|

December 1, 2022 |

| |

(as revised |

|

2022 Prospectus |

iShares S&P Allocation Series

•

iShares Core Conservative Allocation ETF | AOK | NYSE ARCA

iShares Core Conservative Allocation ETF | AOK | NYSE ARCA

•

iShares Core Moderate Allocation ETF | AOM | NYSE ARCA

iShares Core Moderate Allocation ETF | AOM | NYSE ARCA

•

iShares Core Growth Allocation ETF | AOR | NYSE ARCA

iShares Core Growth Allocation ETF | AOR | NYSE ARCA

•

iShares Core Aggressive Allocation ETF | AOA | NYSE ARCA

iShares Core Aggressive Allocation ETF | AOA | NYSE ARCA

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

| iShares Core Conservative Allocation ETF |

|

| iShares Core Moderate Allocation ETF |

|

| iShares Core Growth Allocation ETF |

|

| iShares Core Aggressive Allocation ETF |

|

| More Information About the Funds |

|

| Investment Objectives of the Funds |

|

| A Further Discussion of Principal Risks |

|

| A Further Discussion of Other Risks |

|

| Portfolio Holdings Information |

|

| A Further Discussion of Principal Investment Strategies |

|

| Management |

|

| Shareholder Information |

|

| Distribution |

|

| Financial Highlights |

|

| Index Provider |

|

| Disclaimer |

39 |

“Standard & Poor's®,” “S&P®,” “S&P Target Risk Indices®,” “S&P Target Risk Conservative Index,” “S&P Target Risk Moderate Index,” “S&P Target Risk Growth Index” and “S&P Target Risk Aggressive Index” are trademarks of Standard & Poor’s Financial Services LLC (“SPFS”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by S&P Dow Jones Indices LLC, a subsidiary of S&P Global (“SPDJI”) and its subsidiaries and sublicensed for certain purposes by BlackRock Fund Advisors and/or its affiliates. iShares® and BlackRock® are registered trademarks of BlackRock Fund Advisors and its affiliates. The Funds are not sponsored, endorsed, sold or promoted by SPDJI, SPFS, Dow Jones, their respective affiliates or their third party licensors and none of such parties makes any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Underlying Index.

i

iShares Core Conservative Allocation ETF

Ticker: AOKStock Exchange: NYSE Arca

Investment Objective

The iShares Core Conservative Allocation ETF (the “Fund”) seeks to track the investment results of an index composed of a portfolio of underlying equity and fixed income funds intended to represent a conservative target risk allocation strategy.

Fees and Expenses

The following table describes the fees and expenses that you will incur if you buy, hold and sell shares of the Fund. The investment advisory agreement between iShares Trust (the “Trust”) and BlackRock Fund Advisors (“BFA”) (the “Investment Advisory Agreement”) provides that BFA will pay all operating expenses of the Fund, except: (i) the management fees, (ii) interest expenses, (iii) taxes, (iv) expenses incurred with respect to the acquisition and disposition of portfolio securities and the execution of portfolio transactions, including brokerage commissions, (v) distribution fees or expenses, and (vi) litigation expenses and any extraordinary expenses. The Fund may incur “Acquired Fund Fees and Expenses.” Acquired Fund Fees and Expenses reflect the Fund's pro rata share of the fees and expenses incurred indirectly by the Fund as a result of investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and Expenses are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund's prospectus (the “ Prospectus ” ). BFA, the investment adviser to the Fund, has contractually agreed to waive a portion of its management fees in an amount equal to the Acquired Fund Fees and Expenses, if any, attributable to investments by the Fund in other series of the Trust and iShares, Inc. through November 30, 2026. The contractual waiver may be terminated prior to November 30, 2026 only upon written agreement of the Trust and BFA.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses2 |

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Fee Waiver and/or Expense Reimbursement |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

| |

|

|

|

|

( |

|

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

Principal Investment Strategies

The Fund is a fund of funds and seeks to achieve its investment objective by investing primarily in Underlying Funds that themselves seek investment results corresponding to their own respective underlying indexes. The Underlying Funds invest primarily in distinct asset classes, such as large- or mid-capitalization U.S. or non-U.S. equity, the aggregate bond market

S-1

(including allocation to international bonds as well as USD-denominated bonds) or the U.S. Treasury bond market; each such asset class has its own risk profile.

The S&P Target Risk Conservative Index (the “Underlying Index”) is composed of a portfolio of equity and fixed-income Underlying Funds and measures the performance of the S&P Dow Jones Indices LLC (the “Index Provider” or “SPDJI”) proprietary allocation model that is intended to represent a “conservative” target risk allocation strategy as defined by SPDJI. The Underlying Index seeks to emphasize exposure to fixed income, in order to produce a current income stream and avoid excessive volatility of returns. Equities are included in the Underlying Index to seek to protect long-term purchasing power. SPDJI’s estimation of a conservative target risk allocation may differ from your own.

The Fund is designed for investors seeking current income, capital preservation and avoidance of excessive volatility of returns. As of July 31, 2022, the Underlying Index included a fixed allocation of 30% of its assets in Underlying Funds that invest primarily in equity securities and 70% of its assets in Underlying Funds that invest primarily in bonds. As of July 31, 2022, the Fund invested approximately 28.82% of its assets in Underlying Funds that invest primarily in equity securities, 70.89% of its assets in Underlying Funds that invest primarily in bonds and the remainder of its assets in Underlying Funds that invest primarily in money market instruments.

As of July 31, 2022, the Fund invested in the iShares Core International Aggregate Bond ETF, iShares Core MSCI Emerging Markets ETF, iShares Core MSCI International Developed Markets ETF, iShares Core S&P 500 ETF, iShares Core S&P Mid-Cap ETF, iShares Core S&P Small-Cap ETF, iShares Core Total USD Bond Market ETF and money market funds advised by BFA or its affiliates (“BlackRock Cash Funds”). BFA may add, eliminate or replace any or all Underlying Funds at any time. As of July 31, 2022, a significant portion of the Underlying Index is represented by companies in the financials industry or sector and by U.S. treasury securities. The components of the Underlying Index are likely to change over time.

BFA uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Indexing seeks to achieve lower costs and better after-tax performance by aiming to keep portfolio turnover low in comparison to actively managed investment companies.

BFA uses a representative sampling indexing strategy to manage the Fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to that of an applicable underlying index. The securities selected are expected

to have, in the aggregate, investment characteristics (based on factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar to those of an applicable underlying index. The Fund and an Underlying Fund may or may not hold all of the securities in the applicable Underlying Index.

The Fund generally will invest at least 80% of its assets in the component securities of its Underlying Index and in investments that have economic characteristics that are substantially identical to the component securities of its Underlying Index (i.e., depositary receipts representing securities of the Underlying Index) and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the Underlying Index, but which BFA believes will help the Fund track the Underlying Index. Cash and cash equivalent investments associated with a derivative position will be treated as part of that position for the purposes of calculating the percentage of investments included in the Underlying Index. The Fund seeks to track the investment results of the Underlying Index before fees and expenses of the Fund.

The Fund may lend securities representing up to one-third of the value of the Fund's total assets (including the value of any collateral received).

The Underlying Index is a product of SPDJI, which is independent of the Fund and BFA. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities) and repurchase agreements collateralized by U.S. government securities are not considered to be issued by members of any industry.

Summary of Principal Risks

Affiliated Fund Risk. In managing the Fund, BFA has the ability to select Underlying Funds and substitute Underlying Funds with other exchange-traded funds (“ETFs”) that it believes will achieve the Fund’s objective. BFA may be subject to potential conflicts of interest in selecting Underlying Funds and substituting Underlying

S-2

Funds with other ETFs because the fees paid to BFA by some Underlying Funds and other ETFs managed by BFA may be higher than the fees paid by other Underlying Funds. If an Underlying Fund or other ETF holds interests in an affiliated fund in excess of a certain amount, the Fund may be prohibited from purchasing shares of that Underlying Fund or other ETF.

Allocation Risk. The Fund’s ability to achieve its investment objective depends upon the Index Provider’s ability to develop a model that accurately assesses the Fund’s asset class allocation and selects the best mix of Underlying Funds and other ETFs. There is a risk that the Index Provider’s evaluations and assumptions regarding asset classes or Underlying Funds, which are utilized as inputs in the model, may be incorrect in view of actual market conditions.

Asset Class Risk. Securities and other assets in the Underlying Index or in the Fund's or an Underlying Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes.

Authorized Participant Concentration Risk. Only an Authorized Participant (as defined in the Creations and Redemptions section of this prospectus (the “Prospectus”)) may engage in creation or redemption transactions directly with the Fund, and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. The Fund has a limited number of institutions that may act as Authorized Participants on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting.

Calculation Methodology Risk. The Underlying Index relies on various sources of information to assess the criteria of issuers included in the Underlying Index, including information that may be based on assumptions and estimates. Neither the Fund nor BFA can offer assurances that the Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers.

Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or repay the security before its stated maturity, and the Fund or an Underlying Fund may have to reinvest the proceeds in securities with lower yields, which would result in a decline in the Fund's income, or in securities with greater risks or with other less favorable features.

Concentration Risk. The Fund may be susceptible to an increased risk of loss, including losses due to adverse events that affect the Fund’s investments more than the market as a whole, to the extent that the Fund's or an Underlying Fund's investments are concentrated in the securities and/or other assets of a particular issuer or issuers, country, group of countries, region,

market, industry, group of industries, sector, market segment or asset class.

Credit Risk. Debt issuers and other counterparties may be unable or unwilling to make timely interest and/or principal payments when due or otherwise honor their obligations. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also adversely affect the value of the Fund’s or an Underlying Fund's investment in that issuer. The degree of credit risk depends on an issuer's or counterparty's financial condition and on the terms of an obligation.

Currency Risk. Because the Fund's and the Underlying Funds' NAVs are determined in U.S. dollars, the Fund's NAV could decline if a currency of a non-U.S. market in which a Fund or an Underlying Fund invests depreciates against the U.S. dollar or if there are delays or limits on repatriation of such currency. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, the Fund's NAV may change quickly and without warning.

Cybersecurity Risk. Failures or breaches of the electronic systems of the Fund or the Underlying Funds, the Funds' or the Underlying Funds' adviser, distributor, the Index Provider and other service providers, market makers, Authorized Participants or the issuers of securities in which the Fund invests have the ability to cause disruptions, negatively impact the Fund’s business operations and/or potentially result in financial losses to the Fund and its shareholders. While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in such plans and systems. Furthermore, the Fund cannot control the cybersecurity plans and systems of the Fund’s Index Provider and other service providers, market makers, Authorized Participants or issuers of securities in which the Fund invests.

Derivatives Risk. The Fund or an Underlying Fund may invest in certain types of derivatives contracts, including futures, options and swaps, which can be more sensitive to changes in interest rates or to sudden fluctuations in market prices than conventional securities, which can result in greater losses to the Fund.

Equity Securities Risk. Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. Certain Underlying Funds invest in common stocks, which generally subject their holders to more risks than preferred stocks and debt securities because common stockholders’ claims are subordinated to those of holders of preferred stocks and debt securities upon the bankruptcy of the issuer.

Extension Risk. During periods of rising interest rates, certain debt obligations may be paid off substantially more slowly than originally anticipated and the value of those securities may fall sharply, resulting in a decline in the Fund’s income and potentially in the value of the Fund’s or an Underlying Fund's investments.

Financials Sector Risk. Performance of companies in the financials sector may be adversely impacted by many factors,

S-3

including, among others, changes in government regulations, economic conditions, and interest rates, credit rating downgrades, and decreased liquidity in credit markets. The extent to which the Fund or an Underlying Fund may invest in a company that engages in securities-related activities or banking is limited by applicable law. The impact of changes in capital requirements and recent or future regulation of any individual financial company, or of the financials sector as a whole, cannot be predicted. Cyberattacks and technology malfunctions and failures have become increasingly frequent and have caused significant losses to companies in this sector, which may negatively impact an Underlying Fund.

Geographic Risk. A natural disaster could occur in a geographic region in which the Fund or an Underlying Fund invests, which could adversely affect the economy or the business operations of companies in the specific geographic region, causing an adverse impact on the Fund's or an Underlying Fund's investments in, or which are exposed to, the affected region.

High Yield Securities Risk. Securities that are rated below investment-grade (commonly referred to as “junk bonds,” which may include those bonds rated below “BBB-” by Standard & Poor's® Global Ratings, a subsidiary of S&P Global (“S&P Global Ratings”) and Fitch Ratings, Inc. (“Fitch”) or below “Baa3” by Moody's Investors Service, Inc. (“Moody's”)), or are unrated, may be deemed speculative, may involve greater levels of risk than higher-rated securities of similar maturity and may be more likely to default.

Income Risk. The Fund's income may decline if interest rates fall. This decline in income can occur because the Fund or an Underlying Fund may subsequently invest in lower-yielding bonds when bonds in its portfolio mature, are near maturity or are called, bonds in the Underlying Index are substituted, or the Fund or an Underlying Fund otherwise needs to purchase additional bonds.

Index-Related Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions or other unforeseen circumstances (such as natural disasters, political unrest or war) may impact the Index Provider or a third-party data provider, and could cause the Index Provider to postpone a scheduled rebalance. This could cause the Underlying Index to vary from its normal or expected composition.

Infectious Illness Risk. A widespread outbreak of an infectious illness, such as the COVID-19 pandemic, may result in travel restrictions, disruption of healthcare services, prolonged quarantines, cancellations, supply chain disruptions, business

closures, lower consumer demand, layoffs, ratings downgrades, defaults and other significant economic, social and political impacts. Markets may experience temporary closures, extreme volatility, severe losses, reduced liquidity and increased trading costs. Such events may adversely affect the Fund and its investments and may impact the Fund’s ability to purchase or sell securities or cause elevated tracking error and increased premiums or discounts to the Fund's NAV. Despite the development of vaccines, the duration of the COVID-19 pandemic and its effects cannot be predicted with certainty.

Interest Rate Risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Very low or negative interest rates may magnify interest rate risk. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, result in heightened market volatility and detract from the Fund’s performance to the extent the Fund is exposed to such interest rates. Additionally, under certain market conditions in which interest rates are low and the market prices for portfolio securities have increased, the Fund may have a very low or even negative yield. A low or negative yield would cause the Fund to lose money in certain conditions and over certain time periods. An increase in interest rates will generally cause the value of securities held by the Fund or an Underlying Fund to decline, may lead to heightened volatility in the fixed-income markets and may adversely affect the liquidity of certain fixed-income investments, including those held by the Fund or an Underlying Fund. Because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities. The historically low interest rate environment in recent years heightens the risks associated with rising interest rates.

Investment in Underlying Funds Risk. The Fund invests substantially all of its assets in the Underlying Funds, so the Fund’s investment performance is directly related to the performance of the Underlying Funds. The Fund’s NAV will change with changes in the value of the Underlying Funds and other securities in which the Fund invests based on their market valuations. An investment in the Fund will entail more costs and expenses than a direct investment in the Underlying Funds.

As the Underlying Funds, or the Fund’s allocations among the Underlying Funds, change from time to time, or to the extent that the total annual fund operating expenses of any Underlying Fund change, the weighted average operating expenses borne by the Fund may increase or decrease.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund or an Underlying Fund has exposure. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline.

Large-Capitalization Companies Risk. Large-capitalization companies may be less able than smaller capitalization

S-4

companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large-capitalization companies has trailed the overall performance of the broader securities markets.

Management Risk. As the Fund or the Underlying Funds will not fully replicate their respective indexes, they are subject to the risk that BFA's investment strategy may not produce the intended results.

Market Risk. The Fund and the Underlying Funds could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. The countries in which the Fund invests may be subject to considerable degrees of economic, political and social instability. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund, the Underlying Funds and their investments and could result in increased premiums or discounts to the Fund’s or Underlying Fund's NAV.

Market Trading Risk. The Fund and the Underlying Funds face numerous market trading risks, including the potential lack of an active market for their shares, losses from trading in secondary markets, periods of high volatility and disruptions in the creation/redemption process. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE FUND'S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Model Risk. Neither the Fund nor BFA can offer assurances that the Underlying Index's allocation model will achieve its intended results or maximize returns or minimize risk, or be appropriate for every investor seeking a particular risk profile.

National Closed Market Trading Risk. To the extent that the underlying securities and/or other assets held by the Fund or the Underlying Funds trade on foreign exchanges or in foreign markets that may be closed when the securities exchange on which the Fund’s or an Underlying Fund's shares trade is open, there are likely to be deviations between the current price of such an underlying security and the last quoted price for the underlying security (i.e., the Fund’s or an Underlying Fund's quote from the closed foreign market). The impact of a closed foreign market on the Fund or an Underlying Fund is likely to be greater where a large portion of the Fund’s or an Underlying Fund's underlying securities and/or other assets trade on that closed foreign market or when the foreign market is closed for unscheduled reasons. These deviations could result in premiums or discounts to the Fund’s or an Underlying Fund's NAV that may be greater than those experienced by other ETFs.

Non-U.S. Issuers Risk. Securities issued by non-U.S. issuers carry different risks from securities issued by U.S. issuers. These risks include differences in accounting, auditing and financial reporting standards, the possibility of expropriation or confiscatory taxation, adverse changes in investment or exchange

control regulations, political instability, regulatory and economic differences, and potential restrictions on the flow of international capital.

Non-U.S. Securities Risk. Investments in the securities of non-U.S. issuers are subject to the risks associated with investing in those non-U.S. markets, such as heightened risks of inflation or nationalization. The Fund or an Underlying Fund

may lose money due to political, economic and geographic events affecting issuers of non-U.S. securities or non-U.S. markets. In addition, non-U.S. securities markets may trade a small number of securities and may be unable to respond effectively to changes in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

may lose money due to political, economic and geographic events affecting issuers of non-U.S. securities or non-U.S. markets. In addition, non-U.S. securities markets may trade a small number of securities and may be unable to respond effectively to changes in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

Operational Risk. The Fund and the Underlying Funds are exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third parties, failed or inadequate processes and technology or systems failures. The Fund, the Underlying Funds and BFA seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address significant operational risks.

Passive Investment Risk. The Fund and the Underlying Funds are not actively managed, and BFA generally does not attempt to take defensive positions under any market conditions, including declining markets.

Prepayment Risk. During periods of falling interest rates, issuers of certain debt obligations may repay principal prior to the security’s maturity, which may cause the Fund to have to reinvest in securities with lower yields or higher risk of default, resulting in a decline in the Fund’s income or return potential.

Reinvestment Risk. The Fund or an Underlying Fund may invest a portion of its assets in short-term fixed-income instruments and, as a result, may be adversely affected if interest rates fall because they may have to invest in lower-yielding bonds as bonds mature.

Reliance on Trading Partners Risk. The Fund and certain Underlying Funds invest in countries or regions whose economies are heavily dependent upon trading with key partners. Any reduction in this trading may have an adverse impact on the Fund's investments. Through its holdings of securities of certain issuers, the Fund is specifically exposed to Asian Economic Risk, European Economic Risk and U.S. Economic Risk.

Risk of Investing in Russia. Investing in Russian securities involves significant risks, including legal, regulatory, currency and economic risks that are specific to Russia. In addition, investing in Russian securities involves risks associated with the settlement of portfolio transactions and loss of the Fund’s or an Underlying Fund's ownership rights in its portfolio securities as a result of the system of share registration and custody in Russia. Governments in the U.S. and many other countries have imposed economic

S-5

sanctions on certain Russian individuals and Russian corporate and banking entities. A number of jurisdictions may also institute broader sanctions on Russia. Recently, Russia has issued a number of countersanctions, some of which restrict the distribution of profits by limited liability companies (e.g., dividends), and prohibit Russian persons from entering into transactions with designated persons from “unfriendly states” as well as the export of raw materials or other products from Russia to certain sanctioned persons. Russia launched a large-scale invasion of Ukraine on February 24, 2022. The extent and duration of the military action, resulting sanctions and resulting future market disruptions, including declines in its stock markets and the value of the ruble against the U.S. dollar, are impossible to predict, but could be significant. Disruptions caused by Russian military action or other actions (including cyberattacks and espionage) or resulting actual and threatened responses to such activity, including purchasing and financing restrictions, boycotts or changes in consumer or purchaser preferences, sanctions, import and export restrictions, tariffs or cyberattacks on the Russian government, Russian companies, or Russian individuals, including politicians, may impact Russia’s economy and Russian companies in which the Fund or an Underlying Fund invests. Actual and threatened responses to Russian military action may also impact the markets for certain Russian commodities, such as oil and natural gas, as well as other sectors of the Russian economy, and are likely to have collateral impacts on such sectors globally. Russian companies may be unable to pay dividends and, if they pay dividends, the Fund or an Underlying Fund may be unable to receive them. As a result of sanctions, the Fund is currently restricted from trading in Russian securities, including those in its portfolio, while the Underlying Index has removed Russian securities. It is unknown when, or if, sanctions may be lifted or the Fund’s ability to trade in Russian securities will resume.

Risk of Investing in Saudi Arabia. The ability of foreign investors (such as the Fund or an Underlying Fund) to invest in the securities of Saudi Arabian issuers is relatively new. Such ability could be restricted by the Saudi Arabian government at any time, and unforeseen risks could materialize with respect to foreign ownership in such securities. The economy of Saudi Arabia is dominated by petroleum exports. A sustained decrease in petroleum prices could have a negative impact on all aspects of the economy. Investments in the securities of Saudi Arabian issuers involve risks not typically associated with investments in securities of issuers in more developed countries that may negatively affect the value of the Fund’s or Underlying Fund's investments. Such heightened risks may include, among others, expropriation and/or nationalization of assets, restrictions on and government intervention in international trade, confiscatory taxation, political instability, including authoritarian and/or military involvement in governmental decision making, armed conflict, crime and instability as a result of religious, ethnic and/or socioeconomic unrest. There remains the possibility that instability in the larger Middle East region could adversely impact the economy of Saudi Arabia, and there is no assurance of political stability in Saudi Arabia.

Saudi Arabia Broker Risk. There are a number of different ways of conducting transactions in equity securities in the Saudi

Arabian market. The Fund (or an Underlying Fund) generally expects to conduct its transactions in a manner in which the Fund would not be limited by Saudi Arabian regulations to a single broker. However, there may be a limited number of brokers who can provide services to the Fund (or an Underlying Fund), which may have an adverse impact on the prices, quantity or timing of Fund (or an Underlying Fund) transactions.

Risk of Investing in the U.S. Certain changes in the U.S. economy, such as when the U.S. economy weakens or when its financial markets decline, may have an adverse effect on the securities to which the Fund or the Underlying Funds has exposure.

Securities Lending Risk. The Fund or an Underlying Fund may engage in securities lending. Securities lending involves the risk that the Fund or the Underlying Funds may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund or the Underlying Funds could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund or an Underlying Fund.

Tax Risk. Because the Fund is expected to invest in the Underlying Funds, the Fund’s realized losses on sales of shares of an Underlying Fund may be indefinitely or permanently deferred as “wash sales.” Distributions of short-term capital gains by an Underlying Fund will be recognized as ordinary income by the Fund and would not be offset by the Fund’s capital loss carryforwards, if any. Capital loss carryforwards of an Underlying Fund, if any, would not offset net capital gains of the Fund.

Tracking Error Risk. The Fund and the Underlying Funds may be subject to “tracking error,” which is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities and other instruments held in the Fund’s portfolio and those included in the Underlying Index, pricing differences (including, as applicable, differences between a security’s price at the local market close and the Fund's or an Underlying Fund's valuation of a security at the time of calculation of the Fund's or Underlying Fund's NAV, respectively), transaction costs incurred by the Fund, the Fund’s holding of uninvested cash, differences in timing of the accrual or the valuation of dividends or interest received by a Fund or distributions paid to a Fund’s or an Underlying Fund’s shareholders, the requirements to maintain pass-through tax treatment, portfolio transactions carried out to minimize the distribution of capital gains to shareholders, acceptance of custom baskets, changes to the Underlying Index or the costs to the Fund or an Underlying Fund of complying with various new or existing regulatory requirements, among other reasons. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund or an Underlying Fund incurs fees and expenses, while the Underlying Index does not. The Underlying Funds are also subject to tracking error risk in seeking to track their own performance of the applicable underlying indexes.

S-6

Treaty/Tax Risk. Certain of the Underlying Funds invest all of their assets that are invested in India in wholly owned subsidiaries located in the Republic of Mauritius (the “Subsidiaries”). These Underlying Funds and the Subsidiaries rely on the Double Tax Avoidance Agreement between India and Mauritius (“DTAA”) for relief from certain Indian taxes. The DTAA has been renegotiated and as such, treaty relief is reduced or not available on investments in securities made on or after April 1, 2017, which may result in higher taxes and/or lower returns for the Fund. After April 1, 2017, an Underlying Fund may continue to invest in a Subsidiary until an alternative method for investing in the securities of Indian issuers is selected. Further, Mauritius has not notified its tax treaty with India as a Covered Tax Agreement (“CTA”) for purposes of the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent BEPS (the “MLI”). Therefore the MLI will not apply to the DTAA. India and Mauritius may again renegotiate the DTAA, which could impact the returns received by the Fund on its investments.

U.S. Treasury Obligations Risk. U.S. Treasury obligations may differ from other securities in their interest rates, maturities, times of issuance and other characteristics and may provide relatively lower returns than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of

a government may cause the value of the Fund's or an Underlying Fund's U.S. Treasury obligations to decline.

Valuation Risk. The price the Fund or an Underlying Fund could receive upon the sale of a security or other asset may differ from the Fund's or the Underlying Fund's valuation of the security or other asset and from the value used by its underlying index, particularly for securities or other assets that trade in low volume or volatile markets or that are valued using a fair value methodology as a result of trade suspensions or for other reasons. In addition, the value of the securities or other assets in the Fund's or an Underlying Fund's portfolio may change on days or during time periods when shareholders will not be able to purchase or sell the Fund's or an Underlying Fund's shares. Authorized Participants who purchase or redeem shares of the Fund or an Underlying Fund on days when the Fund or an Underlying Fund is holding fair-valued securities may receive fewer or more shares, or lower or higher redemption proceeds, than they would have received had the Fund or an Underlying Fund not fair-valued securities or used a different valuation methodology. The Fund’s or an Underlying Fund's ability to value investments may be impacted by technological issues or errors by pricing services or other third-party service providers.

S-7

Performance Information

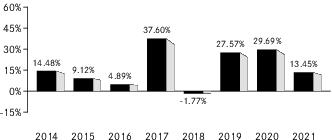

Year by Year Returns1 (Years Ended December 31)

1

The best calendar quarter return during the periods shown above was 8.00 % in the 2nd quarter of 2020 ; the worst was -6.28 % in the 1st quarter of 2020 .

Updated performance information, including the Fund’s current NAV, may be obtained by visiting our website at www.iShares.com or by calling 1-800-iShares (1-800-474-2737) (toll free) .

Average Annual Total Returns

(for the periods ended December 31, 2021)

(for the periods ended December 31, 2021)

| |

One Year |

Five Years |

Ten Years |

| (Inception Date: |

|

|

|

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions2 |

|

|

|

| Return After Taxes on Distributions and Sale of Fund Shares2 |

|

|

|

| S&P Target Risk Conservative Index (Index returns do not reflect deductions for fees, expenses, or taxes) |

|

|

|

2

S-8

Management

Investment Adviser. BlackRock Fund Advisors.

Portfolio Managers. Jennifer Hsui, Greg Savage and Paul Whitehead (the “Portfolio Managers”) are primarily responsible for the day-to-day management of the Fund. Each Portfolio Manager supervises a portfolio management team. Ms. Hsui, Mr. Savage and Mr. Whitehead have been Portfolio Managers of the Fund since 2012, 2008 and 2022, respectively.

Purchase and Sale of Fund Shares

The Fund is an ETF. Individual shares of the Fund may only be bought and sold in the secondary market through a broker-dealer. Because ETF shares trade at market prices rather than at NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the “bid-ask spread”).

Tax Information

The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing

through a tax-deferred arrangement such as a 401(k) plan or an IRA, in which case, your distributions generally will be taxed when withdrawn.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

S-9

iShares Core Moderate Allocation ETF

Ticker: AOMStock Exchange: NYSE Arca

Investment Objective

The iShares Core Moderate Allocation ETF (the “Fund”) seeks to track the investment results of an index composed of a portfolio of underlying equity and fixed income funds intended to represent a moderate target risk allocation strategy.

Fees and Expenses

The following table describes the fees and expenses that you will incur if you buy, hold and sell shares of the Fund. The investment advisory agreement between iShares Trust (the “Trust”) and BlackRock Fund Advisors (“BFA”) (the “Investment Advisory Agreement”) provides that BFA will pay all operating expenses of the Fund, except: (i) the management fees, (ii) interest expenses, (iii) taxes, (iv) expenses incurred with respect to the acquisition and disposition of portfolio securities and the execution of portfolio transactions, including brokerage commissions, (v) distribution fees or expenses, and (vi) litigation expenses and any extraordinary expenses. The Fund may incur “Acquired Fund Fees and Expenses.” Acquired Fund Fees and Expenses reflect the Fund's pro rata share of the fees and expenses incurred indirectly by the Fund as a result of investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and Expenses are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund's prospectus (the “ Prospectus ” ). BFA, the investment adviser to the Fund, has contractually agreed to waive a portion of its management fees in an amount equal to the Acquired Fund Fees and Expenses, if any, attributable to investments by the Fund in other series of the Trust and iShares, Inc. through November 30, 2026. The contractual waiver may be terminated prior to November 30, 2026 only upon written agreement of the Trust and BFA.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses2 |

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Fee Waiver and/or Expense Reimbursement |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

| |

|

|

|

|

( |

|

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

Principal Investment Strategies

The Fund is a fund of funds and seeks to achieve its investment objective by investing primarily in Underlying Funds that themselves seek investment results corresponding to their own respective underlying indexes. The Underlying Funds invest primarily in distinct asset classes, such as large- or mid-capitalization U.S. or non-U.S. equity, the aggregate bond market

S-10

(including allocation to international bonds as well as USD-denominated bonds) or the U.S. Treasury bond market; each such asset class has its own risk profile.

The S&P Target Risk Moderate Index (the “Underlying Index”) is composed of a portfolio of equity and fixed-income Underlying Funds and measures the performance of the S&P Dow Jones Indices LLC (the “Index Provider” or “SPDJI”) proprietary allocation model that is intended to represent a “moderate” target risk allocation strategy as defined by SPDJI. The Underlying Index seeks to provide significant exposure to fixed income, while also providing increased opportunity for capital growth through equities. SPDJI’s estimation of a moderate target risk allocation may differ from your own.

The Fund is designed for investors seeking current income, some capital preservation and an opportunity for moderate to low capital appreciation. As of July 31, 2022, the Underlying Index included a fixed allocation of 40% of its assets in Underlying Funds that invest primarily in equity securities and 60% of its assets in Underlying Funds that invest primarily in bonds. As of July 31, 2022, the Fund invested approximately 37.17% of its assets in Underlying Funds that invest primarily in equity securities, 58.75% of its assets in Underlying Funds that invest primarily in bonds and the remainder of its assets in Underlying Funds that invest primarily in money market instruments.

As of July 31, 2022, the Fund invested in the iShares Core International Aggregate Bond ETF, iShares Core MSCI Emerging Markets ETF, iShares Core MSCI International Developed Markets ETF, iShares Core S&P 500 ETF, iShares Core S&P Mid-Cap ETF, iShares Core S&P Small-Cap ETF, iShares Core Total USD Bond Market ETF and money market funds advised by BFA or its affiliates (“BlackRock Cash Funds”). BFA may add, eliminate or replace any or all Underlying Funds at any time. As of July 31, 2022, a significant portion of the Underlying Index is represented by companies in the financials industry or sector and by U.S. treasury securities. The components of the Underlying Index are likely to change over time.

BFA uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Indexing seeks to achieve lower costs and better after-tax performance by aiming to keep portfolio turnover low in comparison to actively managed investment companies.

BFA uses a representative sampling indexing strategy to manage the Fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to that of an applicable underlying index. The securities selected are expected to have, in the aggregate, investment characteristics (based on

factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar to those of an applicable underlying index. The Fund and an Underlying Fund may or may not hold all of the securities in the applicable Underlying Index.

The Fund generally will invest at least 80% of its assets in the component securities of its Underlying Index and in investments that have economic characteristics that are substantially identical to the component securities of its Underlying Index (i.e., depositary receipts representing securities of the Underlying Index) and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the Underlying Index, but which BFA believes will help the Fund track the Underlying Index. Cash and cash equivalent investments associated with a derivative position will be treated as part of that position for the purposes of calculating the percentage of investments included in the Underlying Index. The Fund seeks to track the investment results of the Underlying Index before fees and expenses of the Fund.

The Fund may lend securities representing up to one-third of the value of the Fund's total assets (including the value of any collateral received).

The Underlying Index is a product of SPDJI, which is independent of the Fund and BFA. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities) and repurchase agreements collateralized by U.S. government securities are not considered to be issued by members of any industry.

Summary of Principal Risks

Affiliated Fund Risk. In managing the Fund, BFA has the ability to select Underlying Funds and substitute Underlying Funds with other exchange-traded funds (“ETFs”) that it believes will achieve the Fund’s objective. BFA may be subject to potential conflicts of interest in selecting Underlying Funds and substituting Underlying Funds with other ETFs because the fees paid to BFA by some

S-11

Underlying Funds and other ETFs managed by BFA may be higher than the fees paid by other Underlying Funds. If an Underlying Fund or other ETF holds interests in an affiliated fund in excess of a certain amount, the Fund may be prohibited from purchasing shares of that Underlying Fund or other ETF.

Allocation Risk. The Fund’s ability to achieve its investment objective depends upon the Index Provider’s ability to develop a model that accurately assesses the Fund’s asset class allocation and selects the best mix of Underlying Funds and other ETFs. There is a risk that the Index Provider’s evaluations and assumptions regarding asset classes or Underlying Funds, which are utilized as inputs in the model, may be incorrect in view of actual market conditions.

Asset Class Risk. Securities and other assets in the Underlying Index or in the Fund's or an Underlying Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes.

Authorized Participant Concentration Risk. Only an Authorized Participant (as defined in the Creations and Redemptions section of this prospectus (the “Prospectus”)) may engage in creation or redemption transactions directly with the Fund, and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. The Fund has a limited number of institutions that may act as Authorized Participants on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting. Authorized Participant concentration risk may be heightened for ETFs, such as the Fund, that invest in securities issued by non-U.S. issuers or other securities or instruments that have lower trading volumes.

Calculation Methodology Risk. The Underlying Index relies on various sources of information to assess the criteria of issuers included in the Underlying Index, including information that may be based on assumptions and estimates. Neither the Fund nor BFA can offer assurances that the Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers.

Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or repay the security before its stated maturity, and the Fund or an Underlying Fund may have to reinvest the proceeds in securities with lower yields, which would result in a decline in the Fund's income, or in securities with greater risks or with other less favorable features.

Concentration Risk. The Fund may be susceptible to an increased risk of loss, including losses due to adverse events that affect the Fund’s investments more than the market as a whole, to the extent that the Fund's or an Underlying Fund's investments are concentrated in the securities and/or other assets of a

particular issuer or issuers, country, group of countries, region, market, industry, group of industries, sector, market segment or asset class.

Credit Risk. Debt issuers and other counterparties may be unable or unwilling to make timely interest and/or principal payments when due or otherwise honor their obligations. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also adversely affect the value of the Fund’s or an Underlying Fund's investment in that issuer. The degree of credit risk depends on an issuer's or counterparty's financial condition and on the terms of an obligation.

Currency Risk. Because the Fund's and the Underlying Funds' NAVs are determined in U.S. dollars, the Fund's NAV could decline if a currency of a non-U.S. market in which a Fund or an Underlying Fund invests depreciates against the U.S. dollar or if there are delays or limits on repatriation of such currency. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, the Fund's NAV may change quickly and without warning.

Cybersecurity Risk. Failures or breaches of the electronic systems of the Fund or the Underlying Funds, the Funds' or the Underlying Funds' adviser, distributor, the Index Provider and other service providers, market makers, Authorized Participants or the issuers of securities in which the Fund invests have the ability to cause disruptions, negatively impact the Fund’s business operations and/or potentially result in financial losses to the Fund and its shareholders. While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in such plans and systems. Furthermore, the Fund cannot control the cybersecurity plans and systems of the Fund’s Index Provider and other service providers, market makers, Authorized Participants or issuers of securities in which the Fund invests.

Derivatives Risk. The Fund or an Underlying Fund may invest in certain types of derivatives contracts, including futures, options and swaps, which can be more sensitive to changes in interest rates or to sudden fluctuations in market prices than conventional securities, which can result in greater losses to the Fund.

Equity Securities Risk. Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. Certain Underlying Funds invest in common stocks, which generally subject their holders to more risks than preferred stocks and debt securities because common stockholders’ claims are subordinated to those of holders of preferred stocks and debt securities upon the bankruptcy of the issuer.

Extension Risk. During periods of rising interest rates, certain debt obligations may be paid off substantially more slowly than originally anticipated and the value of those securities may fall sharply, resulting in a decline in the Fund’s income and potentially in the value of the Fund’s or an Underlying Fund's investments.

S-12

Financials Sector Risk. Performance of companies in the financials sector may be adversely impacted by many factors, including, among others, changes in government regulations, economic conditions, and interest rates, credit rating downgrades, and decreased liquidity in credit markets. The extent to which the Fund or an Underlying Fund may invest in a company that engages in securities-related activities or banking is limited by applicable law. The impact of changes in capital requirements and recent or future regulation of any individual financial company, or of the financials sector as a whole, cannot be predicted. Cyberattacks and technology malfunctions and failures have become increasingly frequent and have caused significant losses to companies in this sector, which may negatively impact an Underlying Fund.

Geographic Risk. A natural disaster could occur in a geographic region in which the Fund or an Underlying Fund invests, which could adversely affect the economy or the business operations of companies in the specific geographic region, causing an adverse impact on the Fund's or an Underlying Fund's investments in, or which are exposed to, the affected region.

High Yield Securities Risk. Securities that are rated below investment-grade (commonly referred to as “junk bonds,” which may include those bonds rated below “BBB-” by Standard & Poor's® Global Ratings, a subsidiary of S&P Global (“S&P Global Ratings”) and Fitch Ratings, Inc. (“Fitch”) or below “Baa3” by Moody's Investors Service, Inc. (“Moody's”)), or are unrated, may be deemed speculative, may involve greater levels of risk than higher-rated securities of similar maturity and may be more likely to default.

Income Risk. The Fund's income may decline if interest rates fall. This decline in income can occur because the Fund or an Underlying Fund may subsequently invest in lower-yielding bonds when bonds in its portfolio mature, are near maturity or are called, bonds in the Underlying Index are substituted, or the Fund or an Underlying Fund otherwise needs to purchase additional bonds.

Index-Related Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions or other unforeseen circumstances (such as natural disasters, political unrest or war) may impact the Index Provider or a third-party data provider, and could cause the Index Provider to postpone a scheduled rebalance. This could cause the Underlying Index to vary from its normal or expected composition.

Infectious Illness Risk. A widespread outbreak of an infectious illness, such as the COVID-19 pandemic, may result in travel

restrictions, disruption of healthcare services, prolonged quarantines, cancellations, supply chain disruptions, business closures, lower consumer demand, layoffs, ratings downgrades, defaults and other significant economic, social and political impacts. Markets may experience temporary closures, extreme volatility, severe losses, reduced liquidity and increased trading costs. Such events may adversely affect the Fund and its investments and may impact the Fund’s ability to purchase or sell securities or cause elevated tracking error and increased premiums or discounts to the Fund's NAV. Despite the development of vaccines, the duration of the COVID-19 pandemic and its effects cannot be predicted with certainty.

Interest Rate Risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Very low or negative interest rates may magnify interest rate risk. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, result in heightened market volatility and detract from the Fund’s performance to the extent the Fund is exposed to such interest rates. Additionally, under certain market conditions in which interest rates are low and the market prices for portfolio securities have increased, the Fund may have a very low or even negative yield. A low or negative yield would cause the Fund to lose money in certain conditions and over certain time periods. An increase in interest rates will generally cause the value of securities held by the Fund or an Underlying Fund to decline, may lead to heightened volatility in the fixed-income markets and may adversely affect the liquidity of certain fixed-income investments, including those held by the Fund or an Underlying Fund. Because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities. The historically low interest rate environment in recent years heightens the risks associated with rising interest rates.

Investment in Underlying Funds Risk. The Fund invests substantially all of its assets in the Underlying Funds, so the Fund’s investment performance is directly related to the performance of the Underlying Funds. The Fund’s NAV will change with changes in the value of the Underlying Funds and other securities in which the Fund invests based on their market valuations. An investment in the Fund will entail more costs and expenses than a direct investment in the Underlying Funds.

As the Underlying Funds, or the Fund’s allocations among the Underlying Funds, change from time to time, or to the extent that the total annual fund operating expenses of any Underlying Fund change, the weighted average operating expenses borne by the Fund may increase or decrease.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund or an Underlying Fund has exposure. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline.

S-13

Large-Capitalization Companies Risk. Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large-capitalization companies has trailed the overall performance of the broader securities markets.

Management Risk. As the Fund or the Underlying Funds will not fully replicate their respective indexes, they are subject to the risk that BFA's investment strategy may not produce the intended results.

Market Risk. The Fund and the Underlying Funds could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. The countries in which the Fund invests may be subject to considerable degrees of economic, political and social instability. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund, the Underlying Funds and their investments and could result in increased premiums or discounts to the Fund’s or Underlying Fund's NAV.

Market Trading Risk. The Fund and the Underlying Funds face numerous market trading risks, including the potential lack of an active market for their shares, losses from trading in secondary markets, periods of high volatility and disruptions in the creation/redemption process. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE FUND'S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Mid-Capitalization Companies Risk. Compared to large-capitalization companies, mid-capitalization companies may be less stable and more susceptible to adverse developments. In addition, the securities of mid-capitalization companies may be more volatile and less liquid than those of large-capitalization companies.

Model Risk. Neither the Fund nor BFA can offer assurances that the Underlying Index's allocation model will achieve its intended results or maximize returns or minimize risk, or be appropriate for every investor seeking a particular risk profile.

National Closed Market Trading Risk. To the extent that the underlying securities and/or other assets held by the Fund or the Underlying Funds trade on foreign exchanges or in foreign markets that may be closed when the securities exchange on which the Fund’s or an Underlying Fund's shares trade is open, there are likely to be deviations between the current price of such an underlying security and the last quoted price for the underlying security (i.e., the Fund’s or an Underlying Fund's quote from the closed foreign market). The impact of a closed foreign market on the Fund or an Underlying Fund is likely to be greater where a large portion of the Fund’s or an Underlying Fund's underlying securities and/or other assets trade on that closed foreign market or when the foreign market is closed for unscheduled

reasons. These deviations could result in premiums or discounts to the Fund’s or an Underlying Fund's NAV that may be greater than those experienced by other ETFs.

Non-U.S. Issuers Risk. Securities issued by non-U.S. issuers carry different risks from securities issued by U.S. issuers. These risks include differences in accounting, auditing and financial reporting standards, the possibility of expropriation or confiscatory taxation, adverse changes in investment or exchange control regulations, political instability, regulatory and economic differences, and potential restrictions on the flow of international capital.

Non-U.S. Securities Risk. Investments in the securities of non-U.S. issuers are subject to the risks associated with investing in those non-U.S. markets, such as heightened risks of inflation or nationalization. The Fund or an Underlying Fund

may lose money due to political, economic and geographic events affecting issuers of non-U.S. securities or non-U.S. markets. In addition, non-U.S. securities markets may trade a small number of securities and may be unable to respond effectively to changes in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

may lose money due to political, economic and geographic events affecting issuers of non-U.S. securities or non-U.S. markets. In addition, non-U.S. securities markets may trade a small number of securities and may be unable to respond effectively to changes in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

Operational Risk. The Fund and the Underlying Funds are exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third parties, failed or inadequate processes and technology or systems failures. The Fund, the Underlying Funds and BFA seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address significant operational risks.

Passive Investment Risk. The Fund and the Underlying Funds are not actively managed, and BFA generally does not attempt to take defensive positions under any market conditions, including declining markets.

Prepayment Risk. During periods of falling interest rates, issuers of certain debt obligations may repay principal prior to the security’s maturity, which may cause the Fund to have to reinvest in securities with lower yields or higher risk of default, resulting in a decline in the Fund’s income or return potential.

Reinvestment Risk. The Fund or an Underlying Fund may invest a portion of its assets in short-term fixed-income instruments and, as a result, may be adversely affected if interest rates fall because they may have to invest in lower-yielding bonds as bonds mature.

Reliance on Trading Partners Risk. The Fund and certain Underlying Funds invest in countries or regions whose economies are heavily dependent upon trading with key partners. Any reduction in this trading may have an adverse impact on the Fund's investments. Through its holdings of securities of certain issuers, the Fund is specifically exposed to Asian Economic Risk, European Economic Risk and U.S. Economic Risk.

S-14

Risk of Investing in Russia. Investing in Russian securities involves significant risks, including legal, regulatory, currency and economic risks that are specific to Russia. In addition, investing in Russian securities involves risks associated with the settlement of portfolio transactions and loss of the Fund’s or an Underlying Fund's ownership rights in its portfolio securities as a result of the system of share registration and custody in Russia. Governments in the U.S. and many other countries have imposed economic sanctions on certain Russian individuals and Russian corporate and banking entities. A number of jurisdictions may also institute broader sanctions on Russia. Recently, Russia has issued a number of countersanctions, some of which restrict the distribution of profits by limited liability companies (e.g., dividends), and prohibit Russian persons from entering into transactions with designated persons from “unfriendly states” as well as the export of raw materials or other products from Russia to certain sanctioned persons. Russia launched a large-scale invasion of Ukraine on February 24, 2022. The extent and duration of the military action, resulting sanctions and resulting future market disruptions, including declines in its stock markets and the value of the ruble against the U.S. dollar, are impossible to predict, but could be significant. Disruptions caused by Russian military action or other actions (including cyberattacks and espionage) or resulting actual and threatened responses to such activity, including purchasing and financing restrictions, boycotts or changes in consumer or purchaser preferences, sanctions, import and export restrictions, tariffs or cyberattacks on the Russian government, Russian companies, or Russian individuals, including politicians, may impact Russia’s economy and Russian companies in which the Fund or an Underlying Fund invests. Actual and threatened responses to Russian military action may also impact the markets for certain Russian commodities, such as oil and natural gas, as well as other sectors of the Russian economy, and are likely to have collateral impacts on such sectors globally. Russian companies may be unable to pay dividends and, if they pay dividends, the Fund or an Underlying Fund may be unable to receive them. As a result of sanctions, the Fund is currently restricted from trading in Russian securities, including those in its portfolio, while the Underlying Index has removed Russian securities. It is unknown when, or if, sanctions may be lifted or the Fund’s ability to trade in Russian securities will resume.

Risk of Investing in Saudi Arabia. The ability of foreign investors (such as the Fund or an Underlying Fund) to invest in the securities of Saudi Arabian issuers is relatively new. Such ability could be restricted by the Saudi Arabian government at any time, and unforeseen risks could materialize with respect to foreign ownership in such securities. The economy of Saudi Arabia is dominated by petroleum exports. A sustained decrease in petroleum prices could have a negative impact on all aspects of the economy. Investments in the securities of Saudi Arabian issuers involve risks not typically associated with investments in securities of issuers in more developed countries that may negatively affect the value of the Fund’s or Underlying Fund's investments. Such heightened risks may include, among others, expropriation and/or nationalization of assets, restrictions on and government intervention in international trade, confiscatory taxation, political instability, including authoritarian and/or military involvement in governmental decision making, armed conflict, crime and instability as a result of religious, ethnic

and/or socioeconomic unrest. There remains the possibility that instability in the larger Middle East region could adversely impact the economy of Saudi Arabia, and there is no assurance of political stability in Saudi Arabia.

Saudi Arabia Broker Risk. There are a number of different ways of conducting transactions in equity securities in the Saudi Arabian market. The Fund (or an Underlying Fund) generally expects to conduct its transactions in a manner in which the Fund would not be limited by Saudi Arabian regulations to a single broker. However, there may be a limited number of brokers who can provide services to the Fund (or an Underlying Fund), which may have an adverse impact on the prices, quantity or timing of Fund (or an Underlying Fund) transactions.

Risk of Investing in the U.S. Certain changes in the U.S. economy, such as when the U.S. economy weakens or when its financial markets decline, may have an adverse effect on the securities to which the Fund or the Underlying Funds has exposure.

Securities Lending Risk. The Fund or an Underlying Fund may engage in securities lending. Securities lending involves the risk that the Fund or the Underlying Funds may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund or the Underlying Funds could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund or an Underlying Fund.

Tax Risk. Because the Fund is expected to invest in the Underlying Funds, the Fund’s realized losses on sales of shares of an Underlying Fund may be indefinitely or permanently deferred as “wash sales.” Distributions of short-term capital gains by an Underlying Fund will be recognized as ordinary income by the Fund and would not be offset by the Fund’s capital loss carryforwards, if any. Capital loss carryforwards of an Underlying Fund, if any, would not offset net capital gains of the Fund.

Tracking Error Risk. The Fund and the Underlying Funds may be subject to “tracking error,” which is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities and other instruments held in the Fund’s portfolio and those included in the Underlying Index, pricing differences (including, as applicable, differences between a security’s price at the local market close and the Fund's or an Underlying Fund's valuation of a security at the time of calculation of the Fund's or Underlying Fund's NAV, respectively), transaction costs incurred by the Fund, the Fund’s holding of uninvested cash, differences in timing of the accrual or the valuation of dividends or interest received by a Fund or distributions paid to a Fund’s or an Underlying Fund’s shareholders, the requirements to maintain pass-through tax treatment, portfolio transactions carried out to minimize the distribution of capital gains to shareholders, acceptance of custom baskets, changes to the Underlying Index or the costs to the Fund or an Underlying Fund of complying with various new or existing regulatory requirements, among other reasons. This risk

S-15