UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

MATERION CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

þ | No fee required |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4)Date Filed:

Materion Corporation

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

Notice of Annual Meeting of Shareholders

The annual meeting of shareholders of Materion Corporation will be held at Executive Caterers at Landerhaven, 6111 Landerhaven Dr., Mayfield Heights, Ohio 44124 on May 7, 2014 at 11:00 a.m., local time, for the following purposes:

(1) | To elect four directors, each to serve for a term of three years and until a successor is elected and qualified; |

(2) | To approve the Materion Corporation 2006 Stock Incentive Plan (As Amended and Restated as of May 7, 2014); |

(3) | To approve the Materion Corporation 2006 Non-employee Director Equity Plan (As Amended and Restated as of May 7, 2014); |

(4) | To ratify Ernst & Young LLP as the independent registered public accounting firm for Materion Corporation for the year 2014; |

(5) | To approve, by non-binding vote, named executive officer compensation; |

(6) | To approve an amendment to Materion’s Amended and Restated Code of Regulations to opt out of the Ohio Control Share Acquisition Act; |

(7) | To approve amendments to Materion’s Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to declassify the Board of Directors (implementation of this Proposal 7 is conditioned upon the approval of Proposal 8); |

(8) | To approve amendments to Materion’s Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to eliminate cumulative voting in the election of directors (implementation of this Proposal 8 is conditioned upon the approval of Proposal 7); and |

(9) | To transact any other business that may properly come before the meeting. |

Shareholders of record as of the close of business on March 10, 2014 are entitled to notice of the meeting and to vote at the meeting or any adjournment or postponement of the meeting.

Michael C. Hasychak |

Secretary |

April 1, 2014

Important — your proxy is enclosed.

Please sign, date and return your proxy in the accompanying envelope or use one of the other methods listed below to vote your proxy.

MATERION CORPORATION

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

PROXY STATEMENT

April 1, 2014

GENERAL INFORMATION

Your Board of Directors is furnishing this proxy statement to you in connection with our solicitation of proxies to be used at our annual meeting of shareholders to be held on May 7, 2014. The proxy statement is being mailed to shareholders on April 1, 2014.

Registered Holders. If your shares are registered in your name, you may vote in person or by proxy. If you decide to vote by proxy, you may do so by telephone, over the Internet or by mail.

By telephone. After reading the proxy materials and with your proxy card in front of you, you may call the toll-free number, 1-866-883-3382, using a touch-tone telephone. You will be prompted to enter the last four digits of your Social Security Number or Tax Identification Number. Then follow the simple instructions that will be given to you to record your vote.

Over the Internet. After reading the proxy materials and with your proxy card in front of you, you may access the web site at http://www.proxypush.com/mtrn. You will be prompted to enter the last four digits of your Social Security Number or Tax Identification Number. Then follow the simple instructions that will be given to you to record your vote.

By mail. After reading the proxy materials, you may mark, sign and date your proxy card and return it in the enclosed prepaid and addressed envelope.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to give voting instructions and confirm that those instructions have been recorded properly. Without affecting any vote previously taken, you may revoke your proxy by delivery to us of a new, later dated proxy with respect to the same shares, or giving written notice to us before or at the annual meeting. Your presence at the annual meeting will not, in and of itself, revoke your proxy.

Participants in the Retirement Savings Plan and/or the Payroll Stock Ownership Plan (PAYSOP). If you participate in the Retirement Savings Plan and/or the PAYSOP, the independent trustee for each plan, Fidelity Management Trust Company, will vote your plan shares according to your voting directions. You may give your voting directions to the plan trustee in any one of the three ways set forth above. If you do not return your proxy card or do not vote over the Internet or by telephone, the trustee will not vote your plan shares. Each participant who gives the trustee voting directions acts as a named fiduciary for the applicable plan under the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Nominee Shares. If your shares are held by a bank, broker, trustee or some other nominee, that entity will give you separate voting instructions.

In addition to the solicitation of proxies by mail, we may solicit the return of proxies in person, by telephone, facsimile or e-mail. We will request brokerage houses, banks and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of shares and will reimburse them for their expenses. We will bear the cost of the solicitation of proxies. We retained Georgeson, Inc., at an estimated cost of $112,500 plus reimbursement of expenses, to assist in the solicitation of proxies from brokers, nominees, institutions and individuals.

Voting. At the close of business on March 10, 2014, the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting, we had outstanding and entitled to vote 20,917,242 shares of common stock. Each outstanding share of common stock entitles its holder to one vote on each matter brought before the meeting.

With respect to Proposal 1, the four nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation, subject to the Company's Majority Voting Policy. The approval of each of Proposals 2, 3, 4, 5, 6, 7 and 8 requires the affirmative vote of a majority of the votes cast on such proposals at the 2014 annual meeting.

Cumulative Voting. Under Ohio law, shareholders have cumulative voting rights in the election of directors, provided that the shareholder gives not less than 48 hours notice in writing to the President or the Secretary of Materion Corporation that the shareholder desires that voting at the election be cumulative and provided further that an announcement is made upon the convening of the meeting informing shareholders that notice requesting cumulative voting has been given by the shareholder.

When cumulative voting applies, each share has a number of votes equal to the number of directors to be elected, and a shareholder may give all of the shareholder's votes to one nominee or divide the shareholder's votes among as many nominees as he or she sees fit. Unless contrary instructions are received on proxies given to us, in the event that cumulative voting applies, all votes represented by the proxies will be divided evenly among the candidates nominated by the Board of Directors, except that if

1

voting in this manner would not be effective to elect all the nominees, the votes will be cumulated at the discretion of the Board of Directors so as to maximize the number of the Board of Directors' nominees elected.

Abstentions and Broker Non-Votes. At the annual meeting, the inspectors of election appointed for the meeting will tabulate the results of shareholder voting. Under Ohio law and our code of regulations, properly signed proxies that are marked “abstain” or are held in “street name” by brokers and not voted on one or more of the items (but otherwise voted on at least one item) before the meeting will be counted for purposes of determining whether a quorum has been achieved at the annual meeting.

If you have not provided directions to your broker, your broker or other nominee will not be able to vote your shares with respect to the election of directors (Proposal 1); the approval of the Materion Corporation 2006 Stock Incentive Plan (As Amended and Restated as of May 7, 2014) (Proposal 2); the approval of the Materion Corporation 2006 Non-employee Director Equity Plan (As Amended and Restated as of May 7, 2014) (Proposal 3) or the non-binding vote to approve named executive officer compensation (Proposal 5); the approval of an amendment to the Company’s Amended and Restated Code of Regulations to opt out of the Ohio Control Share Acquisition Act (Proposal 6); the approval of amendments to the Company's Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to declassify the Board of Directors (Proposal 7); or the approval of amendments to the Company's Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to eliminate cumulative voting in the election of directors (Proposal 8).

Abstentions and broker non-votes will not affect the vote on the election of directors. For purposes of the shareholder approval requirements of the New York Stock Exchange, because abstentions are deemed to be votes cast, abstentions will have the effect of votes against the approval of the Materion Corporation 2006 Stock Incentive Plan (As Amended and Restated as of May 7, 2014) (Proposal 2) and the Materion Corporation 2006 Non-employee Director Equity Plan (As Amended and Restated as of May 7, 2014) (Proposal 3), although broker non-votes will not affect the vote on such proposals. An abstention and broker non-vote will have the effect of votes against: the approval of the amendment to the Company’s Amended and Restated Code of Regulations to opt out of the Ohio Control Share Acquisition Act (Proposal 6); the approval of amendments to the Company's Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to declassify the Board of Directors (Proposal 7); and the approval of amendments to the Company's Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations to eliminate cumulative voting in the election of directors (Proposal 8).

An abstention or broker non-vote with respect to the non-binding vote to approve named executive officer compensation (Proposal 5) will have no effect on the proposals as the abstention or broker non-vote will not be counted in determining the number of votes cast.

Because the vote to ratify the appointment of Ernst & Young LLP (Proposal 4) is considered to be routine, your broker or other nominee will be able to vote your shares with respect to this proposal without your instructions. An abstention will have no effect on this proposal as the abstention will not be counted in determining the number of votes cast.

* * *

We know of no other matters that will be presented at the meeting; however, if other matters do properly come before the meeting, the persons named in the proxy card will vote on these matters in accordance with their best judgment.

If you sign, date and return your proxy card but do not specify how you want to vote your shares, your shares will be voted as recommended by the Board of Directors as indicated on the proxy card.

2

1. ELECTION OF DIRECTORS

Currently, our Amended and Restated Articles of Incorporation and Amended and Restated Code of Regulations provide for three classes of directors whose terms expire in different years. The Board of Directors has nominated each of Edward F. Crawford, Joseph P. Keithley, N. Mohan Reddy and Craig S. Shular to serve as a director until the 2017 annual meeting of shareholders or until his successor has been selected.

In March 2014, GAMCO Asset Management Inc. (GAMCO) provided notice to the Company that it intended to nominate two individuals for election to the Board at the annual meeting. On March 19, 2014, the Company and GAMCO entered into an agreement regarding the election of directors at the annual meeting. Under the terms of the agreement, the Company has agreed to nominate and recommend the election of one of GAMCO's candidates, Edward F. Crawford, as a new director.

Your Board of Directors unanimously recommends a vote for each of Edward F. Crawford, Joseph P. Keithley, N. Mohan Reddy and Craig S. Shular.

Your Board of Directors recommends a vote for these nominees.

If any of these nominees becomes unavailable, it is intended that the proxies will be voted as the Board of Directors determines. We have no reason to believe that any of the nominees will be unavailable. The four nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation. However, our Board of Directors has adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” election is expected to tender his or her resignation following certification of the shareholder vote, subject to a 90-day review process by our Governance and Organization Committee and Board of Directors to consider whether the tendered resignation should be accepted. An abstention or broker non-vote is not treated as a vote “withheld” under our Majority Voting Policy. For additional details on the Majority Voting Policy, see page 10 of this proxy statement.

The following sets forth information concerning the director nominees and the directors whose terms of office will continue after the annual meeting:

Director Nominees

Edward F. Crawford, Director, Chairman and Chief Executive Officer, Park-Ohio Holdings Corp. (an industrial supply chain logistics and diversified manufacturing company). Mr. Crawford has served as Director, Chairman and Chief Executive Officer of Park-Ohio Holdings Corp. since 1992 and served as President of Park-Ohio from 1997 to 2003. Mr. Crawford has served as Chairman and Chief Executive Officer of The Crawford Group (a venture capital, management consulting company) since 1964. Mr. Crawford has served as a director of Hickok Incorporated since 2012. Mr. Crawford is 74 years old. Mr. Crawford's experience as Chairman and Chief Executive Officer of a public company with global operations provides significant value to our Board of Directors.

Joseph P. Keithley, Non-executive Chairman of the Board, Nordson Corporation (industrial application equipment manufacturer). Mr. Keithley has served on the Board of Directors of Nordson Corporation since 2001 and Chairman of that board since February 2010. Mr. Keithley had also been Chairman of the Board of Keithley Instruments, Inc. (electronic test and measurement products) since 1991 and was a member of that board from 1986 until December 2010, when Keithley Instruments was purchased by Danaher Corporation. Mr. Keithley had served as Chief Executive Officer of Keithley Instruments since November 1993 and as its President since May 1994, prior to the purchase by Danaher. Mr. Keithley has also served on the Board of Directors of Axcelis Technologies, Inc. since August 2011. Mr. Keithley is 65 years old and has been a director of Materion Corporation since 1997. Mr. Keithley brings an extensive, broad-based business background from his role as Chairman of the Board of Nordson and leadership roles at Keithley Instruments to his role on our Board of Directors. Among other things, Mr. Keithley draws upon his extensive knowledge in the global semiconductor, fiber optics, telecommunications and electronics industries garnered while at Keithley Instruments.

N. Mohan Reddy, Ph.D., B. Charles Ames, Professor of Management, Case Western Reserve University. Dr. Reddy was appointed B. Charles Ames, Professor of Management on February 22, 2014. Prior to that he had served as the Albert J. Weatherhead III Professor of Management from January 2007 until June 2012 and as the Dean of the Weatherhead School of Management, Case Western Reserve University from December 2006 until June 2012. Dr. Reddy had been Associate Professor of Marketing since 1991 and Keithley Professor of Technology Management from 1996 to 2006 at the Weatherhead School of Management, Case Western Reserve University. Dr. Reddy had served on the Board of Directors of Keithley Instruments, Inc. from 2001 until December 2010, when Keithley Instruments was purchased by Danaher Corporation. Dr. Reddy had also served on the Board of Directors of Lubrizol Corporation from February 2011 until October 2011, when Lubrizol was purchased by Berkshire Hathaway Inc. Dr. Reddy also serves as a consultant to firms in the electronics and semiconductor industries, primarily in the areas of product and market development. Dr. Reddy is 60 years old and has been a director of Materion Corporation since 2000. Dr. Reddy’s knowledge of industrial marketing, technology development and extensive global knowledge in the electronics and semiconductor industries provides valuable insight to our Board of Directors.

3

Craig S. Shular, Executive Chairman of the Board, GrafTech International Ltd. (electrical industrial apparatus). Mr. Shular was elected Chairman of the Board of GrafTech International in February 2007 and will serve in that capacity until the end of 2014. He has been a director since January 2003. Mr. Shular served as Chief Executive Officer from January 2003 and as President from May 2002 until he retired from both positions in January 2014. From August 2001 until May 2002, he served as Executive Vice President of GrafTech’s largest business, Graphite Electrodes. Mr. Shular joined GrafTech as its Vice President and Chief Financial Officer in January 1999 and assumed the additional duties of Executive Vice President, Electrode Sales and Marketing in February 2000 until August 2001. Mr. Shular serves on the Board of Directors of Junior Achievement of Greater Cleveland. Mr. Shular is 61 years old and has been a director of Materion Corporation since 2008. As the former Chairman, Chief Executive Officer and President and former Chief Financial Officer of GrafTech International Ltd., Mr. Shular brings a breadth of financial and operational management experience and provides our Board of Directors with a perspective of someone with all facets of a global enterprise.

Directors Whose Terms End in 2015

Richard J. Hipple, Chairman, President and Chief Executive Officer, Materion Corporation. In May 2006, Mr. Hipple was named Chairman and Chief Executive Officer of Materion Corporation. He has served as President since May 2005 and as Chief Operating Officer from May 2005 until May 2006. Mr. Hipple was President of Performance Alloys from May 2002 until May 2005. He joined the Company in July 2001 as Vice President of Strip Products, Performance Alloys and served in that position until May 2002. Prior to joining Materion Corporation, Mr. Hipple was President of LTV Steel Company, a business unit of The LTV Corporation (integrated steel producer and metal fabricator). Mr. Hipple has served on the Board of Directors of Ferro Corporation since June 2007 and as Lead Director since April 2010. Mr. Hipple has served on the Board of Directors of KeyCorp since July 2012. Mr. Hipple is 61 years old. Mr. Hipple’s broad experience and deep understanding of the Company and the materials business, combined with his drive for innovation and excellence, positions him well to serve as our Chairman, President and Chief Executive Officer.

William B. Lawrence, Non-executive Chairman of the Board, Ferro Corporation (performance coatings, performance colors and glass; pigments; powders; oxide polymers; additives and specialty plastics). Mr. Lawrence has served as Acting Chairman of the Board of Ferro Corporation since November 2012 and was elected as Ferro's Non-executive Chairman in April 2013. Additionally he has served on Ferro's Board of Directors since 1999. Prior to the sale of TRW, Inc. (advanced technology products and services) to Northrop Grumman Corporation in December 2002, Mr. Lawrence served as TRW’s Executive Vice President, General Counsel and Secretary since 1997 and held various other executive positions at TRW since 1976. Mr. Lawrence is 69 years old and has been a director of Materion Corporation since 2003. Mr. Lawrence’s background as an Executive Vice President, General Counsel and Secretary of TRW, Inc. and as a director at Ferro Corporation provides him with the knowledge and experience to address the complex legislative, governance and financial issues facing global companies today.

Geoffrey Wild, Chief Executive Officer, AZ Electronic Materials S.A. (specialty chemicals and materials). Mr. Wild has served as the Chief Executive Officer and a director of AZ Electronic Materials since 2010. From 2008 to 2009, Mr. Wild was President and Chief Executive Officer of Cascade Microtech, Inc. (precision electrical measurement products and services). Prior to that time, from 2002 to 2007, Mr. Wild was Chief Executive Officer of Nikon Precision Inc. (precision optical products). Mr. Wild served on the Board of Directors of Axcelis Technologies, Inc. from November 2006 until April 2011. Mr. Wild is 58 years old and was appointed to our Board of Directors in July 2011. Mr. Wild’s substantial knowledge and management experience in the global semiconductor industry, including the role of a supplier of equipment and materials to international customers, deepens our Board of Directors’ insight into the operational issues that global companies face. Additionally, Mr. Wild’s role as a chief executive officer has exposed him to international financial and accounting issues.

Directors Whose Terms End in 2016

Vinod M. Khilnani, Retired Executive Chairman, CTS Corporation (electronic components and accessories). Mr. Khilnani became Executive Chairman of CTS Corporation in January 2013 and served in that capacity until May 2013. He had served as Chairman, President and Chief Executive Officer of CTS from July 2007 until January 2013. Prior to that time, he served as Senior Vice President and Chief Financial Officer since May 2001. Mr. Khilnani was appointed to the Board of Directors of 1st Source Corporation on April 26, 2013. Mr. Khilnani is 61 years old and has been a director of Materion Corporation since 2009. As the former Executive Chairman and Chief Executive Officer and President of CTS (and its former Chief Financial Officer), Mr. Khilnani offers a wealth of management experience and business knowledge regarding operational, financial and corporate governance issues, as well as extensive international experience with global operations.

4

Darlene J. S. Solomon, Ph.D., Senior Vice President and Chief Technology Officer, Agilent Technologies, Inc. (life sciences and diagnostics). Dr. Solomon has served as Senior Vice President and Chief Technology Officer of Agilent Technologies since 2006. Prior to that time, she served as Vice President and Director of Agilent Laboratories. Dr. Solomon joined Agilent in 1999 and served in a dual capacity as the director of the Life Sciences Technologies Laboratory and as the senior director, research and development/technology for Agilent’s Life Sciences and Chemical Analysis business. Dr. Solomon is 55 years old and was appointed to the Board of Directors in July 2011. With extensive knowledge and experience in materials measurement and analysis technologies, Dr. Solomon brings to our Board of Directors valuable insight on research and development and other operational issues faced by companies focused on innovations in technology.

Robert B. Toth, Chairman, President and Chief Executive Officer, Polypore International, Inc. (high technology filtration products). Mr. Toth has served as President, Chief Executive Officer and a director of Polypore International since 2005 and was named Chairman of the Board in 2011. Mr. Toth previously was Chief Executive Officer and President of CP Kelco ApS (leading global manufacturer of hydrocolloids). Prior to joining CP Kelco in June 2001, he spent 19 years at Monsanto Company (multinational biotechnology company), and its spinoff company, Solutia Inc. (materials and specialty chemicals manufacturer), in roles of increasing responsibility. Mr. Toth is 53 years old and was appointed to our Board of Directors in February 2013. With extensive experience in leading corporations in the manufacturing and specialty materials sector, including his knowledge and skills in senior management, finance and operations, Mr. Toth brings to our Board of Directors significant insight into the strategic and operational issues facing companies in the advanced materials industry.

5

CORPORATE GOVERNANCE; COMMITTEES OF THE BOARD OF DIRECTORS

We have adopted a Policy Statement on Significant Corporate Governance Issues and a Code of Conduct Policy in compliance with New York Stock Exchange and Securities and Exchange Commission requirements. These materials, along with the charters of the Audit, Compensation and Governance and Organization Committees of our Board of Directors (Board), which also comply with applicable requirements, are available on our web site at http://materion.com, or upon request by any shareholder to Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. We also make our reports on Forms 10-K, 10-Q and 8-K available on our web site, free of charge, as soon as reasonably practicable after these reports are filed with the Securities and Exchange Commission. Any amendments or waivers to our Code of Conduct Policy, Committee Charters and Policy Statement on Significant Corporate Governance Issues will also be made available on our web site. The information on our web site is not incorporated by reference into this proxy statement or any of our periodic reports.

Director Independence

The New York Stock Exchange listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the New York Stock Exchange listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the Company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, or its subsidiaries or affiliates. Our Board has adopted the following standards, which are identical to those of the New York Stock Exchange listing standards, to assist it in its determination of director independence. A director will be determined not to be independent under the following circumstances:

• | the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

• | the director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

• | (a) the director is a current partner or employee of a firm that is the Company’s internal or external auditor; (b) the director has an immediate family member who is a current partner of such a firm; (c) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (d) the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

• | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee; or |

• | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000, or two percent of such other company’s consolidated gross revenues. |

Additionally, for purposes of determining whether a director has a material relationship with the Company apart from his or her service as a director, our Board has deemed the following relationships as categorically immaterial:

• | the director, or an immediate family member, is a current employee, director or trustee of a tax-exempt organization and the Company’s contributions to the organization (excluding Company matching of employee contributions) in any fiscal year are less than $120,000; or |

• | the director is a director of a company that has made payments to, or received payments or deposits from, the Company for property, goods or services in the ordinary course of business in an amount which, in any fiscal year, is less than the greater of $1,000,000, or two percent of such other company’s consolidated gross revenues. |

Our Board has affirmatively determined that each of our directors and director nominees, other than Mr. Hipple, is “independent” within the meaning of that term as defined in the New York Stock Exchange listing standards; a “non-employee director” within the meaning of that term as defined in Rule 16b-3(b)(3) promulgated under the Securities Exchange Act of 1934 (Exchange Act); and an “outside director” within the meaning of that term as defined in the regulations promulgated under Section 162(m) of the Internal Revenue Code (Code).

Charitable Contributions

Within the last three years, we have made no charitable contributions during any single fiscal year to any charity in which an independent director serves as an executive officer, of over the greater of $1,000,000 or 2% of the charity’s consolidated gross revenues.

6

Non-management Directors

Our Policy Statement on Significant Corporate Governance Issues provides that the non-management members of the Board will meet during each regularly scheduled meeting of the Board of Directors. Presently, Mr. Lawrence is the lead non-management director (Lead Director).

In addition to the other duties of a director under our Policy Statement on Significant Corporate Governance Issues, the Lead Director, in collaboration with the other independent directors, is responsible for coordinating the activities of the independent directors and in that role will:

• | chair the executive sessions of the independent directors at each regularly scheduled meeting; |

• | make recommendations to the Chairman regarding the timing and structuring of Board meetings; |

• | make recommendations to the Chairman concerning the agenda for Board meetings, including allocation of time as well as subject matter; |

• | advise the Board Chairman as to the quality, quantity and timeliness of the flow of information from management to the Board; |

• | serve as the independent point of contact for shareholders wishing to communicate with the Board other than through management; |

• | interview all Board candidates, and provide the Governance and Organization Committee with recommendations on each candidate; |

• | maintain close contact with the Chairman of each standing committee and assist in ensuring communications between each committee and the Board; |

• | lead the Chief Executive Officer annual evaluation process; and |

• | be the ombudsman for the Chief Executive Officer to provide two-way communication with the Board. |

Board Communications

Shareholders or other interested parties may communicate with the Board as a whole, the Lead Director or the non-management directors as a group, by forwarding relevant information in writing to Lead Director, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. Any other communication to individual directors or committees of the Board of Directors may be similarly addressed to the appropriate recipients, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

Board Leadership

Currently, the Chairman of the Board also serves as the Chief Executive Officer. The Board has no policy with respect to the separation of these offices. The Board believes that this issue is part of the succession planning process and that it is in the best interests of the Company for the Board to consider it each time that it elects the Chief Executive Officer. The Board recognizes that there may be circumstances in the future that would lead it to separate these offices, but it believes that there is no reason to do so at this time.

As both a director and officer, Mr. Hipple fulfills a valuable leadership role that the Board believes is essential to the continued success of the Company’s business operations at this time. In the Board’s opinion, Mr. Hipple’s dual role enhances the Company’s ability to coordinate long-term strategic direction with important business opportunities at the operational level and enhances his ability to provide insight and direction on important strategic initiatives impacting the Company and its shareholders to both management and the independent directors.

Unless the Chairman of the Board is an independent director, the independent directors periodically select from among their number, one director who will serve as the Lead Director. The Lead Director works with the Chairman and Chief Executive Officer and other Board members to provide strong, independent oversight of the Company’s management and affairs.

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal

7

controls, and receives an annual risk assessment report from the Company’s internal auditors. In addition, management also provides a risk management report including a financial risk assessment and enterprise risk management update and information technology contingency plans to the Audit Committee. In setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy. Finally, the Company’s Governance and Organization Committee conducts an annual assessment of the Board for compliance with corporate governance and risk management best practices. The Company believes that the Board’s role in risk oversight is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees providing oversight in connection with those efforts, with particular focus on the most significant risks facing the Company.

Audit Committee

The Audit Committee held six meetings in 2013. The Audit Committee membership consists of Mr. Shular, as Chairman, and Messrs. Keithley and Wild and Dr. Reddy. Under the Audit Committee Charter, the Audit Committee’s principal functions include assisting our Board in fulfilling its oversight responsibilities with respect to:

• | the integrity of our financial statements and our financial reporting process; |

• | compliance with ethics policies and legal and other regulatory requirements; |

• | our independent registered public accounting firm’s qualifications and independence; |

• | our systems of internal accounting and financial controls; and |

• | the performance of our independent registered public accounting firm and of our internal audit functions. |

We currently do not limit the number of audit committees on which our Audit Committee members may serve. No member of our Audit Committee serves on the audit committee of three or more public companies in addition to ours. The Audit Committee also prepared the Audit Committee report included under the heading “Audit Committee Report” in this proxy statement.

Audit Committee Expert, Financial Literacy and Independence

Our Board of Directors has determined that the Audit Committee Chairman, Mr. Shular, is the Audit Committee financial expert, as defined by the Securities and Exchange Commission. Each member of the Audit Committee is financially literate and satisfies the independence requirements in section 303A.02 of the New York Stock Exchange listing standards.

Compensation Committee

The Compensation Committee held six meetings in 2013. Its membership consists of Mr. Khilnani, as Chairman, and Messrs. Lawrence and Toth and Dr. Solomon. Each member of the Compensation Committee has been determined by the Board to be independent within the meaning of Section 303A.02(a)(ii) of the NYSE Listed Company Manual. The Compensation Committee may, at its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee; provided that such subcommittee has a published charter in accordance with the rules of the New York Stock Exchange. The Compensation Committee’s principal functions include:

• | reviewing and approving executive compensation, including severance payments; |

• | overseeing and recommending equity and non-equity incentive plans; |

• | overseeing regulatory compliance with respect to compensation matters; |

• | advising on senior management compensation; and |

• | reviewing and discussing the Compensation Discussion and Analysis (CD&A) and Compensation Committee Report. |

For additional information regarding the operation of the Compensation Committee, see the “Compensation Discussion and Analysis” in this proxy statement.

Governance and Organization Committee

The Governance and Organization Committee held five meetings in 2013. The Governance and Organization Committee membership consists of Mr. Lawrence, as Chairman, and Messrs. Keithley, Khilnani, Shular, Toth and Wild and Drs. Reddy and Solomon. All of the members are independent in accordance with the New York Stock Exchange listing requirements. The Governance and Organization Committee’s principal functions include:

• | evaluating candidates for Board membership, including any nominations of qualified candidates submitted in writing by shareholders to our Secretary; |

• | making recommendations to the full Board regarding directors’ compensation; |

• | making recommendations to the full Board regarding governance matters; |

8

• | overseeing the evaluation of the Board and management of the Company; |

• | assisting in management succession planning; and |

• | reviewing related party transactions. |

As noted above, the Governance and Organization Committee is involved in determining compensation for our directors. The Governance and Organization Committee administers our equity incentive plans with respect to our directors, including approval of grants of stock options and other equity or equity-based awards, and makes recommendations to the Board with respect to incentive compensation plans and equity-based plans for directors. The Governance and Organization Committee periodically reviews director compensation in relation to comparable companies and other relevant factors. Any change in director compensation must be approved by the Board. Other than in his capacity as a director, no executive officer other than the Chief Executive Officer participates in setting director compensation. From time to time, the Governance and Organization Committee or the Board may engage the services of a compensation consultant to provide information regarding director compensation at comparable companies.

Nomination of Director Candidates

The Governance and Organization Committee will consider candidates recommended by shareholders for nomination as directors of Materion Corporation. Any shareholder desiring to submit a candidate for consideration by the Governance and Organization Committee should send the name of the proposed candidate, together with biographical data and background information concerning the candidate, to the Governance and Organization Committee, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

In recommending candidates to the Board for nomination as directors, the Governance and Organization Committee’s charter requires it to consider such factors as it deems appropriate, consistent with our Policy Statement on Significant Corporate Governance Issues. These factors are as follows:

• | broad-based business, governmental, non-profit, or professional skills and experiences that indicate whether the candidate will be able to make a significant and immediate contribution to the Board’s discussion and decision making in the array of complex issues facing the Company; |

• | exhibited behavior that indicates he or she is committed to the highest ethical standards and the values of the Company; |

• | special skills, expertise and background that add to and complement the range of skills, expertise and background of the existing directors; |

• | whether the candidate will effectively, consistently and appropriately take into account and balance the legitimate interests and concerns of all our shareholders and other stakeholders in reaching decisions; |

• | a global business and social perspective, personal integrity and sound judgment; and |

• | time available to devote to Board activities and to enhance their knowledge of the Company. |

Although the Company does not have a formal policy regarding diversity, as part of the analysis of the foregoing factors, the Governance and Organization Committee considers whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin.

The Governance and Organization Committee’s evaluation of candidates recommended by shareholders does not differ materially from its evaluation of candidates recommended from other sources.

The Governance and Organization Committee utilizes a variety of methods for identifying and evaluating director candidates. The Governance and Organization Committee regularly reviews the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Governance and Organization Committee considers various potential candidates for director. Candidates may come to the attention of the Governance and Organization Committee through current Board members, professional search firms, shareholders or other persons. Additionally, from time to time, the Governance and Organization Committee has used the services of an executive search firm to help identify potential director candidates who possess the characteristics described above. The search firm has prepared a biography of each candidate, conducted reference checks and screened candidates.

A shareholder of record entitled to vote in an election of directors who timely complies with the procedures set forth in our code of regulations and with all applicable requirements of the Exchange Act and the rules and regulations thereunder, may also directly nominate individuals for election as directors at a shareholders’ meeting. Copies of our code of regulations are available by a request addressed to Materion Corporation, c/o Secretary, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

To be timely, notice of a shareholder nomination for an annual meeting must be received at our principal executive offices not fewer than 60 nor more than 90 days prior to the date of the annual meeting. However, if the date of the meeting is more than one week before or after the first anniversary of the previous year’s meeting and we do not give notice of the meeting at least 75 days in advance, nominations must be received within ten days from the date of our notice.

9

Majority Voting Policy

Our Board adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” election, which we refer to as a Majority Withheld Vote, is expected to tender his or her resignation following certification of the shareholder vote. In such an event, the Governance and Organization Committee will consider the tendered resignation and make a recommendation to the Board of Directors. The Board will act on the Governance and Organization Committee’s recommendation within 90 days following certification of the shareholder vote. Any director who tenders his or her resignation pursuant to this policy will not participate in the Governance and Organization Committee’s recommendation or Board’s action regarding whether to accept or reject the tendered resignation.

However, if each member of the Governance and Organization Committee received a Majority Withheld Vote in the same election, then the Board will appoint a committee comprised solely of independent directors who did not receive a Majority Withheld Vote at that election to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation. Further, if all of the director nominees received a Majority Withheld Vote in the same election, the Board will appoint a committee comprised solely of independent directors to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation.

Director Attendance

Our Board held six meetings in 2013. All of the directors who were directors in 2013 attended at least 75% of the Board and assigned committee meetings during 2013. Our policy is that directors are expected to attend all meetings including the annual meeting of shareholders. All of our directors attended last year’s annual meeting of shareholders.

Use of Blank Check Preferred Stock

Our Board has adopted a resolution that it will not, without prior shareholder approval, authorize the issuance of any series of preferred stock for any defensive or anti-takeover purpose, for the purpose of implementing any shareholder rights plan or with features specifically intended to make any attempted acquisition of the Company more difficult or costly; provided, however, that, within the limits described above, the Board may authorize the issuance of preferred stock for capital raising transactions, acquisitions, joint ventures or other corporate purposes.

Position Statement on Shareholder Rights Plans

Our Board has adopted a Position Statement on Shareholder Rights Plans. The Position Statement provides that, if the Board adopts a shareholder rights plan, it will do so by action of the majority of its independent directors after careful deliberation and in the exercise of its fiduciary duties, and the Board will seek prior shareholder approval of the plan unless, due to time constraints or other considerations, the majority of the independent directors determine that it would be in the best interest of the Company and its shareholders to adopt the rights plan without first obtaining shareholder approval. The Position Statement also provides that, if the Board adopts a rights plan without prior shareholder approval, the plan will expire on the first anniversary of its effective date unless prior to such time the plan has been ratified by a vote of the Company’s shareholders, which vote may exclude shares held by any potential acquiring shareholders.

10

2013 DIRECTOR COMPENSATION

For 2013, the compensation for non-employee directors was comprised of cash compensation, consisting of annual retainer fees, and equity compensation, consisting of restricted stock units (RSUs). Each of these components is described in more detail below:

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (3) | Total ($) | |||

Joseph P. Keithley | 70,000 | 80,000 | 150,000 | |||

Vinod M. Khilnani | 75,069 | (1) | 80,000 | 155,069 | ||

William B. Lawrence | 95,000 | 80,000 | 175,000 | |||

N. Mohan Reddy | 68,333 | 80,000 | 148,333 | |||

William R. Robertson | 32,500 | (2) | — | 32,500 | ||

John Sherwin, Jr. | 35,000 | (2) | — | 35,000 | ||

Craig S. Shular | 80,054 | (1) | 80,000 | 160,054 | ||

Darlene J. S. Solomon | 68,333 | 80,000 | 148,333 | |||

Robert B. Toth | 68,333 | 180,012 | (4) | 248,345 | ||

Geoffrey Wild | 70,000 | 80,000 | 150,000 | |||

(1) | Pursuant to the 2006 Non-employee Director Equity Plan (As Amended and Restated as of May 4, 2011) (Director Plan), Mr. Khilnani and Mr. Shular elected to defer 100% of their compensation in the form of deferred stock units in 2013. |

(2) | Mr. Robertson's and Mr. Sherwin's terms of office expired at the May 1, 2013 annual meeting of shareholders and they did not stand for re-election under the Company’s retirement policy included in the Policy Statement on Significant Corporate Governance Issues. |

(3) | The amounts reported in this column reflect the aggregate grant date fair value as computed in accordance with FASB ASC Topic 718 for stock awards granted during 2013. See Note K to the Consolidated Financial Statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for the assumptions used in calculating such fair value. On May 2, 2013, these directors were awarded 3,186 RSUs, with a grant date fair value of $25.11 per unit, pursuant to the Director Plan. |

(4) | Mr. Toth's stock award includes 3,544 shares of common stock, with a grant date fair value of $28.22 per share, granted upon appointment to the Board of Directors on February 6, 2013, as described below under Equity Compensation. |

As of December 31, 2013, the aggregate number of stock options outstanding and the aggregate number of stock awards subject to forfeiture were as follows:

Name | Stock Options | Restricted Stock Units | |

Joseph P. Keithley | — | 3,186 | |

Vinod M. Khilnani | — | 3,186 | |

William B. Lawrence | 2,000 | 3,186 | |

N. Mohan Reddy | — | 3,186 | |

Craig S. Shular | — | 3,186 | |

Darlene J. S. Solomon | — | 3,186 | |

Robert B. Toth | — | 3,186 | |

Geoffrey Wild | — | 3,186 | |

Annual Retainer Fees

Non-employee directors receive an annual retainer fee in the amount of $65,000. Non-employee directors who chair a committee receive an additional $5,000 annually, with the exception of the Chairman of the Compensation Committee (Mr. Khilnani in 2013), who receives an additional $10,000 annually, and the Chairman of the Audit Committee (Mr. Shular effective May 2013), who receives an additional $15,000 annually. The Lead Director (Mr. Lawrence effective May 2013) receives an additional $25,000 annually effective May 2013 (an increase from $20,000 annually). Members of the Audit Committee, with the exception of the Chairman, receive an additional $5,000 annually.

11

Equity Compensation

Under the Director Plan, non-employee directors who continue to serve as a director following an annual meeting of shareholders receive $80,000 worth of RSUs, an increase of $15,000 effective May 2013, which will be paid out in common stock at the end of a one-year restriction period unless the participant elects that the shares be received in the form of deferred stock units. These RSUs are automatically granted on the day following the annual meeting. The number of RSUs granted is equal to $80,000 divided by the closing price of our common stock on the day of the annual meeting. In the event a new director is elected or appointed, common stock will be granted on the first business day following the election or appointment to the Board of Directors. This grant of common stock will be equal to $100,000 divided by the closing price of our common stock on the day the director is elected or appointed to the Board of Directors.

Deferred Compensation

Non-employee directors may defer all or a part of their annual retainer fees in the form of deferred stock units under the Director Plan until ceasing to be a member of the Board of Directors. A director may also elect to have RSUs or other stock awards made under the Director Plan deferred in the form of deferred stock units.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of Materion Corporation’s common stock by each person known by Materion to be the beneficial owner of more than 5% of the common stock, by each present director and director nominee of Materion, by each of the Chief Executive Officer, Chief Financial Officer and other most highly compensated executive officers (each named executive officer or NEO) of Materion and by all directors and executive officers of Materion as a group, as of February 14, 2014, unless otherwise indicated. The shareholders listed in the table have sole voting and investment power with respect to shares beneficially owned by them, unless otherwise indicated. Shares that are subject to stock options and stock appreciation rights (SARs) that may be exercised within 60 days of February 14, 2014 are reflected in the number of shares shown and in computing the percentage of Materion’s common stock beneficially owned by the person who owns those stock options and SARs.

Non-officer Directors | Number of Shares | Percent of Class | ||

Edward F. Crawford | — | * | ||

Joseph P. Keithley | 30,523 | (1) | * | |

Vinod M. Khilnani | 23,219 | (1) | * | |

William B. Lawrence | 23,056 | (1)(2) | * | |

N. Mohan Reddy | 34,482 | (1) | * | |

Craig S. Shular | 35,668 | (1) | * | |

Darlene J. S. Solomon | 8,346 | * | ||

Robert B. Toth | 6,755 | * | ||

Geoffrey Wild | 8,421 | (1) | * | |

Named Executive Officers | ||||

Richard J. Hipple | 321,300 | (2) | 1.5% | |

John D. Grampa | 123,939 | (2) | * | |

Gregory R. Chemnitz | 25,426 | (2) | * | |

All directors, director nominees and executive officers as a group (including the Named Executive Officers (12 persons) | 641,135 | (3) | 3.1% | |

Other Persons | ||||

Heartland Advisors, Inc. | 2,020,598 | (4) | 9.7% | |

789 North Water Street | ||||

Milwaukee, WI 53202 | ||||

BlackRock, Inc. | 1,927,263 | (5) | 9.2% | |

40 East 52nd Street | ||||

New York, NY 10022 | ||||

GAMCO Asset Management Inc. | 1,799,600 | (6) | 8.7% | |

One Corporate Center | ||||

Rye, NY 10580 | ||||

Opus Capital Management Inc. | 1,391,970 | (7) | 6.7% | |

221 East Fourth St., Suite 2700 | ||||

Cincinnati, OH 45202 | ||||

The Vanguard Group, Inc | 1,288,267 | (8) | 6.2% | |

100 Vanguard Blvd. | ||||

Malvern, PA 19355 | ||||

* | Less than 1% of common stock. |

(1) | Includes deferred shares under the Deferred Compensation Plans for Non-employee Directors as follows: Mr. Keithley 18,296, Mr. Khilnani 13,456, Mr. Lawrence 12,022, Dr. Reddy 19,878, Mr. Shular 32,457 and Mr. Wild 5,210. |

(2) | Includes shares covered by outstanding stock options and SARs exercisable within 60 days as follows: Mr. Hipple 178,464, Mr. Grampa 78,666, Mr. Chemnitz 1,373 and 2,000 for Mr. Lawrence. |

(3) | Includes 260,503 shares subject to outstanding options and SARs held by officers and directors and exercisable within 60 days. |

13

(4) | Heartland Advisers, Inc., an investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E), reported on a Schedule 13G/A filed with the Securities and Exchange Commission on February 6, 2014, that as of December 31, 2013, it had shared voting and shared dispositive power with respect to 2,020,598 shares. The Schedule 13G/A further indicates that William J. Nasgovitz, by virtue of his control of Heartland Advisors, Inc., may be deemed to beneficially own 2,020,598 shares. |

(5) | BlackRock, Inc. reported on a Schedule 13G filed with the Securities and Exchange Commission on January 30, 2014 that as of December 31, 2013, it had sole voting power with respect to 1,867,761 shares and sole dispositive power with respect to 1,927,263 shares. |

(6) | A Schedule 13D/A filed with the Securities and Exchange Commission on March 19, 2014 indicates that, as of March 19, 2014: (a) Gabelli Funds, LLC had sole voting and dispositive power with respect to 443,800 shares; (b) GAMCO Asset Management Inc. had sole voting power with respect to 1,096,000 shares and sole dispositive power with respect to 1,177,000 shares; and (c) Teton Advisors, Inc. had sole voting and dispositive power with respect 178,800 shares. The Schedule 13D/A further indicates that it was being filed by Mario J. Gabelli and various entities which he directly or indirectly controls or for which he acts as chief investment officer and that he, GSI and certain other entities named therein may be deemed to have beneficial ownership of the shares owned beneficially by each of the foregoing entities as well as certain other persons or entities named therein. |

(7) | Opus Capital Group, LLC, an investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E), reported on a Schedule 13G/A filed with the Securities and Exchange Commission on January 31, 2014, that as of December 31, 2013, it had sole voting power with respect to 959,842 shares and sole dispositive power with respect to 1,391,970 shares. |

(8) | The Vanguard Group, Inc., an investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E), reported on a Schedule 13G/A, filed with the Securities and Exchange Commission on February 11, 2014, that as of December 31, 2013, it had sole voting power with respect to 30,877 shares, shared dispositive power with respect to 29,777 shares and sole dispositive power with respect to 1,258,490 shares. The amount beneficially owned totals 1,288,267 shares. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, officers and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission. Directors, officers and greater than 10% shareholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Forms 3, 4 and 5 they file.

Based solely on our review of copies of forms that we have received, and written representations by our directors, officers and greater than 10% shareholders, all of our directors, officers and greater than 10% shareholders complied with all filing requirements applicable to them with respect to transactions in our equity securities during the fiscal year ended December 31, 2013 with the following exceptions. With respect to each of the named executive officers (NEOs) (Messrs. Hipple, Grampa and Chemnitz), on three occasions during 2012 and four occasions in 2013, a Form 4 reporting a dividend equivalent acquisition was not filed. With respect to each of the directors (Messrs. Keithley, Khilnani, Lawrence, Shular, Toth, Wild and Drs. Reddy and Solomon), on three occasions during 2013, a Form 4 reporting a dividend equivalent acquisition was not filed. For each NEO and director, these acquisitions were subsequently reported on Form 5.

14

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (CD&A) provides an overview of our executive compensation program and fiscal 2013 pay determinations for our three named executive officers (NEOs), as shown below:

Name Title

Richard J. Hipple Chairman, President and Chief Executive Officer

John D. Grampa Senior Vice President Finance and Chief Financial Officer

Gregory R. Chemnitz Vice President, General Counsel

As part of our ongoing effort to enhance shareholder communications, we have reformatted the CD&A to consist of the following three sections:

Section 1: Executive Summary - 2013 in Review

Section II: Overview of the Executive Compensation Program

Section III: Details and Analysis of the 2013 Executive Compensation Program

Section I: Executive Summary - 2013 in Review

During 2013, we continued to enhance the structure of our executive compensation program to reinforce key business objectives and to further strengthen the alignment between executive pay and both longer-term company performance and shareholder value creation. We also adhered to our pay-for-performance philosophy, as evidenced by (1) the year-over-year decline in short-term cash incentive (STI) award funding levels and payouts in 2013 based on financial performance that was below expectations and (2) the increased emphasis on performance-contingent long-term incentives (LTI). The Compensation Committee (Committee) also approved stock ownership guidelines for executive officers and non-employee directors, effective January 2014, which replaced previous guidelines, to further strengthen alignment with shareholder interests and best competitive practice.

2013 Say-On-Pay Vote

At our 2013 annual meeting of shareholders, we received approximately 86% approval, based on the total votes cast, for our annual advisory “Say-on-Pay” proposal to approve the compensation of our NEOs. The Committee considered the 2013 voting results at its meetings after the vote, and while it believes the voting results demonstrate significant support for our overall executive pay program, the Committee remains dedicated to continuously improving the existing executive pay programs and the governance environment surrounding the overall program. As a result, the Committee implemented executive pay and corporate governance changes described below for 2013 and beyond, to further align the Company's executive compensation program with best practices in the competitive market.

Recent Compensation Program Design Changes

The Committee approved the following changes to our compensation program design for 2013 and beyond:

• | Introduced a value-added sales metric (defined as sales less the cost of gold, silver, platinum, palladium, and copper), in addition to the existing operating profit measure, within our annual Management Incentive Plan (MIP) to allow for a more meaningful assessment of performance. The 2013 performance mix for our NEOs was tied 85% to operating profit and 15% to value-added sales; |

• | Re-allocated a portion (100% for our CEO and 50% for other NEOs) of the annual cash incentive award opportunity, formerly tied to one-year return on invested capital (ROIC) relative to peers, to longer-term equity-based incentives tied to our three-year actual versus targeted ROIC. The remaining 50% of this re-allocation for NEOs other than our CEO will occur in fiscal 2014; |

• | Increased the weighting on performance-based restricted stock units (PRSUs) to 50% (from 33% in 2012) of the total target long-term incentive award mix for our NEOs. The equity program for 2013 had four components, each equally weighted in terms of target award value, including stock appreciation rights (SARs), PRSUs tied to our relative total shareholder return (RTSR PRSUs), PRSUs tied to our absolute return on invested capital (ROIC PRSUs) and time-based restricted stock units (RSUs). Including PRSUs and SARs, 75% of the total target LTI award mix for our NEOs is “at risk”, up from 66.7% in 2012; |

15

• | Established stock ownership guidelines and share holder requirements, effective January 1, 2014, for executives (including our NEOs) and non-employee directors, which replaced previous share retention guidelines, to further promote long-term equity ownership and to strengthen alignment with shareholder interests; and |

• | Received shareholder approval to qualify the Management Incentive Plan for the qualified "performance-based compensation" exemption under Code Section 162(m). Beginning in 2014, and based on current tax law, annual cash incentive awards to our CEO and other qualifying "covered employees" are designed to permit them to be fully tax deductible to the Company. |

Corporate Governance Changes

Over the past several years, the committee has made a number of executive pay and related corporate governance changes to further align our executive compensation program with best competitive practice. These changes include:

• | elimination of the "modified single trigger" provision from all future severance agreements with new executives; |

• | allowed the excise tax gross-up provisions in existing severance agreements to expire and will exclude them from any new agreements; |

• | elimination of all executive perquisite programs, other than periodic executive physicals, for the NEOs; |

• | implementation of a "double trigger" for all new equity grants beginning in 2011 which will require both a change in control and subsequent qualifying employment termination to take place prior to the vesting of the equity associated with the grants in the event of a change in control. We also increased the change in control beneficial ownership percentage trigger to 30%; and |

• | implementation of a formal clawback policy that goes beyond the existing provisions contained in our equity award agreements and mandates of the Sarbanes-Oxley Act of 2002. When regulations for clawbacks are promulgated by the SEC and New York Stock Exchange (NYSE), we will modify our policy accordingly to ensure compliance with new regulations. |

2013 Company Performance Overview

During 2013, our financial performance continued to be adversely impacted by challenging market conditions, including a significant decrease in defense orders across several business segments and competitive pricing pressures. Our results were also adversely impacted by inventory security issues relating to precious metals at our Albuquerque, New Mexico facility and equipment design "start up" delays at our Elmore, Ohio beryllium pebble plant.

As a result, our operating profit declined by approximately 27% year over year, and value-added sales decreased by about 1%. During the second quarter of 2013, we increased our quarterly dividend from $0.075 per share to $0.08 per share, and our full-year total shareholder return (including stock price appreciation plus dividends) increased by 187%. Year-over-year comparisons are summarized in the following table:

Metric ($ in millions) | 2012 | 2013 | % Change | |||

Operating Profit | $36.8 | $26.8 | (27.2)% | |||

Value-added Sales | $615.6 | 609.1 | (1.1)% | |||

Quarterly Dividend Per Common Share | $0.075 | $0.08 | 6.7% | |||

Total Shareholder Return | 7.3% | 21% | 21% | |||

As described later in this CD&A, our NEOs earned approximately 21% of their target award opportunities for 2013, down from approximately 26% of target awards for 2012. In terms of award funding relative to target, this represented a reduction of approximately 19%. Year-over-year declines in actual incentive payouts were even greater, with a 39.8% reduction for our CEO, partially due to the re-allocation of a portion of annual incentive award opportunities to longer-term incentives.

During 2013, we made progress on new product development initiatives, significantly improved our Net Promoter Score (customer loyalty index) and achieved a record safety performance for the Company. We also reduced costs through various restructuring activities, including plant closings and consolidations, product rationalization actions, significant supply chain savings as well as debt refinancing. These activities are expected to improve our profitability and growth in 2014 and beyond.

2013 CEO Pay-At-A-Glance

As shown in the following chart, total direct compensation for our CEO for 2013 was below target due to the annual incentive award earned based on 2013 performance. Consistent with our pay-for-performance philosophy, 75% of the target LTI award opportunity is “at risk” and subject to performance criteria tied to long-term company performance and shareholder value creation. Actual values for these LTI grants may be higher or lower than the reported grant date values below, and will be determined after the end of the applicable three-year performance cycles and vesting periods.

16

*Reported total pay 19% below target primarily due to smaller earned STI award based on performance

Section II: Overview of the Executive Compensation Program

Compensation Philosophy and Objectives

Our long-standing compensation philosophy has three key objectives:

• | attract, motivate and retain key executives with the ability to profitably grow our business portfolio; |

• | build a pay-for-performance environment with total pay levels targeted at the competitive market median; and |

• | provide opportunities for share ownership to align the interests of our executives with our shareholders. |

Primary Components of the Executive Compensation Program

To achieve these objectives, our executive compensation program includes the following primary components:

Component | Purpose / Objective | Performance Linkage | Form of Payout | |||

Base Salaries | Provide a fixed, competitive level of pay based on responsibility, qualifications, experience and performance | Moderate; merit increases are based on individual performance | Cash | |||

Short-term Cash Incentives (STI) | Align variable pay with short-term performance in support of our annual business plan and strategic objectives | Strong; awards are tied to pre-established objective goals. | Cash | |||

Long-term Incentives (LTI) including: SARs, PRSUs and RSUs: | Align variable pay with longer- term, sustained performance and shareholder value creation; enhance executive retention and provide an equity stake to further align with shareholder interests | Strong; PRSUs represent 50% of the total target award opportunity, and, including SARs, 75% of total target LTI is “at risk” | SARs, RSUs and PRSUs tied to RTSR versus peers are paid in equity. PRSUs tied to absolute ROIC are payable in either cash or equity | |||

Health, Welfare and Retirement Benefits | Provide for competitive health, welfare, and retirement needs and enhance executive retention. NEOs are also eligible for periodic executive physicals, but no other perquisites are provided | None | Retirement benefits are payable in cash following qualifying separation from service | |||

17

Target Total Pay Mix

Due to our long-standing pay-for-performance philosophy, the Committee has set salaries as a relatively small part of total compensation for the NEOs and has provided a significant portion of NEO total pay in the form of equity-based LTI, including grants of SARs, PRSUs and RSUs that more closely aligns management's interests with those of our shareholders. In 2013, performance-based grants represented 75% of the target equity opportunities offered to our NEOs.

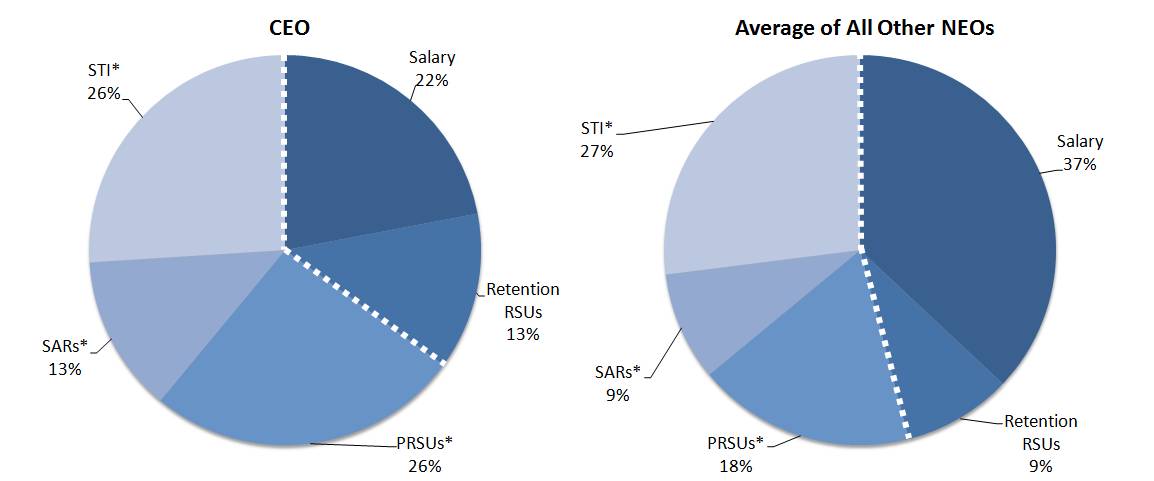

The following charts summarize the target total pay mix for our CEO and the average target total pay mix for our other NEOs.

*Variable Pay Tied to Performance

As shown above, the majority of the target mix is tied to variable, performance-based incentives, with considerable emphasis on equity-based LTI. Overall, the charts illustrate the following:

• | long-term incentives represent 52% of the total target pay mix for our CEO, with 48% provided in the form of cash-based, short-term pay (the combination of salary and target STI); |

• | long-term incentives represent 36% of the total average target pay mix for our other NEOs, with 64% provided in the form of cash-based short-term pay. The emphasis on LTI will increase in 2014 as an additional portion of incentive award opportunities for our other NEOs is re-allocated from STI to equity-based LTI; and |

• | performance-based pay (the combination of target STI, SARs and PRSUs) equals 65% of target total pay for our CEO and averages 54% of target total pay for our other NEOs, versus fixed pay (salary and RSUs) of 35% and 46%, respectively. |

Our Commitment to Sound Corporate Governance

The Committee works to ensure that our executive compensation program adheres to sound corporate governance and best competitive practices. The following table highlights our shareholder-friendly corporate governance practices:

What We Do | What We Don’t Do | |

NEO pay is targeted at the median relative to comparably sized organizations | No multi-year guarantees for salary increases, bonuses or incentives, or equity grants | |

Target mix places primary emphasis on variable incentives to align pay with performance | No excessive benefits or NEO perquisites, other than periodic executive physicals | |

Incentives are tied to pre-established, objective goals, with no payouts for below-threshold performance | No excise or other tax gross-ups in current or future NEO employment agreements | |

Majority of LTI awards are “at risk”, with 50% based on PRSUs tied to three-year performance goals | No repricing of SARs or stock options without prior shareholder approval | |

Beginning in 2014, NEOs are subject to mandatory stock ownership guidelines (which replaced previous guidelines) along with stock holding requirements | Effective in 2013, there are no single trigger provisions in the event of a change in control for cash severance or equity award agreements | |

Incentive awards to NEOs are subject to a formal clawback policy | No dividends paid on unearned PRSUs | |

Share hedging or pledging activities are prohibited | ||

18

The Compensation Committee and its Role in Determining Executive Pay

The Committee is responsible for the design and oversight of our executive compensation programs covering NEOs. All of the members of the Committee are independent, non-employee directors as defined by the rules of the New York Stock Exchange. The Committee makes policy and strategic recommendations to the Board of Directors (the “Board”) and has authority delegated from the Board to:

• | implement executive pay decisions; |

• | design the base pay, incentive pay and benefit programs for the top executives; and |

• | oversee the equity incentive plans. |

The Committee met six times in 2013 and most meetings included an executive session during which management was not present. Most compensation decisions are finalized in the first quarter of each fiscal year. The Committee Charter, which sets forth the Committee's responsibilities on a more comprehensive basis, is available under the “Corporate Governance” tab at http://materion.com and is reviewed on an annual basis to ensure it continues to satisfy changing corporate governance requirements and expectations. This charter was most recently amended in February 2014.