Form 485BPOS

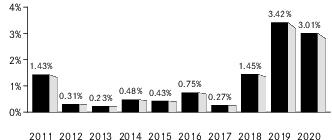

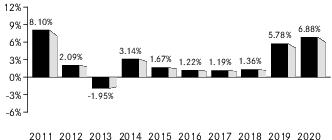

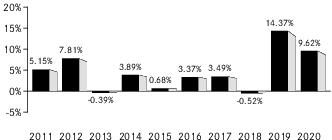

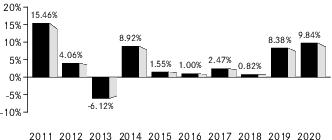

0001100663 false 485BPOS 2021-02-28 8.10 2.09 1.95 3.14 1.67 1.22 1.19 1.36 5.78 6.88 1.43 0.31 0.23 0.48 0.43 0.75 0.27 1.45 3.42 3.01 1.34 3.28 1.03 0.74 0.70 1.77 1.41 1.34 7.01 5.26 15.46 4.06 6.12 8.92 1.55 1.00 2.47 0.82 8.38 9.84 21.58 4.09 8.48 14.42 1.28 0.91 4.06 0.10 10.83 13.60 15.31 12.91 7.05 15.54 4.76 9.92 12.07 7.18 23.39 13.58 33.60 3.25 13.91 27.35 1.65 1.36 8.92 2.07 14.93 17.92 5.15 7.81 0.39 3.89 0.68 3.37 3.49 0.52 14.37 9.62 4.62 1.99 1.31 3.55 1.00 1.30 1.84 1.33 5.65 5.82 8.05 9.12 2.33 7.37 0.98 5.46 5.99 2.40 14.16 9.52 11.88 7.73 1.93 9.99 3.31 0.21 4.85 0.69 7.15 4.57 7.58 4.04 2.15 6.04 0.48 2.56 3.53 0.05 8.68 7.43 0.83 6.95 5.02 8.61 8.71 8.50 4.55 7.41 2.56 5.81 0.05 2.77 3.84 0.61 9.59 2.79 14.58 9.76 7.55 2.88 15.91 21.68 8.32 8.72 17.83 2.97 7.64 10.97 5.00 19.91 15.95 3.89 0.07 8.82 6.37 5.89 13.83 5.90 2.00 5.55 13.92 6.09 1.93 14.23 4.12 3.07 15.87 11.12 8.89 11.68 2.49 8.57 1.08 5.97 7.16 3.76 17.13 11.14 5.88 2.23 1.92 6.16 1.28 1.28 2.37 0.81 6.27 4.03 10.85 6.14 3.26 8.61 2.99 0.06 4.61 0.86 7.28 4.87 5.64 3.64 1.05 2.93 0.85 1.89 1.96 0.70 6.64 6.23 10.29 6.46 2.62 8.63 3.23 0.13 4.37 0.57 6.74 4.18 2.80 0.94 0.71 0.57 0.65 0.03 0.90 1.57 3.09 2.27 0.07 0.02 0.01 0.00 0.01 0.43 0.65 1.74 2.33 0.83 0001100663 ist:S000057341Member ist:BlackRockHighYieldDefensiveBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000057341Member ist:C000182992Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000057341Member ist:C000182992Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000057341Member 2021-06-29 2021-06-29 0001100663 ist:S000026652Member ist:BloombergBarclaysUSUniversalTenPlusYearIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000026652Member ist:C000080010Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000026652Member ist:C000080010Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000026652Member 2021-06-29 2021-06-29 0001100663 ist:S000013694Member ist:C000037536Member 2021-06-29 2021-06-29 0001100663 ist:S000023507Member ist:C000069126Member 2021-06-29 2021-06-29 0001100663 ist:S000019342Member ist:C000053740Member 2021-06-29 2021-06-29 0001100663 ist:S000013700Member ist:C000037542Member 2021-06-29 2021-06-29 0001100663 ist:S000018861Member ist:C000052220Member 2021-06-29 2021-06-29 0001100663 ist:S000013702Member ist:C000037544Member 2021-06-29 2021-06-29 0001100663 ist:S000004361Member ist:C000012091Member 2021-06-29 2021-06-29 0001100663 ist:S000057342Member ist:C000182993Member 2021-06-29 2021-06-29 0001100663 ist:S000016772Member ist:C000046846Member 2021-06-29 2021-06-29 0001100663 ist:S000055401Member ist:C000174365Member 2021-06-29 2021-06-29 0001100663 ist:S000026652Member ist:C000080010Member 2021-06-29 2021-06-29 0001100663 ist:S000057341Member ist:C000182992Member 2021-06-29 2021-06-29 0001100663 ist:S000058037Member ist:C000189865Member 2021-06-29 2021-06-29 0001100663 ist:S000062159Member ist:C000201167Member 2021-06-29 2021-06-29 0001100663 ist:S000013701Member ist:C000037543Member 2021-06-29 2021-06-29 0001100663 ist:S000058036Member ist:C000189864Member 2021-06-29 2021-06-29 0001100663 ist:S000004362Member ist:C000012092Member 2021-06-29 2021-06-29 0001100663 ist:S000019341Member ist:C000053739Member 2021-06-29 2021-06-29 0001100663 ist:S000013699Member ist:C000037541Member 2021-06-29 2021-06-29 0001100663 ist:S000023506Member ist:C000069125Member 2021-06-29 2021-06-29 0001100663 ist:S000013698Member ist:C000037540Member 2021-06-29 2021-06-29 0001100663 ist:S000004360Member ist:C000012090Member 2021-06-29 2021-06-29 0001100663 ist:S000026651Member ist:C000080009Member 2021-06-29 2021-06-29 0001100663 ist:S000013696Member ist:C000037538Member 2021-06-29 2021-06-29 0001100663 ist:S000004358Member ist:C000012088Member 2021-06-29 2021-06-29 0001100663 ist:S000013697Member ist:C000037539Member 2021-06-29 2021-06-29 0001100663 ist:S000004357Member ist:C000012087Member 2021-06-29 2021-06-29 0001100663 ist:S000013695Member ist:C000037537Member 2021-06-29 2021-06-29 0001100663 2021-06-29 2021-06-29 0001100663 ist:S000023507Member ist:SandPShortTermNationalAMTFreeMunicipalBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000023507Member ist:C000069126Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000023507Member ist:C000069126Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000023507Member 2021-06-29 2021-06-29 0001100663 ist:S000013700Member ist:BloombergBarclaysUSIntermediateGovernmentCreditBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013700Member ist:C000037542Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013700Member ist:C000037542Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013700Member 2021-06-29 2021-06-29 0001100663 ist:S000062159Member ist:BloombergBarclaysMsciUsAggregateEsgFocusIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000062159Member ist:C000201167Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000062159Member ist:C000201167Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000062159Member 2021-06-29 2021-06-29 0001100663 ist:S000013697Member ist:CorporateIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013697Member ist:C000037539Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013697Member ist:C000037539Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013697Member 2021-06-29 2021-06-29 0001100663 ist:S000018861Member ist:SPNationalAMTFreeMunicipalBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000018861Member ist:C000052220Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000018861Member ist:C000052220Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000018861Member 2021-06-29 2021-06-29 0001100663 ist:S000016772Member ist:MarkitiBoxxUsdLiquidHighYieldIndexOneMember 2021-06-29 2021-06-29 0001100663 ist:S000016772Member ist:C000046846Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000016772Member ist:C000046846Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000016772Member 2021-06-29 2021-06-29 0001100663 ist:S000068817Member ist:C000219898Member 2021-06-29 2021-06-29 0001100663 ist:S000068817Member 2021-06-29 2021-06-29 0001100663 ist:S000013695Member ist:ICEUSTreasuryThreeSevenYearBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013695Member ist:C000037537Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013695Member ist:C000037537Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013695Member 2021-06-29 2021-06-29 0001100663 ist:S000013694Member ist:ICEShortUSTreasurySecuritiesIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013694Member ist:C000037536Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013694Member ist:C000037536Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013694Member 2021-06-29 2021-06-29 0001100663 ist:S000004361Member ist:MarkitiBoxUSDLiquidInvestmentGradeIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000004361Member ist:C000012091Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000004361Member ist:C000012091Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000004361Member 2021-06-29 2021-06-29 0001100663 ist:S000058036Member ist:BloombergBarclaysMsciUsCorporateOneFiveYearEsgFocusIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000058036Member ist:C000189864Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000058036Member ist:C000189864Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000058036Member 2021-06-29 2021-06-29 0001100663 ist:S000069558Member ist:C000221912Member 2021-06-29 2021-06-29 0001100663 ist:S000069558Member 2021-06-29 2021-06-29 0001100663 ist:S000004360Member ist:ICEUSTreasuryTwentyPlusYearBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000004360Member ist:C000012090Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000004360Member ist:C000012090Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000004360Member 2021-06-29 2021-06-29 0001100663 ist:S000013696Member ist:ICEUSTreasuryTenHypenTwentyYearBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013696Member ist:C000037538Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013696Member ist:C000037538Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013696Member 2021-06-29 2021-06-29 0001100663 ist:S000068768Member ist:C000219740Member 2021-06-29 2021-06-29 0001100663 ist:S000068768Member 2021-06-29 2021-06-29 0001100663 ist:S000055401Member ist:BloombergBarclaysUSUniversalFiveHypenTenYearIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000055401Member ist:C000174365Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000055401Member ist:C000174365Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000055401Member 2021-06-29 2021-06-29 0001100663 ist:S000019341Member ist:SPCaliforniaAMTFreeMunicipalBondIndexTmMember 2021-06-29 2021-06-29 0001100663 ist:S000019341Member ist:C000053739Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000019341Member ist:C000053739Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000019341Member 2021-06-29 2021-06-29 0001100663 ist:S000004357Member ist:ICEUSTreasuryOneHypenThreeYearBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000004357Member ist:C000012087Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000004357Member ist:C000012087Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000004357Member 2021-06-29 2021-06-29 0001100663 ist:S000019342Member ist:SPNewYorkAMTFreeMunicipalBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000019342Member ist:C000053740Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000019342Member ist:C000053740Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000019342Member 2021-06-29 2021-06-29 0001100663 ist:S000058037Member ist:BloombergBarclaysMSCIUSCorporateESGFocusIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000058037Member ist:C000189865Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000058037Member ist:C000189865Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000058037Member 2021-06-29 2021-06-29 0001100663 ist:S000013698Member ist:ICEBofAFiveTenYearUSCorporateIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013698Member ist:C000037540Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013698Member ist:C000037540Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013698Member 2021-06-29 2021-06-29 0001100663 ist:S000057342Member ist:BlackRockInvestmentGradeEnhancedBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000057342Member ist:C000182993Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000057342Member ist:C000182993Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000057342Member 2021-06-29 2021-06-29 0001100663 ist:S000004362Member ist:BloombergBarclaysUsAggregateBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000004362Member ist:C000012092Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000004362Member ist:C000012092Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000004362Member 2021-06-29 2021-06-29 0001100663 ist:S000026651Member ist:ICEBofATenPlusYearUSCorporateIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000026651Member ist:C000080009Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000026651Member ist:C000080009Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000026651Member 2021-06-29 2021-06-29 0001100663 ist:S000004358Member ist:ICEUSTreasurySevenHypenTenYearBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000004358Member ist:C000012088Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000004358Member ist:C000012088Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000004358Member 2021-06-29 2021-06-29 0001100663 ist:S000013699Member ist:ICEBofAUSCorporateIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013699Member ist:C000037541Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013699Member ist:C000037541Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013699Member 2021-06-29 2021-06-29 0001100663 ist:S000023506Member ist:BloombergBarclaysUSAgencyBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000023506Member ist:C000069125Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000023506Member ist:C000069125Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000023506Member 2021-06-29 2021-06-29 0001100663 ist:S000013702Member ist:BloombergBarclaysUSMBSIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013702Member ist:C000037544Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013702Member ist:C000037544Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013702Member 2021-06-29 2021-06-29 0001100663 ist:S000013701Member ist:BloombergBarclaysUsGovernmentCreditBondIndexMember 2021-06-29 2021-06-29 0001100663 ist:S000013701Member ist:C000037543Member rr:AfterTaxesOnDistributionsAndSalesMember 2021-06-29 2021-06-29 0001100663 ist:S000013701Member ist:C000037543Member rr:AfterTaxesOnDistributionsMember 2021-06-29 2021-06-29 0001100663 ist:S000013701Member 2021-06-29 2021-06-29 xbrli:pure iso4217:USD

As filed with the U.S. Securities and Exchange Commission on June 22, 2021

File Nos. 333‑92935 and 811‑09729

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

|

|

|

|

|

|

|

REGISTRATION STATEMENT |

|

|

|

|

UNDER |

|

|

|

|

THE SECURITIES ACT OF 1933 |

|

☒ |

|

|

Post-Effective Amendment No. 2,473 |

|

☒ |

|

|

and/or |

|

|

|

|

REGISTRATION STATEMENT |

|

|

|

|

UNDER |

|

|

|

|

THE INVESTMENT COMPANY ACT OF 1940 |

|

☒ |

|

|

Amendment No. 2,473 |

|

☒ |

(Check appropriate box or boxes)

iShares Trust

(Exact Name of Registrant as Specified in Charter)

c/o State Street Bank and Trust Company

1 Lincoln Street

Mail Stop SFC0805

Boston, MA 02111

(Address of Principal Executive Office)(Zip Code)

Registrant’s Telephone Number, including Area Code: (415) 670‑2000

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and Address of Agent for Service)

With Copies to:

|

|

|

| MARGERY K. NEALE, ESQ. WILLKIE FARR & GALLAGHER LLP 787 SEVENTH AVENUE NEW YORK, NY 10019-6099 |

|

DEEPA DAMRE SMITH, ESQ. BLACKROCK FUND ADVISORS 400 HOWARD STREET SAN FRANCISCO, CA 94105 |

It is proposed that this filing will become effective (check appropriate box):

| ☐ |

Immediately upon filing pursuant to paragraph (b) |

| ☒ |

On June 29, 2021 pursuant to paragraph (b) |

| ☐ |

60 days after filing pursuant to paragraph (a)(1) |

| ☐ |

On (date) pursuant to paragraph (a)(1) |

| ☐ |

75 days after filing pursuant to paragraph (a)(2) |

| ☐ |

On (date) pursuant to paragraph (a)(2) |

If appropriate, check the following box:

| ☐ |

This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

|

June 29, 2021 |

| |

|

|

2021 Prospectus |

iShares Trust

| • |

iShares 0-3 Month Treasury Bond ETF | SGOV | NYSE ARCA |

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

S-1 |

|

1 |

|

2 |

|

10 |

|

12 |

|

12 |

|

15 |

|

23 |

|

23 |

|

25 |

|

25 |

ICE® is a trademark of ICE Data Indices, LLC or its affiliates and has been licensed for use for certain purposes by BlackRock Fund Advisors or its affiliates. iShares® and BlackRock® are registered trademarks of BlackRock Fund Advisors and its affiliates.

[THIS PAGE INTENTIONALLY LEFT BLANK]

iSHARES® 0-3 MONTH TREASURY BOND ETF

| Ticker: SGOV |

Stock Exchange: NYSE Arca |

Investment Objective

The iShares 0-3 Month Treasury Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities of less than or equal to three months.

Fees and Expenses

The following table describes the fees and expenses that you will incur if you buy, hold and sell shares of the Fund. The investment advisory agreement between iShares Trust (the “Trust”) and BlackRock Fund Advisors (“BFA”) (the “Investment Advisory Agreement”) provides that BFA will pay all operating expenses of the Fund, except the management fees, interest expenses, taxes, expenses incurred with respect to the acquisition and disposition of portfolio securities and the execution of portfolio transactions, including brokerage commissions, distribution fees or expenses, litigation expenses and any extraordinary expenses. BFA, the investment adviser to the Fund, has contractually agreed to waive a portion of its management fee so that the Fund’s total annual fund operating expenses after the fee waiver will not exceed 0.03% through June 30, 2022. The contractual waiver may be terminated prior to June 30, 2022 only upon written agreement of the Trust and BFA.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses

(ongoing expenses that you pay each year as a

percentage of the value of your investments) |

Management

Fees |

|

Distribution and

Service (12b-1)

Fees |

|

Other

Expenses1 |

|

Total Annual

Fund

Operating

Expenses |

|

Fee Waiver |

|

Total Annual

Fund

Operating

Expenses

After

Fee Waiver |

| 0.12% |

|

None |

|

0.00% |

|

0.12% |

|

(0.09)% |

|

0.03% |

| 1 |

The amount rounded to 0.00%. |

Example. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

| $3 |

|

$30 |

|

$59 |

|

$145 |

Portfolio Turnover. The Fund may pay transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. From inception (May 26, 2020) to the most recent fiscal year end, the Fund's portfolio turnover rate was 326% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to track the investment results of the ICE® 0-3 Month US Treasury Securities Index (the “Underlying Index”), which measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of less than or equal to three months. As of February 28, 2021, there were 34 components in the Underlying Index.

The Underlying Index is market value weighted based on amounts outstanding of issuances consisting of publicly issued U.S. Treasury securities with a remaining term to final maturity of less than or equal to three months as of the rebalance date and have $1 billion or more of outstanding face value, excluding amounts held by the Federal Reserve System Open Market Account. In addition, the securities in the Underlying Index must have a fixed coupon schedule and be denominated in U.S. dollars. Excluded from the Underlying Index are inflation-linked securities, cash management bills and zero-coupon bonds that have been

stripped from coupon-paying bonds (e.g., Separate Trading of Registered Interest and Principal of Securities). However, the amounts outstanding of qualifying coupon securities in the Underlying Index are not reduced by any individual components of such securities (i.e., coupon or principal) that have been stripped after inclusion in the Underlying Index. The Underlying Index is rebalanced on the last calendar day of each month.

The Underlying Index does not provide for the reinvestment of cash flows from coupon payments or the proceeds of maturing component securities between rebalance dates. Consequently, the Fund may hold money market instruments.

BFA uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Indexing seeks to achieve lower costs and better after-tax performance by aiming to keep portfolio turnover low in comparison to actively managed investment companies.

BFA uses a representative sampling indexing strategy to manage the Fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to that of an applicable underlying index. The securities

selected are expected to have, in the aggregate, investment characteristics (based on factors such as market value and industry weightings), fundamental characteristics (such as return variability, duration, maturity, credit ratings and yield) and liquidity measures similar to those of an applicable underlying index. The Fund may or may not hold all of the securities in the Underlying Index.

The Fund generally will invest at least 90% of its assets in the component securities of the Underlying Index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates (“BlackRock Cash Funds”), as well as in securities not included in the Underlying Index, but which BFA believes will help the Fund track the Underlying Index. From time to time when conditions warrant, however, the Fund may invest at least 80% of its assets in the component securities of the Underlying Index and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of BlackRock Cash Funds, as well as in securities not included in the Underlying Index, but which BFA believes will help the Fund track the Underlying Index. The Fund seeks to track the investment results of the Underlying Index before fees and expenses of the Fund.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of any collateral received).

The Underlying Index is sponsored by ICE Data Indices, LLC or its affiliates (collectively, the “Index Provider” or

“IDI”), which is independent of the Fund and BFA. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

Summary of Principal Risks

As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund's net asset value per share (“NAV”), trading price, yield, total return and ability to meet its investment objective. The order of the below risk factors does not indicate the significance of any particular risk factor.

U.S. Treasury Obligations Risk. U.S. Treasury obligations may differ from other securities in their interest rates, maturities, times of issuance and other characteristics and may provide relatively lower returns than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's U.S. Treasury obligations to decline.

Interest Rate Risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Very low or negative interest rates may magnify interest rate risk. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, result in heightened market volatility and detract from the Fund’s performance to the extent the Fund is exposed to such interest rates. Additionally, under

certain market conditions in which interest rates are low and the market prices for portfolio securities have increased, the Fund may have a very low or even negative yield. A low or negative yield would cause the Fund to lose money in certain conditions and over certain time periods. An increase in interest rates will generally cause the value of securities held by the Fund to decline, may lead to heightened volatility in the fixed-income markets and may adversely affect the liquidity of certain fixed-income investments, including those held by the Fund. The historically low interest rate environment heightens the risks associated with rising interest rates.

Income Risk. The Fund's income may decline if interest rates fall. This decline in income can occur because the Fund may subsequently invest in lower-yielding bonds as bonds in its portfolio mature, are near maturity or are called, bonds in the Underlying Index are substituted, or the Fund otherwise needs to purchase additional bonds.

Risk of Investing in the U.S. Certain changes in the U.S. economy, such as when the U.S. economy weakens or when its financial markets decline, may have an adverse effect on the securities to which the Fund has exposure.

Asset Class Risk. Securities in the Underlying Index or in the Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes.

Assets Under Management (AUM) Risk. From time to time, an Authorized Participant (as defined in the Creations and Redemptions section of this prospectus (the “Prospectus”)), a third-party investor, the Fund’s adviser or an

affiliate of the Fund’s adviser, or a fund may invest in the Fund and hold its investment for a specific period of time to allow the Fund to achieve size or scale. There can be no assurance that any such entity would not redeem its investment or that the size of the Fund would be maintained at such levels, which could negatively impact the Fund.

Authorized Participant Concentration Risk. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund, and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. The Fund has a limited number of institutions that may act as Authorized Participants on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting.

Concentration Risk. The Fund may be susceptible to an increased risk of loss, including losses due to adverse events that affect the Fund’s investments more than the market as a whole, to the extent that the Fund's investments are concentrated in the securities and/or other assets of a particular issuer or issuers, country, group of countries, region, market, industry, group of industries, sector, market segment or asset class.

Cybersecurity Risk. Failures or breaches of the electronic systems of the Fund, the Fund's adviser, distributor, the Index Provider and other service

providers, market makers, Authorized Participants or the issuers of securities in which the Fund invests have the ability to cause disruptions, negatively impact the Fund’s business operations and/or potentially result in financial losses to the Fund and its shareholders. While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in such plans and systems. Furthermore, the Fund cannot control the cybersecurity plans and systems of the Fund’s Index Provider and other service providers, market makers, Authorized Participants or issuers of securities in which the Fund invests.

High Portfolio Turnover Risk. High portfolio turnover (considered by the Fund to mean higher than 100% annually) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities.

Index-Related Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market

conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition.

Infectious Illness Risk. An outbreak of an infectious respiratory illness, COVID-19, caused by a novel coronavirus has resulted in travel restrictions, disruption of healthcare systems, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, layoffs, ratings downgrades, defaults and other significant economic impacts. Certain markets have experienced temporary closures, extreme volatility, severe losses, reduced liquidity and increased trading costs. These events will have an impact on the Fund and its investments and could impact the Fund’s ability to purchase or sell securities or cause elevated tracking error and increased premiums or discounts to the Fund's NAV. Other infectious illness outbreaks in the future may result in similar impacts.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. The Fund may be adversely affected if an issuer of underlying securities held by the Fund is unable or unwilling to repay principal or interest when due.

Management Risk. As the Fund will not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results.

Market Risk. The Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Local, regional or global events such as war, acts of

terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments and could result in increased premiums or discounts to the Fund’s NAV.

Market Trading Risk. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruptions in the creation/redemption process. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE FUND'S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Operational Risk. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. The Fund and BFA seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address significant operational risks.

Passive Investment Risk. The Fund is not actively managed, and BFA generally does not attempt to take defensive positions under any market conditions, including declining markets.

Securities Lending Risk. The Fund may engage in securities lending. Securities lending involves the risk that the Fund may lose money because the borrower of the loaned securities fails to return

the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities held in the Fund’s portfolio and those included in the Underlying Index, pricing differences, transaction costs incurred by the Fund, the Fund’s holding of uninvested cash, differences in timing of the accrual of or the valuation of distributions, the requirements to maintain pass-through tax treatment, portfolio transactions carried out to minimize the distribution of capital gains to shareholders, acceptance of custom baskets, changes to the Underlying Index or the costs to the Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not.

Performance Information

As of the date of the Prospectus, the Fund has been in operation for less than one full calendar year and therefore does not report its performance information.

Management

Investment Adviser. BlackRock Fund Advisors.

Portfolio Managers. James Mauro and Karen Uyehara (the “Portfolio Managers”) are primarily responsible for the day-to-day management of the Fund. Each Portfolio Manager supervises a portfolio management team. Mr. Mauro and Ms. Uyehara have been Portfolio Managers of the Fund since 2020 and 2021, respectively.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (commonly referred to as an “ETF”). Individual shares of the Fund may only be bought and sold in the secondary market through a broker-dealer. Because ETF shares trade at market prices rather than at NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the “bid-ask spread”).

Tax Information

The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a 401(k) plan or an individual retirement account (“IRA”), in which case, your distributions generally will be taxed when withdrawn. Certain states and localities may exempt from tax distributions attributable to interest from U.S. federal government obligations. Please consult your personal tax advisor.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

[THIS PAGE INTENTIONALLY LEFT BLANK]

More Information About the Fund

This Prospectus contains important information about investing in the Fund. Please read this Prospectus carefully before you make any investment decisions. Additional information regarding the Fund is available at www.iShares.com.

BFA is the investment adviser to the Fund. Shares of the Fund are listed for trading on NYSE Arca, Inc. (“NYSE Arca”). The market price for a share of the Fund may be different from the Fund’s most recent NAV.

ETFs are funds that trade like other publicly-traded securities. The Fund is designed to track an index. Similar to shares of an index mutual fund, each share of the Fund represents an ownership interest in an underlying portfolio of securities and other instruments intended to track a market index. Unlike shares of a mutual fund, which can be bought and redeemed from the issuing fund by all shareholders at a price based on NAV, shares of the Fund may be purchased or redeemed directly from the Fund at NAV solely by Authorized Participants and only in aggregations of a specified number of shares (“Creation Units”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

The Fund invests in a particular segment of the securities markets and seeks to track the performance of a securities index that is not representative of the market as a whole. The Fund is designed to be used as part of broader asset allocation strategies. Accordingly, an investment in the Fund should not constitute a complete investment program.

An index is a financial calculation, based on a grouping of financial instruments, and is not an investment product, while the Fund is an actual investment portfolio. The performance of the Fund and the Underlying Index may vary for a number of reasons, including transaction costs, non-U.S. currency valuations, asset valuations, corporate actions (such as mergers and spin-offs), timing variances and differences between the Fund’s portfolio and the Underlying Index resulting from the Fund's use of representative sampling or from legal restrictions (such as diversification requirements) that apply to the Fund but not to the Underlying Index. From time to time, the Index Provider may make changes to the methodology or other adjustments to the Underlying Index. Unless otherwise determined by BFA, any such change or adjustment will be reflected in the calculation of the Underlying Index performance on a going-forward basis after the effective date of such change or adjustment. Therefore, the Underlying Index performance shown for periods prior to the effective date of any such change or adjustment will generally not be recalculated or restated to reflect such change or adjustment.

“Tracking error” is the divergence of the Fund's performance from that of the Underlying Index. Because the Fund uses a representative sampling indexing strategy, it can be expected to have a larger tracking error than if it used a replication indexing strategy. “Replication” is an indexing strategy in which a fund invests in substantially all

of the securities in its underlying index in approximately the same proportions as in the underlying index.

An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, BFA or any of its affiliates.

The Fund's investment objective and the Underlying Index may be changed without shareholder approval.

A Further Discussion of Principal Risks

The Fund is subject to various risks, including the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. You could lose all or part of your investment in the Fund, and the Fund could underperform other investments. The order of the below risk factors does not indicate the significance of any particular risk factor.

U.S. Treasury Obligations Risk. U.S. Treasury obligations may differ from other securities in their interest rates, maturities, times of issuance and other characteristics. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's U.S. Treasury obligations to decline. On August 5, 2011, S&P Global Ratings downgraded U.S. Treasury securities from AAA rating to AA+ rating. A further downgrade of the ratings of U.S. government debt obligations, which are often used as a benchmark for other borrowing arrangements, could result in higher interest rates for individual and corporate borrowers, cause disruptions in the international bond markets and have a substantial negative effect on the U.S. economy. A downgrade of U.S. Treasury securities from another ratings agency or a further downgrade below AA+ rating by S&P Global Ratings may cause the value of the Fund’s U.S. Treasury obligations to decline.

Interest Rate Risk. If interest rates rise, the value of fixed-income securities or other instruments held by the Fund would likely decrease. A measure investors commonly use to determine this price sensitivity is called duration. Fixed-income securities with longer durations tend to be more sensitive to interest rate changes, usually making their prices more volatile than those of securities with shorter durations. To the extent the Fund invests a substantial portion of its assets in fixed-income securities with longer duration, rising interest rates may cause the value of the Fund's investments to decline significantly, which would adversely affect the value of the Fund. An increase in interest rates may lead to heightened volatility in the fixed-income markets and adversely affect certain fixed-income investments, including those held by the Fund. In addition, decreases in fixed income dealer market-making capacity may lead to lower trading volume, heightened volatility, wider bid-ask spreads and less transparent pricing in certain fixed-income markets.

The historically low interest rate environment was created in part by the world’s major central banks keeping their overnight policy interest rates at, near or below zero percent and implementing monetary policy facilities, such as asset purchase programs, to anchor longer-term interest rates below historical levels. During periods of very low

or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Certain countries have recently experienced negative interest rates on certain fixed-income instruments. Very low or negative interest rates may magnify interest rate risk. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, result in heightened market volatility and detract from the Fund’s performance to the extent the Fund is exposed to such interest rates. Additionally, under certain market conditions in which interest rates are set at low levels and the market prices of portfolio securities have increased, the Fund may have a very low, or even negative yield. A low or negative yield would cause the Fund to lose money in certain conditions and over certain time periods. Central banks may increase their short-term policy rates or begin phasing out, or “tapering,” accommodative monetary policy facilities in the future. The timing, coordination, magnitude and effect of such policy changes on various markets are uncertain, and such changes in monetary policy may adversely affect the value of the Fund’s investments.

Income Risk. The Fund’s income may decline if interest rates fall. This decline in income can occur because the Fund may subsequently invest in lower-yielding bonds as bonds in its portfolio mature, are near maturity or are called, bonds in the Underlying Index are substituted, or the Fund otherwise needs to purchase additional bonds. The Index Provider’s substitution of bonds in the Underlying Index may occur, for example, when the time to maturity for the bond no longer matches the Underlying Index’s stated maturity guidelines.

Risk of Investing in the U.S. A decrease in imports or exports, changes in trade regulations and/or an economic recession in the U.S. may have a material adverse effect on the U.S. economy and the securities listed on U.S. exchanges. Proposed and adopted policy and legislative changes in the U.S. are changing many aspects of financial, commercial, public health, environmental, and other regulation and may have a significant effect on U.S. markets generally, as well as on the value of certain securities. Governmental agencies project that the U.S. will continue to maintain elevated public debt levels for the foreseeable future. Although elevated debt levels do not necessarily indicate or cause economic problems, elevated public debt service costs may constrain future economic growth.

The U.S. has developed increasingly strained relations with a number of foreign countries. If relations with certain countries deteriorate, it could adversely affect U.S. issuers as well as non-U.S. issuers that rely on the U.S. for trade. The U.S. has also experienced increased internal unrest and discord, as well as significant challenges in managing and containing the outbreak of COVID-19. If these trends were to continue, it may have an adverse impact on the U.S. economy and the issuers in which the Fund invests.

Asset Class Risk. The securities in the Underlying Index or in the Fund’s portfolio may underperform in comparison to other securities or indexes that track other countries, groups of countries, regions, industries, groups of industries, markets, market segments, asset classes or sectors. Various types of securities and indexes may experience cycles of outperformance and underperformance in comparison to the

general financial markets. This may cause the Fund to underperform other investment vehicles that invest in different asset classes.

Assets Under Management (AUM) Risk. From time to time, an Authorized Participant, a third-party investor, the Fund’s adviser or an affiliate of the Fund’s adviser, or a fund may invest in the Fund and hold its investment for a specific period of time to allow the Fund to achieve size or scale. There can be no assurance that any such entity would not redeem its investment or that the size of the Fund would be maintained at such levels, which could negatively impact the Fund.

Authorized Participant Concentration Risk. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund, and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. The Fund has a limited number of institutions that may act as Authorized Participants on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting.

Concentration Risk. The Fund may be susceptible to an increased risk of loss, including losses due to adverse events that affect the Fund’s investments more than the market as a whole, to the extent that the Fund's investments are concentrated in the securities and/or other assets of a particular issuer or issuers, country, group of countries, region, market, industry, group of industries, sector, market segment or asset class. The Fund may be more adversely affected by the underperformance of those securities and/or other assets, may experience increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting those securities and/or other assets than a fund that does not concentrate its investments.

Cybersecurity Risk. With the increased use of technologies such as the internet to conduct business, the Fund, Authorized Participants, service providers and the relevant listing exchange are susceptible to operational, information security and related “cyber” risks both directly and through their service providers. Similar types of cybersecurity risks are also present for issuers of securities in which the Fund invests, which could result in material adverse consequences for such issuers and may cause the Fund’s investment in such issuers to lose value. Unlike many other types of risks faced by the Fund, these risks typically are not covered by insurance. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber incidents include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Cyberattacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users). Recently, geopolitical tensions may have increased the scale and sophistication of deliberate attacks, particularly those from nation-states or from entities with nation-state backing.

Cybersecurity failures by, or breaches of, the systems of the Fund’s adviser, distributor and other service providers (including, but not limited to, index and benchmark providers, fund accountants, custodians, transfer agents and administrators), market makers, Authorized Participants or the issuers of securities in which the Fund invests, have the ability to cause disruptions and impact business operations, potentially resulting in: financial losses, interference with the Fund’s ability to calculate its NAV, disclosure of confidential trading information, impediments to trading, submission of erroneous trades or erroneous creation or redemption orders, the inability of the Fund or its service providers to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs. In addition, cyberattacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. Substantial costs may be incurred by the Fund in order to resolve or prevent cyber incidents in the future. While the Fund has established business continuity plans in the event of, and risk management systems to prevent, such cyber incidents, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified and that prevention and remediation efforts will not be successful or that cyberattacks will go undetected. Furthermore, the Fund cannot control the cybersecurity plans and systems put in place by service providers to the Fund, issuers in which the Fund invests, the Index Provider, market makers or Authorized Participants. The Fund and its shareholders could be negatively impacted as a result.

High Portfolio Turnover Risk. High portfolio turnover (considered by the Fund to mean higher than 100% annually) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. These effects of higher than normal portfolio turnover may adversely affect Fund performance.

Index-Related Risk. The Fund seeks to achieve a return that corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. There is no assurance that the Index Provider or any agents that may act on its behalf will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed or calculated accurately. While the Index Provider provides descriptions of what the Underlying Index is designed to achieve, neither the Index Provider nor its agents provide any warranty or accept any liability in relation to the quality, accuracy or completeness of the Underlying Index or its related data, and they do not guarantee that the Underlying Index will be in line with the Index Provider’s methodology. BFA’s mandate as described in this Prospectus is to manage the Fund consistently with the Underlying Index provided by the Index Provider to BFA. BFA does not provide any warranty or guarantee against the Index Provider’s or any agent’s errors. Errors in respect of the quality, accuracy and completeness of the data used to compile the Underlying Index may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used as benchmarks by funds or managers. Such errors may negatively or positively impact the Fund and its shareholders. For example, during a period where the Underlying Index contains

incorrect constituents, the Fund would have market exposure to such constituents and would be underexposed to the Underlying Index’s other constituents. Shareholders should understand that any gains from Index Provider errors will be kept by the Fund and its shareholders and any losses or costs resulting from Index Provider errors will be borne by the Fund and its shareholders.

Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance to the Underlying Index, which could cause the Underlying Index to vary from its normal or expected composition. The postponement of a scheduled rebalance in a time of market volatility could mean that constituents of the Underlying Index that would otherwise be removed at rebalance due to changes in market value, issuer credit ratings, or other reasons may remain, causing the performance and constituents of the Underlying Index to vary from those expected under normal conditions. Apart from scheduled rebalances, the Index Provider or its agents may carry out additional ad hoc rebalances to the Underlying Index due to reaching certain weighting constraints, unusual market conditions or corporate events or, for example, to correct an error in the selection of index constituents. When the Underlying Index is rebalanced and the Fund in turn rebalances its portfolio to attempt to increase the correlation between the Fund’s portfolio and the Underlying Index, any transaction costs and market exposure arising from such portfolio rebalancing will be borne directly by the Fund and its shareholders. Therefore, errors and additional ad hoc rebalances carried out by the Index Provider or its agents to the Underlying Index may increase the costs to and the tracking error risk of the Fund.

Infectious Illness Risk. An outbreak of an infectious respiratory illness, COVID-19, caused by a novel coronavirus that was first detected in December 2019 has spread globally. The impact of this outbreak has adversely affected the economies of many nations and the global economy, and may impact individual issuers and capital markets in ways that cannot be foreseen. The duration of the outbreak and its effects cannot be predicted with certainty. Any market or economic disruption can be expected to result in elevated tracking error and increased premiums or discounts to the Fund's NAV.

| ■ |

General Impact. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of, and delays in, healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, temporary and permanent closures of stores, restaurants and other commercial establishments, layoffs, defaults and other significant economic impacts, as well as general concern and uncertainty. |

| ■ |

Market Volatility. The outbreak has also resulted in extreme volatility, severe losses, and disruptions in markets which can adversely impact the Fund and its investments, including impairing hedging activity to the extent a Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. In addition, to the extent the Fund invests in short-term instruments that have negative yields, the Fund’s value may be impaired as a result. Certain issuers of equity securities have cancelled or announced the suspension of dividends. The outbreak has, and may continue to, negatively affect the credit ratings of some fixed-income securities and their issuers. |

| ■ |

Market Closures. Certain local markets have been or may be subject to closures, and there can be no assurance that trading will continue in any local markets in which the Fund may invest, when any resumption of trading will occur or, once such markets resume trading, whether they will face further closures. Any suspension of trading in markets in which the Fund invests will have an impact on the Fund and its investments and will impact the Fund’s ability to purchase or sell securities in such markets. |

| ■ |

Operational Risk. The outbreak could also impair the information technology and other operational systems upon which the Fund’s service providers, including BFA, rely, and could otherwise disrupt the ability of employees of the Fund’s service providers to perform critical tasks relating to the Fund, for example, due to the service providers’ employees performing tasks in alternate locations than under normal operating conditions or the illness of certain employees of the Fund’s service providers. |

| ■ |

Governmental Interventions. Governmental and quasi-governmental authorities and regulators throughout the world have responded to the outbreak and the resulting economic disruptions with a variety of fiscal and monetary policy changes, including direct capital infusions into companies and other issuers, new monetary policy tools, and lower interest rates. An unexpected or sudden reversal of these policies, or the ineffectiveness of such policies, is likely to increase market volatility, which could adversely affect the Fund’s investments. |

| ■ |

Pre-Existing Conditions. Public health crises caused by the outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally, which could adversely affect the Fund and its investments and could result in increased premiums or discounts to the Fund's NAV. |

Other infectious illness outbreaks that may arise in the future could have similar or other unforeseen effects.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. The Fund may be adversely affected if an issuer of underlying securities held by the Fund is unable or unwilling to repay principal or interest when due.

Management Risk. Because BFA uses a representative sampling indexing strategy, the Fund will not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. As a result, the Fund is subject to the risk that BFA’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results.

Market Risk. The Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Market risk arises mainly from uncertainty about future values of financial instruments and may be influenced by price, currency and interest rate movements. It represents the potential loss the Fund may suffer through holding financial instruments in the face of market movements or uncertainty. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a

particular issuer or issuers, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments and could result in increased premiums or discounts to the Fund’s NAV. During a general market downturn, multiple asset classes may be negatively affected. Fixed-income securities with short-term maturities are generally less sensitive to such changes than are fixed-income securities with longer-term maturities. Changes in market conditions and interest rates generally do not have the same impact on all types of securities and instruments.

Market Trading Risk.

Absence of Active Market. Although shares of the Fund are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained by market makers or Authorized Participants.

Risk of Secondary Listings. The Fund's shares may be listed or traded on U.S. and non-U.S. stock exchanges other than the U.S. stock exchange where the Fund's primary listing is maintained, and may otherwise be made available to non-U.S. investors through funds or structured investment vehicles similar to depositary receipts. There can be no assurance that the Fund’s shares will continue to trade on any such stock exchange or in any market or that the Fund’s shares will continue to meet the requirements for listing or trading on any exchange or in any market. The Fund's shares may be less actively traded in certain markets than in others, and investors are subject to the execution and settlement risks and market standards of the market where they or their broker direct their trades for execution. Certain information available to investors who trade Fund shares on a U.S. stock exchange during regular U.S. market hours may not be available to investors who trade in other markets, which may result in secondary market prices in such markets being less efficient.

Secondary Market Trading Risk. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. At such times, shares may trade in the secondary market with more significant premiums or discounts than might be experienced at times when the Fund accepts purchase and redemption orders.

Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. In addition, trading in Fund shares on a stock exchange or in any market may be subject to trading halts caused by extraordinary market volatility pursuant to “circuit breaker” rules on the stock exchange or market.

Shares of the Fund, similar to shares of other issuers listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility and price decreases associated with being sold short. In addition, trading activity in derivative products based on the Fund may lead to increased trading volume and volatility in the secondary market for the shares of the Fund.

Shares of the Fund May Trade at Prices Other Than NAV. Shares of the Fund trade on stock exchanges at prices at, above or below the Fund’s most recent NAV. The NAV of the Fund is calculated at the end of each business day and fluctuates with changes in the market value of the Fund’s holdings. The trading price of the Fund's shares fluctuates continuously throughout trading hours based on both market supply of and demand for Fund shares and the underlying value of the Fund's portfolio holdings or NAV. As a result, the trading prices of the Fund’s shares may deviate significantly from NAV during periods of market volatility, including during periods of significant redemption requests or other unusual market conditions. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE FUND'S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV. However, because shares can be created and redeemed in Creation Units at NAV, BFA believes that large discounts or premiums to the NAV of the Fund are not likely to be sustained over the long term (unlike shares of many closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their NAVs). While the creation/redemption feature is designed to make it more likely that the Fund’s shares normally will trade on stock exchanges at prices close to the Fund’s next calculated NAV, exchange prices are not expected to correlate exactly with the Fund's NAV due to timing reasons, supply and demand imbalances and other factors. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. Authorized Participants may be less willing to create or redeem Fund shares if there is a lack of an active market for such shares or its underlying investments, which may contribute to the Fund’s shares trading at a premium or discount to NAV.

Costs of Buying or Selling Fund Shares. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission and other charges. In addition, you may incur the cost of the “spread”; that is, the difference between what investors are willing to pay for Fund shares (the “bid” price) and the price at which they are willing to sell Fund shares (the “ask” price). The spread, which varies over time for shares of the Fund based on trading volume and market liquidity, is generally narrower if the Fund has more trading volume and market liquidity and wider if the Fund has less trading volume and market liquidity. In addition, increased market volatility may cause wider spreads. There may also be regulatory and other charges that are incurred as a result of trading activity. Because of the costs inherent in buying or selling Fund shares, frequent trading may detract significantly from investment results and an investment in Fund shares may not be advisable for investors who anticipate regularly making small investments through a brokerage account.

Operational Risk. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund's service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. The Fund and BFA seek to reduce these operational risks through controls and procedures. However,

these measures do not address every possible risk and may be inadequate to address significant operational risks.

Passive Investment Risk. The Fund is not actively managed and may be affected by a general decline in market segments related to the Underlying Index. The Fund invests in securities included in, or representative of, the Underlying Index, regardless of their investment merits. BFA generally does not attempt to invest the Fund's assets in defensive positions under any market conditions, including declining markets.

Securities Lending Risk. The Fund may engage in securities lending. Securities lending involves the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund. BlackRock Institutional Trust Company, N.A. (“BTC”), the Fund's securities lending agent, will take into account the tax impact to shareholders of substitute payments for dividends when managing the Fund's securities lending program.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities held in the Fund’s portfolio and those included in the Underlying Index, pricing differences, transaction costs incurred by the Fund, the Fund’s holding of uninvested cash, differences in timing of the accrual of or the valuation of distributions, the requirements to maintain pass-through tax treatment, portfolio transactions carried out to minimize the distribution of capital gains to shareholders, acceptance of custom baskets, changes to the Underlying Index or the costs to the Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not.

A Further Discussion of Other Risks

The Fund may also be subject to certain other risks associated with its investments and investment strategies. The order of the below risk factors does not indicate the significance of any particular risk factor.

Cash Management Risk. To the extent the Fund holds cash, the Fund will earn reduced income (if any) on the cash and will be subject to the credit risk of the depository institution holding the cash and any fees imposed on large cash balances. If a significant amount of the Fund’s assets are invested in cash and cash equivalents, the Fund may underperform other funds that do not similarly invest in cash and cash equivalents for investment purposes and/or to collateralize derivative instruments.

Close-Out Risk for Qualified Financial Contracts. Regulations adopted by global prudential regulators require counterparties that are part of U.S. or foreign global systemically important banking organizations to include contractual restrictions on close-out and cross-default in agreements relating to qualified financial contracts. Qualified financial contracts include agreements relating to swaps, currency forwards

and other derivatives as well as repurchase agreements and securities lending agreements. The restrictions prevent the Fund from closing out a qualified financial contract during a specified time period if the counterparty is subject to resolution proceedings and also prohibit the Fund from exercising default rights due to a receivership or similar proceeding of an affiliate of the counterparty. These requirements may increase credit risk and other risks to the Fund.

Illiquid Investments Risk. The Fund may invest up to an aggregate amount of 15% of its net assets in illiquid investments. An illiquid investment is any investment that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without significantly changing the market value of the investment. To the extent the Fund holds illiquid investments, the illiquid investments may reduce the returns of the Fund because the Fund may be unable to transact at advantageous times or prices. An investment may be illiquid due to, among other things, the reduced number and capacity of traditional market participants to make a market in securities or instruments or the lack of an active market for such securities or instruments. To the extent that the Fund invests in securities or instruments with substantial market and/or credit risk, the Fund will tend to have increased exposure to the risks associated with illiquid investments. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. There can be no assurance that a security or instrument that is deemed to be liquid when purchased will continue to be liquid for as long as it is held by the Fund, and any security or instrument held by the Fund may be deemed an illiquid investment pursuant to the Fund’s liquidity risk management program. Illiquid investments may be harder to value, especially in changing markets. Although the Fund primarily seeks to redeem shares of the Fund on an in-kind basis, if the Fund is forced to sell underlying investments at reduced prices or under unfavorable conditions to meet redemption requests or for other cash needs, the Fund may suffer a loss. This may be magnified in a rising interest rate environment or other circumstances where redemptions from the Fund may be greater than normal. Other market participants may be attempting to liquidate holdings at the same time as the Fund, causing increased supply of the Fund’s underlying investments in the market and contributing to illiquid investments risk and downward pricing pressure. During periods of market volatility, liquidity in the market for the Fund’s shares may be impacted by the liquidity in the market for the underlying securities or instruments held by the Fund, which could lead to the Fund’s shares trading at a premium or discount to the Fund’s NAV.

Money Market Instruments Risk. The value of money market instruments may be affected by changing interest rates and by changes in the credit ratings of the investments. If a significant amount of the Fund's assets are invested in money market instruments, it will be more difficult for the Fund to achieve its investment objective. An investment in a money market fund is not insured or guaranteed by the FDIC or any other government agency. It is possible to lose money by investing in a money market fund. Money market funds other than government money market funds or retail money market funds “float” their NAV instead of using a stable $1.00 per share price.

Threshold/Underinvestment Risk. If certain aggregate and/or fund-level ownership thresholds are reached through transactions undertaken by BFA, its affiliates or the

Fund, or as a result of third-party transactions or actions by an issuer or regulator, the ability of BFA and its affiliates on behalf of clients (including the Fund) to purchase or dispose of investments, or exercise rights or undertake business transactions, may be restricted by regulation or otherwise impaired. The capacity of the Fund to make investments in certain securities may be affected by the relevant threshold limits, and such limitations may have adverse effects on the liquidity and performance of the Fund’s portfolio holdings compared to the performance of the Underlying Index. This may increase the risk of the Fund being underinvested to the Underlying Index and increase the risk of tracking error.

For example, in certain circumstances where the Fund invests in securities issued by companies that operate in certain regulated industries or in certain emerging or international markets, is subject to corporate or regulatory ownership restrictions, or invests in certain futures or other derivative transactions, there may be limits on the aggregate and/or fund-level amount invested or voted by BFA and its affiliates for their proprietary accounts and for client accounts (including the Fund) that may not be exceeded without the grant of a license or other regulatory or corporate consent or, if exceeded, may cause BFA and its affiliates, the Fund or other client accounts to suffer disadvantages or business restrictions.

Portfolio Holdings Information

A description of the Trust's policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available in the Fund's Statement of Additional Information (“SAI”). The Fund discloses its portfolio holdings daily at www.iShares.com. Fund fact sheets provide information regarding the Fund's top holdings and may be requested by calling 1-800-iShares (1-800-474-2737).

Management