Exhibit 99.2

Protect your brand. Grow your business. Second Quarter 2023 Investor Conference Call August 10, 2023 www.VerifyMe.com NASDAQ:VRME 1

Agenda NASDAQ:VRME 01 Welcome & Introductions Operations and Strategic Update Financial Review Q&A Closing Remarks 02 03 www.VerifyMe.com 04 05 2

Forward Looking Statements In addition to historical information, this presentation contains statements relating to the acquisitions of PeriShip , LLC and Trust Codes Limited, by VerifyMe, Inc . and integration of the companies, anticipated synergies of the acquisitions, revenue opportunities, anticipated revenue, profitability of the combined company, future business, financial performance, future catalysts and future events or developments, strategy, projected costs, prospects, plans, objectives of management and future operations, future revenue, and expected market growth of VerifyMe, Inc . together with its wholly owned subsidiaries PeriShip Global LLC and Trust Codes Global Limited, (“VerifyMe,” the “ Company,” “we,” or “us”) that may constitute “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . The words "believe," "may," "will," “beginning,” "expect" and similar expressions, as they relate to us, are intended to identify forward - looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . Important factors that could cause actual results to differ from those in the forward - looking statements include our engagement in future acquisitions or strategic partnerships that increase our capital requirements or cause us to incur debt or assume contingent liabilities, the successful integration of our acquisitions (including the assets of PeriShip Global and Trust Codes Global), our reliance on one key strategic partner for shipping services in our Precision Logistics segment, competition including by our key strategic partner, seasonal trends in our business, severe climate conditions, the highly competitive nature of the industry in which we operate, our brand image and corporate reputation, impairments related to our goodwill and other intangible assets, economic and other factors such as recessions, downturns in the economy, inflation, global uncertainty and instability, the effects of pandemics, changes in United States social, political, and regulatory conditions and/or a disruption of financial markets, reduced freight volumes due to economic conditions, reduced discretionary spending in a recessionary environment, global supply - chain delays or shortages, fluctuations in labor costs, raw materials, and changes in the availability of key suppliers, our history of losses, our ability to use our net operating losses to offset future taxable income, the confusion of our name brand with other brands, the ability of our technology to work as anticipated and to successfully provide analytics logistics management, our ability to manage our growth effectively, our ability to successfully develop and expand our sales and marketing capabilities, risks related to doing business outside of the U . S . , intellectual property litigation, our ability to successfully develop, implement, maintain, upgrade, enhance, and protect our information technology systems, our reliance on third - party information technology service providers, our ability to respond to evolving laws related to information technology such as privacy laws, risks related to deriving revenue from some clients in the cannabis industry, our ability to retain key management personnel, our ability to work with partners in selling our technologies to businesses, production difficulties, our inability to enter into contracts and arrangements with future partners, our ability to acquire new customers, issues which may affect the reluctance of large companies to change their purchasing of products, acceptance of our technologies and the efficiency of our authenticators in the field, our ability to comply with the continued listing standards of the Nasdaq Capital Market, and our ability to timely pay amounts due and comply with the covenants under our debt facilities . More detailed information about these factors may be found in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10 - K for the year ended December 31 , 2022 , and subsequent Quarterly Reports on Form 10 - Q . The statements made herein speak only as of the date of this presentation . The Company’s actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward - looking statements . The Company undertakes no obligation to update or revise its forward - looking statements to reflect events or circumstances after the date of this presentation, except as required by law . Market data and industry information used herein are based on our management's knowledge of the industry and the good faith estimates of management . We also relied, to the extent available, upon managements review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third - party sources . All of the market data and industry information used herein involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates . Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information . Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described, above . These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties . Non - GAAP Financial Measures This presentation includes non - GAAP financial information . This non - GAAP information is in addition to, not a substitute for or superior to, measures of financial performance or liquidity determined in accordance with GAAP . The Securities and Exchange Commission‘s Regulation G applies to any public disclosure or release of material information that includes a non - GAAP financial measure and requires : ( i ) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non - GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP . The required presentations and reconciliations are contained in this presentation and can also be found at our website at www . verifyme . com 3 www.VerifyMe.com NASDAQ:VRME

Welcome Adam Stedham Chief Executive Officer and President www.VerifyMe.com NASDAQ:VRME – Remarks – Future Outlook 4

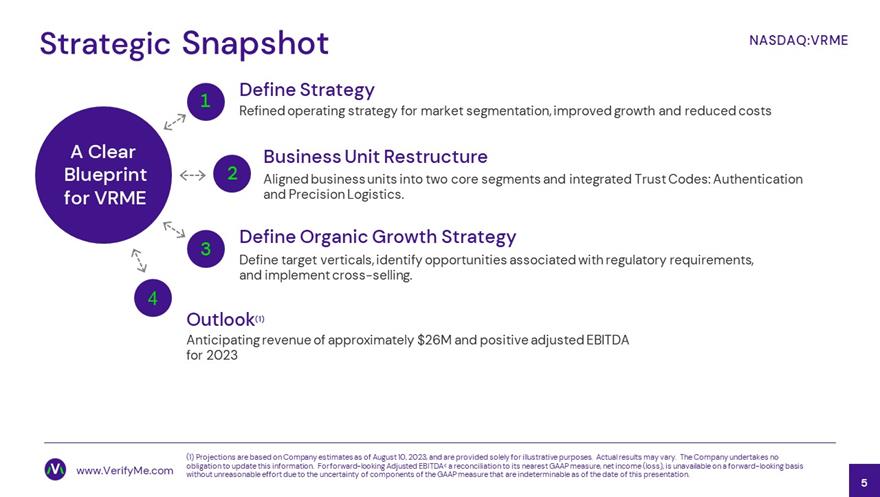

A Clear Blueprint for VRME Define Strategy 1 Refined operating strategy for market segmentation, improved growth and reduced costs Business Unit Restructure Aligned business units into two core segments and integrated Trust Codes: Authentication and Precision Logistics. Define Organic Growth Strategy Define target verticals, identify opportunities associated with regulatory requirements, and implement cross - selling. 3 2 Strategic Snapshot 5 www.VerifyMe.com NASDAQ:VRME 4 Outlook (1) Anticipating revenue of approximately $26M and positive adjusted EBITDA for 2023 (1) Projections are based on Company estimates as of August 10, 2023, and are provided solely for illustrative purposes. Act ual results may vary. The Company undertakes no obligation to update this information. For forward - looking Adjusted EBITDA< a reconciliation to its nearest GAAP measure, net i ncome (loss), is unavailable on a forward - looking basis without unreasonable effort due to the uncertainty of components of the GAAP measure that are indeterminable as of the date o f t his presentation.

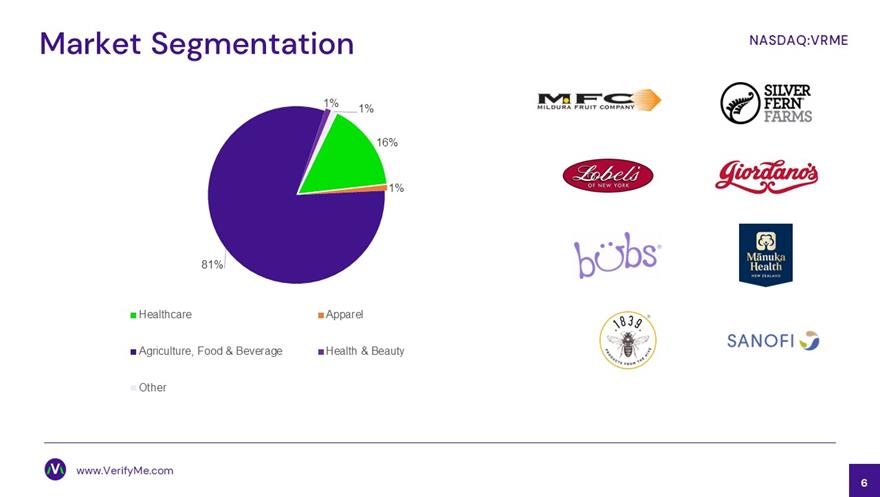

A Clear Blueprint for VRME Market Segmentation 16% 1% 81% 1% 1% Healthcare Apparel Agriculture, Food & Beverage Health & Beauty Other 6 www.VerifyMe.com NASDAQ:VRME

Financials www.VerifyMe.com NASDAQ:VRME – Q2 2023 Financial Highlights – SG&A Expenses – Balance Sheet 7

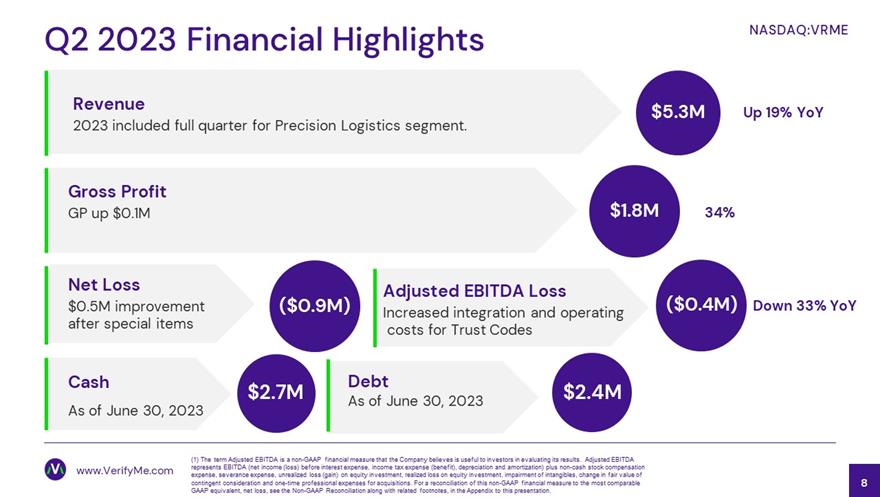

Q2 2023 Financial Highlights Revenue 2023 included full quarter for Precision Logistics segment. $5.3M Net Loss $0.5M improvement after special items Cash As of June 30, 2023 Debt As of June 30, 2023 ($0.4M) $2.7M $2.4M Gross Profit GP up $0.1M $1.8M Up 19% YoY Down 33% YoY 34% (1) The term Adjusted EBITDA is a non - GAAP financial measure that the Company believes is useful to investors in evaluating its results. Adjusted EBITDA represents EBITDA (net income (loss) before interest expense, income tax expense (benefit), depreciation and amortization) pl us non - cash stock compensation expense, severance expense, unrealized loss (gain) on equity investment, realized loss on equity realized loss on equity inve stm ent, impairment of intangibles, change in fair value of contingent consideration and one - time professional expenses for acquisitions. For a reconciliation of th is non - GAAP financial measure to the most comparable GAAP equivalent, net loss, see the Non - GAAP Reconciliation along with related footnotes, in the Appendix to this presentation. NASDAQ:VRME 8 www.VerifyMe.com ($0.9M) ($0.4M) Adjusted EBITDA Loss Increased integration and operating costs for Trust Codes

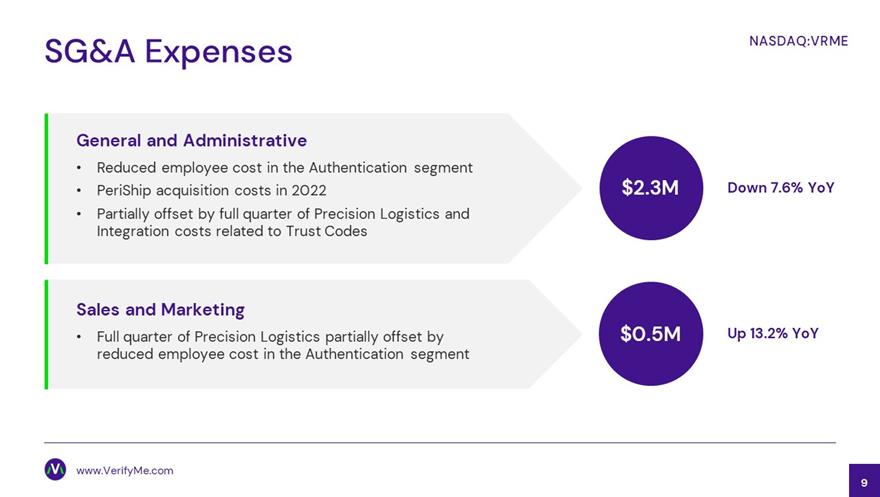

SG&A Expenses NASDAQ:VRME 9 www.VerifyMe.com General and Administrative • Reduced employee cost in the Authentication segment • PeriShip acquisition costs in 2022 • Partially offset by full quarter of Precision Logistics and Integration costs related to Trust Codes $2.3M $0.5M Down 7.6% YoY Up 13.2% YoY Sales and Marketing • Full quarter of Precision Logistics partially offset by reduced employee cost in the Authentication segment

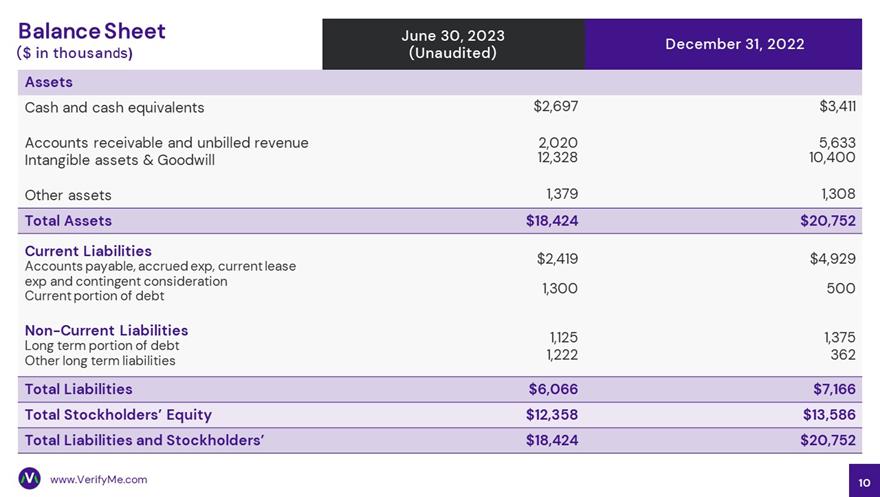

June 30, 2023 (Unaudited) December 31, 2022 Assets Cash and cash equivalents $2,697 $3,411 Accounts receivable and unbilled revenue Intangible assets & Goodwill 2,020 12,328 5,633 10,400 Other assets 1,379 1,308 Total Assets $18,424 $20,752 Current Liabilities Accounts payable, accrued exp, current lease exp and contingent consideration Current portion of debt $2,419 1,300 $4,929 500 Non - Current Liabilities Long term portion of debt Other long term liabilities 1,125 1,222 1,375 362 Total Liabilities $6,066 $7,166 Total Stockholders’ Equity $12,358 $13,586 Total Liabilities and Stockholders’ $18,424 $20,752 Balance Sheet ($ in thousan ds ) www.VerifyMe.com 10

11 Q & A 11 NASDAQ:VRME www.VerifyMe.com Confidential Property of VerifyMe

12 www.VerifyMe.com Confidential Property of VerifyMe NASDAQ:VRME Appendix

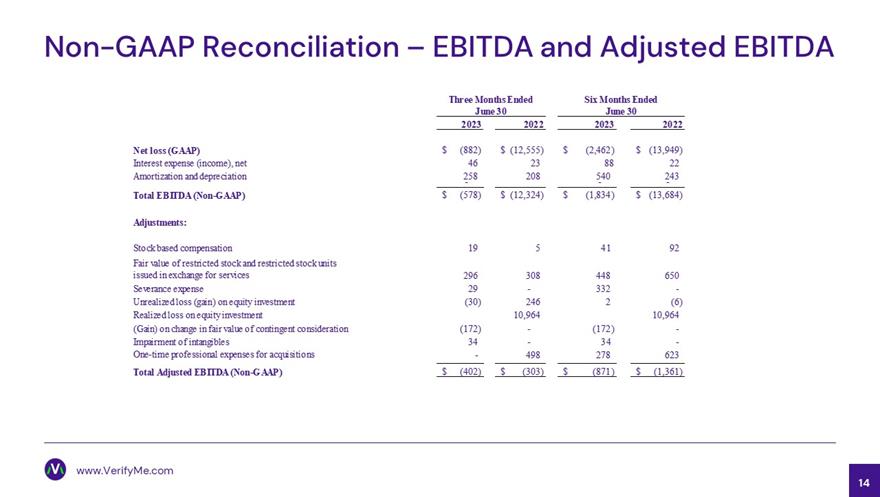

13 www.VerifyMe.com Non - GAAP Reconciliation This presentation includes both financial measures in accordance with U . S . generally accepted accounting principles (“GAAP”), as well as non - GAAP financial measures . Generally, a non - GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP . Non - GAAP financial measures should be viewed as supplemental to and should not be considered as alternatives to any other GAAP financial measures . They may not be indicative of the historical operating results of VerifyMe nor are they intended to be predictive of potential future results . Investors should not consider non - GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP . VerifyMe’s management uses and relies on EBITDA and Adjusted EBITDA, which are non - GAAP financial measures . The Company believes that both management and shareholders benefit from referring to EBITDA and Adjusted EBITDA in planning, forecasting and analyzing future periods . Additionally, the Company believes Adjusted EBIDTA is useful to investors to evaluate its results because it excludes certain items that are not directly related to the Company’s core operating performance . In particular, with regard to our comparison of Adjusted EBITDA for the three and six months ended June 30 , 2023 to the three and six months ended June 30 , 2022 , we believe that certain charges make a three and six month to three and six month comparison of net loss less useful to investors than a comparison of Adjusted EBITDA in understanding the results of operations . The Company’s management uses these non - GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period - to - period comparison . The Company’s management recognizes that EBITDA and Adjusted EBITDA, as non - GAAP financial measures, have inherent limitations because of the described excluded items . The Company defines EBITDA as net income (loss) before interest expense, income tax expense (benefit), and depreciation and amortization . Adjusted EBITDA represents EBITDA plus non - cash stock compensation expense, severance expense, unrealized (loss) gain on equity investment, realized loss on equity investment, impairment of intangibles, change in fair value of contingent consideration and one - time professional expenses for acquisitions . VerifyMe believes EBITDA and Adjusted EBITDA are important measures of VerifyMe’s operating performance because they allow management, investors and analysts to evaluate and assess VerifyMe’s core operating results from period - to - period after removing the impact of items of a non - operational nature that affect comparability . A reconciliation of EBITDA and Adjusted EBITDA to the most comparable financial measure, net loss, calculated in accordance with GAAP is included in the table on the next slide . The Company believes that providing the non - GAAP financial measures, together with the reconciliation to GAAP, helps investors make comparisons between VerifyMe and other companies . In making any comparisons to other companies, investors need to be aware that companies use different non - GAAP measures to evaluate their financial performance . Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules as the presentation here may not be comparable to other similarly titled measures of other companies .

14 www.VerifyMe.com Non - GAAP Reconciliation – EBITDA and Adjusted EBITDA 2023 2022 2023 2022 Net loss (GAAP) (882)$ (12,555)$ (2,462)$ (13,949)$ Interest expense (income), net 46 23 88 22 Amortization and depreciation 258 208 540 243 - - - Total EBITDA (Non-GAAP) (578)$ (12,324)$ (1,834)$ (13,684)$ Adjustments: Stock based compensation 19 5 41 92 Fair value of restricted stock and restricted stock units issued in exchange for services 296 308 448 650 Severance expense 29 - 332 - Unrealized loss (gain) on equity investment (30) 246 2 (6) Realized loss on equity investment 10,964 10,964 (Gain) on change in fair value of contingent consideration (172) - (172) - Impairment of intangibles 34 - 34 - One-time professional expenses for acquisitions - 498 278 623 Total Adjusted EBITDA (Non-GAAP) (402)$ (303)$ (871)$ (1,361)$ Three Months Ended June 30 Six Months Ended June 30

Protect your brand. Grow your business. US Headquarters 801 International Parkway Fifth Floor Lake Mary, FL 32746 +1 585 736 9400 info@ verifyme.com 15