UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PERSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the Year Ended December 31, 2016 |

|

|

Commission file number 000-29599 |

PATRIOT NATIONAL BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

|

Connecticut |

06-1559137 |

|

|

(State of Incorporation) |

(I.R.S. Employer Identification Number) |

|

|

|

|

900 Bedford Street, Stamford, Connecticut 06901

(Address of principal executive offices)

(203) 324-7500

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: Common Stock, par value $0.01 per share

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant in a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

|

Yes |

No |

X |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of 15(d) of the Securities Exchange Act of 1934.

|

Yes |

No |

X |

Check whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

|

Yes |

X |

No |

Check if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10K

|

Yes |

No |

X |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes |

X |

No |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company in Rule 12b-2 of the Exchange Act:

|

Large Accelerated Filer |

Accelerated Filer |

Non-Accelerated Filer |

Smaller Reporting Company |

X |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

|

Yes |

No |

X |

Aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2016 based on the last sale price as reported on the NASDAQ Global Market: $9.6 million

Number of shares of the registrant’s Common stock, $0.01 par value per share, 3,894,132 shares outstanding as of March 30, 2017.

Document Incorporated by Reference

Proxy or Information Statement relating to the registrant’s Annual Meeting of Shareholders to be held in 2017. (A definitive proxy or Information statement will be filed with the Securities and Exchange Commission within 120 days after the close of the Fiscal year covered by this form 10-K.)

Incorporated into part III of this Form 10-K.

PATRIOT NATIONAL BANCORP, INC.

2016 FORM 10-K ANNUAL REPORT

For the Year Ended December 31, 2016

TABLE OF CONTENTS

|

“SAFE HARBOR” STATEMENT UNDER PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 |

1 |

|

PART I |

2 |

|

ITEM 1. Business |

2 |

|

ITEM 1A. Risk Factors |

10 |

|

ITEM 1B. Unresolved Staff Comments |

17 |

|

ITEM 2. Properties |

18 |

|

ITEM 3. Legal Proceedings |

18 |

|

ITEM 4. Mine Safety Disclosures |

18 |

|

PART II |

19 |

|

ITEM 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

19 |

|

ITEM 6. Selected Financial Data |

21 |

|

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation |

22 |

|

ITEM 7A. Quantitative and Qualitative Disclosures about Market Risk |

39 |

|

ITEM 8. Financial Statements and Supplementary Data |

41 |

|

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

43 |

|

ITEM 9A. Controls and Procedures |

43 |

|

ITEM 9B. Other Information |

45 |

|

PART III |

46 |

|

ITEM 10. Directors, Executive Officers and Corporate Governance |

46 |

|

ITEM 11. Executive Compensation |

46 |

|

ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

46 |

|

ITEM 13. Certain Relationships and Related Transactions, and Director Independence |

47 |

|

ITEM 14. Principal Accountant Fees and Services |

47 |

|

Part IV |

48 |

|

ITEM 15. Exhibits and Financial Statement Schedules |

48 |

|

SIGNATURES |

108 |

“Safe Harbor” Statement Under Private Securities Litigation Reform Act of 1995

Certain statements contained in the Company’s public statements, including this one, and in particular in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may be forward-looking and subject to a variety of risks and uncertainties. These factors include, but are not limited to: (1) changes in prevailing interest rates which would affect the interest earned on the Company’s interest earning assets and the interest paid on its interest bearing liabilities; (2) the timing of re-pricing of the Company’s interest earning assets and interest bearing liabilities; (3) the effect of changes in governmental monetary policy; (4) the effect of changes in regulations applicable to the Company and the Bank and the conduct of its business; (5) changes in competition among financial service companies, including possible further encroachment of non-banks on services traditionally provided by banks; (6) the ability of competitors that are larger than the Company to provide products and services which it is impracticable for the Company to provide; (7) the state of the economy and real estate values in the Company’s market areas, and the consequent effect on the quality of the Company’s loans; (8) recent governmental initiatives that are expected to have a profound effect on the financial services industry and could dramatically change the competitive environment of the Company; (9) other legislative or regulatory changes, including those related to residential mortgages, changes in accounting standards, and Federal Deposit Insurance Corporation (“FDIC”) premiums that may adversely affect the Company; (10) the application of generally accepted accounting principles, consistently applied; (11) the fact that one period of reported results may not be indicative of future periods; (12) the state of the economy in the greater New York metropolitan area and its particular effect on the Company's customers, vendors and communities and other such factors, including risk factors, as may be described in the Company’s other filings with the Securities and Exchange Commission (the “SEC”).

Although the Company believes that it offers competitive loan and deposit products and has the resources needed for continued success, future revenues and interest spreads and yields cannot be reliably predicted. These trends may cause the Company to adjust its operations in the future. Because of the foregoing and other factors, recent trends should not be considered reliable indicators of future financial results or stock prices.

PART I

ITEM 1. Business

General

Patriot National Bancorp, Inc. (the “Company”), a Connecticut corporation, is a one-bank holding company for Patriot Bank, N.A, a national banking association headquartered in Stamford, Fairfield County, Connecticut (the “Bank”) (collectively, “Patriot”). The Bank received its charter and commenced operations as a national bank on August 31, 1994. The Bank has a total of ten branch offices comprised of eight branch offices located in Fairfield and New Haven Counties, Connecticut and two branch offices located in Westchester County, New York.

On March 11, 2003, the Company formed Patriot National Statutory Trust I (the “Trust”) for the sole purpose of issuing trust preferred securities and investing the proceeds in subordinated debentures issued by the Company. The Company primarily invested the funds from the issuance of the debt in the Bank. The Bank used the proceeds to fund general operations.

On October 15, 2010, pursuant to a Securities Purchase Agreement (the “Securities Purchase Agreement”), the Company issued and sold to PNBK Holdings LLC (“Holdings”), an investment limited liability company controlled by Michael Carrazza, 3.36 million shares of its common stock at a purchase price of $15.00 per share (adjusted for a 1-for-10 reverse stock split discussed below) for an aggregate purchase price of $50.4 million. The shares sold to Holdings represented 87.6% of the Company’s then issued and outstanding common stock. In connection with the reverse stock split, the par value of the common stock was changed to $0.01 per share. Also in connection with the sale of shares, certain directors and officers of both the Company and the Bank resigned. Such directors and officers were replaced with nominees of Holdings and Michael Carrazza became the Chairman of the Board of the Company.

As of the date hereof, the only business of the Company is its ownership of all of the issued and outstanding capital stock of the Bank and the Trust. Except as specifically noted otherwise herein, the balance of the description of the Company’s business is a description of the Bank’s business.

On March 4, 2015, the Company effected a 1-for-10 reverse stock split. All common stock and per share data included in the financial statements as of and for the year ended December 31, 2014 have been restated to give effect to the reverse stock split.

During 2015, Mr. Michael Carrazza sold 325,000 shares of Holdings to a third party who has sole voting rights and dispositive power for the sold shares. Immediately following this transaction, Mr. Carrazza’s equity interest in Holdings decreased from 87.6% to 75.65%.

On September 28, 2015, the Bank changed its name from Patriot National Bank to Patriot Bank, N.A. The name change came after the Bank reported eight consecutive quarters of increased earnings.

On January 5, 2016, Neil M. McDonnell was appointed as Chief Financial Officer of Patriot. Mr. McDonnell’s appointment was in response to the resignation of Christina L. Maier, who was the Chief Financial Officer of Patriot through that date and who resigned on April 30, 2016 as an Executive Vice President.

On August 19, 2016, the Board of Directors of the Company (the “Board”) appointed Michael A. Carrazza to serve as interim Chief Executive Officer of Patriot and Peter D. Cureau to serve as the interim Chief Operating Officer and President of the Company. These appointments were in response to the resignations of Kenneth T. Neilson, who was the Chief Executive Officer and President of Patriot and Susan Neilson, who was the Chief Operating Officer and Executive Vice President of the Bank.

On January 26, 2017, the Board appointed Richard A. Muskus, Jr. President of Patriot. Mr. Muskus has served as Executive Vice President and Chief Lending Officer of the Bank since February 2014. Mr. Muskus’ appointment replaced Peter D. Cureau, who was acting as the Interim President and Chief Operating Officer of Patriot and, who will continue to work with Mr. Carrazza in the office of the Chairman.

Business Operations

The Bank offers commercial real estate loans, commercial business loans, and a variety of consumer loans with an emphasis on serving the needs of individuals, small and medium-sized businesses and professionals. The Bank previously had offered loans on residential real estate, but discontinued doing so during 2013. The Bank’s lending activities are conducted principally in Fairfield and New Haven Counties in Connecticut and Westchester County in New York, although the Bank’s loan business is not necessarily limited to these areas.

Consumer and commercial deposit accounts offered include: checking, interest-bearing negotiable order of withdrawal “NOW”, money market, time certificates of deposit, savings, Certificate of Deposit Account Registry Service CDARS, Individual Retirement Accounts (“IRAs”), and Health Savings Accounts (“HSAs”). Other services offered by the Bank include Automated Clearing House (“ACH”) transfers, lockbox, internet banking, bill paying, remote deposit capture, debit cards, money orders, traveler’s checks, and automatic teller machines (“ATMs”). In addition, the Bank may in the future offer other financial services.

The Bank’s branch office locations may be summarized as follows:

|

Branch No. |

|

City |

|

County |

|

State |

| 1 | Darien | Fairfield | Connecticut | |||

| 2 | Fairfield | Fairfield | Connecticut | |||

| 3 | Greenwich | Fairfield | Connecticut | |||

| 4 | Milford | New Haven | Connecticut | |||

| 5 | Norwalk | Fairfield | Connecticut | |||

| 6 | Stamford | Fairfield | Connecticut | |||

| 7 | Trumbull | Fairfield | Connecticut | |||

| 8 | Westport | Fairfield | Connecticut | |||

| 9 | Bedford | Westchester | New York | |||

| 10 | Scarsdale | Westchester | New York |

The Stamford, Connecticut location serves as Patriot’s headquarters. Additionally, the Bank also operates a loan origination office at its Stamford location.

The Bank’s employees perform most routine day-to-day banking transactions. The Bank has entered into a number of arrangements with third-party outside service providers, who provide services such as correspondent banking, check clearing, data processing services, credit card processing and armored car carrier transport.

In the normal course of business, subject to applicable government regulations, the Bank invests a portion of its assets in investment securities, which may include government securities. The Bank’s investment portfolio strategy is to maintain a balance of high-quality diversified investments that minimizes risk, maintains adequate levels of liquidity, and limits exposure to interest rate and credit risk. Guaranteed U.S. federal government issues currently comprise the majority of the Bank’s investment portfolio.

Employees

As of December 31, 2016, Patriot had 94 full-time employees and 5 part-time employees. None of Patriot’s employees are covered by a collective bargaining agreement.

Competition

The Bank competes with a variety of financial institutions for loans and deposits in its market area. These include larger financial institutions with greater financial resources, larger branch systems and higher lending limits, as well as the ability to conduct larger advertising campaigns to attract business. The larger financial institutions may also offer additional services such as trust and international banking, which the Bank is not equipped to offer directly. When the need arises, arrangements are made with correspondent financial institutions to provide such services. To attract business in this competitive environment, the Bank relies on local promotional activities, personal contact by officers and directors, customer referrals, and its ability to distinguish itself by offering personalized and responsive banking service.

The customer base of the Bank generally is meant to be diversified, so that there is not a concentration of either loans or deposits within a single industry, a group of industries, or a single person or groups of people. The Bank is not dependent on one or a few major customers for its lending or deposit activities, the loss of any one of which would have a material adverse effect on the business of the Bank.

The Bank’s loan customers extend beyond the towns and cities in which the Bank has branch offices, including nearby towns in Fairfield and New Haven Counties in Connecticut, and Westchester County and the five boroughs of New York City in New York, although the Bank’s loan business is not necessarily limited to these areas. While the Bank does not currently hold or intend to attract significant deposit or loan business from major corporations with headquarters in its market area, the Bank believes that small manufacturers, distributors and wholesalers, and service industry professionals and related businesses, which have been attracted to this area, as well as the individuals that reside in the area, represent current and potential customers of the Bank.

In recent years, intense market demands, economic pressures, and significant legislative and regulatory actions have eroded banking industry classifications, which were once clearly defined, and have increased competition among banks, as well as other financial services institutions including non-bank competitors. This increase in competition has caused banks and other financial services institutions to diversify their services and become more cost effective. The impact of market dynamics, legislative, and regulatory changes on banks and other financial services institutions has increased customer awareness of product and service differences among competitors and increased merger activity among banks and other financial services institutions.

Supervision and Regulation

As a bank holding company, the Company’s operations are subject to regulation, supervision, and examination by the Board of Governors of the Federal Reserve System (the “Fed”). The Fed has established capital adequacy guidelines for bank holding companies that are similar to the Office of the Comptroller of the Currency’s (“OCC”) capital guidelines applicable to the Bank. The Bank Holding Company Act of 1956, as amended (the “BHC”), limits the types of companies that a bank holding company may acquire or organize and the activities in which it or they may engage. In general, bank holding companies and their subsidiaries are only permitted to engage in, or acquire direct control of, any company engaged in banking or in a business so closely related to banking as to be a proper incident thereto. Federal legislation enacted in 1999 authorizes certain entities to register as financial holding companies. Registered financial holding companies are permitted to engage in businesses, including securities and investment banking businesses, which are prohibited to bank holding companies. The creation of financial holding companies has had no significant impact on the Company.

Under the BHC, the Company is required to file a quarterly report of its operations with the Fed. Patriot and any of its subsidiaries are subject to examination by the Fed. In addition, the Company will be required to obtain the prior approval of the Fed to acquire, with certain exceptions, more than 5% of the outstanding voting stock of any bank or bank holding company, to acquire all or substantially all of the assets of a bank, or to merge or consolidate with another bank holding company. Moreover, Patriot and any of its subsidiaries are prohibited from engaging in certain tying arrangements, in connection with any extension of credit or provision of any property or services. The Bank is also subject to certain restrictions imposed by the Federal Reserve Act on issuing any extension of credit to the Company or any of its subsidiaries, or making any investments in the stock or other securities thereof, and on the taking of such stock or securities as collateral for loans to any borrower. If the Company wants to engage in businesses permitted to financial holding companies, but not to bank holding companies, it would need to register with the Fed as a financial holding company.

The Fed has issued a policy statement on the payment of cash dividends by bank holding companies, which expresses its view that a bank holding company should pay cash dividends only to the extent that the bank holding company’s net income for the past year is sufficient to cover both the cash dividend and a rate of earnings retention that is consistent with the bank holding company’s capital needs, asset quality, and overall financial condition. The Fed has also indicated that it would be inappropriate for a bank holding company experiencing serious financial problems to borrow funds to pay dividends. Furthermore, under the prompt corrective action regulations adopted by the Fed, if any its subsidiaries is classified as “undercapitalized”, the bank holding company may be prohibited from paying dividends.

A bank holding company is required to give the Fed prior written notice of any purchase or redemption of its outstanding equity securities, if the gross consideration for the purchase or redemption, when combined with the net consideration paid for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of its consolidated retained earnings. The Fed may disapprove of such a purchase or redemption, if it determines that the proposal would constitute an unsafe or unsound practice or would violate any law, regulation, Fed order, or any condition imposed by, or written agreement with, the Fed.

The Company is subject to capital adequacy rules and guidelines issued by the Fed and the FDIC and the Bank is subject to capital adequacy rules and guidelines issued by the OCC. These substantially identical rules and guidelines require Patriot to maintain certain minimum ratios of capital to adjusted total assets and/or risk-weighted assets. Under the provisions of the FDIC Improvements Act of 1991, the federal regulatory agencies are required to implement and enforce these rules in a stringent manner. The Company is also subject to applicable provisions of Connecticut law, insofar as they do not conflict with, or are not otherwise preempted by, federal banking law. Patriot’s operations are subject to regulation, supervision, and examination by the FDIC and the OCC.

Federal and state banking regulations govern, among other things, the scope of the business of a bank, a bank holding company, or a financial holding company, the investments a bank may make, deposit reserves a bank must maintain, the establishment of branches, and the activities of a bank with respect to mergers and acquisitions. The Bank is a member of the Fed and, as such, is subject to applicable provisions of the Federal Reserve Act and regulations thereunder. The Bank is subject to the federal regulations promulgated pursuant to the Financial Institutions Supervisory Act that are designed to prevent banks from engaging in unsafe and unsound practices, as well as various other federal, state, and consumer protection laws. The Bank is also subject to the comprehensive provisions of the National Bank Act.

The OCC regulates the number and locations of branch offices of a national bank. The OCC may only permit a national bank to maintain branches in locations and under the conditions imposed by state law upon state banks. At this time, applicable Connecticut banking laws do not impose any material restrictions on the establishment of branches by Connecticut banks throughout Connecticut. New York State law is similar; however, the Bank cannot establish a branch in a New York town with a population of less than 50,000 inhabitants, if another bank is headquartered in that town.

The earnings and growth of Patriot and the banking industry in general are affected by the monetary and fiscal policies of the United States (“U.S.”) government and its agencies, particularly the Fed. The Open Market Committee of the Fed implements national monetary policy to curb inflation and combat recession. The Fed uses its power to adjust interest rates on U.S. government securities, the discount rate, and deposit reserve retention rates. The actions of the Fed influence the growth of bank loans, investments, and deposits. They also affect interest rates charged on loans and paid on deposits. The nature and impact of any future changes in monetary policies cannot be predicted.

In addition to other laws and regulations, Patriot is subject to the Community Reinvestment Act (“CRA”), which requires the federal bank regulatory agencies, when considering certain applications involving Patriot, to consider Patriot’s record of helping to meet the credit needs of its entire community, including low- and moderate-income neighborhoods. The CRA was originally enacted because of concern over unfair treatment of prospective borrowers by banks and unwarranted geographic differences in lending patterns. Existing banks have sought to comply with the CRA in various ways; some banks have made use of more flexible lending criteria for certain types of loans and borrowers (consistent with the requirement to conduct safe and sound operations), while other banks have increased their efforts to make loans to help meet identified credit needs within the consumer community, such as those for home mortgages, home improvements, and small business loans. Compliance may also include participation in various government insured lending programs, such as Federal Housing Administration insured or Veterans Administration guaranteed mortgage loans, Small Business Administration loans, and participation in other types of lending programs such as high loan-to-value ratio conventional mortgage loans with private mortgage insurance. To date, the market area from which the Bank draws much of its business is in the towns and cities in which the Bank has branch offices, which are characterized by a very diverse ethnic, economic and racial cross-section of the population. As the Bank expands further, the market areas served by the Bank will continue to evolve. The Company and the Bank have not and will not adopt any policies or practices, which discourage credit applications from, or unlawfully discriminate against, individuals or segments of the communities served by the Bank.

On October 26, 2001, the United and Strengthening America by Providing Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “Patriot Act”) was enacted to further strengthen domestic security following the September 11, 2001 attacks. The Patriot Act amended various federal banking laws, particularly the Bank Secrecy Act, with the intent to curtail money laundering and other activities that might be undertaken to finance terrorist actions. The Patriot Act also requires that financial institutions in the U.S. enhance already established anti-money laundering policies, procedures and audit functions, and ensure that controls are reasonably designed to detect instances of money laundering through certain correspondent or private banking accounts. Verification of customer identification, maintenance of said verification records, and cross-checking names of new customers against government lists of known or suspected terrorists is also required. The Patriot Act was reauthorized and modified with the enactment of The USA Patriot Act Improvement and Reauthorization Act of 2005.

The Company is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance with the Exchange Act, files periodic reports, proxy statements, and other information with the SEC.

On July 20, 2002, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) was enacted, the primary purpose of which is to protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws, and for other purposes. Section 404 of Sarbanes-Oxley, entitled Management Assessment of Internal Controls, requires that each annual report include an internal control report which states that it is the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting, as well as an assessment by management of the effectiveness of the internal control structure and procedures for financial reporting. This section further requires that the external auditors attest to, and report on, the Company’s internal controls over financial reporting; although, Smaller Reporting Companies as defined by the SEC are exempt from this requirement. Sarbanes-Oxley contains provisions for the limitations of services that external auditors may provide, as well as requirements for the credentials of members of the Audit Committee of Patriot’s Board of Directors. In addition, Sarbanes-Oxley requires principal executive and principal financial officers to certify to the adequacy of internal controls over financial reporting and to the accuracy of financial information released to the public on a quarterly and annual basis. Specifically, Sarbanes-Oxley requires Patriot’s Chief Executive and Chief Financial officer to certify that, to their best of their knowledge, the financial information reported accurately presents the financial condition and results of operations of the Company and that it contains no untrue statement or omission of material fact. Patriot’s Chief Executive and Chief Financial officer also are required to certify to their responsibility for establishing and maintaining a system of internal controls, the design and implementation of which insures that all material information is made known to these officers or other responsible individuals; this certification also includes the evaluation of the effectiveness of disclosure controls and procedures, and the impact thereof, on the Company’s financial reporting.

Recent Legislative Developments

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank) was signed into law on July 21, 2010 and has had a major impact on the financial services industry, including the organization, financial condition and operations of banks and bank holding companies. Many of the provisions of Dodd-Frank are aimed at financial institutions that are significantly larger than Patriot. Notwithstanding this, there are many other provisions that Patriot is subject to and has to comply with, including any applicable rules promulgated by the Consumer Financial Protection Bureau (“CFPB”). As rules and regulations are promulgated by the agencies responsible for implementing and enforcing Dodd-Frank, Patriot will have to address them to ensure compliance with such applicable provisions. Management expects the cost of compliance to increase, due to the regulatory burden imposed by Dodd-Frank.

Dodd-Frank broadened the base for FDIC insurance assessments. Under rules issued by the FDIC in February 2011, the base for insurance assessments changed from domestic deposits to consolidated assets less tangible equity. Assessment rates are calculated using formulas that take into account the risks of the institution being assessed. The rule was effective beginning April 1, 2011 and did not have a material impact on the Company.

On June 28, 2011, the Fed approved a final debit-card interchange rule. This primarily impacts larger banks and did not have a material impact on the Company.

It is difficult to predict at this time what specific impact yet to be implemented Dodd-Frank rules and regulations will have on the Company. Financial reform legislation and the implementation of any rules ultimately issued could have adverse implications on the financial industry, the competitive environment, and the Bank’s ability to conduct business. Management will have to dedicate resources to ensure compliance with all applicable provisions of Dodd-Frank and the implementation of any applicable rules, which may increase its costs of operations and adversely impact its earnings.

In July 2013, the Fed, the FDIC, and the OCC approved final rules establishing a new comprehensive capital framework for U.S. Banking organizations (the “New Capital Rules”). The New Capital Rules generally implement the Basel Committee on Banking Supervision’s (the “Basel Committee”) December 2010 final capital framework (referred to as “Basel III”) for strengthening international capital standards. The New Capital Rules substantially revise the risk-based capital requirements applicable to bank holding companies and their depository institution subsidiaries, including Patriot, as compared to the current U.S. general risk-based capital rules. The New Capital Rules revise the definitions and the components of regulatory capital, as well as address other issues affecting the numerator in banking institutions’ regulatory capital ratios. The New Capital Rules also address asset risk weights and other matters affecting the denominator in banking institutions’ regulatory capital ratios and replace the existing general risk-weighting approach with a more risk-sensitive approach, based, in part, on the “standardized approach” adopted by the Basel Committee in 2004. In addition, the New Capital Rules implement certain provisions of Dodd-Frank. The New Capital Rules became effective for Patriot on January 1, 2015. Patriot has not experienced any difficulties in complying with the New Capital Rules.

Recent Developments with Regulators

Based on its satisfactory findings reported to the Company on May 3, 2016, effective July 11, 2016, the Board of Governors of the Federal Reserve System (the “Fed”), the Company’s primary regulator, terminated its Supervisory Letter dated May 5, 2015 that placed certain restrictions on the Company. Citing the satisfactory condition of the Bank and a noted improvement in earnings, the Fed lifted restrictions on Patriot from issuing dividends in any form and creating new debt without prior written approval of the Federal Reserve Bank (“FRB”).

Available Information

The Company’s website address is https://www.bankpatriot.com; however, information found on, or that can be accessed through, the website is not incorporated by reference into this Form 10-K. The Company makes available free of charge on its website (under the links entitled “For Investors”, then “SEC filings”, then “Documents”), its annual report on Form 10-K, its quarterly reports on Form 10-Q, current reports on Form 8-K, information statements on Schedule 14C, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act, as soon as practicable after such reports are electronically filed with or furnished to the SEC. Because the Company is an electronic filer, such reports are filed with the SEC and are also available on their website (http://www.sec.gov). The public may also read and copy any materials filed with the SEC at the SEC’s Public Reference Room, 100 F Street, N.E. Room 1580, Washington, DC 20549. Information about the Public Reference Room can be obtained by calling 1-800-551-8090 or SEC Investor Information Service 1-800-SEC-0330.

ITEM 1A. Risk Factors

Patriot's financial condition and results of operation are subject to various risks inherent to its business, including those noted below.

The risks involved in the Bank’s commercial real estate loan portfolio are material.

The Bank’s commercial real estate loan portfolio constitutes a material portion of its assets and generally has different risks than residential mortgage loans. Commercial real estate loans often involve larger loan balances concentrated with single borrowers or groups of related borrowers as compared to single-family residential loans.

Because the repayment of commercial real estate loans depends on the successful management and operation of the borrower’s properties or related businesses, repayments of such loans can be affected by adverse conditions in the real estate market or local economy. A downturn in the real estate market within the Bank market area may adversely impact the value of properties securing these loans. These risks are partially offset by shorter terms, reduced loan-to-value ratios, and guarantor support of the borrower.

Real estate lending in the Bank’s core market involves risks related to a decline in value of commercial and residential real estate.

The market value of real estate can fluctuate significantly in a relatively short period of time, as a result of market conditions in the geographic area in which real estate is located. A significant portion of the Bank's total loan portfolio is secured by real estate located in Fairfield County, Connecticut and Westchester County, New York, areas historically of high affluence that had been materially impacted by the financial troubles experienced by large financial service companies on Wall Street and other companies during the financial crisis. Since then, credit markets have become tighter and underwriting standards more stringent and the inability of purchasers of real estate to obtain financing will continue to impact the real estate market. Therefore, these loans may be subject to changes in grade, classification, accrual status, foreclosure, or loss, which could have an effect on the adequacy of the allowance for loan losses.

The Bank's business is subject to various lending and other economic risks that could adversely impact its results of operations and financial condition.

Changes in economic conditions, particularly a continued economic slowdown in Fairfield County, Connecticut and the New York metropolitan area could result in the following consequences, any of which may have a material detrimental effect on the Bank's business:

|

|

● |

Increases in: | |

|

|

|

- |

Loan delinquencies; |

|

|

|

- |

Problem assets and foreclosures; or |

|

|

● |

Decreases in: | |

|

|

|

- |

Demand for the Bank's products and services; |

|

|

|

- |

Decreases in customer borrowing power that is caused by declines in the value of assets and/or collateral supporting the Bank's loans, especially real estate. |

During the years 2007 through 2009, the general economic conditions and specific business conditions in the United States, including Fairfield County, Connecticut and the New York metropolitan area, deteriorated, resulting in increases in loan delinquencies, problem assets and foreclosures, and declines in the value and collateral associated with the Bank’s loans. During 2010 through 2015, however, the economic climate improved gradually, contributing to decreases in the Bank’s non-performing assets.

The Bank’s allowance for loan losses may not be adequate to cover actual losses.

Like all financial institutions, the Bank maintains an allowance for loan losses to provide for loan defaults and non-performance. The allowance for loan losses is based on an evaluation of the risks associated with the Bank’s loans receivable, as well as the Bank’s prior loss experience. Deterioration in general economic conditions and unforeseen risks affecting customers could have an adverse effect on borrowers’ capacity to timely repay their obligations before risk grades could reflect those changing conditions. Maintaining the adequacy of the Bank’s allowance for loan losses may require that the Bank make significant and unanticipated increases in the provision for loan losses, which would materially affect the results of operations and capital adequacy. The amount of future losses is susceptible to changes in economic, operating, and other conditions including changes in interest rates that may be beyond the Bank’s control and which losses may exceed current allowance estimates. Although the current economic environment has improved, conditions remain uncertain and may result in additional risk of loan losses.

Federal regulatory agencies, as an integral part of their examination process, review the Bank’s loan portfolio and assess the adequacy of the allowance for loan losses. The regulatory agencies may require the Bank to change classifications or grades on loans, increase the allowance for loan losses by recognizing additional loan loss provisions, or to recognize further loan charge-offs based upon their judgments, which may differ from the Bank’s. Any increase in the allowance for loan losses required by these regulatory agencies could have a negative effect on the Bank’s results of operations and financial condition. While management believes that the allowance for loan losses is currently adequate to cover inherent losses, further loan deterioration could occur, and therefore, management cannot assure shareholders that there will not be a need to increase the allowance for loan losses, or that the regulators will not require management to increase this allowance. Either of these occurrences could materially and adversely affect Patriot’s earnings and profitability.

Patriot is subject to certain risks with respect to liquidity.

"Liquidity" refers to the Patriot’s ability to generate sufficient cash flows to support its operations and fulfill its obligations, including commitments to originate loans, to repay its wholesale borrowings and other liabilities, and to satisfy the withdrawal of deposits by its customers.

Patriot’s primary sources of liquidity are the deposits it acquires organically through its branch network, borrowed funds, primarily in the form of wholesale borrowings, and the cash flows generated through the collection of loan payments and on mortgage-related securities. In addition, depending on current market conditions, the Company may have the ability to access the capital markets.

Deposit flows, calls of investment securities and wholesale borrowings, and prepayments of loans and mortgage-related securities are strongly influenced by such external factors as the direction of interest rates, whether actual or perceived; local and national economic conditions; and competition for deposits and loans in the markets served. Furthermore, changes to the underwriting guidelines for wholesale borrowings, or lending policies may limit or restrict the Patriot’s ability to borrow, and could therefore have a significant adverse impact on its liquidity. A decline in available funding could adversely impact Patriot’s ability to originate loans, invest in securities, and meet its expenses, or to fulfill such obligations as repaying its borrowings or meeting deposit withdrawal demands.

The Bank’s business is subject to interest rate risk and variations in interest rates may negatively affect the Bank’s financial performance.

Patriot is unable to predict, with any degree of certainty, fluctuations of market interest rates, which are affected by many factors including inflation, recession, a rise in unemployment, a tightening money supply, domestic and international disorder, and instability in domestic and foreign financial markets. Changes in the interest rate environment may reduce Patriot's profits. Patriot realizes income from the differential or “spread” between the interest earned on loans, securities, and other interest-earning assets and interest paid on deposits, borrowings, and other interest-bearing liabilities. Net interest spreads are affected by the difference between the maturities and repricing characteristics of interest-earning assets and interest-bearing liabilities. In addition, an increase in the general level of interest rates may adversely affect the ability of some borrowers to pay the interest on and principal of their obligations. Although Patriot has implemented strategies which are designed to reduce the potential effects of changes in interest rates on operations, these strategies may not always be successful. Accordingly, changes in levels of market interest rates could materially and adversely affect the Company’s net interest spread, asset quality, levels of prepayments, and cash flow, as well as the market value of its securities portfolio and overall profitability.

Patriot investment portfolio includes securities that are sensitive to interest rates and variations in interest rates may adversely impact Patriot profitability.

Patriot's security portfolio is classified as available-for-sale, and is comprised primarily of corporate debt and mortgage-backed securities, which are insured or guaranteed by the U.S. government. These securities are sensitive to interest rate fluctuations. Unrealized gains or losses in the available-for-sale portfolio for securities are reported as a separate component of shareholders’ equity. As a result, future interest rate fluctuations may impact shareholders’ equity, causing material fluctuations from quarter to quarter. The inability to hold its securities until market conditions are favorable for a sale, or until payments are received on mortgage-backed securities, could adversely affect Patriot's earnings and profitability.

Patriot is dependent on its management team and the loss of its senior executive officers or other key employees could impair its relationship with its customers and adversely affect its business and financial results.

The Bank’s success is dependent upon the continued services and skills of its management team. The unexpected loss of services of one or more of these key personnel, because of their skills, knowledge of the Bank’s market, years of industry experience, and the difficulty of promptly finding qualified replacement personnel could have an adverse impact on the Bank’s business.

Patriot’s success also depends, in part, on its continued ability to attract and retain experienced commercial lenders and retail bankers, as well as other management personnel. The loss of services of several such key personnel could adversely affect Patriot’s growth and prospects, to the extent replacement personnel are not able to be identified and promptly retained. Competition for commercial lenders and retail bankers is strong, and Patriot may not be successful in retaining or attracting such personnel.

Patriot is subject to certain general affirmative debt covenants, which with it cannot comply, may result in default and actions taken against it by its debt holders.

In December 2016, the Company issued $12 million of senior notes (the “Senior Notes”) that contain certain affirmative covenants, which require the Company to: maintain its and its subsidiaries’ legal entity and tax status, pay its income tax obligations on a timely basis, and comply with SEC and FDIC reporting requirements. The Senior Notes are unsecured, rank equally with all other senior obligations of the Company, are not redeemable nor may they be put to the Company by the holders of the notes, and require no payment of principal until maturity.

The affirmative covenants contained in the Senior Note agreements are of a general nature and not uncommon in such debt agreements. Management does not anticipate an inability to maintain its compliance with the affirmative covenants contained in the notes as such compliance is inherent in the Bank’s continued operation and Patriot’s public company status, as well as management’s overall strategic plan.

A breach of information security could negatively affect the Patriot’s earnings.

Patriot increasingly depends upon data processing, communications, and information exchange on a variety of computing platforms and networks, and the internet to conduct its business. Patriot cannot be certain that all of its systems are entirely free from vulnerability to attack, despite safeguards it has instituted. In addition, Patriot relies on the services of a variety of vendors to meet its data processing and communication needs. If information security is breached, information can be lost or misappropriated and could result in financial loss or costs to Patriot, or damages to others. These financial losses or costs could materially exceed the amount of Patriot’s insurance coverage, if applicable, which would have an adverse effect on its results of operations and financial condition. In addition, the Bank’s reputation could suffer if its database were breached, which could materially affect Patriot’s financial condition and results of operations.

The Bank is subject to environmental liability risk associated with its lending activities.

A significant portion of the Bank’s loan portfolio is secured by real property. During the ordinary course of business, the Bank may foreclose on, and take title to, properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties, which may make the Patriot liable for remediation costs, as well as for personal injury and property damage. In addition, Patriot owns and operates certain properties that may be subject to similar environmental liability risks.

Environmental laws may require the Bank to incur substantial expense and may materially reduce the affected property's value, or limit the Bank’s ability to use or sell the affected property. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase the Bank’s exposure to environmental liability. Although Patriot has policies and procedures requiring the performance of an environmental site assessment before loan approval or initiating any foreclosure action on real property, these assessments may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on Patriot’s financial condition and results of operations.

The Company relies on the dividends it receives from its subsidiary.

The Company is a separate and distinct legal entity from the Bank. The Company’s primary source of revenue is the dividends it receives from the Bank, which cash flow the Company uses to fund its activities, meet its obligations, and remit dividends to its shareholders. Various federal and state laws and regulations limit the amount of dividends that a bank may pay to its parent company. In addition, the Company’s right to participate in a distribution of assets, upon liquidation or reorganization of the Bank or another regulated subsidiary, may be subordinate to claims by the Bank’s or subsidiary's creditors. If the Bank were to be restricted from paying dividends to the Company, the Company’s ability to fund its activities, meet its obligations, or pay dividends to its shareholders might be curtailed. The inability to receive dividends from the Bank could therefore have a material adverse effect on the Company.

The price of the Company’s common stock may fluctuate.

The market price of the Company’s common stock could be subject to significant fluctuations due to changes in sentiment in the market regarding the Company’s operations or business prospects. Among other factors, the Company’s stock price may be affected by:

|

● |

Operating results that vary from the expectations of securities analysts and investors; |

|

● |

Developments in its business or in the financial services sector in-general; |

|

● |

Regulatory or legislative changes affecting its business or the financial services sector in-general; |

|

● |

Operating results or securities price performance of companies that investors consider being comparable to the Company; |

|

● |

Changes in estimates or recommendations by securities analysts or rating agencies; |

|

● |

Announcements of strategic developments, acquisitions, dispositions, financings, and other material events by the Company or the Company’s competitors; and |

|

● |

Changes or volatility in global financial markets and economies, general market conditions, interest or foreign exchange rates, stock, commodity, credit, or asset valuations. |

Difficult market conditions have adversely affected the Company’s industry.

The Company is exposed to general downturns in the U.S. economy, and particularly downturns in the local Connecticut and New York markets in which it operates. Two significant impacts resulting from the financial crisis included the housing market suffering falling home prices leading to increased foreclosures and our customer base experiencing rampant unemployment and sustained under-employment. These conditions negatively impacted the credit performance of mortgage and construction loans, and resulted in significant asset-value write-downs by financial institutions, including government-sponsored enterprises, as well as major commercial and investment banks. The loss of mortgage and construction loan asset-value caused many financial institutions to seek additional capital, to merge with larger and financially stronger financial institutions and, in some cases, to fail. Many lenders and institutional investors reduced or ceased providing funding to borrowers, including other financial institutions. This market turmoil, and the tightening of credit by the Fed, led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, increased market volatility, and generally widespread reductions in business activity. The resulting economic pressure on consumers and lack of confidence in the financial markets has adversely affected the Company’s business, financial condition, and results of operations. A worsening of these conditions would likely exacerbate the adverse effects these difficult market conditions have had on the Company and other financial institutions. In particular:

|

● |

Less than optimal economic conditions may continue to affect market confidence levels and may cause adverse changes in payment patterns, thereby causing increased delinquencies, which could affect the Bank’s provision for loan losses and charge-off of loans receivable. |

|

● |

The ability to assess the creditworthiness of the Bank’s customers, or to accurately estimate loan collateral value, may be impaired if the models and approaches the Bank uses becomes less predictive of future behaviors, valuations, assumptions, or estimates due to the unpredictable economic climate. |

|

● |

Increasing consolidation of financial services companies, as a result of current market conditions, could have unexpected adverse effects on the Bank’s ability to compete effectively. |

The Bank may be required to pay significantly higher FDIC premiums, special assessments, or taxes that could adversely affect its earnings.

Market developments have significantly impacted the insurance fund of the FDIC. As a result, the Bank may be required to pay higher premiums, or special assessments, that could adversely affect earnings. The amount of premiums the FDIC requires for the insurance coverage it provides is outside the Bank’s control. If there are additional banks or financial institution failures, the Bank may be required to pay higher FDIC premiums than are currently assessed. Increases in FDIC insurance premiums, including any future increases or required prepayments, may materially adversely affect the Bank’s results of operations.

Patriot is subject to risks associated with taxation.

The amount of income taxes the Patriot is required to pay on its earnings is based on federal and state legislation and regulations. Patriot provides for current and deferred taxes in its financial statements, based on the results of operations, business activity, legal structure, interpretation of tax statutes, assessment of risk of adjustment upon audit, and application of financial accounting standards. Patriot may take tax return filing positions for which the final determination of tax is uncertain. Patriot’s net income or loss and the related amount per share may be reduced, if a federal, state, or local tax authority assesses additional taxes, penalties, or interest that has not been provided for in the consolidated financial statements. There can be no assurance that Patriot will achieve its anticipated effective tax rate, due to a change in a tax law, or the result of a tax audit that disallows previously recognized tax benefits.

Risks associated with changes in technology.

Financial products and services have become increasingly technology-driven. The Bank’s ability to compete for new and meet the needs of existing customers, in a cost-efficient manner, is dependent on its ability to keep pace with technological advances and to invest in new technology as it becomes available. Many of the Bank’s competitors have greater resources to invest in technology and may be better equipped to market new technology-driven products and services. Failing to keep pace with technological change could have a material adverse impact on the Bank’s business and therefore on Patriot's financial condition and results of operations.

Strong competition in Patriot’s geographical market could limit growth and profitability.

Competition in the banking and financial services industry is intense. Fairfield County, Connecticut and the New York City metropolitan areas have a high concentration of financial institutions including large money center and regional banks, community banks, and credit unions. Some of Patriot’s competitors offer products and services that the Bank currently does not offer, such as private banking and trust services. Many of these competitors have substantially greater resources and lending limits than the Bank, and may offer certain services that Patriot does not or cannot provide. Price competition might result in the Bank earning less on its loans and paying more for deposits, which would reduce net interest income. Patriot expects competition to increase in the future, as a result of legislative, regulatory and technological changes. Patriot’s profitability depends upon its continued ability to successfully compete in its geographical market.

Government regulation may have an adverse effect on the Patriot’s profitability and growth.

Patriot is subject to extensive regulation, supervision, and examination by the OCC as the Bank’s chartering authority, the FDIC as the insurer of its deposits, and the Fed as its primary regulator. Changes in federal and state banking laws and regulations, or in federal monetary policies, could adversely affect the Bank’s profitability and continued growth. In light of recent events, legislative and regulatory changes are expected, but cannot be predicted. For example, new legislation or regulation could limit the manner in which Patriot may conduct its business, including the Bank’s ability to obtain financing, attract deposits, make loans, and achieve satisfactory interest spreads. The laws, regulations, interpretations, and enforcement policies that apply to Patriot have been subject to significant, and sometimes retroactively applied, changes in recent years, and are likely to change significantly in the future.

Legislation enacted by the U.S. Congress, proposing significant structural reforms to the financial services industry, has, among other things, created the CFPB, which is given broad authority to regulate financial service providers and financial products. In addition, the Fed has passed guidance on incentive compensation at financial institutions it regulates and the United States Department of the Treasury and federal banking regulators have issued statements calling for higher capital and liquidity requirements. Complying with any new legislative or regulatory requirements and any programs established thereunder by federal and state governments, could have an adverse impact on Patriot’s operations and the results thereof.

Changing regulation of corporate governance and public disclosure.

Patriot is subject to laws, regulations, and standards relating to corporate governance and public disclosure, SEC rules and regulations, and NASDAQ rules. These laws, regulations, and standards are subject to varying interpretations, and as a result, their practical application may evolve over time as new guidance is provided by regulatory and governing bodies. Due to the evolving legal and regulatory environment, compliance may become more difficult and result in higher costs. Patriot is committed to maintaining high standards of corporate governance and public disclosure. As a result, Patriot’s efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. Patriot’s reputation may be harmed, if it does not continue to comply with these laws, regulations and standards.

The earnings of financial institutions are significantly affected by general business and economic conditions.

As a financial institution, Patriot’s operations and profitability are impacted by general business and economic conditions in the United States and abroad. These conditions include short- and long-term interest rates, inflation, money supply, political issues, legislative and regulatory changes, and the overall strength of the U.S. economy and the local economies in which it operates, all of which conditions are beyond Patriot’s control. In recent years, the financial services industry has experienced unprecedented upheaval, including the failure of some of the World’s leading financial institutions. Further deterioration in economic conditions could result in an increase in loan delinquencies and non-performing assets, decreases in loan collateral values, and a decrease in demand for the Bank’s products and services, among other things, any of which could have a material adverse impact on Patriot’s results of operations and financial condition. Patriot cannot currently predict or implement plans to mitigate the effects of unknown future industry developments.

The Company is a “Controlled Company” within the meaning of the NASDAQ U.S. Market Rules and Regulations and, as a result, the Company qualifies for, and relies on, exemptions from certain corporate governance requirements.

Holdings controls a majority of the Company’s voting common stock. As a result, the Company is a “Controlled Company” within the meaning of Nasdaq corporate governance standards. Under the Nasdaq Rules and Regulations, a company of which more than 50% of the voting power is held by an individual, group or another company is considered a “Controlled Company”, which may utilize exemptions relating to certain Nasdaq corporate governance requirements, including:

|

● |

Requiring the Board of Directors to be comprised of Independent Directors (as defined); |

|

● |

The requirement that the Company have a Nominating and Governance Committee that is composed entirely of independent directors; |

|

● |

The requirement that the Company have a Compensation Committee that is composed entirely of independent directors; and |

|

● |

The requirement for an annual performance evaluation of the Nominating and Governance and Compensation Committees. |

As a result of these exemptions, the Company’s Nominating and Governance Committee and Compensation Committee do not consist entirely of independent directors and the Company is not required to have an annual performance evaluation of the Nominating and Governance and Compensation Committees. Accordingly, a holder of its common stock will not have the same protections afforded to stockholders of companies that are subject to all of the NASDAQ corporate governance requirements.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

The following table summarizes Patriot’s owned and leased properties, as of December 31, 2016:

|

Street Address |

City |

County |

State | |||

| Owned: | ||||||

|

233 Post Road |

Darien |

Fairfield |

Connecticut | |||

|

1755 Black Rock Turnpike |

Fairfield |

Fairfield |

Connecticut | |||

|

100 Mason Street |

Greenwich |

Fairfield |

Connecticut | |||

|

900 Bedford Street |

Stamford |

Fairfield |

Connecticut | |||

|

999 Bedford Street |

Stamford |

Fairfield |

Connecticut | |||

|

50 Charles Street |

Westport |

Fairfield |

Connecticut | |||

|

771 Boston Post Road |

Milford |

New Haven |

Connecticut | |||

|

Church Street |

New Haven |

New Haven |

Connecticut | |||

| Leased: | ||||||

|

16 River Street |

Norwalk |

Fairfield |

Connecticut | |||

|

945 White Plains Road |

Trumbull |

Fairfield |

Connecticut | |||

|

370 Post Road East |

Westport |

Fairfield |

Connecticut | |||

|

432 Old Post Road |

Bedford |

Westchester |

New York | |||

|

495 Central Park Avenue |

Scarsdale |

Westchester |

New York |

In 2013, Patriot purchased 900 Bedford Street, Stamford, Connecticut. In 2015, Patriot moved its corporate headquarters and main branch banking office to this location, leaving some operational departments at the old leased location.

In November 2014, the Bank purchased 999 Bedford Street, Stamford, Connecticut to which it intends to move its main branch banking office in the second quarter of 2017.

In 2013, the Bank purchased its Greenwich branch building.

In 2014, the Bank purchased its Milford branch building and two new buildings for its Darien and Westport branches. In 2015, the Darien branch moved into its newly renovated building and, once renovations are completed, the Westport branch will move to its new building.

At December 31, 2016, five branch buildings were owned and five branch facilities were leased. Additionally, the Bank maintains certain operating and administrative service facilities and additional parking at its main branch banking office, which is subject to three distinct lease agreements. Patriot’s lease agreements have terms ranging from one year to ten years with seven years and seven months remaining on the longest lease term. Generally, Patriot’s lease agreements contain rent escalation clauses, and renewals for one or more periods at the Bank’s option.

At three of its branch buildings, the Bank has excess space that it leases to seven unrelated parties.

For additional information, see the Commitment and Contingencies footnote disclosure in the Consolidated Financial Statements included herein.

ITEM 3. Legal Proceedings

Other than ordinary routine litigation incidental to its business, neither the Company nor the Bank has any pending legal proceedings to which the Company or the Bank is a party or any of its property is subject.

ITEM 4. Mine Safety Disclosures

Not applicable.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information

The Company’s Common Stock is traded on the Nasdaq Global Market under the Symbol “PNBK.” On March 22, 2017, the last sale price for the Company’s Common Stock was $14.65.

The following table sets forth the high and low sales prices of the Company’s Common Stock during each of the calendar quarters of the last two fiscal years adjusted for a 1-for-10 reverse stock split. No cash dividends were declared during this time.

|

Year ended December 31, |

||||||||||||||||||||||||

|

2016 |

2015 |

|||||||||||||||||||||||

|

Sales Price |

Cash dividends |

Sales Price |

Cash dividends |

|||||||||||||||||||||

|

Quarter ended |

High |

Low |

declared |

High |

Low |

declared |

||||||||||||||||||

|

March 31, |

$ | 15.50 | 12.57 | - | $ | 20.10 | 13.55 | - | ||||||||||||||||

|

June 30, |

$ | 14.98 | 12.80 | - | $ | 16.05 | 13.60 | - | ||||||||||||||||

|

September 30, |

$ | 16.50 | 12.80 | - | $ | 18.68 | 15.14 | - | ||||||||||||||||

|

December 31, |

$ | 15.24 | 13.00 | - | $ | 17.49 | 14.55 | - | ||||||||||||||||

Holders

There were approximately 200 shareholders of record of the Company’s Common Stock as of December 31, 2016. This number does not reflect the number of persons or entities holding stock in nominee name through banks, brokerage firms or other nominees.

Dividends

The Company’s ability to pay dividends is dependent on the Bank’s ability to pay dividends to the Company. The Bank can pay dividends to the Company pursuant to a dividend policy requiring compliance with the Bank's OCC-approved capital program, in compliance with applicable law, and with the prior written determination of no supervisory objection by the Assistant Deputy Comptroller. In addition to the capital program, certain other restrictions exist regarding the ability of the Bank to transfer funds to the Company in the form of cash dividends, loans or advances. The approval of the OCC is required to pay dividends in excess of the Bank’s earnings retained in the current year plus retained net earnings for the preceding two years. The Company is also prohibited from paying dividends that would reduce its capital ratios below minimum regulatory requirements. The Fed has also imposed dividend restrictions on the Company. OCC regulations impose limitations upon all capital distributions by commercial institutions, like the Bank, such as dividends and payments to repurchase or otherwise acquire shares. The Company may not declare or pay cash dividends on or repurchase any of its shares of common stock, if the effect thereof would cause stockholders’ equity to be reduced below applicable regulatory capital maintenance requirements, or if such declaration and payments would otherwise violate regulatory requirements.

Recent Sales of Unregistered Securities

During the fourth quarter of 2016, the Company did not have any sales of unregistered securities.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Performance Graph

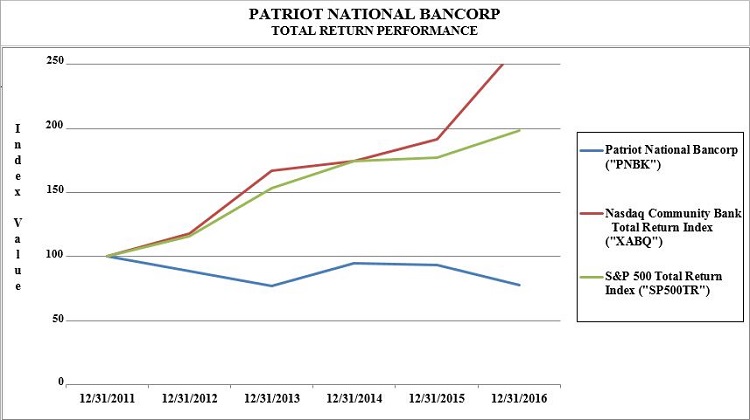

The performance graph compares the Company’s cumulative total shareholder return on its common stock over the last five fiscal years to the NASDAQ Community Bank Total Return Index and the S&P 500 Total Return Index. Total shareholder return is measured by dividing the sum of the cumulative amount of dividends for the measurement period (assuming dividend reinvestment) and the difference between the Company’s share price at the end and the beginning of the measurement period, by the share price at the beginning of the measurement period.

|

|

|

Period Ending |

||||||||||||||||||||||||

|

12/31/2011 |

12/31/2012 |

12/31/2013 |

12/31/2014 |

12/31/2015 |

12/31/2016 |

|||||||||||||||||||

|

Patriot National Bancorp ("PNBK") |

100.00 | % | 88.89 | % | 77.22 | % | 95.00 | % | 93.39 | % | 78.06 | % | ||||||||||||

|

Nasdaq Community Bank |

||||||||||||||||||||||||

|

Total Return Index ("XABQ") |

100.00 | % | 117.71 | % | 166.78 | % | 174.55 | % | 191.21 | % | 265.34 | % | ||||||||||||

|

S&P 500 Total Return Index ("SP500TR") |

100.00 | % | 116.00 | % | 153.57 | % | 174.60 | % | 177.01 | % | 198.18 | % | ||||||||||||

Stock Repurchases

The following table presents share repurchases of Patriot's common stock during the each of the months in the three-month period ended December 31, 2016.

|

Period Beginning |

Period Ending |

No. of Shares Purchased(1) |

Average Price Paid per Share |

No. of Shares Purchased as part of Publicly Announced Plans(1) |

Maximum No. of Shares that may yet be Purchased Under the Plans(1) |

|||||||||||||

|

November 1, 2016 |

November 30, 2016 |

629 | $ | 13.73 | 629 | 498,853 | ||||||||||||

|

December 1, 2016 |

December 31, 2016 |

71,324 | $ | 14.04 | 71,324 | 427,529 | ||||||||||||

| Three-months ended Decmebr 31, 2016 | 71,953 | $ | 14.04 | |||||||||||||||

|

(1) |

All shares have been repurchased in connection with the stock repurchase program (the "Program") authorized by the Company's Board of Directors on July 29, 2016. The Program authorizes the Company's chairman to direct the Company to repurchase up to 500,000 shares of Patriot's common stock on the open-market or in private transactions, through July 31, 2017. |

ITEM 6. Selected Financial Data

|

(In thousands, except per share data) |

|||||||||||||||||||||||

|

As of and for the year ended December 31, |

|||||||||||||||||||||||

|

2016 |

2015 |

2014 |

2013 |

2012 |

|||||||||||||||||||

|

Balance Sheet Data: |

|||||||||||||||||||||||

|

Cash and due from banks |

$ | 92,289 | 85,400 | 73,258 | 34,866 | 70,303 | |||||||||||||||||

|

Short-term investments |

- | - | - | - | 711 | ||||||||||||||||||

| Investment securities | 36,596 | 42,472 | 46,818 | 47,738 | 51,293 | ||||||||||||||||||

|

Loans, net |

576,982 | 479,127 | 471,984 | 418,148 | 458,794 | ||||||||||||||||||

|

Total assets |

756,654 | 653,355 | 632,443 | 541,060 | 617,661 | (1) | |||||||||||||||||

|

Total deposits |

529,324 | 444,665 | 440,889 | 428,104 | 495,210 | (2) | |||||||||||||||||

|

Total borrowings |

159,476 | 142,026 | 128,066 | 65,060 | 65,054 | ||||||||||||||||||

|

Total shareholders' equity |

62,570 | 61,464 | 58,735 | 41,841 | 49,568 | ||||||||||||||||||

|

Operating Data: |

|||||||||||||||||||||||

|

Interest and dividend income |

$ | 25,408 | 23,741 | 20,368 | 21,654 | 25,216 | |||||||||||||||||

|

Interest expense |

3,008 | 2,690 | 2,970 | 4,854 | 7,419 | ||||||||||||||||||

|

Net interest income |

22,400 | 21,051 | 17,398 | 16,800 | 17,797 | ||||||||||||||||||

|

Provision for loan losses |

2,464 | 250 | - | 970 | (2,379 | ) | |||||||||||||||||

|

Non-interest income |

1,556 | 1,551 | 1,832 | 2,426 | 3,274 | ||||||||||||||||||

|

Non-interest expense |

18,355 | 18,851 | 18,271 | 25,884 | 23,986 | ||||||||||||||||||

|

Provision (benefit) for income taxes |

1,207 | 1,358 | (14,750 | ) | (339 | ) | - | ||||||||||||||||

|

Net income (loss) |

$ | 1,930 | 2,143 | 15,709 | (7,289 | ) | (536 | ) | |||||||||||||||

|

Per Share Data: |

|||||||||||||||||||||||

|

Basic income (loss) per share |

$ | 0.49 | 0.55 | 4.08 | (3) | (1.90 | ) | (3) | (0.14 | ) | (3) | ||||||||||||

|

Diluted income (loss) per share |

$ | 0.49 | 0.55 | 4.05 | (3) | (1.90 | ) | (3) | (0.14 | ) | (3) | ||||||||||||

|

Selected Ratios: |

|||||||||||||||||||||||

|

Return on average assets |

0.30 | % | 0.34 | % | 2.81 | % | (1.28 | )% | (0.08 | )% | |||||||||||||

|

Return on average equity |

3.08 | % | 3.55 | % | 32.94 | % | (16.43 | )% | (1.05 | )% | |||||||||||||

|

Average equity to average assets |

9.83 | % | 9.65 | % | 8.53 | % | 7.80 | % | 7.96 | % | |||||||||||||

|

|

(1) |

Includes $88,000 of branch assets held for sale at December 31, 2012. |

|

|

(2) |

Includes $24.7 million of deposits held for sale at December 31, 2012. |

|

|

(3) |

All common stock and per share data have been restated to give effect to a reverse stock split of 1-for-10 effective March 4, 2015 |

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Critical Accounting Policies

The accounting and reporting policies of Patriot conform to accounting principles generally accepted in the United States of America (“U.S. GAAP”) and to general practices within the financial services industry. A summary of Patriot’s significant accounting policies is included in the Notes to Consolidated Financial Statements that are referenced in Item 8. Financial Statements and Supplementary Data. Although all of Patriot’s policies are integral to understanding its Consolidated Financial Statements, certain accounting policies involve Management to exercise judgment, develop assumptions, and make estimates that may have a material impact on the financial information presented in the Consolidated Financial Statements or Notes thereto. The assumptions and estimates are based on historical experience and other factors representing the best available information to Management as of the date of the Consolidated Financial Statements, up to and including the date of issuance or availability for issuance. As the basis for the assumptions and estimates incorporated in the Consolidated Financial Statements may change, as new information comes to light, the Consolidated Financial Statements could reflect different assumptions and estimates.

Due to the judgments, assumptions, and estimates inherent in the following policies, Management considers such accounting policies critical to an understanding of the Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations.

Allowance for Loan Losses (“ALL”)