UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09729

iShares Trust

(Exact name of registrant as specified in charter)

c/o BlackRock Fund Advisors

400 Howard Street, San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: February 29, 2024

Date of reporting period: February 29, 2024

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

|

|

FEBRUARY 29, 2024 |

|

|

2024 Annual Report

| |

iShares Trust

· iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB | NASDAQ

· iShares ESG Aware U.S. Aggregate Bond ETF | EAGG | NYSE Arca

· iShares ESG Aware USD Corporate Bond ETF | SUSC | NASDAQ

Dear Shareholder,

The combination of continued economic growth and cooling inflation provided a supportive backdrop for investors during the 12-month reporting period ended February 29, 2024. Significantly tighter monetary policy helped to rein in inflation, and the Consumer Price Index decelerated substantially while remaining above pre-pandemic levels. A moderating labor market helped ease inflationary pressure, although wages continued to grow. Wage and job growth powered robust consumer spending, backstopping the economy. On October 7, 2023, Hamas launched a horrific attack on Israel. The ensuing war will have a significant humanitarian impact and could lead to heightened economic and market volatility. We see geopolitics as a structural market risk going forward. See our geopolitical risk dashboard at blackrock.com for more details.

Equity returns were robust during the period, as interest rates stabilized and the economy proved to be more resilient than many investors expected. The U.S. economy continued to show strength, and growth further accelerated in the second half of 2023. Large-capitalization U.S. stocks posted particularly substantial gains, supported by the performance of a few notable technology companies, while small-capitalization U.S. stocks advanced at a significantly slower pace. Meanwhile, international developed market equities also gained strongly, while emerging market stocks advanced at a more modest pace.

The 10-year U.S. Treasury yield rose during the reporting period, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. However, higher yields drove positive returns overall for 10-year U.S. Treasuries and solid gains in shorter-duration U.S. Treasuries. The corporate bond market benefited from improving economic sentiment, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), attempting to manage persistent inflation, raised interest rates three times during the 12-month period, but paused its tightening after its July meeting. The Fed also continued to reduce its balance sheet by not replacing some of the securities that reach maturity.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has stopped tightening for now, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period despite the market’s hopes for rapid interest rate cuts, as reflected in the recent rally. In this new regime, we anticipate greater volatility and dispersion of returns, creating more opportunities for selective portfolio management.

Looking at developed market stocks, we have an overweight stance on U.S. stocks overall, particularly given the promise of emerging AI technologies. We are also overweight Japanese stocks as shareholder-friendly policies generate increased investor interest, although we maintain an underweight stance on European stocks. In credit, there are selective opportunities in the near term despite tighter credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock Inc.

Rob Kapito

President, BlackRock Inc.

| Total Returns as of February 29, 2024

|

||||||||

|

6-Month

|

12-Month

|

|||||||

| U.S. large cap equities |

13.93% | 30.45% | ||||||

| U.S. small cap equities |

8.97 | 10.05 | ||||||

| International equities |

9.23 | 14.41 | ||||||

| Emerging market equities |

4.93 | 8.73 | ||||||

| 3-month Treasury bills |

2.69 | 5.22 | ||||||

| U.S. Treasury securities |

0.58 | 0.69 | ||||||

| U.S. investment grade bonds |

2.35 | 3.33 | ||||||

| Tax-exempt municipal bonds |

4.33 | 5.42 | ||||||

| U.S. high yield bonds |

6.18 | 11.01 | ||||||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

|

| |||||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

|

|

||||

| 2 | ||||

| Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| Financial Statements |

||||

| 125 | ||||

| 126 | ||||

| 127 | ||||

| 129 | ||||

| 132 | ||||

| 141 | ||||

| 142 | ||||

| 143 | ||||

| 144 | ||||

| 145 | ||||

| 147 | ||||

| 148 | ||||

iShares Trust

U.S. Bond Market Overview

U.S. investment-grade bonds produced a gain of 3.33% during the 12 months ended February 29, 2024 (the “reporting period”), as measured by the Bloomberg U.S. Aggregate Bond Index. Income made a sizable contribution to performance, and strength in credit-oriented market segments provided an additional boost to returns.

The 12-month gain for the index belies the challenging environment for the bond market through the first eight months of the period. During this time, yields drifted steadily higher (as prices fell) in response to better-than-expected economic growth and continued interest rate increases by the U.S. Federal Reserve (Fed). The Fed raised rates by a quarter-point at its meetings in March, May, and July 2023, moving its benchmark fed funds rate to a range of 5.25% - 5.50%. Although the Fed’s aggressive actions contributed to a decline in inflation, U.S. economic growth remained robust behind persistent strength in the labor market. This trend gave rise to expectations that the central bank would need to keep rates “higher for longer,” fueling a sharp sell-off in the bond market in the span from August through October 2023.

The investment backdrop improved considerably in the final two months of 2023, touching off a rally that helped the fixed-income market quickly recover its earlier losses. The headline Consumer Price Index fell to its lowest levels since early 2021 in the November report, surprising the markets and causing the consensus to shift toward the view that the Fed was in fact finished raising rates. In December, Fed Chairman Jerome Powell provided another positive surprise with his suggestion that rate cuts could begin as early as the first half of 2024. Bond prices moved surged in response, with the credit sectors leading the way amid a pronounced improvement in investor sentiment. While yields crept higher in January and February, the Bloomberg U.S. Aggregate Bond Index finished in positive territory on the strength of its earlier advance.

These trends were reflected in the U.S. Treasury market, where the yield on the two-year note entered the annual period at 4.81%, reached a high of 5.19% in mid-October, and subsequently finished February 2024 at 4.64%. The 10-year issue followed a similar path, climbing from 3.92% at the start of the period to a high of 4.98% before sliding to 4.25% on February 29, 2024. One result of these moves was that the yield curve’s inversion—i.e., the extent to which short-term rates exceeded those of longer-term issues—gradually moderated from the unusually high level reached in early 2023. Short-term Treasuries were the strongest performers on a total return basis, followed by intermediate-term issues. However, longer-dated government bonds (those with maturities of 10 years and above) posted a loss.

Investment-grade corporate bonds were the best performing segment of the index during the 12-month period. The asset class was helped by a larger contribution from yield, together with a decline in yield spreads relative to U.S. Treasuries. Securitized assets—a category that encompasses mortgage-backed securities (MBS), asset backed securities (ABS) and commercial mortgage-backed securities (CMBS)—underperformed the index. While ABS and CMBS both held up well, agency MBS failed to keep pace with the broader fixed-income market due to the combination of the Fed’s ongoing balance sheet reduction and lower buying demand from banks.

| 4 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

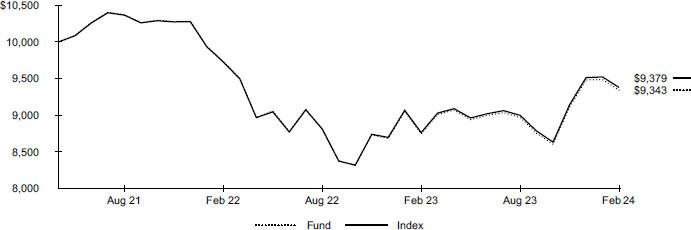

| Fund Summary as of February 29, 2024 | iShares® ESG Aware 1-5 Year USD Corporate Bond ETF |

Investment Objective

The iShares ESG Aware 1-5 Year USD Corporate Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds having remaining maturities between one and five years and issued by companies that have positive environmental, social and governance characteristics while seeking to exhibit risk and return characteristics similar to those of the parent index of such index, as represented by the Bloomberg MSCI US Corporate 1-5 Year ESG Focus Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception |

1 Year | 5 Years | Since Inception |

|||||||||||||||||||||||

| Fund NAV |

5.58 | % | 1.87 | % | 1.82 | % | 5.58 | % | 9.73 | % | 12.74 | % | ||||||||||||||||

| Fund Market |

5.53 | 1.81 | 1.82 | 5.53 | 9.41 | 12.72 | ||||||||||||||||||||||

| Index |

5.71 | 2.09 | 2.04 | 5.71 | 10.91 | 14.36 | ||||||||||||||||||||||

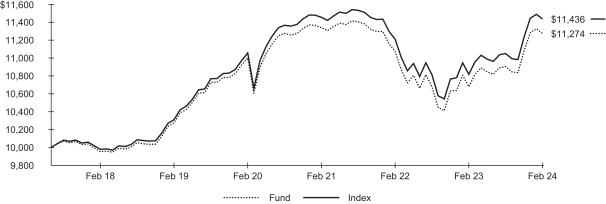

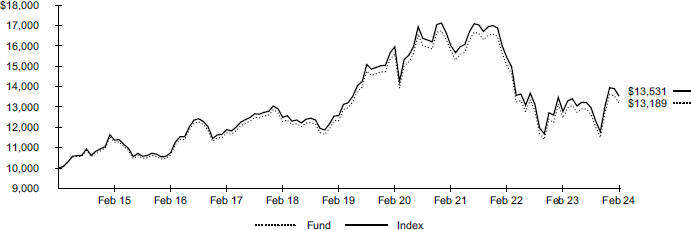

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was July 11, 2017. The first day of secondary market trading was July 13, 2017.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| |

Beginning Account Value (09/01/23) |

|

|

Ending Account Value (02/29/24) |

|

|

Expenses Paid During the Period |

(a) |

|

Beginning Account Value (09/01/23) |

|

|

Ending Account Value (02/29/24) |

|

|

Expenses Paid During the Period |

(a) |

|

Annualized Expense Ratio |

| ||||||||

| $ 1,000.00 | $ 1,033.90 | $ 0.61 | $ 1,000.00 | $ 1,024.30 | $ 0.60 | 0.12 | % | |||||||||||||||||||||

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

| F U N D S U M M A R Y |

5 |

| Fund Summary as of February 29, 2024 (continued) | iShares® ESG Aware 1-5 Year USD Corporate Bond ETF |

Portfolio Management Commentary

Returns for shorter-maturity, investment grade corporate bonds with positive environmental, social and governance (“ESG”) characteristics were positive during the12-month reporting period despite market volatility driven by shifting expectations around inflation and Federal Reserve (Fed) interest rate policy. In this vein, the yield on the two-year Treasury note entered the annual period at 4.81%, reached a high of 5.19% in mid-October of 2023, and subsequently declined on an improved outlook for Fed rate cuts, ending the period at 4.64%. Corporate bonds were the best performing segment of the investment grade market as credit sentiment remained firm and yield spreads relative to U.S. Treasuries narrowed.

The Bloomberg MSCI US 1-5 Year Corporate ESG Focus Index (“the Index”) performed in line with the broader short-term investment grade corporate bond market as represented by the Bloomberg US Corporate 1-5 Year Index. Within the Index, performance was led by lower quality issues in the Moody’s Baa rating category, while bonds rated Aaa were the biggest laggards while still posting positive returns. Relative to the broader market, the ESG selection process leads to overweight and underweight positions in bonds with higher or lower ESG characteristics, respectively. Consequently, the Index achieved an ESG quality score that was higher than the broader market, with lower exposure to carbon intensive companies.

Portfolio Information

| CREDIT QUALITY ALLOCATION |

| |||

|

|

||||

| Moody’s Credit Rating* | Percent of Total Investments(a) |

|||

|

|

||||

| Aaa |

1.7% | |||

| Aa |

3.5 | |||

| A |

47.7 | |||

| Baa |

44.5 | |||

| Ba |

1.2 | |||

| Not Rated |

1.4 | |||

|

|

||||

MATURITY ALLOCATION

|

|

||||

| Maturity | Percent of Total Investments(a) |

|||

|

|

||||

| 1-2 Years |

25.9% | |||

| 2-3 Years |

23.8 | |||

| 3-4 Years |

24.5 | |||

| 4-5 Years |

21.6 | |||

| 5-6 Years |

4.0 | |||

| 7-8 Years |

0.1 | |||

| 21-22 Years |

0.1 | |||

|

|

||||

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 6 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

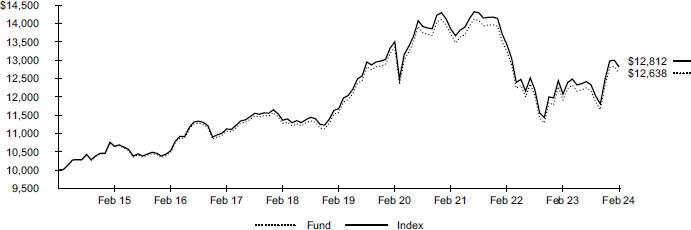

| Fund Summary as of February 29, 2024 | iShares® ESG Aware U.S. Aggregate Bond ETF |

Investment Objective

The iShares ESG Aware U.S. Aggregate Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade bonds from issuers generally evaluated for favorable environmental, social and governance practices while seeking to exhibit risk and return characteristics similar to those of the broad U.S. dollar-denominated investment-grade bond market, as represented by the Bloomberg MSCI US Aggregate ESG Focus Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception |

1 Year | 5 Years | Since Inception |

|||||||||||||||||||||||

| Fund NAV |

3.22 | % | 0.46 | % | 1.07 | % | 3.22 | % | 2.34 | % | 5.88 | % | ||||||||||||||||

| Fund Market |

3.27 | 0.46 | 1.08 | 3.27 | 2.32 | 5.96 | ||||||||||||||||||||||

| Index |

3.33 | 0.60 | 1.18 | 3.33 | 3.01 | 6.51 | ||||||||||||||||||||||

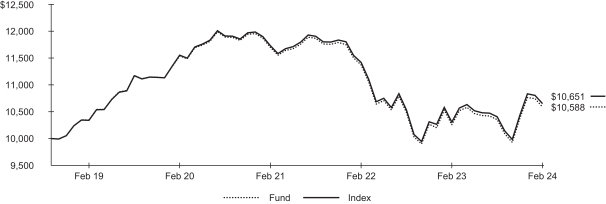

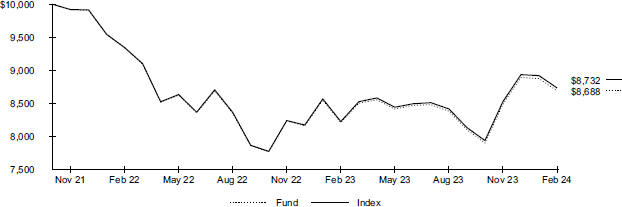

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was October 18, 2018. The first day of secondary market trading was October 23, 2018.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| |

Beginning Account Value (09/01/23) |

|

|

Ending Account Value |

|

|

Expenses Paid During |

|

|

Beginning Account Value |

|

|

Ending Account Value |

|

|

Expenses Paid During the Period |

(a) |

|

Annualized Expense Ratio |

| ||||||||

| $ 1,000.00 | $ 1,022.80 | $ 0.45 | $ 1,000.00 | $ 1,024.40 | $ 0.45 | 0.09 | % | |||||||||||||||||||||

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

| F U N D S U M M A R Y |

7 |

| Fund Summary as of February 29, 2024 (continued) | iShares® ESG Aware U.S. Aggregate Bond ETF |

Portfolio Management Commentary

Returns for investment-grade bonds with positive environmental, social and governance (“ESG”) characteristics were positive during the 12-month reporting period despite market volatility driven by shifting expectations around inflation and Federal Reserve (Fed) interest rate policy. In this vein, the yield on the 10-year Treasury bond began the period at 3.92% and rose more than 100 basis points to 4.98% before declining on an improved outlook for Fed rate cuts, ultimately ending the period at 4.25%. The Bloomberg MSCI US Aggregate ESG Focus Index (“the Index”) performed in line with the broader bond market as represented by the Bloomberg U.S. Aggregate Index.

Investment grade corporate bonds were the best performing segment of the Index during the period as credit sentiment remained firm and yield spreads relative to U.S. Treasuries narrowed. Returns for Treasuries were positive but lagged those for corporate bonds as longer-term Treasury yields finished the period modestly higher. Securitized assets including mortgage-backed securities, asset backed securities and commercial mortgage-backed securities also finished in positive territory while underperforming corporate bonds. In particular, demand for agency mortgage-backed securities was negatively impacted by the Fed’s post-pandemic balance sheet reduction efforts. In addition, banks curtailed their purchases given extended durations for the sector with the rise in mortgage rates seen since the beginning of the Fed’s hiking cycle along with an inverted yield curve that hurt net interest margins.

Portfolio Information

| CREDIT QUALITY ALLOCATION |

| |||

|

|

||||

| Moody’s Credit Rating* | Percent of Total Investments(a) |

|||

|

|

||||

| Aaa |

71.8% | |||

| Aa |

1.5 | |||

| A |

11.6 | |||

| Baa |

12.4 | |||

| Ba |

0.4 | |||

| Not Rated |

2.3 | |||

|

|

||||

PORTFOLIO COMPOSITION

|

|

||||

| Investment Type | Percent of Total Investments(a) |

|||

|

|

||||

| U.S. Government & Agency Obligations |

69.4% | |||

| Corporate Bonds & Notes |

26.1 | |||

| Foreign Government Obligations |

3.4 | |||

| Collaterized Mortgage Obligations |

1.0 | |||

| Asset-Backed Securities |

0.5 | |||

| Municipal Debt Obligations |

—(b) | |||

| TBA Sales Commitments |

(0.4) | |||

|

|

||||

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| (b) | Rounds to less than 0.1% |

| 8 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

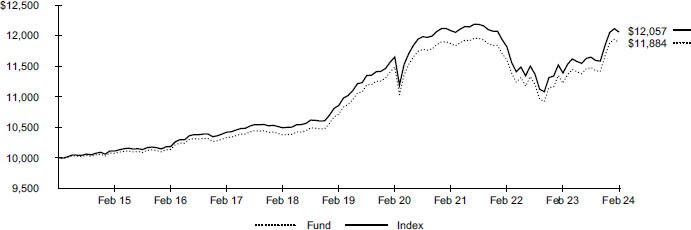

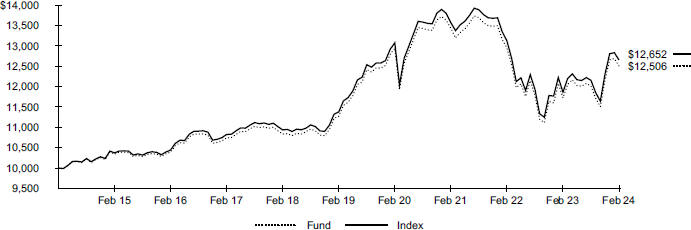

| Fund Summary as of February 29, 2024 | iShares® ESG Aware USD Corporate Bond ETF |

Investment Objective

The iShares ESG Aware USD Corporate Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds issued by companies that have positive environmental, social and governance characteristics while seeking to exhibit risk and return characteristics similar to those of the parent index of such index, as represented by the Bloomberg MSCI US Corporate ESG Focus Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception |

1 Year | 5 Years | Since Inception |

|||||||||||||||||||||||

| Fund NAV |

5.82 | % | 1.61 | % | 1.55 | % | 5.82 | % | 8.32 | % | 10.75 | % | ||||||||||||||||

| Fund Market |

5.91 | 1.54 | 1.56 | 5.91 | 7.95 | 10.80 | ||||||||||||||||||||||

| Index |

5.99 | 1.91 | 1.83 | 5.99 | 9.94 | 12.80 | ||||||||||||||||||||||

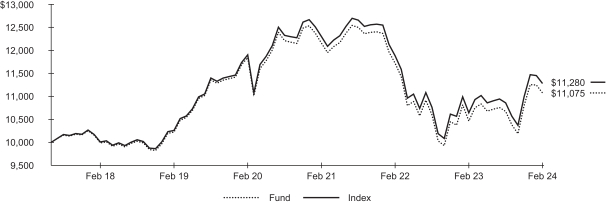

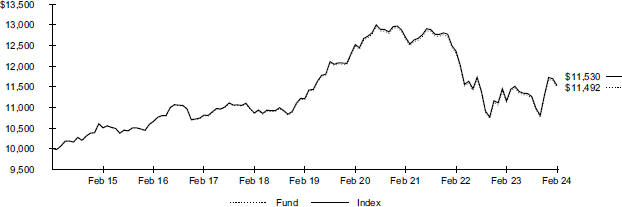

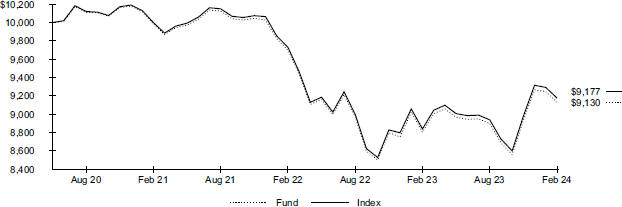

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was July 11, 2017. The first day of secondary market trading was July 13, 2017.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| |

Beginning Account Value |

|

|

Ending Account Value |

|

|

Expenses Paid During |

|

|

Beginning Account Value |

|

|

Ending Account Value |

|

|

Expenses Paid During |

|

|

Annualized Expense Ratio |

| ||||||||

| $ 1,000.00 | $ 1,037.60 | $ 0.91 | $ 1,000.00 | $ 1,024.00 | $ 0.91 | 0.18 | % | |||||||||||||||||||||

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

| F U N D S U M M A R Y |

9 |

| Fund Summary as of February 29, 2024 (continued) | iShares® ESG Aware USD Corporate Bond ETF |

Portfolio Management Commentary

Returns for investment-grade corporate bonds with positive environmental, social and governance (“ESG”) characteristics were positive during the 12-month reporting period despite market volatility driven by shifting expectations around inflation and Federal Reserve (Fed) interest rate policy. In this vein, the yield on the 10-year Treasury bond began the period at 3.92% and rose more than 100 basis points to 4.98% before declining on an improved outlook for Fed rate cuts, ultimately ending the period at 4.25%. Corporate bonds were the best performing segment of the investment grade market as credit sentiment remained firm and yield spreads relative to U.S. Treasuries narrowed.

The Bloomberg MSCI US Corporate ESG Focus Index (“the Index”) performed in line with the broader market as represented by the Bloomberg US Corporate Index. Within the Index, performance was strongest for the lowest rated segment within the investment grade corporate bond market as represented by issues rated Baa byMoody’s Ratings. In terms of maturity, bonds with maturities of 10 years or longer make up the largest proportion of the Index and contributed the most to return for the period.

Relative to the broader market, the ESG selection process leads to overweight and underweight positions in bonds with higher or lower ESG characteristics, respectively. Consequently, the Index achieved an ESG quality score that was higher than the broader market, with lower exposure to carbon intensive companies.

Portfolio Information

| CREDIT QUALITY ALLOCATION |

| |||

|

|

||||

| Moody’s Credit Rating* | Percent of Total Investments(a) |

|||

|

|

||||

| Aaa |

1.6% | |||

| Aa |

4.3 | |||

| A |

45.5 | |||

| Baa |

46.0 | |||

| Ba |

1.6 | |||

| Not Rated |

1.0 | |||

|

|

||||

MATURITY ALLOCATION

|

|

||||

| Maturity | Percent of Total Investments(a) |

|||

|

|

||||

| 1-5 Years |

36.3% | |||

| 5-10 Years |

27.8 | |||

| 10-15 Years |

8.2 | |||

| 15-20 Years |

5.7 | |||

| More than 20 Years |

22.0 | |||

|

|

||||

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 10 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, index returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, index returns would be lower.

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| A B O U T F U N D P E R F O R M A N C E / D I S C L O S U R E O F E X P E N S E S |

11 |

|

February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Corporate Bonds & Notes |

||||||||

| Advertising — 0.0% | ||||||||

| Interpublic Group of Companies Inc. (The), 4.65%, 10/01/28 (Call 07/01/28)(a) |

$ | 250 | $ | 244,814 | ||||

|

|

|

|||||||

| Aerospace & Defense — 0.3% | ||||||||

| Hexcel Corp. |

||||||||

| 4.20%, 02/15/27 (Call 11/15/26) |

945 | 899,686 | ||||||

| 4.95%, 08/15/25 (Call 05/15/25) |

105 | 103,623 | ||||||

| Northrop Grumman Corp., 4.60%, 02/01/29 (Call 01/01/29) |

300 | 294,002 | ||||||

| RTX Corp. |

||||||||

| 2.65%, 11/01/26 (Call 08/01/26) |

45 | 42,347 | ||||||

| 3.13%, 05/04/27 (Call 02/04/27) |

15 | 14,156 | ||||||

| 3.50%, 03/15/27 (Call 12/15/26) |

25 | 23,893 | ||||||

| 3.95%, 08/16/25 (Call 06/16/25) |

83 | 81,415 | ||||||

| 4.13%, 11/16/28 (Call 08/16/28) |

360 | 345,751 | ||||||

| 5.75%, 11/08/26 (Call 10/08/26) |

520 | 527,569 | ||||||

| 5.75%, 01/15/29 (Call 12/15/28) |

405 | 416,931 | ||||||

|

|

|

|||||||

| 2,749,373 | ||||||||

| Agriculture — 0.8% | ||||||||

| Archer-Daniels-Midland Co., 2.50%, 08/11/26 (Call 05/11/26) |

35 | 32,954 | ||||||

| Bunge Ltd. Finance Corp. |

||||||||

| 1.63%, 08/17/25 (Call 07/17/25) |

4,086 | 3,867,975 | ||||||

| 3.25%, 08/15/26 (Call 05/15/26) |

3,080 | 2,936,399 | ||||||

| 3.75%, 09/25/27 (Call 06/25/27) |

305 | 291,796 | ||||||

|

|

|

|||||||

| 7,129,124 | ||||||||

| Airlines — 0.0% | ||||||||

| Delta Air Lines Pass Through Trust, Series 2020, Class AA, 2.00%, 12/10/29(a) |

95 | 84,641 | ||||||

| Southwest Airlines Co., 5.13%, 06/15/27 (Call 04/15/27)(a) |

120 | 119,595 | ||||||

|

|

|

|||||||

| 204,236 | ||||||||

| Apparel — 0.5% | ||||||||

| PVH Corp., 4.63%, 07/10/25 (Call 06/10/25) |

957 | 943,597 | ||||||

| Ralph Lauren Corp., 3.75%, 09/15/25 (Call 07/15/25) |

333 | 325,448 | ||||||

| Tapestry Inc. |

||||||||

| 4.13%, 07/15/27 (Call 04/15/27) |

10 | 9,497 | ||||||

| 4.25%, 04/01/25 (Call 01/01/25) |

140 | 137,847 | ||||||

| 7.05%, 11/27/25 |

210 | 213,926 | ||||||

| 7.35%, 11/27/28 (Call 10/27/28) |

630 | 659,229 | ||||||

| VF Corp. |

||||||||

| 2.40%, 04/23/25 (Call 03/23/25) |

710 | 681,151 | ||||||

| 2.80%, 04/23/27 (Call 02/23/27) |

1,730 | 1,568,588 | ||||||

|

|

|

|||||||

| 4,539,283 | ||||||||

| Auto Manufacturers — 2.3% | ||||||||

| American Honda Finance Corp. |

||||||||

| 1.00%, 09/10/25 |

152 | 142,842 | ||||||

| 1.30%, 09/09/26 |

68 | 62,084 | ||||||

| 2.00%, 03/24/28 |

10 | 8,957 | ||||||

| 2.25%, 01/12/29 |

405 | 359,640 | ||||||

| 2.30%, 09/09/26 |

65 | 60,966 | ||||||

| 4.70%, 01/12/28(a) |

1,935 | 1,925,148 | ||||||

| 4.75%, 01/12/26 |

60 | 59,607 | ||||||

| 4.95%, 01/09/26 |

325 | 324,012 | ||||||

| 5.13%, 07/07/28 |

825 | 831,677 | ||||||

| 5.25%, 07/07/26(a) |

240 | 241,686 | ||||||

| 5.65%, 11/15/28 |

545 | 560,380 | ||||||

| Security | Par (000) |

Value | ||||||

| Auto Manufacturers (continued) | ||||||||

| Cummins Inc. |

||||||||

| 0.75%, 09/01/25 (Call 08/01/25) |

$ | 2,010 | $ | 1,885,443 | ||||

| 4.90%, 02/20/29 (Call 01/20/29)(a) |

800 | 796,017 | ||||||

| Ford Motor Credit Co. LLC |

||||||||

| 2.90%, 02/16/28 (Call 12/16/27)(a) |

1,930 | 1,730,164 | ||||||

| 4.13%, 08/17/27 (Call 06/17/27) |

1,455 | 1,375,202 | ||||||

| 6.80%, 11/07/28 (Call 10/07/28) |

595 | 616,134 | ||||||

| 7.35%, 11/04/27 (Call 10/04/27) |

55 | 57,470 | ||||||

| General Motors Co. |

||||||||

| 4.00%, 04/01/25 |

605 | 595,386 | ||||||

| 6.80%, 10/01/27 (Call 08/01/27) |

45 | 46,989 | ||||||

| General Motors Financial Co. Inc. |

||||||||

| 1.50%, 06/10/26 (Call 05/10/26) |

85 | 77,865 | ||||||

| 2.35%, 02/26/27 (Call 01/26/27)(a) |

895 | 820,557 | ||||||

| 2.40%, 10/15/28 (Call 08/15/28) |

210 | 184,508 | ||||||

| 2.70%, 08/20/27 (Call 06/20/27)(a) |

60 | 55,044 | ||||||

| 2.75%, 06/20/25 (Call 05/20/25)(a) |

165 | 159,248 | ||||||

| 3.85%, 01/05/28 (Call 10/05/27) |

25 | 23,730 | ||||||

| 4.00%, 10/06/26 (Call 07/06/26)(a) |

80 | 77,340 | ||||||

| 4.30%, 07/13/25 (Call 04/13/25) |

102 | 100,315 | ||||||

| 4.35%, 04/09/25 (Call 02/09/25) |

852 | 840,986 | ||||||

| 4.35%, 01/17/27 (Call 10/17/26) |

120 | 116,790 | ||||||

| 5.00%, 04/09/27 (Call 03/09/27) |

1,195 | 1,182,352 | ||||||

| 5.40%, 05/08/27 |

90 | 90,101 | ||||||

| 5.80%, 06/23/28 (Call 05/23/28) |

45 | 45,646 | ||||||

| 5.80%, 01/07/29 (Call 12/07/28) |

305 | 309,026 | ||||||

| 6.00%, 01/09/28 (Call 12/09/27) |

425 | 434,326 | ||||||

| Honda Motor Co. Ltd., 2.53%, 03/10/27 (Call 02/10/27)(a) |

50 | 46,718 | ||||||

| Toyota Motor Credit Corp. |

||||||||

| 1.15%, 08/13/27 |

590 | 522,693 | ||||||

| 1.90%, 01/13/27 |

190 | 174,965 | ||||||

| 3.00%, 04/01/25 |

698 | 681,993 | ||||||

| 3.05%, 03/22/27 |

270 | 256,040 | ||||||

| 3.20%, 01/11/27 |

175 | 167,196 | ||||||

| 3.40%, 04/14/25 |

167 | 163,662 | ||||||

| 4.55%, 09/20/27 |

880 | 872,498 | ||||||

| 5.00%, 08/14/26 |

200 | 199,962 | ||||||

| 5.25%, 09/11/28 |

175 | 177,509 | ||||||

| 5.45%, 11/10/27 |

35 | 35,694 | ||||||

|

|

|

|||||||

| 19,496,568 | ||||||||

| Auto Parts & Equipment — 0.1% | ||||||||

| BorgWarner Inc.,

2.65%, 07/01/27 |

640 | 590,725 | ||||||

| Lear Corp., 3.80%, 09/15/27 (Call 06/15/27) |

55 | 52,639 | ||||||

|

|

|

|||||||

| 643,364 | ||||||||

| Banks — 31.4% | ||||||||

| Banco Bilbao Vizcaya Argentaria SA |

||||||||

| 1.13%, 09/18/25 |

6,733 | 6,293,652 | ||||||

| 6.14%, 09/14/28 (Call 09/14/27), |

775 | 785,743 | ||||||

| Banco Santander SA |

||||||||

| 1.72%, 09/14/27 (Call 09/14/26), |

390 | 352,712 | ||||||

| 1.85%, 03/25/26 |

1,637 | 1,519,181 | ||||||

| 2.75%, 05/28/25 |

325 | 313,545 | ||||||

| 3.80%, 02/23/28(a) |

400 | 376,765 | ||||||

| 4.18%, 03/24/28 (Call 03/24/27), |

1,195 | 1,143,947 | ||||||

| 4.25%, 04/11/27(a) |

565 | 544,400 | ||||||

| 4.38%, 04/12/28 |

450 | 432,378 | ||||||

| 12 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 5.18%, 11/19/25 |

$ | 412 | $ | 406,248 | ||||

| 5.59%, 08/08/28(a) |

800 | 806,199 | ||||||

| 6.53%, 11/07/27 (Call 11/07/26), |

400 | 409,295 | ||||||

| 6.61%, 11/07/28 |

400 | 420,293 | ||||||

| Bank of America Corp. |

||||||||

| 1.20%, 10/24/26 (Call 10/24/25), |

500 | 465,820 | ||||||

| 1.32%, 06/19/26 (Call 06/19/25), |

400 | 378,712 | ||||||

| 1.73%, 07/22/27 (Call 07/22/26), |

2,494 | 2,286,286 | ||||||

| 2.09%, 06/14/29 (Call 06/14/28), |

925 | 811,724 | ||||||

| 2.55%, 02/04/28 (Call 02/04/27), |

780 | 721,364 | ||||||

| 3.25%, 10/21/27 (Call 10/21/26)(a) |

65 | 61,399 | ||||||

| 3.38%, 04/02/26 (Call 04/02/25), |

310 | 302,721 | ||||||

| 3.42%, 12/20/28 (Call 12/20/27), |

2,130 | 1,990,436 | ||||||

| 3.56%, 04/23/27 (Call 04/23/26), |

350 | 336,611 | ||||||

| 3.59%, 07/21/28 (Call 07/21/27), |

1,030 | 975,338 | ||||||

| 3.71%, 04/24/28 (Call 04/24/27), |

2,270 | 2,161,918 | ||||||

| 3.82%, 01/20/28 (Call 01/20/27), |

1,695 | 1,628,415 | ||||||

| 3.88%, 08/01/25 |

66 | 64,945 | ||||||

| 3.97%, 02/07/30 (Call 02/07/29), |

500 | 469,915 | ||||||

| 4.25%, 10/22/26 |

165 | 161,362 | ||||||

| 4.27%, 07/23/29 (Call 07/23/28), |

495 | 475,570 | ||||||

| 4.38%, 04/27/28 (Call 04/27/27), |

1,360 | 1,323,698 | ||||||

| 4.45%, 03/03/26 |

20 | 19,669 | ||||||

| 4.83%, 07/22/26 (Call 07/22/25), |

40 | 39,658 | ||||||

| 4.95%, 07/22/28 (Call 07/22/27), |

1,050 | 1,039,437 | ||||||

| 5.08%, 01/20/27 (Call 01/20/26), |

470 | 466,992 | ||||||

| 5.20%, 04/25/29 (Call 04/25/28), |

1,505 | 1,496,482 | ||||||

| 5.82%, 09/15/29 (Call 09/15/28), |

15 | 15,291 | ||||||

| 6.20%, 11/10/28 (Call 11/10/27), |

1,235 | 1,273,276 | ||||||

| 6.22%, 09/15/26 |

20 | 20,430 | ||||||

| Series L, 3.95%, 04/21/25 |

1,292 | 1,270,645 | ||||||

| Series L, 4.18%, 11/25/27 (Call 11/25/26) |

1,390 | 1,342,257 | ||||||

| Series N, 1.66%, 03/11/27 (Call 03/11/26), |

1,413 | 1,311,856 | ||||||

| Bank of Montreal |

||||||||

| 0.95%, 01/22/27 (Call 01/22/26), |

2,310 | 2,131,353 | ||||||

| 1.25%, 09/15/26 |

1,260 | 1,146,714 | ||||||

| 1.85%, 05/01/25(a) |

222 | 213,298 | ||||||

| 2.65%, 03/08/27 |

190 | 177,272 | ||||||

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 3.70%, 06/07/25 |

$ | 30 | $ | 29,393 | ||||

| 3.80%, 12/15/32 (Call 12/15/27), |

70 | 64,387 | ||||||

| 5.20%, 02/01/28 (Call 01/01/28) |

1,130 | 1,134,188 | ||||||

| 5.27%, 12/11/26 |

185 | 185,446 | ||||||

| 5.30%, 06/05/26 |

190 | 190,460 | ||||||

| 5.72%, 09/25/28 (Call 08/25/28) |

545 | 558,788 | ||||||

| 5.92%, 09/25/25 |

150 | 151,546 | ||||||

| Series H, 4.70%, 09/14/27 (Call 08/14/27) |

90 | 89,097 | ||||||

| Bank of New York Mellon Corp. (The) |

||||||||

| 0.75%, 01/28/26 (Call 12/28/25)(a) |

165 | 152,188 | ||||||

| 1.05%, 10/15/26 (Call 09/15/26) |

80 | 72,263 | ||||||

| 1.60%, 04/24/25 (Call 03/24/25) |

1,870 | 1,796,443 | ||||||

| 1.65%, 07/14/28 (Call 05/14/28)(a) |

1,000 | 875,979 | ||||||

| 2.05%, 01/26/27 (Call 12/26/26) |

30 | 27,681 | ||||||

| 2.45%, 08/17/26 (Call 05/17/26) |

20 | 18,803 | ||||||

| 2.80%, 05/04/26 (Call 02/04/26) |

140 | 133,646 | ||||||

| 3.40%, 01/29/28 (Call 10/29/27) |

30 | 28,375 | ||||||

| 3.44%, 02/07/28 (Call 02/07/27), |

40 | 38,231 | ||||||

| 3.85%, 04/28/28 |

1,265 | 1,220,111 | ||||||

| 3.95%, 11/18/25 (Call 10/18/25) |

105 | 102,742 | ||||||

| 3.99%, 06/13/28 (Call 06/13/27), |

20 | 19,367 | ||||||

| 4.54%, 02/01/29 (Call 02/01/28), |

500 | 490,827 | ||||||

| 4.95%, 04/26/27 (Call 04/26/26), |

425 | 422,783 | ||||||

| 5.80%, 10/25/28 (Call 10/25/27), |

170 | 174,087 | ||||||

| 6.32%, 10/25/29 (Call 10/25/28), |

320 | 335,264 | ||||||

| Series J, 1.90%, 01/25/29 (Call 11/25/28) |

750 | 656,399 | ||||||

| Bank of Nova Scotia (The) |

||||||||

| 1.05%, 03/02/26 |

4,785 | 4,412,248 | ||||||

| 1.30%, 06/11/25 |

1,731 | 1,645,217 | ||||||

| 1.30%, 09/15/26 (Call 06/15/26) |

1,595 | 1,451,709 | ||||||

| 1.35%, 06/24/26 |

1,820 | 1,670,466 | ||||||

| 1.95%, 02/02/27 |

145 | 133,080 | ||||||

| 2.70%, 08/03/26 |

1,320 | 1,246,474 | ||||||

| 2.95%, 03/11/27 |

100 | 94,135 | ||||||

| 3.45%, 04/11/25 |

105 | 102,817 | ||||||

| 4.50%, 12/16/25 |

50 | 49,139 | ||||||

| 5.25%, 06/12/28 |

105 | 105,523 | ||||||

| 5.35%, 12/07/26(a) |

325 | 326,285 | ||||||

| 5.45%, 06/12/25 |

2,000 | 2,001,396 | ||||||

| Bank OZK, 2.75%, 10/01/31 (Call 10/01/26), |

100 | 83,199 | ||||||

| Barclays PLC |

||||||||

| 2.28%, 11/24/27 (Call 11/24/26), |

2,285 | 2,088,331 | ||||||

| 2.85%, 05/07/26 (Call 05/07/25), |

885 | 855,570 | ||||||

| 3.65%, 03/16/25 |

200 | 195,827 | ||||||

| 4.38%, 01/12/26 |

1,680 | 1,645,397 | ||||||

| 4.84%, 05/09/28 (Call 05/07/27) |

815 | 784,532 | ||||||

| 4.97%, 05/16/29 (Call 05/16/28), |

800 | 777,805 | ||||||

| 5.20%, 05/12/26 |

1,000 | 987,885 | ||||||

| 5.30%, 08/09/26 (Call 08/09/25), |

55 | 54,661 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

13 |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 5.50%, 08/09/28 (Call 08/09/27), |

$ | 50 | $ | 49,725 | ||||

| 5.83%, 05/09/27 (Call 05/09/26), |

665 | 666,355 | ||||||

| 6.49%, 09/13/29 (Call 09/13/28), |

265 | 273,051 | ||||||

| 6.50%, 09/13/27 (Call 09/13/26), |

200 | 203,479 | ||||||

| 7.39%, 11/02/28 (Call 11/02/27), |

230 | 243,073 | ||||||

| BPCE SA, 3.38%, 12/02/26 |

175 | 167,768 | ||||||

| Canadian Imperial Bank of Commerce |

||||||||

| 0.95%, 10/23/25(a) |

950 | 887,995 | ||||||

| 1.25%, 06/22/26 (Call 05/22/26) |

235 | 215,430 | ||||||

| 3.30%, 04/07/25 |

215 | 210,030 | ||||||

| 3.95%, 08/04/25 |

230 | 225,506 | ||||||

| 5.00%, 04/28/28 (Call 03/28/28) |

355 | 353,720 | ||||||

| 5.14%, 04/28/25 |

265 | 264,097 | ||||||

| 5.62%, 07/17/26 |

160 | 161,544 | ||||||

| 5.93%, 10/02/26 |

180 | 183,187 | ||||||

| 5.99%, 10/03/28 (Call 09/03/28)(a) |

745 | 771,716 | ||||||

| Citibank NA, 5.80%, 09/29/28 (Call 08/29/28)(a) |

595 | 612,890 | ||||||

| Citigroup Inc. |

||||||||

| 1.12%, 01/28/27 (Call 01/28/26), |

3,090 | 2,848,446 | ||||||

| 1.46%, 06/09/27 (Call 06/09/26), |

1,525 | 1,397,510 | ||||||

| 3.07%, 02/24/28 (Call 02/24/27), |

1,320 | 1,236,588 | ||||||

| 3.11%, 04/08/26 (Call 04/08/25), |

1,302 | 1,267,478 | ||||||

| 3.20%, 10/21/26 (Call 07/21/26) |

95 | 90,225 | ||||||

| 3.29%, 03/17/26 (Call 03/17/25), |

70 | 68,366 | ||||||

| 3.30%, 04/27/25(a) |

518 | 506,525 | ||||||

| 3.40%, 05/01/26 |

95 | 91,406 | ||||||

| 3.52%, 10/27/28 (Call 10/27/27), |

1,010 | 948,718 | ||||||

| 3.67%, 07/24/28 (Call 07/24/27), |

190 | 180,107 | ||||||

| 3.70%, 01/12/26 |

2,050 | 1,995,830 | ||||||

| 3.88%, 03/26/25 |

165 | 161,842 | ||||||

| 3.89%, 01/10/28 (Call 01/10/27), |

1,190 | 1,143,494 | ||||||

| 4.08%, 04/23/29 (Call 04/23/28), |

500 | 477,072 | ||||||

| 4.13%, 07/25/28 |

445 | 422,328 | ||||||

| 4.30%, 11/20/26 |

25 | 24,351 | ||||||

| 4.40%, 06/10/25 |

823 | 811,024 | ||||||

| 4.45%, 09/29/27 |

1,165 | 1,128,673 | ||||||

| 4.60%, 03/09/26 |

185 | 181,957 | ||||||

| 4.66%, 05/24/28 (Call 05/24/27), |

715 | 701,963 | ||||||

| 5.17%, 02/13/30 (Call 02/13/29), |

640 | 633,492 | ||||||

| 5.50%, 09/13/25 |

482 | 480,855 | ||||||

| Citizens Bank NA |

||||||||

| 2.25%, 04/28/25 (Call 03/28/25) |

250 | 239,540 | ||||||

| 4.58%, 08/09/28 (Call 08/09/27), |

430 | 409,502 | ||||||

| Comerica Bank, 4.00%, 07/27/25 |

250 | 242,319 | ||||||

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| Cooperatieve Rabobank UA, 4.38%, 08/04/25 |

$ | 250 | $ | 245,143 | ||||

| Cooperatieve Rabobank UA/NY, 3.38%, 05/21/25 |

30 | 29,378 | ||||||

| Credit Suisse AG/New York |

||||||||

| 2.95%, 04/09/25 |

240 | 233,095 | ||||||

| 5.00%, 07/09/27 |

770 | 762,711 | ||||||

| 7.50%, 02/15/28(a) |

1,220 | 1,314,068 | ||||||

| Deutsche Bank AG |

||||||||

| 4.10%, 01/13/26(a) |

560 | 545,940 | ||||||

| 4.50%, 04/01/25 |

45 | 44,137 | ||||||

| Deutsche Bank AG/New York |

||||||||

| 1.69%, 03/19/26 |

250 | 232,948 | ||||||

| 2.13%, 11/24/26 (Call 11/24/25), |

1,445 | 1,354,860 | ||||||

| 2.31%, 11/16/27 (Call 11/16/26), |

665 | 604,027 | ||||||

| 2.55%, 01/07/28 (Call 01/07/27), |

695 | 633,009 | ||||||

| 4.10%, 01/13/26 |

973 | 949,813 | ||||||

| 6.72%, 01/18/29 (Call 01/18/28), |

210 | 215,701 | ||||||

| 6.82%, 11/20/29 (Call 11/20/28), |

1,115 | 1,152,802 | ||||||

| 7.15%, 07/13/27 (Call 07/13/26), |

370 | 379,760 | ||||||

| Discover Bank |

||||||||

| 3.45%, 07/27/26 (Call 04/27/26) |

60 | 56,895 | ||||||

| 4.25%, 03/13/26 |

5 | 4,856 | ||||||

| 4.65%, 09/13/28 (Call 06/13/28) |

1,440 | 1,374,913 | ||||||

| Fifth Third Bancorp., 6.34%, 07/27/29 (Call 07/27/28), (1-day SOFR + 2.340%)(b) |

680 | 698,295 | ||||||

| First Horizon Corp., 4.00%, 05/26/25 (Call 04/26/25) |

177 | 172,297 | ||||||

| Goldman Sachs Group Inc. (The) |

||||||||

| 1.09%, 12/09/26 (Call 12/09/25), |

235 | 217,745 | ||||||

| 1.43%, 03/09/27 (Call 03/09/26), |

2,377 | 2,197,162 | ||||||

| 1.54%, 09/10/27 (Call 09/10/26), |

1,610 | 1,463,433 | ||||||

| 1.95%, 10/21/27 (Call 10/21/26), |

3,030 | 2,774,639 | ||||||

| 2.64%, 02/24/28 (Call 02/24/27), |

1,710 | 1,584,262 | ||||||

| 3.50%, 04/01/25 (Call 03/01/25) |

144 | 141,025 | ||||||

| 3.50%, 11/16/26 (Call 11/16/25) |

180 | 172,654 | ||||||

| 3.62%, 03/15/28 (Call 03/15/27), |

1,210 | 1,153,794 | ||||||

| 3.69%, 06/05/28 (Call 06/05/27), |

1,060 | 1,011,103 | ||||||

| 3.75%, 05/22/25 (Call 02/22/25) |

141 | 138,282 | ||||||

| 3.75%, 02/25/26 (Call 11/25/25) |

95 | 92,626 | ||||||

| 3.81%, 04/23/29 (Call 04/23/28), |

786 | 742,492 | ||||||

| 3.85%, 01/26/27 (Call 01/26/26) |

140 | 135,270 | ||||||

| 4.22%, 05/01/29 (Call 05/01/28), |

1,095 | 1,049,945 | ||||||

| 4.25%, 10/21/25 |

90 | 88,383 | ||||||

| 4.48%, 08/23/28 (Call 08/23/27), |

235 | 229,256 | ||||||

| 5.95%, 01/15/27 |

175 | 178,597 | ||||||

| 6.48%, 10/24/29 (Call 10/24/28), |

1,265 | 1,325,887 | ||||||

| 14 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| HSBC Holdings PLC |

||||||||

| 1.59%, 05/24/27 (Call 05/24/26), |

$ | 2,670 | $ | 2,444,089 | ||||

| 1.65%, 04/18/26 (Call 04/18/25), |

680 | 648,831 | ||||||

| 2.01%, 09/22/28 (Call 09/22/27), |

175 | 155,066 | ||||||

| 2.10%, 06/04/26 (Call 06/04/25), |

1,270 | 1,214,597 | ||||||

| 2.21%, 08/17/29 (Call 08/17/28), |

1,040 | 902,902 | ||||||

| 2.25%, 11/22/27 (Call 11/22/26), |

540 | 494,285 | ||||||

| 3.90%, 05/25/26 |

2,117 | 2,051,369 | ||||||

| 4.04%, 03/13/28 (Call 03/13/27), |

345 | 330,565 | ||||||

| 4.25%, 08/18/25 |

509 | 498,496 | ||||||

| 4.29%, 09/12/26 (Call 09/12/25), |

1,315 | 1,289,415 | ||||||

| 4.30%, 03/08/26 |

390 | 381,593 | ||||||

| 4.38%, 11/23/26 |

540 | 525,264 | ||||||

| 4.58%, 06/19/29 (Call 06/19/28), |

1,285 | 1,236,145 | ||||||

| 4.76%, 06/09/28 (Call 06/09/27), |

693 | 676,635 | ||||||

| 5.55%, 03/04/30 (Call 03/04/29), |

800 | 799,342 | ||||||

| 6.16%, 03/09/29 (Call 03/09/28), |

295 | 301,371 | ||||||

| 7.39%, 11/03/28 (Call 11/03/27), |

570 | 603,451 | ||||||

| Huntington Bancshares Inc./OH |

||||||||

| 4.00%, 05/15/25 (Call 04/15/25) |

545 | 535,142 | ||||||

| 4.44%, 08/04/28 (Call 08/04/27), |

325 | 312,098 | ||||||

| 6.21%, 08/21/29 (Call 08/21/28), |

205 | 208,503 | ||||||

| Huntington National Bank (The), 4.55%, 05/17/28 (Call 05/17/27), (1-day SOFR + 1.650%)(b) |

1,755 | 1,691,819 | ||||||

| ING Groep NV |

||||||||

| 1.73%, 04/01/27 (Call 04/01/26), |

2,280 | 2,110,141 | ||||||

| 3.87%, 03/28/26 (Call 03/28/25), |

200 | 196,182 | ||||||

| 3.95%, 03/29/27 |

445 | 428,446 | ||||||

| 4.02%, 03/28/28 (Call 03/28/27), |

285 | 273,549 | ||||||

| 4.55%, 10/02/28 |

20 | 19,497 | ||||||

| 6.08%, 09/11/27 (Call 09/11/26), |

200 | 202,271 | ||||||

| JPMorgan Chase & Co. |

||||||||

| 1.04%, 02/04/27 (Call 02/04/26), |

355 | 327,141 | ||||||

| 1.47%, 09/22/27 (Call 09/22/26), |

2,645 | 2,403,399 | ||||||

| 1.58%, 04/22/27 (Call 04/22/26), |

2,235 | 2,065,803 | ||||||

| 2.01%, 03/13/26 (Call 03/13/25), |

2,350 | 2,265,179 | ||||||

| 2.08%, 04/22/26 (Call 04/22/25), |

3,672 | 3,533,479 | ||||||

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 2.18%, 06/01/28 (Call 06/01/27), |

$ | 100 | $ | 91,080 | ||||

| 2.95%, 10/01/26 (Call 07/01/26) |

5 | 4,752 | ||||||

| 2.95%, 02/24/28 (Call 02/24/27), |

460 | 430,757 | ||||||

| 3.20%, 06/15/26 (Call 03/15/26) |

70 | 67,335 | ||||||

| 3.30%, 04/01/26 (Call 01/01/26) |

25 | 24,112 | ||||||

| 3.54%, 05/01/28 (Call 05/01/27), |

225 | 213,764 | ||||||

| 3.78%, 02/01/28 (Call 02/01/27), |

2,185 | 2,097,621 | ||||||

| 3.90%, 07/15/25 (Call 04/15/25) |

116 | 114,023 | ||||||

| 3.96%, 01/29/27 (Call 01/29/26), |

105 | 102,468 | ||||||

| 4.01%, 04/23/29 (Call 04/23/28), |

40 | 38,190 | ||||||

| 4.08%, 04/26/26 (Call 04/26/25), |

125 | 123,130 | ||||||

| 4.13%, 12/15/26 |

80 | 78,092 | ||||||

| 4.25%, 10/01/27 |

45 | 44,016 | ||||||

| 4.32%, 04/26/28 (Call 04/26/27), |

3,145 | 3,069,515 | ||||||

| 4.45%, 12/05/29 (Call 12/05/28), |

500 | 483,554 | ||||||

| 4.85%, 07/25/28 (Call 07/25/27), |

1,810 | 1,789,894 | ||||||

| 5.01%, 01/23/30 (Call 01/23/29), |

1,200 | 1,187,382 | ||||||

| 5.04%, 01/23/28 (Call 01/23/27), |

550 | 547,064 | ||||||

| 5.30%, 07/24/29 (Call 07/24/28), |

1,265 | 1,268,426 | ||||||

| 6.09%, 10/23/29 (Call 10/23/28), |

990 | 1,023,392 | ||||||

| 7.63%, 10/15/26 |

30 | 31,877 | ||||||

| 7.75%, 07/15/25(a) |

115 | 119,142 | ||||||

| 8.00%, 04/29/27(a) |

245 | 266,424 | ||||||

| KeyCorp |

||||||||

| 2.25%, 04/06/27 |

35 | 31,220 | ||||||

| 4.10%, 04/30/28(a) |

700 | 655,189 | ||||||

| Lloyds Bank PLC, 3.50%, 05/14/25 |

480 | 468,667 | ||||||

| Lloyds Banking Group PLC |

||||||||

| 1.63%, 05/11/27 (Call 05/11/26), |

570 | 522,834 | ||||||

| 3.51%, 03/18/26 (Call 03/18/25), |

25 | 24,403 | ||||||

| 3.57%, 11/07/28 (Call 11/07/27), |

315 | 293,779 | ||||||

| 3.75%, 01/11/27 |

80 | 76,751 | ||||||

| 3.75%, 03/18/28 (Call 03/18/27), |

85 | 80,544 | ||||||

| 4.45%, 05/08/25 |

200 | 197,396 | ||||||

| 4.55%, 08/16/28 |

930 | 902,291 | ||||||

| 4.58%, 12/10/25 |

1,457 | 1,427,564 | ||||||

| 4.65%, 03/24/26(a) |

2,890 | 2,831,576 | ||||||

| 5.87%, 03/06/29 (Call 03/06/28), |

315 | 318,064 | ||||||

| Mitsubishi UFJ Financial Group Inc. |

||||||||

| 1.41%, 07/17/25 |

240 | 227,389 | ||||||

| 1.64%, 10/13/27 (Call 10/13/26), |

55 | 50,095 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

15 |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 2.34%, 01/19/28 (Call 01/19/27), |

$ | 595 | $ | 549,326 | ||||

| 3.29%, 07/25/27 |

550 | 520,104 | ||||||

| 3.78%, 03/02/25 |

78 | 76,738 | ||||||

| 3.85%, 03/01/26 |

50 | 48,743 | ||||||

| 3.96%, 03/02/28 |

580 | 558,660 | ||||||

| 4.08%, 04/19/28 (Call 04/19/27), |

965 | 932,447 | ||||||

| 5.02%, 07/20/28 (Call 07/20/27), |

435 | 431,886 | ||||||

| 5.24%, 04/19/29 (Call 04/19/28), |

335 | 335,718 | ||||||

| 5.35%, 09/13/28 (Call 09/13/27), |

410 | 411,037 | ||||||

| 5.42%, 02/22/29 (Call 02/22/28), |

470 | 473,345 | ||||||

| 5.54%, 04/17/26 (Call 04/17/25), |

200 | 199,801 | ||||||

| Mizuho Financial Group Inc. |

||||||||

| 1.23%, 05/22/27 (Call 05/22/26), |

555 | 507,060 | ||||||

| 1.55%, 07/09/27 (Call 07/09/26), |

145 | 132,742 | ||||||

| 2.23%, 05/25/26 (Call 05/25/25), |

1,380 | 1,323,765 | ||||||

| 2.84%, 09/13/26 |

20 | 18,844 | ||||||

| 3.17%, 09/11/27 |

5 | 4,674 | ||||||

| 4.02%, 03/05/28 |

550 | 528,756 | ||||||

| 4.25%, 09/11/29 (Call 09/11/28), |

310 | 297,055 | ||||||

| 5.41%, 09/13/28 (Call 09/13/27), |

65 | 65,278 | ||||||

| 5.67%, 05/27/29 (Call 05/27/28), |

495 | 501,627 | ||||||

| 5.78%, 07/06/29 (Call 07/06/28), |

855 | 870,544 | ||||||

| Morgan Stanley |

||||||||

| 0.99%, 12/10/26 (Call 12/10/25), |

3,397 | 3,134,409 | ||||||

| 1.51%, 07/20/27 (Call 07/20/26), |

1,995 | 1,824,623 | ||||||

| 1.59%, 05/04/27 (Call 05/04/26), |

3,215 | 2,964,047 | ||||||

| 2.19%, 04/28/26 (Call 04/28/25), |

1,563 | 1,504,203 | ||||||

| 2.48%, 01/21/28 (Call 01/21/27), |

1,755 | 1,623,399 | ||||||

| 3.13%, 07/27/26(a) |

1,535 | 1,463,562 | ||||||

| 3.59%, 07/22/28 (Call 07/22/27)(b) |

255 | 241,319 | ||||||

| 3.63%, 01/20/27(a) |

55 | 53,028 | ||||||

| 3.77%, 01/24/29 (Call 01/24/28), |

1,890 | 1,786,291 | ||||||

| 3.88%, 01/27/26 |

1,051 | 1,025,453 | ||||||

| 3.95%, 04/23/27 |

415 | 399,430 | ||||||

| 4.00%, 07/23/25 |

919 | 903,293 | ||||||

| 4.21%, 04/20/28 (Call 04/20/27), |

770 | 745,180 | ||||||

| 4.35%, 09/08/26 |

210 | 205,275 | ||||||

| 4.43%, 01/23/30 (Call 01/23/29), |

5 | 4,801 | ||||||

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 4.68%, 07/17/26 (Call 07/17/25), |

$ | 330 | $ | 326,515 | ||||

| 5.00%, 11/24/25 |

873 | 867,838 | ||||||

| 5.12%, 02/01/29 (Call 02/01/28), |

490 | 487,064 | ||||||

| 5.17%, 01/16/30 (Call 01/16/29), |

1,375 | 1,366,456 | ||||||

| 5.45%, 07/20/29 (Call 07/20/28), |

250 | 251,036 | ||||||

| 6.25%, 08/09/26 |

225 | 230,279 | ||||||

| 6.30%, 10/18/28 (Call 10/18/27), |

120 | 124,037 | ||||||

| 6.41%, 11/01/29 (Call 11/01/28), |

410 | 427,757 | ||||||

| Morgan Stanley Bank NA |

||||||||

| 4.75%, 04/21/26 (Call 03/21/26) |

350 | 347,825 | ||||||

| 4.95%, 01/14/28 (Call 01/14/27), |

640 | 636,400 | ||||||

| National Australia Bank Ltd./New York |

||||||||

| 3.91%, 06/09/27 |

265 | 256,910 | ||||||

| 4.90%, 06/13/28 |

500 | 498,839 | ||||||

| 4.94%, 01/12/28 |

250 | 249,894 | ||||||

| National Bank of Canada, 5.60%, 12/18/28 |

2,460 | 2,484,236 | ||||||

| NatWest Group PLC |

||||||||

| 1.64%, 06/14/27 (Call 06/14/26), |

1,965 | 1,796,088 | ||||||

| 3.07%, 05/22/28 (Call 05/22/27), |

1,330 | 1,234,436 | ||||||

| 4.80%, 04/05/26 |

1,185 | 1,170,338 | ||||||

| 4.89%, 05/18/29 (Call 05/18/28), |

25 | 24,327 | ||||||

| 5.08%, 01/27/30 (Call 01/27/29), |

600 | 586,585 | ||||||

| 5.52%, 09/30/28 (Call 09/30/27), |

200 | 199,834 | ||||||

| 5.58%, 03/01/28 (Call 03/01/27), |

200 | 200,156 | ||||||

| 5.81%, 09/13/29 (Call 09/13/28), |

500 | 505,041 | ||||||

| 5.85%, 03/02/27 (Call 03/02/26), |

235 | 235,932 | ||||||

| Northern Trust Corp. |

||||||||

| 3.38%, 05/08/32 (Call 05/08/27), |

5 | 4,637 | ||||||

| 3.95%, 10/30/25(a) |

378 | 370,769 | ||||||

| PNC Bank NA |

||||||||

| 3.10%, 10/25/27 (Call 09/25/27) |

500 | 464,496 | ||||||

| 3.25%, 06/01/25 (Call 05/02/25) |

277 | 269,604 | ||||||

| 3.25%, 01/22/28 (Call 12/23/27) |

30 | 27,858 | ||||||

| 3.88%, 04/10/25 (Call 03/10/25) |

2,202 | 2,160,086 | ||||||

| PNC Financial Services Group Inc. (The) |

||||||||

| 1.15%, 08/13/26 (Call 07/13/26) |

45 | 40,837 | ||||||

| 2.60%, 07/23/26 (Call 05/23/26) |

80 | 75,212 | ||||||

| 3.15%, 05/19/27 (Call 04/19/27) |

545 | 512,946 | ||||||

| 5.30%, 01/21/28 (Call 01/21/27), |

265 | 264,668 | ||||||

| 5.35%, 12/02/28 (Call 12/02/27), |

1,215 | 1,214,380 | ||||||

| 5.58%, 06/12/29 (Call 06/12/28), |

998 | 1,004,330 | ||||||

| 16 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 6.62%, 10/20/27 (Call 10/20/26), |

$ | 480 | $ | 492,818 | ||||

| Regions Financial Corp. |

||||||||

| 1.80%, 08/12/28 (Call 06/12/28) |

470 | 400,284 | ||||||

| 2.25%, 05/18/25 (Call 04/18/25) |

695 | 665,480 | ||||||

| Royal Bank of Canada |

||||||||

| 0.88%, 01/20/26(a) |

205 | 189,775 | ||||||

| 1.15%, 06/10/25 |

1,088 | 1,033,622 | ||||||

| 1.15%, 07/14/26 |

170 | 155,308 | ||||||

| 1.20%, 04/27/26(a) |

175 | 161,043 | ||||||

| 1.40%, 11/02/26 |

200 | 181,755 | ||||||

| 2.05%, 01/21/27(a) |

55 | 50,758 | ||||||

| 3.63%, 05/04/27 |

155 | 148,546 | ||||||

| 4.24%, 08/03/27 |

120 | 116,912 | ||||||

| 4.65%, 01/27/26 |

140 | 138,603 | ||||||

| 4.88%, 01/12/26 |

160 | 159,349 | ||||||

| 4.88%, 01/19/27 |

325 | 323,395 | ||||||

| 4.90%, 01/12/28 |

1,540 | 1,534,931 | ||||||

| 4.95%, 02/01/29(a) |

1,025 | 1,018,275 | ||||||

| 5.20%, 07/20/26 |

305 | 305,954 | ||||||

| 5.20%, 08/01/28 |

975 | 980,297 | ||||||

| 6.00%, 11/01/27 |

165 | 169,900 | ||||||

| Santander Holdings USA Inc. |

||||||||

| 2.49%, 01/06/28 (Call 01/06/27), |

2,760 | 2,496,064 | ||||||

| 3.24%, 10/05/26 (Call 08/05/26) |

60 | 56,219 | ||||||

| 3.45%, 06/02/25 (Call 05/02/25) |

275 | 266,674 | ||||||

| 4.50%, 07/17/25 (Call 04/17/25) |

300 | 294,100 | ||||||

| 6.50%, 03/09/29 (Call 03/09/28), |

310 | 314,819 | ||||||

| 6.57%, 06/12/29 (Call 06/12/28), |

167 | 170,086 | ||||||

| Santander U.K. Group Holdings PLC |

||||||||

| 1.53%, 08/21/26 (Call 08/21/25), |

200 | 187,343 | ||||||

| 1.67%, 06/14/27 (Call 06/14/26), |

200 | 181,810 | ||||||

| 2.47%, 01/11/28 (Call 01/11/27), |

2,300 | 2,094,517 | ||||||

| 6.53%, 01/10/29 (Call 01/10/28), |

230 | 235,920 | ||||||

| State Street Corp. |

||||||||

| 2.65%, 05/19/26 |

25 | 23,774 | ||||||

| 3.55%, 08/18/25 |

2,635 | 2,581,471 | ||||||

| 5.10%, 05/18/26 (Call 05/18/25), |

105 | 104,611 | ||||||

| 5.68%, 11/21/29 (Call 11/21/28), |

495 | 506,077 | ||||||

| Sumitomo Mitsui Banking Corp., 3.65%, 07/23/25 |

260 | 254,196 | ||||||

| Sumitomo Mitsui Financial Group Inc. |

||||||||

| 1.40%, 09/17/26 |

205 | 186,748 | ||||||

| 1.47%, 07/08/25 |

1,535 | 1,459,117 | ||||||

| 1.90%, 09/17/28 |

1,400 | 1,218,037 | ||||||

| 2.17%, 01/14/27 |

200 | 184,659 | ||||||

| 2.47%, 01/14/29 |

625 | 555,949 | ||||||

| 2.63%, 07/14/26 |

80 | 75,523 | ||||||

| 3.01%, 10/19/26 |

100 | 94,672 | ||||||

| 3.35%, 10/18/27 |

540 | 509,325 | ||||||

| 3.36%, 07/12/27 |

155 | 146,897 | ||||||

| 3.45%, 01/11/27 |

50 | 47,885 | ||||||

| 3.54%, 01/17/28(a) |

95 | 89,979 | ||||||

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 3.94%, 07/19/28(a) |

$ | 700 | $ | 669,950 | ||||

| 4.31%, 10/16/28 |

60 | 58,702 | ||||||

| 5.52%, 01/13/28(a) |

1,405 | 1,427,180 | ||||||

| 5.72%, 09/14/28 |

45 | 46,004 | ||||||

| 5.80%, 07/13/28(a) |

430 | 441,649 | ||||||

| 5.88%, 07/13/26 |

220 | 223,238 | ||||||

| Synchrony Bank, 5.63%, 08/23/27 (Call 07/23/27) |

520 | 505,954 | ||||||

| Synovus Bank, 5.63%, 02/15/28 (Call 01/15/28) |

5 | 4,816 | ||||||

| Toronto-Dominion Bank (The) |

||||||||

| 0.75%, 09/11/25 |

30 | 28,110 | ||||||

| 0.75%, 01/06/26 |

50 | 46,248 | ||||||

| 1.15%, 06/12/25 |

1,244 | 1,180,821 | ||||||

| 1.20%, 06/03/26 |

530 | 486,245 | ||||||

| 1.25%, 09/10/26 |

3,558 | 3,241,742 | ||||||

| 1.95%, 01/12/27(a) |

190 | 174,876 | ||||||

| 2.80%, 03/10/27 |

195 | 182,878 | ||||||

| 3.63%, 09/15/31 (Call 09/15/26), |

830 | 792,110 | ||||||

| 3.77%, 06/06/25 |

70 | 68,752 | ||||||

| 4.11%, 06/08/27 |

190 | 184,392 | ||||||

| 4.69%, 09/15/27 |

85 | 84,030 | ||||||

| 5.26%, 12/11/26 |

185 | 186,127 | ||||||

| 5.52%, 07/17/28(a) |

995 | 1,010,920 | ||||||

| Truist Bank |

||||||||

| 1.50%, 03/10/25 (Call 02/10/25) |

50 | 48,044 | ||||||

| 3.63%, 09/16/25 (Call 08/16/25) |

250 | 242,537 | ||||||

| Truist Financial Corp. |

||||||||

| 1.13%, 08/03/27 (Call 06/03/27) |

20 | 17,407 | ||||||

| 1.20%, 08/05/25 (Call 07/03/25) |

60 | 56,438 | ||||||

| 1.27%, 03/02/27 (Call 03/02/26), |

655 | 601,223 | ||||||

| 1.89%, 06/07/29 (Call 06/07/28), |

875 | 751,492 | ||||||

| 3.70%, 06/05/25 (Call 05/05/25) |

69 | 67,481 | ||||||

| 4.00%, 05/01/25 (Call 03/01/25) |

187 | 183,615 | ||||||

| 4.87%, 01/26/29 (Call 01/26/28), |

535 | 520,672 | ||||||

| 5.44%, 01/24/30 (Call 01/24/29), |

260 | 257,411 | ||||||

| 7.16%, 10/30/29 (Call 10/30/28), |

450 | 476,377 | ||||||

| U.S. Bancorp. |

||||||||

| 1.45%, 05/12/25 (Call 04/11/25) |

50 | 47,844 | ||||||

| 3.10%, 04/27/26 (Call 03/27/26)(a) |

35 | 33,420 | ||||||

| 3.90%, 04/26/28 (Call 03/24/28) |

515 | 492,928 | ||||||

| 4.65%, 02/01/29 (Call 02/01/28), |

965 | 937,796 | ||||||

| 5.38%, 01/23/30 (Call 01/23/29), |

200 | 198,872 | ||||||

| 5.78%, 06/12/29 (Call 06/12/28), |

900 | 909,204 | ||||||

| UBS AG/London |

||||||||

| 5.65%, 09/11/28 |

1,510 | 1,540,098 | ||||||

| 5.80%, 09/11/25 |

1,000 | 1,007,069 | ||||||

| UBS Group AG |

||||||||

| 3.75%, 03/26/25 |

464 | 454,389 | ||||||

| 4.55%, 04/17/26 |

585 | 574,582 | ||||||

| Wells Fargo & Co. |

||||||||

| 2.39%, 06/02/28 (Call 06/02/27), |

3,345 | 3,051,144 | ||||||

| 3.00%, 10/23/26 |

170 | 160,628 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

17 |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Banks (continued) | ||||||||

| 3.20%, 06/17/27 (Call 06/17/26), |

$ | 50 | $ | 47,592 | ||||

| 3.53%, 03/24/28 (Call 03/24/27), |

275 | 260,741 | ||||||

| 3.58%, 05/22/28 (Call 05/22/27), |

869 | 823,087 | ||||||

| 3.91%, 04/25/26 (Call 04/25/25), |

10 | 9,807 | ||||||

| 4.10%, 06/03/26 |

5 | 4,868 | ||||||

| 4.30%, 07/22/27 |

270 | 262,098 | ||||||

| 4.81%, 07/25/28 (Call 07/25/27), |

2,640 | 2,593,306 | ||||||

| 5.20%, 01/23/30 (Call 01/23/29), |

935 | 926,940 | ||||||

| 5.57%, 07/25/29 (Call 07/25/28), |

360 | 362,506 | ||||||

| Westpac Banking Corp. |

||||||||

| 1.15%, 06/03/26 |

80 | 73,513 | ||||||

| 1.95%, 11/20/28 |

950 | 833,272 | ||||||

| 2.85%, 05/13/26 |

80 | 76,444 | ||||||

| 4.32%, 11/23/31 (Call 11/23/26), |

205 | 196,844 | ||||||

|

|

|

|||||||

| 271,689,648 | ||||||||

| Beverages — 3.0% | ||||||||

| Anheuser-Busch Companies LLC/Anheuser-Busch InBev Worldwide Inc., 3.65%, 02/01/26 (Call 11/01/25) |

126 | 122,847 | ||||||

| Anheuser-Busch InBev Worldwide Inc. |

||||||||

| 4.00%, 04/13/28 (Call 01/13/28) |

950 | 920,935 | ||||||

| 4.75%, 01/23/29 (Call 10/23/28) |

1,415 | 1,405,429 | ||||||

| Brown-Forman Corp., 3.50%, 04/15/25 (Call 02/15/25) |

70 | 68,577 | ||||||

| Coca-Cola Co. (The) |

||||||||

| 1.00%, 03/15/28(a) |

79 | 68,822 | ||||||

| 1.45%, 06/01/27 |

2,890 | 2,614,818 | ||||||

| 1.50%, 03/05/28 |

5 | 4,440 | ||||||

| 2.90%, 05/25/27 |

155 | 147,050 | ||||||

| 3.38%, 03/25/27 |

1,920 | 1,849,697 | ||||||

| Constellation Brands Inc. |

||||||||

| 4.35%, 05/09/27 (Call 04/09/27)(a) |

55 | 53,779 | ||||||

| 4.80%, 01/15/29 (Call 12/15/28) |

175 | 172,381 | ||||||

| Diageo Capital PLC |

||||||||

| 1.38%, 09/29/25 (Call 08/29/25) |

5,165 | 4,871,166 | ||||||

| 5.30%, 10/24/27 (Call 09/24/27) |

2,270 | 2,296,401 | ||||||

| Keurig Dr Pepper Inc. |

||||||||

| 2.55%, 09/15/26 (Call 06/15/26) |

65 | 60,957 | ||||||

| 3.43%, 06/15/27 (Call 03/15/27) |

1,725 | 1,641,905 | ||||||

| Molson Coors Beverage Co., 3.00%, 07/15/26 (Call 04/15/26) |

6,099 | 5,808,814 | ||||||

| PepsiCo Inc. |

||||||||

| 2.38%, 10/06/26 (Call 07/06/26) |

185 | 174,295 | ||||||

| 2.63%, 03/19/27 (Call 01/19/27) |

605 | 568,864 | ||||||

| 2.75%, 04/30/25 (Call 01/30/25) |

281 | 273,671 | ||||||

| 2.85%, 02/24/26 (Call 11/24/25) |

30 | 28,851 | ||||||

| 3.50%, 07/17/25 (Call 04/17/25) |

1,571 | 1,538,883 | ||||||

| 3.60%, 02/18/28 (Call 01/18/28) |

60 | 57,689 | ||||||

| 4.45%, 05/15/28 (Call 04/15/28)(a) |

500 | 498,996 | ||||||

| 5.13%, 11/10/26 (Call 10/10/26) |

335 | 337,188 | ||||||

|

|

|

|||||||

| 25,586,455 | ||||||||

| Security | Par (000) |

Value | ||||||

| Biotechnology — 1.0% | ||||||||

| Amgen Inc. |

||||||||

| 1.65%, 08/15/28 (Call 06/15/28) |

$ | 35 | $ | 30,449 | ||||

| 2.20%, 02/21/27 (Call 12/21/26) |

10 | 9,214 | ||||||

| 2.60%, 08/19/26 (Call 05/19/26) |

30 | 28,316 | ||||||

| 3.13%, 05/01/25 (Call 02/01/25) |

466 | 454,381 | ||||||

| 5.15%, 03/02/28 (Call 02/02/28) |

2,065 | 2,069,090 | ||||||

| 5.25%, 03/02/25 |

805 | 803,474 | ||||||

| Baxalta Inc., 4.00%, 06/23/25 (Call 03/23/25) |

150 | 147,290 | ||||||

| Biogen Inc., 4.05%, 09/15/25 (Call 06/15/25) |

467 | 457,807 | ||||||

| Gilead Sciences Inc. |

||||||||

| 1.20%, 10/01/27 (Call 08/01/27) |

2,650 | 2,331,101 | ||||||

| 2.95%, 03/01/27 (Call 12/01/26) |

1,520 | 1,435,621 | ||||||

| 3.65%, 03/01/26 (Call 12/01/25) |

655 | 636,146 | ||||||

| Illumina Inc., 5.75%, 12/13/27 (Call 11/13/27) |

45 | 45,323 | ||||||

|

|

|

|||||||

| 8,448,212 | ||||||||

| Building Materials — 1.9% | ||||||||

| Carrier Global Corp. |

||||||||

| 2.49%, 02/15/27 (Call 12/15/26) |

1,660 | 1,542,667 | ||||||

| 5.80%, 11/30/25 |

700 | 705,027 | ||||||

| Fortune Brands Innovations Inc., |

3,003 | 2,946,647 | ||||||

| Johnson Controls International PLC, |

4,295 | 4,185,562 | ||||||

| Lennox International Inc. |

||||||||

| 1.35%, 08/01/25 (Call 07/01/25) |

210 | 197,975 | ||||||

| 1.70%, 08/01/27 (Call 06/01/27)(a) |

1,085 | 972,466 | ||||||

| 5.50%, 09/15/28 (Call 08/15/28) |

1,205 | 1,216,211 | ||||||

| Masco Corp., 1.50%, 02/15/28 (Call 12/15/27) |

365 | 316,959 | ||||||

| Owens Corning, 3.40%, 08/15/26 (Call 05/15/26) |

900 | 858,904 | ||||||

| Trane Technologies Financing Ltd., 3.50%, 03/21/26 (Call 01/21/26) |

1,215 | 1,174,110 | ||||||

| Trane Technologies Global Holding Co. Ltd., 3.75%, 08/21/28 (Call 05/21/28) |

2,275 | 2,169,422 | ||||||

| Vulcan Materials Co., 4.50%, 04/01/25 (Call 01/01/25) |

65 | 64,309 | ||||||

|

|

|

|||||||

| 16,350,259 | ||||||||

| Chemicals — 1.7% | ||||||||

| Celanese U.S. Holdings LLC |

||||||||

| 6.05%, 03/15/25 |

49 | 49,113 | ||||||

| 6.17%, 07/15/27 (Call 06/15/27) |

935 | 949,331 | ||||||

| Dow Chemical Co. (The), 4.80%, 11/30/28 (Call 08/30/28)(a) |

1,025 | 1,017,125 | ||||||

| DuPont de Nemours Inc., 4.73%, 11/15/28 (Call 08/15/28) |

10 | 9,947 | ||||||

| Eastman Chemical Co., 3.80%, 03/15/25 (Call 12/15/24) |

45 | 44,191 | ||||||

| Ecolab Inc. |

||||||||

| 1.65%, 02/01/27 (Call 01/01/27) |

4,195 | 3,834,370 | ||||||

| 2.70%, 11/01/26 (Call 08/01/26) |

4,095 | 3,881,402 | ||||||

| 3.25%, 12/01/27 (Call 09/01/27) |

1,445 | 1,368,312 | ||||||

| 5.25%, 01/15/28 (Call 12/15/27) |

555 | 563,026 | ||||||

| EIDP Inc., 1.70%, 07/15/25 (Call 06/15/25) |

54 | 51,335 | ||||||

| International Flavors & Fragrances Inc., |

400 | 386,409 | ||||||

| LYB International Finance II BV, |

50 | 47,607 | ||||||

| Nutrien Ltd. |

||||||||

| 3.00%, 04/01/25 (Call 01/01/25) |

75 | 72,950 | ||||||

| 4.00%, 12/15/26 (Call 09/15/26) |

195 | 188,894 | ||||||

| 4.90%, 03/27/28 (Call 02/27/28) |

905 | 897,576 | ||||||

| 18 | 2 0 2 4 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) February 29, 2024 |

iShares® ESG Aware 1-5 Year USD Corporate Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Chemicals (continued) | ||||||||

| PPG Industries Inc. |

||||||||

| 1.20%, 03/15/26 (Call 02/15/26) |

$ | 1,021 | $ | 943,663 | ||||

| 3.75%, 03/15/28 (Call 12/15/27) |

20 | 19,154 | ||||||

| Sherwin-Williams Co. (The), |

115 | 112,063 | ||||||

|

|

|

|||||||

| 14,436,468 | ||||||||

| Commercial Services — 1.2% | ||||||||

| Automatic Data Processing Inc. |

||||||||

| 1.70%, 05/15/28 (Call 03/15/28)(a) |

445 | 396,178 | ||||||

| 3.38%, 09/15/25 (Call 06/15/25) |

8,145 | 7,957,421 | ||||||

| Block Financial LLC |

||||||||

| 2.50%, 07/15/28 (Call 05/15/28) |

150 | 132,115 | ||||||

| 5.25%, 10/01/25 (Call 07/01/25)(a) |

342 | 339,439 | ||||||