lpsn-202112310001102993--12-312021FYfalse00011029932021-01-012021-12-3100011029932021-06-30iso4217:USD00011029932022-02-25xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _____ to _____

Commission File Number 000-30141

LIVEPERSON, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 13-3861628 |

| (State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | |

| 530 7th Ave, Floor M1 | | |

New York, New York | | 10018 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone Number, including area Code: (212) 609-4200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | LPSN | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ | |

| Non-accelerated Filer | ☐ | | Smaller Reporting Company | ☐ | |

| | | Emerging Growth Company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $4,035,402,834 (computed by reference to the last reported sale price on The Nasdaq Global Select Market on that date). The registrant does not have any non-voting common stock outstanding.

On February 10, 2022, 72,570,760 shares of the registrant’s common stock were outstanding.

| | | | | | | | |

| Auditor Name | Auditor Location | Auditor Firm ID |

| BDO USA, LLP | New York, New York | 23 |

LIVEPERSON, INC.

AMENDMENT NO. 1 TO 2021 ANNUAL REPORT ON FORM 10-K/A

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| Explanatory Note | |

| | |

| Cautionary Statement Concerning Forward-Looking Statements | |

| | |

| PART III |

| |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| | |

| Item 11. | Executive Compensation | |

| | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| | |

| Item 14. | Principal Accountant Fees and Services | |

| | |

| PART IV |

| |

| Item 15. | Exhibits and Financial Statement Schedules | |

| | |

EXPLANATORY NOTE

LivePerson, Inc. (“LivePerson”, the “Company”, “we” or “us”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend the Annual Report on Form 10-K for the fiscal year ended December 31, 2021 originally filed with the Securities and Exchange Commission (the “SEC”) by the Company on February 28, 2022 (the “Original Form 10‑K”), solely for the purpose of including the information required by Items 10 through 14 of Part III of Form 10-K. This information was omitted from the Original Form 10‑K in reliance on General Instruction G(3) to Form 10-K, which permits such information to be incorporated by reference from a registrant’s definitive proxy statement, if filed with the SEC not later than 120 days after the end of the fiscal year covered by a Form 10-K (or as such deadline may be extended pursuant to Rule 0-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the “Filing Deadline”). We will not have filed our definitive proxy statement by the Filing Deadline and are therefore amending and restating in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Original Form 10-K. The reference on the cover page of the Original Form 10-K to the incorporation by reference of portions of our definitive proxy statement into Part III of the Original Form 10-K is hereby deleted.

In addition, as required by Rule 12b-15 under the Exchange Act, certifications by LivePerson’s principal executive officer and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV hereof. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. We are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment.

This Amendment does not reflect events occurring after the filing of the Original Form 10-K or modify or update the disclosure contained in the Original Form 10‑K in any way other than as required to reflect the amendments discussed above and reflected below. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and with the Company’s filings with the SEC subsequent to the filing of the Original Form 10-K. Capitalized terms used but not defined herein have the meanings assigned to them in the Original Form 10-K.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Statements in this Amendment about LivePerson that are not historical facts are forward-looking statements. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about LivePerson and our industry. Our expectations, assumptions, estimates and projections are expressed in good faith, and we believe there is a reasonable basis for them, but we cannot assure you that our expectations, assumptions, estimates and projections will be realized. Examples of forward-looking statements include, but are not limited to, statements regarding future business, future results of operations or financial condition (including based on examinations of historical operating trends), management strategies and the COVID-19 pandemic. Many of these statements are found in the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Original Form 10-K. When used in this Amendment, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes” and variations of such words or similar expressions are intended to identify forward-looking statements. However, not all forward-looking statements contain these words. Forward-looking statements are subject to risks and uncertainties that could cause actual future events or results to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause our actual results to differ materially from the forward-looking statements we make in this Amendment include those set forth in the section of the Original Form 10-K entitled “Risk Factors.” It is routine for our internal projections and expectations to change as the year or each quarter in the year progress, and therefore it should be clearly understood that the internal projections and beliefs upon which we base our expectations may change prior to the end of each quarter or the year. Although these expectations may change, we are under no obligation to inform you if they do. Our policy is generally to provide our expectations only once per quarter, and not to update that information until the next quarter. We do not undertake any obligation to revise forward-looking statements to reflect future events or circumstances. All forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following is a brief biographical summary of the experience of our directors, including their ages as of December 31, 2021.

Peter Block, 82, has served as a member of our board of directors (the “Board”) since July 2010. Mr. Block brings experience in management consulting and organizational development, and has been President of Peter Block Inc., a management consulting group, and a partner in Designed Learning, a training company that offers both in-person and virtual workshops designed by Mr. Block to build organizational development skills, since 1997. Mr. Block is also a best-selling author of several books about organizational dynamics, community, and accountability. Among other awards, Mr. Block has received the Organizational Development Network’s Lifetime Achievement Award, the American Society for Training and Development Award for Distinguished Contributions, and the Association for Quality and Participation President’s Award. He is also a member of Training Magazine’s HRD Hall of Fame. Mr. Block holds a B.S. degree in Industrial Administration from the University of Kansas and an M.S. degree in Industrial Administration from Yale University. Mr. Block serves on the Compensation Committee and Social Impact and Culture Committee.

Mr. Block brings to the Board significant expertise on hiring, enabling and retaining talent, building high-performance internal teams and maintaining a diverse, inclusive and engaged workforce and unique perspective on organizational design.

Ernest Cu, 61, has served as a member of the Board since April 2021. Mr. Cu brings a long history of executive leadership experience, having served as Executive Director, President, and Chief Executive Officer (“CEO”) of Globe Telecom, Inc. (PSE:GLO), a major publicly traded telecommunications provider in the Philippines, since April 2009, and as President and CEO of SPi Technologies from 1997 to 2008. He is considered to be one of the founding originators of the business process outsourcing (“BPO”) business model in the Philippines in recognition of his immense contributions to the telecommunications industry. Mr. Cu also brings valuable finance experience as a former executive at Bank of America and former director of Maybank ATR Kim Eng Financial Corp. Mr. Cu has extensive experience as a director of a variety of private companies, including AF Payments (Beep), a financial services company. Mr. Cu has previously been recognized by Ernst & Young as ICT Entrepreneur of the Year, and, on two occasions each, was recognized by Finance Asia as the Philippines’ Best CEO and by Frost & Sullivan as CEO of the Year. He was also recognized as one of the 100 most influential telecom leaders worldwide by London-based Global-Telecoms Business Magazine Power 100 for five consecutive years. Mr. Cu holds a B.S. degree in Industrial Management Engineering from De La Salle University in Manila and an M.B.A. degree from the J.L. Kellogg Graduate School of Management at Northwestern University. Mr. Cu serves on the Social Impact and Culture Committee.

Mr. Cu brings to the Board a global perspective in areas such as infrastructure modernization, sustainability, and product innovation, with particular expertise in communications and consumer offerings, and extensive expertise in financial and operational management and business transformation.

Kevin Lavan, 69, has served as a member of the Board since January 2000. Mr. Lavan currently serves as Chief Financial Officer (“CFO”) of Autoclear LLC, a designer, builder, and distributor of security systems, a role he has held since February 2016. Prior to his current role, Mr. Lavan was an independent consultant to the media and entertainment industries, building on his leadership experience across entertainment, media, and direct and digital marketing. Between April 2010 and December 2014, Mr. Lavan was a Senior Vice President, Worldwide Controller of IMG, an international and diversified sports, entertainment and media company. He also served in various executive roles at Paradysz Matera Company, Inc., MDCPartners, Inc., Now Marketing, Inc., and Wunderman, a marketing division of Young & Rubicam Inc., and previously served as an independent consultant to marketing services organizations. Earlier in Mr. Lavan’s career, he held various finance roles at Young & Rubicam, Viacom Inc. and Viacom’s subsidiary, MTV Networks. Mr. Lavan holds a B.S. degree from Manhattan College, and is a Certified Public Accountant. Mr. Lavan is Chair of the Audit Committee and also serves on the Compensation Committee, Nominating and Corporate Governance Committee, and Social Impact and Culture Committee.

Mr. Lavan brings to the Board highly relevant perspective in digital marketing and advertising, as well as extensive operating, financial senior management experience.

Jill Layfield, 47, has served as a member of the Board since November 2016. Ms. Layfield co-founded Tamara Mellon, a digitally-native, luxury retail company, where she served as CEO from July 2016 to December 2021 and assisted in launching the first-ever digitally led, direct-to-consumer luxury footwear brand. From November 2004 until July 2016, Ms. Layfield served in various roles at Backcountry.com, including as President and CEO from January 2011 to December 2015. During her time at Backcountry.com, she grew the company from $25 million to $515 million in revenue and successfully sold the business to TSG Consumer Partners for $350 million. Ms. Layfield also held various marketing positions at several Silicon Valley companies including Shutterfly, a photography and image sharing company; Cisco Systems, a developer, manufacturer, and seller of technology and

telecommunications equipment; Infogear, a start-up focused on marketing for internet appliances; and 8x8, a manufacturer of videoconferences products and a VOIP service provider. Ms. Layfield currently sits on the board of directors for The Orvis Company. Additionally, Ms. Layfield previously sat on the boards of directors of Camber Outdoors and SmartPak Equine. Ms. Layfield received a B.A. degree in Communications - Journalism from Santa Clara University. Ms. Layfield is recognized as an innovator and industry expert in combining organizational change and advanced technologies to retool customer care for the digital, mobile era. Ms. Layfield is Chair of the Compensation Committee and also serves on the Audit Committee, Nominating and Corporate Governance Committee, and Social Impact and Culture Committee.

Ms. Layfield brings to the Board a deep experience in the retail and technology sector, operational expertise and unique expertise transforming customer experience and forging meaningful, high-quality connections between brands and consumers.

Robert P. LoCascio, 53, has served as a member of our Board since LivePerson’s inception in November 1995. He has been CEO and Chairman since founding the Company, and also served as President until January 2001. As founder and CEO, Mr. LoCascio deeply understands the technology and business of LivePerson and has been an integral part of driving the Company’s market leadership in Conversational Artificial Intelligence and building its best-in-class AI platform. In addition to his role at LivePerson, Mr. LoCascio is a founding board member of EqualAI, an organization which works with companies, policy makers, and experts to reduce bias in AI. Mr. LoCascio has been widely recognized for his leadership in the technology space and was the winner of the 2015 Smart CEO Circle of Evidence Award and was named a New York City Ernst & Young Entrepreneur of the Year finalist in 2001 and 2008. Mr. LoCascio is also a founding member of the NYC Entrepreneurs Council of the Partnership for New York City. In 2001, Mr. LoCascio started the Dream Big Foundation with its first program, FeedingNYC, which gives families in need a Thanksgiving dinner. To date, FeedingNYC has delivered meals to approximately 90,000 families. Its second program, the Dream Big Entrepreneurship Initiative, launched in 2014 to fund, mentor, coach, and empower local entrepreneurs in underserved communities. Mr. LoCascio received a B.B.A. degree from Loyola College. Mr. LoCascio currently serves on the Board’s Social Impact and Culture Committee.

Mr. LoCascio brings to the Board a unique perspective of LivePerson’s business and his strategic vision and operational insights as the Company founder and CEO. In addition, the Company values Mr. LoCascio’s extensive technology experience, specifically in the cloud-based technologies space, as well as his strong entrepreneurial background.

Fred Mossler, 55, has served as a member of the Board since May 2017. Mr. Mossler brings experience as an executive, investor, and entrepreneur. He has been an independent consultant, entrepreneur, and philanthropist since June 2016. From August 1999 until June 2016, Mr. Mossler worked in various senior leadership positions at Zappos, including Senior Vice President of Merchandising, and helped Zappos grow into a company with more than $1 billion in gross merchandise sales before it was bought by Amazon in 2009. From September 1991 to August 1999, Mr. Mossler worked in various positions at Nordstrom. In addition to Mr. Mossler’s career in e-commerce and retail, he assisted with the launch and building of, and previously served on the board of, Downtown Project, a company dedicated to helping revitalize part of downtown Las Vegas through investment in small businesses, tech startups, real estate, arts, culture, and education. Mr. Mossler founded Honus Capital LLC, a hands-on investment fund for Las Vegas-area entrepreneurs. He also co-founded the popular Mexican restaurant chain Nacho Daddy. Mr. Mossler graduated from Southern Oregon University with a B.S. degree in Business. Mr. Mossler serves on the Compensation Committee, Nominating and Corporate Governance Committee, and Social Impact and Culture Committee.

Mr. Mossler brings to the Board significant expertise in call center services, in addition to extensive experience in consumer-facing industries and consumer experience more broadly. Mr. Mossler also has extensive experience in assisting with business growth and providing both technology, e-commerce, and product merchandising knowledge.

William G. Wesemann, 65, has served as a member of the Board since November 2004. Mr. Wesemann brings experience as an executive, board member and investor in various technology companies. Mr. Wesemann has been an independent consultant and an independent investor since 2002. In addition to his role as a member of the Board, Mr. Wesemann has served on the board of directors of Aclarion, Inc. (Nasdaq:ACON), a medical SAAS company that listed on Nasdaq in 2022, since 2016. He also serves on the boards of directors of several privately held companies, including STATIONHEAD, a social audio company, and Mylio, a photo management company. From March 2016 until January 2019, Mr. Wesemann was CEO of LARC Networks Inc., a communication, security, and privacy technology developer. Earlier in his career, Mr. Wesemann was CEO of NextPage, Inc., a provider of document management systems, CEO of netLens Inc., a peer-to-peer platform for creating distributed applications that was acquired by NextPage, and Vice President of Sales of Genesys Telecommunications Laboratories, Inc., a leader in computer-telephony integration. Mr. Wesemann received a B.A. degree from Glassboro State College (now called Rowan University). Mr. Wesemann serves as Chair of the Nominating and Corporate Governance Committee and also serves on the Compensation Committee, Audit Committee, and Social Impact and Culture Committee.

Mr. Wesemann brings to the Board notable technology, software and sales experience, in addition to extensive CEO, management and board experience at public and private software and technology companies.

The following is a brief biographical summary of the experience of the executive officers of LivePerson, including their ages as of December 31, 2021.

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Robert P. LoCascio | | 53 | | Chief Executive Officer & Chairman of the Board |

| John D. Collins | | 40 | | Chief Financial Officer |

| Monica L. Greenberg | | 53 | | Executive Vice President of Public Policy & General Counsel |

Norman M. Osumi (1) | | 57 | | Senior Vice President, Chief Accounting Officer |

(1)Mr. Osumi assumed the role of Senior Vice President, Chief Accounting Officer on March 2, 2021.

Robert P. LoCascio’s biography can be found above in this Amendment, and is included with the biographies of the other members of the Board. Biographies for our other executive officers are listed below.

John D. Collins has served as our CFO since February 2020. Mr. Collins joined LivePerson in September 2019 to lead the development of automations and machine learning to support strategic decision making and predictive analytics as SVP of Quantitative Strategy. In 2013, Mr. Collins co-founded Thasos, a New York City-based predictive intelligence company powering large scale equity trading platforms. Mr. Collins served in various capacities at Thasos, including, most recently, as an Advisory Board Member, as its Chief Product Officer (2016-2019) and as its Portfolio Manager (2013-2016). Prior to that, Mr. Collins held roles in the financial services industry, including regulating financial firms at the NYSE, and structuring transactions in leveraged finance at Credit Suisse. Mr. Collins received his J.D. from Chicago-Kent College of Law at Illinois Institute of Technology, his M.B.A. from the Massachusetts Institute of Technology and a B.S. from the University of Central Florida.

Monica L. Greenberg has been our Executive Vice President of Public Policy and General Counsel since April 2019, our Executive Vice President, Corporate Development, Strategic Alliances and General Counsel from December 2017 to April 2019, our Executive Vice President, Business Affairs and General Counsel from February 2014 to December 2017, and our Senior Vice President, Business Affairs and General Counsel from November 2006 to February 2014. From May 2004 until October 2006, Ms. Greenberg was an independent consultant. From April 2000 until April 2004, Ms. Greenberg served as Vice President, General Counsel and Senior Corporate Counsel of Nuance Communications, Inc. Previously, from January 1999 to March 2000, Ms. Greenberg was the principal of a small business. From July 1996 to December 1998, Ms. Greenberg was associated with the law firm of Wilson Sonsini Goodrich & Rosati in Palo Alto, California. From September 1994 to July 1996, Ms. Greenberg was associated with the law firm of Willkie Farr & Gallagher in New York, NY. Ms. Greenberg received a J.D. from Boston University School of Law where she was a member of the Boston University Law Review, and a B.A. from the University of Pennsylvania.

Norman M. Osumi has served as our Senior Vice President and Chief Accounting Officer since March 9, 2021. Prior to joining LivePerson, Mr. Osumi served in senior finance and accounting roles at Symantec, now known as NortonLifeLock, from October 2007 to February 2021. Prior to that, Mr. Osumi held the position of Vice President of Finance at VeriSign, Inc. from 2004 to 2007, Associate Vice President & Corporate Controller at NEC Electronics America, Inc from 1998 to 2004, and served as Director of Finance at Gymboree Corporation from 1996 to 1998. Mr. Osumi started his career at PricewaterhouseCoopers and received a B.S. from Loyola Marymount University.

Audit Committee

The Audit Committee appoints our independent registered public accounting firm, reviews the plan for and the results of the independent audit, approves the fees of our independent registered public accounting firm, reviews with management and the independent registered public accounting firm our quarterly and annual financial statements and our internal accounting, financial and disclosure controls, reviews and approves transactions between LivePerson and its officers, directors and affiliates, oversees whistle-blower procedures and performs other duties and responsibilities as set forth in a charter approved by the Board. The charter of the Audit Committee is available at https://ir.liveperson.com/corporate-governance/governance-overview. Each member of the Audit Committee is independent, as independence is defined for purposes of Audit Committee membership by the listing standards of The Nasdaq Stock Market (“Nasdaq”) and the applicable rules and regulations of the SEC. The Audit Committee held four meetings during the fiscal year ended December 31, 2021 (the “ 2021 Fiscal Year” or “fiscal 2021”).

The Board has determined that each member of the Audit Committee is able to read and understand fundamental financial statements, including LivePerson’s balance sheet, income statement and cash flow statement, as required by Nasdaq rules. In addition, the Board has determined that Mr. Lavan satisfies the Nasdaq rule requiring that at least one member of our Board’s Audit Committee have past employment experience in finance or accounting, requisite professional certification in accounting or any other comparable experience or background which results in the member’s financial sophistication, including being, or having been, a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. The Board has also determined that Mr. Lavan is the Audit Committee’s “audit committee financial expert” as defined by the SEC.

Delinquent Section 16(a) Reports

The members of our Board, our executive officers and persons who hold more than ten percent of our outstanding common stock are subject to the reporting requirements of Section 16(a) of the Exchange Act, which requires them to file reports with respect to their ownership of our common stock and their transactions in such common stock. Based solely upon a review of the copies of Section 16(a) reports which LivePerson has received from such persons or entities, and the written representations received from the reporting persons that no other reports were required, for transactions in our common stock and their common stock holdings for the 2021 Fiscal Year, LivePerson believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its directors, executive officers and beneficial owners of more than ten percent of its common stock, other than one late Form 4 filed by each of Messrs. Block and Lavan with respect to one transaction each; Messrs. Cu, Mossler, Osumi and Wesemann and Ms. Layfield with regard to two related transactions each; and Mr. Collins with respect to three related transactions.

Codes of Conduct and Corporate Governance Documents

The Company monitors developments in the area of corporate governance and routinely reviews its processes and procedures in light of such developments. Accordingly, the Company reviews federal laws affecting corporate governance as well as various rules promulgated by the SEC and Nasdaq. The Company believes that it has procedures and practices in place which are designed to enhance and protect the interests of its stockholders.

The Board has adopted a Code of Conduct that applies to all officers, directors and employees, and a Code of Ethics for the Chief Executive Officer and Senior Financial Officers that applies to the Company’s Chief Executive Officer and executives who are deemed to be Senior Financial Officers of the Company.

Both codes of conduct can be accessed at https://ir.liveperson.com/corporate-governance/governance-overview and disclosures of any amendments to, or waivers under, the Code of Ethics for the Chief Executive Officer and Senior Financial Officers will be made on our website.

The charters of our Board’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, and LivePerson’s current Amended and Restated Certificate of Incorporation, and Amended and Restated Bylaws can be accessed at https://ir.liveperson.com/corporate-governance/governance-overview. Copies may also be obtained at no charge by writing to LivePerson, Inc., 530 7th Avenue, Floor M1, New York, New York 10018, Attention: Investor Relations.

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation program for our Named Executive Officers (“NEOs”) for 2021, listed below. The CD&A also describes the process followed by the Compensation Committee of the Board (referred to as the Compensation Committee or the Committee in this CD&A) for making pay decisions in respect of our NEOs, as well as its rationale for specific decisions related to 2021 NEO compensation matters. For 2021, our NEOs included:

•Robert P. LoCascio, our Chief Executive Officer;

•John D. Collins, our Chief Financial Officer;

•Monica L. Greenberg, our Executive Vice President of Public Policy and General Counsel;

•Norman M. Osumi, our Senior Vice President and Chief Accounting Officer; and

•Alexander Spinelli, our former Global Chief Technology Officer.

Our Company

LivePerson, Inc. is the market leader in Conversational Artificial Intelligence with a best-in-class platform used by thousands of the world’s top brands to better understand customer intents, connect across channels and deliver meaningful outcomes. The Conversational Cloud, our cloud-based platform, enables businesses to become conversational by securely deploying AI-powered messaging at scale for brands with tens of millions of customers and many thousands of agents across each brand’s primary digital channels, including mobile apps, mobile and desktop web browsers, SMS, social media, and third-party consumer messaging

platforms. More than 18,000 businesses use our conversational solutions to create a convenient, deeply personal relationship with their customers and nearly a billion conversational interactions are powered by our Conversational Cloud each month.

2021 Financial and Strategic Performance Highlights

Delivered strong financial performance in 2021. Reflecting the strength of our core conversational AI platform and expansion of our customer base, in 2021, our revenue grew 28% to $469.6 million, setting a new record for the company. We drove total messaging volume growth by nearly 50%, while our focus on profitable and leverageable growth enabled us to achieve an adjusted EBITDA margin of 6.2%.

Accelerated the momentum of our core AI platform. We continued to execute our strategy of becoming one of the leading AI and automation companies in the world. In 2021, AI-powered messaging volume increased 60% year-over-year with our AI solutions for customer care and commerce powering approximately 75% of interactions across our platform and entire businesses across retail, healthcare, financial services, travel and hospitality sectors.

Unlocked new growth opportunities in healthcare vertical. Expanding upon our traction in the healthcare vertical for digital customer care, we leveraged our technology and innovation capabilities to pursue brand-to-employee solutions in response to client demand, unlocking additional go-forward opportunities in the healthcare sector for digital solutions on our platform.

Completed acquisitions of VoiceBase and Tenfold to deliver integrated voice, digital, and AI offerings in response to market demand. These acquisitions are enabling us to meet client demand for integrated voice and digital engagement solutions, analytics and AI, and are opening new opportunities for strategic relationships to expand our indirect distribution capabilities.

2021 Executive Compensation Program Highlights

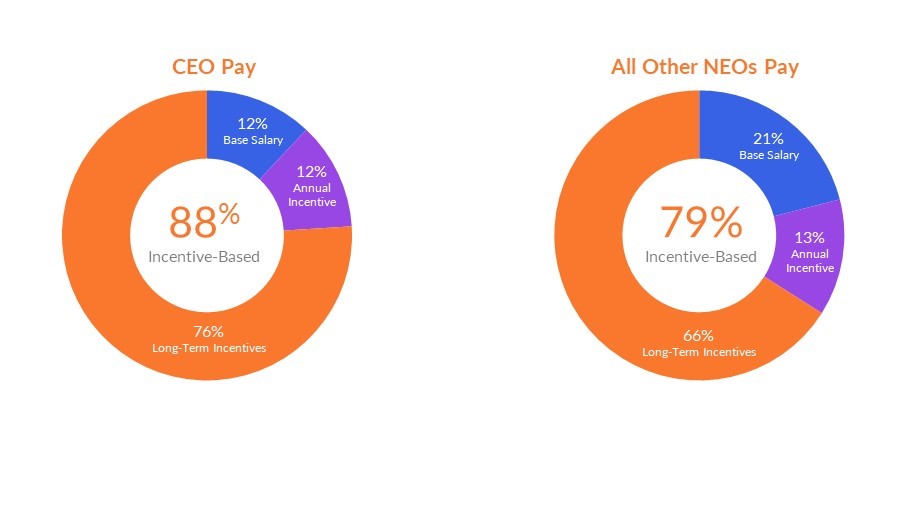

Compensation Program Aligned with Growth. Approximately 88% of our CEO and almost 80% of the compensation for our other NEOs is variable and at risk. To align the long-term interests of our CEO and NEOs with our stockholders, options represented 50% of the 2021 long-term incentive opportunity for our executives and deliver value only if our stock price meaningfully appreciates.

Annual incentives paid out 90% of target. Performance metrics for the annual incentive program include revenue to incentivize top line growth and EBITDA to emphasize disciplined profitability, two of the key drivers of our long-term growth.

Eliminated stock payment premium for the executive annual incentive program. We continued to deliver annual bonus program payouts in the form of vested restricted stock units (“RSUs”) to foster a culture of ownership throughout the company for all bonus plan participants, including our NEOs. For our senior executives, we eliminated the additional premium on bonus RSUs paid in prior years.

Enhanced equity risk mitigation policies. Consistent with our commitment to best governance practices, we adopted robust stock ownership guidelines for our executives, including 5x base salary for the CEO and 2x base salary for other NEOs.

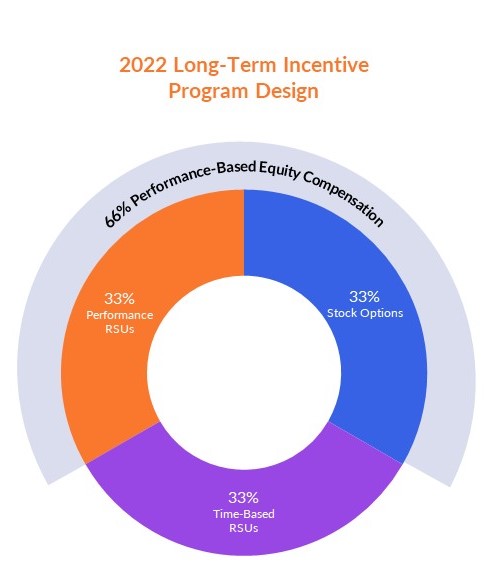

In response to stockholder feedback, we introduced performance RSUs to the 2022 long-term incentive program for executives. Commencing in 2022, long-term incentive equity grants for our NEOs will include performance RSUs with vesting tied to a three-year performance period and the achievement of financial performance and relative TSR metrics. Together with our use of stock options in our executive equity program, we believe the introduction of our performance RSUs further strengthens alignment between the interests of our executives with those of our stockholders, as we continue to evolve our compensation program.

Stockholder Engagement and Say on Pay

We believe that regular, transparent communications with our stockholders are essential to our long-term success. We value the opinions of our stockholders and we are committed to a robust stockholder engagement program to solicit feedback and encourage open, transparent and candid discussion about our strategic priorities, governance programs and sustainability priorities that are important to our stockholders.

Each year, we carefully consider the results of our stockholder advisory say-on-pay vote from the preceding year. In 2021 and 2020, over 92% and 96%, respectively, of the votes cast supported our executive compensation program and decisions. We are pleased with the support we have received in these recent votes as we continue to evolve our executive compensation program with the interests and perspectives of our stockholders in mind. In this regard, based on stockholder feedback, as part of the 2022 long-term incentive program design, the Board adopted a new long-term incentive program structure that will incorporate a performance-based RSU component as part of our annual equity grants to NEOs. We will continue to evaluate and evolve our performance compensation programs over time in response to stockholder feedback and consistent with best practices.

We engage with our stockholders in a variety of ways, including as follows:

•We regularly speak with stockholders, prospective stockholders and investment analysts.

•We participate in equity conferences and investor events across the United States.

•We also directly engage with stockholders to solicit feedback on the following matters: executive compensation, environmental, social and governance (“ESG”) strategies and practices, governance, and other topics of interest related to our business.

As part of our engagement efforts, we seek to provide our investors with insight into our business and practices, answers to their questions, and responses to the valuable insight and feedback they share. We also review and discuss stockholder feedback internally to help ensure we are proactively assessing and informing our policies, programs and areas of focus, as well as balancing the priorities of our stockholders. We intend to continue our efforts to engage with, and solicit feedback from, our stockholders and will, in turn, carefully consider, and may implement, revisions to our compensation programs as a result of that feedback, as we have done for our 2022 program with the adoption of performance-based RSUs.

Compensation Governance

We believe the following practices and policies, embedded in our current NEO compensation plans and programs, promote sound compensation governance and are in the best interests of our stockholders and executives:

| | | | | | | | | | | |

| What We Do | | What We Don’t Do |

| ü | Emphasize variable incentive pay | û | No excise tax gross ups |

| ü | Maintain a clawback policy covering all incentive awards

| û | No guaranteed bonuses |

| ü | Maintain fully independent Compensation Committee | û | No excessive perquisites |

| ü | Retain an independent compensation consultant | û | No option repricing, without stockholder approval |

| ü | Design compensation programs that would not encourage risk-taking | û | No hedging |

| ü | Cap bonus payouts | û | No dividends paid on unvested equity awards |

What Guides Our Program

Compensation Philosophy, Strategy and Objectives

The philosophy underlying our executive compensation program is to employ and retain the best leaders in our industry to ensure we execute on our business goals, and to reward both individual and company performance in order to promote continued growth and profitability, and to effectively create long-term stockholder value. Our executive compensation program strategy is therefore driven by the following objectives:

| | | | | |

| Pay for Performance | A significant portion of an executive’s total compensation should be variable and at risk and aligned with our short- and long-term performance results. |

| Stockholder Alignment | Executives should be compensated through pay elements (annual- and long-term incentives) designed to align executive compensation to the creation of long-term value for our stockholders. |

| Competitiveness | Target compensation should be set at a level that is competitive with that being offered to individuals holding comparable positions at other companies with which we compete for business and leadership talent. |

| Attraction and Retention | The executive compensation program should enable the Company to attract and retain high-potential team players with exceptional leadership capabilities and who want to build a long-term career with LivePerson. |

Elements of Compensation

In order to achieve our compensation objectives and to support our strategy and compensation philosophy, each as outlined above, our compensation program has been designed to include the following principal pay elements:

| | | | | | | | |

| Element | Form of Payment | Purpose |

| Base Salary | Cash

(Fixed) | • Provides a competitive fixed rate of pay relative to similar positions in the market.

• Enables the Company to attract and retain critical executive talent.

• Based on job scope, level of responsibilities, individual performance, experience, and market levels. |

| Annual Incentive | Cash or

Equity

(Variable) | • Focuses executives on achieving important annual financial and strategic goals that drive stockholder value.

• Rewards attainment of annual business goals.

• Allows for assessment of individual performance and contribution.

• Form of award settlement determined by the Compensation Committee as part of annual bonus plan design determination. |

| Long-Term Incentives | Equity

(Variable) | • Provides incentives for executives to execute on longer-term financial and strategic growth goals to maintain focus on long-term stockholder value creation.

• Supports the Company’s executive retention strategy. |

The Company also offers certain benefits, including medical, dental and life insurance benefits, a deferred compensation program, and retirement savings that it considers to be consistent with industry practices and important for competitive recruitment and retention. The NEOs are eligible to participate in these programs on the same basis as our other employees. The Company does not offer special benefits such as supplemental executive retirement plans, perquisites, tax gross-ups or tax equalization.

Pay Mix

In accordance with our executive compensation philosophy, the charts below illustrate the target annual total direct compensation (base salary, target annual incentive opportunity and the grant date fair value of long-term equity-based incentives awarded in 2021) of our CEO and all other NEOs for fiscal year 2021, which shows our emphasis on variable, at-risk compensation.

As illustrated by the charts above, a majority of the CEO’s, and other NEOs’ target pay is incentive-based, and therefore is considered “at risk.” This incentive-based compensation, for each executive, includes an annual bonus award, determined based on the Company’s success over certain financial metrics and paid in the first quarter of 2022 in fully-vested RSUs, and long-term

incentive awards delivered in a mix of 50% stock options and 50% restricted stock unit awards. In each case, the value of the compensation package increases as the value of our shares increase, and the value of the compensation package decreases as our share value decreases. This approach directly aligns our CEO’s interests with those of our stockholders in both times of share price growth, as well as when the Company faces share price pressure.

The Role of the Compensation Committee

The Compensation Committee, comprised of independent, non-employee members of the Board, oversees the executive compensation program for our NEOs. The Compensation Committee works very closely with an independent compensation consultant, having engaged Pearl Meyer through August 2021, at which time it entered into a new engagement with Compensia. The Committee also seeks the input of management to examine the effectiveness of the Company’s executive compensation program throughout the year. The Compensation Committee reviews executive compensation and market and peer compensation data annually, in conjunction with annual operational and financial planning for the current fiscal year and periodically as needed for specific executive compensation issues that may arise at other times. The Compensation Committee makes final determinations regarding compensation for the CEO and our other executive officers in its sole discretion. Details of the Compensation Committee’s authority and responsibilities are specified in the Compensation Committee’s charter, which may be accessed at our website, www.liveperson.com, by selecting “Investor Relations,” and then “Governance,” and then “Governance Overview.”

The Role of Management

Our CEO, with input from a committee of senior executives, assists the Compensation Committee by presenting it with proposals and recommendations for NEO compensation levels (other than for himself), information on Company and individual performance of each NEO and management’s perspective and recommendations on compensation design matters (except that the CEO and senior executives, to the extent present, recuse themselves from that portion of the Compensation Committee meetings involving their own compensation).

The Role of the Independent Compensation Consultant

Under its Charter, the Compensation Committee has the authority to retain an independent compensation consultant to provide expertise on competitive pay practices, program design, and an objective assessment of the inherent risks of any compensation programs. During 2020 and until August 2021, the Committee worked with Pearl Meyer, an independent compensation consulting firm, to assist the Committee in evaluating the elements and levels of our executive compensation for 2021, including base salaries, annual cash incentive awards and equity-based incentives for our CEO and other executive officers.. During this time, Pearl Meyer advised the Committee on a variety of compensation matters, completed a competitive market assessment for executive and non-employee director compensation levels, conducted a compensation peer group review, reviewed governance matters pertaining to executive and employee compensation with the Committee, and reviewed strategies regarding equity grants pursuant to the Company’s short- and long-term incentive programs. During the time of their services, Pearl Meyer also advised and assisted the Committee with other ad hoc requests related to executive compensation. .

In August 2021, the Committee ended its engagement with Pearl Meyer and transitioned to using Compensia as the Committee’s independent compensation consultant. Since its engagement, Compensia has refreshed the Company’s market benchmarking analysis utilizing the previously determined peer group, worked with the Company to review bonus awards under the 2021 short-term incentive bonus program, and focused on development and implementation of an updated long-term equity compensation program that introduces the use of performance share units as part of the annual equity grant mix for executive officers (as more fully described below in the sections of this Amendment entitled “2022 Compensation Design Updates”).

The Compensation Committee conducted an independence assessment of both Pearl Meyer and Compensia in accordance with SEC and Nasdaq rules. Based on this review, the Committee is not aware of any conflicts of interest raised by the work performed by either Pearl Meyer or Compensia that would prevent them from having served, or serving, as applicable, as an independent consultant to the Compensation Committee. The Committee’s compensation consultant reports directly to the Compensation Committee, and neither Pearl Meyer nor Compensia provided any additional services to the Company or management in 2021.

The Role of Competitive Pay Positioning/2021 Benchmarking

As part of the compensation setting process for 2021, the Compensation Committee reviewed surveys and market data provided by Pearl Meyer to evaluate compensation levels and practices for the NEOs. After consideration of the data collected on external competitive levels of compensation and internal relationships within the executive group, the Compensation Committee reviewed and approved 2021 target total compensation opportunities for executives based on the need to attract, motivate and retain an experienced and effective management team.

Pay levels for each of our NEOs are determined based on a number of factors, including the individual’s roles and responsibilities within the Company, the individual’s experience and expertise, the pay levels for peers within the Company, pay levels in the

marketplace for similar positions and performance of the individual and the Company as a whole. The Compensation Committee is responsible for approving pay levels for our NEOs. In determining the pay levels, the Compensation Committee considers all forms of compensation and benefits.

Relative to the general competitive industry market data, the Compensation Committee generally intends that total target compensation (salary, annual incentive and long-term incentive opportunity) is calibrated to be within a reasonable range of the median of the competitive market. As noted above, notwithstanding the Company’s overall pay positioning objectives, pay opportunities for specific individuals vary based on several factors such as scope of duties, tenure, institutional knowledge and/or difficulty in recruiting a new executive. Given that a majority of our compensation consists of variable, at-risk elements, actual total compensation in a given year will vary above or below the target compensation levels based primarily on the attainment of operating goals and the creation of stockholder value.

For purposes of setting compensation for 2021, together with Pearl Meyer and input from management, the Compensation Committee approved a compensation peer group of 17 companies. In developing an appropriate comparator group, the following criteria served as key drivers: industry (inclusive of business scope and business mix), size (market capitalization and revenue), revenue growth rate, gross margin, number of employees and location. The 2021 peer group remained consistent with the peer group utilized for compensation determinations in 2020 as originally adopted in Q4 2019 and includes the following companies:

| | | | | | | | |

| BlackLine, Inc. | MongoDB, Inc. | Twilio, Inc. |

| Box, Inc. | New Relic, Inc. | Varonis Systems, Inc. |

| Datadog, Inc. | Nuance Communications, Inc. | Yext, Inc. |

| 8x8, Inc. | PROS Holdings, Inc. | Zendesk, Inc. |

| Five9, Inc. | Slack Technologies, Inc. | Zuora, Inc. |

| HubSpot, Inc. | Momentive Global (formerly SVMK, Inc.) | |

2021 Compensation Program In Detail

Base Salary

The Compensation Committee believes that executive base salaries should reflect competitive levels of pay and factors unique to each executive such as experience and breadth of responsibilities, performance, individual skill set, time in the role and internal pay parity. Salary adjustments are generally approved during the first quarter of the calendar year and implemented during the second quarter. For 2021, no base salary increases were made for the NEOs, as set forth in the table below.

| | | | | | | | | | | |

| NEO | Base salary as of

December 31, 2020 ($) | Base salary as of

December 31, 2021 ($) | % Adjustment |

| Robert P. LoCascio | 611,820 | | 611,820 | | — | % |

| John D. Collins | 450,000 | | 450,000 | | — | % |

| Monica L. Greenberg | 400,000 | | 400,000 | | — | % |

Norman M. Osumi (1) | — | | 340,000 | | N/A |

Alexander Spinelli (2) | 450,000 | | — | | N/A |

(1)Mr. Osumi’s first date of employment with the Company was February 22, 2021.

(2)Mr. Spinelli’s last day of employment with the Company was October 22, 2021. His base salary for 2021 was consistent with the level in effect as of December 31, 2020.

Annual Incentive Compensation

Our NEOs are provided the opportunity to earn a performance-based annual bonus. The annual bonus plan is designed to provide awards to such individuals as an incentive to contribute to and reward revenue growth, profitability, and execution on our strategic corporate objectives.

Actual bonus payouts depend on the achievement of pre-established financial performance objectives and the Compensation Committee’s assessment of contributions toward our strategic corporate objectives, as well as the individual’s target bonus amount.

Target annual bonus opportunities are expressed as a percentage of base salary and were established by the Compensation Committee in consideration of the NEO’s level of responsibility and his or her ability to impact overall results. The Compensation Committee also considers market data in setting target award amounts. For 2021, target award opportunities were as follows:

| | | | | | | | |

| NEO | Target Bonus

as a % of Salary | Target Bonus

($) |

| Robert P. LoCascio | 100 | % | 611,820 | |

John D. Collins (1) | 55 | % | 236,250 | |

| Monica L. Greenberg | 50 | % | 200,000 | |

Norman M. Osumi (2) | 35 | % | 109,083 | |

Alexander Spinelli (3) | 100 | % | 450,000 | |

(1)Mr. Collins’s target bonus opportunity increased from 45% to 55% as of April 1, 2021. The target bonus listed above represents the blended target bonus amount taking into action the April 1, 2021 adjustment.

(2)Mr. Osumi’s first date of employment with the Company was in February 2021 and therefore, his bonus opportunity was prorated for 11 months.

(3)Mr. Spinelli’s employment with the Company terminated prior to the end of fiscal 2021 and the bonus payout date, and he was therefore not entitled to a bonus payment in respect of the 2021 performance year pursuant to the Company’s bonus program and policies.

Annual bonus payouts are based on achievement of financial objectives, and the related threshold, target and maximum performance goals for each objective established by the Compensation Committee in consultation with the CEO. The Company believes it is important to focus on both top line growth (revenue), as well as profitability. The Compensation Committee therefore chose Revenue and Adjusted EBITDA (defined below) as the relevant financial performance metrics for 2021 annual bonuses, consistent with the financial metrics used in prior years. For this purpose, “Adjusted EBITDA” means net (loss) income, before provision for (benefit from) income taxes, interest expense, net, other (expense) income, depreciation and amortization, stock-based compensation, restructuring costs, transaction-based acquisition costs and other non-cash charges. Under the annual bonus program, the Compensation Committee also may, in its discretion, make an assessment of individual performance based on the Company’s execution of its strategic objectives and apply an additional modifier to adjust a recipient’s bonus amount up or down. The Compensation Committee also annually sets a cap on the potential bonus payout under the program. For 2021, bonus payout potential was capped at 150% of target for all NEOs.

While maintaining consistent use of Revenue and Adjusted EBITDA as the financial metrics for the annual bonus program over the last several years, the Committee reevaluates the applicable weightings each year in order to emphasize the measure best suited to drive desired business outcomes. For 2021, the Compensation Committee set the weighting at 80% for the Revenue metric and 20% for the Adjusted EBITDA metric.

Following the determination of the relevant performance goals for 2021, the Company, with the Board’s approval, modified its fiscal plan to make strategic investments directed to driving sustainable growth and creating long term stockholder value (such as investments in strategic acquisitions as well as go-to-market investments). Based on the Company’s actual performance in 2021, the applicable Revenue target was achieved at 100%. However, in light of the strategic investments described above, the associated unplanned expenses materially impacted our EBITDA performance that fell below the performance threshold set at the start of the year. This outcome would have resulted in a combined performance payout at 80% of target.

To account for the shift in our business plan for the year, the Committee determined that it was reasonable and appropriate to assess performance results for the year based on the performance levels that would have otherwise been earned absent the Company’s mid-year strategic investments. The Committee believed that this approach would provide a fair and more comparable determination of the Company’s performance achievement for the year, which would have translated to a bonus payout at 98% of target. To foster alignment of our annual incentive program with the experience of our stockholders in fiscal 2021, the Compensation Committee approved a reduction of the bonus payout down to 90% of target.

The table below summarizes the Revenue and Adjusted EBITDA performance goals and outcomes with respect to the 2021 annual bonus program:

| | | | | | | | | | | | | | | | | | | | | | | |

| Goal | Weighting | Goals

Threshold/

Target/

Maximum

($M) | Achievement Level

($M) | | Payout % Achievement | Weighted Average Achievement | |

| 2021 Revenue | 80 | % | 454.6/466.1/505.9 | 469.5 | | 100 | % | 80 | % | |

| 2021 Adjusted EBITDA | 20 | % | 39.7/50.6/65.3 | 46.9 | (1) | 90 | % | 18 | % | |

| Total for Financial Metrics | 100 | % | | | | | 98 | % | (1) |

| Compensation Committee Adjustment for Final Payout Percentage | | | | | | 90 | % | |

(1)The Adjusted EBITDA achievement level excludes the impact of the strategic investments, which results in a final weighted average achievement of 98%. The actual Adjusted EBITDA achievement level, without excluding the impact of the strategic investments, was $29.2 million.

The Compensation Committee did not revise any NEO bonuses based on individual performance or strategic objectives, other than for Mr. Osumi. In recognition of superior performance and significant achievements in execution of his role since joining the Company in February 2021, including, in part, Mr. Osumi’s efforts in delivering on key strategic and operational goals, the Compensation Committee determined that it was appropriate to apply an individual performance modifier of 120% to Mr. Osumi’s bonus payout for 2021, which when applied to the 90% payout rate set by the Compensation Committee, translated to a payout for Mr. Osumi at 108%. The table below sets forth the target bonus and earned bonus for each NEO for 2021.

| | | | | | | | | | | |

NEO (1) | Target Bonus

($) | Earned Bonus

($) | Earned Bonus

(as a % of Target) |

| Robert P. LoCascio | 611,820 | | 550,638 | | 90 | % |

John D. Collins (2) | 236,250 | | 212,625 | | 90 | % |

| Monica L. Greenberg | 200,000 | | 180,000 | | 90 | % |

Norman M. Osumi (3) | 109,083 | | 117,810 | | 108 | % |

(1)Mr. Spinelli was not employed by the Company at the end of fiscal 2021 and was therefore not entitled to a bonus payment.

(2)Mr. Collins’s target bonus opportunity increased from 45% to 55% as of April 1, 2021. The target bonus listed above represents the blended target bonus amount taking into action the April 1, 2021 adjustment.

(3)Mr. Osumi’s first date of employment with the Company was in February 2021, and therefore, his bonus was prorated for 11 months. In addition to Company achievement of 90%, Mr. Osumi achieved an individual performance modifier of 120%, resulting in an aggregate payout percentage of 108%.

Prior to payment of bonuses for the 2019 performance period, annual bonuses were generally paid entirely in cash. In an effort to further our objective to foster an ownership culture throughout the Company and focus on long-term value creation, beginning in 2020 all annual bonus plan participants, encompassing approximately 84% of employees, including the NEOs, received their annual bonus payout in the form of vested restricted stock units (“Bonus RSUs”). This program continued with respect to 2021 bonus payouts. For the NEOs, the Company calculated the number of Bonus RSUs paid to the NEO by dividing the NEO’s earned bonus amount by the fair market value of a share of Company common stock on the date of settlement of the Bonus RSUs, and no additional premium was applied to the NEOs’ Bonus RSU grants to account for the settlement in shares rather than in cash, as had been the practice in prior years.

Long-Term Incentives - Annual Equity-Based Awards

Equity-based awards are an important factor in aligning the long-term financial interests of our NEOs and our stockholders. The Compensation Committee continually evaluates the use of equity-based awards and intends to continue to use such awards in the future as part of designing and administering the Company’s compensation program. The Compensation Committee may grant equity incentives under the Company’s 2019 Stock Incentive Plan in the form of stock options (non-qualified and incentive stock options), stock appreciation rights, restricted stock, performance shares and other stock-based awards, including, without limitation, RSUs and deferred stock units. The Compensation Committee approves equity grants at one of its regularly scheduled meetings, or at such other times as appropriate or necessary, and generally after the Compensation Committee has its annual compensation review process for the CEO and other NEOs. In 2019, the Company adopted internal grant-making guidelines which contemplate, in part, that the Committee would consider the timing of “open trading windows” as set in accordance with the

Company’s Insider Trading Policy as a factor for alignment with stockholder interests when determining the exercise price methodology for stock options.

In March 2021, the Compensation Committee granted equity awards to the NEOs using a mix of stock options and RSUs. In granting these equity awards, the Compensation Committee considered market data regarding equity compensation awards for executive officers of comparable companies. The Compensation Committee also considered the significant roles each of the NEOs play in driving the Company’s performance and executing on its strategic priorities, as well as their overall level of performance, tenure and existing equity holdings.

The stock options and restricted stock units granted in spring 2021 as part of the Company’s annual long-term incentive program each provide for service-based vesting in four equal annual installments beginning on the first anniversary of the grant date.

The following table describes the equity awards made to the NEOs as described above:

| | | | | | | | | | | | | | | | | |

| NEO | Value of Options at Grant ($) (1) | Stock Options

(# of shares) | Value of RSUs at Grant ($) | RSUs

(# of units) | Total Value of Equity Awards at Grant ($) |

Robert P. LoCascio (2) | $2,000,000 | 82,700 | $2,000,000 | 38,700 | $4,000,000 |

John D. Collins (2) | $700,000 | 29,000 | $700,000 | 13,600 | $1,400,000 |

Monica L. Greenberg (2) | $550,000 | 22,800 | $550,000 | 10,700 | $1,100,000 |

Norman M. Osumi (3) | $601,000 | 23,300 | $303,000 | 5,500 | $904,000 |

Alexander Spinelli (4) | $850,000 | 35,200 | $850,000 | 16,500 | $1,700,000 |

(1)The “Value of Options at Grant” represents the approved target value of the award when approved by the Board (at which time a grant date was set during the next “open trading” window). The actual grant date fair value set forth in the Summary Compensation Table may differ because of the mechanics of converting the dollar target value into a number of shares on the pre-determined grant date, rounding as appropriate, and then calculating the grant date fair value of the resulting number of shares under the applicable accounting principles.

(2)Other than for Mr. Osumi, the total value of each NEO grant was approved by the Committee on April 9, 2021, which amount was to be attributed 50% to stock options and 50% to RSUs. In connection with this grant, as described above, the number of shares subject to each award, and the exercise price for the stock options, was calculated based on the price of a share of Company common stock on May 7, 2021, the first day of the first “open trading window” following the grant approval date, and in the case of stock options, the applicable Black-Scholes value.

(3)Mr. Osumi received the equity awards as part of a new hire grant. The number of shares was calculated on the grant date of April 21, 2021.

(4)Mr. Spinelli was granted equity awards in 2021 but they were forfeited upon his departure from the Company on October 22, 2021.

2022 Compensation Incentive Program Design Updates

In response to our stockholders’ feedback, we introduced performance RSUs into our 2022 long-term incentive program to further foster alignment with our stockholders and long-term financial and relative performance results.

Starting in 2022, our long-term equity incentives for NEOs will be issued in an equal mix of performance RSUs, stock options, and service RSUs. With the introduction of performance RSUs, two-thirds of the long-term incentive opportunities for our CEO and other NEOs will be performance-based with the value only realized upon the achievement of pre-set performance goals and/or increases in our stock price.

The vesting of performance RSUs will be tied to our performance results over a three-year performance period, achieved against preset revenue and EBITDA targets for 2022, together with a modifier based on year over year EBITDA margin performance in 2023, and an additional modifier based on relative Total Shareholder Return to be measured over the three-year performance period ending in 2024. The targets are set at the start of the three-year performance period and are aligned with our operating plan and key drivers of our long-term stockholder value. The program design motivates our executives to maximize both absolute and relative performance results throughout the full performance cycle in support of our sustained long-term growth objectives. Earned performance RSUs, if any, cliff-vest at the end of the three-year performance period, without any interim vesting opportunities.

Other Compensation Practices, Policies, and Guidelines

Stock Ownership

We strongly encourage our executives and non-employee directors to hold an equity interest in our Company, and adopted formal executive stock ownership guidelines in April 2022. Under the new policy, each of our executive officers and non-employee directors is required to build and maintain their share ownership to the levels listed below within a period of five years from start of service with the Company:

•CEO: 5x current base salary.

•Other NEOs: 2x current base salary.

•Non-employee directors: 5x annual cash retainer.

Shares owned outright (including shares from vested RSUs and performance-based RSUs) will count toward the ownership goals, while shares associated with unvested RSUs, performance-based RSUs and unexercised stock options do not count toward compliance with the policy. It is anticipated that all of the executive officers will be in compliance with the suggested ownership levels within the requisite timeframes. If the ownership goals are not achieved within the applicable five-year compliance period, the executive officer would be required to hold all net shares issued upon exercise of stock options or settlement of RSUs and performance-based RSUs (in each case, after payment of any applicable withholding tax obligations) until the guidelines are met.

Compensation Recovery Policy

In April 2020, the Company adopted a policy under which, in the event of an accounting restatement of the Company’s financial statements due to the Company’s material noncompliance with any financial reporting requirements under federal securities laws, the Board could, in its sole discretion, seek to recover cash or equity-based incentive compensation paid to our current and former executive officers in the three years prior to the year of the accounting restatement where the payments were predicated upon the achievement of financial results that were subsequently changed in light of the accounting restatement. The policy may be applied whether or not the accounting restatement was the result of any wrongdoing on the part of the impacted executive officers, in the sole discretion of the Board.

Other Benefits

We do not offer special perquisites to our NEOs. The Company’s executive compensation program includes standard benefits that are also offered to all employees. These benefits include participation in the Company’s 401(k) plan accounts, including Company matching contributions, and Company-paid medical benefits and life insurance coverage. The Company annually reviews these other benefits and perquisites and makes adjustments as warranted based on competitive practices, the Company’s performance and the individual’s responsibilities and performance. The Company’s 401(k) has a Safe Harbor Plan and, in accordance with IRS rules, the Company matches 100% of the first 3% of eligible compensation and 50% of the next 2% of eligible compensation, subject to IRS limitations.

Deferred Compensation Plan

In 2015, the Compensation Committee adopted the Deferred Compensation Plan. Certain key employees of the Company, including our NEOs and members of our Board, are eligible to participate in the Deferred Compensation Plan and generally may elect to defer the receipt of a portion of their base salary, bonus and/or directors’ fees until distribution (which may occur upon the following events: a specified time, a separation from service, death, disability, change of control, or financial hardship that arises in connection with an unforeseeable emergency). To date, none of our current NEOs have elected to make any deferrals under the Deferred Compensation Plan. The Company may make discretionary or matching contributions to the Deferred Compensation Plan, which may or may not be subject to vesting, but has not done so to date.

Post-Termination Compensation and Benefits

Certain employment agreements with our executive officers provide for severance payments and benefits upon an involuntary termination of employment, or resignation for “good reason” (as defined in the agreement). In addition, certain executives are entitled to vesting acceleration in the event they are involuntary terminated or resign for good reason in connection with a change in control. Additional details regarding the employment agreements with our executives, including a description of the severance payments and benefits payable to our executives as well as estimates of amounts payable upon termination of employment, are disclosed in the sections of this Amendment entitled “Employment Agreements for our Named Executive Officers” and “Potential Payments Upon Termination or Change-in-Control.”

Prohibition Against Hedging and Certain Equity Transactions

Our Insider Trading Policy prohibits those officers subject to Section 16 reporting from engaging in hedging or derivative transactions, such as “cashless” collars, forward contracts, equity swaps or other similar or related transactions. In addition, all officers and employees of the Company and all the members of our Board, are prohibited from engaging in “short” sales or other transactions involving LivePerson stock which could reasonably cause our officers to have interests adverse to our stockholders. “Short” sales, which are sales of shares of common stock by a person that does not own the shares at the time of the sale, evidence an expectation that the value of the shares will decline. We prohibit our officers from entering into “short” sales because such transactions signal to the market that the officer has no confidence in us or our short-term prospects and may reduce the officer’s incentive to improve our performance. In addition, Section 16(c) of the Exchange Act expressly prohibits executive officers and directors from engaging in short sales. Our officers are also prohibited from trading in LivePerson-based put and call option

contracts, transacting in straddles and similar transactions without Board approval. These transactions would allow someone to continue to own the covered securities, but without the full risks and rewards of ownership. If an officer were to enter into such a transaction, the officer would no longer have the same objectives as our other stockholders. Under the Insider Trading Policy, officers, employees and all of the members of our Board are also prohibited from margining or pledging their common stock to secure a loan, or from purchasing Company stock “on margin” (that is, borrow funds to purchase stock, including in connection with exercising any Company stock options).

Tax and Accounting Considerations

In determining executive compensation, the Compensation Committee also considers, among other factors, the possible tax consequences to the Company and to its executives. However, to maintain maximum flexibility in designing compensation programs, the Compensation Committee will not limit compensation to those levels or types of compensation that are intended to be deductible.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and as further amended by the Tax Cuts and Jobs Act of 2017, denies a federal income tax deduction for certain compensation in excess of $1.0 million per year paid to certain executive officers of a publicly-traded corporation, with no exception for “performance-based” compensation (other than under limited transition relief). Under Section 162(m), as amended, the Company will be denied a deduction for any compensation exceeding $1.0 million for those considered covered individuals under the rules, unless the transition rules for certain compensation that qualified as performance-based compensation apply. However, to retain highly skilled executives and remain competitive with other employers, the Compensation Committee may authorize compensation that will not be deductible under Section 162(m) or otherwise if it determines that such compensation is in the best interests of the Company and its stockholders.

Sections 280G and 4999 of the Code provide that executive officers, persons who hold significant equity interests and certain other highly-compensated service providers may be subject to an excise tax if they receive payments or benefits in connection with a change in control of the Company that exceeds certain prescribed limits, and that the Company (or a successor) may forfeit a deduction on the amounts subject to this additional tax. Further, Section 409A of the Code imposes certain additional taxes on service providers who enter into certain deferred compensation arrangements that do not comply with the requirements of Section 409A. We have not agreed to pay any NEO a “gross-up” or other reimbursement payment for any tax liability that he or she might owe as a result of the application of Sections 280G, 4999 or 409A.

The Compensation Committee also considers the accounting consequences to the Company of different compensation decisions and the impact of certain arrangements on stockholder dilution. However, neither of these factors by themselves will compel a particular compensation decision.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management and based on the review and discussions, the Compensation Committee recommended to our Board that the Compensation Discussion and Analysis be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Submitted by the Compensation Committee of the Company’s Board:

Jill Layfield (Chair)

Peter Block

Kevin C. Lavan

Fred Mossler

William G. Wesemann

The Compensation Committee Report above does not constitute “soliciting material” and will not be deemed “filed” or incorporated by reference into any of our future filings under the Securities Act of 1933, as amended, (the “Securities Act”) or the Exchange Act that might incorporate our SEC filings by reference, in whole or in part, notwithstanding anything to the contrary set forth in those filings.

Summary Compensation Table

The following table sets forth the compensation earned for all services rendered to the Company in all capacities in each of the last three fiscal years, by our NEOs.

Following the table is a discussion of material factors related to the information disclosed in the table. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Year | Salary

($) | | Stock Awards (1) ($) | | Option Awards (1) ($) | | Non-Equity Incentive Plan Compensation (2) ($) | | All Other Compensation

($) | | Total

($) |

Robert P. LoCascio Chief Executive Officer | 2021 | 611,820 | | | 2,002,338 | | (3) | 2,001,340 | | | 550,638 | | | 28,943 | | (4) | 5,195,079 | |

| 2020 | 611,820 | | | 1,613,271 | | (3) | 1,613,290 | | | 917,730 | | | 27,612 | | | 4,783,723 | |

| 2019 | 611,820 | | | 1,250,029 | | | 1,250,243 | | | 688,302 | | | 35,844 | | | 3,836,238 | |

| | | | | | | | | | | | |

John D. Collins Chief Financial Officer | 2021 | 450,000 | | | 703,664 | | (3) | 701,800 | | | 212,625 | | | 39,179 | | (4) | 2,107,268 | |

| 2020 | 441,667 | | | 655,081 | | (3) | 600,435 | | | 303,750 | | | 37,713 | | | 2,038,646 | |

| | | | | | | | | | | | |

Monica L. Greenberg Executive Vice President, Public Policy and General Counsel | 2021 | 400,000 | | | 553,618 | | (3) | 551,760 | | | 180,000 | | | 19,682 | | (4) | 1,705,060 | |

| 2020 | 400,000 | | | 501,237 | | (3) | 500,969 | | | 300,000 | | | 19,670 | | | 1,721,876 | |

| 2019 | 390,625 | | | 295,500 | | | 605,000 | | | 225,024 | | | 22,882 | | | 1,539,031 | |

| | | | | | | | | | | | |

Norman M. Osumi Chief Accounting Officer (5) | 2021 | 289,872 | | | 303,435 | | (3) | 601,373 | | | 117,810 | | | 26,935 | | (4) | 1,339,425 | |

| | | | | | | | | | | | |