UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive office)

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

|

|

|

|

|

The |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

☐ |

|

|

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of March 4, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

|

|

|

Page |

|

PART I |

||

|

Item 1. |

1 |

|

|

Item 1A. |

8 |

|

|

Item 1B. |

20 |

|

|

Item 2. |

20 |

|

|

Item 3. |

20 |

|

|

Item 4. |

21 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

22 |

|

|

Item 6. |

22 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

Item 7A. |

31 |

|

|

Item 8. |

32 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

66 |

|

Item 9A. |

66 |

|

|

Item 9B. |

68 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

68 |

|

|

|

|

|

PART III |

|

|

|

Item 10. |

69 |

|

|

Item 11. |

69 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

69 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

69 |

|

Item 14. |

69 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

70 |

|

|

Item 16. |

70 |

|

|

71 |

||

|

74 |

||

Forward-looking Statements

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate, and reflect the beliefs and assumptions of our management as of the date hereof.

We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions to identify forward-looking statements. In addition, statements that refer to projections of earnings, revenue, costs or other financial items in future periods; anticipated growth and trends in our business, industry or key markets; cost synergies, growth opportunities and other potential financial and operating benefits of our acqusitions; future growth and revenues from our products; our ability to access capital to fund our future operations; future economic conditions and performance; the impact of the global outbreak of COVID-19, also known as the coronavirus; the impact of interest rate and foreign currency fluctations; anticipated performance of products or services; competition; plans, objectives and strategies for future operations, including our pursuit or strategic acquisiitons and our continued investment in research and development; other characterizations of future events or circumstances; and all other statements that are not statements of historical fact, are forward-looking statements within the meaning of the Securities Act and the Exchange Act. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers are cautioned not to place undue reliance on such forward-looking statements, which are being made as of the date of this Annual Report on Form 10-K. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from our expectations include factors discussed in Part I, Item 1A “Risk Factors” and Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K, as well as factors described from time to time in our future reports filed with the U.S. Securities and Exchange Commission (the “SEC”).

PART I

|

ITEM 1. |

BUSINESS |

DZS Inc. (“DZS” or the “Company,”) was incorporated under the laws of the state of Delaware in June 1999. The Company’s common stock is traded on The Nasdaq Global Select Market (”Nasdaq") under the symbol “DZSI”. The mailing address of our worldwide headquarters is 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024, and our telephone number at that location is (469) 327-1531.

Company Overview

DZS is Enabling a Hyper-Connected World, supporting the transformation of technology providers into experience providers and driving the next generation of Broadband Connectivity, Mobile & Optical Edge and Cloud Software solutions. Our next generation fiber broadband platforms enable customers to expand their services, upgrade their technology and leverage software to improve their efficiency, insights and customer experience.

Our solutions have been deployed by over 750 active customers, including advanced Tier 1, national and regional service providers and enterprise customers in more than 100 countries worldwide. Our intelligent-edge solutions are focused on creating significant value for our customers by delivering innovative solutions that empower global communication advancement by shaping the internet connection experience.

We research, develop, test, sell, manufacture and support platforms in the areas of mobile transport and fixed broadband access, as discussed below. We have regional development and support centers around the world to support our customer needs. As of December 31, 2021, we employed over 840 personnel worldwide.

Our Solutions and Platforms

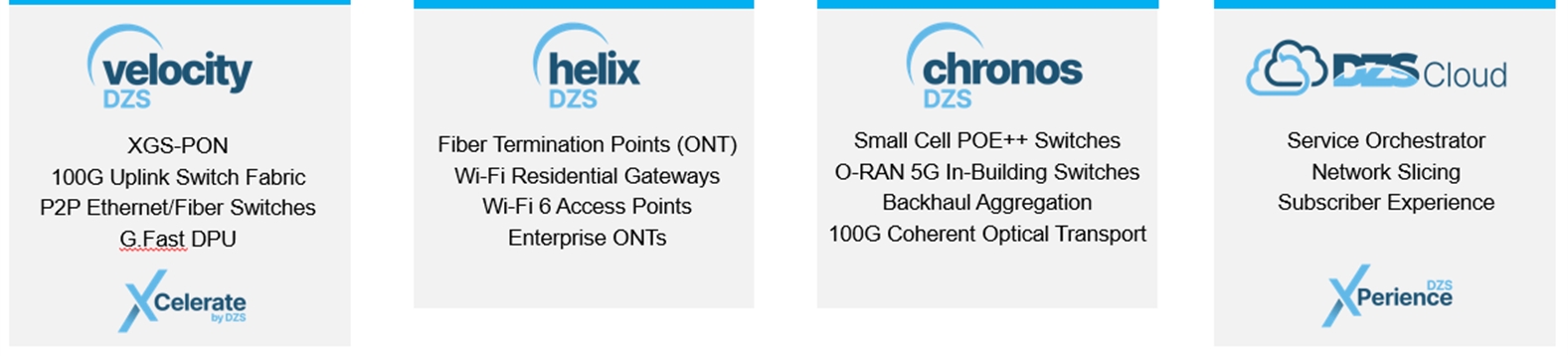

Our solutions and platforms portfolio include products in Broadband Connectivity, Connected Home & Business, Mobile & Optical Edge, and Cloud Software.

|

|

• |

Broadband Connectivity. Our DZS Velocity portfolio offers a variety of solutions for carriers and service providers to connect residential and business customers, either using high-speed fiber or leveraging their existing deployed copper networks to offer broadband services to customer premises. Once our broadband access products are deployed, the service provider can offer voice, high-definition and ultra-high-definition video, highspeed internet access and business class services to their customers. In addition, the switching and routing products we provide in this space offer a high-performance and manageable solution that bridges the gap from carrier access technologies to the core network. XCelerate by DZS increases the velocity with which service providers can leap to multi-gigabit services at scale by enabling rapid transition from Gigabit Ethernet Passive Optical Network (“GPON”) to 10 Gigabit Symmetrical Passive Optical Network (“XGS-PON”) and Gigabit Ethernet to 10 Gigabit Ethernet via any service port across a range of existing DZS Velocity chassis and 10 gig optimized stackable fixed form factor units. |

|

|

• |

Connected Home & Business. Our DZS Helix connected premises product portfolio offer a large collection of smart gateway platforms for any fiber to the “x” (“FTTx”) deployment. DZS Smart Gateway platforms are designed for high bandwidth services being deployed to the home or business. Our connected premises portfolio consists of indoor/outdoor optical network terminal (“ONT”) gateways delivering best-in-class data throughout to support the most demanding FTTx applications. The product feature set gives service providers an elegant migration path from legacy to softswitch architectures without replacing ONTs. |

1

|

|

• |

Mobile & Optical Edge. Our DZS Chronos portfolio provides a robust, manageable and scalable solution for mobile operators that enable them to upgrade their mobile fronthaul/midhaul/backhaul (“xHaul”) systems and migrate to fifth generation wireless technologies (“5G”) and beyond. DZS Chronos provides a full range of 5G-ready xHaul solutions that are open, software-defined, and field proven. Our mobile xHaul products may be collocated at the radio access node base station and can aggregate multiple radio access node base stations into a single backhaul for delivery of mobile traffic to the radio access node network controller. Our products support pure Ethernet switching as well as layer 3 IP and Multiprotocol Label Switching (“MPLS”), and we interoperate with other vendors in these networks. |

|

|

• |

Cloud Software. Our DZS Cloud solution accelerates our software capabilities specifically in the areas of network orchestration, application slicing, automation, analytics, and service assurance. We offer a commercial, carrier-grade network-slicing enabled orchestration platform complementing our position with physical network devices supporting Open RAN (“O-RAN”) and 4G/5G networks. Communications service providers are implementing software defined networking (“SDN”) and network functions virtualization (“NFV”) architectures to reduce reliance on proprietary systems and hardware, which increase service agility, flexibility, and deployment of new network services while lowering costs. |

Industry Background

We believe that expansion in our worldwide business is driven by the increased demand of subscribers and cloud service providers for mobile and fixed network access solutions and communications equipment that enable or support access to higher speed bandwidth access to the internet.

Furthermore, increased competition between service providers for subscriber business has resulted in significant investment pressure to upgrade network infrastructure to meet growing bandwidth needs. Broadband access networks must be multiservice in nature and must have extensive quality of service guarantees in order to support 5G, mobile xHaul, symmetric business services and residential services, as well as virtual overlay networks for alternative operators and wholesale access.

In recent years, the growth of social communications and networking has placed significant demands on legacy access infrastructure, which was exacerbated in 2020 by the global COVID-19 pandemic which drove a dramatic rise in remote work and learning as well as entertainment streaming. This increased demand has been challenging for the industry, even for the newest and most advanced providers. Increased subscriber usage of smartphone, video streaming services, PC gaming services and high definition and ultra-high-definition televisions has increased the network throughput demand driven by music, pictures, user-generated content (as found on many video-sharing sites) and high-definition video, which have all become a growing part of subscribers’ regular exchange of information.

Trends such as software-as-a-service (SaaS), Cloud-based services, Internet of Things (IoT), and 5G have also increased the demand for broadband network access and customer premises solutions. All of these new technologies share a common dependency on high-bandwidth communication networks and sophisticated traffic management tools. As bandwidth demands continue to increase, carriers need to continue to upgrade their network infrastructure to support such demand. The infrastructure upgrade cycle typically has the effect of moving bandwidth bottlenecks from one part of the network to another (such as a carrier’s access network, core network or data centers), depending on the selection of technology and costs.

It is widely acknowledged in the industry that a fiber-optic broadband access network is the preferred network architecture for a broadband fixed network. This network architecture is commonly called Fiber to the Premises (“FTTP”) for business subscribers or Fiber to the Home (“FTTH”) for residential subscribers. With FTTH, all services are generally delivered at the premise through smart optical networking terminal units (“ONT”). The Fiber to the Node (“FTTN”) architecture is also deployed where the fiber-optic cable terminates at a street cabinet which contains a Digital Subscriber Line Access Multiplexer (“DSLAM”) or Multiple Service Access Node (“MSAN”) that then provides higher speed services to their customers over the last mile legacy copper wireline infrastructure. With the shift away from the legacy copper telephone Time-division Multiplexing (“TDM”) switches (used in carrier networks from the 1980’s to the early 2000’s), many carriers that continue to provide services over copper wireline networks are decommissioning their legacy telephone switches and moving services over to Voice over Internet Protocol (“VoIP”) platforms via an MSAN/Softswitch solution. Our broadband access products and solutions are designed to address all these fiber configurations, commonly referred to as FTTx, by allowing carriers and service providers to either use fiber-optic networks or leverage their existing deployed copper networks to offer broadband services to customer premises. The demand for FTTx is also driven by various government sponsored broadband stimulus funding programs. These initiatives cultivate broadband opportunities around the world. Several of the most prominent initiatives are in North America, including American Rescue Plan Act (ARPA), the CARES Act, the Consolidated Appropriations Act, the Rural Digital Opportunity Fund (RDOF) and the Infrastructure Investment and Jobs Act most recently signed into law by President Biden in November 2021. Global government sponsored broadband stimulus initiatives are less commonly known, though equally important in their contributions to the investment in fiber-optic broadband access network. We are benefitting from several customers that have accelerated their network investment because of government broadband stimulus programs.

2

With respect to mobile wireless networks, the popularity of mobile smartphones and increasing demand for mobile data has forced mobile network operators to upgrade their mobile access technologies from 3rd generation wireless (“3G”) to 4th generation wireless (“4G” or “LTE”) and to 5G. These technology upgrades are typically accompanied by network infrastructure upgrades, including upgrades to the carriers’ access networks (referred to as “mobile xHaul”), core networks and data centers. Our mobile xHaul products, which have features for time sensitive networks, provide a robust, manageable and scalable solution for mobile network operators that enable them to upgrade their mobile fronthaul/backhaul systems and migrate to 4G and 5G.

Another growing industry trend is the desire of carriers and service providers to simplify network operation and reduce costs. Increasingly, we see network operators seeking to reduce the number of active components in their networks and to centralize network data and control in data centers, both of which require network redesigns and upgrades. Our FiberLAN portfolio of Passive Optical LAN (“POL”) products, as well as our Ethernet switching products and SDN and NFV tools and building blocks, are designed to address these market trends, with POL emerging as a popular customer choice for network upgrades.

Our Strategy

We strive to balance growth with financial discipline that specifically focuses on improving product margins, increasing recurring software and service revenue, and managing expenses to drive profitability. The principal elements of our strategy include:

|

|

• |

Global Presence. We have a diversified customer base that includes more than 750 active customers in more than 100 countries worldwide. We provide our network access solutions to Tier 1, national, and regional carriers in the Asia-Pacific region, the Middle East region and Europe, as well as in North America and Latin America. We leverage our global infrastructure, which includes sales offices all over the world, research and development centers in the United States of America (“United States” or “U.S.”), the Republic of Korea (“South Korea”), Vietnam, India, and Canada and inhouse and contract manufacturing capabilities in the United States, South Korea, Vietnam, and China, to support our customer base. |

|

|

• |

Leading FTTx Market Position. We hold a strong leadership position in the FTTx network access space. We offer customers an extensive choice of indoor and outdoor fiber demarcation and fully integrated smart gateways with telephone data, Power over Ethernet (“POE”), Wi-Fi and over-the-top set-top box (“OTT STB”) capabilities and other service interfaces. In the FTTx optical line terminal (“OLT”) category, we offer the industry’s largest portfolio of modular chassis, single platforms, and software for deployment in datacenter, central office, extended temperature environments and multi-dwelling unit (“MDU”) scenarios. |

|

|

• |

Technology Leadership. We believe that our future success is built upon our investment in the development of advanced communications technologies. We continue to focus on research and development to maintain our leadership position in broadband network access solutions and communications equipment. These development efforts include innovating around 5G mobile xHaul technology in collaboration with our leading Tier 1 carriers, developing a new generation of SDN/NFV solutions for unified wired and wireless networks, upgrading our broadband access technology for 10 and 25/50/100 gigabyte access speeds, and introducing our cloud managed Wi-Fi solutions and data analytics offerings. We also continue to expand and differentiate our portfolio through software investments in network orchestration, automation and slicing, a unified operating system and a subscriber experience software-as-a-service (SaaS) platform. Our software expansion and vision are designed to improve our long-term margin profile while differentiating DZS in the marketplace. |

|

|

• |

Strategic Mergers and Acquisitions. In addition to organic growth, we may from time to time seek to expand our operations and capabilities through strategic acquisitions. |

On March 3, 2021, the Company acquired substantially all of the assets of RIFT, Inc., a network automation solutions company, and all the outstanding shares of RIFT.IO India Private Limited, a wholly owned subsidiary of RIFT, Inc. (collectively “RIFT”). RIFT developed a carrier-grade software platform that simplifies the deployment of any slice, service, or application on any cloud.

On February 5, 2021, we acquired Optelian Access Networks Corporation (“Optelian”), a leading optical networking solution provider based in Ottawa, Ontario, Canada, and its portfolio of optical transport solutions. This acquisition introduced the “O-Series” to the DZS portfolio of carrier grade optical networking products with 100 gigabits per second and above capability, expanding DZS product portfolios by providing environmentally hardened, high capacity, and flexible solutions at the network edge.

On January 3, 2019, we acquired Keymile to expand our business efforts in the EMEA. The acquired Multi-service Access Nodes (MSAN) portfolio complemented the DZS existing portfolio by offering leading class point-to-point active FTTx Ethernet and copper-based access technology based on G. Fast technology as well as VoIP gateway features.

3

|

|

• |

Ecosystem Partners. We believe there is further opportunity to grow sales through our channel partners, particularly with distributors, value-added resellers, system integrators, as well as with municipalities and government organizations. We have a track record of building a diverse but targeted network of partners to help drive growth in specific segments of our business or in specific geographies. For FiberLAN, we are working with distributors, value added resellers, and system integrators to broaden our enterprise go to market presence. In India, we are working closely with municipalities to deploy their initial fiber-to-the-home vision and help deliver high speed broadband access to residents. |

Customers

We generally sell our products and services directly to carriers and service providers that offer voice, data and video services to businesses, governments, utilities and residential subscribers. Our global customer base includes regional, national and international carriers and service providers. To date, our products have been deployed by hundreds of carriers and service providers worldwide.

We also sell solutions indirectly to end customers through system integrators and distributors to the service providers, hospitality, education, stadiums, manufacturing and business enterprises as well as to the government and military.

For the year ended December 31, 2021, two customers represented 19% and 12% of net revenue, respectively. For the year ended December 31, 2020, two customers represented 14% and 13% of net revenue, respectively

Research and Development

The industry in which we compete is subject to rapid technological developments, evolving industry standards, changes in customer requirements, and continuing developments in communications service offerings. Our continuing ability to adapt to these changes, and to develop new and enhanced products, is a significant factor in maintaining or improving our competitive position and our prospects for growth. Therefore, we continue to make significant investments in product development.

We have core research and development teams located in the United States, South Korea, Vietnam, India and Canada. In all of these centers, we develop and test both our hardware and software solutions. We continue to invest heavily in automated and scale testing capabilities for our products to better emulate our customers’ networks.

Our product development activities focus on products to support both existing and emerging technologies in the segments of the communications industry that we consider viable revenue opportunities. We are continuing to refine our solution architecture, introducing new products using the various solutions we support, and creating additional interfaces and protocols for both domestic and international markets.

4

We are committed to invest in leading edge technology research and development for new products and innovative solutions that align with our business strategy. Our research and product development expenses were $47.0 million and $38.0 million in 2021 and 2020, respectively.

Intellectual Property

We seek to establish, maintain and protect our proprietary rights in our technology and products through the use of patents, copyrights, trademarks and trade secrets. We also seek to maintain our trade secrets and confidential information by nondisclosure policies and through the use of appropriate confidentiality agreements. We have obtained a number of patents and trademarks in the United States of America (“United States”) and in other countries. There can be no assurance, however, that these rights can be successfully enforced against competitive products in every jurisdiction or any particular jurisdiction. Although we believe the protection afforded by our patents, copyrights, trademarks and trade secrets has value, the rapidly changing technology in the networking industry and uncertainties in the legal process, both domestically and internationally, make our future success dependent primarily on the innovative skills, technological expertise, and management abilities of our employees rather than on the protection afforded by patent, copyright, trademark, and trade secret laws.

Many of our products include intellectual property licensed from third parties. While it may be necessary in the future to seek or renew licenses relating to various aspects of our products, we believe, based upon past experience and standard industry practice, that such licenses generally could be obtained on commercially reasonable terms. Nonetheless, there can be no assurance that the necessary licenses would be available on acceptable terms, if at all. Our inability to obtain certain licenses or other rights or to obtain such licenses or rights on favorable terms, or the need to engage in litigation regarding these matters, could have a material adverse effect on our business, operating results and financial condition. The communications industry is characterized by rapidly changing technology, a large number of patents, and frequent claims and related litigation regarding patent and other intellectual property rights. We cannot assure you that our patents or other proprietary rights will not be challenged, invalidated or circumvented, that others will not assert intellectual property rights to technologies that are relevant to us, or that our rights will give us a competitive advantage. In addition, the laws of some foreign countries may not protect our proprietary rights to the same extent as the laws of the United States.

Sales and Marketing

We have a global sales presence with customers from over 100 countries, and we sell our products and services both directly and indirectly through channel partners with support from our sales force. Channel partners include distributors, value added resellers, system integrators and service providers. These partners sell directly to and service end customers and often provide additional value-added services such as system installation, technical support, and professional support services in addition to equipment sales. Our sales efforts are generally organized and sized according to geographical regions for target carriers, service providers, municipalities and enterprise customers.

|

|

• |

Americas Sales. Our Americas Sales organization includes coverage of North America and Latin America regions. The organization establishes and maintains direct and indirect relationships with customers in the Americas, which includes carriers and service providers, cable operators, utilities and enterprises. In addition, this organization is responsible for managing our distribution channel and also manages our inside sales and sales engineering activities. |

|

|

• |

EMEA Sales. This organization establishes and maintains direct and indirect relationships with customers in the EMEA region, which includes carriers and service providers, cable operators, utilities and enterprises. |

|

|

• |

Asia Pacific Sales. This sales organization establishes and maintains direct and indirect relationships with customers in the Asia Pacific region, which includes carriers and service providers, cable operators, utilities and enterprises, in particular, with our South Korean customers, consisting primarily of Tier 1 carriers. These carriers have historically been early innovators across various telecommunications industry upgrade cycles, including broadband access technology and mobile fronthaul/backhaul technology. We partner with such carriers from the early phases of technology development to ensure our products are carrier-grade and purpose-built for the most rigorous of environments. |

|

|

• |

Enterprise Sales. Our Enterprise Sales organization includes global geographic coverage and is primarily focused on coverage of our FiberLAN solutions. The organization establishes and maintains direct and indirect relationships with enterprise customers for both greenfield (i.e., projects that do not follow a prior work) and brownfield (i.e., projects that modify or upgrade existing infrastructure or products) projects targeting enterprise customers in several industry verticals, including education (i.e., K-12, universities and colleges, etc.), hospitality, healthcare, stadiums, corporate campuses, and others. |

5

Our marketing team works closely with our sales, research and product development organizations, and our customers by providing communications that keep the market current on our products and features. Marketing also identifies and sizes new target markets for our products, creates awareness of our company and products, generates contacts and leads within these targeted markets, performs outbound education and public relations, and participates in industry associations and standard industry bodies to promote the growth of the overall industry.

Our backlog consists of purchase orders for products and services that we expect to ship or perform within the next year. Our backlog may fluctuate based on the timing of when purchase orders are received. As of December 31, 2021, our backlog was approximately $225.0 million, compared to $71.0 million at December 31, 2020. We consider backlog to be an indicator, but not the sole predictor, of future sales because our customers may cancel or defer orders without penalty.

Competition

We compete in communications equipment markets, providing products and services for the delivery of broadband connectivity, connected home and business, mobile and optical edge transport, and cloud software-based services. These markets are characterized by rapid change, converging technologies and a migration to solutions that offer advantages in both operational efficiency and service performance. These market factors represent both an opportunity and a competitive threat to us. We compete with numerous vendors in our core broadband connectivity and connected home and business markets, including ADTRAN, Calix, Huawei, Nokia, Ubiquoss, and ZTE, among others. In our FiberLAN business, which is a subset of our broadband connectivity and connected home and business market, our competitors include Cisco, Nokia, and Tellabs, among others. In our mobile and optical edge transport business, our competitors include Ciena, Cisco and Juniper Networks, among others. In our cloud software business, our competitors include solutions from ADTRAN, Calix, Ciena, Nokia, and Solarwinds. In addition, a number of companies have introduced products that address the same network needs that our products and solutions address, both domestically and internationally. The overall number of our competitors may increase, and the identity and composition of competitors may change. As we continue to expand our sales globally, we may see new competition in different geographic regions. Barriers to entry are relatively low, and new ventures to create products that do or could compete with our products are regularly formed. Many of our competitors have greater financial, technical, sales and marketing resources than we do.

The principal competitive factors in the markets in which we presently compete and may compete in the future include:

|

|

• |

product performance; |

|

|

• |

feature capabilities; |

|

|

• |

manufacturing capacity; |

|

|

• |

interoperability with existing products; |

|

|

• |

scalability and upgradeability; |

|

|

• |

conformance to standards; |

|

|

• |

breadth of services; |

|

|

• |

reliability; |

|

|

• |

ease of installation and use; |

|

|

• |

geographic footprints for products; |

|

|

• |

ability to provide customer financing; |

|

|

• |

pricing; |

|

|

• |

technical support and customer service; and |

|

|

• |

brand recognition. |

While we believe that we compete successfully with respect to each of these factors, we currently face and expect we will continue to face intense competition in our markets. In addition, the inherent nature of communications networking requires interoperability. As such, we must cooperate and at the same time compete with many companies.

Manufacturing and Operations

Operationally, we use a global sourcing procurement program to purchase and manage key raw materials and subassemblies through qualified suppliers, sub-contractors, original equipment and design manufacturers and electronic manufacturing service vendors. The manufacturing process uses a strategic combination of procurement from qualified suppliers and in-house manufacturing. Throughout the process we manage the assembly, quality assurance, customer testing, final inspection and shipping of our products.

6

We manufacture our low volume, high mix products at our manufacturing facility in Seminole, Florida, USA. For certain products, we rely on contract manufacturers, primarily located in Vietnam and China, and original design manufacturers for high volume, low mix products. We have generally been able to have sufficient production capacity to meet demand for our product offerings through a combination of existing and added capacity, additional employees and the outsourcing of products or components.

Some completed products are procured to our specifications and shipped directly to our customers. We also acquire completed products from certain suppliers, which we configure and ship from our facility. Some of these purchases are significant. We purchase both standard off-the-shelf parts and components, which are generally available from more than one supplier, and single-source parts and components. We have generally been able to obtain adequate supplies to meet customer demand in a timely manner from our current vendors, or, when necessary, from alternate vendors. We believe that alternate vendors can be identified if current vendors are unable to fulfill our needs, or design changes can be made to employ alternate parts.

The recent outbreak of the coronavirus in China and other countries has negatively impacted our supply chain in recent months. Supply chain pricing, freight and logistics costs, availability, and extended lead-times became a challenge in 2021 as the world economy recovered from the COVID-19 pandemic. As we continue to incur elevated costs for components and expedite fees, our supply chain and operations teams continue to focus on managing through a constrained environment, thereby enabling DZS to maximize shipments despite elongated lead times. We remain cautious about continued supply chain headwinds that challenge the industry and anticipate a constrained supply chain environment to persist throughout 2022.

We design, specify, and monitor all of the tests that are required to meet our quality standards. Our manufacturing and test engineers work closely with our design engineers to ensure manufacturability and testability of our products, and to ensure that manufacturing and testing processes evolve along with our technologies. Our manufacturing engineers specify, build, or procure our test stations, establish quality standards and protocols, and develop comprehensive test procedures and processes to assure the reliability and quality of our products. Products that are procured complete or partially complete are inspected, tested, or audited for quality control.

Our Quality Management System is compliant with, and we are certified to, ISO-9001:2015 by our external registrar, National Standards Authority of Ireland. ISO-9001:2015 requires that our processes be documented, followed and continuously improved. Internal audits are conducted on a regular schedule by our quality assurance personnel, and external audits are conducted by our external registrar each year. Our quality system is based upon our model for quality assurance in production and service to ensure our products meet rigorous quality standards.

Compliance with Regulatory and Industry Standards

Our products must comply with a significant number of voice and data regulations and standards which vary by jurisdiction. Standards for new services continue to evolve, and we may need to modify our products or develop new versions to meet these standards. Standards setting and compliance verification in the United States are determined by the Federal Communications Commission, Underwriters Laboratories (a global safety certification company), Quality Management Institute (a management training and leadership company), Telecordia (an operations management and fraud prevention solutions company which is a subsidiary of Ericsson), and other communications companies. In international markets, our products must comply with standards issued, implemented and enforced by the regulatory authorities of foreign jurisdictions, as applicable, such as the European Telecommunications Standards Institute (“ETSI”), among others.

Environmental Matters

Our operations and manufacturing processes are subject to federal, state, local and foreign environmental protection laws and regulations. Such laws and regulations relate to the presence, use, handling, storage, discharge and disposal of certain hazardous materials and wastes, the pre-treatment and discharge of process waste waters and the control of process air pollutants. Under certain laws of the United States, we can be held responsible for cleanup costs at currently or formerly owned or operated locations or at third party sites to which our wastes were sent for disposal. To date, liabilities relating to contamination have not been significant, and have not had a material impact on our operations or results. We believe that our operations and manufacturing processes currently comply in all material respects with applicable environmental protection laws and regulations. If we fail to comply with any present or future laws or regulations, we could be subject to liabilities, the suspension of production or a prohibition on the sale of our products. In addition, such regulations could require us to incur significant expenses to comply with environmental laws or regulations, including expenses associated with the redesign of any non-compliant product or the development or installation of additional pollution control technology. From time to time new laws or regulations are enacted, and it is difficult to anticipate how such laws or regulations will be implemented and enforced, or the impact they will have on our operations or results.

7

Our operations in the European Union are subject to the Restriction on the Use of Certain Hazardous Substances in Electrical and Electronic Equipment Directive and the Waste Electrical and Electronic Equipment Directive. We are aware of and are taking suitable action to comply with the new European Union Restriction of Hazardous Substances standards. Our operations in the United States or other countries, such as Japan and China are subject to similar legislation. Our failure to comply with any regulatory requirements or contractual obligations relating to environmental matters or hazardous materials could result in us being liable for costs, fines, penalties and third-party claims, and could jeopardize our ability to conduct business in the jurisdictions where such laws or the regulations apply.

Employees

As of December 31, 2021, we employed over 840 personnel worldwide. We consider the relationships with our employees to be positive. Competition for technical personnel in our industry is intense. We believe that our future success depends in part on our continued ability to hire, assimilate and retain qualified personnel. To date, we believe that we have been successful in recruiting qualified employees, but there is no assurance that we will continue to be successful in the future.

Website and Available Information

Our investor website address is http://investor-dzsi.com. The information on, or accessible through, our website does not constitute part of this Annual Report on Form 10-K, or any other report, schedule or document we file or furnish to the SEC. On our investor website, we make available the following filings available free of charge as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

|

ITEM 1A. |

RISK FACTORS |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this Annual Report on Form 10-K and in other filings we make with the SEC before making an investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. If any of such risks and uncertainties actually occurs, our business, financial condition or operating results could differ materially from the plans, projections and other forward-looking statements included in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report and in our other public filings. The trading price of our common stock could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Risks Directly Related to the ongoing COVID-19 Pandemic

The COVID-19 pandemic has previously adversely affected significant portions of our business and could have a material adverse effect on our financial condition and results of operations. Authorities have imposed, and businesses and individuals have implemented, numerous measures to try to contain the virus or treat its impact, such as travel bans and restrictions, quarantines, shelter-in-place/stay-at-home and social distancing orders, shutdowns, and vaccine requirements. These measures have impacted and may further impact our workforce and operations, the operations of our customers, and those of our respective suppliers and partners. We have experienced, and could in the future experience, reduced workforce availability at some of our sites, construction delays, and reduced capacity at some of our suppliers. We have operations in the US, Canada, South Korea, Japan, Vietnam, India, as well as in other countries in Europe, Asia-Pacific, Middle East and Latin America, and each of these countries is taking measures in response to the pandemic. Restrictions on our manufacturing or support operations or workforce, similar limitations for our suppliers, and transportation restrictions or disruptions can limit our ability to meet customer demand and could have a material adverse effect on our financial condition and results of operations. Our customers have experienced, and may in the future experience, disruptions in their operations and supply chains, which can result in delayed, reduced, or cancelled orders, or collection risks, and which may adversely affect our results of operations.

We have experienced and continue to experience disruptions in our supply chain due to the impact of the COVID-19 pandemic, which has also impacted and may adversely impact our operations (including, without limitation, logistical and other operational costs) and the operations of some of our key suppliers. If our vendors for product components are unable to meet our cost, quality, supply and transportation requirements, continue to remain financially viable or fulfill their contractual commitments and obligations, we could experience disruption in our supply chain, including shortages in supply or increases in production costs, which would materially adversely affect our results of operations. The current worldwide shortage of semiconductors may exacerbate these risks.

The pandemic has caused us to modify our business practices, including with respect to employee travel; employee work locations; limitations on physical participation in meetings, events, and conferences; and social distancing measures. Future vaccine mandates in the countries in which we operate could adversely affect our workforce retention and hiring. We may take

8

further actions as required by government authorities or others, or that we determine are in the best interests of our employees, customers, suppliers, and partners. Work-from-home and other measures introduce additional operational risks, including cybersecurity risks, and have affected the way we conduct our product development, validation, and qualification, customer support, and other activities, which could have a material adverse effect on our operations. There is no certainty that such measures will be sufficient to mitigate the risks posed by the virus, and illness and workforce disruptions could lead to unavailability of key personnel and harm our ability to perform critical functions.

The pandemic has significantly increased economic and demand uncertainty and has led to volatility in capital markets and credit markets. Adverse changes in economic conditions related to the COVID-19 pandemic can significantly harm demand for our products and make it more challenging to forecast our operating results. Given the continued and substantial economic uncertainty and volatility created by the pandemic, it is difficult to predict the nature and extent of impacts on demand for our products.

The degree to which COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including the duration and severity of the pandemic; the actions taken to contain the virus or treat its impact; other actions taken by governments, businesses, and individuals in response to the virus and resulting economic disruption; and how quickly and to what extent normal economic and operating conditions can resume. Additional impacts and risks may arise that we are not aware of or able to respond to effectively. We are similarly unable to predict the extent of the impact of the pandemic on our customers, suppliers, and other partners, but a material effect on these parties could also materially adversely affect us. The impact of COVID-19 can also exacerbate other risks discussed in this Risk Factors section and throughout this report.

Risks Related to our Liquidity

We may not have the liquidity to support our future operations and capital requirements.

As of December 31, 2021, we had approximately $46.7 million in unrestricted cash and cash equivalents, including $30.1 million in cash balances held by our international subsidiaries. If we are unable to raise additional capital, we may be unable to adequately fund our existing operations. Our current liquidity condition exposes us to the following risks: (i) vulnerability to adverse economic conditions in our industry or the economy in general; (ii) limitations on our ability to adequately plan for, or react to, changes in our business and industry; and (ii) negative investor and customer perceptions about our financial stability, which could limit our ability to obtain financing or acquire customers.

Our current liquidity condition could be further harmed, and we may incur significant losses or expend significant amounts of capital if: (i) the market for our products develops more slowly than anticipated or if it retracts; (ii) we fail to establish market share or generate revenue at anticipated levels; (iii) our capital expenditure forecasts change or prove to be inaccurate; or (iv) we fail to respond to unforeseen challenges or take advantage of unanticipated opportunities; or (v) the on-going COVID-19 pandemic continues to negatively impact our business or further exacerbates any of the foregoing risks.

To meet our liquidity needs and to finance our capital expenditures and working capital needs for our business, we may be required to raise substantial additional capital, reduce our operations (including through the sale of assets) or both.

We have experienced significant losses and we may incur losses in the future. If we fail to generate sufficient revenue to sustain our profitability, our stock price could decline.

We had a net loss of $34.7 million and $23.1 million for the years ended December 31, 2021 and 2020, respectively. Additionally, we have incurred significant losses in prior years. We have an accumulated deficit of $87.0 million as of December 31, 2021. We expect that we will continue to incur substantial manufacturing, research and product development, sales and marketing, customer support, administrative and other expenses in connection with the ongoing development of our business. In addition, we may be required to spend more on research and product development than originally budgeted to respond to industry trends. We may also incur significant new costs related to acquisitions and the integration of new technologies and other acquisitions that may occur in the future. We may not be able to adequately manage costs and expenses or achieve or maintain adequate operating margins. As a result, our ability to sustain profitability in future periods will depend on our ability to generate and sustain higher revenue while maintaining reasonable costs and expense levels. If we fail to generate sufficient revenue to sustain profitability in future periods, we may continue to incur operating losses, which could be substantial, and our stock price could decline.

In connection with the Keymile acquisition, we assumed certain of Keymile’s liabilities, which could harm our business, operations, financial condition, and liquidity.

Pursuant to the definitive agreement for the acquisition of Keymile GmbH, now DZS GmbH (“Keymile” or “DZS GmbH”), we assumed certain of Keymile’s liabilities, including tax and pension liabilities, and any liabilities that may arise related to breaches of representations and warranties made by Keymile in connection with a prior sale of assets by Keymile that survive through 2022. Although the definitive agreement for the Keymile acquisition entitles us to indemnification for certain losses

9

incurred related to those assumed liabilities, our right to indemnification from the Keymile sellers is limited by the survival period of the representations and warranties included in the Keymile acquisition definitive agreement and recovery is limited in amount to the purchase price of Keymile, or EUR 10.3 million (approximately $11.7 million). Additionally, our rights to recovery against such losses is limited under our and third party provided warranty and indemnity liability insurance coverage of up to EUR 35.3 million (approximately $40.2 million). If such claims or losses exceed such amount, or if they are not indemnifiable under the Keymile acquisition definitive agreement, any such losses could negatively impact our financial situation. In addition, our closing of the Keymile acquisition could give rise to substantial tax liabilities under German law, which could negatively impact our financial condition and liquidity.

Customer and Product Risk

The long and variable sales cycles for our products could cause revenue and operating results to vary significantly from quarter to quarter.

The target customers for our products have substantial and complex networks that they traditionally expand in large increments on a periodic basis. Accordingly, our marketing efforts are focused primarily on prospective customers that may purchase our products as part of a large-scale network deployment. Our target customers typically require a lengthy evaluation, testing and product qualification process. Throughout this process, we are often required to spend considerable time and incur significant expenses educating and providing information to prospective customers about the uses and features of our products. Even after a company makes the final decision to purchase our products, it could deploy our products over extended periods of time. The timing of deployment of our products varies widely, and depends on a number of factors, including our customers’ skill sets, geographic density of potential subscribers, the degree of configuration and integration required to deploy our products, and our customers’ ability to finance their purchase of our products as well as their operations. The impact of the COVID-19 pandemic on our supply chain has increased the volatility of our deployment timeframes. As a result of any of these factors, our revenue and operating results could vary significantly from quarter to quarter.

The market we serve is highly competitive and we may not be able to compete successfully.

Competition in communications equipment markets is intense. These markets are characterized by rapid change, converging technologies and a migration to networking solutions that offer superior advantages. We are aware of many companies in related markets that address particular aspects of the features and functions that our products provide. Currently, our primary competitors in our core business include ADTRAN, Calix, Huawei, Nokia and ZTE, among others. In our FiberLAN business, our competitors include Cisco, Nokia and Tellabs. In our Ethernet switching business, our competitors include Cisco, and Juniper. We also may face competition from other communications equipment companies or other companies that may enter our markets in the future. In addition, a number of companies have introduced products that address the same network needs that our products and solutions address, both domestically and internationally. Many of our competitors have longer operating histories, greater name recognition, larger customer bases and greater financial, technical, sales and marketing resources than we do and may be able to undertake more extensive marketing efforts, adopt more aggressive pricing policies and provide more customer financing than we can. In particular, we are encountering price-focused competitors from Asia, especially China, which places pressure on us to reduce our prices. If we are forced to reduce prices in order to secure customers, we may be unable to sustain gross margins at desired levels or achieve profitability. Competitive pressures could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and failure to increase, or the loss of, market share, any of which could reduce our revenue and adversely affect our financial results. Moreover, our competitors may foresee the course of market developments more accurately than we do and could develop new technologies that render our products less valuable or obsolete.

In our markets, principal competitive factors include: (i) product performance; (ii) interoperability with existing products; (iii) scalability and upgradeability; (iv) conformance to standards; (v) breadth of services; (vi) reliability; (vii) ease of installation and use; (viii) geographic footprints for products; (ix) ability to provide customer financing; (x) pricing; (xi) technical support and customer service; and (xii) brand recognition.

If we are unable to compete successfully against our current and future competitors, we may have difficulty obtaining or retaining customers, and we could experience price reductions, order cancellations, increased expenses and reduced gross margins, any of which could have a material adverse effect on our business, operations, financial condition, and liquidity.

10

We depend upon the development of new products and enhancements to existing products, and if we fail to predict and respond to emerging technological trends and customers’ changing needs, our operating results and market share may suffer.

The markets for our products are characterized by rapidly changing technology, evolving industry standards, changes in end-user requirements, frequent new product introductions and changes in communications offerings from network service provider customers. Our future success depends on our ability to anticipate or adapt to such changes and to offer, on a timely and cost-effective basis, products that meet changing customer demands and industry standards. We may not have sufficient resources to successfully and accurately anticipate customers’ changing needs and technological trends, manage long development cycles or develop, introduce and market new products and enhancements. The process of developing new technology is complex and uncertain, and if we fail to develop new products or enhancements to existing products on a timely and cost-effective basis, or if our new products or enhancements fail to achieve market acceptance, our business, operations, financial condition and liquidity would be materially adversely affected.

Because our products are complex and are deployed in complex environments, our products may have defects that we discover only after full deployment by our customers, which could have a material adverse effect on our business.

We produce highly complex products that incorporate leading-edge technology, including both hardware and software. Software often contains defects or programming flaws that can unexpectedly interfere with expected operations. In addition, our products are complex and are designed to be deployed in large quantities across complex networks. Because of the nature of these products, they can only be fully tested when completely deployed in large networks with high amounts of traffic, and there is no assurance that our pre-shipment testing programs will be adequate to detect all defects. As a result, our customers may discover errors or defects in our hardware or software, or our products may not operate as expected. If we are unable to cure a product defect, we could experience damage to our reputation, reduced customer satisfaction, loss of existing customers and failure to attract new customers, failure to achieve market acceptance, reduced sales opportunities, loss of revenue and market share, increased service and warranty costs, diversion of development resources, legal actions by our customers, and increased insurance costs. Defects, integration issues or other performance problems in our products could also result in damages to our customers, financial or otherwise. Our customers could seek damages for related losses from us, which could seriously harm our business, operations, financial condition and liquidity. A product liability claim brought against us, even if unsuccessful, would likely be time consuming and costly. The occurrence of any of these problems would seriously harm our business, operations, financial condition and liquidity.

Sales to communications service providers are especially volatile, and weakness in sales orders from this industry could harm our business, operations, financial condition and liquidity.

Sales activity in the service provider industry depends upon the stage of completion of expanding network infrastructures, the availability of funding, and the extent to which service providers are affected by regulatory, economic and business conditions in the country of operations. Although some service providers may be increasing capital expenditures over the depressed levels that have prevailed over the last few years, weakness in orders from this industry could have a material adverse effect on our business, operations, financial condition and liquidity. Changes in technology, competition, overcapacity, changes in the service provider market, regulatory developments, adverse economic effects caused by the COVID-19 pandemic and constraints on capital availability have had a material adverse effect on many of our service provider customers, with many of these customers going out of business or substantially reducing their expansion plans. These conditions have materially harmed our business and operating results, and we expect that some or all of these conditions may continue for the foreseeable future. Finally, service provider customers typically have longer implementation cycles; require a broader range of services including design services; demand that vendors take on a larger share of risks; often require acceptance provisions, which can lead to a delay in revenue recognition; and expect financing from vendors. All these factors can add further risk to business conducted with service providers.

We depend on a limited source of suppliers for several key components. If we are unable to obtain these components on a timely basis, we will be unable to meet our customers’ product delivery requirements, which would harm our business.

We currently purchase several key components from a limited number of suppliers. If any of our limited source of suppliers become insolvent, cease business or experience capacity constraints, work stoppages or any other reduction or disruption in output, they may be unable to meet our delivery schedules. Our suppliers may enter into exclusive arrangements with our competitors, be acquired by our competitors, stop selling their products or components to us at commercially reasonable prices, refuse to sell their products or components to us at any price or be unable to obtain or have difficulty obtaining components for their products from their suppliers. If we do not receive critical components from our limited source of suppliers in a timely manner, we will be unable to meet our customers’ product delivery requirements. Any failure to meet a customer’s delivery requirements could materially adversely affect our business, operations, and financial condition and liquidity and could materially damage customer relationships. The current worldwide shortage of semiconductors may exacerbate these risks.

We rely on the availability of third-party licenses.

Many of our products are designed to include software or other intellectual property licensed from third parties. It may be necessary in the future to seek or renew licenses relating to various elements of the technology used to develop these products.

11

We cannot assure you that our existing or future third-party licenses will be available to us on commercially reasonable terms, if at all. Our inability to maintain or obtain any third-party license required to sell or develop our products and product enhancements could require us to obtain substitute technology of lower quality or performance standards, or at greater cost.

Our intellectual property rights could prove difficult to protect and enforce.

We generally rely on a combination of copyrights, patents, trademarks and trade secret laws and commercial agreements containing restrictions on disclosure and other appropriate terms to protect our intellectual property rights. We enter into confidentiality, employee, contractor and commercial agreements with our employees, consultants and corporate partners, and control access to and distribution of our proprietary information and use of our intellectual property and technology. Despite our efforts to protect our proprietary rights, unauthorized parties, including those affiliated with foreign governments, may attempt to copy or otherwise obtain and use our products, technology or intellectual property. Monitoring unauthorized use of our technology and intellectual property is difficult, and we do not know whether the steps we have taken will prevent unauthorized use of our technology, particularly in foreign countries or jurisdictions where laws may not protect our proprietary rights as extensively as in the United States. We cannot assure you that our pending, or any future, patent applications will be granted, that any existing or future patents will not be challenged, invalidated, or circumvented, or that any existing or future patents will be enforceable or that infringement by third parties will even be detected. While we are not dependent on any individual patents, if we are unable to protect our proprietary rights, we may find ourselves at a competitive disadvantage to others who need not incur the substantial expense, time and effort required to create the innovative products.

There are additional risks to our intellectual property as a result of our international business operations.

We may face risks to our technology and intellectual property as a result of our conducting strategic business discussions outside of the United States, and particularly in jurisdictions that do not have comparable levels of protection of corporate proprietary information and assets such as intellectual property, trademarks, trade secrets, know-how and customer information and records. While these risks are common to many companies, conducting business in certain foreign jurisdictions, housing technology, data and intellectual property abroad, or licensing technology to joint ventures with foreign partners may have more significant exposure. For example, we have shared intellectual properties with entities in China, South Korea, India, Thailand, and Vietnam pursuant to confidentiality agreements in connection with discussions on potential strategic collaborations, which may expose us to material risks of theft of our proprietary information and other intellectual property, including technical data, manufacturing processes, data sets or other sensitive information. Our technology may be reverse engineered by the parties or other parties, which could result in our patents being infringed or our know-how or trade secrets stolen. The risk can be by direct intrusion wherein technology and intellectual property is stolen or compromised through cyber intrusions or physical theft through corporate espionage, including with the assistance of insiders, or via more indirect routes.

Claims that our current or future products or components contained in our products infringe the intellectual property rights of others may be costly and time consuming to defend and could adversely affect our ability to sell our products.

The communications equipment industry is characterized by the existence of a large number of patents and frequent claims and related litigation regarding patent, copyright, trademark and other intellectual property rights, that may relate to technologies and related standards that are relevant to us. From time to time, we receive correspondence from companies claiming that our products are using technology covered by or related to the intellectual property rights of these companies and inviting us to discuss or demanding licensing or royalty arrangements for the use of the technology or seeking payment for damages, injunctive relief and other available legal remedies through litigation. These companies also include third-party non-practicing entities (also known as patent trolls) that focus on extracting royalties and settlements by enforcing patent rights through litigation or the threat of litigation. These companies typically have little or no product revenues and therefore our patents could provide little or no deterrence against such companies filing patent infringement lawsuits against us. In addition, third parties have initiated and could continue to initiate litigation against our manufacturers, suppliers, distributors or even our customers alleging infringement or misappropriation of their proprietary rights with respect to existing or future products, or components of our products. For example, proceedings alleging patent infringement are routinely commenced in various jurisdictions against manufacturers and consumers of products in the wireless and broadband communications industry. In some cases, courts have issued rulings adverse to such manufacturers and customers, which can result in monetary damages that we are obligated to indemnify or that may impact the cost and availability of components or sales of our products. Courts may also issue injunctions preventing manufacturers from offering, distributing, using or importing products that include the challenged intellectual property. Adverse rulings or injunctive relief awarded against key suppliers of components for our products could result in delays or stoppages in the shipment of affected components, or require us to recall, modify or redesign our products containing such components. Regardless of the merit of claims against us or our manufacturers, suppliers, distributors or customers, intellectual property litigation can be time consuming and costly, and result in the diversion of the attention of technical and management personnel. Any such litigation could force us to stop manufacturing, selling, distributing, exporting, incorporating or using products or components that include the challenged intellectual property, or to recall, modify or redesign such products. In addition, if a party accuses us of infringing upon its proprietary rights, we may have to enter into royalty or licensing agreements, which may not be available on terms acceptable to us, if at all. If we are unsuccessful in any such litigation, we could be subject to significant liability for damages and loss of our proprietary rights. Any of these events or results could have a material adverse effect on our business, operations, financial condition and liquidity.

12

Due to the international nature of our business, political or economic changes or other factors in a specific country or region could harm our future revenue, costs and expenses, and financial condition.

We currently have significant operations in Canada, South Korea, India and Vietnam, as well as sales and technical support teams in various locations around the world. We continue to consider opportunities to expand our international operations in the future. The successful management and expansion of our international operations requires significant human effort and the commitment of substantial financial resources. Further, our international operations may be subject to certain risks, disruptions and challenges that could materially harm our business, operations, financial condition, and liquidity, including: (i) unexpected changes in laws, policies and regulatory requirements, including but not limited to regulations related to import-export control; (ii) trade protection measures, tariffs, embargoes and other regulatory requirements which could affect our ability to import or export our products into or from various countries; (iii) political unrest or instability, acts of terrorism or war in countries where we or our suppliers or customers have operations, including heightened security concerns stemming from North Korea in relation to our operations in South Korea; (iv) political considerations that affect service provider and government spending patterns; (v) heightened political tensions between the U.S. and China regarding the COVID-19 pandemic, trade practices and intellectual property rights; (vi) differing technology standards or customer requirements; (vii) developing and customizing our products for foreign countries; (viii) fluctuations in currency exchange rates, foreign exchange controls and restrictions on cash repatriation; (ix) longer accounts receivable collection cycles and financial instability of customers; (x) requirements for additional liquidity to fund our international operations; (xi) pandemics, epidemics and other public health crises, such as the COVID-19 pandemic; (xii) difficulties and excessive costs for staffing and managing foreign operations; (xiii) ineffective legal protection of our intellectual property rights in certain countries; (xiv) potentially adverse tax consequences; and (xv) changes in a country’s or region’s political and economic conditions.

In addition, some of our customer purchase agreements are governed by foreign laws and regulations, which may differ significantly from the laws and regulations of the United States. We may be limited in our ability to enforce our rights under these agreements and to collect damages, if awarded. Any of these factors could harm our existing international operations and business or impair our ability to continue expanding into international markets.

We face exposure to foreign currency exchange rate fluctuations.

We conduct significant business in South Korea, Japan, India, Vietnam, Europe, Middle East and Latin America, all of which subject us to foreign currency exchange rate risk.

We have in the past and may in the future undertake a hedging program to mitigate the impact of foreign currency exchange rate fluctuations. The use of such hedging activities may not offset any or more than a portion of the adverse financial effects of unfavorable movements in foreign currency exchange rates over the limited time the hedges are in place. Moreover, the use of hedging instruments may introduce additional risks if we are unable to structure effective hedges with such instruments, which could adversely affect our business, operations, financial condition, and liquidity.

As such, our results of operations and our cash flows could be impacted by changes in foreign currency exchange rates.

Risks Related to our Industry

The telecommunications networking business requires the application of complex revenue and expense recognition rules and the regulatory environment affecting generally accepted accounting principles is uncertain. Changes in financial accounting standards or practices may cause adverse, unexpected financial reporting fluctuations and harm our business.

The nature of our business requires the application of complex revenue and expense recognition rules and the current regulatory environment affecting U.S. GAAP is uncertain. Significant changes in U.S. GAAP could affect our financial statements going forward and may cause adverse, unexpected financial reporting fluctuations and harm our operating results. U.S. GAAP is subject to interpretation by the Financial Accounting Standards Board, the Securities and Exchange Commission (SEC) and various bodies formed to promulgate and interpret appropriate accounting principles. In addition, we have in the past and may in the future need to significantly change our customer contracts, accounting systems and processes when we adopt future or proposed changes in accounting principles. The cost and effect of these changes may negatively impact our results of operations during the periods of transition.

Changes in government regulations related to our business could harm our operations, financial condition, and liquidity.

Our operations are subject to various laws and regulations, including those regulations promulgated by the Federal Communications Commission (“FCC”). The FCC has jurisdiction over the entire communications industry in the United States and, as a result, our existing and future products and our customers’ products are subject to FCC rules and regulations. Changes to current FCC rules and regulations and future FCC rules and regulations could negatively affect our business. Non-compliance with the FCC’s rules and regulations would expose us to potential enforcement actions, including monetary

13