UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-Q

____________________________

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-32259

____________________________

ALIGN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

____________________________

Delaware | 94-3267295 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

2560 Orchard Parkway

San Jose, California 95131

(Address of principal executive offices)

(408) 470-1000

(Registrant’s telephone number, including area code)

____________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of the registrant’s Common Stock, $0.0001 par value, as of April 29, 2016 was 80,184,259.

1

ALIGN TECHNOLOGY, INC.

INDEX

PART I | ||

ITEM 1. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

Invisalign, Align, the Invisalign logo, ClinCheck, Invisalign Assist, Invisalign Teen, Vivera, SmartForce, SmartTrack, SmartStage, Power Ridge, iTero, iTero Element, Orthocad, iCast and iRecord, among others, are trademarks and/or service marks of Align Technology, Inc. or one of its subsidiaries or affiliated companies and may be registered in the United States and/or other countries.

2

PART I—FINANCIAL INFORMATION

ITEM 1 FINANCIAL STATEMENTS

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

Three Months Ended | ||||||||

March 31, | ||||||||

2016 | 2015 | |||||||

Net revenues | $ | 238,720 | $ | 198,086 | ||||

Cost of net revenues | 58,093 | 46,996 | ||||||

Gross profit | 180,627 | 151,090 | ||||||

Operating expenses: | ||||||||

Selling, general and administrative | 112,210 | 88,281 | ||||||

Research and development | 15,083 | 13,885 | ||||||

Total operating expenses | 127,293 | 102,166 | ||||||

Income from operations | 53,334 | 48,924 | ||||||

Interest and other income (expenses), net | (427 | ) | (1,452 | ) | ||||

Net income before provision for income taxes | 52,907 | 47,472 | ||||||

Provision for income taxes | 12,361 | 11,295 | ||||||

Net income | $ | 40,546 | $ | 36,177 | ||||

Net income per share: | ||||||||

Basic | $ | 0.51 | $ | 0.45 | ||||

Diluted | $ | 0.50 | $ | 0.44 | ||||

Shares used in computing net income per share: | ||||||||

Basic | 79,831 | 80,459 | ||||||

Diluted | 81,320 | 81,824 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

Three Months Ended | ||||||||

March 31, | ||||||||

2016 | 2015 | |||||||

Net income | $ | 40,546 | $ | 36,177 | ||||

Net change in cumulative translation adjustment | (150 | ) | (261 | ) | ||||

Change in unrealized gains (losses) on available-for-sale securities, net of tax | 1,152 | 295 | ||||||

Other comprehensive income (loss) | 1,002 | 34 | ||||||

Comprehensive income | $ | 41,548 | $ | 36,211 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

March 31, 2016 | December 31, 2015 | ||||||

(unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 154,418 | $ | 167,714 | |||

Marketable securities, short-term | 393,660 | 359,581 | |||||

Accounts receivable, net of allowances for doubtful accounts and returns of $2,770 and $2,472, respectively | 178,000 | 158,550 | |||||

Inventories | 22,618 | 19,465 | |||||

Prepaid expenses and other current assets | 34,307 | 26,700 | |||||

Total current assets | 783,003 | 732,010 | |||||

Marketable securities, long-term | 132,690 | 151,370 | |||||

Property, plant and equipment, net | 148,029 | 136,473 | |||||

Goodwill and intangible assets, net | 78,606 | 79,162 | |||||

Deferred tax assets | 57,527 | 51,416 | |||||

Other assets | 7,705 | 8,202 | |||||

Total assets | $ | 1,207,560 | $ | 1,158,633 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 36,258 | $ | 34,354 | |||

Accrued liabilities | 92,723 | 107,765 | |||||

Deferred revenues | 145,769 | 129,553 | |||||

Total current liabilities | 274,750 | 271,672 | |||||

Income tax payable | 39,269 | 37,512 | |||||

Other long-term liabilities | 1,511 | 1,523 | |||||

Total liabilities | 315,530 | 310,707 | |||||

Commitments and contingencies (Note 6 and 7) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.0001 par value (5,000 shares authorized; none issued) | — | — | |||||

Common stock, $0.0001 par value (200,000 shares authorized; 80,175 and 79,500 issued and outstanding, respectively) | 8 | 8 | |||||

Additional paid-in capital | 824,063 | 821,507 | |||||

Accumulated other comprehensive income (loss), net | 22 | (980 | ) | ||||

Retained earnings | 67,937 | 27,391 | |||||

Total stockholders’ equity | 892,030 | 847,926 | |||||

Total liabilities and stockholders’ equity | $ | 1,207,560 | $ | 1,158,633 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended | |||||||

March 31, | |||||||

2016 | 2015 | ||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

Net income | $ | 40,546 | $ | 36,177 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Deferred taxes | (6,113 | ) | (4,488 | ) | |||

Depreciation and amortization | 4,792 | 4,308 | |||||

Stock-based compensation | 12,524 | 11,648 | |||||

Net tax benefits from stock-based awards | 7,220 | 4,779 | |||||

Excess tax benefit from share-based payment arrangements | (8,082 | ) | (4,779 | ) | |||

Other non-cash operating activities | 3,754 | 2,614 | |||||

Changes in assets and liabilities: | |||||||

Accounts receivable | (20,839 | ) | (12,233 | ) | |||

Inventories | (3,155 | ) | 1,334 | ||||

Prepaid expenses and other assets | (618 | ) | (10,527 | ) | |||

Accounts payable | 447 | 1,871 | |||||

Accrued and other long-term liabilities | (14,544 | ) | (1,078 | ) | |||

Deferred revenues | 14,748 | 6,019 | |||||

Net cash provided by operating activities | 30,680 | 35,645 | |||||

CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||

Purchase of property, plant and equipment | (20,207 | ) | (15,612 | ) | |||

Purchase of marketable securities | (143,926 | ) | (113,508 | ) | |||

Proceeds from maturities of marketable securities | 128,524 | 86,908 | |||||

Proceeds from sales of marketable securities | 293 | 5,505 | |||||

Other investing activities | — | 46 | |||||

Net cash used in investing activities | (35,316 | ) | (36,661 | ) | |||

CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

Proceeds from issuance of common stock | 5,384 | 4,552 | |||||

Common stock repurchases | — | (1,781 | ) | ||||

Excess tax benefit from share-based payment arrangements | 8,082 | 4,779 | |||||

Employees’ taxes paid upon the vesting of restricted stock units | (22,572 | ) | (14,647 | ) | |||

Net cash used in financing activities | (9,106 | ) | (7,097 | ) | |||

Effect of foreign exchange rate changes on cash and cash equivalents | 446 | (1,780 | ) | ||||

Net decrease in cash and cash equivalents | (13,296 | ) | (9,893 | ) | |||

Cash and cash equivalents, beginning of the period | 167,714 | 199,871 | |||||

Cash and cash equivalents, end of the period | $ | 154,418 | $ | 189,978 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1. Summary of Significant Accounting Policies

Basis of presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared by Align Technology, Inc. (“we”, “our”, or “Align”) in accordance with the rules and regulations of the Securities and Exchange Commission ("SEC") and contain all adjustments, including normal recurring adjustments, necessary to present fairly our results of operations for the three months ended March 31, 2016 and 2015, our comprehensive income for the three months ended March 31, 2016 and 2015, our financial position as of March 31, 2016 and our cash flows for the three months ended March 31, 2016 and 2015. The Condensed Consolidated Balance Sheet as of December 31, 2015 was derived from the December 31, 2015 audited financial statements but does not include all disclosures required by accounting principles generally accepted in the United States of America.

The results of operations for the three months ended March 31, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016 or any other future period, and we make no representations related thereto. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and the Consolidated Financial Statements and notes thereto included in Items 7, 7A and 8, respectively, in our Annual Report on Form 10-K for the year ended December 31, 2015.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles ("GAAP") in the United States of America (“U.S.”) requires our management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. On an ongoing basis, we evaluate our estimates, including those related to the fair values of financial instruments, long-lived assets and goodwill, useful lives of intangible assets and property and equipment, revenue recognition, stock-based compensation, income taxes, and contingent liabilities, among others. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (" FASB") released Accounting Standards Update ("ASU") 2014-9 "Revenue from Contracts with Customers" to supersede nearly all existing revenue recognition guidance under GAAP. The core principle of the standard is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for the goods or services. The new standard defines a five step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process than required under existing GAAP including identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. In addition, the new standard requires that reporting companies disclose the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers.

In August 2015, the FASB deferred the effective date of the update by one year, with early adoption on the original effective date permitted. We are required to adopt this standard starting in the first quarter of fiscal year 2018 using either of two methods: (i) retrospective to each prior reporting period presented with the option to elect certain practical expedients as defined within the standard; or (ii) retrospective with the cumulative effect of initially applying the standard recognized at the date of initial application and providing certain additional disclosures as defined per the standard. We have not yet selected a transition method, and are in the process of determining the impact that the new standard will have on our consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (topic 842). The FASB issued this update to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. The updated guidance is effective for annual periods beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption of the update is permitted. The Company is evaluating the impact of the adoption of this update on our consolidated financial statements and related disclosures.

7

In March 2016, the FASB issued ASU No. 2016-09, "Improvements to Employee Share-Based Payment Accounting." This ASU affects entities that issue share-based payment awards to their employees. The ASU is designed to simplify several aspects of accounting for share-based payment award transactions, which include the income tax consequences, classification of awards as either equity or liabilities, classification on the statement of cash flows and forfeiture rate calculations. This ASU will become effective for the Company on January 1, 2017. Early adoption is permitted in any interim or annual period. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

Note 2. Marketable Securities and Fair Value Measurements

As of March 31, 2016 and December 31, 2015, the estimated fair value of our short-term and long-term marketable securities, classified as available for sale, are as follows (in thousands):

Short-term

March 31, 2016 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||

Commercial paper | $ | 55,972 | $ | — | $ | — | $ | 55,972 | |||||||

Corporate bonds | 181,508 | 79 | (68 | ) | 181,519 | ||||||||||

Municipal securities | 9,718 | 11 | (1 | ) | 9,728 | ||||||||||

U.S. government agency bonds | 74,709 | 17 | (29 | ) | 74,697 | ||||||||||

U.S. government treasury bonds | 71,213 | 28 | (11 | ) | 71,230 | ||||||||||

U.S. dollar dominated foreign corporate bonds | 506 | — | — | 506 | |||||||||||

Asset-backed securities | 8 | — | — | 8 | |||||||||||

Total Marketable Securities, Short-Term | $ | 393,634 | $ | 135 | $ | (109 | ) | $ | 393,660 | ||||||

Long-term

March 31, 2016 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||

U.S. government agency bonds | $ | 23,453 | $ | 31 | $ | (6 | ) | $ | 23,478 | ||||||

Corporate bonds | 72,034 | 221 | (25 | ) | 72,230 | ||||||||||

U.S. government treasury bonds | 29,086 | 40 | (6 | ) | 29,120 | ||||||||||

Municipal securities | 3,958 | 4 | — | 3,962 | |||||||||||

Certificates of deposit | 2,700 | — | — | 2,700 | |||||||||||

Asset-backed securities | 1,201 | — | (1 | ) | 1,200 | ||||||||||

Total Marketable Securities, Long-Term | $ | 132,432 | $ | 296 | $ | (38 | ) | $ | 132,690 | ||||||

Short-term

December 31, 2015 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||

Commercial paper | $ | 38,537 | $ | — | $ | — | $ | 38,537 | |||||||

Corporate bonds | 179,765 | 6 | (251 | ) | 179,520 | ||||||||||

U.S. dollar dominated foreign corporate bonds | 510 | — | (2 | ) | 508 | ||||||||||

Municipal securities | 14,209 | 7 | (2 | ) | 14,214 | ||||||||||

U.S. government agency bonds | 75,172 | — | (53 | ) | 75,119 | ||||||||||

U.S. government treasury bonds | 51,763 | 1 | (81 | ) | 51,683 | ||||||||||

Total Marketable Securities, Short-Term | $ | 359,956 | $ | 14 | $ | (389 | ) | $ | 359,581 | ||||||

8

Long-term

December 31, 2015 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||

U.S. government agency bonds | $ | 43,853 | $ | — | $ | (178 | ) | $ | 43,675 | ||||||

Corporate bonds | 64,012 | 9 | (218 | ) | 63,803 | ||||||||||

U.S. government treasury bonds | 37,673 | — | (107 | ) | 37,566 | ||||||||||

Municipal securities | 3,993 | — | (2 | ) | 3,991 | ||||||||||

Asset-backed securities | 2,338 | — | (3 | ) | 2,335 | ||||||||||

Total Marketable Securities, Long-Term | $ | 151,869 | $ | 9 | $ | (508 | ) | $ | 151,370 | ||||||

Cash and cash equivalents are not included in the table above as the gross unrealized gains and losses are not material. We have no material short-term or long-term investments that have been in a continuous unrealized loss position for greater than twelve months as of March 31, 2016 and December 31, 2015. Amounts reclassified to earnings from accumulated other comprehensive income related to unrealized gain or losses were immaterial for the three months ended March 31, 2016 and 2015. For the three months ended March 31, 2016 and 2015, realized gain or losses were immaterial.

Our fixed-income securities investment portfolio consists of commercial paper, corporate bonds, municipal securities, U.S. government agency bonds, U.S. government treasury bonds, U.S. dollar dominated foreign corporate bonds, certificates of deposits, and asset-backed securities that have a maximum maturity of 27 months. The securities that we invest in are generally deemed to be low risk based on their credit ratings from the major rating agencies. The longer the duration of these securities, the more susceptible they are to changes in market interest rates and bond yields. As interest rates increase, those securities purchased at a lower yield show a mark-to-market unrealized loss. The unrealized losses are due primarily to changes in credit spreads and interest rates. We expect to realize the full value of these investments upon maturity or sale. The weighted average remaining duration of these securities was approximately and 9 months as of March 31, 2016 and December 31, 2015, respectively.

As the carrying value approximates the fair value for our short-term and long-term marketable securities shown in the tables above, the following table summarizes the fair value of our short-term and long-term marketable securities classified by maturity as of March 31, 2016 and December 31, 2015 (in thousands):

March 31, 2016 | December 31, 2015 | ||||||

Due in one year or less | $ | 393,660 | $ | 359,581 | |||

Due in greater than one year | 132,690 | 151,370 | |||||

Total available for sale short-term and long-term marketable securities | $ | 526,350 | $ | 510,951 | |||

Fair Value Measurements

We measure the fair value of our cash equivalents and marketable securities as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. We use the GAAP fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. This hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The three levels of inputs that may be used to measure fair value:

Level 1 — Quoted (unadjusted) prices in active markets for identical assets or liabilities.

Our Level 1 assets consist of money market funds and U.S. government treasury bonds. We did not hold any Level 1 liabilities as of March 31, 2016 and December 31, 2015.

Level 2 — Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability.

Our Level 2 assets consist of commercial paper, corporate bonds, certificates of deposits, U.S. government agency bonds, asset-backed securities, municipal securities, U.S. dollar dominated foreign corporate bonds and our Israeli funds that are mainly invested in insurance policies and foreign currency forward contracts. We obtain fair values for Level 2 investments from our asset manager for each of our portfolios. Our custody bank and asset managers independently use professional pricing services to gather pricing data which may include quoted market prices for identical or comparable financial instruments, or inputs other than quoted

9

prices that are observable either directly or indirectly, and we are ultimately responsible for these underlying estimates. The foreign currency forward contracts are valued using observable inputs such as quotations on forward foreign exchange rates.

Level 3 — Unobservable inputs to the valuation methodology that are supported by little or no market activity and that are significant to the measurement of the fair value of the assets or liabilities. Level 3 assets and liabilities include those whose fair value measurements are determined using pricing models, discounted cash flow methodologies or similar valuation techniques, as well as significant management judgment or estimation.

We did not hold any Level 3 assets or liabilities as of March 31, 2016 or December 31, 2015.

The following tables summarize our financial assets measured at fair value on a recurring basis as of March 31, 2016 and December 31, 2015 (in thousands):

Description | Balance as of March 31, 2016 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | ||||||||

Cash equivalents: | |||||||||||

Money market funds | $ | 67,608 | $ | 67,608 | $ | — | |||||

Commercial paper | 26,453 | — | 26,453 | ||||||||

Corporate bonds | 2,354 | — | 2,354 | ||||||||

Short-term investments: | |||||||||||

Commercial paper | 55,972 | — | 55,972 | ||||||||

Corporate bonds | 181,519 | — | 181,519 | ||||||||

Municipal securities | 9,728 | — | 9,728 | ||||||||

U.S. government agency bonds | 74,697 | — | 74,697 | ||||||||

U.S. government treasury bonds | 71,230 | 71,230 | — | ||||||||

U.S. dollar dominated foreign corporate bonds | 506 | — | 506 | ||||||||

Asset-backed securities | 8 | — | 8 | ||||||||

Long-term investments: | |||||||||||

U.S. government agency bonds | 23,478 | — | 23,478 | ||||||||

Corporate bonds | 72,230 | — | 72,230 | ||||||||

U.S. government treasury bonds | 29,120 | 29,120 | — | ||||||||

Municipal securities | 3,962 | — | 3,962 | ||||||||

Asset-backed securities | 1,200 | — | 1,200 | ||||||||

Certificates of deposits | 2,700 | — | 2,700 | ||||||||

Prepaid expenses and other current assets: | |||||||||||

Israeli funds | 2,455 | — | 2,455 | ||||||||

$ | 625,220 | $ | 167,958 | $ | 457,262 | ||||||

10

Description | Balance as of December 31, 2015 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | ||||||||

Cash equivalents: | |||||||||||

Money market funds | $ | 70,148 | $ | 70,148 | $ | — | |||||

Commercial paper | 36,887 | — | 36,887 | ||||||||

U.S. government Agency bonds | 3,599 | — | 3,599 | ||||||||

Corporate bonds | 625 | — | 625 | ||||||||

Short-term investments: | |||||||||||

Commercial paper | 38,537 | — | 38,537 | ||||||||

Corporate bonds | 179,520 | — | 179,520 | ||||||||

U.S. dollar denominated foreign corporate bonds | 508 | — | 508 | ||||||||

Municipal securities | 14,214 | — | 14,214 | ||||||||

U.S. government agency bonds | 75,119 | — | 75,119 | ||||||||

U.S. government treasury bonds | 51,683 | 51,683 | — | ||||||||

Long-term investments: | |||||||||||

U.S. government agency bonds | 43,675 | — | 43,675 | ||||||||

Corporate bonds | 63,803 | — | 63,803 | ||||||||

U.S. government treasury bonds | 37,566 | 37,566 | — | ||||||||

Municipal securities | 3,991 | — | 3,991 | ||||||||

Asset-backed securities | 2,335 | — | 2,335 | ||||||||

Prepaid expenses and other current assets: | |||||||||||

Israeli funds | 2,436 | — | 2,436 | ||||||||

$ | 624,646 | $ | 159,397 | $ | 465,249 | ||||||

Derivative Financial Instruments

In September 2015, we began entering into foreign currency forward contracts to minimize the short-term impact of foreign currency exchange rate fluctuations on certain trade and intercompany receivables and payables, which are classified within level 2 of the fair value hierarchy. The net loss on these forward contracts was immaterial for the three months ended March 31, 2016. The net gain or loss from the settlement of these foreign currency forward contracts is recorded in Interest and other income (expense), net in the Consolidated Statements of Operations. As of March 31, 2016, the fair value of foreign exchange forward contracts outstanding was a gain of $0.5 million.

The following table presents the gross notional value of all our foreign exchange forward contracts outstanding as of March 31, 2016 (in thousands):

As of March 31, 2016 | |||||||

Local Currency Amount | Notional Contract Amount (USD) | ||||||

US dollar | $ | 22,700 | $ | 22,700 | |||

Euro | €26,600 | 29,827 | |||||

Japanese yen | ¥460,000 | 4,048 | |||||

Australian dollar | A$5,500 | 4,158 | |||||

Hong Kong dollar | HK$ | 33,000 | 4,254 | ||||

$ | 64,987 | ||||||

11

Note 3. Balance Sheet Components

Inventories

Inventories consist of the following (in thousands):

March 31, 2016 | December 31, 2015 | ||||||

Raw materials | $ | 9,676 | $ | 9,950 | |||

Work in process | 9,939 | 7,067 | |||||

Finished goods | 3,003 | 2,448 | |||||

Total Inventories | $ | 22,618 | $ | 19,465 | |||

Work in process includes costs to produce our clear aligner and intra-oral products. Finished goods primarily represent our intra-oral scanners and ancillary products that support our clear aligner products.

Accrued liabilities

Accrued liabilities consist of the following (in thousands):

March 31, 2016 | December 31, 2015 | ||||||

Accrued payroll and benefits | $ | 44,201 | $ | 55,430 | |||

Accrued sales and marketing expenses | 9,015 | 7,071 | |||||

Accrued sales rebates | 7,759 | 8,486 | |||||

Accrued accounts payable | 7,343 | 13,834 | |||||

Accrued sales tax and value added tax | 4,863 | 4,801 | |||||

Accrued professional fees | 3,448 | 2,775 | |||||

Accrued warranty | 2,704 | 2,638 | |||||

Accrued income taxes | 1,793 | 2,646 | |||||

Other accrued liabilities | 11,597 | 10,084 | |||||

Total Accrued Liabilities | $ | 92,723 | $ | 107,765 | |||

Warranty

We regularly review the accrued warranty balances and update these balances based on historical warranty trends. Actual warranty costs incurred have not materially differed from those accrued; however, future actual warranty costs could differ from the estimated amounts.

Clear Aligner

We warrant our Invisalign products against material defects until the Invisalign case is complete. We accrue for warranty costs in cost of net revenues upon shipment of products. The amount of accrued estimated warranty costs is primarily based on historical experience as to product failures as well as current information on replacement costs.

Scanners

We warrant our scanners for a period of one year from the date of training and installation. We accrue for these warranty costs which includes materials and labor based on estimated historical repair costs. Extended service packages may be purchased for additional fees.

Warranty accrual as of March 31, 2016 and 2015 consists of the following activity (in thousands):

12

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Balance at beginning of period | $ | 2,638 | $ | 3,148 | |||

Charged to cost of net revenues | 816 | 440 | |||||

Actual warranty expenditures | (750 | ) | (583 | ) | |||

Balance at end of period | $ | 2,704 | $ | 3,005 | |||

Note 4. Goodwill and Long-lived Assets

Goodwill

The change in the carrying value of goodwill for the three months ended March 31, 2016, all attributable to our Clear Aligner reporting unit, is as follows (in thousands):

Clear Aligner | |||

Balance as of December 31, 2015 | $ | 61,074 | |

Adjustments 1 | 94 | ||

Balance as of March 31, 2016 | $ | 61,168 | |

1 The adjustments to goodwill during the three months ended March 31, 2016 were due to foreign currency translation.

During the fourth quarter of fiscal 2015, we performed the annual goodwill impairment testing and found no impairment events as the fair value of our Clear Aligner reporting unit was significantly in excess of the carrying value.

Acquired intangible assets are being amortized as follows (in thousands):

Weighted Average Amortization Period (in years) | Gross Carrying Amount as of March 31, 2016 | Accumulated Amortization | Accumulated Impairment Loss | Net Carrying Value as of March 31, 2016 | |||||||||||||

Trademarks | 14 | $ | 7,100 | $ | (1,527 | ) | $ | (4,179 | ) | $ | 1,394 | ||||||

Existing technology | 13 | 12,600 | (3,718 | ) | (4,328 | ) | 4,554 | ||||||||||

Customer relationships | 11 | 33,500 | (11,423 | ) | (10,751 | ) | 11,326 | ||||||||||

Other | 8 | 285 | (121 | ) | — | 164 | |||||||||||

Total Intangible Assets | $ | 53,485 | $ | (16,789 | ) | $ | (19,258 | ) | $ | 17,438 | |||||||

Weighted Average Amortization Period (in years) | Gross Carrying Amount as of December 31, 2015 | Accumulated Amortization | Accumulated Impairment Loss | Net Carrying Value as of December 31, 2015 | |||||||||||||

Trademarks | 15 | $ | 7,100 | $ | (1,492 | ) | $ | (4,179 | ) | $ | 1,429 | ||||||

Existing technology | 13 | 12,600 | (3,577 | ) | (4,328 | ) | 4,695 | ||||||||||

Customer relationships | 11 | 33,500 | (10,957 | ) | (10,751 | ) | 11,792 | ||||||||||

Other | 8 | 285 | (113 | ) | — | 172 | |||||||||||

Total Intangible Assets | $ | 53,485 | $ | (16,139 | ) | $ | (19,258 | ) | $ | 18,088 | |||||||

13

The total estimated annual future amortization expense for these acquired intangible assets as of March 31, 2016 is as follows (in thousands):

Fiscal Year Ending December 31, | |||

Remainder of 2016 | $ | 1,950 | |

2017 | 2,600 | ||

2018 | 2,600 | ||

2019 | 2,592 | ||

2020 | 2,582 | ||

Thereafter | 5,114 | ||

Total | $ | 17,438 | |

Note 5. Credit Facilities

On March 17, 2016, we amended the credit facility, originally entered into on March 22, 2013, and extended the maturity date to March 22, 2017. The credit facility provides for a $50.0 million revolving line of credit, with a $10.0 million letter of credit sublimit. The credit facility also requires us to maintain a minimum unrestricted cash balance of $50.0 million and comply with specific financial conditions and performance requirements. The loan bears interest, at our option, at a fluctuating rate per annum equal to the daily one-month adjusted LIBOR rate plus a spread of 1.75% or an adjusted LIBOR rate (based on one, three, six or twelve-month interest periods) plus a spread of 1.75%. As of March 31, 2016, we had no outstanding borrowings under this credit facility and were in compliance with the conditions and performance requirements.

Note 6. Legal Proceedings

Securities Class Action Lawsuit

On November 28, 2012, plaintiff City of Dearborn Heights Act 345 Police & Fire Retirement System filed a lawsuit against Align, Thomas M. Prescott (“Mr. Prescott”), Align’s former President and Chief Executive Officer, and Kenneth B. Arola (“Mr. Arola”), Align’s former Vice President, Finance and Chief Financial Officer, in the United States District Court for the Northern District of California on behalf of a purported class of purchasers of our common stock (the “Securities Action”). On July 11, 2013, an amended complaint was filed, which named the same defendants, on behalf of a purported class of purchasers of our common stock between January 31, 2012 and October 17, 2012. The amended complaint alleged that Align, Mr. Prescott and Mr. Arola violated Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder, and that Mr. Prescott and Mr. Arola violated Section 20(a) of the Securities Exchange Act of 1934. Specifically, the amended complaint alleged that during the purported class period defendants failed to take an appropriate goodwill impairment charge related to the April 29, 2011 acquisition of Cadent Holdings, Inc. in the fourth quarter of 2011, the first quarter of 2012 or the second quarter of 2012, which rendered our financial statements and projections of future earnings materially false and misleading and in violation of U.S. GAAP. The amended complaint sought monetary damages in an unspecified amount, costs and attorneys’ fees. On December 9, 2013, the court granted defendants’ motion to dismiss with leave for plaintiff to file a second amended complaint. Plaintiff filed a second amended complaint on January 8, 2014 on behalf of the same purported class. The second amended complaint states the same claims as the amended complaint. On August 22, 2014, the court granted our motion to dismiss without leave to amend. On September 22, 2014, Plaintiff filed a notice of appeal to the Ninth Circuit Court of Appeals. Align intends to vigorously defend itself against these allegations. Align is currently unable to predict the outcome of this amended complaint and therefore cannot determine the likelihood of loss nor estimate a range of possible loss, if any.

Shareholder Derivative Lawsuit

On February 1, 2013, plaintiff Gary Udis filed a shareholder derivative lawsuit against several of Align’s current and former officers and directors in the Superior Court of California, County of Santa Clara. The complaint alleges that our reported income and earnings were materially overstated because of a failure to timely write down goodwill related to the April 29, 2011 acquisition of Cadent Holdings, Inc., and that defendants made allegedly false statements concerning our forecasts. The complaint asserts various state law causes of action, including claims of breach of fiduciary duty, unjust enrichment, and insider trading, among others. The complaint seeks unspecified damages on behalf of Align, which is named solely as nominal defendant against whom no recovery is sought. The complaint also seeks an order directing Align to reform and improve its corporate governance and internal procedures, and seeks restitution in an unspecified amount, costs, and attorneys’ fees. On July 8, 2013, an Order was entered staying this derivative lawsuit until an initial ruling on our first motion to dismiss the Securities Action. On January 15,

14

2014, an Order was entered staying this derivative lawsuit until an initial ruling on our second motion to dismiss the Securities Action. On October 14, 2014, an Order was entered staying this derivative lawsuit until a ruling by the Ninth Circuit in the Securities Action discussed above. Align is currently unable to predict the outcome of this complaint and therefore cannot determine the likelihood of loss nor estimate a range of possible losses.

In addition, in the course of Align's operations, Align is involved in a variety of claims, suits, investigations, and proceedings, including actions with respect to intellectual property claims, patent infringement claims, government investigations, labor and employment claims, breach of contract claims, tax, and other matters. Regardless of the outcome, these proceedings can have an adverse impact on us because of defense costs, diversion of management resources, and other factors. Although the results of complex legal proceedings are difficult to predict and Align's view of these matters may change in the future as litigation and events related thereto unfold; Align currently does not believe that these matters, individually or in the aggregate, will materially affect Align's financial position, results of operations or cash flows.

Note 7. Commitments and Contingencies

Operating Leases

As of March 31, 2016, minimum future lease payments for non-cancelable operating leases are as follows (in thousands):

Fiscal Year Ending December 31, | Operating leases | |||

Remainder of 2016 | $ | 8,375 | ||

2017 | 7,126 | |||

2018 | 2,808 | |||

2019 | 655 | |||

2020 | 335 | |||

Thereafter | 111 | |||

Total minimum future lease payments | $ | 19,410 | ||

Off-balance Sheet Arrangements

As of March 31, 2016, we had no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our consolidated financial condition, results of operations, liquidity, capital expenditures or capital resources.

Indemnification Provisions

In the normal course of business to facilitate transactions in our services and products, we indemnify certain parties: customers, vendors, lessors and other parties with respect to certain matters, including, but not limited to, services to be provided by us and intellectual property infringement claims made by third parties. In addition, we have entered into indemnification agreements with our directors and our executive officers that will require us, among other things, to indemnify them against certain liabilities that may arise by reason of their status or service as directors or officers. Several of these agreements limit the time within which an indemnification claim can be made and the amount of the claim.

It is not possible to make a reasonable estimate of the maximum potential amount under these indemnification agreements due to the unique facts and circumstances involved in each particular agreement. Additionally, we have a limited history of prior indemnification claims and the payments we have made under such agreements have not had a material adverse effect on our results of operations, cash flows or financial position. However, to the extent that valid indemnification claims arise in the future, future payments by us could be significant and could have a material adverse effect on our results of operations or cash flows in a particular period. As of March 31, 2016, we did not have any material indemnification claims that were probable or reasonably possible.

15

Note 8. Stock-based Compensation

Summary of stock-based compensation expense

As of March 31, 2016, the 2005 Incentive Plan (as amended) has a total reserve of 23,283,379 shares of which 3,617,914 shares are available for issuance.

Stock-based compensation is based on the estimated fair value of awards, net of estimated forfeitures, and recognized over the requisite service period. Estimated forfeitures are based on historical experience at the time of grant and may be revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The stock-based compensation related to all of our stock-based awards and employee stock purchases for the three months ended March 31, 2016 and 2015 is as follows (in thousands):

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Cost of net revenues | $ | 961 | $ | 978 | ||||

Selling, general and administrative | 9,834 | 8,771 | ||||||

Research and development | 1,729 | 1,899 | ||||||

Total stock-based compensation | $ | 12,524 | $ | 11,648 | ||||

Options

Activity for the three months ended March 31, 2016 under the stock option plans is set forth below (in thousands, except years and per share amounts):

Stock Options Number of Shares Underlying Stock Options | Weighted Average Exercise Price per Share | Weighted Average Remaining Contractual Term | Aggregate Intrinsic Value | |||||||||

(in years ) | ||||||||||||

Outstanding as of December 31, 2015 | 496 | $ | 15.14 | |||||||||

Granted | — | — | ||||||||||

Exercised | (30 | ) | 11.69 | |||||||||

Cancelled or expired | — | — | ||||||||||

Outstanding as of March 31, 2016 | 466 | $ | 15.37 | 1.84 | $ | 26,699 | ||||||

Vested and expected to vest at March 31, 2016 | 466 | $ | 15.37 | 1.84 | $ | 26,699 | ||||||

Exercisable at March 31, 2016 | 466 | $ | 15.37 | 1.84 | $ | 26,699 | ||||||

There were no stock options granted during the three months ended March 31, 2016 and 2015. All compensation costs relating to stock options have been recognized as of March 31, 2016.

Restricted Stock Units (“RSU”)

A summary of the RSU activity for the three months ended March 31, 2016 is as follows (in thousands, except years):

Number of Shares Underlying RSU | Weighted Average Grant Date Fair Value | Weighted Remaining Contractual Period | Aggregate Intrinsic Value | |||||||||

(in years) | ||||||||||||

Nonvested as of December 31, 2015 | 2,079 | $ | 49.45 | |||||||||

Granted | 558 | 63.75 | ||||||||||

Vested and released | (646 | ) | 44.27 | |||||||||

Forfeited | (61 | ) | 50.48 | |||||||||

Nonvested as of March 31, 2016 | 1,930 | $ | 55.29 | 1.67 | $ | 140,321 | ||||||

16

As of March 31, 2016, the total unamortized compensation cost related to RSU, net of estimated forfeitures, was $88.7 million, which we expect to recognize over a weighted average period of 2.5 years.

We have granted market-performance based restricted stock units (“MSU”) to our executive officers. Each MSU represents the right to one share of Align’s common stock and will be issued through our amended 2005 Incentive Plan. The actual number of MSU which will be eligible to vest will be based on the performance of Align’s stock price relative to the performance of the NASDAQ Composite Index over the vesting period, generally two to three years, up to 150% of the MSU initially granted.

The following table summarizes the MSU activity for the three months ended March 31, 2016 (in thousands, except years):

Number of Shares Underlying MSU | Weighted Average Grant Date Fair Value | Weighted Average Remaining Contractual Period | Aggregate Intrinsic Value | |||||||||

(in years ) | ||||||||||||

Nonvested as of December 31, 2015 | 611 | $ | 51.41 | |||||||||

Granted | 215 | 55.79 | ||||||||||

Vested and released | (253 | ) | 35.49 | |||||||||

Forfeited | (25 | ) | 53.70 | |||||||||

Nonvested as of March 31, 2016 | 548 | $ | 60.35 | 1.84 | $ | 39,852 | ||||||

As of March 31, 2016, the total unamortized compensation costs related to the MSU, net of estimated forfeitures, was $18.9 million, which we expect to recognize over a weighted average period of 1.8 years.

Employee Stock Purchase Plan ("ESPP")

In May 2010, our stockholders approved the 2010 Employee Stock Purchase Plan ("2010 Purchase Plan") which will continue until terminated by either the Board of Directors or its administrator. The maximum number of shares available for purchase under the 2010 Purchase Plan is 2,400,000 shares. As of March 31, 2016, 1,029,526 shares remain available for purchase under the 2010 Purchase Plan.

The fair value of the option component of the 2010 Purchase Plan shares was estimated at the grant date using the Black-Scholes option pricing model with the following weighted average assumptions:

Three Months Ended March 31, | |||||||||

2016 | 2015 | ||||||||

Expected term (in years) | 1.3 | 1.2 | |||||||

Expected volatility | 33.7 | % | 31.9 | % | |||||

Risk-free interest rate | 0.77 | % | 0.26 | % | |||||

Expected dividends | — | — | |||||||

Weighted average fair value at grant date | $ | 19.96 | $ | 15.98 | |||||

As of March 31, 2016, the total unamortized compensation cost related to employee purchases was $1.7 million, which we expect to recognize over a weighted average period of 0.6 year.

Note 9. Common Stock Repurchase

In April 2014, we announced that our Board of Directors had authorized a stock repurchase program ("April 2014") pursuant to which we may purchase up to $300.0 million of our common stock over the next three years. As of March 31, 2016, we have approximately $100.0 million remaining under the April 2014 stock repurchase program. On May 3, 2016, as part of our $300.0 million April 2014 stock repurchase program, we entered into an ASR to repurchase $50.0 million of our common stock (the "2016 ASR"). Under the terms of the 2016 ASR, we paid $50.0 million on May 4, 2016 and received an initial delivery of approximately 0.5 million shares based on current market prices. The final number of shares to be repurchased will be based on our volume-weighted average stock price during the term of the 2016 ASR, less an agreed upon discount. Commencing immediately after the completion of the 2016 ASR, we will repurchase $50.0 million of our common stock on the open market. These two actions will complete the April 2014 stock repurchase program.

17

On April 28, 2016, we announced that our Board of Directors had authorized a plan to repurchase up to $300.0 million of the Company's stock. This latest authorization is in addition to the existing $300 million authorization announced in April 2014, which brings the total authorization to $600 million. Any purchases under this stock repurchase program may be made, from time-to-time, pursuant to open market purchases (including pursuant to Rule 10b5-1 plans), privately-negotiated transactions, accelerated stock repurchases, block trades or derivative contracts or otherwise in accordance with applicable federal securities laws, including Rule 10b-18 of the Securities Exchange Act of 1934.

Note 10. Accounting for Income Taxes

Our provision for income taxes was $12.4 million and $11.3 million for the three months ended March 31, 2016 and 2015, respectively. This represents effective tax rates of 23.4% and 23.8%, respectively. Our effective tax rates differ from the statutory federal income tax rate of 35% due to certain foreign earnings, primarily from Costa Rica, which are subject to a lower tax rate, state income tax expense, the tax impact of certain stock-based compensation charges and unrecognized tax benefits.

We exercise significant judgment in regards to estimates of future market growth, forecasted earnings and projected taxable income in determining the provision for income taxes, and for purposes of assessing our ability to utilize any future benefit from deferred tax assets.

As of March 31, 2016, we maintained a valuation allowance of $31.7 million against our deferred tax assets which primarily relate to Israel operating loss carryforwards and Australia capital loss carryforwards. These net operating and capital loss carryforwards would result in us recording an income tax benefit if we were to conclude it is more likely than not that the related deferred tax assets will be realized.

Our total gross unrecognized tax benefits, excluding interest, was $40.9 million and $39.4 million as of March 31, 2016 and December 31, 2015, respectively, all of which would impact our effective tax rate if recognized. We have elected to recognize interest and penalties related to unrecognized tax benefits as a component of income taxes. The interest accrued as of March 31, 2016 is $0.9 million. We do not expect any significant changes to the amount of unrecognized tax benefit within the next twelve months.

We file U.S. federal, U.S. state, and non-U.S. income tax returns. Our major tax jurisdictions are U.S. federal and the State of California. For U.S. federal and state tax returns, we are no longer subject to tax examinations for years before 2000. With few exceptions, we are no longer subject to examination by foreign tax authorities for years before 2007. Our subsidiary in Israel is under audit by the local tax authorities for calendar years 2006 through 2013. We are currently under audit by the California Franchise Tax Board for fiscal years 2011, 2012 and 2013.

In June 2009, the Costa Rica Ministry of Foreign Trade, an agency of the Government of Costa Rica, granted a twelve year extension of certain income tax incentives, which were previously granted in 2002. The incentive tax rates will expire in various years beginning in 2017. Under these incentives, all of the income in Costa Rica during these twelve year incentive periods is subject to reduced rate of Costa Rica income tax. In order to receive the benefit of these incentives, we must hire specified numbers of employees and maintain certain minimum levels of fixed asset investment in Costa Rica. If we do not fulfill these conditions for any reason, our incentive could lapse, and our income in Costa Rica would be subject to taxation at higher rates, which could have a negative impact on our operating results. The Costa Rica corporate income tax rate that would apply, absent the incentives, is 30% for 2016 and 2015. Income taxes were reduced by $8.6 million and $8.2 million for the three months ended March 31, 2016 and 2015, respectively, representing a benefit to diluted net income per share of $0.11 and $0.10 in 2016 and 2015, respectively.

Note 11. Net Income Per Share

Basic net income per share is computed using the weighted average number of shares of common stock outstanding during the period. Diluted net income per share is computed using the weighted average number of shares of common stock, adjusted for any dilutive effect of potential common stock. Potential common stock, computed using the treasury stock method, includes RSU, MSU, stock options and ESPP.

The following table sets forth the computation of basic and diluted net income per share attributable to common stock (in thousands, except per share amounts):

18

Three Months Ended, March 31, | ||||||||

2016 | 2015 | |||||||

Numerator: | ||||||||

Net income | $ | 40,546 | $ | 36,177 | ||||

Denominator: | ||||||||

Weighted-average common shares outstanding, basic | 79,831 | 80,459 | ||||||

Dilutive effect of potential common stock | 1,489 | 1,365 | ||||||

Total shares, diluted | 81,320 | 81,824 | ||||||

Net income per share, basic | $ | 0.51 | $ | 0.45 | ||||

Net income per share, diluted | $ | 0.50 | $ | 0.44 | ||||

For the three months ended March 31, 2016 and 2015, the anti-dilutive effect from RSU, MSU and ESPP was not material.

Note 12. Segments and Geographical Information

Segment Information

Operating segments are defined as components of an enterprise for which separate financial information is available and is evaluated regularly by the Chief Operating Decision Maker (“CODM”), or decision-making group, in deciding how to allocate resources and in assessing performance. Our CODM is our Chief Executive Officer. We report segment information based on the management approach. The management approach designates the internal reporting used by the CODM for decision making and performance assessment as the basis for determining our reportable segments. The performance measures of our reportable segments include net revenues and gross profit.

We have grouped our operations into two reportable segments which are also our reporting units: Clear Aligner segment and Scanner segment.

• | Our Clear Aligner segment consists of our Invisalign system which includes Invisalign Full, Express/Lite, Teen, Assist, Vivera retainers, along with our training and ancillary products for treating malocclusion. |

• | Our Scanner segment consists of intra-oral scanning systems and additional services available with the intra-oral scanners that provide digital alternatives to the traditional cast models. This segment includes our iTero scanner and OrthoCAD services. |

These reportable operating segments are based on how our CODM views and evaluates our operations as well as allocation of resources. The following information relates to these segments (in thousands):

For the Three Months Ended March 31, | ||||||||

Net Revenues | 2016 | 2015 | ||||||

Clear Aligner | $ | 219,698 | $ | 187,029 | ||||

Scanner | 19,022 | 11,057 | ||||||

Total net revenues | $ | 238,720 | $ | 198,086 | ||||

Gross profit | ||||||||

Clear Aligner | $ | 172,067 | $ | 147,960 | ||||

Scanner | 8,560 | 3,130 | ||||||

Total gross profit | $ | 180,627 | $ | 151,090 | ||||

Geographical Information

Net revenues are presented below by geographic area (in thousands):

19

For the Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Net revenues: (1) | ||||||||

U.S. | $ | 166,101 | $ | 139,704 | ||||

the Netherlands | 47,400 | 38,645 | ||||||

Other international | 25,219 | 19,737 | ||||||

Total net revenues | $ | 238,720 | $ | 198,086 | ||||

(1) Net revenues are attributed to countries based on location of where revenue is recognized.

Tangible long-lived assets are presented below by geographic area (in thousands):

March 31, 2016 | December 31, 2015 | ||||||

Long-lived assets:(2) | |||||||

United States | $ | 122,113 | $ | 112,632 | |||

Mexico | 15,971 | 15,422 | |||||

Other International | 9,945 | 8,419 | |||||

Total long-lived assets | $ | 148,029 | $ | 136,473 | |||

(2) Long-lived assets are attributed to countries based on entity that owns the asset.

20

ITEM 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

In addition to historical information, this quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, among other things, our expectations regarding the anticipated impact that our new products and product enhancements will have on doctor utilization and our market share, our expectation that the policy simplification “Additional Aligners at No Charge" will help increase Invisalign utilization and volume, our expectations regarding product mix and product adoption, our expectations regarding the existence and impact of seasonality, our expectations regarding the financial and strategic benefits of the Scanner and Services ("Scanner") business, our expectations to increase our investment in manufacturing capacity, our expectations regarding the continued expansion of our international markets, the anticipated number of new doctors trained, the expected date our iTero Element Intraoral Scanner will be available, the effectiveness of our new training course and its impact on volumes, our expectations regarding our stock repurchase program, the level of our operating expenses and gross margins, and other factors beyond our control, as well as other statements regarding our future operations, financial condition and prospects and business strategies. These statements may contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” or other words indicating future results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in particular, the risks discussed below in Part II, Item 1A “Risk Factors”. We undertake no obligation to revise or update these forward-looking statements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The following discussion and analysis of our financial condition and results of operations should be read together with our Condensed Consolidated Financial Statements and related notes included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our Annual Report on form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission.

Overview

Our goal is to establish Invisalign clear aligners as the standard method for treating malocclusion and to establish the iTero intraoral scanner as the preferred scanning device for 3D digital scans, ultimately driving increased product adoption by dental professionals. We intend to achieve this by continued focus and execution of our strategic growth drivers set forth in the Business Strategy section in our Annual Report on Form 10-K.

The successful execution of our business strategy and our results in 2016 and beyond may be affected by a number of other factors including:

• | Additional Aligners at No Charge. In July 2015, we launched a new product policy called "Additional Aligners at No Charge" that addresses one of our customers' top complaints. Previously, we charged customers for additional aligners ordered beyond those covered by the initial treatment plan. With this product policy change, we no longer distinguish between mid-course corrections and case refinements and allow doctors to order additional aligners to address either treatment need at no charge, subject to certain requirements. These changes were effective for all new Invisalign Full, Teen, and Assist treatments shipped worldwide after July 18, 2015 as well as any open Invisalign Full, Teen and Assist cases as of that date. While this policy change was largely immaterial to our cash flows, it does impact the timing at which we recognize revenue. Based on this new product policy, beginning in the third quarter of 2015, we deferred more revenue as a result of providing free additional aligners for eligible treatments. While this product policy change will impact the timing of our revenue recognition, we believe this policy change will result in a significant improvement in customer satisfaction and loyalty, and ultimately increase Invisalign utilization and volume over time. |

• | New Products, Feature Enhancements and Technology Innovation. Product innovation drives greater treatment predictability and clinical applicability, and ease of use for our customers, which supports adoption of Invisalign in their practices. Increasing applicability and treating more complex cases requires that we move away from individual features to more comprehensive solutions so that Invisalign providers can more predictably treat the whole case, such as with Invisalign G5 for deep bite treatment, Invisalign G6 for premolar extraction and ClinCheck Pro, the next generation Invisalign treatment software tool, designed to provide more precise control over final tooth position and to help Invisalign providers achieve their treatment goals. In addition, we began shipping the next generation |

21

iTero Element Intraoral Scanner in September 2015 and expect to continue to ramp up our production over the next few quarters accordingly; however, our ability to fulfill existing orders may be impacted by capacity constraints due to a variety of factors, including our dependency on third party vendors for key components in addition to limited production yields. If we are unable to scale production of our iTero Element scanner to meet customer demand, our financial results may be negatively impacted. We believe that over the long-term, clinical solutions and treatment tools will increase adoption of Invisalign and increase sales of our intraoral scanners; however, it is difficult to predict the rate of adoption which may vary by region and channel.

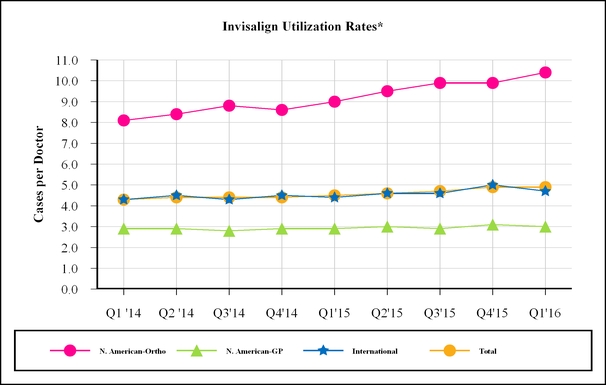

• | Invisalign Adoption. Our goal is to establish Invisalign as the treatment of choice for treating malocclusion ultimately driving increased product adoption and frequency of use by dental professionals, also known as "utilization rates." Our quarterly utilization rates for the previous 9 quarters are as follows: |

* Invisalign Utilization rates = # of cases shipped divided by # of doctors cases were shipped to

Total utilization in the first quarter of 2016 increased to 4.9 cases per doctor compared to 4.5 in the first quarter of 2015. Utilization among our North American orthodontist customers reached an all time high of 10.4 cases per doctor in the first quarter of 2016 compared to 9.0 in the first quarter of 2015. International doctor utilization increased to 4.7 cases in the first quarter of 2016 from 4.4 in the first quarter of 2015. North American GP doctor utilization increased to 3.0 cases in the first quarter of 2016 from 2.9 in the first quarter of 2015. The increase in North America orthodontist utilization reflects improvements in product and technology, which continues to strengthen our doctors’ clinical confidence in the use of Invisalign such that they now utilize Invisalign more often and on more complex cases, including their teenage patients. Increased International utilization reflects growth in both the EMEA and Asia Pacific regions driven by go-to-market and sales coverage investments, improving clinical education and support as well as ongoing technology innovation. We expect that over the long-term our utilization rates will gradually improve as a result of advancements in product and technology, which continue to strengthen our doctors’ clinical confidence in the use of Invisalign, however, we expect that our utilization rates may fluctuate from period to period due to a variety of factors, including seasonal trends in our business along with adoption rates of new products and features.

• | Number of new Invisalign doctors trained. We continue to expand our Invisalign customer base through the training of new doctors. In 2015, Invisalign growth was driven primarily by increased utilization across all regions as well as by the continued expansion of our customer base as we trained a total of 9,795 new Invisalign doctors, of which 56% were trained internationally. During the first quarter of 2016, we trained 2,470 new Invisalign doctors. |

22

• | International Clear Aligner Growth. We will continue to focus our efforts towards increasing adoption of our products by dental professionals in our direct international markets. On a year over year basis, international volume increased 34.1% driven primarily by strong performance in the Asia Pacific region as well as growth in Europe. In 2016, we are continuing to expand in our existing markets through targeted investments in sales coverage and professional marketing and education programs, along with consumer marketing in selected country markets. We expect international revenues to continue to grow at a faster rate than North America for the foreseeable future due to our continued investment in international market expansion, the size of the market opportunity, and our relatively low market penetration in this region. As our international revenues have increased from $55.9 million in the first quarter of 2015 to $69.9 million in the first quarter of 2016, we are increasingly subject to fluctuations in foreign currency exchange rates relative to the U.S. dollar. Although we have historically accepted the exposure to exchange rate movements without using derivative financial instruments to manage risk, in the third quarter of 2015 we initiated a foreign currency economic hedging program to mitigate the foreign currency risk in countries where we have significant monetary assets and liabilities denominated in currencies other than the functional currency. The impact from these forward contracts was not material to our financial statements for the year ended March 31, 2016. |

In addition, as we plan for further international expansion over the next several years, we must provide better support to our customers in these regions and be geographically closer to their practices. Accordingly, we intend to make further investments in our manufacturing over the next few years to enhance our regional capabilities.

• | Establish Regional Order Acquisition and Treatment Planning facilities: We intend to establish additional Order Acquisition and Treatment Planning facilities closer to our International customers in order to improve our operational efficiency and provide doctors with a great experience to further improve their confidence in using Invisalign to treat more patients, more often. If demand for our product in 2016 exceeds our current expectations, or if the timing of receipt of case product orders during a given quarter is different from our expectations, we may not be able to fulfill orders in a timely manner, which may negatively impact our financial results and overall business. Conversely, if demand decreases or if we fail to forecast demand accurately, we could be required to record excess capacity charges, which would lower our gross margin. |

• | Operating Expenses. We expect operating expenses to increase in 2016 due in part to: |

◦ | investments in international expansion in new country markets such as India and Korea; |

◦ | the increase in sales and customer support resources; and |

◦ | product and technology innovation to address such things as treatment times, indications unique to teens, and predictability. |

We believe that these investments will position us to increase our revenue and continue to grow our market share.

• | Stock Repurchase Authorization. On April 28, 2016, we announced that our Board of Directors had authorized a plan to repurchase up to $300.0 million of the Company's stock. Any purchases under this stock repurchase program may be made, from time-to-time, pursuant to open market purchases (including pursuant to Rule 10b5-1 plans), privately-negotiated transactions, accelerated stock repurchases, block trades or derivative contracts or otherwise in accordance with applicable federal securities laws, including Rule 10b-18 of the Securities Exchange Act of 1934. |

• | Accelerated Stock Repurchase. On May 3, 2016, as part of our $300.0 million April 2014 stock repurchase program, we entered into an Accelerated Stock Repurchase (ASR) agreement to repurchase $50.0 million of our common stock (the "2016 ASR"). Under the terms of the 2016 ASR, we paid $50.0 million on May 4, 2016 and received an initial delivery of approximately 0.5 million shares based on current market prices. The final number of shares to be repurchased will be based on our volume-weighted average stock price during the term of the 2016 ASR, less an agreed upon discount. (Refer to Note 9 "Common Stock Repurchase", of the Notes to condensed consolidated financial statements for details on common stock repurchase). |

• | 10b5-1 Stock Repurchase Plan. On May 3, 2016, we also entered into a stock repurchase plan under which we will repurchase up to $50 million of our common stock. This stock repurchase plan is in addition to, and will become effective upon, the completion of the 2016 ASR. This stock repurchase plan will operate in accordance with guidelines specified under Rule 10b5-1 of the Securities Exchange Act of 1934. Accordingly, transactions, if any, will be effected in accordance with the terms of the share repurchase plan, including specified price, volume, and timing conditions. |

23

Results of Operations

Net revenues by Reportable Segment

We group our operations into two reportable segments: Clear Aligner segment and Scanner segment.

• | Our Clear Aligner segment consists of our Invisalign system which includes Invisalign Full, Teen and Assist ("Full Products"), Express/Lite ("Express Products"),Vivera retainers, along with our training and ancillary products for treating malocclusion. |

• | Our Scanner segment consists of intra-oral scanning systems and additional services available with the intra-oral scanners that provide digital alternatives to the traditional cast models. This segment includes our iTero scanner and OrthoCAD services. |

Net revenues for our Clear Aligner segment by region and our Scanner segment by region for the three months ended March 31, 2016 and 2015 is as follows (in millions):

For the Three Months Ended, March 31, | |||||||||||||||

Net Revenues | 2016 | 2015 | Net Change | % Change | |||||||||||

Clear Aligner Revenues: | |||||||||||||||

North America | $ | 135.7 | $ | 118.8 | $ | 16.9 | 14.2 | % | |||||||

International | 69.9 | 55.9 | 14.0 | 25.0 | % | ||||||||||

Invisalign non-case | 14.1 | 12.3 | 1.8 | 14.6 | % | ||||||||||

Total Clear Aligner net revenues | $ | 219.7 | $ | 187.0 | $ | 32.7 | 17.5 | % | |||||||

Scanner net revenues | 19.0 | 11.1 | 7.9 | 72.0 | % | ||||||||||

Total net revenues | $ | 238.7 | $ | 198.1 | $ | 40.5 | 20.5 | % | |||||||

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.

Clear Aligner Case Volume by Region

Case volume data which represents Invisalign case shipments by region for the three months ended March 31, 2016 and 2015 is as follows (in thousands):

For the Three Months Ended, March 31, | ||||||||||||

Region | 2016 | 2015 | Net Change | % Change | ||||||||

North American Invisalign | 110.5 | 91.1 | 19.4 | 21.3 | % | |||||||

International Invisalign | 53.2 | 39.7 | 13.5 | 34.1 | % | |||||||

Total Invisalign case volume | 163.7 | 130.8 | 32.9 | 25.2 | % | |||||||

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.

Total net revenues increased by $40.5 million for the three months ended March 31, 2016, respectively, as compared to the same period in 2015, primarily as a result of Invisalign case volume growth across all regions and most products.

Clear Aligner - North America

In the three months ended March 31, 2016, Clear Aligner North America net revenues increased by $16.9 million compared to the same period in 2015 primarily due to Invisalign case volume growth of approximately $25.3 million across all channels and products. These increases were offset in part by lower average selling prices ("ASP") which decreased net revenues by approximately $8.4 million. The decrease in ASP was as a result of higher net revenue deferrals of $4.9 million primarily due to the impact of our new additional aligner product policy launched in July 2015, and, to a lesser extent, due to higher promotional discounts in the current period compared to the same period in the prior year of $4.1 million. The decrease in ASP was offset in part by the price increase on our Full products effective April 1, 2015.

24

Clear Aligner - International

In the three months ended March 31, 2016, Clear Aligner international net revenues increased by $14.0 million compared to the same period in 2015 primarily driven by Invisalign case volume growth of $19.1 million across all products. This was offset in part by lower ASP which decreased net revenues by approximately $5.1 million. The decrease in ASP was primarily a result of the unfavorable impact from foreign exchange rates of $2.7 million due to the weakening of the Euro compared to the U.S. dollar in the current period compared to the same period in the prior year, higher net deferrals of $2.6 million mainly due to the impact of our new additional aligner product policy launched in July 2015, and, to a lesser extent, due to a product mix shift towards lower priced Invisalign products. These decreases were partially offset by an increase in ASP due to the price increase on our Full products effective July 1, 2015 as well as our transition to a direct sales model in certain Asia Pacific countries.

Clear Aligner - Invisalign Non-Case

Invisalign non-case net revenues consists of training fees and ancillary product revenues. Invisalign non-case net revenues increased by $1.8 million for the three months ended March 31, 2016, respectively compared to the same period in 2015 primarily due to increased Vivera volume both in North America and International.

Scanner

Scanner net revenues increased $7.9 million for the three months ended March 31, 2016, respectively, compared to the same period in 2015 primarily as a result of an increase in the number of scanners recognized as we began shipping our next generation iTero Element scanner in September 2015, and, to a lesser extent, an increase in ASP.

Cost of net revenues and gross profit (in millions):

Three Months Ended March 31, | ||||||||||||

2016 | 2015 | Change | ||||||||||

Clear Aligner | ||||||||||||

Cost of net revenues | $ | 47.6 | $ | 39.1 | $ | 8.5 | ||||||

% of net segment revenues | 21.7 | % | 20.9 | % | ||||||||

Gross profit | $ | 172.1 | $ | 148.0 | $ | 24.1 | ||||||

Gross margin % | 78.3 | % | 79.1 | % | ||||||||

Scanner and Services | ||||||||||||

Cost of net revenues | $ | 10.5 | $ | 7.9 | $ | 2.6 | ||||||

% of net segment revenues | 55.0 | % | 71.7 | % | ||||||||

Gross profit | $ | 8.6 | $ | 3.1 | $ | 5.5 | ||||||

Gross margin % | 45.0 | % | 28.3 | % | ||||||||

Total cost of net revenues | $ | 58.1 | $ | 47.0 | $ | 11.1 | ||||||

% of net revenues | 24.3 | % | 23.7 | % | ||||||||

Gross profit | $ | 180.6 | $ | 151.1 | $ | 29.5 | ||||||

Gross margin % | 75.7 | % | 76.3 | % | ||||||||

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.

Cost of net revenues for our Clear Aligner and Scanner segments includes salaries for staff involved in the production process, the cost of materials, packaging, shipping costs, depreciation on capital equipment used in the production process, amortization of acquired intangible assets from Cadent, training costs and stock-based compensation.

Clear Aligner

Gross margin declined slightly for the three months ended March 31, 2016 compared to the same period in 2015 primarily due to lower ASP related to our new Additional Aligner policy implemented in July last year.

25

Scanner

Gross margin increased for the three months ended March 31, 2016 compared to the same period in 2015 primarily due to higher ASP and lower costs of our iTero Element scanner.

Selling, General and administrative (in millions):

Three Months Ended March 31, | ||||||||||||

2016 | 2015 | Change | ||||||||||

Selling, general and administrative | $ | 112.2 | $ | 88.3 | $ | 23.9 | ||||||

% of net revenues | 47.0 | % | 44.6 | % | ||||||||

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.

Selling, general and administrative expense includes personnel-related costs including payroll, commissions and stock-based compensation for our sales force, marketing and administration in addition to media and advertising expenses, clinical education, trade shows and industry events, product marketing, outside consulting services, legal expenses, depreciation and amortization expense, the medical device excise tax ("MDET") and allocations of corporate overhead expenses including facilities and IT.

Selling, general and administrative expense for the three months ended March 31, 2016 increased compared to the same period in 2015 primarily due to higher compensation related costs of $11.7 million as a result of increased headcount, which led to higher salaries, stock based compensation and commissions and higher marketing costs. In addition, in the first quarter of 2015 there was a refund of MDET taxes paid in 2014 of $6.8 million as our aligners which are now no longer subject to the excise tax. These increased expenses were partially offset by lower outside litigation costs of $1.4 million.

Research and development (in millions):

Three Months Ended March 31, | ||||||||||||

2016 | 2015 | Change | ||||||||||

Research and development | $ | 15.1 | $ | 13.9 | $ | 1.2 | ||||||

% of net revenues | 6.3 | % | 7.0 | % | ||||||||

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.