Plaxe SC, et. al., 2002, Cancer Chemother Pharmacol; 50: 151-4.

Garcia AA, et. al., 2007, Am J Clin Oncol; 30: 428-431.

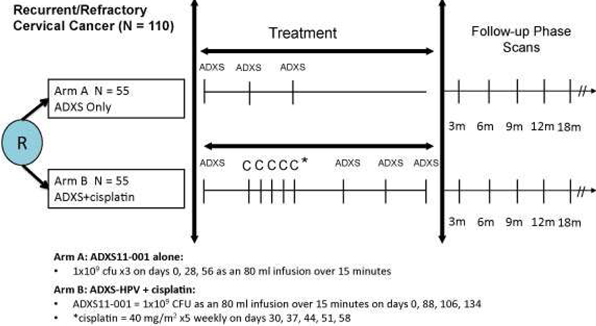

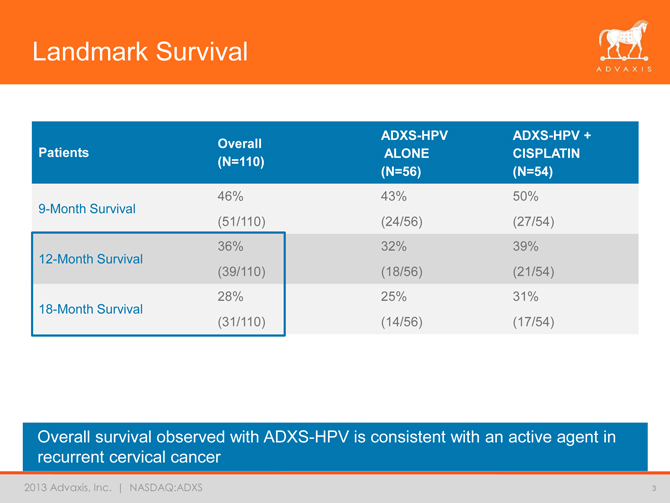

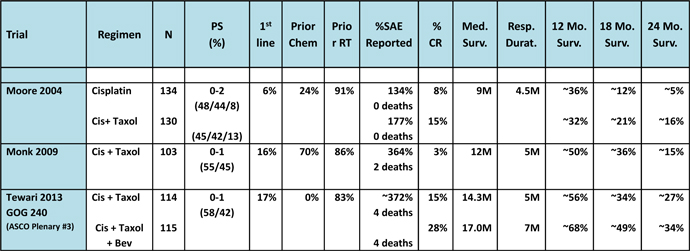

Survival results were not significantly different between treatment groups. Survival outcomes and tumor responses were not affected by ECOG performance status (0 – 2); type of prior therapy (radiation alone, chemotherapy alone, or a combination of both); or aggressiveness of disease (defined as recurrence ≤2 years from initial diagnosis) versus non-aggressive disease (defined as recurrence >2 years from initial diagnosis).

The most important prognostic factors for overall survival and response rate in cervical cancer have been identified in published reports as: ECOG performance status, number of prior therapies, interval from initial therapy to time of recurrence, and local recurrence compared to distant metastases.

Prognostic Factors for Overall Survival in Cervical Cancer

|

|

•

|

Most important prognostic factors for overall survival and response rate are:

|

|

|

–

|

ECOG performance status,

|

|

|

|

|

|

|

–

|

Number of prior therapies,

|

|

|

|

|

|

|

–

|

Interval from initial therapy to time of recurrence, and

|

|

|

|

|

|

|

–

|

Local recurrence vs. distant metastases*

|

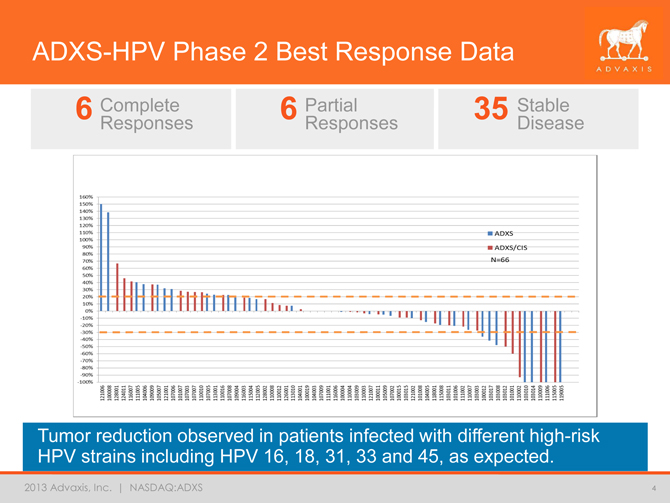

Tumor responses have been observed in 11% of the patients in the study with six complete responses, or CR: four in the ADXS alone treatment arm; two in the ADXS+ cisplatin treatment arm; and six partial responses, or PR; three in the ADXS alone treatment arm; three in the ADXS+ cisplatin treatment arm. 35 patients had durable stable disease for at least 3 months as indicated by the orange dashed lines in the waterfall plot below for a disease control rate of 43% (47/110). Activity against different high risk HPV strains beyond HPV 16 and HPV 18 have been observed, including HPV 16, 18, 31, 33 and 45.

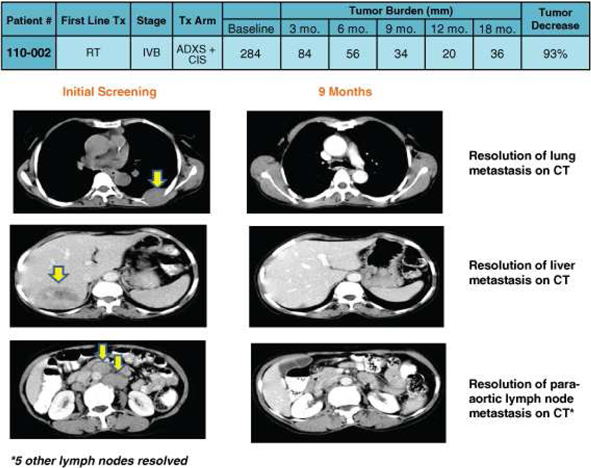

ADXS-HPV has been shown to eliminate major tumors as observed in Patient 110-002 below:

Patient 110-002: Major Tumors Eliminated

Patient 110-002 enrolled with 284mm (sum of linear measures) of disease at 10 sites, including liver, lung, and peri-aortic nodes. The patient was previously treated with surgery and radiation (EBRTx25), and recurred within 1 year with metastatic disease. She was randomized to receive ADXS/Cis. At 3 months, she had 84mm of tumor at 5 sites, at 6 months 56mm at 3 sites, at 9 months 34mm at 2 sites, and at 12 months 20mm in a single peri-aortic node not amenable to biopsy.

ADXS-HPV continues to demonstrate a well-tolerated and manageable safety profile with 41% (45/110) of patients reporting predominately cytokine-release syndrome (CRS) Grade 1 or 2 transient, non-cumulative side effects related/possibly related to ADXS-HPV. Side effects either responded to symptomatic treatment or self-resolved. Less than 2% of patients reported serious adverse events associated with ADXS-HPV (1 Grade 3 CRS with dyspnea and 1 Grade 4 CRS with fever). Serious adverse events may result in death, are life-threatening, cause significant disability or require inpatient hospitalization.

In April 2013, we announced that we had discontinued our Phase 2 dose escalation study that was being conducted in the United States in 120 patients with cervical intraepithelial neoplasia (CIN) 2/3. The goal of this study was to provide a non-surgical treatment that could replace the current surgical treatment (LEEP) for CIN 2/3. This study commenced in March 2010 to assess the safety and efficacy of ADXS-HPV in women with this pre-cancerous condition. Given that we had no prior experience with ADXS-HPV in otherwise healthy subjects, our strategy was to start with a much lower dose than that used in patients with late-stage cervical cancer.

As part of our review of all ongoing clinical and preclinical research projects and evaluating the fit with our revised, and more focused corporate strategy, we have decided to discontinue our support of any clinical trial that evaluates ADXS-HPV in a setting where patients do not have an active malignancy, and have a high likelihood of being “cured” by their primary definitive treatment before receiving ADXS-HPV. The REALISTIC clinical trial falls into this category and we have therefore notified the principal investigator in December 2013 that we have withdrawn our support of the REALISTIC trial.

Our research and development costs decreased from approximately $6.6 million for the year ending October 31, 2012 to approximately $5.6 million for the year ending October 31, 2013 (please also see Item7- Management’s Discussion and Analysis of Financial Condition and Results of Operations).

Business Strategy

Our strategy is to maintain and fortify a leadership position in the discovery, acquisition and development of Lm -LLO immunotherapies that target for cancer and infectious disease. The fundamental goals of our business strategy include the following:

|

|

•

|

Be the first immunotherapy company to commercialize a therapeutic HPV-associated oncology drug. Because we believe ADXS-HPV is the most clinically advanced cervical cancer immunotherapy, we aim to fortify our leadership position and be the first to commercialize our Lm -LLO immunotherapy for this unmet medical need.

|

|

|

•

|

Develop and commercialize ADXS-HPV in multiple HPV-associated cancers. We plan to advance ADXS-HPV through registrational Phase 3 trials and regulatory approval in the United States and relevant markets for the treatment of cervical cancer. If successful, we plan to submit a Biologics License Application, or BLA, to the FDA as the basis for marketing approval in the United States of ADXS-HPV for the treatment of cervical cancer. HPV, the target for ADXS-HPV, is expressed on a wide variety of cancers including cervical, head and neck, anal, vulva, vaginal, and penile. Accordingly, we believe that ADXS-HPV should be active in these HPV-associated cancers and these indications could represent significant market opportunities for ADXS-HPV.

|

|

|

•

|

Obtain Orphan Drug Designation with the FDA and the EMEA for ADXS-HPV for use in the treatment of invasive cervical cancer, head and neck cancer and anal cancer. In June 2013, we filed three applications for Orphan Drug Designation with the FDA for ADXS-HPV for the treatment of anal cancer (granted August 2013), head and neck cancer (granted November 2013), invasive cervical cancer (denied in October 2013 as the target population estimate exceeded the statutory maximum allowed. In January 2014, a telecon meeting was conducted with the FDA to discuss the orphan drug designation request and subsequent denial for ADXS-HPV for invasive cervical cancer. We intend to submit a new application based on the discussions.with the FDA); Orphan status is granted by the FDA to promote the development of products that demonstrate promise for the treatment of rare diseases affecting fewer than 200,000 individuals in the United States annually, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making a drug or biological product available in the United States for this type of disease or condition will be recovered from sales of the product. Orphan drug designation would entitle our company to a seven-year period of marketing exclusivity in the United States to the extent our request is approved by the FDA, and would enable us to apply for research funding, tax credits for certain research expenses, and a waiver from the FDA’s application user fee. Orphan drug status in the European Union has similar but not identical benefits in that jurisdiction.

|

|

|

•

|

Obtain Breakthrough Therapy Designation for ADXS-HPV for the treatment of invasive cervical cancer. On October 7, 2013, we submitted a request for breakthrough therapy designation (BTD) to the IND for ADXS-HPV in the treatment of invasive cervical cancer. The FDA denied the request in December 2013, but stated that a new request may be submitted if we obtain new clinical evidence that supports BTD. A drug that is designated as a breakthrough therapy drug is: intended alone or in combination with one or more other drugs to treat a serious or life threatening disease or condition; and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. If our drug is designated as breakthrough therapy, it will receive all the benefits of fast track designation (opportunities for frequent interactions with the FDA review team, opportunity for a 6-month priority review if supported by clinical data at the time of the BLA submission), potential for a review of portions of the marketing application prior to submitting a complete BLA), intensive guidance on an efficient drug development program, organizational commitment involving senior managers at the FDA in a proactive, collaborative, cross-disciplinary review, will expedite the development and review of such drug.

|

|

|

•

|

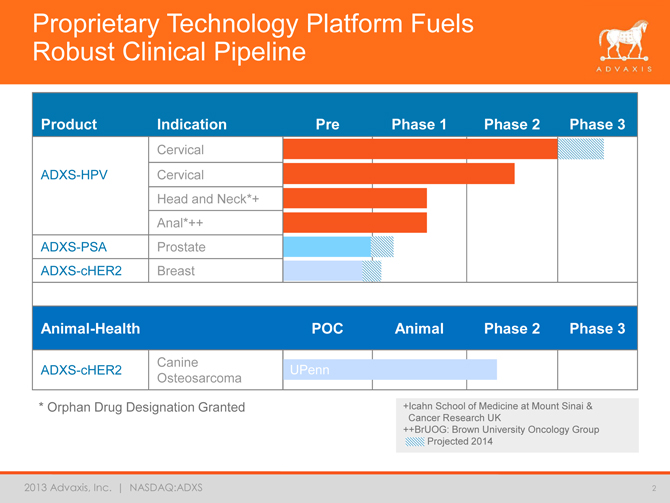

Develop ADXS-PSA in prostate cancer. We plan to advance ADXS-PSA into a Phase 1 dose escalation trial in the first half of 2014 to determine the maximum tolerated dose for the treatment of patients with prostate cancer.

Develop ADXS-cHER2 in breast cancer. We plan to advance ADXS-cHER2 into a Phase 1 dose escalation trial in the second half of 2014 to determine the maximum tolerated dose for the treatment of patients with breast cancer.

|

|

|

•

|

Develop scale-up and commercial manufacturing processes. We plan to develop scale-up and commercial manufacturing processes, including the development of a lyophilized dosage form.

|

|

|

|

|

|

|

•

|

Expand the market for Advaxis Lm-LLO immunotherapies to the treatment of companion animals. We intend to enter into partnerships with animal health companies to develop and commercialize Advaxis Lm-LLO immunotherapies for companion animals.

|

|

|

•

|

Leverage our proprietary discovery platform to identify new therapeutic immunotherapies. We intend to utilize our proprietary discovery platform to identify new antigen-associated product candidates. We may conduct some of these efforts internally and/or leverage our platform to forge strategic collaborations. We have utilized our proprietary discovery platform to identify a number of preclinical product candidates and may initiate studies to support IND submissions either alone or in collaboration with strategic partners. Specifically, we intend to conduct research relating to the development of the next generations of our Lm -LLO immunotherapies using new antigens of interest; improving the Lm -LLO based platform technology by developing new strains of Listeria that may be more suitable as live vaccine vectors; developing bivalent Lm -LLO immunotherapies; further evaluating synergy of Lm -LLO immunotherapies with cytotoxic therapies and continuing to develop the use of LLO as a component of a fusion protein based immunotherapy. We currently have over 15 distinct immunotherapies in various stages of development, developed directly by us and through strategic collaborations with recognized centers of excellence. These include but are not limited to the following Advaxis immunotherapy and corresponding tumor antigen: ADXS11-001/HPV16-E7, ADXS31-142/Prostate Specific Antigen, ADXS31-164/HER2/neu Chimera, Lm -LLO-HMW-MAA/HMW-MAA, C-terminus fragment, Lm -LLO-ISG15/ISG15, Lm -LLO CD105/Endoglin, Lm -LLO-flk/VEGF and Bivalent Therapy, HER-2-Chimera/HMW-MAA-C. We will continue to conduct preclinical research to develop additional Lm -LLO constructs to expand our platform technology and may develop additional distinct immunotherapies in the future. Our growth strategy is to expand from the ADXS-HPV franchise into larger cancer indications such as prostate and breast cancer to further validate the robustness and versatility of the platform technology and to develop immunotherapies that we believe to be of interest to big pharmaceutical partners. We also intend to further expand the research and development programs to provide multiple biomarker-specific products with applications across multiple tumor types that express those biomarkers. Additionally, we plan to partner with or acquire a target discovery company, develop multiple constructs targeting numerous biomarker targets to deliver the promise of biomarker driven multi-targeted immunotherapies. The overall goal with each patient is to: biopsy the patient’s tumor; identify which biomarkers are expressed; treat the patient with our immunotherapies that hit multiple targets simultaneously, adding in the ability to adjust an individual’s immunotherapy over time based on changes in the tumor. We believe that if successful, this has the potential to revolutionize the treatment of cancer.

|

|

|

•

|

Enter into commercialization collaborations for ADXS-HPV. If ADXS-HPV is approved by the FDA and other regulatory authorities for first use, we plan to either enter into commercial partnerships, joint ventures, or other arrangements with competitive or complementary companies, including pharmaceutical companies or commercialize these products ourselves in North America and Europe through direct sales and distribution.

|

|

|

•

|

Develop commercialization capabilities in India, China, South America, North America and Europe. We believe that the infrastructure required to commercialize our oncology products is relatively limited, which may make it cost-effective for us to internally develop a marketing effort and sales force. If ADXS-HPV is approved by the FDA and other regulatory authorities for first use and we do not enter into commercial partnerships, joint ventures, or other arrangements with competitive or complementary companies, including pharmaceutical companies, we plan to commercialize these products ourselves in North America and Europe through direct sales and distribution. However, we will remain opportunistic in seeking strategic partnerships in these and other markets when advantageous.

|

|

|

•

|

Continue to both leverage and strengthen our intellectual property portfolio. We believe we have a strong intellectual property position relating to the development and commercialization of Lm -LLO immunotherapies. We plan to continue to leverage this portfolio to create value. In addition to strengthening our existing intellectual property position, we intend to file new patent applications, in-license new intellectual property and take other steps to strengthen, leverage, and expand our intellectual property position.

|

|

|

|

Short-Term Strategic Goals and Objectives

|

During the next 12 months, our strategic goals and objectives include the following:

|

|

• |

Report final results from the completed Phase 2 clinical trial conducted in India with ADXS-HPV in the treatment of recurrent cervical cancer; |

|

|

• |

Initiate Phase 1/2 high-dose clinical trial in patients with recurrent cervical cancer; |

|

|

• |

Conduct an end of Phase 2 meeting with the FDA and submit a Special Protocol Assessment for ADXS-HPV; |

|

|

• |

Initiate global Phase 3 study in recurrent cervical cancer with ADXS-HPV; |

|

|

• |

Initiate Phase 1 study with ADXS-PSA in prostate cancer; |

|

|

• |

Initiate Phase 1 study with ADXS-cHER2 in breast cancer; |

|

|

• |

Initiate Phase 1 study with ADXS-HPV in HPV-associated lung cancer through our partner GBP in Asia; |

|

|

• |

Continue to support the Phase 2 clinical trial of ADXS-HPV in the treatment of advanced cervical cancer with the GOG, largely underwritten by the NCI; |

|

|

• |

Continue our collaboration with the BrUOG to support the Phase 1/2 clinical trial of ADXS-HPV in the treatment of anal cancer, entirely underwritten by the BrUOG; |

|

|

• |

Continue our collaboration with the Icahn School of Medicine at Mount Sinai (ISMMS) to support the Phase 1/2 study with ADXS-HPV in patients with head and neck cancer; seek to conduct Advisory Board with key opinion leaders; |

|

|

• |

Report data from Mount Sinai Phase 1 study; |

|

|

• |

Discuss development plan for ADXS-HPV in anal cancer with the FDA in light of Orphan Drug Designation; |

|

|

• |

Discuss development plan for ADXS-HPV in head and neck cancer with the FDA in light of Orphan Drug Designation; |

|

|

• |

Obtain Orphan Drug Designation for ADXS-HPV for the treatment of invasive cervical cancer; |

|

|

• |

Submit IND for ADXS-PSA for the treatment of prostate cancer; |

|

|

• |

Submit IND for ADXS-cHER2 for the treatment of breast cancer; |

|

|

• |

Secure a contract manufacturing organization with GMP scale-up and commercialization capabilities; |

|

|

• |

Continue our collaboration with the School of Veterinary Medicine at the University of Pennsylvania to support the Phase 1/2 clinical trial of ADXS-cHER2 in canine osteosarcoma; |

|

|

• |

Continue the preclinical development of additional Lm -LLO constructs as well as research to expand our platform technology; |

|

|

• |

Continue to develop and maintain strategic and development collaborations with academic laboratories, clinical investigators and potential commercial partners; and |

|

|

• |

Continue to actively pursue our global commercialization strategy by executing a second ex-US ADXS-HPV regional licensing deal with another market dominant biopharmaceutical company. |

Collaborations, Partnerships and Agreements

Biocon Limited

On January 20, 2104 the Company and Biocon Limited, a company incorporated under the laws of India (“Biocon”) entered into a Distribution and Supply Agreement (“Agreement”) .

Pursuant to the Agreement, Advaxis granted Biocon an exclusive license (with a right to sublicense) to (i) use Advaxis’ data from clinical development activities, regulatory filings, technical, manufacturing and other information and know-how to enable Biocon to submit regulatory filings for ADXS-HPV in the following territories: India, Malaysia, Kenya, Bangladesh, Bhutan, Maldives, Myanmar, Nepal, Pakistan, Sri Lanka, Bahrain, Jordan, Kuwait, Oman, Saudi Arabia, Qatar, United Arab Emirates, Algeria, Armenia, Egypt, Eritrea, Iran, Iraq, Lebanon, Libya, Sudan, Syria, Tunisia and Yemen (collectively, the “Territory”) and (ii) import, promote, market, distribute and sell pharmaceutical products containing ADXS-HPV. ADXS-HPV is based on a novel platform technology using live, attenuated bacteria that are bio-engineered to secrete an antigen/adjuvant fusion protein(s) that is designed to redirect the powerful immune response all human beings have to the bacterium against their cancer.

Under the Agreement, Biocon has agreed to use its commercially reasonable efforts to obtain regulatory approvals for ADXS-HPV in India. In the event Phase II or Phase III clinical trials are required, Advaxis shall conduct such trials at its cost, provided that if Advaxis is unable to commence such clinical trials, Biocon may conduct such clinical trials, subject to reimbursement of costs by Advaxis. Biocon has agreed to commence commercial distribution of ADXS-HPV no later than 9 months following receipt of regulatory approvals in a country in the Territory. Biocon will be responsible for the costs of obtaining and maintaining regulatory approvals in the Territory.

Advaxis will have the exclusive right to supply ADXS-HPV to Biocon and Biocon will be required to purchase its requirements of ADXS-HPV exclusively from Advaxis at the specified contract price, as such price may be adjusted from time to time. In addition, Advaxis will be entitled to a six-figure milestone payment if net sales of ADXS-HPV for the contract year following the initiation of clinical trials in India exceed certain specified thresholds.

Biocon will also have a right of first refusal relating to the licensing of any new products in the Territory that Advaxis may develop during the term of the Agreement.

The term of the Agreement will be the later of twenty years or the last to expire patent or patent application. In addition, the Agreement may be terminated by either party upon thirty days’ written notice (i) in the event of a material breach by the other party of its obligations under the Agreement, (ii) if the other party becomes bankrupt or insolvent or (iii) if the other party undergoes a change in control.

Global BioPharma, Inc.

On December 9, 2013, the Company entered into an exclusive licensing agreement for the development and commercialization of ADXS-HPV with Global BioPharma, Inc. (GBP), a Taiwanese based biotech company funded by a group of investors led by Taiwan Biotech Co., Ltd (TBC).

GBP plans to conduct registration trials with ADXS-HPV for the treatment of advanced cervical cancer and will explore the use of Advaxis’ lead product candidate in several other indications including lung, head and neck, and anal cancer.

GBP will pay Advaxis event-based financial milestones, an annual development fee, and annual net sales royalty payments in the high single to double digits. In addition, as an upfront payment, GBP made an investment in Advaxis by purchasing from the Company shares of its common stock at market price. GBP has an option to purchase additional shares of Advaxis stock from the Company at a 150% premium to the stock price on the effective date of the agreement.

GBP will be responsible for all clinical development and commercialization costs in the GBP territory. In collaboration with Advaxis, GBP will also identify and pay the clinical trial costs for up to 150 patients with cervical cancer for enrollment in Advaxis’ U.S. and GBP’s Asia registrational programs for cervical cancer. GBP is committed to establishing manufacturing capabilities for its own territory and to serving as a secondary manufacturing source for Advaxis in the future. Under the terms of the agreement, Advaxis will exclusively license the rights to ADXS-HPV to GBP for the Asia, Africa, and former USSR territory, exclusive of India and certain other countries, for all HPV-associated indications. Advaxis will retain exclusive rights to ADXS-HPV for the rest of the world.

University of Pennsylvania

On July 1, 2002 we entered into an exclusive worldwide license agreement with The Trustees of the University of Pennsylvania, or Penn, with respect to the innovative work of Yvonne Paterson, Ph.D., Associate Dean for Research and Professor in the School of Nursing at the University of Pennsylvania, and former Professor of Microbiology at the University of Pennsylvania, in the area of innate immunity, or the immune response attributed to immune cells, including dendritic cells, macrophages and natural killer cells, that respond to pathogens non-specifically (subject to certain U.S. government rights). This agreement has been amended from time to time and was amended and restated as of February 13, 2007.

This license, unless sooner terminated in accordance with its terms, terminates upon the later of (a) the expiration of the last to expire of the Penn patent rights; or (b) twenty years after the effective date of the license. Penn may terminate the license agreement early upon the occurrence of certain defaults by us, including, but not limited to, a material breach by us of the Penn license agreement that is not cured within 60 days after notice of the breach is provided to us.

The license provides us with the exclusive commercial rights to the patent portfolio developed at the University of Pennsylvania as of the effective date of the license, in connection with Dr. Paterson and requires us to pay various milestone, legal, filing and licensing payments to commercialize the technology. In exchange for the license, Penn received shares of our common stock, which currently represent approximately 0.2% of our common stock outstanding on a fully-diluted basis. As of October 31, 2013, Penn owns 28,468 shares of our common stock. In addition, Penn is entitled to receive a non-refundable initial license fee, license fees, royalty payments and milestone payments based on net sales and percentages of sublicense fees and certain commercial milestones. Under the licensing agreement, Penn is entitled to receive 1.5% royalties on net sales in all countries. Notwithstanding these royalty rates, we have agreed to pay Penn a total of $525,000 over a three-year period as an advance minimum royalty after the first commercial sale of a product under each license (which we are not expecting to begin paying within the next five years). In addition, under the license, we are obligated to pay an annual maintenance fee of $100,000 commencing on December 31, 2010, and each December 31 st thereafter for the remainder of the term of the agreement until the first commercial sale of a Penn licensed product. Overall, the amended and restated agreement payment terms reflect lower near term requirements but the savings are offset by higher long term milestone payments for the initiation of a Phase 3 clinical trial and the regulatory approval for the first Penn licensed product. We are responsible for filing new patents and maintaining and defending the existing patents licensed to use and we are obligated to reimburse Penn for all attorneys fees, expenses, official fees and other charges incurred in the preparation, prosecution and maintenance of the patents licensed from Penn.

Furthermore, upon the achievement of the first sale of a product in certain fields, Penn will be entitled to certain milestone payments, as follows: $2.5 million will be due upon the first commercial sale of the first product in the cancer field and $1.0 million will be due upon the date of first commercial sale of a product in each of the secondary strategic fields sold.

As a result of our payment obligations under the license, assuming we have net sales in the aggregate amount of $100.0 million from our cancer products, our total payments to Penn over the next ten years could reach an aggregate of $5.4 million. If over the next 10 years our net sales total an aggregate amount of only $10.0 million from our cancer products, total payments to Penn could be $4.4 million.

As part of the Second Amendment, dated May 10, 2010, we exercised our option for the rights to seven additional patent dockets, including 56 additional patent applications, for (i) an option exercise fee payable in the form of $35,000 in cash and $70,000 in our common stock (approximately 3,111 shares of our common stock based on a price of $22.50 per share) and (ii) the assumption of certain historical costs of approximately $462,000 associated with the 56 additional patent applications acquired under the second amendment. As of October 31, 2013, approximately $325,000 of costs related to all licensing agreements remained outstanding.

Strategically, we intend to maintain our relationship with Dr. Paterson and Penn to generate new intellectual property and to exploit all existing intellectual property covered by the license.

Penn is not involved in the management of our company or in our decisions with respect to exploitation of the patent portfolio.

Dr. Yvonne Paterson

Dr. Paterson is the Associate Dean for Research and Professor in the School of Nursing at the University of Pennsylvania, and former Professor of Microbiology at the University of Pennsylvania, and the inventor of our licensed technology. Dr. Paterson is a fellow of the American Academy for the Advancement of Science, and has been an invited speaker at national and international health field conferences and leading academic institutions. Dr. Paterson has served on many federal advisory boards, such as the NIH expert panel to review primate centers, the Office of AIDS Research Planning Fiscal Workshop and the Allergy and Immunology NIH Study Section. She has written over one hundred publications in the areas of HIV, AIDS and cancer research. Dr. Paterson has trained over forty post-doctoral and doctoral students in the fields of Biochemistry and Immunology.

In the past we have entered into consulting agreements with Dr. Paterson, providing for compensation through cash payments and equity awards. Currently, we do not have a written agreement in place, but Dr. Paterson continues to consult with us on a regular basis, and we intend to continue to compensate Dr. Paterson in cash, equity awards, or a combination thereof as we deem appropriate from time to time.

Recipharm Cobra Biologics Limited (formerly Cobra Biomanufacturing PLC)

We outsource the manufacture and supply of our cervical cancer immunotherapy ADXS-HPV to Recipharm Cobra Biologics Limited, or Cobra. We began this partnership in July 2003. Cobra has extensive experience in manufacturing gene therapy and manufactures and supplies biologic therapeutics for the pharmaceutical and biotech industry. We currently have two agreements with Cobra; one to conduct ongoing stability testing of the ADXS-HPV immunotherapy that they have manufactured, and another to provide analytic services and certification necessary to import ADXS-HPV for use in the United Kingdom head and neck cancer study mentioned below.

Vibalogics GmbH

In April 2008, we entered into a series of agreements with Vibalogics GmbH in Cuxhaven Germany to provide fill and finish services for our final clinical materials that were made for our scheduled clinical trials described above. These agreements cover the fill and finish operations as well as specific tests required in order to release the clinical drug supplies for human use. We have entered into agreements with Vibalogics to produce two Lm -LLO immunotherapies, ADXS-PSA and ADXS-cHER2 for research and/or clinical development. In April 2013, we entered into a settlement agreement with Vibalogics for payment of past-due amounts and used a portion of the proceeds from the October 2013 offering to pay down amounts owing to Vibalogics, resulting in no amounts being owed by Advaxis as of October 31, 2013. We continue to use the services of Vibalogics to provide fill and finish services for our clinical materials.

Numoda Corporation

On June 19, 2009, we entered into a Master Agreement and on July 8, 2009 we entered into a Project Agreement with Numoda Corporation, which we refer to as Numoda, a leading clinical trial and logistics management company, to oversee Phase 2 clinical activity with ADXS-HPV for the multicenter Phase 2 U.S. trial of ADXS-HPV in CIN 2/3 and to act as our U.S. CRO for the multicenter Phase 2 study of ADXS-HPV in recurrent cervical cancer being conducted in India. The scope of the Project Agreement covers over three years, with an estimated cost of approximately $12.2 million for both trials. As of October 31, 2013, we have paid Numoda approximately $8.8 million in cash for clinical trial activities. The Master Agreement with Numoda terminated on June 12, 2012. The Project Agreement with Numoda continues until the project that is the subject of such agreement is completed, unless earlier terminated in accordance with the Master Agreement with Numoda.

On June 13, 2012, we entered into a stock purchase agreement with Numoda, pursuant to which we issued to Numoda 120,000 shares of our common stock at a purchase price per share of $18.75, in exchange for the immediate cancellation of $2,250,000 of accounts receivables owed by us to Numoda pursuant to the Master Agreement.

As of October 31, 2013, the Company owed Numoda approximately $300,000, which is recorded in our Accounts Payable.

National Cancer Institute Gynecologic Oncology Group

On December 13, 2009, we entered into an agreement for GOG to conduct a multicenter, Phase 2 clinical trial of ADXS-HPV, our Lm -LLO based immunotherapy targeted to HPV, in 67 patients with recurrent or refractory cervical cancer who have failed prior cytotoxic therapy. This Phase 2 trial is being underwritten by GOG and will be conducted by GOG investigators. This patient population is similar to the patient population in the cervical cancer study being conducted in India as well as the patients in the Phase 1 trial of ADXS-HPV. Under this Clinical Trial Services Agreement, we are responsible for covering the costs of translational research and agreed to pay a total of $8,003 per patient, with the majority of the costs of this study underwritten by GOG. This agreement shall continue in force until we receive completed case histories for all participants in the clinical trial and questions about data submitted have been resolved, unless terminated earlier upon the occurrence of certain events, including, but not limited to, the FDA imposing a permanent hold on the drug which is subject to the clinical trial, a material breach by us of the agreement that is not cured within a reasonable time period after notice of the breach is provided to us, or sixty days prior written notice by either party for any reason.

Cancer Research U.K.

On February 9, 2010, Cancer Research U.K. (CRUK), the U.K. organization dedicated to cancer research, agreed to fund the cost of a clinical trial to investigate the use of ADXS-HPV, our Lm -LLO based immunotherapy targeted to HPV, for the treatment of head and neck cancer. This Phase 1 clinical trial will investigate the safety and efficacy of ADXS-HPV 6 weeks post-treatment with surgery, radiotherapy and chemotherapy — alone or in combination — in head and neck cancer patients. We will provide the study drug, with all other associated costs to be funded by CRUK. The study is to be conducted at 3 sites in the United Kingdom (The Royal Liverpool University Hospital, Liverpool, U.K., the Royal Marsden Hospital, London, U.K., and the University Hospital of Wales, Cardiff, U.K.). As noted in the Recent Clinical Research Developments, we have notified the principal investigator in December 2013 that we have withdrawn our support of this trial.

School of Veterinary Medicine at the University of Pennsylvania

On August 17, 2010, we entered into a clinical trial agreement with the School of Veterinary Medicine at Penn to investigate the use of ADXS-cHER2 for the treatment of canine osteosarcoma in 15 dogs. This study commenced dosing in July of 2012.

Georgia Reagents University

On March 20, 2012, we announced the continuation of our collaboration with Dr. Samir N. Khleif, the former Chief of the Vaccines Section at the National Cancer Institute, at his new position as Director of the Georgia Health Sciences University Cancer Center in Augusta, Georgia. Dr. Khleif and his laboratory will continue to elaborate the molecular immunologic mechanisms by which live, attenuated strains of Lm can effect therapeutic changes in cancer and other diseases.

Brown University Oncology Group

In January 2013, we entered into an agreement with The Miriam Hospital, an affiliate of Brown University Oncology Group (BrUOG), to evaluate the safety and effectiveness of ADXS-HPV when combined with standard chemotherapy and radiation treatment for anal cancer. BrUOG will fund and conduct a Phase 1/2 study of ADXS-HPV in 25 patients with anal cancer at Brown University, M.D. Anderson Cancer Center, Montefiore Medical Center, Boston Medical Center, and other sites.

Icahn School of Medicine at Mount Sinai

On December 5, 2013, we entered into a clinical trial agreement with the Icahn School of Medicine at Mount Sinai to evaluate the safety, effectiveness and immunogenicity of ADXS-HPV in 25 patients with head and neck cancer. This clinical trial will be the first study to evaluate the effects of ADXS-HPV in patients when they are initially diagnosed with HPV-associated head and neck cancer, prior to receiving any standard of care (surgery, chemotherapy, radiation or a combination thereof) to remove and/or treat their tumors. This study will be an important first step toward understanding ADXS-HPV's potential to treat this type of cancer before chemotherapy and/or radiation and its potential to reduce the need for these treatments.

Intellectual Property

Protection of our intellectual property is important to our business. We have a robust and extensive patent portfolio that protects our product candidates and Lm-based immunotherapy technology. Currently, our patent portfolio includes 42 issued patents and 40 pending patent applications. All of these patents and patent applications are licensed from Penn with the exception of 17 pending patent applications, which are owned by our company. We continuously add to this portfolio by filing applications to protect our ongoing research and development efforts. We aggressively prosecute and defend our patents and proprietary technology. Our material patents that cover the compositions of matter, use, and methods thereof, of our Lm immunotherapies for our product candidates , ADXS-HPV, ADXS-PSA, and ADXS-cHER2, expire at various dates between 2014 and 2033, prior to available patent extensions.

Our approach to the intellectual property portfolio is to create protect and defend our proprietary rights for our products we develop form our immunotherapy technology platform. We endeavor to maintain a coherent and aggressive strategic approach to building our patent portfolio with an emphasis in the field of cancer vaccines.

We successfully defended our intellectual property concerning our Lm- based technology by contesting a challenge made by Anza Therapeutics, Inc. (now known as Aduro BioTech) , to our patent position in Europe on a claim not available in the United States. The European Patent Office, which we refer to as the EPO, Board of Appeals in Munich, Germany ruled in favor of the Trustees of Penn and us, Penn’s exclusive licensee, and reversed a patent ruling that revoked a technology patent that had resulted from an opposition filed by Anza. The ruling of the EPO Board of Appeals is final and cannot be appealed. The granted claims, the subject matter of which was discovered by Dr. Yvonne Paterson, are directed to the method of preparation and composition of matter of recombinant bacteria expressing tumor antigens for the treatment of patients with cancer. The successful development of our immunotherapies will include our ability to create and maintain intellectual property related to our product candidates.

Issued patents which are relevant to and cover our product candidates ADXS-HPV, and ADXS-PSA in the United States, will expire between 2015 and 2017. Issued patents directed to our product candidates ADXS-HPV, and ADXS-PSA outside of the United States, will expire between 2015 and 2018. Issued patents which cover our Lm-based immunotherapy platform in the United States, will expire between 2016 and 2027. Issued patents directed to our Lm-based immunotherapy platform outside of the United States, will expire 2021.

We have pending patent applications for formulations of our product candidates ADXS-HPV, ADXS-PSA, and ADXS-cHER2 that, if issued, would expire in the United States and in countries outside of the United States between 2020 and 2030, depending on the specific compositions and formulations. Issued patents directed to methods of treatment using our product candidates ADXS-HPV and ADXS-PSA in the United States, will expire between 2014 and 2017, depending on the specific indication: infectious disease, any tumor including leukemia, melanoma, breast cancer, pancreatic cancer, and cervical cancer. Issued patents directed to use of our product candidates: ADXS-HPV and ADXS-PSA for indications outside of the United States, will expire between 2015 and 2018, depending on the specific indication: infectious disease, any tumor including leukemia, melanoma, breast cancer, pancreatic cancer, and cervical cancer. We have pending patent applications for use of our product candidates ADXS-HPV, ADXS-PSA, ADXS-cHER2 covering the following indications: any tumor/cancer, including, a her2/neu-expressing cancer, a prostate cancer, cervical dysplasia, and cervical cancer that, if issued would expire in the United States and in countries outside of the United States between 2020 and 2033, depending on the specific indications and formulations.

We will be able to protect our technology from unauthorized use by third parties only to the extent it is covered by valid and enforceable patents or is effectively maintained as trade secrets. Patents and other proprietary rights are an essential element of our business.

Our success will depend in part on our ability to obtain and maintain proprietary protection for our product candidates, technology, and know-how, to operate without infringing on the proprietary rights of others, and to prevent others from infringing our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign patent applications related to our proprietary technology, inventions, and improvements that are important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation, and in-licensing opportunities to develop and maintain our proprietary position.

Any patent applications which we have filed or will file or to which we have licensed or will license rights may not issue, and patents that do issue may not contain commercially valuable claims. In addition, any patents issued to us or our licensors may not afford meaningful protection for our products or technology, or may be subsequently circumvented, invalidated or narrowed, or found unenforceable. Our processes and potential products may also conflict with patents which have been or may be granted to competitors, academic institutions or others. As the pharmaceutical industry expands and more patents are issued, the risk increases that our processes and potential products may give rise to interferences filed by others in the U.S. Patent and Trademark Office, or to claims of patent infringement by other companies, institutions or individuals. These entities or persons could bring legal actions against us claiming damages and seeking to enjoin clinical testing, manufacturing and marketing of the related product or process. In recent years, several companies have been extremely aggressive in challenging patents covering pharmaceutical products, and the challenges have often been successful. If any of these actions are successful, in addition to any potential liability for damages, we could be required to cease the infringing activity or obtain a license in order to continue to manufacture or market the relevant product or process. We may not prevail in any such action and any license required under any such patent may not be made available on acceptable terms, if at all. Our failure to successfully defend a patent challenge or to obtain a license to any technology that we may require to commercialize our technologies or potential products could have a materially adverse effect on our business. In addition, changes in either patent laws or in interpretations of patent laws in the United States and other countries may materially diminish the value of our intellectual property or narrow the scope of our patent protection.

We also rely upon unpatented proprietary technology, and in the future may determine in some cases that our interests would be better served by reliance on trade secrets or confidentiality agreements rather than patents or licenses. We may not be able to protect our rights to such unpatented proprietary technology and others may independently develop substantially equivalent technologies. If we are unable to obtain strong proprietary rights to our processes or products after obtaining regulatory clearance, competitors may be able to market competing processes and products.

Others may obtain patents having claims which cover aspects of our products or processes which are necessary for, or useful to, the development, use or manufacture of our services or products. Should any other group obtain patent protection with respect to our discoveries, our commercialization of potential therapeutic products and methods could be limited or prohibited.

Governmental Regulation

The Drug Development Process

The FDA requires that pharmaceutical and certain other therapeutic products undergo significant clinical experimentation and clinical testing prior to their marketing or introduction to the general public. Clinical testing, known as clinical trials or clinical studies, is either conducted internally by pharmaceutical or biotechnology companies or is conducted on behalf of these companies by Clinical Research Organizations, which we refer to as CROs.

The process of conducting clinical studies is highly regulated by the FDA, as well as by other governmental and professional bodies. Below, we describe the principal framework in which clinical studies are conducted, as well as describe a number of the parties involved in these studies.

Protocols .

Before commencing clinical studies, the sponsor of an investigational new drug must typically receive governmental and institutional approval. In the United States, Federal approval is obtained by submitting an IND to the FDA and amending it for each new proposed study. The clinical research plan is known in the industry as a protocol. A protocol is the blueprint for each drug study. The protocol sets forth, among other things, the following:

|

|

· |

Criteria for subject or patient inclusion/exclusion; |

|

|

· |

Dosing requirements and timing; |

|

|

· |

Tests to be performed; and |

|

|

· |

Evaluations and data assessment. |

Institutional Review Board (Ethics Committee) . An institutional review board is an independent committee of professionals and lay persons which reviews clinical research studies involving human beings and is required to adhere to guidelines issued by the FDA. The institutional review board does not report to the FDA and its members are not appointed by the FDA, but its records are audited by the FDA. All clinical studies must be approved by an institutional review board. The institutional review board is convened by the site or institution where the protocol will be conducted and its role is to protect the rights of the subjects and patients in the clinical studies. It must approve the protocols to be used and then oversee the conduct of the study, including oversight of the communications which we or the CRO conducting the study at that specific site proposes to use to recruit subjects or patients, and the informed consent form which the subjects or patients will be required to sign prior to their enrollment in the clinical studies.

Clinical Trials . Human clinical studies or testing of an investigational new drug prior to FDA approval are generally done in three stages known as Phase 1, Phase 2, and Phase 3 testing. The names of the phases are derived from the CFR 21 that regulates the FDA. Generally, there are multiple studies conducted in each phase.

Phase 1 . Phase 1 studies involve testing an investigational new drug on a limited number of patients. Phase 1 studies determine a drug’s basic safety, maximum tolerated dose and how the drug is absorbed by, and eliminated from, the body. This phase lasts an average of six months to a year. Typically, cancer therapies are initially tested on late stage cancer patients.

Phase 2 . Phase 2 trials involve larger numbers of patients that have been diagnosed with the targeted disease or condition. Phase 2 testing typically lasts an average of one to three years. In Phase 2, the drug is tested to determine its safety and effectiveness for treating a specific disease or condition. Phase 2 testing also involves determining acceptable dosage levels of the drug. If Phase 2 studies show that an investigational new drug has an acceptable range of safety risks and probable effectiveness, a company will continue to evaluate the investigational new drug in Phase 3 studies.

Phase 3 . Phase 3 studies involve testing even larger numbers of patients, typically several hundred to several thousand patients. The purpose is to confirm effectiveness and long-term safety on a large scale. These studies generally last two to six years. Given the larger number of patients required to conduct Phase 3 studies, they are generally conducted at multiple sites and often times in multiple countries.

Biologic License Application. The results of the clinical trials using biologics are submitted to the FDA as part of Biologic License Application, which we refer to as BLA. Following the completion of Phase 3 studies, if the Sponsor of a potential product in the United States believes it has sufficient information to support the safety and effectiveness of the investigational new drug, the Sponsor submits a BLA to the FDA requesting that the investigational new drug be approved for sale. The application is a comprehensive, multi-volume filing that includes the results of all preclinical and clinical studies, information about the drug’s composition, and the Sponsor’s plans for manufacturing, packaging, labeling and testing the investigational new drug. The FDA’s review of an application is designated either as a standard review with a target review time of 10 months or a priority review with a target of 6 months. Depending upon the completeness of the application and the number and complexity of requests and responses between the FDA and the Sponsor, the review time can take months to many years, with the mean review lasting 13.1 months. Once approved, drugs and other products may be marketed in the United States, subject to any conditions imposed by the FDA.

The drug approval process is time-consuming, involves substantial expenditures of resources, and depends upon a number of factors, including the severity of the illness in question, the availability of alternative treatments, and the risks and benefits demonstrated in the clinical trials.

Orphan Drug Designation

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biological product intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making a drug or biological product available in the United States for this type of disease or condition will be recovered from sales of the product. If a sponsor demonstrates that a drug is intended to treat a rare disease or condition, the FDA grants orphan drug designation to the product for that use. The benefits of orphan drug designation can obtain substantial incentives, including research and development tax credits and exemption from user fees, enhanced access to advice from the FDA while the drug is being developed, and market exclusivity once the product reaches approval and begins sales, provided that the new product is first to market. In order to qualify for these incentives, a company must apply for designation of its product as an “Orphan Drug” and obtain approval from the FDA. Orphan product designation does not convey any advantage in or shorten the duration of the regulatory review and approval process. A drug that is approved for the orphan drug designated indication is granted seven years of orphan drug exclusivity. During that period, the FDA generally may not approve any other application for the same product for the same indication, although there are exceptions, most notably when the later product is shown to be clinically superior to the product with exclusivity.

In June 2013, we filed three applications for Orphan Drug Designation with the FDA for ADXS-HPV for treatment of HPV-associated anal cancer (granted August 2013), HPV-associated head and neck cancer (granted November 2013); and invasive cervical cancer (denied in October 2013 as the target population estimate exceeded the statutory maximum allowed. In January 2014, a telecon meeting was conducted with the FDA to discuss the orphan drug designation request and subsequent denial for ADXS-HPV for the treatment of invasive cervical cancer. We intend to submit a new application based on the discussions).

Orphan drug status in the European Union has similar but not identical benefits in that jurisdiction. The applicable exclusivity period, for example, is ten years in Europe, and can be reduced to six years if the drug no longer meets the criteria for orphan drug designation or if the drug is sufficiently profitable so that market exclusivity is no longer justified.

Breakthrough Therapy Designation

On July 9, 2012 the Food and Drug Administration Safety and Innovation Act was signed. FDASIA Section 902 provides for a new designation — Breakthrough Therapy Designation. A breakthrough therapy is a drug: intended alone or in combination with one or more other drugs to treat a serious or life threatening disease or condition; and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. If our drug is designated as breakthrough therapy, it will receive all the benefits of fast track designation (opportunities for frequent interactions with the FDA review team, opportunity for a 6-month priority review if supported by clinical data at the time of the BLA submission), potential for a review of portions of the marketing application prior to submitting a complete BLA), intensive guidance on an efficient drug development program, organizational commitment involving senior managers at the FDA in a proactive, collaborative, cross-disciplinary review, will expedite the development and review of such drug.

Over the course of drug development, it is foreseeable that certain products in breakthrough therapy development programs will no longer be considered a breakthrough therapy. For example, a drug’s development program may be granted breakthrough therapy designation using early clinical testing that shows a much higher response rate than available therapies. However, subsequent interim data derived from a larger study may show a response that is substantially smaller than the response seen in early clinical testing. Another example is where breakthrough therapy designation is granted to two drugs that are being developed for the same use. If one of the two drugs gains traditional approval, the other would not retain its designation unless its sponsor provided evidence that the drug may demonstrate substantial improvement over the recently approved drug. Additionally, if the sponsor recognizes that the development program designated as breakthrough therapy will no longer be pursued, the sponsor should inform the FDA of this change.

When breakthrough therapy designation is no longer supported by emerging data or the designated drug development program is no longer being pursued, the FDA may choose to send a letter notifying the sponsor that the program is no longer designated as a breakthrough therapy development program.

On October 7, 2013, we submitted a request for breakthrough therapy designation to the IND for ADXS-HPV in the treatment of invasive cervical cancer. The FDA denied the request in December 2013, but stated that a new request may be submitted if we obtain new clinical evidence that supports BTD.

Non-U.S. Regulation

Before our products can be marketed outside the United States, they are subject to regulatory approval of the respective authorities in the country in which the product should be marketed. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary widely from country to country. No action can be taken to market any product in a country until an appropriate application has been approved by the regulatory authorities in that country. The current approval process varies from country to country, and the time spent in gaining approval varies from that required for FDA approval. In certain countries, the sales price of a product must also be approved. The pricing review period often begins after market approval is granted. Even if a product is approved by a regulatory authority, satisfactory prices might not be approved for such product.

In Europe, marketing authorizations may be submitted at a centralized, a decentralized or national level. The centralized procedure is mandatory for the approval of biotechnology products and provides for the grant of a single marketing authorization that is valid in all European Union member states. As of January 1995, a mutual recognition procedure is available at the request of the applicant for all medicinal products that are not subject to the centralized procedure. There can be no assurance that the chosen regulatory strategy will secure regulatory approvals on a timely basis or at all.

While we intend to market our products outside the United States in compliance with our respective license agreements, we have not made any applications with non-U.S. authorities. Our current business strategy, however, includes filing three applications to request Orphan Drug Designation with the EMEA for ADX-HPV for use in the treatment of invasive cervical cancer, head and neck cancer and anal cancer.

Manufacturing

The FDA requires that any drug or formulation to be tested in humans be manufactured in accordance with its GMP regulations. This has been extended to include any drug that will be tested for safety in animals in support of human testing. The GMPs set certain minimum requirements for procedures, record-keeping and the physical characteristics of the laboratories used in the production of these drugs.

We have entered into agreements with Cobra and Vibalogics for the manufacture of a portion of our immunotherapies. Both companies have extensive experience in manufacturing gene therapy products for investigational studies. Both companies are full service manufacturing organizations that manufacture and supply biologic based therapeutics for the pharmaceutical and biotech industry. These services include cell banking, GMP manufacturing and stability testing.

Our agreements with Vibalogics cover the manufacture of GMP material for two immunotherapies ADXS-PSA, an Lm -LLO immunotherapy for the treatment of prostate cancer, and ADXS-cHER2, an Lm -LLO immunotherapy for the treatment of HER2 overexpressing cancers (such as breast, gastric and other cancers and for canine osteosarcoma).

Our agreement with Cobra covers GMP manufacturing in several stages, including process development, manufacturing of non-GMP material for toxicology studies and manufacturing of GMP material for the Phase 1 and Phase 2 trials.

Competition

The biotechnology and biopharmaceutical industries are characterized by rapid technological developments and a high degree of competition. As a result, our actual or proposed immunotherapies could become obsolete before we recoup any portion of our related research and development and commercialization expenses. The biotechnology and biopharmaceutical industries are highly competitive, and this competition comes from both biotechnology firms and from major pharmaceutical companies, including: Aduro Biotech, Agenus Inc., Bristol-Myers Squibb, Celgene Corporation, Celldex Therapeutics, Dendreon Corporation, Inovio Pharmaceutical Inc., Oncolytics Biotech Inc., Oncothyreon Inc., et al., each of which is pursuing cancer vaccines and/or immunotherapies.

Many of these companies have substantially greater financial, marketing, and human resources than we do (including, in some cases, substantially greater experience in clinical testing, manufacturing, and marketing of pharmaceutical products). We also experience competition in the development of our immunotherapies from universities and other research institutions and compete with others in acquiring technology from such universities and institutions. In addition, certain of our immunotherapies may be subject to competition from investigational new drugs and/or products developed using other technologies, some of which have completed numerous clinical trials.

Our competition will be determined in part by the potential indications for which drugs are developed and ultimately approved by regulatory authorities. Additionally, the timing of market introduction of some of our potential immunotherapies or of competitors’ products may be an important competitive factor. Accordingly, the speed with which we can develop immunotherapies, complete preclinical testing, clinical trials and approval processes and supply commercial quantities to market are expected to be important competitive factors. We expect that competition among products approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price and patent position.

Employees

As of January 17, 2014, we had 17 employees, all of which were full time employees. None of our employees is represented by a labor union, and we consider our relationship with our employees to be good.

Because we intend to continue to outsource many functions, we do not anticipate any significant increase in the number of employees in the clinical area and the research and development area to support clinical requirements, and in the general and administrative and business development areas over the next two years, even as we expand our research and development activities.

Description of Property

Our corporate offices are currently located at 305 College Road East, Princeton, New Jersey 08540. On April 1, 2011, we entered into a Sublease Agreement for such office, which is an approximately 10,000 square foot leased facility in Princeton, NJ approximately 12 miles south of our prior location. The agreement has a termination date of November 29, 2015.

On March 13, 2013, we entered into a modification of the Sublease Agreement whereby all unpaid accrued lease amounts and future lease amounts through June 30, 2013, which we estimated to be approximately $450,000, would be satisfied by a payment in total of $200,000, with $100,000 paid on March 13, 2013 and $100,000 paid upon the close of our public offering in October 2013. In addition, lease payments for the period July 1, 2013 through November 30, 2015 was reduced to a total of $20,000 per month.

Item 1A: Risk Factors.

You should carefully consider the risks described below as well as other information provided to you in this annual report, including information in the section of this document entitled “Forward-Looking Statements.” The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair our business operations. If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected, the value of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business and Industry

We are a development stage company.

We are an early development stage biotechnology company with a history of losses and can provide no assurance as to future operating results. As a result of losses that will continue throughout our development stage, we may exhaust our financial resources and be unable to complete the development of our products. We anticipate that our ongoing operational costs will increase significantly as we continue conducting our clinical development program. Our deficit will continue to grow during our drug development period. Since our inception, we have had no revenue, and do not expect to have any revenue for another three to five years, depending on when we can commercialize our immunotherapies, if at all.

We have sustained losses from operations in each fiscal year since our inception, and we expect losses to continue for the indefinite future due to the substantial investment in research and development. As of October 31, 2013 we had an accumulated deficit of $70,465,823 and shareholders’ equity of $18,002,142. We expect to spend substantial additional sums on the continued administration and research and development of proprietary products and technologies with no certainty that our immunotherapies will become commercially viable or profitable as a result of these expenditures. If we fail to raise a significant amount of capital, we may need to significantly curtail operations or cease operations in the near future. If any of our product candidates fails in clinical trials or does not gain regulatory approval, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

We commenced our Lm -LLO based immunotherapy development business in February 2002 and have existed as a development stage company since such time. Prior thereto we conducted no business. Accordingly, we have a limited operating history. We have no approved products or products pending approval and therefore have not derived any revenue from the sales of products and have not yet demonstrated ability to obtain regulatory approval, formulate and manufacture commercial scale products, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, there is limited information for investors to use as basis for assessing our future viability. Investors must consider the risks and difficulties we have encountered in the rapidly evolving vaccine and immunotherapy industry. Such risks include the following:

|

|

•

|

difficulties, complications, delays and other unanticipated factors in connection with the development of new drugs;

|

|

|

•

|

competition from companies that have substantially greater assets and financial resources than we have;

|

|

|

•

|

need for acceptance of our immunotherapies;

|

|

|

•

|

ability to anticipate and adapt to a competitive market and rapid technological developments;

|

|

|

•

|

need to rely on multiple levels of complex financing agreements with outside funding due to the length of drug development cycles and governmental approved protocols associated with the pharmaceutical industry; and

|

|

|

•

|

dependence upon key personnel including key independent consultants and advisors.

|

We cannot be certain that our strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition and results of operations could be materially and adversely affected. We may be required to reduce our staff, discontinue certain research or development programs of our future products and cease to operate.

We may face legal claims; Litigation is expensive and we may not be able to afford the costs.

We may face legal claims involving stockholders, consumers, competitors, and other issues. As described in “Legal Proceedings” in Part I Item 3 of this Form 10-K, we are engaged in a number of legal proceedings. Litigation and other legal proceedings are inherently uncertain, and adverse rulings could occur, including monetary damages, or an injunction stopping us from engaging in business practices, or requiring other remedies, such as compulsory licensing of patents.

The costs of litigation or any proceeding relating to our intellectual property or contractual rights could be substantial even if resolved in our favor. Some of our competitors or financial funding sources have far greater resources than we do and may be better able to afford the costs of complex litigation. Also, in a law suit for infringement or contractual breaches, even if frivolous, will require considerable time commitments on the part of management, its attorneys and consultants. Defending these types of proceedings or legal actions involve considerable expense and could negatively affect our financial results.

We can provide no assurance of the successful and timely development of new products.

Our immunotherapies are at various stages of research and development. Further development and extensive testing will be required to determine their technical feasibility and commercial viability. We will need to complete significant additional clinical trials demonstrating that our product candidates are safe and effective to the satisfaction of the FDA and other non-U.S. regulatory authorities. The drug approval process is time-consuming, involves substantial expenditures of resources, and depends upon a number of factors, including the severity of the illness in question, the availability of alternative treatments, and the risks and benefits demonstrated in the clinical trials. Our success will depend on our ability to achieve scientific and technological advances and to translate such advances into licensable, FDA-approvable, commercially competitive products on a timely basis. Failure can occur at any stage of the process. If such programs are not successful, we may invest substantial amounts of time and money without developing revenue-producing products. As we enter a more extensive clinical program for our product candidates, the data generated in these studies may not be as compelling as the earlier results.

Immunotherapies and vaccines that we may develop are not likely to be commercially available until five to ten or more years. The proposed development schedules for our immunotherapies may be affected by a variety of factors, including technological difficulties, clinical trial failures, regulatory hurdles, competitive products, intellectual property challenges and/or changes in governmental regulation, many of which will not be within our control. Any delay in the development, introduction or marketing of our products could result either in such products being marketed at a time when their cost and performance characteristics would not be competitive in the marketplace or in the shortening of their commercial lives. In light of the long-term nature of our projects, the unproven technology involved and the other factors described elsewhere in this section, there can be no assurance that we will be able to successfully complete the development or marketing of any new products.

Our research and development expenses are subject to uncertainty.

Factors affecting our research and development expenses include, but are not limited to:

|

|

•

|

competition from companies that have substantially greater assets and financial resources than we have;

|

|

|

•

|

need for acceptance of our immunotherapies;

|

|

|

•

|

ability to anticipate and adapt to a competitive market and rapid technological developments;

|

|

|

•

|

amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure;

|

|

|

•

|

need to rely on multiple levels of outside funding due to the length of drug development cycles and governmental approved protocols associated with the pharmaceutical industry; and

|

|

|

•

|

dependence upon key personnel including key independent consultants and advisors.

|

There can be no guarantee that our research and development expenses will be consistent from period to period. We may be required to accelerate or delay incurring certain expenses depending on the results of our studies and the availability of adequate funding.

We are subject to numerous risks inherent in conducting clinical trials.

We outsource the management of our clinical trials to third parties. Agreements with clinical investigators and medical institutions for clinical testing and with other third parties for data management services, place substantial responsibilities on these parties that, if unmet, could result in delays in, or termination of, our clinical trials. For example, if any of our clinical trial sites fail to comply with FDA-approved good clinical practices, we may be unable to use the data gathered at those sites. If these clinical investigators, medical institutions or other third parties do not carry out their contractual duties or obligations or fail to meet expected deadlines, or if the quality or accuracy of the clinical data they obtain is compromised due to their failure to adhere to our clinical protocols or for other reasons, our clinical trials may be extended, delayed or terminated, and we may be unable to obtain regulatory approval for, or successfully commercialize, agents such as ADXS-HPV. We are not certain that we will successfully recruit enough patients to complete our clinical trials nor that we will reach our primary endpoints. Delays in recruitment, lack of clinical benefit or unacceptable side effects would delay or prevent the initiation of the Phase 3 trials of ADXS-HPV.

We or our regulators may suspend or terminate our clinical trials for a number of reasons. We may voluntarily suspend or terminate our clinical trials if at any time we believe they present an unacceptable risk to the patients enrolled in our clinical trials or do not demonstrate clinical benefit. In addition, regulatory agencies may order the temporary or permanent discontinuation of our clinical trials at any time if they believe that the clinical trials are not being conducted in accordance with applicable regulatory requirements or that they present an unacceptable safety risk to the patients enrolled in our clinical trials.

Our clinical trial operations are subject to regulatory inspections at any time. If regulatory inspectors conclude that we or our clinical trial sites are not in compliance with applicable regulatory requirements for conducting clinical trials, we may receive reports of observations or warning letters detailing deficiencies, and we will be required to implement corrective actions. If regulatory agencies deem our responses to be inadequate, or are dissatisfied with the corrective actions we or our clinical trial sites have implemented, our clinical trials may be temporarily or permanently discontinued, we may be fined, we or our investigators may be precluded from conducting any ongoing or any future clinical trials, the government may refuse to approve our marketing applications or allow us to manufacture or market our products, and we may be criminally prosecuted.

The lengthy approval process as well as the unpredictability of future clinical trial results may result in our failing to obtain regulatory approval for ADXS-HPV or our other product candidates, which would materially harm our business, results of operations and prospects.

The successful development of immunotherapies is highly uncertain.

Successful development of biopharmaceuticals is highly uncertain and is dependent on numerous factors, many of which are beyond our control. Immunotherapies that appear promising in the early phases of development may fail to reach the market for several reasons including:

|

|

•

|

preclinical study results that may show the immunotherapy to be less effective than desired (e.g., the study failed to meet its primary objectives) or to have harmful or problematic side effects;

|

|

|

•

|

clinical study results that may show the immunotherapy to be less effective than expected (e.g., the study failed to meet its primary endpoint) or to have unacceptable side effects;

|

|

|

•

|

failure to receive the necessary regulatory approvals or a delay in receiving such approvals. Among other things, such delays may be caused by slow enrollment in clinical studies, length of time to achieve study endpoints, additional time requirements for data analysis, or Biologics License Application preparation, discussions with the FDA, an FDA request for additional preclinical or clinical data, or unexpected safety or manufacturing issues;

|

|

|

•

|

manufacturing costs, formulation issues, pricing or reimbursement issues, or other factors that make the immunotherapy uneconomical; and

|

|

|

•

|

the proprietary rights of others and their competing products and technologies that may prevent the immunotherapy from being commercialized.

|

Success in preclinical and early clinical studies does not ensure that large-scale clinical studies will be successful. Clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals. The length of time necessary to complete clinical studies and to submit an application for marketing approval for a final decision by a regulatory authority varies significantly from one immunotherapy to the next, and may be difficult to predict.