0001108134DEF 14Afalse00011081342023-01-012023-12-310001108134bhlb:NitinMhatreMember2023-01-012023-12-31iso4217:USDxbrli:pure0001108134bhlb:NitinMhatreMember2022-01-012022-12-3100011081342022-01-012022-12-310001108134bhlb:NitinMhatreMember2021-01-012021-12-310001108134bhlb:SeanGrayMember2021-01-012021-12-3100011081342021-01-012021-12-310001108134bhlb:SeanGrayMember2020-01-012020-12-310001108134bhlb:RichardMarottaMember2020-01-012020-12-3100011081342020-01-012020-12-31000110813412023-01-012023-12-310001108134bhlb:EquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:PensionAdjustmentsAmendmentsMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:PensionAdjustmentsAmendmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:EquityCompensationGrantedAndVestedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityCompensationGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134ecd:PeoMemberbhlb:EquityCompensationGrantedAndOutstandingDuringTheYearMember2023-01-012023-12-310001108134bhlb:EquityCompensationGrantedAndOutstandingDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134ecd:PeoMemberbhlb:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-310001108134bhlb:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2023-01-012023-12-310001108134bhlb:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-31000110813422023-01-012023-12-31000110813432023-01-012023-12-31000110813442023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Berkshire Hills Bancorp, Inc.

| | |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | | | |

| | April 5, 2024 |

| Dear Berkshire Hills Bancorp Shareholder: |

| |

| It is our pleasure to invite you to attend the 2024 Annual Meeting of Shareholders, which will be held on Thursday, May 16, 2024 at 10:00 a.m, Eastern Time at our offices at:

Berkshire Bank 99 North Street Pittsfield, MA 01201 |

|

|

|

|

|

| |

| CEO, Nitin J. Mhatre | | Please see the Notice of Annual Meeting on the next page for more information about our meeting procedures. |

| |

| | |

| | We urge you to vote your proxy online, or by telephone, or by completing and returning a proxy card by mail as soon as possible, even if you plan to attend the Annual Meeting. |

|

|

|

| |

| Your vote is important to us. Thank you for your attention to the enclosed materials, and for your continued support of our company. |

|

|

| |

| |

Chairperson, David M. Brunelle | | |

| |

| |

| | Nitin J. Mhatre, Chief Executive Officer |

| | |

| |

| |

| | David M. Brunelle, Chairperson of the Board of Directors |

| | | | | | | | | | | | | | | | | |

| Notice of Annual Meeting of Shareholders | | |

| |

|

|

|

|

| | | | | | | | | | | | | | | | | |

Notice of 2024 Annual Meeting of Shareholders of Berkshire Hills Bancorp, Inc. |

| When: | | Where: | | Record Date: |

| Thursday, May 16, 2024 | Berkshire Bank, 99 North Street | March 21, 2024 |

| 10:00 a.m. | Pittsfield, Massachusetts 01201 | |

We are holding this meeting for the following purposes:

1. To elect as directors the nominees named in the Proxy Statement each to serve a one-year term or until their successors are duly elected and qualified;

2. To provide an advisory vote on executive compensation practices;

3. To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for fiscal year 2024; and

4. To transact any other Company business that may properly come before the meeting.

The Board of Directors unanimously recommends that you vote “FOR” each of the proposed director nominees and “FOR” the other proposals to be presented at the Annual Meeting.

Shareholders of record at the close of business on March 21, 2024 are entitled to vote at the meeting, either in person or by proxy. There are several ways to vote. You can vote your shares online, by telephone, by regular mail or in person at the Annual Meeting.

To access your proxy materials and vote online, please visit www.proxyvote.com and follow the instructions. Your proxy card or voting instruction form contains the necessary codes required to vote online. If you wish to vote by telephone, please call 1-800-690-6903 using a touch-tone phone and follow the prompted instructions. You may also vote by mail by completing and returning your proxy card in the envelope provided. Finally, you may vote in person at the Annual Meeting, even if you have previously submitted a proxy.

Whatever method you choose, please vote in advance of the meeting to ensure that your shares will be voted as you direct.

Boston, Massachusetts

April 5, 2024

By order of the Board of Directors

Wm. Gordon Prescott

Senior Executive Vice President, General Counsel and Corporate Secretary

Admission Procedures

The meeting is open to shareholders of Berkshire Hills Bancorp, Inc. Everyone attending the meeting should

bring a photo ID. If your shares are registered in the name of a bank, broker, or other holder of record,

please also bring documentation of your stock ownership as of March 21, 2024 (such as a brokerage

statement). Whether or not you plan to attend the meeting, we urge you to vote by proxy in advance to ensure your vote is counted if you decide not to attend the meeting.

| | |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 16, 2024: The Notice of Annual Meeting, 2024 Proxy Statement, 2023 Summary Annual Report, and 2023 Annual Report on SEC Form 10-K are each available at www.proxyvote.com or ir.berkshirebank.com |

| | | | | | | | | | | |

| Proxy Summary | |

| | 2023 Company Highlights | |

| | 2023 Executive Compensation Highlights | |

| | Shareholder Engagement and Responsiveness | |

| | Corporate Responsibility and Sustainability | |

| Proposal 1 - Election of Directors | |

| | Information Regarding Directors and Director Nominees | |

| | Corporate Governance | |

| | Director Compensation | |

| Proposal 2 - Advisory (Non-Binding) Vote on Executive Compensation | |

| Compensation Discussion and Analysis (CD&A) | |

| | Compensation Committee Report | |

| Executive Compensation | |

| | Summary Compensation and Other Tables | |

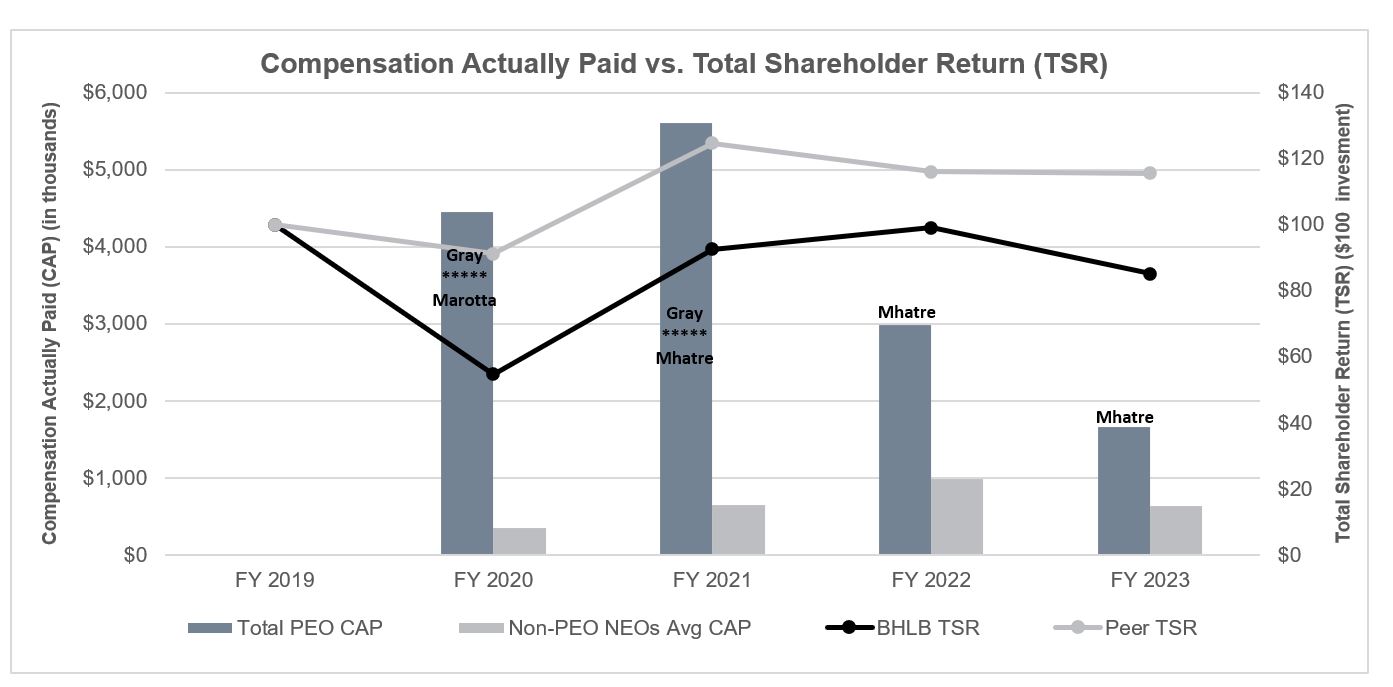

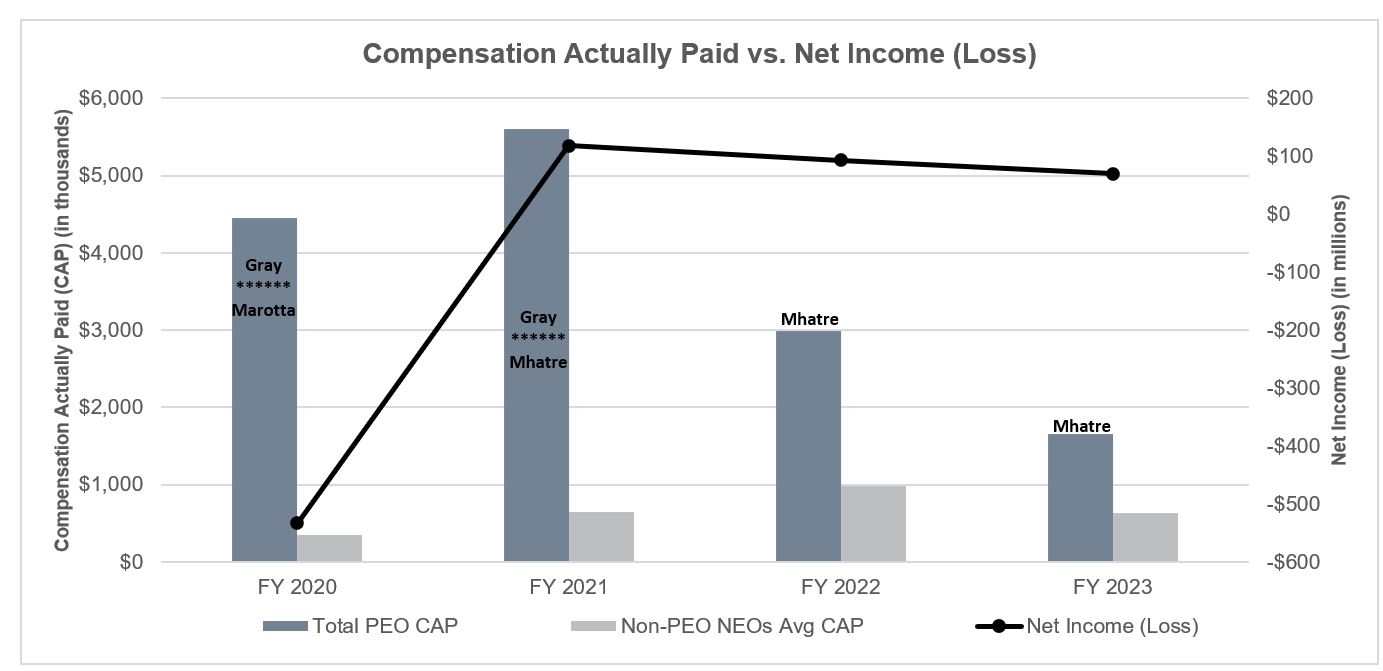

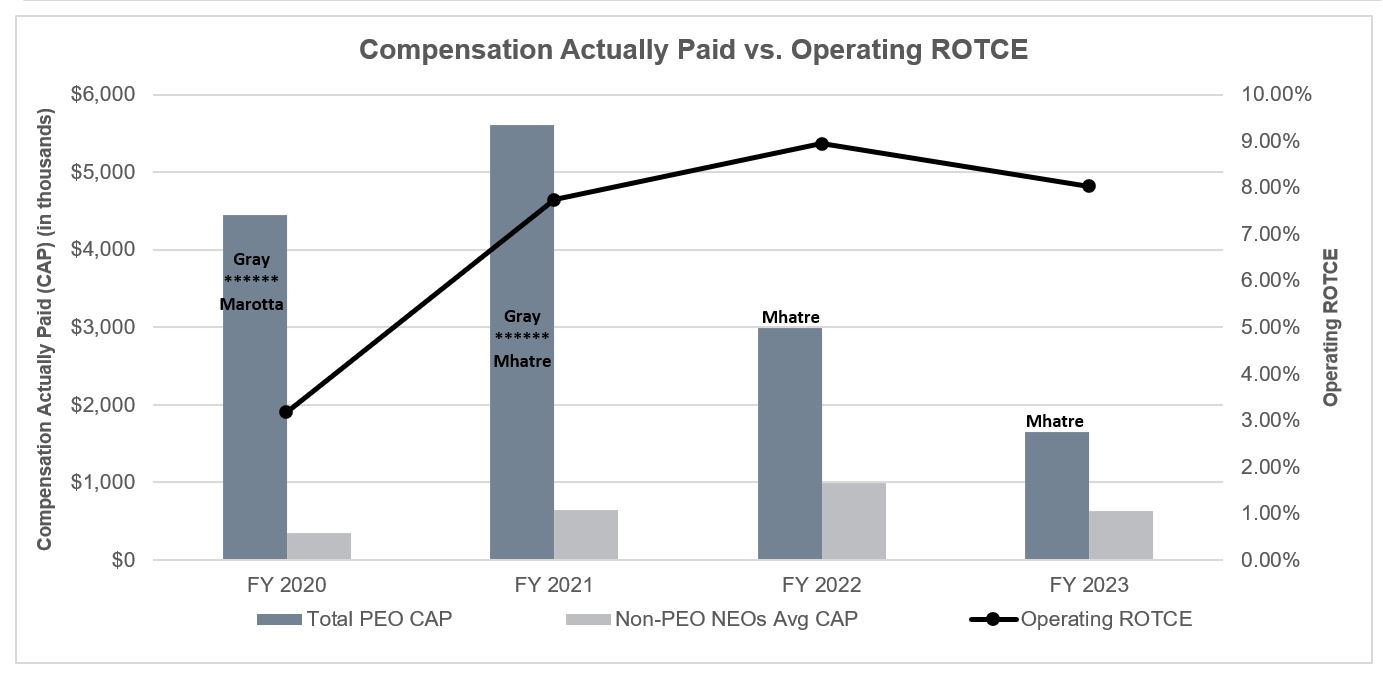

| | Pay Versus Performance | |

| Proposal 3 - Ratification of the Appointment of the Independent Registered Public Accountant | |

| | Audit Committee Report | |

| Additional Information | |

| | Stock Ownership | |

| | Information About Voting | |

| | Other Information Relating to Directors and Executive Officers | |

| | Submission of Business Proposals and Shareholder Nominations | |

| | Shareholder Communications | |

| | Miscellaneous | |

| | Other Matters | |

| Appendix A | A-1 |

| | Summary of and Reconciliation of Certain Non-GAAP Financial Measures | A-1 |

| | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

1 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

| | | | | | | | | | | | | | | | | |

| Berkshire Hills Bancorp, Inc. Proxy Statement | | |

| |

|

|

|

|

Proxy Statement Summary

This summary gives you an overview of selected information in this year’s proxy statement. We encourage you to read the entire proxy statement carefully before voting. We have also provided you with the 2023 Summary Annual Report and the 2023 Annual Report on SEC Form 10-K.

Annual Meeting of Shareholders

Time and Date: 10:00 a.m. Eastern Time, Thursday, May 16, 2024

Place: Berkshire Bank, 99 North Street, Pittsfield, Massachusetts 01201

Record Date: Shareholders as of the close of business on March 21, 2024 are entitled to vote

We are providing this proxy statement to you in connection with the solicitation of proxies for the 2024 Annual Meeting of Shareholders and to transact any other business that may properly come before the meeting. In this proxy statement, we also refer to Berkshire Hills Bancorp, Inc. as “Berkshire” or the “Company”. We also refer to its subsidiary, Berkshire Bank, as the “Bank". We are mailing a notice of the Annual Meeting and this proxy statement to shareholders of record as of March 21, 2024, beginning on or about April 5, 2024.

Summary of Proposals for 2024

1 - Election of Directors. The Company’s Board of Directors is presenting eleven (11) nominees for election as directors at our Annual Meeting. Two of the thirteen current directors, Messrs. Adofo-Wilson and Zaitzeff, are not standing for re-election. Director Callahan was appointed by the Board in September 2023. All nominees currently serve as directors on our Board of Directors. In 2023, all director nominees received at least 98% of the votes cast regarding their nomination. Provided with this proposal is information about our directors, director nominees, corporate governance, and director compensation.

2 - Advisory Vote on Executive Compensation. This advisory vote is for the approval of the Company’s Named Executive Officer compensation as set forth within this proxy statement. Berkshire strives to promote shareholder value and sound risk management by aligning executive pay and company performance. The Compensation Discussion and Analysis (“CD&A”) explains the Board’s processes and decisions with respect to executive compensation. In 2023, 97% of the votes cast were in favor of the proposal “FOR” the advisory approval of our Executive Compensation. Provided with this proposal is the Compensation Discussion and Analysis, the Compensation Committee Report, and Summary Compensation and Other Tables.

3 - Ratification of Independent Registered Public Accounting Firm. This advisory vote ratifies the selection of Crowe LLP (“Crowe”) as the Company’s independent registered public accounting firm for fiscal year 2024. Crowe has served in this capacity since fiscal year 2017. In 2023, 99% of the votes cast were in favor of the proposal for the appointment of Crowe.

2 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

2023 Company Highlights

Berkshire had a solid year of performance in 2023, building on core elements of its strategy to strengthen operations, deliver growth, and improve its long-term outlook. Earnings per share ("EPS") totaled $1.60 in 2023 compared to $2.02 in 2022. Results in 2023 included a $25 million ($0.58 per share) non-operating charge for the sale of securities. The Company's non-GAAP measure of operating earnings totaled $2.14 per share in 2023 compared to $2.19 in 2022. This measure is reconciled to GAAP measures in Exhibit A.

Bank industry operations in 2023 were affected by rising market interest rates and the related impacts on profitability, liquidity and capital, especially following a banking emergency in the first quarter that resulted in the second, third, and fourth largest bank failures in U.S. history. Berkshire maintained steady operations and proactively responded to changing industry conditions while also pursuing its longer term strategic objectives:

•Talent Recruitment. The Company opportunistically recruited executives and front-line commercial relationship talent with an emphasis on deposit, private banking, and wealth management professionals.

•Balance Sheet Growth. Total loans increased 8% and total deposits increased 3% year-over-year, producing a 7% increase in net interest income.

•Balance Sheet Strength. Capital, liquidity, and asset quality metrics all remained solid and supportive of financial soundness, organic growth, and shareholder returns through dividends and buybacks.

•Expense Management. Ongoing procurement and optimization activities resulted in further branch consolidations, the sales of excess premises, and a workforce realignment.

•Technology. The Company introduced its new mobile/digital banking platform, which positions the Bank well to respond to changing customer needs and competitive market offerings.

•Corporate Responsibility. Human capital management practices contributed to record high employee engagement and improved retention. ESG ratings remained in the banking sector top quartile. Berkshire allocated an amount equal to its landmark $100 million sustainability bond to create affordable/workforce housing and green development.

Due to the challenges of the environment, one year and two year total shareholder return was negative for Berkshire, its proxy peers, and the KBW Regional Banking Index (KRX). While Northeastern banks underperformed this national index in both years, Berkshire was favorable to both its proxy peers and the national index for the two year TSR. Over three years, BHLB's 55% TSR exceeded both of these industry groups as well as the S&P 500 index (SPX).

2023 Executive Compensation Highlights

Included later in this report are compensation tables, including a Summary Compensation Table which details executive compensation provided in 2023, as well as a Compensation Discussion and Analysis which provides information about the compensation management process and compensation decisions.

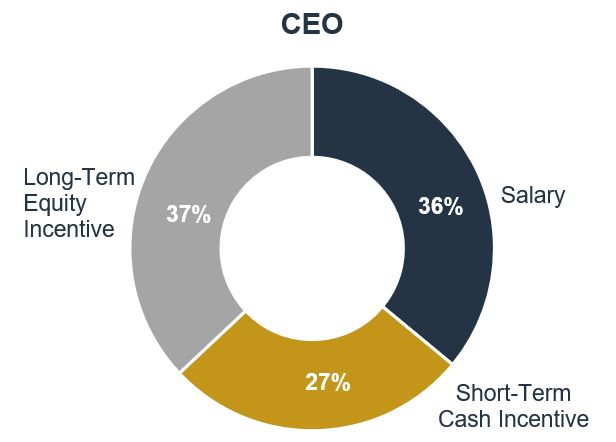

The Compensation Committee maintained the same overall balanced structure for compensation management in 2023.

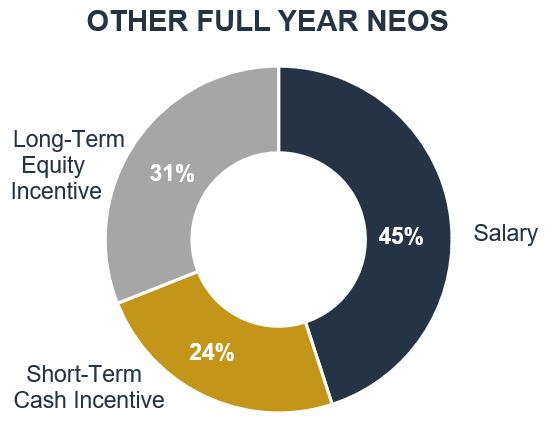

•Direct compensation includes salary, the cash-based short-term incentive, and the equity-based long-term incentive.

•Performance based compensation constitutes the majority of targeted direct compensation.

For those Named Executive Officers who served in their positions for the full year, total targeted direct compensation increased 7% year-over-year, reflecting higher salaries and incentives. Total direct compensation earned by these positions was 1% below target and decreased by 8% year-over-year, including the impact of performance below objectives in 2023.

The Committee’s decisions resulted in a compensation structure that rewarded the achievement of Company objectives and decreased compensation from targets where objectives were not met. Compensation management was aligned with shareholder interests and provides ongoing incentives to improve shareholder value.

3 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

Shareholder Engagement and Responsiveness

In addition to its active outreach and interactions with the investment community, the Company also solicits discussion and feedback annually on corporate stewardship with its thirty largest institutional shareholders.

During 2023, the most frequent topics in these discussions included processes for managing board membership and shareholder meetings; governance of corporate sustainability programs; management of growth, efficiency, and employee turnover; and connecting strategy and compensation through the Company.

There is discussion related to these matters in following sections of the proxy statement. Based on the affirmative shareholder vote of 97% or higher for all items on last year’s Annual Meeting agenda and based on investor feedback and recognition of Berkshire's vision, positioning, and initiatives, we believe that our investors are strongly supportive of our programs for governance and company performance.

Corporate Responsibility and Sustainability

Berkshire's Approach

Since its founding in 1846, Berkshire remains a purpose-driven and values-guided institution working to achieve its vision of becoming a high-performing, relationship-driven, community-focused bank. Berkshire empowers the financial potential of its stakeholders by delivering industry-leading financial expertise and a full suite of tailored banking solutions through its consumer banking, commercial banking and wealth management divisions to clients in New England and New York. For more than 175 years, Berkshire has provided strength, stability and trusted advice to create a positive impact for its clients and communities while upholding equitable, ethical, responsible and sustainable business practices.

Berkshire’s longstanding commitment to operating equitably, responsibly and sustainably is interwoven into the company’s vision, mission, business practices, and strategic goals. Berkshire’s integrated approach to managing environmental, social and governance externalities helps reduce risk and unlock new business opportunities to create an ecosystem of positive impact and value, which in turn drives Berkshire’s commercial performance, creating capacity to invest more in its business, employees, customers, shareholders and communities.

2023 Highlights

•Record high employee engagement contributing to declining turnover

•Allocated an amount equal to the proceeds of Berkshire’s $100MM sustainability bond to create affordable/workforce housing and green building development

•100% on-premises renewable electricity and reduced Greenhouse Gas emissions

•Recognized with the Communitas Award for Leadership in Corporate Social Responsibility, named one of America’s Most Trustworthy Companies and America’s Best Regional Banks by Newsweek and America’s Best Midsize Employers by Forbes.

•Top 20% aggregated ESG rating*, achieving one of five major strategic goals

*National ranking among U.S. banks as of December 31, 2023

Oversight & Responsibility

The management of material environmental, social and governance factors is integral to Berkshire’s business practices, risk management program, competitive positioning and its ability to deliver on its strategic priorities and vision. Berkshire was one of the first banks in the country to establish a dedicated committee of its Board of Directors to oversee corporate culture, diversity and sustainability. The Company is a leader among community banks in integrating these practices into its business strategy and operations.

The Company’s strong foundation of governance systems include:

•Board level oversight of Culture, Sustainability, Community, Climate Change, and Diversity

•Environmental, Social and Governance (ESG) Committee

•Responsible & Sustainable Business Policy and Climate Risk Management Program

•Lending, credit, deposit and investment policies which incorporate environmental and social considerations along with due diligence requirements

•Active involvement from business unit leaders and front lines in managing externalities and risks

•Senior leadership for corporate responsibility and sustainability

4 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

The Board of Directors including its Corporate Responsibility & Culture Committee (CRCC) has ultimate oversight responsibility for environmental, social and governance matters. The CRCC meets quarterly to review performance, examine related risks, and approve relevant policies. Berkshire’s comprehensive approach ensures that the board receives regular reports from management on environmental and social dimensions of its business such as human capital management, diversity, stakeholder relations, climate change, community impact, and cybersecurity. It allows the board to develop a sufficient understanding of the Company’s impacts, management’s programs to mitigate those risks and capture opportunities. It helps inform strategic planning, create accountability and, along with management committees and senior leaders, provides visibility throughout the organization.

Berkshire regularly engages directly with its stakeholders to share information about the progress it’s made in its performance, including through its website, corporate annual report, and proxy statement. Additionally, Berkshire’s Sustainability Report, which is informed by Sustainability Accounting Standards Board (“SASB”) and Task Force on Climate-Related Financial Disclosure (TCFD) disclosure standards, details the Company's programs and performance. The report is available at berkshirebank.com/esg

Climate Change

Climate change manifesting in the form of both physical or transition risks could adversely affect either directly or indirectly, Berkshire’s operations, businesses, customers, communities, and its stakeholders. As the transition to a low-carbon economy accelerates, new policies emerge, and market dynamics shift, Berkshire expects that its efforts to manage its environmental footprint, mitigate the risks associated with climate change, and support the transition will allow it to strengthen its competitive positioning. The Company continues to evolve its practices to align with its mission, current and expected regulations as well as the size, scope, and complexity of its operations.

Climate change and its associated physical and transition risks are managed through Berkshire’s formal Climate Risk Management Program which outlines roles and responsibilities for the board, management and all employees, definitions, along with procedures for identifying, measuring and assessing climate risk. The program also lays out Berkshire’s system of controls which include governance mechanisms, formal policies, due diligence and insurance requirements, exclusionary criteria, business continuity planning, external relations, and employee education. Finally, the program sets expectations for responses to risk events or elevated risk levels, reporting and external disclosure. Further information on Berkshire’s environmental sustainability activities and its approach to governance, risk management, strategy, metrics & targets and next steps can be found in its most recent Sustainability Report.

Equity & Inclusion

Creating a diverse, accessible, inclusive and equitable workplace is an essential enabler to advancing the Company’s strategic goals, social and environmental commitments and vision. Ultimately Berkshire’s goal is to attract and retain individuals from a wide range of backgrounds, cultures and experiences so that the workforce, executives and board composition reflect the diversity of the communities in which it operates. It also seeks to ensure equity, accessibility, fairness and impartiality in all aspects of the Company’s workplace, banking practices and financial solutions while fostering an inclusive environment where all employees feel valued, respected and empowered.

The Company advances those goals through an integrated approach that includes:

•Strong oversight and governance practices through the Corporate Responsibility & Culture Committee of the Board of Directors and management committees

•Talent management and recruitment

•Education and training and workplace programming

•Seven employee resource groups

•Workplace programming

•Multicultural community engagement

•Equitable product and service development and supplier diversity

Additional detailed information on Berkshire’s Human Capital Management and Diversity, Equity & Inclusion practices can be found in the Company’s annual SEC report on Form 10-K and annual Sustainability Report, which details the company's environmental, social and governance programs.

5 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

| | | | | | | | | | | | | | | | | |

| | | | | |

| Proposal 1: Election of Directors for a One-Year Term | | |

| |

| |

|

|

The Company’s Board of Directors has nominated and recommends a vote “FOR” each of the eleven (11) nominees listed below for election as a director. All of the nominees currently serve on the Company’s Board of Directors.

Background. The Company’s Board of Directors is presenting eleven (11) nominees for election as directors at our Annual Meeting. Two of the thirteen current directors, Messrs. Adofo-Wilson and Zaitzeff, are not standing for re-election. All of the nominees currently serve as directors on the Company's Board of Directors. Each director elected at the meeting will serve for a one-year term until our 2025 Annual Meeting or until a successor is duly elected and qualified. Each director nominee has consented to being named in this proxy statement and to serving as a director if elected. If a nominee is unable to be a candidate when the election takes place, the shares represented by valid proxies will be voted in favor of the remaining nominees. The Board of Directors does not currently anticipate that any of the nominees will be unable to be a candidate for election.

Election. The affirmative vote of a plurality of the Company’s outstanding common stock present at the Annual Meeting or by proxy at the Annual Meeting is required to elect the nominees for directors; provided, however, in the case of an uncontested election of directors, it is the Company’s policy that if a director is elected by a plurality but not a majority of the votes cast for such director, such director must submit his or her resignation to the Board of Directors, which will be subject to review by the Corporate Governance/Nominating Committee of the Board of Directors. The Corporate Governance/Nominating Committee will then make a recommendation to the Board of Directors as to whether to accept or reject the director’s resignation. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the election of the nominees as directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ITS DIRECTOR NOMINEES.

6 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

Information Regarding Directors and Director Nominees

2024 Nominees for Election to the Board of Directors

| | | | | | | | | | | | | | | | | |

DAVID M. BRUNELLE, CHAIRPERSON OF THE BOARD OF DIRECTORS OF BERKSHIRE HILLS BANCORP, INC., CO-FOUNDER AND MANAGING DIRECTOR OF NORTH POINTE WEALTH MANAGEMENT |

| Mr. Brunelle is Co-Founder and Managing Director of North Pointe Wealth Management in Worcester, Massachusetts. He has over 20 years of experience in financial services working with businesses, individuals, families and charitable foundations. Mr. Brunelle is a former Director of Commerce Bancshares Corp. and Commerce Bank & Trust Company and served on Commerce’s audit and loan committees. He has also served as trustee or corporator for numerous non-profit entities in and around Worcester, including The Nativity School of Worcester, The Worcester Regional Research Bureau, The Worcester Educational Development Foundation, the UMass/Memorial Foundation, Becker College and the Greater Worcester Community Foundation. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 6 | | Compensation |

Age: 53 | | Corporate Governance/Nominating (Chair) |

| | Corporate Responsibility & Culture |

| | | | | | | | | | | | | | | | | |

MARY ANNE CALLAHAN |

| Ms. Callahan has more than 35 years of investment banking expertise, most recently as a Managing Director in the Financial Services Group at Piper Sandler Companies where her responsibilities included advising bank management and boards of directors in the Northeast region on a broad range of strategic and financial topics. Previously she was a principal in Sandler O’Neill & Partners, L.P.’s investment banking group advising banks, thrifts and specialty finance companies and worked in the financial institutions group at Merrill Lynch and CIBC World Markets. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: <1 | | Compensation |

Age: 61 | | Risk Management, Capital & Compliance |

7 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| NINA A. CHARNLEY, FORMER SENIOR MANAGING DIRECTOR, TIAA |

| Ms. Charnley was Senior Managing Director, Enterprise Customer Experience Executive at TIAA. Ms. Charnley led the strategy, development and execution of a significant portfolio of technology projects launching the company's mobile app and a digital bank, building digital capabilities enabling employees and customers. Previously, she was an executive at Bank of America managing diverse businesses including a de novo sustainable energy lending program and created the strategy, infrastructure, template and accountabilities matrix for Bank of America's Diversity and Inclusion program. Ms. Charnley has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission

|

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 2 | | Audit |

Age: 68 | | Corporate Responsibility & Culture |

| | Risk Management, Capital, & Compliance |

| | | | | | | | | | | | | | | | | |

| MIHIR A. DESAI, PROFESSOR OF FINANCE, HARVARD BUSINESS SCHOOL & PROFESSOR OF LAW, HARVARD LAW SCHOOL |

| Dr. Desai is the Mizuho Financial Group Professor of Finance at Harvard Business School, and Professor of Law at Harvard Law School. Dr. Desai is an accomplished author and expert in finance and tax policy. He is a Research Associate in the National Bureau of Economic Research’s Public Economics and Corporate Finance Programs. In addition to his work at Harvard University, his professional experiences include CS First Boston, McKinsey & Co., and advising a number of firms and governmental organizations. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 2 | | Compensation |

Age: 56 | | Risk Management, Capital & Compliance |

| | | | | | | | | | | | | | | | | |

WILLIAM H. HUGHES III, PRESIDENT AND CEO OF EDUCATION DESIGN LAB |

| Mr. Hughes is President and CEO of Education Design Lab, a national nonprofit focused on expanding opportunity at the intersection of learning and work. He has been a leader, entrepreneur, innovator and board member in educational technology for the past two decades at companies such as Pearson, Cengage, Kaplan, EDC, FineTune Learning (acquired by Prometric) and Intellus Learning (acquired by Macmillan). In his earlier career, he held leadership positions in technology and venture development at Sapient and Cambridge Innovation Center. His more than 30 years of business experience spans strategy, product, services, business development, partnerships, AI and cybersecurity.

|

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 5 | | Corporate Governance/Nominating |

Age: 60 | | Corporate Responsibility & Culture |

8 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

JEFFREY W. KIP, CHIEF EXECUTIVE OFFICER OF ANGI INTERNATIONAL |

| Mr. Kip is Chief Executive Officer of Angi International which provides internet tools and resources for home improvement, maintenance, and repair projects. Angi International is a subsidiary of IAC/InterActive Corp (NASDAQ: IAC), which owns and manages popular online brands and services. Prior to his role as Chief Executive Officer, Mr. Kip was the Chief Financial Officer of IAC/InterActive Corp from 2012-2016. Mr. Kip's previous positions include Chief Financial Officer of Panera Bread, LLC from 2006 – 2012. Mr. Kip has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 2 | | Audit |

Age: 55 | | Compensation (Chair) |

| | | | | | | | | | | | | | | | | |

DR. SYLVIA MAXFIELD, DEAN OF THE PROVIDENCE COLLEGE SCHOOL OF BUSINESS |

| Dr. Maxfield is Dean of the Providence College School of Business and was previously Chair of the Faculty and MBA Program Director at Simmons University in Boston. Additionally, she serves as voting member of the Rhode Island State Investment Commission, which oversees fund performance, including asset allocation and investment-related contracting. Dr. Maxfield also votes on shareholder proxy activity on behalf of the State. Previously, she has served on the boards of the Greater Providence Chamber of Commerce, Social Enterprise Greenhouse and the 21st Century Fund. Dr. Maxfield has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 4 | | Audit (Chair) |

Age: 65 | | Corporate Governance/Nominating |

| | Risk Management, Capital & Compliance |

| | | | | | | | | | | | | | | | | |

NITIN J. MHATRE, PRESIDENT, CHIEF EXECUTIVE OFFICER AND DIRECTOR OF THE COMPANY |

| Mr. Mhatre joined the Company as Chief Executive Officer and a Director in January 2021. He was previously Executive Vice President, Community Banking at Webster Bank, where he was a member of Webster Bank's executive team and led its Consumer and Business Banking groups and Webster Investment Services. Prior to joining Webster, he spent more than 13 years at Citigroup in various leadership roles across consumer-related businesses globally. Mr. Mhatre has served on the Board of the Consumer Bankers Association, headquartered in Washington D.C., since 2014 and was Chairman of the Board from 2019-20. He also serves on the Board of Cradles to Crayons Boston, based in Newton, Massachusetts.

|

|

|

|

|

|

|

|

| Non-Independent | |

Years of Service: 3 | | | | |

Age: 53 | | | | |

9 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

LAURIE NORTON MOFFATT, DIRECTOR & CEO OF THE NORMAN ROCKWELL MUSEUM |

| Ms. Norton Moffatt is the Director and Chief Executive Officer of the Norman Rockwell Museum, Stockbridge, Massachusetts. Since 1986, Ms. Norton Moffatt has overseen the expansion of the museum’s facilities and the creation of a scholars’ research program. Her efforts resulted in the Museum receiving the National Humanities Medal, America’s highest humanities honor. Ms. Norton Moffatt is also an active community leader. She is a founder of 1Berkshire and Berkshire Creative Economy Council and serves as a trustee of Berkshire Health Systems and a director of Berkshire Health Systems, Inc. and Berkshire Medical Center, Inc.

|

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 10 | | Corporate Governance/Nominating |

Age: 67 | | Corporate Responsibility & Culture (Chair) |

| | | | | | | | | | | | | | | | | |

| KARYN POLITO, FORMER LIEUTENANT GOVERNOR OF MASSACHUSETTS |

| Ms. Polito is currently Principal of Polito Development Corporation, a commercial real estate development firm. Ms. Polito was the 72nd Lieutenant Governor of the Commonwealth of Massachusetts from 2015 to 2023. In that position, she advocated for women’s empowerment and championed renewable energy, climate adaption, workforce development, affordable housing, and the innovation economy. She helped increase aid to local communities and spearheaded efforts to expand offshore wind and educational opportunities for careers in science, technology, engineering and math for women and students. Prior to serving as Lieutenant Governor, Ms. Polito was a member of the Massachusetts House of Representatives and a Partner at Milton, Laurence & Dixon, LLP. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 1 | | Corporate Responsibility & Culture |

Age: 57 | | Risk Management, Capital & Compliance |

| | | | | | | | | | | | | | | | | |

ERIC S. ROSENGREN, FORMER PRESIDENT AND CEO OF THE FEDERAL RESERVE BANK OF BOSTON |

| Mr. Rosengren is CEO of Rosengren Consulting and Visiting Scholar at the MIT Golub Center for Finance and Policy. He previously served as President and CEO of the Federal Reserve Bank of Boston from 2007 to his retirement in 2021. As a Federal Reserve Bank president, he was a participant and voting member of the Federal Open Market Committee. He also led projects to help rebuild smaller city economies and provide opportunities for diverse populations to prosper. Mr. Rosengren joined the Boston Fed in 1985 and held various roles in the Bank’s Research and Supervision, Regulation, and Credit Departments. He has published numerous papers and articles, and is often cited in leading academic journals and is featured in major media on topics including macroeconomics, monetary policy, international banking, bank supervision, and risk management. Mr. Rosengren has been designated by the Board of Directors as a financial expert under SEC rules.

|

|

|

|

|

|

|

|

| Independent | Board Committees: |

Years of Service: 1 | | Audit |

Age: 66 | | Risk Management, Capital & Compliance (Chair) |

10 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

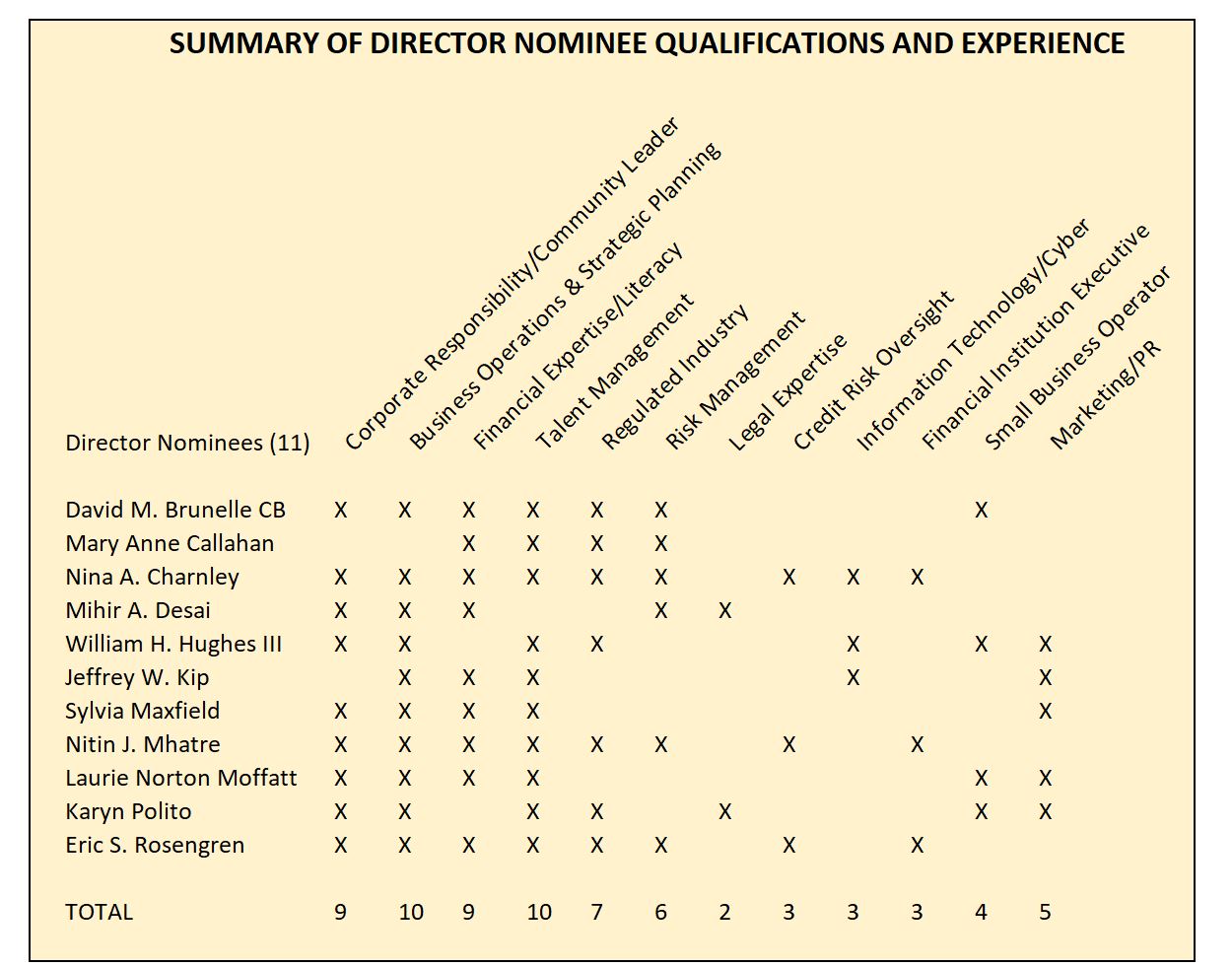

Information About Director Nominees

•73% of our director nominees are female and/or racially or ethnically diverse.

•40% of our Board committees are chaired by diverse directors.

11 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Corporate Governance

The Company is committed to strong corporate governance policies, practices, and procedures designed to make the Board more effective in exercising its oversight role. The following sections provide an overview of our corporate governance structure, including independence and other criteria we use in selecting director nominees, our Board leadership structure, and the responsibilities of the Board and each of its Committees. Our Corporate Governance Policy, among other key governance materials, helps guide our Board and management in the performance of their duties and is regularly reviewed by the Board.

| | | | | | | | |

Key Corporate Governance Documents |

Please visit our investor relations website at ir.berkshirebank.com to view the following documents: |

| | Corporate Governance Policy |

| | Code of Business Conduct |

| | Anonymous (Whistleblower) Reporting Line Policy |

| | Board Committee Charters |

| | Certificate of Incorporation |

| | Company By-Laws |

These documents are available free of charge on our website or by writing to Berkshire Hills Bancorp, c/o Wm. Gordon Prescott, Senior Executive Vice President, General Counsel and Corporate Secretary, 60 State Street, Boston, Massachusetts 02109. |

|

The Board and management regularly review best practices in corporate governance and are committed to a program that serves the long-term interests of our shareholders. We believe good governance strengthens accountability and promotes responsible corporate citizenship. Several of our current best practices are highlighted below:

| | | | | | | | |

| Independent Oversight | Shareholder Orientation and Accountability | Good Governance |

Majority independent directors(1) | Declassified Board with all directors standing for election each year | Diverse board membership (skills, tenure, age); annual director education; active board replenishment program |

| Strong and engaged independent Board Chair | Robust stock-ownership guidelines | Annual evaluation of CEO and senior management and review of succession plans |

All key committees are fully independent and led by the Board chair | Annual shareholder engagement program | Implementation of a Corporate Responsibility & Culture Committee at both Board and employee level |

| Regular executive sessions of independent directors | Plurality voting standard for director elections, with director resignation policy in effect for uncontested elections | Risk oversight by full board and committees |

| Board Chair or Chair of Corporate Governance can call special meeting of the Board at any time for any reason | No poison pill in place; annual election of all directors | Formal ethics code, reporting hotline and ethics training to all employees |

(1) 10 out of 11 of the director nominees will be designated as independent directors; CEO/Director Mhatre is not independent.

12 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Board of Directors

The primary functions of Berkshire’s Board of Directors are:

•To oversee management performance on behalf of shareholders;

•To ensure that the interests of the shareholders are being served;

•To monitor adherence to Berkshire’s standards and policies;

•To promote the exercise of responsible corporate citizenship; and

•To perform the duties and responsibilities assigned to the Board by the laws of Delaware, Berkshire’s state of incorporation.

Customarily, the Board elects its members to serve in identical capacities on the Board of Directors of Berkshire Bank, the Company's main operating subsidiary which is chartered in the Commonwealth of Massachusetts.

Talent Development and Succession Planning

One of the Board's primary responsibilities is to oversee the development and retention of key talent within the Company and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other senior executives. The Board meets regularly with senior management and periodically reviews the readiness of key employees to potentially assume additional roles and responsibilities, including in the event of unexpected circumstances. In addition, our Chief Executive Officer regularly discusses with our Corporate Governance/Nominating Committee recommendations and evaluations as to potential successors for senior positions. The Committee incorporates this feedback into its leadership development and contingency plans. While the Corporate Governance/Nominating Committee has primary responsibility for developing and maintaining a succession plan, the Committee regularly reports to the Board on this matter, and final decisions on senior leadership succession matters, other than the CEO, are made by the CEO in consultation with the full Board.

Identification of Candidates and Diversity

The Corporate Governance/Nominating Committee regularly reviews the composition of our Board and, as appropriate, recommends steps to be taken to ensure that the Board reflects the desired balance of skills, experience and diversity and meets the requirements of all applicable laws and regulations. The Board maintains an ongoing refreshment program to identify highly qualified candidates that are aligned with our long-term strategy. Our corporate governance guidelines provide age and tenure limits, of 75 and 12 years respectively, to facilitate appropriate transition and renewal. In accordance with our Corporate Governance Policy, the Corporate Governance/Nominating Committee and Board shall take into account diversity considerations. Diversity is broadly construed to mean not only diversity of gender, race, ethnicity and sexual orientation, but also diversity with respect to personal and professional experiences, backgrounds, opinions, beliefs, education and perspectives.

The Corporate Governance/Nominating Committee is committed to fostering an environment of diversity and inclusion, including among our directors, and is tasked as part of its annual evaluation with determining whether or not the Board is appropriately diverse.

Board Meetings

During 2023, the Board of Directors held eleven (11) meetings. The average attendance at meetings of the Board and Board Committees during 2023 was over 90%. During this period, each of the current directors attended at least 75% of the aggregate total number of board meetings and committee meetings held on which such directors served.

In addition, the Board of Directors encourages each director to attend annual meetings of shareholders. 13 out of 14 directors (93%) serving as of the date of the 2023 Annual Meeting of Shareholders attended the 2023 Annual Meeting.

13 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Board Leadership Structure

The Board has reviewed the current Board leadership structure of the Company, which consists of a separate Independent Chairperson of the Board and a Chief Executive Officer. The Independent Board Chairperson performs all duties and has all powers which are commonly incident to the office of Chairperson of the Board or which are delegated to that person by the Board of Directors, including presiding at all meetings of the Board of Directors. The Chief Executive Officer has responsibility for the management and control of the business and affairs of the Company and has general supervision of all other officers, employees and agents of the Company. The Board believes that separating these roles enhances the independence of the Board and its effectiveness in discharging its responsibilities and that this procedure is currently the most appropriate Board leadership structure for the Company.

From time to time, the Board may also appoint a Vice Chairperson in the manner and upon the criteria it deems appropriate.

Director Independence

All of the Company’s directors are independent under the listing requirements of The New York Stock Exchange (the “NYSE”), except for Mr. Mhatre who is an officer of the Company and the Bank. Additionally, all of the members of the Audit, Compensation and Corporate Governance/Nominating Committees are independent in accordance with the listing standards of the NYSE, and, in the case of members of the Audit and Compensation Committees, applicable rules and regulations of the Securities and Exchange Commission (“SEC”) and the Federal Deposit Insurance Corporation (“FDIC”). In determining the independence of its directors, the Board considered transactions, relationships and arrangements between the Company and its directors that are not required to be disclosed in this proxy statement under the heading “Transactions with Related Persons,” including loans or lines of credit that the Bank has directly or indirectly made to Director Norton Moffatt.

Corporate Governance Policy

The Board of Directors has adopted a corporate governance policy to govern certain activities, including: the duties and responsibilities of directors; the composition, responsibilities and operation of the Board of Directors; the selection of a Chairperson of the Board of Directors; the selection from time to time in the Board’s discretion of a Vice Chairperson of the Board of Directors; the operation of board committees; succession planning; convening executive sessions of independent directors; the Board of Directors’ interaction with management and third parties; director age limits; the maximum length of directors’ tenure on the Board; and the evaluation of the performance of the Board of Directors and of the Chief Executive Officer. A copy of the corporate governance policy is available in the Governance Documents portion of the Company’s Investor Relations website (ir.berkshirebank.com).

Commitment to Corporate Responsibility and Sustainability

Berkshire Bank’s longstanding commitment to operating equitably, responsibly and sustainably is interwoven into the company’s vision, mission, business practices, and strategic goals. The Board of Directors including its Corporate Responsibility & Culture Committee (CRCC) has ultimate oversight responsibility for environmental, social and governance matters. The CRCC, chaired by Director Laurie Norton Moffatt, meets quarterly to review performance, examine related risks and approve relevant policies. Additional detailed information on Berkshire’s programs can be found in the introductory section of this proxy statement and in its most recent Sustainability Report, available online at berkshirebank.com/esg.

Director Continuing Education

The Board of Directors conducts annual director education sessions, which include presentations by industry experts based on input from directors regarding topics of interest. Directors also receive an annual update on trending compliance and regulatory matters and new developments from the Bank’s outside compliance advisory firm. Our executive management meets with the Board at every regularly scheduled board meeting and annually to review the Company’s strategic plan.

14 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Board and Committee Self Evaluation

The Corporate Governance/Nominating Committee oversees the annual self-evaluation of the performance of the Board of directors and its committees, the results of which are discussed with the full Board and each individual committee, as appropriate. The purpose of the evaluations is to improve the performance of the overall Board and each specific committee. The evaluations include a review of any areas in which Board or committee members believe the Board and the committees can make a better contribution to the governance and oversight of the Company. The Corporate Governance/Nominating Committee also utilizes the results of the Board and committee evaluation process in assessing and determining the characteristics and critical skills required of prospective candidates for election to the Board and appointment to each committee. The evaluation survey forms include open-ended questions in which directors are invited to share their written comments on a confidential basis.

Committees of the Board of Directors

The Board currently has five standing committees: the Audit Committee; the Compensation Committee; the Corporate Governance/Nominating Committee; the Corporate Responsibility and Culture Committee; and the Risk Management, Capital and Compliance Committee. The Board reviews the Committee Charters regularly to ensure it has an effective, efficient committee structure. The Board has determined that all members of the Audit Committee, the Compensation Committee and the Corporate Governance/Nominating Committee are independent in accordance with the listing requirements of the NYSE. Each committee operates under a written charter approved by the Board of Directors that governs its composition, responsibilities and operation. Each committee reviews and reassesses the adequacy of its charter annually or biannually. The current charters of all five committees are available in the Governance Documents portion of the Investor Relations section of the Company’s website (ir.berkshirebank.com).

The following table shows the structure of the Board of Directors as of the filing date of this Proxy Statement. It also shows the number of times each Committee met in 2023. Pending the results of the election of directors at the Company’s Annual Meeting on May 16th, the Board will review its committee memberships and Chair assignments.

15 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Board Structure and Meetings

| | | | | | | | | | | | | | | | | | | | | | | |

| Director Name, Age & Primary Occupation | Director

Since | Director

Category | Audit(1) | Comp | Corp Gov & Nom | Corp Responsibility & Culture | Risk Management, Capital & Compliance |

Baye Adofo-Wilson (2), Age 55 CEO of BAW Development, LLC

| 2019 | I | O | O | | O | |

David M. Brunelle, Age 53 Chairperson of the Board of Directors of Berkshire Hills Bancorp, Inc. Co-Founder and Managing Director of North Pointe Wealth Management | 2017 | I | | O | C | O | |

Mary Anne Callahan (2), Age 61 Former Managing Director in the Financial Services Group at Piper Sandler Companies | 2023 | I | | O | | | O |

Nina A. Charnley, Age 68 Former Senior Managing Director TIAA | 2021 | I | O | | | O | O |

Mihir A. Desai, Age 56 Professor of Finance and Law | 2022 | I | | O | | | O |

William H. Hughes III, Age 60 President of Education Design Lab | 2019 | I | | | O | O | |

Jeffrey W. Kip(1), Age 55 Chief Executive Officer Angi International | 2021 | I | O | C | | | |

Sylvia Maxfield(1), Age 65 Dean Providence College School of Business | 2020 | I | C | | O | | O |

Nitin J. Mhatre, Age 53 President and CEO of Berkshire Hills Bancorp, Inc. | 2021 | N | | | | | |

Laurie Norton Moffatt, Age 67 Director & CEO of the Norman Rockwell Museum | 2013 | I | | | O | C | |

Karyn Polito, Age 57 Former Lieutenant Governor of Massachusetts | 2023 | I | | | | O | O |

Eric S. Rosengren(1), Age 66 Former President and CEO of the Federal Reserve Bank of Boston | 2023 | I | O | | | | C |

Michael A. Zaitzeff(2), Age 41 Co-founder and managing member of VM GP II LLC | 2021 | I | | O | | | O |

| | | | | | | |

| Number of Meetings in 2023 | 11 (Full Board) | | 13 | 4 | 6 | 4 | 6 |

| | | | | | | |

| N = Non-Independent Director | I = Independent Director | C = Chair | O = Committee Member |

(1) Directors Charnley, Kip, Maxfield, and Rosengren have been designated by the Board as Financial Experts.

(2) Directors Adofo-Wilson and Zaitzeff are not standing for re-election. Director Callahan was appointed to the Board in 2023 and is now

standing for election.

16 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Board Committees and Responsibilities

The primary functions of each of the board committees are described below.

| | | | | | | | |

| BOARD COMMITTEES | ROLES AND RESPONSIBILITIES |

| AUDIT COMMITTEE | | Assists the Board of Directors in its oversight of the Company’s accounting and reporting practices |

| |

| All Members Independent | | Reviews the quality and integrity of the Company’s financial reports |

| Chairperson: Dr. Maxfield | | Ensures the Company’s compliance with legal and regulatory requirements related to accounting and financial reporting |

| |

The Board of Directors has determined that Ms. Charnley, Dr. Maxfield, Mr. Kip, and Mr. Rosengren qualify as Audit Committee Financial Experts under the rules of the Securities and Exchange Commission.

Please also see the discussion related to the Ratification of the Public Accounting Firm in this proxy statement. | | Oversees the Company’s internal audit function |

| Annually reviews and approves the internal and external audit plans |

| Engages with the Company’s independent registered public accounting firm (Crowe) and monitors its performance, reporting, and independence |

|

| COMPENSATION COMMITTEE | | Approves the compensation objectives for the Company and its subsidiaries and establishes the compensation for the Chief Executive Officer and other Named Executive Officers of the Company |

| |

| All Members Independent | | Reviews the Company’s incentive compensation and other equity plans and recommends changes to the plans as needed |

Chairperson: Mr. Kip | |

| | Reviews all compensation components for the Company’s Chief Executive Officer and other Named Executive Officers, including base salary, short-term incentive, long-term incentives/equity, benefits, and other perquisites |

See the “Compensation Discussion and Analysis” section for more information regarding the role of the Compensation Committee management and compensation consultants in determining and/or recommending the amount or form of named executive compensation.

| |

|

| Reviews competitive market factors and examines the total compensation mix, pay-for-performance relationship, and how all elements, in the aggregate, comprise the named executive officer’s total compensation package |

|

|

| Administers CEO employment agreement, change in control agreements, and equity incentive plans |

| |

17 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

| | | | | | | | |

| BOARD COMMITTEES | ROLES AND RESPONSIBILITIES |

| CORPORATE GOVERNANCE/NOMINATING COMMITTEE | | Identifies qualified individuals to serve as Board members |

| Considers and recommends nominees for director to stand for election at the Company’s Annual Meeting of Shareholders |

| |

| All Members Independent | | Determines the composition of the Board of Directors and its committees |

| Chairperson: Mr. Brunelle | |

| | Annually reviews policy, procedures and criteria for identifying candidates for election or appointment to the Board of Directors |

| |

| | Monitors a process to assess Board effectiveness, including annual Board and committee self-evaluations |

| |

| | Develops and implements the Company’s corporate governance guidelines, including annual reviews of the Company’s Corporate Governance Policy and Code of Business Conduct |

| |

| | Periodically receives reports from executive officers heading the Company’s compliance and regulatory programs and from other committee chairpersons regarding the work being done by their committees |

| |

| |

| CORPORATE RESPONSIBILITY & CULTURAL COMMITTEE | | Oversee management’s implementation of Corporate Social Responsibility/ESG, Diversity & Inclusion, and Culture programs to foster belonging, enhance reputation, mitigate risk, promote competitive advantage, engage employees, and meet stakeholder expectations |

|

| All Members Independent | |

| Chairperson: Ms. Norton Moffatt | | Review, approve, and recommend programs and policies to the Board that are designed to identify, measure, monitor, control, and enhance Corporate Social Responsibility/ESG, Diversity & Inclusion, and Culture performance |

| |

| |

| | Monitor the performance of Corporate Social Responsibility/ESG, Diversity & Inclusion, and Culture programs and policies by setting goals, examining social and culture risks, as well as reviewing opportunities and threats that could affect the Company |

| |

| |

RISK MANAGEMENT, CAPITAL & COMPLIANCE COMMITTEE | | Oversees management’s program to limit or control the material business risks that confront the Company |

|

| | Approves policies and procedures designed to lead to an understanding and to identify, control, monitor and measure the material business risks of the Company and its subsidiaries |

| All Members Independent | |

Chairperson: Mr. Rosengren | | Plans for future capital needs |

| | Reviews material business risks including, but not limited to, credit risk, interest rate risk, liquidity risk, regulatory risk, legal risk, operational risk, strategic risk, cyber-security risk, and reputation risk |

| |

| | Monitors the Company’s enterprise governance, risk management and compliance (“EGRC”) program, including development and implementation of risk management processes in the area of vendor management, data loss prevention, business continuity, policy management and testing and assessment of operational controls |

| |

| |

| |

| | Ensures compliance with regulations pertaining to capital structure and levels |

| |

18 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Identification and Evaluation of Director Candidates

The Corporate Governance/Nominating Committee is responsible for identifying and recommending to the Board of Directors candidates for Board membership. For purposes of identifying nominees, the Corporate Governance/Nominating Committee may rely on professional networks and contacts of the committee members and other members of the Board of Directors, outside search firms, and its knowledge of members of the communities served by the Company and its subsidiaries. The Corporate Governance/Nominating Committee will also consider director candidates recommended by shareholders in accordance with the policy and procedures set forth below. From time to time the Corporate Governance/Nominating Committee may also use an independent search firm to identify potential nominees.

In evaluating potential nominees, the Corporate Governance/Nominating Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under certain criteria, which are described below under “Director Eligibility Requirements.” If an individual fulfills these criteria, the Corporate Governance/Nominating Committee will conduct a background check and interview the candidate to further assess the qualities of the prospective nominee and the contributions they would make to the Board.

Criteria for Nomination to the Board of Directors

The Corporate Governance/Nominating Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. A candidate must meet the eligibility requirements set forth in the Company’s bylaws, including a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

If the candidate is deemed eligible and qualified for election to the Board of Directors, the Corporate Governance/Nominating Committee will then evaluate the following criteria in selecting nominees:

• financial, regulatory, and business experience;

• expertise in areas that the board considers important to advancing the company’s strategies;

• in most cases, familiarity with and participation in the local communities;

• integrity, honesty, and reputation in connection with upholding a position of trust with respect to customers;

• dedication to the Company and its shareholders; and

• independence.

The Committee will consider a candidate’s background, training, leadership ability and related skills across a broad spectrum of business, professional, entrepreneurial, educational and creative endeavors, as well as technical skills, experience and know-how in fields and professions outside the financial services industry (such as, by way of example, but without limitation, cyber-security, information technology and management, marketing, business and human capital development) that may assist the Company in strengthening, protecting or promoting its business. The Committee also will consider any other factors the Corporate Governance/Nominating Committee deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations. We do not maintain a specific diversity policy, but diversity is considered in our review of candidates. Diversity is considered in terms of how a candidate’s background, experience, qualifications, attributes, and skills may complement, supplement or duplicate those of the Board.

With respect to nominating an existing director for re-election to the Board of Directors, the Corporate Governance/Nominating Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; the experience, skills, and contributions that the existing director brings to the Board; and independence.

19 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Director Eligibility Requirements:

•No person shall be eligible for election or appointment to the Board of Directors: (i) if such person has, within the previous ten years, been the subject of supervisory action by a financial regulatory agency that resulted in a cease and desist order or an agreement or other written statement subject to public disclosure under 12 U.S.C. 1818(u), or any successor provision; (ii) if such person has been convicted of a crime involving dishonesty or breach of trust which is punishable by imprisonment for a term exceeding one year under state or federal law; or (iii) if such person is currently charged in any information, indictment, or other complaint with the commission of or participation in such a crime.

•No person shall be eligible for election or appointment to the Board of Directors if such person is the nominee or representative of a company, as that term is defined in Section 10 of the Home Owners’ Loan Act or any successor provision, of which any director, partner, trustee or shareholder controlling more than 10% of any class of voting stock would not be eligible for election or appointment to the Board of Directors.

•No person may serve on the Board of Directors and at the same time be a director of more than two other public companies, or their subsidiaries.

•No person shall be eligible for election to the Board of Directors if such person is the nominee or representative of a person or group, or of a group acting in concert (as defined in 12 C.F.R Section 303.81(b)), that includes a person who is ineligible for election to the Board of Directors.

•The Board of Directors shall have the power to construe and apply the provisions of the Company’s bylaws and other governance documents, and to make all determinations necessary or desirable to implement such provisions, including but not limited to determinations as to whether a person is a nominee or representative of a person, a company or a group, whether a person or company is included in a group, and whether a person is the nominee or representative of a group acting in concert.

•Pursuant to our Corporate Governance Policy, individuals first appointed or elected to the Board of Directors on or after January 1, 2019 will no longer be eligible for re-election to the Board of Directors after their 75th birthday or the completion of their 12th year of service on the Board. For Directors serving before January 1, 2019, who have surpassed or are approaching either or both of these age and service time limits, the Chairperson of the Board and the Corporate Governance/Nominating Committee shall work with any such Board members approaching mandatory retirement to ensure that timing issues are given due consideration and an appropriate transition and renewal of the Board occurs.

Consideration of Recommendations by Shareholders. It is the policy of the Corporate Governance/ Nominating Committee of the Board of Directors of the Company to consider director candidates recommended by shareholders who appear to be qualified to serve on the Company’s Board of Directors. The Corporate Governance/Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Corporate Governance/ Nominating Committee does not perceive a need to increase the size of the Board of Directors. Recommended candidates will generally be considered along with other potential nominees as part of the Board’s annual review process. To avoid the unnecessary use of the Corporate Governance/Nominating Committee’s resources, the Corporate Governance/Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

20 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Procedures to be Followed by Shareholders. To submit a recommendation of a director candidate to the Corporate Governance/Nominating Committee, a shareholder must submit the following information in writing, addressed to the Chairman of the Corporate Governance/Nominating Committee, care of the Corporate Secretary, at 60 State Street, Boston, Massachusetts 02109:

1. The name of the person recommended as a director candidate;

2. All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934;

3. The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected;

4. As to the shareholder making the recommendation, the name and address of such shareholder as it appears on the Company’s books; provided, however, that if the shareholder is not a registered holder of the Company’s common stock, the shareholder should submit their name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and

5. A statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person.

In order for a director candidate to be considered for nomination at the Company’s Annual Meeting of Shareholders, the recommendation must be received by the Corporate Governance/Nominating Committee at least 120 calendar days before the date the Company’s proxy statement was released to shareholders in connection with the previous year’s Annual Meeting, advanced by one year. The Company has not received any recommendations from shareholders for director candidates to be considered for election at the Company’s 2024 Annual Meeting of Shareholders.

Board Risk Oversight

The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, both as a whole board and through its committees. At least annually, the Board reviews strategic risks and opportunities facing the company and certain of its businesses. Other important categories of risk are assigned to designated Board committees that report back to the full Board. In general, the committees oversee the following risks:

| | | | | | | | |

| Audit Committee | | Accounting and Financial Reporting |

| Compliance with Legal and Regulatory Requirements Related to Accounting and Financial Reporting |

| Compensation Committee | | Compensation Programs |

| Corporate Governance/ Nominating Committee | | Governance Policies and Procedures |

| Board Organization and Membership |

| Committee Membership and Periodic Rotation of Chairpersons |

| Corporate Responsibility & Culture Committee | | Customer, Community, and Employee Engagement |

| Reputational Risk and Business Development |

| Talent and Culture Development |

| Environmental Sustainability, Including Climate Risk |

Risk Management, Capital & Compliance Committee | | Credit Risk |

| Interest Rate Risk |

| Liquidity and Capital Risk |

| Operational and Strategic Risk |

| Cyber-security |

| | Legal, Regulatory, and Compliance Risk |

| Information Security |

21 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | CORPORATE GOVERNANCE

Code of Business Conduct and Anonymous (Whistleblower) Reporting Line Policy

The Company has adopted a Code of Business Conduct that is designed to promote the highest standards of ethical conduct by the Company’s directors, executive officers and employees. The Code of Business Conduct, sets forth the ethical rules and standards ("code of ethics") by which all employees, officers and directors of the Company and its subsidiaries must conduct themselves, and addresses, among other things, conflicts of interest, the treatment of confidential information, general employee conduct and compliance with applicable laws, rules and regulations. The Code of Business Conduct, which also strictly prohibits harassment of any kind in the workplace, is designed to deter wrongdoing and promote honest and ethical conduct, the avoidance of conflicts of interest, a zero tolerance culture and safe environment free from harassment of any kind, full and accurate disclosure and compliance with all applicable laws, rules and regulations.

Paired with the Code of Business Conduct, the Company has also adopted a related Whistleblower Reporting Line Policy,under which the Audit Committee maintains and monitors an anonymous “whistleblower” reporting hotline service that all Berkshire personnel are encouraged to use for reporting actual or potential wrongdoing, apparent or suspected violations of the Code of Business Conduct, or other misconduct by any corporate actors. Both the Code of Business Conduct and the Whistleblower Reporting Line Policy are reviewed and acknowledged annually by all of Berkshire’s directors, officers and employees, and both are written and implemented to ensure that no retaliation is permitted against any Company personnel who report an incident of harassment or any other misconduct in good faith. Copies of the Company’s Code of Business Conduct and Whistleblower Reporting Line (Whistleblower Reporting Line) Policy are available at the Company’s investor relations website (ir.berkshirebank.com).

Anti-Hedging and Pledging Restriction Policy

The Company has adopted a policy that prohibits hedging of Company common stock for all officers of the Company with the title of vice president or higher, all directors, and all persons in the accounting, executive, finance and legal departments (the “Restricted Group”). While there is no prohibition against employees who are not in the Restricted Group to hedge Company common stock, these employees are prohibited from trading Company common stock while in the possession of material non-public information. Under the policy, no person in the Restricted Group may at any time engage in (i) any short sale of Company common stock or other sale of any equity securities of the Company that they do not own, or (ii) any transactions in publicly-traded options, such as puts, calls and other derivative securities based on Company common stock, including, but not limited to, any hedging, monetization or similar transactions designed to decrease the risks associated with holding Company common stock, such as zero-cost collars and forward sales contracts. Generally, a short sale means any transaction whereby one may benefit from a decline in the Company's stock price. In addition, employees, officers and directors are discouraged from pledging Company common stock as collateral for margin purchases or a loan. However, exceptions to this pledging limitation may be granted, if good cause is shown.

22 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS | DIRECTOR COMPENSATION

Director Compensation

The Company uses a combination of cash and restricted stock to attract and retain qualified candidates to serve on the Board. Restricted stock grants are intended to align directors’ interests with those of the Company’s shareholders. The Compensation and Corporate Governance/Nominating Committees review director compensation and benefits annually and make recommendations to the Board. The following table provides the compensation received by individuals who served as directors of the Company during the 2023 fiscal year. Mr. Mhatre does not receive separate compensation for his service on the Board.

| | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(1)(2) | Option Awards

($) | All Other Compensation ($)(3) | Total

($) |

| Baye Adofo-Wilson | 60,000 | | 65,000 | | — | | 3,281 | | 128,281 | |

David M. Brunelle(4) | 125,000 | | 65,000 | | — | | 3,412 | | 193,412 | |

Mary Anne Callahan | 16,877 | | 19,500 | | — | | — | | 36,377 | |

| Nina A. Charnley | 68,000 | | 65,000 | | — | | 1,446 | | 134,446 | |

John B. Davies(5) | 31,000 | | 65,000 | | — | | 3,281 | | 99,281 | |

| Mihir A. Desai | 56,000 | | 65,000 | | — | | 633 | | 121,633 | |

| William H. Hughes III | 56,000 | | 65,000 | | — | | 3,281 | | 124,281 | |

| Jeffrey W. Kip | 63,000 | | 65,000 | | — | | 469 | | 128,469 | |

| Sylvia Maxfield | 81,000 | | 65,000 | | — | | 2,862 | | 148,862 | |

| Laurie Norton Moffatt | 62,000 | | 65,000 | | — | | 3,281 | | 130,281 | |

| Karyn Polito | 50,707 | | 59,150 | | — | | — | | 109,857 | |

| Eric S. Rosengren | 48,195 | | 48,239 | | — | | — | | 96,434 | |