UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09729

iShares Trust

(Exact name of registrant as specified in charter)

| c/o: Investors Bank & Trust Company 200 Clarendon Street; Boston, MA 02116 | ||

| (Address of principal executive offices) (Zip code) | ||

The Corporation Trust Company

1209 Orange Street; Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-474-2737

Date of fiscal year end: February 28, 2006

Date of reporting period: February 28, 2006

| Item 1. | Reports to Stockholders. |

iShares®

2006 ANNUAL REPORT TO SHAREHOLDERS | FEBRUARY 28, 2006

iSHARES BOND FUNDS

iSHARES LEHMAN 1-3 YEAR TREASURY BOND FUND

iSHARES LEHMAN 7-10 YEAR TREASURY BOND FUND

iSHARES LEHMAN 20+ YEAR TREASURY BOND FUND

iSHARES LEHMAN TIPS BOND FUND

iSHARES LEHMAN AGGREGATE BOND FUND

iSHARES GS $ INVESTOPTM CORPORATE BOND FUND

| 1 | ||

| 11 | ||

| 13 | ||

| 13 | ||

| 17 | ||

| 21 | ||

| 25 | ||

| 29 | ||

| 36 | ||

| 42 | ||

| 46 | ||

| 52 | ||

| 59 | ||

| 60 | ||

| 61 | ||

| 63 | ||

| iShares Family of Funds | 66 |

Management’s Discussion of Fund Performance

iSHARES® LEHMAN TREASURY BOND FUNDS

Performance as of February 28, 2006

| Average Annual Total Returns |

Cumulative Total Returns |

||||||||||||||||||||||||||

| Year Ended 2/28/06 |

Inception to 2/28/06 |

Inception to 2/28/06 |

|||||||||||||||||||||||||

| iSHARES BOND FUND |

NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

||||||||||||||||||

| Lehman 1-3 Year Treasury |

2.01 | % | 2.09 | % | 2.15 | % | 1.81 | % | 1.83 | % | 1.96 | % | 6.68 | % | 6.75 | % | 7.25 | % | |||||||||

| Lehman 7-10 Year Treasury |

2.21 | % | 2.32 | % | 2.33 | % | 4.16 | % | 4.16 | % | 4.09 | % | 15.83 | % | 15.86 | % | 15.59 | % | |||||||||

| Lehman 20+ Year Treasury |

6.12 | % | 6.07 | % | 6.22 | % | 7.81 | % | 7.78 | % | 7.90 | % | 31.18 | % | 31.06 | % | 31.58 | % | |||||||||

| Lehman TIPS |

3.04 | % | 3.03 | % | 3.21 | % | 5.16 | % | 5.18 | % | 5.35 | % | 11.92 | % | 11.96 | % | 12.38 | % | |||||||||

Total returns for the periods since inception are calculated from the inception date of each Fund (7/22/02 for the three iShares Lehman Treasury Bond Funds and 12/4/03 for the iShares Lehman TIPS Bond Fund). “Average annual total returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative total returns” represent the total change in value of an investment over the periods indicated.

Each Fund’s per share net asset value or “NAV” is the value of one share of such Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of each Fund and the market return is based on the market price per share of each Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the stock exchange on which the shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. Since shares of each Fund did not trade in the secondary market until several days after each Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (7/26/02 for the three iShares Lehman Treasury Bond Funds and 12/5/03 for the iShares Lehman TIPS Bond Fund), the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in each Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike each Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by each Fund. These expenses negatively impact the performance of each Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The returns shown in the tables above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of each Fund will vary with changes in market conditions. Shares of each Fund may be worth more or less than their original cost when they are redeemed or sold in the market. Each Fund’s past performance is no guarantee of future results.

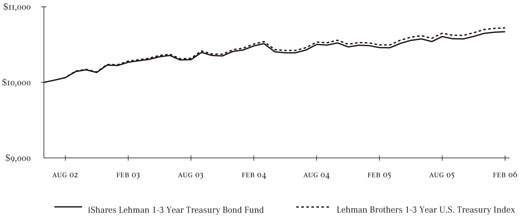

iShares Lehman 1-3 Year Treasury Bond Fund

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

1 |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN TREASURY BOND FUNDS

iShares Lehman 7-10 Year Treasury Bond Fund

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

iShares Lehman 20+ Year Treasury Bond Fund

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

| 2 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN TREASURY BOND FUNDS

iShares Lehman TIPS Bond Fund

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

Performance figures assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike each Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by each Fund. These expenses negatively impact the performance of each Fund. Each Fund’s past performance is no guarantee of future results.

The iShares Lehman 1-3 Year Treasury Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the short-term sector of the United States Treasury market, as defined by the Lehman Brothers 1-3 Year U.S. Treasury Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the one-year period ended February 28, 2006 (the “reporting period”), the Fund returned 2.01%, while the Index returned 2.15%.

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| U.S. Government Obligations |

98.82 | % | |

| Short-Term and Other Net Assets |

1.18 | ||

| TOTAL |

100.00 | % | |

| TOP FIVE FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| U.S. Treasury Notes, 3.75%, 05/15/08 |

11.52 | % | |

| U.S. Treasury Notes, 3.13%, 05/15/07 |

10.60 | ||

| U.S. Treasury Notes, 2.75%, 08/15/07 |

10.46 | ||

| U.S. Treasury Notes, 3.00%, 02/15/08 |

7.85 | ||

| U.S. Treasury Notes, 3.00%, 11/15/07 |

7.49 | ||

| TOTAL |

47.92 | % | |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

3 |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN TREASURY BOND FUNDS

The iShares Lehman 7-10 Year Treasury Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the intermediate-term sector of the United States Treasury market, as defined by the Lehman Brothers 7-10 Year U.S. Treasury Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the reporting period, the Fund returned 2.21%, while the Index returned 2.33%.

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| U.S. Government Obligations |

98.81 | % | |

| Short-Term and Other Net Assets |

1.19 | ||

| TOTAL |

100.00 | % | |

| TOP FIVE FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| U.S. Treasury Bonds, 11.25%, 02/15/15 |

26.78 | % | |

| U.S. Treasury Notes, 4.25%, 11/15/13 |

18.87 | ||

| U.S. Treasury Notes, 4.13%, 05/15/15 |

15.52 | ||

| U.S. Treasury Notes, 4.25%, 08/15/13 |

10.02 | ||

| U.S. Treasury Notes, 4.75%, 05/15/14 |

7.46 | ||

| TOTAL |

78.65 | % | |

The iShares Lehman 20+ Year Treasury Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the long-term sector of the United States Treasury market, as defined by the Lehman Brothers 20+ Year U.S. Treasury Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the reporting period, the Fund returned 6.12%, while the Index returned 6.22%.

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| U.S. Government Obligations |

98.89 | % | |

| Short-Term and Other Net Assets |

1.11 | ||

| TOTAL |

100.00 | % | |

| TOP FIVE FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| U.S. Treasury Bonds, 6.13%, 11/15/27 |

13.87 | % | |

| U.S. Treasury Bonds, 5.38%, 02/15/31 |

12.51 | ||

| U.S. Treasury Bonds, 6.25%, 05/15/30 |

12.10 | ||

| U.S. Treasury Bonds, 4.50%, 02/15/36 |

8.51 | ||

| U.S. Treasury Bonds, 6.13%, 08/15/29 |

8.13 | ||

| TOTAL |

55.12 | % | |

| 4 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN TREASURY BOND FUNDS

The iShares Lehman TIPS Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the inflation-protected sector of the United States Treasury market, as defined by the Lehman Brothers U.S. Treasury Inflation Notes Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the reporting period, the Fund returned 3.04%, while the Index returned 3.21%.

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| U.S. Government Obligations |

99.49 | % | |

| Short-Term and Other Net Assets |

0.51 | ||

| TOTAL |

100.00 | % | |

| TOP FIVE FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| U.S. Treasury Inflation Index Bonds, 3.88%, 04/15/29 |

8.63 | % | |

| U.S. Treasury Inflation Index Bonds, 2.38%, 01/15/25 |

8.43 | ||

| U.S. Treasury Inflation Index Bonds, 0.88%, 04/15/10 |

8.30 | ||

| U.S. Treasury Inflation Index Bonds, 3.00%, 07/15/12 |

7.42 | ||

| U.S. Treasury Inflation Index Bonds, 3.63%, 04/15/28 |

7.00 | ||

| TOTAL |

39.78 | % | |

Despite a challenging environment, Treasury bonds posted positive returns for the reporting period. Long-term Treasury securities produced the best results, while short- and intermediate-term Treasury bonds gained modestly.

One factor influencing bond market performance was the resiliency of the economic recovery. The U.S. economy grew by 3.5% in 2005, down from its 4.2% growth rate in 2004 but higher than the 3.1% average growth rate of the past 20 years. Job growth remained healthy – the economy added 2.1 million jobs during the reporting period, and the unemployment rate fell to its lowest level in more than four years. Retail sales also contributed to the economy’s growth, rising by 6.7% over the past year thanks in part to strong sales of gasoline and building materials.

Inflation also picked up during the reporting period, though the increase was driven largely by soaring energy prices. The consumer price index rose by 3.6% over the past year, up from 3% for the previous 12 months. Energy prices surged by 20%, but increasing industrial activity also contributed to higher prices as manufacturing capacity usage reached its highest level since September 2000.

In this environment, the Federal Reserve Board (the “Fed”) continued its series of short-term interest rate increases. The Fed raised its federal funds rate eight times during the reporting period, each time by a quarter-point. As a result, the federal funds rate rose from 2.5% to 4.5%, its highest level since May 2001. The Fed has now raised rates a total of 14 times in the past 20 months.

The Fed’s rate hikes pushed short-term Treasury yields higher; the two-year Treasury note yield rose from 3.6% to 4.7% during the reporting period, leading to modest price declines. However, interest payments more than offset the price declines, allowing short-term bonds to post gains for the reporting period. Longer-term Treasury yields were more stable – the 10-year Treasury bond yield edged up from 4.4% to 4.6%, and the longest-term Treasurys (maturing in 20 years or more) saw their yields decline during the reporting period. The perceived lack of a broad-based inflation threat kept longer-term yields in check, and consequently long-term bonds posted the best returns in the Treasury market.

Treasury inflation-protected securities (“TIPS”) also performed well, outpacing most of the nominal Treasury market (except for the longest-term bonds). Income from TIPS consists of two components – (1) the nominal interest rate, and (2) inflation adjustments to the principal value of the bond. The nominal yields of TIPS rose by more than the yields of ordinary Treasury securities during the reporting period, producing lower prices on TIPS. However, rising inflation led to increased demand for TIPS, and a higher inflation adjustment provided a boost to TIPS returns.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

5 |

Management’s Discussion of Fund Performance

iSHARES® LEHMAN AGGREGATE BOND FUND

Performance as of February 28, 2006

| Average Annual Total Returns |

Cumulative Total Returns |

|||||||||||||||||||||||

| Year Ended 2/28/06 |

Inception to 2/28/06 |

Inception to 2/28/06 |

||||||||||||||||||||||

| NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

||||||||||||||||

| 2.53% | 2.39 | % | 2.74 | % | 3.32 | % | 3.44 | % | 3.59 | % | 8.30 | % | 8.59 | % | 8.98 | % | ||||||||

Total returns for the periods since inception are calculated from the inception date of the Fund (9/22/03). “Average annual total returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative total returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until several days after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (9/26/03), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The returns shown in the tables above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

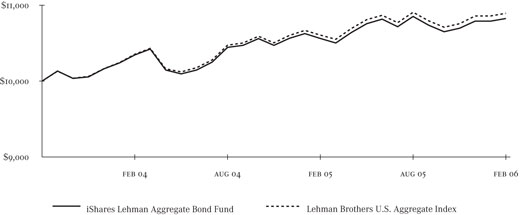

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

Performance figures assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance is no guarantee of future results.

| 6 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN AGGREGATE BOND FUND

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| Mortgage-Backed Securities |

37.61 | % | |

| U.S. Government Obligations |

25.04 | ||

| Financial |

16.81 | ||

| U.S. Government & Agency Obligations |

8.16 | ||

| Communications |

2.37 | ||

| Consumer Non-Cyclical |

2.01 | ||

| Foreign Government Obligations |

1.35 | ||

| Consumer Cyclical |

1.25 | ||

| Utilities |

1.02 | ||

| Energy |

0.83 | ||

| Technology |

0.74 | ||

| Basic Materials |

0.54 | ||

| Government |

0.51 | ||

| Industrial |

0.50 | ||

| Municipal Obligations |

0.25 | ||

| Short-Term and Other Net Assets |

1.01 | ||

| TOTAL |

100.00 | % | |

| TOP TEN FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| Federal National Mortgage Association, 5.50%, 03/01/36 |

5.50 | % | |

| U.S. Treasury Notes, 6.00%, 08/15/09 |

5.24 | ||

| U.S. Treasury Notes, 3.88%, 07/31/07 |

4.31 | ||

| Federal Home Loan Mortgage Corp., 5.50%, 03/01/36 |

4.12 | ||

| Federal National Mortgage Association, 6.00%, 03/01/36 |

4.11 | ||

| U.S. Treasury Notes, 3.00%, 11/15/07 |

3.51 | ||

| Federal Home Loan Mortgage Corp., 2.75%, 03/15/08 |

3.48 | ||

| U.S. Treasury Bonds, 8.13%, 08/15/19 |

3.22 | ||

| U.S. Treasury Bonds, 7.63%, 02/15/25 |

2.89 | ||

| Federal National Mortgage Association, 4.63%, 01/15/08 |

2.88 | ||

| TOTAL |

39.26 | % | |

The iShares Lehman Aggregate Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the total United States investment-grade bond market, as defined by the Lehman Brothers U.S. Aggregate Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the one-year period ended February 28, 2006 (the “reporting period”), the Fund returned 2.53%, while the Index returned 2.74%.

Despite a challenging environment, U.S. bonds posted positive returns for the reporting period. One factor influencing bond market performance was the resiliency of the economic recovery. The U.S. economy grew by 3.5% in 2005, down from its 4.2% growth rate in 2004 but higher than the 3.1% average growth rate of the past 20 years. Job growth remained healthy — the economy added 2.1 million jobs during the reporting period, and the unemployment rate fell to its lowest level in more than four years. Retail sales also contributed to the economy’s growth, rising by 6.7% over the past year thanks in part to strong sales of gasoline and building materials.

Inflation also picked up during the reporting period, though the increase was driven largely by soaring energy prices. The consumer price index rose by 3.6% over the past year, up from 3% for the previous 12 months. Energy prices surged by 20%, but increasing industrial activity also contributed to higher prices as manufacturing capacity usage reached its highest level since September 2000.

In this environment, the Federal Reserve Board (the “Fed”) continued its series of short-term interest rate increases. The Fed raised its federal funds rate eight times during the reporting period, each time by a quarter-point. As a result, the federal funds rate rose from 2.5% to 4.5%, its highest level since May 2001. The Fed has now raised rates a total of 14 times in the past 20 months.

The Fed’s rate hikes pushed short-term bond yields higher, but longer-term yields were relatively stable. The perceived lack of a broad-based inflation threat kept longer-term yields in check, and consequently long-term bonds outperformed during the reporting period.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

7 |

Management’s Discussion of Fund Performance (Continued)

iSHARES® LEHMAN AGGREGATE BOND FUND

From a sector standpoint, every segment of the domestic bond market gained during the reporting period. Mortgage-backed securities posted the best results as long-term interest rates rose enough to keep a lid on mortgage refinancing activity, but not enough to have a significant negative impact on bond prices. Consequently, the returns of mortgage-backed securities derived largely from their relatively high yields, which contributed to their outperformance of the overall bond market.

Treasury and government agency securities produced returns that were in line with the overall bond market. Corporate bonds, which were the market leaders in 2003 and 2004, lagged during the reporting period as investors began to take profits, seeking more attractive values elsewhere in the fixed-income market.

| 8 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance

iSHARES® GS $ INVESTOP™ CORPORATE BOND FUND

Performance as of February 28, 2006

| Average Annual Total Returns |

Cumulative Total Returns |

|||||||||||||||||||||||

| Year Ended 2/28/06 |

Inception to 2/28/06 |

Inception to 2/28/06 |

||||||||||||||||||||||

| NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

NAV |

MARKET |

INDEX |

||||||||||||||||

| 1.12% | 1.14 | % | 0.98 | % | 6.01 | % | 6.08 | % | 5.98 | % | 23.44 | % | 23.75 | % | 23.31 | % | ||||||||

Total returns for the periods since inception are calculated from the inception date of the Fund (7/22/02). “Average annual total returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative total returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until several days after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (7/26/02), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The returns shown in the tables above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

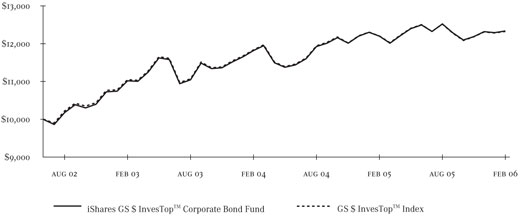

GROWTH OF $10,000 INVESTMENT

SINCE INCEPTION AT NET ASSET VALUE

Performance figures assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

9 |

Management’s Discussion of Fund Performance (Continued)

iSHARES® GS $ INVESTOP™ CORPORATE BOND FUND

| PORTFOLIO ALLOCATION As of 2/28/06 |

| ||

| Sector |

% of Net Assets |

||

| Financial |

52.88 | % | |

| Communications |

15.76 | ||

| Consumer Non-Cyclical |

6.80 | ||

| Consumer Cyclical |

6.75 | ||

| Energy |

5.05 | ||

| Basic Materials |

4.00 | ||

| Industrial |

3.02 | ||

| Technology |

1.95 | ||

| Utilities |

1.94 | ||

| Short-Term and Other Net Assets |

1.85 | ||

| TOTAL |

100.00 | % | |

| TOP TEN FUND HOLDINGS As of 2/28/06 |

| ||

| Security |

% of Net Assets |

||

| AT&T Wireless Services Inc., 8.13%, 05/01/12 |

1.18 | % | |

| Sprint Capital Corp., 8.38%, 03/15/12 |

1.13 | ||

| John Deere Capital Corp., 7.00%, 03/15/12 |

1.12 | ||

| Weyerhaeuser Co., 7.38%, 03/15/32 |

1.10 | ||

| General Electric Capital Corp., 5.00%, 01/08/16 |

1.05 | ||

| United Technologies Corp., 4.38%, 05/01/10 |

1.04 | ||

| Wells Fargo & Co., 4.20%, 01/15/10 |

1.04 | ||

| BellSouth Corp., 6.55%, 06/15/34 |

1.04 | ||

| TXU Energy Co., 7.00%, 03/15/13 |

1.04 | ||

| Kinder Morgan Energy Partners LP, 5.13%, 11/15/14 |

1.04 | ||

| TOTAL |

10.78 | % | |

The iShares GS $ InvesTop™ Corporate Bond Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of a segment of the U.S. investment-grade corporate bond market, as defined by the GS $ InvesTop™ Index (the “Index”). The Fund invests in a representative sample of the securities in the Index, which have a similar investment profile as the Index. Due to the use of representative sampling, the Fund generally does not hold all of the securities that are included in the Index. For the one-year period ended February 28, 2006 (the “reporting period”), the Fund returned 1.12%, while the Index returned 0.98%.

Despite a challenging environment, U.S. bonds posted positive returns for the reporting period. One factor influencing bond market performance was the resiliency of the economic recovery. The U.S. economy grew by 3.5% in 2005, down from its 4.2% growth rate in 2004 but higher than the 3.1% average growth rate of the past 20 years. Job growth remained healthy – the economy added 2.1 million jobs during the reporting period, and the unemployment rate fell to its lowest level in more than four years. Retail sales also contributed to the economy’s growth, rising by 6.7% over the past year thanks in part to strong sales of gasoline and building materials.

Inflation also picked up during the reporting period, though the increase was driven largely by soaring energy prices. The consumer price index rose by 3.6% over the past year, up from 3% for the previous 12 months. Energy prices surged by 20%, but increasing industrial activity also contributed to higher prices as manufacturing capacity usage reached its highest level since September 2000.

In this environment, the Federal Reserve Board (the “Fed”) continued its series of short-term interest rate increases. The Fed raised its federal funds rate eight times during the reporting period, each time by a quarter-point. As a result, the federal funds rate rose from 2.5% to 4.5%, its highest level since May 2001. The Fed has now raised rates a total of 14 times in the past 20 months.

The Fed’s rate hikes pushed short-term bond yields higher, but longer-term yields were relatively stable. The perceived lack of a broad-based inflation threat kept longer-term yields in check, and consequently long-term bonds outperformed during the reporting period.

Corporate bonds, which were the best performers in the domestic bond market in 2003 and 2004, lagged the rest of the market during the reporting period. Although the robust economic environment was favorable for corporate bonds, investors began to take profits in this sector, seeking more attractive values elsewhere in the fixed-income market.

Within the corporate sector, lower-quality bonds performed best, benefiting from a general improvement in credit quality and healthy investor demand for the higher yields offered by lower-rated securities.

| 10 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

iSHARES® TRUST

As a shareholder of an iShares Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from September 1, 2005 to February 28, 2006.

ACTUAL EXPENSES

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line under each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| iShares Bond Fund |

Beginning Account Value (September 1, 2005) |

Ending Account Value (February 28, 2006) |

Annualized Expense Ratio |

Expenses Paid (September 1, 2005 to February 28, 2006) | |||||

| Lehman 1-3 Year Treasury |

|||||||||

| Actual |

$ 1,000.00 | $ 1,006.00 | 0.16 | % | $ 0.80 | ||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,024.00 | 0.16 | 0.80 | |||||

| Lehman 7-10 Year Treasury |

|||||||||

| Actual |

1,000.00 | 981.60 | 0.16 | 0.79 | |||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,024.00 | 0.16 | 0.80 | |||||

| Lehman 20+ Year Treasury |

|||||||||

| Actual |

1,000.00 | 976.20 | 0.16 | 0.78 | |||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,024.00 | 0.16 | 0.80 | |||||

| Lehman TIPS |

|||||||||

| Actual |

1,000.00 | 998.40 | 0.21 | 1.04 | |||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,023.75 | 0.21 | 1.05 |

| SHAREHOLDER EXPENSES | 11 |

Shareholder Expenses (Continued)

iSHARES® TRUST

| iShares Bond Fund |

Beginning Account Value (September 1, 2005) |

Ending Account Value (February 28, 2006) |

Annualized Expense Ratio |

Expenses Paid During Period a (September 1, 2005 to February 28, 2006) | |||||

| Lehman Aggregate |

|||||||||

| Actual |

$ 1,000.00 | $ 997.60 | 0.21 | % | $ 1.04 | ||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,023.75 | 0.21 | 1.05 | |||||

| GS $ InvesTopTM Corporate |

|||||||||

| Actual |

1,000.00 | 984.80 | 0.16 | 0.79 | |||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,024.00 | 0.16 | 0.80 |

| a | Expenses are calculated using each Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). |

| 12 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

iSHARES® LEHMAN 1-3 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| U.S. GOVERNMENT OBLIGATIONS – 98.82% |

||||||

| U.S. Treasury Notes |

||||||

| 2.63%, 05/15/08 |

$ | 142,242,000 | $ | 136,198,136 | ||

| 2.75%, 08/15/071 |

406,002,000 | 394,617,700 | ||||

| 3.00%, 11/15/071 |

290,607,000 | 282,563,004 | ||||

| 3.00%, 02/15/081 |

305,679,000 | 296,147,941 | ||||

| 3.13%, 05/15/07 |

407,415,000 | 399,678,181 | ||||

| 3.13%, 09/15/08 |

107,388,000 | 103,452,229 | ||||

| 3.13%, 10/15/081 |

98,910,000 | 95,179,112 | ||||

| 3.25%, 01/15/091 |

51,810,000 | 49,869,714 | ||||

| 3.38%, 12/15/081 |

103,620,000 | 100,183,959 | ||||

| 3.50%, 05/31/07 |

78,657,000 | 77,453,549 | ||||

| 3.63%, 04/30/07 |

170,502,000 | 168,302,522 | ||||

| 3.63%, 06/30/07 |

138,003,000 | 135,971,596 | ||||

| 3.75%, 05/15/081 |

442,740,000 | 434,341,209 | ||||

| 4.00%, 09/30/071 |

204,885,000 | 202,526,771 | ||||

| 4.13%, 08/15/081 |

236,442,000 | 233,741,837 | ||||

| 4.25%, 10/31/071 |

141,300,000 | 140,173,843 | ||||

| 4.25%, 11/30/07 |

49,455,000 | 49,083,099 | ||||

| 4.38%, 01/31/08 |

115,395,000 | 114,726,861 | ||||

| 4.50%, 02/15/09 |

147,894,000 | 147,235,872 | ||||

| 4.75%, 11/15/08 |

165,321,000 | 165,688,012 | ||||

| TOTAL U.S. GOVERNMENT OBLIGATIONS |

3,727,135,147 | |||||

| SHORT-TERM INVESTMENTS – 48.45% |

||||||

| CERTIFICATES OF DEPOSIT2 – 0.58% |

||||||

| Toronto-Dominion Bank |

||||||

| 3.94%, 07/10/06 |

8,442,327 | 8,442,327 | ||||

| Wells Fargo Bank N.A. |

||||||

| 4.78%, 12/05/06 |

13,507,723 | 13,507,723 | ||||

| 21,950,050 | ||||||

| COMMERCIAL PAPER2 – 1.66% |

||||||

| Amstel Funding Corp. |

||||||

| 4.40%, 05/08/06 |

8,442,327 | 8,372,161 | ||||

| CC USA Inc. |

||||||

| 4.23%, 04/21/06 |

5,065,396 | 5,035,042 | ||||

| Edison Asset Securitization LLC |

||||||

| 4.37%, 05/08/06 |

8,442,327 | 8,372,640 | ||||

| Galaxy Funding Inc. |

||||||

| 4.23%, 04/18/06 |

4,845,896 | 4,818,565 | ||||

| Grampian Funding LLC |

||||||

| 4.41%, 05/15/06 |

8,442,327 | 8,364,763 | ||||

| Nordea North America Inc. |

||||||

| 4.16%, 04/04/06 |

17,728,887 | 17,659,232 | ||||

| Sigma Finance Inc. |

||||||

| 4.16%, 04/06/06 |

10,130,792 | 10,088,648 | ||||

| 62,711,051 | ||||||

| MEDIUM-TERM NOTES2 – 1.51% |

||||||

| Dorada Finance Inc. |

||||||

| 3.93%, 07/07/06 |

5,234,243 | 5,234,059 | ||||

| K2 USA LLC |

||||||

| 3.94%, 07/07/06 |

10,130,792 | 10,130,615 | ||||

| Marshall & Ilsley Bank |

||||||

| 5.18%, 12/15/06 |

16,884,654 | 16,930,660 | ||||

| Toronto-Dominion Bank |

||||||

| 3.81%, 06/20/06 |

21,105,818 | 21,106,444 | ||||

| US Bank N.A. |

||||||

| 2.85%, 11/15/06 |

3,376,931 | 3,332,836 | ||||

| 56,734,614 | ||||||

| REPURCHASE AGREEMENTS – 12.39% |

||||||

| Bear Stearns Companies Inc. (The) Repurchase Agreement, 4.62%, due 3/1/06, maturity value $25,330,231 (collateralized by non-U.S. Government debt securities, value $27,905,213, 0.00% to 9.40%, 11/15/15 to 6/12/47).2 |

25,326,981 | 25,326,981 | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.57%, due 3/1/06, maturity value $84,433,987 (collateralized by U.S. Government obligations, value $86,281,692, 3.69% to 10.00%, 5/1/09 to 1/1/36).2 |

84,423,270 | 84,423,270 | ||||

| SCHEDULES OF INVESTMENTS | 13 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 1-3 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.61%, due 3/1/06, maturity value $42,217,040 (collateralized by non-U.S. Government debt securities, value $44,393,361, 1.01%, 9/19/35).2 |

$ | 42,211,635 | $ | 42,211,635 | ||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.56%, due 3/1/06, maturity value $84,433,964 (collateralized by U.S. Government obligations, value $86,249,959, 4.50% to 7.50%, 9/1/09 to 11/1/35).2 |

84,423,270 | 84,423,270 | ||||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.71%, due 3/1/06, maturity value $84,434,315 (collateralized by non-U.S. Government debt securities, value $88,786,723, 0.00% to 10.00%, 8/15/07 to 2/1/16).2 |

84,423,270 | 84,423,270 | ||||

| Investors Bank & Trust Tri-Party Repurchase Agreement, 4.24%, due 3/1/06, maturity value $24,911,660 (collateralized by U.S. Government obligations, value $25,406,901, 6.13%, 8/15/07). |

24,908,727 | 24,908,727 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.53%, due 3/1/06, maturity value $20,264,135 (collateralized by U.S. Government obligations, value $20,700,417, 3.99% to 5.51%, 7/1/32 to 2/1/36).2 |

20,261,585 | 20,261,585 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.66%, due 3/1/06, maturity value $16,886,840 (collateralized by non-U.S. Government debt securities, value $17,419,720, 0.00% to 7.88%, 5/15/08 to 1/15/16).2 |

16,884,654 | 16,884,654 | ||||

| Morgan Stanley Repurchase Agreement, 4.61%, due 3/1/06, maturity value $84,434,081 (collateralized by non-U.S. Government debt securities, value $88,651,574, 0.00% to 7.16%, 3/1/06 to 3/25/35).2 |

84,423,270 | 84,423,270 | ||||

| 467,286,662 | ||||||

| TIME DEPOSITS2 – 3.27% |

||||||

| KBC Bank | ||||||

| 4.57%, 03/01/06 |

33,769,308 | 33,769,308 | ||||

| Societe Generale |

||||||

| 4.57%, 03/01/06 |

59,096,289 | 59,096,289 | ||||

| US Bank N.A. |

||||||

| 4.45%, 03/01/06 |

30,383,428 | 30,383,428 | ||||

| 123,249,025 | ||||||

| VARIABLE & FLOATING RATE NOTES2 – 29.04% |

||||||

| Allstate Life Global Funding II |

||||||

| 4.57% - 4.63%, 02/08/07 - 03/27/073 |

47,445,878 | 47,453,419 | ||||

| American Express Bank |

||||||

| 4.53% - 4.57%, 06/29/06 - 10/25/06 |

39,678,937 | 39,678,701 | ||||

| American Express Centurion Bank |

||||||

| 4.57%, 06/29/06 |

6,753,862 | 6,753,862 | ||||

| American Express Credit Corp. |

||||||

| 4.67%, 02/05/07 |

5,065,396 | 5,069,453 | ||||

| ASIF Global Financing |

||||||

| 4.75% - 4.95%, 05/30/06 - 08/11/063 |

54,875,126 | 54,889,307 | ||||

| Australia & New Zealand Banking Group Ltd. |

||||||

| 4.55%, 02/23/073 |

10,975,025 | 10,975,025 | ||||

| 14 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® LEHMAN 1-3 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| Bank of Ireland |

||||||

| 4.54%, 03/20/073 |

$ | 16,884,654 | $ | 16,884,654 | ||

| Beta Finance Inc. |

||||||

| 4.53% - 4.54%, 04/25/06 - 05/25/063 |

21,781,204 | 21,780,769 | ||||

| BMW US Capital LLC |

||||||

| 4.54%, 02/15/073 |

16,884,654 | 16,884,654 | ||||

| CC USA Inc. |

||||||

| 4.52% - 4.56%, 03/23/06 - 07/14/063 |

45,419,719 | 45,419,111 | ||||

| Commodore CDO Ltd. |

||||||

| 4.56%, 12/12/063 |

4,221,164 | 4,221,164 | ||||

| DEPFA Bank PLC |

||||||

| 4.50%, 12/15/06 |

16,884,654 | 16,884,654 | ||||

| Dorada Finance Inc. |

||||||

| 4.52%, 06/26/063 |

4,221,164 | 4,221,029 | ||||

| Eli Lilly Services Inc. |

||||||

| 4.54%, 09/01/063 |

16,884,654 | 16,884,654 | ||||

| Fifth Third Bancorp. |

||||||

| 4.55%, 01/23/073 |

33,769,308 | 33,769,308 | ||||

| Five Finance Inc. |

||||||

| 4.54%, 06/26/063 |

3,376,931 | 3,376,822 | ||||

| General Electric Capital Corp. |

||||||

| 4.67%, 03/09/07 |

7,598,094 | 7,603,814 | ||||

| Greenwich Capital Holdings Inc. |

||||||

| 4.53%, 03/02/06 |

4,221,164 | 4,221,164 | ||||

| Hartford Life Global Funding Trusts |

||||||

| 4.56%, 02/15/07 |

16,884,654 | 16,884,654 | ||||

| HBOS Treasury Services PLC |

||||||

| 4.57%, 01/24/073 |

16,884,654 | 16,884,654 | ||||

| Holmes Financing PLC |

||||||

| 4.54%, 12/15/063 |

46,432,799 | 46,432,799 | ||||

| HSBC Bank USA N.A. |

||||||

| 4.70%, 05/04/06 |

5,909,629 | 5,910,473 | ||||

| K2 USA LLC |

||||||

| 4.53%, 06/02/063 |

15,196,189 | 15,195,802 | ||||

| Leafs LLC |

||||||

| 4.57%, 01/22/07 - 02/20/073 |

17,690,390 | 17,690,390 | ||||

| Links Finance LLC |

||||||

| 4.56%, 03/15/063 |

13,507,723 | 13,507,790 | ||||

| Marshall & Ilsley Bank |

||||||

| 4.55%, 02/15/07 |

9,286,560 | 9,286,560 | ||||

| Metropolitan Life Global Funding I |

||||||

| 4.56% - 4.96%, 08/28/06 - 03/06/073 |

50,485,116 | 50,505,894 | ||||

| Mound Financing PLC |

||||||

| 4.53%, 11/08/063 |

33,769,308 | 33,769,308 | ||||

| Natexis Banques Populaires |

||||||

| 4.55%, 03/15/073 |

12,663,491 | 12,663,491 | ||||

| Nationwide Building Society |

||||||

| 4.58% - 4.60%, 01/05/07 - 01/26/073 |

45,588,566 | 45,590,144 | ||||

| Nordea Bank AB |

||||||

| 4.55%, 02/09/073 |

29,548,145 | 29,548,145 | ||||

| Northern Rock PLC |

||||||

| 4.61%, 02/02/073 |

20,261,585 | 20,262,219 | ||||

| Permanent Financing PLC |

||||||

| 4.53%, 03/10/06 - 06/12/063 |

45,926,259 | 45,926,267 | ||||

| Pfizer Investment Capital PLC |

||||||

| 4.53%, 02/15/073 |

42,211,635 | 42,211,635 | ||||

| Principal Life Income Funding Trusts |

||||||

| 4.70%, 05/10/06 |

12,663,491 | 12,663,576 | ||||

| Sedna Finance Inc. |

||||||

| 4.54%, 09/20/063 |

5,065,396 | 5,065,396 | ||||

| Sigma Finance Inc. |

||||||

| 4.53% - 4.55%, 03/20/06 - 08/15/063 |

18,741,966 | 18,741,621 | ||||

| Skandinaviska Enskilda Bank NY |

||||||

| 4.56%, 03/19/073 |

16,884,654 | 16,884,654 | ||||

| Societe Generale |

||||||

| 4.54%, 03/02/073 |

11,819,258 | 11,819,258 | ||||

| Strips III LLC |

||||||

| 4.62%, 07/24/063 |

4,356,171 | 4,356,171 | ||||

| SunTrust Bank |

||||||

| 4.62%, 04/28/06 |

25,326,981 | 25,326,981 | ||||

| Tango Finance Corp. |

||||||

| 4.53% - 4.54%, 05/25/06 - 09/27/063 |

37,652,779 | 37,650,969 | ||||

| Toyota Motor Credit Corp. |

||||||

| 4.57%, 04/10/06 |

7,598,094 | 7,598,082 | ||||

| UniCredito Italiano SpA |

||||||

| 4.43%, 06/14/06 |

21,950,050 | 21,947,811 | ||||

| SCHEDULES OF INVESTMENTS | 15 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 1-3 YEAR TREASURY BOND FUND

| February | 28, 2006 |

| Security |

Principal |

Value |

|||||

| Union Hamilton Special Funding LLC |

|||||||

| 4.52%, 03/28/063 |

$ | 16,884,654 | $ | 16,884,654 | |||

| US Bank N.A. |

|||||||

| 4.54%, 09/29/06 |

7,598,094 | 7,596,937 | |||||

| Variable Funding Capital Corp. |

|||||||

| 4.52%, 03/09/06 - 03/13/06 |

25,326,981 | 25,326,981 | |||||

| Wachovia Asset Securitization Inc. |

|||||||

| 4.57%, 03/26/063 |

32,224,326 | 32,224,326 | |||||

| Wells Fargo & Co. |

|||||||

| 4.56%, 03/15/073 |

8,442,327 | 8,442,969 | |||||

| WhistleJacket Capital Ltd. |

|||||||

| 4.53% - 4.56%, 06/22/06 - 07/28/063 |

8,442,327 | 8,441,886 | |||||

| White Pine Finance LLC |

|||||||

| 4.53% - 4.57%, 03/27/06 - 06/20/063 |

17,728,887 | 17,728,910 | |||||

| Winston Funding Ltd. |

|||||||

| 4.68%, 04/23/063 |

12,055,643 | 12,055,643 | |||||

| World Savings Bank |

|||||||

| 4.52%, 03/09/06 |

25,326,981 | 25,326,951 | |||||

| 1,095,325,565 | |||||||

| TOTAL SHORT-TERM INVESTMENTS |

1,827,256,967 | ||||||

| TOTAL INVESTMENTS IN SECURITIES – 147.27% |

5,554,392,114 | ||||||

| Other Assets, Less Liabilities – (47.27)% |

(1,782,712,979 | ) | |||||

| NET ASSETS – 100.00% |

$ | 3,771,679,135 | |||||

| 1 | All or a portion of this security represents a security on loan. See Note 5. |

| 2 | All or a portion of this security (these securities) represent(s) an investment of securities lending collateral. See Note 5. |

| 3 | This security or a portion of these securities is exempt from registration pursuant to Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

See notes to the financial statements.

| 16 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments

iSHARES® LEHMAN 7-10 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| U.S. GOVERNMENT OBLIGATIONS – 98.81% |

||||||

| U.S. Treasury Bonds |

||||||

| 9.25%, 02/15/16 |

$ | 56,800,000 | $ | 77,593,909 | ||

| 9.88%, 11/15/151 |

11,360,000 | 15,984,201 | ||||

| 11.25%, 02/15/151 |

212,858,000 | 315,336,349 | ||||

| U.S. Treasury Notes |

||||||

| 3.63%, 05/15/131 |

93,010,000 | 87,558,684 | ||||

| 4.13%, 05/15/151 |

189,286,000 | 182,757,532 | ||||

| 4.25%, 08/15/131 |

120,700,000 | 117,958,898 | ||||

| 4.25%, 11/15/131 |

227,484,000 | 222,142,676 | ||||

| 4.25%, 11/15/141 |

57,652,000 | 56,178,991 | ||||

| 4.75%, 05/15/141 |

87,046,000 | 87,852,048 | ||||

| TOTAL U.S. GOVERNMENT OBLIGATIONS |

1,163,363,288 | |||||

| SHORT-TERM INVESTMENTS – 45.80% |

||||||

| CERTIFICATES OF DEPOSIT2 – 0.54% |

||||||

| Toronto-Dominion Bank |

||||||

| 3.94%, 07/10/06 |

2,453,468 | 2,453,468 | ||||

| Wells Fargo Bank N.A. |

||||||

| 4.78%, 12/05/06 |

3,925,549 | 3,925,549 | ||||

| 6,379,017 | ||||||

| COMMERCIAL PAPER2 – 1.55% |

||||||

| Amstel Funding Corp. |

||||||

| 4.40%, 05/08/06 |

2,453,468 | 2,433,077 | ||||

| CC USA Inc. |

||||||

| 4.23%, 04/21/06 |

1,472,081 | 1,463,260 | ||||

| Edison Asset Securitization LLC |

||||||

| 4.37%, 05/08/06 |

2,453,468 | 2,433,216 | ||||

| Galaxy Funding Inc. |

||||||

| 4.23%, 04/18/06 |

1,408,291 | 1,400,348 | ||||

| Grampian Funding LLC |

||||||

| 4.41%, 05/15/06 |

2,453,468 | 2,430,927 | ||||

| Nordea North America Inc. |

||||||

| 4.16%, 04/04/06 |

5,152,284 | 5,132,041 | ||||

| Sigma Finance Inc. |

||||||

| 4.16%, 04/06/06 |

2,944,162 | 2,931,914 | ||||

| 18,224,783 | ||||||

| MEDIUM-TERM NOTES2 – 1.40% |

||||||

| Dorada Finance Inc. |

||||||

| 3.93%, 07/07/06 |

1,521,150 | 1,521,097 | ||||

| K2 USA LLC |

||||||

| 3.94%, 07/07/06 |

2,944,162 | 2,944,110 | ||||

| Marshall & Ilsley Bank |

||||||

| 5.18%, 12/15/06 |

4,906,937 | 4,920,307 | ||||

| Toronto-Dominion Bank |

||||||

| 3.81%, 06/20/06 |

6,133,671 | 6,133,853 | ||||

| US Bank N.A. |

||||||

| 2.85%, 11/15/06 |

981,387 | 968,573 | ||||

| 16,487,940 | ||||||

| REPURCHASE AGREEMENTS – 12.23% |

||||||

| Bear Stearns Companies Inc. (The) Repurchase Agreement, 4.62%, due 3/1/06, maturity value $7,361,350 (collateralized by non-U.S. Government debt securities, value $8,109,679, 0.00% to 9.40%, 11/15/15 to 6/12/47).2 |

7,360,405 | 7,360,405 | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.57%, due 3/1/06, maturity value $24,537,799 (collateralized by U.S. Government obligations, value $25,074,770, 3.69% to 10.00%, 5/1/09 to 1/1/36).2 |

24,534,684 | 24,534,684 | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.61%, due 3/1/06, maturity value $12,268,913 (collateralized by non-U.S. Government debt securities, value $12,901,385, 1.01%, 9/19/35).2 |

12,267,342 | 12,267,342 | ||||

| SCHEDULES OF INVESTMENTS | 17 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 7-10 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.56%, due 3/1/06, maturity value $24,537,792 (collateralized by U.S. Government obligations, value $25,065,548, 4.50% to 7.50%, 9/1/09 to 11/1/35).2 |

$ | 24,534,684 | $ | 24,534,684 | ||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.71%, due 3/1/06, maturity value $24,537,894 (collateralized by non-U.S. Government debt securities, value $25,802,770, 0.00% to 10.00%, 8/15/07 to 2/1/16).2 |

24,534,684 | 24,534,684 | ||||

| Investors Bank & Trust Tri-Party Repurchase Agreement, 4.24%, due 3/1/06, maturity value $15,417,623 (collateralized by U.S. Government obligations, value $15,724,124, 6.13%, 8/15/07). |

15,415,808 | 15,415,808 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.53%, due 3/1/06, maturity value $5,889,065 (collateralized by U.S. Government obligations, value $6,015,855, 3.99% to 5.51%, 7/1/32 to 2/1/36).2 |

5,888,324 | 5,888,324 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.66%, due 3/1/06, maturity value $4,907,572 (collateralized by non-U.S. Government debt securities, value $5,062,435, 0.00% to 7.88%, 5/15/08 to 1/15/16).2 |

4,906,937 | 4,906,937 | ||||

| Morgan Stanley Repurchase Agreement, 4.61%, due 3/1/06, maturity value $24,537,826 (collateralized by non-U.S. Government debt securities, value $25,763,493, 0.00% to 7.16%, 3/1/06 to 3/25/35).2 |

24,534,684 | 24,534,684 | ||||

| 143,977,552 | ||||||

| TIME DEPOSITS2 – 3.04% |

||||||

| KBC Bank |

||||||

| 4.57%, 03/01/06 |

9,813,874 | 9,813,874 | ||||

| Societe Generale |

||||||

| 4.57%, 03/01/06 |

17,174,279 | 17,174,279 | ||||

| US Bank N.A. |

||||||

| 4.45%, 03/01/06 |

8,829,886 | 8,829,886 | ||||

| 35,818,039 | ||||||

| VARIABLE & FLOATING RATE NOTES2 – 27.04% |

||||||

| Allstate Life Global Funding II |

||||||

| 4.57% - 4.63%, 02/08/07 - 03/27/073 |

13,788,492 | 13,790,685 | ||||

| American Express Bank |

||||||

| 4.53% - 4.57%, 06/29/06 - 10/25/06 |

11,531,302 | 11,531,233 | ||||

| American Express Centurion Bank |

||||||

| 4.57%, 06/29/06 |

1,962,775 | 1,962,775 | ||||

| American Express Credit Corp. |

||||||

| 4.67%, 02/05/07 |

1,472,081 | 1,473,260 | ||||

| ASIF Global Financing |

||||||

| 4.75% - 4.95%, 05/30/06 - 08/11/063 |

15,947,545 | 15,951,666 | ||||

| Australia & New Zealand Banking Group Ltd. |

||||||

| 4.55%, 02/23/073 |

3,189,509 | 3,189,509 | ||||

| Bank of Ireland |

||||||

| 4.54%, 03/20/073 |

4,906,937 | 4,906,937 | ||||

| Beta Finance Inc. |

||||||

| 4.53% - 4.54%, 04/25/06 - 05/25/063 |

6,329,948 | 6,329,822 | ||||

| BMW US Capital LLC |

||||||

| 4.54%, 02/15/073 |

4,906,937 | 4,906,937 | ||||

| 18 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® LEHMAN 7-10 YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| CC USA Inc. |

||||||

| 4.52% - 4.56%, 03/23/06 - 07/14/063 |

$ | 13,199,660 | $ | 13,199,482 | ||

| Commodore CDO Ltd. |

||||||

| 4.56%, 12/12/063 |

1,226,734 | 1,226,734 | ||||

| DEPFA Bank PLC |

||||||

| 4.50%, 12/15/06 |

4,906,937 | 4,906,937 | ||||

| Dorada Finance Inc. |

||||||

| 4.52%, 06/26/063 |

1,226,734 | 1,226,695 | ||||

| Eli Lilly Services Inc. |

||||||

| 4.54%, 09/01/063 |

4,906,937 | 4,906,937 | ||||

| Fifth Third Bancorp. |

||||||

| 4.55%, 01/23/073 |

9,813,874 | 9,813,874 | ||||

| Five Finance Inc. |

||||||

| 4.54%, 06/26/063 |

981,387 | 981,356 | ||||

| General Electric Capital Corp. |

||||||

| 4.67%, 03/09/07 |

2,208,122 | 2,209,784 | ||||

| Greenwich Capital Holdings Inc. |

||||||

| 4.53%, 03/02/06 |

1,226,734 | 1,226,734 | ||||

| Hartford Life Global Funding Trusts |

||||||

| 4.56%, 02/15/07 |

4,906,937 | 4,906,937 | ||||

| HBOS Treasury Services PLC |

||||||

| 4.57%, 01/24/073 |

4,906,937 | 4,906,937 | ||||

| Holmes Financing PLC |

||||||

| 4.54%, 12/15/063 |

13,494,076 | 13,494,076 | ||||

| HSBC Bank USA N.A. |

||||||

| 4.70%, 05/04/06 |

1,717,428 | 1,717,673 | ||||

| K2 USA LLC |

||||||

| 4.53%, 06/02/063 |

4,416,243 | 4,416,131 | ||||

| Leafs LLC |

||||||

| 4.57%, 01/22/07 - 02/20/073 |

5,141,096 | 5,141,096 | ||||

| Links Finance LLC |

||||||

| 4.56%, 03/15/063 |

3,925,549 | 3,925,569 | ||||

| Marshall & Ilsley Bank |

||||||

| 4.55%, 02/15/07 |

2,698,815 | 2,698,815 | ||||

| Metropolitan Life Global Funding I |

||||||

| 4.56% - 4.96%, 08/28/06 - 03/06/073 |

14,671,741 | 14,677,779 | ||||

| Mound Financing PLC |

||||||

| 4.53%, 11/08/063 |

9,813,874 | 9,813,874 | ||||

| Natexis Banques Populaires |

||||||

| 4.55%, 03/15/073 |

3,680,203 | 3,680,203 | ||||

| Nationwide Building Society |

||||||

| 4.58% - 4.60%, 01/05/07 - 01/26/073 |

13,248,729 | 13,249,188 | ||||

| Nordea Bank AB |

||||||

| 4.55%, 02/09/073 |

8,587,139 | 8,587,139 | ||||

| Northern Rock PLC |

||||||

| 4.61%, 02/02/073 |

5,888,324 | 5,888,509 | ||||

| Permanent Financing PLC |

||||||

| 4.53%, 03/10/06 - 06/12/063 |

13,346,868 | 13,346,871 | ||||

| Pfizer Investment Capital PLC |

||||||

| 4.53%, 02/15/073 |

12,267,342 | 12,267,342 | ||||

| Principal Life Income Funding Trusts |

||||||

| 4.70%, 05/10/06 |

3,680,203 | 3,680,227 | ||||

| Sedna Finance Inc. |

||||||

| 4.54%, 09/20/063 |

1,472,081 | 1,472,081 | ||||

| Sigma Finance Inc. |

||||||

| 4.53% - 4.55%, 03/20/06 - 08/15/063 |

5,446,700 | 5,446,599 | ||||

| Skandinaviska Enskilda Bank NY |

||||||

| 4.56%, 03/19/073 |

4,906,937 | 4,906,937 | ||||

| Societe Generale |

||||||

| 4.54%, 03/02/073 |

3,434,856 | 3,434,856 | ||||

| Strips III LLC |

||||||

| 4.62%, 07/24/063 |

1,265,969 | 1,265,969 | ||||

| SunTrust Bank |

||||||

| 4.62%, 04/28/06 |

7,360,405 | 7,360,405 | ||||

| Tango Finance Corp. |

||||||

| 4.53% - 4.54%, 05/25/06 - 09/27/063 |

10,942,469 | 10,941,944 | ||||

| Toyota Motor Credit Corp. |

||||||

| 4.57%, 04/10/06 |

2,208,122 | 2,208,118 | ||||

| UniCredito Italiano SpA |

||||||

| 4.43%, 06/14/06 |

6,379,018 | 6,378,367 | ||||

| Union Hamilton Special Funding LLC |

||||||

| 4.52%, 03/28/063 |

4,906,937 | 4,906,937 | ||||

| US Bank N.A. |

||||||

| 4.54%, 09/29/06 |

2,208,122 | 2,207,785 | ||||

| Variable Funding Capital Corp. |

||||||

| 4.52%, 03/09/06 - 03/13/06 |

7,360,405 | 7,360,405 | ||||

| Wachovia Asset Securitization Inc. |

||||||

| 4.57%, 03/26/063 |

9,364,878 | 9,364,878 | ||||

| SCHEDULES OF INVESTMENTS | 19 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 7-10 YEAR TREASURY BOND FUND

| February | 28, 2006 |

| Security |

Principal |

Value |

|||||

| Wells Fargo & Co. |

|||||||

| 4.56%, 03/15/073 |

$ | 2,453,468 | $ | 2,453,655 | |||

| WhistleJacket Capital Ltd. |

|||||||

| 4.53% - 4.56%, 06/22/06 - 07/28/063 |

2,453,468 | 2,453,341 | |||||

| White Pine Finance LLC |

|||||||

| 4.53% - 4.57%, 03/27/06 - 06/20/063 |

5,152,284 | 5,152,291 | |||||

| Winston Funding Ltd. |

|||||||

| 4.68%, 04/23/063 |

3,503,553 | 3,503,553 | |||||

| World Savings Bank |

|||||||

| 4.52%, 03/09/06 |

7,360,405 | 7,360,396 | |||||

| 318,318,240 | |||||||

| TOTAL SHORT-TERM INVESTMENTS |

539,205,571 | ||||||

| TOTAL INVESTMENTS IN SECURITIES – 144.61% |

1,702,568,859 | ||||||

| Other Assets, Less Liabilities – (44.61)% |

(525,189,713 | ) | |||||

| NET ASSETS – 100.00% |

$ | 1,177,379,146 | |||||

| 1 | All or a portion of this security represents a security on loan. See Note 5. |

| 2 | All or a portion of this security (these securities) represent(s) an investment of securities lending collateral. See Note 5. |

| 3 | This security or a portion of these securities is exempt from registration pursuant to Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

See notes to the financial statements.

| 20 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments

iSHARES® LEHMAN 20+ YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| U.S. GOVERNMENT OBLIGATIONS – 98.89% |

||||||

| U.S. Treasury Bonds |

||||||

| 4.50%, 02/15/36 |

$ | 73,910,000 | $ | 73,921,825 | ||

| 5.25%, 11/15/281 |

43,225,000 | 46,772,044 | ||||

| 5.25%, 02/15/291 |

51,205,000 | 55,436,069 | ||||

| 5.38%, 02/15/311 |

97,470,000 | 108,598,142 | ||||

| 5.50%, 08/15/281 |

55,955,000 | 62,435,713 | ||||

| 6.13%, 11/15/27 |

100,700,000 | 120,486,545 | ||||

| 6.13%, 08/15/291 |

58,425,000 | 70,597,843 | ||||

| 6.25%, 05/15/301 |

85,215,000 | 105,065,832 | ||||

| 6.38%, 08/15/27 |

30,210,000 | 37,101,504 | ||||

| 6.50%, 11/15/261 |

52,250,000 | 64,745,066 | ||||

| 6.63%, 02/15/27 |

45,885,000 | 57,722,873 | ||||

| 6.75%, 08/15/26 |

43,985,000 | 55,848,631 | ||||

| TOTAL U.S. GOVERNMENT OBLIGATIONS |

858,732,087 | |||||

| SHORT-TERM INVESTMENTS – 35.06% |

||||||

| CERTIFICATES OF DEPOSIT2 – 0.41% |

||||||

| Toronto-Dominion Bank |

||||||

| 3.94%, 07/10/06 |

1,369,194 | 1,369,194 | ||||

| Wells Fargo Bank N.A. |

||||||

| 4.78%, 12/05/06 |

2,190,711 | 2,190,711 | ||||

| 3,559,905 | ||||||

| COMMERCIAL PAPER2 – 1.17% |

||||||

| Amstel Funding Corp. |

||||||

| 4.40%, 05/08/06 |

1,369,194 | 1,357,814 | ||||

| CC USA Inc. |

||||||

| 4.23%, 04/21/06 |

821,517 | 816,594 | ||||

| Edison Asset Securitization LLC |

||||||

| 4.37%, 05/08/06 |

1,369,194 | 1,357,892 | ||||

| Galaxy Funding Inc. |

||||||

| 4.23%, 04/18/06 |

785,917 | 781,485 | ||||

| Grampian Funding LLC |

||||||

| 4.41%, 05/15/06 |

1,369,194 | 1,356,615 | ||||

| Nordea North America Inc. |

||||||

| 4.16%, 04/04/06 |

2,875,308 | 2,864,011 | ||||

| Sigma Finance Inc. |

||||||

| 4.16%, 04/06/06 |

1,643,033 | 1,636,198 | ||||

| 10,170,609 | ||||||

| MEDIUM-TERM NOTES2 – 1.06% |

||||||

| Dorada Finance Inc. |

||||||

| 3.93%, 07/07/06 |

848,900 | 848,871 | ||||

| K2 USA LLC |

||||||

| 3.94%, 07/07/06 |

1,643,033 | 1,643,004 | ||||

| Marshall & Ilsley Bank |

||||||

| 5.18%, 12/15/06 |

2,738,388 | 2,745,850 | ||||

| Toronto-Dominion Bank |

||||||

| 3.81%, 06/20/06 |

3,422,985 | 3,423,087 | ||||

| US Bank N.A. |

||||||

| 2.85%, 11/15/06 |

547,678 | 540,526 | ||||

| 9,201,338 | ||||||

| REPURCHASE AGREEMENTS – 9.66% |

||||||

| Bear Stearns Companies Inc. (The) Repurchase Agreement, 4.62%, due 3/1/06, maturity value $4,108,110 (collateralized by non-U.S. Government debt securities, value $4,525,726, 0.00% to 9.40%, 11/15/15 to 6/12/47).2 |

4,107,583 | 4,107,583 | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.57%, due 3/1/06, maturity value 13,693,680 (collateralized by U.S. Government obligations, value $13,993,345, 3.69% to 10.00%, 5/1/09 to 1/1/36).2 |

13,691,942 | 13,691,942 | ||||

| Citigroup Global Markets Holdings Inc. Repurchase Agreement, 4.61%, due 3/1/06, maturity value $6,846,848 (collateralized by non-U.S. Government debt securities, value $7,199,808, 1.01%, 9/19/35).2 |

6,845,971 | 6,845,971 | ||||

| SCHEDULES OF INVESTMENTS |

21 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 20+ YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.56%, due 3/1/06, maturity value $13,693,676 (collateralized by U.S. Government obligations, value $13,988,198, 4.50% to 7.50%, 9/1/09 to 11/1/35).2 |

$ | 13,691,942 | $ | 13,691,942 | ||

| Goldman Sachs Group Inc. Repurchase Agreement, 4.71%, due 3/1/06, maturity value $13,693,733 (collateralized by non-U.S. Government debt securities, value $14,399,616, 0.00% to 10.00%, 8/15/07 to 2/1/16).2 |

13,691,942 | 13,691,942 | ||||

| Investors Bank & Trust Tri-Party Repurchase Agreement, 4.24%, due 3/1/06, maturity value $12,149,201 (collateralized by U.S. Government obligations, value $12,390,726, 6.13%, 8/15/07). |

12,147,771 | 12,147,771 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.53%, due 3/1/06, maturity value $3,286,479 (collateralized by U.S. Government obligations, value $3,357,237, 3.99% to 5.51%, 7/1/32 to 2/1/36).2 |

3,286,066 | 3,286,066 | ||||

| Merrill Lynch & Co. Inc. Repurchase Agreement, 4.66%, due 3/1/06, maturity value $2,738,742 (collateralized by non-U.S. Government debt securities, value $2,825,167, 0.00% to 7.88%, 5/15/08 to 1/15/16).2 |

2,738,388 | 2,738,388 | ||||

| Morgan Stanley Repurchase Agreement, 4.61%, due 3/1/06, maturity value $13,693,695 (collateralized by non-U.S. Government debt securities, value $14,377,697, 0.00% to 7.16%, 3/1/06 to 3/25/35).2 |

13,691,942 | 13,691,942 | ||||

| 83,893,547 | ||||||

| TIME DEPOSITS2 – 2.30% |

||||||

| KBC Bank |

||||||

| 4.57%, 03/01/06 |

5,476,777 | 5,476,777 | ||||

| Societe Generale |

||||||

| 4.57%, 03/01/06 |

9,584,359 | 9,584,359 | ||||

| US Bank N.A. |

||||||

| 4.45%, 03/01/06 |

4,927,648 | 4,927,648 | ||||

| 19,988,784 | ||||||

| VARIABLE & FLOATING RATE NOTES2 – 20.46% |

||||||

| Allstate Life Global Funding II |

||||||

| 4.57% - 4.63%, 02/08/07 - 03/27/073 |

7,694,871 | 7,696,095 | ||||

| American Express Bank |

||||||

| 4.53% - 4.57%, 06/29/06 - 10/25/06 |

6,435,213 | 6,435,174 | ||||

| American Express Centurion Bank |

||||||

| 4.57%, 06/29/06 |

1,095,355 | 1,095,355 | ||||

| American Express Credit Corp. |

||||||

| 4.67%, 02/05/07 |

821,517 | 822,174 | ||||

| ASIF Global Financing |

||||||

| 4.75% - 4.95%, 05/30/06 - 08/11/063 |

8,899,762 | 8,902,062 | ||||

| Australia & New Zealand Banking Group Ltd. |

||||||

| 4.55%, 02/23/073 |

1,779,952 | 1,779,952 | ||||

| Bank of Ireland |

||||||

| 4.54%, 03/20/073 |

2,738,388 | 2,738,388 | ||||

| Beta Finance Inc. |

||||||

| 4.53% - 4.54%, 04/25/06 - 05/25/063 |

3,532,521 | 3,532,451 | ||||

| BMW US Capital LLC |

||||||

| 4.54%, 02/15/073 |

2,738,388 | 2,738,388 | ||||

| 22 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® LEHMAN 20+ YEAR TREASURY BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| CC USA Inc. |

||||||

| 4.52% - 4.56%, 03/23/06 - 07/14/063 |

$ | 7,366,265 | $ | 7,366,165 | ||

| Commodore CDO Ltd. |

||||||

| 4.56%, 12/12/063 |

684,597 | 684,597 | ||||

| DEPFA Bank PLC |

||||||

| 4.50%, 12/15/06 |

2,738,388 | 2,738,388 | ||||

| Dorada Finance Inc. |

||||||

| 4.52%, 06/26/063 |

684,597 | 684,575 | ||||

| Eli Lilly Services Inc. |

||||||

| 4.54%, 09/01/063 |

2,738,388 | 2,738,388 | ||||

| Fifth Third Bancorp. |

||||||

| 4.55%, 01/23/073 |

5,476,777 | 5,476,777 | ||||

| Five Finance Inc. |

||||||

| 4.54%, 06/26/063 |

547,678 | 547,660 | ||||

| General Electric Capital Corp. |

||||||

| 4.67%, 03/09/07 |

1,232,275 | 1,233,202 | ||||

| Greenwich Capital Holdings Inc. |

||||||

| 4.53%, 03/02/06 |

684,597 | 684,597 | ||||

| Hartford Life Global Funding Trusts |

||||||

| 4.56%, 02/15/07 |

2,738,388 | 2,738,388 | ||||

| HBOS Treasury Services PLC |

||||||

| 4.57%, 01/24/073 |

2,738,388 | 2,738,388 | ||||

| Holmes Financing PLC |

||||||

| 4.54%, 12/15/063 |

7,530,568 | 7,530,568 | ||||

| HSBC Bank USA N.A. |

||||||

| 4.70%, 05/04/06 |

958,436 | 958,573 | ||||

| K2 USA LLC |

||||||

| 4.53%, 06/02/063 |

2,464,550 | 2,464,487 | ||||

| Leafs LLC |

||||||

| 4.57%, 01/22/07 - 02/20/073 |

2,869,064 | 2,869,065 | ||||

| Links Finance LLC |

||||||

| 4.56%, 03/15/063 |

2,190,711 | 2,190,722 | ||||

| Marshall & Ilsley Bank |

||||||

| 4.55%, 02/15/07 |

1,506,114 | 1,506,114 | ||||

| Metropolitan Life Global Funding I |

||||||

| 4.56% - 4.96%, 08/28/06 - 03/06/073 |

8,187,781 | 8,191,152 | ||||

| Mound Financing PLC |

||||||

| 4.53%, 11/08/063 |

5,476,777 | 5,476,777 | ||||

| Natexis Banques Populaires |

||||||

| 4.55%, 03/15/073 |

2,053,791 | 2,053,791 | ||||

| Nationwide Building Society |

||||||

| 4.58% - 4.60%, 01/05/07 - 01/26/073 |

7,393,649 | 7,393,904 | ||||

| Nordea Bank AB |

||||||

| 4.55%, 02/09/073 |

4,792,180 | 4,792,180 | ||||

| Northern Rock PLC |

||||||

| 4.61%, 02/02/073 |

3,286,066 | 3,286,169 | ||||

| Permanent Financing PLC |

||||||

| 4.53%, 03/10/06 - 06/12/063 |

7,448,416 | 7,448,417 | ||||

| Pfizer Investment Capital PLC |

||||||

| 4.53%, 02/15/073 |

6,845,971 | 6,845,971 | ||||

| Principal Life Income Funding Trusts |

||||||

| 4.70%, 05/10/06 |

2,053,791 | 2,053,805 | ||||

| Sedna Finance Inc. |

||||||

| 4.54%, 09/20/063 |

821,517 | 821,517 | ||||

| Sigma Finance Inc. |

||||||

| 4.53% - 4.55%, 03/20/06 - 08/15/063 |

3,039,611 | 3,039,556 | ||||

| Skandinaviska Enskilda Bank NY |

||||||

| 4.56%, 03/19/073 |

2,738,388 | 2,738,388 | ||||

| Societe Generale |

||||||

| 4.54%, 03/02/073 |

1,916,872 | 1,916,872 | ||||

| Strips III LLC |

||||||

| 4.62%, 07/24/063 |

706,493 | 706,493 | ||||

| SunTrust Bank |

||||||

| 4.62%, 04/28/06 |

4,107,583 | 4,107,583 | ||||

| Tango Finance Corp. |

||||||

| 4.53% - 4.54%, 05/25/06 - 09/27/063 |

6,106,606 | 6,106,314 | ||||

| Toyota Motor Credit Corp. |

||||||

| 4.57%, 04/10/06 |

1,232,275 | 1,232,273 | ||||

| UniCredito Italiano SpA |

||||||

| 4.43%, 06/14/06 |

3,559,905 | 3,559,542 | ||||

| Union Hamilton Special Funding LLC |

||||||

| 4.52%, 03/28/063 |

2,738,388 | 2,738,388 | ||||

| US Bank N.A. |

||||||

| 4.54%, 09/29/06 |

1,232,275 | 1,232,087 | ||||

| Variable Funding Capital Corp. |

||||||

| 4.52%, 03/09/06 - 03/13/06 |

4,107,583 | 4,107,582 | ||||

| Wachovia Asset Securitization Inc. |

||||||

| 4.57%, 03/26/063 |

5,226,208 | 5,226,209 | ||||

| SCHEDULES OF INVESTMENTS |

23 |

Schedule of Investments (Continued)

iSHARES® LEHMAN 20+ YEAR TREASURY BOND FUND

| February | 28, 2006 |

| Security |

Principal |

Value |

|||||

| Wells Fargo & Co. |

|||||||

| 4.56%, 03/15/073 |

$ | 1,369,194 | $ | 1,369,298 | |||

| WhistleJacket Capital Ltd. |

|||||||

| 4.53% - 4.56%, 06/22/06 - 07/28/063 |

1,369,194 | 1,369,122 | |||||

| White Pine Finance LLC |

|||||||

| 4.53% - 4.57%, 03/27/06 - 06/20/063 |

2,875,308 | 2,875,311 | |||||

| Winston Funding Ltd. |

|||||||

| 4.68%, 04/23/063 |

1,955,209 | 1,955,209 | |||||

| World Savings Bank |

|||||||

| 4.52%, 03/09/06 |

4,107,583 | 4,107,578 | |||||

| 177,642,181 | |||||||

| TOTAL SHORT-TERM INVESTMENTS |

304,456,364 | ||||||

| TOTAL INVESTMENTS IN SECURITIES – 133.95% |

1,163,188,451 | ||||||

| Other Assets, Less Liabilities – (33.95)% |

(294,786,764 | ) | |||||

| NET ASSETS – 100.00% |

$ | 868,401,687 | |||||

| 1 | All or a portion of this security represents a security on loan. See Note 5. |

| 2 | All or a portion of this security (these securities) represent(s) an investment of securities lending collateral. See Note 5. |

| 3 | This security or a portion of these securities is exempt from registration pursuant to Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

See notes to the financial statements.

| 24 | 2006 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments

iSHARES® LEHMAN TIPS BOND FUND

February 28, 2006

| Security |

Principal |

Value | ||||

| U.S. GOVERNMENT OBLIGATIONS – 99.49% |

||||||

| U.S. Treasury Inflation Index Bonds |

||||||

| 0.88%, 04/15/10 |

$ | 313,054,129 | $ | 300,168,821 | ||

| 1.63%, 01/15/151 |

216,255,692 | 209,802,622 | ||||

| 1.88%, 07/15/13 |

236,899,084 | 235,311,859 | ||||

| 1.88%, 07/15/15 |

192,345,754 | 190,481,923 | ||||

| 2.00%, 01/15/14 |

240,727,196 | 240,895,705 | ||||

| 2.00%, 07/15/141 |

220,167,482 | 220,425,077 | ||||

| 2.00%, 01/15/16 |

100,882,640 | 100,913,914 | ||||

| 2.00%, 01/15/26 |

111,703,962 | 112,409,931 | ||||

| 2.38%, 01/15/25 |

286,695,552 | 304,880,651 | ||||

| 3.00%, 07/15/121 |

252,396,338 | 268,292,259 | ||||

| 3.38%, 01/15/121 |

73,355,434 | 79,247,343 | ||||

| 3.38%, 04/15/321 |

58,159,063 | 76,946,185 | ||||

| 3.50%, 01/15/11 |

133,754,988 | 143,640,819 | ||||

| 3.63%, 01/15/08 |

203,706,448 | 210,931,915 | ||||

| 3.63%, 04/15/28 |

193,620,022 | 253,115,582 | ||||

| 3.88%, 01/15/09 |

185,037,410 | 195,821,390 | ||||

| 3.88%, 04/15/29 |

228,425,683 | 312,230,498 | ||||

| 4.25%, 01/15/101 |

130,952,807 | 142,615,464 | ||||

| TOTAL U.S. GOVERNMENT OBLIGATIONS |

3,598,131,958 | |||||

| SHORT-TERM INVESTMENTS – 13.74% |

||||||

| CERTIFICATES OF DEPOSIT2 – 0.17% |

||||||

| Toronto-Dominion Bank |

||||||

| 3.94%, 07/10/06 |

2,316,623 | 2,316,623 | ||||

| Wells Fargo Bank N.A. |

||||||

| 4.78%, 12/05/06 |

3,706,597 | 3,706,597 | ||||

| 6,023,220 | ||||||

| COMMERCIAL PAPER2 – 0.48% |

||||||

| Amstel Funding Corp. |

||||||

| 4.40%, 05/08/06 |

2,316,623 | 2,297,371 | ||||

| CC USA Inc. |

||||||

| 4.23%, 04/21/06 |

1,389,974 | 1,381,644 | ||||

| Edison Asset Securitization LLC |