aaaiif-ncsra.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09821

Allied Asset Advisors Funds

(Exact name of Registrant as specified in charter)

721 Enterprise Drive, Suite 100

Oak Brook, IL 60523

(Address of principal executive offices) (Zip code)

Bassam Osman

Allied Asset Advisors Funds

721 Enterprise Drive, Suite 100

Oak Brook, IL 60523

(Name and address of agent for service)

(877) 417-6161

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2011

Date of reporting period: May 31, 2011

Item 1. Reports to Stockholders.

Annual Report

May 31, 2011

Iman Fund

IMAN FUND

July 20, 2011

Dear Shareholder,

Assalamu Alaykum (Greetings of Peace).

We are pleased to report that Iman Fund gained 29.81% in the fiscal year ending May 31, 2011. The Fund outperformed the S&P 500 Index which increased 25.91% during the same period. Iman Fund also outperformed its benchmark the Dow Jones Islamic Market USA Index (up 27.21%) and its Morningstar category (Large Cap Growth) which advanced 25.70% in the same period.

We believe that the Fund’s excellent performance can be attributed to the research, diligence, and discipline of our investment process. This involved both stock selection and sector weighting. This achievement was reached without concentrating the Fund in a few stocks; rather the Fund owned more than 125 stocks (higher than its average peer) and our top ten holdings constitute about 16% (less than its peers). We believe that this approach can help dampen volatility.

Many economists believe that the U.S. economy has turned the corner. U.S. equities continued their generally upward trend in the past fiscal year, notwithstanding periods of short-term volatility attributed to anxiety about the European credit crisis, the disaster in Japan, U.S. debt ceiling with the way Congress is addressing it and the Arab Spring with the potential for oil disruption. Still, uncertainty remains regarding the longer-term economic outlook. Especially worrisome is the persistent high unemployment, subpar growth, and the U.S. fiscal deficit.

In accordance with Islamic principles, the Fund avoids interest-driven financial sector stocks. This helped the Fund performance. However, the superior performance of the Fund cannot be attributed to that factor alone, as the Fund also outperformed the Dow Jones Islamic Market U.S. Index which also avoids these financial stocks. Over-weighting stocks in the basic materials and health sectors helped the Fund considerably over the reporting period in spite of the recent underperformance of the precious metal and mining stocks.

Nobody can consistently predict the future performance of the stock market. However, we believe that the coming year will be a year that rewards wise stock selection, especially among growth stocks of unleveraged companies. These are the kind of companies that Iman Fund seeks to invest in.

A basic tenet of successful investing is to invest for the long run; riding out the markets’ inevitable ups and downs rather than selling into panic or chasing the hottest fad. Patience also affords the benefits of compounding, lower transaction cost, and reduced taxes. Diversification and most importantly geographic diversification are of utmost importance (your Fund’s holdings include more than 20% of non-U.S. stocks.) Another tenet is investing regularly, which can help lower the average cost of your purchases. Investing a fixed sum of money each month or quarter ensures that you won’t purchase all your shares at market highs. This strategy — known as dollar cost averaging — also takes out “emotion” from investing, and helps shareholders avoid irrational panics. No method can eliminate risk totally, but prudent strategies can considerably decrease the impact of short-term declines.

We thank you for entrusting your hard-earned money with us. We promise to continue to work hard to maintain your worthy trust.

Bassam Osman

President, Iman Fund

Past performance is not a guarantee of future results.

The above discussion and analysis of the Fund reflect the opinions of the Advisor as of July 2011, are subject to change, and any forecasts made cannot be guaranteed and should not be considered investment advice.

IMAN FUND

Mutual Fund investing involves risk; principal loss is possible. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Historically, the Advisor believes that the Islamic restrictions placed on the Fund have not adversely affected the Fund; however, it is possible that these restrictions may result in the Fund not performing as well as mutual funds not subject to such restrictions. Investments in smaller companies involve additional risk, such as limited liquidity and greater volatility.

The S&P 500 Index includes 500 common stocks, most of which are listed on the New York Stock Exchange. The Index is a market capitalization-weighted index representing approximately two-thirds of the total market value of all domestic common stocks. The Dow Jones Islamic Market USA Index is a diversified compilation of U.S. equity securities considered by Dow Jones to be in compliance with Islamic principles. The performance of the Dow Jones Islamic Market USA Index does not include the reinvestment of dividends. You cannot invest directly in an index. Correlation is a statistical measure of how two securities move in relation to each other. Each Morningstar category average represents a universe of funds with similar investment objectives.

Diversification does not assure a profit or protect against loss in a declining market.

Dollar Cost Averaging involves continuous investment in securities regardless of fluctuating price levels of such securities. The investor should consider his/her financial ability to continue purchases through periods of low price levels. Such a plan does not assure a profit and does not protect against loss in declining markets.

IMAN FUND

EXPENSE EXAMPLE

May 31, 2011 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (12/1/10 - 5/31/11).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. The example below includes, but is not limited to, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Please note that Iman Fund does not have any sales charge (loads), redemption fees, or exchange fees.

| |

Beginning

|

Ending

|

Expenses Paid

|

| |

Account Value

|

Account Value

|

During Period

|

| |

12/1/10

|

5/31/11

|

12/1/10 - 5/31/11*

|

|

Actual

|

$1,000.00

|

$1,132.60

|

$9.57

|

|

Hypothetical (5% return before expenses)

|

1,000.00

|

1,015.96

|

9.05

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.80% multiplied by the average account value over the period multiplied by 182/365 (to reflect the one-half year period).

|

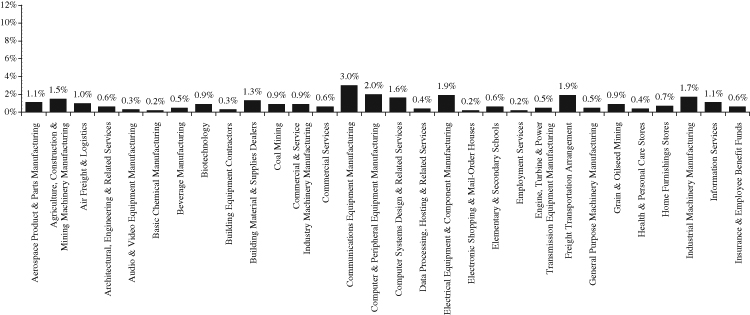

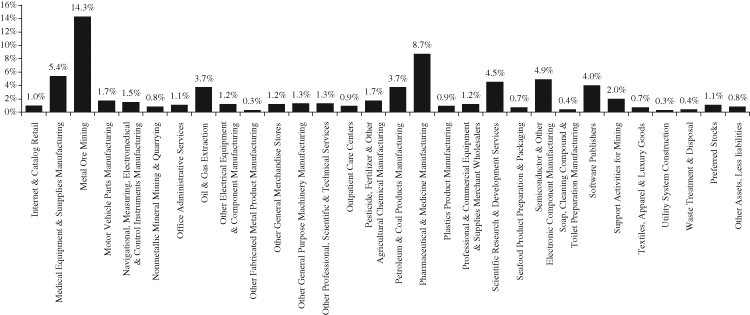

IMAN FUND

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

May 31, 2011 (Unaudited)

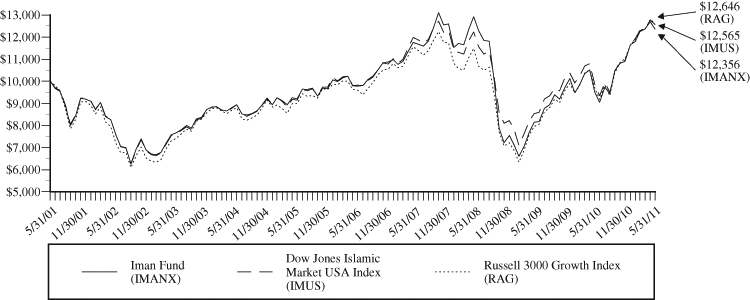

IMAN FUND

Total Rate of Return

For the Period May 31, 2001 to May 31, 2011

(Unaudited)

This chart assumes an initial investment of $10,000 made on May 31, 2001 and held through May 31, 2011.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the recent month end may be obtained by visiting www.investaaa.com.

Indices mentioned are unmanaged and used to measure U.S. markets. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

| |

Six

|

One

|

Five

|

Ten

|

|

Average Annual Total Return as of May 31, 2011

|

Months

|

Year

|

Years

|

Years

|

|

Iman Fund

|

13.26%

|

29.81%

|

4.75%

|

2.14%

|

|

Dow Jones Islamic Market USA Index*

|

14.71%

|

27.21%

|

5.07%

|

2.31%

|

|

Russell 3000 Growth Index**

|

14.08%

|

30.02%

|

5.60%

|

2.38%

|

|

*

|

The Dow Jones Islamic Market USA Index is a diversified compilation of U.S. equity securities considered by Dow Jones to be in compliance with Islamic principles. The index is constructed from stocks in the Dow Jones Indexes (DJGI) family. Dow Jones believes that these stocks are accessible to investors and are well traded. The DJGI methodology removes issues that are not suitable for global investing. The performance of the Dow Jones Islamic Market USA Index does not include the reinvestment of dividends.

|

|

**

|

The Russell 3000 Growth Index takes the largest 3,000 U.S. companies based on market capitalization and measures the performance of those with higher price-to-book ratios and higher forecasted growth values.

|

IMAN FUND

SCHEDULE OF INVESTMENTS

May 31, 2011

(Classifications are based on the North American Industry Classification System)

|

Number of

|

|

|

|

|

|

|

Shares

|

|

|

|

Value

|

|

|

COMMON STOCKS - 98.1%

|

|

|

|

| |

|

AEROSPACE PRODUCT &

|

|

|

|

| |

|

PARTS MANUFACTURING - 1.1%

|

|

|

|

| |

6,300 |

|

Honeywell International, Inc.

|

|

$ |

375,165 |

|

| |

|

|

AGRICULTURE, CONSTRUCTION

|

|

|

|

|

| |

|

|

& MINING MACHINERY

|

|

|

|

|

| |

|

|

MANUFACTURING - 1.5%

|

|

|

|

|

| |

3,200 |

|

FMC Technologies, Inc. (a)

|

|

|

142,816 |

|

| |

5,100 |

|

National Oilwell Varco Inc.

|

|

|

370,158 |

|

| |

|

|

|

|

|

512,974 |

|

| |

|

|

AIR FREIGHT & LOGISTICS - 1.0%

|

|

|

|

|

| |

4,900 |

|

United Parcel Service, Inc. - Class B

|

|

|

360,101 |

|

| |

|

|

ARCHITECTURAL, ENGINEERING

|

|

|

|

|

| |

|

|

& RELATED SERVICES - 0.6%

|

|

|

|

|

| |

10,500 |

|

McDermott International, Inc. (a)(b)

|

|

|

222,810 |

|

| |

|

|

AUDIO & VIDEO EQUIPMENT

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.3%

|

|

|

|

|

| |

2,400 |

|

Harman International Industries, Inc.

|

|

|

115,128 |

|

| |

|

|

BASIC CHEMICAL

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.2%

|

|

|

|

|

| |

2,300 |

|

Cameco Corp. (b)

|

|

|

64,538 |

|

| |

|

|

BEVERAGE MANUFACTURING - 0.5%

|

|

|

|

|

| |

2,400 |

|

The Coca Cola Co.

|

|

|

160,344 |

|

| |

|

|

BIOTECHNOLOGY - 0.9%

|

|

|

|

|

| |

3,200 |

|

Waters Corp. (a)

|

|

|

315,392 |

|

| |

|

|

BUILDING EQUIPMENT

|

|

|

|

|

| |

|

|

CONTRACTORS - 0.3%

|

|

|

|

|

| |

5,300 |

|

Quanta Services, Inc. (a)

|

|

|

104,675 |

|

| |

|

|

BUILDING MATERIAL &

|

|

|

|

|

| |

|

|

SUPPLIES DEALERS - 1.3%

|

|

|

|

|

| |

13,800 |

|

Fastenal Co.

|

|

|

457,884 |

|

| |

|

|

COAL MINING - 0.9%

|

|

|

|

|

| |

5,000 |

|

Peabody Energy Corp.

|

|

|

306,800 |

|

| |

|

|

COMMERCIAL & SERVICE

|

|

|

|

|

| |

|

|

INDUSTRY MACHINERY

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.9%

|

|

|

|

|

| |

6,300 |

|

CANON INC. - ADR (b)

|

|

|

302,274 |

|

| |

|

|

COMMERCIAL SERVICES - 0.6%

|

|

|

|

|

| |

7,900 |

|

Robert Half International, Inc.

|

|

|

217,803 |

|

| |

|

|

COMMUNICATIONS EQUIPMENT

|

|

|

|

|

| |

|

|

MANUFACTURING - 3.0%

|

|

|

|

|

| |

9,300 |

|

Cisco Systems, Inc.

|

|

|

156,240 |

|

| |

2,300 |

|

Polycom, Inc. (a)

|

|

|

132,043 |

|

| |

5,900 |

|

QUALCOMM, Inc.

|

|

|

345,681 |

|

| |

3,300 |

|

Research In Motion Ltd. (a)(b)

|

|

|

141,405 |

|

| |

6,200 |

|

Trimble Navigation Ltd. (a)

|

|

|

270,878 |

|

| |

|

|

|

|

|

1,046,247 |

|

| |

|

|

COMPUTER & PERIPHERAL

|

|

|

|

|

| |

|

|

EQUIPMENT MANUFACTURING - 2.0%

|

|

|

|

|

| |

1,300 |

|

Apple Inc. (a)

|

|

|

452,179 |

|

| |

1,500 |

|

International Business

|

|

|

|

|

| |

|

|

Machines Corp. (IBM)

|

|

|

253,395 |

|

| |

|

|

|

|

|

705,574 |

|

| |

|

|

COMPUTER SYSTEMS DESIGN

|

|

|

|

|

| |

|

|

& RELATED SERVICES - 1.6%

|

|

|

|

|

| |

7,000 |

|

Accenture PLC - Class A (b)

|

|

|

401,730 |

|

| |

12,000 |

|

Internet Capital Group, Inc. (a)

|

|

|

156,360 |

|

| |

|

|

|

|

|

558,090 |

|

| |

|

|

DATA PROCESSING, HOSTING

|

|

|

|

|

| |

|

|

& RELATED SERVICES - 0.4%

|

|

|

|

|

| |

3,900 |

|

Juniper Networks, Inc. (a)

|

|

|

142,779 |

|

| |

|

|

ELECTRICAL EQUIPMENT &

|

|

|

|

|

| |

|

|

COMPONENT MANUFACTURING - 1.9%

|

|

|

|

|

| |

16,700 |

|

ABB Ltd. - ADR (b)

|

|

|

449,230 |

|

| |

9,600 |

|

Corning Inc.

|

|

|

193,440 |

|

| |

|

|

|

|

|

642,670 |

|

| |

|

|

ELECTRONIC SHOPPING &

|

|

|

|

|

| |

|

|

MAIL-ORDER HOUSES - 0.2%

|

|

|

|

|

| |

400 |

|

Amazon.com, Inc. (a)

|

|

|

78,676 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2011

(Classifications are based on the North American Industry Classification System)

|

Number of

|

|

|

|

|

|

|

Shares

|

|

|

|

Value

|

|

|

COMMON STOCKS (CONTINUED)

|

|

|

|

| |

|

ELEMENTARY &

|

|

|

|

| |

|

SECONDARY SCHOOLS - 0.6%

|

|

|

|

| |

1,700 |

|

Strayer Education, Inc.

|

|

$ |

204,306 |

|

| |

|

|

EMPLOYMENT SERVICES - 0.2%

|

|

|

|

|

| |

1,300 |

|

Manpower, Inc.

|

|

|

79,469 |

|

| |

|

|

ENGINE, TURBINE & POWER

|

|

|

|

|

| |

|

|

TRANSMISSION EQUIPMENT

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.5%

|

|

|

|

|

| |

1,700 |

|

Cummins, Inc.

|

|

|

178,908 |

|

| |

|

|

FREIGHT TRANSPORTATION

|

|

|

|

|

| |

|

|

ARRANGEMENT - 1.9%

|

|

|

|

|

| |

2,100 |

|

C.H. Robinson Worldwide, Inc.

|

|

|

168,462 |

|

| |

3,600 |

|

Expeditors International

|

|

|

|

|

| |

|

|

of Washington, Inc.

|

|

|

190,152 |

|

| |

3,200 |

|

FedEx Corp.

|

|

|

299,648 |

|

| |

|

|

|

|

|

658,262 |

|

| |

|

|

GENERAL PURPOSE MACHINERY

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.5%

|

|

|

|

|

| |

3,300 |

|

Illinois Tool Works Inc.

|

|

|

189,156 |

|

| |

|

|

GRAIN & OILSEED MILLING - 0.9%

|

|

|

|

|

| |

9,800 |

|

Unilever NV - NY

|

|

|

|

|

| |

|

|

Reg. Shares - ADR (b)

|

|

|

320,068 |

|

| |

|

|

HEALTH & PERSONAL

|

|

|

|

|

| |

|

|

CARE STORES - 0.4%

|

|

|

|

|

| |

2,500 |

|

Express Scripts, Inc. (a)

|

|

|

148,900 |

|

| |

|

|

HOME FURNISHINGS STORES - 0.7%

|

|

|

|

|

| |

3,100 |

|

Bed Bath & Beyond, Inc. (a)

|

|

|

167,059 |

|

| |

2,400 |

|

Williams-Sonoma, Inc.

|

|

|

93,960 |

|

| |

|

|

|

|

|

261,019 |

|

| |

|

|

INDUSTRIAL MACHINERY

|

|

|

|

|

| |

|

|

MANUFACTURING - 1.7%

|

|

|

|

|

| |

9,100 |

|

ASML Holding N.V. - NY

|

|

|

|

|

| |

|

|

Reg. Shares - ADR (b)

|

|

|

354,991 |

|

| |

5,100 |

|

Lam Research Corp. (a)

|

|

|

239,674 |

|

| |

|

|

|

|

|

594,665 |

|

| |

|

|

INFORMATION SERVICES - 1.1%

|

|

|

|

|

| |

730 |

|

Google Inc. (a)

|

|

|

386,185 |

|

| |

|

|

INSURANCE & EMPLOYEE

|

|

|

|

|

| |

|

|

BENEFIT FUNDS - 0.6%

|

|

|

|

|

| |

2,800 |

|

AMERIGROUP Corp. (a)

|

|

|

198,548 |

|

| |

|

|

INTERNET & CATALOG RETAIL - 1.0%

|

|

|

|

|

| |

11,200 |

|

eBay Inc. (a)

|

|

|

349,104 |

|

| |

|

|

MEDICAL EQUIPMENT &

|

|

|

|

|

| |

|

|

SUPPLIES MANUFACTURING - 5.4%

|

|

|

|

|

| |

1,900 |

|

3M Co.

|

|

|

179,322 |

|

| |

3,500 |

|

Becton, Dickinson & Co.

|

|

|

306,425 |

|

| |

1,600 |

|

C.R. Bard, Inc.

|

|

|

178,848 |

|

| |

9,000 |

|

DENTSPLY International, Inc.

|

|

|

353,160 |

|

| |

2,300 |

|

The Estee Lauder Co. Inc.

|

|

|

235,773 |

|

| |

1,700 |

|

Thermo Fisher Scientific, Inc. (a)

|

|

|

111,265 |

|

| |

7,600 |

|

Varian Medical Systems, Inc. (a)

|

|

|

513,304 |

|

| |

|

|

|

|

|

1,878,097 |

|

| |

|

|

METAL ORE MINING - 14.3%

|

|

|

|

|

| |

4,800 |

|

Agnico-Eagle Mines Ltd. (b)

|

|

|

310,560 |

|

| |

2,800 |

|

Barrick Gold Corp. (b)

|

|

|

133,728 |

|

| |

6,300 |

|

BHP Billiton Ltd. - ADR (b)

|

|

|

601,146 |

|

| |

2,500 |

|

Compania de Minas

|

|

|

|

|

| |

|

|

Buenaventura S.A. - ADR (b)

|

|

|

110,300 |

|

| |

14,500 |

|

Eldorado Gold Corp. (b)

|

|

|

230,405 |

|

| |

3,700 |

|

Freeport-McMoRan

|

|

|

|

|

| |

|

|

Copper & Gold, Inc.

|

|

|

191,068 |

|

| |

5,400 |

|

Gold Fields Ltd. - ADR (b)

|

|

|

88,776 |

|

| |

10,200 |

|

Gold Resource Corp.

|

|

|

285,090 |

|

| |

8,900 |

|

Goldcorp, Inc. (b)

|

|

|

445,623 |

|

| |

5,900 |

|

IAMGOLD Corp. (b)

|

|

|

124,195 |

|

| |

17,500 |

|

International Tower

|

|

|

|

|

| |

|

|

Hill Mines Ltd. (a)(b)

|

|

|

144,025 |

|

| |

11,700 |

|

Ivanhoe Mines Ltd. (a)

|

|

|

294,957 |

|

| |

59,400 |

|

Kinross Gold Corp. (b)

|

|

|

933,768 |

|

| |

4,700 |

|

Pan American Silver Corp. (b)

|

|

|

159,283 |

|

| |

3,000 |

|

Randgold Resources Ltd. - ADR (b)

|

|

|

245,880 |

|

| |

7,600 |

|

Silver Wheaton Corp. (b)

|

|

|

279,300 |

|

| |

2,100 |

|

Southern Copper Corp.

|

|

|

72,576 |

|

| |

5,500 |

|

Vale SA - ADR (b)

|

|

|

177,430 |

|

| |

13,100 |

|

Yamana Gold Inc. (b)

|

|

|

168,335 |

|

| |

|

|

|

|

|

4,996,445 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2011

(Classifications are based on the North American Industry Classification System)

|

Number of

|

|

|

|

|

|

|

Shares

|

|

|

|

Value

|

|

|

COMMON STOCKS (CONTINUED)

|

|

|

|

| |

|

MOTOR VEHICLE PARTS

|

|

|

|

| |

|

MANUFACTURING - 1.7%

|

|

|

|

| |

7,000 |

|

Johnson Controls, Inc.

|

|

$ |

277,200 |

|

| |

4,500 |

|

WABCO Holdings, Inc. (a)

|

|

|

308,475 |

|

| |

|

|

|

|

|

585,675 |

|

| |

|

|

NAVIGATIONAL, MEASURING,

|

|

|

|

|

| |

|

|

ELECTROMEDICAL & CONTROL

|

|

|

|

|

| |

|

|

INSTRUMENTS MANUFACTURING - 1.5%

|

|

|

|

|

| |

1,800 |

|

Danaher Corp.

|

|

|

98,154 |

|

| |

4,200 |

|

FLIR Systems, Inc.

|

|

|

151,830 |

|

| |

2,700 |

|

Illumina, Inc. (a)

|

|

|

194,616 |

|

| |

1,300 |

|

St. Jude Medical, Inc.

|

|

|

65,871 |

|

| |

|

|

|

|

|

510,471 |

|

| |

|

|

NONMETALLIC MINERAL

|

|

|

|

|

| |

|

|

MINING & QUARRYING - 0.8%

|

|

|

|

|

| |

5,100 |

|

Potash Corp. of Saskatchewan Inc. (b)

|

|

|

288,660 |

|

| |

|

|

OFFICE ADMINISTRATIVE

|

|

|

|

|

| |

|

|

SERVICES - 1.1%

|

|

|

|

|

| |

4,300 |

|

Gartner, Inc. (a)

|

|

|

167,829 |

|

| |

6,300 |

|

Paychex, Inc.

|

|

|

203,490 |

|

| |

|

|

|

|

|

371,319 |

|

| |

|

|

OIL & GAS EXTRACTION - 3.7%

|

|

|

|

|

| |

1,100 |

|

Apache Corp.

|

|

|

137,060 |

|

| |

300 |

|

CNOOC Ltd. - ADR (b)

|

|

|

75,174 |

|

| |

4,000 |

|

Continental Resources, Inc. (a)

|

|

|

264,880 |

|

| |

4,800 |

|

Devon Energy Corp.

|

|

|

403,536 |

|

| |

800 |

|

EOG Resources, Inc.

|

|

|

87,312 |

|

| |

1,300 |

|

Occidental Petroleum Corp.

|

|

|

140,205 |

|

| |

4,600 |

|

Southwestern Energy Co. (a)

|

|

|

201,342 |

|

| |

|

|

|

|

|

1,309,509 |

|

| |

|

|

OTHER ELECTRICAL

|

|

|

|

|

| |

|

|

EQUIPMENT & COMPONENT

|

|

|

|

|

| |

|

|

MANUFACTURING - 1.2%

|

|

|

|

|

| |

7,700 |

|

Emerson Electric Co.

|

|

|

420,035 |

|

| |

|

|

OTHER FABRICATED METAL

|

|

|

|

|

| |

|

|

PRODUCT MANUFACTURING - 0.3%

|

|

|

|

|

| |

1,000 |

|

Parker Hannifin Corp.

|

|

|

88,850 |

|

| |

|

|

OTHER GENERAL

|

|

|

|

|

| |

|

|

MERCHANDISE STORES - 1.2%

|

|

|

|

|

| |

7,100 |

|

O’Reilly Automotive, Inc. (a)

|

|

|

426,781 |

|

| |

|

|

OTHER GENERAL PURPOSE

|

|

|

|

|

| |

|

|

MACHINERY MANUFACTURING - 1.3%

|

|

|

|

|

| |

1,600 |

|

Flowserve Corp.

|

|

|

193,968 |

|

| |

2,900 |

|

Gardner Denver Inc.

|

|

|

242,962 |

|

| |

|

|

|

|

|

436,930 |

|

| |

|

|

OTHER PROFESSIONAL,

|

|

|

|

|

| |

|

|

SCIENTIFIC & TECHNICAL

|

|

|

|

|

| |

|

|

SERVICES - 1.3%

|

|

|

|

|

| |

5,100 |

|

IHS, Inc. - Class A (a)

|

|

|

447,372 |

|

| |

|

|

OUTPATIENT CARE CENTERS - 0.9%

|

|

|

|

|

| |

12,600 |

|

America Service Group, Inc.

|

|

|

327,222 |

|

| |

|

|

PESTICIDE, FERTILIZER & OTHER

|

|

|

|

|

| |

|

|

AGRICULTURAL CHEMICAL

|

|

|

|

|

| |

|

|

MANUFACTURING - 1.7%

|

|

|

|

|

| |

4,700 |

|

Monsanto Co.

|

|

|

333,888 |

|

| |

3,700 |

|

The Mosaic Co.

|

|

|

262,145 |

|

| |

|

|

|

|

|

596,033 |

|

| |

|

|

PETROLEUM & COAL PRODUCTS

|

|

|

|

|

| |

|

|

MANUFACTURING - 3.7%

|

|

|

|

|

| |

5,800 |

|

Chevron Corp.

|

|

|

608,478 |

|

| |

6,200 |

|

Exxon Mobil Corp.

|

|

|

517,514 |

|

| |

2,600 |

|

Murphy Oil Corp.

|

|

|

179,114 |

|

| |

|

|

|

|

|

1,305,106 |

|

| |

|

|

PHARMACEUTICAL & MEDICINE

|

|

|

|

|

| |

|

|

MANUFACTURING - 8.7%

|

|

|

|

|

| |

6,000 |

|

Amarin Corp. PLC - ADR (a)(b)

|

|

|

114,420 |

|

| |

7,100 |

|

Ardea Biosciences, Inc. (a)

|

|

|

177,429 |

|

| |

5,000 |

|

BioMarin Pharmaceutical Inc. (a)

|

|

|

141,150 |

|

| |

53,300 |

|

Durect Corp. (a)

|

|

|

186,550 |

|

| |

2,400 |

|

Gilead Sciences, Inc. (a)

|

|

|

100,176 |

|

| |

3,500 |

|

IDEXX Laboratories, Inc. (a)

|

|

|

275,520 |

|

| |

9,600 |

|

Impax Laboratories, Inc. (a)

|

|

|

257,760 |

|

| |

7,400 |

|

MAP Pharmaceuticals, Inc. (a)

|

|

|

125,726 |

|

| |

4,100 |

|

Mead Johnson Nutrition Co.

|

|

|

277,939 |

|

| |

2,600 |

|

Merck & Co., Inc.

|

|

|

95,550 |

|

| |

4,676 |

|

Novartis AG - ADR (b)

|

|

|

301,696 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2011

(Classifications are based on the North American Industry Classification System)

|

Number of

|

|

|

|

|

|

|

Shares

|

|

|

|

Value

|

|

|

COMMON STOCKS (CONTINUED)

|

|

|

|

| |

|

PHARMACEUTICAL & MEDICINE

|

|

|

|

| |

|

MANUFACTURING (Continued)

|

|

|

|

| |

1,200 |

|

Novo Nordisk A/S - ADR (b)

|

|

$ |

151,212 |

|

| |

5,000 |

|

Salix Pharmaceuticals, Ltd. (a)

|

|

|

200,150 |

|

| |

2,300 |

|

Shire PLC - ADR (b)

|

|

|

219,857 |

|

| |

3,800 |

|

United Therapeutics Corp. (a)

|

|

|

245,366 |

|

| |

3,000 |

|

Vertex Pharmaceuticals Inc. (a)

|

|

|

161,970 |

|

| |

|

|

|

|

|

3,032,471 |

|

| |

|

|

PLASTICS PRODUCT

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.9%

|

|

|

|

|

| |

5,300 |

|

Raven Industries, Inc.

|

|

|

296,800 |

|

| |

|

|

PROFESSIONAL & COMMERCIAL

|

|

|

|

|

| |

|

|

EQUIPMENT & SUPPLIES

|

|

|

|

|

| |

|

|

MERCHANT WHOLESALERS - 1.2%

|

|

|

|

|

| |

5,600 |

|

Henry Schein, Inc. (a)

|

|

|

402,192 |

|

| |

|

|

SCIENTIFIC RESEARCH &

|

|

|

|

|

| |

|

|

DEVELOPMENT SERVICES - 4.5%

|

|

|

|

|

| |

7,800 |

|

Alexion Pharmaceuticals, Inc. (a)

|

|

|

369,876 |

|

| |

5,300 |

|

The Babcock & Wilcox Co. (a)

|

|

|

148,665 |

|

| |

3,100 |

|

Celgene Corp. (a)

|

|

|

188,821 |

|

| |

6,300 |

|

Covance, Inc. (a)

|

|

|

370,818 |

|

| |

19,500 |

|

Incyte Corp. (a)

|

|

|

345,735 |

|

| |

10,300 |

|

Ironwood Pharmaceuticals, Inc. (a)

|

|

|

155,736 |

|

| |

|

|

|

|

|

1,579,651 |

|

| |

|

|

SEAFOOD PRODUCT

|

|

|

|

|

| |

|

|

PREPARATION & PACKAGING - 0.7%

|

|

|

|

|

| |

19,400 |

|

Omega Protein Corp. (a)

|

|

|

251,618 |

|

| |

|

|

SEMICONDUCTOR & OTHER

|

|

|

|

|

| |

|

|

ELECTRONIC COMPONENT

|

|

|

|

|

| |

|

|

MANUFACTURING - 4.9%

|

|

|

|

|

| |

1,700 |

|

Cree, Inc. (a)

|

|

|

74,613 |

|

| |

13,300 |

|

Intersil Corp. - Class A

|

|

|

190,855 |

|

| |

20,600 |

|

JDS Uniphase Corp. (a)

|

|

|

415,914 |

|

| |

14,500 |

|

Microchip Technology Inc.

|

|

|

573,185 |

|

| |

6,700 |

|

Texas Instruments Inc.

|

|

|

236,510 |

|

| |

6,000 |

|

Xilinx, Inc.

|

|

|

214,080 |

|

| |

|

|

|

|

|

1,705,157 |

|

| |

|

|

SOAP, CLEANING COMPOUND

|

|

|

|

|

| |

|

|

& TOILET PREPARATION

|

|

|

|

|

| |

|

|

MANUFACTURING - 0.4%

|

|

|

|

|

| |

1,600 |

|

Colgate-Palmolive Co.

|

|

|

140,048 |

|

| |

|

|

SOFTWARE PUBLISHERS - 4.0%

|

|

|

|

|

| |

10,400 |

|

Adobe Systems, Inc. (a)

|

|

|

360,152 |

|

| |

1,700 |

|

Informatica Corp. (a)

|

|

|

99,722 |

|

| |

14,600 |

|

Microsoft Corp.

|

|

|

365,146 |

|

| |

13,900 |

|

Nuance Communications, Inc. (a)

|

|

|

305,244 |

|

| |

7,600 |

|

Oracle Corp.

|

|

|

260,072 |

|

| |

|

|

|

|

|

1,390,336 |

|

| |

|

|

SUPPORT ACTIVITIES FOR MINING - 2.0%

|

|

|

|

|

| |

5,500 |

|

Halliburton Co.

|

|

|

275,825 |

|

| |

6,000 |

|

Patterson-UTI Energy, Inc.

|

|

|

187,980 |

|

| |

2,700 |

|

Schlumberger Ltd. (b)

|

|

|

231,444 |

|

| |

|

|

|

|

|

695,249 |

|

| |

|

|

TEXTILES, APPAREL

|

|

|

|

|

| |

|

|

& LUXURY GOODS - 0.7%

|

|

|

|

|

| |

3,000 |

|

Nike, Inc. - Class B

|

|

|

253,350 |

|

| |

|

|

UTILITY SYSTEM CONSTRUCTION - 0.3%

|

|

|

|

|

| |

1,400 |

|

Fluor Corp.

|

|

|

96,502 |

|

| |

|

|

WASTE TREATMENT & DISPOSAL - 0.4%

|

|

|

|

|

| |

8,700 |

|

US Ecology, Inc.

|

|

|

152,598 |

|

| |

|

|

TOTAL COMMON STOCKS

|

|

|

|

|

| |

|

|

(Cost $32,004,575)

|

|

|

34,242,991 |

|

|

PREFERRED STOCKS - 1.1%

|

|

|

|

|

| |

|

|

METAL ORE MINING - 1.1%

|

|

|

|

|

| |

12,800 |

|

Vale SA - ADR (b)

|

|

|

375,040 |

|

| |

|

|

TOTAL PREFERRED STOCKS

|

|

|

|

|

| |

|

|

(Cost $375,296)

|

|

|

375,040 |

|

| |

|

|

Total Investments

|

|

|

|

|

| |

|

|

(Cost $32,379,871) - 99.2%

|

|

|

34,618,031 |

|

| |

|

|

Other Assets in Excess

|

|

|

|

|

| |

|

|

of Liabilities - 0.8%

|

|

|

293,784 |

|

| |

|

|

TOTAL NET ASSETS - 100.0%

|

|

$ |

34,911,815 |

|

ADR - American Depositary Receipt

PLC - Public Limited Company

(a)Non Income Producing

(b)Foreign Issued Securities

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2011

|

Assets:

|

|

|

|

|

Investments, at value (cost $32,379,871)

|

|

$ |

34,618,031 |

|

|

Cash

|

|

|

156,014 |

|

|

Income receivable

|

|

|

43,078 |

|

|

Receivable for capital shares sold

|

|

|

875 |

|

|

Receivable for investments sold

|

|

|

178,853 |

|

|

Other assets

|

|

|

19,887 |

|

|

Total Assets

|

|

|

35,016,738 |

|

| |

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

Payable to Advisor (Note 3)

|

|

|

28,963 |

|

|

Payable to Administrator

|

|

|

16,129 |

|

|

Payable for professional fees

|

|

|

21,640 |

|

|

Accrued expenses and other liabilities

|

|

|

38,191 |

|

|

Total Liabilities

|

|

|

104,923 |

|

|

Net Assets

|

|

$ |

34,911,815 |

|

| |

|

|

|

|

|

Net assets consist of:

|

|

|

|

|

|

Paid-in capital

|

|

$ |

34,477,247 |

|

|

Accumulated net realized loss on investments

|

|

|

(1,803,592 |

) |

|

Net unrealized appreciation on investments

|

|

|

2,238,160 |

|

|

Net Assets

|

|

$ |

34,911,815 |

|

| |

|

|

|

|

|

Shares of beneficial interest outstanding

|

|

|

|

|

|

(unlimited number of shares authorized, no par value)

|

|

|

3,890,283 |

|

|

Net asset value, redemption price and offering price per share

|

|

$ |

8.97 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENT OF OPERATIONS

For the Year Ended May 31, 2011

|

Investment income:

|

|

|

|

|

Dividend income (Net of foreign withholding tax of $10,602)

|

|

$ |

355,272 |

|

|

Total investment income

|

|

|

355,272 |

|

| |

|

|

|

|

|

Expenses:

|

|

|

|

|

|

Advisory fees (Note 3)

|

|

|

321,531 |

|

|

Administration fees

|

|

|

52,456 |

|

|

Transfer agent fees and expenses

|

|

|

46,650 |

|

|

Legal fees

|

|

|

42,455 |

|

|

Fund accounting fees

|

|

|

36,941 |

|

|

Federal and state registration fees

|

|

|

25,774 |

|

|

Audit fees

|

|

|

13,750 |

|

|

Custody fees

|

|

|

11,526 |

|

|

Reports to shareholders

|

|

|

10,635 |

|

|

Other expenses

|

|

|

1,700 |

|

|

Total expenses

|

|

|

563,418 |

|

|

Net investment loss

|

|

|

(208,146 |

) |

| |

|

|

|

|

|

Realized and unrealized gain on investments:

|

|

|

|

|

|

Net realized gain from security transactions

|

|

|

6,307,017 |

|

|

Change in net unrealized appreciation/depreciation on investments

|

|

|

2,224,758 |

|

|

Realized and unrealized gain on investments

|

|

|

8,531,775 |

|

|

Net increase in net assets from operations

|

|

$ |

8,323,629 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENTS OF CHANGES IN NET ASSETS

| |

|

Year Ended

|

|

|

Year Ended

|

|

| |

|

May 31, 2011

|

|

|

May 31, 2010

|

|

|

From operations:

|

|

|

|

|

|

|

|

Net investment loss

|

|

$ |

(208,146 |

) |

|

$ |

(65,796 |

) |

|

Net realized gain on investments

|

|

|

6,307,017 |

|

|

|

4,619,813 |

|

|

Change in net unrealized appreciation/depreciation on investments

|

|

|

2,224,758 |

|

|

|

(399,158 |

) |

|

Net increase in net assets from operations

|

|

|

8,323,629 |

|

|

|

4,154,859 |

|

| |

|

|

|

|

|

|

|

|

|

From capital share transactions:

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of shares

|

|

|

2,273,237 |

|

|

|

2,037,191 |

|

|

Payments for shares redeemed

|

|

|

(3,398,318 |

) |

|

|

(3,195,289 |

) |

|

Net decrease in net assets from capital share transactions

|

|

|

(1,125,081 |

) |

|

|

(1,158,098 |

) |

| |

|

|

|

|

|

|

|

|

|

Total increase in net assets

|

|

|

7,198,548 |

|

|

|

2,996,761 |

|

| |

|

|

|

|

|

|

|

|

|

Net assets:

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

27,713,267 |

|

|

|

24,716,506 |

|

|

End of year

|

|

$ |

34,911,815 |

|

|

$ |

27,713,267 |

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout each Period

| |

|

Year Ended May 31,

|

|

| |

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

Net asset value, beginning of year

|

|

$ |

6.91 |

|

|

$ |

5.92 |

|

|

$ |

9.70 |

|

|

$ |

8.84 |

|

|

$ |

7.37 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss(1)

|

|

|

(0.05 |

) |

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

|

(0.03 |

) |

|

|

(0.01 |

) |

|

Net realized and unrealized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

gains (losses) on investments

|

|

|

2.11 |

|

|

|

1.01 |

|

|

|

(3.57 |

) |

|

|

0.90 |

|

|

|

1.48 |

|

|

Total from investment operations

|

|

|

2.06 |

|

|

|

0.99 |

|

|

|

(3.59 |

) |

|

|

0.87 |

|

|

|

1.47 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less distributions paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From net investment income

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

From net realized gain on investments

|

|

|

— |

|

|

|

— |

|

|

|

(0.19 |

) |

|

|

(0.01 |

) |

|

|

— |

|

|

Total distributions paid

|

|

|

— |

|

|

|

— |

|

|

|

(0.19 |

) |

|

|

(0.01 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year

|

|

$ |

8.97 |

|

|

$ |

6.91 |

|

|

$ |

5.92 |

|

|

$ |

9.70 |

|

|

$ |

8.84 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return

|

|

|

29.81 |

% |

|

|

16.72 |

% |

|

|

(36.86 |

)% |

|

|

9.91 |

% |

|

|

19.95 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets at end of period (000’s)

|

|

$ |

34,912 |

|

|

$ |

27,713 |

|

|

$ |

24,717 |

|

|

$ |

43,137 |

|

|

$ |

35,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of expenses to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before waiver and expense reimbursement

|

|

|

1.75 |

% |

|

|

1.71 |

% |

|

|

1.72 |

% |

|

|

1.36 |

% |

|

|

1.52 |

% |

|

After waiver and expense reimbursement

|

|

|

1.75 |

%(2) |

|

|

1.71 |

%(2) |

|

|

1.72 |

%(2) |

|

|

1.42 |

% |

|

|

1.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of net investment income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before expense reimbursement

|

|

|

(0.65 |

)% |

|

|

(0.23 |

)% |

|

|

(0.33 |

)% |

|

|

(0.25 |

)% |

|

|

0.02 |

% |

|

After expense reimbursement

|

|

|

(0.65 |

)%(2) |

|

|

(0.23 |

)%(2) |

|

|

(0.33 |

)%(2) |

|

|

(0.31 |

)% |

|

|

(0.13 |

)% |

|

Portfolio turnover rate

|

|

|

169.3 |

% |

|

|

177.5 |

% |

|

|

108.7 |

% |

|

|

138.7 |

% |

|

|

32.2 |

% |

|

(1)

|

Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences.

|

|

(2)

|

Effective October 1, 2008, the Fund no longer has an Expense Waiver Agreement in place

|

The accompanying notes are an integral part of these financial statements.

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2011

1.Organization

Allied Asset Advisors Funds (the “Trust”), an open-end management investment company, was organized as a Delaware statutory trust on January 14, 2000. The Trust currently offers one series of shares to investors, the Iman Fund (the “Fund”), a diversified series of the Trust. Allied Asset Advisors, Inc. (“AAA” or the “Advisor”), a Delaware corporation, serves as investment advisor to the Fund.

The Trust is authorized to issue an unlimited number of shares without par value, of each series. The Trust currently offers one class of shares of the Fund.

The investment objective of the Fund is to seek growth of capital while adhering to Islamic principles. To achieve its investment objective, the Fund seeks investments that meet Islamic principles whose price the Fund’s Advisor anticipates will increase over the long term. Under normal circumstances, the Fund invests its net assets in domestic and foreign securities chosen by the Advisor in accordance with Islamic principles. Islamic principles generally preclude investments in certain businesses (e.g., alcohol, pornography and gambling) and investments in interest bearing debt obligations. Any uninvested cash will be held in non-interest bearing deposits or invested in a manner following Islamic principles.

2.Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates: In preparing the financial statements in conformity with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Security Valuation: Investment securities are carried at fair value determined using the following valuation methods:

|

•

|

Equity securities listed on a U.S. securities exchange or NASDAQ for which market quotations are readily available are valued at the last quoted sale price on the valuation date.

|

|

•

|

Options, futures, unlisted U.S. securities and listed U.S. securities not traded on the valuation date for which market quotations are readily available are valued at the most recent quoted bid price. The Fund did not hold any such securities during the year ended May 31, 2011.

|

|

•

|

Securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Advisor under direction of the Board of Trustees.

|

The Fund has adopted fair valuation accounting standards which establish an authoritative definition of fair value and a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes.

Summary of Fair Value Exposure at May 31, 2011

The Trust has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

|

Level 1 -

|

Quoted prices in active markets for identical securities.

|

|

Level 2 -

|

Other significant observable inputs (including quoted prices for similar securities in active markets, quoted prices for identical or similar instruments in

|

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2011

| |

|

markets that are not active, model-derived valuations in which all significant inputs and significant value drives are observable in active markets, interest rates, prepayment speeds, credit risk, etc.)

|

|

Level 3 -

|

Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

|

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Advisor, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Advisor. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of May 31, 2011:

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Common Stocks

|

|

$ |

34,242,991 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

34,242,991 |

|

|

Preferred Stock

|

|

|

375,040 |

|

|

|

— |

|

|

|

— |

|

|

|

375,040 |

|

|

Total*

|

|

$ |

34,618,031 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

34,618,031 |

|

* Additional information regarding the industry and/or geographical classification of these investments is disclosed in the Schedule of Investments.

There were no significant transfers into or out of Level 1, Level 2 or Level 3 fair value measurements during the reporting period for the Fund, as compared to their classification from the most recent annual report. It is the Fund’s policy to consider transfers into or out of Level 1, Level 2 or Level 3 as of the end of the reporting period.

Foreign Securities: Investing in securities of foreign companies and foreign governments involves special risks and consideration not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. The Fund does not invest in securities of U.S. or foreign governments.

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and the Fund intends to distribute all of its taxable income and net capital gains to shareholders. Therefore, no federal income tax provision is required.

As of and during the year ended May 31, 2011, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as other expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations on the Fund’s tax returns remains open for the years ended May 31, 2008 through May 31, 2011.

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for eight years following the year of the loss and offset such

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2011

losses against any future realized capital gains. At May 31, 2011, the Fund had capital loss carryovers as follows:

|

Net Capital

|

Capital Loss

|

|

Loss Carryovers*

|

Carryover Expiration

|

|

$1,801,934

|

5/31/2018

|

* Capital gain distributions will resume in the future to the extent gains are realized in excess of the available carryovers.

As of May 31, 2011, the components of distributable earnings on a tax basis were as follows:

|

Cost of investments

|

|

$ |

32,381,529 |

|

|

Gross tax unrealized appreciation

|

|

$ |

2,984,542 |

|

|

Gross tax unrealized depreciation

|

|

|

(748,040 |

) |

|

Net tax unrealized appreciation

|

|

$ |

2,236,502 |

|

|

Undistributed ordinary income

|

|

|

— |

|

|

Undistributed long-term capital gain

|

|

|

— |

|

|

Total distributable earnings

|

|

$ |

— |

|

|

Other accumulated losses

|

|

|

(1,801,934 |

) |

|

Total accumulated gain

|

|

$ |

434,568 |

|

The difference between book basis and tax basis unrealized and realized gains and losses is attributable primarily to the tax deferral of losses relating to wash sale transactions.

Under current tax laws, losses realized after October 31 may be deferred and treated as occurring on the first business day of the following fiscal year. The Fund did not have post-October losses for the fiscal year ended May 31, 2011.

Distributions to Shareholders: The Fund will distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

No distributions were paid for the years ended May 31, 2011 and May 31, 2010.

Dividend income and distributions to shareholders are recorded on the ex-dividend date. The Fund may periodically make reclassifications among certain of its capital accounts to reflect the tax character of permanent book/tax differences related to the components of the Fund’s net assets. These reclassifications have no impact on the net assets or net asset value of the Fund. For the fiscal year ended May 31, 2011, undistributed net investment income was increased by $208,146, accumulated net realized loss was decreased by $40 and paid in capital was decreased by $208,106.

Other: Investment transactions and shareholder transactions are accounted for on the trade date. Net realized gains and losses on securities are computed on the basis of specific security lot identification. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

The RIC Modernization Act: On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”) was signed by the President. The Modernization Act is the first major piece of legislation affecting Regulated Investment Companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. Some highlights of the enacted provisions are as follows:

New capital losses may now be carried forward indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital, irrespective of the character of the original loss.

The Modernization Act contains simplification provisions, which are aimed at preventing disqualification of a RIC for “inadvertent” failures of the asset diversification and/or qualifying income tests. Additionally, the Modernization Act exempts RICs from the preferential dividend rule, and repealed the 60-day designation requirement for certain types of pay-through income and gains.

Finally, the Modernization Act contains several provisions aimed at preserving the character of distributions made by a fiscal year RIC during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2011

under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions.

Except for the simplification provisions related to RIC qualification, the Modernization Act is effective for taxable years beginning after December 22, 2010. The provisions related to RIC qualification are effective for taxable years for which the extended due date of the tax return is after December 22, 2010.

Subsequent Events: In preparing these financial statements, management has performed an evaluation of subsequent events and transactions for potential recognition or disclosure through the date of issuance of the financial statements.

3.Investment Advisory and Other Agreements

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Advisor, with whom certain officers and Trustees of the Trust are affiliated, to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Trust, on behalf of the Fund, compensates the Advisor for its management services at the annual rate of 1.00% of the Fund’s daily average net assets.

Effective October 1, 2006 through September 30, 2008, the Advisor contractually agreed to waive or reimburse the Fund if the aggregate annual operating expenses exceeded 1.70% of average net assets. Effective October 1, 2008, the Expense Waiver Agreement is no longer in place.

For the year ended May 31, 2011, the Fund had advisory expenses of $321,531 and at May 31, 2011, the Fund had $28,963 payable to the Advisor.

The Trust has a distribution agreement and a servicing agreement with Quasar Distributors, LLC (the “Distributor”). Fees for such distribution services are paid to the Distributor by the Advisor.

4.Capital Share Transactions

Transactions in shares of the Fund for the year ended May 31, 2011, were as follows:

| |

|

Amount

|

|

|

Shares

|

|

|

Shares sold

|

|

$ |

2,273,237 |

|

|

|

297,315 |

|

|

Shares redeemed

|

|

|

(3,398,318 |

) |

|

|

(415,387 |

) |

|

Net decrease in shares

|

|

$ |

(1,125,081 |

) |

|

|

(118,072 |

) |

| |

|

|

|

|

|

|

|

|

|

Shares Outstanding

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

|

|

|

|

4,008,355 |

|

|

End of year

|

|

|

|

|

|

|

3,890,283 |

|

Transactions in shares of the Fund for the year ended May 31, 2010, were as follows:

| |

|

Amount

|

|

|

Shares

|

|

|

Shares sold

|

|

$ |

2,037,191 |

|

|

|

295,988 |

|

|

Shares redeemed

|

|

|

(3,195,289 |

) |

|

|

(459,952 |

) |

|

Net decrease in shares

|

|

$ |

(1,158,098 |

) |

|

|

(163,964 |

) |

| |

|

|

|

|

|

|

|

|

|

Shares Outstanding

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

|

|

|

|

4,172,319 |

|

|

End of year

|

|

|

|

|

|

|

4,008,355 |

|

5.Securities Transactions

During the year ended May 31, 2011, the cost of purchases and proceeds from sales of investment securities, other than short-term investments were $53,887,066 and $55,298,281, respectively. There were no purchases or sales of U.S. government securities for the Fund.

6.Beneficial Ownership