Table of Contents

Exhibit 99.1

[Graphic Appears Here] 2020 SUN LIFE FINANCIAL INC. NOTICE OF ANNUAL MEETING OF COMMON SHAREHOLDERS May 5, 2020 MANAGEMENT INFORMATION CIRCULAR [Graphic Appears Here]

Table of Contents

| 1 | ||||||

| 2 | ||||||

| 3 | ||||||

| 3 | ||||||

| ● | 3 | |||||

| 5 | ||||||

| ● | 5 | |||||

| ● | 9 | |||||

| ● | 17 | |||||

| ● | Non-binding advisory vote on approach to executive compensation |

18 | ||||

| 19 | ||||||

| ● | 19 | |||||

| ● | 20 | |||||

| ● | 21 | |||||

| ● | 31 | |||||

| ● | 33 | |||||

| ● | 34 | |||||

| 43 | ||||||

| ● | 43 | |||||

| ● | 46 | |||||

| 47 | ||||||

| ● | 48 | |||||

| ● | 51 | |||||

| ● | 72 | |||||

| 95 | ||||||

| 96 | ||||||

Table of Contents

You are invited to attend our annual meeting of common shareholders on Tuesday, May 5, 2020 at 5:00 p.m. (Toronto time). At Sun Life, we are in the business of helping Canadians achieve lifetime financial security and live healthier lives. We have been actively monitoring COVID-19 developments and the directives from public health and government authorities. The health and well-being of our employees, Clients, investors and communities is our priority. In line with the latest guidance from public health and government authorities, this year’s meeting will be held in a virtual only format by way of live webcast. Shareholders will have the opportunity to attend the meeting online in real time regardless of their location, to submit questions and to vote on a number of important matters.

The business of the meeting is described in the accompanying Notice of our 2020 annual meeting and Management Information Circular.

We will be conducting the annual meeting of the voting policyholders and sole shareholder of Sun Life Assurance Company of Canada at the same time. The formal business of each meeting will be conducted separately, however, management’s presentation will address shareholders and policyholders.

Your vote is important. If you cannot attend the virtual meeting, please vote by submitting your proxy by mail, internet or telephone by 5:00 p.m. (Toronto time) on Friday, May 1, 2020, as described on pages 5 to 8 in the attached circular. If your shares are held in the name of a nominee, see page 7 for information about how to vote your shares.

We look forward to your attendance at this year’s meeting, which will occur by live webcast at https://web.lumiagm.com/186947015. Additional information on how to attend the meeting can be found in the attached circular.

|

| |

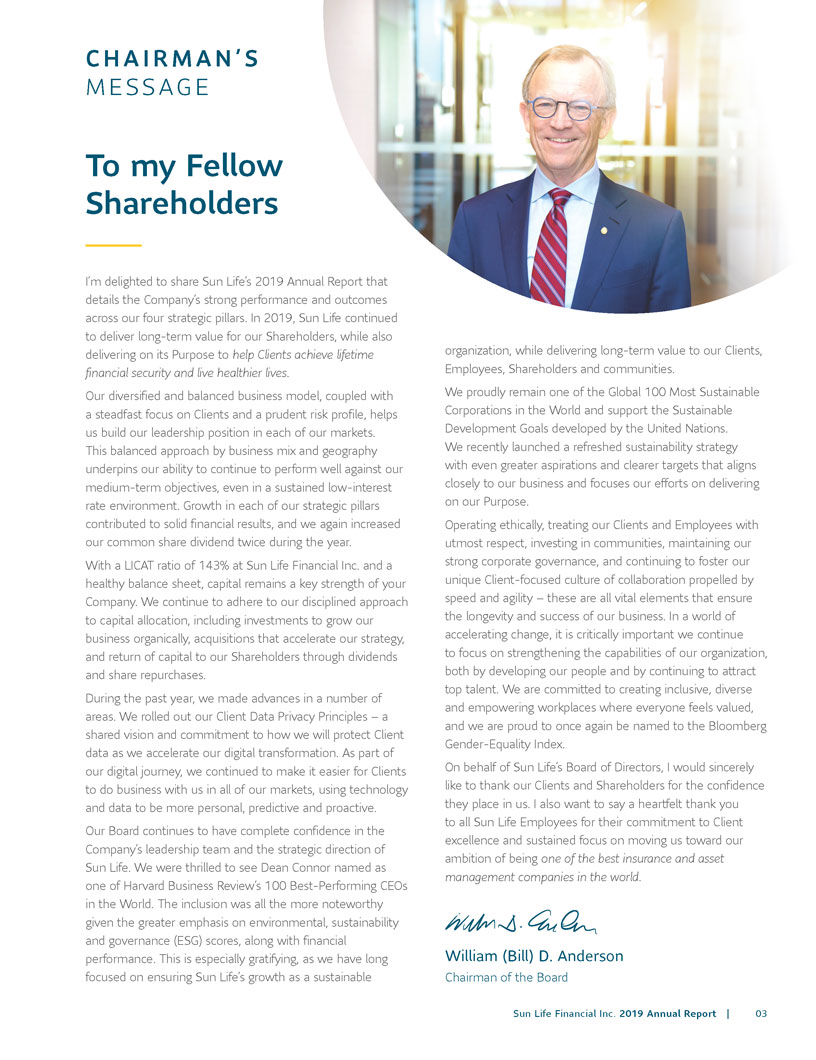

| William D. Anderson | Dean A. Connor | |

| Chairman of the Board |

President & Chief Executive Officer |

Si vous désirez recevoir l’avis de convocation à l’assemblée annuelle et la circulaire d’information en français, veuillez communiquer avec le secrétaire en écrivant au 1 York Street, 31st Floor, Toronto (Ontario) Canada M5J 0B6, en composant le 1-877-786-5433, ou en envoyant un courriel à servicesauxactionnaires@sunlife.com.

MANAGEMENT INFORMATION CIRCULAR 2020 | 1

Table of Contents

Notice of our 2020 annual meeting

You are invited to our annual meeting of common shareholders:

| When | Tuesday, May 5, 2020 at 5:00 p.m. (Toronto time) |

| Where | Virtual only meeting via live audio webcast online at https://web.lumiagm.com/186947015 |

| Password: “sunlife2020” (case sensitive) |

What the meeting will cover

| 1. | Receipt of the 2019 consolidated financial statements |

| 2. | Election of the directors |

| 3. | Appointment of the auditor |

| 4. | A non-binding advisory vote on our approach to executive compensation |

| 5. | Consideration of other business that may properly be brought before the meeting. |

A total of 585,109,774 votes are eligible to be cast at the meeting.

Consistent with the latest guidance from public health and government authorities regarding COVID-19, and in consideration of the health and safety of our employees, shareholders and the broader community, this year’s meeting will be held in a virtual only format by way of live webcast. Shareholders will have the opportunity to attend the meeting online in real time regardless of their geographic location, to submit questions and to vote on a number of important matters.

The annual meeting of Sun Life Assurance Company of Canada will also be held at the same time.

Registered shareholders and duly appointed proxyholders will be able to attend the virtual meeting, submit questions and vote in real time, provided they are connected to the internet and follow the instructions in the attached circular. Non-registered shareholders who have not duly appointed themselves as proxyholder will be able to attend the virtual meeting as guests but will not be able to vote at the virtual meeting.

Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form (including a non-registered shareholder who wishes to appoint themselves to attend the virtual meeting) must carefully follow the instructions in the attached circular and on their form of proxy or voting instruction form. These instructions include the additional step of registering such proxyholder with our transfer agent, AST Trust Company (Canada), after submitting the form of proxy or voting instruction form. If you wish that a person other than the management nominees identified on the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your Shares, you MUST register such proxyholder after having submitted your form of proxy or voting instruction form identifying such proxyholder. Failure to register the proxyholder with our transfer agent will result in the proxyholder not receiving a control number to participate in the virtual meeting and only being able to attend as a guest. Guests will be able to listen to the virtual meeting but will not be able to vote.

The attached circular is being sent to you because you owned common shares of Sun Life Financial Inc. on March 13, 2020 (the record date). It includes important information about what the meeting will cover, who can vote and how to vote.

The board of directors has approved the contents of this circular and has authorized us to send it to you.

Troy Krushel

Vice-President, Associate General Counsel & Corporate Secretary

Toronto, Ontario

March 13, 2020

2 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

Management Information Circular

March 13, 2020

In this document, we, us, our, the company and SLF Inc. mean Sun Life Financial Inc., and Sun Life Assurance means Sun Life Assurance Company of Canada. You, your and shareholder mean common shareholders of SLF Inc.

As permitted by the Canadian Securities Administrators and pursuant to an exemption from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions Canada (OSFI), we are using “notice and access” to deliver this Management Information Circular (Circular) to both our registered and non-registered shareholders. Instead of receiving a paper copy of this Circular in the mail, shareholders who hold common shares of SLF Inc. as of March 13, 2020, the record date for the meeting, have access to it online. A package was sent to the shareholders in the mail with a notice (Notice) explaining how to access this Circular electronically and how to request a paper copy of it. A form of proxy for registered shareholders and share ownership account participants, or a voting instruction form for non-registered shareholders, was included with the Notice with instructions so that you can vote your shares.

Notice and access allows for faster access to this Circular, helps reduce printing and postage costs, contributes to the protection of the environment and is consistent with our sustainability strategy.

How to access the Circular electronically

This Circular is available on our website (www.sunlife.com/2020agm) and on the website of our transfer agent, AST Trust Company (Canada) (AST) (www.meetingdocuments.com/astca/slf), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov/edgar.shtml).

Delivery of financial statements and management’s discussion and analysis

The manner in which we deliver our financial statements and management’s discussion and analysis (MD&A) to you depends on whether you are a registered shareholder, a share ownership account participant or a non-registered shareholder.

| • | You are registered shareholder if you hold a paper share certificate in your name or your shares are recorded electronically in the Direct Registration System (DRS) maintained by our transfer agent; |

| • | You are a share ownership account participant if you hold a share ownership statement; and |

| • | You are a non-registered shareholder (also known as a beneficial shareholder) if your securities broker, clearing agency, financial institution, trustee or custodian or other intermediary (your nominee) holds your shares for you in a nominee account. |

Registered shareholders

Registered shareholders who have not opted out of receiving our financial statements will receive them in hard copy, unless they have consented to electronic delivery (e-delivery). Please see Go digital! below for more information on signing up for e-delivery of our financial statements.

As permitted under securities laws, we are using notice and access to deliver our MD&A to registered shareholders. You may access the MD&A online in the same manner as described above for accessing the Circular online.

Share ownership account participants and non-registered shareholders

As permitted under securities laws, we are using notice and access to deliver our financial statements and MD&A to share ownership account participants and non-registered shareholders. You may access these materials online in the same manner as described above for accessing the Circular online.

MANAGEMENT INFORMATION CIRCULAR 2020 | 3

Table of Contents

Go Digital!

All shareholders are encouraged to sign up for email delivery of notices of meeting.

Registered shareholders who have not opted out of receiving our financial statements and who currently receive them in hard copy are encouraged to consent to e-delivery to receive them. Doing so means that you will be notified by email when the financial statements are made available, at which time they can be viewed and/or downloaded from our website (www.sunlife.com).

The chart below outlines the process by which shareholders can sign up for e-delivery.

| Go Digital! How to sign up for e-delivery | ||

| Registered shareholders and share ownership account participants |

Non-registered shareholders in Canada and the United States | |

| Sign up for e-delivery at the following website: https://ca.astfinancial.com/SLFGoDigital or by checking the box on the reverse side of your proxy form and providing your email address. |

Sign up for e-delivery at www.proxyvote.com using the control number appearing on your voting instruction form, or after the meeting by obtaining a unique registration number from your financial intermediary. | |

How to request a paper copy of materials provided to you through notice and access

Shareholders may request a paper copy of this Circular or our financial statements and MD&A up to one year from the date the Circular was filed on SEDAR. If you would like to receive a paper copy prior to the meeting, please follow the instructions provided in the Notice or make a request at any time prior to the meeting on AST’s website (www.meetingdocuments.com/astca/slf) or by contacting AST at 1-888-433-6443 (toll free in Canada and the United States) or 416-682-3801 (other countries). A copy of the requested documents will be sent to you at no cost within three business days of your request. If you request a paper copy of any materials, you will not receive a new form of proxy, so you should keep the original form sent to you in order to vote.

Questions?

If you have questions about notice and access or to request a paper copy of this Circular after the meeting at no charge, you can call AST at 1-888-433-6443 (toll free in Canada and the United States), or 416-682-3801 (other countries).

4 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

Consistent with the latest guidance from public health and government authorities regarding COVID-19, and in consideration of the health and safety of our employees, shareholders and the broader community, this year’s annual meeting will be held in a virtual only format by way of live webcast. Shareholders will have the opportunity to attend the meeting online in real time regardless of their geographic location, to submit questions and to vote on a number of important matters. Shareholders will not be able to attend the meeting in person. A summary of the information shareholders will need to attend the meeting online is provided below. In particular, see Voting on pages 5 to 8.

What the meeting will cover:

Financial statements

You will receive the consolidated financial statements for the year ended December 31, 2019, the auditors’ reports thereon and the actuary’s report on the policy liabilities reported in the financial statements.

Electing the directors (see pages 9 - 16)

You will vote on the election of 11 directors to serve on our board until the next annual meeting. All of the director nominees currently serve on our board. All 11 individuals are also nominated to serve as directors of Sun Life Assurance, a principal operating subsidiary which we wholly own.

Appointing the auditor (see page 17)

You will vote on the appointment of Deloitte LLP (Deloitte) as our auditor for 2020. Deloitte has been our auditor since SLF Inc. was incorporated in 1999 and has served as the auditor of Sun Life Assurance since 1875.

Having a “say on pay” (see page 18)

You will participate in a non-binding advisory vote on our approach to executive compensation, giving you an opportunity to express your view on the board’s approach to setting executive compensation as described in the Executive compensation section starting on page 47.

We will file the results of the votes, including the advisory vote, on SEDAR (www.sedar.com) and publish them on our website (www.sunlife.com). If a significant number of shareholders oppose the “say on pay” resolution, the board will consult shareholders to understand their concerns, and then review our approach to executive compensation with their concerns in mind. Our executive officers have a material interest in the outcome of the vote because it may affect our process for determining their compensation. It is impossible, however, for us to describe the impact of the vote or the consultations before they have taken place.

Considering other business

You can vote on other items of business that are properly brought before the meeting. As of the date of this Circular, we were not aware of any other items to be brought forward.

Who can vote

You are entitled to receive notice of and vote at our annual meeting of common shareholders if you were a shareholder of record as of 5:00 p.m. (Toronto time) on March 13, 2020.

As of March 13, 2020, we had 585,109,774 common shares outstanding. Each common share carries one vote. We require a simple majority of votes cast for any of the items of business to be approved.

Two persons holding, or representing by proxy, at least 25% of the shares entitled to vote constitute a quorum for the transaction of business at the meeting.

To the best of our knowledge, no person or company beneficially owns or exercises control or direction over, directly or indirectly, more than 10% of the voting rights attached to our common shares.

Common shares cannot be voted if they are beneficially owned by the Government of Canada, any province or territory of Canada, the government of a foreign country, or any political subdivision or agency of any of those entities.

MANAGEMENT INFORMATION CIRCULAR 2020 | 5

Table of Contents

How to vote

You have two ways to vote:

| • | by proxy; or |

| • | during the meeting by online ballot through the live webcast platform. |

Registered shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder) that attend the meeting online will be able to vote by completing a ballot online during the meeting through the live webcast platform.

Guests (including non-registered shareholders who have not duly appointed themselves as proxyholder) can log into the meeting as set out below. Guests will be able to listen to the meeting but will not be able to vote during the meeting.

| • | Step 1: Log in online at https://web.lumiagm.com/186947015. We recommend that you log in at least one hour before the meeting starts. |

| • | Step 2: Follow these instructions: |

Registered shareholders: Click “I have a control number” and then enter your control number and password ”sunlife2020” (case sensitive). The control number located on the form of proxy or in the email notification you received from AST is your control number. If you use your control number to log in to the meeting, any vote you cast at the meeting will revoke any proxy you previously submitted. If you do not wish revoke a previously submitted proxy, you should not vote during the meeting.

Duly appointed proxyholders: Click “I have a control number” and then enter your control number and password ”sunlife2020” (case sensitive). Proxyholders who have been duly appointed and registered with AST as described in this circular will receive a control number by email from AST after the proxy voting deadline has passed.

Guests: Click “Guest” and then complete the online form.

It is your responsibility to ensure internet connectivity for the duration of the meeting and you should allow ample time to log in to the meeting online before it begins.

|

|

|

Voting by proxy

|

| You can provide your instructions in one of these ways:

| ||

|

Mark, sign, date and return in the envelope provided.

| |

|

Mark, sign, date, scan and email both pages to proxyvote@astfinancial.com.

| |

|

(Canada & U.S. only) Call 1-888-489-7352 from a touchtone telephone and follow the voice instructions. You will need your control number printed on the front of the proxy form.

| |

|

Go to www.astvotemyproxy.com and follow the instructions on screen. You will need your control number printed on the front of the proxy form. | |

If you did not receive a form of proxy with a control number, you can find a form of proxy on AST’s website at www.meetingdocuments.com/astca/slf and can contact our transfer agent AST at 1 (877) 224-1760 (within North America) or 1 (416) 682-3865 (outside of North America) to obtain your control number.

|

Voting during the meeting

|

We are holding our annual meeting in a virtual only format and it will be conducted via live audio webcast. Attending the virtual meeting gives you an opportunity to hear directly from management.

If you want to attend the virtual meeting and vote your shares during the meeting, do not complete or return the proxy form. Provided you are connected to the internet and follow the instructions in this circular, you will be able to vote online in real time by completing an online ballot through the live webcast platform.

6 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

|

If you change your mind

|

You can revoke instructions you have already provided by giving us new instructions.

Registered shareholders and share ownership account participants can send a new proxy form in one of four ways:

| • | complete and sign a proxy form with a later date than the one you previously sent, and deliver or deposit it to AST as described above before 5:00 p.m. (Toronto time) on Friday, May 1, 2020 |

| • | submit new voting instructions to AST by telephone or internet before 5:00 p.m. (Toronto time) on Friday, May 1, 2020 |

| • | deliver or deposit a notice in writing with your new instructions signed by you, or your attorney as authorized by you in writing, to us before 5:00 p.m. (Toronto time) on Monday, May 4, 2020, or if the meeting is adjourned, before 5:00 p.m. (Toronto time) on the business day before the meeting is reconvened, at: SLF Inc., 1 York Street, 31st Floor, Toronto, Ontario, Canada M5J 0B6 Attention: Corporate Secretary. |

If you have followed the instructions for attending and voting at the meeting online, voting at the meeting online will revoke your previous instructions.

|

|

Non-Registered Holders who have not objected to their intermediary disclosing certain ownership information about themselves to the company are referred to as non-objecting beneficial owners or “NOBOs”. The company has elected to send the proxy-related materials directly to the NOBOs.

Carefully follow the instructions on the voting instruction form or proxy form your nominee provided with this Circular.

|

Voting by proxy

|

|

You can provide your instructions in one of these ways:

| ||

|

Mark, sign, date and return in the envelope provided.

| |

|

(Canada only) Call 1-800-474-7493 (English) or 1-800-474-7501 (French); or (U.S. only) Call 1-800-454-8683, from a touchtone telephone and follow the voice instructions. You will need your control number printed on the front of the form.

| |

|

Go to proxyvote.com and follow the instructions on screen. You will need your control number printed on the front of the form. | |

If you are a non-registered holder and you did not receive a form of proxy or voting instruction form with a control number please contact your nominee (i.e. your securities broker, clearing agency, financial institution, trustee or custodian or other intermediary).

|

Voting during the meeting

|

If you want to attend and vote at the virtual meeting, you must appoint yourself as proxyholder by printing your name in the space provided on the form and then following your nominee’s instructions for returning the form. You must also complete the additional step of registering the proxyholder by calling AST at 1-866-751-6315 (within North America) or 1 (212) 235-5754 (outside of North America) by no later than 5:00 p.m. (Toronto time) on Friday, May 1, 2020. Failing to register your proxyholder online will result in the proxyholder not receiving a control number, which is required to vote at the meeting.

Non-registered shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the meeting but will be able to participate as a guest.

|

If you change your mind

|

Non-registered shareholders can send a new voting instruction form to their nominees. To allow your nominee time to act on your instructions, you should provide them your instructions at least seven days before the meeting.

MANAGEMENT INFORMATION CIRCULAR 2020 | 7

Table of Contents

Voting by proxy is the easiest way to vote because you are giving someone else the authority to attend the meeting and vote your shares for you (called your proxyholder). If you specify on your proxy form or in your voting instructions how you want to vote on a particular matter, then your proxyholder must vote your shares according to your instructions.

The enclosed proxy form names William D. Anderson, Chairman of the Board, or in his absence Scott F. Powers, Chair of the Governance, Nomination & Investment Committee (GNIC), or in his absence another director appointed by the board, as your proxyholder to vote your shares at the meeting according to your instructions.

If you appoint them as proxyholders but do not specify on the proxy form how you want to vote your shares, your shares will be voted:

| • | FOR electing each of the director nominees who are listed in the proxy form and Circular |

| • | FOR appointing Deloitte as auditor |

| • | FOR the advisory resolution accepting our approach to executive compensation. |

You can appoint another person to vote your shares by printing his or her name in the space provided on the proxy form and registering them online, as described above. This person does not need to be a shareholder, but your vote can only be counted if he or she participates in the virtual meeting and votes for you. Regardless of who you appoint as your proxyholder, if you do not specify how you want to vote your shares, your proxyholder can vote as he or she sees fit. Your proxyholder can also vote as he or she decides on any other items of business that properly come before the meeting, and on any amendments to the items listed above.

AST must receive your voting instructions by 5:00 p.m. (Toronto time) on Friday, May 1, 2020 to have your vote recorded. If the meeting is adjourned, AST must receive your voting instructions by 5:00 p.m. (Toronto time) on the date that is two business days before the meeting is reconvened.

|

|

||||||

| You can call AST or one of its agents directly at the following numbers: |

||||||

| Canada and the United States: |

1-877-224-1760 | |||||

| United Kingdom, Republic of Ireland, Channel Islands and Isle of Man: |

+ 44 (0) 345-602-1587 | |||||

| Philippines: |

632-5318-8567 (Metro Manila) 1-800-1-888-2422 (Provinces) |

|||||

| Hong Kong: |

852-2862-8555 | |||||

| Other countries: |

416-682-3865 | |||||

Processing the votes

AST counts and tabulates the votes on our behalf. Individual shareholder votes are kept confidential and voting instructions are only communicated to management if it is clear that the shareholder wants to communicate directly with management, or when the law requires it.

We will file the voting results on SEDAR (www.sedar.com) and publish them on our website (www.sunlife.com).

Solicitation of proxies

Management is soliciting your proxy, and we have retained Kingsdale Advisors (Kingsdale) to assist us at an estimated cost of $41,000. The solicitation of proxies will be made primarily by mail, but Kingsdale may also contact you by telephone. We pay all solicitation costs.

8 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

As of the date of this Circular, we have 11 directors on our board. Under our by-laws, the board can have eight to 20 directors. At its meeting held on February 12, 2020, the board fixed the number of directors at 11. At the 2020 annual meeting, 11 directors are to be elected for a term ending at the conclusion of the next annual meeting. All of the 11 nominees currently serve on our board. Below are key highlights of your director nominees.

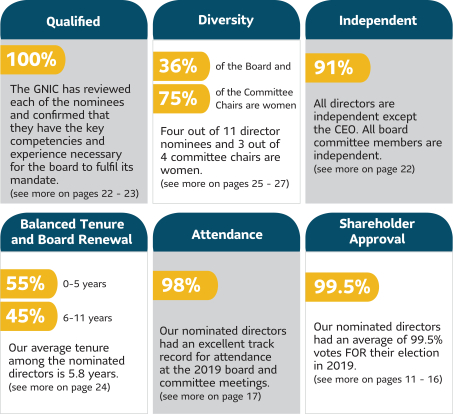

Qualified (see more on page ") 100% The GNIC has reviewed each of the nominees and confirmed that they have the key competencies and experience necessary for the board to fulfil its mandate. Diversity (see more on page ") 36% of the Board and 75% of the Committee Chairs are women Four out of 11 director nominees and 3 out of 4 committee chairs are women Independent (see more on pages ") 91% All directors are independent except the CEO. All board committee members are independent. Balanced Tenure and Board Renewal (see more on page ") 55% 0-5 years 45% 6-11 years Our average tenure among the nominated directors is 5.8 years. Attendance (see more on page ") 98% Our nominated directors had an excellent track record for attendance at the 2019 board and committee meetings. Shareholder Approval (see more on pages ") 99.5% Our nominated directors had an average of 99.5% votes FOR their election in 2019.

We expect that all of the nominees will be able to serve as director but if for any reason a nominee is unable to serve, the persons named in the proxy form have the right to vote at their discretion for another nominee proposed according to the company’s by-laws and applicable law.

The board recommends that shareholders vote for electing each of the director nominees profiled below. If you do not specify in the proxy form or your voting instruction how you want to vote your shares, the persons named in the form will vote for electing each of the director nominees profiled below.

Our policy on majority voting

The election of directors at the meeting is expected to be an uncontested election, meaning that the number of nominees will be equal to the number of directors to be elected. If a director receives more “withheld” than “for” votes in an uncontested election, he or she must tender a written offer to resign to the board. The board will accept the resignation within 90 days unless there are exceptional circumstances and will disclose the reasons for its decision in a news release. The director will not participate in these deliberations.

MANAGEMENT INFORMATION CIRCULAR 2020 | 9

Table of Contents

Our policy on proxy access

Under the board’s proxy access policy, qualifying shareholders may submit one or more director nominations to be included in the Circular and form of proxy and ballot for any annual meeting. To make a nomination, qualifying shareholders must, prior to the deadline for submitting proposals (see Shareholder proposals on page 33), submit a nomination notice in the required form. The policy has the following principal features:

| • | one or more nominating shareholders (up to a maximum of 20) may nominate up to the greater of two directors and 20% of the board |

| • | nominating shareholders must collectively own at least 5% of the company’s common shares |

| • | nominating shareholders must have held their shares for at least three years |

| • | the proposal will be included in the company’s Circular, form of proxy and ballot for the annual shareholders’ meeting |

| • | nominating shareholders may include a statement of up to 500 words in support of their candidates. |

A copy of the policy is available on our website (www.sunlife.com).

Alternatively, in accordance with section 147 of the Insurance Companies Act (Canada), shareholders holding in the aggregate not less than 5% of the company’s shares for the minimum period of time set out by the Insurance Companies Act (Canada) may submit a formal proposal for individuals to be nominated for election as directors in accordance with the specified procedures to be followed.

Our advance notice by-law

Our by-laws specify that a shareholder who wishes to nominate an individual for election as a director at an annual meeting must provide between 30 and 65 days advance notice to the company. The notice to the company must include information about the nominee, including age, address, principal occupation, the number of SLF Inc. shares owned or controlled, and any other information that would be required to be disclosed in a dissident’s proxy circular in connection with solicitations of proxies for the election of directors. The notice must also include information about the nominating shareholder, including ownership or control of, or rights to vote, SLF Inc. shares and any other information that would be required to be disclosed in a dissident’s proxy circular in connection with solicitations of proxies for the election of directors. The company may require additional information to be provided, including information to comply with requirements of OSFI relating to the suitability of directors and potential changes to the board.

The advance notice provisions described above do not apply to nominations made by or on behalf of the board or by shareholders pursuant to shareholder proposals, requisitioned meetings, or through our proxy access policy which have separate requirements and deadlines. In addition, in the case of a special meeting at which directors are to be elected, a shareholder’s notice of a nomination must be provided not later than 15 days after the date of the special meeting is announced.

Director nominee profiles

The following profiles provide information about each of the director nominees, including when they joined our board, their business experience, their committee memberships, their attendance at board and committee meetings in 2019, the level of support received from shareholders at our 2019 annual meeting, and other public company directorships held in the last five years. Our 11 director nominees have an average board tenure of 5.8 years and four of them (36%) are women.

The director nominee profiles also include information about the value of their holdings of SLF Inc. common shares and deferred share units (DSUs). A DSU is equal in value to a common share but cannot be redeemed until a director leaves the board. Common shares and DSUs count towards the achievement of our share ownership guidelines for directors which each director is expected to meet within five years of joining the board. The share ownership guidelines provide that director must own at least $735,000 in common shares and/or DSUs within five years of joining the board. For director nominees who have not achieved the guideline, we determine if they are “on target” by calculating the number of common shares and DSUs they will hold by their achievement due dates based on the form of remuneration they have individually elected. For this purpose we assume that the share price and dividend rate remain constant until the applicable achievement due date. The amounts shown in the profiles are as of February 28, 2020 and March 1, 2019 when the closing price of our common shares on the Toronto Stock Exchange (TSX) was $57.99 and $50.37, respectively. You can find additional information about our director compensation program and share ownership guidelines starting on pages 43 and 44, respectively.

10 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

|

William D. Anderson, FCPA, FCA Toronto, ON, Canada

Director since May 2010

Independent

Age: 70

Areas of expertise:

• finance, accounting and actuarial • risk management • international business • public company • corporate strategy and development

Current committees:

• None1 |

Mr. Anderson is the Chairman of the Boards of SLF Inc. and Sun Life Assurance. He was President of BCE Ventures, the strategic investment unit of the global telecommunications company BCE Inc., until he retired in December 2005. Mr. Anderson held senior positions including Chief Financial Officer of BCE Inc. and Bell Canada during his 14 years with that company. He spent 17 years with the public accounting firm KPMG, where he was a partner for nine years. Mr. Anderson is a Fellow of the Institute of Chartered Professional Accountants of Ontario and is also a Fellow of the Institute of Corporate Directors.

| |||||||||||||||||||||

|

2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Gildan Activewear Inc. |

|

2006 – present | ||||||||||||||

|

|

TransAlta Corporation |

|

2003 – 2016 | |||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: | ||||||||||||||||||||||

| Year | Common shares | DSUs | |

Total common shares and DSUs |

|

|

Total value |

|

Share ownership guideline/ target date | |||||||||||||

|

2020 |

15,600 |

|

27,836 |

|

|

43,436 |

|

|

$2,518,854 |

|

Meets | |||||||||||

|

2019 |

15,600 |

|

22,605 |

|

|

38,205 |

|

|

$1,924,386 |

|

||||||||||||

|

Change |

0 |

|

5,231 |

|

|

5,231 |

|

|

$594,468 |

|

||||||||||||

|

1 Mr. Anderson attends committee meetings in his capacity as non-executive Chairman.

| ||||||||||||||||||||||

|

Dean A. Connor Toronto, ON, Canada

Director since July 2011

Non-independent

Age: 63

Current committees:

• None1 |

Mr. Connor is President & Chief Executive Officer of SLF Inc. and Sun Life Assurance. He was named as one of the 100 best performing CEOs of 2019 by Harvard Business Review, received the Ivey Business Leader of the Year award in 2018 from the Ivey Business School, and was named Canada’s Outstanding CEO of the Year® for 2017. Prior to his appointment in December 2011 he held progressively senior positions with Sun Life Inc. and Sun Life Assurance, including President, Chief Operating Officer, President of Sun Life Canada, and Executive Vice-President. Prior to joining the company in September 2006, Mr. Connor spent 28 years with Mercer Human Resource Consulting where he held numerous senior positions, most recently President for the Americas. Mr. Connor is a Fellow of the Canadian Institute of Actuaries and the Society of Actuaries. He is a trustee of the University Health Network in Toronto and a director of the Business Council of Canada. Mr. Connor is a member of the Ivey Advisory Board, Ivey Business School, Western University and the Asia Business Leaders Advisory Council. He holds an Honours Business Administration degree.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

None |

|

|||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

|

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

95,643 |

|

140,567 |

|

|

236,210 |

|

|

$13,697,818 |

|

Meets2 | |||||||||||

|

2019 |

94,807 |

|

135,385 |

|

|

230,192 |

|

|

$11,594,771 |

|

||||||||||||

|

Change |

836 |

|

5,182 |

|

|

6,018 |

|

|

$2,103,047 |

|

||||||||||||

|

1 Mr. Connor attends committee meetings, in full or in part, as appropriate, at the request of the committee chairs, but is not a member of any committee.

2 As President & Chief Executive Officer, Mr. Connor is subject to different share ownership guidelines than the independent directors. See page 59. | ||||||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 2020 | 11

Table of Contents

|

Stephanie L. Coyles Toronto, ON, Canada

Director since January 2017

Independent

Age: 53

Areas of expertise:

• client needs, sales and distribution • international business • public company • corporate strategy and development • digital and data/analytics

Current committees:

• Audit • Governance, Nomination & Investment |

Ms. Coyles is a corporate director. Her background is as a strategic consultant and advisor who has worked with a diverse clientele across North America, including retail, consumer distribution, private equity and business consulting organizations. She was previously Chief Strategic Officer at LoyaltyOne Co. from 2008 to 2012 and a principal at McKinsey & Company Canada from 2000 to 2008. In addition to the public company boards listed below, Ms. Coyles serves on the advisory board of Reliant Web Hosting Inc. and on the board of The Earth Rangers Foundation. She holds a Master in Public Policy degree. Ms. Coyles received the ICD.D designation from the Institute of Corporate Directors and the CERT Certificate in Cybersecurity Oversight, issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Corus Entertainment Inc. |

|

March 2020 – present | ||||||||||||||

|

Audit |

5 of 5 |

|

100% |

|

|

Metro Inc. |

|

2015 – present | ||||||||||||||

|

Governance, Nomination & Investment |

2 of 2 |

|

100% |

|

|

Hudson’s Bay Company |

|

2019 – March 2020 | ||||||||||||||

|

Risk & Conduct Review |

3 of 3 |

|

100% |

|

|

Postmedia Network

Canada |

|

January – | ||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

|

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

5,100 |

|

7,058 |

|

|

12,158 |

|

$ |

705,042 |

|

On target for January 1, 2022 | |||||||||||

|

2019 |

3,600 |

|

4,687 |

|

|

8,287 |

|

$ |

417,416 |

| ||||||||||||

|

Change |

1,500 |

|

2,371 |

|

|

3,871 |

|

$ |

287,626 |

| ||||||||||||

|

Martin J. G. Glynn Vancouver, BC, Canada

Director since December 2010

Independent

Age: 68

Areas of expertise:

• finance, accounting and actuarial • risk management • talent and culture • international business • public company

Current committees:

• Management Resources • Risk & Conduct Review |

Mr. Glynn is Chair of the Public Sector Pension Investment Board. He was President and Chief Executive Officer of HSBC Bank USA until his retirement in 2006. During his 24 years with HSBC, an international banking and financial services organization, Mr. Glynn held various senior positions including President and Chief Executive Officer of HSBC Bank Canada. He is a director of The American Patrons of the National Library and Galleries of Scotland and St Andrews Applied Research Limited and is on the Fund Advisory Board for Balfour Pacific Capital. He holds a Master of Business Administration degree.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Husky Energy Inc. |

|

2000 – present | ||||||||||||||

|

Management Resources |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

Risk & Conduct Review |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

|

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

10,316 |

|

22,077 |

|

|

32,393 |

|

|

$1,878,470 |

|

Meets | |||||||||||

|

2019 |

10,316 |

|

19,152 |

|

|

29,468 |

|

|

$1,484,303 |

|

||||||||||||

|

Change |

0 |

|

2,925 |

|

|

2,925 |

|

|

$394,167 |

|

||||||||||||

12 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

|

Ashok K. Gupta, FFA London, England

Director since May 2018

Independent

Age: 65

Areas of expertise:

• finance, accounting and actuarial • insurance, health and wealth • risk management • corporate strategy and development • digital and data/analytics

Current committees:

• Management Resources • Risk & Conduct Review |

Mr. Gupta is a corporate director. During his 40-year career in the UK insurance and financial services industry, he has held a number of senior executive, advisor and actuarial positions. From 2010 to 2013, he was an advisor to the Group Chief Executive Officer of Old Mutual plc. Prior to this he held various senior positions with the Pearl Group plc (now Phoenix Group Holdings plc), Kinnect of Lloyd’s of London, CGU plc (now part of Aviva plc), Scottish Amicable Life Assurance Company (now part of Prudential) and Tillinghast, Nelson & Warren Inc. (now part of Willis Towers Watson plc). Mr. Gupta is a Fellow of the Institute and Faculty of Actuaries. He is also Chairman of EValue Ltd., and a trustee of the Ethical Journalism Network. From 2013 to September 2019, Mr. Gupta was a director of New Ireland Assurance Company plc. He was involved in the UK public sector and served on the Actuarial Council and Codes and Standards Committee of the Financial Reporting Council in the U.K. between 2012 and 2018, was Chair of the Defined Benefits Taskforce of the Pensions and Lifetime Savings Association from 2016 to 2017 and Joint Deputy Chair of the Procyclicality Working Group of the Bank of England from 2012 to 2014. Mr. Gupta holds a Master of Business Administration degree.

|

| ||||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships |

| ||||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

JPMorgan European |

|

|

2013 – present |

| ||||||||||||||

|

Management Resources |

6 of 6 |

|

100% |

|

||||||||||||||||||||

|

Risk & Conduct Review |

6 of 6 |

|

100% |

|

||||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.6% |

|

|||||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||||

| Year | Common shares | DSUs | |

Total common shares and DSUs |

|

|

Total value |

|

|

Share ownership guideline/ target date |

| |||||||||||||

|

2020 |

462 |

|

4,391 |

|

|

4,853 |

|

|

$281,425 |

|

|

On target for May 9, 2023 |

| |||||||||||

|

2019 |

0 |

|

1,852 |

|

|

1,852 |

|

|

$93,285 |

| ||||||||||||||

|

Change |

462 |

|

2,539 |

|

|

3,001 |

|

|

$188,140 |

| ||||||||||||||

|

M. Marianne Harris Toronto, ON, Canada

Director since December 2013

Independent

Age: 62

Areas of expertise:

• finance, accounting and actuarial • insurance, health and wealth • talent and culture • public company • corporate strategy and development

Current committees:

• Management Resources (Chair) • Risk & Conduct Review |

Ms. Harris is a corporate director. She was Managing Director and President, Corporate and Investment Banking, Merrill Lynch Canada, Inc., an international banking and financial services organization, until 2013. She held progressively senior positions during her 13-year career with Merrill Lynch and affiliated companies in Canada and the U.S., including President, Global Markets and Investment Banking, Canada, Head of Financial Institutions Group, Americas and Head of Financial Institutions, Canada. Before joining Merrill Lynch, Ms. Harris held various investment banking positions with RBC Capital Markets from 1984 to 2000, including Head of the Financial Institutions Group. She is a director of President’s Choice Bank and a member of the Dean’s Advisory Council for the Schulich School of Business & the Advisory Council for the Hennick Centre for Business and Law. Ms. Harris holds a Master of Business Administration degree and a Juris Doctorate.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Loblaw Companies Limited |

|

2016 – present | ||||||||||||||

|

Management Resources |

6 of 6 |

|

100% |

|

|

Hydro One Limited |

|

2015 – 2018 | ||||||||||||||

|

Risk & Conduct Review |

6 of 6 |

|

100% |

|

|

Agrium Inc. |

|

2014 – 2015 | ||||||||||||||

|

2019 Annual Meeting votes in favour: 99.4% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares | DSUs | |

Total common shares and DSUs |

|

|

Total value |

|

Share ownership guideline/ target date | |||||||||||||

|

2020 |

5,961 |

|

34,229 |

|

|

40,190 |

|

|

$2,330,618 |

|

Meets | |||||||||||

|

2019 |

5,743 |

|

27,986 |

|

|

33,729 |

|

|

$1,698,930 |

|

||||||||||||

|

Change |

218 |

|

6,243 |

|

|

6,461 |

|

|

$631,688 |

|

||||||||||||

MANAGEMENT INFORMATION CIRCULAR 2020 | 13

Table of Contents

|

Sara Grootwassink Lewis, CPA, CFA Scottsdale, AZ, United States

Director since December 2014

Independent

Age: 52

Areas of expertise:

• finance, accounting and actuarial • talent and culture • government relations/policy • public company • corporate strategy and development

• designated audit committee financial expert

Current committees:

• Audit (Chair) • Governance, Nomination & Investment |

Ms. Lewis is a corporate director. Prior to 2009 she held progressively senior positions during her seven-year career with Washington Real Estate Investment Trust, a publicly traded real estate investment trust, including Executive Vice-President, and was Chief Financial Officer from 2002 to 2009. In addition to the public company boards listed below, Ms. Lewis serves on the Leadership Board and Governance Working Group for the United States Chamber of Commerce—Center for Capital Markets Competitiveness and is Trustee of The Brookings Institution. She is a Board Leadership Fellow of the National Association of Corporate Directors and a member of the Tapestry West Audit Committee Network and the Institute of Corporate Directors. Ms. Lewis is a Certified Public Accountant and a Chartered Financial Analyst. She was named to the National Association of Corporate Directors (NACD) Directorship 100 in 2017.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Healthpeak Properties, Inc. |

|

2019 – present | ||||||||||||||

|

Audit |

5 of 5 |

|

100% |

|

|

Weyerhaeuser Company1 |

|

2016 – present | ||||||||||||||

|

Governance, Nomination & Investment |

5 of 5 |

|

100% |

|

|

PS Business Parks, Inc. |

|

2010 – 2019 | ||||||||||||||

|

|

Adamas Pharmaceuticals, Inc. |

|

2014 – 2016 | |||||||||||||||||||

|

|

Plum Creek Timber Company, Inc.1 |

|

2013 – 2016 | |||||||||||||||||||

|

|

CapitalSource, Inc. |

|

2004 – 2014 | |||||||||||||||||||

|

2019 Annual Meeting votes in favour: 98.8% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares | DSUs | |

Total common shares and DSUs |

|

|

Total value |

|

Share ownership guideline/ target date | |||||||||||||

|

2020 |

5,680 |

|

24,880 |

|

|

30,560 |

|

|

$1,772,174 |

|

Meets | |||||||||||

|

2019 |

5,500 |

|

21,060 |

|

|

26,560 |

|

|

$1,337,827 |

|

||||||||||||

|

Change |

180 |

|

3,820 |

|

|

4,000 |

|

|

$434,347 |

|

||||||||||||

|

1 In 2016, Weyerhaeuser Company merged with Plum Creek Timber Company, Inc. and the combined company retained the Weyerhaeuser name. Ms. Lewis continues to serve on the board of Weyerhaeuser. | ||||||||||||||||||||||

|

James M. Peck San Antonio, TX, United States

Director since January 2019

Independent

Age: 56

Areas of expertise:

• talent and culture • international business • public company • corporate strategy and development • digital and data/analytics

Current committees:

• Management Resources • Risk & Conduct Review |

Mr. Peck has over 20 years of information management, global product development and engineering experience. Mr. Peck served as Senior Advisor of TransUnion from May 2019 to February 2020 and as President & Chief Executive Officer from 2012 to May 2019. Prior to joining TransUnion in 2012 Mr. Peck held progressively senior positions during his career with Reed Elsevier (now RELX Group), a FTSE 100 multinational information and analytics company, where he served as Chief Executive Officer of its LexisNexis Risk Solutions business from 2004 to 2012. From 1999 to 2001 Mr. Peck was General Manager, Online Business and Senior Vice-President, Product Development with Celera Genomics, a bio-technology firm that sequenced the human genome. He is a director of CCC Information Services, Inc. and Neo on Business Ltd. Mr. Peck holds a Master of Business Administration degree, and received the CERT Certificate in Cybersecurity Oversight, issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

10 of 11 |

|

91% |

|

|

TransUnion |

|

2012 – | ||||||||||||||

|

Management Resources |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

Risk & Conduct Review |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.4% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

|

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

0 |

|

4,695 |

|

|

4,695 |

|

|

$272,263 |

|

On target for January 1, 2024 | |||||||||||

|

2019 |

0 |

|

0 |

|

|

0 |

|

|

$0 |

| ||||||||||||

|

Change |

0 |

|

4,695 |

|

|

4,695 |

|

|

$272,263 |

| ||||||||||||

14 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

|

Scott F. Powers Boston, MA, United States

Director since October 2015

Independent

Age: 60

Areas of expertise:

• talent and culture • client needs, sales and distribution • international business • public company • corporate strategy and development

Current committees:

• Governance, Nomination & Investment (Chair) • Management Resources |

Mr. Powers is a corporate director. He was President and Chief Executive Officer of State Street Global Advisors until his retirement in August 2015. Before joining State Street in 2008 he was President and Chief Executive Officer of Old Mutual Asset Management Plc, the U.S.-based global asset management business of Old Mutual plc. Prior to 2008 Mr. Powers held senior executive positions at Mellon Institutional Asset Management, BNY Mellon’s investment management business, and at The Boston Company Asset Management, LLC. He has also served as a member of the Systemic Risk Council and the Advisory Board of the U.S. Institute of Institutional Investors.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

Automatic Data Processing, Inc. |

|

2018 – Present | ||||||||||||||

|

Governance, Nomination & Investment |

5 of 5 |

|

100% |

|

|

PulteGroup, Inc. |

|

2016 – Present | ||||||||||||||

|

|

Whole Foods Market, Inc. |

|

May – August 2017 | |||||||||||||||||||

|

Management Resources |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

|

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

975 |

|

17,061 |

|

|

18,036 |

|

|

$1,045,908 |

|

Meets | |||||||||||

|

2019 |

975 |

|

12,209 |

|

|

13,184 |

|

|

$664,078 |

|

||||||||||||

|

Change |

0 |

|

4,852 |

|

|

4,852 |

|

|

$381,830 |

|

||||||||||||

|

Hugh D. Segal, OC, OONT., CD Kingston, ON, Canada

Director since May 2009

Independent

Age: 69

Areas of expertise:

• risk management • client needs, sales and distribution • government relations/policy • public company • corporate strategy and development

Current committees:

• Audit • Governance, Nomination & Investment |

Mr. Segal is a corporate director. He served as Principal of Massey College, University of Toronto from 2014 to June 2019. Before that, he was a Canadian senator from 2005 to 2014 and President and Chief Executive Officer of the Institute for Research on Public Policy from 1999 to 2006. Mr. Segal was formerly Chair of the NATO Association of Canada and Vice-Chair of the Institute of Canadian Advertising. He is a Senior Advisor at Aird & Berlis LLP. Mr. Segal is Chair and a Distinguished Fellow at the School of Policy Studies External Advisory Board and the Donald Matthews Faculty Fellow in Global Public Policy, Queen’s University, a Distinguished Fellow at the Munk School of Global Affairs, University of Toronto and a Senior Fellow at the Canadian Institute of Global Affairs. He is an Honorary Captain of the Royal Canadian Navy, an Honorary Captain of the Canadian Forces College and Honorary Chair of the Navy League of Canada. Mr. Segal is an officer of the Order of Canada and a member of the Order of Ontario.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

10 of 11 |

|

91% |

|

|

Just Energy Group Inc. (formerly |

|

2001 – 2015 | ||||||||||||||

|

Audit |

5 of 5 |

|

100% |

|

||||||||||||||||||

|

Governance, Nomination & Investment |

5 of 5 |

|

100% |

|

||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.3% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

|

Total value |

Share ownership guideline/ target date | ||||||||||||||

|

2020 |

8,657 |

|

26,014 |

|

|

34,671 |

|

|

$2,010,571 |

|

Meets | |||||||||||

|

2019 |

8,657 |

|

22,944 |

|

|

31,601 |

|

|

$1,591,742 |

|

||||||||||||

|

Change |

0 |

|

3,070 |

|

|

3,070 |

|

|

$418,829 |

|

||||||||||||

MANAGEMENT INFORMATION CIRCULAR 2020 | 15

Table of Contents

|

Barbara G. Stymiest, FCPA, FCA Toronto, ON, Canada

Director since May 2012

Independent

Age: 63

Areas of expertise:

• finance, accounting and actuarial • insurance, health and wealth • risk management • government relations/policy • corporate strategy and development

• designated audit committee financial expert

Current committees:

• Risk & Conduct Review (Chair) • Audit |

Ms. Stymiest is a corporate director. She was a member of the Group Executive at Royal Bank of Canada, an international banking and financial services organization, from 2004 to 2011; Royal Bank’s Group Head, Strategy, Treasury and Corporate Services from 2010 to 2011; Chief Operating Officer from 2004 to 2009. Prior to that Ms. Stymiest held senior positions in the financial services sector including Chief Executive Officer, TSX Group Inc., Executive Vice-President and Chief Financial Officer, BMO Nesbitt Burns, and Partner, Financial Services Group, Ernst & Young LLP. She is a Fellow of the Institute of Chartered Professional Accountants of Ontario and received an Award of Outstanding Merit from that organization in 2011. In addition to the public company boards listed below, Ms. Stymiest is the Vice-Chair of the University Health Network in Toronto, a director of the Canadian Institute for Advanced Research and a director of President’s Choice Bank. She holds an Honours Business Administration degree. Ms. Stymiest was named to National Association of Corporate Directors (NACD) Directorship 100 in 2018.

| |||||||||||||||||||||

| 2019 Meeting attendance |

|

|

Other public company directorships | |||||||||||||||||||

|

Board |

11 of 11 |

|

100% |

|

|

George Weston Limited |

|

2011 – present | ||||||||||||||

|

Audit |

5 of 5 |

|

100% |

|

|

BlackBerry Limited |

|

2007 – present | ||||||||||||||

|

Risk & Conduct Review |

6 of 6 |

|

100% |

|

||||||||||||||||||

|

2019 Annual Meeting votes in favour: 99.7% |

|

|||||||||||||||||||||

| SLF Inc. securities held: |

|

|||||||||||||||||||||

| Year | Common shares |

DSUs | |

Total common shares and DSUs |

|

Total value |

Share ownership guideline/ target date | |||||||||||||||

|

2020 |

5,000 |

|

40,295 |

|

|

45,295 |

|

|

$2,626,657 |

|

Meets | |||||||||||

|

2019 |

5,000 |

|

34,532 |

|

|

39,532 |

|

|

$1,991,227 |

|

||||||||||||

|

Change |

0 |

|

5,763 |

|

|

5,763 |

|

|

$635,430 |

|

||||||||||||

To the knowledge of the company, other than as set out below, no proposed director is, as at the date of this Circular, or has been, in the last ten years (a) a director, chief executive officer or chief financial officer of any company (including SLF Inc.) that was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days that: (i) was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or (b) a director or executive officer of any company (including SLF Inc.) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Further, to the knowledge of the company, other than as set forth below, no proposed director has been (a) bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or (b) subject to (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director:

| • | Ms. Coyles was a director of Postmedia Network Canada Corp. while it completed a restructuring following an arrangement plan under the Canada Business Corporations Act in October 2016. Ms. Coyles is no longer a director of Postmedia Network Canada Corp. |

| • | Mr. Glynn was a director of MF Global Holdings Ltd. when it filed a voluntary petition under Chapter 11 of the Bankruptcy Code in the United States in October 2011. Mr. Glynn is no longer a director of MF Global Holdings Ltd. |

16 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

| • | Mr. Peck was a director and President & Chief Executive Officer of TransUnion when it agreed to settle a Civil Investigative Demand by the U.S. Consumer Financial Protection Bureau (CFPB) in December 2016 focused on common industry practices relating to the advertising, marketing and sale of consumer reports, credit scores or credit monitoring products to consumers by TransUnion’s Consumer Interactive segment. TransUnion executed a Stipulation and Consent to the Issuance of a Consent Order which was issued by the CFPB in January 2017, which required them to implement certain practice changes in the way they advertise, market and sell products and services to consumers, develop a comprehensive compliance plan, and pay approximately US$13.9 million for redress to eligible customers and a civil money penalty to the CFPB in the amount of US$3.0 million. |

Meeting attendance

The GNIC reviews the attendance record of each director as part of the nomination process. Directors must attend at least 75% of board and committee meetings every year. A director who does not meet this attendance requirement in two consecutive years must offer to resign. The table below is a consolidated view of how many board and committee meetings each director attended in 2019. From time to time unscheduled board meetings may be called on short notice to consider mergers and acquisitions (M&A) transactions or other matters and one or more of our directors may be unable to attend these meetings due to the short notice. Where a director is unable to attend a meeting, feedback and questions based on meeting materials are directed to the Chairman of the Board or the Chair of the applicable committee, as appropriate, to address at the meeting. During the year ended December 31, 2019, average attendance of all directors at both board and committee meetings was 98%.

| Name | Board meetings attended |

Committee meetings attended |

Total meetings attended | |||||||||||||||||||||||||||

| William D. Anderson1 |

11 of 11 | 100% | n/a | n/a | 11 of 11 | 100% | ||||||||||||||||||||||||

| Dean A. Connor2 |

11 of 11 | 100% | n/a | n/a | 11 of 11 | 100% | ||||||||||||||||||||||||

| Stephanie L. Coyles3 |

11 of 11 | 100% | 10 of 10 | 100% | 21 of 21 | 100% | ||||||||||||||||||||||||

| Martin J. G. Glynn |

11 of 11 | 100% | 12 of 12 | 100% | 23 of 23 | 100% | ||||||||||||||||||||||||

| Ashok K. Gupta |

11 of 11 | 100% | 12 of 12 | 100% | 23 of 23 | 100% | ||||||||||||||||||||||||

| M. Marianne Harris |

11 of 11 | 100% | 12 of 12 | 100% | 23 of 23 | 100% | ||||||||||||||||||||||||

| Sara Grootwassink Lewis |

11 of 11 | 100% | 10 of 10 | 100% | 21 of 21 | 100% | ||||||||||||||||||||||||

| Christopher J. McCormick4 |

3 of 4 | 75% | 4 of 6 | 67% | 7 of 10 | 70% | ||||||||||||||||||||||||

| James M. Peck |

10 of 11 | 91% | 12 of 12 | 100% | 22 of 23 | 96% | ||||||||||||||||||||||||

| Scott F. Powers |

11 of 11 | 100% | 11 of 11 | 100% | 22 of 22 | 100% | ||||||||||||||||||||||||

| Hugh D. Segal |

10 of 11 | 91% | 10 of 10 | 100% | 20 of 21 | 95% | ||||||||||||||||||||||||

| Barbara G. Stymiest |

11 of 11 | 100% | 11 of 11 | 100% | 22 of 22 | 100% | ||||||||||||||||||||||||

| 1 | Mr. Anderson attended committee meetings in his capacity as non-executive Chairman. |

| 2 | Mr. Connor attended committee meetings in his capacity as President & Chief Executive Officer and a director. |

| 3 | On May 9, 2019, Ms. Coyles ceased to be a member of the Risk & Conduct Review Committee and became a member of the GNIC. |

| 4 | On May 9, 2019, Mr. McCormick retired. He was a member of the GNIC and the Management Resources Committee. |

The board, on the recommendation of the Audit Committee (AC), recommends that shareholders vote for the appointment of Deloitte as auditor of SLF Inc. for 2020. Deloitte has been our auditor since SLF Inc. was incorporated in 1999 and has served as the auditor of Sun Life Assurance since 1875. If you do not specify in the proxy form or your voting instructions how you want to vote your shares, the persons named in the form will vote for the appointment of Deloitte as auditor.

MANAGEMENT INFORMATION CIRCULAR 2020 | 17

Table of Contents

Auditor’s fees

The following table shows the fees relating to services provided by Deloitte for the past two years.

| For the year ended December 31 | ($millions) | |||||||

| 2019 | 20181 | |||||||

| Audit services |

18.1 | 17.4 | ||||||

| Audit-related services |

1.2 | 1.1 | ||||||

| Tax services |

0.5 | 0.3 | ||||||

| All other services |

1.7 | 1.3 | ||||||

| Total |

21.5 | 20.1 | ||||||

| 1 | Adjustment of $0.1 to audit services; adjustment of $0.3 to other services. |

Audit fees relate to professional services rendered by the auditors for the audit of our annual consolidated financial statements, the statements for our segregated funds and services related to statutory and regulatory filings. Audit services fees of $12.6 (2018: $11.1) relates to audit of the consolidated financial statements of SLF Inc. and its subsidiaries to support the group audit opinions expressed in Deloitte’s report; the remaining Audit services fees of $5.5 (2018: $6.3) relates to audit of the statements for segregated funds and statutory and regulatory filing.

Audit-related services fees include assurance services not directly related to performing the audit of the annual consolidated financial statements of the company. These include internal control reviews, specified procedure audits and employee benefit plan audits.

Tax services fees relate to tax compliance, tax advice and tax planning.

All other services fees relate to products and services other than audit, audit-related and tax as described above.

We have a policy that requires the AC to pre-approve any services that are to be provided by the external auditor. The committee has, subject to certain fee thresholds and reporting requirements, pre-approved certain audit, audit-related and other permissible non-audit services that are consistent with maintaining the independence of the external auditor. You can find more information about this policy in our 2019 annual information form which is filed with the Canadian Securities Regulators on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov/edgar.shtml).

Non-binding advisory vote on our approach to executive compensation

Since 2010, the board has held an annual advisory vote on our approach to executive compensation to respond to shareholders and other stakeholders who were advocating for this form of shareholder engagement.

One of the board’s primary responsibilities is to ensure Sun Life is able to attract, retain and reward qualified executives. While shareholders will provide their collective views on our approach to executive compensation through the advisory vote, the directors are still fully responsible for their compensation decisions. Detailed information on our approach to executive compensation and what we paid our named executive officers can be found beginning on page 47 of this Circular.

We will ask the shareholders to consider and vote on the following resolution. The board recommends that shareholders vote for the resolution. If you do not specify in the proxy form or your voting instructions how you want to vote your shares, the persons named in the form will vote for the resolution.

“RESOLVED THAT on an advisory basis and not to diminish the role and responsibilities of the board of directors, the shareholders accept the approach to executive compensation disclosed in the Management Information Circular dated March 13, 2020 delivered in advance of the annual meeting of common shareholders on May 5, 2020.”

18 | MANAGEMENT INFORMATION CIRCULAR 2020

Table of Contents

Corporate governance practices

Our board regularly reviews our governance processes and practices to make sure the board continues to effectively oversee management and our business affairs, and to ensure our governance framework meets regulatory requirements and reflects evolving best practices.

We believe our governance processes and practices are consistent with the Insurance Companies Act (Canada), the Canadian Securities Administrators’ corporate governance guidelines, guidelines issued by OSFI for effective corporate governance in federally regulated financial institutions, the TSX corporate governance rules, the New York Stock Exchange (NYSE) corporate governance rules for U.S. publicly listed companies and the Philippine Stock Exchange corporate governance guidelines applicable to us.

We say “Yes” to

| ü | Strong Culture (see more on page 20)

|

| • | We have a strong culture built on a foundation of ethical behavior, high business standards, integrity, respect and doing the right thing for our Clients |

| • | Our Code of Business Conduct (Code) applies to every director, officer and employee, who are required to review and certify compliance every year |

| ü | Independence (see more on page 22)

|

| • | Our Chairman of the Board, committee chairs and all members of our committees are independent directors |

| • | Independent directors meet without management at each board and committee meeting |

| ü | Key competencies and experience (see more on pages 22 - 23)

|

| • | The eight key attributes we expect of our directors are integrity, independent and informed judgment, accountability, knowledge of business issues and financial matters, commitment to operational excellence, responsiveness, initiative and collaboration |

| • | The GNIC ensures that the board includes members with a broad range of skills and experience to carry out its mandate |

| ü | Tenure and renewal (see more on page 24)

|

| • | We use professional executive search firms and referrals to identify prospective director candidates |

| • | The GNIC, together with the Chairman of the Board, continuously monitors board succession requirements and maintains a directors’ skills matrix |

| • | Shareholders elect individual directors annually |

| • | Our policy on majority voting is informed by best practices and complies with TSX rules |

| • | We limit the number of public company directorships our directors may have (limit of one other for directors that are employed full-time, and limit of three others for those not employed full-time) |

| • | We have a limit on board interlocks (no more than two directors may serve on the board of another public company and directors may not serve together on more than two other public companies) |

| • | The board has adopted a proxy access policy |

| ü | Diversity and inclusion (see more on pages 25 - 27)

|

| • | We have a board diversity policy that considers multiple aspects of diversity, including gender, race, religion, age, country of origin, physical ability and sexual orientation |

| • | We are committed to diversity and inclusion, and have an enterprise strategy to strengthen diversity |

| • | Four out of our current 11 directors and director nominees (36%) are women |