How You May Revoke or Change Your Vote

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

• | sending written notice of revocation to our Corporate Secretary; |

• | submitting another properly completed proxy by telephone, Internet or mail; or |

• | attending the Annual Meeting and voting your shares electronically. |

General Information on Voting

You are entitled to cast one vote for each share of common stock you own on the Record Date. If you are a shareholder of record and you do not submit a proxy or vote in person, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum.

The election of each director nominee, the ratification of our independent registered public accounting firm for fiscal year 2021 (“fiscal 2021”), and the approval of the executive compensation by non-binding vote, must be approved by a majority of the voting power represented at the Annual Meeting in person or by proxy and entitled to vote on the matter. Our Board adopted a director resignation policy on February 1, 2019, which policy will require that any director nominee who receives a number of votes cast in favor of their election that is less than a majority of the number of votes cast either for or against their election at the relevant meeting will tender their resignation from the Board. The policy also requires that if our Board decides not to accept such resignation, our Board will publicly disclose a detailed explanation of their decision within 60 days of the date such resignation is tendered. Shareholders do not have the right to vote cumulatively in electing directors. Shares represented by a proxy marked “against” or “abstain” on any matter will be considered present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote but will not be considered to have voted in favor of a director nominee. Therefore, any proxy marked “against” or “abstain” will have the effect of a vote against a nominee.

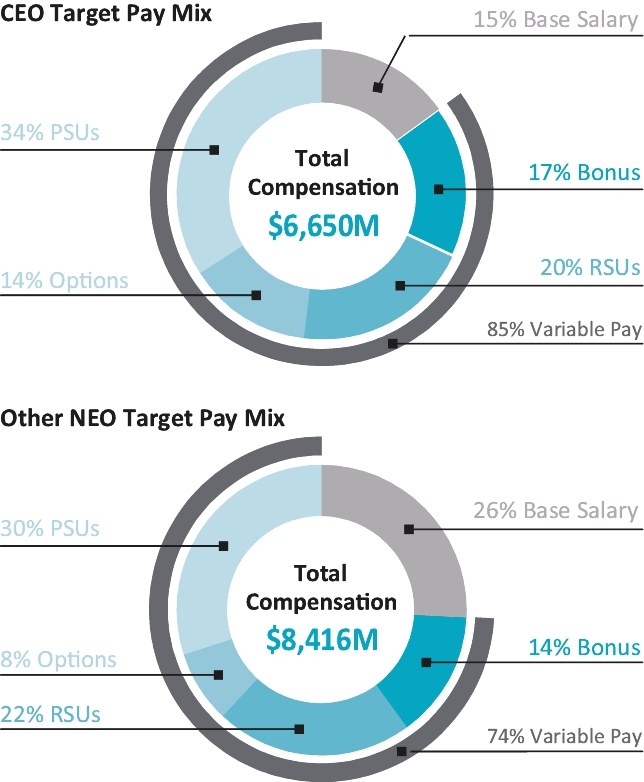

While the shareholder vote on executive compensation is advisory and not binding on our Company, our Board and the Compensation Committee of our Board, which is responsible for administering our executive compensation programs, are interested in the opinions expressed by our shareholders in their vote on this proposal and will consider the outcome of the votes when making future compensation decisions for our NEOs.

All shares for which proxies have been properly submitted—whether by telephone, Internet or mail—and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you sign a proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by our Board.

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in your properly submitted proxy card will have the discretion to vote on those matters for you. As of the date of this Proxy Statement, no other matters have been raised for consideration at the Annual Meeting.

Beneficial Owners and Broker Non-Votes

If your shares are held by a bank, broker or other nominee, you are considered the “beneficial owner” of the shares, which are held in “street name.” If you hold your shares in street name, you can instruct the broker, bank or other nominee who is the shareholder of record how to vote these shares by using the voting instructions given to you by the broker, bank, or other nominee.

The broker, bank, or other nominee may vote the shares in the absence of your voting instructions only with regard to “routine” matters. The election of directors and the advisory vote on executive compensation are considered “non-routine” matters and, accordingly, if you do not instruct your broker, bank or other nominee how to vote in these matters, no votes will be cast on your behalf with respect to these matters.

Your broker, bank or other nominee does, however, have discretion to vote any uninstructed shares on the ratification of the appointment of our accounting firm. If the broker, bank or other nominee votes the uninstructed shares on the ratification of the accounting firm (either personally or by proxy), these shares may be considered as “present” for quorum purposes but will not be deemed voted on other matters and will be considered “broker non-votes” with respect to such other matters.

Such broker non-votes shall have no effect on the votes on election of directors or the advisory vote on executive compensation.