EXHIBIT 3.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______.

(Name of small business issuer in its charter) |

|

| |||

(State of Incorporation) |

| (Commission File Number) |

| (IRS Employer Identification No.) |

(Address of principal executive offices) (Zip code)

Issuer’s telephone number: (

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the issuer as of June 30, 2021 was $

As of April 4, 2022 there were

TABLE OF CONTENTS

| 2 |

| Table of Contents |

PART I

Forward Looking Statements

This Form 10-K contains “forward-looking” statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include, but are not limited to, economic conditions generally and in the industries in which we may participate, competition within our chosen industry, including competition from much larger competitors, technological advances, our ability to obtain approval from the FDA or other governmental agencies and the failure by us to successfully develop business relationships. In addition, these forward-looking statements are subject, among other things, to our successful completion of the research and development of our technologies; successful commercialization and mass production of, among other things, the advanced materials, the nanomedicine, successful protection of our licensed patents; and effective significant industry competition from various entities whose research and development, financial, sales and marketing and other capabilities far exceeds ours. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to announce publicly revisions to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

ITEM 1. DESCRIPTION OF BUSINESS

OVERVIEW

COMPANY HISTORY AND OVERVIEW

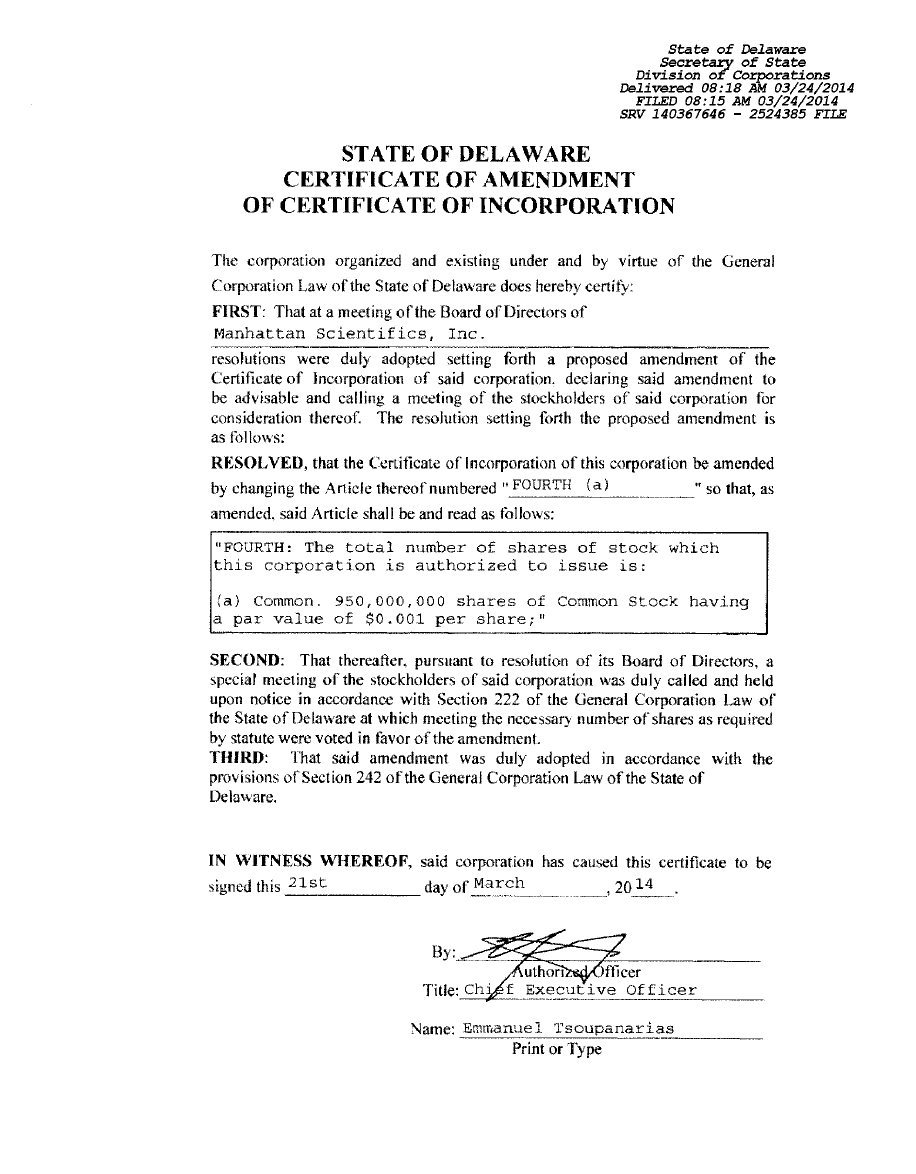

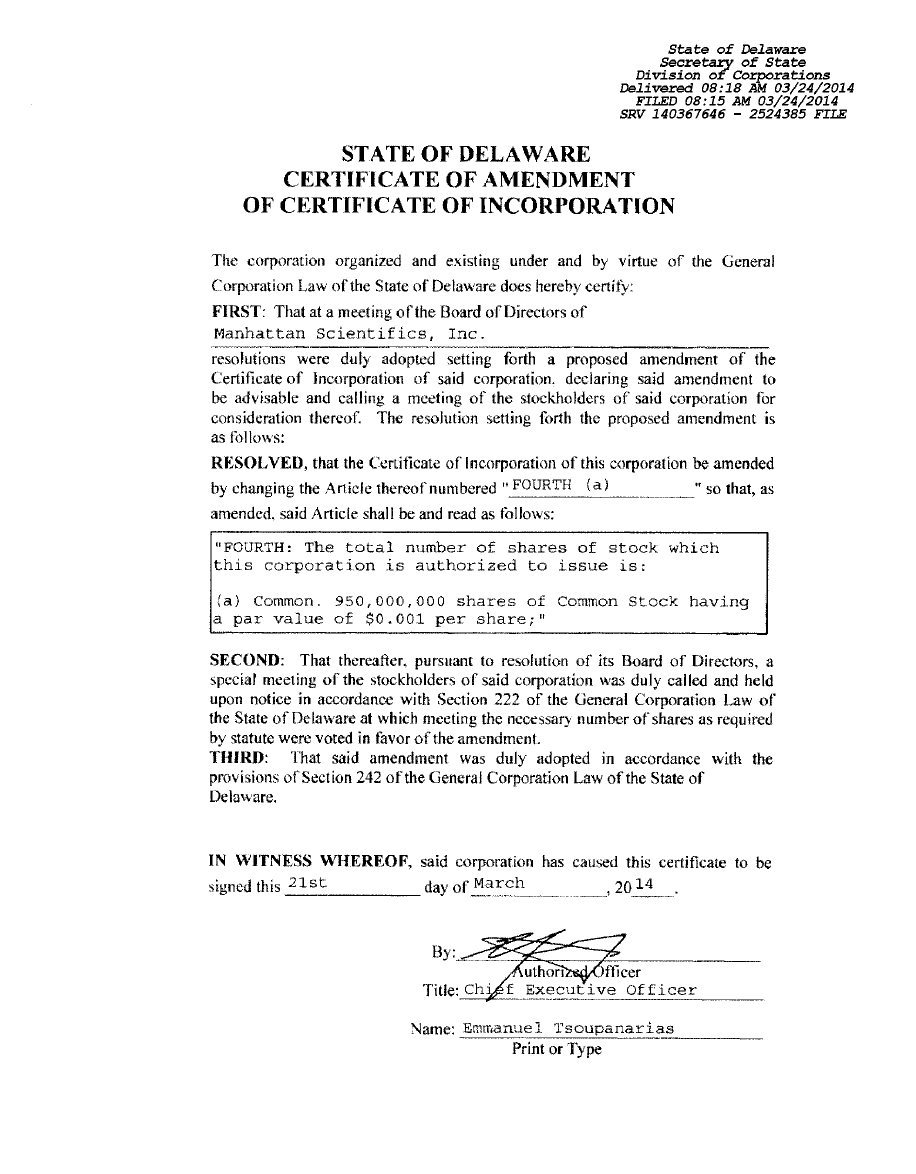

Manhattan Scientifics, Inc. (the “Company” or “Manhattan Scientifics”), a Delaware corporation, was established on July 31, 1992 and has one operating wholly-owned subsidiary: Metallicum, Inc., (“Metallicum”). The Company also holds a 5%, noncontrolling interest in Imagion Biosystems, Inc. (f/k/a Senior Scientific LLC) (“Imagion”).

Manhattan Scientifics, Inc. is focused on technology transfer and commercialization of these transformative technologies. The Company operates as a technology incubator that seeks to acquire, develop and commercialize life-enhancing technologies in various fields To achieve this goal, the Company continues to identify emerging technologies through strategic alliances with scientific laboratories, educational institutions, scientists and leaders in industry and government. The Company and its executives have a long-standing relationship with Los Alamos Laboratories in New Mexico.

In June 2008, we acquired Metallicum and its licensed patented technology. In January 2009, Metallicum was granted an exclusive license by The Los Alamos National Laboratory on patents related to nanostructured metals.

On May 31, 2011, we entered into an Agreement and Plan of Reorganization to acquire Senior Scientific. The total purchase price was 21,668,000 restricted shares of our common stock (less 7,667,000 shares previously issued pursuant to an option agreement). As a result of this acquisition, Senior Scientific owned patented technologies that can use biosafe nanoparticles and sensitive magnetic sensors to detect and measure cancer cells in biopsies or in the human body with the potential to transform how cancer is detected and treated. On November 17, 2016, Senior Scientific merged with and into Imagion, a Nevada company. Following the merger, Imagion held all of the liabilities, obligations and assets of Senior Scientific and the Company continued as the sole equity holder of Imagion. On June 30, 2017, Imagion completed its initial public offering and listing on the Australian Stock Exchange (ASX). As of December 31, 2020, the Company owns 53,516,508 shares of Imagion (1,000,000 restricted shares), now resulting in a noncontrolling interest of approximately 5% of Imagion’s issued and outstanding common stock decreased primarily as a result of dilutive issuances by Imagion. Based upon Imagion’s latest trading price of approximately $0.11 per share, the fair value of the Imagion shares is approximately $5,875,000.

OUR DEVELOPMENT MODEL

Our goal has been to influence the future through the development of potentially life changing technologies. Our business model is to: (i) identify significant technologies, (ii) acquire them or the rights to them, (iii) secure the services of inventors, engineers or other staff who were instrumental in their creation, (iv) provide or contract for suitable work facilities, laboratories, and other aids where appropriate, (v) prototype the technologies to demonstrate “proof of principle” feasibility, (vi) secure patent and or other intellectual property protection, (vii) secure early customers for product trials where feasible and appropriate, and (viii) commercialize through licenses, sales or cooperative efforts with other manufacturing and distribution firms.

Since our technologies are still in their development phase, the need for operating and acquisition capital is a continuous concern requiring the ongoing efforts of our management. The Company’s success will depend in part on its ability to obtain patents and license rights, maintain trade secrets, and operate without infringing on the proprietary rights of others, both in the United States and other countries. There can be no assurance that patents issued to or licensed by the Company will not be challenged, invalidated, or circumvented, or that the rights granted thereunder will provide proprietary protection or competitive advantages to the Company.

We utilize the intellectual property sale/licensing model, and not a production model, though management is opportunistic and is open to explore all methods leading to commercializing our technologies. We intend to consider all appropriate avenues for the commercialization of our technologies.

The Company is not engaged in the business of investing, reinvesting, or trading in securities. The Company has not sold some of its investments on the open market.

| 3 |

| Table of Contents |

DESCRIPTION OF TECHNOLOGIES

ADVANCED METALS

Our business model is based on licensing metals technology to metals manufacturers. Although competing commercial products are provided by existing specialty metals companies, the only competing processes for creating nanostructured metals are either limited or cannot be economically scaled. Metallicum does not yet face direct competition, but expects competition will emerge as the metal is commercialized.

In January 2009, we entered into a patent license agreement with Los Alamos National Security, LLC for the exclusive licensing use of certain technology relating to the manufacture and application of nanostructuring metals and alloys. Pursuant to such agreement we provided a non-refundable fee and 2,000,000 shares of our common stock with a fair market value of $33,000. Additionally, we are required to pay an annual license fee of $10,000 starting in February 2010 and royalties on future net sales.

The nanostructured metals technology may have wide implications for use in the medical device and prosthetics industries including dental implants, replacements for hips, shoulders, knees and cardio vascular stents. In December 2008, a manufacturing joint venture partner in Albuquerque, NM received U.S. Food and Drug Administration 510(k) clearance to market nanostructured titanium metal dental implants using our technology. This clearance positions us closer to our goal of commercializing our technology for nanostructured metals. We are in talks with many of the key manufacturers of dental implants and have signed material testing agreements with several manufacturers.

In September 2009, the Company entered into a contract with Carpenter to sell certain nanostructured metal technologies acquired from Metallicum, its wholly owned subsidiary, to Carpenter and to provide sub-license rights to Carpenter covering license agreements that the Company has from Los Alamos Laboratories. In January 2013, the Company entered into a licensing agreement with a party granting certain licensing rights to the Company’s nanostructured metal technology. On February 11, 2015, the Company and Carpenter entered into a Settlement Agreement and Mutual Release pursuant to which the parties provided a full release of one another, Carpenter paid the Company $8,000,000, Carpenter transferred to the Company all intellectual and physical property that was part of the original agreement, Carpenter agreed to provide follow-up technical assistance and Carpenter provided a list of all customers and contacts. Following the return of the Company’s nanostructured metal technology, the Company has commenced exploring strategic alternatives for its Metallicum division. At this time we are exploring and working with partner companies in the fields of titanium dental implants, titanium and magnesium medical devices, high voltage aluminum conductors as well as oil and gas field applications.

INTELLECTUAL PROPERTY / RESEARCH AND DEVELOPMENT

In June 2008, we acquired Metallicum and its licensed rights to patented technology. The technology is comprised of three US Patents (US Patent numbers 7152448, 6197129 and 6399215) for which Metallicum (subsequently, Manhattan) had been assigned an exclusive license rights by Los Alamos National Security LLC (LANL). Under the license rights, Metallicum had all rights, title and interest throughout the world in and to any and all inventions, original works of authorship, developments, concepts, know-how, and improvements on the patents or trade secrets whether or not patentable or registerable under copyright or similar laws. The purchase price paid for these licenses was $305,000, which represents its fair value. The Company obtained an exclusive license on two patents and a non-exclusive license on the third patent. The value attributable to license agreements is being amortized over the period of its estimated benefit period of 10 years.

Our ability to compete depends in part on the protection of and our ability to defend our proprietary technology and on the goodwill associated with our trade names, service marks and other proprietary rights. However, we do not know if current laws will provide us with sufficient enough protection that others will not develop technologies similar or superior to ours, or that third parties will not copy or otherwise obtain or use our technologies without our authorization.

The success of our business will depend, in part, to identify technology, obtain patents, protect and enforce patents once issued and operate without infringing on the proprietary rights of others. Our success will also depend on our ability to maintain exclusive rights to trade secrets and proprietary technology we own are currently developing and will develop. We can give no assurance that any issued patents will provide us with competitive advantages or will not be challenged by others, or that the patents of others will not restrict our ability to conduct business.

In addition, we rely on certain technology licensed with a perpetual term from the Los Alamos National Laboratory and may be required to license additional technologies in the future. We do not know if these third-party licenses will be available or will continue to be available to us on acceptable commercial terms or at all. The inability to enter into and maintain any of these licenses could have a material adverse effect on our business, financial condition or results of our operations.

Policing unauthorized use of our proprietary technology and other intellectual property rights could entail significant expense. In addition, we do not know if third parties will bring claims of copyright or trademark infringement against us or claim that our use of certain technologies violates a patent or other intellectual property. Any claims of infringement, with or without merit, could be time consuming and expensive to defend, result in costly litigation, divert management attention, require us to enter into costly royalty or licensing arrangements or prevent us from using important technologies or methods, any of which could have a material adverse effect on our business, financial condition or results of our operations.

| 4 |

| Table of Contents |

SALES AND MARKETING

Although our technologies presently are in the development stage, we are engaged in an early commercialization program intended to facilitate the transition from development to licensing, manufacturing and/or sale. This program consists of preliminary dialogues with potential strategic partners, investors, manufacturers, potential licensees and/or purchasers.

COMPETITION

As a result of our licensed technology, we do not have any direct competitors in our advanced materials operations. We may, however, face competition from leading researchers and manufacturers worldwide that develop competing technology.

With respect to our nanomedicine technology, our cancer detection technology will face competition primarily from companies such as Abbott Laboratories Inc., Cepheid Inc., Philips, GE Healthcare, Siemens, Gen-Probe Incorporated, MDxHealth SA, EpiGenomics AG, Roche Diagnostics and Sequenom, Inc.

Competitors may successfully challenge our licensed technology, produce similar products that do not infringe our licensed technology or produce products in countries where we have not applied for intellectual property protection. Many of these competitors may have longer operating histories and significantly greater financial, marketing and other resources than we have. Furthermore, competitors may introduce new products that address our potential markets. Competition could have a material adverse effect on our business, financial condition and results of our operations.

The markets in which we compete are highly competitive and constantly evolving. We believe that the principal competitive factors in our technology markets include without limitation:

· | capitalization; |

· | cost of product; |

· | first to market with product in market segment; |

· | strong intellectual portfolio; |

· | product reliability; |

· | strong customer base; and |

· | strong manufacturing and supplier relationships. |

CUSTOMERS AND SUPPLIERS

For the years ended December 31, 2021 and 2020, one customer generated all of our revenue. We did not have any significant suppliers.

EMPLOYEES

As of December 31, 2021, we had no full-time employees. We do not expect any significant change in the total number of employees in the near future. Most of our research and development work has been performed by employees of our various research and development independent contractors (see below). We have historically indirectly funded the salaries of these individuals through our contract research and development payments to their employers. Although not technically our employees, we have considered these individuals to be an integral part of our research and development team. None of our employees or contractors are members of any union or collective bargaining organization. We consider our relationships with independent contractor employees to be good.

As noted above, a significant portion of our research and development has been performed by independent contractors from whom we acquired or licensed certain technologies, and their various employees. Our independent contractors utilize a number of their own various employees to satisfy their research and development obligations to us, and their employees are considered to be part of our research and development team.

The Company’s officer and its directors spend substantially all of their time managing the Company’s business of developing and licensing its intellectual property in the metals industry.

ITEM 1A. RISK FACTORS

Item 1A Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| 5 |

| Table of Contents |

ITEM 2. DESCRIPTION OF PROPERTIES

Our principal executive office is at 244 Fifth Avenue, Suite 2341, New York, New York, 10001. We lease approximately 300 square feet of office space on a month-to-month basis. The aggregate annual rent for this office space was $719 in 2021.

Since October 2016, we lease an approximately 3,000 square foot office at 331 Corporate Circle, Golden, CO 80401. In June 2019, we entered into an assignment and assumption of lease with the landlord and another entity for two years and is set to expire in April 2021. The average aggregate annual rent for this space is $30,360.

We believe our facilities are adequate for our current and planned business operations.

ITEM 3. LEGAL PROCEEDINGS

We are subject from time to time to litigation, claims and suits arising in the ordinary course of business. As of December 31, 2021, we were not a party to any material litigation, claim or suit whose outcome could have a material effect on our financial statements other than the litigation described above which was subsequently settled.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 6 |

| Table of Contents |

PART II

ITEM 5. MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

We are currently trading on the OTCQB operated by www.otcmarkets.com. The following sets forth for the periods indicated, the high and low per share bid information for our common stock for the fiscal years ended December 31, 2021 and 2020, as reported by www.otcmarkets.com. Such high and low bid information reflects inter-dealer quotes, without retail mark-ups, mark-downs or commissions and may not represent actual transactions.

As of April 4, 2022, there were 559,281,064 shares of common stock of the issuer issued and outstanding and approximately 635 record shareholders.

DIVIDENDS

We have never paid any cash dividends. We presently intend to reinvest earnings, if any, to fund the development and expansion of our business and, therefore, do not anticipate paying cash dividends on our common stock in the foreseeable future. The declaration of cash dividends will be at the discretion of our board of directors and will depend upon our earnings, capital requirements, financial position, general economic conditions and other pertinent factors.

RECENT SALES OF UNREGISTERED SECURITIES

During the past two years, we have issued unregistered shares of common stock and options and warrants for the purchase of common stock in the following transactions in reliance on an exemption from registration pursuant to Section 4(2) of the Securities Act:

2021 and 2020

During the year ended December 31, 2020, the Company issued 1,500,000 shares of common stock for services valued at $24,000. The shares were valued based on the market price of the Company’s common shares of $0.016 on the grant date.

Securities Authorized for Issuance under Equity Incentive Plans

The 2000 Plan is administered by a committee of two or more members of the Board of Directors or, if no committee is appointed, then by the Board of Directors. The 2000 Plan allows for the issuance of incentive stock options (which, pursuant to Section 422 of the Internal Revenue Code, can only be granted to employees), non-qualified stock options, stock appreciation rights, stock awards, or stock bonuses. The committee, or the Board of Directors if there is no committee, determines the type of option granted, the exercise price, the option term, which may be no more than ten years, terms and conditions of exercisability and methods of exercise. Options must vest within ten-years. Under the 2000 Plan, the exercise price may not be less than fair market value on the date of grant for the incentive stock options. The 2000 Plan also allows for the granting of Stock Appreciation Rights. No Stock Appreciation Rights have been granted. The number of shares under the 2000 Plan available for grant at December 31, 2021 was 18,869,763.

In November 2004, our Board of Directors adopted the 2004 Consultant Stock Plan (the “2004 Plan”). The purpose of this 2004 Consultant Stock Plan is to advance our interests by helping us obtain and retain the services of persons providing consulting services upon whose judgment, initiative, efforts and/or services we are substantially dependent, by offering to or providing those persons with incentives or inducements affording such persons an opportunity to become owners of our capital stock. We reserved 2,000,000 shares of our Common Stock for awards to be made under the 2004 Plan. We filed a registration statement on Form S-8 with the SEC on November 26, 2004 to register the shares underlying the 2004 plan. The 2004 Plan is administered by a committee of two or more members of the Board of Directors or, if no committee is appointed, then by the Board of Directors. The committee or the Board of Directors if there is no committee, determines who is eligible to receive awards under the plan, grant awards and interpret the 2004 Plan. The number of shares under the 2004 Plan available for grant at December 31, 2021 was 500,000.

| 7 |

| Table of Contents |

On May 9, 2005, our Board of Directors adopted the 2005 Equity Compensation Plan (the “2005 Plan”). The purpose of this Plan is to provide incentives to attract, retain and motivate eligible persons whose present and potential contributions are important to our success, by offering them an opportunity to participate in the our future performance through awards of Options, the right to purchase Common Stock and Stock Bonuses. We reserved 10,000,000 shares of our Common Stock for awards to be made under the 2005 Plan. The 2005 Plan is administered by a committee of two or more members of the Board of Directors or, if no committee is appointed, then by the Board of Directors. The committee, or the Board of Directors if there is no committee, determines who is eligible to receive awards under the plan, grant awards and interpret the 2005 Plan. We filed a registration statement on Form S-8 with the SEC on June 8, 2005 to register the shares underlying the 2005 plan. The number of shares under the 2006 Plan available for grant at December 31, 2021 was -0-.

In January 2015, our Board of Directors adopted the 2015 Incentive Stock Plan (the “2015 Plan”). The purpose of this Plan is to provide incentive stock options (which, pursuant to Section 422 of the Internal Revenue Code, can only be granted to employees), non-qualified stock options, stock appreciation rights, stock awards, or stock bonuses. The committee, or the Board of Directors if there is no committee, determines the type of option granted, the exercise price, the option term, which may be no more than ten years, terms and conditions of exercisability and methods of exercise. Options must vest within ten-years. Under the 2015 Plan, the exercise price may not be less than fair market value on the date of grant for the incentive stock options. The 2015 Plan also allows for the granting of Stock Appreciation Rights. No Stock Appreciation Rights have been granted. The number of shares under the 2015 Plan available for grant at December 31, 2021 was 4,000,000.

Set forth in the table below is information regarding awards made through compensation plans or arrangements through December 31, 2021.

Equity Compensation Plan Information | ||||||||||||

| ||||||||||||

Plan category |

| Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

|

| Weighted-average exercise price of outstanding options, warrants and rights |

|

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| |||

Equity compensation plans approved by security holders |

|

| — |

|

|

| — |

|

|

| — |

|

Equity compensation plans not approved by security holders |

|

| — |

|

|

| — |

|

|

| 23,369,763 |

|

Total |

|

| — |

|

|

| — |

|

|

| 23,369,763 |

|

A summary of the Company’s stock option activity and related information is as follows:

|

| Number of Options |

|

| Exercise Price Per Share |

|

| Weighted Average Exercise Price |

|

| Number of Options Exercisable |

| ||||

Outstanding as of December 31, 2019 |

|

| 22,075,000 |

|

|

|

|

|

|

|

|

| 22,075,000 |

| ||

Granted |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 500,000 |

|

Exercised |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

Expired |

|

| (3,575,000 | ) |

|

| 0.07 |

|

|

| 0.07 |

|

|

| (3,575,000 | ) |

Outstanding as of December 31, 2020 |

|

| 18,500,000 |

|

|

|

|

|

|

|

|

|

|

| 18,500,000 |

|

Granted |

|

| 15,000,000 |

|

|

| 0.02 |

|

|

| 0.02 |

|

|

| 15,000,000 |

|

Exercised |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

Expired |

|

| (7,000,000 | ) |

|

| - |

|

|

| - |

|

|

| (7,000,000 | ) |

Outstanding as of December 31, 2021 |

|

| 26,500,000 |

|

|

|

|

|

|

|

|

|

|

| 26,500,000 |

|

| 8 |

| Table of Contents |

Exercise prices and weighted-average contractual lives of 26,500,000 stock options outstanding as of December 31, 2021 are as follows:

|

|

|

|

| Options Outstanding |

|

| Options Exercisable |

| |||||||||||||

Exercise Price |

|

| Number Outstanding |

|

| Weighted Average Remaining Contractual Life |

|

| Weighted Average Exercise Price |

|

| Number Exercisable |

|

| Weighted Average Exercise Price |

| ||||||

| $ | 0.02 |

|

|

| 15,500,000 |

|

|

| 8.80 |

|

| $ | 0.02 |

|

|

| 15,500,000 |

|

| $ | 0.02 |

|

| $ | 0.05 |

|

|

| 3,000,000 |

|

|

| 3.50 |

|

| $ | 0.05 |

|

|

| 3,000,000 |

|

| $ | 0.05 |

|

| $ | 0.06 |

|

|

| 5,000,000 |

|

|

| 4.35 |

|

| $ | 0.06 |

|

|

| 5,000,000 |

|

| $ | 0.06 |

|

| $ | 0.14 |

|

|

| 3,000,000 |

|

|

| 2.75 |

|

| $ | 0.14 |

|

|

| 3,000,000 |

|

| $ | 0.14 |

|

The fair value for options granted were determined using the Black-Scholes option-pricing model. At December 31, 2021, the 26,500,000 outstanding options had an aggregate intrinsic value of $1,340,000.

Warrants:

The Company issued the following warrants at the corresponding weighted average exercise price as of December 31, 2020.

|

| Warrants |

|

| Weighted average Exercise Price |

| ||

Outstanding as of December 31, 2019 |

|

| 9,700,000 |

|

| $ | 0.07 |

|

Issued/Vested |

|

| - |

|

|

| - |

|

Cancelled/Expired |

|

| (9,700,000 | ) |

|

| (0.07 | ) |

Outstanding as of December 31, 2020 |

|

| - |

|

| $ | - |

|

Issued/Vested |

|

| - |

|

|

| - |

|

Exercised |

|

| - |

|

|

| - |

|

Cancelled/Expired |

|

| - |

|

|

| - |

|

Outstanding as of December 31, 2021 |

|

| - |

|

| $ | - |

|

ITEM 6. SELECTED FINANCIAL DATA

N/A

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis should be read in conjunction with our financial statements and accompanying notes appearing elsewhere in this Form 10-K.

OVERVIEW

Manhattan Scientifics, Inc. (the “Company” or “Manhattan Scientifics”), a Delaware corporation, was established on July 31, 1992 and has one operating wholly-owned subsidiary: Metallicum, Inc., (“Metallicum”). Manhattan Scientifics is focused on technology transfer and commercialization of these transformative technologies.

The Company operates as a technology incubator that seeks to acquire, develop and commercialize life-enhancing technologies in various fields, with emphasis in the areas of nanotechnology. Nanotechnology is the use and manipulation of matter on an atomic and molecular scale. To achieve this goal, the Company is actively seeking to identify emerging technologies through strategic alliances with scientific laboratories, educational institutions, scientists and leaders in industry and government. The Company and its executives have a long-standing relationship with Los Alamos Laboratories in New Mexico.

Metallicum

In June 2008, we acquired Metallicum and its licensed patented technology. We entered into a stock purchase agreement with Metallicum to acquire all of the outstanding capital in exchange for 15,000,000 restricted shares of our common stock. An additional 15,000,000 shares of our common stock will be payable to Metallicum in the event of meeting certain milestones. On December 31, 2011, one milestone was met. Metallicum was granted an exclusive license by The Los Alamos National Laboratory on patents related to nanostructured metals. In September 2009, we entered into a technology transfer agreement and sale with Carpenter Technology Corporation, (“Carpenter”) wherein Carpenter was to fully develop, manufacture and market a new class of high strength metals. On February 11, 2015, the Company and Carpenter entered into a Settlement Agreement and Mutual Release pursuant to which the parties provided a full release of one another, Carpenter paid the Company $8,000,000, Carpenter transferred to the Company all intellectual and physical property that was part of the original agreement, Carpenter agreed to provide follow-on technical assistance and Carpenter provided a list of all customers and contacts.

| 9 |

| Table of Contents |

On May 1, 2019, Manhattan Scientifics, Inc., a Delaware corporation (the “Company”), and Metallicum, Inc., a wholly-owned subsidiary of the Company, entered into an Overarching Agreement with a non-affiliated third party (“Third Party”), providing for an exclusive license by the Company of its ECAP technology to the Third Party for a term of 17 years unless terminated sooner, a sublicense by the Company to the Third Party of its rights under that certain Exclusive Field-of-Use Patent License Agreement dated January 5, 2009 entered with The Los Alamos National Laboratory for a term until the expiration of the last valid claim to expire of the patents pursuant to such agreement and the sale by the Company of ECAP-C machines to the Third party. As part of the above license agreements, the Company will receive royalty payments, including minimum payments, based on a percentage of the Third Party’s sales. The Company anticipates royalty income as the nanotitanium is commercialized for use in medial prosthetics. Royalties will be 10% on sales of licensed dental products and an average of 5% in all other sales of licensed products. We expect to start earning royalties in 2023.

Imagion

On May 31, 2011, we entered into an Agreement and Plan of Reorganization to acquire Senior Scientific. The total purchase price was 21,668,000 restricted shares of our common stock (less 7,667,000 shares previously issued pursuant to an option agreement). As a result of this acquisition, Senior Scientific owned patented technologies that can use biosafe nanoparticles and sensitive magnetic sensors to detect and measure cancer cells in biopsies or in the human body with the potential to transform how cancer is detected and treated. On November 17, 2016, Senior Scientific merged with and into Imagion, a Nevada company. Following the merger, Imagion held all of the liabilities, obligations and assets of Senior Scientific and the Company continued as the sole equity holder of Imagion. On November 29, 2016, the Company announced a plan to have Imagion pursue an IPO and listing on the Australian Stock Exchange (ASX).

As of December 31, 2021, Manhattan Scientifics presently owns 52,516,508 shares of Imagion, with a fair market value of approximately $2,901,000, based upon the closing price per share of Imagion common stock on the Australian Stock Exchange. The Company accounts for its investment in Imagion in accordance with ASC 825-10 and elected fair value option. We initially held 31% of the total issued and outstanding shares of Imagion and had one seat on the Board of Directors of Imagion. The guidance allows entities to elect to measure certain financial assets and financial liabilities (as well as certain nonfinancial instruments that are similar to financial instruments) at fair value. Investments over which an investor has the ability to exercise significant influence are eligible for the fair value option as they represent recognized financial assets. When the fair value option is elected for an instrument, all subsequent changes in fair value for that instrument are reported in earnings. As of December 31, 2021, we hold approximately 5% of the total issued and outstanding shares of Imagion and no longer have a seat on the Board of Directors of Imagion.

Novint

We made an investment in Novint Technologies Inc. (“Novint”) in 2001. Novint is currently engaged in the development and sale of 3D haptics products and equipment. Haptics refers to one’s sense of touch and Novint’s focus is in the consumer interactive computer gaming market. The Company owns 1,028,425 shares of Novint’s common stock. The fair value of the Novint shares are not recorded on the balance sheet as of December 31, 2021.

RESULTS OF OPERATIONS

YEAR ENDED DECEMBER 31, 2021 COMPARED TO YEAR ENDED DECEMBER 31, 2020

REVENUES. In the year ended December 31, 2021, we recognized $50,000 in revenue compared to $50,000 of revenue recognized for the year ended December 31, 2020.

GENERAL AND ADMINISTRATIVE. General and administrative expenses consist of consultants, contractors, accounting, legal, travel, rent, telephone and other day-to-day operating expenses. General and administrative expenses were $727,000 for the year ended December 31, 2021 compared with $714,000 for the year ended December 31, 2020. The primary increase in general and administrative expense was the result of the increase in computer expenses and filing expenses. During the year ended, the officers and directors total compensation was $531,000 of which a total of $255,000 was paid to two individuals that are an officer and directors of the Company and the unpaid balance is recorded in accrued expenses – related party.

RESEARCH AND DEVELOPMENT. Research and development expenses consist of consultants and contractors. Research and development expenses were $10,000 for the year ended December 31, 2021 compared with $11,000 for the year ended December 31, 2020.

OTHER INCOME AND (EXPENSES). Total other income (expense) for the year ended December 31, 2021 totaled ($2,952,000), compared to the other income of $4,989,000 for the year ended December 31, 2020. This is primarily attributable to the loss on fair value adjustments of its investment in Imagion partially offset in part by gain on settlement of legal fees.

INCOME (LOSS). As of the year ended December 31, 2021, the Company has net loss of $3,639,000, compared to the net income of $4,314,000 for the year ended December 31, 2020. This is primarily attributable to the loss on fair value adjustment of investment in Imagion, offset in part by gain on forgiveness of debt.

| 10 |

| Table of Contents |

LIQUIDITY AND PLAN OF OPERATIONS

Stockholders’ equity totaled $1,035,000 on December 31, 2021 and the working capital deficit was $(684,000) on such date. We had a decrease of $121,000 in cash and cash equivalents for the year ended December 31, 2021.

Based upon current projections, our principal cash requirements for the next 12 months consists of (1) fixed expenses, including payroll, and professional services and (2) variable expenses, including technology research and development, milestone payments and intellectual property protection, and additional scientific consultants. As of December 31, 2021, we had $232,000 in cash. We believe our current cash position may not be sufficient to maintain our operations for the next twelve months. Accordingly, we may need to engage in equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing that we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed.

On October 17, 2019, we executed a secured note with our only independent director for $100,000 and a secured note with an unrelated party for $50,000. The secured notes are due on October 17, 2022. The Company agreed that the notes bear interest at 10% per annum, to be paid in advance with shares of Imagion Biosystems Limited common stock (“IBX”), calculated at $0.015 per share or 3,000,000 shares of IBX. We currently do not plan any further sale of transfer of IBX common stock to raise funds for operations. To fund operations, we plan on relying on payments of $300,000, to be collected during the next two years in equal increments from the sale of assets in 2019 and future royalties from the Metallicum license.

CASH FLOW INFORMATION

The Company had cash and cash equivalents of approximately $232,000 and $353,000 at December 31, 2021 and 2020, respectively. This represents an decrease in cash of $121,000.

OPERATING ACTIVITIES

The Company used approximately $421,000 of cash for operating activities in the year ended December 31, 2021 as compared to using $388,000 of cash for operating activities in the year ended December 31, 2020. The reason for the increase in cash used for operating activities is a lower increase in current liabilities partially offset by a lower net loss after adjustment for non-cash items.

INVESTING ACTIVITIES

The Company received approximately $300,000 of cash for investing activities in the year ended December 31, 2021 as compared to receiving $480,000 of cash for investing activities in the year ended December 31, 2020. This decrease in cash received in investing activities, is primarily attributed to proceeds from sale of investment of Imagion Biosystems shares in the prior year, but not in the current year and sale of assets.

FINANCING ACTIVITIES

The Company received $0 of cash for financing activities in the year ended December 31, 2021 and 2020.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amount of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. A significant estimate includes the carrying value of our patents, fair value of our common stock, assumptions used in calculating the value of stock options, depreciation and amortization.

License Agreements

In 2008, the Company obtained licenses to the rights of certain patents regarding nano-structured materials developed by another company as a result of the acquisition of Metallicum. The purchase price paid for these licenses was $305,000, which represents its fair value. The Company obtained an exclusive license on two patents and a non-exclusive license on the third patent. The value attributable to license agreements is being amortized over the period of its estimated benefit period of 10 years. Under the terms of the agreement, the Company may be required to pay royalties, as defined, to the licensors.

| 11 |

| Table of Contents |

In 2009, the Company entered into a patent license agreement with Los Alamos National Security LLC for the exclusive use of certain technology relating to the manufacture and application of nanostructuring metals and alloys. The value attributable to license agreements is being amortized over the period of its estimated benefit period of 10 years. Under the terms of the agreement the Company is required to pay an annual license fee of $10,000 and, may be required to pay royalties, as defined, to the licensors.

Revenue Recognition

The Company recognizes revenue in accordance with generally accepted accounting principles as outlined in the Financial Accounting Standard Board’s (“FASB”) Accounting Standards Codification (“ASC”) 606, Revenue From Contracts with Customers, which consists of five steps to evaluating contracts with customers for revenue recognition: (i) identify the contract with the customer; (ii) identity the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price; and (v) recognize revenue when or as the entity satisfied a performance obligation.

Revenue recognition occurs at the time we satisfy a performance obligation to our customers, when control transfers to customers, provided there are no material remaining performance obligations required of the Company or any matters of customer acceptance. We only record revenue when collectability is probable.

Marketable Securities:

The Company considers securities with original maturities of greater than 90 days to be available for sale securities. Securities under this classification are recorded at fair value and unrealized gains and losses within other income (loss). The estimated fair value of the available for sale securities is determined based on quoted market prices or rates for similar instruments. In addition, the cost of debt securities in this category is adjusted for amortization of premium and accretion of discount to maturity. For available for sale debt securities in an unrealized loss position, the Company assesses whether it intends to sell or if it is more likely than not that the Company will be required to sell the security before recovery of its amortized cost basis. If either of the criteria regarding intent or requirement to sell is met, the security’s amortized cost basis is written down to fair value. If the criteria are not met, the Company evaluates whether the decline in fair value has resulted from a credit loss or other factors. In making this assessment, management considers, among other factors, the extent to which fair value is less than amortized cost, any changes to the rating of the security by a rating agency, and adverse conditions specifically related to the security. If this assessment indicates that a credit loss exists, the present value of cash flows expected to be collected from the security are compared to the amortized cost basis of the security. If the present value of the cash flows expected to be collected is less than the amortized cost basis, a credit loss exists and an allowance for credit losses is recorded for the credit loss, limited by the amount that the fair value is less than the amortized costs basis. Any impairment that has not been recorded through an allowance for credit losses is recognized in other income (loss). For the year ended December 31, 2021, no allowance was recorded for credit losses.

Stock-Based Compensation:

In June 2018, FASB issued ASU No. 2018-07, Compensation – Stock Compensation (Topic 718),Improvements to Nonemployee Share Based Payment Accounting. The amendments in this Update expand the scope of stock compensation to include share-based payment transactions for acquiring goods and services from nonemployees. The guidance in this Update does not apply to transactions involving equity instruments granted to a lender or investor that provides financing to the issuer. The guidance is effective for fiscal years beginning after December 31, 2018 including interim periods within the fiscal year. The Company adopted with an effective date of January 1, 2019. Upon adoption, there was no material impact to the financial statements.

Due from the Sale of Assets:

Non-current assets are classified as held for sale if it is highly probably that they will be recovered primarily through sale rather than through continuing use.

Immediately before classification as held for sale, the assets are remeasured at the lower of their carrying amount and fair value less costs to sell. Any impairment loss on initial classification as held for sale and subsequent gains and losses on remeasurement are recognized in profit or loss. Gains are not recognized in excess of any cumulative impairment loss.

During the year ended December 31, 2019, the Company sold the assets held for sale that were presented on the balance sheet as of December 31, 2018. During the year ended December 31, 2018, the Company recorded impairment and adjusted the asset valuation to $1.2 million. On May 1, 2021 and 2020, the Company received $300,000 for sale of assets for a total of $1.2 million during the year ended December 31, 2019. The remaining $300,000 will be collected during the next two years in equal increments on the anniversary date of the agreement, May 1. As of December 31, 2021, the Company evaluated the collectability and determined that no allowance is needed at this time due to the payment history with this third party and the subsequent receipt of funds.

| 12 |

| Table of Contents |

Fair Value Measurements:

The Company recognized the fair value of financial instruments in accordance with FASB ASC 820, Fair Value Measurements and Disclosures, “Fair Value Measurements”, which provides a framework for measuring fair value under GAAP. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The standard also expands disclosures about instruments measured at fair value and establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1 — Quoted prices for identical assets and liabilities in active markets;

Level 2 — Quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

Level 3 — Valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

GOING CONCERN

As of December 31, 2021, the Company has an accumulated deficit of 68,520,000 and negative working capital of $684,000. Because of these conditions, the Company will require additional working capital to develop business operations. The Company intends to raise additional working capital through the continued licensing of its technology as well as to generate revenues for other services. There are no assurances that the Company will be able to achieve the level of revenues adequate to generate sufficient cash flow from operations to support the Company’s working capital requirements. To the extent that funds generated are insufficient, the Company will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available, the Company may not continue its operations.

As of the filing date, the Coronavirus (“COVID-19”) has caused significant volatility in global markets, including the market price of our securities. The demand for our products and services has decreased and the ability of our customers to make payments for the products and services they purchased has been negatively impacted.

These factors raise substantial doubt about the Company’s ability to continue within one year from the date of filing. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

The ability to continue as a going concern is dependent on out generating cash from the sale of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plan includes selling our equity securities and/or obtaining debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance the Company will be successful in these efforts.

OFF BALANCE SHEET ARRANGEMENTS

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations liquidity, capital expenditures or capital resources and would be considered material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a Small Reporting Company, we are not required to provide the information under Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

| 13 |

| Table of Contents |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

| F-1 |

| Table of Contents |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Manhattan Scientifics, Inc.:

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Manhattan Scientifics, Inc. ("the Company") as of December 31, 2021 and 2020, the related consolidated statements of operations, stockholders' equity (deficit), and cash flows for each of the the years in the two-year period ended December 31, 2021 and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2020, and the results of its operations and its cash flows each of the the years in the two-year period ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Explanatory Paragraph Regarding Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has an accumulated deficit, negative cash flows from operations, and negative working capital, which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there were no critical audit matters.

/s/

We have served as the Company's auditor since 2020.

April 5, 2022

| F-2 |

| Table of Contents |

MANHATTAN SCIENTIFICS, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

|

| December 31, |

|

| December 31, |

| ||

|

| 2021 |

| 2020 |

| |||

|

|

|

|

|

|

| ||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Prepaid expenses |

|

|

|

|

|

| ||

Due from the sale of assets - current portion |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Investment in equity securities |

|

|

|

|

|

| ||

Property and equipment, net |

|

|

|

|

|

| ||

Due from the sale of assets |

|

|

|

|

|

| ||

Other assets |

|

|

|

|

|

| ||

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

| $ |

|

| $ |

| ||

Accrued expenses - related parties |

|

|

|

|

|

| ||

Notes payable - related parties, net of discounts |

|

|

|

|

|

| ||

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

|

|

Notes payable - related parties, net of discounts |

|

|

|

|

|

| ||

Total long-term liabilities |

|

|

|

|

|

| ||

Total liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and Contingencies - Note 8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series D convertible preferred mandatory redeemable, authorized |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Capital stock $ |

|

|

|

|

|

|

|

|

Preferred, authorized |

|

|

|

|

|

| ||

Class A Convertible Preferred, authorized 182,525, |

|

|

|

|

|

| ||

Class B Convertible Preferred, authorized |

|

|

|

|

|

| ||

Class C Redeemable Convertible Preferred, authorized |

|

|

|

|

|

| ||

Common, authorized |

|

|

|

|

|

| ||

Additional paid-in-capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

Total stockholders' equity |

|

|

|

|

|

| ||

TOTAL LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these audited consolidated financial statements.

| F-3 |

| Table of Contents |

MANHATTAN SCIENTIFICS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| FOR THE YEARS ENDED |

| |||||

|

| DECEMBER 31, |

| |||||

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

| ||

Revenue |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Operating costs: |

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

|

|

|

| ||

Research and development |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total operating costs and expenses |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Loss from operations before other income and expenses |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Other income and (expenses): |

|

|

|

|

|

|

|

|

Gain (Loss) on fair value adjustment of investments |

|

| ( | ) |

|

|

| |

Gain on settlement of legal fees |

|

|

|

|

|

| ||

Interest expense |

|

| ( | ) |

|

| ( | ) |

Total other income (expense) |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

| $ | ( | ) |

| $ |

| |

|

|

|

|

|

|

|

|

|

INCOME (LOSS) PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding (Basic) |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Basic income (loss) per common share |

| $ | ( | ) |

| $ |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding (Diluted) |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Diluted income (loss) per common share |

| $ | ( | ) |

| $ |

| |

The accompanying notes are an integral part of these audited consolidated financial statements.

| F-4 |

| Table of Contents |

MANHATTAN SCIENTIFICS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

FOR THE YEARS ENDED DECEMBER 31, 2021 and 2020

|

| Preferred Stock - Series B |

|

| Preferred Stock - Series C |

|

| Common Stock |

|

| Additional |

|

|

|

|

| Total |

| ||||||||||||||||||

|

| $0.001 Par Value |

|

| $0.001 Par Value |

|

| $0.001 Par Value |

|

| Paid-In |

|

| Accumulated |

|

| Shareholders' Equity |

| ||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| (Deficit) |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

December 31, 2019 |

|

|

|

| $ |

|

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ | ( | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclassification of liability to equity |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comman stock payable for services |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020 |

|

|

|

| $ |

|

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| ( | ) |

|

| ( | ) | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2021 |

|

|

|

| $ |

|

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||||||

The accompanying notes are an integral part of these audited consolidated financial statements.

| F-5 |

| Table of Contents |

MANHATTAN SCIENTIFICS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| FOR THE YEARS ENDED |

| |||||

|

| DECEMBER 31, |

| |||||

|

| 2021 |

|

| 2020 |

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net income (loss) |

| $ | ( | ) |

| $ |

| |

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Common stock issued for services |

|

|

|

|

|

| ||

Depreciation and amortization |

|

|

|

|

|

| ||

Loss (Gain) on fair value adjustment of investments |

|

|

|

|

| ( | ) | |

Gain on settlement of legal fees |

|

|

|

|

|

| ||

Amortization of debt discount |

|

|

|

|

|

| ||

Changes in: |

|

|

|

|

|

|

|

|

Prepaid expenses |

|

| (3,000 | ) |

|

|

| |

Accounts payable and accrued expenses |

|

| ( | ) |

|

| ( | ) |

Accounts payable and accrued expenses - related party |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchase of fixed assets |

|

|

|

|

| ( | ) | |

Proceeds from sale of assets held for sale |

|

|

|

|

|

| ||

Proceeds from sale of investments |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH |

|

| ( | ) |

|

|

| |

CASH, BEGINNING OF PERIOD |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH, END OF PERIOD |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Interest paid |

| $ |

|

| $ |

| ||

Income taxes paid |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Reclassification of liabilities to equity |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these audited consolidated financial statements.

| F-6 |

| Table of Contents |

MANHATTAN SCIENTIFICS, INC. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2021

NOTE 1 – BASIS OF PRESENTATION

Manhattan Scientifics, Inc., a Delaware corporation (formerly Grand Enterprises, Inc) (“Grand”) was established on July 31, 1992 and has a wholly-owned subsidiary: Metallicum, Inc. (“Metallicum”). On June 12, 2008, the Company acquired Metallicum, Inc, for

Metallicum is a nanotechnology start-up company located in Colorado. Metallicum Inc. has focused on the development and manufacture of nanostructured metals for medical implants and other applications. Metallicum intends to establish manufacturing partner relationships with major Fortune 500 metals companies and strategic partnering with significant customers in the medical device & prosthetics industries as well as in auto, truck, & aircraft manufacturing industries. Metallicum’s initial products include nanostructured bulk metals and alloys in the form of rod, bar, wire and foil. The Company conducts its operations primarily in the United States.

Manhattan Scientifics purchased Metallicum to acquire its licensed rights to patented technology. The technology is comprised of three US Patents (US Patent numbers 7152448, 6197129 and 6399215) for which Metallicum (subsequently, Manhattan) had been assigned an exclusive license rights by Los Alamos National Security LLC (LANL). Under the license rights, Metallicum had all rights, title and interest throughout the world in and to any and all inventions, original works of authorship, developments, concepts, know-how, and improvements on the patents or trade secrets whether or not patentable or registrable under copyright or similar laws.

In January 2009, the Company entered into a patent license agreement with Los Alamos National Security, LLC for the exclusive licensing use of certain technology relating to the manufacture and application of nanostructuring metals and alloys. Pursuant to such agreement the Company provided a non-refundable fee and

In September 2009, the Company entered into a technology transfer agreement with Carpenter Technologies Corporation (“Carpenter”). Wherein Carpenter will fully develop, manufacture and market a new class of high strength metals under an exclusive technology transfer agreement from Manhattan Scientifics and the Los Alamos National Laboratory. The proprietary process will enable super-strength metals and alloys to make products that weigh far less than in the past and without significant cost premiums. On February 11, 2015, the Company entered into a Settlement Agreement and Mutual General Releases (the “Settlement Agreement”) with Carpenter Technology Corporation related to the agreement discussed in Note 7, pursuant to which the parties settled and released each other from any and all liabilities and claims related to the Carpenter Agreements.