Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on November 1, 2011

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

under

THE SECURITIES ACT OF 1933

|

|

|

UNILEVER N.V.

(Exact name of Registrant as specified in its charter) |

|

UNILEVER PLC

(Exact name of Registrant as specified in its charter) |

THE NETHERLANDS

(State or other jurisdiction of incorporation or organization) |

|

ENGLAND

(State or other jurisdiction of incorporation or organization) |

None

(I.R.S. Employer Identification Number) |

|

None

(I.R.S. Employer Identification Number) |

WEENA 455

3013 AL Rotterdam

The Netherlands

Tel. No.: 011-31-10-217-4000

(Address and telephone number of

Registrant's principal executive offices) |

|

UNILEVER HOUSE

100 VICTORIA EMBANKMENT

BLACKFRIARS

London EC4Y 0DY, England

Tel. No.: 011-44-20-7822-5252

(Address and telephone number of

Registrant's principal executive offices) |

UNILEVER UNITED STATES, INC.

(Exact name of Registrant as specified in its charter) |

|

UNILEVER CAPITAL CORPORATION

(Exact name of Registrant as specified in its charter) |

Delaware

(State or other jurisdiction of incorporation or organization) |

|

Delaware

(State or other jurisdiction of incorporation or organization) |

13-2915928

(I.R.S. Employer Identification Number) |

|

13-3153661

(I.R.S. Employer Identification Number) |

700 Sylvan Avenue

Englewood Cliffs, New Jersey 07632

Tel. No.: (201) 894-7135

(Address and telephone number of

Registrant's principal executive offices) |

|

700 Sylvan Avenue

Englewood Cliffs, New Jersey 07632

Tel. No.: (201) 894-7135

(Address and telephone number of

Registrant's principal executive offices) |

RONALD M. SOIEFER

Senior Vice President, Secretary and General Counsel

UNILEVER UNITED STATES, INC.

700 Sylvan Avenue

Englewood Cliffs, New Jersey 07632

Tel. No.: (201) 894-2750

(Name, address and telephone number of agent for service)

Copies to:

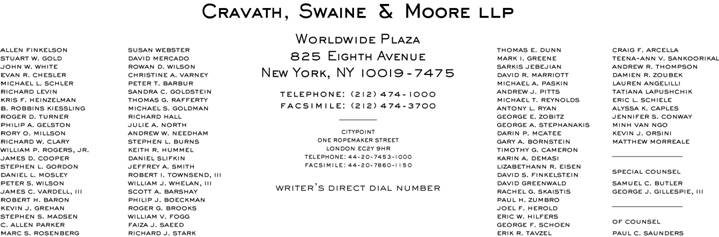

LIZABETHANN R. EISEN, ESQ.

CRAVATH, SWAINE & MOORE LLP

Worldwide Plaza

825 Eighth Avenue

New York, NY 10019

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

Title of each class

of securities to be registered

|

|

Amount to be

registered

|

|

Proposed maximum

offering price per

unit

|

|

Proposed maximum

aggregate offering

price

|

|

Amount of

registration fee

|

| |

| Guaranteed Debt Securities |

|

|

|

|

|

|

|

|

| |

| Guarantees—Constituting Guarantees of Debt Securities(3) |

|

|

|

|

|

(1)(2) |

|

|

| |

| Ordinary Shares, €0.16 par value of Unilever N.V.(4) |

|

|

|

|

|

|

|

|

| |

- (1)

- An indeterminate aggregate initial offering price or number of the securities of each identified class is being

registered. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities.

- (2)

- Pursuant

to Rule 415(a)(6), $6,250,000,000 aggregate principal amount of securities which were registered on registration statement

333-12592 and remain unsold are included in this registration statement. A filing fee of $1,319,700 was paid with respect to such unsold securities. In accordance with Rules 456(b)

and 457(r) the registrant is deferring payment of all other registration fees.

- (3)

- Guaranteed

Debt Securities issued by Unilever N.V. will be guaranteed, jointly, severally, fully and unconditionally by Unilever PLC and

Unilever United States, Inc. Guaranteed Debt Securities issued by Unilever Capital Corporation will be guaranteed jointly, severally, fully and unconditionally by Unilever N.V.,

Unilever PLC and Unilever U.S. No separate consideration will be received from investors for the Guarantees.

- (4)

- Also

being registered are such currently indeterminate number of Ordinary Shares as may be issuable upon or in connection with the conversion of the Debt

Securities being registered hereunder or in prior registration statements if any such Debt Securities shall be convertible Debt Securities.

Table of Contents

PROSPECTUS

Unilever N.V.

Unilever Capital Corporation

Guaranteed Debt Securities

Payment

of Principal, Premium, if any,

and Interest, if any, Guaranteed Jointly, Severally, Fully

and Unconditionally by

Unilever United States, Inc.,

Unilever N.V. and Unilever PLC

From time to time, we may sell guaranteed debt securities on terms we will determine at the times we sell the guaranteed debt securities. When we

decide to sell a particular series of guaranteed debt securities, we will prepare and deliver a supplement to this prospectus describing the particular terms of the guaranteed debt securities we are

offering. Payment of principal, premium, if any, and interest, if any, with respect to the guaranteed debt securities will be guaranteed by Unilever United States, Inc., and either or both of

Unilever N.V. and Unilever PLC (depending on whether Unilever N.V. is the issuer of a particular series of debt securities). At the option of Unilever Capital Corporation or

Unilever N.V., as the case may be, any series of the guaranteed debt securities and the guarantees on such series may be subordinated to all Senior Debt of the issuer and guarantors of such

series and/or may be convertible into Ordinary Shares, par value €0.16 per share, of Unilever N.V.

We

may sell the guaranteed debt securities directly, through agents, through underwriters or dealers, or through a combination of such methods. If we elect to use agents, underwriters or

dealers in any offering of guaranteed debt securities, we will disclose their names and the nature of our arrangements with them in the prospectus supplement we prepare for such offering. Our net

proceeds from such sale will also be set forth in the prospectus supplement we prepare for such offering.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these

securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is November 1, 2011.

Table of Contents

Unilever N.V. and Unilever PLC and their group companies are together referred to in this prospectus as "Unilever", the "Unilever Group" or

the

"Group". For such purposes "group companies" means, in relation to Unilever N.V. and Unilever PLC, those companies required to be consolidated in accordance with Netherlands and United

Kingdom legislative requirements relating to consolidated accounts. Unilever N.V. and Unilever PLC and their group companies together constitute a single group for the purpose of meeting

those requirements.

In

this prospectus references to "U.S.$", "U.S. Dollars" and "United States Dollars" are to the lawful currency of the United States of America, references to "£" and "pounds

sterling" are to the lawful currency of the United Kingdom, references to "€" and "euro" are to the lawful currency of the member states of the European Monetary Union that have

adopted or that adopt the single currency in accordance with the Treaty establishing the European Community, as amended by the Treaty on European Union (the "Treaty").

TABLE OF CONTENTS

ENFORCEMENT OF CIVIL LIABILITIES

AGAINST FOREIGN PERSONS

Unilever N.V. is a Netherlands corporation and Unilever PLC is a company incorporated under the laws of and registered in

England and Wales. Most of the directors of Unilever N.V. and Unilever PLC and certain of the experts named in this Prospectus are residents of The Netherlands or the United Kingdom or

other countries and all or a substantial portion of their respective assets are located outside the United States. As a result, it may not be possible for investors to effect service of process within

the United States upon Unilever N.V., Unilever PLC or such persons with respect to matters arising under the Federal securities laws or to enforce against them judgments of courts of the

United States predicated upon civil liability under the Federal securities laws. Unilever N.V. has been advised by its Dutch counsel, De Brauw Blackstone Westbroek London B.V., that a claim

based solely upon Federal securities laws may not be enforceable in a Dutch court and that, in addition, a judgement of a United States court, whether or not based solely upon Federal securities laws,

will not be enforceable in the Netherlands, although a Dutch court may give binding effect to such judgement if certain conditions are satisfied. Unilever PLC has been advised by its English

counsel, Slaughter and May, that there is doubt as to the enforceability in the United Kingdom, in original actions or in actions for enforcement of judgments of United States courts, of liabilities

predicated solely upon the Federal securities laws. Unilever N.V. and Unilever PLC have consented to service of process in New York City for claims based upon the Indenture, the debt

securities and the guarantees described under "Description of Debt Securities and Guarantees."

i

Table of Contents

WHERE YOU CAN FIND MORE

INFORMATION ABOUT US

Unilever N.V. and Unilever PLC file annual reports with and furnish other information to the SEC. You may read and copy

any document we file with or furnish to the SEC at the SEC's public reference room at 100 F Street, N. E., Washington, D.C., 20549. Please call the SEC at

1-800-SEC-0330 for further information on the public reference room. The SEC maintains an internet site that contains reports, proxy and information statements, and

other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

The

SEC allows us to "incorporate by reference" into this prospectus the information we file with or furnish to it, which means that we can disclose important information to you by

referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file with the SEC after the date of this prospectus

will automatically update and supersede the information in this prospectus. We incorporate by reference the documents listed below and any future filings made with the SEC under Section 13(a),

13(c) or 15(d) of the Securities Exchange Act of 1934, as well as any Form 6-K we furnish to the SEC which so provides, until our offering is completed (Unilever N.V.'s and

Unilever PLC's file numbers with the SEC are 1-4547 and 1-4546 respectively).

- •

- (a) Unilever N.V.'s Annual Report on Form 20-F for the year ended December 31, 2010;

- •

- (b) Unilever PLC's Annual Report on Form 20-F for the year ended December 31, 2010;

- •

- (c) Unilever N.V.'s Reports on Form 6-K furnished to the Securities and Exchange Commission on

March 4, 2011 (Annual Report and Accounts 2010), March 25, 2011 (Unilever sells Sanex and acquires laundry brands), March 30, 2011 (Chairman's Letter and Notice of Meeting; Voting

Instruction Form), April 1, 2011 (Unilever issues first-ever Renminbi Bond), April 13, 2011 (Settlement Reached with European Commission), May 5, 2011 (Trading

Statement First Quarter 2011), May 11, 2011 (Unilever Completes Alberto Culver Acquisition), October 21, 2011 (Half Year Results); and

- •

- (d) Unilever PLC's Reports on Form 6-K furnished to the Securities and Exchange Commission on

March 4, 2011 (Annual Report and Accounts 2010), March 25, 2011 (Unilever sells Sanex and acquires laundry brands), March 30, 2011 (Chairman's Letter and Notice of Meeting; Proxy

Form for Voting), April 1, 2011 (Annual Financial Report, Unilever issues first-ever Renminbi Bond, Annual Information update), April 13, 2011 (Settlement Reached with

European Commission), May 5, 2011 (Trading Statement First Quarter 2011), May 11, 2011 (Unilever Completes Alberto Culver Acquisition), June 7, 2011 (Publication of Prospectus,

Approval to Acquire Alberto Culver, Result of AGM, Director Declaration, Doc re. (Result of AGM)), October 21, 2011 (Half Year Results).

You

may request a paper copy of these filings, at no cost, by writing to or telephoning us at the following address:

Vice

President-Finance

Unilever United States, Inc.

800 Sylvan Avenue

Englewood Cliffs, New Jersey 07632

(201) 894-2829

1

Table of Contents

UNILEVER GROUP

UNILEVER N.V. AND UNILEVER PLC

UNILEVER N.V. AND UNILEVER PLC

Unilever N.V. ("N.V.") and Unilever PLC ("PLC") are the two parent companies of the Unilever Group of

companies. N.V. was incorporated under the name Naamlooze Vennootschap Margarine Unie in The Netherlands in 1927. PLC was incorporated under the name Lever Brothers Limited in England

and Wales in 1894.

Together

with their group companies, N.V. and PLC operate effectively as a single economic entity. This is achieved by a series of agreements between N.V.

and PLC (The Equalisation Agreement, The Deed of Mutual Covenants and The Agreement for Mutual Guarantees of Borrowing), together with special provisions in the Articles of Association

of N.V. and PLC. N.V. and PLC have the same Directors, have the same Chairman and adopt the same accounting principles. Shareholders of both companies receive dividends on

an equalised basis. N.V. and PLC and their group companies constitute a single reporting entity for the purposes of presenting consolidated accounts. Accordingly, the acounts of the

Unilever Group are presented by both N.V. and PLC as their respective consolidated accounts.

N.V.

and PLC have agreed to cooperate in all areas and ensure that all group companies act accordingly. N.V. and PLC are holding and service companies, and the

business activity of Unilever is carried out by their subsidiaries around the world. Shares in group companies may ultimately be held wholly by either N.V. or PLC, or jointly by the two

companies, in varying proportions.

The

two companies have different shareholder constituencies and shareholders cannot convert or exchange the shares of one company for shares of the other. N.V is listed in Amsterdam and

New York. PLC is listed in London and New York.

BUSINESS OF THE UNILEVER GROUP

Unilever is one of the world's leading suppliers of fast-moving consumer goods across foods and home and personal care

categories.

Unilever is organised in to four categories covering Food which includes Savoury, Spreads and Dressings; Refreshment which includes Ice

Cream and Beverages; Personal Care which consists of Skin, Deodorants, Oral and Hair; and Home Care. In addition we have our Foodsolutions business,

which is a global food service business providing solutions for professional chefs and caterers.

The

categories are responsible for the development of category and brand strategies, the development of brand communication, and the delivery of relevant innovation.

Foods:

- —

- Savoury, dressings and spreads includes sales of soups, bouillons, sauces, snacks, mayonnaise, salad dressings,

margarines, spreads and cooking products such as liquid margarines and some frozen foods. Our key brands here are Knorr, Hellmann's, Becel Flora (Healthy Heart), Rama Blue Band

(Family Goodness), Calvé, Wish-Bone, Amora,

Ragú, and Bertolli (other than

olive oil).

2

Table of Contents

Refreshment:

- —

- Ice cream and beverages includes ice cream sold under the international Heart brand, including Cornetto,

Magnum, Carte d'Or and Solero, Wall's, Kibon, Algida and Ola. Our portfolio also includes Ben & Jerry's,

Breyers, Klondike,

Good Humor and Popsicle. This category in addition covers tea-based beverages, where our

principal brands are Lipton, Brooke Bond and PG Tips.

This category also includes weight management products, principally Slim-Fast, and nutritionally

enhanced products sold in developing markets, including Annapurna and AdeS/AdeZ.

Personal

Care:

- —

- Six global brands are the core of our business in the mass skin care, daily hair care and deodorants product

areas—Dove, Lux, Rexona (including Sure and Degree), Sunsilk (including Seda/Sedal), AXE and Pond's. Other important brands

include Radox, Duschdas, Neutral, Suave, Clear, Lifebuoy and

Vaseline, together with Signal and Close Up in oral

care.

Home

Care:

- —

- The range includes laundry products (outside of North America), such as tablets, traditional powders and liquids for

washing of clothing by hand or machine. Our brands include OMO ("Dirt is Good" platform), Comfort, Radiant

and Skip. Our household care products include surface cleaners and bleach, sold under the Cif, Domestos and

Sun/Sunlight brands.

Unilever operates with a single global markets organisation under the Chief Operating Officer. There are eight geographical market

clusters within such organisation which are: Europe (including Central and Eastern Europe), North Asia (Greater China and North East Asia), South East Asia and Australasia, South Asia, Africa (Central

Africa and South Africa), North America, Latin America (including Mexico) and (as one market cluster) North Africa, Middle East, Turkey and Russia.

UNILEVER CAPITAL CORPORATION

Unilever Capital Corporation was incorporated under the laws of the State of Delaware on October 7, 1982 for the sole purpose of

issuing and selling debt securities and making the net proceeds of such issues available to companies in the Unilever Group. All the common stock of Unilever Capital Corporation is owned by Unilever

U.S. Its registered office is at 1209 Orange Street, Wilmington, Delaware 19801. Its principal place of business is at 700 Sylvan Avenue, Englewood Cliffs, New Jersey 07632.

The

Directors of Unilever Capital Corporation are:

|

|

|

| Neal Vorchheimer |

|

President |

| Ronald Soiefer |

|

Senior Vice President, Secretary and General Counsel |

| David Schwartz |

|

Vice President and Assistant Secretary |

The

business address of all Directors is 700 Sylvan Avenue, Englewood Cliffs, New Jersey 07632. Messrs. Vorchheimer, Soiefer and Schwartz are full-time employees

within the Unilever Group.

Unilever

Capital Corporation has no subsidiaries.

UNILEVER UNITED STATES, INC.

Unilever United States, Inc. ("UNUS") was incorporated with limited liability and unlimited duration under the laws of the State

of Delaware, United States of America, on 31st August 1977. UNUS has its registered office at 1209 Orange Street, Wilmington, Delaware 19801, United States of

3

Table of Contents

America.

The principal place of business of UNUS is at 800 Sylvan Avenue, Englewood Cliffs, New Jersey 07632, United States of America (telephone number +1 201 894

2829).

UNUS'

principal operating subsidiary, Conopco, Inc., a New York corporation, has three principal product categories, Food which include savouries, spreads and dressings; Refreshment

which includes ice cream and beverages, and Personal Care which consists of skin, deodorants and hair.

Brands:

Food

products include Lipton soups recipe products and side dishes; Wish-Bone salad dressings; Shedd's Spread,

Country

Crock, Promise and I Can't Believe It's Not Butter spreads, Ragu and Bertolli pasta sauces; Knorr bouillons,

gravies, sauces, recipe classics and side dishes: Hellmann's (and Best Foods') mayonnaise and dressings; Skippy peanut butter; Bertolli and PF Chang's frozen

meals.

Refreshment

products include Ben & Jerry's, Breyers, Good

Humor, Klondike, Magnum and Popsicle ice creams and frozen novelties; Lipton teas and Slim-Fast nutritional products to aid in weight management, including snack bars, shakes, shake mixes and meal bars.

Personal

care products include deodorants, hair and skin care products, as well as soap. Major brands include AXE, Dove personal care products; Suave, Lever 2000,

Caress, Degree, Pond's, Vaseline, St.

Ives, TRESemmé and TIGI; as well as Q-tips cotton swabs.

The

Directors of Unilever U.S. are:

|

|

|

| Kees Kruythoff |

|

President |

| Neal Vorchheimer |

|

Senior Vice President—Finance |

The

business address of all Directors is 700 Sylvan Avenue, Englewood Cliffs, New Jersey 07632, Messrs. Kruythoff and Vorchheimer are full-time employees within the

Unilever Group.

RATIOS OF EARNINGS TO FIXED CHARGES

The combined ratios of earnings to fixed charges for the Unilever Group for the periods shown are as follows. Such ratios have been

calculated using financial information prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union (EU) and in accordance with IFRS as issued by the

International Accounting Standard Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31 |

|

Six Months Ended June 30, 2011

|

|

2006 |

|

2007 |

|

2008 |

|

2009 |

|

2010 |

|

11.5 |

|

|

7.5 |

|

|

8.3 |

|

|

11.7 |

|

|

8.8 |

|

|

10.7 |

|

In

the ratio of earnings to fixed charges, earnings consist of net profit from continuing operations excluding net profit or loss of joint ventures and associates increased by fixed charges, income

taxes and dividends received from joint ventures and associates. Fixed charges consist of interest payable on debt and a portion of lease costs determined to be representative of interest. This ratio

takes no account of interest receivable although Unilever's treasury operations involve both borrowing and depositing funds.

4

Table of Contents

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the guaranteed debt securities for general purposes of the Unilever Group, including

acquisitions and to meet maturities of outstanding borrowings. The guaranteed debt securities will be offered pursuant to the Unilever Group's policy of diversifying the sources of international

capital available to it and the maturities of such capital.

DESCRIPTION OF DEBT SECURITIES AND GUARANTEES

The guaranteed debt securities will be issued by either Unilever Capital Corporation or Unilever N.V., as the case may be, under

an indenture (the "Indenture") between Unilever Capital Corporation, Unilever N.V., Unilever PLC, Unilever U.S., and The Bank of New York Mellon, as Trustee. The Indenture does not limit

the amount of debt securities that we may issue. We have summarized selected provisions of the Indenture and the guaranteed debt securities below. This summary is not complete. We have filed the form

of the Indenture with the SEC as an exhibit to the

Registration Statement of which this Prospectus is a part, and you should read the Indenture for provisions that may be important to you.

General

The guaranteed debt securities will rank equally with all other unsecured and unsubordinated debt, unless the prospectus supplement

states otherwise. The guarantees of Unilever N.V., Unilever PLC and Unilever U.S., as the case may be, will rank equally with all unsecured and unsubordinated debt of

Unilever N.V., Unilever PLC and Unilever U.S., as the case may be, unless the prospectus supplement states otherwise.

The

prospectus supplement relating to any series of debt securities being offered will include specific terms relating to the offering. These terms will include some or all of the

following:

- (a)

- the

issuer of the guaranteed debt securities (either Unilever N.V. or Unilever Capital Corporation);

- (b)

- the

title of the guaranteed debt securities;

- (c)

- the

total principal amount of the guaranteed debt securities;

- (d)

- the

date or dates on which the principal of and any premium on the guaranteed debt securities will be payable;

- (e)

- any

interest rate (which may be a floating rate), the date from which interest will accrue, interest payment dates and record dates for interest payments;

- (f)

- whether

the guaranteed debt securities shall be subordinated to the Senior Debt of the issuer;

- (g)

- any

provisions that would obligate us to redeem, purchase or repay guaranteed debt securities;

- (h)

- the

denominations in which we will issue the guaranteed debt securities;

- (i)

- whether

payments on the guaranteed debt securities will be payable in foreign currency or currency units or another form and whether payments will be

payable by reference to any index or formula;

- (j)

- any

changes or additions to the events of default or covenants described in this prospectus;

- (k)

- any

terms for the conversion or exchange of the guaranteed debt securities for Ordinary Shares of Unilever N.V. or other securities of Unilever Group

companies or any other entity; and

- (l)

- any

other terms of the guaranteed debt securities.

5

Table of Contents

Unless

otherwise stated in the related prospectus supplement, the principal of and the premium on, if any, and interest on, if any, registered guaranteed debt securities will be payable

and such guaranteed debt securities will be transferable at the corporate trust office in the City of New York of the Trustee, provided that payment of interest, if any, may be made by check mailed to

the address of the person entitled thereto as it appears in the Security

Register. In the case of bearer guaranteed debt securities, principal, premium, if any, and interest, if any, will be payable at such place or places outside the United States designated in the

related prospectus supplement. The guarantees are joint, several, full and unconditional.

Unless

otherwise indicated in the related prospectus supplement, we will issue the guaranteed debt securities only in fully registered form without coupons in denominations of $1,000 and

integral multiples of $1,000. No service charge will be made for any transfer or exchange of the guaranteed debt securities, but Unilever Capital Corporation or Unilever N.V., as the case may

be, may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

We

may sell the guaranteed debt securities at a discount (which may be substantial) below their stated principal amount. The guaranteed debt securities may bear no interest or interest

at a rate that at the time of issuance is below market rates.

If

we sell any of the guaranteed debt securities for any foreign currency or currency unit or if payments on the guaranteed debt securities are payable in any foreign currency or

currency unit, we will describe in the prospectus supplement the restrictions, elections, specific terms and other information relating to those guaranteed debt securities and the foreign currency or

currency unit.

Guarantees

If Unilever Capital Corporation issues the guaranteed debt securities, Unilever N.V., Unilever PLC and Unilever U.S. will

jointly, severally, fully and unconditionally guarantee the due and punctual payment of the principal of and premium on, if any, and interest on, if any, and the due and punctual payment of the

sinking fund or analogous payments, if any, with respect to the guaranteed debt securities when and as they shall become due and payable, whether at stated maturity, by declaration of acceleration,

call for redemption or otherwise. If Unilever N.V. issues the guaranteed debt securities, Unilever U.S. and Unilever PLC will act as guarantors on the same terms.

Interest on LIBOR Debt Securities

We may issue floating rate debt securities bearing interest calculated with reference to LIBOR. Interest on any LIBOR debt securities

will accrue from and including the date of

issuance of such LIBOR debt securities, to but excluding the first interest payment date and then from and including the most recent interest payment date to which interest has been paid or duly

provided for to but excluding the next interest payment date or maturity date, as the case may be. We refer to each of these periods as an "interest period." The amount of accrued interest that we

will pay for any interest period can be calculated by multiplying the face amount of the LIBOR debt security by an accrued interest factor. This accrued interest factor is computed by adding the

interest factor calculated for each day from the date of issuance of the LIBOR debt security, or from the last date we paid interest to you, to the date for which accrued interest is being calculated.

The interest factor for each day is computed by dividing the interest rate applicable to that day by 360.

When

we use the term "London business day," we mean any day on which dealings in United States dollars are transacted in the London interbank market. A "business day" means any day

except a Saturday, a Sunday or a legal holiday in The City of New York or a day on which banking institutions in The City of New York are authorized or obligated by law, regulation or executive order

to close. In the event that any interest payment date (other than the maturity date) and interest reset date would

6

Table of Contents

otherwise

fall on a day that is not a business day, that interest payment date and interest reset date will be postponed to the next day that is a business day. If the postponement would cause the day

to fall in the next calendar month, the interest payment date and interest reset date will be the immediately preceding business day.

The

interest rate on any LIBOR debt securities will be calculated by the calculation agent appointed by us, initially The Bank of New York Mellon, and will be equal to LIBOR plus a

spread that will be set forth in a prospectus supplement. The calculation agent will reset the interest rate on each interest payment date and on the original issuance date of the LIBOR debt

securities, each of which we refer to as an "interest reset date." The second London business day preceding an interest reset date will be the "interest determination date" for that interest reset

date. The interest rate in effect on each day that is not an interest reset date will be the interest rate determined as of the interest determination date pertaining to the immediately preceding

interest reset date. The interest rate in effect on any day that is an interest reset date will be the interest rate determined as of the interest determination date pertaining to that interest reset

date.

"LIBOR"

will be determined by the calculation agent in accordance with the following provisions:

(a) With

respect to any interest determination date, LIBOR will be the rate for deposits in United States dollars having a maturity of the Index Maturity commencing on the

first day of the applicable interest period that appears on Reuters Screen LIBOR01 Page as of 11:00 a.m., London time, on that interest determination date. If no rate appears, LIBOR for that

interest determination date will be determined in accordance with the provisions described in (b) below.

(b) With

respect to an interest determination date on which no rate appears on Reuters Screen LIBOR01 Page, as specified in (a) above, the calculation agent will

request the principal London offices of each of four major reference banks in the London interbank market, as selected by the calculation agent (after consultation with us), to provide the calculation

agent with its offered quotation for deposits in United States dollars for the Index Maturity, commencing on the first day of the applicable interest period, to prime banks in the London interbank

market at approximately 11:00 a.m., London time, on that interest determination date and in a principal amount that is representative for a single transaction in United States dollars in that

market at that time. If at least two quotations are provided, then LIBOR on that interest determination date will be the arithmetic mean of those quotations. If fewer than two quotations are provided,

then LIBOR on the interest determination date will be the arithmetic mean of the rates quoted at approximately 11:00 a.m., in The City of New York, on the interest determination date by three

major banks in The City of New York selected by the calculation agent (after consultation with us) for loans in United States dollars to leading European banks, having an Index Maturity and in a

principal amount that is representative for a single transaction in United States dollars in that market at that time. If, however, the banks selected by the calculation agent are not providing

quotations in the manner described by the previous sentence, LIBOR determined as of that interest determination date will be LIBOR in effect on that interest determination date.

"Reuters

Screen LIBOR01 Page" means the display designated as the Reuters Screen LIBOR01 Page, or such other screen as may replace the Reuters Screen LIBOR01 Page on the service

or any successor service as may be nominated by the British Bankers' Association for the purpose of displaying London interbank offered rates for United States dollar deposits.

The

Index Maturity will be disclosed in a prospectus supplement.

All

percentages resulting from any calculation of the interest rate on any LIBOR debt securities will be rounded to the nearest one hundred-thousandth of a percentage point with five one

millionths of a percentage point rounded upwards (e.g., 9.876545% (or .09876545) would be rounded to 9.87655% (or .0987655)), and all dollar amounts used in or resulting from such calculation

will be rounded to the

7

Table of Contents

nearest

cent (with one-half cent being rounded upward). Each calculation of the interest rate on any LIBOR debt securities by the calculation agent will (in the absence of manifest error)

be final and binding on the holders and us.

So

long as any LIBOR debt securities of a series remain outstanding, there will at all times be a calculation agent for that series. If the original calculation agent is unable or

unwilling to continue to act as the calculation agent or if it fails to calculate properly the interest rate for any interest period, we will appoint another leading commercial or investment bank to

act as calculation agent in its place. The calculation agent may not resign its duties without a successor having been appointed.

Payment of Additional Amounts

If any deduction or withholding for any present or future taxes, assessments or other governmental charges of the United Kingdom, The

Netherlands, or (if the prospectus supplement so states) the United States, including any political subdivision or taxing authority of or in any such jurisdiction (respectively, a "United Kingdom

Tax", a "Netherlands Tax", or a "United States Tax") shall at any time be required in respect of any amounts to be paid by the issuer or a guarantor pursuant to the terms of the debt securities, the

issuer or the guarantor will pay as additional interest to the holder of a debt security (or to the holder of any coupon appertaining thereto) such additional amounts ("Additional Amounts") as may be

necessary in order that the net amounts paid to such holder pursuant to the terms of such guaranteed debt security or such guarantee, after such deduction or withholding, shall be not less than such

amounts as would have been received by the holder had no such withholding or deduction been required; provided, however, that (a) amounts with

respect to United Kingdom Tax shall be payable only to holders that are not resident in the United Kingdom for purposes of its tax, (b) amounts with respect to Netherlands Tax shall be payable

only to holders that are not resident in The Netherlands for purposes of its tax, and (c) amounts with respect to United States Tax shall be payable only to a holder that is, for United States

tax purposes, a nonresident alien individual, a foreign corporation, or an estate or trust not subject to tax on a net income basis with respect to income on the debt securities (a "United States

Alien"), and provided further, that the issuer or guarantor shall not be required to make any payment of Additional Amounts for or on account

of:

- (a)

- any

tax, assessment or other governmental charge which would not have been imposed but for the existence of any present or former connection between such

holder (or between a fiduciary, settlor, beneficiary, member or shareholder of, or possessor of a power over, such holder, if such holder is an estate, trust, partnership or corporation) and the

United Kingdom, The Netherlands, or the United States (in the case of a United Kingdom Tax, a Netherlands Tax, or a United States Tax, respectively), or any political subdivision or territory or

possession thereof or therein or area subject to its jurisdiction, including, without limitation, such holder (or such fiduciary, settlor, beneficiary, member, shareholder or possessor) being or

having been a citizen or resident thereof or treated as a resident thereof or being or having been present or engaged in trade or business therein or having or having had a permanent establishment

therein;

- (b)

- any

estate, inheritance, gift, sales, transfer, personal property or similar tax, assessment or other governmental charge;

- (c)

- any

tax, assessment or other governmental charge which is payable other than by withholding from payments of (or in respect of) principal of, premium, if

any, or any interest on, the debt securities or coupons, if any;

- (d)

- with

respect to any United States Tax, any such tax imposed by reason of the holder's past or present status as a personal holding company, foreign personal

holding company or foreign private foundation or similar tax-exempt organization with respect to the United States or as a corporation which accumulates earnings to avoid United States

Federal income tax;

8

Table of Contents

- (e)

- with

respect to any United States Tax, any such Tax imposed by reason of such holder's past or present status as (i) the actual or constructive owner

of 10% or more of the total combined voting power of all classes of stock of Unilever Capital Corporation or Unilever U.S., or (ii) a controlled foreign corporation that is related to Unilever

Capital Corporation or Unilever U.S. through stock ownership;

- (f)

- any

tax, assessment or other governmental charge required to be withheld by any paying agent from any payment of principal of, premium, if any, or any

interest on, any guaranteed debt security or coupon, if any, if such payment can be made without such withholding by any other paying agent;

- (g)

- any

tax, assessment or other governmental charge which would not have been imposed or withheld if such holder had made a declaration of nonresidence or

other similar claim for exemption or presented any applicable form or certificate, upon the making or presentation of which that holder would either have been able to avoid such tax, assessment or

charge or to obtain a refund of such tax, assessment or charge, including, with respect to any United States Tax, certification or documentation to the effect that such holder or beneficial owner is a

United States Alien and lacks other connections with the United States;

- (h)

- any

tax, assessment or other governmental charge which would not have been imposed but for the presentation of a debt security (where presentation is

required) or coupon, if any, for payment on a date more than 30 days after the date on which such payment became due and payable or the date on which payment thereof was duly provided for,

whichever occurred later; or

- (i)

- any

combination of items (a), (b), (c), (d), (e), (f), (g) and (h) above;

nor

shall Additional Amounts be paid with respect to any payment of the principal of, premium, if any, or any interest on any debt security or coupon to any such holder who is a fiduciary or a

partnership or a beneficial owner who is other than the sole beneficial owner of such payment to the extent a beneficiary or settlor with respect to such fiduciary or a member of such partnership or a

beneficial owner would not have been entitled to such Additional Amounts had it been the holder of the debt security or coupon.

Redemption of Debt Securities Under Certain Circumstances

The issuer, and any guarantor, may redeem each series of guaranteed debt securities in whole but not in part at any time (except in the

case of guaranteed debt securities that have a variable rate of interest, which may be redeemed on any interest payment date), on giving not less than 30 nor more than 60 days' notice of such

redemption, at a redemption price equal to the principal amount plus accrued interest, if any, to the date fixed for redemption (except in the case of discounted debt securities which may be redeemed

at the redemption price specified by the terms of each series of such debt securities), if,

- (i)

- the

issuer or any guarantor of such series of guaranteed debt securities determines that, as a result of any change in or amendment to the laws or any

regulations or rulings promulgated thereunder of the United Kingdom, The Netherlands or the United States (or of any political subdivision or taxing authority of or in any such jurisdiction), or any

change in the application or official interpretation of such laws, regulations or rulings, or any change in the application or official interpretation of, or any execution of or amendment to, any

treaty or treaties affecting taxation to which any such jurisdiction is a party, which change, execution or

9

Table of Contents

Prior

to the publication of any notice of redemption pursuant to this provision, the issuer or the applicable guarantor shall deliver to the Trustee (i) a certificate signed by a

duly authorized officer of Unilever Capital Corporation or Unilever N.V., as the case may be, or the applicable guarantor stating that it is entitled to effect a redemption described in

clause (i) of the preceding paragraph and setting forth a statement of facts showing that the conditions precedent of the right so to redeem have occurred or (ii) an opinion of

independent legal counsel of recognized standing to the effect that the conditions specified in clause (ii) of the preceding paragraph have been satisfied. Such notice, once delivered to the

Trustee, will be irrevocable.

Limitation on Liens

The Indenture provides that Unilever N.V. and Unilever PLC will not, nor will they permit any Restricted Subsidiary (as

defined below) to, issue, assume or guarantee any

indebtedness for money borrowed ("debt") secured by a mortgage, security interest, pledge, lien or other encumbrance (a "mortgage" or "mortgages") on any Principal Property (as defined below) or upon

any shares of stock or indebtedness of any Restricted Subsidiary (whether such Principal Property, shares of stock or indebtedness are now owned or hereafter acquired) without in any such case

effectively providing concurrently with the issuance, assumption or guarantee of any debt that the guarantees shall be secured equally and ratably with (or prior to) the debt. These restrictions,

however, shall not apply to debt secured by (and there shall be excluded from debt in any computation under this limitation):

- (i)

- mortgages

on property, shares of stock or indebtedness of any corporation, which mortgages are existing at the time such corporation becomes a Restricted

Subsidiary;

- (ii)

- mortgages

on property, which mortgages are existing at the time of the acquisition of such property, and certain mortgages on property to finance the

acquisition thereof;

10

Table of Contents

- (iii)

- mortgages

on property to secure debt incurred to finance all or part of the cost of construction, alteration, or repair of, or improvements to, all or any

part of such property;

- (iv)

- mortgages

securing debt owing to any guarantor or any Restricted Subsidiary by any Restricted Subsidiary or any guarantor;

- (v)

- mortgages

on assets held by banks to secure amounts due to such banks in the ordinary course of business and certain statutory and other mortgages incurred

in the ordinary course of business or imposed by law;

- (vi)

- mortgages

on property in favor of the United Kingdom, Canada, the United States or The Netherlands or any political subdivision of any thereof, or any

department, agency or other instrumentality of any thereof, to secure partial, progress, advance or other payments pursuant to the provisions of any contract or statute;

- (vii)

- mortgages

existing at the date of the execution of the Indenture;

- (viii)

- mortgages

incurred in connection with engaging in leveraged or single investor lease transactions;

- (ix)

- mortgages

on property, shares of stock or indebtedness of a corporation existing at the time such corporation is merged into or consolidated or amalgamated

with Unilever N.V., Unilever PLC or a Restricted Subsidiary or at the time of a sale, lease or other disposition of the properties of a corporation as an entirety or substantially as an

entirety to Unilever N.V., Unilever PLC or a Restricted Subsidiary;

- (x)

- mortgages

on property incurred or assumed in connection with the issuance of revenue bonds, the interest on which is exempt from United States Federal

income taxation pursuant to Section 103 of the United States Internal Revenue Code, as amended from time to time; and

- (xi)

- extensions,

renewals or replacements (or successive extensions, renewals or replacements) in whole or in part of any mortgage referred to in the foregoing

clauses (i) through (x) inclusive.

Notwithstanding the foregoing, Unilever N.V. and Unilever PLC may, and they may permit a Restricted Subsidiary to, issue, assume or guarantee debt

secured by mortgages not excepted in the foregoing clauses (i) through (x) inclusive without equally and ratably securing the guarantees; provided,

however, that the aggregate principal amount of all such debt then outstanding, plus the principal amount of such debt then being issued, assumed or guaranteed, and the

aggregate amount of the Attributable Debt (as defined below) in respect of sale and leaseback transactions (with the exception of Attributable Debt which is excluded pursuant to clauses (i)

through (iv) inclusive described under "Limitations on Sales and Leasebacks" below), shall not exceed 10% of Capital Employed (as defined below).

Limitations on Sales and Leasebacks

The Indenture provides that Unilever N.V. and Unilever PLC will not, and will not permit any Restricted Subsidiary to,

enter into any transaction with any person for the leasing by Unilever N.V. or Unilever PLC or a Restricted Subsidiary of any Principal Property, the acquisition or the completion of

construction and commencement of full operation, whichever is later, of which has occurred more than 120 days prior thereto, which Principal Property has been or is to be sold or transferred by

Unilever N.V. or Unilever PLC or such Restricted Subsidiary to that person in contemplation of such leasing unless, after giving effect thereto, the aggregate amount of all Attributable

Debt with respect to all such transactions plus all debt secured by mortgages on Principal Properties (with the exception of debt which is excluded pursuant to clauses (i) through

(xi) inclusive described under "Limitation on Liens" above) would not exceed 10% of Capital Employed. This covenant shall not apply to, and there

11

Table of Contents

shall

be excluded from Attributable Debt in any computation under such restriction or under "Limitation on Liens" above, Attributable Debt with respect to any sale and leaseback transaction

if:

- (i)

- the

lease in such sale and leaseback transaction is for a term of not more than three years;

- (ii)

- Unilever N.V.,

Unilever PLC or the relevant Restricted Subsidiary, as the case may be, shall apply or cause to be applied an amount in cash

equal to the greater of the net proceeds of such sale or transfer or the fair value (as determined by the Board of Directors of Unilever N.V. and Unilever PLC) of such Principal Property

to the retirement (other than any mandatory retirement or by way of payment at maturity), within 120 days of the effective date of any such arrangement, of debt of Unilever N.V.,

Unilever PLC or Restricted Subsidiaries (other than debt owed by any Subsidiary), which by its terms matures more than 12 months after the date of the creation of such debt, or shall

apply such proceeds to investment in other Principal Properties within a period not exceeding 12 months prior or subsequent to any such arrangement;

- (iii)

- such

sale and leaseback transaction is entered into between any guarantor and a Restricted Subsidiary or between Restricted Subsidiaries or between

guarantors; or

- (iv)

- Unilever N.V.,

Unilever PLC or a Restricted Subsidiary would be entitled to incur a mortgage on such Principal Property pursuant to

clauses (i) through (xi) inclusive described under "Limitation on Liens" above, securing debt without equally and ratably securing the guarantees.

Subordination of Debt Securities

The prospectus supplement for any applicable series of guaranteed debt securities will provide that the guaranteed debt securities of

such series will be expressly subordinate and subject in right of payment to the prior payment in full of all Senior Debt (as defined below) of the issuer of such series (whether Unilever N.V.

or Unilever Capital Corporation), and the obligations of each guarantor of such series evidenced by the guarantees will be expressly subordinate and subject in right of payment to the prior payment in

full of all Senior Debt of the guarantor.

In

the event and during the continuation of any default in the payment of any Senior Debt of the issuer continuing beyond the period of grace, if any, specified in the instrument

evidencing such Senior Debt (unless and until such event shall have been cured or waived or shall have ceased to exist), no payments on account of principal, premium, if any, or interest if any, on

the subordinated debt securities or sums payable with respect to the conversion, if applicable, of such subordinated debt securities may be made by the issuer pursuant to the subordinated debt

securities.

In

the event and during the continuation of any default in the payment of any Senior Debt of any guarantor continuing beyond the period of grace, if any, specified in the instrument

evidencing such Senior Debt (unless and until such event shall have been cured or waived or shall have ceased to exist), no payments on account of principal, premium, if any, or interest, if any, on

the subordinated debt securities or sums payable with respect to the conversion, if applicable, of such subordinated debt securities may be made by the guarantor pursuant to its guarantee with respect

thereto.

Upon

any payment or distribution of the assets of the issuer (Unilever N.V. or Unilever Capital Corporation, as applicable) or the assets of any guarantor to creditors upon

dissolution or winding-up or total or partial liquidation or reorganization, whether voluntary or involuntary or in bankruptcy, insolvency, receivership or other proceedings for the issuer

or the guarantor, the holders of our Senior Debt or the Senior Debt of the guarantor, as the case may be, will be entitled to receive payment in full of all amounts due thereon before any payment is

made by us or the guarantor, as the case may be, on account of principal, premium, if any, or interest, if any, on the subordinated debt securities or sums payable with respect to the conversion, if

applicable, of such subordinated debt securities.

12

Table of Contents

By

reason of such subordination, in the event of the insolvency of the issuer (Unilever N.V. or Unilever Capital Corporation, as applicable) or any guarantor, holders of the

subordinated debt securities may recover less, ratably, and holders of Senior Debt may recover more, ratably, than other of our creditors or creditors of any guarantor.

The

term "Senior Debt," when used with reference to us or any guarantor, will be defined in the Indenture to mean the principal of, premium, if any, and interest, if any, which is due

and payable on:

- (a)

- all

of our indebtedness or all indebtedness of the guarantor, as the case may be (other than the subordinated debt securities or the guarantees), whether

outstanding on the date of execution of the Indenture or thereafter created, incurred or assumed, which

- (i)

- is

for money borrowed,

- (ii)

- is

evidenced by a note, debenture, bond or similar instrument, whether or not for money borrowed,

- (iii)

- constitutes

obligations under any agreement to lease, or any lease of, any real or personal property which are required to be capitalized on the balance

sheet of lessee in accordance with generally accepted United Kingdom and Dutch accounting principles applicable in the preparation of our most recent audited financial statements or the most recent

audited financial statements of the guarantor or made as part of any sale and leaseback transaction to which we are a party or the guarantor is a party, or

- (iv)

- constitutes

purchase money indebtedness;

- (b)

- any

indebtedness of others of the kinds described in the preceding clause (a) for the payment of which the issuer or the guarantor, as the case may

be, are responsible or liable as guarantor or otherwise; and

- (c)

- amendments,

renewals, extensions and refundings of any such indebtedness; unless in any instrument or instruments evidencing or securing such indebtedness

or pursuant to which the same is outstanding, or in any such amendment, renewal, extension or refunding, it is provided that such indebtedness is subordinate to all other of our indebtedness or the

indebtedness of the guarantor, as the case may be, or that such indebtedness is not superior in right of payment to the subordinated debt securities or the guarantees; provided, however, that Senior

Debt shall not be deemed to include any obligation of the issuer (Unilever N.V. or Unilever Capital Corporation,

as applicable) or any guarantor to any Subsidiary or to Unilever N.V. or Unilever PLC.

The

Indenture does not limit the amount of Senior Debt which the issuer (Unilever N.V. or Unilever Capital Corporation, as applicable) may issue, or that may be issued by either

issuer or any guarantor.

Conversion

The prospectus supplement for each series of guaranteed debt securities will provide whether the securities are convertible and, if so,

the conversion price and terms.

Glossary

"Attributable Debt" means, as to any particular lease under which Unilever N.V.,

Unilever PLC or any Restricted Subsidiary is at any time liable as lessee and at any date as of which the amount thereof is to be determined, the total net obligations of the lessee for rental

payments during the remaining term of the lease (including any period for which such lease has been extended or may, at the option of the lessor, be extended) discounted as provided in the Indenture.

13

Table of Contents

"Capital Employed" means the combined capital and reserves, outside interests in group companies, creditors due after more than one year

and provisions for liabilities and charges, as shown on our combined consolidated balance sheet as published in the most recent Annual Accounts of Unilever PLC and Unilever N.V. (as

defined in the Indenture).

"Principal Property" means any manufacturing or processing plant or warehouse located in the United States, Canada or the United Kingdom,

owned or leased by Unilever N.V., Unilever PLC or any Restricted Subsidiary, other than (i) any such property which, in the opinion of the Board of Directors of

Unilever N.V. and Unilever PLC, is not of material importance to the total business conducted by Unilever N.V. and Unilever PLC and their Subsidiaries and associated

companies, or (ii) any portion of such property which, in the opinion of the Board of Directors of Unilever N.V. and Unilever PLC, is not of material importance to the use or

operation of such property.

"Restricted Subsidiary" means any Subsidiary (i) substantially all the property of which is located, and substantially all the

operations of which are conducted, in the United States, Canada or the United Kingdom, and (ii) which owns or leases a Principal Property.

"Subsidiary" means any corporation which qualifies to be included as a group company of either Unilever N.V. or Unilever PLC

in the combined consolidated balance sheet of Unilever N.V. and Unilever PLC and their respective Subsidiaries as published in the most recent Annual Accounts of Unilever PLC and

Unilever N.V.

Modification of the Indenture

Unilever Capital Corporation, Unilever N.V., Unilever PLC, Unilever U.S. and the Trustee may modify and amend the

Indenture, with the consent of the holders of not less than 662/3% in aggregate principal amount of the outstanding securities of all series under the Indenture which are affected by

the modification or amendment (voting as one class); provided, however, that no such modification or amendment may, without the consent of the holder of

each such outstanding security of any series affected thereby, among other things:

- (a)

- change

the stated maturity date of the principal of or any installment of interest on such security;

- (b)

- reduce

the principal amount of, or the rate or rates of any interest on, any such security or any premium payable upon the redemption thereof or any sinking

fund or analogous payment with respect thereto, or reduce the amount of the principal of a discounted debt security that would be due and payable upon a declaration of acceleration of the maturity

thereof or upon the redemption thereof,

- (c)

- change

the currency of payment of principal of or any premium or interest on any such security;

- (d)

- impair

the right to institute suit for the enforcement of any such payment on or after the stated maturity thereof;

- (e)

- reduce

the above-stated percentage of holders of securities necessary to modify or amend the Indenture;

- (f)

- modify

the foregoing requirements or reduce the percentage of outstanding securities of any series necessary to waive any past default to less than a

majority; or

- (g)

- change

in any manner materially adverse to the interests of the holders of such securities the terms and conditions of the obligations of any guarantor

regarding the due and punctual payment of the principal thereof, and premium, if any, and interest, if any, thereon or the sinking fund or analogous payments, if any, with respect to such securities.

14

Table of Contents

Unilever

Capital Corporation, Unilever N.V., Unilever PLC, Unilever U.S. and the trustee may also amend the Indenture in certain circumstances without the consent of the

holders of the debt securities to evidence the succession of another corporation to Unilever Capital Corporation, Unilever N.V., Unilever PLC or Unilever U.S., as the case may be, or the

replacement of the trustee with respect to the debt securities of one or more series and for certain other purposes.

Events of Default

The following are defined as Events of Default with respect to securities of any series outstanding under the Indenture (unless

otherwise stated in the related prospectus supplement):

- (a)

- failure

to pay at maturity the principal of, or premium, if any, on any security of such series outstanding under the Indenture;

- (b)

- failure

to pay any interest or any additional interest on any security of such series outstanding under the Indenture when due continued for 30 days;

- (c)

- failure

to deposit any sinking fund or analogous payment with respect to such series when and as due or beyond any applicable period of grace;

- (d)

- failure

to perform any other covenant of Unilever Capital Corporation, Unilever N.V., Unilever PLC or Unilever U.S. (other than a covenant

expressly included in the Indenture solely for the benefit of a series other than such series), continued for 90 days after written notice; and

- (e)

- certain

events in bankruptcy, insolvency or reorganization of Unilever Capital Corporation, Unilever N.V. or Unilever PLC.

If

an Event of Default shall occur and be continuing, the Trustee in its discretion may proceed to protect and enforce its rights and those of the holders of such series of securities.

If an Event of Default shall occur and be continuing, either the Trustee or the holders of not less than 25% in aggregate principal amount of the outstanding securities of such series (or of all

affected series in the case of defaults under clauses (d) and (e) above (voting as one class)) may accelerate the maturity of all such outstanding securities of such series by written

notice. The holders of not less than a majority in aggregate principal amount of outstanding securities of such series (or of all such affected series in the case of defaults under clauses (d)

and (e) above (voting as one class), as the case may be) under the Indenture may waive any past default under the Indenture, except, among other things, a default in the payment of principal,

premium, if any, or interest, if any. The holders of not less than a majority in aggregate principal amount of outstanding securities of any series (or of all such affected series in the case of

defaults under clauses (d) and (e) above (voting as one class), as the case may be) may rescind a declaration of acceleration of securities of such series but only if all Events of

Default have been remedied and all payments due (other than those due as a result of acceleration) have been made. Since each series of guaranteed debt securities will be independent of each other

series, a default with respect to one series of guaranteed debt securities will not in itself necessarily result in the acceleration of the maturity of a different series of guaranteed debt

securities.

Unilever

Capital Corporation, Unilever N.V., Unilever PLC and Unilever U.S. are required to furnish to the Trustee annually a statement as to performance or fulfillment of

covenants, agreements or conditions in the Indenture or a statement as to the nature of any default.

Consolidation, Merger and Sale of Assets

Unilever Capital Corporation, Unilever N.V., Unilever PLC and Unilever U.S. may, without the consent of the holders of

any of the securities outstanding under the Indenture, consolidate or

15

Table of Contents

amalgamate

with, merge into any other corporation or convey, transfer or lease its properties and assets substantially as an entirety to, any corporation if:

- (i)

- in

the case of Unilever Capital Corporation or Unilever N.V., as the case may be, the successor corporation is organized under the laws of the United

States or The Netherlands, respectively, and the successor corporation assumes the obligations of Unilever Capital Corporation or Unilever N.V., as the case may be, on the securities issued

under the Indenture;

- (ii)

- in

the case of Unilever N.V., Unilever PLC or Unilever U.S., the successor corporation assumes the obligations of Unilever N.V.,

Unilever PLC or Unilever U.S., as the case may be, on the guarantees and under the Indenture and, in the case of Unilever U.S., if such successor corporation is not organized under the laws of

the United States, agrees to make payments under the guarantees free of any deduction or withholding for or on account of taxes, levies, imposts and charges of the country of incorporation (or any

political subdivision or taxing authority therein), subject to certain exceptions;

- (iii)

- immediately

after giving effect thereto, no Event of Default, and no event which, after giving of notice or lapse of time, would become an Event of

Default, shall have occurred and be continuing; and

- (iv)

- certain

other conditions are met.

Unilever N.V.,

Unilever PLC or Unilever U.S. or any of their respective Subsidiaries may, subject to certain restrictions, assume the obligations of any of Unilever Capital

Corporation or Unilever N.V. as obligor under the securities issued under the Indenture.

Defeasance and Discharge

The Indenture provides that Unilever Capital Corporation, Unilever N.V., Unilever PLC and Unilever U.S., at the option of

Unilever Capital Corporation, Unilever N.V., Unilever PLC or Unilever U.S., as the case may be:

- (a)

- will

be discharged from any and all obligations in respect of any series of guaranteed debt securities and the guarantees relating to such series (except

for certain obligations to register the transfer or exchange of guaranteed debt securities of such series, replace stolen, lost or mutilated guaranteed debt securities of such series and maintain

paying agencies), or

- (b)

- need

not comply with certain restrictive covenants of the Indenture (including those described under "Limitation on Liens" and "Limitations on Sales and

Leasebacks" above),

if

in each case, Unilever Capital Corporation or Unilever N.V., as the case may be, irrevocably deposits with the Trustee, in trust, (i) in the case of guaranteed debt securities of such

series denominated in U.S. dollars, money and/or U.S. government obligations or (ii) in the case of guaranteed debt securities of such series denominated in a foreign currency (other than a

basket currency, as defined in the Indenture), money and/or foreign government securities in the same foreign currency, which through the payment of interest thereon and principal thereof in

accordance with their terms will provide money in an amount in cash sufficient to pay all the principal of (including any mandatory sinking fund or analogous payments), and any premium and interest

on, the guaranteed debt securities of such series not later than one day before the dates such payments are due in accordance with the terms of the guaranteed debt securities of such series.

In

the case of a discharge pursuant to clause (a) above, Unilever Capital Corporation or Unilever N.V., as the case may be, is required to deliver to the Trustee either an

opinion of counsel to the effect that the holders of guaranteed debt securities of such series will not recognize income, gain or loss for United States Federal income tax purposes as a result of such

deposit and related

16

Table of Contents

defeasance

and will be subject to United States Federal income tax in the same manner and at the same times as would have been the case if such deposit and related defeasance had not been exercised or

a ruling to such effect received from or published by the United States Internal Revenue Service.

In

the event we exercise our option pursuant to clause (b) above, Unilever Capital Corporation or Unilever N.V., as the case may be, will deliver to the Trustee an opinion

of counsel to the effect that the holders of guaranteed debt securities of such series will not recognize income, gain or loss for United States Federal income tax purposes as a result of such deposit

and related defeasance and will be subject to United States Federal income tax in the same manner and at the same times as would have been the case if such deposit and related defeasance had not been

exercised.

If

the Trustee or paying agent is unable to apply any money, U.S. government obligations and/or foreign government securities deposited in trust by reason of any legal proceeding or by

reason of any order or judgment of any court or governmental authority located within the United States and having jurisdiction in the premises, enjoining, restraining or otherwise prohibiting such

application (including any such order or judgment requiring the payment of money, U.S. government obligations and/or foreign government securities to Unilever Capital Corporation or

Unilever N.V., as the case may be), the obligations of Unilever Capital Corporation, Unilever N.V., Unilever PLC and Unilever U.S. under the Indenture, the guaranteed debt

securities of such series and the guarantees relating to such guaranteed debt securities will be revived and reinstated as though no such deposit had occurred, until such time as the Trustee or paying

agent is permitted to apply all such money, U.S. government

obligations and/or foreign government securities to payments of the principal of or any premium and interest on the guaranteed debt securities of such series. If any issuer or any guarantor makes any

payment of principal of or any interest on any guaranteed debt securities of such series because of any such reinstatement of obligations, the issuer or the guarantor will be subrogated to the rights

of the holders of the guaranteed debt securities of such series to receive such payment from the money, U.S. government obligations and/or foreign government securities held by the Trustee.

Governing Law

New York law will govern the Indenture and the guaranteed debt securities.

Concerning the Trustee

The Bank of New York Mellon is Trustee under the Indenture. Unilever N.V., Unilever PLC and Unilever U.S. and certain of

their respective Subsidiaries maintain deposit accounts and conduct other banking transactions with The Bank of New York Mellon and its affiliates in the ordinary course of their respective

businesses.

Pursuant

to the Trust Indenture Act, should a default occur with respect to either the guaranteed debt securities constituting Senior Debt of the issuer or any guarantor or subordinated

guaranteed debt securities, The Bank of New York Mellon would be required to resign as Trustee with respect to the guaranteed debt securities constituting Senior Debt or the subordinated guaranteed

debt securities under the Indenture within 90 days of such default unless such default were cured, duly waived or otherwise eliminated.

The

trustee shall be under no obligation to exercise any of the rights or powers vested in it by the Indenture at the request or direction of any of the holders pursuant to the

Indenture, unless such holders shall have offered to the trustee security or indemnity satisfactory to the trustee against the costs, expenses and liabilities which might be incurred by it in

compliance with such request or direction.

17

Table of Contents

PLAN OF DISTRIBUTION

We may sell the guaranteed debt securities in and outside the United States (i) through underwriters or dealers,

(ii) directly to purchasers or (iii) through agents. The prospectus supplement will include the following information:

- (a)

- the

terms of the offering;

- (b)

- the

names of any underwriters or agents;

- (c)

- the

purchase price of the securities from us;

- (d)

- the

net proceeds to us from the sale of the securities;

- (e)

- any

delayed delivery arrangements;

- (f)

- any

underwriting discounts and other items constituting underwriters' compensation;

- (g)

- any

initial public offering price; and

- (h)

- any

discounts or concessions allowed or reallowed or paid to dealers.

Sale Through Underwriters or Dealers

If we use underwriters in the sale, the underwriters will acquire the guaranteed debt securities for their own account. The

underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of

sale. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters.

Unless we inform you otherwise in the prospectus supplement, the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will be

obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts or concessions allowed

or reallowed or paid to dealers.

During

and after an offering through underwriters, the underwriters may purchase and sell the guaranteed debt securities in the open market. These transactions may include overallotment

and stabilizing transactions and purchases to cover syndicate short positions created in connection with the offering. The underwriters may also impose a penalty bid, whereby selling concessions

allowed to syndicate members or other broker-dealers for the offered securities sold for their account may be reclaimed by the syndicate if such offered securities are repurchased by the syndicate in

stabilizing or

covering transactions. These activities may stabilize, maintain or otherwise affect the market price of the offered securities, which may be higher than the price that might otherwise prevail in the

open market. If commenced, these activities may be discontinued at any time.

If

we use dealers in the sale of the guaranteed debt securities, we will sell the securities to them as principals. They may then resell those securities to the public at varying prices

determined by the dealers at the time of resale. We will include in the prospectus supplement the names of the dealers and the terms of the transaction.

Direct Sales and Sales Through Agents