JANUARY 28, 2013

|

SUMMARY PROSPECTUS

|

|

BlackRock Balanced Capital Fund, Inc. | Investor, Institutional and Class R Shares

Investor A: MDCPX Ÿ Investor B: MBCPX Ÿ Investor C: MCCPX Ÿ Institutional: MACPX Ÿ Class R: MRBPX

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements) and other information about the Fund, including the Fund’s statement of additional information and shareholder report, online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request to prospectus.request@blackrock.com, or from your financial professional. The Fund’s prospectus and statement of additional information, both dated January 28, 2013, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Summary Prospectus

Key Facts about BlackRock Balanced Capital Fund, Inc.

Investment Objective

The investment objective of BlackRock Balanced Capital Fund, Inc. (the “Fund”) is to seek the highest total investment return through a fully managed investment policy utilizing equity, debt (including money market) and convertible securities.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in the BlackRock-advised fund complex. More information about these and other discounts is available from your financial professional and in the “Details about the Share Classes” section on page 11 of the Fund’s prospectus and in the “Purchase of Shares” section on page II-73 of the Fund’s statement of additional information.

| Shareholder Fees (fees paid directly from your investment) |

Investor A Shares |

Investor B Shares |

Investor C Shares |

Institutional Shares |

Class R Shares |

|||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as percentage of offering price) |

5.25 | % | None | None | None | None | ||||||||||||||

| Maximum Deferred Sales Charge (Load) (as percentage of offering price or redemption proceeds, whichever is lower) |

None | 1 | 4.50 | %2 | 1.00 | %2 | None | None | ||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the |

Investor A Shares |

Investor B Shares |

Investor C Shares |

Institutional Shares |

Class R Shares |

|||||||||||||||

| Management Fee3 |

0.43% | 0.43% | 0.43% | 0.43% | 0.43% | |||||||||||||||

| Distribution and/or Service (12b-1) Fees |

0.25% | 1.00% | 1.00% | None | 0.50% | |||||||||||||||

| Other Expenses |

0.60% | 0.86% | 0.63% | 0.54% | 4 | 0.74% | ||||||||||||||

| Other Expenses |

0.60% | 0.86% | 0.63% | 0.54%4 | 0.74% | |||||||||||||||

| Other Expenses of the Subsidiary5 |

— | — | — | — | — | |||||||||||||||

| Total Annual Fund Operating Expenses |

1.28% | 2.29% | 2.06% | 0.97% | 1.67% | |||||||||||||||

| Fee Waivers and/or Expense Reimbursements3 |

(0.31)% | (0.31)% | (0.31)% | (0.31)% | (0.31)% | |||||||||||||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements3 |

0.97% | 1.98% | 1.75% | 0.66% | 1.36% | |||||||||||||||

| 1 | A contingent deferred sales charge (“CDSC”) of 0.75% is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge was paid at the time of purchase of an investment of $1,000,000 or more. |

| 2 | The CDSC for Investor B Shares is 4.50% if shares are redeemed in less than one year. The CDSC for Investor B Shares decreases for redemptions made in subsequent years. After six years there is no CDSC on Investor B Shares. (See the section “Details about the Share Classes — Investor B Shares” for the complete schedule of CDSCs.) There is no CDSC on Investor C Shares after one year. |

| 3 | As described in the Fund’s prospectus on page 38, BlackRock has contractually agreed to waive its management fee by the amount of any management fees the Fund pays the manager of the Master Portfolios (defined below) indirectly through its investment in the Master Portfolios for as long as the Fund invests in the Master Portfolios. The contractual agreement may be terminated upon 90 days notice by a majority of the non-interested directors of the Fund or by a vote of a majority of the outstanding voting securities of the Fund. |

| 4 | Other expenses have been restated to reflect current fees. |

| 5 | Other expenses of the BlackRock Cayman Master Total Return Portfolio I, Ltd. (the “Subsidiary”) were less than 0.01% for the Fund’s last fiscal year. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Investor A Shares |

$ | 619 | $ | 818 | $ | 1,033 | $ | 1,652 | ||||||||

| Investor B Shares |

$ | 651 | $ | 971 | $ | 1,268 | $ | 2,045 | ||||||||

| Investor C Shares |

$ | 278 | $ | 551 | $ | 949 | $ | 2,062 | ||||||||

| Institutional Shares |

$ | 67 | $ | 211 | $ | 368 | $ | 822 | ||||||||

| Class R Shares |

$ | 138 | $ | 431 | $ | 745 | $ | 1,635 | ||||||||

2

You would pay the following expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Investor B Shares |

$ | 201 | $ | 621 | $ | 1,068 | $ | 2,045 | ||||||||

| Investor C Shares |

$ | 178 | $ | 551 | $ | 949 | $ | 2,062 | ||||||||

Portfolio Turnover:

The Total Return Portfolio (defined below) and the Core Portfolio (defined below) pay transaction costs, such as commissions, when they buy and sell securities (or “turn over” their portfolios). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the performance of the Total Return Portfolio and the Core Portfolio. During the most recent fiscal year, the Total Return Portfolio’s turnover rate was 1,346% of the average value of its portfolio and the Core Portfolio’s turnover rate was 128% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund invests in equity securities (including common stock, preferred stock, securities convertible into common stock, or securities or other instruments whose price is linked to the value of common stock) and fixed-income securities (including debt securities, convertible securities and short term securities). The Fund may make investments directly in equity and fixed-income securities, indirectly through one or more funds that invest in such securities, or in a combination of securities and funds. Fund management shifts the allocation among these securities types. The proportion the Fund invests in each category at any given time depends on Fund management’s view of how attractive that category appears relative to the others. This flexibility is the keystone of the Fund’s investment strategy. The Fund intends to invest at least 25% of its assets in equity securities and at least 25% of its assets in senior fixed-income securities, such as U.S. government debt securities, corporate debt securities, and mortgage-backed and asset-backed securities. The Fund may also enter into dollar rolls. Fund management expects that, as a general rule, a majority of the Fund’s equity investments will be equity securities of large cap companies selected from the Russell 1000® Index. Large cap companies are companies that at the time of purchase have a market capitalization equal to or greater than the top 80% of the companies that comprise the Russell 1000® Index. As of June 22, 2012, the most recent rebalance date, the lowest market capitalization in this group was $1.4 billion. The market capitalizations of companies in the index change with market conditions and the composition of the index. The Fund may also invest in mid cap companies. Management of the Core Portfolio (defined below) chooses equity securities for the Fund using a proprietary multifactor quantitative model to analyze and rank each stock in the universe based on a series of measurable factors, including valuation, accounting, fundamental momentum and investment sentiment. The Fund may invest up to 30% of its net assets in securities of foreign issuers, of which 20% (as a percentage of the Fund’s net assets) may be in emerging markets issuers. Investments in U.S. dollar-denominated securities of foreign issuers, excluding issuers from emerging markets, are permitted beyond the 30% limit. This means that the Fund may invest in such U.S. dollar-denominated securities of foreign issuers without limit. The Fund may invest in debt securities of any duration or maturity. The Fund will invest primarily in fixed-income securities that are rated investment grade, but may also invest in fixed-income securities rated below investment grade or unrated securities of equivalent credit quality.

The Fund intends to invest all of its fixed-income assets in the Master Total Return Portfolio (the “Total Return Portfolio”) of Master Bond LLC (“Master Bond LLC”). The primary objective of the Total Return Portfolio is to realize total return that exceeds that of the Barclays U.S. Aggregate Bond Index. The Fund intends to invest all of its equity assets in the Master Large Cap Core Portfolio (the “Core Portfolio” and together with the Total Return Portfolio, the “Master Portfolios”) of Master Large Cap Series LLC (“Master Large Cap LLC”). The Core Portfolio utilizes a blended investment strategy that emphasizes a mix of both growth and value and will seek to outperform the Russell 1000® Index.

The Total Return Portfolio may use derivatives, including, but not limited to, interest rate, total return and credit default swaps, indexed and inverse floating rate securities, options, futures, option on futures and swaps, for hedging purposes, as well as to increase the return on its portfolio investments. The Total Return Portfolio may also invest in credit-linked or structured notes or other instruments evidencing interests in entities that hold or represent interests in fixed-income securities. The Core Portfolio may use derivatives, including options, futures, indexed securities, inverse securities, swaps and forward contracts both to seek to increase the return of the Core Portfolio and to hedge (or protect) the value of its assets against adverse movements in currency exchange rates, interest rates and movements in the securities markets. In order to effectively manage cash flows into or out of the Core Portfolio, the Core Portfolio may buy and sell financial futures contracts or options on such contracts. Derivatives are financial instruments whose value is derived from another security, a commodity (such as oil or gas), a currency or an index, including but not limited to the S&P 500 Index and the VIX. The use of options, futures, indexed securities, inverse securities, swaps and forward contracts can be effective in protecting or enhancing the value of the Core Portfolio’s assets.

3

The investment results of the fixed-income and equity portions of the Fund’s portfolio will correspond directly to the investment results of (i) the Total Return Portfolio together with those of any fixed-income investments held directly by the Fund and (ii) the Core Portfolio together with those of any equity investments held directly by the Fund, respectively. For simplicity, this Prospectus uses the term “Fund” to include the underlying Total Return Portfolio and Core Portfolio in which the Fund invests.

The Fund may seek to provide exposure to the investment returns of real assets that trade in the commodity markets through investment in commodity-linked derivative instruments and investment vehicles that exclusively invest in commodities such as exchange traded funds, which are designed to provide this exposure without direct investment in physical commodities. The Fund may also gain exposure to commodity markets by investing, through the Total Return Portfolio, up to 25% of its total assets in the Subsidiary, a wholly owned subsidiary of the Total Return Portfolio formed in the Cayman Islands, which invests primarily in commodity-related instruments.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The following is a summary description of certain risks of investing in the Fund.

| n | Commodities Related Investments Risks — Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. |

| n | Convertible Securities Risk — The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock. |

| n | Credit Risk — Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| n | Derivatives Risk — The Fund’s use of derivatives may reduce the Fund’s returns and/or increase volatility. Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with the overall securities markets. The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately. Derivatives may give rise to a form of leverage and may expose the Fund to greater risk and increase its costs. Recent legislation calls for new regulation of the derivatives markets. The extent and impact of the regulation is not yet known and may not be known for some time. New regulation may make derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect the value or performance of derivatives. |

| n | Dollar Rolls Risk — Dollar rolls involve the risk that the market value of the securities that the Fund is committed to buy may decline below the price of the securities the Fund has sold. These transactions may involve leverage. |

| n | Emerging Markets Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. |

| n | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| n | Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall. |

4

| n | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| — | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| — | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| — | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| — | The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their capital markets or in certain industries. |

| — | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| — | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| n | High Portfolio Turnover Risk — The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover (more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies. These effects of higher than normal portfolio turnover may adversely affect Fund performance. In addition, investment in mortgage dollar rolls and participation in TBA transactions may significantly increase the Fund’s portfolio turnover rate. A TBA transaction is a method of trading mortgage-backed securities where the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount, and price. |

| n | Interest Rate Risk — Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall, and decrease as interest rates rise. |

| n | Investment Style Risk — Because different kinds of stocks go in and out of favor depending on market conditions, the Fund’s performance may be better or worse than other funds with different investment styles (e.g., growth vs. value, large cap vs. small cap). |

| n | Junk Bonds Risks — Although junk bonds generally pay higher rates of interest than investment grade bonds, junk bonds are high risk investments that may cause income and principal losses for the Fund. |

| n | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| n | Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. |

| n | Money Market Securities Risk — If market conditions improve while the Fund has temporarily invested some or all of its assets in high quality money market securities, this strategy could result in reducing the potential gain from the market upswing, thus reducing the Fund’s opportunity to achieve its investment objective. |

| n | Mortgage- and Asset-Backed Securities Risks — Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. |

| n | Preferred Securities Risk — Preferred securities may pay fixed or adjustable rates of return. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. In addition, a company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred securities will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Preferred securities of smaller companies may be more vulnerable to adverse developments than preferred stock of larger companies. |

5

| n | Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields. |

| n | Sovereign Debt Risk — Sovereign debt instruments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. |

| n | Structured Notes Risk — Structured notes and other related instruments purchased by the Fund are generally privately negotiated debt obligations where the principal and/or interest is determined by reference to the performance of a specific asset, benchmark asset, market or interest rate (“reference measure”). The purchase of structured notes exposes a Fund to the credit risk of the issuer of the structured product. Structured notes may be leveraged, increasing the volatility of each structured note’s value relative to the change in the reference measure. Structured notes may also be less liquid and more difficult to price accurately than less complex securities and instruments or more traditional debt securities. |

| n | Subsidiary Risk — By indirectly investing in the Subsidiary through its investment in the Total Return Portfolio, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The commodity-related instruments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund or the Total Return Portfolio and are subject to the same risks that apply to similar investments if held directly by the Fund or the Total Return Portfolio (see “Commodities Related Investment Risks” above). There can be no assurance that the investment objective of the Subsidiary will be achieved. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and, unless otherwise noted in this prospectus, is not subject to all the investor protections of the Investment Company Act. However, the Total Return Portfolio wholly owns and controls the Subsidiary, and the Total Return Portfolio and the Subsidiary are both managed by BlackRock, making it unlikely that the Subsidiary will take action contrary to the interests of the Fund and its shareholders. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to operate as described in this prospectus and the Statement of Additional Information (“SAI”) and could adversely affect the Fund. |

| n | U.S. Government Issuer Risk — Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Obligations of U.S. Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U.S. Government. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so. |

| n | U.S. Government Mortgage-Related Securities Risk — There are a number of important differences among the agencies and instrumentalities of the U.S. Government that issue mortgage-related securities and among the securities that they issue. Mortgage-related securities guaranteed by the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) are guaranteed as to the timely payment of principal and interest by GNMA and such guarantee is backed by the full faith and credit of the United States. GNMA securities also are supported by the right of GNMA to borrow funds from the U.S. Treasury to make payments under its guarantee. Mortgage-related securities issued by Fannie Mae or Freddie Mac are solely the obligations of Fannie Mae or Freddie Mac, as the case may be, and are not backed by or entitled to the full faith and credit of the United States but are supported by the right of the issuer to borrow from the Treasury. |

Performance Information

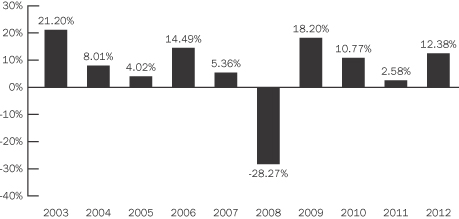

The information shows you how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the Russell 1000® Index, the Barclays U.S. Aggregate Bond Index and a customized weighted index comprised of the returns of the Russell 1000 Index (60%) and the Barclays U.S. Aggregate Bond Index (40%), which are relevant to the Fund because they have characteristics similar to the Fund’s investment strategies. The returns for Class R shares prior to January 3, 2003, the commencement of operations of Class R shares, are based upon performance of the Fund’s Institutional shares. The returns for Class R shares, however, are adjusted to reflect the distribution and service (12b-1) fees applicable to Class R shares. As with all such investments, past performance (before and after taxes) is not an indication of future results. The information in the chart and table for periods prior to October 1, 2003 does not reflect any investment by the Fund in the Total Return Portfolio. The information in the chart and table for periods prior to February 2009 does not reflect any investment by the Fund in the Core Portfolio. Sales charges are not reflected in the bar chart. If they were, returns would be less than those shown. However, the table includes all applicable fees and sales charges. If the Fund’s investment manager and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s performance can be obtained by visiting http://www.blackrock.com/funds or can be obtained by phone at 800-882-0052.

6

Investor A Shares

ANNUAL TOTAL RETURNS1

BlackRock Balanced Capital Fund, Inc.

As of 12/31

During the ten-year period shown in the bar chart, the highest return for a quarter was 11.81% (quarter ended June 30, 2003) and the lowest return for a quarter was –15.23% (quarter ended December 31, 2008).

| As of 12/31/12 Average Annual Total Returns |

1 Year | 5 Years1 | 10 Years1 | |||||||||

| BlackRock Balanced Capital Fund, Inc. — Investor A |

||||||||||||

| Return Before Taxes |

6.48 | % | 0.51 | % | 5.36 | % | ||||||

| Return After Taxes on Distributions |

5.06 | % | (0.61 | )% | 4.02 | % | ||||||

| Return After Taxes on Distributions and Sale of Shares |

4.92 | % | (0.14 | )% | 4.07 | % | ||||||

| BlackRock Balanced Capital Fund, Inc. — Investor B |

||||||||||||

| Return Before Taxes |

6.75 | % | 0.30 | % | 5.21 | % | ||||||

| BlackRock Balanced Capital Fund, Inc. — Investor C |

||||||||||||

| Return Before Taxes |

10.50 | % | 0.81 | % | 5.10 | % | ||||||

| BlackRock Balanced Capital Fund, Inc. — Institutional |

||||||||||||

| Return Before Taxes |

12.75 | % | 1.93 | % | 6.23 | % | ||||||

| BlackRock Balanced Capital Fund, Inc. — Class R |

||||||||||||

| Return Before Taxes |

11.96 | % | 1.17 | % | 5.64 | % | ||||||

| Russell 1000® Index (Reflects no deduction for fees, expenses or taxes) |

16.42 | % | 1.92 | % | 7.52 | % | ||||||

| Barclays U.S. Aggregate Bond Index (Reflects no deduction for fees, expenses or taxes) |

4.21 | % | 5.95 | % | 5.18 | % | ||||||

| 60% Russell 1000 Index/40% Barclays U.S. Aggregate Bond Index (Reflects no deduction for fees, expenses or taxes) |

11.55 | % | 3.99 | % | 6.89 | % | ||||||

| 1 | A portion of the Fund’s total return was attributable to proceeds received in a settlement of a litigation seeking recovery of investment losses previously realized by the Fund. |

After-tax returns are calculated using the historical highest individual Federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Investor A Shares only, and the after-tax returns for Investor B, Investor C, Institutional and Class R Shares will vary.

Investment Manager

The Fund’s investment manager is BlackRock Advisors, LLC (“BlackRock”). The Fund’s sub-adviser is BlackRock Investment Management, LLC. Where applicable, the use of the term BlackRock also refers to the Fund’s sub-adviser.

Portfolio Managers

The asset allocation of the equity and fixed-income portions of the Fund’s portfolio is managed by Philip Green.

| Name |

Portfolio Manager of the Fund Since |

Title | ||

| Phillip Green |

2006 | Managing Director of BlackRock, Inc. | ||

7

The Total Return Portfolio in which the Fund invests a portion of its assets is managed by a team of investment professionals comprised of Rick Rieder and Bob Miller.

| Name |

Portfolio Manager of the Total Return Portfolio Since |

Title | ||

| Rick Rieder |

2010 | Chief Investment Officer of Fixed Income, Fundamental Portfolios BlackRock, Inc. | ||

| Bob Miller |

2011 | Managing Director of BlackRock, Inc. | ||

The Core Portfolio in which the Fund invests a portion of its assets is managed by a team of investment professionals comprised of Chris Leavy, CFA and Peter Stournaras, CFA.

| Name |

Portfolio Manager of the Core Portfolio Since |

Title | ||

| Chris Leavy, CFA |

2012 | Managing Director of BlackRock, Inc. and Chief Investment Officer of Fundamental Equity (Americas) | ||

| Peter Stournaras, CFA |

2010 | Managing Director of BlackRock, Inc. | ||

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New York Stock Exchange (“NYSE”) is open. To purchase or sell shares you should contact your financial intermediary or financial professional, or, if you hold your shares through the Fund, you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds, P.O. Box 9819, Providence, Rhode Island 02940-8019), or by the Internet at www.blackrock.com/funds. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

| Investor A and Investor C Shares |

Investor B Shares | Institutional Shares | Class R Shares | |||||

| Minimum Initial Investment | $1,000 for all accounts except: • $250 for certain fee-based programs • $100 for retirement plans • $50, if establishing an Automatic Investment Plan (“AIP”) |

Available only for exchanges and dividend reinvestments by current holders and for purchase by certain qualified employee benefit plans. | $2 million for institutions and individuals. Institutional Shares are available to clients of registered investment advisors who have $250,000 invested in the Fund. | $100 for all accounts. | ||||

| Minimum Additional Investment | $50 for all accounts except certain retirement plans and payroll deduction programs may have a lower minimum. | N/A | No subsequent minimum. | No subsequent minimum. |

Tax Information

The Fund’s dividends and distributions may be subject to Federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to Federal income tax upon withdrawal from such tax deferred arrangements.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the intermediary for the sale of Fund shares and other services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your individual financial professional to recommend the Fund over another investment. Ask your individual financial professional or visit your financial intermediary’s website for more information.

8

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

| INVESTMENT COMPANY ACT FILE # 811-02405 BlackRock Balanced Capital Fund, Inc. — Investor SPRO-BC-0113 |

|