UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

LETTER TO STOCKHOLDERS

To RPM International Inc. Stockholders:

I would like to extend a personal invitation for you to participate in this year’s Annual Meeting of RPM Stockholders, which will be held in virtual meeting format on Thursday, October 3, 2024 at 1:30 p.m., Eastern Daylight Time.

At this year’s Annual Meeting, you will vote (i) to adopt an amendment to the Company’s Amended and Restated Certificate of Incorporation to require the annual election of Directors, (ii) on the election of three Directors, (iii) in a non-binding, advisory capacity, on a proposal to approve our executive compensation, (iv) to approve and adopt the Company’s 2024 Omnibus Equity and Incentive Plan and (v) on a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the current fiscal year ending May 31, 2025. We also look forward to giving you a report on the first quarter of our current fiscal year, which ends on August 31. As in the past, there will be a discussion of the Company’s business, during which time your questions and comments will be welcomed.

This year’s Annual Meeting will be held in virtual format through a live webcast. You will not be able to attend the Annual Meeting physically in person. You will be able to vote and submit questions by visiting www.virtualshareholdermeeting.com/RPM2024 and participating live in the webcast. A secure control number that will allow you to participate in the meeting electronically can be found on your notice of internet availability or the enclosed proxy card.

All stockholders are cordially invited to participate in the Annual Meeting. Whether or not you plan to participate in the Annual Meeting virtually, voting in advance via the internet or the return of the enclosed Proxy as soon as possible would be greatly appreciated and will ensure that your shares will be represented at the Annual Meeting. If you do participate in the Annual Meeting virtually, you may, of course, withdraw your Proxy should you wish to vote during the Annual Meeting.

On behalf of the Directors and management of RPM, I would like to thank you for your continued support and confidence.

Sincerely yours,

Frank C. Sullivan

Chair and Chief Executive Officer

August 22, 2024

| |  RPM INTERNATIONAL INC. 2628 PEARL ROAD MEDINA, OHIO 44256 330-273-5090 | |

NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

Notice is hereby given that the Annual Meeting of Stockholders of RPM International Inc. will be held on Thursday, October 3, 2024, at 1:30 p.m., Eastern Daylight Time, for the following purposes:

Items to be Voted on

| | 1 | | | To adopt an amendment to the Company’s Amended and Restated Certificate of Incorporation to require the annual election of Directors; | |

| | 2 | | | To elect three Directors to serve in Class II of the Board; | |

| | 3 | | | To hold a non-binding, advisory vote to approve the Company’s executive compensation; | |

| | 4 | | | To approve and adopt the Company’s 2024 Omnibus Equity and Incentive Plan; | |

| | 5 | | | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the current fiscal year ending May 31, 2025; and | |

| | 6 | | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | |

Meeting Details

| DATE Thursday, October 3, 2024 | | |  | VIRTUAL MEETING Online at www.virtualshareholder meeting.com/RPM2024 | |

| TIME 1:30 p.m., Eastern Daylight Time | | |  | RECORD DATE Friday, August 9, 2024 | |

This year’s Annual Meeting will be held in virtual format through a live webcast. Stockholders will not be able to attend the Annual Meeting physically in person. Stockholders will be able to vote and submit questions by visiting www.virtualshareholdermeeting.com/RPM2024 and participating live in the webcast. A secure control number that will allow you to participate in the meeting electronically can be found on your notice of internet availability or the enclosed proxy card.

Holders of shares of Common Stock of record at the close of business on August 9, 2024 are entitled to receive notice of and to vote at the Annual Meeting.

By Order of the Board of Directors.

Edward W. Moore, Secretary

August 22, 2024

| |  Your Vote is Important  RPM INTERNATIONAL INC. 2628 PEARL ROAD MEDINA, OHIO 44256 330-273-5090 | |

2024 PROXY STATEMENT

TABLE OF CONTENTS

2628 PEARL ROAD

MEDINA, OHIO 44256

PROXY STATEMENT

Mailed on or about August 22, 2024

Annual Meeting of Stockholders to be held on October 3, 2024

This Proxy Statement is furnished in connection with the solicitation of Proxies by the Board of Directors of RPM International Inc. (the “Company” or “RPM”) to be used at the Annual Meeting of Stockholders of the Company to be held on October 3, 2024, and any adjournment or postponement thereof. The time, place and purposes of the Annual Meeting are stated in the Notice of Annual Meeting of Stockholders which accompanies this Proxy Statement.

The accompanying Proxy is solicited by the Board of Directors of the Company. All validly executed Proxies received by the Board of Directors of the Company pursuant to this solicitation will be voted at the Annual Meeting, and the directions contained in such Proxies will be followed in each instance. If no directions are given, the Proxy will be voted (i) FOR the amendment of the Amended and Restated Certificate of Incorporation, (ii) FOR the election of the three nominees listed on the Proxy, (iii) FOR Proposal Three relating to the advisory vote on executive compensation, (iv) FOR the approval and adoption of the Company’s 2024 Omnibus Equity and Incentive Plan (the “2024 Omnibus Plan”) and (v) FOR ratifying the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending May 31, 2025.

Any person giving a Proxy pursuant to this solicitation may revoke it. A stockholder, without affecting any vote previously taken, may revoke a Proxy by giving notice to the Company in writing, in open meeting or by a duly executed Proxy bearing a later date.

The expense of soliciting Proxies, including the cost of preparing, assembling and mailing the Notice, Proxy Statement and Proxy, will be borne by the Company. The Company may pay persons holding shares for others their expenses for sending proxy materials to their principals. In addition to solicitation of Proxies by mail, the Company’s Directors, officers and employees, without additional compensation, may solicit Proxies by telephone, electronic means and personal interview. Also, the Company has engaged a professional proxy solicitation firm, Innisfree M&A Incorporated (“Innisfree”), to assist it in soliciting proxies. The Company will pay a fee of approximately $20,000, plus expenses, to Innisfree for these services.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on October 3, 2024: Proxy materials for the Company’s Annual Meeting, including the 2024 Annual Report on Form 10-K and this Proxy Statement, are now available over the Internet by accessing the Investors section of our website at www.rpminc.com. You also can obtain a printed copy of this Proxy Statement, free of charge, by writing to: RPM International Inc., c/o Secretary, 2628 Pearl Road, Medina, Ohio 44256.

| | | 2024 Proxy Statement | | | 1 |

This summary highlights information contained elsewhere in this Proxy Statement and in the Company’s Annual Report on Form 10-K. For more complete information about these topics, please review the Company’s complete Proxy Statement and Annual Report on Form 10-K.

Meeting Details | | | How to Vote | | ||

| DATE Thursday, October 3, 2024 | | |  | BY PHONE Call 1-800-690-6309 by 11:59 PM, Eastern Daylight Time, on October 2, 2024 for shares held directly or 11:59 PM, Eastern Daylight Time, on September 30, 2024 for shares held in a Plan | |

| TIME 1:30 PM, Eastern Daylight Time | | |  | BY MAIL Sign, date and return your proxy card or voting instruction form by October 2, 2024 | |

| VIRTUAL MEETING Online at www.virtualshareholder meeting.com/RPM2024 | | |  | BY TABLET OR SMARTPHONE Online at www.virtualshareholder meeting.com/RPM2024 | |

| RECORD DATE Shareholders of record on the close of business on August 9, 2024 are entitled to vote at the 2024 Annual Meeting. | | |  | BY INTERNET Using your computer visit proxyvote.com until 11:59 PM, Eastern Daylight Time, on October 2, 2024 for shares held directly or 11:59 PM, Eastern Daylight Time, on September 30, 2024 for shares held in a Plan or vote online on October 3, 2024 during the Annual Meeting at: www.virtualshareholdermeeting.com/RPM2024 | |

| | Proposals | | | Board Recommendation | | | Page | | |||

| | 1 | | | To adopt an amendment to the Company’s Amended and Restated Certificate of Incorporation to require the annual election of Directors | | | FOR | | | | |

| | 2 | | | To elect three Directors to serve in Class II of the Board | | | FOR each Director | | | | |

| | 3 | | | To hold a non-binding, advisory vote to approve the Company’s executive compensation | | | FOR | | | | |

| | 4 | | | To approve and adopt the Company’s 2024 Omnibus Equity and Incentive Plan (the “2024 Omnibus Plan”) | | | FOR | | | | |

| | 5 | | | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the current fiscal year ending May 31, 2025 | | | FOR | | | | |

2 | | | 2024 Proxy Statement | | |  |

PROXY SUMMARY

RPM International Inc.

RPM International Inc. owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related services. The Company operates across four reportable segments: consumer, construction products, performance coatings and specialty products. RPM has a diverse portfolio of market-leading brands, including Rust-Oleum, DAP, Zinsser, Varathane, Day-Glo, Legend Brands, Stonhard, Carboline, Tremco and Dryvit. From homes and workplaces to infrastructure and precious landmarks, RPM’s brands are trusted by consumers and professionals alike to help build a better world. The Company employs approximately 17,200 individuals worldwide.

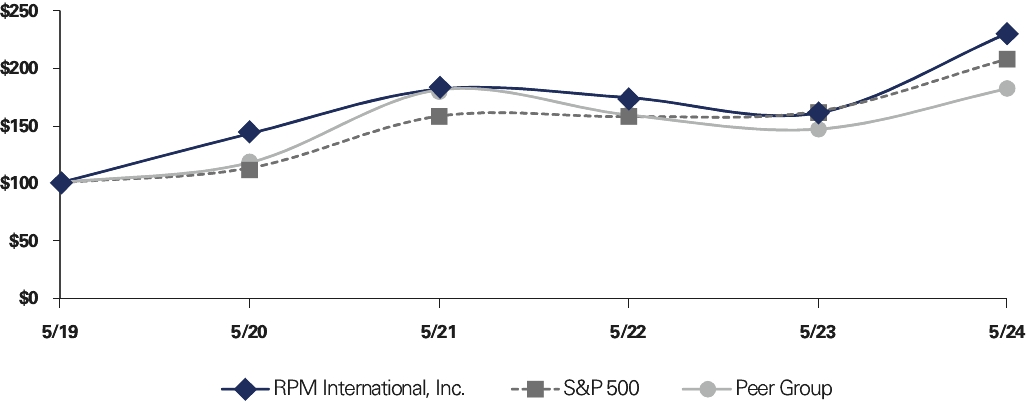

The Company’s consolidated net sales, net income, diluted earnings per share and cash provided by operating activities for the fiscal year ended May 31, 2024, each a record for the Company, were as follows:

• | Consolidated net sales increased 1.1% to $7.34 billion in fiscal 2024 from $7.26 billion in fiscal 2023; |

• | Net income attributable to RPM International Inc. stockholders increased 22.9% to $588.4 million in fiscal 2023 from $478.7 million in fiscal 2023; |

• | Diluted earnings per share increased 22.6% to $4.56 in fiscal 2024 from $3.72 in fiscal 2023; and |

• | Cash provided by operating activities increased to $1.12 billion in fiscal 2024 from $577.1 million in fiscal 2023, with the increase driven by improved profitability and working capital efficiency, both of which were enabled by MAP 2025 initiatives. |

Increased Cash Dividend Every Year for 50 Consecutive Years

On October 5, 2023, the Board of Directors increased the quarterly dividend on shares of the Company’s Common Stock to $0.46 per share, an increase of 10.0% from the prior year and the highest ever paid by the Company. With a 50-year track record of a continuously increasing cash dividend, the Company is in an elite category of less than one-half of one percent of all publicly traded U.S. companies to have increased the dividend for this period of time or longer, according to Dividend Radar. Only 41 other publicly traded U.S. companies, besides the Company, have consecutively paid an increasing annual dividend for a longer period of time. During this timeframe, the Company has returned approximately $3.5 billion in cash dividends to its stockholders.

MAP 2025 Continues to Build on Success of MAP to Growth

In August 2022, the Company approved and announced its Margin Achievement Plan (“MAP”) 2025, which is a multi-year restructuring plan to build on the achievements of the Company’s successful Margin Acceleration Plan to Growth and designed to improve margins by streamlining business processes, reducing working capital, implementing commercial initiatives to drive improved mix and sales force effectiveness and improving operating efficiency. Initial phases of MAP 2025 have focused on commercial initiatives, operational efficiencies, and procurement. The Company’s goal is to achieve $465 million in incremental earnings before interest and taxes (“EBIT”) on a run-rate basis by the end of fiscal 2025. During fiscal 2023, the Company generated over $120 million of benefits from MAP 2025-related initiatives. For fiscal 2024, the Company generated over $160 million of run-rate benefits from MAP 2025-related initiatives, in-line with our fiscal 2024 run-rate target.

Stock Repurchase Program

During the fiscal year ended May 31, 2024, the Company repurchased 526,113 shares of Common Stock under this program at a cost of approximately $55.0 million, or an average cost of $104.50 per share. During the fiscal year ended May 31, 2023, the Company repurchased 598,653 shares of Common Stock under this program at a cost of approximately $50.0 million, or an average cost of $83.52 per share. During the fiscal year ended May 31, 2022, the Company repurchased 601,155 shares of Common Stock under this program at a cost of approximately $52.5 million, or an average cost of $87.33 per share. The maximum dollar amount that may yet be repurchased under the repurchase program was approximately $262.3 million at May 31, 2024.

Additional information regarding the Company’s stock repurchase program can be found in Note I of the Notes to Consolidated Financial Statements of the Company’s Annual Report on Form 10-K.

Adoption of Proxy Access By-Law

In fiscal 2024, the Board of Directors approved and adopted an amendment to the Company’s Amended and Restated By-Laws (the “By-Laws”) to add a proxy access by-law. The proxy access by-law permits a stockholder or a group of up to 20 stockholders that has owned three percent or more of the Company’s outstanding Common Stock continuously for at least three years to

| | | 2024 Proxy Statement | | | 3 |

PROXY SUMMARY

nominate, and include in the Company’s proxy materials for its Annual Meeting, candidates for Director constituting up to the greater of (i) two Directors or (ii) 20% of the number of the Company’s Directors then-serving on the Board of Directors, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the proxy access by-law.

Sustainability Goals

The Company’s sustainability goals for 2025 (using 2021 data as the baseline) include:

| | Reduce Scope 1 and Scope 2 greenhouse gas emissions from the Company’s facilities by 20% per ton of production | | | Reduce energy consumed in the Company’s facilities by 10% per ton of production | | | Identify and implement additional opportunities for water reuse and conservation, including actively evaluating and investing in the replacement of single-pass water discharge systems | |

The Company is currently undertaking a proactive, innovative project targeting more than 20 chemical compounds for elimination or substantial minimization globally from product formulations through, among other strategies, replacement with more sustainable alternative substances. This highly collaborative effort among sustainability, regulatory, technical and legal team leaders will make our products even safer and more sustainable for our employees, our customers and the environment. Ultimately, our continued development and expansion of more eco-friendly technology will also give us a competitive commercial advantage. This project signifies the Company’s enduring commitment to conducting business by doing the right things, the right way, for the right reasons.

In addition to other information that can be found on its Building a Better World website, the Company includes EEO-1 data for 2023, 2022 and 2021.

Building a Better World Oversight Committee

The Company’s Building a Better World Oversight Committee supports the Company’s on-going commitment, consistent with the Company’s code of conduct set forth in The Values & Expectations of 168, to responsibly serve the Company’s stakeholders on matters relating to ESG topics such as the environment, health and safety, corporate social responsibility, diversity and inclusion, corporate governance, sustainability, climate change and other public policy trends, issues and concerns. A cross-functional committee chaired by the Company’s Vice President – Investor Relations and Sustainability, the Building a Better World Oversight Committee’s duties and responsibilities include:

• | Overseeing the Company’s sustainability program; |

• | Determining which ESG risks and opportunities are of strategic significance to the Company, and recommending policies, practices and disclosures relating to same to the Chief Executive Officer and the Board of Directors; |

• | Reporting to the Governance and Nominating Committee of the Board of Directors concerning ESG matters; and |

• | Developing a framework to monitor the Company’s compliance with ESG matters. |

4 | | | 2024 Proxy Statement | | |  |

PROXY SUMMARY

Corporate Governance

The Company is committed to meeting high standards of ethical behavior, corporate governance and business conduct. This commitment has led the Company to implement the following practices:

| | Board Independence | | | Ten of the eleven current Directors are independent under the Company’s Corporate Governance Guidelines and NYSE listing standards. All members of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee are independent. | |

| | Independent Directors Meetings | | | Independent Directors meet in executive sessions each year in January, April and July, without management present. | |

| | Lead Director | | | One independent Director serves as Lead Director. | |

| | Majority Voting for Directors | | | In an uncontested election, any nominee for Director who receives more votes “withheld” from his or her election than votes “for” such election is expected to tender his or her resignation for prompt consideration by the Governance and Nominating Committee and by the Board of Directors. | |

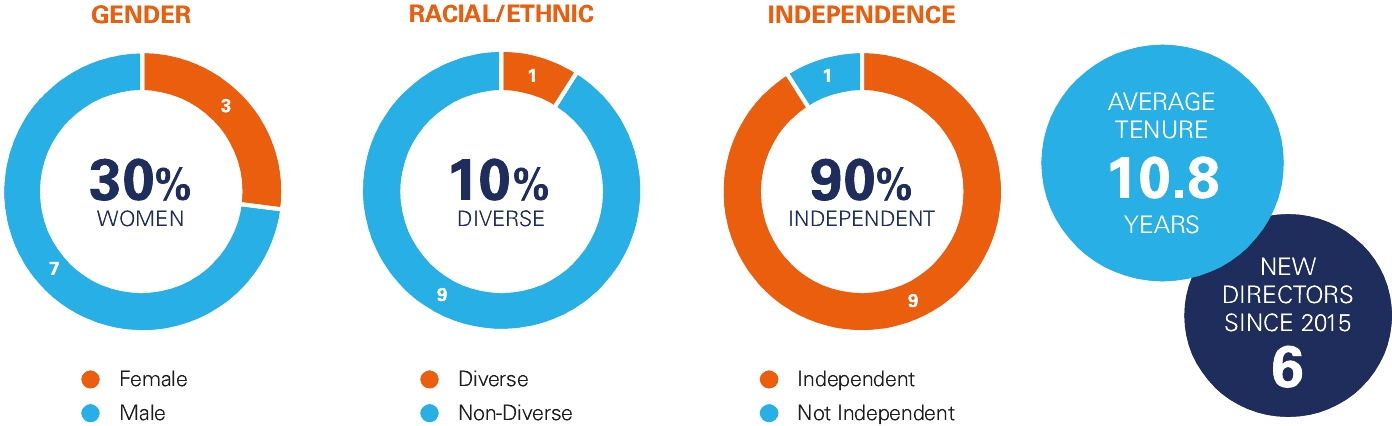

| | Director Tenure | | | The average tenure of our independent Directors will be 10.8 years as of the date of the Annual Meeting, and six of our current independent Directors have joined the Board of Directors since 2015. | |

| | Stock Ownership Guidelines for Directors and Executive Officers | | | The Company adopted stock ownership guidelines for Directors and executive officers in 2012, and the Company increased the stock ownership guidelines for Directors in 2014 and executive officers in 2022. Each of the Directors and executive officers satisfies the stock ownership guidelines or is within the grace period provided by the stock ownership guidelines to achieve compliance. | |

| | Annual Board and Chief Executive Officer Self-Evaluations | | | Each year, the Governance and Nominating Committee of the Board of Directors administers self-evaluations of the Board of Directors and its committees, and the Compensation Committee of the Board of Directors administers an evaluation of the Chief Executive Officer. | |

| | Hedging Transactions Prohibited | | | The Company’s insider trading policy prohibits short sales and hedging transactions of shares of the Company’s Common Stock by Directors, officers and employees. | |

| | Pledging Prohibited | | | The Company’s insider trading policy was amended in fiscal 2017 to provide that, effective as of June 1, 2017, pledging of shares of the Company’s Common Stock by Directors, officers and employees is prohibited, subject to limited exceptions. | |

| | Performance-Based Compensation | | | The Company relies heavily on performance-based compensation for executive officers, including awards of performance-based restricted stock. | |

| | Double-Trigger Vesting Provisions | | | The Amended and Restated RPM International Inc. 2014 Omnibus Equity and Incentive Plan (the “2014 Omnibus Plan”) and the proposed RPM International Inc. 2024 Omnibus Equity and Incentive Plan provide double-trigger vesting provisions for long-term equity awards. | |

| | Clawback Policies | | | Since 2012, the Company has maintained a clawback policy (the “Clawback Policy”) under which the Board of Directors may require reimbursement of certain bonuses or incentive compensation awarded to an executive officer if, as the result of that executive officer’s misconduct, the Company is required to restate all or a portion of its financial statements. In addition to the Clawback Policy, in October 2023 the Board of Directors adopted the RPM International Inc. Incentive-Based Compensation Clawback Policy (the “NYSE Clawback Policy”) in accordance with newly-adopted NYSE listing standards. The NYSE Clawback Policy provides for the recovery of certain incentive-based compensation in the event of an Accounting Restatement (as defined in the NYSE Clawback Policy). | |

| | Chief Executive Officer Succession Planning | | | The Company’s succession plan, which the Board of Directors reviews annually, addresses both an unexpected loss of the Chief Executive Officer as well as longer-term succession. | |

| | The Values & Expectations of 168 | | | The Company’s code of business conduct and ethics, entitled “The Values & Expectations of 168,” emphasizes individual responsibility and accountability, encourages reporting and dialogue about business practices, ethics, or integrity concerns, and focuses on the Company’s values of transparency, trust and respect. | |

| | Statement of Governance Policy | | | The Board of Directors adopted our Statement of Governance Policy in 2016, which recognizes that conducting our business in conformity with The Values & Expectations of 168 is essential to advancing our fundamental objective of building long-term stockholder value. | |

| | | 2024 Proxy Statement | | | 5 |

PROXY SUMMARY

See also “Information Regarding Meetings and Committees of the Board of Directors” at page 24 for further information on the Company’s governance practices. Additional information about our majority voting policy appears under the caption “Voting Rights” on page 11.

| | RPM INTERNATIONAL INC. STATEMENT OF GOVERNANCE POLICY | |

| | RPM International’s fundamental objective is to build long-term stockholder value by profitably growing our businesses and consistently delivering strong financial performance. We think that our ability to generate value for our stockholders is inextricably linked to our ability to provide value to our principal stakeholders, including our customers and associates. • We must continue to earn the ongoing commitment and trust of our stockholders by delivering the solid returns expected by them from an investment in RPM. • We must continue to offer our customers innovative, high-quality products and services at competitive prices. • We must attract and retain high-quality associates at every level of our organization, provide them with the tools they need to do their jobs, and compensate them in such a way as to closely align their interests with our long-term success. • We must conduct our business in conformity with The Values & Expectations of 168, which encompass complying with all legal and ethical standards, and working to be exemplary corporate citizens. We do not focus narrowly on efforts to maximize the short-term price of our stock, and think that such an approach is fundamentally misguided. Instead, we believe that emphasizing consistent value creation in our businesses will maximize the long-term value of our stockholders’ investment. In short, we manage our businesses to create wealth for our stockholders. Creating value for our stakeholders is how we have achieved, and will continue to achieve, that objective. | |

6 | | | 2024 Proxy Statement | | |  |

PROXY SUMMARY

Experience, Qualifications, Attributes, Skills and Diversity of Directors

The Board of Directors believes that all the Company’s Directors have specific employment and leadership experiences and skills that qualify them for service on the Board of Directors. Such qualities are included in their individual biographies and also summarized in the following table:

| | Director Qualifications and Experience | | | Kirkland B. Andrews | | | John M. Ballbach | | | Bruce A. Carbonari | | | Jenniffer D. Deckard | | | Salvatore D. Fazzolari | | | Robert A. Livingston | | | Frederick R. Nance | | | Ellen M. Pawlikowski | | | William B. Summers, Jr. | | | Elizabeth F. Whited | | | Frank C. Sullivan |

| | Adherence to The Values & Expectations of 168 Understands and adheres to the code of conduct set forth in The Values & Expectations of 168 | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| | Leadership and Operating Experience Significant leadership and operating experience | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| | Independence Satisfies the independence requirements of the NYSE and the SEC | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | |

| | Finance Experience Possesses the background, knowledge, and experience to provide the Company with valuable insight in overseeing the Company’s finances | | | • | | | • | | | • | | | • | | | • | | | • | | | | | • | | | • | | | • | | | • | |

| | Public Company Board and Corporate Governance Experience Experience serving on the boards of other publicly traded companies | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | | | • | |

| | Environmental, Social and Governance Experience Knowledge of and experience with ESG initiatives | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| | Knowledge of the Company Experience with the Company for a period in excess of ten years | | | | | | | • | | | | | • | | | | | • | | | | | • | | | | | • | ||||||

| | Diversity Contributes to the Board in a way that enhances perspectives through diversity in gender, ethnicity, race and cultural and other backgrounds | | | | | | | | | • | | | | | | | • | | | • | | | | | • | | | |||||||

| | Merger and Acquisition Experience Possesses experience or insight related to mergers and acquisitions | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| | Cybersecurity Experience Knowledge of and experience with cybersecurity matters | | | • | | | • | | | | | | | • | | | | | | | • | | | | | | | • |

| | | 2024 Proxy Statement | | | 7 |

PROXY SUMMARY

* | Upon John M. Ballbach’s retirement at the Annual Meeting, the authorized number of Directors will be fixed at ten. Mr. Ballbach is not included in the statistics shown above. |

The Company has retained the services of a firm to assist the Governance and Nominating Committee in identifying potential Director candidates to add to the Board of Directors. In selecting potential Director candidates for nomination, the Governance and Nominating Committee desires to ensure that the proper balance of skills, knowledge, diversity, backgrounds and experience is represented on the Board of Directors. In addition, Director candidates should possess the personal qualities of integrity, commitment, entrepreneurship and courage. Under the “Rooney Rule,” which was adopted by the Governance and Nominating Committee in fiscal 2020, the Governance and Nominating Committee will include qualified candidates in its search who reflect diverse backgrounds, including diversity of gender and ethnicity. The goal of the Governance and Nominating Committee is to recommend one or more candidates to be appointed to the Board of Directors within the current fiscal year.

Enterprise-Wide Risk Oversight

The Board of Directors, assisted by its committees, oversees management’s enterprise-wide risk management activities. Risk management activities include assessing and taking actions necessary to manage risk incurred in connection with the long-term strategic direction and operation of the Company’s business. See “Information Regarding Meetings and Committees of the Board of Directors – Role in Risk Oversight” for further information.

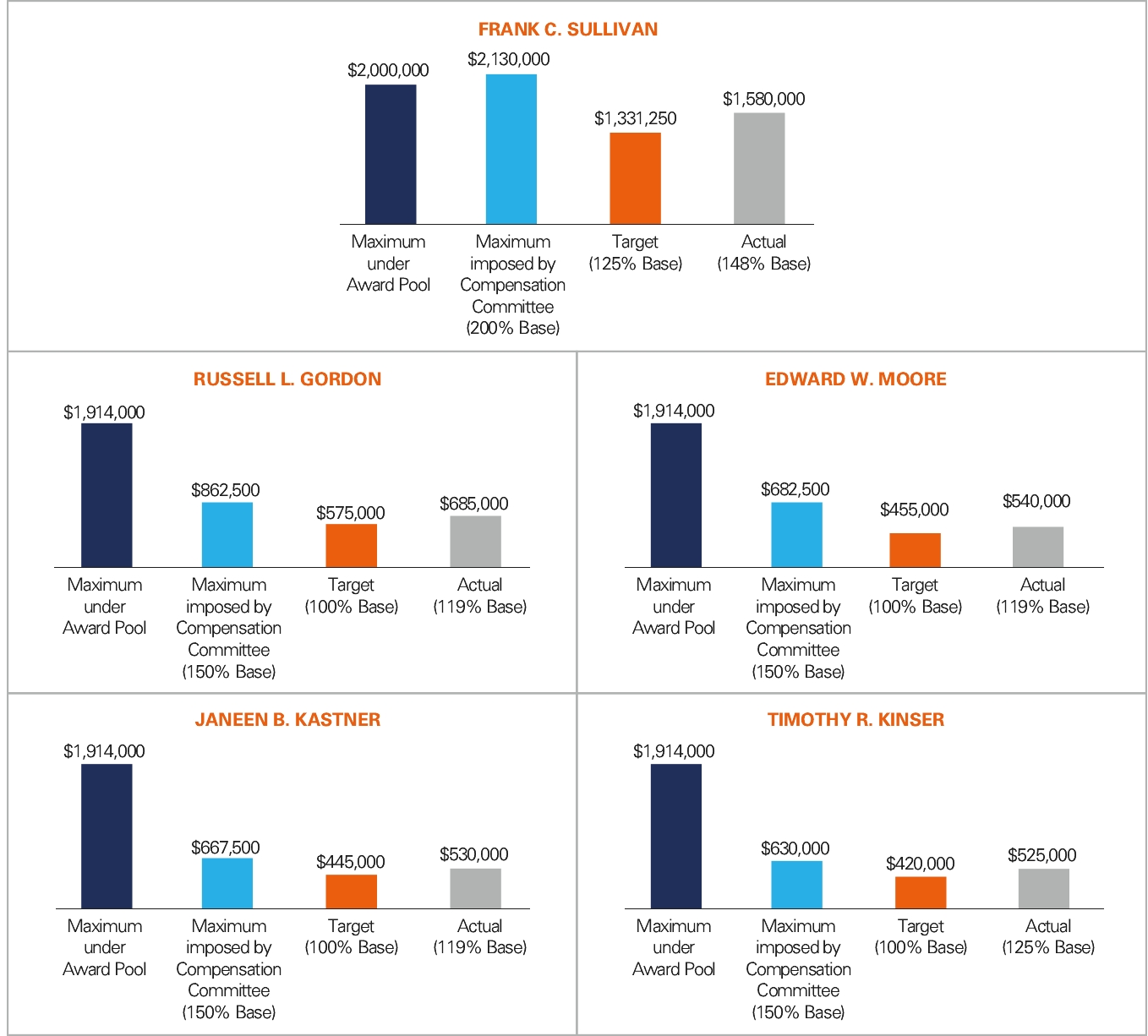

Executive Compensation

The Company’s executive compensation program utilizes a mix of base salary, annual cash incentives, equity awards and standard benefits to attract and retain highly qualified executives and maintain a strong relationship between executive pay and Company performance. Seventy-five percent (75%) of the votes cast on the Say-on-Pay proposal last year were voted in support of the compensation of our named executive officers, which was an increase over the prior year’s sixty-seven percent (67%) approval level. In connection with last year’s Say-on-Pay vote, the Company reached out to 16 of our largest stockholders representing approximately 47.5% of our shares of Common Stock outstanding (the “Stockholder Outreach Group”) in order to discuss, including with the Chair of the Compensation Committee, their views and understanding of the Company’s compensation practices. None of the members of the Stockholder Outreach Group requested a meeting or expressed any specific concerns about the Company’s executive compensation practices. A detailed discussion of this outreach is included in “Consideration of Last Year’s Say-on-Pay Vote” on page 36.

Overall Compensation Program Principles

Pay for performance – The Company’s general compensation philosophy is performance-based in that the Company’s executive officers should be well compensated for achieving strong operating and financial results. The Company engages in a rigorous process intended to provide its executive officers a fair level of compensation that reflects the Company’s positive operating financial results, the relative skills and experience of the individuals involved, Compensation Peer Group compensation levels and other similar benchmarks.

Compensation weighted toward at-risk pay – The mix of compensation of the Company’s named executive officers is weighted toward at-risk pay (consisting of cash and equity compensation). Maintaining this pay mix results in a pay-for-performance

8 | | | 2024 Proxy Statement | | |  |

PROXY SUMMARY

orientation, which aligns to the Company’s compensation philosophy of paying total direct compensation that is competitive with peer group levels based on relative company performance. For fiscal 2024, 59% of the earned amounts of the principal compensation components for our named executive officers in the aggregate was variable and tied to our performance.

Compensation Benchmark Study – In 2024, the Compensation Committee retained the professional consulting firm of Willis Towers Watson to conduct an executive compensation benchmark study. Based on its analysis and findings, Willis Towers Watson concluded that our Chief Executive Officer’s target total direct compensation was slightly lower than the 50th percentile with a large portion of compensation linked to performance-based equity. Overall, our named executive officers’ salaries and total target cash compensation are generally below the market median, and their long-term incentives and total direct compensation are generally at or above the market median.

Summary of Compensation Paid to Frank C. Sullivan, the Company’s Chief Executive Officer, in Fiscal 2024

• | Base salary – $1,065,000, which was a 7% increase over his fiscal 2023 base salary of $995,000; his base salary had been $995,000 for each of fiscal 2023, fiscal 2022, fiscal 2021 and fiscal 2020. |

• | Annual cash incentive compensation – Annual cash incentive compensation of $1,580,000, which was $460,000 more than his fiscal 2023 annual cash incentive compensation. |

• | Equity compensation – Mr. Sullivan received 11,140 Performance Earned Restricted Stock (“PERS”) for fiscal 2024. |

• | Other compensation – Matching contribution of $13,800 under the Company’s 401(k); automobile allowance of $26,089; life insurance premiums of $192,905; matched charitable contributions of $2,000; and financial consulting fees of $15,750. |

Stockholder Actions

Proposal One – Amendment of Amended and Restated Certificate of Incorporation (see page 12)

The Board of Directors has proposed an amendment to the Company’s Amended and Restated Certificate of Incorporation to require the annual election of Directors. The Board recommends that stockholders vote FOR the amendment of the Company’s Amended and Restated Certificate of Incorporation.

The Board of Directors has nominated three candidates for election to serve in Class II of the Board. The Board recommends that stockholders vote FOR the election of each nominee.

| | | 2024 Proxy Statement | | | 9 |

PROXY SUMMARY

The Board of Directors is seeking an advisory vote to approve the Company’s executive compensation. Before considering this proposal, please read the Compensation Discussion and Analysis in this Proxy Statement, which explains the Compensation Committee’s compensation decisions and how the Company’s executive compensation program aligns the interests of the executive officers with those of the Company’s stockholders. Although the vote is advisory and is not binding on the Board of Directors, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions. The Board recommends that stockholders vote FOR the approval of the Company’s executive compensation.

The Company is seeking to approve and adopt the 2024 Omnibus Plan. The Board recommends that stockholders vote FOR the approval and adoption of the 2024 Omnibus Plan.

Proposal Five – Ratification of Appointment of Independent Registered Public Accounting Firm (see page 84)

The Audit Committee has appointed Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2025. The Board of Directors is seeking stockholder ratification of this appointment. The Board recommends that stockholders vote FOR ratification of the selection of Deloitte & Touche LLP.

| | VIRTUAL ANNUAL MEETING INFORMATION | |

| | The Company will be hosting a virtual Annual Meeting. Stockholders will be able to participate in the Annual Meeting online, in virtual meeting format, via live webcast. Provided below is the summary of the information that you will need to participate in the Annual Meeting: • Stockholders can participate in the Annual Meeting online, in virtual meeting format, via live webcast over the Internet at www.virtualshareholdermeeting.com/RPM2024. • You will need your unique control number, which is provided on your notice of internet availability or proxy card, to vote and submit questions during the Annual Meeting webcast. • The webcast of the Annual Meeting will begin at 1:30 p.m., Eastern Daylight Time. • Instructions as to how to participate via the Internet, including how to verify stock ownership, are available at www.virtualshareholdermeeting.com/RPM2024. • If you have questions regarding how vote your shares of Common Stock, you may call Innisfree M&A Incorporated, at (877) 800-5195 (Toll Free). • Replay of the Annual Meeting webcast will be available until October 2, 2025. | |

10 | | | 2024 Proxy Statement | | |  |

The record date for determination of stockholders entitled to vote at the Annual Meeting was the close of business on August 9, 2024 (the “Record Date”). On that date, the Company had 128,775,153 shares of Common Stock, par value $0.01 per share (the “Common Stock”), outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote.

At the Annual Meeting, in accordance with the General Corporation Law of the State of Delaware and the By-Laws, the inspectors of election appointed by the Board of Directors for the Annual Meeting will determine the presence of a quorum and will tabulate the results of stockholder voting. As provided by the General Corporation Law of the State of Delaware and the By-Laws, holders of shares entitling them to exercise a majority of the voting power of the Company, present in person or by proxy at the Annual Meeting, will constitute a quorum for such meeting. Under applicable Delaware law, if a broker returns a Proxy and has not voted on a certain proposal (generally referred to as a “broker non-vote”), such broker non-votes will count for purposes of determining a quorum. The shares represented at the Annual Meeting by Proxies which are marked “withheld” with respect to the election of Directors will be counted as shares present for the purpose of determining whether a quorum is present.

Under the rules of the New York Stock Exchange, if you are the beneficial owner of shares held in street name and do not provide the bank, broker or other intermediary that holds your shares with specific voting instructions, that bank, broker or other intermediary may generally vote on routine matters but cannot vote on non-routine matters. Proposals One, Two, Three and Four are considered non-routine matters. Unless you instruct the bank, broker or other intermediary that holds your shares to vote on Proposals One, Two, Three and Four, no votes will be cast on your behalf with respect to those proposals. Therefore, it is important that you instruct the bank, broker or other intermediary to cast your vote if you want it to count on Proposals One, Two, Three and Four. Proposal Five is considered a routine matter and, therefore, broker non-votes are not expected to exist on Proposal Five.

For approval, Proposal One must receive the affirmative vote of at least 80% of the outstanding shares of Common Stock. In voting for Proposal One, votes may be cast in favor, against or abstained. Abstentions and broker non-votes will have the effect of a vote against Proposal One.

For Proposal Two, nominees for election as Directors who receive the greatest number of votes will be elected Directors. The General Corporation Law of the State of Delaware provides that stockholders cannot elect Directors by cumulative voting unless a company’s certificate of incorporation so provides. The Company’s Amended and Restated Certificate of Incorporation (the “Certificate”) does not provide for cumulative voting.

Our Corporate Governance Guidelines include a majority voting policy, which sets forth our procedures if a Director-nominee is elected but receives a majority of “withheld” votes. In an uncontested election, the Board of Directors expects any nominee for Director who receives a greater number of votes “withheld” from his or her election than votes “for” such election to tender his or her resignation following certification of the stockholder vote. The Board of Directors shall fill Board vacancies and shall nominate for election or re-election as Director only candidates who agree to tender their resignations in such circumstances. The Governance and Nominating Committee will act on an expedited basis to determine whether to accept a Director’s resignation tendered in accordance with the policy and will make recommendations to the Board of Directors for its prompt consideration with respect to any such letter of resignation. For the full details of our majority voting policy, which is part of our Corporate Governance Guidelines, please see our Corporate Governance Guidelines on our website at www.rpminc.com.

Proposals Three, Four and Five will be decided by the vote of the holders of a majority of the shares entitled to vote thereon present in person or by proxy at the Annual Meeting. In voting for Proposals Three, Four and Five, votes may be cast in favor, against or abstained. Abstentions will count as present for purposes of the items on which the abstention is noted and will have the effect of a vote against the proposal. Broker non-votes, however, are not counted as present for purposes of determining whether a proposal has been approved and will have no effect on the outcome of such proposal.

Pursuant to the By-Laws, any other matters brought before the Annual Meeting will be decided, unless otherwise provided by law or by the Certificate, by the vote of the holders of a majority of the shares entitled to vote thereon present in person or by proxy at the Annual Meeting. In voting on such other matters, votes may be cast in favor, against or abstained. Abstentions will count as present for purposes of the items on which the abstention is noted and will have the effect of a vote against any such matter. Broker non-votes, however, are not counted as present for purposes of determining whether any such matter has been approved and will have no effect on the outcome of such matter.

If you have any questions or need any assistance in voting your shares of Common Stock, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

(877) 800-5195 (Toll Free)

| | | 2024 Proxy Statement | | | 11 |

Currently, the Certificate divides the Board of Directors into three classes (Class I, Class II and Class III), each with a three-year term. The terms of the classes are staggered, such that only one of the three classes stands for election for a three-year term at each Annual Meeting of Stockholders.

The Board of Directors has determined that it is advisable and in the best interests of the Company and its stockholders to amend the Certificate to declassify the Board of Directors to allow the stockholders of the Company to vote on the election of the entire Board of Directors on an annual basis, rather than on a staggered basis. Accordingly, the Board of Directors has resolved to recommend that the stockholders of the Company approve the amendment to the Certificate set forth on Appendix A attached hereto (the “Certificate Amendment”).

Under the Certificate Amendment, Directors standing for election at each Annual Meeting of Stockholders, commencing with the Annual Meeting, will be elected for a term expiring at the next Annual Meeting of Stockholders following their election and until their respective successors are elected and qualified. The Certificate Amendment will not shorten the term of any current Director. If the Certificate Amendment is approved by the stockholders of the Company by the requisite vote at the Annual Meeting, then the Certificate Amendment will become effective immediately upon the filing of the Certificate Amendment with the office of the Secretary of State of the State of Delaware, which we intend to do during the course of the Annual Meeting if this proposal is approved, and it will apply to the election of Directors at the Annual Meeting.

If the Certificate Amendment is approved by the Company’s stockholders:

• | the classification of the Board of Directors will be phased out over the next three Annual Meetings, such that (i) at the Annual Meeting, each of the Directors in Class II will be elected to hold office for a term of one year, (ii) at the 2025 Annual Meeting of Stockholders, each of the Directors in Class I and Class II will be elected to hold office for a term of one year, and (iii) at the 2026 Annual Meeting of Stockholders, each of the Directors in Class I, Class II and Class III will be elected to hold office for a term of one year, and thereafter the classification of the Board of Directors will terminate in its entirety, and |

• | the term of office of the persons elected as Directors in Class II at this year’s Annual Meeting will expire at the time of the 2025 Annual Meeting of Stockholders. |

If the Certificate Amendment is not approved by the Company’s stockholders by the requisite vote at the Annual Meeting, the Company will continue to have a classified board as currently provided by the Certificate.

For approval, the Certificate Amendment must be approved by the affirmative vote of at least 80% of the voting power of the outstanding shares of Common Stock as of the Record Date. The description of the Certificate Amendment in this Proxy Statement is qualified in its entirety by reference to the Certificate Amendment, which is attached hereto as Appendix A.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL AND ADOPTION OF THE AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION.

| | Your Board recommends a vote “FOR” this Amendment. | |

| | |

12 | | | 2024 Proxy Statement | | |  |

The authorized number of Directors of the Company presently is fixed at 11, with the Board of Directors divided into three Classes. Currently, each of Class I and Class II has four Directors, and Class III has three Directors.

John M. Ballbach, a Director in Class II, will retire as a Director effective as of the expiration of his term at this year’s Annual Meeting and after six years of service on the Board of Directors. Upon Mr. Ballbach’s retirement, the authorized number of Directors of the Company will be fixed at ten.

If Proposal One is approved by the Company’s stockholders:

• | the classification of the Board of Directors will be phased out over the next three Annual Meetings, such that (i) at the Annual Meeting, each of the Directors in Class II will be elected to hold office for a term of one year, (ii) at the 2025 Annual Meeting of Stockholders, each of the Directors in Class I and Class II will be elected to hold office for a term of one year, and (iii) at the 2026 Annual Meeting of Stockholders, each of the Directors in Class I, Class II and Class III will be elected to hold office for a term of one year, and thereafter the classification of the Board of Directors will terminate in its entirety, and |

• | the term of office of the persons elected as Directors in Class II at this year’s Annual Meeting will expire at the time of the 2025 Annual Meeting of Stockholders. |

If Proposal One is not approved by the Company’s stockholders:

• | the term of office of one Class of Directors will expire each year, and at each Annual Meeting of Stockholders the successors to the Directors of the Class whose term is expiring at that time will continue to be elected to hold office for a term of three years, and |

• | the term of office of the persons elected as Directors in Class II at this year’s Annual Meeting will expire at the time of the 2027 Annual Meeting of Stockholders. |

Each Director in Class II will serve until the expiration of such Director’s term or until his or her successor shall have been duly elected. The Board of Directors’ nominees for election as Directors in Class II are Bruce A. Carbonari, Jenniffer D. Deckard and Salvatore D. Fazzolari. Ms. Deckard and Messrs. Carbonari and Fazzolari currently serve as Directors in Class II.

The Proxy holders named in the accompanying Proxy (or their substitutes) will vote such Proxy at the Annual Meeting or any adjournment or postponement thereof for the election of the three nominees unless the stockholder instructs, by marking the appropriate space on the Proxy, that authority to vote is withheld. If any nominee becomes unavailable for election (which is not now contemplated or foreseen), it is intended that the shares represented by the Proxy will be voted for a substitute nominee named by the Board of Directors. In no event will the accompanying Proxy be voted for more than three nominees or for persons other than those named below or any substitute nominee.

| | Your Board recommends a vote “FOR” each director nominee. | |

| | Class II Director Nominees • Bruce A. Carbonari • Jenniffer D. Deckard • Salvatore D. Fazzolari | |

| | All currently serve as Directors in Class II.  | |

| | |

| | | 2024 Proxy Statement | | | 13 |

Bruce A. Carbonari Director since 2002 Age: 68 Committees: Executive, Governance and Nominating Class: Class II Director Nominee Shares of Common Stock beneficially owned: 42,521 | | | Experience Retired Chair and Chief Executive Officer, Fortune Brands, Inc., a diversified consumer products company. Prior to his retirement, Mr. Carbonari served as the Chair and Chief Executive Officer of Fortune Brands from 2008 to 2011, and as its President and Chief Executive Officer from 2007 to 2008. Previously, he held positions with Fortune Brands business unit, Fortune Brands Home & Hardware LLC, as Chair and Chief Executive Officer from 2005 until 2007 and as President and Chief Executive Officer from 2001 to 2005. Mr. Carbonari was the President and Chief Executive Officer of Fortune Brands Kitchen and Bath Group from 1998 to 2001 and was previously the President and Chief Executive Officer of Moen, Inc. from 1990 to 1998. Prior to joining Moen in 1990, Mr. Carbonari was Executive Vice President and Chief Financial Officer of Stanadyne, Inc., Moen’s parent company at that time. He began his career at PricewaterhouseCoopers prior to joining Stanadyne in 1981. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Carbonari should serve as a Director because of his extensive executive management experience, including his service as Chair and Chief Executive Officer of Fortune Brands, Inc. In that position, Mr. Carbonari dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. | | | Key Skills • Financial • Strategic • Technology • Compensation • Management Development | | | • Acquisitions • Capital Allocation • Government and Stockholder Relations | ||

| | |||||||||

14 | | | 2024 Proxy Statement | | |  |

Jenniffer D. Deckard Director since 2015 Age: 58 Committee: Audit Class: Class II Director Nominee Shares of Common Stock beneficially owned: 14,845 | | | Experience Chief Finance and Administrative Officer of The Sisters of Notre Dame of the United States (“SND”). The SND is a community of religious women whose ministries include, but are not limited to, the founding and serving of dozens of faith-based educational institutions from pre-schools to a college, multiple faith-based retirement communities and a hospital. Ms. Deckard is the first lay person to manage finances, administration and operations for the SND. Former President and Chief Executive Officer of Covia Holdings Corporation, a leading provider of minerals and materials solutions for the industrial and energy markets (formerly, NYSE: CVIA). Ms. Deckard also served as a director on Covia’s board of directors from 2018 until May 2019. Covia filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in June 2020. Ms. Deckard previously served as President, Chief Executive Officer and director of Fairmount Santrol Holdings Inc. from 2013 until 2018, when Fairmount Santrol and Unimin Corporation merged to form Covia. Previously, Ms. Deckard served as Fairmount Santrol’s President from 2011 until 2013, Vice President of Finance and Chief Financial Officer from 1999 until 2011, Corporate Controller from 1996 to 1999 and Accounting Manager from 1994 until 1996. Ms. Deckard also serves on the board of the Great Lakes Construction Company, an Ohio-based heavy civil engineering and construction company, where Ms. Deckard serves on the board’s investment, audit and ESOP advisory committees. Ms. Deckard also serves on the non-profit boards of the University Hospitals and the Edwins Foundation, serving on the finance committee for University Hospitals. Ms. Deckard received a bachelor of science from the University of Tulsa and a M.B.A. degree from Case Western Reserve University. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Ms. Deckard should serve as a Director because of her extensive executive management experience and financial expertise, including her service as President and Chief Executive Officer of Covia. In that position, Ms. Deckard dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. She was integral in the creation of Fairmount Santrol’s (and later Covia’s) industry-leading sustainable development program and has significant experience in ESG-related matters. With her extensive financial background, Ms. Deckard is a financial expert for the Company’s Audit Committee. Ms. Deckard also provides the Board of Directors a valuable perspective as a member of the boards of several prominent local non-profit organizations. | | | Key Skills • Financial • Strategic • Technology • Compensation • Management Development | | | • Acquisitions • Capital Allocation • Government and Stockholder Relations | ||

| | |||||||||

| | | 2024 Proxy Statement | | | 15 |

Salvatore D. Fazzolari Director since 2013 Age: 72 Committees: Audit, Executive Class: Class II Director Nominee Shares of Common Stock beneficially owned: 19,549 | | | Experience Former Chair, President and Chief Executive Officer of Harsco Corporation (now known as Enviri Corp.), a global environmental solutions company. Mr. Fazzolari served as Chair and Chief Executive Officer of Harsco Corporation from 2008 until 2012, in addition to serving as its President from 2010 until 2012. During the course of his over 30 years of service to Harsco Corporation, Mr. Fazzolari held various other positions, including President (2006 – 2007), Chief Financial Officer (1998 – 2007) and Treasurer and Corporate Controller. Mr. Fazzolari is a certified public accountant (inactive) and a certified information systems auditor (inactive). He serves on the board of directors of Bollman Hat Company and RDG Companies (a developer, investor and general partner in real estate transactions). He previously served on the board of directors of Gannett Fleming, Inc. until December 2022. He earned his bachelor of business administration degree in accounting from Pennsylvania State University. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Fazzolari should serve as a Director because of his extensive executive management experience, including his service as Chair, President and Chief Executive Officer of Harsco Corporation. In that position, Mr. Fazzolari dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government, environmental solutions and stockholder relations, that the Company deals with today. Mr. Fazzolari has almost four decades of extensive experience in the metals and minerals markets in developing innovative solutions that significantly improve the environment. His past board service includes chairing an audit committee where he was responsible for overseeing cybersecurity matters. Also, Mr. Fazzolari has extensive global experience, and because of his considerable financial background, he is a financial expert for the Company’s Audit Committee and serves as its chair. | | | Key Skills • Financial • Strategic • Technology • Compensation • Management Development | | | • Acquisitions • Capital Allocation • Government and Stockholder Relations • Environmental Solutions | ||

| | |||||||||

16 | | | 2024 Proxy Statement | | |  |

Kirkland B. Andrews Director since 2018 Age: 56 Committee: Audit Class: Director in Class I (term expiring in 2025) Shares of Common Stock beneficially owned: 11,628 | | | Experience Senior Vice President and Chief Financial Officer of Consolidated Edison, Inc. (NYSE: ED), one of the nation’s largest investor-owned energy-delivery companies (“Con Edison”), and Consolidated Edison Company of New York, Inc., since July 2024. Previously, Mr. Andrews served as Executive Vice President and Chief Financial Officer of Evergy, Inc. (NYSE: EVRG), a regulated utility holding company serving 1.6 million customers in Kansas and Missouri, from February 2021 until July 2024. From March 2020 until February 2021, Mr. Andrews had been a director of Evergy, where he was a member of the audit committee, the power delivery and safety committee, and the strategic review and operations committee. Prior to that, Mr. Andrews was Executive Vice President and Chief Financial Officer of NRG Energy, Inc. (NYSE: NRG) from 2011 until February 2021. Mr. Andrews was a director of NRG Yield, Inc. from 2012 until 2018 (when NRG Yield, Inc. became Clearway Energy, Inc.), and also served as Executive Vice President, Chief Financial Officer of NRG Yield, Inc. from 2012 to 2016. Mr. Andrews also previously served as Chief Financial Officer of GenOn Energy, Inc., a wholly-owned subsidiary of NRG, which filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in 2017. Prior to joining NRG, he served as Managing Director and Co-Head Investment Banking, Power and Utilities – Americas at Deutsche Bank Securities from 2009 to 2011. Prior to that, he served in several capacities at Citigroup Global Markets Inc., including Managing Director, Group Head, North American Power from 2007 to 2009, and Head of Power M&A, Mergers and Acquisitions from 2005 to 2007. In his banking career, Mr. Andrews led multiple large and innovative strategic, debt, equity and commodities transactions. | ||||||

| | Reasons for Nomination Mr. Andrews was initially appointed as a Director pursuant to the Cooperation Agreement, dated June 27, 2018, among the Company and Elliott Associates, L.P., Elliott International, L.P. and Elliott International Capital Advisors Inc. related to, among other things, appointment of additional Directors to the Board of Directors. The Board of Directors has determined that Mr. Andrews should serve as a Director because of his extensive executive management experience and his considerable financial background as Con Edison’s Senior Vice President and Chief Financial Officer. At Con Edison, Mr. Andrews deals with many of the major issues, such as financial, strategic, technology, management development, acquisitions and capital allocation, that the Company deals with today. Also, with his extensive financial background, Mr. Andrews is a financial expert for the Company’s Audit Committee. As previously disclosed in the Company’s Current Report on Form 8-K dated July 25, 2024, Mr. Andrews has informed the Board of Directors that he intends to step down as a Director before his term expires at the Annual Meeting of Stockholders in October 2025. The Board of Directors currently anticipates that the effective date of Mr. Andrews’ resignation will be at the conclusion of the Board of Directors’ regularly scheduled meeting on January 15, 2025. Mr. Andrews also will step down as a member of the Audit Committee at such time. | | | Key Skills • Financial • Strategic • Technology | | | • Management Development • Acquisitions • Capital Allocation | ||

| | |||||||||

| | | 2024 Proxy Statement | | | 17 |

General Ellen M. Pawlikowski (Retired) Director since 2022 Age: 67 Committee: Governance and Nominating Class: Director in Class I (term expiring in 2025) Shares of Common Stock beneficially owned: 3,700 | | | Experience Gen. Pawlikowski is a retired four-star general of the U.S. Air Force and was the third woman to achieve this rank. In her last assignment, she served as Commander, Air Force Materiel Command, Wright-Patterson Air Force Base, Ohio, from 2015 until 2018. Gen. Pawlikowski entered active duty with the Air Force in 1982, and her distinguished 36-year career spanned a wide variety of technical management, leadership, and staff positions of increasing responsibility. She commanded five times as a general officer, commanding the MILSATCOM Systems Wing, the Air Force element of the National Reconnaissance Office, the Air Force Research Laboratory, the Space and Missile Systems Center, and Air Force Materiel Command. Nationally recognized for her leadership and technical management acumen, Gen. Pawlikowski has received the Women in Aerospace Life-Time Achievement Award, the National Defense Industrial Association’s Peter B. Teets Award, and the Air Force Association Executive Management Award. She is an Honorary Fellow of the American Institute of Aeronautics and Astronautics and a member of the National Academy of Engineers. She has served as a director of RTX Corporation (formerly Raytheon Technologies Corporation) (NYSE: RTX) since 2020. She was previously a director of Raytheon Company from 2018 until 2020, Intelsat S.A. from 2019 until February 2022, and Velo3D, Inc. (NYSE: VLD) from 2022 until June 2023. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Gen. Pawlikowski should serve as a Director because of the extensive senior leadership and management experience she gained during her distinguished military career in which she ultimately became a four-star general in the U.S. Air Force. As Commander, Air Force Materiel Command, Gen. Pawlikowski commanded 80,000 personnel and managed a budget of $60 billion on an annual basis. Her responsibilities included addressing environmental, energy efficiency and conservation matters concerning U.S. Air Force operations, and Gen. Pawlikowski helped develop the U.S. Air Force’s cybersecurity plan. Her experience enables her to assist the Company with leadership development and provides a unique strategic perspective to the Company. | | | Key Skills • Finance • Strategic • Technology • Cybersecurity • ESG | | | • ESG • Management Development • Acquisitions • Capital Allocation | ||

| | |||||||||

18 | | | 2024 Proxy Statement | | |  |

Frank C. Sullivan Director since 1995 Age: 63 Committee: Executive Class: Director in Class I (term expiring in 2025) Shares of Common Stock beneficially owned: 1,361,998 | | | Experience Chair, President and Chief Executive Officer, RPM International Inc. Mr. Sullivan entered the University of North Carolina as a Morehead Scholar and received his B.A. degree in 1983. From 1983 to 1987, Mr. Sullivan held various commercial lending and corporate finance positions at Harris Bank and First Union National Bank prior to joining RPM as Regional Sales Manager from 1987 to 1989 at RPM’s AGR Company joint venture. In 1989, he became RPM’s Director of Corporate Development. He became a Vice President in 1991, Chief Financial Officer in 1993, Executive Vice President in 1995, President in 1999, Chief Operating Officer in 2001, Chief Executive Officer in 2002, and was elected Chair of the Board in 2008 and President in 2018. Since 2003, Mr. Sullivan has been a director of The Timken Company, a global manufacturer of engineered bearings and power transmission products (NYSE: TKR), where he serves on both Timken’s compensation committee and its nominating and corporate governance committee. He also serves on the boards of the American Coatings Association, the Cleveland Clinic, the Cleveland Rock and Roll Hall of Fame and Museum, Greater Cleveland Partnership and the Ohio Business Roundtable. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Sullivan should serve as a Director because of his role as the Company’s Chief Executive Officer, his intimate knowledge of the Company, and his experience serving as a director of another public company and non-profit organizations. The Board of Directors believes that Mr. Sullivan’s extensive experience in and knowledge of the Company’s business gained as a result of his long-time service as a member of management is essential to the Board of Directors’ oversight of the Company and its business operations. The Board of Directors also believes that continuing participation by qualified members of the Sullivan family on the Board of Directors is an important part of the Company’s corporate culture that has contributed significantly to its long-term success. | | | Key Skills • Finance • Strategic • Leadership and Operating Experience • Acquisitions | | | • Capital Allocation • Vast Knowledge of the Company • Important Part of the Company’s Corporate Culture | ||

| | |||||||||

| | | 2024 Proxy Statement | | | 19 |

Elizabeth F. Whited Director since 2021 Age: 59 Committee: Compensation Class: Director in Class I (term expiring in 2025) Shares of Common Stock beneficially owned: 4,300 | | | Experience Elizabeth F. Whited is president of Union Pacific Corporation, one of America’s leading transportation companies (NYSE: UNP), where her responsibilities include the strategy, workforce resources, sustainability, law, corporate relations and government affairs functions. From February 2022 until July 2023, Ms. Whited served as Union Pacific’s executive vice president – sustainability and strategy, where she helped develop and implement Union Pacific’s strategic vision and led Union Pacific’s human resources organization, pioneering efforts to provide a world-class employee experience. Ms. Whited continues to lead environmental, social and governance (“ESG”) efforts at Union Pacific and was named to Constellation Research’s “ESG 50” in 2023 in recognition of Union Pacific’s strides in sustainability. After joining Union Pacific in 1987, Ms. Whited held a variety of executive roles in strategic planning, investor relations, ESG, finance, and marketing and sales, including president of subsidiary Union Pacific Distributions Services. In 2016, she was named executive vice president and chief marketing officer, and in 2018, she was named executive vice president and human resource officer. Ms. Whited served as executive vice president – sustainability and strategy from February 2022 until she was appointed to her current role as president in July 2023. Ms. Whited holds a bachelor’s degree in business administration from the University of Iowa. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Ms. Whited should serve as a Director because of her extensive management experience, including her service as president at Union Pacific as well as her prior executive roles. In those positions, Ms. Whited has dealt with many of the major issues, such as sustainability, strategic planning, human resources, investor relations, ESG, finance, and marketing and sales, that the Company deals with today. | | | Key Skills • Sustainability • Strategic Planning • Human Resources • Stockholder Relations | | | • ESG • Finance • Acquisitions • Capital Allocation • Marketing and Sales | ||

| | |||||||||

20 | | | 2024 Proxy Statement | | |  |

Robert A. Livingston Director since 2017 Age: 70 Committees: Compensation, Executive Class: Director in Class III (term expiring in 2026) Shares of Common Stock beneficially owned: 16,159 | | | Experience Retired President and Chief Executive Officer, Dover Corporation, a $8.5 billion diversified manufacturer (NYSE: DOV). Mr. Livingston served as Dover’s President and Chief Executive Officer from 2008 until his retirement in 2018. Previously, he held positions with Dover business units Dover Engineered Systems, Inc. (as President and Chief Executive Officer) from 2007 until 2008, and Dover Electronics, Inc. (as President and Chief Executive Officer) from 2004 until 2007. Mr. Livingston was previously the President of Vectron International, Inc., a Dover business unit, from 2001 until 2004, and the Executive Vice President (from 1998 until 2001) and Vice President, Finance and Chief Financial Officer (from 1987 until 1998) of Dover Technologies, Inc. Prior to its acquisition by Dover in 1983, Mr. Livingston was Vice President, Finance of K&L Microwave, and continued to serve in that capacity until 1984, when he became Vice President and General Manager of K&L Microwave until 1987. Mr. Livingston was a director of Dover Corporation from 2008 until his retirement in 2018. Since December 2018, Mr. Livingston has been a director of Amphenol Corporation, a manufacturer of electrical and fiber optic connectors and interconnect systems (NYSE: APH), where he serves on Amphenol’s audit, compensation (which he chairs) and executive committees. Mr. Livingston received his B.S. degree in business administration from Salisbury University. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Livingston should serve as a Director because of his extensive executive management experience, including his service as President and Chief Executive Officer of Dover. In that position, Mr. Livingston dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and investor relations, that the Company deals with today. | | | Key Skills • Financial • Strategic • Technology • Compensation • Management Development | | | • Acquisitions • Capital Allocation • Government and Stockholder Relations | ||

| | |||||||||

| | | 2024 Proxy Statement | | | 21 |

Frederick R. Nance Director since 2007 Age: 70 Committees: Executive, Governance and Nominating Class: Director in Class III (term expiring in 2026) Shares of Common Stock beneficially owned: 8,180 | | | Experience Executive Group Member and Global DEI Counsel of Squire Patton Boggs (US) LLP, Attorneys-at-law, which serves clients from 40 offices across four continents. He received his B.A. degree from Harvard University and his J.D. degree from the University of Michigan. Mr. Nance joined Squire Patton Boggs directly from law school, became partner in 1987, served as the Managing Partner of the firm’s Cleveland office from 2002 until 2007, and served as the firm’s Regional Managing Partner from 2007 until 2017. From 2017 until the end of 2022, Mr. Nance served as the firm’s Global Managing Partner. Mr. Nance also served two four-year terms on the firm’s worldwide, seven-person Management Committee. In addition to his duties at Squire Patton Boggs, where he heads the firm’s U.S. Sports and Entertainment practice representing clients including LeBron James, Mr. Nance serves on the board of the Cleveland Clinic, where he chairs the governance committee. Mr. Nance previously served on the board of the Greater Cleveland Partnership, which he chaired, and the board of McDonald & Company Investments, Inc. In 2015, Mr. Nance was inducted into the Northeast Ohio Business Hall of Fame. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Nance should serve as a Director primarily due to his significant legal background and global management experience. As Global DEI Counsel of Squire Patton Boggs (US) LLP, Mr. Nance oversees a multinational staff pursuing diversity and inclusion efforts for thousands of partners and employees across the globe. Mr. Nance’s background allows him to provide valuable insights to the Board of Directors, particularly in regard to corporate governance and risk issues that confront the Company. Mr. Nance also provides the Board of Directors a valuable perspective as a current or past member of the boards of several prominent local non-profit organizations. | | | Key Skills • Management Development • Acquisitions • Capital Allocation | | | • Corporate Governance • Risk Management • Non-profit Organizations | ||

| | |||||||||

22 | | | 2024 Proxy Statement | | |  |

William B. Summers, Jr., Director since 2004 Age: 74 Committee: Compensation Class: Director in Class III (term expiring in 2026) Shares of Common Stock beneficially owned: 46,188 | | | Experience Retired Chair and Chief Executive Officer of McDonald Investments Inc., an investment banking and securities firm and a part of KeyBanc Capital Markets. Prior to his retirement, Mr. Summers served as Chair of McDonald Investments Inc. from 2000 to 2006, and as its Chief Executive Officer from 1994 to 2000. From 1998 until 2000, Mr. Summers served as the Chair of Key Capital Partners and an Executive Vice President of KeyCorp. Mr. Summers is a director of Integer Holdings Corporation, a medical device outsource manufacturer (NYSE: ITGR), and a member of the advisory board of Citymark Capital. From 2004 until 2011, Mr. Summers was a director of Developers Diversified Realty Corporation. Mr. Summers was previously a member of the New York Stock Exchange board of directors and a member of the Nasdaq Stock Market board of directors, and served as the chair of the Nasdaq Stock Market board of directors for two years. Mr. Summers is a trustee of Baldwin Wallace University and a Life Trustee of the Rock & Roll Hall of Fame and Museum. | ||||||

| | Reasons for Nomination The Board of Directors has determined that Mr. Summers should serve as a Director because of his extensive executive management experience, including over 15 years of experience as Chair and Chief Executive Officer of McDonald Investments Inc., service on the boards of both the New York Stock Exchange and the Nasdaq Stock Market, and his experience serving as a director of other private and public companies. His experience enables Mr. Summers to provide keen insight and diverse perspectives on several critical areas impacting the Company, including capital markets, financial and external reporting, long-term strategic planning and business modeling. Mr. Summers also provides the Board of Directors a valuable perspective as a member of the boards of several prominent local non-profit organizations. | | | Key Skills • Finance • Strategic • Management Development • Acquisitions | | | • Capital Allocation • Non-profit Organizations | ||

| | |||||||||

| | | 2024 Proxy Statement | | | 23 |

The Board of Directors has an Executive Committee, Audit Committee, Compensation Committee, and Governance and Nominating Committee. The Executive Committee has the power and authority of the Board of Directors in the interim period between Board meetings. The functions of each of the Audit Committee, Compensation Committee, and Governance and Nominating Committee are governed by charters that have been adopted by the Board of Directors. The Board of Directors also has adopted Corporate Governance Guidelines to assist the Board of Directors in the exercise of its responsibilities, and a code of business conduct and ethics (“The Values & Expectations of 168”) that applies to the Company’s Directors, officers and employees.

The charters of the Audit Committee, Compensation Committee, and Governance and Nominating Committee, the Corporate Governance Guidelines and The Values & Expectations of 168 are available on the Company’s website at www.rpminc.com and in print to any stockholder who requests a copy. Requests for copies should be directed to the Vice President — Investor Relations and Sustainability, RPM International Inc., 2628 Pearl Road, Medina, Ohio 44256. The Company intends to disclose any amendments to The Values & Expectations of 168, and any waiver of The Values & Expectations of 168 granted to any Director or executive officer of the Company, on the Company’s website. As of the date of this Proxy Statement, there have been no such waivers.

The Company’s Corporate Governance Guidelines and the New York Stock Exchange (the “NYSE”) listing standards provide that at least a majority of the members of the Board of Directors must be independent, i.e., free of any material relationship with the Company, other than his or her relationship as a Director or Board Committee member. A Director is not independent if he or she fails to satisfy the standards for independence under the NYSE listing standards, the rules of the Commission, and any other applicable laws, rules and regulations. The Board of Directors adopted categorical standards (the “Categorical Standards”) to assist it in making independence determinations. The Categorical Standards specify the criteria by which the independence of the Directors will be determined and meet or exceed the independence requirements set forth in the NYSE listing standards and the rules of the Commission. The Categorical Standards are available on the Company’s website at www.rpminc.com.

During the Board of Directors’ annual review of director independence, the Board of Directors considers transactions, relationships and arrangements between each Director or an immediate family member of the Director and the Company. The Board of Directors also considers transactions, relationships and arrangements between each Director or an immediate family member of the Director and the Company’s senior management.

In July 2024, the Board of Directors performed its annual director independence review for fiscal 2025. As a result of this review, the Board of Directors determined that 10 out of 11 current Directors are independent, and that all members of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee are independent. The Board of Directors determined that Ms. Deckard, Gen. Pawlikowski, Ms. Whited, and Messrs. Andrews, Ballbach, Carbonari, Fazzolari, Livingston, Nance and Summers meet the Categorical Standards and are independent. In addition, they each satisfy the independence requirements of the NYSE. Mr. Sullivan is not considered to be independent because of his position as Chair and Chief Executive Officer of the Company.