UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Transition Period From to

Commission File Number 1-15525

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

(949 ) 250-2500

Registrant's telephone number, including area code

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbols(s) | Name of each exchange on which registered: | ||||||

Securities registered pursuant to Section 12(g) of the Act: None | ||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☒ .

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The aggregate market value of the registrant's common stock held by non-affiliates as of June 30, 2021 (the last trading day of the registrant's most recently completed second quarter): $64,028,235,982 based on the closing price of the registrant's common stock on the New York Stock Exchange. This calculation does not reflect a determination that persons are affiliates for any other purpose.

The number of shares outstanding of the registrant's common stock, $1.00 par value, as of January 31, 2022, was 623,207,437 .

Documents Incorporated by Reference

EDWARDS LIFESCIENCES CORPORATION

Form 10-K Annual Report—2021

Table of Contents

PART I

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements contained in this report to be covered by the safe harbor provisions of such Acts. Some statements other than statements of historical fact in this report or referred to or incorporated by reference into this report are "forward-looking statements" for purposes of these sections. These statements include, among other things, the continued impact of COVID-19 on our business, any predictions, opinions, expectations, plans, strategies, objectives and any statements of assumptions underlying any of the foregoing relating to our current and future business and operations, including, but not limited to, financial matters, development activities, clinical trials and regulatory matters, manufacturing and supply operations, and product sales and demand. These statements can sometimes be identified by the use of the forward-looking words such as "may," "believe," "will," "expect," "project," "estimate," "should," "anticipate," "plan," "goal," "continue," "seek," "pro forma," "forecast," "intend," "guidance," "optimistic," "aspire," "confident," other forms of these words or similar words or expressions or the negative thereof. Statements of past performance, efforts, or results about which inferences or assumptions may be made can also be forward-looking statements and are not indicative of future performance or results; these statements can be identified by the use of words such as "preliminary," "initial," diligence," "industry-leading," "compliant," "indications," or "early feedback" or other forms of these words or similar words or expressions or the negative thereof. These forward-looking statements are subject to substantial risks and uncertainties that could cause our results or future business, financial condition, results of operations or performance to differ materially from our historical results or experiences or those expressed or implied in any forward-looking statements contained in this report. These risks and uncertainties include, but are not limited to: uncertainties regarding the severity and duration of the COVID-19 pandemic and its impact on our business and the economy generally, clinical trial or commercial results or new product approvals and therapy adoption; inability or failure to comply with applicable regulations; unpredictability of product launches; competitive dynamics; changes to reimbursement for the company's products; the company’s success in developing new products and avoiding manufacturing and quality issues; the impact of currency exchange rates; the timing or results of research and development and clinical trials; unanticipated actions by the United States Food and Drug Administration and other regulatory agencies; unexpected impacts or expenses resulting from litigation or internal or government investigations; and other risks detailed under "Risk Factors" in Part I, Item 1A below, as such risks and uncertainties may be amended, supplemented or superseded from time to time by our subsequent reports on Forms 10-Q and 8-K we file with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

Unless otherwise indicated or otherwise required by the context, the terms "we," "our," "it," "its," "Company," "Edwards," and "Edwards Lifesciences" refer to Edwards Lifesciences Corporation and its subsidiaries.

1

Item 1. Business

Overview

Edwards Lifesciences Corporation is the global leader in patient-focused medical innovations for structural heart disease and critical care monitoring. Driven by a passion to help patients, we partner with the world’s leading clinicians and researchers and invest in research and development to transform care for those impacted by structural heart disease or who require hemodynamic monitoring in the hospital setting. Edwards Lifesciences has been a leader in these areas for over six decades. Since our founder, Lowell Edwards, first dreamed of using engineering to address diseases of the human heart, we have steadily built a company on the premise of imagining, building, and realizing a better future for patients.

A pioneer in the development of heart valve therapies, we are the world's leading manufacturer of heart valve systems and repair products used to replace or repair a patient's diseased or defective heart valve. Our innovative work in heart valves encompasses both surgical and transcatheter therapies for heart valve replacement and repair. In addition, our robust pipeline of future technologies is focused on the less invasive repair or replacement of the mitral and tricuspid valves of the heart, which are more complex and more challenging to treat than the aortic valve that is currently the focus of many of our commercially approved valve technologies. We are also a global leader in hemodynamic and noninvasive brain and tissue oxygenation monitoring systems used to measure a patient's cardiovascular function in the hospital setting.

Cardiovascular disease is the number-one cause of death in the world and is the top disease in terms of health care spending in nearly every country. Cardiovascular disease is progressive in that it tends to worsen over time and often affects the structure of an individual's heart.

Patients undergoing treatment for cardiovascular disease can be treated with a number of our medical technologies, which are designed to address individual patient needs with respect to disease process, comorbidities, and health status. For example, an individual with a heart valve disorder may have a faulty valve that is affecting the function of his or her heart or blood flow throughout his or her body. A clinician may elect to remove the valve and replace it with one of our bioprosthetic surgical tissue heart valves or surgically re-shape and repair the faulty valve with an Edwards Lifesciences annuloplasty ring. Alternatively, a clinician may implant an Edwards Lifesciences transcatheter valve or repair system via a catheter-based approach that does not require traditional open-heart surgery and can be done while the heart continues to beat. Patients in the hospital setting, including high-risk patients in the operating room or intensive care unit, are candidates for having their cardiac function or fluid levels monitored by our Critical Care products through multiple monitoring options, including noninvasive and minimally- invasive technologies. These technologies enable proactive clinical decisions while also providing the opportunity for improving diagnoses and developing individualized therapeutic management plans for patients.

Corporate Background

Edwards Lifesciences Corporation was incorporated in Delaware on September 10, 1999.

Our principal executive offices are located at One Edwards Way, Irvine, California 92614. The telephone number at that address is (949) 250-2500. We make available, free of charge on our website located at www.edwards.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after filing such reports with the Securities and Exchange Commission ("SEC"). The contents of our website are not incorporated by reference into this report.

Edwards Lifesciences' Product and Technology Offerings

The following discussion summarizes the main areas of products and technologies we offer to treat advanced cardiovascular disease. Our products and technologies are categorized into four main areas: Transcatheter Aortic Valve Replacement, Transcatheter Mitral and Tricuspid Therapies, Surgical Structural Heart, and Critical Care. For more information on net sales from these four main areas, see "Net Sales by Product Group" in Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Transcatheter Aortic Valve Replacement

We are the global leader in transcatheter heart valve replacement technologies designed for the minimally-invasive replacement of aortic heart valves. The Edwards SAPIEN family of valves, including Edwards SAPIEN XT, the Edwards SAPIEN 3, and the Edwards SAPIEN 3 Ultra transcatheter heart valves, and their respective delivery systems, are used to treat heart valve disease using catheter-based approaches for patients who have severe symptomatic aortic stenosis and certain

2

patients with congenital heart disease. Delivered while the heart is beating, these valves can enable patients to experience a better quality of life sooner than patients receiving traditional surgical therapies. We began offering our transcatheter aortic heart valves to patients commercially in Europe in 2007, in the United States in 2011, and in Japan in 2013. Supported by extensive customer training and service, and a growing body of compelling clinical evidence, our SAPIEN family of transcatheter aortic heart valves are the most widely prescribed transcatheter heart valves in the world.

Sales of our transcatheter aortic valve replacement products represented 65%, 65%, and 63% of our net sales in 2021, 2020, and 2019, respectively.

Transcatheter Mitral and Tricuspid Therapies

We continue to make significant investments in the development of transcatheter heart valve repair and replacement technologies designed to treat mitral and tricuspid valve diseases. While many of these technologies are in development and clinical phases, the PASCAL and Cardioband transcatheter valve repair systems are commercially available in Europe for mitral and tricuspid valve repair. The PASCAL system provides a differentiated, minimally-invasive therapy to address the needs of patients with mitral or tricuspid regurgitation through leaflet approximation, while the Cardioband system enables clinicians to reduce the valve's annulus to restore a patient’s mitral or tricuspid valve to a more functional state and lower regurgitation. In addition to transcatheter repair, we believe transcatheter replacement is key to unlocking the full mitral and tricuspid opportunity, given the complex and diverse patient population. Our two-platform mitral replacement strategy positions us for leadership in the mid-to-long term. SAPIEN M3 is based on the proven SAPIEN valve, paired with a novel docking system. EVOQUE Eos is our next generation transcatheter replacement system, designed specifically for mitral patients. Both SAPIEN M3 and EVOQUE Eos are implanted with transfemoral delivery systems that are sub 30-French, which has benefits for femoral puncture and septal crossing, contributing to ease of use, and patient safety. For tricuspid valve replacement, our EVOQUE system is also sub 30-French, and available in three valve sizes to enable treatment in a wide range of patient anatomies.

Surgical Structural Heart

We are pioneering more resilient surgical therapies that help patients and can improve the quality of their lives. Our RESILIA tissue, now with five years of published clinical data showing 0% structural valve deterioration through five years1, is helping us redefine tissue durability standards. Our latest innovation, the INSPIRIS RESILIA aortic valve, is built on our PERIMOUNT platform and offers RESILIA tissue and VFit technology. INSPIRIS is the leading aortic surgical valve in the world. Sales of our surgical therapies in the United States also continue to gain traction with KONECT RESILIA, the first pre-assembled, aortic tissue valved conduit, for patients who require replacement of the valve, root, and ascending aorta. In 2021, we also received regulatory approval with reimbursement in Japan for our MITRIS RESILIA valve, a new mitral valve incorporating our newest tissue technology. In addition to our replacement valves, we are the worldwide leader in surgical heart valve repair therapies. Our recently launched HARPOON Beating Heart Mitral Valve Repair System can help transform care for many patients with degenerative mitral regurgitation. We believe the demand for surgical structural heart therapies is growing worldwide and that our innovation strategy will continue to extend our leadership and patient impact.

Sales of our surgical tissue heart valve products represented 15%, 16%, and 17% of our net sales in 2021, 2020, and 2019, respectively.

Critical Care

We are a world leader in advanced hemodynamic monitoring systems used to measure a patient's heart function and fluid status in surgical and intensive care settings. Hemodynamic monitoring plays an important role in enhancing surgical recovery. Edwards’ complete hemodynamic portfolio helps clinicians make proactive clinical decisions that can improve patient outcomes. The portfolio includes the minimally invasive FloTrac and Acumen IQ sensors, the noninvasive ClearSight and Acumen IQ cuffs, and the ForeSight noninvasive tissue oximetry sensor. We also support clinical needs with our well-established Swan-Ganz line of pulmonary artery catheters and arterial pressure monitoring products. Compatible with our portfolio of sensors and catheters, the HemoSphere monitoring platform displays valuable physiological information in an easy to understand and actionable manner. Our first predictive algorithm, Acumen Hypotension Prediction Index software, alerts clinicians in advance of a patient developing dangerously low blood pressure and amplifies the clinical need for our Acumen IQ and HemoSphere monitoring solutions.

1 Bavaria, et al. Five-year Outcomes of the COMMENCE trial investigating Aortic Valve Replacement with a Bioprosthetic Valve with a Novel Tissue. The Society of Thoracic Surgeons 2021 Annual Meeting; Bartus, et al. Final 5-year outcomes following aortic valve replacement with RESILIA tissue bio prosthesis. European Journal of Cardio-Thoracic Surgery, 2020.

3

Sales of our hemodynamic products represented 8%, 9%, and 10% of our net sales in 2021, 2020, and 2019, respectively.

Competition

The medical technology industry is highly competitive. We compete with many companies, including divisions of companies much larger than us and smaller companies that compete in specific product lines or certain geographies. Furthermore, new product development and technological change characterize the areas in which we compete. Our present or future products could be rendered obsolete or uneconomical as a result of technological advances by one or more of our present or future competitors or by other therapies, including drug therapies. We must continue to develop and commercialize new products and technologies to remain competitive in the cardiovascular medical technology industry. We believe that we are competitive primarily because we deliver superior clinical outcomes that are supported by extensive data, and innovative features that enhance patient benefit, product performance, and reliability; these superior clinical outcomes are in part due to the level of customer and clinical support we provide.

The cardiovascular segment of the medical technology industry is dynamic and subject to significant change due to cost-of-care considerations, regulatory reform, industry and customer consolidation, and evolving patient needs. The ability to provide products and technologies that demonstrate value and improve clinical outcomes is becoming increasingly important for medical technology manufacturers.

We believe that we are a leading global competitor in each of our product lines. In Transcatheter Aortic Valve Replacement, our primary competitors include Medtronic PLC and Abbott Laboratories ("Abbott"). In Transcatheter Mitral and Tricuspid Therapies, our primary competitor is Abbott, and there are a considerable number of large and small companies with development efforts in these fields. In Surgical Structural Heart, our primary competitors include Medtronic PLC, Abbott, and Artivion, Inc (formerly CryoLife). In Critical Care, we compete primarily with a variety of companies in specific product lines including ICU Medical, Inc., PULSION Medical Systems SE, a subsidiary of Getinge AB, Cheetah Medical, Inc., a subsidiary of Baxter International, and LiDCO Group PLC, a subsidiary of Masimo Corporation.

Sales and Marketing

Our portfolio includes some of the most recognizable cardiovascular device product brands in treating structural heart disease today. We have a number of product lines that require sales and marketing strategies tailored to deliver high-quality, cost-effective products and technologies to customers worldwide. Because of the diverse global needs of the population that we serve, our distribution system consists of several direct sales forces as well as independent distributors. We are not dependent on any single customer and no single customer accounted for 10% or more of our net sales in 2021.

To ensure optimal outcomes for patients, we conduct educational symposia and best practices training for our physician, hospital executive, service line leadership, nursing, and clinical-based customers. We rely extensively on our sales and field clinical specialist personnel who work closely with our customers in hospitals. Field clinical specialists routinely attend procedures where Edwards' products are being used in order to provide guidance on the use of our devices, thereby enabling physicians and staff to reach expert proficiency and deliver positive patient outcomes. Our customers include physicians, nurses, and other clinical personnel, but can also include decision makers such as service line leaders, material managers, biomedical staff, hospital administrators and executives, purchasing managers, and ministries of health. Also, for certain of our product lines and where appropriate, our corporate sales team actively pursues approval of Edwards Lifesciences as a qualified supplier for hospital group purchasing organizations ("GPOs") that negotiate contracts with suppliers of medical products. Additionally, we have contracts with a number of United States and European national and regional buying groups, including healthcare systems and Integrated Delivery Networks. Where we choose to market our products is also influenced by the existence of, or potential for, adequate reimbursement to hospitals and other providers by national healthcare systems.

United States. In the United States, we sell substantially all of our products through our direct sales forces. In 2021, 57% of our net sales were derived from sales to customers in the United States.

Outside of the United States. In 2021, 43% of our net sales were derived outside of the United States through our direct sales forces and independent distributors. Of the total sales outside of the United States, 53% were in Europe, 23% were in Japan, and 24% were in Rest of World. We sell our products in approximately 100 countries, and our major international markets include Canada, China, France, Germany, Italy, Japan, Spain, and the United Kingdom. A majority of the sales and marketing approach outside of the United States is direct sales, although it varies depending on each country's size and state of development.

4

Raw Materials and Manufacturing

We operate manufacturing facilities in various geographies around the world. We manufacture our Transcatheter Aortic Valve Replacement, Transcatheter Mitral and Tricuspid technologies, and Structural Surgical Heart products primarily in the United States (California and Utah), Singapore, Costa Rica, and Ireland. We manufacture our Critical Care products primarily in Puerto Rico and the Dominican Republic.

We use a diverse and broad range of raw and organic materials in the design, development, and manufacture of our products. We manufacture our non-implantable products from fabricated raw materials including resins, chemicals, electronics, and metals. Most of our replacement heart valves are manufactured from natural tissues harvested from animal tissue, as well as fabricated materials. We purchase certain materials and components used in manufacturing our products from external suppliers. In addition, we purchase certain supplies from single sources for reasons of sole source availability or constraints resulting from regulatory requirements.

We work with our suppliers to mitigate risk and seek continuity of supply while maintaining quality and reliability. Alternative supplier options are generally considered, identified, and approved for materials deemed critical to our products, although we do not typically pursue immediate regulatory qualification of alternative sources due to the strength of our existing supplier relationships and the time and expense associated with the regulatory validation process.

We comply with all current global guidelines regarding risks for products incorporating animal tissue intended to be implanted in humans. We follow rigorous sourcing and manufacturing procedures intended to safeguard humans from potential risks associated with diseases such as bovine spongiform encephalopathy ("BSE"). We obtain bovine tissue used in our pericardial tissue valve products only from sources within the United States and Australia, where strong control measures and surveillance programs exist. In addition, bovine tissue used in our pericardial tissue valve products is from tissue types considered by global health and regulatory organizations to have shown no risk of infectibility. Our manufacturing and sterilization processes are designed to render tissue biologically safe from all known infectious agents and viruses.

Quality Assurance

We are committed to providing to our patients quality products and have implemented modern quality systems and concepts throughout the organization. The quality system starts with the initial design concept, risk management, and product specification, and continues through the design of the product, packaging and labeling, and the manufacturing, sales, support, and servicing of the product. The quality system is intended to design quality into the products and utilizes continuous improvement concepts, including Lean/Six Sigma principles, throughout the product lifecycle.

Our operations are frequently inspected by the many regulators that oversee medical device manufacturing, including the United States Food and Drug Administration ("FDA"), European Notified Bodies, and other regulatory entities. The medical technology industry is highly regulated and our facilities and operations are designed to comply with all applicable quality systems standards, including the International Organization for Standardization ("ISO") 13485. These standards require, among other items, quality system controls that are applied to product design, component material, suppliers, and manufacturing operations. These regulatory approvals and ISO certifications can be obtained only after a successful audit of a company's quality system has been conducted by regulatory or independent outside auditors. Periodic reexamination by an independent outside auditor is required to maintain these certifications.

Environmental, Health, and Safety

We are committed to providing a safe and healthy workplace and complying with all relevant regulations and medical technology industry standards. Through our corporate and site level Environmental, Health, and Safety functions, we establish and monitor programs to reduce pollution, prevent injuries, and maintain compliance with applicable regulations. In order to measure performance, we monitor and report on a number of metrics, including regulated and non-regulated waste disposal, energy usage, water consumption, air toxic emissions, and injuries from our production activities. Each of our manufacturing sites is evaluated regularly with respect to a broad range of Environmental, Health, and Safety criteria.

5

Research and Development

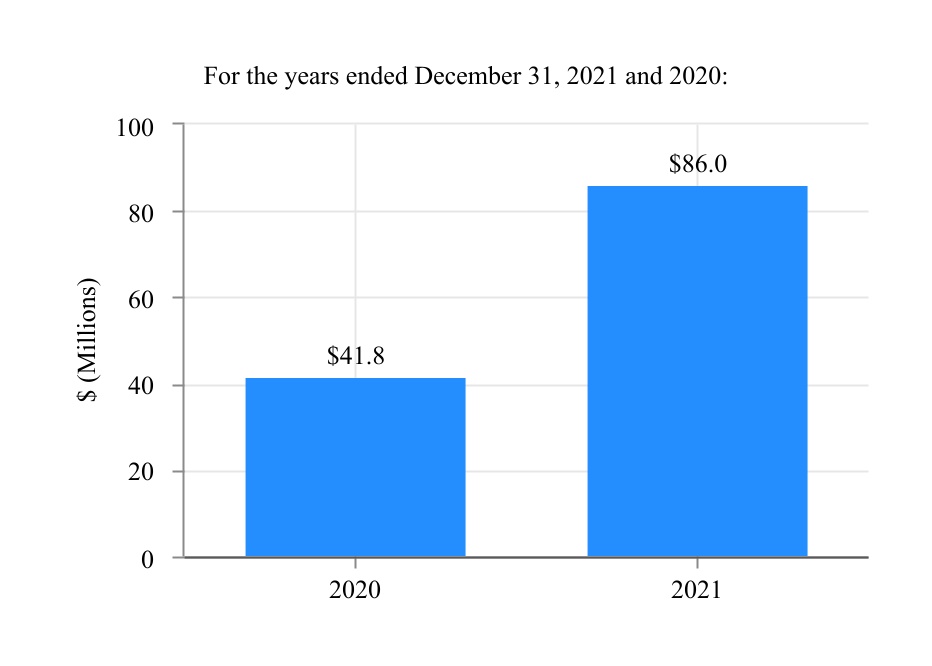

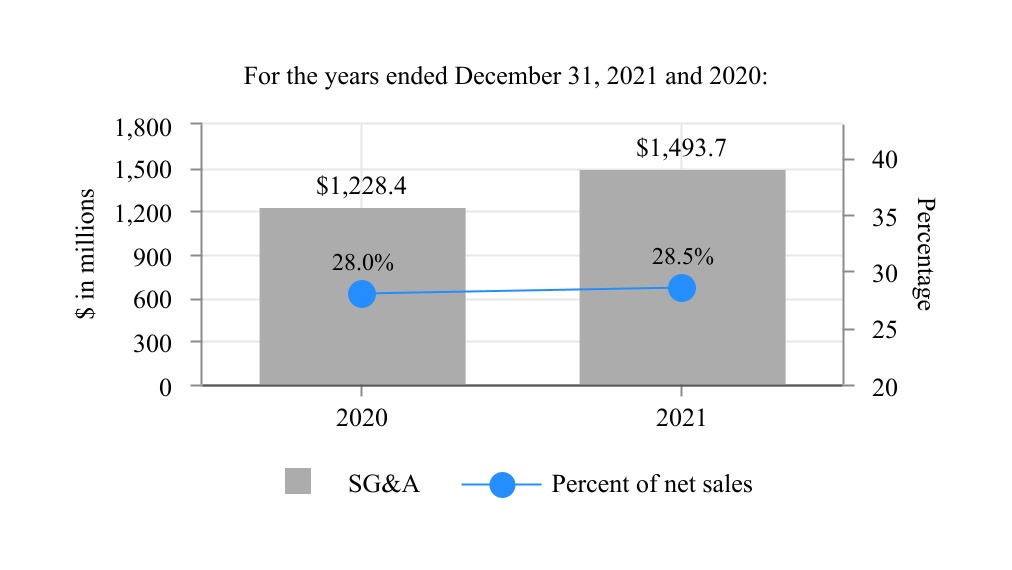

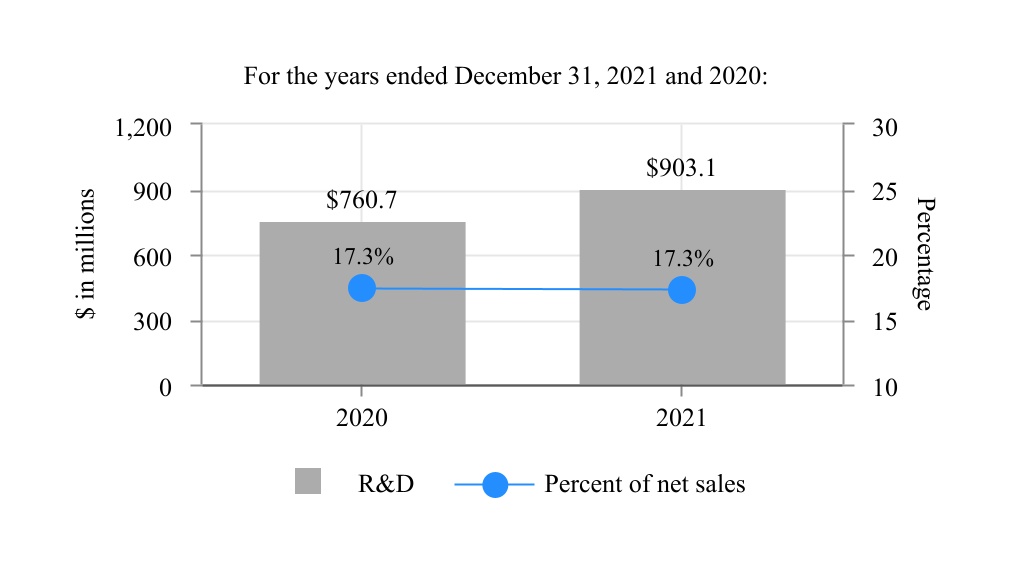

In 2021, we made significant investments in research and development as we worked to develop therapies that we believe have the potential to change the practice of medicine. Research and development spending increased 19% year over year, representing 17% of 2021 sales. This increase was primarily the result of significant investments in our transcatheter structural heart programs, including an increase in clinical research for our mitral and tricuspid therapies. We are engaged in ongoing research and development to deliver clinically advanced new products, to enhance the effectiveness, ease of use, safety, and reliability of our current leading products, and to expand the applications of our products as appropriate. We focus on opportunities within specific areas of structural heart disease and critical care monitoring.

A considerable portion of our research and development investment includes clinical trials and the collection of evidence that provide data for use in regulatory submissions, and required post-market approval studies involving applications of our products. Our investment in clinical studies also includes outcomes and cost-effectiveness data for payers, clinicians, and healthcare systems.

In Transcatheter Aortic Valve Replacement, we are developing new products to further improve and streamline transcatheter aortic heart valve replacement procedures.

In Transcatheter Mitral and Tricuspid Therapies, we are making significant investments in innovation and clinical evidence to develop technologies designed to treat mitral and tricuspid valve diseases. In addition to our internally developed programs, we have made investments in several companies that are independently developing minimally-invasive technologies to treat structural heart diseases.

Our Surgical Structural Heart development programs include innovative platforms for patients who are best treated surgically, specifically active patients and patients with more complex combined procedures.

In our Critical Care product line, we are pursuing the development of a variety of decision support solutions for our clinicians. This includes next-generation noninvasive and minimally-invasive hemodynamic monitoring systems, and a next-generation monitor platform. We are also developing a decision support software suite with advanced algorithms for proactive hemodynamic management, including a semi-closed loop system for standardized management of patient fluid levels. Lastly, we are developing a connectivity platform that will offer clinicians additional clinical support, remote monitoring capability, analytics, and insights for their patients’ hemodynamic status.

Our research and development activities are conducted primarily in facilities located in the United States and Israel. Our experienced research and development staff are focused on product design and development, quality, clinical research, and regulatory compliance. To pursue primary research efforts, we have developed alliances with several leading research institutions and universities, and also work with leading clinicians around the world in conducting scientific studies on our existing and developing products.

Proprietary Technology

Patents, trademarks, and other proprietary rights are important to the success of our business. We also rely upon trade secrets, know-how, continuing innovations, licensing opportunities, and non-disclosure agreements to develop and maintain our competitive position.

We own or have rights to a substantial number of patents and have patent applications pending both in the United States and in foreign countries. We continue to innovate and file new patent applications to protect our new products and technologies.

Additionally, we are a party to license agreements with various third parties pursuant to which we have obtained, for varying terms, the exclusive or non-exclusive rights to certain patents held by such third parties in consideration for cross-licensing rights and/or royalty payments. We have also licensed certain patent rights to others.

We undertake reasonable measures to protect our patent rights, including monitoring the products of our competitors for possible infringement of our patents. Litigation has been necessary to enforce certain patent rights held by us, and we plan to continue to defend and prosecute our rights with respect to such patents.

6

Moreover, we own certain United States registered trademarks used in our business. Many of our trademarks have also been registered for use in certain foreign countries where registration is available and where we have determined it is commercially advantageous to do so.

Government Regulation and Other Matters

Our products and facilities are subject to regulation by numerous government agencies, including the FDA, European Union Member States competent authorities, and the Japanese Pharmaceuticals and Medical Devices Agency, to confirm compliance with the various laws and regulations governing the development, testing, manufacturing, labeling, marketing, and distribution of our products.

We are also governed by federal, state, local, and international laws of general applicability, including, but not limited to, those regulating employee health and safety, labor, competition, trade secret, and the protection of the environment. Overall, the amount and scope of domestic and foreign laws and regulations applicable to our business has increased over time. Compliance with these regulations has not had a material effect on our capital expenditures, earnings, or competitive position to date, but new regulations or amendments to existing regulations to make them more stringent could have such an effect in the future. We cannot estimate the expenses we may incur to comply with potential new laws or changes to existing laws, or the other potential effects these laws may have on our business.

United States Regulation. In the United States, the FDA has responsibility for regulating medical devices. The FDA regulates design, development, testing, clinical studies, manufacturing, labeling, promotion, and record keeping for medical devices, and reporting of adverse events, recalls, or other field actions by manufacturers and users to identify potential problems with marketed medical devices. Many of the devices that we develop and market are in a category for which the FDA has implemented stringent clinical investigation and pre-market clearance or approval requirements. The process of obtaining FDA clearance or approval to market a product is resource intensive, lengthy, and costly. FDA review may involve substantial delays that adversely affect the marketing and sale of our products. A number of our products are pending regulatory clearance or approval to begin commercial sales in various markets. Ultimately, the FDA may not authorize the commercial release of a medical device if it determines the device is not safe and effective or does not meet other regulatory standards. Additionally, even if a product is cleared or approved, the FDA may impose restrictions or require testing and surveillance programs to monitor the effects of these products once commercialized.

The FDA has the authority to halt the distribution of certain medical devices, detain or seize adulterated or misbranded medical devices, order the repair, replacement, or refund of the costs of such devices, or preclude the importation of devices that are or appear violative. The FDA also conducts inspections to determine compliance with the quality system regulations concerning the manufacturing and design of devices and current medical device reporting regulations, recall regulations, clinical testing regulations, and other requirements. The FDA may withdraw product clearances or approvals due to failure to comply with regulatory standards, or the occurrence of unforeseen problems following initial approval, and require notification of health professionals and others with regard to medical devices that present unreasonable risks of substantial harm to the public health. Additionally, the failure to comply with FDA or comparable regulatory standards or the discovery of previously unknown product problems could result in fines, delays, suspensions or withdrawals of regulatory clearances or approvals, seizures, injunctions, recalls, refunds, civil money penalties, or criminal prosecution. Our compliance with applicable regulatory requirements is subject to continual review. Moreover, the FDA and several other United States agencies administer controls over the export of medical devices from the United States and the import of medical devices into the United States, which could also subject us to sanctions for noncompliance.

We are also subject to additional laws and regulations that govern our business operations, products, and technologies, including:

•federal, state, and foreign anti-kickback laws and regulations, which generally prohibit payments to anyone, including physicians as an inducement to purchase or recommend a product;

•the Stark law, which prohibits physicians from referring Medicare or Medicaid patients to a provider that bills these programs for the provision of certain designated health services if the physician (or a member of the physician's immediate family) has a financial relationship with that provider;

•federal and state laws and regulations that protect the confidentiality of certain patient health information, including patient records, and restrict the use and disclosure of such information, in particular, the Health Insurance Portability and Accountability Act of 1996;

7

•the Physician Payments Sunshine Act, which requires public disclosure of the financial relationships of United States physicians and teaching hospitals with applicable manufacturers, including medical device, pharmaceutical, and biologics companies;

•the False Claims Act, which prohibits the submission of false or otherwise improper claims for payment to a federally funded health care program, and health care fraud statutes that prohibit false statements and improper claims to any third-party payor; and

•the United States Foreign Corrupt Practices Act, which can be used to prosecute United States companies for arrangements with foreign government officials or other parties, or for not keeping accurate financial records or maintaining adequate internal controls to prevent and detect arrangements with foreign government officials or other parties.

Failure to comply with these laws and regulations could result in criminal liability, significant fines or penalties, negative publicity, and substantial costs and expenses associated with investigation and enforcement activities. To assist in our compliance efforts, we work to adhere to many codes of ethics and conduct regarding our business activities in the United States and other countries in which we operate. In addition, we have in place a dedicated team to improve our internal business compliance programs and policies.

Regulation Outside of the United States. Outside of the United States, the regulation of medical devices is complex. In Europe, our products are subject to extensive regulatory requirements. The regulatory regime in the European Union for medical devices became mandatory in June 1998. It requires that medical devices may only be placed on the market if they do not compromise safety and health when properly installed, maintained, and used in accordance with their intended purpose. National laws conforming to the European Union's legislation regulate our products under the medical devices regulatory system. Although the more variable national requirements under which medical devices were formerly regulated have been substantially replaced by the European Union Medical Devices Directive, individual nations can still impose unique requirements that may require supplemental submissions. The European Union medical device laws require manufacturers to declare that their products conform to the essential regulatory requirements after which the products may be placed on the market bearing the CE Mark. Manufacturers' quality systems for products in all but the lowest risk classification are also subject to certification and audit by an independent notified body. In Europe, particular emphasis is being placed on more sophisticated and faster procedures for the reporting of adverse events to the competent authorities.

In May 2017, the European Union (the "EU") implemented a new regulatory scheme for medical devices under the Medical Device Regulation ("MDR"). The MDR became fully effective on May 26, 2021 and brought significant new requirements for many medical devices, including enhanced requirements for clinical evidence and documentation, increased focus on device identification and traceability, new definitions and registration of economic operators throughout the distribution chain, and additional post-market surveillance and vigilance. Compliance with the MDR requires re-certification of many of our products to the enhanced standards, and has resulted in and will continue to result in substantial additional expense. In addition, in the EU, we import some of our devices through our offices in Switzerland. Switzerland is not a member state of the EU, but is linked to the EU through bilateral treaties; therefore, the free movement of goods, including medical devices, between the EU and Switzerland after implementation of the MDR requires a revised Mutual Recognition Agreement ("MRA"). If an MRA covering the MDR is not put in place, then non-EU manufacturers may be required to make significant changes, including replacement of Swiss economic operators with operators based in EU Member States, and changes will need to be made to our device labeling and/or packaging to satisfy MDR requirements. If these measures are unable to be taken, it may no longer be possible to place such devices on the EU market.

In Japan, pre-market approval and clinical studies are required as is governmental pricing approval for medical devices. Clinical studies are subject to a stringent Japanese "Good Clinical Practices" standard. Approval time frames from the Japanese Ministry of Health, Labour and Welfare vary from simple notifications to review periods of one or more years, depending on the complexity and risk level of the device. In addition, importation of medical devices into Japan is subject to the "Good Import Practices" regulations. As with any highly regulated market, significant changes in the regulatory environment could adversely affect future sales.

In many of the other foreign countries in which we market our products, we may be subject to regulations affecting, among other things:

•product standards and specifications;

•packaging requirements;

8

•labeling requirements;

•product collection and disposal requirements;

•quality system requirements;

•import restrictions;

•tariffs;

•duties; and

•tax requirements.

Many of the regulations applicable to our devices and products in these countries are similar to those of the FDA. In some regions, the level of government regulation of medical devices is increasing, which can lengthen time to market and increase registration and approval costs. In many countries, the national health or social security organizations require our products to be qualified before they can be marketed and considered eligible for reimbursement.

Health Care Initiatives. Government and private sector initiatives to limit the growth of health care costs, including price regulation and competitive pricing, coverage and payment policies, comparative effectiveness reviews, technology assessments, increasing evidentiary demands, and managed-care arrangements, are continuing in many countries where we do business, including the United States, Europe, and Japan. As a result of these changes, the marketplace has placed increased emphasis on the delivery of more cost-effective medical therapies. For example, government programs, private health care insurance, and managed-care plans have attempted to control costs by restricting coverage and limiting the level of reimbursement for procedures or treatments, and some third-party payors require their pre-approval before new or innovative devices or therapies are utilized by patients. These various initiatives have created increased price sensitivity over medical products generally and may impact demand for our products and technologies.

The delivery of our products is subject to regulation by the United States Department of Health and Human Services ("HHS") and comparable state and foreign agencies responsible for reimbursement and regulation of health care items and services. Foreign governments also impose regulations in connection with their health care reimbursement programs and the delivery of health care items and services. Reimbursement schedules regulate the amount the United States government will reimburse hospitals and doctors for the inpatient care of persons covered by Medicare. HHS' Centers for Medicare & Medicaid Services ("CMS") may also review whether and/or under what circumstances a procedure or technology is reimbursable for Medicare beneficiaries. Changes in current coverage and reimbursement levels could have an adverse effect on market demand and our pricing flexibility. The CMS National Coverage Determination for Transcatheter Aortic Valve Replacement was issued in June 2019. The modernized requirements and more streamlined patient evaluation process are meaningful enhancements that may help ensure equitable access for more patients suffering from severe aortic stenosis.

Health care cost containment efforts have also prompted domestic hospitals and other customers of medical device manufacturers to consolidate into larger purchasing groups to enhance purchasing power. The medical technology industry has also experienced some consolidation, partly in order to offer a broader range of products to large purchasers. As a result, transactions with customers are larger, more complex, and tend to involve more long-term contracts than in the past. These larger customers, due to their enhanced purchasing power, may have a material impact on product pricing.

These laws or any future legislation, including deficit reduction legislation, could impact medical procedure volumes, reimbursement for our products, and demand for our products or the prices at which we sell our products.

Seasonality

Our quarterly net sales are influenced by many factors, including new product introductions, acquisitions, regulatory approvals, patient and physician holiday schedules, and other factors. Net sales in the third quarter are typically lower than other quarters of the year due to the seasonality of the United States and European markets, where summer vacation schedules normally result in fewer medical procedures.

9

Human Capital Management Strategy

Human Capital Management ("HCM") Governance

Attracting, developing, and retaining talent is fundamental to our success. The primary goals of our talent management strategy are to attract and maintain a motivated, professional workforce and to ensure alignment on our patient-focused innovation strategy.

Our Board of Directors routinely engages with leadership in human capital management with time dedicated at each regularly scheduled meeting to discuss talent management, including, among other things, talent strategy, diversity, succession planning, employee development, employee health, safety, and welfare, results of employee surveys, and compensation. The Board of Directors also approves Key Operating Drivers, which are strategic milestones that include financial objectives and are tracked using a point system across our entire organization, that focus the Company and management toward short, medium, and long-term goals that align with our talent management strategy. In addition, the Chief Executive Officer ("CEO") has talent management related performance goals tied to his compensation; these Performance Management Objectives are reviewed on an annual basis, tracked, and then reported to and evaluated by our Board of Directors.

As we scale to reach more patients around the world, we have integrated our Talent & Organization (“T&O”) Strategy with our Edwards Strategic Planning process. The purpose of our T&O Strategy is to anticipate dynamic global trends related to our workforce, develop our talent to meet future organizational needs, and enable us to be well-poised for ongoing market success. The T&O Strategy enables us to explore external workforce signals, share insights, and identify and build emerging capabilities across our organization. The T&O Strategy framework takes a comprehensive approach which includes envisioning the future of our work (the "what" and "how" we deliver our patient focused strategy), planning our workforce (the "who" joining our community of trusted partners), and designing our workplace (the "where" and "when" work gets done). This consistent and scalable approach looks across all our product groups, regions, and significant functions to align and elevate priorities, critical capabilities, and organizational evolutions in line with our strategic plan. This integrated approach informs our yearly objectives and fuels our talent roadmap across the strategic horizon.

Our HCM governance includes a global talent development review ("TDR") process as well as an HCM dashboard. The purpose of our TDR process is to align our business strategy with talent strategies, assess talent against future organizational needs, evaluate critical talent populations, and enhance the strength of our succession planning. Our HCM dashboard is generated quarterly and provides insights on key metrics related to areas such as attraction and growth rates, retention trends, diversity, and employee sentiment.

Culture

Investing in our workforce means our employees can stay focused on our patient-focused innovation strategy and the development of life-saving therapies for the patients we serve. We are committed to maintaining an ethical culture where we celebrate diversity, promote good health and safety, empower employees to speak up, and ensure that employees' voices are heard. We strive to offer competitive employee benefits packages and are committed to fair and equitable pay practices. We track compensation patterns in all geographies where we operate, and we regularly look for ways to ensure fair and equitable pay.

We are committed to fostering an environment where all employees can grow and thrive. A diverse workforce results in a broader range of perspectives, helping drive our commitment to innovation. We have established a Diversity, Inclusion, and Belonging strategy that incorporates the four pillars of Business, People, Communication, and Community.

We believe in empowering our employees and providing avenues that enable their voices to be heard. We conduct a multilingual global employee survey, called myVoice, to pulse our employees and gain their feedback in a confidential manner. We gain insights on various topics including patient focus, diversity, inclusion and belonging, quality, innovation, and engagement. Speak-Up is a resource available to all employees to bring forth compliance related concerns; a key element of our compliance program is that each employee is accountable for maintaining ethical business practices. In addition, during each quarterly townhall meeting, our CEO has an "Ask Mike" section in which he answers questions that have been submitted to him by employees. Answers to questions that are not covered in the townhall meeting are posted online internally.

We understand that good health leads to better performance. We offer competitive employee benefits packages that include, among other things, health and welfare insurance, health savings accounts, family support services, and a variety of site-specific programs. We regularly evaluate our benefits package to make modifications that are aligned with the competitive landscape, legislative changes, and the unique needs of our population. We also provide robust wellness programs that address prevention, nutrition, mental health, physical activity, education, financial fitness, and community service. In recent years, mental wellness has become a central topic for organizations worldwide. As part of our regular evaluation and commitment to putting employees first, we launched a new program, Mind+, which offers a wide variety of mental health benefits and wellness

10

programs for our employees. This commitment extends to creating a work environment where employees can feel confident speaking about mental health with their managers and know how best to access the tools and resources available to support them. We believe there are strong benefits when employees are feeling their best. Employees who are mentally healthy are more innovative, resilient, better decision-makers, and able to build stronger relationships. We also believe that prioritizing and promoting Mind+ allows us to help patients around the world to live longer, healthier, and more productive lives and supports employees to be their best self at home and at work.

Talent Development

In addition to our robust TDR process and tuition reimbursement programs, we provide a variety of leadership, technical, and professional development programs around the globe.

Headcount and Labor Representation

As of December 31, 2021, we had approximately 15,700 employees worldwide, the majority of whom were located in the United States, Singapore, the Dominican Republic, and Costa Rica. None of our North American employees are represented by a labor union. In various countries outside of North America, we interact with trade unions and work councils that represent employees.

Additional details regarding diversity, talent development, compensation, and employee health and safety can be found in our Sustainability Report posted on our website at www.edwards.com under "About Us — Corporate Responsibility."

References to our website in this Annual Report on Form 10-K are provided for convenience only and the content on our website does not constitute a part of this Report.

Item 1A. Risk Factors

Our business and assets are subject to varying degrees of risk and uncertainty. An investor should carefully consider the risks described below, as well as other information contained in this Annual Report on Form 10-K and in our other filings with the SEC. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business. If any of these events or circumstances occurs, our business, financial condition, results of operations, or prospects could be materially harmed. In that case, the value of our securities could decline and an investor could lose part or all of his or her investment. In addition, forward-looking statements within the meaning of the federal securities laws that are contained in this Annual Report on Form 10-K or in our other filings or statements may be subject to the risks described below as well as other risks and uncertainties. Please note that the headers provided below are intended to assist the reader in navigating the risk factors; however, some risks, present or future, may implicate multiple types of risks. Please read the cautionary notice regarding forward-looking statements in Part I above.

Business and Operating Risks

We are subject to risks associated with public health threats and epidemics, including the novel coronavirus ("COVID-19") and any variants of COVID-19.

We are subject to risks associated with public health threats and epidemics, including the global health concerns related to the COVID-19 pandemic. The global pandemic has adversely impacted and is likely to further adversely impact nearly all aspects of our business and markets, including our workforce and operations and the operations of our customers, suppliers, and business partners. In particular, we may experience material financial or operational impacts, including:

•Significant volatility or reductions in demand for our products;

•Impacts and delays to clinical trials, our pipeline milestones, or regulatory clearances and approvals; or

•The inability to meet our customers’ needs or other obligations due to disruptions to our operations or the operations of our third-party partners, suppliers, contractors, logistics partners, or customers including disruptions to production, development, manufacturing, administrative, and supply operations and arrangements.

The extent to which the COVID-19 global pandemic and measures taken in response thereto impact our business, results

of operations, and financial condition will depend on future developments, which are highly uncertain and are difficult to

11

predict. These developments include, but are not limited to, the duration and spread of the outbreak (including new variants of COVID-19), its severity, the actions to contain the virus or address its impact, the timing, distribution, and efficacy of vaccines and other treatments, United States and foreign government actions to respond to the reduction in global economic activity, and how quickly and to what extent normal economic and operating conditions can resume.

Failure to successfully innovate and develop new and differentiated products in a timely manner and effectively market these products could have a material effect on our prospects.

Our continued growth and success depend on our ability to innovate and develop new and differentiated products in a timely manner and effectively market these products. Without the timely innovation and development of products, our products could be rendered obsolete or less competitive by changing customer preferences or because of the introduction of a competitor’s newer technologies. Innovating products requires the devotion of significant financial and other resources to research and development activities; however, there is no certainty that the products we are currently developing will complete the development process, or that we will obtain the regulatory or other approvals required to market such products in a timely manner or at all. Even if we timely innovate and develop products, our ability to market them could be constrained by a number of different factors, including barriers in patients' treatment pathway (including disease awareness, detection, and diagnosis), the need for regulatory clearance, restrictions imposed on approved indications, and uncertainty over third-party reimbursement. Failure in any of these areas could have a material effect on our prospects.

Unsuccessful clinical trials or procedures relating to products could have a material adverse effect on our prospects.

The regulatory approval process for new products and new indications for existing products requires extensive clinical trials and procedures, including early clinical feasibility and regulatory studies. Unfavorable or inconsistent clinical data from current or future clinical trials or procedures conducted by us, our competitors, or third parties, or perceptions regarding this clinical data, could adversely affect our ability to obtain necessary approvals and the market's view of our future prospects. Such clinical trials and procedures are inherently uncertain and there can be no assurance that these trials or procedures will be enrolled or completed in a timely or cost-effective manner or result in a commercially viable product or indication; failure to do so could have a material adverse effect on our prospects. Clinical trials or procedures may experience significant setbacks even after earlier trials have shown promising results. Further, preliminary results from clinical trials or procedures may be contradicted by subsequent analyses. In addition, results from our clinical trials or procedures may not be supported by actual long-term studies or clinical experience. If preliminary clinical results are later contradicted, or if initial results cannot be supported by actual long-term studies or clinical experience, our business could be adversely affected. Clinical trials or procedures may be delayed, suspended, or terminated by us, the FDA, or other regulatory authorities at any time if it is believed that the trial participants face unacceptable health risks or any other reasons, and any such delay, suspension, or termination could have a material adverse effect on our prospects or the market's view of our future prospects.

We operate in highly competitive markets, and if we do not compete effectively, our business will be harmed.

We face substantial competition and compete with companies of all sizes on the basis of cost-effectiveness, technological innovations, product performance, brand name recognition, breadth of product offerings, real or perceived product advantages, pricing and availability and rate of reimbursement. In addition, given the trend toward value-based healthcare, if we are not able to continue to demonstrate the full value of our differentiated products to healthcare providers and payors, our competitive position could be adversely affected. See "Competition" under "Business" in Part I, Item 1 included herein.

If we identify underperforming operations or products or if there are unforeseen operating difficulties and expenditures in connection with business acquisitions or strategic alliances, we may be required, from time to time, to recognize charges, which could be substantial and which could adversely affect our results of operations.

We actively manage a portfolio of research and development products, and we regularly explore potential acquisitions of complementary businesses, technologies, services, or products, as well as potential strategic alliances. From time to time, we identify operations and products that are underperforming, do not fit with our longer-term business strategy or there may be unforeseen operating difficulties and significant expenditures during the integration of an acquired business, technology, service, or product into our existing operations. We may seek to dispose of these underperforming operations or products, and we may also seek to dispose of other operations or products for strategic or other business reasons. If we cannot dispose of an operation or product on acceptable terms, we may voluntarily cease operations related to that product. In addition, we may be required to take charges or write-downs in connection with acquisitions and divestitures. In particular, acquisitions of businesses engaged in the development of new products may give rise to developed technology and/or in-process research and development assets. To the extent that the value of these assets decline, we may be required to write down the value of the assets. Also, in connection with certain asset acquisitions, we may be required to take an immediate charge related to acquired in-process research and development assets. Any of these events could result in charges, which could be substantial and which could adversely affect our results of operations.

12

The success of many of our products depends upon certain key physicians.

We work with leading global physicians who provide considerable knowledge and experience. These physicians may assist us as researchers, marketing consultants, product trainers and consultants, inventors, and as public speakers. If new laws, regulations, or other developments limit our ability to appropriately engage these professionals or to continue to receive their advice and input or we are otherwise unsuccessful in maintaining strong working relationships with these physicians, the development, marketing, and successful use of our products could suffer, which could have a material adverse effect on our business, financial condition, and results of operations.

If we or one of our suppliers or logistics partners encounters manufacturing, logistics, or quality problems, our business could be materially adversely affected.

The manufacture and sterilization of many of our products is highly complex due in part to rigorous regulatory requirements. Quality is extremely important due to the serious and costly consequences of a product failure. Problems can arise for a number of reasons, including disruption of facility utilities, equipment malfunction, failure to follow protocols and procedures, raw material problems, software problems, cyber incidents, or human error. Disruptions can occur at any time, including during production line transfers and expansions. Disruptions can also occur if our manufacturing and warehousing facilities are damaged by earthquakes, hurricanes, volcanoes, fires, and other natural disasters or catastrophic circumstances. As we expand into new markets and scale new products for commercial production, we may face unanticipated delays or surges in demand which could strain our production capacity and lead to other types of disruption. If any of these manufacturing, logistics, or quality problems arise or if we or one of our suppliers or logistics partners otherwise fail to meet internal quality standards or those of the FDA or other applicable regulatory body, our reputation could be damaged, we could become subject to a safety alert or a recall, we could incur product liability and other costs, product approvals and production could be delayed, and our business could otherwise be materially adversely affected.

We rely on third parties in the design, manufacture, and sterilization of our products. Any failure by or loss of a vendor could result in delays and increased costs, which may adversely affect our business.

We rely on third parties for a broad range of raw and organic materials and other items in the design, manufacture, and sterilization of our products, and we purchase certain supplies and services from single sources for reasons of quality assurance, cost-effectiveness, availability, constraints resulting from regulatory requirements, and other reasons. We may experience supply interruptions due to a variety of factors, including:

•General economic conditions that could adversely affect the financial viability of our vendors;

•Vendors' election to no longer service medical technology companies due to the burdens of applicable quality requirements and regulations;

•The limitation or ban of certain chemicals or other materials used in the manufacture of our products; and

•Delays or shortages due to trade or regulatory embargoes.

A change or addition to our vendors could require significant effort due to the rigorous regulations and requirements of the FDA and other regulatory authorities; it could be difficult to establish additional or replacement sources on a timely basis or at all, which could have a material adverse effect on our business.

13

Failure to protect our information technology infrastructure and our products against cyber-based attacks, network security breaches, service interruptions, or data corruption could materially disrupt our operations and adversely affect our business and operating results.

The operation of our business depends on our information technology systems. We rely on our information technology systems to, among other things, effectively manage sales and marketing data, accounting and financial functions, inventory management, product development tasks, clinical data, customer service and technical support functions. Our information technology systems are vulnerable to damage or interruption from earthquakes, fires, floods and other natural disasters, terrorist attacks, power losses, computer system or data network failures, security breaches, and data corruption.

In addition, our information technology infrastructure and products are vulnerable to cyber-based attacks. Cyber-based attacks can include, but are not limited to, computer viruses, denial-of-service attacks, phishing attacks, ransomware attacks, and other introduction of malware to computers and networks; unauthorized access through the use of compromised credentials; exploitation of design flaws, bugs, or security vulnerabilities; intentional or unintentional acts by employees or other insiders with access privileges; and intentional acts of vandalism by third parties and sabotage. In addition, United States federal and state laws and regulations, and the laws and regulations of jurisdictions outside of the United States, such as the General Data Protection Regulation adopted by the European Union and the California Consumer Privacy Act, can expose us to investigations and enforcement actions by regulatory authorities and claims from individuals potentially resulting in penalties and significant legal liability, if our information technology security efforts are inadequate. In addition, we rely upon technology suppliers, including cloud‑based data management applications hosted by third‑party service providers, whose security and information technology systems are subject to similar risks.

Significant disruption in either our or our service providers’ or suppliers’ information technology or the security of our products could impede our operations or result in decreased sales, result in liability claims or regulatory penalties, or lead to increased overhead costs, product shortages, loss or misuse of proprietary or confidential information, intellectual property, or sensitive or personal information, all of which could have a material adverse effect on our reputation, business, financial condition, and operating results.

Our business and results of operations may be adversely affected if we are unable to recruit and retain qualified management and other personnel.

Our continued success depends, in large part, on our ability to hire and retain qualified people or otherwise have access to such qualified people globally and if we are unable to do so, our business and operations may be impaired or disrupted. See "Human Capital Management Strategy" under "Business" in Part I, Item 1 included herein. Competition for highly qualified people is intense, and there is no assurance that we will be successful in attracting or retaining replacements to fill vacant positions, successors to fill retirements or employees moving to new positions, or other highly qualified personnel.

Market and Other External Risks

Because we operate globally, our business is subject to a variety of risks associated with international sales and operations.

Our extensive global operations and business activity as well as the fact that many of our manufacturing facilities and suppliers are outside of the United States are accompanied by certain financial, economic, political, and other risks, including those listed below.

Domestic and Global Economic Conditions. We cannot predict to what extent general domestic and global economic conditions may negatively impact our business. These include, but are not limited to, credit and capital markets, interest rates, tax law, including tax rate and policy changes, factors affecting global economic stability, and the political environment relating to health care. These and other conditions could also adversely affect our customers, payers, vendors and other stakeholders and may impact their ability or decision to purchase our products or make payments on a timely basis.

Health Care Legislation and Other Regulations. We are subject to various federal and foreign laws that govern our domestic and international business practices. For example, in the United States, the Affordable Care Act, the Medicare Access and CHIP Reauthorization Act of 2015, and the 21st Century Cures Act, or any future legislation, including deficit reduction legislation, could impact medical procedure volumes, reimbursement for our products, and demand for our products or the prices at which we sell our products. In addition, a Mutual Recognition Agreement still under negotiation for the Medical Device Regulation can result in a lack of free movement of medical devices between the European Union and Switzerland, can impact our access in the European Union and can, ultimately, have a material effect on our business, financial condition, and results of operations. For more information about these laws as they relate to our business, see the section entitled “Government Regulation and Other Matters” in Part I, Item 1, “Business.”

14

In addition, the United States Foreign Corrupt Practices Act, the United Kingdom Bribery Act, and similar laws in other jurisdictions contain prohibitions against bribery and other illegal payments, and make it an offense to fail to have procedures in place that prevent such payments. Penalties resulting from any violation of these laws could adversely affect us and our business.

Taxes. We are subject to income taxes in the United States as well as other jurisdictions.

•Provision for Income Taxes. Our provision for income taxes and our underlying effective tax rate could fluctuate due to changes in the mix of earnings and losses in countries with differing statutory tax rates. Our income tax provision could also be impacted by changes in excess tax benefits of stock-based compensation, federal and state tax credits, non-deductible expenses, changes in the valuation of deferred tax assets and liabilities and our ability to utilize them, the applicability and creditability of withholding taxes, and effects from acquisitions.

•Tax Reform. Our provision for income taxes could be materially impacted by changes in accounting principles or evolving tax laws, including, but not limited to, global corporate tax reform and base-erosion and tax transparency efforts. For example, many countries are aligning their international tax rules with the Organisation for Economic Co-operation and Development’s Base Erosion and Profit Shifting recommendations and action plans that aim to standardize and modernize international corporate tax policy, including changes to cross-border taxes, transfer pricing documentation rules, nexus-based tax practices, and taxation of digital activities.

•Tax Audits. We are subject to ongoing tax audits in the various jurisdictions in which we operate. Tax authorities may disagree with certain positions we have taken and assess additional taxes. Although we regularly assess the likely outcomes of the audits and record reserves for potential tax payments, the calculation of tax liabilities involves the application of complex tax laws, and our estimates could be different than the amounts for which we are ultimately liable.

•Tax Incentives. We benefit from various global tax incentives extended to encourage investment or employment. Several foreign jurisdictions have granted us tax incentives which require renewal at various times in the future. If our incentives are not renewed or we cannot or do not wish to satisfy all or part of the tax incentive conditions, we may lose the tax incentives and could be required to refund tax incentives previously realized. As a result, our provision for income taxes could be higher than it would have been had we maintained the benefits of the tax incentives.

Other economic, political, and social risks. In addition to the factors enumerated above, we are from time to time impacted by a variety of other factors associated with doing business internationally that can harm our future results, including the following:

•trade protection measures, quotas, embargoes, import or export requirements, and duties, tariffs, or surcharges;

•cultural or other local factors affecting financial terms with customers;

•differing labor regulations; and

•currency exchange rate fluctuations; that is, decreases in the value of the United States dollar to the Euro or the Japanese yen, as well as other currencies, have the effect of increasing our reported revenues even when the volume of sales outside of the United States has remained constant. Increases in the value of the United States dollar relative to the Euro or the Japanese yen, as well as other currencies, have the opposite effect. Significant increases or decreases in the value of the United States dollar could have a material adverse effect on our revenues, cost of sales, or results of operations.

If government and other third-party payors decline to reimburse our customers for our products or impose other cost containment measures to reduce reimbursement levels, our ability to profitably sell our products will be harmed.

We sell our products and technologies to hospitals and other health care providers, nearly all of which receive reimbursement for the health care services provided to patients from third-party payors, such as government programs (both domestic and outside of the United States), private insurance plans, and managed care programs. The ability of customers to obtain appropriate reimbursement for their products from private and governmental third-party payors is critical to our success. The availability of reimbursement affects which products customers purchase and the prices they are willing to pay. Reimbursement varies from country to country and can significantly impact acceptance of new products.

15

Government and other third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement for medical products and services. Reimbursement levels may be decreased in the future. Additionally, future legislation, regulation, or reimbursement policies of third-party payors may otherwise adversely affect the demand for and price levels of our products. The introduction of cost containment incentives, combined with closer scrutiny of health care expenditures by both private health insurers and employers, has resulted in increased discounts and contractual adjustments to hospital charges for services performed. Hospitals or physicians may respond to such cost-containment pressures by substituting lower cost products or other therapies.