0001104657DEF 14AFALSE00011046572022-01-012022-12-31iso4217:USD00011046572021-01-012021-12-3100011046572020-01-012020-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:EquityAwardAdjustmentsMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:PensionAdjustmentsMember2022-01-012022-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:EquityAwardAdjustmentsMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:PensionAdjustmentsMember2021-01-012021-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:EquityAwardAdjustmentsMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:PensionAdjustmentsMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingUnvestedMember2022-01-012022-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2022-01-012022-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingUnvestedMember2021-01-012021-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2021-01-012021-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:EquityAwardsOutstandingUnvestedMember2020-01-012020-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310001104657ecd:PeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardAdjustmentsMember2022-01-012022-12-310001104657ecd:NonPeoNeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2022-01-012022-12-310001104657mtrn:PensionAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardAdjustmentsMember2021-01-012021-12-310001104657ecd:NonPeoNeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2021-01-012021-12-310001104657mtrn:PensionAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardAdjustmentsMember2020-01-012020-12-310001104657ecd:NonPeoNeoMembermtrn:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsAdjustmentMember2020-01-012020-12-310001104657mtrn:PensionAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsOutstandingMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsOutstandingUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001104657mtrn:EquityAwardsOutstandingMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsOutstandingUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001104657mtrn:EquityAwardsOutstandingMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsOutstandingUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657ecd:NonPeoNeoMembermtrn:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001104657mtrn:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310001104657mtrn:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-31000110465712022-01-012022-12-31000110465722022-01-012022-12-31000110465732022-01-012022-12-31000110465742022-01-012022-12-31000110465752022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

MATERION CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11 |

Materion Corporation

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

Notice of Annual Meeting of Shareholders

The annual meeting of shareholders of Materion Corporation will be held at the Boston Marriott Newton Hotel, 2345 Commonwealth Avenue, Newton, Massachusetts 02466, on May 17, 2023 at 8:00 a.m. (EDT) for the following purposes:

(1)To elect nine directors, each to serve for a term of one year and until a successor is elected and qualified;

(2)To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for Materion Corporation for the year 2023;

(3)To approve, by non-binding vote, named executive officer compensation;

(4)To recommend, by non-binding vote, the frequency of future named executive officer compensation advisory votes; and

(5)To transact any other business that may properly come before the meeting.

Shareholders of record as of the close of business on March 20, 2023 are entitled to notice of the meeting and to vote at the meeting or any adjournment or postponement of the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our proxy statement and Annual Report for the year ended December 31, 2022, and to vote online or by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials on the Notice of Internet Availability of Proxy Materials.

| | |

Gregory R. Chemnitz |

| Secretary |

April 4, 2023

Important — your proxy is enclosed.

You are requested to cooperate in assuring a quorum by voting online at www.proxyvote.com or, if you received a paper copy of the proxy materials, by filling in, signing and dating the enclosed proxy and promptly mailing it in the return envelope.

MATERION CORPORATION

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

PROXY STATEMENT

April 4, 2023

GENERAL INFORMATION

Your Board of Directors (Board) is furnishing this proxy statement to you in connection with our solicitation of proxies to be used at our annual meeting of shareholders to be held on May 17, 2023. The proxy statement and other proxy materials are being sent to shareholders on April 4, 2023.

Registered Holders. If your shares are registered in your name, you may vote in person or by proxy. If you decide to vote by proxy, you may do so by telephone, over the Internet or by mail.

By telephone. After reading the proxy materials, you may call the toll-free number, 1-800-690-6903, using a touch-tone telephone. You will be prompted to enter your control number, which is a 16-digit number located in a box on your proxy card that you can also receive in the mail, if requested, then follow the simple instructions that will be given to you to record your vote.

Over the Internet. After reading the proxy materials, you may vote and submit your proxy online at www.proxyvote.com. Even if you request and receive a paper copy of the proxy materials, you may vote online by going to www.proxyvote.com and entering your control number, which is a 16-digit number located in a box on your proxy card that you can also receive in the mail, if requested, then follow the simple instructions that will be given to you to record your vote.

By mail. After reading the proxy materials, you may mark, sign and date your proxy card and return it in the enclosed prepaid and addressed envelope.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to give voting instructions and confirm that those instructions have been recorded properly. Without affecting any vote previously taken, you may revoke your proxy by delivery to us of a new, later dated proxy with respect to the same shares, or giving written notice to us before or at the annual meeting. Your presence at the annual meeting will not, in and of itself, revoke your proxy.

Participants in the Materion Corporation Retirement Savings Plan. If you participate in the Retirement Savings Plan, the independent trustee for the plan, Fidelity Management Trust Company, will vote your plan shares according to your voting directions. You may give your voting directions to the plan trustee in any one of the three ways set forth above. If you do not return your proxy card or do not vote over the Internet or by telephone, the trustee will not vote your plan shares. Each participant who gives the trustee voting directions acts as a named fiduciary for the applicable plan under the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Nominee Shares. If your shares are held by a bank, broker, trustee or some other nominee, that entity will give you separate voting instructions.

In addition to the solicitation of proxies by mail, we may solicit the return of proxies in person, by telephone, facsimile or e-mail. We will request brokerage houses, banks and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of shares and will reimburse them for their expenses. We will bear the cost of the solicitation of proxies.

Voting. At the close of business on March 20, 2023, the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting, there were 20,608,637 shares of common stock outstanding and entitled to vote at the meeting. Each outstanding share of common stock entitles its holder to one vote on each matter brought before the meeting.

With respect to Proposal 1, the nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation, subject to the Company's Majority Voting Policy (described below). The approval of each of Proposals 2 and 3 requires the affirmative vote of a majority of the votes cast, whether in person or by proxy, on such proposals at the annual meeting and the frequency of future advisory votes on named executive officer compensation in Proposal 4 receiving the greatest number of votes (every year, every two years or every three years) will be the frequency recommended by shareholders.

Abstentions and Broker Non-votes. At the annual meeting, the inspectors of election appointed for the meeting will tabulate the results of shareholder voting. Under Ohio law and our Code of Regulations, properly signed proxies that are marked “abstain” or are held in “street name” by brokers and not voted on one or more of the items (but otherwise voted on at least one item) before the meeting will be counted for purposes of determining whether a quorum has been achieved at the annual meeting.

If you do not provide directions to your broker, your broker or other nominee will not be able to vote your shares with respect to the election of directors (Proposal 1), the non-binding vote to approve named executive officer compensation (Proposal 3) or the non-binding vote to recommend the frequency of future advisory votes on named executive officer compensation (Proposal 4).

Abstentions and broker non-votes will not affect the vote on the election of directors.

An abstention or broker non-vote with respect to the non-binding vote to approve named executive officer compensation (Proposal 3) or the non-binding vote to recommend the frequency of future advisory votes on named executive officer compensation (Proposal 4) will have no effect on the proposal as the abstention or broker non-vote will not be counted in determining the number of votes cast.

Because the vote to ratify the appointment of Ernst & Young LLP (Proposal 2) is considered to be routine, your broker or other nominee will be able to vote your shares with respect to this proposal without your instructions. An abstention will have no effect on this proposal as the abstention will not be counted in determining the number of votes cast.

* * *

We know of no other matters that will be presented at the meeting; however, if other matters do properly come before the meeting, the persons named in the proxy card will vote on these matters in accordance with their best judgment.

If you sign, date and return your proxy card but do not specify how you want to vote your shares, your shares will be voted as recommended by the Board as indicated on the proxy card.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Articles of Incorporation and Code of Regulations establish the number of directors at no fewer than nine and no more than 18. There are currently nine directors on the Board. At the 2023 Annual Meeting, the shareholders will consider the election of nine directors, each to serve a one-year term. Each of the nominees for election is a current Director.

Nominees for Director

Vinod M. Khilnani

Age: 70

Director Since: 2009

Mr. Khilnani was appointed our Non-Executive Chairman of the Board in January 2018. Now retired, Mr. Khilnani was the Executive Chairman of CTS Corporation (electronic components and accessories). Mr. Khilnani became Executive Chairman of CTS Corporation in January 2013 and served in that capacity until May 2013. He had served as Chairman, President and Chief Executive Officer of CTS from 2007 until 2013. Prior to that time, he served as Senior Vice President and Chief Financial Officer of CTS since 2001. Mr. Khilnani was appointed to the Board of Gibraltar Industries in October 2014 and to the Board of ESCO Technologies Inc. in August 2014 and has served on the Board of Directors of 1st Source Corporation since 2013. As the former Executive Chairman and Chief Executive Officer and President of CTS (and its former Chief Financial Officer), Mr. Khilnani offers a wealth of management experience and business knowledge regarding operational, financial and corporate governance issues, as well as extensive international experience with global operations.

Emily M. Liggett

Age: 67

Director Since: 2020

Ms. Liggett has served as the Chief Executive Officer of Liggett Advisors (business strategy and execution consulting) since 2017. Prior to that, Ms. Liggett served as President and Chief Executive Officer of NovaTorque, Inc. (manufacturer of high-efficiency electric motor systems) from 2009 until 2016, when it was acquired by Regal Beloit; Apexon, Inc. (provider of supply chain optimization software solutions for global manufacturers) from 2004 until 2007; and Capstone Turbine Corporation (provider of microturbine systems for clean, continuous distributed energy generation) from 2002 until 2003. Prior to Capstone Turbine, Ms. Liggett served in various management and executive roles at Raychem Corporation (manufacturer of materials, electronics, telecom and energy products acquired by Tyco International in 1999) from 1984 until 2001, including as Corporate Vice President of Raychem and Managing Director of Tyco Ventures. Ms. Liggett has served on the Board of Directors of Ultra Clean Holdings, Inc. since 2014 and previously served on the Boards of Directors of Kaiser Aluminum Corporation from 2018 until 2022 and MTS Systems Corporation from 2010 until 2016. She also served on the Purdue University School of Engineering Advisory Board from 2000 until 2018. Ms. Liggett's expertise in strategy, operations, product development, sales, marketing and business development gained from her chief executive officer, management and

public company board experience in a variety of international industrial companies provides our Board of Directors with valuable insights.

Robert J. Phillippy

Age: 62

Director Since: 2018

Mr. Phillippy is an independent consultant, advising technology companies on a range of strategic, operational and organizational issues. From September 2007 until April 2016, he was the President, Chief Executive Officer and a director of Newport Corporation (lasers, optics and photonics technologies). Mr. Phillippy joined Newport in 1996 and served in various executive management positions prior to his appointment as Chief Executive Officer in 2007. In April 2016, Newport was acquired by MKS Instruments (instruments, components, subsystems, and process control solutions for advanced manufacturing applications), and from July 2016 until May 2018, Mr. Phillippy served on the board of directors of MKS Instruments. From April 2016 to September 2016, he also served as Executive Advisor to MKS Instruments. Mr. Phillippy has also served as a director of ESCO Technologies Inc. since May 2014 and as a director of Kimball Electronics since November 2018. Mr. Phillippy's deep understanding of technology-related industries, extensive experience as the former Chief Executive Officer of a global technology company and significant knowledge of matters impactful to public company boards makes him a valuable contributor to the Board of Directors.

Patrick Prevost

Age: 67

Director Since: 2019

Mr. Prevost served as the President and Chief Executive Officer of Cabot Corporation (global specialty chemical and performance materials company) from January 2008 until his retirement in March 2016. Prior to Cabot, Mr. Prevost served as President, Performance Chemicals at BASF AG (international chemical company) from October 2005 to December 2007. Prior to that, he was responsible for BASF Corporation’s Chemicals and Plastics business in North America. Mr. Prevost previously held senior management positions with increasing responsibility at BP Plc from 1999 to 2003 and Amoco Chemicals from 1983 until 1999. Mr. Prevost serves on the Board of Directors of Southwestern Energy Company and previously served on the Board of Directors of Cabot Corporation and General Cable Corporation. Mr. Prevost also serves as trustee of the New England Conservatory and the French Cultural Center of Boston. Mr. Prevost brings to our Board of Directors substantial leadership experience in a variety of complex international businesses, a chemical engineering background with broad experience in material science and chemistry, which are important to our business, extensive experience involving acquisitions and strategic alliances and deep knowledge of international business, strategic planning, manufacturing and financial matters.

N. Mohan Reddy, Ph.D.

Age: 69

Director Since: 2000

Dr. Reddy is B. Charles Ames, Professor of Management at Case Western Reserve University. Dr. Reddy was appointed B. Charles Ames, Professor of Management in February 2014. Prior to that, he had served as the Albert J. Weatherhead III Professor of Management from 2007 until 2012 and as the Dean of the Weatherhead School of Management, Case Western Reserve University from 2006 until 2012. Dr. Reddy had been Associate Professor of Marketing since 1991 and Keithley Professor of Technology Management from 1996 to 2006 at the Weatherhead School of Management, Case Western Reserve University. Dr. Reddy had served on the Board of Directors of Keithley Instruments, Inc. from 2001 until December 2010, when Keithley Instruments was purchased by Danaher Corporation. Dr. Reddy had also served on the Board of Directors of Lubrizol Corporation from February 2011 until October 2011, when Lubrizol was purchased by Berkshire Hathaway Inc. Dr. Reddy also serves as a consultant to firms in the electronics and semiconductor industries, primarily in the areas of product and market development. Dr. Reddy’s knowledge of industrial marketing, technology development and extensive global knowledge in the electronics and semiconductor industries provides valuable insight to our Board of Directors.

Craig S. Shular

Age: 70

Director Since: 2008

Mr. Shular is Co-Founder of Global Graphite Group LLC (advanced materials company specializing in graphite products), which he co-founded in November 2017. Mr. Shular is the former Executive Chairman of the Board of GrafTech International Ltd. (electrical industrial apparatus). Mr. Shular was elected Chairman of the Board of GrafTech in 2007 and served in that capacity until December 2014. He had been a director of GrafTech from January 2003 until May 2014. Mr. Shular served as Chief Executive Officer of GrafTech from 2003 and as President from 2002 until he retired from both positions in January 2014. From 2001 until 2002, he served as Executive Vice President of GrafTech’s largest business, Graphite Electrodes. Mr. Shular joined GrafTech as its Vice President and Chief Financial Officer in 1999 and assumed the additional duties of

Executive Vice President, Electrode Sales and Marketing in 2000 until 2001. As the former Chairman, Chief Executive Officer and President and former Chief Financial Officer of GrafTech, Mr. Shular brings a breadth of financial and operational management experience and provides our Board of Directors with a perspective of someone familiar with all facets of a global enterprise.

Darlene J. S. Solomon, Ph.D.

Age: 64

Director Since: 2011

Since 2006, Dr. Solomon has served as Senior Vice President and Chief Technology Officer of Agilent Technologies, Inc. (life sciences, diagnostics and applied chemical markets). An expert in the start-up/venture ecosystem, she developed and leads Agilent’s corporate venture program. Prior to 2006, she served as Vice President and Director of Agilent Laboratories, Agilent's centralized advanced research organization. Ms. Solomon has served on the Board of Directors of Novanta Inc. since 2022. She is a member of the National Academy of Engineering and serves on multiple academic and government advisory boards focused on science, technology and innovation. As a global senior technology business executive with deep experience in corporate governance, transformation, and high-tech industry, she brings valuable perspective in strategy, innovation, and digital leadership in support of core and adjacent business growth. Additionally, with extensive knowledge and experience in materials measurement and leading innovation in a diversified global technology enterprise, Dr. Solomon brings to our Board of Directors valuable insight on research and development and other operational issues faced by companies focused on innovations in technology.

Robert B. Toth

Age: 62

Director Since: 2013

Mr. Toth was a Managing Director of CCMP Capital Advisors, LLC (global private equity investment firm) from 2016 to 2019. Mr. Toth also served as President, Chief Executive Officer and Director of Polypore International, Inc. (high technology filtration products) from 2005 until 2015 and as Chairman of the Board from 2011 until 2015. Prior to Polypore, Mr. Toth served as President, Chief Executive Officer, and Director of CP Kelco ApS. Mr. Toth also spent 19 years at Monsanto Company, and its spin-off company, Solutia Inc., where he held a variety of executive and managerial roles. Mr. Toth serves on the Board of Directors of SPX Technologies. He also served on the Board of Directors of PQ Corporation and Hayward Industries, Inc. Mr. Toth currently acts as an advisor for several private equity firms. With extensive experience in leading corporations in the manufacturing and specialty materials sector, including his knowledge and skills in senior management, finance and operations, Mr. Toth brings to our Board of Directors significant insight into the strategic and operational issues facing companies in the advanced materials industry.

Jugal K. Vijayvargiya

Age: 55

Director Since: 2017

Mr. Vijayvargiya is President and Chief Executive Officer and member of the Board of Materion Corporation. He joined Materion as President and Chief Executive Officer in March 2017. Prior to joining Materion, Mr. Vijayvargiya had an extensive 26-year international career with Delphi Automotive PLC (leading global technology solutions provider to the automotive and transportation sectors). He most recently led Delphi's Automotive Electronics and Safety segment, a $3 billion global business based in Germany. In this role, Mr. Vijayvargiya served as an officer of Delphi and a member of its Executive Committee. Previously, he attained progressively responsible positions in Europe and North America in product and manufacturing engineering, sales, product line management, acquisition integration and general management. Mr. Vijayvargiya’s broad and diverse experience at Delphi and as Chief Executive Officer of Materion provides significant value to our Board of Directors.

Your Board of Directors unanimously recommends a vote for each of Vinod M. Khilnani, Emily M. Liggett, Robert J. Phillippy, Patrick Prevost, N. Mohan Reddy, Ph.D., Craig S. Shular, Darlene J. S. Solomon, Ph.D., Robert B. Toth, and Jugal K. Vijayvargiya.

If any of these nominees becomes unavailable, it is intended that the proxies will be voted as the Board of Directors determines. We have no reason to believe that any of the nominees will be unavailable. The nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation. However, our Board of Directors has adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election is expected to tender his or her resignation following certification of the shareholder vote, subject to a 90-day review process by our Nominating, Governance, and Corporate Responsibility Committee and Board of Directors to consider whether the tendered resignation should be accepted. An

abstention or broker non-vote is not treated as a vote “withheld” under our Majority Voting Policy. For additional details on the Majority Voting Policy, see page 9 of this proxy statement.

CORPORATE GOVERNANCE; ENVIRONMENTAL AND SOCIAL MATTERS

Materion is committed to strong corporate governance, as evidenced by the following practices.

| | | | | |

Board Independence | ü 8 of 9 Director nominees are independent ü Independent Chair of the Board |

Director Elections | ü Commitment to Board refreshment and diversity – 4 new Directors added since the beginning of 2017 ü All standing committee members are independent ü Declassified Board with annual Board election ü Director elections are subject to our Majority Voting Policy, which requires any Director who fails to receive a majority of the votes cast in favor of his or her election to submit his or her resignation to the Board |

Board Practices | ü Stock ownership requirements for nonemployee Directors (4x cash retainer) ü At each Board meeting, the independent Directors have the opportunity to conduct an executive session ü Annual Board, committee and Director evaluation |

Shareholder Rights | ü Limitations on adoption of shareholder rights plan ü Opted out of Ohio Control Shareholder Act |

Other Best Practices | ü Annual advisory vote on our named executive officer compensation ü 5 of 9 Directors are ethnically or gender diverse ü Code of Conduct Policy for Directors, officers and employees ü 2 Audit Committee financial experts ü Audit and Risk Committee receives at least quarterly reports on information technology and cyber risk profile, enterprise cyber program and key enterprise cyber initiatives and annually reviews and recommends our information security policy and information security program to Board for approval ü Nominating, Governance and Corporate Responsibility Committee provides oversight for environmental, social and governance matters, including climate change |

We have adopted a Policy Statement on Significant Corporate Governance Issues and a Code of Conduct Policy in compliance with the New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) requirements. These materials, along with the charters of the Audit and Risk, Compensation and Human Capital, and Nominating, Governance, and Corporate Responsibility Committees of our Board, which also comply with applicable requirements, are available on our website at https://materion.com, or upon request by any shareholder to: Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. We also make our reports on Forms 10-K, 10-Q and 8-K available on our website, free of charge, as soon as reasonably practicable after these reports are filed with the SEC. Any amendments or waivers to our Code of Conduct Policy, Committee Charters and Policy Statement on Significant Corporate Governance Issues will also be made available on our website. The information on our website is not incorporated by reference into this proxy statement or any of our periodic reports.

Director Independence

The NYSE listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the Company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, or its subsidiaries or affiliates. Our Board has adopted the following standards, which are identical to those of the NYSE listing standards, to assist in its determination of director independence. A director will be determined not to be independent under the following circumstances:

•the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company;

•the director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service);

•the director (a) is a current partner or employee of a firm that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (d) was or has an immediate family member who was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;

•the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serve or served on that company’s compensation committee; or

•the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000 or two percent of such other company’s consolidated gross revenues.

Additionally, for purposes of determining whether a director has a material relationship with the Company apart from his or her service as a director, our Board has deemed the following relationships as categorically immaterial:

•the director, or an immediate family member, is a current employee, director or trustee of a tax-exempt organization and the Company’s contributions to the organization (excluding Company matching of employee contributions) in any fiscal year are less than $120,000; or

•the director is a director of a company that has made payments to, or received payments or deposits from, the Company for property, goods or services in the ordinary course of business in an amount which, in any fiscal year, is less than the greater of $1,000,000, or two percent of such other company’s consolidated gross revenues.

Our Board has affirmatively determined that each of our current directors, other than Mr. Vijayvargiya, is “independent” within the meaning of that term as defined in the NYSE listing standards and a “non-employee director” within the meaning of that term as defined in Rule 16b-3(b)(3) promulgated under the Securities Exchange Act of 1934 (Exchange Act).

Charitable Contributions

Within the preceding three years, we have not made a contribution to any charitable organization in which any of our directors serves as a director, trustee, or executive officer.

Non-management Directors and Non-Executive Chairman

Our Policy Statement on Significant Corporate Governance Issues provides that the non-management members of the Board will meet during each regularly scheduled meeting of the Board of Directors in executive session. Additional executive sessions may be scheduled by the Non-Executive Chairman or other non-management directors. The Non-Executive Chairman will chair these sessions. Mr. Khilnani was appointed our Non-Executive Chairman in January 2018.

The non-management directors have access to our management as they deem necessary or appropriate. In addition, the Chair of each of the Audit and Risk Committee, Nominating, Governance, and Corporate Responsibility Committee and Compensation and Human Capital Committee meets periodically with members of senior management.

In addition to the other duties of a director under our Policy Statement on Significant Corporate Governance Issues, the Non-Executive Chairman, in collaboration with the other independent directors, is responsible for coordinating the activities of the independent directors and in that role will:

•chair the executive sessions of the independent directors at each regularly scheduled meeting;

•determine the timing and structuring of Board meetings;

•establish the agenda for Board meetings, including allocation of time as well as subject matter;

•determine the quality, quantity and timeliness of the flow of information from management to the Board;

•serve as the independent point of contact for shareholders wishing to communicate with the Board other than through management;

•interview all Board candidates and provide the Nominating, Governance, and Corporate Responsibility Committee with recommendations on each candidate;

•maintain close contact with the Chairman of each standing committee and assist in ensuring communications between each committee and the Board;

•lead the Chief Executive Officer annual evaluation process; and

•be the ombudsman for the Chief Executive Officer to provide two-way communication with the Board.

Board Communications

Shareholders or other interested parties may communicate with the Board as a whole, the non-executive chairman or the non-management directors as a group, by forwarding relevant information in writing to: Non-Executive Chairman, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. Any other communication to individual directors or committees of the Board of Directors may be similarly addressed to the appropriate recipients, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

Board Leadership

The Board does not have a policy as to whether the role of Chief Executive Officer and Chairman of the Board should be separate or combined, or whether the Chairman should be a management or non-management director. Currently, the roles of Chairman of the Board and Chief Executive Officer are split, though in the past these roles have been combined. Mr. Khilnani was appointed Non-Executive Chairman of the Board effective January 2018, eliminating the need for a Lead Director. During 2020, Mr. Vijayvargiya was the only member of our Board who was not independent.

Unless the Chairman of the Board is an independent director, a Lead Director would be elected solely by the independent members of our Board of Directors. The Lead Director works with the Chairman of the Board and other Board members to provide strong, independent oversight of the Company’s management and affairs as described above under "Non-management Directors and Non-Executive Chairman".

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit and Risk Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company’s internal auditors. The Audit and Risk Committee also focuses on risks relating to precious metal inventory, precious metal security and cybersecurity.

As part of its program of regular oversight, all members of the Audit and Risk Committee are responsible for overseeing cyber risk, information security, and information technology risk, including management’s actions to identify, assess, mitigate, and remediate material cyber issues and risks. The Audit and Risk Committee receives at least quarterly reports from the Chief Information Officer on the Company’s information technology and cyber risk profile, enterprise cyber program, key enterprise cyber initiatives, and significant updates on external audits of our information security program. The full Board attends two of the Audit and Risk Committee meetings at which information technology and cyber risk are discussed. Additionally, at least annually, the full Board attends a cybersecurity training from external experts and reviews and discusses the Company’s technology strategy with the Chief Information Officer and approves the Company’s technology strategic plan.

In addition, management provides a risk management report, including a financial risk assessment and enterprise risk management update and information technology contingency plan, to the Audit and Risk Committee. In setting compensation, the Compensation and Human Capital Committee strives to create incentives that encourage a level of risk-taking consistent with the Company’s business strategy. Finally, the Company’s Nominating, Governance, and Corporate Responsibility Committee conducts an annual assessment of the Board for compliance with corporate governance and risk management best practices and additionally oversees the Company's risk with respect to climate change. The Company believes that the Board’s role in risk oversight is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees providing oversight in connection with those efforts, with particular focus on the most significant risks facing the Company.

Audit and Risk Committee

The Audit and Risk Committee held six meetings in 2022. The Committee membership consists of Mr. Shular, as Chairman, and Mr. Phillippy and Drs. Reddy and Solomon. Under the Committee charter, the Committee’s principal functions include assisting our Board in fulfilling its oversight responsibilities with respect to:

•the integrity of our financial statements and our financial reporting process;

•compliance with ethics policies and legal and other regulatory requirements;

•our independent registered public accounting firm’s qualifications and independence;

•our systems of internal accounting and financial controls;

•the performance of our independent registered public accounting firm and of our internal audit functions; and

•other matters as deemed appropriate, including our Code of Conduct Policy and our risk management practices and policies.

No member of the Committee serves on the audit committee of three or more public companies in addition to ours unless the Board determines that such services would not impair the member's ability to serve on the Committee. The Committee also prepared the Committee report included under the heading “Audit Committee Report” in this proxy statement.

Audit and Risk Committee Expert, Financial Literacy and Independence

Our Board has determined that Messrs. Phillippy and Shular are "audit committee" financial experts, as defined by the SEC. Each member of the Audit and Risk Committee is financially literate and satisfies the independence requirements as set forth in the NYSE listing standards.

Compensation and Human Capital Committee

The Compensation and Human Capital Committee held five meetings in 2022. The Committee membership consists of Mr. Toth, as Chairman, Ms. Liggett, and Messrs. Khilnani and Prevost. Each member of the Committee has been determined by the Board to be independent in accordance with NYSE listing standards. The Committee may, at its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee, provided that such subcommittee has a published charter in accordance with NYSE rules. The Committee’s principal functions include:

•reviewing and approving executive compensation, including severance payments;

•overseeing and recommending equity and non-equity incentive plans;

•overseeing regulatory compliance with respect to compensation matters;

•advising on senior management compensation; and

•reviewing and discussing the Compensation Discussion and Analysis (CD&A) and Compensation Committee Report.

For additional information regarding the operation of the Committee, see the “Compensation Discussion and Analysis” in this proxy statement.

Nominating, Governance, and Corporate Responsibility Committee

The Nominating, Governance, and Corporate Responsibility Committee held five meetings in 2022. The Committee membership consists of Mr. Khilnani, as Chairman, Ms. Liggett, Messrs. Phillippy, Prevost, Shular, and Toth and Drs. Reddy and Solomon. All of the members are independent in accordance with the NYSE listing requirements. The Committee’s principal functions include:

•evaluating candidates for Board membership, including any nominations of qualified candidates submitted in writing by shareholders to our Secretary;

•making recommendations to the full Board regarding director compensation;

•making recommendations to the full Board regarding governance matters;

•overseeing environmental, social, and governance (ESG) matters significant to the Company, including matters relating to climate change;

•overseeing the evaluation of the Board and management of the Company;

•evaluating potential successors to the Chief Executive Officer for recommendation to the Board and assisting in management succession planning; and

•reviewing related party transactions.

As noted above, the Committee is involved in determining compensation for our directors. The Committee administers our equity incentive plans with respect to our directors, including approval of grants of stock options and other equity or equity-based awards, and makes recommendations to the Board with respect to incentive compensation plans and equity-based plans for directors. The Committee periodically reviews director compensation in relation to comparable companies and other relevant factors. Any change in director compensation must be approved by the Board. No executive officer other than the Chief Executive Officer in his capacity as director participates in setting director compensation. From time to time, the Committee or the Board may engage the services of a compensation consultant to provide information regarding director compensation at comparable companies.

Annual Board Self-assessments

The Board has instituted annual self-assessments of the Board, as well as of the Audit and Risk Committee, the Compensation and Human Capital Committee and the Nominating, Governance, and Corporate Responsibility Committee, to assist in determining whether the Board and its committees are functioning effectively. Annually, each of the members of the Board completes a detailed survey regarding the Board and its committees that provides for quantitative ratings in key areas and seeks subjective comments. The results of the survey are compiled and discussed at the Board level and in each committee. Any

matters requiring follow-up are identified by the Nominating, Governance, and Corporate Responsibility Committee, which is responsible for any action items. Each of the committees also reviews its charter on an annual basis for any changes.

Also annually, each member of the Board completes a confidential evaluation of each other director that, among other things, seeks subjective comments in certain key areas. The responses to the evaluation are collected by a third party and a summary of the responses are conveyed to the Non-Executive Chairman. The Non-Executive Chairman uses the results of the evaluation as part of the process the Nominating, Governance, and Corporate Responsibility Committee undertakes in determining whether to recommend that those directors be nominated for re-election.

Nomination of Director Candidates

The Nominating, Governance, and Corporate Responsibility Committee will consider candidates recommended by shareholders for nomination as directors of Materion Corporation. Any shareholder desiring to submit a candidate for consideration by the Committee should send the name of the proposed candidate, together with biographical data and background information concerning the candidate, to the Nominating, Governance, and Corporate Responsibility Committee, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

In recommending candidates to the Board for nomination as directors, the Committee’s charter requires it to consider such factors as it deems appropriate, consistent with our Policy Statement on Significant Corporate Governance Issues. These factors are as follows:

•broad-based business, governmental, non-profit, or professional skills and experiences that indicate whether the candidate will be able to make a significant and immediate contribution to the Board’s discussion and decision-making in the array of complex issues facing the Company;

•exhibited behavior that indicates he or she is committed to the highest ethical standards and the values of the Company;

•special skills, expertise and background that add to and complement the range of skills, expertise and background of the existing directors;

•whether the candidate will effectively, consistently and appropriately take into account and balance the legitimate interests and concerns of all our shareholders and other stakeholders in reaching decisions;

•a global business and social perspective, personal integrity and sound judgment; and

•time available to devote to Board activities and to enhance their knowledge of the Company.

As part of the analysis of the foregoing factors, the Committee considers whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin. Additionally, the Board has adopted a diversity policy, which emphasizes that the Board is committed to enhancing its diversity. Pursuant to the diversity policy, in identifying and nominating new candidates for election to the Board, diversity on the Board, including the level of representation of women and under-represented groups, will influence succession planning and be a key criterion for the Committee. It is anticipated that the Committee will assess the effectiveness of the diversity policy as part of its annual self-assessment.

The Committee’s evaluation of candidates recommended by shareholders does not differ materially from its evaluation of candidates recommended from other sources.

The Committee utilizes a variety of methods for identifying and evaluating director candidates. The Committee regularly reviews the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Committee considers various potential candidates for director. Candidates may come to the attention of the Committee through current Board members, professional search firms, shareholders or other persons. Additionally, from time to time, the Committee has used the services of an executive search firm to help identify potential director candidates who possess the characteristics described above. In such instance, the search firm has prepared a biography of each candidate, conducted reference checks and screened candidates.

A shareholder of record entitled to vote in an election of directors who timely complies with the procedures set forth in our code of regulations and with all applicable requirements of the Exchange Act and the rules and regulations thereunder, may also directly nominate individuals for election as directors at a shareholders’ meeting. Copies of our code of regulations are available by a request addressed to Materion Corporation, c/o Secretary, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

To be timely, notice of a shareholder nomination for an annual meeting must be received at our principal executive offices not fewer than 60 nor more than 90 days prior to the date of the annual meeting. However, if the date of the meeting is more than one week before or after the first anniversary of the previous year’s meeting and we do not give notice of the meeting at least 75 days in advance, nominations must be received within ten days from the date of our notice.

Majority Voting Policy

Our Board adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” election, which we refer to as a Majority Withheld Vote, is expected to tender his or her resignation following certification of the shareholder vote. In such an event, the Nominating, Governance, and Corporate Responsibility Committee will consider the tendered resignation and make a recommendation to the Board. The Board will act on the Committee’s recommendation within 90 days following certification of the shareholder vote. Any director who tenders his or her resignation pursuant to this policy will not participate in the Committee’s recommendation or Board’s action regarding whether to accept or reject the tendered resignation.

However, if each member of the Committee received a Majority Withheld Vote in the same election, then the Board would appoint a committee comprised solely of independent directors who did not receive a Majority Withheld Vote at that election to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation. Further, if all of the director nominees received a Majority Withheld Vote in the same election, the Board would appoint a committee comprised solely of independent directors to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation.

Director Attendance

Our Board held five meetings in 2022. All of the current directors who were directors in 2022 attended at least 75% of the Board and assigned committee meetings during the period each individual served as a director during 2022. Our policy is that directors are expected to attend all meetings, including the annual meeting of shareholders. All of our directors attended last year’s annual meeting of shareholders.

ESG Matters

For more than 90 years, Materion has helped our customers meet their greatest science and technology challenges. Our ability to deliver on our mission is rooted, in part, in our strong ESG practices towards our customers, our employees, and our operations and communities. We are committed to ensuring that our organization’s governance and operations are fully aligned with environmentally and socially responsible practices. Our ESG approach is structured around three focus areas:

Our Commitment - From our leadership team to the Board of Directors, strong governance, ethical operations and upholding compliance standards are vital to our organization's continued advancement.

Our People – Materion’s values and corporate culture define who we are, how we act, and what we believe is our responsibility to conducting business. And our diverse employee base, that embodies our culture, is the driving force behind our success.

Our Operations and Communities – Materion consistently strives to integrate a variety of sustainability-based initiatives in our own operations and in the communities where we operate, from more efficient use of energy and materials to educating our employees on how to better serve as stewards of the planet. We also require our business partners and suppliers to abide by the same responsible business standards and principles.

As noted above, in addition to corporate governance, our Nominating, Governance and Corporate Responsibility Committee oversees environmental and social matters significant to the Company. The Nominating, Governance and Corporate Responsibility Committee’s primary ESG responsibilities include overseeing and periodically reviewing the Company’s ESG strategy, initiatives and risks and opportunities, as well as the evolving ESG regulatory landscape, including, but not limited to, matters relating to climate change. Nominating, Governance and Corporate Responsibility Committee membership currently includes all of our independent directors, ensuring an integrated and aligned oversight approach to the company-wide strategic ESG activities and initiatives. The Nominating, Governance and Corporate Responsibility Committee held five meetings in 2022 and the Company’s ESG initiatives and related matters, including but not limited to, matters relating to climate change, were discussed at each meeting. Executive oversight of environmental and social matters is conducted by management through our ESG Steering Committee, which is composed of leaders from multiple functions including operations, legal, human resources, finance, and purchasing. In addition, environmental and social matters are integrated into our risk oversight and enterprise-wide risk management approach. In support of these broad-based efforts, in 2021 Materion appointed a dedicated ESG leadership position to support ongoing and new ESG-related activities and strategic initiatives globally, including, but not limited to, matters relating to climate change. In early 2022, we further appointed a global sustainability operations manager to support identification and deployment of best-in-class sustainability-focused operational programs, systems and processes across Materion operations globally.

Good corporate citizenship and our commitment to strong ESG practices for our people, our operations and our communities are important elements of our vision, mission and values at Materion. We conduct our business activities in accordance with these values. Additionally, the core of our business ethics is “doing the right thing.” This fundamental principle is what drives

Materion to be a socially responsible business that meets the highest standards of ethics and professionalism. We are committed to:

• Maintaining the highest standards of health, safety and security;

• Producing materials that enable technologies to provide a safer and more sustainable environment;

• Designing, manufacturing and distributing products in a safe and environmentally responsible manner;

• Respecting and protecting human rights wherever we operate;

• Embracing a set of values where we partner in the betterment of our communities; and

• Continuously promoting fair dealing and respect towards our customers, shareholders, employees, business partners and communities.

For more information about our corporate social responsibility and sustainability program, please see https://materion.com/about/environmental-social-and-governance. The information on our website is not incorporated by reference into this proxy statement.

2022 Compensation of Non-Employee Directors

Total compensation of our non-employee directors for the year ended December 31, 2022 was as follows:

| | | | | | | | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash

($) | | Stock Awards(1) ($) | | Total

($) |

Vinod M. Khilnani(2) | 140,000 | | | 113,410 | | | 253,410 | |

| Emily M. Liggett | 75,000 | | | 113,410 | | | 188,410 | |

Robert J. Phillippy(2) | 75,000 | | | 113,410 | | | 188,410 | |

Patrick Prevost(2) | 75,000 | | | 113,410 | | | 188,410 | |

| N. Mohan Reddy | 75,000 | | | 113,410 | | | 188,410 | |

Craig S. Shular(2) | 90,000 | | | 113,410 | | | 203,410 | |

| Darlene J. S. Solomon | 75,000 | | | 113,410 | | | 188,410 | |

| Robert B. Toth | 85,000 | | | 113,410 | | | 198,410 | |

(1) The amounts in this column reflect the grant date fair value of time-based restricted stock unit (RSU) awards as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718.

(2) Mr. Khilnani, Mr. Phillippy, Mr. Prevost and Mr. Shular elected to defer 100% of their compensation in the form of deferred stock units, as described below under Deferred Compensation.

The following table presents the RSU awards granted to non-employee directors in 2022. Awards were made on May 5, 2022 and valued based on that day's closing price of $81.59. These awards in general will vest on May 5, 2023, if the individual remains as a director until that date. As of December 31, 2022, no other stock or option awards were outstanding for our non-employee directors.

| | | | | | | | |

| Name | | Restricted

Stock Units |

| Vinod M. Khilnani | | 1,390 |

| Emily M. Liggett | | 1,390 |

| Robert J. Phillippy | | 1,390 |

| Patrick Prevost | | 1,390 |

| N. Mohan Reddy | | 1,390 |

| Craig S. Shular | | 1,390 |

| Darlene J. S. Solomon | | 1,390 |

| Robert B. Toth | | 1,390 |

Annual Retainer Fees

In 2022, non-employee directors received an annual retainer fee in the amount of $65,000. Non-employee directors also received the following additional annual retainers: member of Compensation and Human Capital Committee, $5,000 ($15,000 for Chairman, Mr. Toth); member of Audit and Risk Committee, $5,000 ($20,000 for Chairman, Mr. Shular); member of Nominating, Governance, and Corporate Responsibility Committee, $5,000 ($10,000 for Chairman, Mr. Khilnani); and Chairman of the Board, $60,000 (Mr. Khilnani).

Equity Compensation

Under the 2006 Non-Employee Director Equity Plan (Director Equity Plan), non-employee directors who continued to serve as directors following the 2022 annual meeting of shareholders received $120,000 worth of RSUs (subject to rounding) which will generally be paid out in common stock at the end of a one-year restriction period. These RSUs were granted on the day following the annual meeting. The number of RSUs granted is equal to $120,000 divided by the closing price of our common stock on the day of the annual meeting (subject to rounding).

In the event a new director is elected or appointed, common stock may be granted, at the Board's discretion, usually on the first business day following the election or appointment to the Board of Directors. This grant of common stock has typically been equal to $100,000 divided by the closing price of our common stock on the day the director is elected or appointed to the Board of Directors. The grant is expected to be prorated by multiplying such number of shares of common stock by a fraction (in no case greater than one), (1) the numerator of which is one plus the number of full quarters remaining in the calendar year in which such election or appointment occurs after the date such election or appointment occurs, and (2) the denominator of which is four. The Company does not issue any fractional shares.

Deferred Compensation

Non-employee directors may defer all or a part of their annual retainer fees in the form of deferred stock units under the Director Equity Plan until ceasing to be a member of the Board of Directors or a date specified by the participant. A director may also elect to have RSUs or other stock awards granted under the Director Equity Plan deferred in the form of deferred stock units.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following information is set forth with respect to persons known to management to be the beneficial owners of more than 5% of Materion’s common shares as of December 31, 2022.

| | | | | | | | | | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | | Percent of Class |

| BlackRock, Inc. | 3,321,059 | | (2) | 16.2 | % |

| 55 East 52nd Street | | | |

| New York, NY 10055 | | | |

| The Vanguard Group | 2,347,204 | | (3) | 11.4 | % |

| 100 Vanguard Blvd. | | | |

| Malvern, PA 19355 | | | |

| Dimensional Fund Advisors LP | 1,281,871 | | (4) | 6.2 | % |

| 6300 Bee Cave Road, Building One | | | |

| Austin, TX 78746 | | | |

| Capital Research Global Investors | 1,089,822 | | (5) | 5 | % |

| 333 South Hope Street, 55th Floor | | | |

| Los Angeles, CA 90071 | | | |

(1) The information contained in this table, including related footnotes, is based on the Schedule 13G and Schedule 13D filings made by the beneficial owners identified herein.

(2) BlackRock, Inc. has sole investment power over 3,289,367 shares and sole voting power over 3,321,059 shares.

(3) The Vanguard Group has sole voting power over 0 shares, shared voting power over 33,549 shares, sole dispositive power over 2,295,680 shares and shared dispositive power over 51,524 shares. The amount beneficially owned totals 2,347,204 shares.

(4) Dimensional Fund Advisors LP has sole investment power over 1,261,620 shares and sole voting power over 1,281,871 shares.

(5) Capital Research Global Investors has sole investment power and sole voting power over 1,089,822 shares.

Security Ownership of Directors and Named Executive Officers

The following table sets forth information with respect to the beneficial ownership of the Company’s common stock by each director and director nominee for election as a director of the Company, each of the named executive officers and all directors and executive officers as a group, as of January 31, 2023, unless otherwise indicated. The shareholders listed in the table have sole voting and investment power with respect to shares beneficially owned by them, unless otherwise indicated. Shares that are subject to stock appreciation rights (SARs) that may be exercised within 60 days of January 31, 2023 are reflected in the number of shares shown and in computing the percentage of Materion’s common stock beneficially owned by the person who owns those SARs.

| | | | | | | | | | | |

| Name | Number of

Shares | | Percent of Class |

Shelly M. Chadwick(2) | 12,179 | | | * |

Gregory R. Chemnitz(2), (3) | 38,788 | | | * |

Vinod M. Khilnani(1) | 33,667 | | | * |

| Emily M. Liggett | 4,873 | | | * |

Robert J. Phillippy(1) | 13,290 | | | * |

Patrick Prevost(1) | 9,942 | | | * |

N. Mohan Reddy(1) | 41,945 | | | * |

Craig S. Shular(1) | 51,395 | | | * |

| Darlene J. S. Solomon | 24,712 | | | * |

| Robert B. Toth | 23,121 | | | * |

Jugal K. Vijayvargiya(2), (3) | 227,843 | | | * |

All Directors and Executive Officers as a group (including the Named Executive Officers (11 persons))(4) | 481,755 | | | 2.3% |

| *Less than 1% of Materion's outstanding common stock | | | |

(1)Includes deferred shares under the Director Plan as follows: Mr. Khilnani 18,552, Mr. Phillippy 11,837, Mr. Prevost 9,942, Dr. Reddy 41,945 and Mr. Shular 45,486.

(2)Includes shares covered by SARs exercisable within 60 days of January 31, 2023 as follows: Mr. Vijayvargiya 140,217, Ms. Chadwick 5,494 and Mr. Chemnitz 9,568.

(3)Includes shares covered by RSUs and PRSUs vesting within 60 days of January 31, 2023 as follows: Mr. Vijayvargiya 32,916, Ms. Chadwick 1,068 and Mr. Chemnitz 6,760.

(4)Includes an aggregate of 196,022 shares subject to SARs/RSUs held by executive officers exercisable/vesting within 60 days of January 31, 2023 and an aggregate of 127,293 deferred shares held by directors.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires that certain of our officers, our directors and persons who beneficially own more than 10% of a registered class of our equity securities file reports of ownership and changes in ownership with the SEC. The SEC has established specific due dates for these reports and we are required to disclose in this proxy statement any known late filings or failures to file. Based solely on our review of Section 16 reports filed electronically with the SEC and written representations from certain reporting persons, we believe that during 2022 and for prior years, all Section 16(a) filing requirements applicable to those officers, directors and 10% shareholders were satisfied, except that, due to administrative error, (1) for each of Messrs. Vijayvargiya and Chemnitz: (a) one Form 4, reporting one transaction relating to the grant of restricted stock units was filed one day late; and (b) one amended Form 4, reporting one transaction relating to the vesting of restricted stock units was filed to correct disclosure on the initially filed Form 4, and (2) for John Zaranec, our Chief Accounting Officer, (a) his Form 3 required in connection with his promotion was filed late and (b) one Form 4, reporting three transactions relating to additional restricted stock units acquired upon the reinvestment of dividend equivalents, was filed late.

RELATED PARTY TRANSACTIONS

We recognize that transactions between any of our directors or executive officers and us can present potential or actual conflicts of interest and create the appearance that our decisions are based on considerations other than the best interests of our shareholders. Pursuant to its charter, the Nominating, Governance, and Corporate Responsibility Committee considers and makes recommendations to the Board with regard to possible conflicts of interest of Board members or management. The Board then makes a determination as to whether to approve the transaction.

The Committee reviews all relationships and transactions in which Materion Corporation and its directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Our Secretary is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions in order to enable the Committee to determine, based on the facts and circumstances, whether Materion or a related person has a direct or indirect material interest in the transaction. As set forth in the Committee’s charter, in the course of the review of a potentially material related person transaction, the Committee considers:

•the nature of the related person’s interest in the transaction;

•the material terms of the transaction, including, without limitation, the amount and type of transaction;

•the importance of the transaction to the related person;

•the importance of the transaction to Materion;

•whether the transaction would impair the judgment of a director or executive officer to act in the best interest of Materion; and

•any other matters the Committee deems appropriate.

Based on this review, the Committee will determine whether to approve or ratify any transaction which is directly or indirectly material to Materion or a related person.

Any member of the Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote with respect to the approval or ratification of the transaction; however, such director may be counted in determining the presence of a quorum at a meeting of the Committee that considers the transaction. There were no related party transactions in 2022.

AUDIT COMMITTEE REPORT

The Audit and Risk Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the Company’s systems of internal controls. In fulfilling its oversight responsibilities, the Audit and Risk Committee reviewed the audited financial statements in the annual report with management, and discussed with management the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit and Risk Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. The Audit and Risk Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit and Risk Committee concerning independence, and has discussed with the independent registered public accounting firm such firm’s independence.

The Audit and Risk Committee discussed with the Company’s internal auditors and the independent registered public accounting firm the overall scope and plans for the respective audits. The Audit and Risk Committee meets with the internal auditors and the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit and Risk Committee held six meetings during 2022.

In reliance on these reviews and discussions, the Audit and Risk Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2022 for filing with the SEC.

The current Audit and Risk Committee charter is available on our website at https://materion.com.

Craig S. Shular (Chairman)

Robert J. Phillippy

N. Mohan Reddy

Darlene J.S. Solomon

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (CD&A) provides an overview of our executive compensation program and 2022 pay determinations for our named executive officers (NEOs), as shown below:

Named Executive Officers

Jugal K. Vijayvargiya, President and Chief Executive Officer

Shelly M. Chadwick, Vice President, Finance and Chief Financial Officer

Gregory R. Chemnitz, Vice President, General Counsel and Secretary

This CD&A consists of the following three sections:

Section I: Executive Summary - 2022 in Review

Section II: Executive Compensation Program Overview

Section III: Details and Analysis of the 2022 Executive Compensation Program

Section I: Executive Summary - 2022 in Review

Materion Corporation has a long-standing and strong commitment toward pay-for-performance in its executive compensation program. We maintain this orientation throughout economic cycles that may cause fluctuation in our operating results.

We believe the decisions regarding our NEO compensation program in 2022 described in the CD&A below reflect our ongoing commitment to sustaining our pay-for-performance philosophy.

2022 Company Performance Overview(1)

The Company delivered record results in 2022 with net sales of $1.7 billion, an increase of 16% from 2021 driven by organic sales growth across most major end markets, as well as a full year of sales related to the November 1st, 2021 acquisition of HCS-Electronic Materials. The Company’s profits also grew substantially compared to 2021 as a result of the increased demand, improved pricing and strong operating performance. Operating profit for 2022 was $119.8 million as compared to operating profit of $77.1 million in 2021, an increase of over 55%.

Value-added sales is a non-GAAP financial measure that removes the impact of pass through metal costs and allows for analysis without the distortion of the movement or volatility in metal prices and changes in mix due to customer-supplied material. Internally, we manage our business on this basis, and a reconciliation of net sales, the most directly comparable GAAP financial measure, to value-added sales is included herein in Appendix A. Value-added sales of $1,114.4 million(2) in 2022 were up 34% compared to 2021. The increase was due to strong demand across all of our markets, our ability to capitalize on new business opportunities, and the successful integration of the HCS-Electronic Materials acquisition.

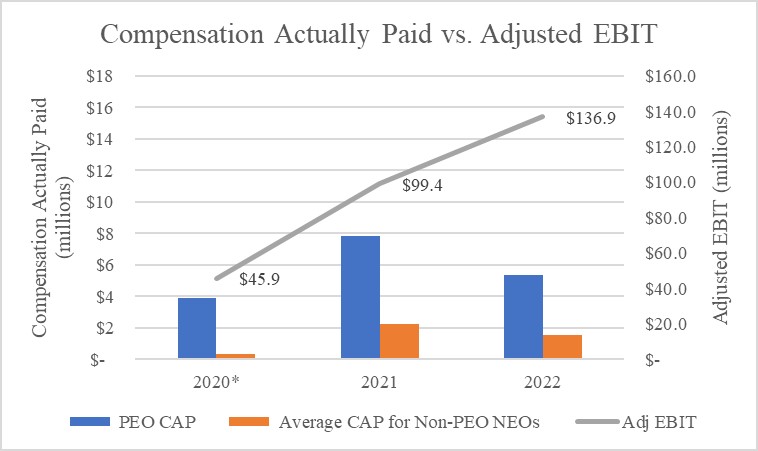

Net income was $86.0 million, or $4.14 per share, diluted, in 2022, compared to $72.5 million, or $3.50 per share in 2021. Adjusted net income (excluding acquisition amortization) per diluted share was $5.27 in 2022, compared to $4.06 in 2021 driven by the factors impacting operating profit. Adjusted EBIT is a non-GAAP financial measure that removes interest, tax and depreciation and amortization expense from net income and also excludes special items related to mergers and acquisition costs, restructuring costs, and additional start up resources and scrap. Adjusted EBIT for 2022 totaled $142.6 million, compared to $99.4 million in 2021, an increase of over 43% driven by the items mentioned above related to the growth of operating profit year over year. Through delivering above market growth and operational excellence, the Company delivered records in value-added sales, adjusted EBIT, and adjusted EPS in 2022.

The Company generated strong operating cash flow of $116.0 million in 2022 and maintains more than adequate liquidity while still investing in organic and inorganic growth in 2022. The Company has borrowing capacity of $185.3 million as of December 31, 2022.

(1) See Appendix A for a definition of value-added sales and a reconciliation of non-GAAP to GAAP financial measures.

(2) The value-added sales reflect the amounts presented in the Company’s Current Report on Form 8-K furnished to the SEC on March 22, 2023.

Key Financial and Strategic Highlights for 2022

| | | | | |