Exhibit 13.1

REDIFF.COM INDIA LIMITED

18TH ANNUAL REPORT

2012-2013

(UNDER COMPANIES ACT, 1956)

(INDIAN LAWS)

Rediff.com India Ltd.

Board of Directors

Ajit Balakrishnan (Chairman & Managing Director)

Arun Nanda

Sunil Phatarphekar

Ashok Narasimhan

Sridar Iyengar

Rashesh Shah

M. Madhavan Nambiar

Statutory Auditors

M/s. Deloitte Haskins & Sells

Chartered Accountants

Indiabulls Finance Centre, Tower 3,

27th - 32nd Floor, Elphinstone Mill

Compound, Senapati Bapat Marg,

Elphinstone (West), Mumbai – 400013

India.

Registered Office

First Floor,

Mahalaxmi Engineering Estate

L. J. First Cross Road

Mahim (West)

Mumbai 400 016, India

Contents

| Sr. no. |

Particulars |

Page Nos. | ||

| Documents as required under Companies Act, 1956 (Indian law) | ||||

| 1. | Notice of Annual General Meeting | 5-8 | ||

| 2. | Directors Report of Rediff.com India Ltd. | 9-13 | ||

| 3. | Auditors’ Report of Rediff.com India Ltd. | 14-16 | ||

| 4. | Balance Sheet and Statement of Profit and Loss, Notes thereto of Rediff.com India Ltd. | 17-43 | ||

| 5. | Statement pursuant to Section 212 of the Companies Act 1956 | 44 | ||

| 6. | Directors Report of Vubites India Pvt. Ltd. | 45-47 | ||

| 7. | Auditors’ Report of Vubites India Pvt. Ltd. | 48-49 | ||

| 8. | Balance Sheet and Statement of Profit and Loss, Notes thereto of Vubites India Pvt. Ltd. | 50-65 | ||

| 9. | Directors Report of Rediff Holdings Inc. | 66 | ||

| 10. | Auditors’ Report of Rediff Holdings Inc. | 67-68 | ||

| 11. | Balance Sheet and Statement of Profit and Loss, Notes thereto of Rediff Holdings Inc. | 69-77 | ||

| 12. | Directors Report of India Abroad Publications Inc. | 78 | ||

| 13. | Auditors’ Report of India Abroad Publications Inc. | 79-80 | ||

| 14. | Balance Sheet and Statement of Profit and Loss, Notes thereto of India Abroad Publications Inc. | 81-90 | ||

| 15. | Directors Report of India in New York Inc | 91 | ||

| 16. | Auditors’ Report of India in New York Inc | 92-93 | ||

| 17. | Balance Sheet and Statement of Profit and Loss, Notes thereto of India in New York Inc | 94-100 | ||

| 18. | Directors Report of India Abroad Publications (Canada) Inc. | 101 |

| 19. | Auditors’ Report of India Abroad Publications (Canada) Inc. | 102-103 | ||

| 20. | Balance Sheet and Statement of Profit and Loss, Notes thereto of India Abroad Publications (Canada) Inc. | 104-112 | ||

| 21. | Directors Report of Rediff.com Inc. | 113 | ||

| 22. | Auditors’ Report of Rediff.com Inc. | 114-115 | ||

| 23. | Balance Sheet and Statement of Profit and Loss, Notes thereto of Rediff.com Inc. | 116-124 | ||

| 24. | Directors Report of Value Communications Corporation | 125 | ||

| 25. | Auditors’ Report of Value Communications Corporation | 126-127 | ||

| 26. | Balance Sheet and Statement of Profit and Loss, Notes thereto of Value Communications Corporation | 128-134 | ||

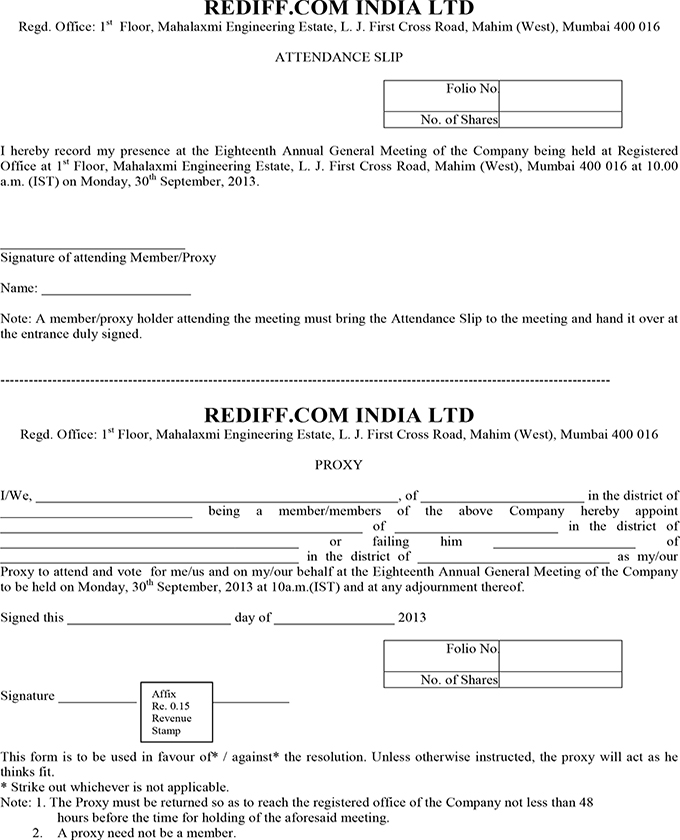

| 27. | Proxy Form and Attendance Slip | 135 |

NOTICE

Notice is hereby given that the Eighteenth Annual General Meeting of the Members of Rediff.com India Limited will be held on Monday, September 30, 2013, at 10.00 a.m. (IST) at the Registered Office of the Company situated at First Floor, Mahalaxmi Engineering Estate, L. J. First Cross Road, Mahim (West), Mumbai 400016, to transact the following business:

ORDINARY BUSINESS

| 1. | To receive, consider and adopt the Audited Balance Sheet as at March 31, 2013 and Profit & Loss Account for the year ended as on that date and the reports of the Auditors and Directors’ thereon. |

| 2. | To appoint a Director in place of Mr. Sunil Phatarphekar, Director retiring by rotation and being eligible, offers himself for reappointment. |

| 3. | To appoint a Director in place of Mr. Sridar Iyengar, Director retiring by rotation and being eligible, offers himself for reappointment. |

| 4. | To appoint Auditors and fix their remuneration by passing the following resolution as an Ordinary Resolution with or without modification(s); |

“RESOLVED that M/s Deloitte Haskins & Sells, Chartered Accountants (Reg. no. 117366W), Mumbai be and are hereby re-appointed as Statutory Auditors of Rediff.com India Limited and to hold office from the conclusion of this Annual General Meeting till the conclusion of the next Annual General Meeting at a remuneration to be decided by the Board of Directors/Audit Committee of the Directors of the Company.”

SPECIAL BUSINESS

| 5. | To consider and if thought fit, to pass with or without modification, the following resolution as Ordinary resolutions: |

“RESOLVED THAT pursuant to the provisions of Section 269 read with Schedule XIII and any other applicable provisions of the Companies Act, 1956, including any statutory modification or re- enactment thereof, the approval of the members be and is hereby accorded for the re-appointment of Mr. Ajit Balakrishnan as the Managing Director of the Company for a period of 5 years commencing from 22nd August, 2013 on the same terms and conditions as set out in the draft agreement the details of which are specified in the Explanatory Statement annexed to the Notice convening this meeting.

5

“RESOLVED FURTHER THAT the Board of Directors and the Company Secretary be and are hereby authorized to do all such acts, deeds and things, to execute all such documents, instruments and writings as may be required and to take all such steps as may be necessary, proper and expedient to give effect to the aforesaid resolution.”

| By Order of the Board | ||||

| For Rediff.com India Limited | ||||

| Place: Mumbai | /s/ Jyoti Ravi Sachdeva | |||

| Date: September 5, 2013 | Company Secretary and | |||

| Head Legal & Govt. affairs | ||||

NOTES:

A MEMBER ENTITLED TO ATTEND AND VOTE AT THE MEETING IS ENTITLED TO APPOINT A PROXY TO ATTEND AND VOTE INSTEAD OF HIMSELF/HERSELF AND SUCH A PROXY NEED NOT BE A MEMBER OF THE COMPANY. PROXIES TO BE EFFECTIVE MUST BE RECEIVED BY THE COMPANY NOT LESS THAN 48 HOURS BEFORE THE COMMENCEMENT OF THE ANNUAL GENERAL MEETING.

The relative Explanatory Statement pursuant to the provisions of Section 173 of the Companies Act, 1956 for item Nos. 5 is enclosed and forms part of this Notice.

6

REDIFF.COM INDIA LIMITED

EXPLANATORY STATEMENT PURSUANT TO THE PROVISIONS OF SECTION

173(2) OF THE COMPANIES ACT, 1956.

Pursuant to the provisions of Section 173(2) of the Companies Act, 1956, the following Explanatory Statement sets out the material facts relating to the item of Special Business mentioned in the accompanying Notice dated 23rd July, 2013 and shall be form part of the Notice

Item No. 5

Mr. Ajit Balakrishnan is the Founder of the Company and has been the Chairman and Managing Director and CEO since inception.

At the annual general meeting held on September 24, 2008, the members of the Company re-appointed Mr. Ajit Balakrishnan as the Chairman and Managing Director for a period of five (5) years w.e.f. 23rd August, 2008. Accordingly, Mr. Balakrishnan holds the office till 22nd August, 2013. The Board of Directors at their meeting held on July 23, 2013 approved the re-appointment of Mr. Balakrishnan as the Managing Director of the Company for a period of five (5) years with effect from August 22, 2013, subject to the approval of the members.

The principal terms and conditions of re-appointment of Mr. Ajit Balakrishnan are as under:

| 1) | Period of Appointment: 5 years with effect from August 22, 2013. |

| 2) | Mr. Ajit Balakrishnan shall carry out such duties and exercise such powers as may be entrusted to him from time to time by the Board. |

| 3) | The Managing Director shall be entitled for the reimbursement of any out-of pocket expenses, travelling and conveyance expenses that may be incurred by the Managing Director in discharge of his duties in terms of this Agreement. |

In compliance with the requirements of the Act, the terms of re-appointment specified above are now placed before the members in the General Meeting for their approval.

This may be treated as an abstract of the draft agreement between the Company and Mr. Ajit Balakrishnan pursuant to Section 302 of the Companies Act, 1956.

The draft agreement between the Company and Mr. Ajit Balakrishnan is available for inspection by the members of the Company at its Registered Office between 11.00 a.m. to 1.00 p.m. on any working day of the Company.

7

The Directors, therefore, recommend the passing of the Resolution under Item no.5 of the accompanying Notice.

No Director other than Mr. Ajit Balakrishnan may be considered to be concerned or interested in the passing of this Resolution.

| By Order of the Board | ||||

| For Rediff.com India Limited | ||||

| Place: Mumbai | /s/ Jyoti Ravi Sachdeva | |||

| Date: September 5, 2013 | Company Secretary and | |||

| Head Legal & Govt. affairs | ||||

8

REDIFF.COM INDIA LIMITED

DIRECTORS’ REPORT

To,

The Members,

Rediff.com India Limited

Your Directors have pleasure in presenting to you the Eighteenth Annual Report together with the Audited Annual Accounts for the year ended March 31, 2013.

| 1. | REDIFF.COM INDIA LTD.’S FINANCIAL HIGHLIGHTS |

| (a) | Total Revenue:-

856 million (previous year

856 million (previous year

904 million).

904 million). |

| (b) | Net Profit/ Loss:- After providing for depreciation and amortization of

153 million and exceptional items of

153 million and exceptional items of

266 million net loss for the year were

266 million net loss for the year were

540 million (previous year net loss

540 million (previous year net loss

473 million).

473 million). |

| 2. | DIVIDEND |

Your Board does not recommend any dividend.

| 3. | CORPORATE GOVERNANCE |

The various committees constituted by the Company including the Audit Committee and Compensation Committee have been functioning satisfactorily during the year. The present Board comprises of eminent professionals from various fields, in addition to Chairman and Managing Director who looks after the day to day affairs of the Company.

The composition of the Audit Committee of the Board is as follows:-

| Name | Designation in the Committee | |

| Sridar Iyengar | Chairman | |

| Sunil Phatarphekar | Member | |

| Rashesh Shah M. Madhavan Nambiar |

Member Member |

The composition of the Compensation Committee of the Board is as follows:-

| Name | Designation in the Committee | |

| Ajit Balakrishnan | Chairman | |

| Arun Nanda | Member | |

| Sunil N Phatarphekar | Member |

9

REDIFF.COM INDIA LIMITED

| 4. | FIXED DEPOSITS |

During the year under review, our Company had not accepted any Fixed Deposit from the Public.

| 5. | DIRECTORS |

In accordance with the provisions of the Companies Act, 1956, Sunil Phatarphekar and Sridar Iyengar, Directors retire by rotation at the conclusion of the ensuing Annual General Meeting and being eligible, offer themselves for re-appointment.

At the annual general meeting held on September 24, 2008, the members of the Company re-appointed Mr. Ajit Balakrishnan for a period of five (5) years w.e.f. 23rd August, 2008. Accordingly, Mr. Balakrishnan held the office till 22nd August, 2013. The Board of Directors at their meeting held on July 23, 2013 approved the re-appointment of Mr. Balakrishnan as the Managing Director of the Company for a period of five (5) years with effect from August 22, 2013, subject to the approval of the members.

| 6. | PARTICULARS OF EMPLOYEES |

The Company had employees who were in receipt of remuneration

of not less than

60 lakhs during the year ended 31st March, 2013 or not less than

60 lakhs during the year ended 31st March, 2013 or not less than

5 lakhs per month during any part of the said year. However, as per the provisions of section 219(1)(b)(iv) of the Companies Act, 1956, the Directors Report being sent to the shareholders does not include this Annexure.

Any shareholder interested in obtaining a copy of the Annexure may write to the Company Secretary at the Registered Office of the Company.

5 lakhs per month during any part of the said year. However, as per the provisions of section 219(1)(b)(iv) of the Companies Act, 1956, the Directors Report being sent to the shareholders does not include this Annexure.

Any shareholder interested in obtaining a copy of the Annexure may write to the Company Secretary at the Registered Office of the Company.

| 7. | AUDITORS |

M/s. Deloitte Haskins & Sells, Chartered Accountants (Reg. no. 117366W), the Statutory Auditors of Company and who hold the office till the conclusion of ensuing Annual General Meeting are eligible to be re-appointed as the Statutory Auditors of the Company till the conclusion of next Annual General Meeting. The Company has received from the Auditors undertaking their eligibility to accept the office, if reappointed. The members are requested to consider their re-appointment as set out in the Notice convening the Annual General Meeting.

The observations made by the Auditors’ in their report and notes to accounts are self- explanatory and do not call for any further comments.

| 8. | DIRECTORS’ RESPONSIBILITY STATEMENT |

Pursuant to Section 217 (2AA) of the Companies Act, 1956, the Directors confirm that:

| a) | In the preparation of the annual accounts, the applicable accounting standards had been followed along-with proper explanation relating to material departures. |

| b) | The Directors had selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year on March 31, 2013 and of the loss of the company for that period. |

10

REDIFF.COM INDIA LIMITED

| c) | The Directors have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 1956, for safeguarding the assets of the company and for preventing and detecting the frauds and other irregularities. |

| d) | The directors had prepared the annual accounts on a going concern basis. |

| 9. | CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE EARNINGS AND OUTGO |

The information required under Section 217(1)(e) of the Companies Act, 1956 read with the Companies (Disclosure of Particulars in the Report of the Board of Directors) Rules, 1988 is as under:

| 1. | Conservation of Energy:- |

The operation of your Company is not energy intensive. Adequate measures have however been taken to reduce energy consumption by using energy efficient computer equipments incorporating latest technologies.

| 2. | Technologies Absorption |

Since technology related to internet portal business is constantly evolving, continuous investments and improvements are being made to the content, community and commerce offerings made to the customers. The investments are classified as deferred revenue expenditure and amortized.

| 3. | Foreign Exchange Earnings and outgo |

Foreign exchange earned by the Company in the

fiscal year ended March 31, 2013 was

29 million (Previous year

29 million (Previous year

21 million) and the foreign exchange outgo in the same period was

21 million) and the foreign exchange outgo in the same period was

66 million (Previous year

66 million (Previous year

78 million).

78 million).

| 10. | ACKNOWLEDGEMENTS |

The Directors place on record their appreciation for the dedicated services rendered by the employees of our Company and acknowledge the cooperation extended by our Company’s bankers.

| On behalf of Board of Directors | ||||

| Place: Mumbai, India | ||||

| Date : September 5, 2013 | /s/ Ajit Balakrishnan | |||

| Chairman and Managing Director | ||||

11

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF

REDIFF.COM INDIA LIMITED

Report on the Financial Statements

We have audited the accompanying financial statements of REDIFF.COM INDIA LIMITED (“the Company”), which comprise the Balance Sheet as at 31st March, 2013, the Statement of Profit and Loss and the Cash Flow Statement for the year then ended, and a summary of the significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

The Company’s Management is responsible for the preparation of these financial statements that give a true and fair view of the financial position, financial performance and cash flows of the Company in accordance with the Accounting Standards referred to in Section 211(3C) of the Companies Act, 1956 (“the Act”) and in accordance with the accounting principles generally accepted in India. This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and the disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. An audit also includes evaluating the appropriateness of the accounting policies used and the reasonableness of the accounting estimates made by the Management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

12

Opinion

In our opinion and to the best of our information and according to the explanations given to us, the aforesaid financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India:

| (a) | in the case of the Balance Sheet, of the state of affairs of the Company as at 31st March, 2013; |

| (b) | in the case of the Statement of Profit and Loss, of the loss of the Company for the year ended on that date; and |

| (c) | in the case of the Cash Flow Statement, of the cash flows of the Company for the year ended on that date. |

Report on Other Legal and Regulatory Requirements

| 1. | As required by the Companies (Auditor’s Report) Order, 2003 (“the Order”) issued by the Central Government in terms of Section 227(4A) of the Act, we give in the Annexure a statement on the matters specified in paragraphs 4 and 5 of the Order. |

| 2. | As required by Section 227(3) of the Act, we report that: |

| (a) | We have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit. |

| (b) | In our opinion, proper books of account as required by law have been kept by the Company so far as it appears from our examination of those books. |

| (c) | The Balance Sheet, the Statement of Profit and Loss, and the Cash Flow Statement dealt with by this Report are in agreement with the books of account. |

| (d) | In our opinion, the Balance Sheet, the Statement of Profit and Loss, and the Cash Flow Statement comply with the Accounting Standards referred to in Section 211(3C) of the Act. |

| (e) | On the basis of the written representations received from the directors as on 31st March, 2013 taken on record by the Board of Directors, none of the directors is disqualified as on 31st March, 2013 from being appointed as a director in terms of Section 274(1)(g) of the Act. |

| For DELOITTE HASKINS & SELLS | ||||

| Chartered Accountants | ||||

| (Firm Registration No. 117366W) | ||||

| /s/ Saira Nainar | ||||

| Partner | ||||

| (Membership No. 40081) | ||||

MUMBAI, September 5, 2013

13

ANNEXURE TO THE INDEPENDENT AUDITORS’ REPORT

(Referred to in paragraph 1 under ‘Report on Other Legal and Regulatory Requirements’ section of our report of even date)

| (i) | Having regard to the nature of the Company’s business/ activities/ results/ clauses (ii), (viii), (xiii), (xiv) of paragraph 4 of the Order are not applicable to the company. |

| (ii) | In respect of its fixed assets: |

| (a) | The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets. |

| (b) | The Company has a program of verification of fixed assets once in three years which, in our opinion, is reasonable having regard to the size of the Company and the nature of its assets. Pursuant to the program, fixed assets were physically verified by the Management during the year. According to the information and explanations given to us no material discrepancies were noticed on such verification. |

| (c) | The fixed assets disposed off during the year, in our opinion, do not constitute a substantial part of the fixed assets of the Company and such disposal has, in our opinion, not affected the going concern status of the Company. |

| (iii) | The Company has neither granted nor taken any loans, secured or unsecured, to/from companies, firms or other parties covered in the Register maintained under Section 301 of the Companies Act, 1956. |

| (iv) | In our opinion and according to the information and explanations given to us, there is an adequate internal control system commensurate with the size of the Company and the nature of its business for the purchase of fixed assets and for the sale of services and during the course of the audit we have not observed any continuing failure to correct major weakness in such internal control system. The nature of the Company’s business is such that it does not involve purchase of inventories and sale of goods. |

| (v) | To the best of our knowledge and belief and according to the information and explanations given to us, the Company has not entered into any contracts or arrangements which are required to be entered in the Register maintained pursuant to Section 301 of the Act. |

14

| (vi) | According to the information and explanations given to us, the Company has not accepted deposits in terms of provisions of Sections 58A and 58AA or other relevant provisions of the Companies Act, 1956. Therefore, the provisions of paragraph 4 (vi) of the Order are not applicable to the Company. |

| (vii) | In our opinion, the internal audit functions carried out during the year by firm of Chartered Accountants appointed by the management have been commensurate with the size of the Company and the nature of the business. |

| (viii) | According to the information and explanations given to us, in respect of statutory dues: |

| (a) | The Company has been regular in depositing undisputed statutory dues, including Provident Fund, Investor Education and Protection Fund, Employees’ State Insurance, Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues applicable to it with the appropriate authorities. |

| (b) | There were no undisputed amounts payable in respect of Provident Fund, Investor Education and Protection Fund, Employees’ State Insurance, Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues in arrears as at 31st March, 2013 for a period of more than six months from the date they became payable. |

| (c) | Details of dues of Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty and Cess which have not been deposited as on 31st March, 2013 on account of disputes are given below: |

| Name of Statute |

Nature of Dues |

Forum where Dispute is Pending |

Period to which the Amount Relates |

Amount Involved (Rs.) | ||||

| Income-tax Act, 1961 | Income Tax | Refer note below | 2009-10 and 2010-11 | 4,484,908 |

Note: The Company is in the process of filing the appeal with Commissioner of Income Tax (Appeal)

| (ix) | The accumulated losses of the Company at the end of the financial year are not more than fifty percent of its net worth (determined before adjusting for accumulated losses) and the Company has incurred cash losses during the financial year covered by our audit and in the immediately preceding financial year. |

| (x) | In our opinion and according to the information and explanations given to us, there were no dues payable by the Company to financial institutions, banks and debenture holders during the year. |

| (xi) | According to the information and explanations given to us, the Company has not granted loans and advances on the basis of security by way of pledge of shares, debentures and other securities. |

15

| (xii) | In our opinion and according to the information and explanations given to us, during the year the Company has not given any guarantee for loans taken by others from banks and financial institutions. |

| (xiii) | According to the information and explanations given to us, the Company has not availed any term loan. |

| (xiv) | In our opinion and according to the information and explanations given to us, and on an overall examination of the Balance Sheet of the Company, we report that funds raised on short-term basis have, prima facie, not been used during the year for long-term investment. |

| (xv) | According to the information and explanations given to us, the Company has not made any preferential allotment of shares during the year. |

| (xvi) | According to the information and explanations given to us, the Company has not issued any debentures during the year. |

| (xvii) | According to the information and explanations given to us, during the year the Company has not raised any money through public issue. |

| (xviii) | To the best of our knowledge and according to the information and explanations given to us, no fraud by the Company and no material fraud on the Company has been noticed or reported during the year. |

| For DELOITTE HASKINS & SELLS | ||||

| Chartered Accountants | ||||

| (Firm Registration No. 117366W) | ||||

| /s/ Saira Nainar | ||||

| Partner | ||||

| (Membership No. 40081) | ||||

MUMBAI, September 5, 2013

16

REDIFF.COM INDIA LIMITED

Balance Sheet as at March 31, 2013

| Note | As at March 31, 2013 | As at March 31, 2012 | ||||||||||

|

|

|||||||||||

| I EQUITY AND LIABILITIES |

||||||||||||

| 1 Shareholders’ Funds |

||||||||||||

| (a) Share Capital |

3 | 74,050,890 | 74,050,890 | |||||||||

| (b) Reserves and Surplus |

4 | 1,940,627,976 | 2,469,313,346 | |||||||||

|

|

|

|

|

|||||||||

| 2,014,678,866 | 2,543,364,236 | |||||||||||

| 2 Non—Current Liabilities |

||||||||||||

| (a) Other Long Term Liabilities |

5 | 15,653,658 | 12,948,443 | |||||||||

| (b) Long—Term Provisions |

6 | 56,804,150 | 47,553,898 | |||||||||

|

|

|

|

|

|||||||||

| 72,457,808 | 60,502,341 | |||||||||||

| 3 Current Liabilities |

||||||||||||

| (a) Trade Payables (also refer Note 28) |

197,396,399 | 142,831,002 | ||||||||||

| (b) Other Current Liabilities |

7 | 141,244,444 | 162,705,438 | |||||||||

| (c) Short—Term Provisions |

8 | 7,444,602 | 6,365,786 | |||||||||

|

|

|

|

|

|||||||||

| 346,085,445 | 311,902,226 | |||||||||||

|

|

|

|

|

|||||||||

| TOTAL |

2,433,222,119 | 2,915,768,803 | ||||||||||

|

|

|

|

|

|||||||||

| II ASSETS |

||||||||||||

| 1 Non—Current Assets |

||||||||||||

| (a) Fixed Assets |

9 | |||||||||||

| (i) Tangible Assets |

141,934,911 | 189,823,760 | ||||||||||

| (ii) Intangible Assets |

90,371,503 | 82,762,100 | ||||||||||

| (iii) Intangible Assets under Development |

46,761,840 | 55,895,954 | ||||||||||

|

|

|

|

|

|||||||||

| 279,068,254 | 328,481,814 | |||||||||||

| (b) Non—Current Investments |

10 | 68,075,804 | 349,259,409 | |||||||||

| (c) Long—Term Loans and Advances |

11 | 789,303,932 | 669,871,869 | |||||||||

|

|

|

|

|

|||||||||

| 857,379,736 | 1,019,131,278 | |||||||||||

| 2 Current Assets |

||||||||||||

| (a) Trade Receivables |

12 | 179,922,848 | 282,023,912 | |||||||||

| (b) Cash and Cash Equivalents |

13 | 1,075,348,839 | 1,225,820,352 | |||||||||

| (c) Short-Term Loans and Advances |

14 | 41,502,442 | 60,311,447 | |||||||||

|

|

|

|

|

|||||||||

| 1,296,774,129 | 1,568,155,711 | |||||||||||

|

|

|

|

|

|||||||||

| TOTAL |

2,433,222,119 | 2,915,768,803 | ||||||||||

|

|

|

|

|

|||||||||

| III NOTES FORMING PART OF THE FINANCIAL STATEMENTS |

1-33 | |||||||||||

| In terms of our report attached. |

For and on behalf of the Board of Directors | |||

| For Deloitte Haskins & Sells | ||||

| Chartered Accountants | ||||

| /s/ Saira Nainar | /s/ Ajit Balakrishnan | /s/ Sunil Phatarphekar | ||

| Partner | Chairman & Managing Director | Director | ||

| /s/ Jyoti Ravi Sachdeva | ||||

| Company Secretary | ||||

| Mumbai, India | Mumbai, India | |||

| Date: September 5, 2013 | Date: September 5, 2013 | |||

17

REDIFF.COM INDIA LIMITED

Statement of Profit and Loss for the Year Ended March 31, 2013

| Note | For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

||||||||||

|

|

|||||||||||

| I Revenue From Operations |

15 | 673,034,071 | 778,703,520 | |||||||||

| II Other Income (Net) |

16 | 183,158,009 | 125,781,805 | |||||||||

|

|

|

|

|

|||||||||

| TOTAL REVENUE |

856,192,080 | 904,485,325 | ||||||||||

| III Expenses: |

||||||||||||

| (a) Employee Benefit Expenses |

17 | 377,620,686 | 360,001,736 | |||||||||

| (b) Depreciation and Amortization Expenses |

9 | 153,416,360 | 129,904,528 | |||||||||

| (c) Operation and Other Expenses |

18 | 599,027,018 | 663,542,290 | |||||||||

|

|

|

|

|

|||||||||

| TOTAL EXPENSES |

1,130,064,064 | 1,153,448,554 | ||||||||||

|

|

|

|

|

|||||||||

| IV LOSS BEFORE EXCEPTIONAL ITEMS AND TAX |

(273,871,984 | ) | (248,963,229 | ) | ||||||||

|

|

|

|

|

|||||||||

| V Exceptional Items | ||||||||||||

| (a) Provision for Diminution in Long Term Investment |

31 | 266,183,605 | 224,059,000 | |||||||||

|

|

|

|

|

|||||||||

| VI LOSS FOR THE YEAR |

(540,055,589 | ) | (473,022,229 | ) | ||||||||

|

|

|

|

|

|||||||||

| VII Earnings Per Equity Share (Face Value of

|

(36.47 | ) | (32.02 | ) | ||||||||

| VIII NOTES FORMING PART OF THE FINANCIAL STATEMENTS |

1-33 | |||||||||||

| In terms of our report attached. |

For and on behalf of the Board of Directors | |||

| For Deloitte Haskins & Sells | ||||

| Chartered Accountants | ||||

| /s/ Saira Nainar | /s/ Ajit Balakrishnan | /s/ Sunil Phatarphekar | ||

| Partner | Chairman & Managing Director | Director | ||

| /s/ Jyoti Ravi Sachdeva | ||||

| Company Secretary | ||||

| Mumbai, India | Mumbai, India | |||

| Date: September 5, 2013 | Date: September 5, 2013 | |||

18

REDIFF.COM INDIA LIMITED

Cash Flow Statement for the Year Ended March 31, 2013

| For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

|||||||||||

|

|

|||||||||||

| Cash Flows from Operating Activities |

||||||||||||

| (Loss) Before Taxes |

(540,055,589 | ) | (473,022,229 | ) | ||||||||

| Adjustments for: |

||||||||||||

| Depreciation and Amortisation |

153,416,360 | 129,904,528 | ||||||||||

| Employee Stock Option Expenses |

11,370,219 | 22,081,783 | ||||||||||

| Provision for Diminution in Long Term Investment |

266,183,605 | 224,059,000 | ||||||||||

| Interest Income |

(110,446,324 | ) | (124,024,315 | ) | ||||||||

| Write Back of Provision of Doubtful Receivables |

(5,199,050 | ) | — | |||||||||

| (Profit) / Loss on Sale of Investment |

(64,200,000 | ) | 5,040,000 | |||||||||

| (Profit) / Loss on Sale of Fixed Assets |

(49,336 | ) | 248,131 | |||||||||

| Unrealised Exchange Difference |

837,604 | 3,948,145 | ||||||||||

|

|

|

|

|

|||||||||

| Operating Loss Before Working Capital Changes |

(288,142,511 | ) | (211,764,957 | ) | ||||||||

|

|

|

|

|

|||||||||

| Changes in Working Capital: |

||||||||||||

| Trade Receivables |

107,143,361 | 9,549,613 | ||||||||||

| Loans and Advances |

(1,860,804 | ) | (7,018,081 | ) | ||||||||

| Trade Payables, Current Liabilities and Provisions |

33,679,428 | (83,514,579 | ) | |||||||||

|

|

|

|

|

|||||||||

| Cash used in Operating Activities |

(149,180,526 | ) | (292,748,004 | ) | ||||||||

|

|

|

|

|

|||||||||

| Taxes Paid, Net of Refund |

(7,854,334 | ) | (1,855,651 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net Cash used in Operating Activities (A) |

(157,034,860 | ) | (294,603,655 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash Flows From Investing Activities |

||||||||||||

| Payments to Acquire Fixed Assets |

(94,775,793 | ) | (211,095,796 | ) | ||||||||

| Proceeds from Sale of Fixed Assets |

413,962 | 864,022 | ||||||||||

| Proceeds from Sale of long term Investment |

79,200,000 | 48,000,000 | ||||||||||

| Loan given to Vubites India Pvt Ltd |

(61,540,000 | ) | (95,000,000 | ) | ||||||||

| Loan given to India aborad publication Inc. |

(27,181,146 | ) | (28,106,436 | ) | ||||||||

| Interest Income Received |

110,446,324 | 124,102,212 | ||||||||||

|

|

|

|

|

|||||||||

| Net Cash used in Investing Activities (B) |

6,563,347 | (161,235,998 | ) | |||||||||

|

|

|

|

|

|||||||||

| Cash Flows From Financing Activities |

||||||||||||

| Net Proceeds from Issue of Equity Shares |

— | 61,310,009 | ||||||||||

|

|

|

|

|

|||||||||

| Net Cash used in Financing Activities (C) |

— | 61,310,009 | ||||||||||

|

|

|

|

|

|||||||||

| Net Increase / (Decrease) in Cash and Cash Equivalents (A+B+C) |

(150,471,513 | ) | (394,529,644 | ) | ||||||||

| Cash and Cash Equivalents at the Beginning of the Year |

1,225,820,352 | 1,620,349,996 | ||||||||||

| Cash and Cash Equivalents at the End of the Year |

1,075,348,839 | 1,225,820,352 | ||||||||||

| Notes |

||||||||||||

| Cash and Cash Equivalents Include: |

||||||||||||

| Cash on Hand |

5,211 | 11 | ||||||||||

| Bank Balances |

1,075,414,260 | 1,225,608,212 | ||||||||||

|

|

|

|

|

|||||||||

| Cash and Cash Equivalents |

1,075,419,471 | 1,225,608,223 | ||||||||||

| Effect of Exchange Rate Changes |

(70,632 | ) | 212,129 | |||||||||

|

|

|

|

|

|||||||||

| Cash and Cash Equivalents Restated |

1,075,348,839 | 1,225,820,352 | ||||||||||

|

|

|

|

|

|||||||||

| NOTES FORMING PART OF THE FINANCIAL STATEMENTS |

1-33 | |||||||||||

| In terms of our report attached. | For and on behalf of the Board of Directors | |||

| For Deloitte Haskins & Sells | ||||

| Chartered Accountants | ||||

| /s/ Saira Nainar | /s/ Ajit Balakrishnan | /s/ Sunil Phatarphekar | ||

| Partner | Chairman & Managing Director | Director | ||

| /s/ Jyoti Ravi Sachdeva | ||||

| Company Secretary | ||||

19

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 1. | CORPORATE INFORMATION |

Rediff.com India Limited (“Rediff” or “the Company”) is in the business of providing online internet based services, focusing on India and the global Indian community. Its websites consists of matters relevant to Indian interests such as cricket, astrology, matchmaker and movies, content on various matters like news and finance, search facilities, a range of community features such as e-mail, chat, messenger, e-commerce, broadband wireless content and mobile value-added services to mobile phone subscribers in India.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| a) | Basis of preparation of financial statements |

The financial statements are prepared under the historical cost convention, on an accrual basis of accounting in accordance with the accounting principles generally accepted in India (‘Indian GAAP’) and comply with the Companies (Accounting Standards) Rules, 2006 (as amended) and relevant provisions of Companies Act, 1956 (‘the Act’).

| b) | Use of estimates |

The preparation of financial statements in conformity with generally accepted accounting principles requires that management make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities on the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Differences between actual results and estimates are recognised in the periods in which the results materialise or are known.

| c) | Revenue recognition |

Revenues comprise of revenues from online advertising and fee based services. Online advertising includes advertisement and sponsorships. Fee based services include e-commerce, subscription services and mobile value-added services. E-commerce revenues primarily comprise of commission earned on sale of items to customers who shop online while subscription services comprise of subscriptions received for using e-mail, matchmaker and other subscriber services. Mobile value-added services include revenues derived from mobile operators based on value added text messages received and sent by mobile subscribers over their mobile phones.

Online advertising

Advertisement and sponsorship income is derived from customers who advertise on the Company’s website or to whom direct links from the Company’s website to their own websites are provided.

Revenue from advertisement and sponsorships is recognised ratably based on the delivery over the contractual period of the advertisement, commencing when the advertisement is placed on the website. Revenues are also derived from sponsor buttons placed in specific areas of the Company’s website, which generally provide users with direct links to sponsor websites. These revenues are recognised ratably over the period in which the advertisement is displayed, provided that no significant Company obligations remain and collection of the resulting receivable is probable. Company obligations may include guarantees of a minimum number of impressions or clicks or leads or times that an advertisement appears in pages viewed by users of the Company’s website. To the extent that minimum guaranteed impressions are not met, the Company defers recognition of the corresponding revenues until the guaranteed impression levels are achieved.

20

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

Fee based services

Online shopping revenue primarily consists of commission from the sale of books, music, apparel, confectionery, gifts and other items to retail customers who shop at the Company’s online store. The Company recognises as revenues the commission earned on these transactions and shipping costs recovered from customers.

Subscription service revenues primarily include income from various paid email, web hosting and other service products that cater to a cross section of the Company’s registered user base. The revenue for subscription based service products is deferred and recognised ratably over the period of subscription.

Subscription revenues are also derived from providing mobile value added services (MVAS) such as e-mail and other related products to mobile phone users. The Company contracts with third party mobile operators for sharing revenues from these services. SMS based revenues are recognised when the service is performed.

| d) | Tangible assets, intangibles, depreciation and amortisation |

Tangible Assets

Tangible assets are stated at cost less accumulated depreciation. The Company depreciates tangible assets using the straight-line method, over the estimated useful lives of assets. The estimated useful lives of assets are as follows:

| Furniture and fixtures |

10 years | |||

| Computer equipment |

3 years | |||

| Office equipment |

3 to 10 years | |||

| Vehicles |

8 years | |||

| Leasehold improvements |

6 years |

The effective rates of depreciation based on the estimated useful life of the tangible assets is higher than the rates as prescribed under Schedule XIV to the Companies Act, 1956.

Individual assets costing less than

5,000 are depreciated in full in the year of acquisition.

5,000 are depreciated in full in the year of acquisition.

Intangible Assets

Intangible Assets are stated at cost less accumulated amortisation. Software includes costs incurred in the operations stage that provides additional functions or features to the Company’s website, accounting and monitoring software. These are amortised over their estimated useful life of one to three years. Maintenance expenses or costs that do not result in new features or functions are expensed as product development costs, when incurred.

21

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| e) | Impairment of assets |

The carrying values of assets of the Company’s cash-generating units are reviewed for impairment annually or more often if there is an indication of decline in value. If any indication of such impairment exists, the recoverable amounts of those assets are estimated and impairment loss is recognised, if the carrying amount of those assets exceeds their recoverable amount. The recoverable amount is the greater of the net selling price and their value in use. Value in use is arrived at by discounting the estimated future cash flows to their present value based on appropriate discount factor.

| f) | Investments |

Investments classified as long-term investments are stated at cost. Provision is made to recognise a decline, other than temporary, in the value of such investments. Cost of investments in wholly owned subsidiaries comprise of purchase cost as increased by legal fees, due diligence fees and other direct expenses connected with such acquisition.

| g) | Employee benefits |

(i) Short term

Short term employee benefits are recognised as an expense at the undiscounted amount expected to be paid over the period of services rendered by the employees to the Company.

(ii) Long term

The Company has both defined-contribution and defined-benefit plans.

| • | Defined-contribution plans |

These are plans in which the Company pays pre-defined amounts to separate funds. These comprise of contributions to the employees’ provident fund and family pension fund. The Company’s payments to the defined-contribution plans are reported as expenses during the period in which the employees perform the services that the payment covers.

| • | Defined-benefit plans |

The obligation for the unfunded defined-benefit gratuity is determined using the Projected Unit Credit Method, with actuarial valuations being carried out at each balance sheet date. Actuarial gain and losses are recognised in full in the Statement of Profit and Loss for the period in which they occur.

(iii) Other employee benefits

Compensated absences which accrue to employees and which can be carried to future periods but are expected to be encashed or availed in twelve months immediately following the year end are reported as expenses during the year in which the employees perform the services that the benefit covers and the liabilities are reported at the undiscounted amount of the benefits after deducting amounts already paid. Where there are restrictions on availment of encashment of such accrued benefit or where the availment or encashment is otherwise not expected to wholly occur in the next twelve months, the liability on account of the benefit is actuarially determined using the projected unit credit method

22

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| h) | Foreign currency transactions |

Transactions in foreign currency are recorded at the original rates of exchange in force at the time transactions are effected.

Monetary items of assets and liabilities denominated in a foreign currency are translated using the exchange rates prevailing at the date of Balance Sheet. Exchange gains / losses on account of exchange difference either on settlement or translation are recognised in the Statement of Profit and Loss.

Non-monetary items such as investments denominated in a foreign currency are reported using the exchange rate at the date of the transaction.

| i) | Stock based compensation |

The Company accounts for compensation expense under the Employee Stock Option schemes using the intrinsic value method as per the Guidance Note “Accounting for Employee Share-based Payments” issued by the Institute of Chartered Accountants of India.

| j) | Earnings per share |

Basic earnings per equity share is computed by dividing the net profit/loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year. Diluted earnings per share is computed by dividing the net profit/loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year as adjusted for the effects of all potential equity shares on account of stock options outstanding. For the purpose of Earnings Per Share calculations, ADRs are converted to equity shares.

| k) | Taxes |

Income taxes comprise both current and deferred tax.

Current income tax is measured at the amount expected to be paid to / recovered from the revenue authorities, using applicable tax rates and laws. Deferred tax is accounted for by computing the tax effect of timing differences, which arise during the year and reverse in subsequent periods. Deferred tax assets on account of accumulated losses, unabsorbed depreciation and other items are recognised only to the extent that there is virtual certainty of realisation of such assets in future.

23

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

Advance taxes and provisions for current income taxes are presented in the balance sheet after off-setting advance tax paid and income tax provision arising in the same tax jurisdiction and the Company intends to settle the asset and liability on a net basis.

| l) | Cash and cash equivalent |

The Company considers all highly liquid investments with a remaining maturity at the date of purchase of three months or less and that are readily convertible to known amounts of cash to be cash equivalents.

Cash and cash equivalents consist of cash on hand, balances in current accounts, deposits with banks which are unrestricted as to withdrawal and use.

| m) | Research and development expenses |

Revenue expenditure pertaining to research is charged to the Statement of Profit and Loss. Development costs of products are also charged to the Statement of Profit and Loss unless a product’s technological feasibility has been established, in which case such expenditure is capitalised. The amount capitalised comprises expenditure that can be directly attributed or allocated on a reasonable and consistent basis to creating, producing and making the asset ready for its intended use. Fixed assets utilised for research and development are capitalised and depreciated in accordance with the policies stated for Tangible Fixed Assets and Intangible Assets.

| n) | Leases |

Leasing of assets whereby the lessor essentially remains the owner of the asset is classified as operating leases. The payments made by the Company as lessee in accordance with operational leasing contracts or rental agreements are expensed proportionally during the lease or rental period respectively. Any compensation, according to agreement, that the lessee is obliged to pay to the lessor if the leasing contract is terminated prematurely is expensed during the period in which the contract is terminated.

| o) | Provisions and Contingencies |

A provision is recognized when the Company has a present obligation as a result of past event and it is probable that an outflow of resources will be required to settle the obligation, in respect of which reliable estimate can be made. Provisions (excluding retirement benefits) are not discounted to its present value and are determined based on best estimate required to settle the obligation at the balance sheet date. These are reviewed at each balance sheet date and adjusted to reflect the current best estimates. Contingent liabilities are not recognized but are disclosed in the notes to the financial statement. A contingent asset is neither recognized nor disclosed.

24

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 3. | SHARE CAPITAL |

| As at March 31, 2013 | As at March 31, 2012 | |||||||||||||||

| Number |

|

Number |

|

|||||||||||||

| Authorised |

||||||||||||||||

| Equity Shares of

|

24,000,000 | 120,000,000 | 24,000,000 | 120,000,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Issued, Subscribed and Fully Paid up |

||||||||||||||||

| Equity Shares of

|

14,810,178 | 74,050,890 | 14,810,178 | 74,050,890 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| a. | Reconciliation of shares outstanding at the beginning and at the end of the reporting period: |

| As at March 31, 2013 | As at March 31, 2012 | |||||||||||||||

| Number |

|

Number |

|

|||||||||||||

| At the beginning of the year |

14,810,178 | 74,050,890 | 14,615,800 | 73,079,000 | ||||||||||||

| Shares issued during the year (on account of Stock Options exercised) |

— | — | 194,378 | 971,890 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding at the end of the period |

14,810,178 | 74,050,890 | 14,810,178 | 74,050,890 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| b. | Shares held by Holding/Ultimate Holding Company and/or its subsidiaries/associates: |

| As at March 31, 2013 | As at March 31, 2012 | |||||||||||||||

| Number |

|

Number |

|

|||||||||||||

| Rediff.com India Limited Employee Trust, a Trust controlled by the Board of the Company. |

1,015,000 | 5,075,000 | 1,015,000 | 5,075,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| c. | Details of shares held by each shareholder holding more than 5% shares: |

| As at March 31, 2013 | As at March 31, 2012 | |||||||||||||||

| Name of shareholder | Number | % Holding | Number | % Holding | ||||||||||||

| Rediffusion Holdings Private Limited |

2,200,002 | 14.85 | % | 2,200,002 | 14.85 | % | ||||||||||

| Draper-India International |

— | — | 2,200,002 | 14.85 | % | |||||||||||

| Draper International India LP |

2,178,000 | 14.71 | % | — | — | |||||||||||

| Edelwiess Finance & Investments Limited. |

1,523,000 | 10.28 | % | 1,523,000 | 10.28 | % | ||||||||||

| Diwan Arun Nanda |

1,244,740 | 8.40 | % | 1,244,740 | 8.40 | % | ||||||||||

| Ajit Balakrishnan |

1,100,190 | 7.43 | % | 1,100,190 | 7.43 | % | ||||||||||

| Rediff.com India Limited Employee Trust |

1,015,000 | 6.85 | % | 1,015,000 | 6.85 | % | ||||||||||

25

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| d. | Terms / rights attached to equity shares: |

In respect of every ordinary share, voting right shall be in the same proportion as the capital paid upon such Ordinary share bears to the total paid up ordinary capital of the company.

Holders of ADRs are not entitled to attend or vote at shareholders meetings. Holders of ADRs may exercise voting rights with respect to ordinary shares represented by ADRs only in accordance with the provisions of the Company’s deposit agreement and Indian Law.

Each ADRs represents one half of an equity share.

| 4. | RESERVES AND SURPLUS |

Reserves and surplus consist of the following reserves:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Securities premium account |

||||||||

| Opening balance |

3,430,862,460 | 3,370,524,341 | ||||||

| Addition during the year (On account of Stock Options exercised) |

— | 60,338,119 | ||||||

| Closing balance |

3,430,862,460 | 3, 430,862,460 | ||||||

|

|

|

|

|

|||||

| Stock option outstanding account |

||||||||

| Opening balance |

116,531,258 | 94,449,475 | ||||||

| ESOP Compensation Cost |

11,370,219 | 22,081,783 | ||||||

| Closing balance |

127,901,477 | 116,531,258 | ||||||

|

|

|

|

|

|||||

| (Deficit) in the statement of profit and loss |

||||||||

| Opening balance |

(1,078,080,372 | ) | (605,058,143 | ) | ||||

| Deficit during the year |

(540,055,589 | ) | (473,022,229 | ) | ||||

| Closing balance |

(1,618,135,961 | ) | (1,078,080,372 | ) | ||||

|

|

|

|

|

|||||

| Total |

1,940,627,976 | 2,469,313,346 | ||||||

|

|

|

|

|

|||||

| 5. | OTHER LONG-TERM LIABILITIES (UNSECURED) |

Other long-term liabilities consist of the followings:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Income received in advance |

11,803,771 | 10,938,653 | ||||||

| Deposits from employees |

3,849,887 | 2,009,790 | ||||||

|

|

|

|

|

|||||

| Total |

15,653,658 | 12,948,443 | ||||||

|

|

|

|

|

|||||

26

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 6. | LONG – TERM PROVISIONS |

Long–term provisions consist of following:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Provision for employee benefits: |

||||||||

| Gratuity (unfunded) |

27,054,202 | 21,713,975 | ||||||

| Compensated absence (unfunded) |

29,749,948 | 25,839,923 | ||||||

|

|

|

|

|

|||||

| Total |

56,804,150 | 47,553,898 | ||||||

|

|

|

|

|

|||||

| 7. | OTHER CURRENT LIABILITIES |

Other current liabilities consist of the followings:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Capital creditors |

11,130,238 | 1,538,606 | ||||||

| Advance received from customers |

9,659,003 | 50,461,890 | ||||||

| Income received in advance |

55,644,647 | 50,735,433 | ||||||

| Other Liabilities |

2,566,118 | 2,269,011 | ||||||

| Statutory liabilities |

||||||||

| Tax deducted at source Payable |

9,682,865 | 4,970,698 | ||||||

| Service Tax Payable |

325,479 | 3,404,410 | ||||||

| Others |

2,725,134 | 2,682,055 | ||||||

| Other payables to related parties (unsecured): |

||||||||

| Rediff.com Inc. |

36,051,903 | 34,017,791 | ||||||

| Rediff Holding Inc. |

6,492,621 | 6,111,202 | ||||||

| Value Communication Corporation |

6,966,436 | 6,514,342 | ||||||

|

|

|

|

|

|||||

| Total |

141,244,444 | 162,705,438 | ||||||

|

|

|

|

|

|||||

| 8. | SHORT – TERM PROVISIONS |

Short-term provisions consist of the followings:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Provision for employee benefits: |

||||||||

| Gratuity (unfunded) |

2,438,962 | 1,782,747 | ||||||

| Compensated absence (unfunded) |

5,005,640 | 4,583,039 | ||||||

|

|

|

|

|

|||||

| Total |

7,444,602 | 6,365,786 | ||||||

|

|

|

|

|

|||||

27

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 9. | FIXED ASSETS |

Fixed assets consist of the followings: (Amount in

)

)

| Description |

Gross Block as at April 1, 2012 |

Additions | Deletions | Gross Block as at March 31, 2013 |

Accumulated Depreciation as at April 1, 2012 |

Depreciation for the Year |

Deletions | Accumulated Depreciation as at March 31, 2013 |

Net Block Value as at March 31, 2013 |

Net Block Value as at March 31, 2012 |

||||||||||||||||||||||||||||||

| Tangible assets |

||||||||||||||||||||||||||||||||||||||||

| Furniture and fixture |

20,542,335 | — | — | 20,542,335 | (18,082,676 | ) | (460,322 | ) | — | (18,542,998 | ) | 1,999,337 | 2,459,659 | |||||||||||||||||||||||||||

| Computer |

1,368,417,009 | 46,142,770 | (172,741,859 | ) | 1,241,817,920 | (1,205,013,536 | ) | (92,246,351 | ) | 172,643,639 | (1,124,616,248 | ) | 117,201,672 | 163,403,473 | ||||||||||||||||||||||||||

| Office equipment |

16,716,016 | 1,079,451 | (407,555 | ) | 17,387,912 | (11,275,355 | ) | (1,391,797 | ) | 392,070 | (12,275,082 | ) | 5,112,830 | 5,440,660 | ||||||||||||||||||||||||||

| Vehicle |

13,110,370 | 3,187,793 | (1,013,704 | ) | 15,284,459 | (5,228,910 | ) | (1,809,133 | ) | 762,783 | (6,275,260 | ) | 9,009,199 | 7,881,460 | ||||||||||||||||||||||||||

| Leasehold Improvement |

24,990,385 | — | — | 24,990,385 | (14,351,877 | ) | (2,026,635 | ) | — | (16,378,512 | ) | 8,611,873 | 10,638,508 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total tangible assets |

1,443,776,115 | 50,410,014 | (174,163,118 | ) | 1,320,023,011 | (1,253,952,354 | ) | (97,934,238 | ) | 173,798,492 | (1,178,088,100 | ) | 141,934,911 | 189,823,760 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Previous year |

1,326,881,863 | 146,444,529 | (29,550,277 | ) | 1,443,776,115 | (1,187,588,173 | ) | (94,805,303 | ) | 28,441,122 | (1,253,952,354 | ) | 189,823,760 | — | ||||||||||||||||||||||||||

| Intangible assets |

||||||||||||||||||||||||||||||||||||||||

| Software |

165,347,719 | 63,091,525 | — | 228,439,244 | (82,585,619 | ) | (55,482,122 | ) | — | (138,067,741 | ) | 90,371,503 | 82,762,100 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total intangible assets |

165,347,719 | 63,091,525 | — | 228,439,244 | (82,585,619 | ) | (55,482,122 | ) | — | (138,067,741 | ) | 90,371,503 | 82,762,100 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Previous year |

107,247,350 | 58,100,369 | — | 165,347,719 | (47,486,389 | ) | (35,099,225 | ) | — | (82,585,614 | ) | 82,762,100 | — | |||||||||||||||||||||||||||

| Intangible assets under development |

— | — | — | — | — | — | — | — | 46,761,840 | 55,895,954 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Grand Total |

1,609,123,834 | 113,501,539 | (174,163,118 | ) | 1,548,462,255 | (1,336,537,973 | ) | (153,416,360 | ) | 173,798,492 | (1,316,155,841 | ) | 279,068,254 | 328,481,814 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

28

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 10. | NON-CURRENT INVESTMENTS |

Non – current investments consists of the following:

| Face Value |

No | As at March 31, 2013 |

As at March 31, 2012 |

|||||||||||||

|

|

|

||||||||||||||

| Trade investments |

||||||||||||||||

| A- Others, Fully paid equity shares (unquoted) |

||||||||||||||||

| Traveljini.com Limited |

10 | 88,350 | 60,300,253 | 60,300,253 | ||||||||||||

| Tachyon Technologies Pvt. Ltd. |

10 | 13,177 | 41,700,000 | 41,700,000 | ||||||||||||

| Vakow Technologies Pvt. Ltd. |

10 | 500,000 | 5,000,000 | 5,000,000 | ||||||||||||

| Imere Technologies Pvt. Ltd. |

10 | 7,857 | — | 15,000,000 | ||||||||||||

| BigSlick Infotech Pvt. Ltd. |

1 | 59,230 | 4,000,000 | 4,000,000 | ||||||||||||

|

|

|

|

|

|||||||||||||

| 111,000,253 | 126,000,253 | |||||||||||||||

|

|

|

|

|

|||||||||||||

| B – Wholly Owned Subsidiary Companies, Fully paid equity shares (unquoted) |

||||||||||||||||

| Rediff Holding Inc., USA |

$ | 0.0001 | 11,066,667 | 1,134,483,000 | 1,134,483,000 | |||||||||||

| Value Communication Corporation, USA |

|

No par value |

|

12,000,000 | 340,609,949 | 340,609,949 | ||||||||||

| Vubites India Pvt. Ltd. |

1 | 1,000,000 | 13,153,409 | 13,153,409 | ||||||||||||

|

|

|

|

|

|||||||||||||

| 1,488,246,358 | 1,488,246,358 | |||||||||||||||

|

|

|

|

|

|||||||||||||

| Total (A+B) |

1,599,246,611 | 1,614,246,611 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Less Provision for diminution in value of investments |

1,531,170,807 | 1,264,987,202 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net investments |

68,075,804 | 349,259,409 | ||||||||||||||

|

|

|

|

|

|||||||||||||

Book value of unquoted investments (net of provisions for diminution) –

68,075,804. (Previous Year

68,075,804. (Previous Year

349,259,409)

349,259,409)

29

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 11. | LONG –TERM LOANS AND ADVANCES (Unsecured) |

Long – term loans and advances consists of the following:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Considered Good |

||||||||

| Rent deposits |

39,987,191 | 27,623,290 | ||||||

| Loans to employees |

1,736,658 | 2,589,803 | ||||||

| Recoverable taxes (net of provision of

|

154,563,726 | 146,709,392 | ||||||

| Prepaid expenses. |

10,180,497 | 15,754,522 | ||||||

| Loans and advances to related parties: |

||||||||

| Vubites India Pvt. Ltd. |

311,667,416 | 246,879,601 | ||||||

| Rediff.com India Ltd. Employee Trust |

201,002,530 | 201,002,530 | ||||||

| India Abroad Publication Inc. |

70,165,914 | 29,312,731 | ||||||

|

|

|

|

|

|||||

| 789,303,932 | 669,871,869 | |||||||

|

|

|

|

|

|||||

| 12. | TRADE RECEVABLES (Unsecured) |

Trade receivables consist of the following:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| (a) Over six months from the date they were due for payments |

||||||||

| (i) Considered good |

1,903,991 | 15,868,481 | ||||||

| (ii) Considered doubtful |

21,876,674 | 141,874,395 | ||||||

|

|

|

|

|

|||||

| 23,780,665 | 157,742,876 | |||||||

|

|

|

|

|

|||||

| (b) Others |

||||||||

| Considered good |

178,018,857 | 266,155,431 | ||||||

|

|

|

|

|

|||||

| 178,018,857 | 266,155,431 | |||||||

|

|

|

|

|

|||||

| Total (a+b) |

201,799,522 | 423,898,307 | ||||||

|

|

|

|

|

|||||

| Less: Provision for doubtful debts |

21,876,674 | 141,874,395 | ||||||

|

|

|

|

|

|||||

| 179,922,848 | 282,023,912 | |||||||

|

|

|

|

|

|||||

30

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 13. | CASH AND CASH EQUIVALENT |

Cash and cash equivalent consist of the following:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| (a) Cash and cash equivalents |

||||||||

| Balances with banks |

||||||||

| In current account |

48,037,231 | 83,485,460 | ||||||

| In EEFC account |

3,030,808 | 478,486 | ||||||

| Cash on hand |

5,211 | 11 | ||||||

|

|

|

|

|

|||||

| 51,073,250 | 83,963,957 | |||||||

|

|

|

|

|

|||||

| (b) Other |

||||||||

| In deposits account |

1,024,275,589 | 1,141,856,395 | ||||||

|

|

|

|

|

|||||

| 1,024,275,589 | 1,141,856,395 | |||||||

|

|

|

|

|

|||||

| Total (a+b) |

1,075,348,839 | 1,225,820,352 | ||||||

|

|

|

|

|

|||||

| 14. | SHORT-TERM LOANS AND ADVANCES (Unsecured, considered good) |

Short-term loans and advances consist of the following:

| As at March 31, 2013 |

As at March 31, 2012 |

|||||||

|

|

|||||||

| Supplier advances |

2,627,115 | 2,202,907 | ||||||

| Rent deposits |

3,470,000 | 15,008,900 | ||||||

| Loan to employees |

2,087,726 | 2,841,938 | ||||||

| Prepaid expenses |

33,067,008 | 39,643,679 | ||||||

| Other loans and advances |

250,593 | 614,023 | ||||||

|

|

|

|

|

|||||

| Total |

41,502,442 | 60,311,447 | ||||||

|

|

|

|

|

|||||

| 15. | REVENUE FROM OPERATIONS |

Revenue from operations consists of the following:

| For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

|||||||

|

|

|||||||

| Online advertising |

452,709,343 | 600,696,790 | ||||||

| Fee based services |

220,324,728 | 178,006,730 | ||||||

|

|

|

|

|

|||||

| Total |

673,034,071 | 778,703,520 | ||||||

|

|

|

|

|

|||||

31

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 16. | OTHER INCOME (NET) |

Other income (net) consists of the following:

| For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

|||||||

|

|

|||||||

| Interest income: |

||||||||

| Interest on fixed deposits |

106,201,609 | 124,024,315 | ||||||

| Interest on income-tax refund |

4,149,107 | 1,652,586 | ||||||

| Interest others |

95,608 | 104,904 | ||||||

| Profit on sale of long-term investments |

64,200,000 | — | ||||||

| Miscellaneous Income Provision for doubtful debts written back |

|

3,312,635 5,199,050 |

|

|

— — |

| ||

|

|

|

|

|

|||||

| Total |

183,158,009 | 125,781,805 | ||||||

|

|

|

|

|

|||||

| 17. | EMPLOYEE BENEFIT EXPENSES |

Employee benefit expenses consist of the following:

| For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

|||||||

|

|

|||||||

| Salaries and wages |

338,974,679 | 312,057,334 | ||||||

| Contribution to provident fund |

12,799,836 | 12,490,859 | ||||||

| Gratuity |

7,434,551 | 4,652,480 | ||||||

| ESOP compensation costs |

11,370,219 | 22,081,783 | ||||||

| Staff welfare expenses |

7,041,401 | 8,719,280 | ||||||

|

|

|

|

|

|||||

| Total |

377,620,686 | 360,001,736 | ||||||

|

|

|

|

|

|||||

32

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 18. | OPERATION AND OTHER EXPENSES |

Operation and other expenses consist of the following:

| For the year ended March 31, 2013 |

For the year ended March 31, 2012 |

|||||||

|

|

|||||||

| Content Charges |

18,804,385 | 18,482,546 | ||||||

| Domain registration charges |

21,716,779 | 18,609,902 | ||||||

| Subscription and SMS based costs |

30,392,528 | 41,449,130 | ||||||

| E-Commerce – Courier, Freight & Forward |

64,041,628 | 34,168,168 | ||||||

| Bandwidth |

148,522,495 | 171,993,006 | ||||||

| Software Usage charges |

28,675,109 | 25,063,307 | ||||||

| Product development charges |

24,514,738 | 36,994,255 | ||||||

| Advertising |

2,657,840 | 83,818,860 | ||||||

| Market support |

41,166,234 | 30,645,253 | ||||||

| Rent and amenities |

48,725,211 | 48,187,437 | ||||||

| Electricity charges |

8,270,517 | 7,429,503 | ||||||

| Telecommunication |

4,329,895 | 4,115,574 | ||||||

| Repairs and maintenance: |

||||||||

| Computers |

39,024,484 | 31,557,588 | ||||||

| Others |

1,263,830 | 1,799,970 | ||||||

| Insurance |

19,094,062 | 8,020,438 | ||||||

| Travel and conveyance |

32,460,137 | 37,523,268 | ||||||

| Rates and taxes |

353,732 | 265,890 | ||||||

| Foreign exchange loss |

495,334 | 4,415,676 | ||||||

| Bank Charges |

6,697,493 | 3,889,841 | ||||||

| Provision for doubtful debts |

||||||||

| Write back of provision (114,798,671) |

||||||||

| Bad debts written off 114,798,671 |

— | — | ||||||

| Legal and professional fees |

33,796,435 | 26,832,908 | ||||||

| Loss / (Gain) on Sale of Fixed Assets |

(92,698 | ) | 248,131 | |||||

| Loss on Sale of Long Term Investments |

— | 5,040,000 | ||||||

| Other Miscellaneous expenses |

24,116,850 | 22,991,639 | ||||||

|

|

|

|

|

|||||

| Total |

599,027,018 | 663,542,290 | ||||||

|

|

|

|

|

|||||

33

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

| 19. | AUDITOR’S REMUNERATION |

| 2012-13 | 2011-12 | |||||||

|

|

|||||||

| (i) For service as auditors |

2,000,000 | 1,500,000 | ||||||

| (ii) For taxation matters |

700,000 | 1,200,000 | ||||||

| (iii) For other services (US GAAP and SOX) |

7,050,000 | 6,050,000 | ||||||

| (iv) For reimbursement of expenses |

34,171 | 90,147 | ||||||

| (v) For service tax* |

1,209,324 | 1,070,185 | ||||||

|

|

|

|

|

|||||

| 10,993,495 | 9,910,332 | |||||||

|

|

|

|

|

|||||

Auditors’ remuneration includes fees of

5 Lacs (2012:

5 Lacs (2012:

10 Lacs) payable/ paid for professional services to a firm of chartered accountants in which some partners of the firm of statutory auditors are partners.

10 Lacs) payable/ paid for professional services to a firm of chartered accountants in which some partners of the firm of statutory auditors are partners.

| * | Service tax credit has been availed. |

| 20. | RETIREMENT BENEFIT PLAN |

Defined – Benefit Plans

The Company offers its employees unfunded defined-benefit plan in the form of gratuity. This plan provides for a lump-sum payment to be made to vested employees at retirement, death or termination of employment. Commitments are actuarially determined at year-end. Actuarial valuation is done based on “Projected Unit Credit” method. Gains and losses of changed actuarial assumptions are charged to the Statement of Profit and Loss.

Defined benefit commitments:

| 2012-13 | 2011-12 | |||||||

|

|

|||||||

| Benefit obligation at the beginning of the year |

23,496,722 | 20,732,081 | ||||||

| Actuarial (gain) |

1,008,042 | (1,268,229 | ) | |||||

| Current service cost |

4,139,798 | 3,992,710 | ||||||

| Interest cost |

2,286,710 | 1,927,999 | ||||||

| Benefits paid |

(1,438,109 | ) | (1,887,839 | ) | ||||

| Benefit obligation at the end of the year |

29,493,163 | 23,496,722 | ||||||

Expenses on defined benefit plan:

| 2012-13 | 2011-12 | |||||||

|

|

|||||||

| Service cost |

4,139,798 | 3,992,710 | ||||||

| Interest cost |

2,286,710 | 1,927,999 | ||||||

| Recognised net actuarial (gain) |

1,008,042 | (1,268,229 | ) | |||||

| Net gratuity cost |

7,434,550 | 4,652,480 | ||||||

34

REDIFF.COM INDIA LIMITED

Notes forming part of the Financial Statements

The actuarial calculations used to estimate defined benefit commitments and expenses are based on the following assumptions which if changed, would affect the defined benefit commitment’s size and expense:

| 2012-13 | 2011-12 | |||

| Rate for discounting liabilities |

8.00% | 8.55% | ||

| Salary escalation rate |

7.00% | 7.00% | ||

| Expected rate of return on assets |

0.00% | 0.00% | ||

| Mortality rates |

Indian Assured live mortality table (2006-08) |

LIC 1994-96 mortality table |

The estimate of future salary increase, considered in the actuarial valuation, take account of inflation, seniority, promotion, and other relevant factors. The above information is certified by the actuary.