UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2017

CHANTICLEER HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-29507 | 20-2932652 | ||

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

7621 Little Avenue, Suite 414

Charlotte, North Carolina 28226

(Address of principal executive offices)

Registrant’s telephone number, including area code: (704) 366-5122

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2017, Chanticleer Holdings Inc. (the “Company”) issued a press release announcing its third quarter earnings results. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company will host a webcast and conference call on Monday, November 13, 2017 at 4:30 p.m. Eastern Time.

To access the call, dial (888) 289-0438 approximately five minutes prior to the scheduled start time. International callers please dial (323)-794-2423. To access the webcast, including the quarterly slide presentation, log in to the following participate linkhttp://public.viavid.com/index.php?id=127210.

A replay of the teleconference will be available until December 13, 2017 and may be accessed by dialing (844) 512-2921. International callers may dial (412) 317-6671. Callers should use conference PIN: 4153759.

Use of Non-GAAP Measures

Chanticleer Holdings, Inc. prepares its condensed consolidated financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In addition to disclosing financial results prepared in accordance with GAAP, the Company discloses information regarding Adjusted EBITDA and Restaurant EBITDA, which differ from the term EBITDA as it is commonly used. In addition to adjusting net income (loss) from continuing operations to exclude taxes, interest, and depreciation and amortization, Adjusted EBITDA also excludes pre-opening and closing costs for our restaurants, non cash expenses, transaction and severance related expenses, change in fair value of derivative liability and other income and expenses. In addition, Restaurant EBITDA also excludes management fee income, franchise revenue and general and administrative expenses. Adjusted EBITDA and restaurant EBITDA are not measures of performance defined in accordance with GAAP. However, adjusted EBITDA and restaurant EBITDA are used internally in planning and evaluating the Company’s operating performance and by the Company’s creditors. Accordingly, management believes that disclosure of these metrics offers investors, bankers and other stakeholders an additional view of the Company’s operations that, when coupled with the GAAP results, provides a more complete understanding of the Company’s financial results. Adjusted EBITDA and Restaurant EBITDA should not be considered as alternatives to net loss or to net cash used in operating activities as a measure of operating results or of liquidity. It may not be comparable to similarly titled measures used by other companies, and it excludes financial information that some may consider important in evaluating the company’s performance. A reconciliation of GAAP net income (loss) to Adjusted EBITDA and Restaurant EBITDA is included in the accompanying financial schedules to the press release. For further information, please refer to Chanticleer’s Quarterly Report on Form 10-Q to be filed with the SEC on or about May 15, 2017, available online at www.sec.gov.

The information in this Item 2.02 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

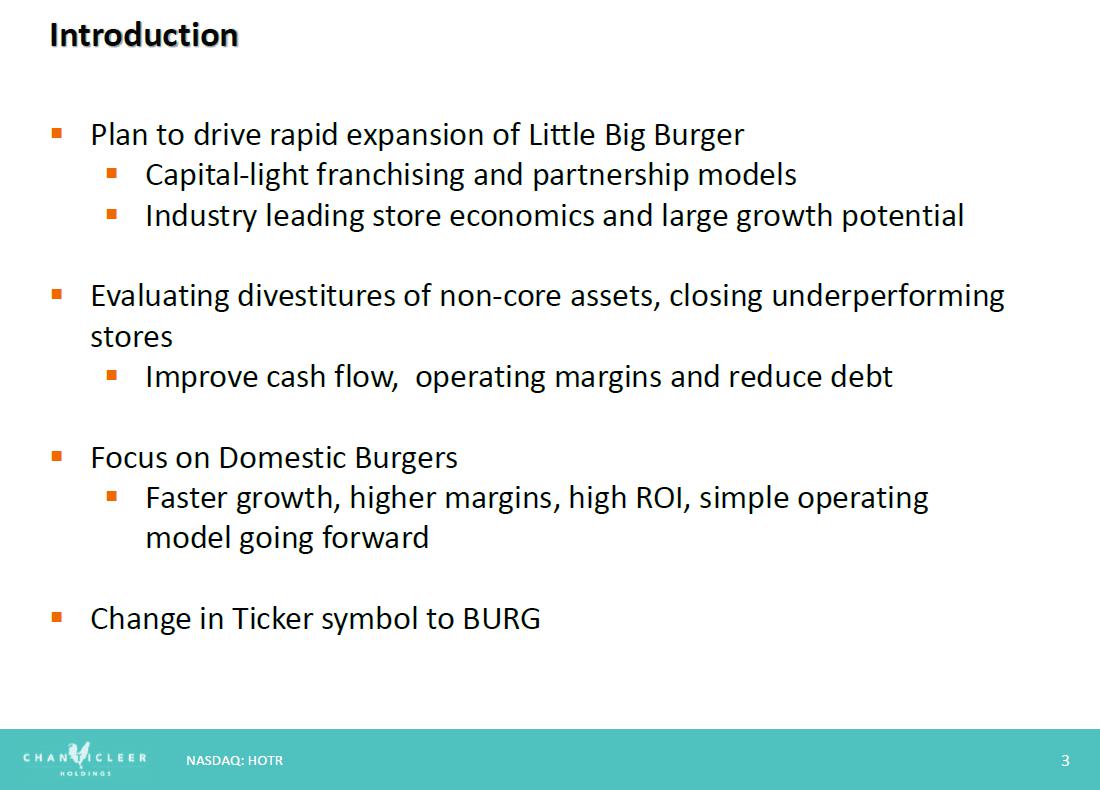

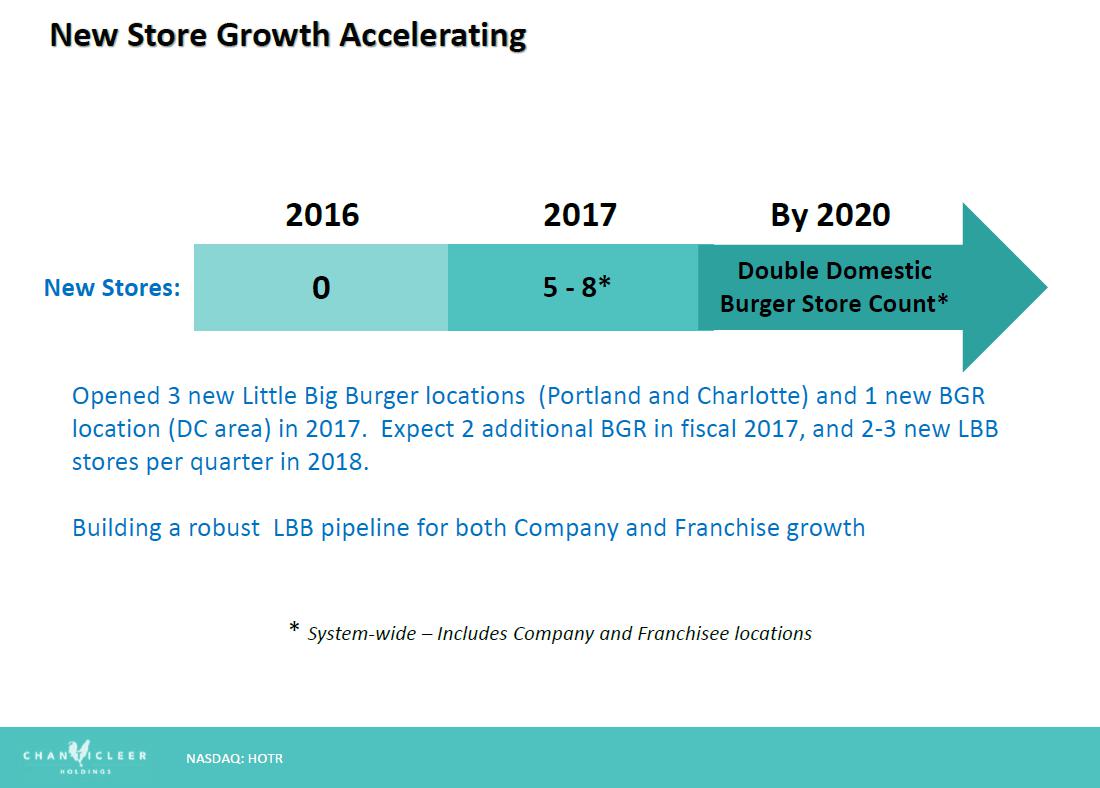

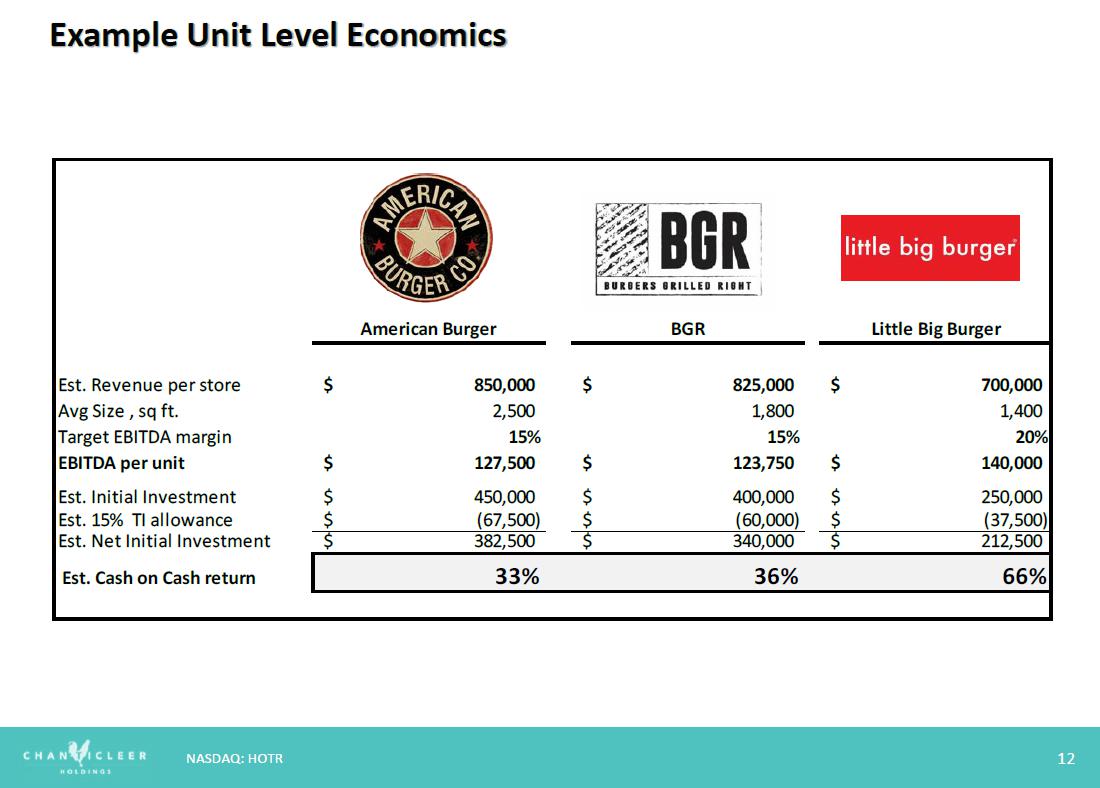

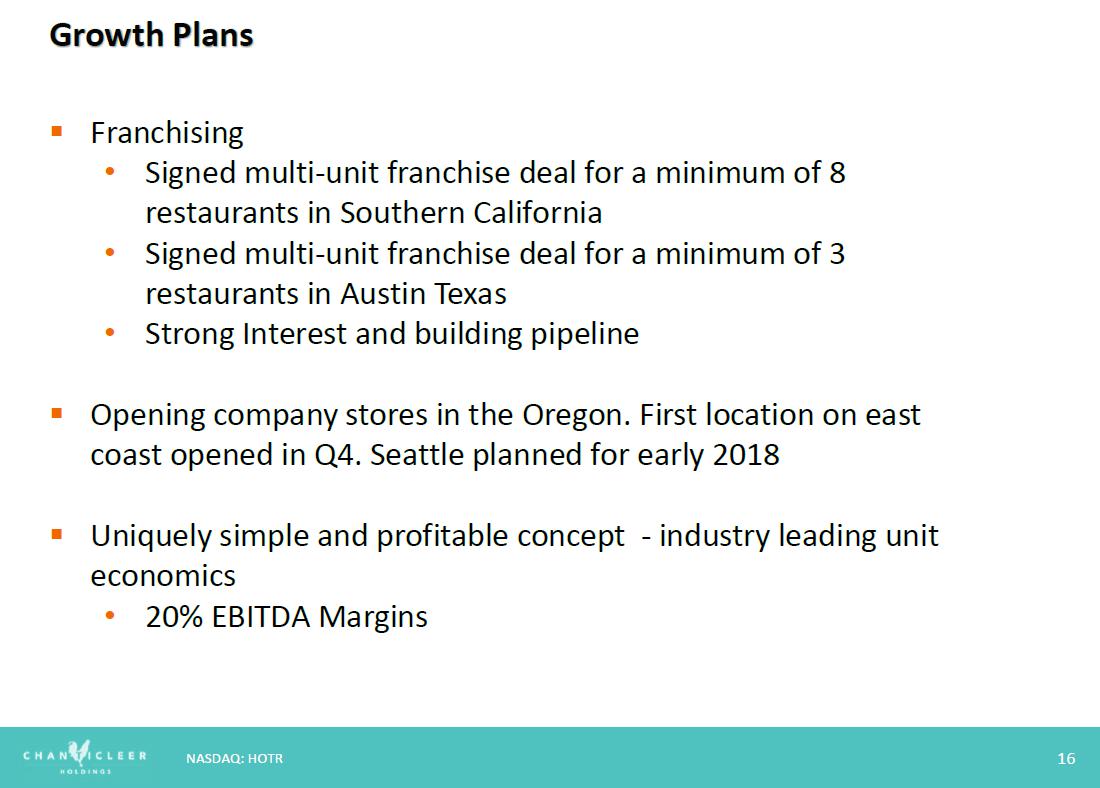

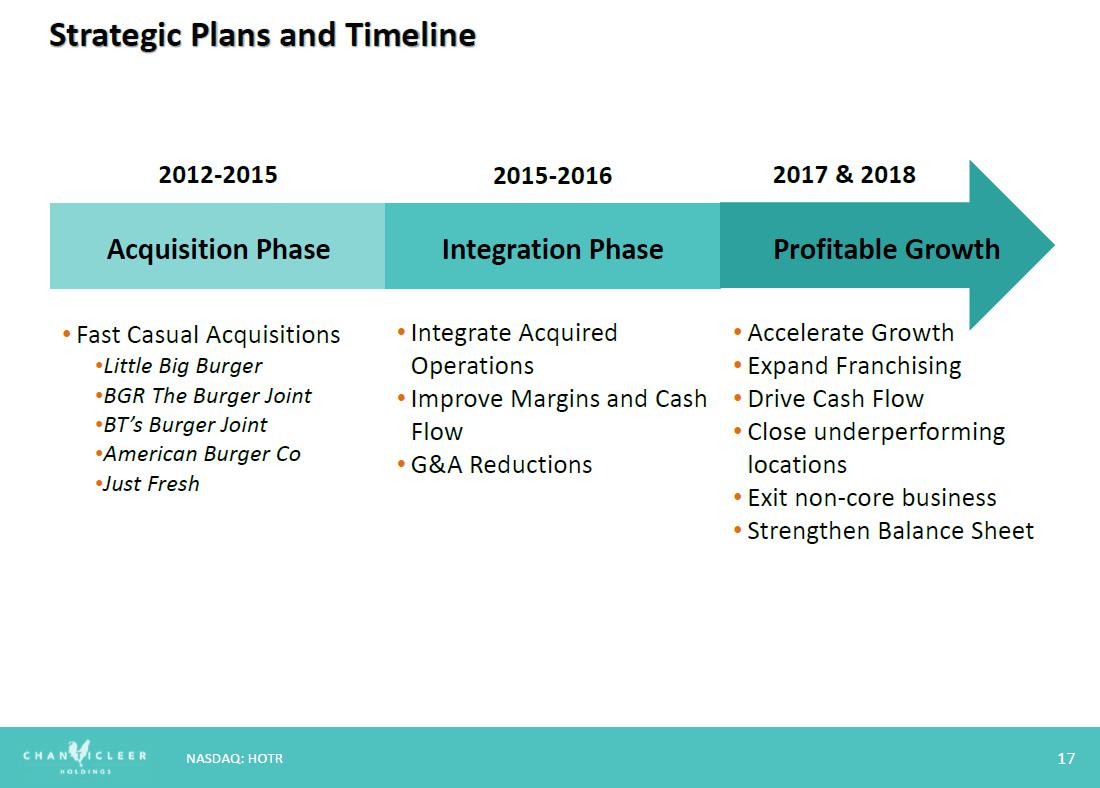

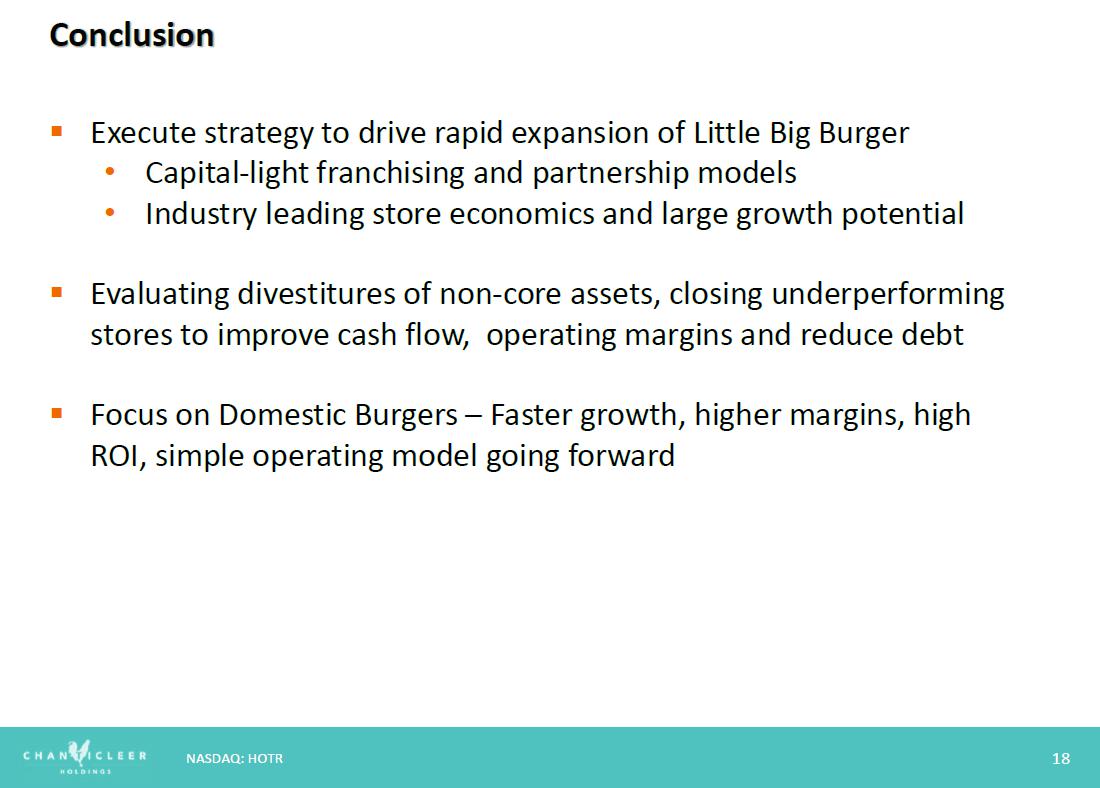

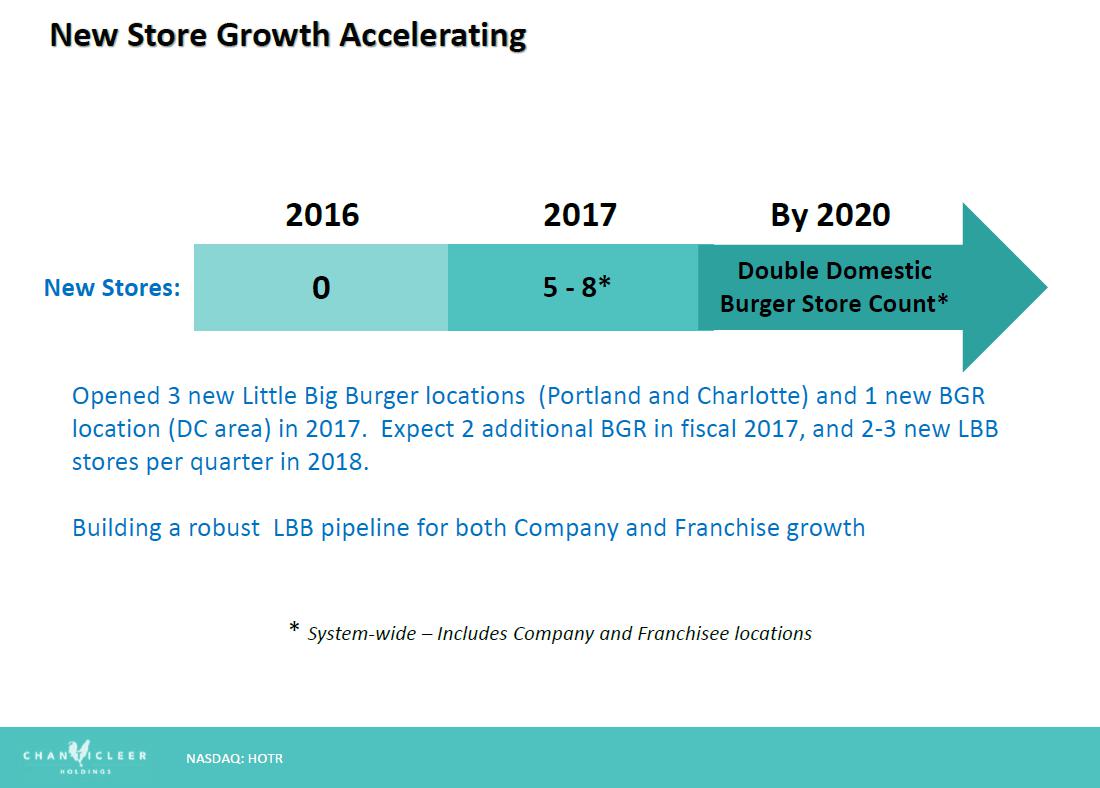

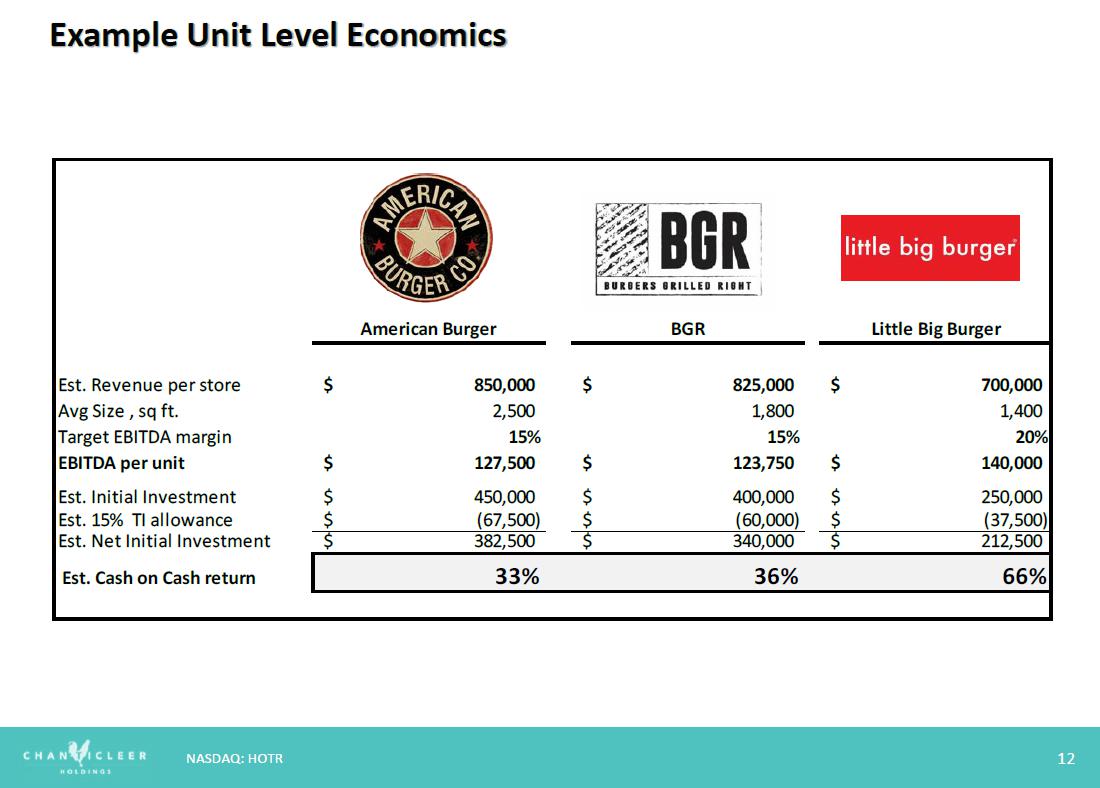

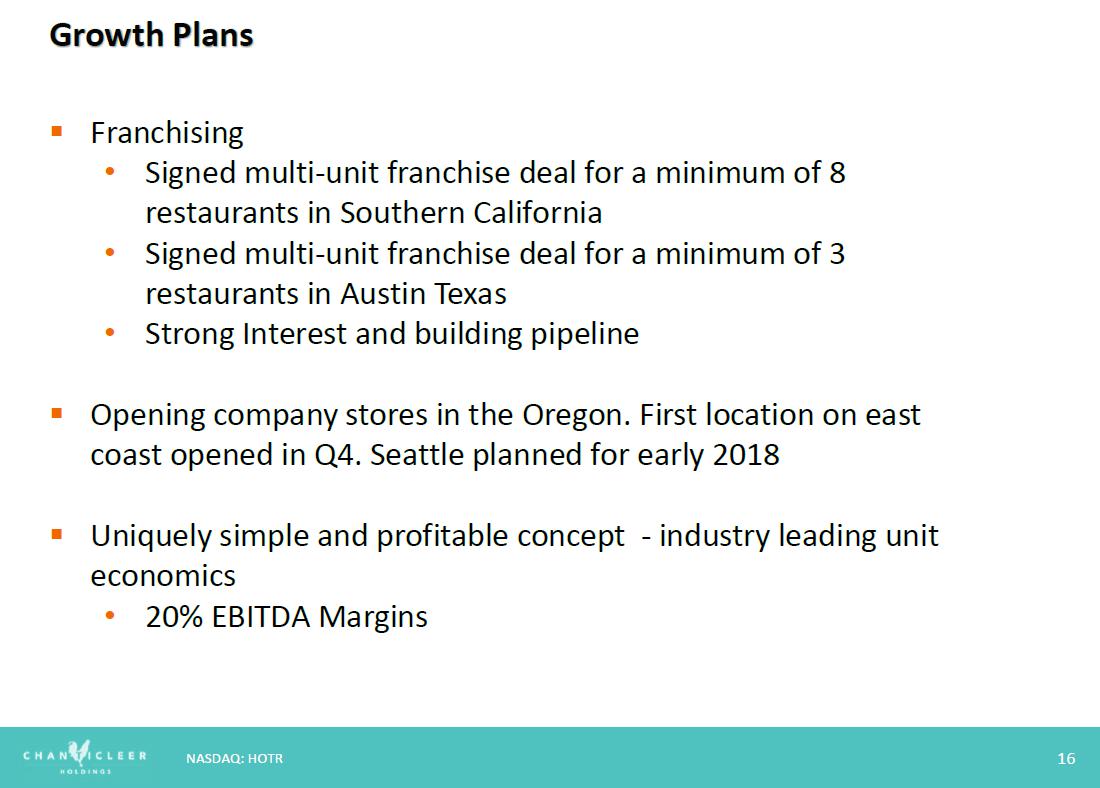

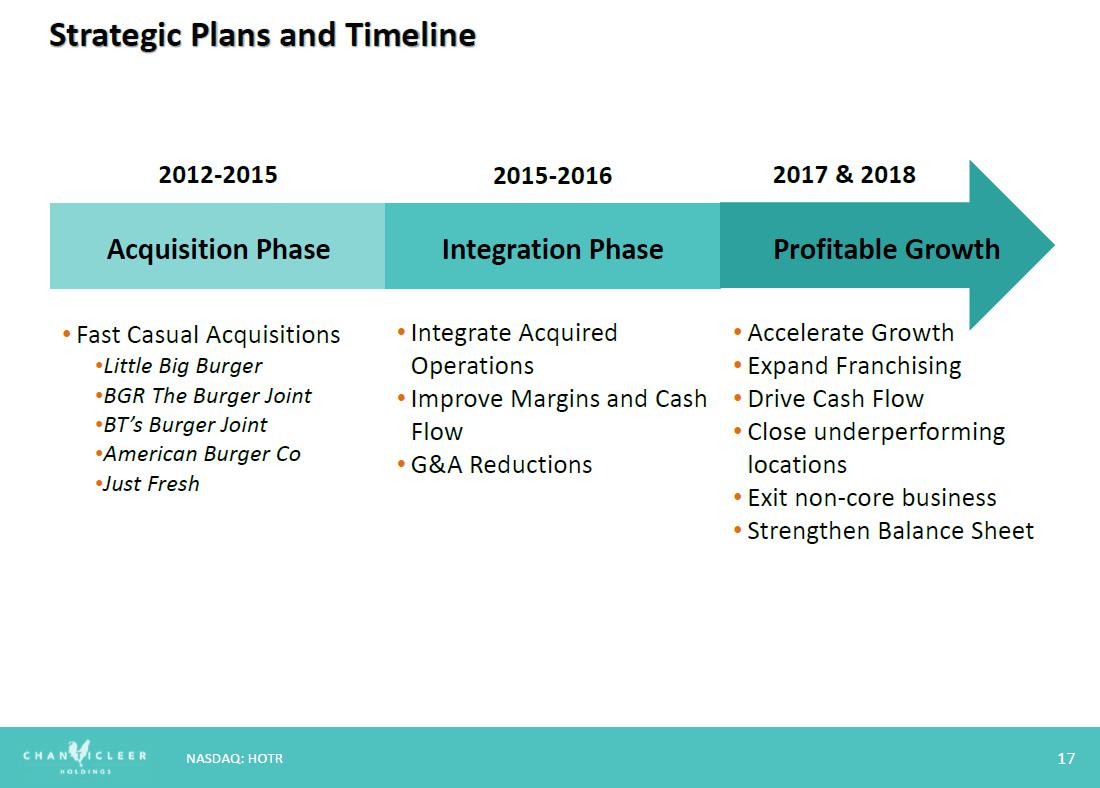

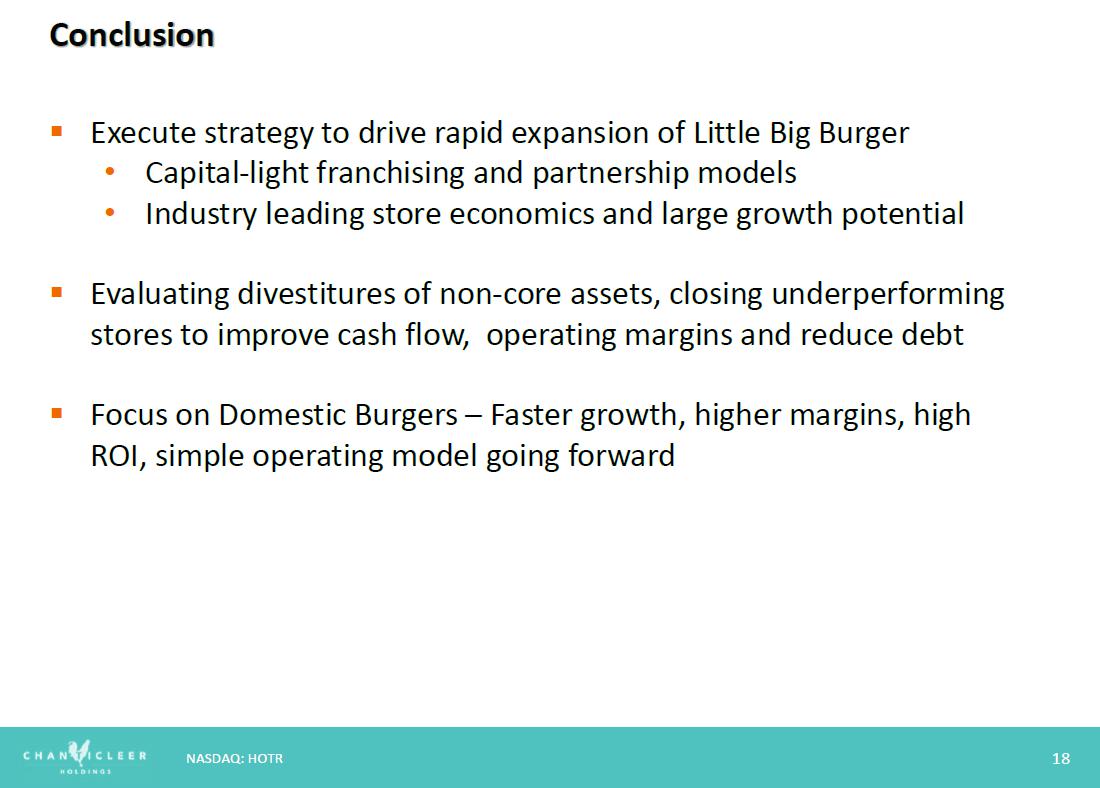

On November 10, 2017, the Company announced the Company’s common stock will trade on the Nasdaq Capital Market under the symbol “Burg”. The change to the ticker symbol will be effective at the start of trading on Tuesday, November 14, 2017. The Company is changing its ticker symbol to better align with the Company's strategic direction and its focus on the domestic better burger market, particularly Little Big Burger. The Company expects to accelerate growth of the Little Big Burger brand, which has industry-leading operating margins and a robust pipeline of new locations planned for 2018.

The information in this Item 7.01 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

99.1 Press release of Chanticleer Holdings Inc. dated November 13, 2017.

Forward-Looking Statements:

Any statements that are not historical facts contained in this Current Report on Form 8-K are "forward-looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward-looking statements are based on current expectations, involve known and unknown risks, a reliance on third parties for information, transactions or orders that may be cancelled, and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from anticipated results include risks and uncertainties related to the fluctuation of global economic conditions, the performance of management and our employees, our ability to obtain financing or required licenses, competition, general economic conditions and other factors that are detailed in our periodic reports and on documents we file from time to time with the Securities and Exchange Commission. The forward-looking statements contained in this Current Report on Form 8-K speak only as of the date the statements were made, and the companies do not undertake any obligation to update forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the PSLRA.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned duly authorized.

| Chanticleer

Holdings, Inc., a Delaware corporation (Registrant) | ||

| Date: November 13, 2017 | By: | /s/ Michael D. Pruitt |

| Name: | Michael D. Pruitt | |

| Title: | Chief Executive Officer | |

Chanticleer Holdings Reports Operating Results for

Third Quarter Ended September 30, 2017

CHARLOTTE, NC – November 13, 2017 — Chanticleer Holdings, Inc. (NASDAQ: HOTR) (“Chanticleer,” or the “Company”), owner, operator and franchisor of multiple branded restaurants in the U.S. and abroad, today announced financial results for the third quarter ended September 30, 2017.

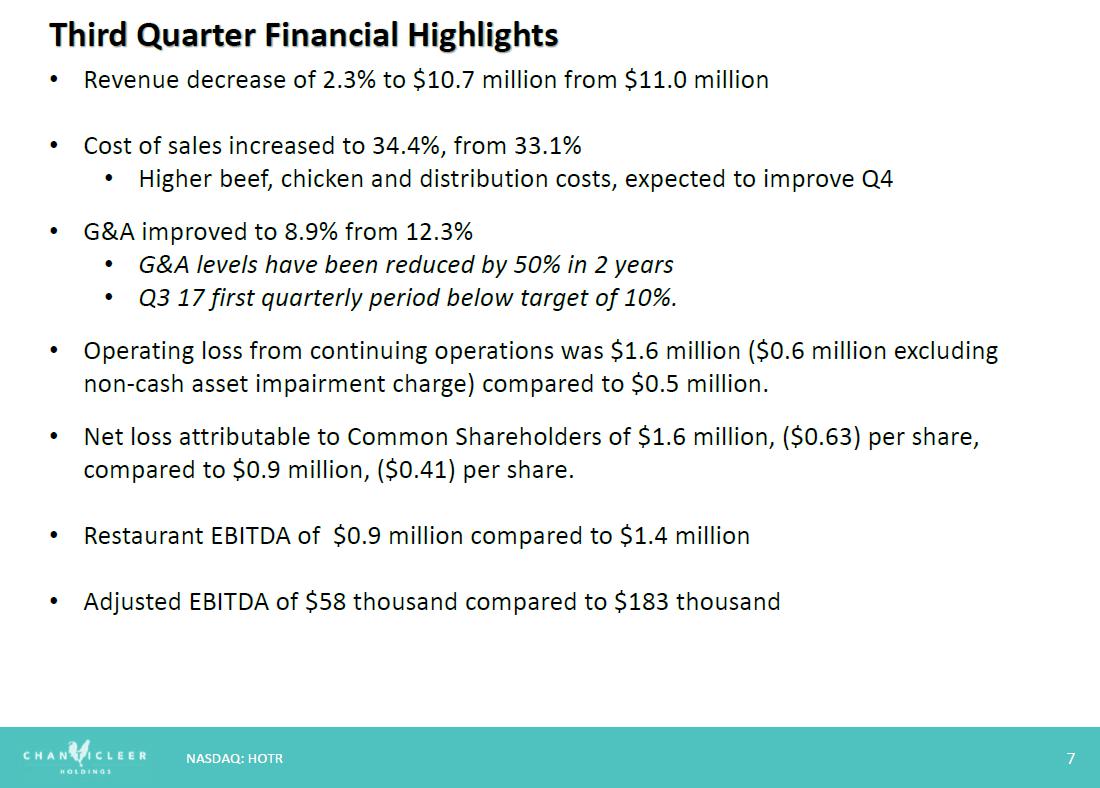

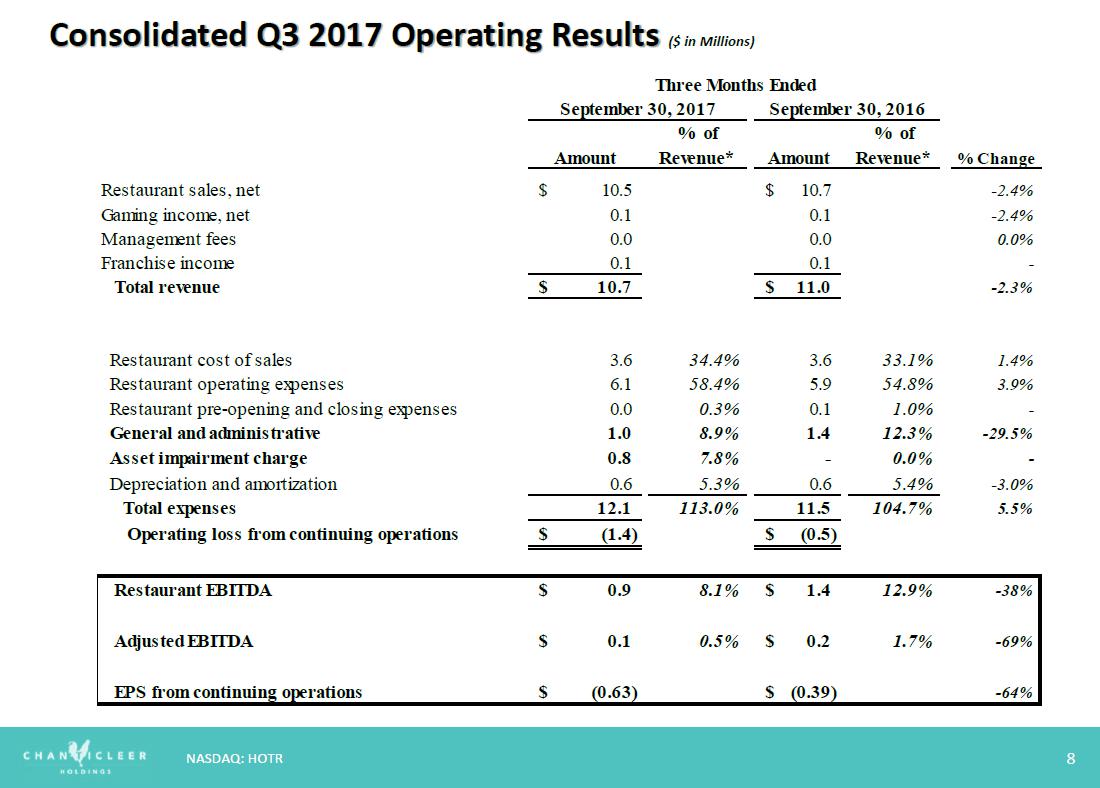

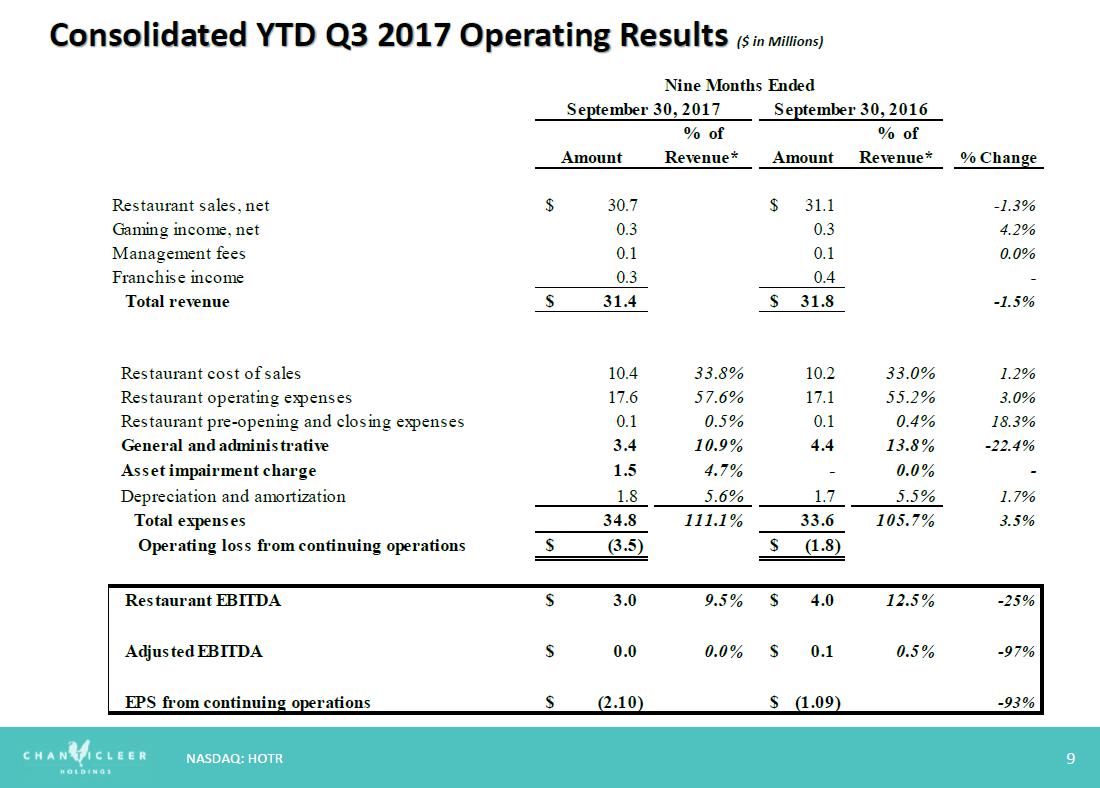

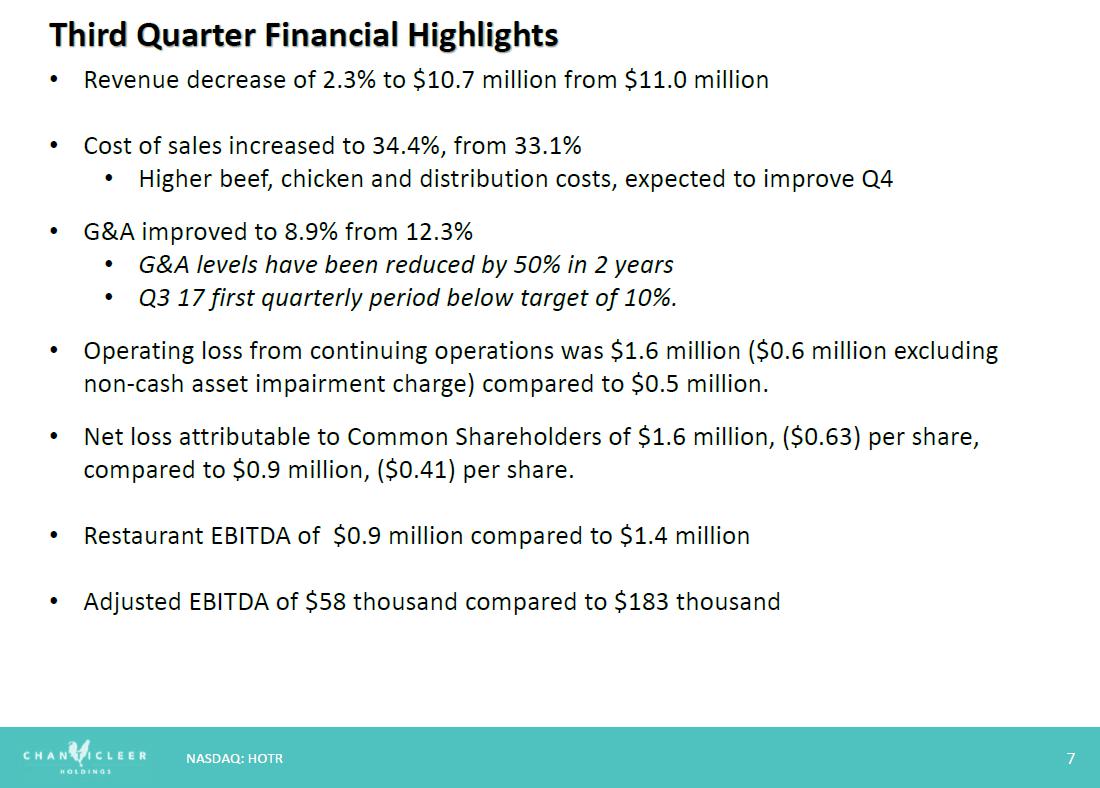

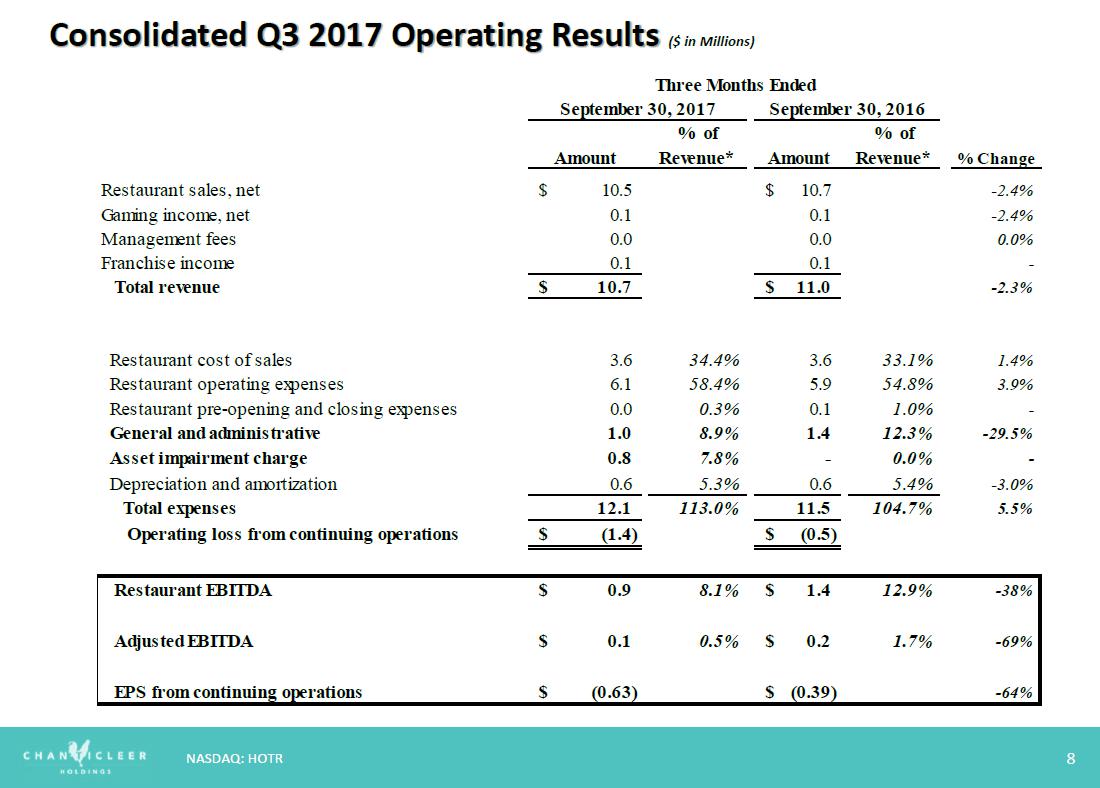

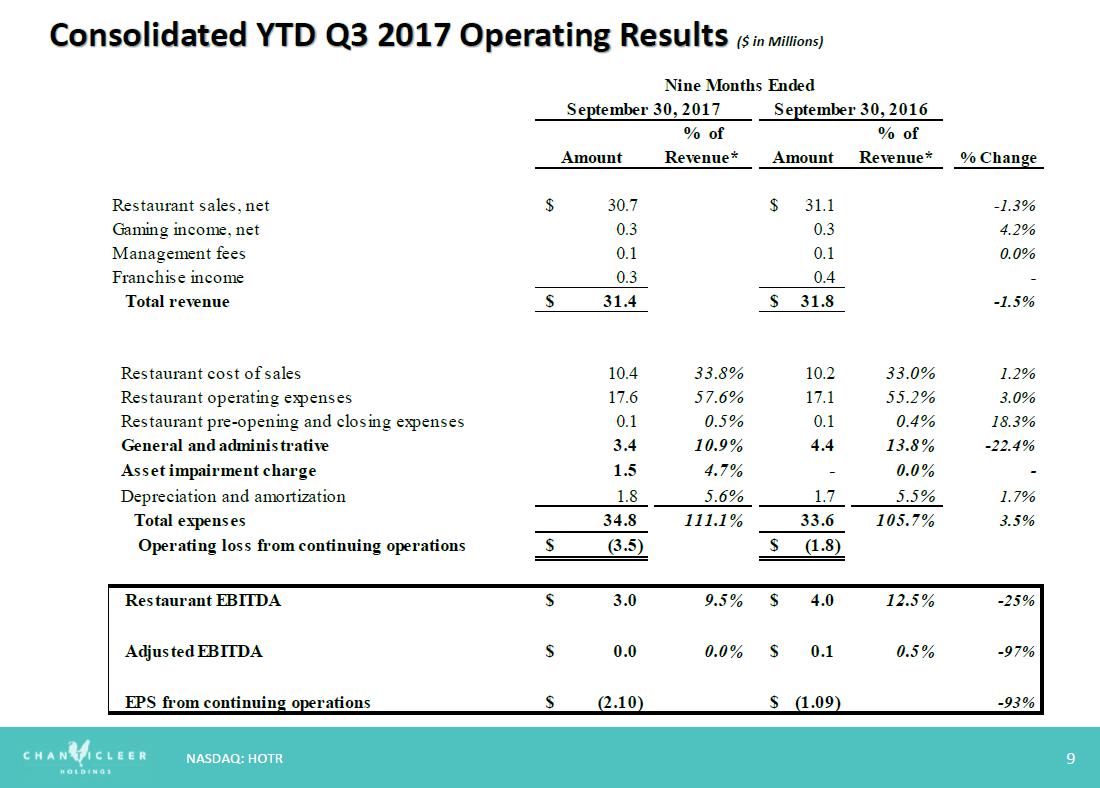

Financial Highlights of the Third Quarter

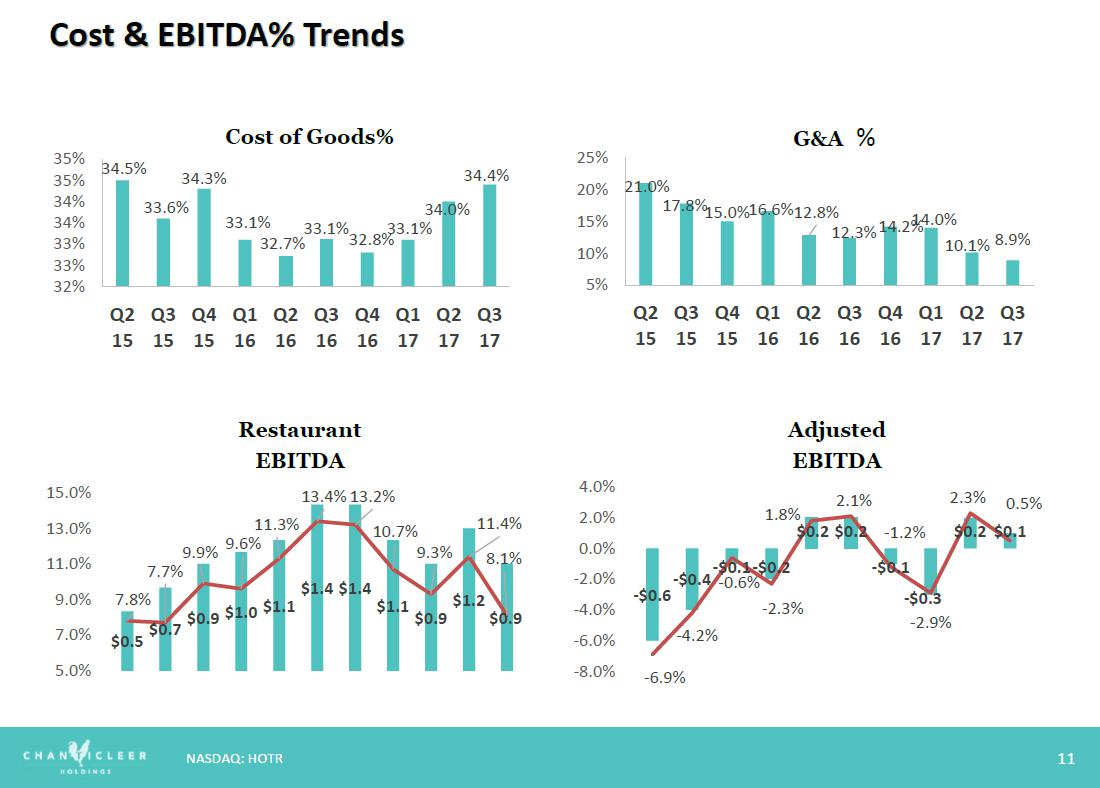

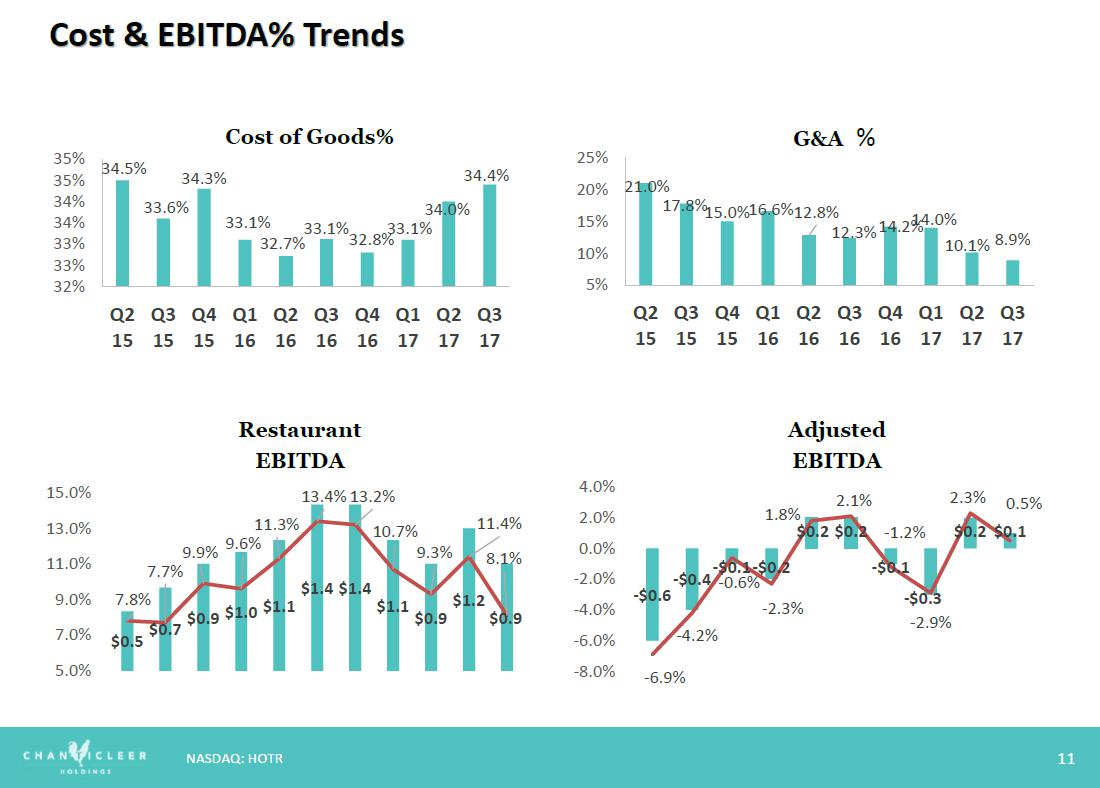

| ● | Revenue decreased 2.3% to $10.7 million from $11.0 million from Q2 16 | ||

| ● | Cost of sales as a percentage of restaurant sales was 34.4%, compared to 33.1% in the comparable quarter last year, on higher beef, chicken and distribution costs which are expected to moderate in future periods. | ||

| ● | General and administrative expenses as a percentage of total revenue improved to 8.9% from 12.3% in the comparable quarter last year | ||

| ● | G&A levels have been reduced by 50% over the past 2 years as a result of integration and efficiency initiatives -Q3 17 is first quarterly period below target of 10%. | ||

| ● | Operating loss from continuing operations was $1.4 million ($0.6 million excluding non-cash asset impairment charges) compared to $0.5 million in the comparable quarter last year. | ||

| ● | Net loss attributable to Common Shareholders was $1.6 million, ($0.63) per share, compared to $0.9 million, ($0.41) per share in the comparable quarter last year. | ||

| ● | Restaurant EBITDA was $0.9 million compared to $1.4 million for the comparable quarter of last year. | ||

| ● | Adjusted EBITDA was $58 thousand compared to $183 thousand in the comparable quarter last year. | ||

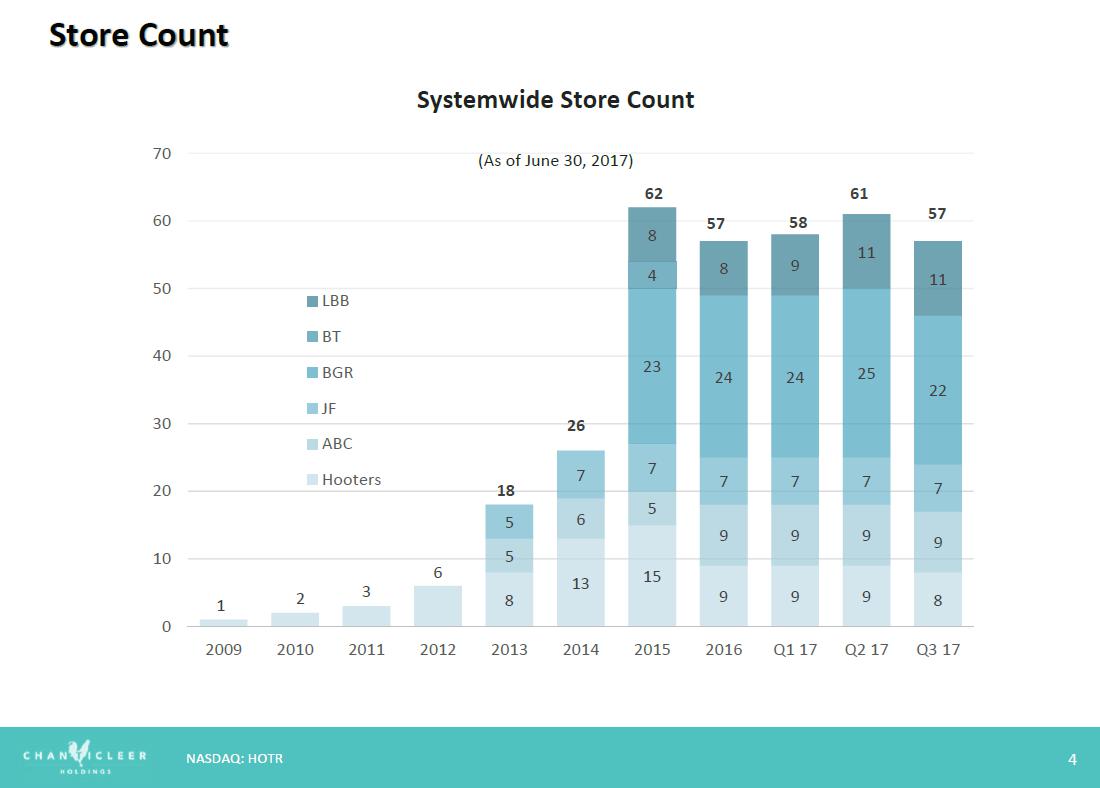

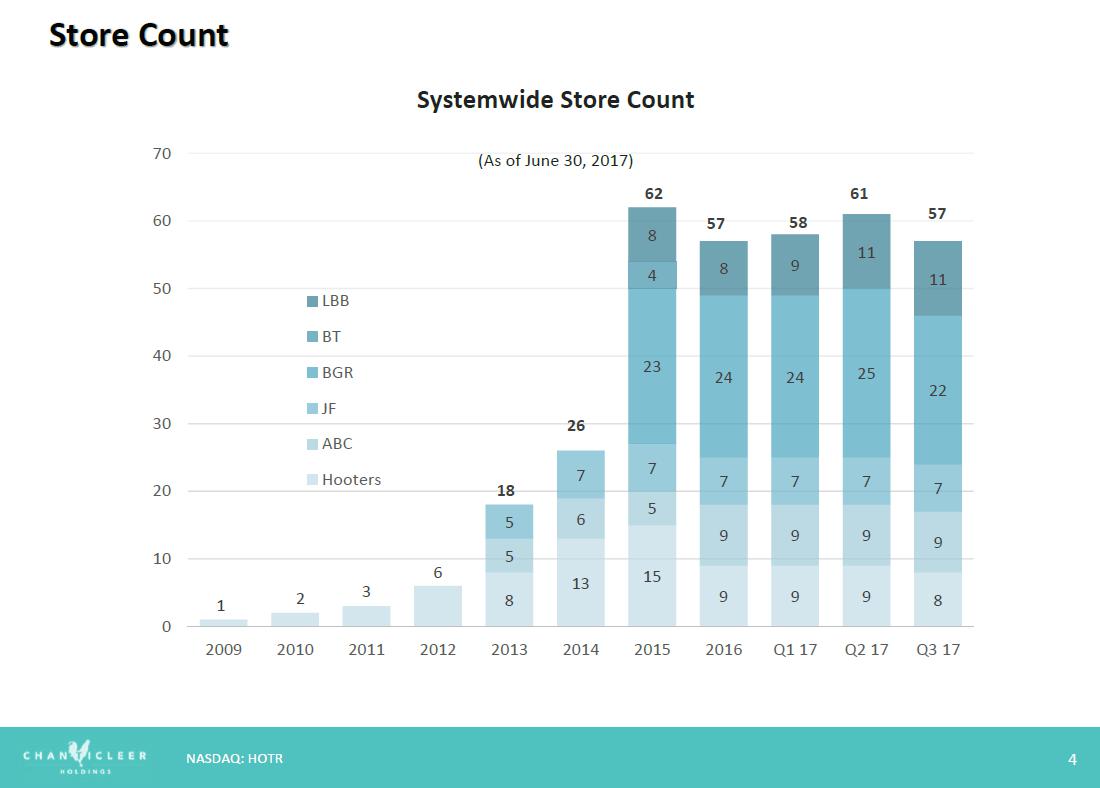

| ● | Through October, the Company has opened 4 new Little Big Burger locations and 1 new BGR location and expects to open 2 to 3 per quarter each of the next four quarters. The Company also closed 3 underperforming locations in Q3 which resulted in non-cash impairment charges and are expected to contribute to improved operating performance in future periods. | ||

Mike Pruitt, Chairman and CEO of Chanticleer commented, “We are continuing to accelerate growth of our Little Big Burger Concept. Our new locations are generating above average unit economics and outperforming our expectations. We have just started the growth phase for Little Big Burger and have a robust pipeline of locations to support future growth. We currently expect to open 8-12 new stores annually going forward, with upside to those expectations as new franchisee partners come on line.

“Chanticleer is in process of evolving and narrowing its strategic focus and allocation of resources to the domestic better burger segment where we generate the highest margins and rates of return. As we increase focus on the domestic burger business, we are also evaluating the potential sale of our domestic non-burger and international operations which would streamline the Company’s operations and significantly increase operating margins going forward.

To better reflect the increasing focus on Little Big Burger and the domestic better burger market, effective November 14, 2017, the common shares of Chanticleer Holdings will begin to trade on the NASDAQ Capital Market under the new ticker symbol “BURG”.

Conference Call

The Company will host a webcast and conference call on Monday, November 13, 2017 at 4:30 p.m. ET.

To access the call, dial (888) 289-0438 approximately five minutes prior to the scheduled start time. International callers please dial (323)-794-2423. To access the webcast, including the quarterly slide presentation, log in to the following participate link http://public.viavid.com/index.php?id=127210.

A replay of the teleconference will be available until December 13, 2017 and may be accessed by dialing (844) 512-2921. International callers may dial (412) 317-6671. Callers should use conference PIN: 4153759.

Use of Non-GAAP Measures

Chanticleer Holdings, Inc. prepares its condensed consolidated financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In addition to disclosing financial results prepared in accordance with GAAP, the Company discloses information regarding Adjusted EBITDA and Restaurant EBITDA, which differ from the term EBITDA as it is commonly used. In addition to adjusting net income (loss) from continuing operations to exclude taxes, interest, and depreciation and amortization, Adjusted EBITDA also excludes pre-opening and closing costs for our restaurants, non-cash expenses, transaction and severance related expenses, change in fair value of derivative liability and other income and expenses.

In addition, Restaurant EBITDA also excludes management fee income, franchise revenue and general and administrative expenses. Adjusted EBITDA and restaurant EBITDA are not measures of performance defined in accordance with GAAP. However, adjusted EBITDA and restaurant EBITDA are used internally in planning and evaluating the company’s operating performance and by the Company’s creditors. Accordingly, management believes that disclosure of these metrics offers investors, bankers and other stakeholders an additional view of the company’s operations that, when coupled with the GAAP results, provides a more complete understanding of the Company’s financial results.

Adjusted EBITDA and Restaurant EBITDA should not be considered as alternatives to net loss or to net cash used in operating activities as a measure of operating results or of liquidity. It may not be comparable to similarly titled measures used by other companies, and it excludes financial information that some may consider important in evaluating the company’s performance. A reconciliation of GAAP net income (loss) to Adjusted EBITDA and Restaurant EBITDA is included in the accompanying financial schedules.

For further information, please refer to Chanticleer’s Quarterly Report on Form 10-Q to be filed with the SEC on or about November 13, 2017, available online at www.sec.gov.

About Chanticleer Holdings, Inc.

Headquartered in Charlotte, NC, Chanticleer Holdings (HOTR), owns, operates and franchises fast casual and full service restaurant brands, including American Burger Company, BGR – Burgers Grilled Right, Little Big Burger, Just Fresh and Hooters.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include projections, predictions, expectations or statements as to beliefs or future events or results or refer to other matters that are not historical facts. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by these statements. The forward-looking statements contained in this press release are based on various factors and were derived using numerous assumptions. In some cases, you can identify these forward-looking statements by the words “anticipate”, “estimate”, “plan”, “project”, “continuing”, “ongoing”, “target”, “aim”, “expect”, “believe”, “intend”, “may”, “will”, “should”, “could”, or the negative of those words and other comparable words.

Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Forward-looking statements in this press release include, without limitation, statements reflecting management’s expectations for future financial performance and operating expenditures, expected growth, profitability and business outlook, increased sales and marketing expenses, and the expected results from the integration of our acquisitions.

Forward-looking statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from those anticipated by such statements. These factors include, but are not limited to, the Company’s ability to manage growth; integrate acquisitions; manage debt; meet development goals; and other important risks and uncertainties referenced and discussed under the heading titled “Risk Factors” in the Company’s filings with the Securities and Exchange Commission. Although we believe that the expectations reflected in the forward-looking statements contained in this press release are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company does not assume any obligations to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

Contact:

Chanticleer Holdings, Inc.

Mike Pruitt, Chairman/CEO

Phone: 704.366.5122 x 1

ir@chanticleerholdings.com

Chanticleer Holdings, Inc. and Subsidiaries

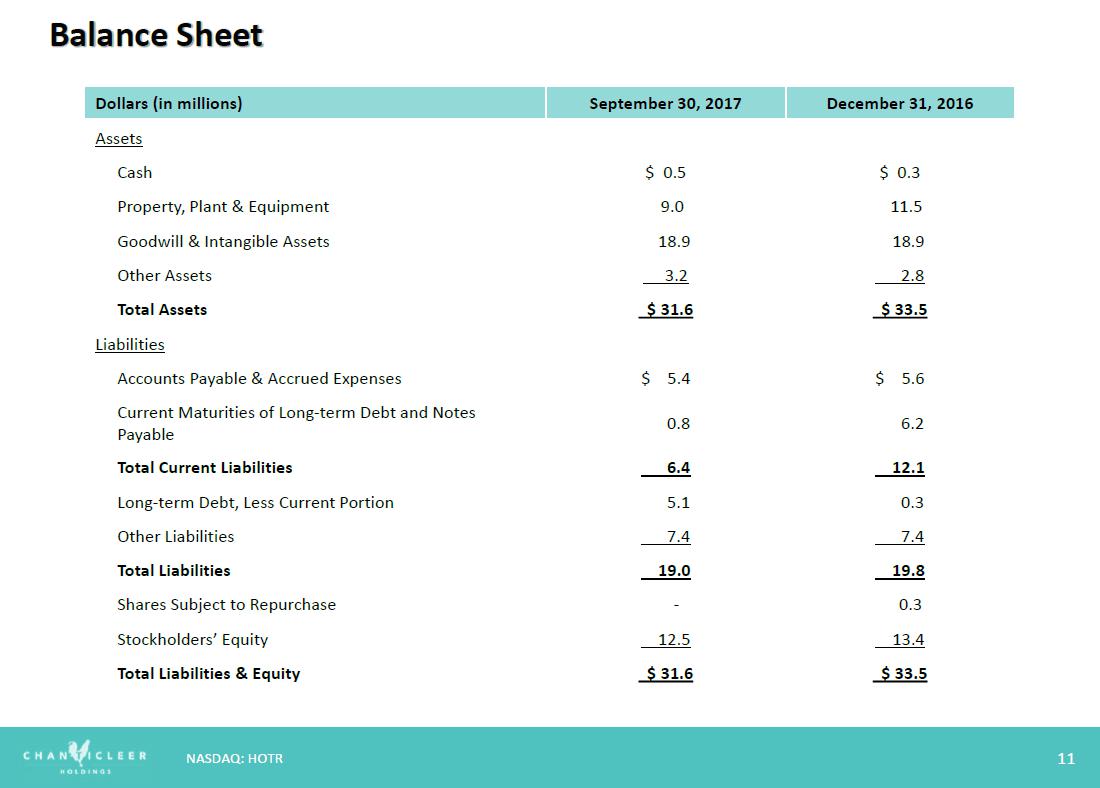

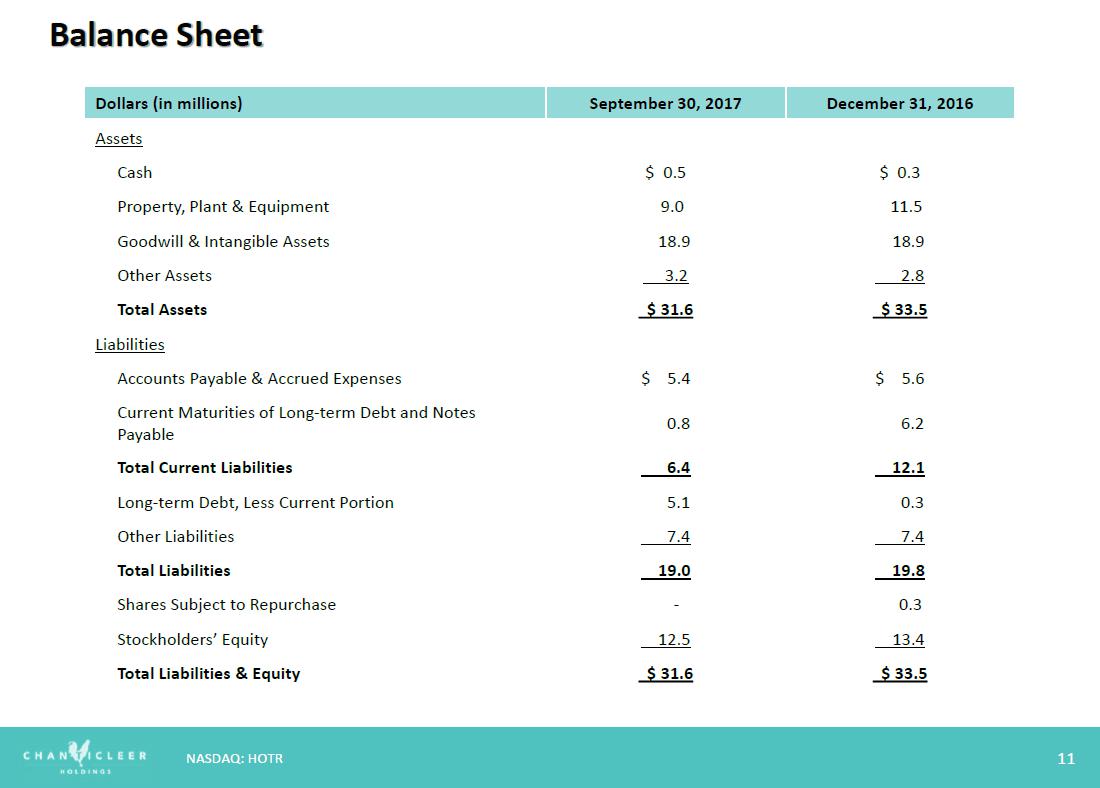

Condensed Consolidated Balance Sheets

| (Unaudited) | ||||||||

| September 30, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 295,462 | $ | 268,575 | ||||

| Restricted cash | 250,861 | - | ||||||

| Accounts and other receivables | 275,205 | 524,481 | ||||||

| Inventories | 463,866 | 539,550 | ||||||

| Prepaid expenses and other current assets | 333,593 | 461,074 | ||||||

| Assets held for sale, net | 725,644 | - | ||||||

| TOTAL CURRENT ASSETS | 2,344,631 | 1,793,680 | ||||||

| Property and equipment, net | 9,006,200 | 11,513,693 | ||||||

| Goodwill | 12,603,545 | 12,405,770 | ||||||

| Intangible assets, net | 6,310,949 | 6,530,243 | ||||||

| Investments | 800,000 | 800,000 | ||||||

| Deposits and other assets | 499,264 | 442,737 | ||||||

| TOTAL ASSETS | $ | 31,564,589 | $ | 33,486,123 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 5,384,918 | $ | 5,553,068 | ||||

| Current maturities of long-term debt and notes payable | 771,032 | 6,171,649 | ||||||

| Current maturities of capital leases payable | 4,210 | 18,449 | ||||||

| Due to related parties | 194,350 | 194,350 | ||||||

| Deferred rent | 89,571 | 173,775 | ||||||

| TOTAL CURRENT LIABILITIES | 6,444,081 | 12,111,291 | ||||||

| Long-term debt, less current portion, net of discount and deferred financing costs of $1,466,739 and $0, respectively | 5,142,343 | 287,445 | ||||||

| Convertible notes payable, net of debt discount (premium) of ($14,704) and $46,936, respectively | 3,214,704 | 3,678,064 | ||||||

| Redeemable preferred stock: no par value, 62,876 and 19,050 shares issued and outstanding, net of discount of $226,089 and $0, respectively | 631,433 | 257,175 | ||||||

| Deferred rent | 2,006,715 | 1,961,751 | ||||||

| Deferred tax liabilities | 1,591,284 | 1,485,554 | ||||||

| TOTAL LIABILITIES | 19,030,560 | 19,781,280 | ||||||

| Commitments and contingencies | ||||||||

| Common stock subject to repurchase obligation; 0 and 56,290 shares issued and outstanding, respectively | - | 349,000 | ||||||

| Stockholders' equity: | ||||||||

| Preferred stock: no par value; authorized 5,000,000 shares; 62,876 and 19,050 issued issued and outstanding, respectively | - | - | ||||||

| Common stock: $0.0001 par value; authorized 45,000,000 shares; issued and outstanding 2,514,157 and 2,139,424 shares, respectively | 251 | 213 | ||||||

| Additional paid in capital | 59,506,252 | 55,926,196 | ||||||

| Accumulated other comprehensive loss | (934,703 | ) | (1,155,658 | ) | ||||

| Accumulated deficit | (46,942,691 | ) | (42,206,325 | ) | ||||

| Total Chanticleer Holdings, Inc, Stockholder's Equity | 11,629,109 | 12,564,426 | ||||||

| Non-Controlling Interests | 904,920 | 791,417 | ||||||

| TOTAL STOCKHOLDERS' EQUITY | 12,534,029 | 13,355,843 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 31,564,589 | $ | 33,486,123 | ||||

See accompanying notes to unaudited condensed consolidated financial statements

Chanticleer Holdings, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | |||||||||||||

| Revenue: | ||||||||||||||||

| Restaurant sales, net | $ | 10,479,275 | $ | 10,737,961 | $ | 30,657,215 | $ | 31,068,281 | ||||||||

| Gaming income, net | 115,268 | 118,136 | 328,855 | 315,647 | ||||||||||||

| Management fee income | 24,999 | 25,000 | 74,982 | 75,000 | ||||||||||||

| Franchise income | 105,823 | 95,542 | 289,626 | 381,481 | ||||||||||||

| Total revenue | 10,725,365 | 10,976,639 | 31,350,678 | 31,840,409 | ||||||||||||

| Expenses: | ||||||||||||||||

| Restaurant cost of sales | 3,605,212 | 3,553,684 | 10,376,160 | 10,248,770 | ||||||||||||

| Restaurant operating expenses | 6,119,561 | 5,888,509 | 17,649,532 | 17,140,692 | ||||||||||||

| Restaurant pre-opening and closing expenses | 34,349 | 110,432 | 139,545 | 117,987 | ||||||||||||

| General and administrative expenses | 952,959 | 1,351,112 | 3,413,001 | 4,400,826 | ||||||||||||

| Asset impairment charge | 838,928 | - | 1,472,890 | - | ||||||||||||

| Depreciation and amortization | 572,798 | 590,433 | 1,768,837 | 1,738,815 | ||||||||||||

| Total expenses | 12,123,807 | 11,494,170 | 34,819,965 | 33,647,090 | ||||||||||||

| Operating loss from continuing operations | (1,398,442 | ) | (517,531 | ) | (3,469,287 | ) | (1,806,681 | ) | ||||||||

| Other (expense) income | ||||||||||||||||

| Interest expense | (309,538 | ) | (453,150 | ) | (1,218,379 | ) | (1,704,556 | ) | ||||||||

| Change in fair value of derivative liabilities | - | 102,507 | - | 1,231,608 | ||||||||||||

| Gain (loss) on debt refinancing | - | - | (95,310 | ) | - | |||||||||||

| Other income (expense) | 37,839 | 32,357 | 50,050 | 12,388 | ||||||||||||

| Total other expense | (271,699 | ) | (318,286 | ) | (1,263,639 | ) | (460,560 | ) | ||||||||

| Loss from continuing operations before income taxes | (1,670,141 | ) | (835,817 | ) | (4,732,926 | ) | (2,267,241 | ) | ||||||||

| Income tax expense | (56,070 | ) | (52,474 | ) | (169,398 | ) | (137,867 | ) | ||||||||

| Loss from continuing operations | (1,726,211 | ) | (888,291 | ) | (4,902,324 | ) | (2,405,108 | ) | ||||||||

| Discontinued operations | ||||||||||||||||

| Loss from discontinued operations, net of tax | - | (68,718 | ) | - | (1,304,627 | ) | ||||||||||

| Loss on write down of net assets | - | - | - | (3,876,161 | ) | |||||||||||

| Consolidated net loss | (1,726,211 | ) | (957,009 | ) | (4,902,324 | ) | (7,585,896 | ) | ||||||||

| Less: Net loss attributable to non-controlling interest of continuing operations | 168,772 | 39,248 | 245,943 | 53,612 | ||||||||||||

| Less: Net loss attributable to non-controlling interest of discontinued operations | - | 13,744 | - | 260,925 | ||||||||||||

| Net loss attributable to Chanticleer Holdings, Inc. | $ | (1,557,439 | ) | $ | (904,017 | ) | $ | (4,656,381 | ) | $ | (7,271,359 | ) | ||||

| - | - | |||||||||||||||

| Net loss attributable to Chanticleer Holdings, Inc.: | ||||||||||||||||

| Loss from continuing operations | $ | (1,557,439 | ) | $ | (849,043 | ) | $ | (4,656,381 | ) | $ | (2,351,497 | ) | ||||

| Loss from discontinued operations | - | (54,974 | ) | - | (4,919,862 | ) | ||||||||||

| Net loss attributable to Chanticleer Holdings, Inc. | $ | (1,557,439 | ) | $ | (904,017 | ) | $ | (4,656,381 | ) | $ | (7,271,359 | ) | ||||

| Dividends on redeemable preferred stock | (28,219 | ) | - | (79,988 | ) | - | ||||||||||

| Net loss attributable to common shareholders of Chanticleer Holdings, Inc. | $ | (1,585,658 | ) | $ | (904,017 | ) | $ | (4,736,369 | ) | $ | (7,271,359 | ) | ||||

| Net loss attributable to Chanticleer Holdings, Inc. per common share, basic and diluted: | $ | (0.63 | ) | $ | (0.41 | ) | $ | (2.10 | ) | $ | (3.37 | ) | ||||

| Continuing operations attributable to common stockholders, basic and diluted | $ | (0.63 | ) | $ | (0.39 | ) | $ | (2.10 | ) | $ | (1.09 | ) | ||||

| Discontinued operations attributable to common stockholders, basic and diluted | $ | - | $ | (0.02 | ) | $ | - | $ | (2.28 | ) | ||||||

| Weighted average shares outstanding, basic and diluted | 2,501,534 | 2,195,715 | 2,258,013 | 2,160,703 | ||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements

Chanticleer Holdings, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

| Nine Months Ended | ||||||||

| September 30, 2017 | September 30, 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (4,902,324 | ) | $ | (7,585,896 | ) | ||

| Net loss from discontinued operations | - | 5,180,788 | ||||||

| Net loss from continuing operations | (4,902,324 | ) | (2,405,108 | ) | ||||

| Adjustments to reconcile net loss from continuing operations to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 1,768,837 | 1,738,815 | ||||||

| Asset impairment charge | 1,472,890 | - | ||||||

| Loss on debt refinancing | 95,310 | - | ||||||

| Common stock and warrants issued for services | 217,816 | 24,510 | ||||||

| Common stock and warrants issued for interest | - | 349,000 | ||||||

| Amortization of debt discount | 501,126 | 925,806 | ||||||

| Change in assets and liabilities: | ||||||||

| Accounts and other receivables | 249,255 | (34,820 | ) | |||||

| Prepaid and other assets | 50,667 | 153,895 | ||||||

| Inventory | 23,872 | 55,173 | ||||||

| Accounts payable and accrued liabilities | 320,135 | 501,078 | ||||||

| Change in amounts payable to related parties | - | 196,600 | ||||||

| Derivative liabilities | - | (1,231,608 | ) | |||||

| Deferred income taxes | 105,729 | 96,318 | ||||||

| Deferred rent | 109,219 | (290,530 | ) | |||||

| Net cash provided by (used in) operating activities from continuing operations | 12,532 | 79,129 | ||||||

| Net cash used in operating activities from discontinued operations | - | (75,000 | ) | |||||

| Net cash provided by (used in) operating activities | 12,532 | 4,129 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchase of property and equipment | (1,323,066 | ) | (708,214 | ) | ||||

| Cash paid for acquisitions, net of cash acquired | - | (72,215 | ) | |||||

| Proceeds from sale of investments | - | 8,902 | ||||||

| Net cash used in investing activities from continuing operations | (1,323,066 | ) | (771,527 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from sale of preferred stock | 591,651 | - | ||||||

| Payments related to sale of preferred stock | (243,480 | ) | - | |||||

| Loan proceeds | 6,594,535 | 125,000 | ||||||

| Payment of deferred financing costs | (293,294 | ) | ||||||

| Loan repayments | (5,706,774 | ) | (340,582 | ) | ||||

| Proceeds from convertible debt | - | |||||||

| Capital lease payments | (20,916 | ) | (32,897 | ) | ||||

| Contribution of non-controlling interest | 675,000 | 796,911 | ||||||

| Net cash provided by (used in) financing activities from continuing operations | 1,596,722 | 548,432 | ||||||

| Effect of exchange rate changes on cash | (8,440 | ) | (14,693 | ) | ||||

| Net increase (decrease) in cash and restricted cash | 277,748 | (233,659 | ) | |||||

| Cash and restricted cash, beginning of period | 268,575 | 1,224,415 | ||||||

| Cash and restricted cash, end of period | $ | 546,323 | $ | 990,756 | ||||

See accompanying notes to unaudited condensed consolidated financial statements

Chanticleer Holdings, Inc. and Subsidiaries

Reconcilation of Net Loss to EBITDA

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | |||||||||||||

| Consolidated net loss | $ | (1,726,211 | ) | $ | (888,291 | ) | $ | (4,902,324 | ) | $ | (2,405,108 | ) | ||||

| Interest expense | 309,538 | 453,150 | 1,218,379 | 1,704,556 | ||||||||||||

| Income tax | 56,070 | 52,474 | 169,398 | 137,867 | ||||||||||||

| Depreciation and amortization | 572,798 | 590,433 | 1,768,837 | 1,738,815 | ||||||||||||

| EBITDA | $ | (787,805 | ) | $ | 207,767 | $ | (1,745,709 | ) | $ | 1,176,130 | ||||||

| Restaurant pre-opening and closing expenses | 34,349 | 110,432 | 139,545 | 117,987 | ||||||||||||

| Change in fair value of derivative liabilities | - | (102,507 | ) | - | (1,231,608 | ) | ||||||||||

| (Gain) loss on debt refinancing | - | - | 95,310 | - | ||||||||||||

| Asset impairment charge | 838,928 | - | 1,472,890 | - | ||||||||||||

| Transaction and severence related expenses | 10,000 | - | 92,750 | 98,399 | ||||||||||||

| Other income (expense) | (37,839 | ) | (32,357 | ) | (50,050 | ) | (12,388 | ) | ||||||||

| Adjusted EBITDA | $ | 57,634 | $ | 183,334 | $ | 4,737 | $ | 148,520 | ||||||||

| General and administrative expenses | 942,959 | 1,351,112 | 3,340,251 | 4,302,427 | ||||||||||||

| Franchise revenues | (105,823 | ) | (95,542 | ) | (289,626 | ) | (381,481 | ) | ||||||||

| Management fee revenue | (24,999 | ) | (25,000 | ) | (74,982 | ) | (75,000 | ) | ||||||||

| Restaurant EBITDA | $ | 869,771 | $ | 1,413,905 | $ | 2,980,380 | $ | 3,994,466 | ||||||||

>GJ>@J&:]B9FQ9NHY-!T\6LKILB1D3:>-Q<\C

MUX#?3FN>GO\ [//(5=OF)=23G"]A^F?SJSJU[!JLEG>6XD2TCB2)OO'RR,EN

M3UYSS[5E1HLMU.$/[K)"DG=D?7OQBLJEW+38UA91UW(VO#<"/9&RD Y(/4^M

M:$ BBE"M+DHHD?