 180 days following closing of the first tranche, the Company is prohibited from issuing any shares of its common stock.

The February 2022 Convertible Notes and February 2022 Warrants may not be converted or exercised by the holder if, after give effect to such conversion or exercise, the holder would beneficially own greater than 4.99% of the Company's outstanding common stock, provided that the holder may, on not less than 61 days prior written notice to the Company, increase the limitation to 9.99% of the Company's outstanding common stock.

In connection with the Offering, the Company also entered into a registration rights agreement (the "Mercer Registration Agreement") with Mercer, pursuant to which the Company has agreed to file a registration statement (a with the Securities and Exchange Commission to register the resale of the shares of common stock issuable upon conversion of the February 2022 Convertible Notes and the February 2022 Warrants by no later than April 7, 2022, and to use commercially reasonable efforts to have such registration statement declared effective within 60 days after filing.

The February 2022 Convertible Note Offering was completed pursuant to the exemptions from registration provided by Rule 506(b) of Regulation D of the United States Securities Act of 1933, as amended (the "Securities Act"), on the basis that Mercer is an "accredited investor" as defined in Rule 501 of Regulation D.

In connection with the February 2022 Convertible Note Offering, the Company issued 221,402 shares of the Company's common stock at a deemed cost of $0.271 per share as a brokerage fee.

March 2022 Convertible Note Offering

On March 28, 2022, the Company completed a private placement offering (the "March 2022 Convertible Note Offering") of Original Issue Discount Senior Unsecured Convertible Promissory Notes (the "March 2022 Convertible Notes") and warrants to purchase shares of the Company's common stock (the "March 2022 Warrants"). For gross proceeds of $886,000, the Company issued March 2022 Convertible Notes having an aggregate face value of $956,880 and March 2022 Warrants exercisable for a total of 2,110,765 shares of the Company's common stock.

22

The March 2022 Convertible Notes mature 24 months after issuance, bear interest at a rate of 4% per annum and are convertible into shares of the Company's common stock at an initial conversion price of $0.34 per share, subject to adjustment for certain stock splits, stock combinations and dilutive share issuances. The Company may prepay the March 2022 Convertible Notes (i) at any time during the first 90 days following closing at the face value of the March 2022 Convertible Notes, (ii) at any time during the period from 91 to 180 days following closing at a premium of 110% of the face value of the March 2022 Convertible Notes, and (iii) thereafter at 120% of the face value of the March 2022 Convertible Notes. The March 2022 Convertible Notes contain a number of customary events of default. The March 2022 Convertible Notes are unsecured.

The March 2022 Warrants are exercisable at an initial exercise price of $0.60 per share for a term ending on the 5 year anniversary of the date of issuance. The exercise price of the March 2022 Warrants are subject to adjustment for certain stock splits, stock combinations and dilutive share issuances.

There were no most favored nation rights or registration rights granted in respect of the March 2022 Convertible Note Offering.

The March 2022 Convertible Note Offering was completed pursuant to the exemptions from registration provided by Rule 506(b) of Regulation D and Rule 903 of the Securities Act, on the basis that each subscriber was either an "accredited investor" as defined in Rule 501 of Regulation D or was not a U.S. person as defined in Rule 902 of Regulation S.

October 2022 Convertible Note Offering

On October 27, 2022, the Company completed a private placement offering (the "October 2022 Convertible Note Offering") of Original Issue Discount Senior Unsecured Convertible Promissory Notes (the "October 2022 Convertible Notes") and warrants to purchase shares of the Company's common stock (the "October 2022 Warrants") with Mercer pursuant to a securities purchase agreement between the Company and Mercer (the "October 2022 Securities Purchase Agreement"). For purchase price of $700,000, the Company issued October 2022 Convertible Notes having an aggregate original principal amount of $755,000 and October 2022 Warrants exercisable for a total of 3,145,833 shares of the Company's common stock.