UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09631

Cohen & Steers Institutional Realty Shares, Inc.

(Exact name of registrant as specified in charter)

280 Park Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 832-3232

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

To Our Shareholders:

We would like to share with you our report for the year ended December 31, 2022. The total returns for Cohen & Steers Institutional Realty Shares, Inc. (the Fund) and its comparative benchmarks were:

| Six Months Ended December 31, 2022 |

Year Ended December 31, 2022 |

|||||||

| Cohen & Steers Institutional Realty Shares |

–7.57 | % | –24.73 | % | ||||

| FTSE Nareit All Equity REITs Indexa |

–7.14 | % | –24.95 | % | ||||

| S&P 500 Indexa |

2.31 | % | –18.11 | % | ||||

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at net asset value (NAV). Fund performance reflects fee waivers and/or expense reimbursements, without which the performance would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. Distributions in excess of the Fund’s investment company taxable income and net realized gains are a return of capital distributed from the Fund’s assets.

Market Review

In the 12-month period that ended December 31, 2022, real estate securities declined along with financial assets broadly. The economy slowed and inflation climbed to a 40-year high amid lingering supply chain issues and as Russia’s invasion of Ukraine led to a pronounced increase in food and energy prices as well as heightened economic uncertainty. Bond yields rose meaningfully in what was one of the worst bond bear markets on record. In an effort to reduce demand to check persistently high inflation, the Federal Reserve aggressively raised its benchmark lending rate and shifted its policy toward quantitative tightening.

The sharp increases in interest rates during the year were particularly unsettling for REITs, which underwent a valuation reset even though real estate has not seen significant speculation or aggressive leverage. While all real estate sectors experienced negative total returns, fundamentals for most property types remained healthy, with rising demand and limited new supply (as indicated by data showing high occupancy rates) allowing landlords to raise rents. And although a deceleration in REIT earnings is anticipated given expectations for a recession, cash flows are nevertheless projected to be resilient in 2023, particularly compared to the broad equity market.

| a | The FTSE Nareit All Equity REITs Index contains all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance. |

1

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

Fund Performance

The Fund had a negative total return in the period and performed in line with the FTSE Nareit All Equity REITs Index.

Despite inflationary headwinds, retail-focused REITs outperformed as the strong job market and a decline in oil prices in the year’s second half bolstered consumer discretionary spending. Free standing REITs benefited from relatively low multiples; these companies also have defensive cash flow characteristics which helped in the challenging macro environment. Shopping centers also defended well, driven by rising occupancies and rents. Security selection and an overweight allocation in free standing REITs contributed to the Fund’s relative performance. A beneficial overweight in the regional mall sector also contributed, although an underweight in shopping centers offset this.

Hotel REITs outperformed, supported by rising leisure and business travel demand. Also, hotels are among the shorter-lease-duration property types, which characteristically allows the sector to adjust rents rapidly in inflationary environments. The Fund’s overweight allocation in hotels/gaming aided relative performance.

Self storage companies modestly trailed the benchmark despite healthy demand (and despite their short-duration leases, which can quickly adjust amid inflationary conditions) on the prospect that a slowing economy could erase the occupancy gains the sector experienced during the pandemic. Stock selection in the self storage sector contributed to relative performance; the portfolio favored the index’s largest storage constituent, which investors generally viewed as a safe haven. Toward year-end, the company reported an increased average length of stay as a greater proportion of customers sought out storage due to lack of space (rather than relocating).

Health care was a modest outperformer. Improving senior housing occupancies translated into higher rates charged to existing tenants, but the sector also contended with labor issues and a decline in venture capital targeting life sciences (which will potentially weigh on future lab space demand). The portfolio’s security selection in health care detracted from relative performance, although a favorable overweight allocation in the sector partially offset this negative.

The more growth-oriented real estate sectors trailed the benchmark amid interest rate pressures. Data centers were caught up in the broader technology sector selloff. Performance notwithstanding, demand and pricing power for data centers remained strong, with expectations for increased occupancy and margin expansion in 2023. Stock selection in data centers detracted from performance, although a favorable underweight allocation in the sector partially offset this.

Industrial REITs also trailed for the year despite expectations for continued high rent growth in 2023. Infrastructure lagged amid challenges to near-term growth, including rising interest expenses, foreign exchange headwinds and higher international churn. The Fund’s security selection in the industrial sector contributed to relative returns due partly to overweight positions in a recovering cold storage company and a REIT that was taken private. An underweight and selection in infrastructure also contributed to the Fund’s relative returns.

Residential property companies lagged on concerns around softening rental and leasing rates. Manufactured home REITs trailed despite better-than-expected same-store revenues, boosted partly by high seasonal and transient RV sales. Single family homes underperformed on concerns about asset values and as companies faced rising property taxes in some states. Nevertheless, asking rents rose

2

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

amid affordability issues in the for-sale home market, which are expected to continue to support leasing strength in the sector. Apartments trailed on softer rents in coastal markets and anticipated technology-related job losses. The portfolio’s overweight allocations to apartments and single family homes hindered relative performance.

Offices underperformed amid questions about future demand for space. Given tenants’ flexible work arrangements, office buildings remained less populated than they were before the pandemic. Office companies with assets concentrated in coastal markets were particularly hard hit amid layoffs at large technology companies. The Fund’s stock selection and underweight allocation in the office sector contributed to relative performance. In contrast, security selection in the diversified sector hindered relative performance, partly due to an out-of-index investment in a real estate services company; the company has substantial exposure to the transaction and leasing market, and it significantly declined in the year.

Also detracting from relative performance was the Fund’s underweight allocation in the specialty sector, which is composed of a handful of companies operating disparate businesses, several of which meaningfully outperformed in the period.

Sincerely,

|

|

| |

| JON CHEIGH | JASON A. YABLON | |

| Portfolio Manager | Portfolio Manager | |

MATHEW KIRSCHNER

Portfolio Manager

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

3

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions.

4

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

Performance Review (Unaudited)

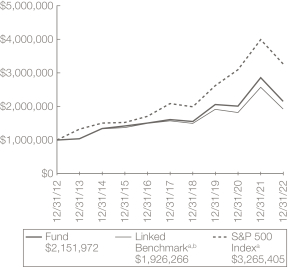

Growth of a $1,000,000 Investment

Average Annual Total Returns—For Periods Ended December 31, 2022

| 1 Year | 5 Years | 10 Years | Since Inceptionc | |||||||||||||

|

Cohen & Steers Institutional Realty Shares, Inc. |

–24.73 | % | 5.94 | % | 7.97 | % | 10.69 | % | ||||||||

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. Total return assumes the reinvestment of all dividends and distributions at NAV. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the periods presented above, the investment manager waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

The annualized gross and net expense ratios, respectively, were 0.76% and 0.75% as disclosed in the May 1, 2022 prospectus. The investment manager has contractually agreed to waive its fee and/or reimburse expenses so that the Fund’s total annual operating expenses as reflected in the Fund’s financial statements (excluding brokerage fees and commissions, taxes, certain other expenses and upon approval of the Board of Directors, extraordinary expenses) never exceed 0.75% of the average daily net assets of the Fund. This commitment is currently expected to remain in place for the life of the Fund, can only be amended or terminated by agreement of the Fund’s Board of Directors and the investment manager and will terminate automatically in the event of termination of the investment management agreement between the Fund and the investment manager.

5

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

Performance Review (Unaudited)—(Continued)

| a | The comparative indexes are not adjusted to reflect expenses or other fees that the U.S. Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. The Fund’s performance assumes the reinvestment of all dividends and distributions at NAV. For more information, including charges and expenses, please read the prospectus carefully before you invest. |

| b | The Linked Benchmark is represented by the performance of the FTSE Nareit Equity REITs Index through March 31, 2019 and the FTSE Nareit All Equity REITs Index thereafter. The FTSE Nareit Equity REITs Index contains all tax-qualified real estate investment trusts (REITs) except timber and infrastructure REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. The FTSE Nareit All Equity REITs Index contains all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. |

| c | Inception date of February 14, 2000. |

6

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs including investment management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2022—December 31, 2022.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value July 1, 2022 |

Ending Account Value December 31, 2022 |

Expenses Paid During Perioda July 1, 2022— December 31, 2022 |

||||||||||

| Actual (–7.57% return) |

$ | 1,000.00 | $ | 924.30 | $ | 3.64 | ||||||

| Hypothetical (5% annual return before expenses) |

$ | 1,000.00 | $ | 1,021.42 | $ | 3.82 | ||||||

| a | Expenses are equal to the Fund’s annualized net expense ratio of 0.75% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

7

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

December 31, 2022

Top Ten Holdingsa

(Unaudited)

| Security |

Value | % of Net Assets |

||||||

| Prologis, Inc. |

$ | 579,311,128 | 10.0 | |||||

| Welltower, Inc. |

415,419,389 | 7.2 | ||||||

| American Tower Corp. |

398,884,712 | 6.9 | ||||||

| Public Storage |

396,359,856 | 6.9 | ||||||

| Digital Realty Trust, Inc. |

372,770,470 | 6.4 | ||||||

| Simon Property Group, Inc. |

360,892,686 | 6.3 | ||||||

| Realty Income Corp. |

303,916,409 | 5.3 | ||||||

| Invitation Homes, Inc. |

271,612,928 | 4.7 | ||||||

| Crown Castle, Inc. |

231,896,112 | 4.0 | ||||||

| Equinix, Inc. |

200,605,558 | 3.5 | ||||||

| a | Top ten holdings (excluding short-term investments and derivative instruments) are determined on the basis of the value of individual securities held. |

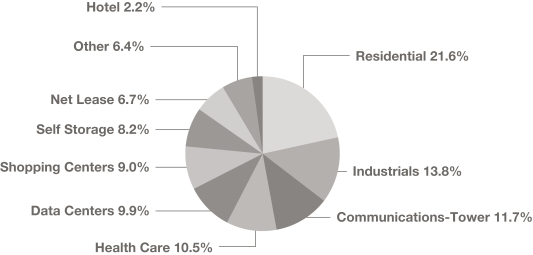

Sector Breakdown (Based on Net Assets) (Unaudited)

8

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS

December 31, 2022

| Shares | Value | |||||||||||

| COMMON STOCK |

98.9% | |||||||||||

| COMMUNICATIONS—TOWERS |

11.7% | |||||||||||

| American Tower Corp. |

|

1,882,775 | $ | 398,884,712 | ||||||||

| Crown Castle, Inc. |

|

1,709,644 | 231,896,112 | |||||||||

| SBA Communications Corp. |

|

162,730 | 45,614,846 | |||||||||

|

|

|

|||||||||||

| 676,395,670 | ||||||||||||

|

|

|

|||||||||||

| CONSUMER, CYCLICAL—HOTELS, RESTAURANTS & LEISURE |

0.9% | |||||||||||

| Boyd Gaming Corp. |

|

915,332 | 49,913,054 | |||||||||

|

|

|

|||||||||||

| REAL ESTATE |

86.3% | |||||||||||

| DATA CENTERS |

9.9% | |||||||||||

| Digital Realty Trust, Inc. |

|

3,717,667 | 372,770,470 | |||||||||

| Equinix, Inc. |

|

306,254 | 200,605,558 | |||||||||

|

|

|

|||||||||||

| 573,376,028 | ||||||||||||

|

|

|

|||||||||||

| HEALTH CARE |

10.5% | |||||||||||

| Healthcare Realty Trust, Inc. |

|

5,914,250 | 113,967,597 | |||||||||

| Healthpeak Properties, Inc. |

|

3,028,775 | 75,931,389 | |||||||||

| Welltower, Inc. |

|

6,337,443 | 415,419,389 | |||||||||

|

|

|

|||||||||||

| TOTAL HEALTH CARE |

|

605,318,375 | ||||||||||

|

|

|

|||||||||||

| HOTEL |

2.2% | |||||||||||

| Host Hotels & Resorts, Inc. |

|

8,102,064 | 130,038,127 | |||||||||

|

|

|

|||||||||||

| INDUSTRIALS |

13.8% | |||||||||||

| Americold Realty Trust, Inc. |

|

6,305,691 | 178,514,112 | |||||||||

| BG LLH, LLC (Lineage Logistics)a |

|

409,584 | 38,603,270 | |||||||||

| Prologis, Inc. |

|

5,138,926 | 579,311,128 | |||||||||

|

|

|

|||||||||||

| 796,428,510 | ||||||||||||

|

|

|

|||||||||||

| NET LEASE |

6.7% | |||||||||||

| Realty Income Corp. |

|

4,791,367 | 303,916,409 | |||||||||

| Spirit Realty Capital, Inc. |

|

2,124,603 | 84,835,398 | |||||||||

|

|

|

|||||||||||

| 388,751,807 | ||||||||||||

|

|

|

|||||||||||

| OFFICE |

1.9% | |||||||||||

| Highwoods Properties, Inc. |

|

3,861,323 | 108,039,817 | |||||||||

|

|

|

|||||||||||

| REAL ESTATE SERVICES |

1.9% | |||||||||||

| Jones Lang LaSalle, Inc.b |

|

697,629 | 111,181,134 | |||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

9

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2022

| Shares | Value | |||||||||||

| RESIDENTIAL |

21.6% | |||||||||||

| APARTMENT |

11.5% | |||||||||||

| Apartment Income REIT Corp. |

|

2,709,801 | $ | 92,973,272 | ||||||||

| Camden Property Trust |

|

1,694,207 | 189,547,879 | |||||||||

| Essex Property Trust, Inc. |

|

138,682 | 29,389,490 | |||||||||

| Mid-America Apartment Communities, Inc. |

|

1,139,829 | 178,941,755 | |||||||||

| UDR, Inc. |

|

4,532,406 | 175,540,084 | |||||||||

|

|

|

|||||||||||

| 666,392,480 | ||||||||||||

|

|

|

|||||||||||

| MANUFACTURED HOME |

3.4% | |||||||||||

| Sun Communities, Inc. |

|

1,383,250 | 197,804,750 | |||||||||

|

|

|

|||||||||||

| SINGLE FAMILY |

6.7% | |||||||||||

| American Homes 4 Rent, Class A |

|

3,726,165 | 112,306,613 | |||||||||

| Invitation Homes, Inc. |

|

9,163,729 | 271,612,928 | |||||||||

|

|

|

|||||||||||

| 383,919,541 | ||||||||||||

|

|

|

|||||||||||

| TOTAL RESIDENTIAL |

|

1,248,116,771 | ||||||||||

|

|

|

|||||||||||

| SELF STORAGE |

8.2% | |||||||||||

| Extra Space Storage, Inc. |

|

512,009 | 75,357,485 | |||||||||

| Public Storage |

|

1,414,611 | 396,359,856 | |||||||||

|

|

|

|||||||||||

| 471,717,341 | ||||||||||||

|

|

|

|||||||||||

| SHOPPING CENTERS |

9.0% | |||||||||||

| COMMUNITY CENTER |

2.7% | |||||||||||

| Kimco Realty Corp. |

|

5,582,616 | 118,239,807 | |||||||||

| SITE Centers Corp. |

|

2,933,457 | 40,071,022 | |||||||||

|

|

|

|||||||||||

| 158,310,829 | ||||||||||||

|

|

|

|||||||||||

| REGIONAL MALL |

6.3% | |||||||||||

| Simon Property Group, Inc. |

|

3,071,950 | 360,892,686 | |||||||||

|

|

|

|||||||||||

| TOTAL SHOPPING CENTERS |

|

519,203,515 | ||||||||||

|

|

|

|||||||||||

| TIMBER |

0.7% | |||||||||||

| Weyerhaeuser Co. |

|

1,246,382 | 38,637,842 | |||||||||

|

|

|

|||||||||||

| TOTAL REAL ESTATE |

|

4,990,809,267 | ||||||||||

|

|

|

|||||||||||

| TOTAL COMMON

STOCK |

|

5,717,117,991 | ||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

10

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2022

| Shares | Value | |||||||||||

| SHORT-TERM INVESTMENTS |

0.8% | |||||||||||

| MONEY MARKET FUNDS |

||||||||||||

| State Street Institutional Treasury Money Market Fund, Premier Class, 3.79%c |

|

45,361,311 | $ | 45,361,311 | ||||||||

|

|

|

|||||||||||

| TOTAL SHORT-TERM

INVESTMENTS |

|

45,361,311 | ||||||||||

|

|

|

|||||||||||

| TOTAL INVESTMENTS IN

SECURITIES |

99.7% | 5,762,479,302 | ||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES |

0.3 | 18,187,018 | ||||||||||

|

|

|

|

|

|||||||||

| NET ASSETS (Equivalent to $42.56 per share based

on |

100.0% | $ | 5,780,666,320 | |||||||||

|

|

|

|

|

|||||||||

Glossary of Portfolio Abbreviations

| REIT |

Real Estate Investment Trust |

Note: Percentages indicated are based on the net assets of the Fund.

| a | Restricted security. Aggregate holdings equal 0.7% of the net assets of the Fund. This security was acquired on August 3, 2020 and September 22, 2021, at an aggregate cost of $27,049,198. Security value is determined based on significant unobservable inputs (Level 3). |

| b | Non-income producing security. |

| c | Rate quoted represents the annualized seven-day yield. |

See accompanying notes to financial statements.

11

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2022

| ASSETS: |

| |||

| Investments in securities, at value (Identified cost—$5,599,081,690) |

$ | 5,762,479,302 | ||

| Receivable for: |

||||

| Fund shares sold |

23,300,501 | |||

| Dividends |

17,227,687 | |||

| Investment securities sold |

6,184,770 | |||

| Other assets |

43,260 | |||

|

|

|

|||

| Total Assets |

5,809,235,520 | |||

|

|

|

|||

| LIABILITIES: |

| |||

| Payable for: |

||||

| Fund shares redeemed |

19,765,824 | |||

| Investment securities purchased |

4,939,878 | |||

| Investment management fees |

3,715,991 | |||

| Other liabilities |

147,507 | |||

|

|

|

|||

| Total Liabilities |

28,569,200 | |||

|

|

|

|||

| NET ASSETS applicable to 135,814,690 shares of $0.001 par value of common stock outstanding |

$ | 5,780,666,320 | ||

|

|

|

|||

| NET ASSET VALUE PER SHARE: |

| |||

| ($5,780,666,320 ÷ 135,814,690 shares outstanding) |

$ | 42.56 | ||

|

|

|

|||

| NET ASSETS consist of: |

| |||

| Paid-in capital |

$ | 5,742,266,321 | ||

| Total distributable earnings/(accumulated loss) |

38,399,999 | |||

|

|

|

|||

| $5,780,666,320 | ||||

|

|

|

|||

See accompanying notes to financial statements.

12

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2022

| Investment Income: |

||||

| Dividend income |

$ | 164,295,196 | ||

|

|

|

|||

| Expenses: |

||||

| Investment management fees |

49,670,659 | |||

| Registration and filing fees |

233,429 | |||

| Directors’ fees and expenses |

222,077 | |||

| Miscellaneous |

31,791 | |||

|

|

|

|||

| Total Expenses |

50,157,956 | |||

| Reduction of Expenses (See Note 2) |

(487,297 | ) | ||

|

|

|

|||

| Net Expenses |

49,670,659 | |||

|

|

|

|||

| Net Investment Income (Loss) |

114,624,537 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss): |

| |||

| Net realized gain (loss) on investments in securities |

66,605,568 | |||

| Net change in unrealized appreciation (depreciation) on investments in securities |

(2,125,674,393 | ) | ||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss) |

(2,059,068,825 | ) | ||

|

|

|

|||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (1,944,444,288 | ) | |

|

|

|

|||

See accompanying notes to financial statements.

13

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

STATEMENT OF CHANGES IN NET ASSETS

| For the Year Ended December 31, 2022 |

For the Year Ended December 31, 2021 |

|||||||

| Change in Net Assets: |

||||||||

| From Operations: |

||||||||

| Net investment income (loss) |

$ | 114,624,537 | $ | 46,946,008 | ||||

| Net realized gain (loss) |

66,605,568 | 374,378,346 | ||||||

| Net change in unrealized appreciation (depreciation) |

(2,125,674,393 | ) | 1,603,298,542 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

(1,944,444,288 | ) | 2,024,622,896 | |||||

|

|

|

|

|

|||||

| Distributions to Shareholders |

(280,402,036 | ) | (271,338,645 | ) | ||||

|

|

|

|

|

|||||

| Capital Stock Transactions: |

||||||||

| Increase (decrease) in net assets from Fund share transactions |

529,400,733 | 1,804,062,089 | ||||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

(1,695,445,591 | ) | 3,557,346,340 | |||||

| Net Assets: |

||||||||

| Beginning of year |

7,476,111,911 | 3,918,765,571 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 5,780,666,320 | $ | 7,476,111,911 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

14

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout each year and other

performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| For the Year Ended December 31, | ||||||||||||||||||||

| Per Share Operating Data: |

2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||

| Net asset value, beginning of year |

$59.18 | $43.31 | $46.89 | $39.25 | $43.32 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss)a |

0.85 | 0.43 | 0.80 | 0.84 | 0.93 | |||||||||||||||

| Net realized and unrealized gain (loss) |

(15.37 | ) | 17.73 | (2.25 | ) | 11.80 | (2.51 | )b | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(14.52 | ) | 18.16 | (1.45 | ) | 12.64 | (1.58 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.78 | ) | (0.51 | ) | (1.03 | ) | (0.63 | ) | (0.75 | ) | ||||||||||

| Net realized gain |

(1.32 | ) | (1.78 | ) | (1.00 | ) | (4.37 | ) | (1.74 | ) | ||||||||||

| Tax return of capital |

— | — | (0.10 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total dividends and distributions to shareholders |

(2.10 | ) | (2.29 | ) | (2.13 | ) | (5.00 | ) | (2.49 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net increase (decrease) in net asset value |

(16.62 | ) | 15.87 | (3.58 | ) | 7.64 | (4.07 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$42.56 | $59.18 | $43.31 | $46.89 | $39.25 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total returnc |

–24.73 | % | 42.47 | % | –2.57 | % | 33.01 | % | –4.01 | %b | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying notes to financial statements.

15

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| For the Year Ended December 31, | ||||||||||||||||||||

| Ratios/Supplemental Data: |

2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||

| Net assets, end of year (in millions) |

$5,780.7 | $7,476.1 | $3,918.8 | $3,712.1 | $2,659.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||

| Expenses (before expense reduction) |

0.76 | % | 0.76 | % | 0.76 | % | 0.76 | % | 0.78 | %b | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses (net of expense reduction) |

0.75 | % | 0.75 | % | 0.75 | % | 0.75 | % | 0.77 | %b | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net investment income (loss) (before expense reduction) |

1.72 | % | 0.81 | % | 1.93 | % | 1.81 | % | 2.22 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net investment income (loss) (net of expense reduction) |

1.73 | % | 0.82 | % | 1.94 | % | 1.82 | % | 2.23 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Portfolio turnover rate |

34 | % | 34 | % | 66 | % | 82 | % | 68 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| a | Calculation based on average shares outstanding. |

| b | During the reporting period the Fund settled legal claims against two issuers of securities previously held by the Fund. As a result, the net realized and unrealized gain (loss) on investments per share includes proceeds received from the settlements. Without these proceeds the net realized and unrealized gain (loss) on investments per share would have been $(2.56). Additionally, the expense ratio includes extraordinary expenses related to the direct action. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 0.76% and 0.75%, respectively. Excluding the proceeds from and expenses relating to the settlements, the total return would have been -4.12%. |

| c | Return assumes the reinvestment of all dividends and distributions at net asset value. |

See accompanying notes to financial statements.

16

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Institutional Realty Shares, Inc. (the Fund) was incorporated under the laws of the State of Maryland on October 13, 1999 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a non-diversified, open-end management investment company. The Fund’s investment objective is total return.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined.

Readily marketable securities traded in the over-the-counter (OTC) market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment manager) to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at net asset value (NAV).

The Board of Directors has designated the investment manager as the Fund’s “Valuation Designee” under Rule 2a-5 under the 1940 Act. As Valuation Designee, the investment manager is authorized to make fair valuation determinations, subject to the oversight of the Board of Directors. The investment manager has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

17

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Securities for which market prices are unavailable, or securities for which the investment manager determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities would be categorized as Level 2 or 3 in the hierarchy, depending on the relative significance of the valuation inputs. Securities, including private placements or other restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach, the income approach and cost approach, and are categorized as Level 3 in the hierarchy. The market approach considers factors including the price of recent investments in the same or a similar security or financial metrics of comparable securities. The income approach considers factors including expected future cash flows, security specific risks and corresponding discount rates. The cost approach considers factors including the value of the security’s underlying assets and liabilities.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund’s investments is summarized below.

| • | Level 1—quoted prices in active markets for identical investments |

| • | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing investments may or may not be an indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

18

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

The following is a summary of the inputs used as of December 31, 2022 in valuing the Fund’s investments carried at value:

| Quoted Prices in Active Markets for Identical Investments (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | |||||||||||||

| Common Stock: |

||||||||||||||||

| Real Estate—Industrials |

$ | 757,825,240 | $ | — | $ | 38,603,270 | a | $ | 796,428,510 | |||||||

| Other Industries |

4,920,689,481 | — | — | 4,920,689,481 | ||||||||||||

| Short-Term Investments |

— | 45,361,311 | — | 45,361,311 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securitiesb |

$ | 5,678,514,721 | $ | 45,361,311 | $ | 38,603,270 | $ | 5,762,479,302 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| a | Restricted security, where observable inputs are limited, has been fair valued by the Valuation Committee, pursuant to the Fund’s fair value procedures and classified as Level 3 security. |

| b | Portfolio holdings are disclosed individually on the Schedule of Investments. |

The following is a reconciliation of investments for which significant unobservable inputs (Level 3) were used in determining fair value:

| Common Stock—Real Estate—Industrials |

||||

| Balance as of December 31, 2021 |

$ | 41,126,307 | ||

| Change in unrealized appreciation (depreciation) |

(2,523,037 | ) | ||

|

|

|

|||

| Balance as of December 31, 2022 |

$ | 38,603,270 | ||

|

|

|

|||

The change in unrealized appreciation (depreciation) attributable to securities owned on December 31, 2022 which were valued using significant unobservable inputs (Level 3) amounted to $(2,523,037).

The following table summarizes the quantitative inputs and assumptions used for investments categorized in Level 3 of the fair value hierarchy.

|

Fair Value at |

Valuation |

Unobservable |

Amount |

Valuation Impact | ||||||

| Common Stock— Real Estate— Industrials |

$38,603,270 | Market Comparable Companies |

Enterprise Value/ EBITDAb Multiple |

21.2x |

Increase |

| a | Represents the directional change in the fair value of the Level 3 investments that could have resulted from an increase in the corresponding input as of year end. A decrease to the unobservable input |

19

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

| would have had the opposite effect. Significant changes in these inputs may result in a materially higher or lower fair value measurement. |

| b | Earnings Before Interest, Taxes, Depreciation and Amortization. |

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income, which includes the amortization of premiums and accretion of discounts, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Distributions from REITs are recorded as ordinary income, net realized capital gain or return of capital based on information reported by the REITs and management’s estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the REITs and actual amounts may differ from the estimated amounts.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid quarterly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the NAV per share at the close of business on the payable date, unless the shareholder has elected to have them paid in cash.

Dividends from net investment income are subject to recharacterization for tax purposes. Based upon the results of operations for the year ended December 31, 2022, a portion of the dividends has been reclassified to distributions from net realized gain.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company (RIC), if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to RICs, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is necessary. Management has analyzed the Fund’s tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for all open tax years and has concluded that as of December 31, 2022, no additional provisions for income tax are required in the Fund’s financial statements. The Fund’s tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

Note 2. Investment Management Fees and Other Transactions with Affiliates

Investment Management Fees: Cohen & Steers Capital Management, Inc. serves as the Fund’s investment manager pursuant to an investment management agreement (the investment management agreement). Under the terms of the investment management agreement, the investment manager provides the Fund with day-to-day investment decisions and generally manages the Fund’s investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

20

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

For the services provided to the Fund, the investment manager receives a fee, accrued daily and paid monthly, at the annual rate of 0.75% of the average daily net assets of the Fund.

The investment manager is also responsible, under the investment management agreement, for the performance of certain administrative functions for the Fund. Additionally, the investment manager pays certain expenses of the Fund, including, but not limited to, administrative and custody fees, transfer agent fees, professional fees, and reports to shareholders.

The investment manager has contractually agreed to waive its fee and/or reimburse the Fund so that the Fund’s total annual operating expenses as reflected in the Fund’s financial statements (excluding brokerage fees and commissions, taxes, certain other expenses and upon approval of the Board of Directors, extraordinary expenses) never exceed 0.75% of the average daily net assets of the Fund. This commitment is currently expected to remain in place for the life of the Fund, can only be amended or terminated by agreement of the Fund’s Board of Directors and the investment manager and will terminate automatically in the event of termination of the investment management agreement between the investment manager and the Fund. For the year ended December 31, 2022, fees waived and/or expenses reimbursed totaled $487,297.

Directors’ and Officers’ Fees: Certain directors and officers of the Fund are also directors, officers, and/or employees of the investment manager. The Fund does not pay compensation to directors and officers affiliated with the investment manager.

Other: As of December 31, 2022, approximately 10% of the Fund’s outstanding shares were owned by shareholders investing either directly or indirectly through an account, platform or program sponsored by one financial institution. Investment and asset allocation decisions by either a direct shareholder or financial institution regarding the account, platform or program through which multiple shareholders invest may result in subscription and redemption decisions that have a significant impact on the assets, expenses and trading activities of the Fund. Such a decision may cause the Fund to sell assets at disadvantageous times or prices, and may negatively affect the Fund’s NAV and performance.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the year ended December 31, 2022, totaled $2,729,826,366 and $2,233,857,820, respectively.

Note 4. Income Tax Information

The tax character of dividends and distributions paid was as follows:

| For the Year Ended December 31, |

||||||||

| 2022 | 2021 | |||||||

| Ordinary income |

$ | 104,258,064 | $ | 61,042,056 | ||||

| Long-term capital gain |

176,143,972 | 210,296,589 | ||||||

|

|

|

|

|

|||||

| Total dividends and distributions |

$ | 280,402,036 | $ | 271,338.645 | ||||

|

|

|

|

|

|||||

21

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

As of December 31, 2022, the tax-basis components of accumulated earnings, the federal tax cost and net unrealized appreciation (depreciation) in value of investments held were as follows:

| Cost of investments in securities for federal income tax purposes |

$ | 5,672,198,855 | ||

|

|

|

|||

| Gross unrealized appreciation on investments |

$ | 629,284,045 | ||

| Gross unrealized depreciation on investments |

(539,003,598 | ) | ||

|

|

|

|||

| Net unrealized appreciation (depreciation) on investments |

$ | 90,280,447 | ||

|

|

|

|||

| Undistributed ordinary income |

$ | 6,963,833 | ||

|

|

|

The Fund incurred short-term capital loss of $52,451,142 and long-term capital loss of $20,743,391 after October 31, 2022 that it has elected to defer to the following year.

As of December 31, 2022, the Fund had temporary book/tax differences primarily attributable to wash sales on portfolio securities, straddle deferrals and certain REIT dividends, and permanent book/tax differences primarily attributable to prior year REIT distribution adjustments. To reflect reclassifications arising from the permanent differences, paid-in capital was credited $415,602 and total distributable earnings/(accumulated loss) was charged $415,602. Net assets were not affected by this reclassification.

Note 5. Capital Stock

The Fund is authorized to issue 250 million shares of capital stock, at a par value of $0.001 per share. The Board of Directors of the Fund may increase or decrease the aggregate number of shares of common stock that the Fund has authority to issue. Transactions in Fund shares were as follows:

| For the Year Ended December 31, 2022 |

For the Year Ended December 31, 2021 |

|||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold |

44,950,961 | $ | 2,235,301,322 | 51,908,715 | $ | 2,633,069,620 | ||||||||||

| Issued as reinvestment of dividends and distributions |

5,647,053 | 257,750,273 | 4,583,387 | 249,674,931 | ||||||||||||

| Redeemed |

(41,113,455 | ) | (1,963,650,862 | ) | (20,644,497 | ) | (1,078,682,462 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) |

9,484,559 | $ | 529,400,733 | 35,847,605 | $ | 1,804,062,089 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Note 6. Other Risks

Common Stock Risk: While common stocks have historically generated higher average returns than fixed-income securities over the long-term, common stocks have also experienced significantly more volatility in those returns, although under certain market conditions, fixed-income investments may have comparable or greater price volatility. The value of common stocks and other equity securities will

22

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

fluctuate in response to developments concerning the company, political and regulatory circumstances, the stock market, and the economy. In the short term, stock prices can fluctuate dramatically in response to these developments. Different parts of the market and different types of equity securities can react differently to these developments. For example, stocks of large companies can react differently than stocks of smaller companies, and value stocks (stocks of companies that are undervalued by various measures and have potential for long-term capital appreciation), can react differently from growth stocks (stocks of companies with attractive cash flow returns on invested capital and earnings that are expected to grow). These developments can affect a single company, all companies within the same industry, economic sector or geographic region, or the stock market as a whole.

Real Estate Market Risk: Since the Fund concentrates its assets in companies engaged in the real estate industry, an investment in the Fund will be closely linked to the performance of the real estate markets. Risks of investing in real estate securities include falling property values due to increasing vacancies, declining rents resulting from economic, legal, tax, political or technological developments, lack of liquidity, limited diversification, and sensitivity to certain economic factors such as interest-rate changes and market recessions. Real estate company prices also may drop because of the failure of borrowers to pay their loans and poor management, and residential developers, in particular, could be negatively impacted by falling home prices, slower mortgage origination and rising construction costs. The risks of investing in REITs are similar to those associated with direct investments in real estate securities.

REIT Risk: In addition to the risks of securities linked to the real estate industry, REITs are subject to certain other risks related to their structure and focus. REITs are dependent upon management skills and generally may not be diversified. REITs are also subject to heavy cash flow dependency, defaults by borrowers and self-liquidation. In addition, REITs could possibly fail to (i) qualify for pass-through of income under applicable tax law, or (ii) maintain their exemptions from registration under the 1940 Act. The above factors may also adversely affect a borrower’s or a lessee’s ability to meet its obligations to the REIT. In the event of a default by a borrower or lessee, the REIT may experience delays in enforcing its rights as a mortgagee or lessor and may incur substantial costs associated with protecting its investments.

Small- and Medium-Sized Companies Risk: Real estate companies in the industry tend to be small- to medium-sized companies in relation to the equity markets as a whole. There may be less trading in a smaller company’s stock, which means that buy and sell transactions in that stock could have a larger impact on the stock’s price than is the case with larger company stocks. Smaller companies also may have fewer lines of business so that changes in any one line of business may have a greater impact on a smaller company’s stock price than is the case for a larger company. Further, smaller company stocks may perform differently in different cycles than larger company stocks. Accordingly, real estate company shares can, and at times will, perform differently than large company stocks.

Non-Diversification Risk: As a “non-diversified” investment company, the Fund can invest in fewer individual companies than a diversified investment company. As a result, the Fund is more susceptible to any single political, regulatory or economic occurrence and to the financial condition of individual

23

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

issuers in which it invests. The Fund’s relative lack of diversity may subject investors to greater risk of loss than a fund that has a diversified portfolio.

Geopolitical Risk: Occurrence of global events similar to those in recent years, such as war (including Russia’s military invasion of Ukraine), terrorist attacks, natural or environmental disasters, country instability, infectious disease epidemics or pandemics, such as that caused by the COVID-19 virus and its variants (COVID-19), market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers and other governmental trade or market control programs, the potential exit of a country from its respective union and related geopolitical events, may result in market volatility and may have long-lasting impacts on U.S. and global economies and financial markets. Supply chain disruptions or significant changes in the supply or prices of commodities or other economic inputs may have material and unexpected effects on both global securities markets and individual countries, regions, sectors, companies or industries. Events occurring in one region of the world may negatively impact industries and regions that are not otherwise directly impacted by the events. Additionally, those events, as well as other changes in foreign and domestic political and economic conditions, could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, secondary trading, credit ratings, inflation, investor sentiment and other factors affecting the value of the Fund’s investments.

Although the long-term economic fallout of COVID-19 is difficult to predict, it has contributed to, and may continue to contribute to, market volatility, inflation and systemic economic weakness. COVID-19 and efforts to contain its spread may also exacerbate other pre-existing political, social, economic, market and financial risks. In addition, the U.S. government and other central banks across Europe, Asia, and elsewhere announced and/or adopted economic relief packages in response to COVID-19. The end of any such program could cause market downturns, disruptions and volatility, particularly if markets view the ending as premature. The COVID-19 pandemic and its effects are expected to continue, and therefore the economic outlook, particularly for certain industries and businesses, remains inherently uncertain.

On January 31, 2020, the United Kingdom (UK) withdrew from the European Union (EU) (referred to as Brexit), commencing a transition period that ended on December 31, 2020. The EU-UK Trade and Cooperation Agreement, a bilateral trade and cooperation deal governing the future relationship between the UK and the EU (TCA), provisionally went into effect on January 1, 2021, and entered into force officially on May 1, 2021, but critical aspects of the relationship remain unresolved and subject to further negotiation and agreement. Brexit has resulted in volatility in European and global markets and could have negative long-term impacts on financial markets in the UK and throughout Europe. There is still considerable uncertainty relating to the potential consequences of the exit, how the negotiations for new trade agreements will be conducted, and whether the UK’s exit will increase the likelihood of other countries also departing the EU. During this period of uncertainty, the negative impact on the UK, European and broader global economies, could be significant, potentially resulting in increased market volatility and illiquidity, political, economic, and legal uncertainty, and lower economic growth for companies that rely significantly on Europe for their business activities and revenues.

On February 24, 2022, Russia launched a large-scale invasion of Ukraine significantly amplifying already existing geopolitical tensions. The United States and many other countries have instituted

24

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

various economic sanctions against Russia, Russian individuals and entities and Belarus. The extent and duration of the military action, sanctions imposed and other punitive actions taken (including any Russian retaliatory responses to such sanctions and actions), and resulting disruptions in Europe and globally cannot be predicted, but could be significant and have a severe adverse effect on the global economy, securities markets and commodities markets globally, including through global supply chain disruptions, increased inflationary pressures and reduced economic activity. To the extent the Fund has exposure to the energy sector, the Fund may be especially susceptible to these risks. These disruptions may also make it difficult to value the Fund’s portfolio investments and cause certain of the Fund’s investments to become illiquid. The strengthening or weakening of the U.S. dollar relative to other currencies may, among other things, adversely affect the Fund’s investments denominated in non-U.S. dollar currencies. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have, and the duration of those effects.

Regulatory Risk: The U.S. government has proposed and adopted multiple regulations that could have a long-lasting impact on the Fund and on the mutual fund industry in general. The U.S. Securities and Exchange Commission’s (SEC) final rules, related requirements and amendments to modernize reporting and disclosure, along with other potential upcoming regulations, could, among other things, restrict the Fund’s ability to engage in transactions, impact flows into the Fund and/or increase overall expenses of the Fund. In addition to Rule 18f-4, which governs the way derivatives are used by registered investment companies, the SEC, Congress, various exchanges and regulatory and self-regulatory authorities, both domestic and foreign, have undertaken reviews of the use of derivatives by registered investment companies, which could affect the nature and extent of instruments used by the Fund. The Fund and the instruments in which it invests may be subject to new or additional regulatory constraints in the future. While the full extent of all of these regulations is unclear, these regulations and actions may adversely affect both the Fund and the instruments in which the Fund invests and its ability to execute its investment strategy. For example, climate change regulation (such as decarbonization legislation, other mandatory controls to reduce emissions of greenhouse gases, or related disclosure requirements) could significantly affect the Fund or its investments by, among other things, increasing compliance costs or underlying companies’ operating costs and capital expenditures. Similarly, regulatory developments in other countries may have an unpredictable and adverse impact on the Fund.

Large Shareholder Risk: The Fund may have one or more large shareholders or a group of shareholders investing in Fund shares indirectly through an account, platform or program sponsored by a financial institution. Investment and asset allocation decisions by such financial institutions regarding the account, platform or program through which multiple shareholders invest may result in subscription and redemption decisions that have a significant impact on the assets, expenses and trading activities of the Fund. Such a decision may cause the Fund to sell assets (or invest cash) at disadvantageous times or prices, increase or accelerate taxable gains or transaction costs and may negatively affect the Fund’s NAV, performance, or ability to satisfy redemptions in a timely manner.

This is not a complete list of the risks of investing in the Fund. For additional information concerning the risks of investing in the Fund, please consult the Fund’s prospectus.

25

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Note 7. Other

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. Subsequent Events

Management has evaluated events and transactions occurring after December 31, 2022 through the date that the financial statements were issued, and has determined that no additional disclosure in the financial statements is required.

26

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Cohen & Steers Institutional Realty Shares, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cohen & Steers Institutional Realty Shares, Inc. (the “Fund”) as of December 31, 2022, the related statement of operations for the year ended December 31, 2022, the statement of changes in net assets for each of the two years in the period ended December 31, 2022, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2022 and the financial highlights for each of the five years in the period ended December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian, transfer agent, issuers of privately offered securities and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

February 22, 2023

We have served as the auditor of one or more investment companies in the Cohen & Steers family of mutual funds since 1991.

27

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

TAX INFORMATION—2022 (Unaudited)

For the calendar year ended December 31, 2022, for individual taxpayers, the Fund designates $2,044,452 as qualified dividend income eligible for reduced tax rates, long-term capital gain distributions of $172,827,672 taxable at the maximum 20% rate, long-term capital gain distributions of $3,316,300 taxable at the 25% maximum rate and $102,213,612 as qualified business income. In addition, for corporate taxpayers, 0.53% of the ordinary dividends paid qualified for the dividends received deduction (DRD).

OTHER INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 800-330-7348, (ii) on our website at cohenandsteers.com or (iii) on the U.S. Securities and Exchange Commission’s (SEC) website at http://www.sec.gov. In addition, the Fund’s proxy voting record for the most recent 12-month period ended June 30 is available by August 31 of each year (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC’s website at http://www.sec.gov.

Disclosures of the Fund’s complete holdings are required to be made monthly on Form N-PORT, with every third month made available to the public by the SEC 60 days after the end of the Fund’s fiscal quarter. The Fund’s Form N-PORT is available (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC’s website at http://www.sec.gov.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. Distributions in excess of the Fund’s net investment company taxable income and realized gains are a return of capital distributed from the Fund’s assets. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year.

28

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

MANAGEMENT OF THE FUND

The business and affairs of the Fund are managed under the direction of the Board of Directors. The Board of Directors approves all significant agreements between the Fund and persons or companies furnishing services to it, including the Fund’s agreements with its investment manager, administrator, co-administrator, custodian and transfer agent. The management of the Fund’s day-to-day operations is delegated to its officers, the investment advisor, administrator and co-administrator, subject always to the investment objective and policies of the Fund and to the general supervision of the Board of Directors.

The Board of Directors and officers of the Fund and their principal occupations during at least the past five years are set forth below. The statement of additional information (SAI) includes additional information about fund directors and is available, without charge, upon request by calling 800-330-7348.

| Name, Address and Year of Birth1 |

Position(s) Held With Fund |

Term of Office2 |

Principal Occupation During At Least The Past 5 Years (Including Other Directorships Held) |

Number of Funds Within Fund Complex Overseen by Director (Including the Fund) |

Length of Time Served3 |

|||||||

| Interested Directors4 | ||||||||||||

| Joseph M. Harvey 1963 |

Director, Chair |

Until Next Election of Directors | Chief Executive Officer since 2022 and President since 2003 of Cohen & Steers Capital Management, Inc. (CSCM or the Advisor), and Chief Executive Officer since 2022 and President since 2004 of Cohen & Steers, Inc. (CNS). Chief Investment Officer of CSCM from 2003 to 2019. Prior to that, Senior Vice President and Director of Investment Research of CSCM. | 21 | Since 2014 | |||||||

| Adam M. Derechin 1964 |

Director | Until Next Election of Directors | Chief Operating Officer of CSCM since 2003 and CNS since 2004. President and Chief Executive Officer of the Funds from 2005 to 2021. | 21 | Since 2021 | |||||||

| Independent Directors | ||||||||||||

| Michael G. Clark 1965 |

Director | Until Next Election of Directors | CFA; From 2006 to 2011, President and Chief Executive Officer of DWS Funds and Managing Director of Deutsche Asset Management. | 21 | Since 2011 | |||||||

(table continued on next page)

29

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

(table continued from previous page)

| Name, Address and Year of Birth1 |

Position(s) Held With Fund |

Term of Office2 |

Principal Occupation During At Least The Past 5 Years (Including Other Directorships Held) |

Number of Funds Within Fund Complex Overseen by Director (Including the Fund) |

Length of Time Served3 |

|||||

| George Grossman 1953 |

Director | Until Next Election of Directors | Attorney-at-law. | 21 | Since 1993 | |||||

| Dean A. Junkans 1959 |

Director | Until Next Election of Directors | CFA; Advisor to SigFig (a registered investment advisor) since July, 2018; Chief Investment Officer at Wells Fargo Private Bank from 2004 to 2014 and Chief Investment Officer of the Wealth, Brokerage and Retirement group at Wells Fargo & Company from 2011 to 2014; former Member and Chair, Claritas Advisory Committee at the CFA Institute from 2013 to 2015; former Adjunct Professor and Executive-In-Residence, Bethel University, 2015 to 2022; former Board Member and Investment Committee member, Bethel University Foundation, 2010 to 2022; former Corporate Executive Board Member of the National Chief Investment Officers Circle, 2010 to 2015; formerly, Member of the Board of Governors of the University of Wisconsin Foundation, River Falls, 1996 to 2004; U.S. Army Veteran, Gulf War. | 21 | Since 2015 | |||||

(table continued on next page)

30

COHEN & STEERS INSTITUTIONAL REALTY SHARES, INC.

(table continued from previous page)

| Name, Address and Year of Birth1 |

Position(s) Held With Fund |

Term of Office2 |

Principal Occupation During At Least The Past 5 Years (Including Other Directorships Held) |

Number of Funds Within Fund Complex Overseen by Director (Including the Fund) |

Length of Time Served3 |

|||||

| Gerald J. Maginnis 1955 |

Director | Until Next Election of Directors | Philadelphia Office Managing Partner, KPMG LLP from 2006 to 2015; Partner in Charge, KPMG Pennsylvania Audit Practice from 2002 to 2008; President, Pennsylvania Institute of Certified Public Accountants (PICPA) from 2014 to 2015; Member, PICPA Board of Directors from 2012 to 2016; Member, Council of the American Institute of Certified Public Accountants (AICPA) from 2013 to 2017; Member, Board of Trustees of AICPA Foundation from 2015 to 2020; Board member and Audit Committee Chairman of inTEST Corporation since 2020; Chairman of the Advisory Board of Centri Consulting LLC since 2022. | 21 | Since 2015 | |||||

| Jane F. Magpiong 1960 |