EX-99.1

Exhibit 99.1

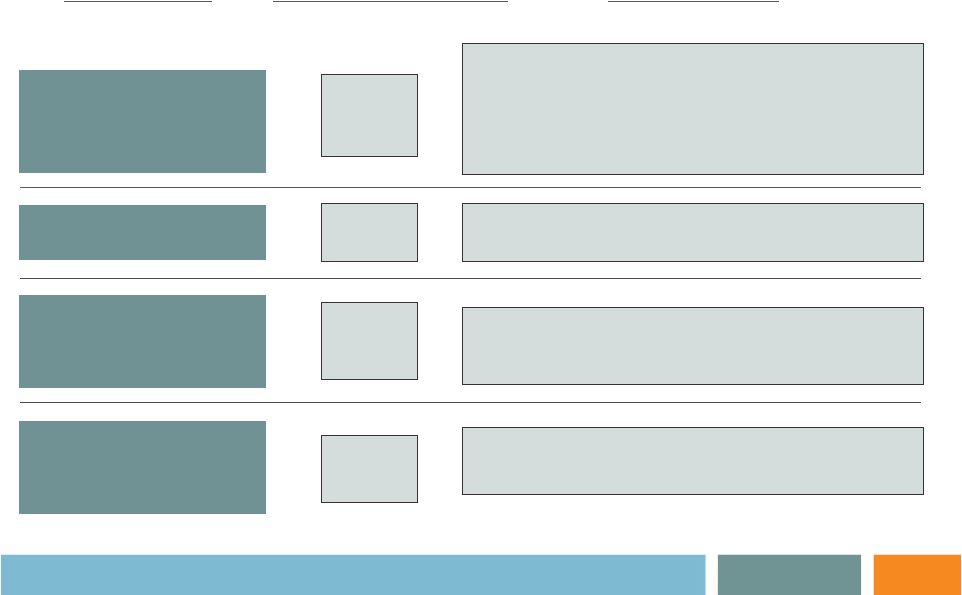

INDEX TO FINANCIAL STATEMENTS

|

|

|

|

|

| |

|

Page |

|

|

|

| Health Management Associates, Inc. Consolidated Financial Statements: |

|

|

|

|

|

|

| Report of Independent Registered Public Accounting Firm |

|

|

2 |

|

|

|

| Consolidated Statements of Operations for the years ended December 31, 2013, 2012 and 2011 |

|

|

3 |

|

|

|

| Consolidated Statements of Comprehensive Income (Loss) for the years ended December 31, 2013, 2012 and 2011 |

|

|

4 |

|

|

|

| Consolidated Balance Sheets as of December 31, 2013 and 2012 |

|

|

5 |

|

|

|

| Consolidated Statements of Stockholders’ Equity for the years ended December 31, 2013, 2012 and 2011 |

|

|

6 |

|

|

|

| Consolidated Statements of Cash Flows for the years ended December 31, 2013, 2012 and 2011 |

|

|

7 |

|

|

|

| Notes to Consolidated Financial Statements |

|

|

8 |

|

1

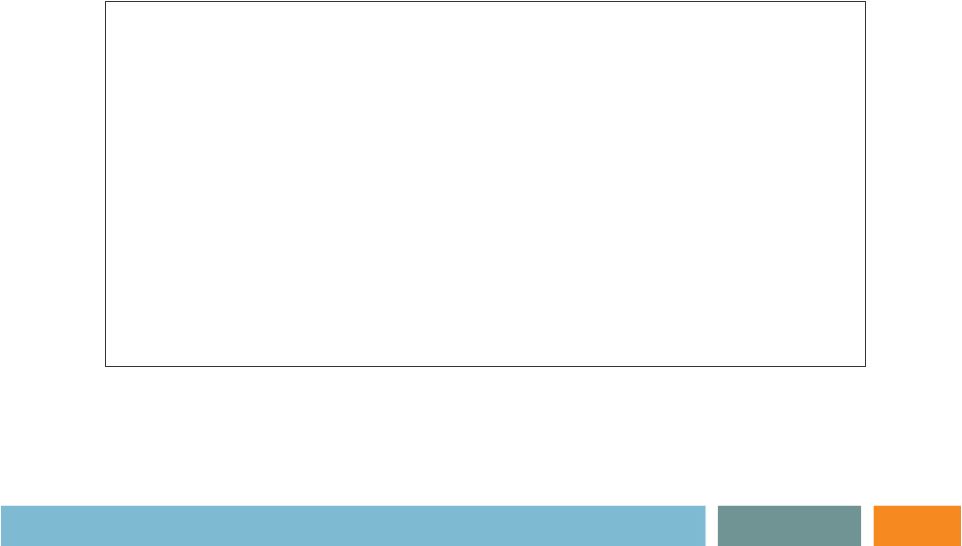

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

Health Management

Associates, Inc.

We have audited the accompanying consolidated balance sheets of Health Management Associates, Inc. as of

December 31, 2013 and 2012, and the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity and cash flows for each of the three years in the period ended December 31, 2013. These financial

statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards

require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal controls over financial

reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Company’s internal controls over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the

accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of

Health Management Associates, Inc. at December 31, 2013 and 2012, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2013, in conformity with U.S. generally

accepted accounting principles.

/s/ ERNST & YOUNG LLP

Certified Public Accountants

Tampa, Florida

April 9, 2014

2

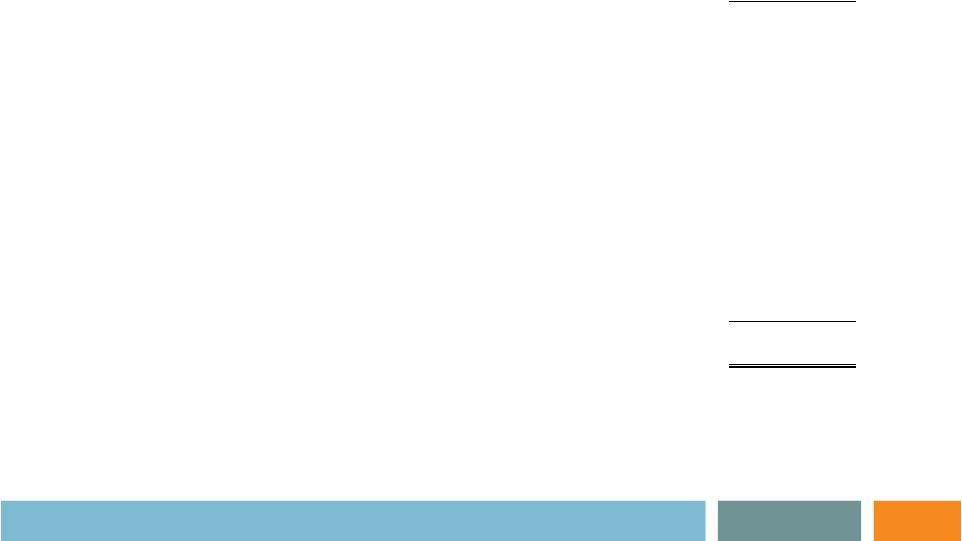

HEALTH MANAGEMENT ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Net revenue before the provision for doubtful accounts |

|

$ |

6,701,384 |

|

|

$ |

6,712,646 |

|

|

$ |

5,765,347 |

|

| Provision for doubtful accounts |

|

|

(1,158,966 |

) |

|

|

(876,779 |

) |

|

|

(712,003 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

|

5,542,418 |

|

|

|

5,835,867 |

|

|

|

5,053,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and benefits |

|

|

2,670,116 |

|

|

|

2,601,481 |

|

|

|

2,284,269 |

|

| Supplies |

|

|

919,626 |

|

|

|

901,153 |

|

|

|

773,476 |

|

| Rent expense |

|

|

167,992 |

|

|

|

171,700 |

|

|

|

153,136 |

|

| Other operating expenses |

|

|

1,448,719 |

|

|

|

1,300,557 |

|

|

|

1,058,933 |

|

| Medicare and Medicaid HCIT incentive program |

|

|

(100,496 |

) |

|

|

(73,056 |

) |

|

|

(30,976 |

) |

| Change in control and other related expenses |

|

|

133,033 |

|

|

|

— |

|

|

|

— |

|

| Depreciation and amortization |

|

|

390,993 |

|

|

|

347,188 |

|

|

|

264,110 |

|

| Interest expense |

|

|

281,254 |

|

|

|

311,067 |

|

|

|

223,208 |

|

| Write-offs of deferred debt issuance costs and other related expenses |

|

|

584 |

|

|

|

— |

|

|

|

24,595 |

|

| Other |

|

|

1,928 |

|

|

|

238 |

|

|

|

(1,771 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,913,749 |

|

|

|

5,560,328 |

|

|

|

4,748,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from continuing operations before income taxes |

|

|

(371,331 |

) |

|

|

275,539 |

|

|

|

304,364 |

|

| Income tax benefit (provision) |

|

|

135,341 |

|

|

|

(90,054 |

) |

|

|

(104,063 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from continuing operations |

|

|

(235,990 |

) |

|

|

185,485 |

|

|

|

200,301 |

|

| Loss from discontinued operations, including gains/losses on disposals, net of income taxes |

|

|

(6,091 |

) |

|

|

(8,566 |

) |

|

|

(1,755 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

|

(242,081 |

) |

|

|

176,919 |

|

|

|

198,546 |

|

| Net income attributable to noncontrolling interests |

|

|

(18,528 |

) |

|

|

(26,972 |

) |

|

|

(25,215 |

) |

| Accretion of redeemable equity securities |

|

|

(67,930 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to Health Management Associates, Inc. |

|

$ |

(328,539 |

) |

|

$ |

149,947 |

|

|

$ |

173,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

3

HEALTH MANAGEMENT ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Net (loss) income |

|

$ |

(242,081 |

) |

|

$ |

176,919 |

|

|

$ |

198,546 |

|

| Components of other comprehensive income before income taxes attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate swap contract Changes in fair value |

|

|

— |

|

|

|

— |

|

|

|

47,735 |

|

| Reclassification adjustments for amortization of expense into net income |

|

|

70,317 |

|

|

|

78,969 |

|

|

|

10,384 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net activity attributable to the interest rate swap contract |

|

|

70,317 |

|

|

|

78,969 |

|

|

|

58,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available-for-sale securities Unrealized gains (losses), net |

|

|

4,467 |

|

|

|

7,974 |

|

|

|

(117 |

) |

| Reclassification adjustments for net gains into net income |

|

|

— |

|

|

|

— |

|

|

|

(1,020 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net activity attributable to available-for-sale securities |

|

|

4,467 |

|

|

|

7,974 |

|

|

|

(1,137 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income before income taxes |

|

|

74,784 |

|

|

|

86,943 |

|

|

|

56,982 |

|

| Income tax expense related to items of other comprehensive income |

|

|

(28,754 |

) |

|

|

(33,443 |

) |

|

|

(21,298 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income, net |

|

|

46,030 |

|

|

|

53,500 |

|

|

|

35,684 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income |

|

|

(196,051 |

) |

|

|

230,419 |

|

|

|

234,230 |

|

| Comprehensive income attributable to noncontrolling interests |

|

|

(18,528 |

) |

|

|

(26,972 |

) |

|

|

(25,215 |

) |

| Accretion of redeemable equity securities |

|

|

(67,930 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income attributable to Health Management Associates, Inc. common stockholders |

|

$ |

(282,509 |

) |

|

$ |

203,447 |

|

|

$ |

209,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

4

HEALTH MANAGEMENT ASSOCIATES, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2013 |

|

|

2012 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

29,971 |

|

|

$ |

59,173 |

|

| Available-for-sale securities |

|

|

67,047 |

|

|

|

121,106 |

|

| Accounts receivable, less allowances for doubtful accounts of $935,253 and $670,729 at December 31, 2013 and 2012,

respectively |

|

|

746,943 |

|

|

|

957,918 |

|

| Supplies, at cost (first-in, first-out method) |

|

|

163,025 |

|

|

|

158,524 |

|

| Prepaid expenses |

|

|

66,468 |

|

|

|

60,769 |

|

| Deferred income taxes and other income tax receivables |

|

|

174,954 |

|

|

|

60,438 |

|

| Restricted funds |

|

|

33,541 |

|

|

|

26,525 |

|

| Assets of discontinued operations |

|

|

10,293 |

|

|

|

24,676 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,292,242 |

|

|

|

1,469,129 |

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment: |

|

|

|

|

|

|

|

|

| Land and improvements |

|

|

278,859 |

|

|

|

255,904 |

|

| Buildings and improvements |

|

|

3,206,842 |

|

|

|

2,945,429 |

|

| Leasehold improvements |

|

|

274,237 |

|

|

|

271,971 |

|

| Equipment |

|

|

2,012,489 |

|

|

|

1,793,977 |

|

| Construction in progress |

|

|

93,578 |

|

|

|

224,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,866,005 |

|

|

|

5,491,547 |

|

| Accumulated depreciation and amortization |

|

|

(2,292,404 |

) |

|

|

(2,036,808 |

) |

|

|

|

|

|

|

|

|

|

| Net property, plant and equipment |

|

|

3,573,601 |

|

|

|

3,454,739 |

|

|

|

|

|

|

|

|

|

|

| Restricted funds |

|

|

131,333 |

|

|

|

125,532 |

|

| Goodwill |

|

|

1,042,312 |

|

|

|

1,020,704 |

|

| Deferred charges and other assets |

|

|

345,163 |

|

|

|

236,588 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

6,384,651 |

|

|

$ |

6,306,692 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

196,788 |

|

|

$ |

211,387 |

|

| Accrued payroll and related taxes |

|

|

111,294 |

|

|

|

94,277 |

|

| Accrued expenses and other liabilities |

|

|

350,883 |

|

|

|

384,151 |

|

| Due to third-party payors |

|

|

19,753 |

|

|

|

51,642 |

|

| Deferred income taxes |

|

|

8,068 |

|

|

|

29,026 |

|

| Current maturities of long-term debt and capital lease obligations |

|

|

115,400 |

|

|

|

126,262 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

802,186 |

|

|

|

896,745 |

|

| Deferred income taxes |

|

|

385,116 |

|

|

|

301,237 |

|

| Long-term debt and capital lease obligations, less current maturities |

|

|

3,649,188 |

|

|

|

3,440,353 |

|

| Other long-term liabilities |

|

|

451,750 |

|

|

|

460,886 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

5,288,240 |

|

|

|

5,099,221 |

|

|

|

|

|

|

|

|

|

|

| Redeemable equity securities |

|

|

320,130 |

|

|

|

212,458 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Health Management Associates, Inc. equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $0.01 par value, 5,000 shares authorized, none issued |

|

|

— |

|

|

|

— |

|

| Common stock, Class A, $0.01 par value, 750,000 shares authorized, 264,553 shares and 256,394 shares issued at December 31,

2013 and 2012, respectively |

|

|

2,645 |

|

|

|

2,564 |

|

| Accumulated other comprehensive income (loss), net of income taxes |

|

|

4,090 |

|

|

|

(41,940 |

) |

| Additional paid-in capital |

|

|

231,603 |

|

|

|

173,843 |

|

| Retained earnings |

|

|

515,399 |

|

|

|

843,938 |

|

|

|

|

|

|

|

|

|

|

| Total Health Management Associates, Inc. stockholders’ equity |

|

|

753,737 |

|

|

|

978,405 |

|

| Noncontrolling interests |

|

|

22,544 |

|

|

|

16,608 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

776,281 |

|

|

|

995,013 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

6,384,651 |

|

|

$ |

6,306,692 |

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

5

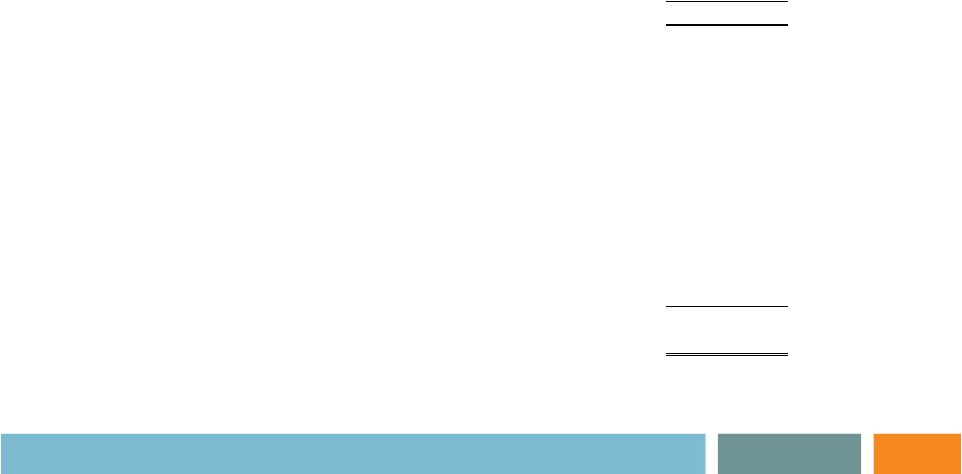

HEALTH MANAGEMENT ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Years Ended December 31, 2013, 2012 and 2011

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Health Management Associates, Inc. |

|

|

|

|

|

|

|

| |

|

Common Stock |

|

|

Accumulated

Other

Comprehensive |

|

|

Additional

Paid-in |

|

|

Retained |

|

|

Noncontrolling |

|

|

Total

Stockholders’ |

|

| |

|

Shares |

|

|

Par Value |

|

|

Income (Loss), Net |

|

|

Capital |

|

|

Earnings |

|

|

Interests |

|

|

Equity |

|

| Balances at January 1, 2011 |

|

|

250,880 |

|

|

$ |

2,509 |

|

|

$ |

(131,124 |

) |

|

$ |

123,701 |

|

|

$ |

520,660 |

|

|

$ |

12,591 |

|

|

$ |

528,337 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

173,331 |

|

|

|

25,215 |

|

|

|

198,546 |

|

| Unrealized gains (losses) on available-for-sale securities and reclassifications into net income, net |

|

|

— |

|

|

|

— |

|

|

|

(741 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(741 |

) |

| Change in fair value of interest rate swap contract and amortization of expense into net income, net |

|

|

— |

|

|

|

— |

|

|

|

36,425 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

36,425 |

|

| Exercises of stock options and related tax matters |

|

|

1,563 |

|

|

|

16 |

|

|

|

— |

|

|

|

16,237 |

|

|

|

— |

|

|

|

— |

|

|

|

16,253 |

|

| Issuances of deferred stock and restricted stock and related tax matters, net of forfeitures |

|

|

1,713 |

|

|

|

17 |

|

|

|

— |

|

|

|

(7,587 |

) |

|

|

— |

|

|

|

— |

|

|

|

(7,570 |

) |

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24,508 |

|

|

|

— |

|

|

|

— |

|

|

|

24,508 |

|

| Distributions to noncontrolling shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25,394 |

) |

|

|

(25,394 |

) |

| Noncontrolling shareholder interests in acquired businesses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,563 |

|

|

|

3,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances at December 31, 2011 |

|

|

254,156 |

|

|

|

2,542 |

|

|

|

(95,440 |

) |

|

|

156,859 |

|

|

|

693,991 |

|

|

|

15,975 |

|

|

|

773,927 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

149,947 |

|

|

|

26,972 |

|

|

|

176,919 |

|

| Unrealized gains (losses) on available-for-sale securities and reclassifications into net income, net |

|

|

— |

|

|

|

— |

|

|

|

5,186 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,186 |

|

| Change in fair value of interest rate swap contract and amortization of expense into net income, net |

|

|

— |

|

|

|

— |

|

|

|

48,314 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

48,314 |

|

| Issuances of deferred stock and restricted stock and related tax matters, net of forfeitures |

|

|

2,238 |

|

|

|

22 |

|

|

|

— |

|

|

|

(8,322 |

) |

|

|

— |

|

|

|

— |

|

|

|

(8,300 |

) |

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25,599 |

|

|

|

— |

|

|

|

— |

|

|

|

25,599 |

|

| Distributions to noncontrolling shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(27,095 |

) |

|

|

(27,095 |

) |

| Purchases of subsidiary shares from noncontrolling shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(293 |

) |

|

|

— |

|

|

|

(1,161 |

) |

|

|

(1,454 |

) |

| Noncontrolling shareholder interests in acquired businesses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,917 |

|

|

|

1,917 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances at December 31, 2012 |

|

|

256,394 |

|

|

|

2,564 |

|

|

|

(41,940 |

) |

|

|

173,843 |

|

|

|

843,938 |

|

|

|

16,608 |

|

|

|

995,013 |

|

| Net loss, including amount attributable to accretion of redeemable equity securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(328,539 |

) |

|

|

18,528 |

|

|

|

(310,011 |

) |

| Unrealized gains (losses) on available-for-sale securities and reclassifications into net income, net |

|

|

— |

|

|

|

— |

|

|

|

3,009 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,009 |

|

| Change in fair value of interest rate swap contract and amortization of expense into net income, net |

|

|

— |

|

|

|

— |

|

|

|

43,021 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43,021 |

|

| Issuances of deferred stock and restricted stock and related tax matters, net of forfeitures |

|

|

8,159 |

|

|

|

81 |

|

|

|

— |

|

|

|

(1,149 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,068 |

) |

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

58,909 |

|

|

|

— |

|

|

|

— |

|

|

|

58,909 |

|

| Distributions to noncontrolling shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,742 |

) |

|

|

(26,742 |

) |

| Noncontrolling shareholder interests in acquired businesses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,150 |

|

|

|

14,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances at December 31, 2013 |

|

|

264,553 |

|

|

$ |

2,645 |

|

|

$ |

4,090 |

|

|

$ |

231,603 |

|

|

$ |

515,399 |

|

|

$ |

22,544 |

|

|

$ |

776,281 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

6

HEALTH MANAGEMENT ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(242,081 |

) |

|

$ |

176,919 |

|

|

$ |

198,546 |

|

| Adjustments to reconcile net (loss) income to net cash provided by continuing operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

402,895 |

|

|

|

358,167 |

|

|

|

270,736 |

|

| Amortization related to interest rate swap contract |

|

|

70,317 |

|

|

|

78,969 |

|

|

|

10,384 |

|

| Fair value adjustments related to interest rate swap contract |

|

|

4,316 |

|

|

|

24,201 |

|

|

|

5,979 |

|

| Provision for doubtful accounts |

|

|

1,158,966 |

|

|

|

876,779 |

|

|

|

712,003 |

|

| Stock-based compensation expense |

|

|

58,909 |

|

|

|

25,599 |

|

|

|

24,508 |

|

| Losses on sales of assets, net |

|

|

6,716 |

|

|

|

4,790 |

|

|

|

1,325 |

|

| Gains on sales of available-for-sale securities, net |

|

|

(3,992 |

) |

|

|

(3,081 |

) |

|

|

(518 |

) |

| Write-offs of deferred debt issuance costs |

|

|

584 |

|

|

|

— |

|

|

|

24,045 |

|

| Deferred income tax expense (benefit) |

|

|

(36,719 |

) |

|

|

(2,727 |

) |

|

|

76,473 |

|

| Changes in assets and liabilities of continuing operations, net of the effects of acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(990,295 |

) |

|

|

(946,946 |

) |

|

|

(863,969 |

) |

| Supplies |

|

|

2,710 |

|

|

|

(1,894 |

) |

|

|

(3,057 |

) |

| Prepaid expenses |

|

|

(5,438 |

) |

|

|

(2,168 |

) |

|

|

(8,124 |

) |

| Prepaid and recoverable income taxes |

|

|

(47,605 |

) |

|

|

29,083 |

|

|

|

(18,633 |

) |

| Deferred charges and other long-term assets |

|

|

(34,089 |

) |

|

|

(70 |

) |

|

|

(5,812 |

) |

| Accounts payable |

|

|

(11,878 |

) |

|

|

10,177 |

|

|

|

24,179 |

|

| Accrued expenses and other liabilities |

|

|

(93,775 |

) |

|

|

(38,456 |

) |

|

|

95,315 |

|

| Equity compensation excess income tax benefits |

|

|

(19,056 |

) |

|

|

(1,492 |

) |

|

|

(2,999 |

) |

| Loss from discontinued operations, net |

|

|

6,091 |

|

|

|

8,566 |

|

|

|

1,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by continuing operating activities |

|

|

226,576 |

|

|

|

596,416 |

|

|

|

542,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions of hospitals and other ancillary health care businesses |

|

|

(183,524 |

) |

|

|

(73,948 |

) |

|

|

(582,090 |

) |

| Additions to property, plant and equipment |

|

|

(274,175 |

) |

|

|

(388,059 |

) |

|

|

(301,308 |

) |

| Proceeds from sales of assets and insurance recoveries |

|

|

108 |

|

|

|

2,857 |

|

|

|

2,765 |

|

| Proceeds from sales of discontinued operations |

|

|

— |

|

|

|

1,392 |

|

|

|

4,851 |

|

| Purchases of available-for-sale securities |

|

|

(486,594 |

) |

|

|

(1,947,028 |

) |

|

|

(1,385,580 |

) |

| Proceeds from sales of available-for-sale securities |

|

|

545,503 |

|

|

|

1,954,653 |

|

|

|

1,321,398 |

|

| Increase in restricted funds, net |

|

|

(9,208 |

) |

|

|

(22,923 |

) |

|

|

(35,309 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in continuing investing activities |

|

|

(407,890 |

) |

|

|

(473,056 |

) |

|

|

(975,273 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from long-term debt borrowings |

|

|

623,900 |

|

|

|

47,000 |

|

|

|

3,356,970 |

|

| Principal payments on debt and capital lease obligations |

|

|

(493,309 |

) |

|

|

(141,823 |

) |

|

|

(2,869,380 |

) |

| Payments of debt issuance costs |

|

|

(1,588 |

) |

|

|

(702 |

) |

|

|

(75,149 |

) |

| Proceeds from exercises of stock options |

|

|

27,949 |

|

|

|

— |

|

|

|

14,067 |

|

| Cash received from noncontrolling shareholders |

|

|

— |

|

|

|

3,591 |

|

|

|

— |

|

| Cash payments to noncontrolling shareholders |

|

|

(28,861 |

) |

|

|

(35,543 |

) |

|

|

(28,284 |

) |

| Equity compensation excess income tax benefits |

|

|

19,056 |

|

|

|

1,492 |

|

|

|

2,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) continuing financing activities |

|

|

147,147 |

|

|

|

(125,985 |

) |

|

|

401,223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net decrease in cash and cash equivalents before discontinued operations |

|

|

(34,167 |

) |

|

|

(2,625 |

) |

|

|

(31,914 |

) |

| Net increases (decreases) in cash and cash equivalents from discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating activities |

|

|

(1,016 |

) |

|

|

(1,438 |

) |

|

|

7,709 |

|

| Investing activities |

|

|

5,981 |

|

|

|

(869 |

) |

|

|

(13,464 |

) |

| Financing activities |

|

|

— |

|

|

|

(38 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net decrease in cash and cash equivalents |

|

|

(29,202 |

) |

|

|

(4,970 |

) |

|

|

(37,669 |

) |

| Cash and cash equivalents at the beginning of the year |

|

|

59,173 |

|

|

|

64,143 |

|

|

|

101,812 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at the end of the year |

|

$ |

29,971 |

|

|

$ |

59,173 |

|

|

$ |

64,143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid during the year for: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest, net of amounts capitalized |

|

$ |

270,995 |

|

|

$ |

270,226 |

|

|

$ |

188,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes |

|

$ |

8,591 |

|

|

$ |

71,737 |

|

|

$ |

50,651 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

7

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2013

| 1. |

Business and Summary of Significant Accounting Policies |

Health Management Associates,

Inc. by and through its subsidiaries (collectively, “HMA” or the “Company”) provides health care services to patients in hospitals and other health care facilities in non-urban communities located primarily in the southeastern

United States. As of December 31, 2013, the Company operated 70 hospitals in fifteen states with a total of 10,706 licensed beds, including twenty-three hospitals located in Florida, ten hospitals in Mississippi and nine hospitals in Tennessee.

On July 29, 2013, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Community Health

Systems, Inc. (“CHS”) and FWCT-2 Acquisition Corporation, an indirect, wholly-owned subsidiary of CHS (“Merger Sub”), pursuant to which Merger Sub merged with and into the Company and became an indirect, wholly-owned subsidiary

of CHS (the “Merger”). The Merger was completed on January 27, 2014 and the terms and conditions are described in more detail in Note 13.

As further described in Note 12, on August 12, 2013, Glenview Capital Management, LLC and certain of its affiliated investment funds

(collectively “Glenview”), delivered written consents from holders of the Company’s common stock, or their duly authorized proxies, sufficient to replace the Company’s entire Board of Directors with nominees of Glenview pursuant

to a consent solicitation process (the “Consent Solicitation Process”) that had previously been commenced by Glenview.

Unless

specifically indicated otherwise, all amounts and percentages presented in the notes below are exclusive of the Company’s discontinued operations, which are identified at Note 10.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires

management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

The Company consistently applies the accounting policies described below.

a. Principles of consolidation

The consolidated financial statements include the accounts of the Company and its subsidiaries, all of which are controlled by the Company

through majority voting control. All significant intercompany accounts and transactions have been eliminated. The Company uses the equity method of accounting for investments in entities in which it exhibits significant influence, but not control,

and has an ownership interest ranging from 20% to 50%.

For consolidation and variable interest entity disclosure purposes, management

evaluates circumstances where the Company has ownership, contractual or other financial interests that may result in its (i) ability to direct the activities of an entity that most significantly impact such entity’s economic performance

and/or (ii) obligation to absorb the losses of, or the right to receive the benefits from, an entity that could potentially be significant to that entity; however, no such arrangements that would be material to the Company’s consolidated

financial position or results of operations have been identified.

b. Cash and cash equivalents

Cash and cash equivalents include all highly liquid investments with an original maturity of three months or less. The Company’s cash

equivalents primarily consist of investment grade financial instruments.

c. Available-for-sale securities

The Company’s investments in debt securities and shares in publicly traded stocks and mutual funds have been designated by management as

available-for-sale securities, as defined by GAAP. The estimated fair values of such securities are based on quoted market prices and pricing valuation models. Changes in temporary unrealized gains and losses are recorded as adjustments to other

comprehensive income, net of income taxes. Periodically, management performs an evaluative assessment of individual securities to determine whether declines in fair value are other-than-temporary. Management considers various quantitative,

qualitative and judgmental factors when performing its evaluation, including, but not limited to, the nature of the security being analyzed and the length of time and extent to which a security’s fair value is below its historical/amortized

cost. Also, see Notes 5 and 11 for more information regarding the Company’s available-for-sale securities.

8

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

d. Property, plant and equipment

Property, plant and equipment are stated at cost and include major expenditures that extend an asset’s useful life. Ordinary repair and

maintenance costs (e.g., medical equipment adjustments, painting, cleaning, etc.) are expensed as incurred. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the underlying assets. Estimated

useful lives for buildings and improvements range from fifteen to forty years and for equipment range from three to fifteen years. Leasehold improvements, capital lease assets and other assets of a similar nature are amortized on a straight-line

basis over the shorter of the term of the respective lease or the useful life of the underlying asset. Depreciation expense was approximately $247.9 million, $240.0 million and $215.8 million during the years ended December 31, 2013, 2012 and

2011, respectively.

e. Deferred debt issuance costs, goodwill and other long-lived assets

Deferred debt issuance costs. Deferred charges and other assets include deferred debt issuance costs that are being amortized over the

estimated economic life of the related debt using the effective interest method. A rollforward of the Company’s deferred debt issuance costs is presented in the table below (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Balances at the beginning of the year |

|

$ |

67,903 |

|

|

$ |

67,201 |

|

|

$ |

48,515 |

|

| Costs associated with the issuance of long-term debt |

|

|

1,588 |

|

|

|

702 |

|

|

|

75,149 |

|

| Write-offs (see debt restructuring at Note 2) |

|

|

(584 |

) |

|

|

— |

|

|

|

(56,463 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances at the end of the year |

|

$ |

68,907 |

|

|

$ |

67,903 |

|

|

$ |

67,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated amortization of deferred debt issuance costs was approximately $26.7 million and $14.5 million at

December 31, 2013 and 2012, respectively. Amortization of deferred debt issuance costs was $12.3 million, $11.4 million and $7.6 million during the years ended December 31, 2013, 2012 and 2011, respectively. As further discussed in Note 2,

in conjunction with the completion of the Merger, the Company’s borrowings under its Credit Facility and the Senior Notes due 2016 and 2020 were repaid and the related deferred debt issuance costs were written off.

Goodwill. GAAP calls for goodwill (i.e., the excess of cost over acquired net assets) and intangible assets with indefinite useful

lives to be tested for impairment annually and whenever circumstances indicate that a possible impairment might exist. Management performs the goodwill impairment test by initially comparing the estimated fair values of the reporting unit’s net

assets, including allocated home office net assets, to the corresponding carrying amounts on the Company’s consolidated balance sheets. The estimated fair value of the Company’s reporting unit is determined using a market approach

methodology based on revenue multiples. Management also considers a market approach valuation methodology based on comparable transactions. If the estimated fair value of the reporting unit’s net assets is less than the balance sheet carrying

amount, management determines the implied fair value of the reporting unit’s goodwill, compares such fair value to the corresponding carrying amount and, if necessary, records a goodwill impairment charge.

Reporting units are one level below the operating segment level (see Note 1(n)). Prior to the Merger, the Company performed its goodwill

impairment testing at the divisional operating level. After the announcement of the Merger Agreement, changes in executive management occurred and new executive management reorganized all of the Company’s division operations and the level of

operational reviews and management oversight under the direction of CHS. From that point forward, financial and operating performance review of the Company’s hospitals performed by the chief operating decision maker, was performed on an

entity-wide basis. As a result management concluded that the Company’s goodwill should be combined into one reporting unit representing the Company’s entire hospital operations. This conclusion, reached during the third quarter of 2013,

was considered as part of the Company’s annual test for goodwill impairment.

There were no goodwill impairment charges in continuing

operations during the years ended December 31, 2013, 2012 and 2011.

9

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

Physician and Physician Group Guarantees. Deferred charges and other assets include

estimated physician and physician group guarantee costs, which aggregated approximately $53.3 million and $49.1 million at December 31, 2013 and 2012, respectively. Such amounts are being amortized over the required service periods of the

underlying contractual arrangements. The corresponding accumulated amortization was $26.4 million and $28.0 million at December 31, 2013 and 2012, respectively. Amortization expense related to estimated physician and physician group guarantee

costs was $12.9 million, $17.3 million and $29.0 million during the years ended December 31, 2013, 2012 and 2011, respectively. Based on the December 31, 2013 balances, future amortization expense is expected to be $14.1 million, $8.5

million, and $3.3 million during the years ending December 31, 2014, 2015 and 2016, respectively. See Note 14 for further information regarding physician and physician group guarantees.

Intangible Assets. Included in deferred charges and other assets at December 31, 2013 and 2012 were intangible assets of

approximately $216.2 million and $99.2 million, respectively, relating to contractual rights to operate hospitals and non-compete arrangements (together, the “Intangible Assets”), net of $32.4 million and $15.2 million, respectively of

accumulated amortization. See Note 4 for further information regarding the Company’s acquisition of the Intangible Assets for $117.0 million in 2013 and $48.0 million in 2012. Amortization expense related to the Intangible Assets was $17.2

million, $13.2 million and $2.0 million during the years ended December 31, 2013, 2012 and 2011, respectively. Future amortization of such assets is expected to approximate $17.9 million, $17.2 million, $14.3 million, $9.0 million and $8.0

million during the years ending December 31, 2014, 2015, 2016, 2017 and 2018, respectively.

Impairment of Long-lived Assets.

When events, circumstances or operating results indicate that the carrying values of long-lived assets and/or identifiable intangible assets (excluding goodwill) that are expected to be held and used might be impaired, management prepares

projections of the undiscounted future cash flows expected to result from the use of the assets and their eventual disposition. If the projections indicate that the recorded amounts are not expected to be recoverable, such long-lived assets are

reduced to their estimated fair values, as determined by management through various discrete valuation analyses, and the Company records an impairment charge. Long-lived assets to be disposed of are reported at the lower of their carrying amount or

estimated fair value, less costs to sell. The estimates of fair value are based on recent sales of similar assets, market analyses, pending disposition transactions and market responses based on discussions with, and offers received from, potential

buyers (i.e., Level 2 inputs under the GAAP fair value hierarchy described at Note 5).

There were no long-lived asset impairment

charges that were material to the Company’s continuing operations during the years ended December 31, 2013, 2012 and 2011. During the years ended December 31, 2013, 2012 and 2011, the Company recorded long-lived asset and goodwill

impairment charges of approximately $7.0 million, $3.0 million and $3.6 million, respectively, in discontinued operations (see Note 10).

f. Net revenue, cost of revenue and related other

Net Revenue. The Company records gross patient service charges on the accrual basis in the period that the services are rendered. Net

revenue before the provision for doubtful accounts represents gross patient service charges less provisions for contractual adjustments and uninsured self-pay patient discounts. The Company’s provisions for contractual adjustments were

approximately $26,590 million, $23,990 million and $18,522 million during the years ended December 31, 2013, 2012 and 2011, respectively. The corresponding uninsured self-pay patient discounts are disclosed in a table at the end of this Note

1(f).

Approximately 37%, 37% and 40% of the Company’s net revenue before the provision for doubtful accounts during the years ended

December 31, 2013, 2012 and 2011, respectively, related to services rendered to patients covered by Medicare and various state Medicaid programs. Payments for services rendered to patients covered by those programs and other government programs

are generally less than billed charges and, therefore, provisions for contractual adjustments are made to reduce gross patient service charges to the estimated cash receipts based on each program’s principles of payment/reimbursement. Final

settlements under these programs are subject to administrative review and audit and, accordingly, the Company periodically provides reserves for the adjustments that may ultimately result therefrom. Such adjustments were not material to the

Company’s consolidated results of operations during the years presented herein. Laws, rules and regulations governing the Medicare and Medicaid programs are extremely complex and subject to interpretation. As a result, estimates recorded in the

consolidated financial statements and disclosed in the accompanying notes may change in the future and such changes in estimates, if any, will be recorded in the Company’s operating results in the period they are identified by management.

Revenue and receivables from government programs are significant to the Company’s operations; however, management does not believe that there are substantive credit risks associated with such programs. There are no other concentrations of

revenue or accounts receivable with any individual payor that subject the Company to significant credit or other risks.

10

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

Estimates of contractual allowances for services rendered to patients covered by commercial

insurance, including managed care health plans, are primarily based on historical collection percentages reflecting the payment terms of contractual arrangements, such as predetermined rates per diagnosis, per diem rates or discounted fee for

service rates.

In the ordinary course of business, the Company provides services to patients who are financially unable to pay for their

care. Accounts identified as charity and indigent care are not recognized in net revenue before the provision for doubtful accounts. The Company maintains a policy whereby patient account balances are characterized as charity and indigent care only

if the patient meets certain percentages of the federal poverty level guidelines. Local hospital personnel and the Company’s collection agencies pursue payments on accounts receivable from patients who do not meet such criteria. For uninsured

self-pay patients who do not qualify for charity and indigent care treatment, the Company recognizes net revenue before the provision for doubtful accounts using its standard gross patient service charges, less discounts of 60% or more for

non-elective procedures. Because a significant portion of uninsured self-pay patients will be unable or unwilling to pay for their care, the Company records a significant provision for doubtful accounts in the period that the services are provided

to those patients. Management monitors the levels of charity and indigent care provided by the Company’s hospitals and other health care facilities and the procedures employed to identify and account for those patients. Most states include an

estimate of charity and indigent care costs in the determination of a hospital’s eligibility for Medicaid disproportionate share payments.

Net revenue before the provision for doubtful accounts, by major payor source, is summarized in the table below (dollars in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

| Medicare |

|

$ |

1,805,236 |

|

|

|

26.9 |

% |

|

$ |

1,888,201 |

|

|

|

28.2 |

% |

| Medicaid |

|

|

668,172 |

|

|

|

10.0 |

|

|

|

618,294 |

|

|

|

9.2 |

|

| Commercial insurance |

|

|

3,340,260 |

|

|

|

49.8 |

|

|

|

3,342,529 |

|

|

|

49.9 |

|

| Self-pay |

|

|

758,577 |

|

|

|

11.3 |

|

|

|

719,824 |

|

|

|

10.7 |

|

| Other |

|

|

129,139 |

|

|

|

2.0 |

|

|

|

143,798 |

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6,701,384 |

|

|

|

100.0 |

% |

|

$ |

6,712,646 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Uncompensated Patient Care. To quantify the overall impact of, and trends related to, uninsured

accounts, management believes that it is beneficial to view the Company’s: (i) foregone/unrecognized revenue for charity and indigent care; (ii) uninsured self-pay patient discounts; and (iii) provision for doubtful accounts,

which is collectively referred to herein as “uncompensated patient care,” in combination rather than separately. Management estimates the costs of the Company’s uncompensated patient care using a cost-to-charge ratio that is

calculated by dividing patient care costs by gross patient charges. Those costs include select direct and indirect costs such as salaries and benefits, supplies, depreciation and amortization, rent and other operating expenses.

The table below sets forth the estimated costs of the Company’s uncompensated patient care (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Charity and indigent care foregone/unrecognized revenue (based on established rates) |

|

$ |

112,615 |

|

|

$ |

103,547 |

|

|

$ |

91,928 |

|

| Uninsured self-pay patient discounts |

|

|

1,465,017 |

|

|

|

1,275,671 |

|

|

|

935,494 |

|

| Provision for doubtful accounts |

|

|

1,158,966 |

|

|

|

876,779 |

|

|

|

712,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,736,598 |

|

|

|

2,255,997 |

|

|

|

1,739,425 |

|

| Cost-to-charge ratio |

|

|

16.9 |

% |

|

|

18.6 |

% |

|

|

18.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated costs of uncompensated patient care |

|

$ |

462,485 |

|

|

$ |

419,615 |

|

|

$ |

327,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Revenue. The presentation of costs and expenses in the Company’s consolidated

statements of operations does not differentiate between costs of revenue and other costs because substantially all such costs and expenses relate to providing health care services. Furthermore, management believes that the natural classification

11

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

of expenses is the most meaningful presentation of the Company’s operations. Amounts that could be classified as general and administrative expenses include the costs of the Company’s

home office and the regional service centers, which were approximately $330.4 million, $275.8 million and $168.8 million during the years ended December 2013, 2012 and 2011, respectively.

g. Accounts receivable and the provision for doubtful accounts

The Company grants credit without requiring collateral from its patients, most of whom live near the Company’s hospitals and are insured

under third party payor agreements. In certain circumstances, the Company charges interest on past due accounts receivable (delinquent accounts are identified by reference to contractual or other payment terms); however, such interest amounts were

not material to the years presented herein. The credit risk for non-governmental accounts receivable, excluding uninsured self-pay patients, is limited due to the large number of insurance companies and other payors that provide payment and

reimbursement for patient services. Accounts receivable are reported net of estimated allowances for doubtful accounts.

Collection of

accounts receivable from third party payors and patients is the Company’s primary source of cash and is therefore critical to its successful operating performance. Accordingly, management regularly monitors the Company’s cash collection

trends and the aging of its accounts receivable. The Company’s collection risks principally relate to uninsured self-pay patient accounts and patient accounts for which the primary insurance payor has paid but patient responsibility amounts

(generally deductibles and co-payments) remain outstanding. Provisions for doubtful accounts are primarily estimated based on major payor classification and accounts receivable aging reports. For accounts receivable associated with services provided

to patients who have governmental and/or commercial insurance coverage, management analyzes contractually due amounts and the Company records an allowance for doubtful accounts as necessary. For accounts receivable associated with self-pay patients,

which includes both patients without insurance and patients with deductible and co-payment balances due for which third party coverage exists for part of the bill, the Company records a significant provision for doubtful accounts in the period of

service because many patients will not pay the portion of their bill for which they are financially responsible. Management monitors the aging of accounts receivable from self-pay patients and the Company records supplemental provisions for doubtful

accounts when the accounts receivable age and the likelihood of collection deteriorates.

When considering the adequacy of the allowance

for doubtful accounts, the Company reviews accounts receivable balances, historical collection analyses, and other trends/indicators relating to the collectability of patient accounts. Accounts receivable are written off after collection efforts

have been pursued in accordance with the Company’s policies and procedures. Accounts written off as uncollectible are deducted from the allowance for doubtful accounts and subsequent recoveries are netted against the provision for doubtful

accounts. Changes in payor mix, general economic conditions or federal and state government health care coverage could each have a material adverse effect on the Company’s accounts receivable collections, cash flows and results of operations.

During the quarter ended December 31, 2013, the Company recorded a change in estimate to their allowance for doubtful accounts and

contractual allowances totaling $246 million. These changes in estimates were the result of several circumstances occurring during 2013. Throughout 2013, the Company moved a significant amount of their billing and collection processes from

hospital-based business offices into regional service centers. Additionally, during the second half of 2013, the Company underwent a significant change in management, including the replacement of the entire Board of Directors and changes in several

key management positions including its chief executive officer, chief financial officer and chief information officer. Subsequent to year end, on January 27, 2014, but prior to the completion of the accounting and financial reporting for the

period ended December 31, 2013, the Company completed the Merger with Merger Sub, an indirect, wholly-owned subsidiary of CHS. Following the Merger, the Company performed various analyses and other estimation techniques utilized by CHS,

including a review of the historical write-offs of patient accounts receivable, which were used to quantify a reduction in the estimated collectability of accounts receivable.

12

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

The table below provides a rollforward of the Company’s allowance for doubtful accounts

for the three year period ending December 31, 2013. This table includes the activity of discontinued operations, as identified in Note 10.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Balances at the beginning of the year |

|

$ |

670,729 |

|

|

$ |

578,972 |

|

|

$ |

495,486 |

|

| Provision for doubtful accounts |

|

|

1,202,137 |

|

|

|

906,413 |

|

|

|

746,450 |

|

| Deductions for write-offs |

|

|

(937,613 |

) |

|

|

(814,656 |

) |

|

|

(662,964 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances at the end of the year |

|

$ |

935,253 |

|

|

$ |

670,729 |

|

|

$ |

578,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h. Electronic health record incentive programs

Beginning in calendar year 2011, the American Recovery and Reinvestment Act of 2009 provides for Medicare and Medicaid incentive payments to be

paid to eligible hospitals, physicians and certain other professionals that implement and achieve meaningful use of certified electronic health record (“EHR”) technology. Hospitals may be eligible to receive EHR incentive payments under

various Medicare and Medicaid Healthcare Information Technology programs (collectively, the “HCIT Programs”); however, physicians and other professionals are only eligible to receive either Medicare or Medicaid incentive payments under the

HCIT Programs, but not both. Eligibility for annual Medicare incentive payments is dependent on providers demonstrating meaningful use of EHR technology in each period over a four-year period. Initial Medicaid incentive payments are available to

providers that adopt, implement or upgrade certified EHR technology. Providers must then demonstrate meaningful use of such technology in subsequent years to qualify for additional incentive payments. Medicaid EHR incentive payments are fully funded

by the federal government and administered by the states.

Using a gain contingency model, the Company recognizes a benefit under the HCIT

Programs in its consolidated statement of operations when the eligible hospitals and physician practices have demonstrated meaningful use of certified EHR technology during the period and, if applicable, the cost report information for the full cost

report year that will determine the final calculation of the incentive payment is available. Specifically, a benefit is recorded (i) for Medicaid HCIT Programs when the Company’s eligible hospitals and physician practices adopt, implement

or demonstrate meaningful use of certified EHR technology for the applicable period because the cost report information for the full cost report year that will determine the final calculation of the incentive payment is known at that time and

(ii) for the Medicare HCIT Program when eligible hospitals and physician practices demonstrate meaningful use of certified EHR technology for the applicable period and the cost report information for the full cost report year that will

determine the final calculation of the incentive payment is available. In addition, HCIT incentive payments previously recognized as income are subject to audit and potential recoupment if it is determined that the Company did not meet the

applicable meaningful use standards required in connection with such incentive payments.

During the years ended December 31, 2013,

2012 and 2011, the Company recognized benefits in its consolidated statements of operations of approximately $100.5 million, $73.1 million and $31.0 million, respectively, related to the HCIT Programs. Included in the Company’s consolidated

balance sheets at December 31, 2013 and 2012 were receivables under the HCIT Programs of $68.3 million and $11.6 million, respectively. The corresponding deferred incentive revenue was $19.2 million at December 31, 2012. There was no such

deferred revenue at December 31, 2013.

i. Professional liability claims

Reserves for self-insured professional liability indemnity claims and related expenses, including attorneys’ fees and other related costs

of litigation that have been incurred and will be incurred in the future, are determined using actuarially-based techniques and methodologies. The data used to develop such reserves is based on asserted and unasserted claim information that has been

accumulated by the Company’s incident reporting system, historical loss payment patterns and industry trends. Such long-term liabilities have been discounted to their estimated present values. Management selects a discount rate that represents

a risk-free interest rate correlating to the period when the claims are projected to be paid.

The reserves for self-insured professional

liability claims and expenses are periodically reviewed and adjustments thereto are recorded as more information about claim trends becomes known to management.

13

HEALTH MANAGEMENT ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 1. |

Business and Summary of Significant Accounting Policies (continued) |

Adjustments to the reserves are recognized in the Company’s operating results in the period that the change in estimate is identified. See Note 14 for further discussion of the

Company’s professional liability risks and related matters.

j. Self-insured workers’ compensation and health and welfare

programs

The Company provides (i) income continuance to, and reimburses certain health care costs of, its disabled employees

(collectively, “workers’ compensation”) and (ii) health and welfare benefits to its employees, their spouses and certain beneficiaries. While such employee benefit programs are primarily self-insured, stop-loss insurance policies

are maintained in amounts deemed appropriate by management. Nevertheless, there can be no assurances that the amount of stop-loss insurance coverage will be adequate for such Company programs.

The Company records estimated liabilities for both reported and incurred but not reported workers’ compensation and health and welfare

claims based on historical loss experience and other information provided by the Company’s third party administrators. The long-term liabilities for workers’ compensation are determined using actuarially-based techniques and methodologies

and are discounted to their estimated present values. Management selects a discount rate that represents a risk-free interest rate correlating to the period when such benefits are projected to be paid. Although there can be no assurances, management