ew-20240630000109980012/312024Q2falsehttp://fasb.org/us-gaap/2024#BusinessCombinationContingentConsiderationArrangementsChangeInAmountOfContingentConsiderationLiability1http://fasb.org/us-gaap/2024#BusinessCombinationContingentConsiderationArrangementsChangeInAmountOfContingentConsiderationLiability1http://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://www.edwards.com/20240630#AccruedAndOtherLiabilitiesCurrenthttp://www.edwards.com/20240630#AccruedAndOtherLiabilitiesCurrent96xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURew:lawsuitew:agreement00010998002024-01-012024-06-3000010998002024-07-2600010998002024-06-3000010998002023-12-3100010998002024-04-012024-06-3000010998002023-04-012023-06-3000010998002023-01-012023-06-3000010998002022-12-3100010998002023-06-300001099800us-gaap:CommonStockMember2023-12-310001099800us-gaap:TreasuryStockCommonMember2023-12-310001099800us-gaap:AdditionalPaidInCapitalMember2023-12-310001099800us-gaap:RetainedEarningsMember2023-12-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001099800us-gaap:ParentMember2023-12-310001099800us-gaap:NoncontrollingInterestMember2023-12-310001099800us-gaap:RetainedEarningsMember2024-01-012024-03-310001099800us-gaap:ParentMember2024-01-012024-03-310001099800us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100010998002024-01-012024-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001099800us-gaap:CommonStockMember2024-01-012024-03-310001099800us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001099800us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001099800us-gaap:CommonStockMember2024-03-310001099800us-gaap:TreasuryStockCommonMember2024-03-310001099800us-gaap:AdditionalPaidInCapitalMember2024-03-310001099800us-gaap:RetainedEarningsMember2024-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001099800us-gaap:ParentMember2024-03-310001099800us-gaap:NoncontrollingInterestMember2024-03-3100010998002024-03-310001099800us-gaap:RetainedEarningsMember2024-04-012024-06-300001099800us-gaap:ParentMember2024-04-012024-06-300001099800us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001099800us-gaap:CommonStockMember2024-04-012024-06-300001099800us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001099800us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001099800us-gaap:CommonStockMember2024-06-300001099800us-gaap:TreasuryStockCommonMember2024-06-300001099800us-gaap:AdditionalPaidInCapitalMember2024-06-300001099800us-gaap:RetainedEarningsMember2024-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001099800us-gaap:ParentMember2024-06-300001099800us-gaap:NoncontrollingInterestMember2024-06-300001099800us-gaap:CommonStockMember2022-12-310001099800us-gaap:TreasuryStockCommonMember2022-12-310001099800us-gaap:AdditionalPaidInCapitalMember2022-12-310001099800us-gaap:RetainedEarningsMember2022-12-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001099800us-gaap:ParentMember2022-12-310001099800us-gaap:NoncontrollingInterestMember2022-12-310001099800us-gaap:RetainedEarningsMember2023-01-012023-03-310001099800us-gaap:ParentMember2023-01-012023-03-3100010998002023-01-012023-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001099800us-gaap:CommonStockMember2023-01-012023-03-310001099800us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001099800us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001099800us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001099800us-gaap:CommonStockMember2023-03-310001099800us-gaap:TreasuryStockCommonMember2023-03-310001099800us-gaap:AdditionalPaidInCapitalMember2023-03-310001099800us-gaap:RetainedEarningsMember2023-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001099800us-gaap:ParentMember2023-03-310001099800us-gaap:NoncontrollingInterestMember2023-03-3100010998002023-03-310001099800us-gaap:RetainedEarningsMember2023-04-012023-06-300001099800us-gaap:ParentMember2023-04-012023-06-300001099800us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001099800us-gaap:CommonStockMember2023-04-012023-06-300001099800us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001099800us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001099800us-gaap:CommonStockMember2023-06-300001099800us-gaap:TreasuryStockCommonMember2023-06-300001099800us-gaap:AdditionalPaidInCapitalMember2023-06-300001099800us-gaap:RetainedEarningsMember2023-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001099800us-gaap:ParentMember2023-06-300001099800us-gaap:NoncontrollingInterestMember2023-06-300001099800us-gaap:SegmentDiscontinuedOperationsMember2024-01-012024-06-300001099800us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-06-300001099800us-gaap:SegmentContinuingOperationsMember2024-06-300001099800us-gaap:SegmentContinuingOperationsMember2023-12-310001099800us-gaap:SegmentDiscontinuedOperationsMember2024-06-300001099800us-gaap:SegmentDiscontinuedOperationsMember2023-12-3100010998002023-04-122023-04-120001099800ew:MedtronicIncMember2023-04-122023-04-120001099800ew:MedtronicIncMember2023-03-012023-03-310001099800ew:MedtronicIncMember2023-04-300001099800ew:MedtronicIncMember2023-04-012023-04-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-06-030001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-06-032024-06-030001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-04-012024-06-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-04-012023-06-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-01-012024-06-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-01-012023-06-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-06-300001099800ew:CriticalCareMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-12-310001099800us-gaap:BankTimeDepositsMember2024-06-300001099800us-gaap:BankTimeDepositsMember2023-12-310001099800us-gaap:USTreasuryAndGovernmentMember2024-06-300001099800us-gaap:USTreasuryAndGovernmentMember2023-12-310001099800us-gaap:AssetBackedSecuritiesMember2024-06-300001099800us-gaap:AssetBackedSecuritiesMember2023-12-310001099800us-gaap:CorporateDebtSecuritiesMember2024-06-300001099800us-gaap:CorporateDebtSecuritiesMember2023-12-310001099800us-gaap:MunicipalBondsMember2024-06-300001099800us-gaap:MunicipalBondsMember2023-12-310001099800ew:NewMarketsTaxCreditMemberus-gaap:LimitedLiabilityCompanyMember2024-06-300001099800us-gaap:LimitedLiabilityCompanyMember2024-01-012024-06-300001099800us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300001099800us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001099800ew:MedicalDeviceCompanyMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-06-012022-06-300001099800ew:MedicalDeviceCompanyMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-06-300001099800ew:MedicalDeviceCompanyMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2019-01-012019-12-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalTechnologyCompanyMember2022-05-012022-05-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalTechnologyCompanyMember2021-01-012021-12-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalTechnologyCompanyMember2024-06-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:SubsequentEventMemberew:MedicalTechnologyCompanyMember2024-07-260001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyApril2021InvestmentMember2021-04-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyApril2021InvestmentMember2023-12-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyApril2021InvestmentMember2024-06-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyMarch2023InvestmentMember2023-03-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyMarch2023InvestmentMember2023-03-012024-06-300001099800ew:ConvertiblePromissoryNoteMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyMarch2023InvestmentMember2023-03-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyMarch2023InvestmentMember2024-06-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedicalDeviceCompanyMarch2023InvestmentMember2023-12-310001099800us-gaap:FairValueInputsLevel2Member2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001099800ew:ContingentConsiderationLiabilityMemberew:MeasurementInputProbabilityOfMilestoneAchievementMember2024-06-300001099800ew:ContingentConsiderationLiabilityMember2024-06-300001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-06-300001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-06-300001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-06-300001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-06-300001099800ew:ContingentConsiderationLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300001099800us-gaap:OtherLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300001099800us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300001099800us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001099800us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001099800us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001099800us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001099800us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001099800us-gaap:ForeignExchangeContractMember2024-06-300001099800us-gaap:CurrencySwapMember2024-06-300001099800us-gaap:ForeignExchangeContractMember2023-12-310001099800us-gaap:CurrencySwapMember2023-12-310001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CostOfSalesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:InterestIncomeMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CostOfSalesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:InterestIncomeMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2024-04-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2024-04-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-04-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2024-01-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2024-01-012024-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2023-01-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2023-01-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CostOfSalesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:InterestIncomeMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CostOfSalesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:InterestIncomeMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2023-04-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2023-04-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-04-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2023-01-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestIncomeMember2023-01-012023-06-300001099800us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-06-300001099800us-gaap:CostOfSalesMember2024-04-012024-06-300001099800us-gaap:CostOfSalesMember2023-04-012023-06-300001099800us-gaap:CostOfSalesMember2024-01-012024-06-300001099800us-gaap:CostOfSalesMember2023-01-012023-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001099800ew:LongTermStockIncentiveCompensationProgramMemberus-gaap:CommonStockMember2024-05-072024-05-070001099800ew:LongTermStockIncentiveCompensationProgramMemberus-gaap:CommonStockMember2024-05-070001099800ew:LongTermStockIncentiveCompensationProgramMemberus-gaap:RestrictedStockUnitsRSUMember2024-05-072024-05-070001099800ew:LongTermStockIncentiveCompensationProgramMemberus-gaap:RestrictedStockUnitsRSUMember2024-05-070001099800us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001099800ew:MarketBasedRestrictedStockUnitsMember2024-01-012024-06-300001099800srt:MinimumMemberew:MarketBasedRestrictedStockUnitsMember2024-01-012024-06-300001099800ew:MarketBasedRestrictedStockUnitsMembersrt:MaximumMember2024-01-012024-06-300001099800ew:MarketBasedRestrictedStockUnitsMember2023-01-012023-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2024-04-012024-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2023-04-012023-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2024-01-012024-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2023-01-012023-06-300001099800us-gaap:EmployeeStockMember2024-04-012024-06-300001099800us-gaap:EmployeeStockMember2023-04-012023-06-300001099800us-gaap:EmployeeStockMember2024-01-012024-06-300001099800us-gaap:EmployeeStockMember2023-01-012023-06-300001099800ew:InitialDeliveryOfSharesSettledFebruary2023Member2023-02-280001099800ew:InitialDeliveryOfSharesSettledFebruary2023Member2023-02-012023-02-280001099800ew:February2023StockRepurchaseProgramSharesSoldInMarch2023Member2023-03-012023-03-310001099800ew:InitialDeliveryOfSharesSettledApril2024Member2024-04-300001099800ew:InitialDeliveryOfSharesSettledApril2024Member2024-04-012024-04-300001099800ew:April2024StockRepurchaseProgramSharesSoldInMay2024Member2024-05-012024-05-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2024-04-012024-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-04-012024-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-04-012024-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-04-012024-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2023-04-012023-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-012023-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-012023-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-012023-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001099800us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-04-012024-06-300001099800us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-012023-06-300001099800us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-06-300001099800us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001099800us-gaap:StockCompensationPlanMember2024-04-012024-06-300001099800us-gaap:StockCompensationPlanMember2023-04-012023-06-300001099800us-gaap:StockCompensationPlanMember2024-01-012024-06-300001099800us-gaap:StockCompensationPlanMember2023-01-012023-06-3000010998002020-12-3100010998002021-01-012021-12-3100010998002022-11-012022-11-3000010998002024-03-012024-03-310001099800us-gaap:IsraelTaxAuthorityMember2024-01-012024-03-310001099800us-gaap:OperatingSegmentsMemberew:UnitedStatesSegmentMember2024-04-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:UnitedStatesSegmentMember2023-04-012023-06-300001099800us-gaap:OperatingSegmentsMemberew:UnitedStatesSegmentMember2024-01-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:UnitedStatesSegmentMember2023-01-012023-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001099800us-gaap:OperatingSegmentsMemberew:JapanSegmentMember2024-04-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:JapanSegmentMember2023-04-012023-06-300001099800us-gaap:OperatingSegmentsMemberew:JapanSegmentMember2024-01-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:JapanSegmentMember2023-01-012023-06-300001099800us-gaap:OperatingSegmentsMemberew:RestOfWorldSegmentMember2024-04-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:RestOfWorldSegmentMember2023-04-012023-06-300001099800us-gaap:OperatingSegmentsMemberew:RestOfWorldSegmentMember2024-01-012024-06-300001099800us-gaap:OperatingSegmentsMemberew:RestOfWorldSegmentMember2023-01-012023-06-300001099800us-gaap:OperatingSegmentsMember2024-04-012024-06-300001099800us-gaap:OperatingSegmentsMember2023-04-012023-06-300001099800us-gaap:OperatingSegmentsMember2024-01-012024-06-300001099800us-gaap:OperatingSegmentsMember2023-01-012023-06-300001099800us-gaap:MaterialReconcilingItemsMember2024-04-012024-06-300001099800us-gaap:MaterialReconcilingItemsMember2023-04-012023-06-300001099800us-gaap:MaterialReconcilingItemsMember2024-01-012024-06-300001099800us-gaap:MaterialReconcilingItemsMember2023-01-012023-06-300001099800us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001099800us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001099800us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001099800us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001099800country:US2024-04-012024-06-300001099800country:US2023-04-012023-06-300001099800country:US2024-01-012024-06-300001099800country:US2023-01-012023-06-300001099800srt:EuropeMember2024-04-012024-06-300001099800srt:EuropeMember2023-04-012023-06-300001099800srt:EuropeMember2024-01-012024-06-300001099800srt:EuropeMember2023-01-012023-06-300001099800country:JP2024-04-012024-06-300001099800country:JP2023-04-012023-06-300001099800country:JP2024-01-012024-06-300001099800country:JP2023-01-012023-06-300001099800ew:RestOfWorldMember2024-04-012024-06-300001099800ew:RestOfWorldMember2023-04-012023-06-300001099800ew:RestOfWorldMember2024-01-012024-06-300001099800ew:RestOfWorldMember2023-01-012023-06-300001099800ew:TranscatheterAorticValveReplacementMember2024-04-012024-06-300001099800ew:TranscatheterAorticValveReplacementMember2023-04-012023-06-300001099800ew:TranscatheterAorticValveReplacementMember2024-01-012024-06-300001099800ew:TranscatheterAorticValveReplacementMember2023-01-012023-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2024-04-012024-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2023-04-012023-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2024-01-012024-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2023-01-012023-06-300001099800ew:SurgicalHeartValveTherapyMember2024-04-012024-06-300001099800ew:SurgicalHeartValveTherapyMember2023-04-012023-06-300001099800ew:SurgicalHeartValveTherapyMember2024-01-012024-06-300001099800ew:SurgicalHeartValveTherapyMember2023-01-012023-06-300001099800us-gaap:SubsequentEventMemberew:JenaValveTechnologyMember2024-07-012024-07-260001099800us-gaap:SubsequentEventMemberew:JenaValveTechnologyMember2024-07-260001099800us-gaap:SubsequentEventMemberew:EndotronixIncMember2024-07-012024-07-260001099800us-gaap:SubsequentEventMemberew:EndotronixIncMember2024-07-260001099800ew:BioMedicalLimitedMemberus-gaap:SubsequentEventMember2024-07-012024-07-260001099800ew:BioMedicalLimitedMemberus-gaap:SubsequentEventMember2024-07-260001099800us-gaap:SubsequentEventMemberew:MedicalDeviceCompanyMember2024-05-012024-07-260001099800ew:MedicalDeviceCompanyMember2024-05-012024-05-310001099800us-gaap:SubsequentEventMemberew:MedicalDeviceCompanyMember2024-07-012024-07-260001099800us-gaap:SubsequentEventMemberew:MedicalDeviceCompanyMember2024-07-260001099800ew:LarryWoodMember2024-01-012024-06-300001099800ew:LarryWoodMember2024-04-012024-06-300001099800ew:LarryWoodMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-15525

EDWARDS LIFESCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 36-4316614 | |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

One Edwards Way

Irvine, California 92614

(Address of principal executive offices and zip code)

(949) 250-2500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | EW | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant's common stock, $1.00 par value, as of July 26, 2024 was 602.4 million.

EDWARDS LIFESCIENCES CORPORATION

FORM 10-Q

For the quarterly period ended June 30, 2024

TABLE OF CONTENTS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend the forward-looking statements contained in this report to be covered by the safe harbor provisions of such Acts. Statements other than statements of historical or current fact in this report or referred to or incorporated by reference into this report are "forward-looking statements" for purposes of these safe harbor provisions. These statements can sometimes be identified by the use of the forward-looking words such as "may," "believe," "will," "expect," "project," "estimate," "should," "anticipate," "plan," "goal," "continue," "seek," "pro forma," "forecast," "intend," "guidance," "optimistic," "aspire," "confident," other forms of these words or similar words or expressions or the negatives thereof. Statements regarding past performance, efforts, or results about which inferences or assumptions may be made can also be forward-looking statements and are not indicative of future performance or results; these statements can be identified by the use of words such as "preliminary," "initial," "potential," "possible," "diligence," "industry-leading," "compliant," "indications," or "early feedback" or other forms of these words or similar words or expressions or the negatives thereof. These forward-looking statements are subject to substantial risks and uncertainties that could cause our results or future business, financial condition, results of operations or performance to differ materially from our historical results or experiences or those expressed or implied in any forward-looking statements contained in this report. These risks and uncertainties include, but are not limited to: our ability to complete or realize the anticipated benefits of the sale of our critical care product group; our ability to develop new products and avoid manufacturing and quality issues; risks related to our recent pending acquisitions, including our ability to close the transactions in a timely manner or at all; clinical trial or commercial results or new product approvals and therapy adoption; the impact of domestic and global conditions; competition in the markets in which we operate; our reliance on vendors, suppliers, and other third parties; damage, failure or interruption of our information technology systems; the impact of public health crises; consolidation in the healthcare industry; our ability to protect our intellectual property; our compliance with applicable regulations; our exposure to product liability claims; use of our products in unapproved circumstances; changes to reimbursement for our products; the impact of currency exchange rates; unanticipated actions by the United States Food and Drug Administration and other regulatory agencies; changes to tax laws; unexpected impacts or expenses of litigation or internal or government investigations; and other risks detailed under “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2023, as amended in this report, and as such risks and uncertainties may be further amended, supplemented or superseded from time to time by our subsequent reports on Forms 10-Q and 8-K we file with the United States Securities and Exchange Commission. These forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

Unless otherwise indicated or otherwise required by the context, the terms "we," "our," "it," "its," "Company," "Edwards," and "Edwards Lifesciences" refer to Edwards Lifesciences Corporation and its subsidiaries.

Part I. Financial Information

Item 1. Financial Statements

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(in millions, except par value; unaudited) | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,644.5 | | | $ | 1,136.1 | |

| Short-term investments (Note 5) | 345.3 | | | 500.5 | |

Accounts receivable, net of allowances of $13.9 and $8.3, respectively | 778.3 | | | 771.5 | |

| Other receivables | 56.1 | | | 56.6 | |

| Inventories (Note 2) | 1,024.7 | | | 918.3 | |

| | | |

| Prepaid expenses | 110.2 | | | 128.8 | |

| Other current assets | 252.1 | | | 224.9 | |

| Current assets of discontinued operations (Note 4) | 304.8 | | | 299.0 | |

| Total current assets | 4,516.0 | | | 4,035.7 | |

| Long-term investments (Note 5) | 353.3 | | | 583.9 | |

| Property, plant, and equipment, net | 1,640.1 | | | 1,592.8 | |

| Operating lease right-of-use assets | 92.8 | | | 84.4 | |

| Goodwill | 1,151.0 | | | 1,152.5 | |

| Other intangible assets, net | 417.1 | | | 399.4 | |

| Deferred income taxes | 832.6 | | | 749.4 | |

| Other assets (Note 2) | 789.8 | | | 463.1 | |

| Non-current assets of discontinued operations (Note 4) | 306.6 | | | 302.0 | |

| Total assets | $ | 10,099.3 | | | $ | 9,363.2 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 185.9 | | | $ | 186.6 | |

| Accrued and other liabilities (Note 2) | 902.4 | | | 858.2 | |

| Operating lease liabilities | 21.5 | | | 22.9 | |

| | | |

| | | |

| Current liabilities of discontinued operations (Note 4) | 107.2 | | | 127.7 | |

| Total current liabilities | 1,217.0 | | | 1,195.4 | |

| Long-term debt | 597.3 | | | 597.0 | |

| | | |

| Taxes payable | 1.1 | | | 80.6 | |

| Operating lease liabilities | 74.2 | | | 65.2 | |

| Uncertain tax positions | 343.2 | | | 335.0 | |

| Litigation settlement accrual | 74.8 | | | 94.2 | |

| Other liabilities | 257.1 | | | 251.3 | |

| Non-current liabilities of discontinued operations (Note 4) | 30.0 | | | 25.1 | |

| Total liabilities | 2,594.7 | | | 2,643.8 | |

| Commitments and contingencies (Note 11) | | | |

| Stockholders' equity | | | |

Preferred stock, $0.01 par value, authorized 50.0 shares, no shares outstanding | — | | | — | |

Common stock, $1.00 par value, 1,050.0 shares authorized, 653.5 and 650.5 shares issued, and 602.3 and 601.1 shares outstanding, respectively | 653.5 | | | 650.5 | |

| Additional paid-in capital | 2,476.3 | | | 2,274.4 | |

| Retained earnings | 9,710.6 | | | 8,992.4 | |

| Accumulated other comprehensive loss (Note 12) | (220.2) | | | (242.8) | |

Treasury stock, at cost, 51.2 and 49.4 shares, respectively | (5,182.8) | | | (5,024.5) | |

| Total Edwards Lifesciences Corporation stockholders' equity | 7,437.4 | | | 6,650.0 | |

| Noncontrolling interest | 67.2 | | | 69.4 | |

| Total stockholders' equity | 7,504.6 | | | 6,719.4 | |

| Total liabilities and equity | $ | 10,099.3 | | | $ | 9,363.2 | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(in millions, except per share information; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

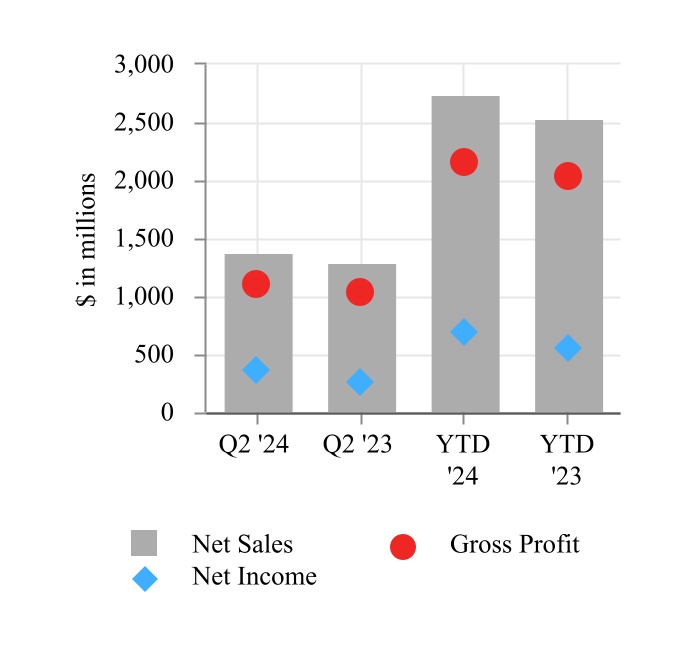

| Net sales | $ | 1,385.9 | | | $ | 1,295.5 | | | $ | 2,732.8 | | | $ | 2,533.2 | |

| Cost of sales | 285.3 | | | 256.9 | | | 581.6 | | | 495.9 | |

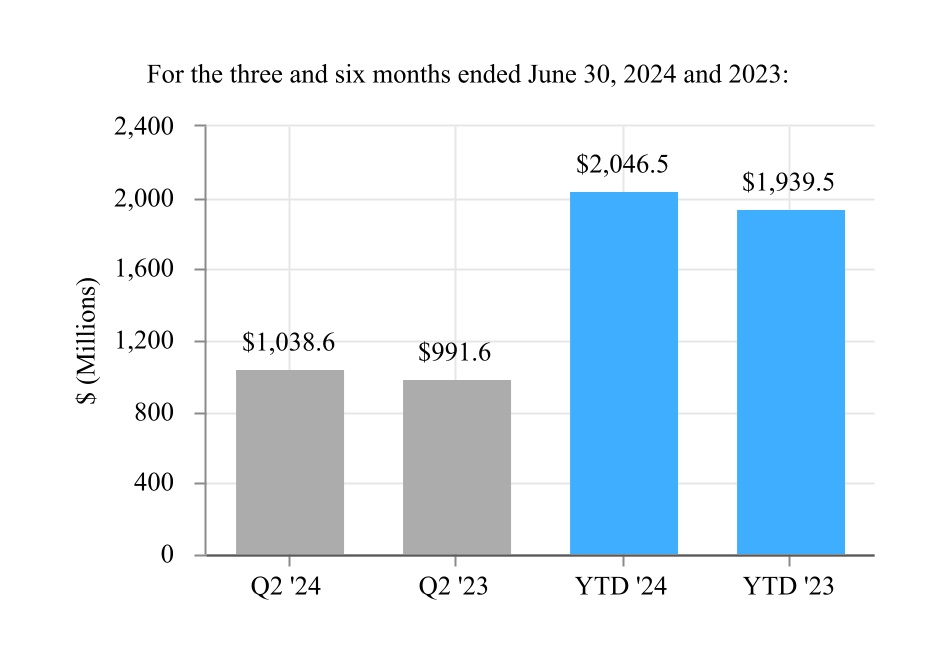

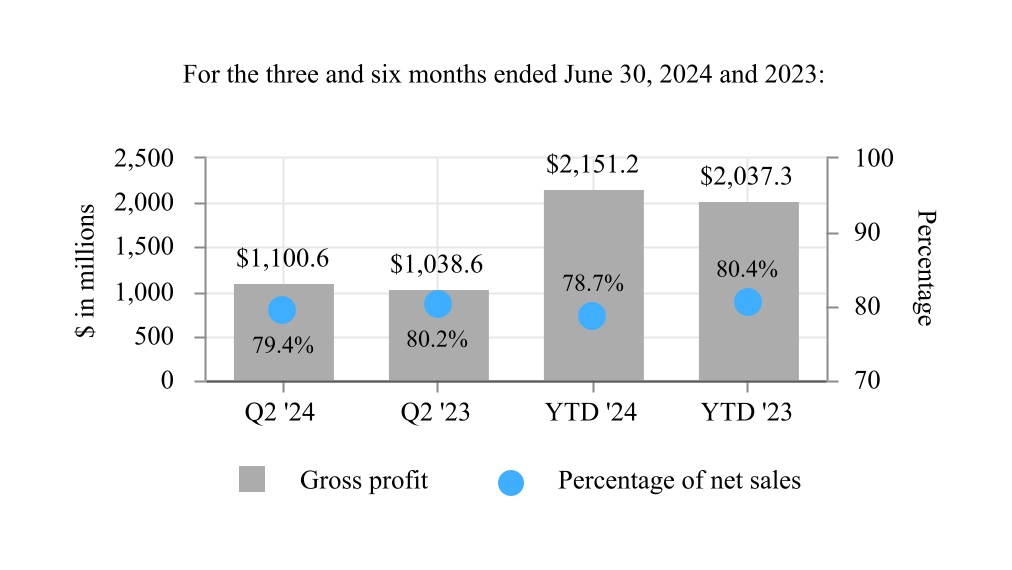

| Gross profit | 1,100.6 | | | 1,038.6 | | | 2,151.2 | | | 2,037.3 | |

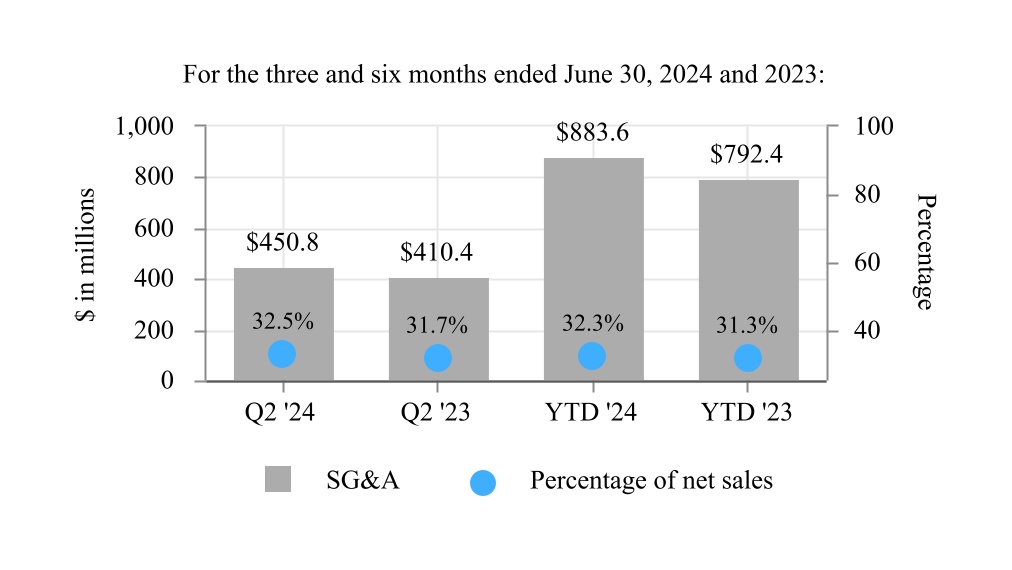

| Selling, general, and administrative expenses | 450.8 | | | 410.4 | | | 883.6 | | | 792.4 | |

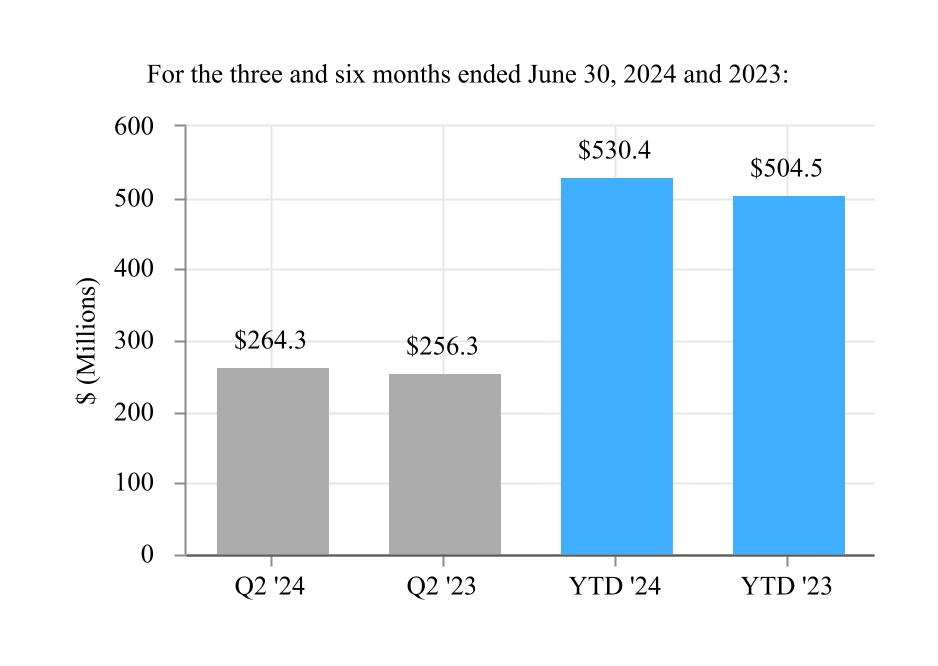

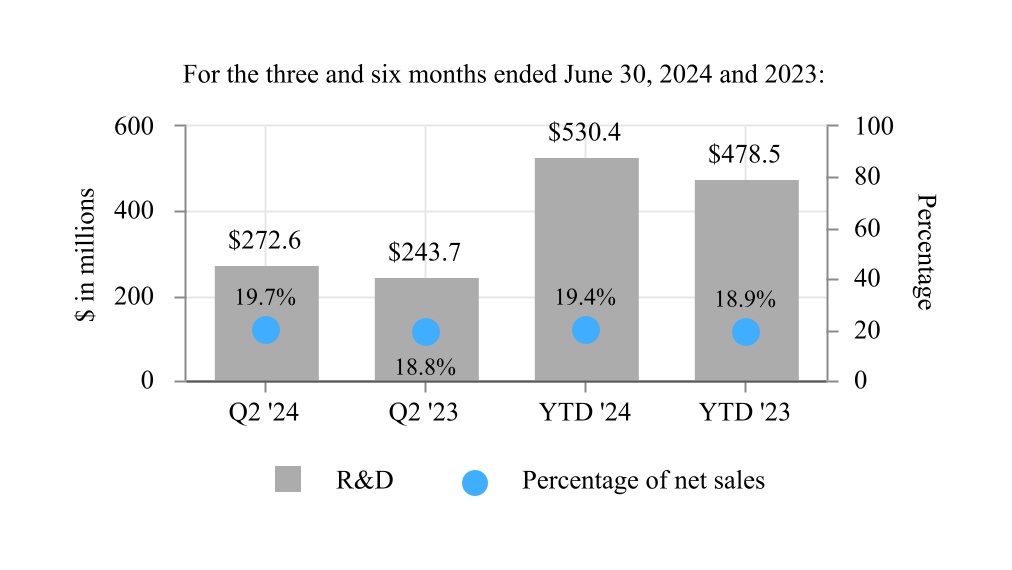

| Research and development expenses | 272.6 | | | 243.7 | | | 530.4 | | | 478.5 | |

Intellectual property agreement and certain litigation expenses (Note 3) | 8.1 | | | 147.9 | | | 17.0 | | | 191.4 | |

| Change in fair value of contingent consideration liabilities (Note 7) | — | | | (26.9) | | | — | | | (26.2) | |

| | | | | | | |

| | | | | | | |

| Operating income, net | 369.1 | | | 263.5 | | | 720.2 | | | 601.2 | |

| Interest income, net | (15.5) | | | (9.1) | | | (32.0) | | | (17.7) | |

| | | | | | | |

| Other income, net | (2.0) | | | (2.5) | | | (7.7) | | | (3.7) | |

| Income from continuing operations before provision for income taxes | 386.6 | | | 275.1 | | | 759.9 | | | 622.6 | |

| Provision for income taxes | 20.2 | | | 20.9 | | | 66.8 | | | 66.2 | |

| Net income from continuing operations | 366.4 | | | 254.2 | | | 693.1 | | | 556.4 | |

| (Loss) income from discontinued operations, net of tax | (1.4) | | | 51.3 | | | 22.9 | | | 89.6 | |

| Net income | 365.0 | | | 305.5 | | | 716.0 | | | 646.0 | |

| Net loss attributable to noncontrolling interest | (1.3) | | | (1.6) | | | (2.2) | | | (1.6) | |

| Net income attributable to Edwards Lifesciences Corporation | $ | 366.3 | | | $ | 307.1 | | | $ | 718.2 | | | $ | 647.6 | |

| | | | | | | |

Share information (Note 13) | | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | | | | | | | |

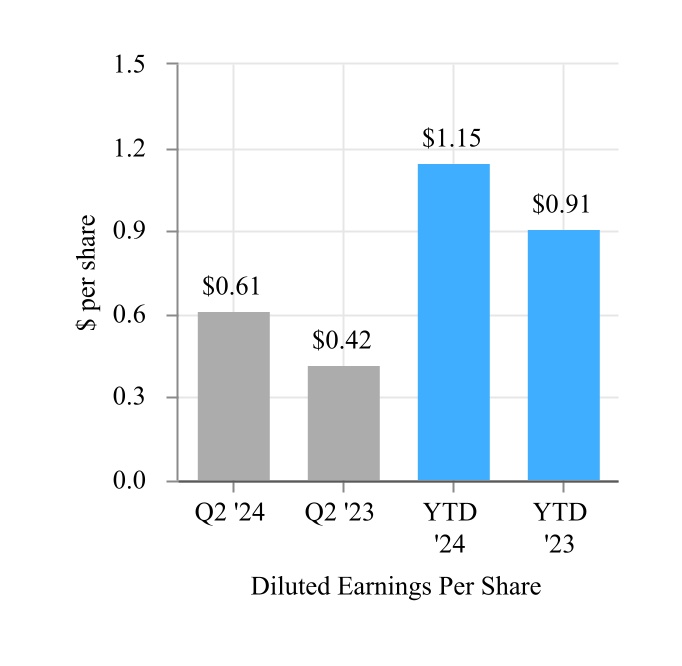

| Continuing operations | $ | 0.61 | | | $ | 0.42 | | | $ | 1.15 | | | $ | 0.92 | |

| Discontinued operations | $ | — | | | $ | 0.09 | | | $ | 0.04 | | | $ | 0.15 | |

| Basic earnings per share | $ | 0.61 | | | $ | 0.51 | | | $ | 1.19 | | | $ | 1.07 | |

| Diluted | | | | | | | |

| Continuing operations | $ | 0.61 | | | $ | 0.42 | | | $ | 1.15 | | | $ | 0.91 | |

| Discontinued operations | $ | — | | | $ | 0.08 | | | $ | 0.04 | | | $ | 0.15 | |

| Diluted earnings per share | $ | 0.61 | | | $ | 0.50 | | | $ | 1.19 | | | $ | 1.06 | |

| Weighted-average number of common shares outstanding: | | | | | | | |

| Basic | 602.1 | | | 606.9 | | | 601.8 | | | 607.2 | |

| Diluted | 604.3 | | | 610.3 | | | 604.2 | | | 610.6 | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 365.0 | | | $ | 305.5 | | | $ | 716.0 | | | $ | 646.0 | |

Other comprehensive income (loss), net of tax (Note 12): | | | | | | | |

| Foreign currency translation adjustments | 1.0 | | | (11.5) | | | (25.1) | | | (7.7) | |

Unrealized gain (loss) on hedges | 6.9 | | | 5.3 | | | 33.8 | | | (11.9) | |

Unrealized pension (costs) credits | (0.1) | | | 0.2 | | | 0.2 | | | 0.1 | |

Unrealized gain on available-for-sale investments | 5.3 | | | 5.9 | | | 13.7 | | | 18.9 | |

Other comprehensive income (loss), net of tax | 13.1 | | | (0.1) | | | 22.6 | | | (0.6) | |

| Comprehensive income | 378.1 | | | 305.4 | | | 738.6 | | | 645.4 | |

Comprehensive loss attributable to noncontrolling interest | (1.3) | | | (1.6) | | | (2.2) | | | (1.6) | |

| Comprehensive income attributable to Edwards Lifesciences Corporation | $ | 379.4 | | | $ | 307.0 | | | $ | 740.8 | | | $ | 647.0 | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(in millions; unaudited) | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 716.0 | | | $ | 646.0 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 78.1 | | | 71.3 | |

| Non-cash operating lease cost | 15.1 | | | 13.7 | |

| Stock-based compensation (Note 9) | 88.5 | | | 76.3 | |

| | | |

| | | |

| Change in fair value of contingent consideration liabilities (Note 7) | — | | | (26.2) | |

| | | |

| Deferred income taxes | (101.9) | | | (134.7) | |

| | | |

| Other | 2.0 | | | (0.7) | |

| Changes in operating assets and liabilities: | | | |

| Accounts and other receivables, net | (32.0) | | | (124.3) | |

| Inventories | (163.7) | | | (113.7) | |

| Accounts payable and accrued liabilities | 62.7 | | | 76.2 | |

| Income taxes | (370.0) | | | 31.0 | |

| Prepaid expenses and other current assets | 40.1 | | | (43.4) | |

| Intellectual property agreement accrual | (11.8) | | | (14.5) | |

| Long-term prepaid royalties (Note 3) | 4.2 | | | (114.0) | |

| Other | (9.3) | | | 4.7 | |

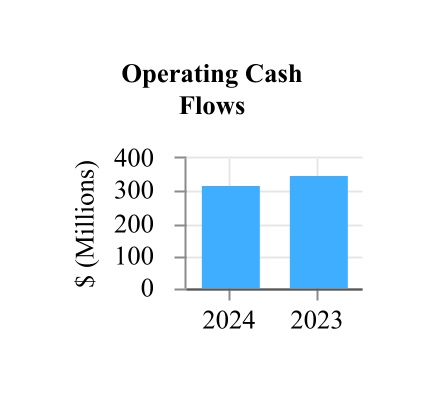

| Net cash provided by operating activities | 318.0 | | | 347.7 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (150.7) | | | (109.4) | |

| Purchases of held-to-maturity investments (Note 5) | (14.1) | | | (15.5) | |

| Proceeds from held-to-maturity investments (Note 5) | 25.2 | | | 83.5 | |

| Purchases of available-for-sale investments (Note 5) | (1.8) | | | (6.8) | |

| Proceeds from available-for-sale investments (Note 5) | 388.4 | | | 314.5 | |

| Investments in intangible assets | (20.0) | | | (13.3) | |

| | | |

| | | |

| | | |

| Business combination, net of cash | — | | | (141.2) | |

| Payment for acquisition options (Note 6) | (10.8) | | | (15.0) | |

| Issuances of notes receivable | (17.5) | | | (22.5) | |

| | | |

| Other | (10.8) | | | (3.6) | |

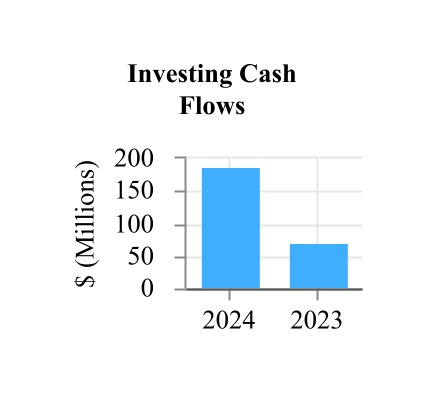

| Net cash provided by investing activities | 187.9 | | | 70.7 | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Purchases of treasury stock | (158.3) | | | (256.8) | |

| | | |

| Proceeds from stock plans | 116.4 | | | 102.7 | |

| | | |

| Other | 7.0 | | | (0.4) | |

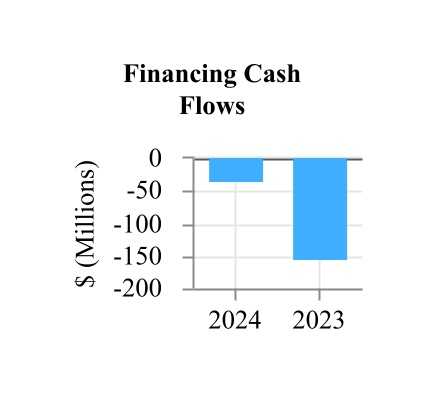

| Net cash used in financing activities | (34.9) | | | (154.5) | |

| Effect of currency exchange rate changes on cash, cash equivalents, and restricted cash | 39.1 | | | 11.0 | |

| Net increase in cash, cash equivalents, and restricted cash | 510.1 | | | 274.9 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 1,148.0 | | | 772.6 | |

| Cash, cash equivalents, and restricted cash at end of period (Note 2) | $ | 1,658.1 | | | $ | 1,047.5 | |

| | | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | | | | | | | | | | | |

| | Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Edwards Lifesciences Corporation Stockholders' Equity | | Noncontrolling Interest | | Total Stockholders' Equity |

| Balance at December 31, 2023 | 650.5 | | | $ | 650.5 | | | 49.4 | | | $ | (5,024.5) | | | $ | 2,274.4 | | | $ | 8,992.4 | | | $ | (242.8) | | | $ | 6,650.0 | | | $ | 69.4 | | | $ | 6,719.4 | |

| Net income | | | | | | | | | | | 351.9 | | | | | 351.9 | | | (0.9) | | | 351.0 | |

| Other comprehensive gain, net of tax | | | | | | | | | | | | | 9.5 | | | 9.5 | | | | | 9.5 | |

| Common stock issued under stock plans | 1.3 | | | 1.3 | | | | | | | 60.8 | | | | | | | 62.1 | | | | | 62.1 | |

| Stock-based compensation expense | | | | | | | | | 44.6 | | | | | | | 44.6 | | | | | 44.6 | |

| | | | | | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | — | | | (0.2) | | | | | | | | | (0.2) | | | | | (0.2) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2024 | 651.8 | | | $ | 651.8 | | | 49.4 | | | $ | (5,024.7) | | | $ | 2,379.8 | | | $ | 9,344.3 | | | $ | (233.3) | | | $ | 7,117.9 | | | $ | 68.5 | | | $ | 7,186.4 | |

| Net income | | | | | | | | | | | 366.3 | | | | | 366.3 | | | (1.3) | | | 365.0 | |

| Other comprehensive gain, net of tax | | | | | | | | | | | | | 13.1 | | | 13.1 | | | | | 13.1 | |

Common stock issued under equity plans | 1.7 | | | 1.7 | | | | | | | 52.6 | | | | | | | 54.3 | | | | | 54.3 | |

| Stock-based compensation expense | | | | | | | | | 43.9 | | | | | | | 43.9 | | | | | 43.9 | |

| | | | | | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 1.8 | | | (158.1) | | | | | | | | | (158.1) | | | | | (158.1) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Balance at June 30, 2024 | 653.5 | | | $ | 653.5 | | | 51.2 | | | $ | (5,182.8) | | | $ | 2,476.3 | | | $ | 9,710.6 | | | $ | (220.2) | | | $ | 7,437.4 | | | $ | 67.2 | | | $ | 7,504.6 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | | | | | | | | | | | |

| | Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Edwards Lifesciences, Inc. Stockholders' Equity | | Noncontrolling Interest | | Total Stockholders' Equity |

| Balance at December 31, 2022 | 646.3 | | | $ | 646.3 | | | 38.0 | | | $ | (4,144.0) | | | $ | 1,969.3 | | | $ | 7,590.0 | | | $ | (254.9) | | | $ | 5,806.7 | | | $ | — | | | $ | 5,806.7 | |

| Net income | | | | | | | | | | | 340.5 | | | | | 340.5 | | | — | | | 340.5 | |

| Other comprehensive loss, net of tax | | | | | | | | | | | | | (0.5) | | | (0.5) | | | | | (0.5) | |

| Common stock issued under stock plans | 0.8 | | | 0.8 | | | | | | | 41.1 | | | | | | | 41.9 | | | | | 41.9 | |

| Stock-based compensation expense | | | | | | | | | 38.9 | | | | | | | 38.9 | | | | | 38.9 | |

| | | | | | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 3.1 | | | (249.5) | | | | | | | | | (249.5) | | | | | (249.5) | |

| | | | | | | | | | | | | | | | | | | |

| Changes to noncontrolling interest | | | | | | | | | | | | | | | | | 84.0 | | | 84.0 | |

Balance at March 31, 2023 | 647.1 | | | $ | 647.1 | | | 41.1 | | | $ | (4,393.5) | | | $ | 2,049.3 | | | $ | 7,930.5 | | | $ | (255.4) | | | $ | 5,978.0 | | | $ | 84.0 | | | $ | 6,062.0 | |

| Net income | | | | | | | | | | | 307.1 | | | | | 307.1 | | | (1.6) | | | 305.5 | |

| Other comprehensive loss, net of tax | | | | | | | | | | | | | (0.1) | | | (0.1) | | | | | (0.1) | |

Common stock issued under equity plans | 2.0 | | | 2.0 | | | | | | | 58.8 | | | | | | | 60.8 | | | | | 60.8 | |

| Stock-based compensation expense | | | | | | | | | 37.4 | | | | | | | 37.4 | | | | | 37.4 | |

| | | | | | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 0.1 | | | (7.5) | | | | | | | | | (7.5) | | | | | (7.5) | |

| | | | | | | | | | | | | | | | | | | |

| Changes to noncontrolling interest | | | | | | | | | | | | | | | | | (11.6) | | | (11.6) | |

Balance at June 30, 2023 | 649.1 | | | $ | 649.1 | | | 41.2 | | | $ | (4,401.0) | | | $ | 2,145.5 | | | $ | 8,237.6 | | | $ | (255.5) | | | $ | 6,375.7 | | | $ | 70.8 | | | $ | 6,446.5 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated condensed financial statements.

1. BASIS OF PRESENTATION

The accompanying interim consolidated condensed financial statements and related disclosures have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") and should be read in conjunction with the consolidated financial statements and notes included in Edwards Lifesciences' Annual Report on Form 10-K for the year ended December 31, 2023. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") have been condensed or omitted.

The consolidated condensed financial statements include the accounts of all wholly-owned subsidiaries and variable interest entities for which the Company is the primary beneficiary. The Company attributes the net income or losses of its consolidated variable interest entities to controlling and noncontrolling interests using the hypothetical liquidation at book value method. All intercompany accounts and transactions have been eliminated in consolidation.

On June 3, 2024, the Company entered into a definitive agreement to sell its Critical Care product group ("Critical Care"). The historical results of Critical Care are reflected as discontinued operations in the Company's consolidated condensed financial statements for all periods presented. Unless otherwise indicated, the information in the notes to the consolidated condensed financial statements refer only to Edwards Lifesciences' continuing operations. For more information, see Note 4.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Actual results could differ from those estimates.

In the opinion of management, the unaudited interim consolidated condensed financial statements reflect all adjustments necessary for a fair statement of the results for the interim periods presented. All such adjustments, unless otherwise noted herein, are of a normal, recurring nature. The results of operations for the interim periods are not necessarily indicative of the results of operations to be expected for the full year.

There have been no material changes to the Company's significant accounting policies from those described in the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

Recently Adopted Accounting Standards

In March 2023, the Financial Accounting Standards Board ("FASB") issued an amendment to the accounting guidance on investments in tax credit structures to allow entities to elect to account for their tax equity investments, regardless of the tax credit program from which the income tax credits are received, using the proportional amortization method if certain conditions are met. The guidance is effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. The Company adopted this guidance on January 1, 2024. The adoption of this guidance did not have a material impact on the Company's consolidated financial statements.

New Accounting Standards Not Yet Adopted

In March 2024, the SEC issued final climate-related disclosure rules that will require disclosure of material climate-related risks and material direct greenhouse gas emissions from operations owned or controlled (Scope 1) and/or material indirect greenhouse gas emissions from purchased energy consumed in owned or controlled operations (Scope 2). Additionally, the rules require disclosure in the notes to the financial statements of the effects of severe weather events and other natural conditions, subject to certain materiality thresholds. The new rules will be effective for annual reporting periods beginning in fiscal year 2025, except for the greenhouse gas emissions disclosures which will be effective for annual reporting periods beginning in fiscal year 2026. Subsequent to issuance, the rules became the subject of litigation, and the SEC has issued a stay to allow the legal process to proceed. The Company is currently evaluating the impact the guidance will have on its consolidated financial statements.

In December 2023, the FASB issued an amendment to the accounting guidance on income taxes which requires entities to provide additional information in the rate reconciliation and additional disaggregated disclosures about income taxes paid. This guidance requires public entities to disclose in their rate reconciliation table additional categories of information about federal, state, and foreign income taxes and to provide more details about the reconciling items in some categories if the items meet a quantitative threshold. The guidance is effective for annual periods beginning after December 15, 2024. The Company does not expect the adoption of this guidance to impact its financial statements, but the guidance will impact its income tax disclosures.

In November 2023, the FASB issued an amendment to the accounting guidance on segment reporting. The amendments require disclosure of significant segment expenses and other segment items and requires entities to provide in interim periods all disclosures about a reportable segment's profit or loss and assets that are currently required annually. The amendment also requires disclosure of the title and position of the chief operating decision maker ("CODM") and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. The guidance is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Retrospective application is required, and early adoption is permitted. The Company is currently evaluating the impact the guidance will have on its consolidated financial statements.

2. OTHER CONSOLIDATED FINANCIAL STATEMENT DETAILS

Composition of Certain Financial Statement Captions

(in millions)

Components of selected captions in the consolidated condensed balance sheets consisted of the following:

| | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 |

| Inventories | | | |

| Raw materials | $ | 233.5 | | | $ | 196.9 | |

| Work in process | 237.7 | | | 195.7 | |

| Finished products | 553.5 | | | 525.7 | |

| $ | 1,024.7 | | | $ | 918.3 | |

At June 30, 2024 and December 31, 2023, $167.1 million and $164.6 million, respectively, of the Company's finished products inventories were held on consignment.

| | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 |

| Other assets | | | |

| Tax receivable (Note 14) | $ | 290.0 | | | $ | — | |

| Notes and other receivables | 172.3 | | | 155.1 | |

| Acquisition options | 176.9 | | | 161.3 | |

| Long-term prepaid royalties | 105.7 | | | 109.9 | |

| Fair value of derivatives | 30.5 | | | 23.4 | |

| Other long-term assets | 14.4 | | | 13.4 | |

| $ | 789.8 | | | $ | 463.1 | |

| | | |

| Accrued and other liabilities | | | |

| | | |

| Employee compensation and withholdings | $ | 288.7 | | | $ | 318.2 | |

| Taxes payable | 47.0 | | | 52.7 | |

| Property, payroll, and other taxes | 73.8 | | | 53.8 | |

| Research and development accruals | 78.0 | | | 71.6 | |

| Accrued rebates | 120.6 | | | 123.5 | |

| Fair value of derivatives | 4.7 | | | 15.2 | |

| Accrued marketing expenses | 13.0 | | | 13.7 | |

| Legal and insurance | 32.5 | | | 28.9 | |

| Litigation settlement | 76.7 | | | 69.1 | |

| Accrued relocation costs | 17.0 | | | 16.9 | |

| Accrued professional services | 59.1 | | | 8.5 | |

| Accrued realignment reserves | 8.9 | | | 6.4 | |

| | | |

| | | |

| Other accrued liabilities | 82.4 | | | 79.7 | |

| $ | 902.4 | | | $ | 858.2 | |

Supplemental Cash Flow Information

(in millions)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Cash paid during the year for: | | | |

Income taxes (a) (Note 14) | $ | 528.9 | | | $ | 193.5 | |

| Amounts included in the measurement of operating lease liabilities | $ | 14.5 | | | $ | 12.7 | |

| Non-cash investing and financing transactions: | | | |

| | | |

| | | |

| | | |

| Right-of-use assets obtained in exchange for new lease liabilities | $ | 24.6 | | | $ | 5.2 | |

| Capital expenditures accruals | $ | 24.1 | | | $ | 26.2 | |

| | | |

| | | |

______________________________________

(a) Includes cash paid for income taxes from discontinued operations of $7.1 million and $22.3 million for the six months ended June 30, 2024 and 2023, respectively.

Cash, Cash Equivalents, and Restricted Cash

(in millions)

| | | | | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 | |

| Continuing operations | | | | |

| Cash and cash equivalents | $ | 1,644.5 | | | $ | 1,136.1 | | |

| Restricted cash included in other current assets | 3.5 | | | 3.3 | | |

| Restricted cash included in other assets | 0.9 | | | 0.7 | | |

| Total | $ | 1,648.9 | | | $ | 1,140.1 | | |

| Discontinued operations | | | | |

| Cash and cash equivalents | $ | 9.2 | | | $ | 7.9 | | |

| Total | $ | 9.2 | | | $ | 7.9 | | |

| Total cash, cash equivalents, and restricted cash | $ | 1,658.1 | | | $ | 1,148.0 | | |

Amounts included in restricted cash primarily represent funds placed in escrow related to litigation.

3. INTELLECTUAL PROPERTY AGREEMENT AND CERTAIN LITIGATION EXPENSES

On April 12, 2023, Edwards entered into an Intellectual Property Agreement (the "Intellectual Property Agreement") with Medtronic, Inc. ("Medtronic") pursuant to which the parties agreed to a 15-year global covenant not to sue ("CNS") for infringement of certain patents in the structural heart space owned or controlled by each other. In consideration for the global CNS and related mutual access to certain intellectual property rights, Edwards paid to Medtronic a one-time, lump sum payment of $300.0 million and is paying annual royalties tied to net sales of certain Edwards products. Based upon the terms of the Intellectual Property Agreement, the Company identified the relevant elements for accounting purposes and allocated the $300.0 million upfront payment based on their respective fair values. The Company recorded a $37.0 million pre-tax charge in Intellectual Property Agreement and Certain Litigation Expenses in March 2023 related primarily to prior commercial sales incurred through March 31, 2023. The Company recorded a prepaid royalty asset of $124.0 million in April 2023 related to future commercial sales, which will be amortized to expense during the term of the Intellectual Property Agreement. Separately, the Company recorded a $139.0 million pre-tax charge in Intellectual Property Agreement and Certain Litigation Expenses in April 2023 related to products currently in development.

4. DISCONTINUED OPERATIONS

On June 3, 2024, the Company entered into a definitive agreement to sell its Critical Care product group ("Critical Care") to Becton, Dickinson and Company in an all-cash transaction for $4.2 billion, subject to certain customary adjustments as set forth in the agreement. The closing of the transaction is subject to regulatory approvals and other customary closing conditions.

Critical Care was historically reported in each of the Company's segments (United States, Europe, Japan, and Rest of World).

The Company concluded that Critical Care met the criteria to be classified as held-for-sale in June 2024 and determined that the conditions for discontinued operations presentation had been met with respect to Critical Care. A component of an entity is reported in discontinued operations after meeting the criteria for held-for-sale classification if the disposition represents a strategic shift that has (or will have) a major effect on the entity's operations and financial results. The Company analyzed the quantitative and qualitative factors relevant to the divestiture of Critical Care, including its significance to the Company’s overall net income and total assets, and determined that those conditions for discontinued operations presentation had been met. As such, the historical financial condition and results of Critical Care have been reflected as discontinued operations in the Company's consolidated condensed financial statements. The assets and liabilities associated with Critical Care are classified as assets and liabilities of discontinued operations in the Company's consolidated condensed balance sheets. Prior period amounts have been adjusted to reflect the discontinued operations presentation.

In connection with the sale, the Company plans to enter into a Transition Services Agreement ("TSA") to provide certain support services for up to 36 months from the closing date of the sale (with certain extension rights as provided therein). These services may include, among others, accounting, information technology, human resources, quality assurance, regulatory affairs, customer support, and global supply chain. Income recognized related to the TSA will be recorded in Other Operating Income, net on the Company's consolidated condensed statements of operations.

Details of Income from Discontinued Operations are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 246.4 | | | $ | 234.7 | | | $ | 497.7 | | | $ | 456.6 | |

| Cost of sales | 91.2 | | | 86.1 | | | 180.5 | | | 176.6 | |

| Gross profit | 155.2 | | | 148.6 | | | 317.2 | | | 280.0 | |

| Selling, general, and administrative expenses | 57.7 | | | 58.3 | | | 114.6 | | | 112.6 | |

| Research and development expenses | 30.6 | | | 26.6 | | | 58.0 | | | 53.0 | |

| | | | | | | |

| | | | | | | |

| Separation costs | 79.7 | | | — | | | 121.0 | | | — | |

| | | | | | | |

| Operating (loss) income, net | (12.8) | | | 63.7 | | | 23.6 | | | 114.4 | |

| | | | | | | |

| | | | | | | |

| Other expense (income), net | 1.1 | | | 0.3 | | | 1.4 | | | (0.1) | |

| (Loss) income from discontinued operations before provision for income taxes | (13.9) | | | 63.4 | | | 22.2 | | | 114.5 | |

| (Benefit from) provision for income taxes from discontinued operations | (12.5) | | | 12.1 | | | (0.7) | | | 24.9 | |

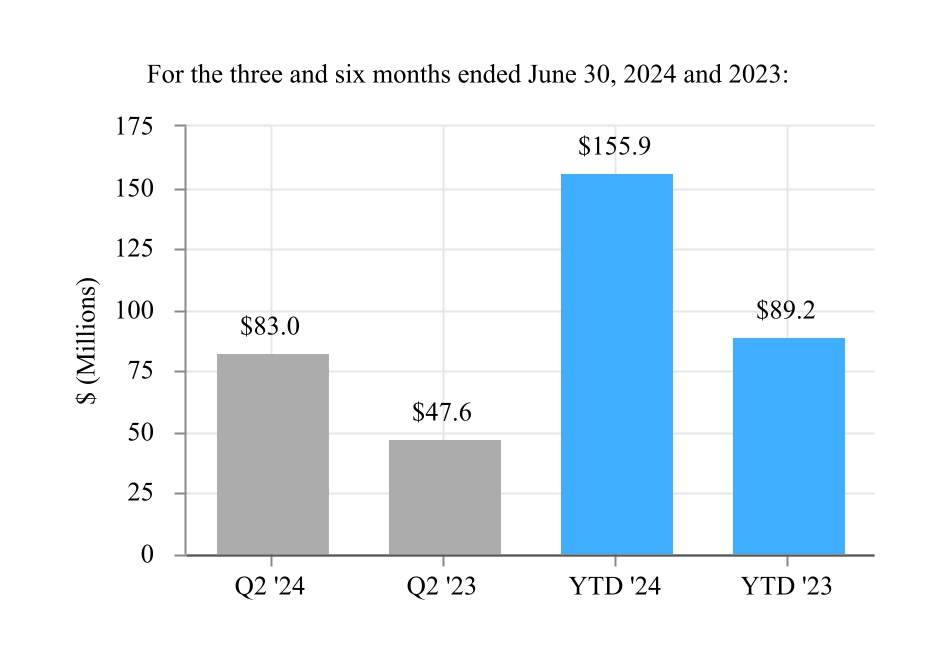

| Net (loss) income from discontinued operations | (1.4) | | | 51.3 | | | 22.9 | | | 89.6 | |

Separation costs related primarily to consulting, legal, tax, and other professional advisory services associated with the planned sale of Critical Care.

Details of assets and liabilities of discontinued operations are as follows (in millions):

| | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Cash and cash equivalents | $ | 9.2 | | | $ | 7.9 | |

| | | |

| Accounts receivable, net of allowances | 4.9 | | | 3.6 | |

| Other receivables | 4.1 | | | 5.2 | |

| Inventories | 261.9 | | | 249.9 | |

| Prepaid expenses | 17.9 | | | 18.0 | |

| Other current assets | 6.8 | | | 14.4 | |

| Total current assets of discontinued operations | $ | 304.8 | | | $ | 299.0 | |

| | | |

| Property, plant, and equipment, net | 158.6 | | | 156.6 | |

| Operating lease right-of-use assets | 14.2 | | | 9.6 | |

| Goodwill | 101.0 | | | 101.0 | |

| Other intangible assets, net | 27.3 | | | 29.0 | |

| Deferred income taxes | 5.2 | | | 5.2 | |

| Other assets | 0.3 | | | 0.6 | |

| Total non-current assets of discontinued operations | $ | 306.6 | | | $ | 302.0 | |