|

|

| (as revised November 10, 2021) |

|

2021 Prospectus |

| • | iShares 0-3 Month Treasury Bond ETF | SGOV | NYSE ARCA |

| Ticker: SGOV | Stock Exchange: NYSE Arca |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses |

Fee Waiver | Total Annual Fund Operating Expenses After Fee Waiver | |||||

| ( |

||||||||||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| ■ | General Impact. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of, and delays in, healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, temporary and permanent closures of stores, restaurants and other commercial establishments, layoffs, defaults and other significant economic impacts, as well as general concern and uncertainty. |

| ■ | Market Volatility. The outbreak has also resulted in extreme volatility, severe losses, and disruptions in markets which can adversely impact the Fund and its investments, including impairing hedging activity to the extent a Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. In addition, to the extent the Fund invests in short-term instruments that have negative yields, the Fund’s value may be impaired as a result. Certain |

| issuers of equity securities have cancelled or announced the suspension of dividends. The outbreak has, and may continue to, negatively affect the credit ratings of some fixed-income securities and their issuers. | |

| ■ | Market Closures. Certain local markets have been or may be subject to closures, and there can be no assurance that trading will continue in any local markets in which the Fund may invest, when any resumption of trading will occur or, once such markets resume trading, whether they will face further closures. Any suspension of trading in markets in which the Fund invests will have an impact on the Fund and its investments and will impact the Fund’s ability to purchase or sell securities in such markets. |

| ■ | Operational Risk. The outbreak could also impair the information technology and other operational systems upon which the Fund’s service providers, including BFA, rely, and could otherwise disrupt the ability of employees of the Fund’s service providers to perform critical tasks relating to the Fund, for example, due to the service providers’ employees performing tasks in alternate locations than under normal operating conditions or the illness of certain employees of the Fund’s service providers. |

| ■ | Governmental Interventions. Governmental and quasi-governmental authorities and regulators throughout the world have responded to the outbreak and the resulting economic disruptions with a variety of fiscal and monetary policy changes, including direct capital infusions into companies and other issuers, new monetary policy tools, and lower interest rates. An unexpected or sudden reversal of these policies, or the ineffectiveness of such policies, is likely to increase market volatility, which could adversely affect the Fund’s investments. |

| ■ | Pre-Existing Conditions. Public health crises caused by the outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally, which could adversely affect the Fund and its investments and could result in increased premiums or discounts to the Fund's NAV. |

(For a share outstanding throughout the period)

| iShares 0-3 Month Treasury Bond ETF | |

| Period From 05/26/20(a) to 02/28/21 | |

| Net asset value, beginning of period | $100.01 |

| Net investment income(b) | 0.05 |

| Net realized and unrealized gain(c) | 0.00(d) |

| Net increase from investment operations | 0.05 |

| Distributions(e) | |

| From net investment income | (0.05) |

| Total distributions | (0.05) |

| Net asset value, end of period | $100.01 |

| Total Return | |

| Based on net asset value | 0.05%(f) |

| Ratios to Average Net Assets | |

| Total expenses | 0.12%(g) |

| Total expenses after fees waived | 0.03%(g) |

| Net investment income | 0.07%(g) |

| Supplemental Data | |

| Net assets, end of period (000) | $735,108 |

| Portfolio turnover rate(h) | 326%(f) |

(a) Commencement of operations. | |

| (b) Based on average shares outstanding. | |

| (c) The amount reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |

| (d) Rounds to less than $0.01. | |

| (e) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |

| (f) Not annualized. | |

| (g) Annualized. | |

| (h) Portfolio turnover rate excludes in-kind transactions. | |

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

June 29, 2021 |

| (as revised November 10, 2021) |

|

2021 Prospectus |

| • | iShares Short Treasury Bond ETF | SHV | NASDAQ |

| Ticker: SHV | Stock Exchange: NASDAQ |

| (ongoing expenses that you pay each year as a percentage of the value of your investments)1 | ||||||||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses 2 |

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Fee Waiver | Total Annual Fund Operating Expenses After Fee Waiver | ||||||

| ( |

||||||||||||

| 1 | |

| 2 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

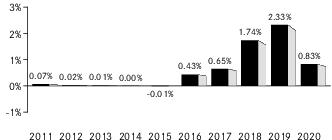

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes | |||||

| Return After Taxes on Distributions1 | |||||

| Return After Taxes on Distributions and Sale of Fund Shares1 | |||||

| ICE Short US Treasury Securities Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 |

| 1 | |

| 2 | |

| ■ | General Impact. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of, and delays in, healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, temporary and permanent closures of stores, restaurants and other commercial establishments, layoffs, defaults and other significant economic impacts, as well as general concern and uncertainty. |

| ■ | Market Volatility. The outbreak has also resulted in extreme volatility, severe losses, and disruptions in markets which can adversely impact the Fund and its investments, including impairing hedging activity to the extent a Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. In addition, to the extent the Fund invests in short-term instruments that have negative yields, the Fund’s value may be impaired as a result. Certain issuers of equity securities have cancelled or announced the suspension of dividends. The outbreak has, and may continue to, negatively affect the credit ratings of some fixed-income securities and their issuers. |

| ■ | Market Closures. Certain local markets have been or may be subject to closures, and there can be no assurance that trading will continue in any local markets in which the Fund may invest, when any resumption of trading will occur or, once such markets resume trading, whether they will face further closures. Any suspension of trading in markets in which the Fund invests will have an impact on the Fund and its investments and will impact the Fund’s ability to purchase or sell securities in such markets. |

| ■ | Operational Risk. The outbreak could also impair the information technology and other operational systems upon which the Fund’s service providers, including BFA, rely, and could otherwise disrupt the ability of employees of the Fund’s service providers to perform critical tasks relating to the Fund, for example, due to the service providers’ employees performing tasks in alternate locations than under normal operating conditions or the illness of certain employees of the Fund’s service providers. |

| ■ | Governmental Interventions. Governmental and quasi-governmental authorities and regulators throughout the world have responded to the outbreak and the resulting economic disruptions with a variety of fiscal and monetary policy changes, including direct capital infusions into companies and other issuers, new monetary policy tools, |

| and lower interest rates. An unexpected or sudden reversal of these policies, or the ineffectiveness of such policies, is likely to increase market volatility, which could adversely affect the Fund’s investments. | |

| ■ | Pre-Existing Conditions. Public health crises caused by the outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally, which could adversely affect the Fund and its investments and could result in increased premiums or discounts to the Fund's NAV. |

(For a share outstanding throughout each period)

| iShares Short Treasury Bond ETF | |||||||||

| Year Ended 02/28/21 |

Year Ended 02/29/20 |

Year Ended 02/28/19 |

Year Ended 02/28/18 |

Year Ended 02/28/17 | |||||

| Net asset value, beginning of year | $110.68 | $110.52 | $110.29 | $110.36 | $110.29 | ||||

| Net investment income(a) | 0.40 | 2.28 | 2.16 | 1.01 | 0.42 | ||||

| Net realized and unrealized gain (loss)(b) | 0.10 | 0.25 | 0.01 | (0.22) | 0.05 | ||||

| Net increase from investment operations | 0.50 | 2.53 | 2.17 | 0.79 | 0.47 | ||||

| Distributions(c) | |||||||||

| From net investment income | (0.50) | (2.37) | (1.94) | (0.86) | (0.40) | ||||

| From net realized gain | (0.16) | — | — | — | — | ||||

| Total distributions | (0.66) | (2.37) | (1.94) | (0.86) | (0.40) | ||||

| Net asset value, end of year | $110.52 | $110.68 | $110.52 | $110.29 | $110.36 | ||||

| Total Return | |||||||||

| Based on net asset value | 0.45% | 2.31% | 1.98% | 0.71% | 0.44% | ||||

| Ratios to Average Net Assets | |||||||||

| Total expenses | 0.15% | 0.15% | 0.15% | 0.15% | 0.15% | ||||

| Net investment income | 0.36% | 2.06% | 1.95% | 0.91% | 0.38% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $16,193,171 | $20,276,511 | $19,131,299 | $9,506,603 | $4,447,672 | ||||

| Portfolio turnover rate(d) | 115% | 42% | 73% | 47% | 78% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |