Document

false--12-31Q220190001099800890000088000001.001.00350000000350000000215200000216900000207700000207900000587000000.010.01500000005000000000P3Y75000009000000

0001099800

2019-01-01

2019-06-30

0001099800

2019-07-23

0001099800

2018-12-31

0001099800

2019-06-30

0001099800

2019-04-01

2019-06-30

0001099800

2018-04-01

2018-06-30

0001099800

2018-01-01

2018-06-30

0001099800

2017-12-31

0001099800

2018-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0001099800

us-gaap:CommonStockMember

2017-12-31

0001099800

us-gaap:CommonStockMember

2019-01-01

2019-03-31

0001099800

us-gaap:RetainedEarningsMember

2019-01-01

2019-03-31

0001099800

us-gaap:TreasuryStockMember

2017-12-31

0001099800

us-gaap:RetainedEarningsMember

2018-01-01

2018-03-31

0001099800

us-gaap:TreasuryStockMember

2018-03-31

0001099800

2019-01-01

2019-03-31

0001099800

us-gaap:RetainedEarningsMember

2019-03-31

0001099800

us-gaap:CommonStockMember

2018-01-01

2018-03-31

0001099800

2018-03-31

0001099800

us-gaap:TreasuryStockMember

2018-01-01

2018-03-31

0001099800

us-gaap:RetainedEarningsMember

2018-01-01

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001099800

2018-01-01

2018-03-31

0001099800

us-gaap:TreasuryStockMember

2019-04-01

2019-06-30

0001099800

us-gaap:CommonStockMember

2019-06-30

0001099800

us-gaap:TreasuryStockMember

2018-12-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-06-30

0001099800

us-gaap:RetainedEarningsMember

2017-12-31

0001099800

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-03-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-03-31

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-04-01

2018-06-30

0001099800

us-gaap:TreasuryStockMember

2019-03-31

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-03-31

0001099800

us-gaap:RetainedEarningsMember

2018-12-31

0001099800

us-gaap:RetainedEarningsMember

2018-06-30

0001099800

us-gaap:RetainedEarningsMember

2018-03-31

0001099800

us-gaap:TreasuryStockMember

2018-06-30

0001099800

us-gaap:AdditionalPaidInCapitalMember

2019-04-01

2019-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-31

0001099800

us-gaap:RetainedEarningsMember

2019-06-30

0001099800

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0001099800

2018-01-01

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0001099800

us-gaap:CommonStockMember

2018-04-01

2018-06-30

0001099800

2019-03-31

0001099800

us-gaap:CommonStockMember

2018-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

0001099800

us-gaap:TreasuryStockMember

2019-01-01

2019-03-31

0001099800

us-gaap:CommonStockMember

2018-12-31

0001099800

us-gaap:TreasuryStockMember

2018-04-01

2018-06-30

0001099800

us-gaap:TreasuryStockMember

2019-06-30

0001099800

us-gaap:AdditionalPaidInCapitalMember

2019-03-31

0001099800

us-gaap:CommonStockMember

2019-03-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-04-01

2019-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0001099800

us-gaap:CommonStockMember

2018-03-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-03-31

0001099800

us-gaap:CommonStockMember

2019-04-01

2019-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0001099800

us-gaap:CommonStockMember

2018-01-01

0001099800

us-gaap:RetainedEarningsMember

2019-04-01

2019-06-30

0001099800

us-gaap:TreasuryStockMember

2018-01-01

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-03-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-03-31

0001099800

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

0001099800

us-gaap:RetainedEarningsMember

2018-04-01

2018-06-30

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-04-01

2018-06-30

0001099800

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0001099800

us-gaap:AccountingStandardsUpdate201602Member

2019-01-01

0001099800

srt:MaximumMember

2019-06-30

0001099800

srt:MinimumMember

2019-06-30

0001099800

2017-01-01

2017-12-31

0001099800

2016-01-01

2016-12-31

0001099800

2018-01-01

2018-12-31

0001099800

ew:EarlystageTranscatheterIntellectualPropertyMember

2019-03-31

0001099800

us-gaap:PensionPlansDefinedBenefitMember

2018-03-01

2018-03-31

0001099800

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-06-30

0001099800

us-gaap:USTreasuryAndGovernmentMember

2019-06-30

0001099800

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0001099800

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0001099800

us-gaap:CommercialPaperMember

2019-06-30

0001099800

us-gaap:USTreasuryAndGovernmentMember

2018-12-31

0001099800

us-gaap:MunicipalBondsMember

2018-12-31

0001099800

us-gaap:CommercialPaperMember

2018-12-31

0001099800

us-gaap:ForeignGovernmentDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:MunicipalBondsMember

2019-06-30

0001099800

us-gaap:BankTimeDepositsMember

2019-06-30

0001099800

us-gaap:BankTimeDepositsMember

2018-12-31

0001099800

ew:CASMedicalSystemsInc.Member

2019-04-18

0001099800

ew:CASMedicalSystemsInc.Member

2019-04-18

2019-04-18

0001099800

ew:CASMedicalSystemsInc.Member

us-gaap:DevelopedTechnologyRightsMember

2019-04-18

0001099800

ew:CASMedicalSystemsInc.Member

us-gaap:CustomerRelationshipsMember

2019-04-18

0001099800

ew:CASMedicalSystemsInc.Member

us-gaap:DevelopedTechnologyRightsMember

2019-04-18

2019-04-18

0001099800

ew:CASMedicalSystemsInc.Member

2019-02-11

0001099800

ew:CASMedicalSystemsInc.Member

2019-02-11

2019-02-11

0001099800

ew:CASMedicalSystemsInc.Member

us-gaap:CustomerRelationshipsMember

2019-04-18

2019-04-18

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-06-30

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasuryAndGovernmentMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ForeignGovernmentDebtSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0001099800

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0001099800

srt:MaximumMember

us-gaap:FairValueInputsLevel3Member

us-gaap:ObligationsMember

ew:MeasurementInputProbabilityOfMilestoneAchievementMember

2019-06-30

0001099800

srt:MinimumMember

us-gaap:FairValueInputsLevel3Member

us-gaap:ObligationsMember

ew:MeasurementInputProbabilityOfMilestoneAchievementMember

2019-06-30

0001099800

srt:MinimumMember

us-gaap:FairValueInputsLevel3Member

us-gaap:ObligationsMember

us-gaap:MeasurementInputDiscountRateMember

2019-06-30

0001099800

srt:MaximumMember

us-gaap:FairValueInputsLevel3Member

us-gaap:ObligationsMember

us-gaap:MeasurementInputDiscountRateMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel3Member

us-gaap:ObligationsMember

ew:MeasurementInputVolatilityOfFutureRevenueMember

2019-06-30

0001099800

us-gaap:FairValueInputsLevel2Member

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-04-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-04-01

2019-06-30

0001099800

us-gaap:OtherNoncurrentAssetsMember

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:OtherNoncurrentAssetsMember

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:OtherNoncurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:OtherNoncurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:OtherCurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

us-gaap:OtherCurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestIncomeMember

2018-04-01

2018-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-04-01

2018-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestIncomeMember

2019-04-01

2019-06-30

0001099800

ew:ForeignCurrencyDenominatedDebtMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-04-01

2018-06-30

0001099800

ew:ForeignCurrencyDenominatedDebtMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-04-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-04-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-01-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestIncomeMember

2018-01-01

2018-06-30

0001099800

ew:ForeignCurrencyDenominatedDebtMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-01-01

2018-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestIncomeMember

2019-01-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-01-01

2018-06-30

0001099800

ew:ForeignCurrencyDenominatedDebtMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-04-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0001099800

ew:ForeignCurrencyDenominatedDebtMember

us-gaap:NetInvestmentHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2019-01-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-01-01

2018-06-30

0001099800

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-06-30

0001099800

us-gaap:CurrencySwapMember

2019-06-30

0001099800

us-gaap:ForeignExchangeContractMember

2019-06-30

0001099800

us-gaap:CurrencySwapMember

2018-12-31

0001099800

us-gaap:ForeignExchangeContractMember

2018-12-31

0001099800

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-06-30

0001099800

ew:MarketBasedRestrictedStockUnitsMember

2019-01-01

2019-06-30

0001099800

ew:MarketBasedRestrictedStockUnitsMember

2018-01-01

2018-06-30

0001099800

srt:MinimumMember

ew:MarketBasedRestrictedStockUnitsMember

2019-01-01

2019-06-30

0001099800

ew:EmployeeAndNonemployeeStockOptionsMember

2019-01-01

2019-06-30

0001099800

srt:MaximumMember

ew:MarketBasedRestrictedStockUnitsMember

2019-01-01

2019-06-30

0001099800

ew:EmployeeAndNonemployeeStockOptionsMember

2018-01-01

2018-06-30

0001099800

ew:EmployeeAndNonemployeeStockOptionsMember

2018-04-01

2018-06-30

0001099800

ew:EmployeeAndNonemployeeStockOptionsMember

2019-04-01

2019-06-30

0001099800

us-gaap:EmployeeStockMember

2019-01-01

2019-06-30

0001099800

us-gaap:EmployeeStockMember

2018-04-01

2018-06-30

0001099800

us-gaap:EmployeeStockMember

2019-04-01

2019-06-30

0001099800

us-gaap:EmployeeStockMember

2018-01-01

2018-06-30

0001099800

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ResearchAndDevelopmentExpenseMember

2018-01-01

2018-03-31

0001099800

us-gaap:ResearchAndDevelopmentExpenseMember

2019-04-01

2019-06-30

0001099800

us-gaap:CostOfSalesMember

2018-01-01

2018-03-31

0001099800

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-03-31

0001099800

us-gaap:CostOfSalesMember

2019-01-01

2019-06-30

0001099800

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-06-30

0001099800

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-06-30

0001099800

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0001099800

us-gaap:ResearchAndDevelopmentExpenseMember

2019-01-01

2019-06-30

0001099800

us-gaap:ResearchAndDevelopmentExpenseMember

2018-01-01

2018-06-30

0001099800

us-gaap:CostOfSalesMember

2018-01-01

2018-06-30

0001099800

ew:June2019StockRepurchaseProgramMember

2019-06-01

2019-06-30

0001099800

ew:InitialDeliveryofSharesSettledMay2019Member

2019-05-01

2019-05-31

0001099800

ew:May2019StockRepurchaseProgramMember

2019-05-01

2019-05-31

0001099800

ew:InitialDeliveryOfSharesSettledJune2019Member

2019-05-01

2019-05-31

0001099800

ew:April2018StockRepurchaseProgramMember

2018-04-01

2018-04-30

0001099800

ew:July2018StockRepurchaseProgramMember

2018-07-01

2018-07-31

0001099800

ew:April2018StockRepurchaseProgramMember

2018-04-30

0001099800

ew:InitialDeliveryofSharesSettledMay2019Member

2019-05-31

0001099800

ew:InitialDeliveryOfSharesSettledJune2019Member

2019-05-31

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-01-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-01-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-04-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-04-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-01-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-04-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-04-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-01-01

2018-06-30

0001099800

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-06-30

0001099800

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-12-31

0001099800

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-06-30

0001099800

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-01-01

2019-06-30

0001099800

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-06-30

0001099800

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-06-30

0001099800

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-01-01

2019-06-30

0001099800

us-gaap:AccumulatedTranslationAdjustmentMember

2019-06-30

0001099800

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-12-31

0001099800

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0001099800

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-12-31

0001099800

us-gaap:StockCompensationPlanMember

2018-01-01

2018-06-30

0001099800

us-gaap:StockCompensationPlanMember

2019-01-01

2019-06-30

0001099800

us-gaap:StockCompensationPlanMember

2019-04-01

2019-06-30

0001099800

us-gaap:StockCompensationPlanMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:EuropeSegmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:EuropeSegmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

2019-01-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:JapanSegmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:RestOfWorldSegmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:JapanSegmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

2019-04-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:EuropeSegmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:UnitedStatesSegmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:JapanSegmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:UnitedStatesSegmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:RestOfWorldSegmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:UnitedStatesSegmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:RestOfWorldSegmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:EuropeSegmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:OperatingSegmentsMember

2018-01-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:JapanSegmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:UnitedStatesSegmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:OperatingSegmentsMember

ew:RestOfWorldSegmentMember

2019-01-01

2019-06-30

0001099800

us-gaap:MaterialReconcilingItemsMember

2019-04-01

2019-06-30

0001099800

us-gaap:CorporateNonSegmentMember

2019-04-01

2019-06-30

0001099800

us-gaap:MaterialReconcilingItemsMember

2018-01-01

2018-06-30

0001099800

us-gaap:CorporateNonSegmentMember

2018-01-01

2018-06-30

0001099800

us-gaap:MaterialReconcilingItemsMember

2019-01-01

2019-06-30

0001099800

us-gaap:CorporateNonSegmentMember

2018-04-01

2018-06-30

0001099800

us-gaap:MaterialReconcilingItemsMember

2018-04-01

2018-06-30

0001099800

us-gaap:CorporateNonSegmentMember

2019-01-01

2019-06-30

0001099800

ew:RestOfWorldMember

2019-01-01

2019-06-30

0001099800

ew:TranscatheterAorticValveReplacementMember

2018-04-01

2018-06-30

0001099800

ew:TranscatheterMitralAndTricuspidTherapiesMember

2018-01-01

2018-06-30

0001099800

country:US

2018-01-01

2018-06-30

0001099800

ew:SurgicalHeartValveTherapyMember

2019-04-01

2019-06-30

0001099800

country:JP

2018-01-01

2018-06-30

0001099800

ew:SurgicalHeartValveTherapyMember

2019-01-01

2019-06-30

0001099800

srt:EuropeMember

2019-04-01

2019-06-30

0001099800

ew:TranscatheterAorticValveReplacementMember

2019-01-01

2019-06-30

0001099800

country:US

2019-01-01

2019-06-30

0001099800

ew:SurgicalHeartValveTherapyMember

2018-04-01

2018-06-30

0001099800

country:JP

2019-01-01

2019-06-30

0001099800

ew:CriticalCareMember

2019-04-01

2019-06-30

0001099800

srt:EuropeMember

2018-01-01

2018-06-30

0001099800

ew:TranscatheterMitralAndTricuspidTherapiesMember

2018-04-01

2018-06-30

0001099800

country:US

2019-04-01

2019-06-30

0001099800

ew:TranscatheterMitralAndTricuspidTherapiesMember

2019-04-01

2019-06-30

0001099800

ew:TranscatheterAorticValveReplacementMember

2019-04-01

2019-06-30

0001099800

country:JP

2018-04-01

2018-06-30

0001099800

ew:TranscatheterMitralAndTricuspidTherapiesMember

2019-01-01

2019-06-30

0001099800

ew:RestOfWorldMember

2018-04-01

2018-06-30

0001099800

ew:SurgicalHeartValveTherapyMember

2018-01-01

2018-06-30

0001099800

ew:CriticalCareMember

2018-04-01

2018-06-30

0001099800

ew:TranscatheterAorticValveReplacementMember

2018-01-01

2018-06-30

0001099800

ew:RestOfWorldMember

2019-04-01

2019-06-30

0001099800

ew:CriticalCareMember

2018-01-01

2018-06-30

0001099800

ew:CriticalCareMember

2019-01-01

2019-06-30

0001099800

country:JP

2019-04-01

2019-06-30

0001099800

srt:EuropeMember

2019-01-01

2019-06-30

0001099800

srt:EuropeMember

2018-04-01

2018-06-30

0001099800

ew:RestOfWorldMember

2018-01-01

2018-06-30

0001099800

country:US

2018-04-01

2018-06-30

0001099800

country:US

2018-12-31

0001099800

srt:EuropeMember

2018-12-31

0001099800

ew:RestOfWorldMember

2018-12-31

0001099800

srt:EuropeMember

2019-06-30

0001099800

country:JP

2018-12-31

0001099800

country:US

2019-06-30

0001099800

country:JP

2019-06-30

0001099800

ew:RestOfWorldMember

2019-06-30

xbrli:pure

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:EUR

ew:lawsuit

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-15525

EDWARDS LIFESCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 36-4316614 | |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| |

One Edwards Way | Irvine | California | 92614 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(949) 250-2500

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $1.00 per share | EW | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant's common stock, $1.00 par value, as of July 23, 2019 was 207,969,219.

EDWARDS LIFESCIENCES CORPORATION

FORM 10-Q

For the quarterly period ended June 30, 2019

TABLE OF CONTENTS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend the forward-looking statements contained in this report to be covered by the safe harbor provisions of such Acts. All statements other than statements of historical fact in this report or referred to or incorporated by reference into this report are "forward-looking statements" for purposes of these sections. These statements include, among other things, any predictions of earnings, revenues, expenses or other financial items, plans or expectations with respect to development activities, clinical trials or regulatory approvals, any statements of plans, strategies and objectives of management for future operations, any statements concerning our future operations, financial conditions and prospects, and any statements of assumptions underlying any of the foregoing. These statements can sometimes be identified by the use of the forward-looking words such as "may," "believe," "will," "expect," "project," "estimate," "should," "anticipate," "plan," "goal," "continue," "seek," "pro forma," "forecast," "intend," "guidance," "optimistic," "aspire," "confident," other forms of these words or similar words or expressions or the negative thereof. Investors are cautioned not to unduly rely on such forward-looking statements. These forward-looking statements are subject to substantial risks and uncertainties that could cause our results or future business, financial condition, results of operations or performance to differ materially from our historical results or experiences or those expressed or implied in any forward-looking statements contained in this report. Investors should carefully review the information contained in, or incorporated by reference into, our annual report on Form 10-K for the year ended December 31, 2018 and subsequent reports on Forms 10-Q and 8-K for a description of certain of these risks and uncertainties. These forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

Unless otherwise indicated or otherwise required by the context, the terms "we," "our," "it," "its," "Company," "Edwards," and "Edwards Lifesciences" refer to Edwards Lifesciences Corporation and its subsidiaries.

Part I. Financial Information

Item 1. Financial Statements

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(in millions, except par value; unaudited)

|

| | | | | | | |

| June 30,

2019 | | December 31,

2018 |

ASSETS | |

| | |

|

Current assets | |

| | |

|

Cash and cash equivalents | $ | 726.8 |

| | $ | 714.1 |

|

Short-term investments (Note 5) | 207.5 |

| | 242.4 |

|

Accounts and other receivables, net of allowances of $8.8 and $8.9, respectively | 609.6 |

| | 537.3 |

|

Inventories (Note 2) | 624.9 |

| | 607.0 |

|

Prepaid expenses | 55.7 |

| | 54.3 |

|

Other current assets | 130.2 |

| | 131.8 |

|

Total current assets | 2,354.7 |

| | 2,286.9 |

|

Long-term investments (Note 5) | 412.9 |

| | 506.3 |

|

Property, plant, and equipment, net | 931.1 |

| | 867.5 |

|

Operating lease right-of-use assets (Note 3) | 71.2 |

| | — |

|

Goodwill | 1,173.9 |

| | 1,112.2 |

|

Other intangible assets, net | 385.6 |

| | 343.2 |

|

Deferred income taxes | 163.8 |

| | 174.0 |

|

Other assets | 80.3 |

| | 33.6 |

|

Total assets | $ | 5,573.5 |

| | $ | 5,323.7 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | |

|

Current liabilities | |

| | |

|

Accounts payable and accrued liabilities (Note 2) | $ | 673.2 |

| | $ | 876.6 |

|

Operating lease liabilities (Note 3) | 23.8 |

| | — |

|

Total current liabilities | 697.0 |

| | 876.6 |

|

Long-term debt | 594.1 |

| | 593.8 |

|

Contingent consideration liabilities (Note 7) | 193.3 |

| | 178.6 |

|

Taxes payable | 236.7 |

| | 259.4 |

|

Operating lease liabilities (Note 3) | 50.4 |

| | — |

|

Uncertain tax positions | 139.5 |

| | 124.9 |

|

Other long-term liabilities | 162.2 |

| | 150.0 |

|

Commitments and contingencies (Note 11) |

|

| |

|

|

Stockholders' equity | |

| | |

|

Preferred stock, $.01 par value, authorized 50.0 shares, no shares outstanding | — |

| | — |

|

Common stock, $1.00 par value, 350.0 shares authorized, 216.9 and 215.2 shares issued, and 207.9 and 207.7 shares outstanding, respectively | 216.9 |

| | 215.2 |

|

Additional paid-in capital | 1,512.3 |

| | 1,384.4 |

|

Retained earnings | 3,186.7 |

| | 2,694.7 |

|

Accumulated other comprehensive loss (Note 12) | (138.2 | ) | | (138.5 | ) |

Treasury stock, at cost, 9.0 and 7.5 shares, respectively | (1,277.4 | ) | | (1,015.4 | ) |

Total stockholders' equity | 3,500.3 |

| | 3,140.4 |

|

Total liabilities and stockholders' equity | $ | 5,573.5 |

| | $ | 5,323.7 |

|

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(in millions, except per share information; unaudited)

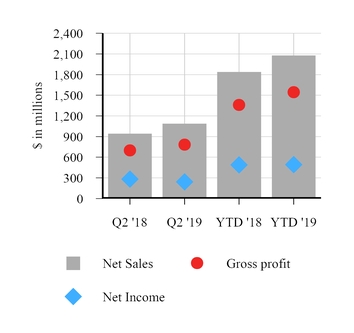

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

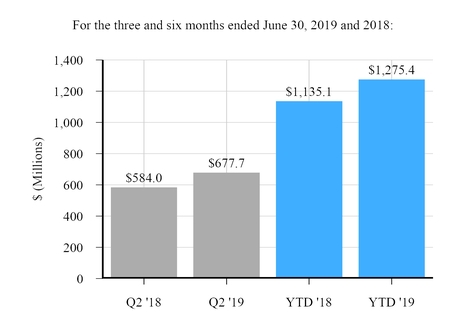

Net sales | $ | 1,086.9 |

| | $ | 943.7 |

| | $ | 2,079.9 |

| | $ | 1,838.5 |

|

Cost of sales | 304.0 |

| | 246.2 |

| | 535.8 |

| | 479.8 |

|

Gross profit | 782.9 |

| | 697.5 |

| | 1,544.1 |

| | 1,358.7 |

|

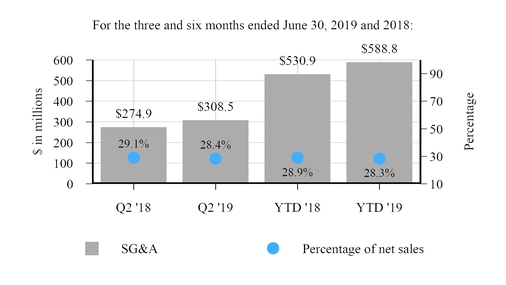

Selling, general, and administrative expenses | 308.5 |

| | 274.9 |

| | 588.8 |

| | 530.9 |

|

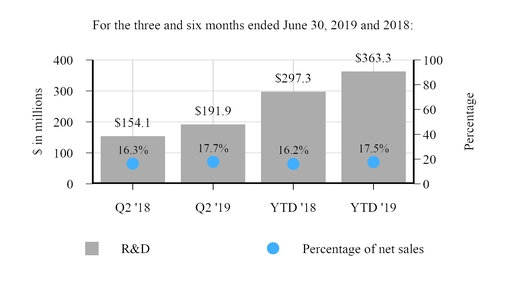

Research and development expenses | 191.9 |

| | 154.1 |

| | 363.3 |

| | 297.3 |

|

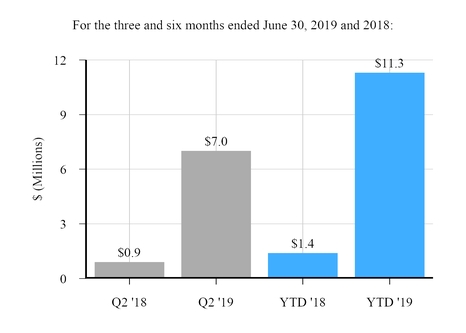

Intellectual property litigation expenses | 7.0 |

| | 5.5 |

| | 11.6 |

| | 11.2 |

|

Change in fair value of contingent consideration liabilities, net (Note 7) | 8.0 |

| | 10.9 |

| | 14.7 |

| | 14.7 |

|

Special charge (Note 4) | — |

| | — |

| | 24.0 |

| | — |

|

Operating income | 267.5 |

| | 252.1 |

| | 541.7 |

| | 504.6 |

|

Interest income, net | (2.4 | ) | | — |

| | (4.4 | ) | | (0.8 | ) |

Special gain (Note 4) | — |

| | — |

| | — |

| | (7.1 | ) |

Other (income) expense, net | (1.4 | ) | | 1.1 |

| | (3.2 | ) | | (2.0 | ) |

Income before provision for (benefit from) income taxes | 271.3 |

| | 251.0 |

| | 549.3 |

| | 514.5 |

|

Provision for (benefit from) income taxes | 29.0 |

| | (31.7 | ) | | 57.3 |

| | 25.2 |

|

Net income | $ | 242.3 |

| | $ | 282.7 |

| | $ | 492.0 |

| | $ | 489.3 |

|

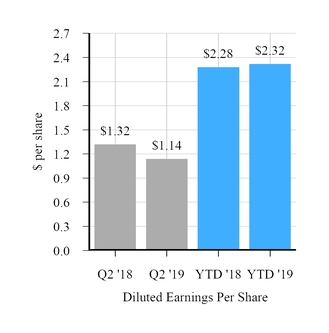

Share information (Note 13) | |

| | |

| | |

| | |

|

Earnings per share: | |

| | |

| | |

| | |

|

Basic | $ | 1.16 |

| | $ | 1.35 |

| | $ | 2.37 |

| | $ | 2.33 |

|

Diluted | $ | 1.14 |

| | $ | 1.32 |

| | $ | 2.32 |

| | $ | 2.28 |

|

Weighted-average number of common shares outstanding: | |

| | |

| | |

| | |

|

Basic | 208.1 |

| | 209.5 |

| | 208.0 |

| | 209.8 |

|

Diluted | 212.1 |

| | 214.0 |

| | 212.1 |

| | 214.5 |

|

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME

(in millions; unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Net income | $ | 242.3 |

| | $ | 282.7 |

| | $ | 492.0 |

| | $ | 489.3 |

|

Other comprehensive income (loss), net of tax (Note 12): | | | | | | | |

Foreign currency translation adjustments | 9.5 |

| | (66.2 | ) | | (3.6 | ) | | (32.9 | ) |

Unrealized (loss) gain on cash flow hedges | (9.0 | ) | | 33.5 |

| | (1.8 | ) | | 23.8 |

|

Defined benefit pension plans | — |

| | 0.2 |

| | (0.1 | ) | | 0.5 |

|

Unrealized gain (loss) on available-for-sale investments | 2.2 |

| | 2.1 |

| | 5.5 |

| | (4.0 | ) |

Reclassification of net realized investment loss to earnings | 0.3 |

| | 0.9 |

| | 0.3 |

| | 2.3 |

|

Other comprehensive income (loss) | 3.0 |

| | (29.5 | ) | | 0.3 |

| | (10.3 | ) |

Comprehensive income | $ | 245.3 |

| | $ | 253.2 |

| | $ | 492.3 |

| | $ | 479.0 |

|

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(in millions; unaudited) |

| | | | | | | |

| Six Months Ended

June 30, |

| 2019 | | 2018 |

Cash flows from operating activities | |

| | |

|

Net income | $ | 492.0 |

| | $ | 489.3 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

|

Depreciation and amortization | 42.3 |

| | 38.3 |

|

Non-cash operating lease cost | 11.8 |

| | — |

|

Stock-based compensation (Note 9) | 43.1 |

| | 37.6 |

|

Inventory reserves | 46.2 |

| | — |

|

Change in fair value of contingent consideration liabilities, net (Note 7) | 14.7 |

| | 14.7 |

|

Deferred income taxes | 12.9 |

| | 18.9 |

|

Purchase of intellectual property (Note 4) | 24.0 |

| | — |

|

Other | (7.7 | ) | | 2.0 |

|

Changes in operating assets and liabilities: | |

| | |

|

Accounts and other receivables, net | (89.2 | ) | | 2.6 |

|

Inventories | (61.9 | ) | | (20.5 | ) |

Accounts payable and accrued liabilities | (190.6 | ) | | (89.2 | ) |

Income taxes | (3.5 | ) | | (188.9 | ) |

Prepaid expenses and other current assets | 3.9 |

| | (11.5 | ) |

Other | 4.7 |

| | (1.8 | ) |

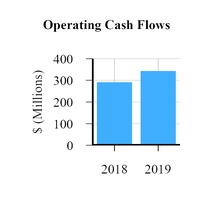

Net cash provided by operating activities | 342.7 |

| | 291.5 |

|

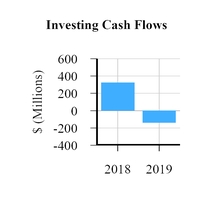

Cash flows from investing activities | |

| | |

|

Capital expenditures | (106.8 | ) | | (96.0 | ) |

Purchases of held-to-maturity investments (Note 5) | (30.0 | ) | | — |

|

Proceeds from held-to-maturity investments (Note 5) | 50.0 |

| | 339.5 |

|

Purchases of available-for sale investments (Note 5) | (75.4 | ) | | — |

|

Proceeds from available-for-sale investments (Note 5) | 190.8 |

| | 101.1 |

|

Investments in intangible assets | (24.0 | ) | | (3.0 | ) |

Payment of contingent consideration | — |

| | (10.0 | ) |

Acquisition (Note 6) | (100.2 | ) | | — |

|

Payment for acquisition option | (35.0 | ) | | — |

|

Other | (7.2 | ) | | (6.4 | ) |

Net cash (used in) provided by investing activities | (137.8 | ) | | 325.2 |

|

Cash flows from financing activities | |

| | |

|

Proceeds from issuance of debt, net | 9.7 |

| | 685.8 |

|

Payments on debt and capital lease obligations | (20.2 | ) | | (522.2 | ) |

Purchases of treasury stock | (262.0 | ) | | (350.4 | ) |

Equity forward contract related to accelerated share repurchase agreement (Note 10) | — |

| | (80.0 | ) |

Proceeds from stock plans | 86.5 |

| | 84.3 |

|

Payment of contingent consideration | — |

| | (15.1 | ) |

Other | (1.0 | ) | | (2.2 | ) |

Net cash used in financing activities | (187.0 | ) | | (199.8 | ) |

Effect of currency exchange rate changes on cash and cash equivalents | (5.2 | ) | | (8.8 | ) |

Net increase in cash and cash equivalents | 12.7 |

| | 408.1 |

|

Cash and cash equivalents at beginning of period | 714.1 |

| | 818.3 |

|

Cash and cash equivalents at end of period | $ | 726.8 |

| | $ | 1,226.4 |

|

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions; unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | | | | | | | |

| Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

Balance at December 31, 2018 | 215.2 |

| | $ | 215.2 |

| | 7.5 |

| | $ | (1,015.4 | ) | | $ | 1,384.4 |

| | $ | 2,694.7 |

| | $ | (138.5 | ) | | $ | 3,140.4 |

|

Net income | |

| | |

| | |

| | |

| | |

| | 249.7 |

| | |

| | 249.7 |

|

Other comprehensive income, net of tax | |

| | |

| | |

| | |

| | |

| | |

| | (2.7 | ) | | (2.7 | ) |

Common stock issued under equity plans | 0.8 |

| | 0.8 |

| | |

| | |

| | 44.2 |

| | |

| | |

| | 45.0 |

|

Stock-based compensation expense | |

| | |

| | |

| | |

| | 20.8 |

| | |

| | |

| | 20.8 |

|

Purchases of treasury stock | |

| | |

| | 0.1 |

| | (5.7 | ) | |

|

| | |

| | |

| | (5.7 | ) |

Balance at March 31, 2019 | 216.0 |

| | $ | 216.0 |

| | 7.6 |

| | $ | (1,021.1 | ) | | $ | 1,449.4 |

| | $ | 2,944.4 |

| | $ | (141.2 | ) | | $ | 3,447.5 |

|

Net income |

|

| |

|

| |

|

| |

|

| |

|

| | 242.3 |

| |

|

| | 242.3 |

|

Other comprehensive income, net of tax |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | 3.0 |

| | 3.0 |

|

Common stock issued under equity plans | 0.9 |

| | 0.9 |

| |

|

| |

|

| | 40.6 |

| |

|

| |

|

| | 41.5 |

|

Stock-based compensation expense |

|

| |

|

| |

|

| |

|

| | 22.3 |

| |

|

| |

|

| | 22.3 |

|

Purchases of treasury stock |

|

| |

|

| | 1.4 |

| | (256.3 | ) | |

|

| |

|

| |

|

| | (256.3 | ) |

Balance at June 30, 2019 | 216.9 |

| | $ | 216.9 |

| | 9.0 |

| | $ | (1,277.4 | ) | | $ | 1,512.3 |

| | $ | 3,186.7 |

| | $ | (138.2 | ) | | $ | 3,500.3 |

|

| | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | | | | | | | |

| Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

Balance at December 31, 2017 | 212.0 |

| | $ | 212.0 |

| | 2.3 |

| | $ | (252.1 | ) | | $ | 1,166.9 |

| | $ | 1,962.1 |

| | $ | (132.7 | ) | | $ | 2,956.2 |

|

Impact to retained earnings from adoption of ASU 2016-16 and ASU 2018-02 | | | | | | | | | | | 10.4 |

| | (7.8 | ) | | 2.6 |

|

Balance at January 1, 2018 | 212.0 |

| | 212.0 |

| | 2.3 |

| | (252.1 | ) | | 1,166.9 |

| | 1,972.5 |

| | (140.5 | ) | | 2,958.8 |

|

Net income | |

| | |

| | |

| | |

| | |

| | 206.6 |

| | |

| | 206.6 |

|

Other comprehensive loss, net of tax | |

| | |

| | |

| | |

| | |

| | |

| | 19.2 |

| | 19.2 |

|

Common stock issued under equity plans | 1.0 |

| | 1.0 |

| | |

| | |

| | 43.8 |

| | |

| | |

| | 44.8 |

|

Stock-based compensation expense | |

| | |

| | |

| | |

| | 18.4 |

| | |

| | |

| | 18.4 |

|

Purchases of treasury stock | |

| | |

| | | | (2.1 | ) | | | | |

| | |

| | (2.1 | ) |

Balance at March 31, 2018 | 213.0 |

| | $ | 213.0 |

| | 2.3 |

| | $ | (254.2 | ) | | $ | 1,229.1 |

| | $ | 2,179.1 |

| | $ | (121.3 | ) | | $ | 3,245.7 |

|

Net income |

|

| |

|

| |

|

| |

|

| |

|

| | 282.7 |

| |

|

| | 282.7 |

|

Other comprehensive loss, net of tax |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | (29.5 | ) | | (29.5 | ) |

Common stock issued under equity plans | 1.0 |

| | 1.0 |

| |

|

| |

|

| | 38.5 |

| |

|

| |

|

| | 39.5 |

|

Stock-based compensation expense |

|

| |

|

| |

|

| |

|

| | 19.2 |

| |

|

| |

|

| | 19.2 |

|

Shares issued in payment for contingent consideration liabilities |

|

| |

|

| | (0.3 | ) | | 32.2 |

| | 2.7 |

| |

|

| |

|

| | 34.9 |

|

Purchases of treasury stock |

|

| |

|

| | 2.8 |

| | (348.3 | ) | | (80.0 | ) | |

|

| |

|

| | (428.3 | ) |

Balance at June 30, 2018 | 214.0 |

| | $ | 214.0 |

| | 4.8 |

| | $ | (570.3 | ) | | $ | 1,209.5 |

| | $ | 2,461.8 |

| | $ | (150.8 | ) | | $ | 3,164.2 |

|

1. BASIS OF PRESENTATION

The accompanying interim consolidated condensed financial statements and related disclosures have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") and should be read in conjunction with the consolidated financial statements and notes included in Edwards Lifesciences Corporation's Annual Report on Form 10-K for the year ended December 31, 2018. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") have been condensed or omitted.

In the opinion of management, the interim consolidated condensed financial statements reflect all adjustments considered necessary for a fair statement of the interim periods. All such adjustments are of a normal, recurring nature. The results of operations for the interim periods are not necessarily indicative of the results of operations to be expected for the full year.

Recently Adopted Accounting Standards

In February 2016, the Financial Accounting Standards Board ("FASB") issued an amendment to the guidance on leases. The amendment improves transparency and comparability among companies by recognizing lease assets and lease liabilities on the balance sheet and by disclosing key information about leasing arrangements. The guidance was effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach was required upon adoption. Reporting entities could elect to adjust comparative periods and record the cumulative effect adjustment at the beginning of the earliest comparative period, or to not adjust comparative periods and record the cumulative effect adjustment at the effective date.

The Company adopted the new guidance as of the effective date of January 1, 2019 with no adjustments to the comparative period presented in the financial statements. In addition, the Company elected the package of practical expedients permitted under the transition guidance to not reassess (1) whether any expired or existing contracts are, or contain, leases, (2) the lease classification for expired or existing leases, and (3) initial direct costs for existing leases. The Company implemented internal controls and system solutions to enable the preparation and disclosure of financial information about its leasing arrangements upon adoption.

The adoption of the guidance resulted in the recognition of right-of-use ("ROU") assets and additional lease liabilities for operating leases of $58.7 million as of January 1, 2019. The guidance did not have an impact on the Company's consolidated condensed statements of operations. See Note 3 for disclosures related to the Company's leases.

2. OTHER CONSOLIDATED FINANCIAL STATEMENT DETAILS

Composition of Certain Financial Statement Captions

Components of selected captions in the consolidated condensed balance sheets consisted of the following (in millions):

|

| | | | | | | |

| June 30, 2019 | | December 31, 2018 |

Inventories | | | |

Raw materials | $ | 120.7 |

| | $ | 111.5 |

|

Work in process | 164.4 |

| | 144.8 |

|

Finished products | 339.8 |

| | 350.7 |

|

| $ | 624.9 |

| | $ | 607.0 |

|

At June 30, 2019 and December 31, 2018, $128.6 million and $106.5 million, respectively, of the Company's finished products inventories were held on consignment. During the three months ended June 30, 2019, the Company recorded a $46.2 million charge to "Cost of Sales," primarily comprised of the write off of inventory related to strategic decisions regarding its transcatheter aortic valve portfolio, including the decision to discontinue its CENTERA program.

|

| | | | | | | |

| June 30, 2019 | | December 31, 2018 |

Accounts payable and accrued liabilities | |

| | |

|

Accounts payable | $ | 151.0 |

| | $ | 134.0 |

|

Employee compensation and withholdings | 197.8 |

| | 226.1 |

|

Taxes payable (Note 14) | 14.6 |

| | 31.3 |

|

Property, payroll, and other taxes | 39.2 |

| | 39.5 |

|

Research and development accruals | 55.8 |

| | 48.9 |

|

Accrued rebates | 82.5 |

| | 80.0 |

|

Fair value of derivatives | 4.6 |

| | 4.4 |

|

Accrued marketing expenses | 15.5 |

| | 22.3 |

|

Litigation and insurance reserves | 19.0 |

| | 196.7 |

|

Accrued relocation costs | 13.0 |

| | 11.3 |

|

Accrued professional services | 9.4 |

| | 11.0 |

|

Accrued realignment reserves | 17.0 |

| | 6.8 |

|

Other accrued liabilities | 53.8 |

| | 64.3 |

|

| $ | 673.2 |

| | $ | 876.6 |

|

Supplemental Cash Flow Information

(in millions)

|

| | | | | | | |

| Six Months Ended

June 30, |

| 2019 | | 2018 |

Cash paid during the year for: | | | |

Income taxes | $ | 45.2 |

| | $ | 195.1 |

|

Amounts included in the measurement of lease liabilities: | | | |

Operating cash flows from operating leases | $ | 12.7 |

| | $ | — |

|

Non-cash investing and financing transactions: | |

| | |

|

Fair value of shares issued in payment for contingent consideration liabilities | $ | — |

| | $ | 34.3 |

|

Right-of-use assets obtained in exchange for new lease liabilities | $ | 23.5 |

| | $ | — |

|

Capital expenditures accruals | $ | 21.8 |

| | $ | 14.5 |

|

3. LEASES

The Company determines whether a contract is, or contains, a lease at inception. ROU assets represent the Company’s right to use an underlying asset during the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at lease commencement based upon the estimated present value of unpaid lease payments over the lease term. The Company uses its incremental borrowing rate based on the information available at lease commencement in determining the present value of unpaid lease payments. ROU assets also include any lease payments made at or before lease commencement and any initial direct costs incurred, and exclude any lease incentives received.

The Company determines the lease term as the noncancellable period of the lease, and may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Leases with a term of 12 months or less are not recognized on the balance sheet. Certain of the Company’s leases include variable lease payments that are based on costs incurred or actual usage, or adjusted periodically based on an index or a rate. The Company’s leases do not contain any residual value guarantees.

The Company accounts for the lease and non-lease components as a single lease component for all of its leases except vehicle leases, for which the lease and non-lease components are accounted for separately.

Operating leases are included in “Operating Lease Right-of-Use Assets” and “Operating Lease Liabilities” on the Company’s consolidated condensed balance sheets.

The Company leases certain office space, manufacturing facilities, land, apartments, warehouses, vehicles, and equipment with remaining lease terms ranging from less than 1 year to 22 years, some of which include options to extend or terminate the leases.

Operating lease costs for the three and six months ended June 30, 2019 were $7.2 million and $13.5 million, respectively. Short-term and variable lease costs were not material for the three and six months ended June 30, 2019.

Supplemental balance sheet information related to operating leases was as follows (in millions, except lease term and discount rate):

|

| | | |

| June 30,

2019 |

Operating lease ROU assets | $ | 71.2 |

|

| |

Operating lease liabilities, current portion | $ | 23.8 |

|

Operating lease liabilities, long-term portion | 50.4 |

|

Total operating lease liabilities | $ | 74.2 |

|

Maturities of operating lease liabilities at June 30, 2019 were as follows (in millions):

|

| | | |

2019 | $ | 13.2 |

|

2020 | 23.4 |

|

2021 | 15.6 |

|

2022 | 10.5 |

|

2023 | 7.6 |

|

Thereafter | 10.0 |

|

Total lease payments | 80.3 |

|

Less: imputed interest | (6.1 | ) |

Total lease liabilities | $ | 74.2 |

|

| |

Weighted-average remaining lease term (in years) | 4.5 |

|

Weighted-average discount rate | 3.0 | % |

As of June 30, 2019, the Company had additional operating lease commitments of $8.0 million for office space that have not yet commenced. These leases will commence during 2019 with lease terms of 3 years to 7 years.

Disclosures related to periods prior to adopting the new lease guidance

Certain facilities and equipment are leased under operating leases expiring at various dates. Most of the operating leases contain renewal options. Total expense for all operating leases was $27.0 million, $27.3 million, and $22.9 million for the years 2018, 2017, and 2016, respectively.