UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended: December 31 , 2020

For the transition period from to

Commission File Number: 001-15781

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Registrant’s telephone number, including area code: (617 ) 641-9206 ,

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered | ||||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý

No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one)

| Large Accelerated Filer | o | x | ||||||||||||

| Non-Accelerated Filer | o | Smaller Reporting Company | ||||||||||||

| Emerging Growth Company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15

U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $548 million, based upon the closing price of $11.02 as quoted on the New York Stock Exchange as of the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares outstanding of the registrant’s common stock as of February 25, 2021 was 51,035,606 .

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the 2021 Annual Meeting of Shareholders are incorporated by reference in Part III of this Form 10-K.

INDEX

2

| TABLE INDEX | |||||||||||

ITEM 1 TABLE 1 — LOAN PORTFOLIO ANALYSIS | |||||||||||

ITEM 1 TABLE 3 — PROBLEM ASSETS | |||||||||||

3

PART I

ITEM 1. BUSINESS

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document that are not historical facts may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (referred to as the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (referred to as the Securities Exchange Act), and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these statements from the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions.

These forward-looking statements are subject to significant risks, assumptions and uncertainties, including among other things, changes in general economic and business conditions, increased competitive pressures, changes in the interest rate environment, legislative and regulatory change, changes in the financial markets, and other risks and uncertainties disclosed from time to time in documents that Berkshire Hills Bancorp files with the Securities and Exchange Commission, including the Risk Factors in Item 1A of this report.

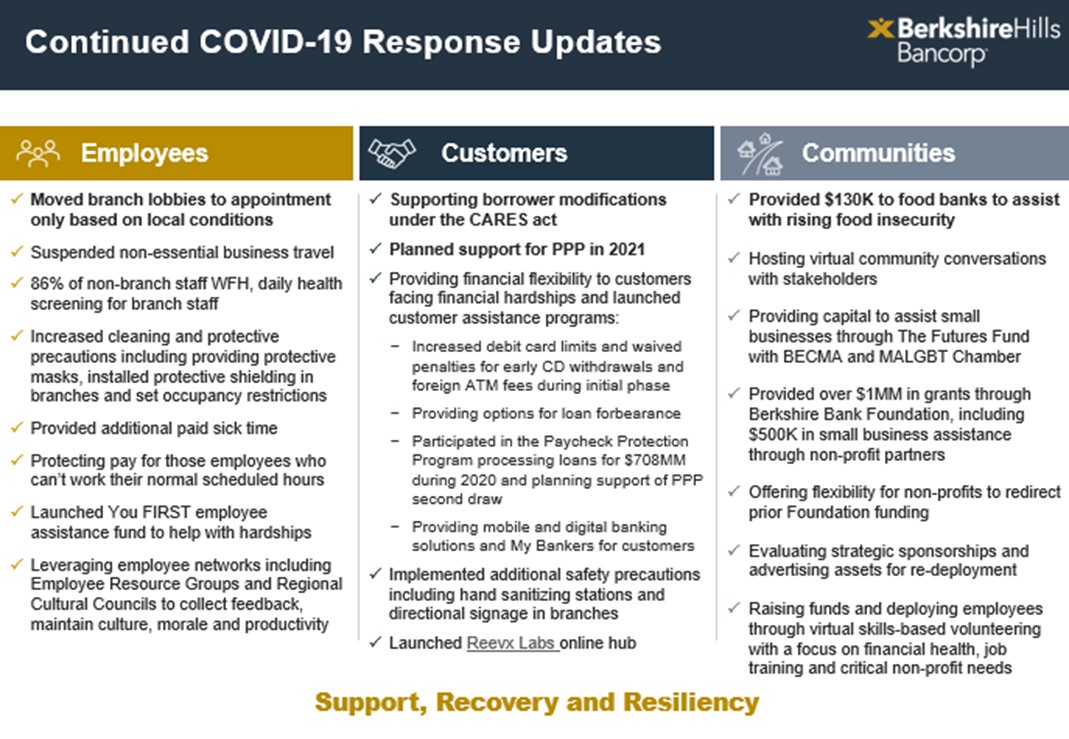

Further, the ongoing COVID-19 pandemic and the related local and national economic disruption may result in a continued decline in demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; an increase in our allowance for loan losses; a decline in the value of loan collateral, including real estate; a greater decline in the yield on our interest-earning assets than the decline in the cost of our interest-bearing liabilities; and increased cybersecurity risks, as employees continue to work remotely.

Because of these and other uncertainties, Berkshire’s actual results, performance or achievements, or industry results, may be materially different from the results indicated by these forward-looking statements. In addition, Berkshire’s past results of operations do not necessarily indicate Berkshire’s combined future results. You should not place undue reliance on any of the forward-looking statements, which speak only as of the dates on which they were made. Berkshire is not undertaking an obligation to update forward-looking statements, even though its situation may change in the future, except as required under federal securities law. Berkshire qualifies all of its forward-looking statements by these cautionary statements.

GENERAL

Berkshire Hills Bancorp, Inc. (“Berkshire” or “the Company”) is headquartered in Boston, Massachusetts. Berkshire is a Delaware corporation and the holding company for Berkshire Bank (“the Bank”) and Berkshire Insurance Group, Inc.

At year-end 2020, the Bank had 130 full-service banking offices in its New England, New York, and Mid-Atlantic footprint. The Bank has an agreement to sell its 8 Mid-Atlantic branches and has announced a plan to consolidate another 16 offices in its New England/New York footprint. The actions are targeted to be completed by mid-year 2021, and the Bank has a target of 106 branches as a result of these actions. The Company offers a wide range of deposit, lending, insurance, and wealth management products to retail and commercial customers in its market areas. The Bank also operates a socially responsible platform, Reevx LabsTM , to support emerging entrepreneurs, artists, and small non-profit organizations by providing them with the resources and connections needed to power them today and far into the 21st century.

FILINGS

Information regarding the Company is available through the Investor Relations tab at berkshirebank.com. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge at sec.gov and at berkshirebank.com under the Investor Relations tab. Information on the website is not incorporated by reference and is not a part of this annual report on Form 10-K.

4

COMPETITION

The Company is subject to strong competition from banks and other financial institutions and financial service providers. Its competition includes national and super-regional banks. Non-bank competitors include credit unions, brokerage firms, insurance providers, financial planners, and the mutual fund industry. New technology is reshaping customer interaction with financial service providers and the increase of internet-accessible financial institutions increases competition for the Company’s customers. The Company generally competes on the basis of customer service, relationship management, and the fair pricing of loan and deposit products and wealth management and insurance services. The location and convenience of branch offices is also a significant competitive factor, particularly regarding new offices. The Company does not rely on any individual, group, or entity for a material portion of its deposits.

LENDING ACTIVITIES

General. The Bank originates loans in the four basic portfolio categories discussed below. Lending activities are limited by federal and state laws and regulations. Loan interest rates and other key loan terms are affected principally by the Bank’s credit policy, asset/liability strategy, loan demand, competition, and the supply of money available for lending purposes. These factors, in turn, are affected by general and economic conditions, monetary policies of the federal government, including the Federal Reserve, legislative tax policies, and governmental budgetary matters. Most of the Bank’s loans held for investment are made in its market areas and are secured by real estate located in its market areas. Lending is therefore affected by activity in these real estate markets. The Bank does not engage in subprime lending activities. The Bank monitors and manages the amount of long-term fixed-rate lending volume. Adjustable-rate loan products generally reduce interest rate risk but may produce higher loan losses in the event of sustained rate increases. The Bank generally originates loans for investment except for residential mortgages, which are generally originated for sale on a servicing released basis. Additionally, the Bank also originates Small Business Administration ("SBA") 7A loans for sale to investors. The Bank also conducts wholesale purchases and sales of loans and loan participations generally with other banks doing business in its markets, including selected national banks. The information discussed below describes the Company’s ongoing lending activities. The COVID-19 pandemic conditions that affected the Company’s activities in 2020 are discussed in Management’s Discussion and Analysis in Item 7 of this report.

Loan Portfolio Analysis. The following table sets forth the year-end composition of the Bank’s loan portfolio in dollar amounts and as a percentage of the portfolio at the dates indicated. Further information about the composition of the loan portfolio is contained in Note 6 - Loans of the Consolidated Financial Statements.

Item 1 - Table 1 - Loan Portfolio Analysis

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||||||

| (In millions) | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||||||||||||

| Loans: | ||||||||||||||||||||||||||||||||

| Construction | $ | 455 | 5.6 | % | $ | 449 | 4.7 | % | $ | 371 | 4.1 | % | $ | 385 | 4.6 | % | $ | 351 | 5.4 | % | ||||||||||||

| Commercial multifamily | 483 | 6.0 | 632 | 6.7 | 552 | 6.1 | 495 | 6.0 | 349 | 5.3 | ||||||||||||||||||||||

| Commercial real estate owner occupied | 552 | 6.8 | 673 | 7.1 | 562 | 6.2 | 646 | 7.8 | 595 | 9.1 | ||||||||||||||||||||||

| Commercial real estate non-owner occupied | 2,119 | 26.2 | 2,190 | 23.0 | 1,849 | 20.4 | 1,700 | 20.5 | 1,253 | 19.1 | ||||||||||||||||||||||

| Commercial and industrial | 1,943 | 24.0 | 1,844 | 19.4 | 1,954 | 21.6 | 1,740 | 21.0 | 1,044 | 15.9 | ||||||||||||||||||||||

| Residential real estate | 1,932 | 23.9 | 2,853 | 30.0 | 2,727 | 30.2 | 2,264 | 27.3 | 2,047 | 31.3 | ||||||||||||||||||||||

| Home equity | 294 | 3.7 | 379 | 4.0 | 377 | 4.2 | 409 | 4.9 | 362 | 5.5 | ||||||||||||||||||||||

| Consumer other | 303 | 3.8 | 483 | 5.1 | 651 | 7.2 | 660 | 7.9 | 549 | 8.4 | ||||||||||||||||||||||

| Total | $ | 8,081 | 100.0 | % | $ | 9,503 | 100.0 | % | $ | 9,043 | 100.0 | % | $ | 8,299 | 100.0 | % | $ | 6,550 | 100.0 | % | ||||||||||||

Allowance for credit losses (1) | (127) | (64) | (61) | (52) | (44) | |||||||||||||||||||||||||||

| Net loans | $ | 7,954 | $ | 9,439 | $ | 8,982 | $ | 8,247 | $ | 6,506 | ||||||||||||||||||||||

(1) Beginning January 1, 2020, the allowance calculation is based on current expected loss methodology. Prior to January 1, 2020, the allowance calculation was based on the incurred loss model.

5

Commercial Real Estate. The Bank originates commercial real estate loans on properties used for business purposes such as small office buildings, industrial, healthcare, lodging, recreation, or retail facilities. Commercial real estate loans are provided on owner-occupied properties and on investor-owned properties. The portfolio includes commercial 1-4 family and multifamily properties. Loans may generally be made with amortizations of up to 30 years and with interest rates that adjust periodically (primarily from short-term to five years). Most commercial real estate loans are originated with final maturities of 10 years or less. As part of its business activities, the Bank also enters into commercial loan participations.

Commercial real estate loans are among the largest of the Bank’s loans, and may have higher credit risk and lending spreads. Because repayment is often dependent on the successful operation or management of the properties, repayment of commercial real estate loans may be affected by adverse conditions in the real estate market or the economy. The Bank seeks to manage these risks through its underwriting disciplines and portfolio management processes. The Bank generally requires that borrowers have debt service coverage ratios (the ratio of available cash flows before debt service to debt service) of at least 1.25 times based on stabilized cash flows of leases in place, with some exceptions for national credit tenants. For variable rate loans, the Bank underwrites debt service coverage to interest rate shocks of 300 basis points or higher based on a minimum of 1.0 times coverage and it uses loan maturities to manage risk based on the lease base and interest sensitivity. Loans at origination may be made up to 80% of appraised value based on property type and risk, with sublimits of 75% or less for designated specialty property types. Generally, commercial real estate loans are supported by full or partial personal guarantees by the principals. Credit enhancements in the form of additional collateral or guarantees are normally considered for start-up businesses without a qualifying cash flow history.

The Bank offers interest rate swaps to certain larger commercial mortgage borrowers. These swaps allow the Bank to originate a mortgage based on short-term LIBOR rates and allow the borrower to swap into a longer-term fixed rate. The Bank simultaneously sells an offsetting back-to-back swap to an investment grade national bank so that it does not retain this fixed-rate risk. The Bank also records fee income on these interest rate swaps based on the terms of the offsetting swaps with the bank counterparties.

The Bank originates construction loans to developers and commercial borrowers in and around its markets. The maximum loan to value limits for construction loans follow Federal Deposit Insurance Corporation ("FDIC") supervisory limits, up to a maximum of 85 percent. The Bank commits to provide the permanent mortgage financing on most of its construction loans on income-producing property. Advances on construction loans are made in accordance with a schedule reflecting the cost of the improvements. Construction loans include land acquisition loans up to a maximum 50 percent loan to value on raw land. Construction loans may have greater credit risk due to the dependence on completion of construction and other real estate improvements, as well as the sale or rental of the improved property. The Bank generally mitigates these risks with presale or preleasing requirements and phasing of construction.

Commercial and Industrial Loans ("C&I"). C&I loans are managed through the Bank’s commercial middle market banking organization. The Bank offers secured commercial term loans with repayment terms which are normally limited to the expected useful life of the asset being financed, and generally not exceeding ten years. The Bank also offers revolving loans, lines of credit, letters of credit, time notes and SBA guaranteed loans. Business lines of credit have adjustable rates of interest and can be committed or are payable on demand, subject to annual review and renewal. Commercial and industrial loans are generally secured by a variety of collateral such as accounts receivable, inventory and equipment, and are generally supported by personal guarantees. Loan-to-value ratios depend on the collateral type and generally do not exceed 80 percent of orderly liquidation value. Some commercial loans may also be secured by liens on real estate. The Bank generally does not make unsecured commercial loans. Commercial loans are of higher risk and are made primarily on the basis of the borrower’s ability to make repayment from the cash flows of its business. Further, any collateral securing such loans may depreciate over time, may be difficult to monitor and appraise and may fluctuate in value. The Bank gives additional consideration to the borrower’s credit history and the guarantor’s capacity to help mitigate these risks. Additionally, the Bank uses loan structures including shorter terms, amortizations, and advance rate limitations to additionally mitigate credit risk. The Company considers these loans, together with its owner-occupied commercial real estate loans, as constituting the primary relationship based component of its commercial lending activities. The loans

6

originated through the Company’s participation in the SBA’s Paycheck Protection Program (“PPP”) lending program in 2020 were classified as C&I loans. These loans were viewed as zero credit risk due to the related SBA guarantee.

Asset Based Lending. The Asset Based Lending Group serves the commercial middle market in New England, as well as the Bank’s market in northeastern New York and in the Mid-Atlantic. The group expands the Bank’s business lending offerings to include revolving lines of credit and term loans secured by accounts receivable, inventory, and other assets to manufacturers, distributors and select service companies experiencing seasonal working capital needs, rapid sales growth, a turnaround, buyout or recapitalization with credit needs generally ranging from $2 to $25 million. Asset based lending involves monitoring loan collateral so that outstanding balances are always properly secured by business assets, which reduces the risks associated with these loans.

Small Business Banking. This group is also referred to as Business Banking, and handles most business relationships which are smaller than the middle market category. Additionally, some smaller business needs are handled through the Bank’s retail branch system. Berkshire Bank also owns 44 Business Capital, a dedicated SBA 7A program lending team based in the Philadelphia area. This team originates loans in the Northeast, Mid-Atlantic and nationally. 44 Business Capital also works with business banking and small business teams to provide SBA guaranteed loans to business Banking Customers in Berkshire’s footprint. This team sells the guaranteed portions of these loans with servicing retained and the Bank retains the unguaranteed portions of the loans. The Bank is a preferred SBA lender and closely manages the servicing portfolio pursuant to SBA requirements. This team is the Bank’s largest source of commercial lending fee revenue, and it is targeting to further expand these operations. Berkshire Bank also owns Firestone Financial Corp. ("Firestone"), which is located in Needham, MA. Firestone originates loans secured by business-essential equipment through over 160 equipment distributors and manufacturers and directly via the end borrower in all 50 states. Key customer segments include the fitness, carnival, gaming, and entertainment industries.

Residential Mortgages. Through its mortgage banking operations, the Bank offers fixed-rate and adjustable-rate residential mortgage loans to individuals with maturities of up to 30 years that are fully amortizing with monthly loan payments. The majority of loans are originated for sale with rate lock commitments which are recorded as derivative financial instruments. Mortgages are generally underwritten according to U.S. government sponsored enterprise guidelines designated as “A” or “A-” and referred to as “conforming loans”. The Bank also originates jumbo loans above conforming loan amounts which generally are consistent with secondary market guidelines for these loans and are often held in portfolio. The Bank does not offer subprime mortgage lending programs. The Bank buys and sells seasoned mortgages primarily with smaller financial institutions operating in its markets.

The majority of the Bank’s secondary marketing is to U.S. secondary market investors on a servicing-released basis. The Bank also sells directly to government sponsored enterprises with servicing retained. Mortgage sales generally involve customary representations and warranties and are nonrecourse in the event of borrower default. The Bank is also an approved originator of loans for sale to the Federal Housing Administration (“FHA”), U.S. Department of Veteran Affairs (“VA”), state housing agency programs, and other government sponsored mortgage programs.

The Bank does not offer interest-only or negative amortization mortgage loans. Adjustable rate mortgage loan interest rates may rise as interest rates rise, thereby increasing the potential for default. The Bank also originates construction loans which generally provide 15-month construction periods followed by a permanent mortgage loan, and follow the Bank’s normal mortgage underwriting guidelines. Mortgage banking also requires flexible and scalable operations due to the volatility of mortgage demand over time. Investor management is integral to maintaining the secondary market support that is required for these operations.

Consumer Loans. The Bank’s consumer loans are centrally underwritten and processed by its experienced consumer lending team based in Syracuse, New York. The Bank’s primary consumer lending activity in recent years has been indirect auto lending. In 2019, the Company decided to end the origination of indirect auto loans. This decision reflects the Company’s heightened emphasis on community banking in its local markets. The Bank’s other major consumer lending activity is prime home equity lending, following its conforming mortgage underwriting guidelines with more streamlined verifications and documentation. Most of these outstanding loans are

7

prime based home equity lines with a maximum combined loan-to-value of 85 percent. Home equity line credit risks include the risk that higher interest rates will affect repayment and possible compression of collateral coverage on second lien home equity lines.

Maturity and Sensitivity of Loan Portfolio. The following table shows contractual final maturities of loans at year-end 2020. The contractual maturities do not reflect premiums, discounts, deferred costs, or prepayments.

Item 1 - Table 2A - Loan Contractual Maturity - Scheduled loan amortizations are not included in the maturities presented.

| Contractual Maturity | One Year | One to | More Than | |||||||||||||||||||||||

| (In thousands) | or Less | Five Years | Five Years | Total | ||||||||||||||||||||||

| Loans: | ||||||||||||||||||||||||||

| Construction | $ | 80,625 | $ | 206,398 | $ | 167,490 | $ | 454,513 | ||||||||||||||||||

| Commercial multifamily | 32,296 | 191,876 | 259,178 | 483,350 | ||||||||||||||||||||||

| Commercial real estate owner occupied | 49,176 | 171,991 | 331,246 | 552,413 | ||||||||||||||||||||||

| Commercial real estate non-owner occupied | 187,556 | 1,062,087 | 869,620 | 2,119,263 | ||||||||||||||||||||||

| Commercial and industrial | 218,898 | 1,404,958 | 319,308 | 1,943,164 | ||||||||||||||||||||||

| Residential real estate | 12,308 | 37,218 | 1,882,155 | 1,931,681 | ||||||||||||||||||||||

| Home equity | 3,207 | 6,077 | 284,697 | 293,981 | ||||||||||||||||||||||

| Consumer other | 10,022 | 229,877 | 63,255 | 303,154 | ||||||||||||||||||||||

| Total | $ | 594,088 | $ | 3,310,482 | $ | 4,176,949 | $ | 8,081,519 | ||||||||||||||||||

Item 1 - Table 2B - Total loans due after one year - fixed and variable interest rates

| (In thousands) | Fixed Interest Rate | Variable Interest Rate | Total | |||||||||||||||||

| Loans: | ||||||||||||||||||||

| Construction | $ | 2,969 | $ | 370,919 | $ | 373,888 | ||||||||||||||

| Commercial multifamily | 135,881 | 315,173 | 451,054 | |||||||||||||||||

| Commercial real estate owner occupied | 165,731 | 337,506 | 503,237 | |||||||||||||||||

| Commercial real estate non-owner occupied | 600,778 | 1,330,929 | 1,931,707 | |||||||||||||||||

| Commercial and industrial | 1,042,474 | 681,792 | 1,724,266 | |||||||||||||||||

| Residential real estate | 1,450,034 | 469,339 | 1,919,373 | |||||||||||||||||

| Home equity | 6,100 | 284,674 | 290,774 | |||||||||||||||||

| Consumer other | 288,582 | 4,550 | 293,132 | |||||||||||||||||

| Total | $ | 3,692,549 | $ | 3,794,882 | $ | 7,487,431 | ||||||||||||||

Loan Administration. Lending activities are governed by a loan policy approved by the Board’s Risk Management and Capital Committee. Internal staff perform and monitor post-closing loan documentation review, quality control, and commercial loan administration. The lending staff assigns a risk rating to all commercial loans, excluding point scored small business loans. Management primarily relies on internal risk management staff to review the risk ratings of the majority of commercial loan balances.

The Bank’s lending activities follow written, non-discriminatory underwriting standards and loan origination procedures established by the Risk Management and Capital Committee and Management, under the leadership of the Chief Risk Officer. The Bank’s loan underwriting is based on a review of certain factors including risk ratings, recourse, loan-to-value ratios, and material policy exceptions. The Risk Management and Capital Committee has established individual and combined loan limits and lending approval authorities. Management’s Executive Loan Committee is responsible for commercial loan approvals in accordance with these standards and procedures. Generally, pass rated secured commercial loans can be approved jointly up to $7 million by the regional lending manager and regional credit officer. Loans up to $10 million can be approved with the additional signature of the Chief Credit Officer. Loans in excess of this amount, and designated lower rated loans are approved by the

8

Executive Loan Committee. The Bank tracks loan underwriting exceptions and exception reports are actively monitored by executive lending management.

The Bank’s lending activities are conducted by its salaried and commissioned loan personnel. Designated salaried branch staff originate conforming residential mortgages and receive bonuses based on overall performance. Additionally, the Bank employs commissioned residential mortgage originators. Commercial lenders receive salaries and are eligible for bonuses based on individual and overall performance. The Bank purchases whole loans and participations in loans from banks headquartered in its market and from outside of its market. These loans are underwritten according to the Bank’s underwriting criteria and procedures and are generally serviced by the originating lender under terms of the applicable agreement. The Bank routinely sells newly originated, fixed-rate residential mortgages in the secondary market. Customer rate locks are offered without charge and rate locked applications are generally committed for forward sale or hedged with derivative financial instruments to minimize interest rate risk pending delivery of the loans to the investors. The Bank also sells interest rate derivatives to larger commercial borrowers desiring to fix their interest rates, and includes these derivatives in its underwriting and administrative procedures.

The Bank also sells residential mortgages and commercial loan participations on a non-recourse basis. The Bank issues loan commitments to its prospective borrowers conditioned on the occurrence of certain events. Loan origination commitments are made in writing on specified terms and conditions and are generally honored for up to 60 days from approval; some commercial commitments are made for longer terms. The Company also monitors pipelines of loan applications and has processes for issuing letters of interest for commercial loans and pre-approvals for residential mortgages, all of which are generally conditional on completion of underwriting prior to the issuance of formal commitments.

The loan policy sets certain limits on concentrations of credit and requires periodic reporting of concentrations to the Risk Management and Capital Committee. The Bank has heightened monitoring of its 25 largest borrower relationships. Commercial real estate is generally managed within federal regulatory monitoring guidelines of 300% of risk based capital for non-owner occupied commercial real estate and 100% for construction loans. The Bank has hold limits for numerous categories of commercial specialty lending including healthcare, hospitality, designated franchises, and leasing, as well as hold limits for designated commercial loan participations purchased. In most cases, these limits are below 100% of risk based capital for all outstanding loans in each monitored category.

9

Problem Assets. The Bank prefers to work with borrowers to resolve problems rather than proceeding to foreclosure. For commercial loans, this may result in a period of forbearance or restructuring of the loan, which is normally done at current market terms and does not result in a “troubled” loan designation. For residential mortgage loans, the Bank generally follows FDIC guidelines to attempt a restructuring that will enable owner-occupants to remain in their home. However, if these processes fail to result in a performing loan, then the Bank generally will initiate foreclosure or other proceedings no later than the 90th day of a delinquency, as necessary, to minimize any potential loss. Management reports delinquent loans and non-performing assets to the Board quarterly. Loans are generally removed from accruing status when they reach 90 days delinquent, except for certain loans which are well secured and in the process of collection. Loan collections are managed by a combination of the related business units and the Bank’s special assets group, which focuses on larger, riskier collections and the recovery of purchased credit deteriorated loans.

Real estate obtained by the Bank as a result of loan collections, including foreclosures, is classified as real estate owned until sold. When property is acquired it is recorded at fair market value less estimated selling costs at the date of foreclosure, establishing a new cost basis. Holding costs and decreases in fair value after acquisition are expensed. Interest income that would have been recorded for 2020, if non-accruing loans had been current

according to their original terms, amounted to $6.8 million. Included in the amount is $64 thousand related to

troubled debt restructurings. The amount of interest income on those loans that was recognized in net income in

2020 was $4.8 million. Included in this amount is $27 thousand related to troubled debt restructurings. Interest

income on accruing troubled debt restructurings totaled $1.1 million for 2020. The total carrying value of

troubled debt restructurings was $20.5 million at year-end.

Item 1 - Table 3 - Problem Assets

| (In thousands) | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||||

| Non-accruing loans: | ||||||||||||||||||||||||||||||||

| Construction | $ | — | $ | — | $ | 150 | $ | 159 | $ | — | ||||||||||||||||||||||

| Commercial multifamily | 757 | 811 | 474 | 263 | 363 | |||||||||||||||||||||||||||

| Commercial real estate owner occupied | 4,509 | 15,389 | 16,555 | 3,747 | 2,841 | |||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 29,572 | 1,031 | 2,056 | 2,023 | 2,136 | |||||||||||||||||||||||||||

| Commercial and industrial | 12,441 | 11,218 | 6,003 | 7,314 | 7,523 | |||||||||||||||||||||||||||

| Residential real estate | 9,711 | 6,411 | 3,394 | 4,062 | 4,468 | |||||||||||||||||||||||||||

| Home equity | 2,654 | 1,798 | 1,662 | 3,645 | 3,192 | |||||||||||||||||||||||||||

| Consumer other | 5,304 | 2,982 | 2,131 | 1,686 | 1,717 | |||||||||||||||||||||||||||

| Total non-performing loans | $ | 64,948 | $ | 39,640 | $ | 32,425 | $ | 22,899 | $ | 22,240 | ||||||||||||||||||||||

| Other real estate owned | 149 | — | — | — | 151 | |||||||||||||||||||||||||||

| Repossessed assets | 1,932 | 858 | 1,209 | 1,147 | — | |||||||||||||||||||||||||||

| Total non-performing assets | $ | 67,029 | $ | 40,498 | $ | 33,634 | $ | 24,046 | $ | 22,391 | ||||||||||||||||||||||

| Total non-performing loans/total loans | 0.80 | % | 0.42 | % | 0.36 | % | 0.28 | % | 0.34 | % | ||||||||||||||||||||||

| Total non-performing assets/total assets | 0.52 | % | 0.31 | % | 0.28 | % | 0.21 | % | 0.24 | % | ||||||||||||||||||||||

Asset Classification and Delinquencies. The Bank performs an internal analysis of its commercial loan portfolio and assets to classify such loans and assets in a manner similar to that employed by federal banking regulators. There are four classifications for loans with higher than normal risk: Loss, Doubtful, Substandard, and Special Mention. Usually an asset classified as Loss is fully charged-off. Substandard assets have one or more defined weaknesses and are characterized by the distinct possibility that the insured institution will sustain some loss if the deficiencies are not corrected. Doubtful assets have the weaknesses of substandard assets with the additional characteristic that the weaknesses make collection or liquidation in full on the basis of currently existing facts, conditions, and values questionable, and there is a high possibility of loss. Assets that do not currently expose the insured institution to sufficient risk to warrant classification in one of the aforementioned categories, but possess weaknesses, are designated Special Mention. Please see the additional discussion of non-accruing and potential problem loans in Item 7 and additional information in notes to the financial statements. Impaired loans acquired in

10

business combinations are normally rated Substandard or lower and the fair value assigned to such loans at acquisition includes a component for the possibility of loss if deficiencies are not corrected.

Allowance for Credit Losses on Loans. The Bank’s loan portfolio is regularly reviewed by management to evaluate the adequacy of the allowance for loan losses. Prior to 2020, the allowance represented management’s estimate of inherent incurred losses that are probable and estimable as of the date of the financial statements. The allowance included a specific component for impaired loans (a “specific loan loss reserve”) and a general component for portfolios of all outstanding loans (a “general loan loss reserve”). At the time of acquisition, no allowance for loan losses was assigned to loans acquired in business combinations. These loans were initially recorded at fair value, including the impact of expected losses, as of the acquisition date. An allowance on such loans was established subsequent to the acquisition date through the provision for loan losses based on an analysis of factors including environmental factors.

On January 1, 2020, the Company adopted the new loan loss allowance standard based on Current Expected Credit losses (“CECL”). Under this standard, management makes estimates of future economic conditions over the life of the loan portfolio and other future conditions and arrives at a reasonable estimate of expected loan losses. The basis of the allowance changed from an incurred model to an expected model based on this standard. As a result, the amount of the loan loss allowance and the loan loss provision in 2020 is not comparable to prior years. Also, since different banks may use different estimates and arrive at different expectations, comparisons between banks are more difficult. Further, since the accounting is based on future projections our estimates may change significantly from period to period, the amounts of the allowance and provision may be more volatile than under the previous model. Further information about the allowance is discussed further in Note 1 - Summary of Significant Accounting Policies of the Consolidated Financial Statements.

Management believes that it uses the best information available to establish the allowance. However, future adjustments to the allowance for loan losses may be necessary, and results of operations could be adversely affected if circumstances differ substantially from the assumptions used in making its determinations. There can be no assurance that the existing allowance for loan losses is adequate or that increases will not be necessary should the quality of any loan or loan portfolio category deteriorate. Regulatory agencies may require the Bank to make additional provisions for credit losses based upon judgments different from those of management. Any material increase in the allowance may adversely affect the Bank’s financial condition and results of operations.

11

Item 1 - Table 4 - Allowance for Credit Losses

| (In thousands) | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||||

| Balance at beginning of year | $ | 63,575 | $ | 61,469 | $ | 51,834 | $ | 43,998 | $ | 39,308 | ||||||||||||||||||||||

| Impact of ASC 326 | 25,434 | — | — | — | — | |||||||||||||||||||||||||||

| Charged-off loans: | ||||||||||||||||||||||||||||||||

| Construction | $ | 834 | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| Commercial multifamily | 100 | 837 | 32 | 86 | 50 | |||||||||||||||||||||||||||

| Commercial real estate owner occupied | 8,686 | 5,342 | 4,441 | 1,041 | 841 | |||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 11,653 | 934 | 3,007 | 3,181 | 2,152 | |||||||||||||||||||||||||||

| Commercial and industrial | 19,328 | 24,370 | 4,795 | 4,219 | 5,714 | |||||||||||||||||||||||||||

| Residential real estate | 2,285 | 1,180 | 1,481 | 2,033 | 2,926 | |||||||||||||||||||||||||||

| Home equity | 347 | 742 | 1,103 | 1,112 | 498 | |||||||||||||||||||||||||||

| Consumer other | 2,562 | 3,149 | 3,152 | 2,912 | 1,845 | |||||||||||||||||||||||||||

| Total charged-off loans | 45,795 | 36,554 | 18,011 | 14,584 | 14,026 | |||||||||||||||||||||||||||

| Recoveries on charged-off loans: | ||||||||||||||||||||||||||||||||

| Construction | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| Commercial multifamily | 100 | — | 11 | 59 | 60 | |||||||||||||||||||||||||||

| Commercial real estate owner occupied | 1,053 | 160 | 68 | 109 | 211 | |||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 307 | 1,094 | 289 | 52 | 33 | |||||||||||||||||||||||||||

| Commercial and industrial | 4,285 | 1,425 | 874 | 432 | 386 | |||||||||||||||||||||||||||

| Residential real estate | 1,359 | 186 | 191 | 321 | 306 | |||||||||||||||||||||||||||

| Home equity | 292 | 47 | 307 | 15 | 10 | |||||||||||||||||||||||||||

| Consumer other | 609 | 329 | 455 | 407 | 348 | |||||||||||||||||||||||||||

| Total recoveries | 8,005 | 3,241 | 2,195 | 1,395 | 1,354 | |||||||||||||||||||||||||||

| Net loans charged-off | 37,790 | 33,313 | 15,816 | 13,189 | 12,672 | |||||||||||||||||||||||||||

| Provision for credit losses | 76,083 | 35,419 | 25,451 | 21,025 | 17,362 | |||||||||||||||||||||||||||

Balance at end of year (1) | $ | 127,302 | $ | 63,575 | $ | 61,469 | $ | 51,834 | $ | 43,998 | ||||||||||||||||||||||

| Ratios: | ||||||||||||||||||||||||||||||||

| Net charge-offs/average loans | 0.41 | % | 0.35 | % | 0.18 | % | 0.19 | % | 0.21 | % | ||||||||||||||||||||||

| Recoveries/charged-off loans | 17.48 | 8.87 | 12.19 | 9.57 | 9.65 | |||||||||||||||||||||||||||

| Net loans charged-off/allowance for credit losses | 29.69 | 52.40 | 25.73 | 25.44 | 28.80 | |||||||||||||||||||||||||||

| Non-accrual loans/total loans | 0.80 | 0.42 | 0.36 | 0.28 | 0.34 | |||||||||||||||||||||||||||

| Allowance for credit losses/total loans | 1.58 | 0.67 | 0.68 | 0.62 | 0.67 | |||||||||||||||||||||||||||

| Allowance for credit losses/non-accruing loans | 196.01 | 160.38 | 189.57 | 226.36 | 197.83 | |||||||||||||||||||||||||||

(1) Beginning January 1, 2020, the allowance calculation is based on current expected loss methodology. Prior to January 1, 2020, the allowance calculation was based on the incurred loss model.

12

The following tables present year-end data for the approximate allocation of the allowance for loan losses by loan categories at the dates indicated (including an apportionment of any unallocated amount). The first table shows for each category the amount of the allowance allocated to that category as a percentage of the outstanding loans in that category. The second table shows the allocated allowance together with the percentage of loans in each category to total loans. Management believes that the allowance can be allocated by category only on an approximate basis. The allocation of the allowance to each category is not indicative of future losses and does not restrict the use of any of the allowance to absorb losses in any category. Due to the impact of accounting standards for acquired loans, data in the accompanying tables may not be comparable between accounting periods.

Item 1 - Table 5A - Allocation of Allowance for Credit Losses by Category (as of year-end)

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Amount Allocated | Percent Allocated to Total Loans in Each Category | Amount Allocated | Percent Allocated to Total Loans in Each Category | Amount Allocated | Percent Allocated to Total Loans in Each Category | Amount Allocated | Percent Allocated to Total Loans in Each Category | Amount Allocated | Percent Allocated to Total Loans in Each Category | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction | $ | 5,111 | 1.1 | % | $ | 2,713 | 0.6 | % | $ | 2,030 | 0.6 | % | $ | 1,993 | 0.5 | % | $ | 2,104 | 0.6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Commercial multifamily | 5,916 | 1.2 | 4,413 | 0.7 | 4,312 | 0.8 | 3,389 | 0.7 | 2,790 | 0.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 12,380 | 2.2 | 4,880 | 0.7 | 5,083 | 0.9 | 4,847 | 0.8 | 4,865 | 0.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 35,850 | 1.7 | 16,344 | 0.8 | 12,940 | 0.7 | 10,000 | 0.6 | 8,690 | 0.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 25,013 | 1.3 | 20,099 | 1.1 | 17,558 | 0.9 | 14,975 | 0.9 | 10,597 | 1.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | 28,491 | 1.5 | 9,970 | 0.4 | 11,659 | 0.4 | 10,466 | 0.5 | 8,906 | 0.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 6,482 | 2.2 | 1,470 | 0.4 | 1,772 | 0.5 | 1,224 | 0.3 | 1,776 | 0.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer other | 8,059 | 2.7 | 3,686 | 0.8 | 6,115 | 0.9 | 4,940 | 0.8 | 4,270 | 0.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total (1) | $ | 127,302 | 1.6 | % | $ | 63,575 | 0.7 | % | $ | 61,469 | 0.7 | % | $ | 51,834 | 0.6 | % | $ | 43,998 | 0.7 | % | ||||||||||||||||||||||||||||||||||||||||||

(1) Beginning January 1, 2020, the allowance calculation is based on current expected loss methodology. Prior to January 1, 2020, the allowance calculation was based on the incurred loss model.

Item 1 - Table 5B - Allocation of Allowance for Credit Losses (as of year-end)

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Amount Allocated | Percent of Loans in Each Category to Total Loans | Amount Allocated | Percent of Loans in Each Category to Total Loans | Amount Allocated | Percent of Loans in Each Category to Total Loans | Amount Allocated | Percent of Loans in Each Category to Total Loans | Amount Allocated | Percent of Loans in Each Category to Total Loans | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction | $ | 5,111 | 5.6 | % | $ | 2,713 | 4.7 | % | $ | 2,030 | 4.1 | % | $ | 1,993 | 4.6 | % | $ | 2,104 | 5.4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Commercial multifamily | 5,916 | 6.0 | 4,413 | 6.7 | 4,312 | 6.1 | 3,389 | 6.0 | 2,790 | 5.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 12,380 | 6.8 | 4,880 | 7.1 | 5,083 | 6.2 | 4,847 | 7.8 | 4,865 | 9.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 35,850 | 26.2 | 16,344 | 23.0 | 12,940 | 20.4 | 10,000 | 20.5 | 8,690 | 19.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 25,013 | 24.0 | 20,099 | 19.4 | 17,558 | 21.6 | 14,975 | 21.0 | 10,597 | 15.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | 28,491 | 23.9 | 9,970 | 30.0 | 11,659 | 30.2 | 10,466 | 27.3 | 8,906 | 31.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 6,482 | 3.7 | 1,470 | 4.0 | 1,772 | 4.2 | 1,224 | 4.9 | 1,776 | 5.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer other | 8,059 | 3.8 | 3,686 | 5.1 | 6,115 | 7.2 | 4,940 | 7.9 | 4,270 | 8.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total (1) | $ | 127,302 | 100.0 | % | $ | 63,575 | 100.0 | % | $ | 61,469 | 100.0 | % | $ | 51,834 | 100.0 | % | $ | 43,998 | 100.0 | % | ||||||||||||||||||||||||||||||||||||||||||

(1) Beginning January 1, 2020, the allowance calculation is based on current expected loss methodology. Prior to January 1, 2020, the allowance calculation was based on the incurred loss model.

13

INVESTMENT SECURITIES ACTIVITIES

The securities portfolio provides cash flow to protect the safety of customer deposits and as a potential source of liquidity. The portfolio is also used to manage interest rate risk and to earn a reasonable return on investment. Decisions are made in accordance with the Company’s investment policy and include consideration of risk, return, duration, and portfolio concentrations. Day-to-day oversight of the portfolio rests with the Chief Financial Officer and the Treasurer. The Enterprise Risk Management/Asset-Liability Committee meets multiple times each quarter and reviews investment strategies. The Risk Management and Capital Committee of the Board of Directors provides general oversight of the investment function.

The Company has historically maintained a high-quality portfolio of managed duration mortgage-backed securities, together with a portfolio of municipal bonds including national and local issuers and local economic development bonds issued to non-profit organizations. Nearly all of the mortgage-backed securities are issued by Ginnie Mae, Fannie Mae, or Freddie Mac, consisting principally of collateralized mortgage obligations (generally consisting of planned amortization class bonds and pass-through securities). Other than securities issued by the above agencies, no other issuer concentrations exceeding 10% of stockholders’ equity existed at year-end 2020. The municipal portfolio provides tax-advantaged yield, and the local economic development bonds were originated by the Company to area borrowers. The Company invests in investment grade corporate bonds and Agency commercial mortgage-backed securities. Purchases of non-investment grade fixed-income securities have consisted primarily of capital instruments issued by local and regional financial institutions. The Company also invests in funds financing community reinvestment projects. The Bank owns restricted equity in the Federal Home Loan Bank of Boston (“FHLBB”) based on its operating relationship with the FHLBB. The Company owns an interest rate swap against a tax advantaged economic development bond issued to a local not-for-profit organization, and as a result this security is carried as a trading account security. The Company generally designates debt securities as available for sale, but sometimes designates longer-duration municipal and other securities as held to maturity based on its intent. This also allows the Company to more effectively manage the potential impact of longer-duration, fixed-rate securities on stockholders' equity in the event of rising interest rates.

The following tables present the year-end amortized cost and fair value of the Company's securities, by type of security, for the three years indicated.

Item 1 - Table 6A Amortized Cost and Fair Value of Securities

| 2020 | 2019 | 2018 | ||||||||||||||||||||||||||||||||||||

| (In thousands) | Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||||||||||||||||||||||

| Securities available for sale | ||||||||||||||||||||||||||||||||||||||

| Municipal bonds and obligations | $ | 90,273 | $ | 97,803 | $ | 104,325 | $ | 110,138 | $ | 109,648 | $ | 111,207 | ||||||||||||||||||||||||||

| Mortgage-backed securities | 1,452,526 | 1,483,608 | 1,037,205 | 1,043,652 | 1,182,552 | 1,160,130 | ||||||||||||||||||||||||||||||||

| Other bonds and obligations | 111,178 | 113,821 | 155,809 | 157,765 | 129,073 | 128,310 | ||||||||||||||||||||||||||||||||

| Total securities available for sale | $ | 1,653,977 | $ | 1,695,232 | $ | 1,297,339 | $ | 1,311,555 | $ | 1,421,273 | $ | 1,399,647 | ||||||||||||||||||||||||||

| Securities held to maturity | ||||||||||||||||||||||||||||||||||||||

| Municipal bonds and obligations | $ | 246,520 | $ | 266,626 | $ | 252,936 | $ | 266,026 | $ | 264,524 | $ | 264,492 | ||||||||||||||||||||||||||

| Mortgage-backed securities | 214,907 | 221,472 | 86,291 | 89,191 | 89,273 | 88,442 | ||||||||||||||||||||||||||||||||

| Tax advantaged economic development bonds | 3,369 | 3,462 | 18,456 | 17,764 | 19,718 | 18,042 | ||||||||||||||||||||||||||||||||

| Other bonds and obligations | 295 | 295 | 296 | 296 | 248 | 248 | ||||||||||||||||||||||||||||||||

| Total securities held to maturity | $ | 465,091 | $ | 491,855 | $ | 357,979 | $ | 373,277 | $ | 373,763 | $ | 371,224 | ||||||||||||||||||||||||||

| Trading account security | $ | 8,655 | $ | 9,708 | $ | 9,390 | $ | 10,769 | $ | 10,090 | $ | 11,212 | ||||||||||||||||||||||||||

| Marketable equity securities | 18,061 | 18,513 | 37,138 | 41,556 | 55,471 | 56,638 | ||||||||||||||||||||||||||||||||

| Restricted equity securities | 34,873 | 34,873 | 48,019 | 48,019 | 77,344 | 77,344 | ||||||||||||||||||||||||||||||||

Item 1 - Table 6B - Amortized Cost and Fair Value of Securities

| 2020 | 2019 | 2018 | ||||||||||||||||||||||||||||||||||||

| (In thousands) | Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||||||||||||||||||||||

| U.S. Treasuries, other Government agencies and corporations | $ | 1,685,494 | $ | 1,723,593 | $ | 1,160,634 | $ | 1,174,399 | $ | 1,327,296 | $ | 1,305,210 | ||||||||||||||||||||||||||

| Municipal bonds and obligations and tax advantaged securities | 348,817 | 377,599 | 385,107 | 404,697 | 403,980 | 404,953 | ||||||||||||||||||||||||||||||||

| Other | 146,346 | 148,989 | 204,124 | 206,080 | 206,665 | 205,902 | ||||||||||||||||||||||||||||||||

| Total Securities | $ | 2,180,657 | $ | 2,250,181 | $ | 1,749,865 | $ | 1,785,176 | $ | 1,937,941 | $ | 1,916,065 | ||||||||||||||||||||||||||

The schedule includes available-for-sale and held-to-maturity securities, as well as the trading security, marketable equity securities, and restricted equity securities.

14

The following table summarizes year-end 2020 amortized cost, weighted average yields, and contractual maturities of debt securities. Yields are shown on a fully taxable equivalent basis. A significant portion of the mortgage-based securities are planned amortization class bonds. Their expected durations are 3-5 years at current interest rates, but the contractual maturities shown reflect the underlying maturities of the collateral mortgages. Additionally, the mortgage-based securities maturities shown below are based on final maturities and do not include scheduled amortization. Yields include amortization and accretion of premiums and discounts.

Item 1 - Table 7 - Weighted Average Yield

| One Year or Less | More than One Year to Five Years | More than Five Years to Ten Years | More than Ten Years | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Amortized Cost | Weighted Average Yield | Amortized Cost | Weighted Average Yield | Amortized Cost | Weighted Average Yield | Amortized Cost | Weighted Average Yield | Amortized Cost | Weighted Average Yield | |||||||||||||||||||||||||||||||||||||||||||||||||

| Municipal bonds and obligations | $ | 4.1 | 4.0 | % | $ | 7.0 | 4.0 | % | $ | 37.6 | 5.0 | % | $ | 288.1 | 4.0 | % | $ | 336.8 | 5.0 | % | |||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | — | — | % | 11.2 | 2.0 | % | 154.6 | 2.0 | % | 1,501.6 | 2.0 | % | 1,667.4 | 2.0 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Other bonds and obligations | 31.1 | — | % | 4.4 | 5.0 | % | 53.3 | 5.0 | % | 26.0 | 3.0 | % | 114.8 | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 35.2 | 0.6 | % | $ | 22.6 | 3.5 | % | $ | 245.5 | 3.3 | % | $ | 1,815.7 | 2.2 | % | $ | 2,119.0 | 2.3 | % | |||||||||||||||||||||||||||||||||||||||

DEPOSIT ACTIVITIES AND OTHER SOURCES OF FUNDS

Deposits are the major source of funds for the Bank’s lending and investment activities. Deposit accounts are the primary product and service interaction with the Bank’s customers. The Bank serves personal, commercial, non-profit, and municipal deposit customers. Most of the Bank’s deposits are generated from the areas surrounding its branch offices. The Bank offers a wide variety of deposit accounts with a range of interest rates and terms. The Bank also periodically offers promotional interest rates and terms for limited periods of time. The Bank’s deposit accounts consist of demand deposits (non-interest-bearing checking), NOW (interest-bearing checking), regular savings, money market savings, and time certificates of deposit. The Bank emphasizes its transaction deposits – checking and NOW accounts – for personal accounts and checking accounts promoted to businesses. These accounts have the lowest marginal cost to the Bank and are also often a core account for a customer relationship. The Bank offers a courtesy overdraft program to improve customer service, and also provides debit cards and other electronic fee producing payment services to transaction account customers. The Bank offers targeted online and mobile deposit account opening capabilities for personal accounts. The Bank promotes remote deposit capture devices so that commercial accounts can make deposits from their place of business. Additionally, the Bank offers a variety of retirement deposit accounts to personal and business customers. Deposit related fees are a significant source of fee income to the Bank, including overdraft and interchange fees related to debit card usage. Deposit service fee income also includes other miscellaneous transactions and convenience services sold to customers through the branch system as part of an overall service relationship. The Bank offers compensating balance arrangements for larger business customers as an alternative to fees charged for checking account services. Berkshire’s Business Connection is a personal financial services benefit package designed for the employees of its business customers. In addition to providing service through its branches, Berkshire provides services to deposit customers through its private bankers, MyBankers, commercial/small business relationship managers, and call center representatives. Commercial cash management services are an important commercial service offered to commercial and governmental depositors and a fee income source to the bank. The Bank also operates a commercial payment processing business that serves regional and national payroll service bureau customers. Online banking and mobile banking functionality is increasingly important as a component of deposit account access and service delivery. The Bank is also gradually deploying its MyTeller video tellers to complement and extend its service capabilities in its branches.

The Company also is monitoring the development of payment services which are growing in their importance in the personal and commercial deposit markets.

15

The following table presents information concerning average balances and weighted average interest rates on the Bank’s interest-bearing deposit accounts for the years indicated.

Item 1 - Table 8 - Average Balance and Weighted Average Rates for Deposits

| 2020 | 2019 | 2018 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Average Balance | Percent of Total Average Deposits | Weighted Average Rate | Average Balance | Percent of Total Average Deposits | Weighted Average Rate | Average Balance | Percent of Total Average Deposits | Weighted Average Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Demand | $ | 2,324.6 | 23 | % | — | % | $ | 1,745.2 | 18 | % | — | % | $ | 1,622.4 | 19 | % | — | % | ||||||||||||||||||||||||||||||||||||||

| NOW and other | 1,216.6 | 12 | 0.3 | 1,053.9 | 11 | 0.6 | 824.7 | 9 | 0.5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Money market | 2,713.6 | 26 | 0.6 | 2,542.6 | 26 | 1.2 | 2,432.2 | 28 | 0.9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Savings | 914.1 | 9 | 0.1 | 798.2 | 8 | 0.2 | 740.8 | 9 | 0.2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Time | 3,102.9 | 30 | 1.7 | 3,754.2 | 37 | 2.0 | 3,075.5 | 35 | 1.7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 10,271.8 | 100 | % | 0.7 | % | $ | 9,894.1 | 100 | % | 1.2 | % | $ | 8,695.6 | 100 | % | 0.9 | % | ||||||||||||||||||||||||||||||||||||||

At year-end 2020, the Bank had time deposit accounts in amounts of $100 thousand or more maturing as follows:

Item 1 - Table 9 - Maturity of Deposits >$100,000

| Maturity Period | Amount | Weighted Average Rate | ||||||||||||

| (In thousands) | ||||||||||||||

| Three months or less | $ | 458,997 | 1.46 | % | ||||||||||

| Over 3 months through 6 months | 337,721 | 1.14 | ||||||||||||

| Over 6 months through 12 months | 359,777 | 1.13 | ||||||||||||

| Over 12 months | 565,266 | 1.26 | ||||||||||||

| Total | $ | 1,721,761 | 1.26 | % | ||||||||||

The Bank’s deposits are insured by the FDIC. The Bank utilizes brokered time deposits to broaden its funding base, augment its interest rate risk management vehicles, and to support loan growth. The Bank also offers brokered reciprocal money market arrangements to provide additional deposit protection to certain large commercial and institutional accounts. These balances are viewed as part of overall relationship balances with regional customers. Brokered deposits are sourced through selected Board approved brokers; these deposits are viewed as potentially more volatile than other deposits and are managed as a component of the Bank's liquidity policies.

The Company also uses borrowings from the FHLBB as an additional source of funding, particularly for daily cash management and for funding longer duration assets. FHLBB advances also provide more pricing and option alternatives for particular asset/liability needs. The FHLBB functions as a central reserve bank providing credit for member institutions. As an FHLBB member, the Company is required to own capital stock of the organization. Borrowings from this institution are secured by a blanket lien on most of the Bank’s mortgage loans and mortgage-related securities, as well as certain other assets. Advances are made under several different credit programs with different lending standards, interest rates, and range of maturities.

The Company had a $15 million trust preferred obligation and a $7 million trust preferred obligation outstanding, as well as $74 million in senior subordinated notes at year-end 2020. The Company’s common stock is listed on the New York Stock Exchange. Subject to certain limitations, the Company can also choose to issue common stock, preferred stock, subordinated debt, or senior debt in public stock offerings or private placements. In 2020, the Company renewed its universal securities shelf registration with the SEC to facilitate potential future capital issuances. The Company has maintained a shelf registration as part of its routine capital management for many years.

16

DERIVATIVE FINANCIAL INSTRUMENTS

The Company offers interest rate swaps to commercial loan customers who wish to fix the interest rates on their loans, and the Company backs these swaps with offsetting swaps with national bank counterparties. With other lending institutions, the Company engages in risk participation agreements. These arrangements are structured similarly to its swaps with commercial borrowers, but a different bank is the lead underwriter. The Company gets paid a fee to take on the risk associated with having to make the lead bank whole on Berkshire’s portion of the pro-rated swap should the borrower default. These swaps are designated as economic hedges. Interest rate swaps that meet certain criteria to be viewed as conforming are required to be cleared through exchanges. The Bank has designated a national financial institution as its clearing agent.

The Company’s mortgage banking activities result in derivatives. Commitments to lend are provided on applications for residential mortgages intended for resale and are accounted for as non-hedging derivatives. The Company arranges offsetting forward sales commitments for most of these rate-locks with national bank counterparties, which are designated as economic hedges. Commitments on applications intended to be held for investment are not accounted for as derivative financial instruments. The Company has a policy for managing its derivative financial instruments, and the policy and program activity are overseen by the Risk Management and Capital Committee. Derivative financial instruments with counterparties which are not customers are limited to a select number of national financial institutions. Collateral may be required based on financial condition tests. The Company works with third-party firms which assist in marketing derivative transactions, executing transactions, and providing information for bookkeeping and accounting purposes.

The Company sometimes uses interest rate swap instruments for its own account to fix the interest rate on some of its borrowings, all of which have been designated as cash flow hedges. The Company also has begun offering forward foreign exchange derivatives to its commercial markets as part of its expanded international banking services. The Company expects to back these forwards with offsetting forwards with national bank counterparties. This activity would be targeted to support routine commercial needs of customers engaged in international trading activities and would only be offered for bank approved currencies and durations.

LIBOR BASED INSTRUMENTS

The Company’s floating-rate funding, certain hedging transactions and certain of the Company’s products, such as floating-rate loans and mortgages, determine the applicable interest rate or payment amount by reference to a benchmark rate, such as the London Interbank Offered Rate (“LIBOR”), or to an index, currency, basket or other financial metric. LIBOR and certain other benchmark rates are the subject of recent national, international, and other regulatory guidance and proposals for reform. In July 2017, the Chief Executive of the Financial Conduct Authority (“FCA”) announced that the FCA intends to stop persuading or compelling its panel banks to submit rates for the calculation of LIBOR after 2021.

The Company has approximately 950 commercial loans with a total balance of $2.6 billion with the contract interest rate tied to LIBOR. Additionally, the Company has approximately 500 interest rate swap contracts with a notional value of approximately $3.8 billion, including customer, dealer, and risk participation agreements. Many of these interest rate swap contracts are associated with the LIBOR based commercial loans.

The Company established an enterprise-wide LIBOR transition committee in 2019. The committee has assessed the on and off-balance sheet products that will be impacted with the LIBOR transition. The areas with the most impact are LIBOR based interest rate swaps and commercial loans that utilize LIBOR as the indexed rate. During 2019 revised LIBOR fallback language was added to all new Commercial loan contracts that contemplated the use of LIBOR as an index rate. An impact assessment has been completed to identify further exposures, such as systems, processes, and models affected by the discontinuation of LIBOR. The Company continues to develop and execute plans to transition products associated with LIBOR to alternative reference rates.

17

WEALTH MANAGEMENT SERVICES

The Company’s Wealth Management Group provides consultative investment management, trust administration, and financial planning to individuals, businesses, and institutions, with an emphasis on personal investment management. The Wealth Management Group has built a track record over more than a decade with its dedicated in-house investment management team. The Bank also provides a full line of investment products, financial planning, and brokerage services through BerkshireBanc Investment Services utilizing Commonwealth Financial Network as the broker/dealer. The Bank is integrating with its growing private banking and MyBanker teams to further develop wealth management account generation.

INSURANCE

As an independent insurance agent, the Berkshire Insurance Group represents a carefully selected group of financially sound, reputable insurance companies offering attractive coverage at competitive prices. The Insurance Group offers a full line of personal and commercial property and casualty insurance. It also offers employee benefits insurance and a full line of personal life, health, and financial services insurance products. Berkshire Insurance Group operates a focused cross-sell program of insurance and banking products through all offices and branches of the Bank with some of the Group’s offices located within the Bank’s branches. The Group’s principal operations are in Western New England, and also provides its services in the Company’s other regions. The Group focuses on the Bank’s distribution channels in order to broaden its retail and commercial customer base.

HUMAN CAPITAL MANAGEMENT

Berkshire’s people are the core of its ability to deliver on its strategic objectives, just as they have been for 175 years. The Company’s approach to human capital management is grounded in its Be FIRST values. It focuses on strong oversight, talent acquisition, development, engagement, retention, and offering a competitive benefits package. The Board of Directors has ultimate responsibility for the strategy of the Company. The Compensation Committee of the Board of Directors oversees executive compensation matters and the Corporate Responsibility & Culture committee oversees company culture, diversity, and employee engagement. The Company further enhanced this oversight in 2020 by appointing an experienced human resources leader to Executive Vice President Chief Human Resources & Culture Officer.

Talent acquisition is the first step to ensuring Berkshire has employees with the right mix of skills and experiences. The Company leverages internship placements, affinity group relationships, and the use of experienced recruiters for key management and specialized positions. After hiring, employees’ undergo an onboarding journey including attending a virtual new hire orientation. Throughout an employees’ career Berkshire focus on development as the Company believes it’s a critical factor to long-term retention. In 2020, the Company launched a new mentoring program to pair high potential junior employees with senior staff to build on existing development opportunities. The Company reskilled and upskilled employees from across the bank to assist in government relief programs such as the SBA’s Paycheck Protection Program (“ PPP") and for employees looking to expand their professional experience in the classroom, the Company offers an education assistance program.

Berkshire continually evaluates its strategies and looks at best practices to provide competitive pay and benefits packages. All of Berkshire’s benefits are available to married same-sex or different-sex couples as well as domestic partners. In 2020, the Company completed a salary survey to ensure pay and performance measures aligned with the markets it serves and a pay equity analysis to ensure that all employees, regardless of gender and ethnicity, in comparable roles are compensated equitably. Berkshire was listed in the Bloomberg Gender-Equality Index for the second consecutive year in recognition of its work and achieved a perfect score on the Human Rights Campaign Corporate Equality Index for the first time.

Berkshire employees' health, safety, and economic stability has and continues to be a priority as the Company continues to navigate the global COVID-19 pandemic. Berkshire suspended non-essential business travel and accelerated its ongoing Work from Home initiative to swiftly, safely and securely move 86% of non-branch staff to a fully remote environment. The Company provided protective equipment to front-line employees, including masks and gloves, and offered all additional paid sick time, paid quarantine/isolation leave, job protected personal leave, flexible work schedules for remote employees, premium pay for onsite employees and maintained full pay for employees with reduced schedules, as a result of the pandemic. Berkshire enhanced support through its Employee

18

Assistance Program and launched the You FIRST Fund to help employees impacted by personal financial hardships. As a result of Berkshire’s collective actions, there were no bank related pandemic layoffs in 2020 and the Company instituted a special compensation program for employees assisting with government relief programs.

| Human Capital* | Total Full Time Equivalent | 1,505 | ||||||

| Voluntary Retention Rate | 85 | % | ||||||

*All metrics reported are as of or for the year-ended December 31, 2020.

DIVERSITY, EQUITY, AND INCLUSION

Berkshire’s journey to build a more diverse, equitable, and inclusive company is grounded in its Be FIRST values. The Company’s goal is to build a workplace that reflects its communities' unique diversity and creates wealth in underrepresented neighborhoods across its footprint. The Company focuses on its governance practices, employee education, talent acquisition & workplace culture, supplier diversity, and product and service offerings. A collection of governance practices serve as the foundation, ensuring the appropriate oversight. The Corporate Responsibility & Culture Committee of the Board of Directors has ultimate responsibility for Diversity, Equity, and Inclusion Program performance and ensuring Management creates a workplace culture consistent with its Be FIRST values. The Company’s Diversity & Inclusion Employee Committee, which reports up to the Corporate Responsibility & Culture Committee, focuses on the diversity and inclusion strategy. The committee consists of employees from throughout the business and works to develop and execute goals, strategies, and tactics and monitor progress.

The Company offers seven Employee Resource Groups each of whom play an integral role for employees and the culture of the company. Each Employee Resource Group provides a safe space for dialogue, education, and collective action on topics relevant to their mission. These groups continue to help the company facilitate important cultural shifts, update policies, host important cultural heritage events, and attend affinity group job fairs. In 2020, the Company rolled out a new suite of Diversity, Equity, and Inclusion trainings. In addition, it continues to develop deeper partnerships with colleges, affinity groups and non-profit organizations to expand its networks beyond those traditionally touched by the banking industry. The Company leverages internal expertise and experienced external recruitment professionals to ensure it receives candidate pools that reflect the rural and urban communities where it operates. In addition, the Company regularly reviews the gender and ethnic diversity of its workforce at the employee, manager and executive management level.

| Diversity & Inclusion* | Percent of women in workforce | 68 | % | |||||

| Percent of ethnic minorities in workforce | 14 | % | ||||||

| Percent disabled in workforce | 2 | % | ||||||

*All metrics reported are as of December 31, 2020.

Additional information on Berkshire’s Culture, Human Capital and Diversity, Equity & Inclusion practices can be found in the Company’s annual Corporate Responsibility Report at www.berkshirebank.com/csr, which details the company's environmental, social, governance, and cultural programs.

SUBSIDIARY ACTIVITIES

The Company wholly-owns two active consolidated subsidiaries: the Bank and Berkshire Insurance Group, Inc. The Bank operates as a commercial bank under a Massachusetts trust company charter. Berkshire Insurance Group is incorporated in Massachusetts. Berkshire Bank owns Firestone Financial, LLC which is a Massachusetts limited liability company, as well as consolidated subsidiaries operated as Massachusetts securities corporations and other subsidiary entities. The Company also owns all of the common stock of Delaware statutory business trusts, Berkshire Hills Capital Trust I and SI Capital Trust II. The capital trusts are unconsolidated and their only material assets are trust preferred securities related to the junior subordinated debentures reported in the Company’s Consolidated Financial Statements. Additional information about the subsidiaries is contained in Exhibit 21 to this report.

19

REGULATION AND SUPERVISION

The Company is a Delaware corporation and a bank holding company that has elected financial holding company status within the meaning of the Bank Holding Company Act of 1956, as amended. As such, it is registered with, supervised by and required to comply with the rules and regulations of the Federal Reserve Board. The Federal Reserve Board requires the Company to file various reports and also conducts examinations of the Company. The Company must receive the approval of the Federal Reserve Board to engage in certain transactions, such as acquisitions of additional banks and savings associations.

The Bank is a Massachusetts-chartered trust company and its deposits are insured up to applicable limits by the FDIC. The Bank was previously a Massachusetts-chartered savings bank and converted to a Massachusetts-chartered trust company in July 2014. The Bank is subject to extensive regulation by the Massachusetts Commissioner of Banks (the “Commissioner”), as its chartering agency, and by the FDIC, as its deposit insurer. The Bank is required to file reports with the Commissioner and the FDIC concerning its activities and financial condition in addition to obtaining regulatory approvals prior to entering into certain transactions such as mergers with, or acquisitions of, other depository institutions or branches of other institutions. The Commissioner and the FDIC conduct periodic examinations to test the Bank’s safety and soundness and compliance with various regulatory requirements. The regulatory structure gives the regulatory authorities extensive discretion in connection with supervisory and enforcement activities and examination policies, including policies with respect to the classification of assets and the establishment of adequate loan loss reserves for regulatory purposes. Any change in such regulatory requirements and policies, whether by the Commissioner, the Massachusetts legislature, the FDIC, the Federal Reserve Board, or Congress, could have a material adverse impact on the Company, the Bank, and their operations.

Certain regulatory requirements applicable to the Company are referred to below. The description of statutory provisions and regulations applicable to financial institutions and their holding companies set forth in this Form 10-K does not purport to be a complete description of such statutes and regulations and their effects on the Company and is qualified in its entirety by reference to the actual laws and regulations.A summary of the regulatory requirements referred to below is as follows:

•Massachusetts Banking Laws and Supervision

•Federal Regulations

•Enforcement

•Holding Company Regulation

•Mergers and Acquisitions

•Other Regulations

•Taxation

Massachusetts Banking Laws and Supervision