Table of Contents

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☒ |

| Pre-Effective Amendment No. | □ |

| Post-Effective Amendment No. 69 | ☒ |

| INVESTMENT COMPANY ACT OF 1940 | ☒ |

| Amendment No. 57 | ☒ |

United States of America

55 East 52nd Street

United States of America

| Counsel for the Fund: | |

| Margery

K. Neale, Esq. Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019-6099 |

Benjamin

Archibald, Esq. BlackRock Advisors, LLC 55 East 52nd Street New York, New York 10055 |

Table of Contents

Title of Securities Being Registered: Shares of Common Stock, par value $.10 per share.

Table of Contents

Table of Contents

| Fund Overview | Key facts and details about the Fund listed in this prospectus, including investment objectives, principal investment strategies, principal risk factors, fee and expense information, and historical performance information | |

|

|

3 | |

|

|

3 | |

|

|

4 | |

|

|

5 | |

|

|

9 | |

|

|

10 | |

|

|

10 | |

|

|

11 | |

|

|

13 | |

|

|

13 |

| Account Information | Information about account services, sales charges and waivers, shareholder transactions, and distributions and other payments | |

|

|

31 | |

|

|

34 | |

|

|

39 | |

|

|

40 | |

|

|

46 | |

|

|

47 | |

|

|

47 | |

|

|

48 |

| Management of the Fund | Information about BlackRock and the Portfolio Manager | |

|

|

50 | |

|

|

51 | |

|

|

52 | |

|

|

53 | |

|

|

53 | |

|

|

54 |

| Financial Highlights |

Financial Performance of the

Fund |

56 |

| General Information |

|

61 |

|

|

61 | |

|

|

62 |

| Glossary |

Glossary of Investment

Terms |

63 |

| For More Information |

|

Inside Back Cover |

|

|

Back Cover |

Table of Contents

| Shareholder

Fees (fees paid directly from your investment) |

Investor

A Shares |

Investor

B Shares |

Investor

C Shares |

Institutional

Shares |

Class

R Shares | |||||

| Maximum Sales Charge (Load) Imposed on Purchases (as percentage of offering price) | 5.25% | None | None | None | None | |||||

| Maximum Deferred Sales Charge (Load) (as percentage of offering price or redemption proceeds, percentage of offering price or redemption proceeds, whichever is lower) | None 1 | 4.50% 2 | 1.00% 3 | None | None | |||||

| Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor

A Shares |

Investor

B Shares |

Investor

C Shares |

Institutional

Shares |

Class

R Shares |

|||||

| Management Fee4 | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% | |||||

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 1.00% | None | 0.50% | |||||

| Other Expenses | 0.52% | 0.85% | 0.54% | 0.49% | 0.60% | |||||

| Interest Expense | 0.02% | 0.02% | 0.02% | 0.02% | 0.02% | |||||

| Other Expenses of the Fund | 0.50% | 0.83% | 0.52% | 0.47% | 0.58% | |||||

| Other Expenses of the Subsidiary5 | — | — | — | — | — | |||||

| Total Annual Fund Operating Expenses | 1.20% | 2.28% | 1.97% | 0.92% | 1.53% | |||||

| Fee Waivers and/or Expense Reimbursements4 | (0.32)% | (0.32)% | (0.32)% | (0.32)% | (0.32)% | |||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements4 | 0.88% | 1.96% | 1.65% | 0.60% | 1.21% |

| 1 | A contingent deferred sales charge (“CDSC”) of 0.75% is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge was paid at the time of purchase of an investment of $1,000,000 or more. |

| 2 | The CDSC for Investor B Shares is 4.50% if shares are redeemed in less than one year. The CDSC for Investor B Shares decreases for redemptions made in subsequent years. After six years there is no CDSC on Investor B Shares. (See the section “Details About the Share Classes — Investor B Shares” in the Fund’s prospectus for the complete schedule of CDSCs.) |

| 3 | There is no CDSC on Investor C Shares after one year. |

| 4 | As described in the Fund’s prospectus on page 50, BlackRock has contractually agreed to waive its management fee by the amount of any management fees the Fund pays the manager of the Master Portfolios (defined below) indirectly through its investment in the Master Portfolios for as long as the Fund invests in the Master Portfolios. The contractual agreement may be terminated upon 90 days notice by a majority of the non-interested directors of the Fund or by a vote of a majority of the outstanding voting securities of the Fund. |

| 5 | Other expenses of the BlackRock Cayman Master Total Return Portfolio I, Ltd. (the “Subsidiary”) were less than 0.01% for the Fund’s last fiscal year. |

Table of Contents

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor A Shares | $610 | $ 856 | $1,121 | $1,876 |

| Investor B Shares | $649 | $1,032 | $1,391 | $2,318 |

| Investor C Shares | $268 | $ 587 | $1,033 | $2,270 |

| Institutional Shares | $ 61 | $ 261 | $ 478 | $1,102 |

| Class R Shares | $123 | $ 452 | $ 804 | $1,796 |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor B Shares | $199 | $682 | $1,191 | $2,318 |

| Investor C Shares | $168 | $587 | $1,033 | $2,270 |

Table of Contents

| ■ | Commodities Related Investments Risk — Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. |

| ■ | Convertible Securities Risk — The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock. |

| ■ | Corporate Loans Risk — Commercial banks and other financial institutions or institutional investors make corporate loans to companies that need capital to grow or restructure. Borrowers generally pay interest on corporate loans at rates that change in response to changes in market interest rates such as the London Interbank Offered Rate (“LIBOR”) or the prime rates of U.S. banks. As a result, the value of corporate loan investments is generally less exposed to the adverse effects of shifts in market interest rates than investments that pay a fixed rate of interest. |

Table of Contents

| The market for corporate loans may be subject to irregular trading activity and wide bid/ask spreads. In addition, transactions in corporate loans may settle on a delayed basis. As a result, the proceeds from the sale of corporate loans may not be readily available to make additional investments or to meet the Fund’s redemption obligations. To the extent the extended settlement process gives rise to short-term liquidity needs, the Fund may hold additional cash, sell investments or temporarily borrow from banks and other lenders. |

| ■ | Debt Securities Risk — Debt securities, such as bonds, involve interest rate risk, credit risk, extension risk, and prepayment risk, among other things. |

| Interest Rate Risk — The market value of bonds and other fixed-income securities changes in response to interest rate changes and other factors. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. For example, if interest rates increase by 1%, assuming a current portfolio duration of ten years, and all other factors being equal, the value of the Fund’s investments would be expected to decrease by 10%. The magnitude of these fluctuations in the market price of bonds and other fixed-income securities is generally greater for those securities with longer maturities. Fluctuations in the market price of the Fund’s investments will not affect interest income derived from instruments already owned by the Fund, but will be reflected in the Fund’s net asset value. The Fund may lose money if short-term or long-term interest rates rise sharply in a manner not anticipated by Fund management. To the extent the Fund invests in debt securities that may be prepaid at the option of the obligor (such as mortgage-backed securities), the sensitivity of such securities to changes in interest rates may increase (to the detriment of the Fund) when interest rates rise. Moreover, because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities. These basic principles of bond prices also apply to U.S. Government securities. A security backed by the “full faith and credit” of the U.S. Government is guaranteed only as to its stated interest rate and face value at maturity, not its current market price. Just like other fixed-income securities, government-guaranteed securities will fluctuate in value when interest rates change. A general rise in interest rates has the potential to cause investors to move out of fixed-income securities on a large scale, which may increase redemptions from funds that hold large amounts of fixed-income securities. Heavy redemptions could cause the Fund to sell assets at inopportune times or at a loss or depressed value and could hurt the Fund’s performance. | |

| Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make principal and interest payments when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. | |

| Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these obligations to fall. | |

| Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields. |

| ■ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

| Volatility Risk — Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate with the overall securities markets. | |

| Counterparty Risk — Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. | |

| Market and Liquidity Risk — The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately. | |

| Valuation Risk — Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them. | |

| Leverage Risk — Certain transactions in derivatives involve substantial leverage risk and may expose the Fund to potential losses that exceed the amount originally invested by the Fund. | |

| Regulatory Risk — Derivative contracts, including, without limitation, swaps, currency forwards and non-deliverable forwards, are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) in the U.S. and under comparable regimes in Europe, Asia and other non-U.S. jurisdictions. Under the Dodd-Frank Act, certain derivatives may become subject to margin requirements when regulations are finalized. |

Table of Contents

| Implementation of such regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase the costs to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund. In December 2015, the Securities and Exchange Commission proposed a new rule to regulate the use of derivatives by registered investment companies, such as the Fund. If the rule goes into effect, it could limit the ability of the Fund to invest or remain invested in derivatives. Certain aspects of the tax treatment of derivative instruments, including swap agreements and commodity-linked derivative instruments, are currently unclear and may be affected by changes in legislation, regulations or other legally binding authority that could affect the character, timing and amount of the Fund’s taxable income or gains and distributions. |

| ■ | Dollar Rolls Risk — Dollar rolls involve the risk that the market value of the securities that the Fund is committed to buy may decline below the price of the securities the Fund has sold. These transactions may involve leverage. |

| ■ | Emerging Markets Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. |

| ■ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ■ | Expense Risk — Fund expenses are subject to a variety of factors, including fluctuations in the Fund’s net assets. Accordingly, actual expenses may be greater or less than those indicated. For example, to the extent that the Fund’s net assets decrease due to market declines or redemptions, the Fund’s expenses will increase as a percentage of Fund net assets. During periods of high market volatility, these increases in the Fund’s expense ratio could be significant. |

| ■ | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| ■ | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| ■ | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| ■ | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| ■ | The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their capital markets or in certain industries. |

| ■ | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| ■ | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| ■ | High Portfolio Turnover Risk — The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover (more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies. These effects of higher than normal portfolio turnover may adversely affect Fund performance. In addition, investment in mortgage dollar rolls and participation in TBA transactions may significantly increase the Fund’s portfolio turnover rate. A TBA transaction is a method of trading mortgage-backed securities where the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount, and price at the time the contract is entered into but the mortgage-backed securities are delivered in the future, generally 30 days later. |

| ■ | Investment Style Risk — Because different kinds of stocks go in and out of favor depending on market conditions, the Fund’s performance may be better or worse than other funds with different investment styles (e.g., growth vs. value, large cap vs. small cap). |

| ■ | Junk Bonds Risk — Although junk bonds generally pay higher rates of interest than investment grade bonds, junk bonds are high risk investments that may cause income and principal losses for the Fund. |

Table of Contents

| ■ | Leverage Risk — Some transactions may give rise to a form of economic leverage. These transactions may include, among others, derivatives, and may expose the Fund to greater risk and increase its costs. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet any required asset segregation requirements. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| ■ | Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. |

| ■ | Money Market Securities Risk — If market conditions improve while the Fund has temporarily invested some or all of its assets in high quality money market securities, this strategy could result in reducing the potential gain from the market upswing, thus reducing the Fund’s opportunity to achieve its investment objective. |

| ■ | Mortgage- and Asset-Backed Securities Risks — Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. |

| ■ | Preferred Securities Risk — Preferred securities may pay fixed or adjustable rates of return. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. In addition, a company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred securities will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Preferred securities of smaller companies may be more vulnerable to adverse developments than preferred stock of larger companies. |

| ■ | Sovereign Debt Risk — Sovereign debt instruments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. |

| ■ | Structured Notes Risk — Structured notes and other related instruments purchased by the Fund are generally privately negotiated debt obligations where the principal and/or interest is determined by reference to the performance of a specific asset, benchmark asset, market or interest rate (“reference measure”). The purchase of structured notes exposes the Fund to the credit risk of the issuer of the structured product. Structured notes may be leveraged, increasing the volatility of each structured note’s value relative to the change in the reference measure. Structured notes may also be less liquid and more difficult to price accurately than less complex securities and instruments or more traditional debt securities. |

| ■ | Subsidiary Risk — By indirectly investing in the Subsidiary through its investments in the Total Return Portfolio, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The commodity-related instruments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund or the Total Return Portfolio and are subject to the same risks that apply to similar investments if held directly by the Fund or the Total Return Portfolio (see “Commodities Related Investment Risks” above). There can be no assurance that the investment objective of the Subsidiary will be achieved. The Subsidiary is not registered under the Investment Company Act, and, unless otherwise noted in this prospectus, is not subject to all the investor protections of the Investment Company Act. However, the Total Return Portfolio wholly owns and controls the Subsidiary, and the Total Return Portfolio and the Subsidiary are both managed by BlackRock, making it unlikely that the Subsidiary will take action contrary to the interests of the Fund and its shareholders. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to operate as described in this prospectus and the Statement of Additional Information (the “SAI”) and could adversely affect the Fund. |

| In late July 2011, the Internal Revenue Service suspended the granting of private letter rulings that concluded that the income and gain generated by a registered investment company’s investments in commodity-linked notes, and the income generated from investments in controlled foreign subsidiaries that invest in physical commodities and/or commodity-linked derivative instruments, would be “qualifying income” for regulated investment company |

Table of Contents

| qualification purposes. As a result, there can be no assurance that the Internal Revenue Service will treat such income and gain as “qualifying income.” If the Internal Revenue Service makes an adverse determination relating to the treatment of such income and gain, the Fund will likely need to change its investment strategies, which could adversely affect the Fund. |

| ■ | U.S. Government Issuer Risk — Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Obligations of U.S. Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U.S. Government. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so. |

| ■ | U.S. Government Mortgage-Related Securities Risk — There are a number of important differences among the agencies and instrumentalities of the U.S. Government that issue mortgage-related securities and among the securities that they issue. Mortgage-related securities guaranteed by the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) are guaranteed as to the timely payment of principal and interest by GNMA and such guarantee is backed by the full faith and credit of the United States. GNMA securities also are supported by the right of GNMA to borrow funds from the U.S. Treasury to make payments under its guarantee. Mortgage-related securities issued by Fannie Mae or Freddie Mac are solely the obligations of Fannie Mae or Freddie Mac, as the case may be, and are not backed by or entitled to the full faith and credit of the United States but are supported by the right of the issuer to borrow from the Treasury. |

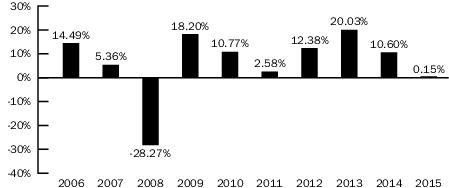

As of 12/31

| As

of 12/31/15 Average Annual Total Returns |

1 Year | 5 Years | 10 Years1 |

| BlackRock Balanced Capital Fund — Investor A Shares |

Table of Contents

| As

of 12/31/15 Average Annual Total Returns |

1 Year | 5 Years | 10 Years1 |

| Return Before Taxes | (5.11)% | 7.75% | 5.11% |

| Return After Taxes on Distributions | (6.26)% | 5.69% | 3.36% |

| Return After Taxes on Distributions and Sale of Fund Shares | (2.06)% | 5.67% | 3.64% |

| BlackRock Balanced Capital Fund — Investor B Shares | |||

| Return Before Taxes | (5.27)% | 7.50% | 4.89% |

| BlackRock Balanced Capital Fund — Investor C Shares | |||

| Return Before Taxes | (1.58)% | 8.07% | 4.84% |

| BlackRock Balanced Capital Fund — Institutional Shares | |||

| Return Before Taxes | 0.39% | 9.24% | 5.99% |

| BlackRock Balanced Capital Fund — Class R Shares | |||

| Return Before Taxes | (0.19)% | 8.53% | 5.28% |

| Russell

1000® Index (Reflects no deduction for fees, expenses or taxes) |

0.92% | 12.44% | 7.40% |

| Barclays

U.S. Aggregate Bond Index (Reflects no deduction for fees, expenses or taxes) |

0.55% | 3.25% | 4.51% |

| 60%

Russell 1000® Index/40% Barclays U.S. Aggregate Bond Index (Reflects no deduction for fees, expenses or taxes) |

1.00% | 8.88% | 6.55% |

| 1 | A portion of the Fund’s total return was attributable to proceeds received in a settlement of a litigation seeking recovery of investment losses previously realized by the Fund. |

| Name | Portfolio

Manager of the Fund Since |

Title |

| Philip Green | 2006 | Managing Director of BlackRock, Inc. |

| Name | Portfolio

Manager of the Total Return Portfolio Since |

Title |

| Rick Rieder | 2010 | Chief

Investment Officer of Fixed Income, Fundamental Portfolios BlackRock, Inc. |

| Bob Miller | 2011 | Managing Director of BlackRock, Inc. |

| Name | Portfolio

Manager of the Core Portfolio Since |

Title |

| Peter Stournaras, CFA | 2010 | Managing Director of BlackRock, Inc. |

Table of Contents

Table of Contents

| Investor

A and Investor C Shares |

Investor B Shares | Institutional Shares | Class R Shares | |

| Minimum

Initial Investment |

$1,000

for all accounts except: • $250 for certain fee-based programs. • $100 for certain employer-sponsored retirement plans. • $50, if establishing an Automatic Investment Plan. |

Available only through exchanges and dividend reinvestments by current holders and for purchase by certain employer-sponsored retirement plans. | There

is no minimum initial investment for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles,

unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. $2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. $1,000 for investors of Financial Intermediaries that: (i) charge such investors a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform. |

$100 for all accounts. |

| Minimum

Additional Investment |

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | N/A | No subsequent minimum. | No subsequent minimum. |

Table of Contents

Table of Contents

| ■ | Valuation |

| ■ | Management |

| ■ | Capital allocation |

| ■ | Business growth, and |

| ■ | Investor sentiment |

Table of Contents

| ■ | Relative price to earnings and price to book ratios |

| ■ | Stability and quality of earnings |

| ■ | Earnings momentum and growth |

| ■ | Weighted median market capitalization of the Core Portfolio’s portfolio |

| ■ | Allocation among the economic sectors of the Core Portfolio’s portfolio as compared to the applicable index |

| ■ | Weighted individual stocks within the applicable index |

Table of Contents

| ■ | U.S. Government debt securities |

| ■ | Corporate debt securities issued by U.S. and foreign companies |

| ■ | Asset-backed securities |

| ■ | Mortgage-backed securities |

| ■ | Preferred securities issued by U.S. and foreign companies |

| ■ | Corporate debt securities and preferred securities convertible into common stock |

| ■ | Foreign sovereign debt instruments |

| ■ | Money market securities |

Table of Contents

| ■ | Borrowing — The Fund may borrow for temporary or emergency purposes, including to meet redemptions, for the payment of dividends, for share repurchases or for the clearance of transactions. In addition, the Fund may participate in certain loan programs sponsored by the United States of America (and any of its subdivisions, agencies, departments, commissions, boards, authorities, instrumentalities or bureaus) to the extent permitted by the Investment Company Act or any SEC relief granted thereunder. Such participations will not be considered borrowings for purposes of the Fund’s limitation on borrowing, but may create similar risk of leverage to the Fund. Borrowing may exaggerate changes in the net asset value of Fund shares and in the return on the Fund’s portfolio. Borrowing will cost the Fund interest expense and other fees. The costs of borrowing may reduce the Fund’s return. Certain derivative securities that the Fund may buy or other techniques that the Fund may use may create leverage, including, but not limited to, when-issued securities, forward commitments and futures contracts and options. |

| ■ | Collateralized Debt Obligations — The Fund may invest up to 10% of its net assets in collateralized debt obligations (“CDOs”), of which 5% (as a percentage of the Fund’s net assets) may be in collateralized loan obligations (“CLOs”). CDOs are types of asset-backed securities. CLOs are ordinarily issued by a trust or other special purposes entity and are typically collateralized by a pool of loans, which may include, among others, domestic and non-U.S. senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans, held by such issuer. |

| ■ | Depositary Receipts — The Fund may invest in securities of foreign issuers in the form of depositary receipts or other securities that are convertible into securities of foreign issuers. |

| ■ | Illiquid/Restricted Securities — The Fund may invest up to 15% of its net assets in illiquid securities that it cannot sell within seven days at approximately current value. The Subsidiary will also limit its investment in illiquid securities to 15% of its net assets. In applying the illiquid securities restriction to the Fund, the Total Return Portfolio’s investment in the Subsidiary is considered to be liquid. Restricted securities are securities that cannot be offered for public resale unless registered under the applicable securities laws or that have a contractual restriction that prohibits or limits their resale (i.e., Rule 144A securities). They may include private placement securities that have not been registered under the applicable securities laws. Restricted securities may not be listed on an exchange and may have no active trading market and therefore may be considered to be illiquid. Rule 144A securities are restricted securities that can be resold to qualified institutional buyers but not to the general public. |

Table of Contents

| ■ | Indexed and Inverse Securities — The Fund may invest in securities the potential return of which is directly related to changes in an underlying index or interest rate, known as indexed securities. The Fund may also invest in securities the potential return of which is inversely related to changes in an interest rate (inverse floaters). The Fund may also purchase synthetically created inverse floating rate bonds evidenced by custodial or trust receipts. |

| ■ | Investment Companies — The Fund has the ability to invest in other investment companies, such as exchange-traded funds, unit investment trusts, and open-end and closed-end funds. The Fund may invest in affiliated investment companies, including affiliated money market funds and affiliated exchange-traded funds. |

| ■ | Master Limited Partnerships — The Fund may invest in publicly traded master limited partnerships (“MLPs”), which are limited partnerships or limited liability companies taxable as partnerships. MLPs generally have two classes of owners, the general partner and limited partners. If investing in an MLP, the Fund intends to purchase publicly traded common units issued to limited partners of the MLP. Limited partners have a limited role in the operations and management of the MLP. |

| ■ | Real Estate Investment Trusts — The Fund may invest in real estate investment trusts (“REITs”). |

| ■ | Repurchase Agreements and Purchase and Sale Contracts — The Fund may enter into certain types of repurchase agreements or purchase and sale contracts. Under a repurchase agreement, the seller agrees to repurchase a security at a mutually agreed-upon time and price. A purchase and sale contract is similar to a repurchase agreement, but purchase and sale contracts also provide that the purchaser receives any interest on the security paid during the period. |

| ■ | Reverse Repurchase Agreements — Reverse repurchase agreements involve the sale of securities held by a Fund with an agreement to repurchase the securities at an agreed-upon price, date and interest payment. |

| ■ | Securities Lending — The Fund may lend securities with a value up to 33 1⁄3% of its total assets to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral. |

| ■ | Short Sales — The Fund may make short sales of securities, either as a hedge against potential declines in value of a portfolio security or to realize appreciation when a security that the Fund does not own declines in value. The Fund will not make a short sale if, after giving effect to such sale, the market value of all securities sold short exceeds 10% of the value of its total assets. The Fund may also make short sales “against-the-box” without regard to this restriction. In this type of short sale, at the time of the sale, the Fund owns or has the immediate and unconditional right to acquire the identical security at no additional cost. |

| ■ | Small Cap and Emerging Growth Securities — The Fund may invest in equity securities of issuers with limited product lines or markets. |

| ■ | Standby Commitment Agreements — Standby commitment agreements commit the Fund, for a stated period of time, to purchase a stated amount of securities that may be issued and sold to the Fund at the option of the issuer. |

| ■ | Temporary Defensive Strategies — For temporary defensive purposes, the Fund may restrict the markets in which it invests and may invest without limitation in cash, cash equivalents, money market securities, such as U.S. Treasury and agency obligations, other U.S. Government securities, short-term debt obligations of corporate issuers, certificates of deposit, bankers acceptances, commercial paper (short-term, unsecured, negotiable promissory notes of a domestic or foreign issuer) or other high quality fixed-income securities. Normally a portion of the Fund’s assets would be held in these securities in anticipation of investment in equities or to meet redemptions. Investments in money market securities can be sold easily and have limited risk of loss. These investments may affect the Fund’s ability to achieve its investment objective. |

| ■ | When-Issued and Delayed Delivery Securities and Forward Commitments — The purchase or sale of securities on a when-issued basis, on a delayed delivery basis or through a forward commitment involves the purchase or sale of securities by the Fund at an established price with payment and delivery taking place in the future. The Fund enters into these transactions to obtain what is considered an advantageous price to the Fund at the time of entering into the transaction. |

Table of Contents

| ■ | Commodities Related Investments Risk — Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. |

| ■ | Convertible Securities Risk — The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock. |

| ■ | Corporate Loans Risk — Commercial banks and other financial institutions or institutional investors make corporate loans to companies that need capital to

grow or restructure. Borrowers generally pay interest on corporate loans at rates that change in response to changes in market interest rates such as the London Interbank Offered Rate (“LIBOR”) or the prime rates of U.S. banks. As a

result, the value of corporate loan investments is generally less exposed to the adverse effects of shifts in market interest rates than investments that pay a fixed rate of interest. However, because the trading market for certain corporate loans

may be less developed than the secondary market for bonds and notes, the Fund may experience difficulties in selling its corporate loans. Transactions in corporate loans may settle on a delayed basis. As a result, the proceeds from the sale of

corporate loans may not be readily available to make additional investments or to meet the Fund’s redemption obligations. To the extent the extended settlement process gives rise to short-term liquidity needs, the Fund may hold additional

cash, sell investments or temporarily borrow from banks and other lenders. Leading financial institutions often act as agent for a broader group of lenders, generally referred to as a syndicate. The syndicate’s agent arranges the corporate

loans, holds collateral and accepts payments of principal and interest. If the agent develops financial problems, the Fund may not recover its investment or recovery may be delayed. By investing in a corporate loan, the Fund may become a member of

the syndicate. |

| The market for corporate loans may be subject to irregular trading activity and wide bid/ask spreads. | |

| The corporate loans in which the Fund invests are subject to the risk of loss of principal and income. Although borrowers frequently provide collateral to secure repayment of these obligations they do not always do so. If they do provide collateral, the value of the collateral may not completely cover the borrower’s obligations at the time of a default. If a borrower files for protection from its creditors under the U.S. bankruptcy laws, these laws may limit the Fund’s rights to its collateral. In addition, the value of collateral may erode during a bankruptcy case. In the event of a bankruptcy, the holder of a corporate loan may not recover its principal, may experience a long delay in recovering its investment and may not receive interest during the delay. |

| ■ | Debt Securities Risk — Debt securities, such as bonds, involve interest rate risk, credit risk, extension risk, and prepayment risk, among other things. |

Table of Contents

| ■ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

Table of Contents

Table of Contents

| ■ | Dollar Rolls Risk — A dollar roll transaction involves a sale by the Fund of a mortgage-backed or other security concurrently with an agreement by the Fund to repurchase a similar security at a later date at an agreed-upon price. Dollar roll transactions involve the risk that the market value of the securities the Fund is required to purchase may decline below the agreed upon repurchase price of those securities. If the broker/dealer to whom the Fund sells securities becomes insolvent, the Fund’s right to purchase or repurchase securities may be restricted. Successful use of mortgage dollar rolls may depend upon the adviser’s ability to correctly predict interest rates and prepayments. There is no assurance that dollar rolls can be successfully employed. |

Table of Contents

| ■ | Emerging Markets Risk — The risks of foreign investments are usually much greater for emerging markets. Investments in emerging markets may be considered speculative. Emerging markets may include those in countries considered emerging or developing by the World Bank, the International Finance Corporation or the United Nations. Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. They are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging markets have far lower trading volumes and less liquidity than developed markets. Since these markets are often small, they may be more likely to suffer sharp and frequent price changes or long-term price depression because of adverse publicity, investor perceptions or the actions of a few large investors. In addition, traditional measures of investment value used in the United States, such as price to earnings ratios, may not apply to certain small markets. Also, there may be less publicly available information about issuers in emerging markets than would be available about issuers in more developed capital markets, and such issuers may not be subject to accounting, auditing and financial reporting standards and requirements comparable to those to which U.S. companies are subject. |

| Many emerging markets have histories of political instability and abrupt changes in policies. As a result, their governments are more likely to take actions that are hostile or detrimental to private enterprise or foreign investment than those of more developed countries, including expropriation of assets, confiscatory taxation, high rates of inflation or unfavorable diplomatic developments. In the past, governments of such nations have expropriated substantial amounts of private property, and most claims of the property owners have never been fully settled. There is no assurance that such expropriations will not reoccur. In such an event, it is possible that the Fund could lose the entire value of its investments in the affected market. Some countries have pervasiveness of corruption and crime that may hinder investments. Certain emerging markets may also face other significant internal or external risks, including the risk of war, and ethnic, religious and racial conflicts. In addition, governments in many emerging market countries participate to a significant degree in their economies and securities markets, which may impair investment and economic growth. National policies that may limit the Fund’s investment opportunities include restrictions on investment in issuers or industries deemed sensitive to national interests. | |

| Emerging markets may also have differing legal systems and the existence or possible imposition of exchange controls, custodial restrictions or other foreign or U.S. governmental laws or restrictions applicable to such investments. Sometimes, they may lack or be in the relatively early development of legal structures governing private and foreign investments and private property. Many emerging markets do not have income tax treaties with the United States, and as a result, investments by the Fund may be subject to higher withholding taxes in such countries. In addition, some countries with emerging markets may impose differential capital gains taxes on foreign investors. | |

| Practices in relation to settlement of securities transactions in emerging markets involve higher risks than those in developed markets, in part because the Fund will need to use brokers and counterparties that are less well capitalized, and custody and registration of assets in some countries may be unreliable. The possibility of fraud, negligence, undue influence being exerted by the issuer or refusal to recognize that ownership exists in some emerging markets, and, along with other factors, could result in ownership registration being completely lost. The Fund would absorb any loss resulting from such registration problems and may have no successful claim for compensation. In addition, communications between the United States and emerging market countries may be unreliable, increasing the risk of delayed settlements or losses of security certificates. |

| ■ | Equity Securities Risk — Common and preferred stocks represent equity ownership in a company. Stock markets are volatile. The price of equity securities will fluctuate and can decline and reduce the value of a portfolio investing in equities. The value of equity securities purchased by the Fund could decline if the financial condition of the companies the Fund invests in declines or if overall market and economic conditions deteriorate. The value of equity securities may also decline due to factors that affect a particular industry or industries, such as labor shortages or an increase in production costs and competitive conditions within an industry. In addition, the value may decline due to general market conditions that are not specifically related to a company or industry, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or generally adverse investor sentiment. |

| ■ | Expense Risk — Fund expenses are subject to a variety of factors, including fluctuations in the Fund’s net assets. Accordingly, actual expenses may be greater or less than those indicated. For example, to the extent that the Fund’s net assets decrease due to market declines or redemptions, the Fund’s expenses will increase as a percentage of Fund net assets. During periods of high market volatility, these increases in the Fund’s expense ratio could be significant. |

| ■ | Foreign Securities Risk — Securities traded in foreign markets have often (though not always) performed differently from securities traded in the United States. However, such investments often involve special risks not present in |

Table of Contents

| U.S. investments that can increase the chances that the Fund will lose money. In particular, the Fund is subject to the risk that because there may be fewer investors on foreign exchanges and a smaller number of securities traded each day, it may be more difficult for the Fund to buy and sell securities on those exchanges. In addition, prices of foreign securities may go up and down more than prices of securities traded in the United States. |

Table of Contents

| ■ | High Portfolio Turnover Risk — The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover (more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies. These effects of higher than normal portfolio turnover may adversely affect Fund performance. In addition, investment in mortgage dollar rolls and participation in TBA transactions may significantly increase the Fund’s portfolio turnover rate. A TBA transaction is a method of trading mortgage-backed securities where the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount, and price at the time the contract is entered into but the mortgage-backed securities are delivered in the future, generally 30 days later. |

| ■ | Investment Style Risk — Under certain market conditions, growth investments have performed better during the later stages of economic expansion and value investments have performed better during periods of economic recovery. Therefore, these investment styles may over time go in and out of favor. At times when the investment style used by the Fund is out of favor, the Fund may underperform other equity funds that use different investment styles. |

| ■ | Junk Bonds Risk — Although junk bonds generally pay higher rates of interest than investment grade bonds, junk bonds are high risk investments that may cause income and principal losses for the Fund. The major risks of junk bond investments include: |

| ■ | Junk bonds may be issued by less creditworthy issuers. Issuers of junk bonds may have a larger amount of outstanding debt relative to their assets than issuers of investment grade bonds. In the event of an issuer’s bankruptcy, claims of other creditors may have priority over the claims of junk bond holders, leaving few or no assets available to repay junk bond holders. |

| ■ | Prices of junk bonds are subject to extreme price fluctuations. Adverse changes in an issuer’s industry and general economic conditions may have a greater impact on the prices of junk bonds than on other higher rated fixed-income securities. |

| ■ | Issuers of junk bonds may be unable to meet their interest or principal payment obligations because of an economic downturn, specific issuer developments, or the unavailability of additional financing. |

| ■ | Junk bonds frequently have redemption features that permit an issuer to repurchase the security from the Fund before it matures. If the issuer redeems junk bonds, the Fund may have to invest the proceeds in bonds with lower yields and may lose income. |

| ■ | Junk bonds may be less liquid than higher rated fixed-income securities, even under normal economic conditions. There are fewer dealers in the junk bond market, and there may be significant differences in the prices quoted for junk bonds by the dealers. Because they are less liquid, judgment may play a greater role in valuing certain of the Fund’s securities than is the case with securities trading in a more liquid market. |

| ■ | The Fund may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms with a defaulting issuer. |

| ■ | Leverage Risk — Some transactions may give rise to a form of economic leverage. These transactions may include, among others, derivatives, and may expose the Fund to greater risk and increase its costs. As an open-end investment company registered with the SEC, the Fund is subject to the federal securities laws, including the Investment Company Act,, the rules thereunder, and various SEC and SEC staff interpretive positions. In accordance |

Table of Contents

| with these laws, rules and positions, the Fund must “set aside” liquid assets (often referred to as “asset segregation”), or engage in other SEC- or staff-approved measures, to “cover” open positions with respect to certain kinds of instruments. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet any required asset segregation requirements. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. | |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| ■ | Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. |

| ■ | Money Market Securities Risk — If market conditions improve while the Fund has temporarily invested some or all of its assets in high quality money market securities, this strategy could result in reducing the potential gain from the market upswing, thus reducing the Fund’s opportunity to achieve its investment objective. |

| ■ | Mortgage- and Asset-Backed Securities Risks — Mortgage-backed securities (residential and commercial) and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Although asset-backed and commercial mortgage-backed securities (“CMBS”) generally experience less prepayment than residential mortgage-backed securities, mortgage-backed and asset-backed securities, like traditional fixed-income securities, are subject to credit, interest rate, prepayment and extension risks. |

| Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. The Fund’s investments in asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. These securities also are subject to the risk of default on the underlying mortgage or assets, particularly during periods of economic downturn. Certain CMBS are issued in several classes with different levels of yield and credit protection. The Fund’s investments in CMBS with several classes may be in the lower classes that have greater risks than the higher classes, including greater interest rate, credit and prepayment risks. | |

| Mortgage-backed securities may be either pass-through securities or collateralized mortgage obligations (“CMOs”). Pass-through securities represent a right to receive principal and interest payments collected on a pool of mortgages, which are passed through to security holders. CMOs are created by dividing the principal and interest payments collected on a pool of mortgages into several revenue streams (tranches) with different priority rights to portions of the underlying mortgage payments. Certain CMO tranches may represent a right to receive interest only (“IOs”), principal only (“POs”) or an amount that remains after floating-rate tranches are paid (an inverse floater). These securities are frequently referred to as “mortgage derivatives” and may be extremely sensitive to changes in interest rates. Interest rates on inverse floaters, for example, vary inversely with a short-term floating rate (which may be reset periodically). Interest rates on inverse floaters will decrease when short-term rates increase, and will increase when short-term rates decrease. These securities have the effect of providing a degree of investment leverage. In response to changes in market interest rates or other market conditions, the value of an inverse floater may increase or decrease at a multiple of the increase or decrease in the value of the underlying securities. If the Fund invests in CMO tranches (including CMO tranches issued by government agencies) and interest rates move in a manner not anticipated by Fund management, it is possible that the Fund could lose all or substantially all of its investment. Certain mortgage-backed securities in which the Fund may invest may also provide a degree of investment leverage, which could cause the Fund to lose all or substantially all of its investment. | |

| The mortgage market in the United States has experienced difficulties that may adversely affect the performance and market value of certain of the Fund’s mortgage-related investments. Delinquencies and losses on mortgage loans (including subprime and second-lien mortgage loans) generally have increased and may continue to increase, and a decline in or flattening of real-estate values (as has been experienced and may continue to be experienced in many housing markets) may exacerbate such delinquencies and losses. Also, a number of mortgage loan originators have experienced serious financial difficulties or bankruptcy. Reduced investor demand for mortgage loans and mortgage-related securities and increased investor yield requirements have caused limited liquidity in the secondary market for mortgage-related securities, which can adversely affect the market value of mortgage-related securities. It is possible that such limited liquidity in such secondary markets could continue or worsen. | |

| Asset-backed securities entail certain risks not presented by mortgage-backed securities, including the risk that in certain states it may be difficult to perfect the liens securing the collateral backing certain asset-backed securities. |

Table of Contents

| In addition, certain asset-backed securities are based on loans that are unsecured, which means that there is no collateral to seize if the underlying borrower defaults. | |

| ■ | Preferred Securities Risk — Preferred securities may pay fixed or adjustable rates of return. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. In addition, a company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred securities will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Preferred securities of smaller companies may be more vulnerable to adverse developments than preferred stock of larger companies. |

| ■ | Sovereign Debt Risk — Sovereign debt instruments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. If a governmental entity defaults, it may ask for more time in which to pay or for further loans. There is no legal process for collecting sovereign debt that a government does not pay nor are there bankruptcy proceedings through which all or part of the sovereign debt that a governmental entity has not repaid may be collected. |

| ■ | Structured Notes Risk — Structured notes and other related instruments purchased by the Fund are generally privately negotiated debt obligations where the principal and/or interest is determined by reference to the performance of a specific asset, benchmark asset, market or interest rate (“reference measure”). The interest rate or the principal amount payable upon maturity or redemption may increase or decrease, depending upon changes in the value of the reference measure. The terms of a structured note may provide that, in certain circumstances, no principal is due at maturity and, therefore, may result in a loss of invested capital by the Fund. The interest and/or principal payments that may be made on a structured product may vary widely, depending on a variety of factors, including the volatility of the reference measure. |

| Structured notes may be positively or negatively indexed, so the appreciation of the reference measure may produce an increase or a decrease in the interest rate or the value of the principal at maturity. The rate of return on structured notes may be determined by applying a multiplier to the performance or differential performance of reference measures. Application of a multiplier involves leverage that will serve to magnify the potential for gain and the risk of loss. | |

| The purchase of structured notes exposes the Fund to the credit risk of the issuer of the structured product. Structured notes may also be more volatile, less liquid, and more difficult to price accurately than less complex securities and instruments or more traditional debt securities. | |

| ■ | Subsidiary Risk — By indirectly investing in the Subsidiary through its investment in the Total Return Portfolio, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The commodity-related instruments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund or the Total Return Portfolio and are subject to the same risks that apply to similar investments if held directly by the Fund or the Total Return Portfolio (see “Commodities Related Investment Risks” above). These risks are described elsewhere in this prospectus. There can be no assurance that the investment objective of the Subsidiary will be achieved. The Subsidiary is not registered under the Investment Company Act, and, unless otherwise noted in this prospectus, is not subject to all the investor protections of the Investment Company Act. However, the Total Return Portfolio wholly owns and controls the Subsidiary, and the Total Return Portfolio and the Subsidiary are both managed by BlackRock, making it unlikely that the Subsidiary will take action contrary to the interests of the Fund and its shareholders. The Board has oversight responsibility for the investment activities of the Fund and the Total Return Portfolio, including the Total Return Portfolio’s investment in the Subsidiary, and the Total Return Portfolio’s role as sole shareholder of the Subsidiary. The Subsidiary will be subject to the same investment restrictions and limitations, and follow the same compliance policies and procedures, as the Fund and the Master Bond LLC. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund, the Total Return Portfolio and/or the Subsidiary to operate as described in this prospectus and the SAI and could adversely affect the Fund. For example, the Cayman Islands does not currently impose any income, corporate or capital gains tax, estate duty, inheritance tax, gift tax or withholding tax on the Subsidiary. If Cayman Islands law changes such that the Subsidiary must pay Cayman Islands taxes, Fund shareholders would likely suffer decreased investment returns. |

| In addition, in late July 2011, the Internal Revenue Service suspended the granting of private letter rulings that concluded that the income and gain generated by a registered investment company’s investments in commodity-linked notes, and the income generated from investments in controlled foreign subsidiaries that invest in physical commodities and/or commodity-linked derivative instruments, would be “qualifying income” for regulated investment |

Table of Contents

| company qualification purposes. As a result, there can be no assurance that the Internal Revenue Service will treat such income and gain as “qualifying income.” If the Internal Revenue Service makes an adverse determination relating to the treatment of such income and gain, the Fund will likely need to change its investment strategies, which could adversely affect the Fund. | |

| ■ | U.S. Government Issuer Risk — Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Obligations of U.S. Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U.S. Government. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so. |

| ■ | U.S. Government Mortgage-Related Securities Risk — There are a number of important differences among the agencies and instrumentalities of the U.S. Government that issue mortgage-related securities and among the securities that they issue. Mortgage-related securities guaranteed by the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) are guaranteed as to the timely payment of principal and interest by GNMA and such guarantee is backed by the full faith and credit of the United States. GNMA securities also are supported by the right of GNMA to borrow funds from the U.S. Treasury to make payments under its guarantee. Mortgage-related securities issued by Fannie Mae or Freddie Mac are solely the obligations of Freddie Mac or Fannie Mae, as the case may be, and are not backed by or entitled to the full faith and credit of the United States but are supported by the right of the issuer to borrow from the Treasury. |

| ■ | Borrowing Risk — Borrowing may exaggerate changes in the net asset value of Fund shares and in the return on the Fund’s portfolio. Borrowing will cost the Fund interest expense and other fees. The costs of borrowing may reduce the Fund’s return. Borrowing may cause the Fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations. |

| ■ | Collateralized Debt Obligations Risk — In addition to the typical risks associated with fixed-income securities and asset-backed securities, CDOs carry additional risks including, but not limited to: (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments; (ii) the risk that the collateral may default or decline in value or be downgraded, if rated by a nationally recognized statistical rating organization; (iii) the Fund may invest in tranches of CDOs that are subordinate to other tranches; (iv) the structure and complexity of the transaction and the legal documents could lead to disputes among investors regarding the characterization of proceeds; (v) the investment return achieved by the Fund could be significantly different than those predicted by financial models; (vi) the lack of a readily available secondary market for CDOs; (vii) risk of forced “fire sale” liquidation due to technical defaults such as coverage test failures; and (viii) the CDO’s manager may perform poorly. In addition, investments in CDOs may be characterized by the Fund as illiquid securities. |

| ■ | Depositary Receipts Risk — The issuers of unsponsored depositary receipts are not obligated to disclose information that is, in the United States, considered material. Therefore, there may be less information available regarding these issuers and there may not be a correlation between such information and the market value of the depositary receipts. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. |

| ■ | Expense Risk — Fund expenses are subject to a variety of factors, including fluctuations in the Fund’s net assets. Accordingly, actual expenses may be greater or less than those indicated. For example, to the extent that the Fund’s net assets decrease due to market declines or redemptions, the Fund’s expenses will increase as a percentage of Fund net assets. During periods of high market volatility, these increases in the Fund’s expense ratio could be significant. |

| ■ | Indexed and Inverse Securities Risk — Certain indexed and inverse securities have greater sensitivity to changes in interest rates or index levels than other securities, and the Fund’s investment in such instruments may decline significantly in value if interest rates or index levels move in a way Fund management does not anticipate. |

| ■ | Investment in Other Investment Companies Risk — As with other investments, investments in other investment companies are subject to market and selection risk. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their proportionate share of expenses in the Fund (including management and advisory fees) and, indirectly, the expenses of the investment companies. To the extent the Fund is held by an affiliated fund, the ability of the Fund itself to hold other investment companies may be limited. |

| ■ | Liquidity Risk — Liquidity risk exists when particular investments are difficult to purchase or sell. The Fund’s investment in illiquid securities may reduce the returns of the Fund because it may be difficult to sell the illiquid securities at an advantageous time or price. To the extent that the Fund’s principal investment strategies involve |

Table of Contents

| derivatives or securities with substantial market and/or credit risk, the Fund will tend to have the greatest exposure to liquidity risk. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. Illiquid investments may be harder to value, especially in changing markets, and if the Fund is forced to sell these investments to meet redemption requests or for other cash needs, the Fund may suffer a loss. In addition, when there is illiquidity in the market for certain securities, the Fund, due to limitations on illiquid investments, may be subject to purchase and sale restrictions. | |

| ■ | Master Limited Partnerships Risk — The common units of an MLP are listed and traded on U.S. securities exchanges and their value fluctuates predominantly based on prevailing market conditions and the success of the MLP. Unlike owners of common stock of a corporation, owners of common units have limited voting rights and have no ability annually to elect directors. In the event of liquidation, common units have preference over subordinated units, but not over debt or preferred units, to the remaining assets of the MLP. |

| ■ | Real Estate Related Securities Risk — The main risk of real estate related securities is that the value of the underlying real estate may go down. Many factors may affect real estate values. These factors include both the general and local economies, the amount of new construction in a particular area, the laws and regulations (including zoning and tax laws) affecting real estate and the costs of owning, maintaining and improving real estate. The availability of mortgages and changes in interest rates may also affect real estate values. If the Master Portfolio’s real estate related investments are concentrated in one geographic area or in one property type, the Master Portfolio will be particularly subject to the risks associated with that area or property type. |

| ■ | REIT Investment Risk — In addition to the risks facing real estate related securities, such as a decline in property values due to increasing vacancies, a decline in rents resulting from unanticipated economic, legal or technological developments or a decline in the price of securities of real estate companies due to a failure of borrowers to pay their loans or poor management, investments in REITs involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume and may be more volatile than other securities. |

| ■ | Repurchase Agreements and Purchase and Sale Contracts Risk — If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security in either situation and the market value of the security declines, the Fund may lose money. |

| ■ | Reverse Repurchase Agreements Risk — Reverse repurchase agreements involve the sale of securities held by the Fund with an agreement to repurchase the securities at an agreed-upon price, date and interest payment. Reverse repurchase agreements involve the risk that the other party may fail to return the securities in a timely manner or at all. The Fund could lose money if it is unable to recover the securities and the value of the collateral held by the Fund, including the value of the investments made with cash collateral, is less than the value of the securities. These events could also trigger adverse tax consequences to the Fund. |

| ■ | Securities Lending Risk — Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, the Fund may lose money and there may be a delay in recovering the loaned securities. The Fund could also lose money if it does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral. These events could trigger adverse tax consequences for the Fund. |

| ■ | Short Sales Risk — Because making short sales in securities that it does not own exposes the Fund to the risks associated with those securities, such short sales involve speculative exposure risk. The Fund will incur a loss as a result of a short sale if the price of the security increases between the date of the short sale and the date on which the Fund replaces the security sold short. The Fund will realize a gain if the security declines in price between those dates. As a result, if the Fund makes short sales in securities that increase in value, it will likely underperform similar funds that do not make short sales in securities they do not own. There can be no assurance that the Fund will be able to close out a short sale position at any particular time or at an acceptable price. Although the Fund’s gain is limited to the amount at which it sold a security short, its potential loss is limited only by the maximum attainable price of the security, less the price at which the security was sold. The Fund may also pay transaction costs and borrowing fees in connection with short sales. |

| ■ | Small Cap and Emerging Growth Securities Risk — Small cap or emerging growth companies may have limited product lines or markets. They may be less financially secure than larger, more established companies. They may depend on a small number of key personnel. If a product fails or there are other adverse developments, or if management changes, the Fund’s investment in a small cap or emerging growth company may lose substantial value. In addition, it is more difficult to get information on smaller companies, which tend to be less well known, have shorter operating histories, do not have significant ownership by large investors and are followed by relatively few securities analysts. |

Table of Contents