UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| Berkshire Hills Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

N/A

| (2) | Aggregate number of securities to which transaction applies: |

N/A

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

N/A

| (4) | Proposed maximum aggregate value of transaction: |

N/A

| (5) | Total fee paid: |

N/A

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

N/A

| (2) | Form, Schedule or Registration Statement No.: |

N/A

| (3) | Filing Party: |

N/A

| (4) | Date Filed: |

N/A

March 30, 2012

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Berkshire Hills Bancorp, Inc. to be held at:

The Crowne Plaza Hotel

One West Street

Pittsfield, Massachusetts 01201

Thursday, May 10, 2012

10:00 a.m., local time

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. Directors and officers of the Company, as well as a representative of PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card promptly. If you attend the meeting, you may vote in person even if you have previously voted.

The Board of Directors recommends that you vote “FOR” each of the proposals to be presented at the annual meeting.

Sincerely,

| /s/ Michael P. Daly | /s/ Lawrence A. Bossidy | |

| Michael P. Daly | Lawrence A. Bossidy | |

| President and Chief Executive Officer | Non-Executive Chairman of the Board |

24 North Street

Pittsfield, Massachusetts 01201

(413) 443-5601

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | 10:00 a.m. on Thursday, May 10, 2012 | |

| PLACE |

Crowne Plaza Hotel One West Street Pittsfield, Massachusetts 01201 | |

| ITEMS OF BUSINESS |

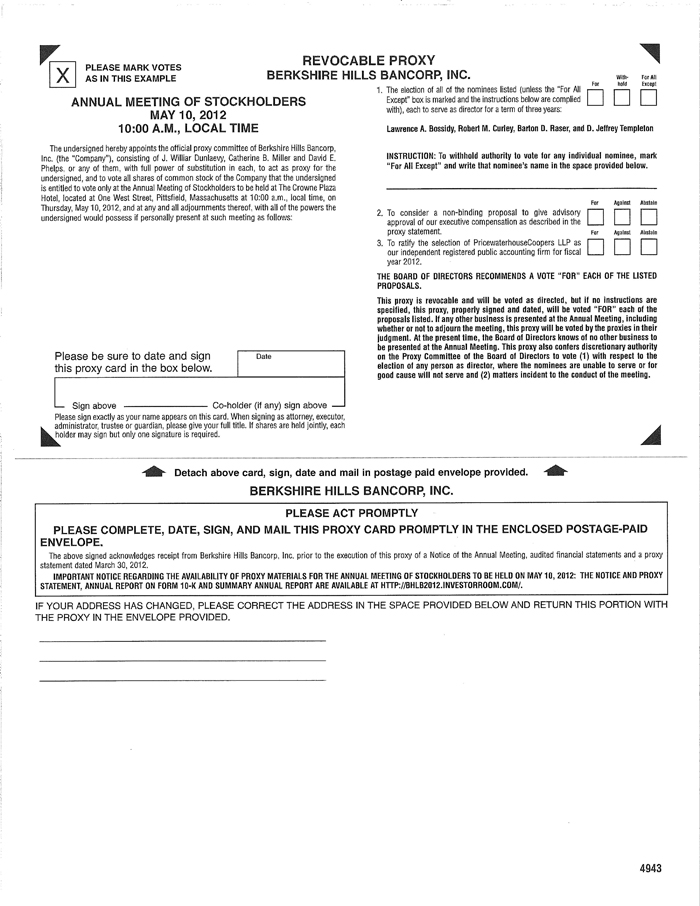

(1) To elect four directors to serve for a term of three years.

(2) To consider a non-binding proposal to give advisory approval of our executive compensation as described in the proxy statement.

(3) To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2012.

(4) To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. | |

| RECORD DATE | Stockholders as of the close of business on the record date, March 15, 2012, are entitled to one vote for each share of common stock held at that time. | |

| VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy or voting instruction card and included in the accompanying proxy statement. Stockholders owning their shares through a broker, bank or other nominee may be able to vote by telephone or by the Internet. Please see the enclosed voting instructions on how to vote your shares. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. |

/s/ Wm. Gordon Prescott

Wm. Gordon Prescott

Corporate Secretary

March 30, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 10, 2012—THIS PROXY STATEMENT AND BERKSHIRE HILLS BANCORP, INC.’S 2011 ANNUAL REPORT TO STOCKHOLDERS ARE EACH AVAILABLE AT HTTP://BHLB2012.INVESTORROOM.COM/.

Berkshire Hills Bancorp, Inc.

Proxy Statement

Table of Contents

| General Information | 1 |

| Information About Voting | 1 |

| Corporate Governance | 4 |

| Audit Committee Report | 9 |

| Director Compensation | 11 |

| Stock Ownership | 13 |

| Proposals to be Voted on by Stockholders | 15 |

| Proposal 1 — Election of Directors | 15 |

| Proposal 2 — Advisory (Non-Binding) Vote on Executive Compensation | 17 |

| Proposal 3 — Ratification of the Independent Registered Public Accounting Firm | 18 |

| Compensation Discussion and Analysis | 20 |

| Executive Compensation | 37 |

| Other Information Relating to Directors and Executive Officers | 44 |

| Submission of Business Proposals and Stockholder Nominations | 47 |

| Stockholder Communications | 47 |

| Miscellaneous | 48 |

| Other Matters | 48 |

Berkshire Hills Bancorp, Inc.

Proxy Statement

General Information

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Berkshire Hills Bancorp, Inc. for the 2012 Annual Meeting of stockholders and for any adjournment or postponement of the meeting. In this proxy statement, we may also refer to Berkshire Hills Bancorp, Inc. as “Berkshire Hills,” the “Company,” “we,” “our” or “us.”

Berkshire Hills is the holding company for Berkshire Bank and Berkshire Insurance Group, Inc. In this proxy statement, we may also refer to Berkshire Bank as the “Bank.”

We are holding the 2012 Annual Meeting at the Crowne Plaza Hotel, One West Street, Pittsfield, Massachusetts on May 10, 2012 at 10:00 a.m., local time.

We intend to mail this proxy statement and the enclosed proxy card to stockholders of record beginning on or about March 30, 2012.

Information About Voting

Who Can Vote at the Meeting

You are entitled to vote the shares of Berkshire Hills common stock that you owned as of the close of business on March 15, 2012. As of the close of business on March 15, 2012, a total of 21,193,105 shares of Company common stock were outstanding. Each share of common stock has one vote.

The Company’s Certificate of Incorporation provides that a record owner of the Company’s common stock who beneficially owns, either directly or indirectly, in excess of 10% of the Company’s outstanding shares, is not entitled to any vote in respect of the shares held in excess of the 10% limit. To our knowledge, there are no such record owners as of March 15, 2012.

Ownership of Shares; Attending the Meeting

You may own shares of Berkshire Hills in one of the following ways:

| · | Directly in your name as the stockholder of record; |

| · | Indirectly through a broker, bank or other holder of record in “street name”; or |

| · | Indirectly in the Berkshire Hills Bancorp, Inc. Stock Fund of our 401(k) Plan, the trust that holds restricted stock awards issued to directors and employees under our equity plans, or through the Legacy Banks Employee Stock Ownership Plan or Rome Bancorp, Inc. Employee Stock Ownership Plan. |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the meeting. If you wish to vote at the meeting, you will need to bring proof of identity.

| 1 |

If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote by filling out a voting form that accompanies your proxy materials. Your broker, bank or nominee may allow you to provide voting instructions by telephone or by the Internet. Please see the form provided by your broker, bank or nominee that accompanies this proxy statement.

If you hold your shares in street name and wish to attend the meeting, you will need to bring proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Berkshire Hills common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or nominee who is the record holder of your shares. You will also need to bring proof of identity to vote at the meeting.

Quorum and Vote Required

Quorum. We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of the outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy.

Votes Required for Proposals. At this year’s annual meeting, stockholders will elect four directors to serve a term of three years. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the four nominees receiving the greatest number of votes will be elected.

In voting on the non-binding proposal to give advisory approval of our executive compensation, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To approve the proposal, the affirmative vote of a majority of the votes cast at the annual meeting is required. While this vote is required by law, it will neither be binding on us or the Board of Directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on us or the Board of Directors.

In voting on the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2012, the affirmative vote of a majority of the votes cast at the annual meeting is required.

Routine and Non-Routine Proposals. Applicable rules determine whether proposals presented at stockholder meetings are routine or non-routine. If a proposal is routine, a broker or other entity holding shares for an owner in street name may vote on the proposal without receiving voting instructions from the owner. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the owner has provided voting instructions. The New York Stock Exchange (“NYSE”) allows its member-brokers to vote shares held by them for their customers on matters the NYSE determines are routine, even though the brokers have not received voting instructions from their customers. The NYSE currently considers the ratification of our independent auditors (Item 3) as a routine matter. Your broker, therefore, may vote your shares in its discretion on these routine matters if you do not instruct your broker how to vote on them. If the NYSE does not consider a matter routine, then your broker is prohibited from voting your shares on the matter unless you have given voting instructions on that matter to your broker. The NYSE no longer considers the election of directors or compensation matters to be routine (Items 1 and 2). Therefore, brokers holding shares for their customers will not have the ability to cast votes with respect to the election of directors unless they have received instructions from their customers. It is important, therefore, that you provide instructions to your broker if your shares are held by a broker so that your vote with respect to the election of directors is counted.

| 2 |

How We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposals to give advisory approval of our executive compensation and to ratify the selection of the independent registered public accounting firm, we will not count abstentions or broker non-votes as votes cast on these proposals. Therefore, abstentions and broker non-votes will have no impact on the outcome of these proposals.

Solicitation of Proxies. The Company will bear the entire cost of soliciting proxies from you. In addition to solicitation of proxies by mail, we will request that banks, brokers and other holders of record send proxies and proxy materials to the beneficial owners of Berkshire Hills Bancorp, Inc. common stock and secure their voting instructions, if necessary. We have also made arrangements with Phoenix Advisory Partners to assist us in soliciting proxies and have agreed to pay them a fee of $6,000 plus reasonable expenses for their services. If necessary, we may also use several of its employees, who will not be specially compensated, to solicit proxies from stockholders, personally or by telephone, facsimile or letter.

Voting by Proxy

The Company’s Board of Directors is sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the persons named as proxies on the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends that you vote “FOR” each of the nominees for director, “FOR” our executive compensation as described in this proxy statement “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2012.

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named as proxies on the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided such new meeting occurs within 30 days of the annual meeting and you have not revoked your proxy. The Company does not currently know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy or attend the meeting and vote your shares in person by ballot. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

| 3 |

Participants in the Berkshire Bank 401(k) Plan

If you invest in Berkshire Hills common stock through the Berkshire Hills Bancorp Stock Fund in our 401(k) Plan, you will receive a voting instruction card that reflects all shares you may vote under the plan. Under the terms of the 401(k) Plan, a participant is entitled to direct the trustee how to vote the shares in the Berkshire Hills Bancorp, Inc. Stock Fund credited to his or her account. The trustee will vote all shares for which it does not receive timely instructions from participants in the same proportion as shares for which the trustee received voting instructions. Your voting instructions must be received by May 3, 2012.

Former Participants in the Legacy Banks Employee Stock Ownership Plan and the Rome Bancorp, Inc. Employee Stock Ownership Plan

As a result of our acquisition of Legacy Bancorp, Inc. and Rome Bancorp, Inc., the Legacy Banks Employee Stock Option Plan and Rome Bancorp, Inc. Employee Stock Option Plan (collectively, the “ESOP”) hold Berkshire Hills common stock. If you are a former participant in either ESOP, you are entitled to direct the applicable ESOP Trustee on how to vote the shares of Berkshire Hills common stock allocated to your account. Each former participant in the ESOP will receive a voting instruction card that reflects all the shares that he or she is entitled to vote. The applicable ESOP Trustee will vote all shares for which it does not receive timely instructions from participants in the same proportion as shares for which the applicable ESOP Trustee received voting instructions. Your voting instructions must be received by May 3, 2012.

Holders of Non-Vested Restricted Stock Awards

If you have been granted a restricted stock award under the Berkshire Hills Bancorp, Inc. Amended and Restated 2003 Equity Compensation Plan or the 2011 Equity Incentive Plan (collectively referred to as the “Incentive Plan”), you will receive a voting instruction card that reflects all unvested shares of Berkshire Hills common stock subject to the restricted stock award that you may vote under the plan. Under the terms of the Incentive Plan, a participant is entitled to direct the trustee how to vote the unvested shares of restricted Berkshire Hills common stock awarded to him or her. The trustee will vote the shares of Berkshire Hills common stock held in the Incentive Plan Trust in accordance with instructions it receives from you and other stock award recipients. Your voting instructions must be received by May 3, 2012.

Corporate Governance

Director Independence

The Company’s Board of Directors currently consists of 12 members, all of whom are independent under the listing requirements of The NASDAQ Stock Market, except for Messrs. Daly and Curley, who are Officers of Berkshire Hills and Berkshire Bank, and Mr. Dunlaevy, by reason of his Non-Competition and Consulting Agreement with the Company, dated April 6, 2011, pursuant to Legacy Bancorp, Inc.’s merger with and into the Company. In determining the independence of its directors, the Board considered transactions, relationships and arrangements between the Company and its directors that are not required to be disclosed in this proxy statement under the heading “Transactions with Related Persons,” including loans or lines of credit that the Bank has directly or indirectly made to Directors Daly, Mahoney, Miller, Phelps, Raser and Templeton.

| 4 |

Corporate Governance Policy

The Board of Directors has adopted a corporate governance policy to govern certain activities, including: the duties and responsibilities of directors; the composition, responsibilities and operation of the Board of Directors; the operation of board committees; succession planning; convening executive sessions of independent directors; the Board of Directors’ interaction with management and third parties; and the evaluation of the performance of the Board of Directors and of the Chief Executive Officer.

Committees of the Board of Directors

The following table identifies our standing committees and their members. All members of the Audit Committee, the Compensation Committee and the Corporate Governance/Nominating Committee are independent in accordance with the listing requirements of The NASDAQ Stock Market. Each committee operates under a written charter that is approved by the Board of Directors that governs its composition, responsibilities and operation. Each committee reviews and reassesses the adequacy of its charter at least annually. The charters of all four committees are available in the Governance Documents portion of the Investor Relations section of the Company’s Web site (www.berkshirebank.com).

| Director | Audit Committee |

Compensation Committee |

Corporate Governance/ Nominating Committee |

Risk Management Committee |

Capital Committee (formed October 2011) | |||||

| Lawrence A. Bossidy | X | X | ||||||||

| Robert M. Curley | X* | X | ||||||||

| Michael P. Daly | ||||||||||

| John B. Davies | X* | X | ||||||||

| Rodney C. Dimock | X | X | ||||||||

| Susan M. Hill | X* | |||||||||

| Cornelius D. Mahoney | X | X* | ||||||||

| Catherine B. Miller | X | X | ||||||||

| David E. Phelps | X | X* | ||||||||

| D. Jeffrey Templeton | X | X | ||||||||

| Barton D. Raser | X | X | ||||||||

| J. Williar Dunlaevy | X | X | ||||||||

| Number of Meetings in 2011 | 7 | 6 | 6 | 6 | 1 |

| * | Denotes Chairperson |

Audit Committee

The Audit Committee assists the Board of Directors in its oversight of the Company’s accounting and reporting practices, the quality and integrity of the Company’s financial reports and the Company’s compliance with legal and regulatory requirements related to accounting and financial reporting. The Committee is also responsible for engaging the Company’s independent registered public accounting firm and monitoring its performance and independence. Each member of the Audit Committee is independent under the listing requirements of The NASDAQ Stock Market and the rules of the Securities and Exchange Commission applicable to audit committee members. The Board of Directors has designated Director Hill as an audit committee financial expert under the rules of the Securities and Exchange Commission.

| 5 |

Compensation Committee

The Compensation Committee approves the compensation objectives for the Company and its subsidiaries and establishes the compensation for the Chief Executive Officer and other executives. The Compensation Committee also reviews the Company’s incentive compensation and other equity plans and recommends changes to the plans as needed. The Compensation Committee reviews all compensation components for the Company’s Chief Executive Officer and other highly compensated executive officers, including base salary, annual incentive, long-term incentives/equity, benefits and other perquisites. In addition to reviewing competitive market factors, the Compensation Committee also examines the total compensation mix, pay-for-performance relationship, and how all elements, in the aggregate, comprise the executive’s total compensation package. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board of Directors. See “Compensation Discussion and Analysis” for more information regarding the role of the Compensation Committee, management and compensation consultants in determining and/or recommending the amount or form of executive compensation.

Corporate Governance/Nominating Committee

The Company’s Corporate Governance/Nominating Committee assists the Board of Directors in: (1) identifying qualified individuals to serve as Board members, (2) determining the composition of the Board of Directors and its committees, (3) monitoring a process to assess Board effectiveness and (4) developing and implementing the Company’s corporate governance guidelines. The Corporate Governance/Nominating Committee also considers and recommends the nominees for director to stand for election at the Company’s annual meeting of stockholders.

Minimum Qualifications. The Corporate Governance/Nominating Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. A candidate must meet the eligibility requirements set forth in the Company’s bylaws, which include a residency requirement and a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

These qualifications include:

| · | No person shall be eligible for election or appointment to the Board of Directors: (i) if such person has, within the previous 10 years, been the subject of supervisory action by a financial regulatory agency that resulted in a cease and desist order or an agreement or other written statement subject to public disclosure under 12 U.S.C. 1818(u), or any successor provision; (ii) if such person has been convicted of a crime involving dishonesty or breach of trust which is punishable by imprisonment for a term exceeding one year under state or federal law; (iii) if such person is currently charged in any information, indictment, or other complaint with the commission of or participation in such a crime; and (iv) except for persons serving as members of the initial Board of Directors or except as otherwise approved by the Board of Directors, unless such person has been, for a period of at least one year immediately prior to his or her nomination or appointment, a resident of a county in which the Corporation or its subsidiaries maintains a banking office or a county contiguous to any such county. |

| · | No person shall be eligible for election or appointment to the Board of Directors if such person is the nominee or representative of a company, as that term is defined in Section 10 of the Home Owners' Loan Act or any successor provision, of which any director, partner, trustee or shareholder controlling more than 10% of any class of voting stock would not be eligible for election or appointment to the Board of Directors. |

| 6 |

| · | No person may serve on the Board of Directors and at the same time be a director of more than two other public companies, or their subsidiaries. |

| · | No person shall be eligible for election to the Board of Directors if such person is the nominee or representative of a person or group, or of a group acting in concert (as defined in 12 C.F.R Section 574.4(d)), that includes a person who is ineligible for election to the Board of Directors. |

| · | The Board of Directors shall have the power to construe and apply the provisions of the Company's by-laws and other governance documents, and to make all determinations necessary or desirable to implement such provisions, including but not limited to determinations as to whether a person is a nominee or representative of a person, a company or a group, whether a person or company is included in a group, and whether a person is the nominee or representative of a group acting in concert. |

If the candidate is deemed eligible and qualified for election to the Board of Directors, the Corporate Governance/Nominating Committee will then evaluate the following criteria in selecting nominees:

| · | financial, regulatory and business experience; |

| · | familiarity with and participation in the local communities; |

| · | integrity, honesty and reputation in connection with upholding a position of trust with respect to customers; |

| · | dedication to the Company and its stockholders; and |

| · | independence. |

The Committee also will consider any other factors the Corporate Governance/Nominating Committee deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations. We do not maintain a specific diversity policy, but diversity is considered in our review of candidates. Diversity is considered in terms of how a candidate’s background, experience, qualifications, attributes and skills may complement, supplement or duplicate those of other prospective candidates.

With respect to nominating an existing director for re-election to the Board of Directors, the Corporate Governance/Nominating Committee will consider and review an existing director’s board and committee attendance and performance; length of board service; the experience, skills and contributions that the existing director brings to the board; and independence.

Director Nomination Process. The Corporate Governance/Nominating Committee has adopted a process to identify and evaluate individuals to be nominated for election to the Board of Directors. For purposes of identifying nominees, the Corporate Governance/Nominating Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as its knowledge of members of the communities served by the Company and its subsidiaries. The Corporate Governance/Nominating Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth below. The Corporate Governance/Nominating Committee has not previously used an independent search firm to identify nominees.

| 7 |

In evaluating potential nominees, the Corporate Governance/Nominating Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under certain criteria, which are described above under “Minimum Qualifications.” If such individual fulfills these criteria, the Corporate Governance/Nominating Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Consideration of Recommendations by Stockholders. It is the policy of the Corporate Governance/Nominating Committee of the Board of Directors of the Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Corporate Governance/Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Corporate Governance/Nominating Committee does not perceive a need to increase the size of the Board of Directors. To avoid the unnecessary use of the Corporate Governance/Nominating Committee’s resources, the Corporate Governance/Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Corporate Governance/Nominating Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Corporate Governance/Nominating Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | As to the stockholder making the recommendation, the name and address of such stockholder as it appears on the Company’s books; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Corporate Governance/Nominating Committee at least 120 calendar days before the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Leadership Structure

The Board has no policy with respect to the separation of the offices of Chairman and Chief Executive Officer. The Board believes that the current leadership structure has served the Company well over recent years and that it is the best leadership structure for the Company at the present time.

| 8 |

Capital Committee

The Capital Committee assists the Board of Directors in planning for future capital needs. The Capital Committee is also responsible for ensuring compliance with regulations pertaining to capital structure and levels. In accordance with its charter, a majority of the directors serving on the Capital Committee must meet the definition of independent director under the listing requirements of the NASDAQ stock market. The committee presently has five directors and is chaired by Cornelius D. Mahoney.

Risk Management Committee

The Risk Management Committee assists the Board of Directors in: (1) overseeing management’s program to limit or control the material business risks that confront the Company; and (2) approving policies and procedures designed to lead to an understanding of and to identify, control, monitor and measure the material business risks of the Company and its subsidiaries. These material business risks include, but are not limited to, credit risk, interest rate risk, liquidity risk, regulatory risk, legal risk, operational risk, strategic risk and reputation risk.

Board and Committee Meetings

During 2011, the Board of Directors held eleven meetings. All of the current directors attended at least 75% of the total number of the board meetings and committee meetings held on which such directors served during 2011.

Director Attendance at Annual Meeting of Stockholders

The Board of Directors encourages each director to attend annual meetings of stockholders. All but three directors attended the 2011 annual meeting of stockholders.

Code of Business Conduct

The Company has adopted a Code of Business Conduct that is designed to promote the highest standards of ethical conduct by the Company’s directors, executive officers and employees. The Code of Business Conduct, which applies to all employees and directors, addresses conflicts of interest, the treatment of confidential information, general employee conduct and compliance with applicable laws, rules and regulations. In addition, the Code of Business Conduct is designed to deter wrongdoing and promote honest and ethical conduct, the avoidance of conflicts of interest, full and accurate disclosure and compliance with all applicable laws, rules and regulations. A copy of the Code of Business Conduct can be found in the Governance Documents portion of the Investor Relations section of the Company’s Web site (www.berkshirebank.com).

Audit Committee Report

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the fair presentation of those financial statements in conformity with generally accepted accounting principles. The independent registered public accounting firm is also responsible for issuing an opinion on the Company’s internal control over financial reporting based on criteria issued by the Committee on Sponsoring Organizations of the Treadway Commission. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

| 9 |

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles and provided its Report on Internal Control over Financial Reporting. The Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements. The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examination, its evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning the independent registered public accounting firm’s independence. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm that, in its report, expresses an opinion on the fairness and conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s financial statements are presented fairly in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent registered public accounting firm is “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the Securities and Exchange Commission. The Audit Committee also has approved, subject to stockholder ratification, the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

Audit Committee of the Board of Directors of

Berkshire Hills Bancorp, Inc.

Susan M. Hill, Chair

David E. Phelps

Barton D. Raser

D. Jeffrey Templeton

| 10 |

Director Compensation

The Company uses a combination of cash, restricted stock and stock options to attract and retain qualified candidates to serve on the Board. Equity compensation provides the opportunity to earn more based on the Company’s total stockholder return and to align directors’ interests with those of the Company’s stockholders. The Corporate Governance/Nominating Committee reviews director compensation and benefits annually and makes recommendations to the Board. The following table provides the compensation received by individuals who served as non-employee directors of the Company during the 2011 fiscal year. This table excludes perquisites, which did not exceed $10,000 in the aggregate for each director.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Option Awards ($) (1) | All Other Compensation ($) (2) | Total ($) | |||||||||||||||

| Wallace W. Altes | — | — | — | 32,959 | (3) | 32,959 | ||||||||||||||

| Lawrence A. Bossidy | 57,000 | 20,010 | — | 1,248 | 78,258 | |||||||||||||||

| Robert M. Curley | 33,000 | 70,027 | — | 389 | 103,416 | |||||||||||||||

| John B. Davies | 41,000 | 20,010 | — | 1,248 | 62,258 | |||||||||||||||

| Rodney C. Dimock | 33,000 | 20,010 | — | 1,248 | 54,258 | |||||||||||||||

| Susan M. Hill | 33,000 | 20,010 | — | 1,248 | 54,258 | |||||||||||||||

| Cornelius D. Mahoney | 41,000 | 20,010 | — | 28,304 | (4) | 89,314 | ||||||||||||||

| Catherine B. Miller | 33,000 | 20,010 | — | 1,248 | 54,258 | |||||||||||||||

| David E. Phelps | 42,000 | 20,010 | — | 1,248 | 63,258 | |||||||||||||||

| D. Jeffrey Templeton | 33,000 | 20,010 | — | 1,248 | 54,258 | |||||||||||||||

| J. Williar Dunlaevy | 13,750 | (5) | — | — | 255,357 | (5) | 269,107 | |||||||||||||

| Barton D. Raser | 13,750 | — | — | 167 | (6) | 13,750 | ||||||||||||||

| (1) | Represents the grant date fair value of the restricted stock awarded under the Amended and Restated Berkshire Hills Bancorp, Inc. 2003 Equity Compensation Plan, and/or the 2011 Equity Incentive Plan. The grant date fair value of the restricted stock awards has been computed in accordance with the stock based accounting rules under FASB ASC Topic 718 (formerly FAS 123(R)). A discussion of the assumptions used in calculating the award values may be found at Note 20 to our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2011. No Option Awards were granted to any director in 2011. As of December 31, 2011, each non-employee director had the following number of unvested shares of restricted stock and stock options outstanding: |

| 11 |

| Name | Shares of Unvested Restricted Stock Held in Trust | Stock Options Outstanding | ||||||

| Lawrence A. Bossidy | 2,151 | 12,005 | ||||||

| Robert M. Curley | 4,372 | — | ||||||

| John B. Davies | 2,151 | 21,621 | ||||||

| Rodney C. Dimock | 2,151 | — | ||||||

| Susan M. Hill | 2,151 | — | ||||||

| Cornelius D. Mahoney | 2,151 | 15,000 | ||||||

| Catherine B. Miller | 2,151 | 495 | ||||||

| David E. Phelps | 2,151 | — | ||||||

| D. Jeffrey Templeton | 2,151 | 5,260 | ||||||

| J. Williar Dunlaevy | — | 136,638 | ||||||

| Barton D. Raser | — | — | ||||||

| (2) | Reflects the dollar value of dividends paid on stock awards. |

| (3) | Mr. Altes retired from the Board on December 11, 2009, but by agreement is continuing to receive Board fees through May 2012, when his term otherwise would have expired. |

| (4) | For Mr. Mahoney, also includes $27,020 in imputed income on split dollar insurance. |

| (5) | Mr. Dunlaevy became a non-employee director on July 21, 2011, and his 2011 compensation figures reflect compensation paid to Mr. Dunlaevy beginning with that date. In addition, Mr. Dunlaevy was paid $254,167 in 2011 pursuant to a non-competition and consulting agreement entered into with us and which was effective on July 21, 2011, and $1,190 in imputed income on split dollar insurance. |

| (6) | Mr. Raser was paid $167 in imputed income on split dollar insurance. |

Retainers for Non-Employee Directors. The following table sets forth the applicable retainers that will be paid to our non-employee directors for their service on our Board of Directors during 2012.

| Annual Cash Retainer for Board Service | $ | 30,000 | ||

| Annual Cash Retainer for Board Chair | $ | 45,000 | ||

| Annual Equity Retainer for Board Service | $ | 30,000 | ||

| Annual Retainer for Audit Committee Chair | $ | 10,000 | ||

| Annual Retainer for Risk Management Committee Chair | $ | 6,000 | ||

| Annual Retainer for Capital, Compensation, Governance/Nominating and Capital Committee Chair | $ | 4,000 | ||

| Annual Retainer for Attendance at Committee Meetings | $ | 8,000 | ||

| Annual Retainer for Attendance at Governance and Nominating Committee Meetings | $ | 4,000 |

Agreement with J. Williar Dunlaevy. We entered into a Non-Competition and Consulting Agreement with Mr. J. Williar Dunlaevy effective July 21, 2011, which is the same date we acquired Legacy Bancorp, Inc. Under the agreement, Mr. Dunlaevy has agreed to perform consulting services as a liaison to Legacy Banks Foundation for a period of twelve months. In addition, for a period of twenty-four months, Mr. Dunlaevy has also agreed not to solicit or offer employment to any employee of Berkshire Hills or our subsidiaries. In exchange for the consulting services and the agreement not to compete or solicit, we have agreed to pay Mr. Dunlaevy $400,000, with $150,000 paid on July 21, 2011 and $250,000 payable in monthly installments over the twelve month consulting period.

| 12 |

Stock Ownership

The following table provides information as of March 15, 2012, with respect to persons known by the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power. Percentages are based on 21,193,105 shares outstanding at March 15, 2012.

| Name and Address | Number of Shares Owned | Percent of Common Stock Outstanding | |||||

| Royce & Associates, LLC 745 Fifth Avenue New York, New York 10151 | 1,074,500 | (1) | 5.1 | ||||

| Heartland Advisors, Inc. 789 North Water Street Milwaukee, WI 53202 | 1,221,545 | (2) | 5.8 | ||||

| BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | 1,317,658 | (3) | 6.2 | ||||

| Dimensional Fund Advisors LP Palisades West Building One 6300 Bee Cave Road Austin, TX 78746 | 1,468,626 | (4) | 6.9 | ||||

| (1) | Based on information contained in a Schedule13G/A filed with the U.S. Securities and Exchange Commission on January 9, 2012. |

| (2) | Based on information contained in a Schedule 13G filed with the U.S. Securities and Exchange Commission on February 10, 2012. |

| (3) | Based on information contained in a Schedule 13G/A filed with the U.S. Securities and Exchange Commission on February 13, 2012. |

| (4) | Based on information contained in a Schedule 13G/A filed with the U.S. Securities and Exchange Commission on February 14, 2012. |

The following table provides information about the shares of Company common stock that are owned by each director or nominee for director of the Company, by the executive officers named in the Summary Compensation Table and the aggregate number of shares owned by all directors, nominees for director and executive officers of the Company as a group as of March 15, 2012. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting and investment power with respect to the shares shown and none of the shares shown have been pledged. The number of shares owned by all directors and named executive officers as a group totaled 3.8% of our outstanding common stock as of March 15, 2012. Each director and named executive officer owned less than 1.0% of our outstanding common stock as of that date. Percentages are based on 21,193,105 shares outstanding at March 15, 2012.

| 13 |

| Name | Number of Shares Owned (Excluding Options) (1) | Options Exercisable Within 60 Days | Total | |||||||||

| Directors | ||||||||||||

| Lawrence A. Bossidy | 76,747 | (2) | 12,005 | 88,752 | ||||||||

| Robert M. Curley | 8,287 | — | 8,287 | |||||||||

| Michael P. Daly | 103,623 | 47,481 | 151,104 | |||||||||

| John B. Davies | 16,958 | 21,621 | 38,579 | |||||||||

| Rodney C. Dimock | 12,174 | (3) | — | 12,174 | ||||||||

| Susan M. Hill | 22,945 | (4) | — | 22,945 | ||||||||

| Cornelius D. Mahoney | 39,811 | (5) | 15,000 | 54,811 | ||||||||

| Catherine B. Miller | 17,234 | (6) | 495 | 17,729 | ||||||||

| David E. Phelps | 9,002 | — | 9,002 | |||||||||

| D. Jeffrey Templeton | 21,135 | 5,260 | 26,395 | |||||||||

| Barton D. Raser | 21,495 | (7) | — | 21,495 | ||||||||

| J. Williar Dunlaevy | 70,175 | (8) | 136,638 | 206,813 | ||||||||

| Named Executive Officers Who Are Not Directors | ||||||||||||

| Kevin P. Riley | 48,543 | — | 48,543 | |||||||||

| Sean A. Gray | 15,935 | — | 15,935 | |||||||||

| Linda Johnston | 28,181 | — | 28,181 | |||||||||

| Richard M. Marotta | 15,150 | — | 15,150 | |||||||||

| Patrick J. Sullivan | 19,034 | (9) | 15,662 | 34,696 | ||||||||

| All Executive Officers and Directors, as a Group (17 persons) | 546,429 | 254,162 | 800,591 | |||||||||

| (1) | This column includes the following: |

| Name | Shares of Granted but Unearned Restricted Stock Held In Trust | Shares Held In Trust in the Berkshire Bank 401(k) Plan | ||||||

| Mr. Bossidy | 2,542 | — | ||||||

| Mr. Curley | 4,763 | — | ||||||

| Mr. Daly | 13,226 | 19,790 | ||||||

| Mr. Davies | 2,542 | — | ||||||

| Mr. Dimock | 2,542 | — | ||||||

| Ms. Hill | 2,542 | — | ||||||

| Mr. Mahoney | 2,542 | — | ||||||

| Ms. Miller | 2,542 | — | ||||||

| Mr. Phelps | 2,542 | — | ||||||

| Mr. Templeton | 2,542 | — | ||||||

| Mr. Raser | 1,310 | — | ||||||

| Mr. Dunlaevy | 1,310 | |||||||

| Mr. Riley | 7,200 | 5,986 | ||||||

| Mr. Gray | 6,704 | 559 | ||||||

| Ms. Johnston | 5,070 | 13,903 | ||||||

| Mr. Marotta | 6,510 | — | ||||||

| Mr. Sullivan | 6,746 | 575 | ||||||

| (2) | Includes 69,518 shares held in a trust. |

| (3) | Includes 3,400 shares held by an LLC. |

| (4) | Includes 322 shares held by Ms. Hill’s spouse’s IRA. |

| (5) | Includes 675 shares held by each of Mr. Mahoney’s two children via trusts. Includes 35,919 shares pledged as security. |

| (6) | Includes 1,031 shares held by Ms. Miller’s spouse. |

| (7) | Includes 12,404 shares held by a Company. |

| (8) | Includes 8,457 shares held by Mr. Dunlaevy’s spouse and 5,226 shares held in an employee stock ownership plan. |

| (9) | Includes 436 shares held by an employee stock ownership plan for the benefit of Mr. Sullivan. |

| 14 |

Proposals to be Voted on by Stockholders

Proposal 1 — Election of Directors

The Company’s Board of Directors currently consists of 12 members. The Board is divided into three classes, each with three-year staggered terms, with one-third of the directors elected each year. The nominees for election this year are Lawrence A. Bossidy, Robert M. Curley, Barton D. Raser and D. Jeffrey Templeton , all of whom are current directors of the Company and the Bank.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees named above. If any nominee is unable to serve, the persons named in the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve. Except as indicated herein, there are no arrangements or understandings between the nominees and any other person pursuant to which such nominees were selected.

The Board of Directors recommends a vote “FOR” the election of all nominees.

Information regarding the nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The age indicated in each nominee’s biography is as of December 31, 2009. There are no family relationships among the directors or executive officers. The indicated period for service as a director includes service as a director of the Bank.

Board Nominees for Terms Ending in 2015

Lawrence A. Bossidy held the positions of Chairman and Chief Executive Officer of Honeywell International, Inc. and before that he was Chairman and Chief Executive Officer of AlliedSignal. Before that, he held the positions of Chief Operating Officer of General Electric Credit, President of General Electric’s Services and Materials Sector and Vice Chairman of General Electric. Mr. Bossidy has served as a member of the Boards of Directors of Merck & Co., Inc., JPMorgan Chase, and K&F Industries Holdings. Mr. Bossidy has authored two prominent books on business leadership and is nationally recognized and respected for his business success and contributions to corporate governance and to the arts of business execution and leadership development. Age 77. Director since 2002.

Robert M. Curley served as Chairman and President for Citizens Bank in New York from 2005 to 2009. Prior to joining Citizens, Mr. Curley served at Charter One Bank where he was President for New York and New England. During the period of 1976 to 1999, Mr. Curley was employed by KeyCorp., where he rose to the position of Vice Chairman of KeyBank N.A., and served as President and Chief Executive Officer of four subsidiary banks. Mr. Curley was hired by the Company and the Bank as Chairman of their New York bank and appointed as a non-independent director of the Company and the Bank in December 2009. He brings a wealth of knowledge to the Board concerning the banking industry in the northeastern United States generally, and our New York Capital District region specifically, as well as the day-to-day management and oversight of a highly successful bank. Age 64. Director since 2009.

Barton D. Raser is the co-owner and Vice President of Carr Hardware, with its headquarters located in Pittsfield, Massachusetts. Mr. Raser has served in this capacity since 1990. Mr. Raser served as director of Legacy Bancorp, Inc. and Legacy Banks from 2001 to 2011, during which time he served on Legacy Bancorp’s Audit Committee, Trust Committee and Governance and Nominating Committee and chaired Legacy Banks’ Credit/ALCO Committee. Mr. Raser enhances the Board with his knowledge of the Berkshire County economy and marketplace, as well as his experience with day to day management and oversight of a successful retail/wholesale business. Age 47. Director since 2011.

| 15 |

D. Jeffrey Templeton is the owner and President of The Mosher Company, Inc., located in Chicopee, Massachusetts, a manufacturer of buffing and polishing compounds, abrasive slurries and a distributor of related grinding, polishing and lapping machinery. Mr. Templeton is a former director of Woronoco Bancorp and provides experience and perspective as a successful business owner in our Springfield and central Massachusetts markets. Age 70. Director since 2005.

Directors with Terms Ending in 2013

John B. Davies is a former Executive Vice President of Massachusetts Mutual Life Insurance and is currently an Agent Emeritus with Massachusetts Mutual providing high net worth counseling with a focus on tax efficiency and intergenerational transfers of wealth. Mr. Davies is a former director of Woronoco Bancorp, and provides the Board with knowledge and understanding of our Springfield and central Massachusetts markets, as well as experience in financial institution management, and expertise in financial services including insurance and wealth management. Age 62. Director since 2005.

Rodney C. Dimock is a Principal at Arrow Capital, LLC, a private investing property development and consulting services company, located in West Granby, Connecticut. He was formerly President, Chief Operating Officer and a director of Cornerstone Properties, a $4.8 billion office building real estate investment trust and before that he was President of Aetna Realty Investors, Inc., one of the country’s largest real estate investment management advisors. Mr. Dimock provides experience in financial institution management, as well as experience and perspective on commercial real estate markets and the business climate and opportunities in Southern New England. Age 65. Director since 2006.

David E. Phelps is the President and Chief Executive Officer of Berkshire Health Systems, whose major affiliates are Berkshire Medical Center, Fairview Hospital and Berkshire Health Care Systems, an operator of nursing and rehabilitative care facilities throughout Berkshire County and other areas of Massachusetts, Ohio and Pennsylvania. Mr. Phelps is a prominent corporate executive in Berkshire County with strong ties to the local community and economy. Age 59. Director since 2006.

J. Williar Dunlaevy is the former Chief Executive Officer and Chairman of the Board of Legacy Bancorp, Inc. and Legacy Banks (collectively, “Legacy”). Mr. Dunlaevy served as the Chief Executive Officer and Chairman of the Board of Legacy since 1996. Mr. Dunlaevy’s extensive banking experience and knowledge of local markets enhances the breadth of experience of the Board. Age 65. Director since 2011.

Directors with Terms Ending in 2014

Michael P. Daly is President and Chief Executive Officer of the Company and the Bank. Before these appointments, Mr. Daly served as Executive Vice President and Senior Loan Officer of the Bank. He has been an employee of the Bank since 1986. Mr. Daly’s extensive banking experience and knowledge of local markets enhances the breadth of experience of the Board of Directors. Age 50. Director since 2002.

Susan M. Hill is President of Hill & Thompson, P.C., a certified public accounting firm located in Manchester Center, Vermont. She served as a director of Factory Point Bancorp, Inc. and Factory Point National Bank of Manchester Center from 1992 until their acquisition by Berkshire Hills in September 2007. As an accountant, Ms. Hill provides knowledge and expertise to the Board in the areas of financial statement preparation and reporting, and serves as the Company’s Audit Committee Financial Expert. Ms. Hill is designated as a Certified Financial Planner and adds value in the oversight of the Company’s financial services and wealth management business. She also provides experience and perspective concerning operations in our Vermont region. Age 62. Director since 2007.

| 16 |

Cornelius D. Mahoney served as President, Chief Executive Officer and Chairman of the Board of Woronoco Bancorp and Woronoco Savings Bank before their merger with the Company and the Bank in June 2005. He is a former Chairman of America’s Community Bankers and the Massachusetts Bankers Association and a former Director of the Federal Home Loan Bank of Boston. He was a member of the Thrift Institution Advisory Council to the Federal Reserve Board of Governors and is a past Chairman of the Board of Trustees at Westfield State College. Mr. Mahoney provides valuable experience and insight as a successful banking executive and nationally recognized industry contributor, as well as knowledge of and involvement with our Springfield region markets. Age 66. Director since 2005.

Catherine B. Miller was a Vice President and an owner of Wheeler & Taylor, Inc., an insurance agency with offices in Stockbridge, Great Barrington and Sheffield, Massachusetts. Ms. Miller previously held administrative and faculty appointments at the State University of New York in Albany and Simon’s Rock College of Bard in Great Barrington, Massachusetts. Ms. Miller is a prominent business and community leader in southern Berkshire County, and provides perspective and understanding to the Board concerning the operations of the Company’s insurance business. Age 70. Director since 1983.

Proposal 2 — Advisory (Non-Binding) Vote on Executive Compensation

In accordance with Section 14A of the Exchange Act, stockholders are being given the opportunity to vote on an advisory (non-binding) resolution at the Annual Meeting to approve our executive compensation, as described above under “Compensation Discussion and Analysis,” compensation tables and narrative discussion of Named Executive compensation in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives stockholders the opportunity to endorse or not endorse the Company’s executive pay program.

The purpose of our compensation policies and procedures is to attract and retain experienced, highly qualified executives critical to the Company’s long-term success and enhancement of stockholder value. The Board of Directors believes the Company’s compensation policies and procedures achieve this objective, and therefore recommend stockholders vote “For” the proposal.

“Resolved, that the compensation paid to the Company’s Named Executive Officers, as disclosed in this proxy statement pursuant to Item 402 of Securities and Exchange Commission Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby Approved.”

Is the Stockholder Vote Binding on the Company? This is an advisory vote only, and neither the Company nor the Board of Directors will be bound to take action based upon the outcome. The Compensation Committee will consider the vote of the stockholders when considering future executive compensation arrangements.

What Is The Board’s Recommendation On Voting On This Proposal? The Board unanimously recommends that stockholders vote “For” this proposal.

| 17 |

Proposal 3 — Ratification of the Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP to be the Company’s independent registered public accounting firm for the 2012 fiscal year, subject to ratification by stockholders. On February 24, 2011, the Audit Committee dismissed Wolf & Company, P.C. (“Wolf”) as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2011 and any quarterly periods therein. Such decision became effective upon completion by Wolf of its audit of consolidated financial statements of the Company for the year ended December 31, 2010, the filing of the related Form 10-K, and the Company’s annual filing with the U.S. Department of Housing and Urban Development. The decision to dismiss Wolf was approved by the Audit Committee.

The audit reports on the consolidated financial statements of the Company for the years ended December 31, 2010 and 2009 did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified, as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2010 and 2009 and the subsequent interim period through February 24, 2011, there were no: (1) disagreements with Wolf on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to Wolf’s satisfaction, would have caused Wolf to make reference to the subject matter of such disagreements in its reports, or (2) reportable events under Item 304(a)(1)(v) of Regulation S-K.

The Company requested that Wolf furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not Wolf agreed with the above statements. A copy of Wolf’s letter is provided as an Exhibit to our Form 8-K, filed with the Securities and Exchange Commission on March 1, 2011.

On February 24, 2011, the Company engaged PricewaterhouseCoopers LLP as the Company’s new principal accountants for the fiscal year ending December 31, 2011. The engagement was approved by the Audit Committee of the Board of Directors of the Company. During the fiscal years ended December 31, 2010 and 2009, and the subsequent interim period prior to February 24, 2011, the Company did not consult with PricewaterhouseCoopers LLP regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

A representative of PricewaterhouseCoopers LLP is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the firm is not approved by a majority of the votes cast by stockholders at the annual meeting, other independent registered public accounting firms may be considered by the Audit Committee of the Board of Directors.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2012 fiscal year.

| 18 |

Audit Fees. The following table sets forth the fees billed to the Company for the fiscal year ended December 31, 2011 by PricewaterhouseCoopers LLP, and for the fiscal year ended December 31, 2010 by Wolf, respectively:

| 2011 | 2010 | |||||||

| Audit Fees(1) | $ | 886,609 | $ | 440,000 | ||||

| Audit-Related Fees(2) | $ | 482,704 | $ | 54,480 | ||||

| Tax Fees(3) | $ | 97,795 | $ | 71,000 | ||||

| All Other Fees | $ | — | $ | — | ||||

| (1) | Includes fees for the financial statement and internal control over financial reporting audits and quarterly reviews. Fees in 2011 were billed by PricewaterhouseCoopers LLP. Fees in 2010 were billed by Wolf. |

| (2) | Fees in 2011 relate to purchase accounting, systems conversion, tax credit limited partnership investments, employee benefit plan, and comfort letter issuance. Fees in 2010 relate to benefit plan audits, consents for registration statements, due diligence assistance, and comfort letter issuance. |

| (3) | Consists of tax return preparation, and tax-related compliance and services. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. Such approval process ensures that the external auditor does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm. Requests for services by the independent registered public accounting firm must be specific as to the particular services to be provided for compliance with the auditor services policy.

The request may be made with respect to either specific services or a type of service for predictable or recurring services.

During the years ended December 31, 2011 and 2010, respectively, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

| 19 |

Compensation Discussion and Analysis

Executive Summary

Performance Summary. The Board of Directors and Management are proud of the Company's results achieved for 2011. Even during these challenging regulatory and global economic times, the Company remained committed to providing our shareholders with solid returns on their investment. The Company continues to follow long term strategies that balance investing in growth and increasing returns for our shareholders. In 2011, these strategies led us through the mergers of Rome and Legacy, the signing of a definitive agreement with CBT, the hiring of a commercial banking team in Westborough, adding two new de novo branches in our Albany, NY region and the signing of an agreement to convert our core banking systems. In 2011, our shareholders were also rewarded as we produced results exceeding the core earnings targets established in our budget and incentive plans, as well as exceeding our stated objectives for equity and capital measures. The strength of the earnings is reflected in the different financial ratios and their improvement which are detailed in this discussion and analysis.

Many key ratios are incorporated into the incentive plans that would reward management if performance objectives are met. Our 2011 short term incentive plan used the core financial measures of Core Earnings, Non-Interest Expense/Total Assets and Efficiency Ratio; and for the last two years, our long term incentive plan performance awards were tied to growing Core EPS and Core ROE. Results of the Company's performance to the incentive plan objectives are highlighted in following sections of the proxy. The short term incentive plan for 2012 will include the Efficiency Ratio and the Criticized Assets/Tier 1 Capital + Allowance Ratio, in addition to Core Earnings. It is management’s objective to focus on those measures that drive shareholder value over time and set goals that support our objective to be a top performer in our industry.

In 2011, our shareholders received a total return of 3.5%, while the peer group returned a median loss of 5.7% and the SNL Bank and Thrift Index returned a loss of 22.2%. The comparatively strong performance in 2011 validates the success of the Company’s current strategies and builds confidence in our ability to join the ranks of high performing companies. In the third quarter, the Company also increased its quarterly cash dividend by 6.0%, to $0.17 per share. The Company’s goal is to continue to achieve above average growth in core EPS in 2012 and to see its total stock return continue to outperform the industry and its peers.

The Company continues to follow long term strategies that balance investing in growth and increasing returns for our shareholders. Our financial achievements benefited from disciplined business development in all of the Company's operating regions, together with careful control of operating expenses and the costs of business expansion. Additionally, the year's results reflect a number of focused actions that management undertook to build and strengthen the Company. These accomplishments were reflected in the Company’s results in the fourth quarter of the year, which was the first full quarter with the combined operations of Rome and Legacy. The fourth quarter return on assets increased to 0.85% and the return on equity increased to 6.2%, while annualized total revenues advanced by 45% to $160 million, reflecting the increased scale and performance achieved in the execution of the Company’s strategies.

Compensation Highlights. We develop our programs to attract, motivate and retain the talent that will help us achieve our objectives. Ultimately our compensation programs are designed to achieve overarching goals that motivate and reward performance, ensure sound risk management, and deliver long-term value to our shareholders. To achieve these objectives, the Compensation Committee regularly reviews and modifies our compensation and incentive programs to ensure they align with these core objectives. We assess our program from the perspective of our shareholders and regulators, considering best practices and making improvements as appropriate.

| 20 |

During 2011 the Committee enhanced/reinforced our total compensation program in the following ways:

| · | Expanded financial performance measures to include a balanced portfolio of metrics including Core EPS, Core Earnings, Expense Management and Core ROE, along with strategic plan goals. |

| · | Continued our long-term incentive measures reflecting both absolute and relative performance. |

| · | Conducted assessments of Chief Executive Officer pay-performance alignment to provide ongoing perspective for assessing the effectiveness of executive pay programs. |

| · | Continued to enhance and formalize the review of our compensation plans and polices to support sound risk management practices. |

While our shareholders showed strong support, with over 97% voting in favor during last year’s vote on executive pay, the Compensation Committee is committed to continuing to review and evolve programs and practices to ensure alignment with emerging best practices and regulatory guidelines.

Highlights of Compensation Program and 2011 Results:

| · | Continued to manage base salaries in a conservative manner; monitoring the market and making modest market adjustments for select executives. |

| · | Balanced incentive award opportunities approximately half as cash and half as stock based compensation, to reflect our desire to focus on both the annual business objectives while keeping a focus on the long-term results. |

| · | Funded an incentive pool at 117% of target based on exceeding our 2011 core earnings and efficiency ratio goals, and exceeding our strategic goals. |

| · | Granted 50% of our long-term incentive in performance shares that will vest only upon achievement of our three year performance of core ROE growth relative to peers and our own target EPS growth. |

| · | To promote alignment of management and stockholder interests, certain executives are expected to meet stock ownership guidelines in the following denominations of base salary: President and Chief Executive Officer, 4.5x, and other executives, 2.5x. The Compensation Committee will monitor attainment of the ownership guidelines on an annual basis. |

Role of the Compensation Committee, Management and the Compensation Consultant in the Executive Compensation Process

Role of the Compensation Committee. The Compensation Committee of the Board of Directors is responsible for discharging the Board’s duties in executive compensation matters and for administering the Company’s incentive and equity-based plans. The Committee oversees the development and implementation of the total compensation program for Berkshire’s named executive officers. Throughout the following discussion and analysis, we refer to the Compensation Committee as “the Committee”.

Details on the Committee’s functions are more fully described in its charter, which has been approved by the Board of Directors and available on our website. To fulfill its charter and responsibilities, the Committee met throughout the year, meeting 6 times in 2011 and also takes action by written consent. The Chair of the Committee regularly reports on Committee actions at meetings of the Company’s Board.

| 21 |

The Committee reviews all compensation components for the Company’s Chief Executive Officer and other executive officers, including base salary, annual incentive, long-term incentives/equity, benefits and other perquisites. In addition to reviewing competitive market values, the Committee also examines the total compensation mix, pay-for-performance relationship, and how all elements, in aggregate comprise the executive’s total compensation package. The Committee also reviews the employment contract with the Chief Executive Officer and the Change in Control agreements with other executive officers.

The Committee reviews the Chief Executive Officer’s performance annually and makes decisions regarding the Chief Executive Officer’s compensation, including base salary, incentives and equity grants based on this review. Input and data from the Executive Vice President of Human Resources and outside consultants and advisors are provided as a matter of practice and as requested by the Committee to provide external reference and perspective. While the Chief Executive Officer makes recommendations on other named executives, the Committee is ultimately responsible for approving compensation for all named executive officers. The Compensation Committee reviews its recommendations with the full Board of Directors.

The Committee has the authority and resources to obtain advice and assistance from internal or external legal, human resource, accounting or other advisors, or consultants as it deems desirable or appropriate.

Role of the Compensation Consultant. The Committee has the sole authority to retain and terminate a compensation consultant and to approve the consultant’s fees and all other terms of the engagement. The Committee has direct access to outside advisors and consultants throughout the year as they relate to executive compensation. The Committee has direct access to and meets periodically with the compensation consultant independently of management.