UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| (Mark One) | |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For

the fiscal year ended: or | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from _____________ to _____________

Commission

File Number:

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip code)

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Securities | Exchanges on which Registered | |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the registrant’s common stock, $0.001 par value per share, held by non-affiliates on June 30, 2022 was

approximately $

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

SUMMARY RISK FACTORS

Our business involves significant risks. Below is a summary of the material risks that our business faces, which makes an investment in our securities speculative and risky. This summary does not address all these risks. These risks are more fully described below under the heading “Risk Factors” in Part I, Item 1A of this annual report on Form 10-K. Before making investment decisions regarding our securities, you should carefully consider these risks. The occurrence of any of the events or developments described below could have a material adverse effect on our business, results of operations, financial condition, prospects and stock price. In such event, the market price of our securities could decline, and you could lose all or part of your investment. In addition, there are also additional risks not described below that are either not presently known to us or that we currently deem immaterial, and these additional risks could also materially impair our business, operations or market price of our common stock.

| ● | Our business is at an early stage of development and we may not develop therapeutic products that can be commercialized. | |

| ● | We have a history of operating losses and we expect to continue to incur losses for the foreseeable future and we may never generate revenue or achieve profitability. | |

| ● | If we fail to meet our obligations under our license agreements, we may lose our rights to key technologies on which our business depends. | |

| ● | Our reliance on the activities of our non-employee consultants, research institutions and scientific contractors, whose activities are not wholly within our control, may lead to delays in development of our proposed products. | |

| ● | We have limited clinical testing and regulatory capabilities, and human clinical trials are subject to extensive regulatory requirements, very expensive, time-consuming and difficult to design and implement. Our products may fail to achieve necessary safety and efficacy endpoints during clinical trials, which may limit our ability to generate revenues from therapeutic products. | |

| ● | We are subject to extensive regulation, which can be costly and time consuming and can subject us to unanticipated delays. Even if we obtain regulatory approval for some of our products, those products may still face regulatory difficulties. | |

| ● | Our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any. | |

| ● | We currently lack manufacturing capabilities to produce our therapeutic product candidates at commercial-scale quantities and do not have an alternate manufacturing supply, which could negatively impact our ability to meet any future demand for the product. | |

| ● | We rely on third parties to conduct preclinical and clinical trials of our product candidates. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our product candidates and our business could be substantially harmed. | |

| ● | Epidemic or pandemic outbreaks such as COVID-19 (coronavirus), natural disasters, whether or not caused by climate change, unusual weather conditions, terrorist acts and political events, could disrupt business and result in halting our clinical trials and otherwise adversely affect our financial performance. | |

| ● | There has been a limited public market for our common stock , and we do not know whether one will develop to provide you adequate liquidity. Furthermore, the trading price for our common stock, should an active trading market develop, may be volatile and could be subject to wide fluctuations in per-share price. | |

| ● | Because our common stock may be deemed a “penny” stock, an investment in our common stock should be considered high-risk and subject to marketability restrictions. |

PART I

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including any documents which may be incorporated by reference into this Annual Report, contains “Forward-Looking Statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are “Forward-Looking Statements” for purposes of these provisions, including our plans of operation, any projections of revenues or other financial items, any statements of the plans and objectives of management for future operations, any statements concerning proposed new products or services, any statements regarding future economic conditions or performance, and any statements of assumptions underlying any of the foregoing. All Forward-Looking Statements included in this document are made as of the date hereof and are based on information available to us as of such date. We assume no obligation to update any Forward-Looking Statement. In some cases, Forward-Looking Statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “potential,” or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the Forward-Looking Statements contained herein are reasonable, there can be no assurance that such expectations or any of the Forward-Looking Statements will prove to be correct, and actual results could differ materially from those projected or assumed in the Forward-Looking Statements. Future financial condition and results of operations, as well as any Forward-Looking Statements are subject to inherent risks and uncertainties, including any other factors referred to in our press releases and reports filed with the Securities and Exchange Commission. All subsequent Forward-Looking Statements attributable to the company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Additional factors that may have a direct bearing on our operating results are described under “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

Introductory Comment

Throughout this Annual Report on Form 10-K, the terms “GT Biopharma,” “GTBP,” “we,” “us,” “our,” “the company” and “our company” refer to GT Biopharma, Inc., a Delaware corporation formerly known as DDI Pharmaceuticals, Inc., Diagnostic Data, Inc. and Oxis International, Inc., together with our subsidiaries.

ITEM 1. BUSINESS

We are a clinical stage biopharmaceutical company focused on the development and commercialization of novel immuno-oncology products based on our proprietary Tri-specific Killer Engager (TriKE®) fusion protein immune cell engager technology platform. Our TriKE® platform generates proprietary therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells, or NK cells. Once bound to an NK cell, our moieties are designed to enhance the NK cell, and precisely direct it to one or more specifically targeted proteins expressed on a specific type of cancer cell or virus infected cell, resulting in the targeted cell’s death. TriKE®s can be designed to target any number of tumor antigens on hematologic malignancies or solid tumors and do not require patient-specific customization.

We are using our TriKE® platform with the intent to bring to market immuno-oncology products that can treat a range of hematologic malignancies, and solid tumors. The platform is scalable, and we are putting processes in place to be able to produce investigational new drug (IND) ready moieties in a timely manner after a specific TriKE® conceptual design. Specific drug candidates can then be advanced into the clinic on our own or through potential collaborations with partnering companies. We believe our TriKE®s may have the ability, if approved for marketing, to be used as both monotherapy and in combination with other standard-of-care therapies.

We are also using our TriKE® platform to develop therapeutics useful for the treatment of infectious disease such as for the treatment of patients infected by the human immunodeficiency virus (HIV). While the use of anti-retroviral drugs has substantially improved the health and increased the longevity of individuals infected with HIV, these drugs are designed to suppress virus replication to help modulate progression to acquired immunodeficiency syndrome (AIDS) and to limit further transmission of the virus. Despite the use of anti-retroviral drugs, infected individuals retain reservoirs of latent HIV-infected cells that, upon cessation of anti-retroviral drug therapy, can reactivate and re-establish an active HIV infection. For a curative therapy, destruction of these latent HIV infected cells must take place. The HIV-TriKE® contains the antigen binding fragment (Fab) from a broadly neutralizing antibody targeting the HIV-Env protein or a protein that binds infected CD4+ T cells. The HIV-TriKE® is designed to target HIV while redirecting NK cell killing specifically to actively replicating HIV infected cells. The HIV-TriKE® induced NK cell proliferation and demonstrated the ability in vitro to reactivate and kill HIV-infected T-cells. These findings indicate a potential role for the HIV-TriKE® in the reactivation and elimination of the latently infected HIV reservoir cells by harnessing the NK cell’s ability to mediate the antibody-directed cellular cytotoxicity (ADCC).

| 1 |

Our initial work has been conducted in collaboration with the Masonic Cancer Center at the University of Minnesota under a program led by Dr. Jeffrey Miller, the Deputy Director. Dr. Miller is a recognized key opinion leader in the field of NK cell and IL-15 biology and their therapeutic potential. We have exclusive rights to the TriKE® platform and are generating additional intellectual property for specific moieties.

Immuno-Oncology Platform

Tri-specific Killer Engagers (TriKE®s)

The generation of chimeric antigen receptor, or CAR, expressing T cells from monoclonal antibodies has represented an important step forward in cancer therapy. These therapies involve the genetic engineering of T cells to express either CARs, or T cell receptors, or TCRs, and are designed such that the modified T cells can recognize and destroy cancer cells. While a great deal of interest has recently been placed upon chimeric antigen receptor T, or CAR-T, therapy, it has certain limitations for broad potential applicability because it can require an individual approach that is expensive, time consuming, and may be difficult to apply on a large scale. NK cells represent an important immunotherapeutic target as they are involved in tumor immune-surveillance, can mediate antibody-dependent cell-mediated cytotoxicity (ADCC), contain pre-made granules with perforin and granzyme B and can quickly secrete inflammatory cytokines, and unlike T cells they do not require antigen priming and can kill cells in the absence of major histocompatibility complex (MHC) presentation of antigens. Unlike full-length antibodies, TriKE® constructs are composed of a single-chain fusion protein that binds the CD16 receptor of NK cells directly producing a potent and lasting cytotoxic killing response, interleukin 15 (IL-15) to promote NK cell activation, persistence and proliferation, and a cancer cell targeting moiety. An additional benefit of TriKE® may have been its attractive biodistribution, as a consequence of their smaller size, which we expect to be important in the treatment of solid tumors. In addition to these advantages, TriKE® is designed to be non-immunogenic, have appropriate clearance properties, and can be engineered to target a variety of tumor antigens.

We believe there is a continued unmet medical need for targeted immuno-oncology therapies that can have the potential to be dosed in a patient-friendly outpatient setting, can be used on a stand-alone basis, augment the current monoclonal antibody therapeutics, or be used in conjunction with more traditional cancer therapy. We believe our TriKE® constructs have this potential and therefore we have generated, and intend to continue to generate, a pipeline of product candidates to be advanced into the clinic on our own or through potential collaborations with larger companies.

GTB-3550 TriKE® and Phase 1 Acute Myeloid Leukemia/Myelodysplastic Syndrome (AML/MDS) Phase 1 Clinical Trial

GTB-3550 is the Company’s first-generation TriKE® product candidate which is a single-chain, tri-specific recombinant fusion protein construct composed of the variable regions of the heavy and light chains of anti-CD16 and anti-CD33 antibodies and a modified form of IL-15, all connected by small peptide linkers. The GTB-3550 Phase 1 clinical trial for treatment of patients with CD33-expressing, high risk myelodysplastic syndromes and refractory/relapsed acute myeloid leukemia opened for patient enrollment in September 2019 and completed enrollment in September 2021. The clinical trial was conducted at the University of Minnesota’s Masonic Cancer Center in Minneapolis, Minnesota under the direction of Dr. Erica Warlick and Dr. Mark Juckett.

Background and Select Non-Clinical Data

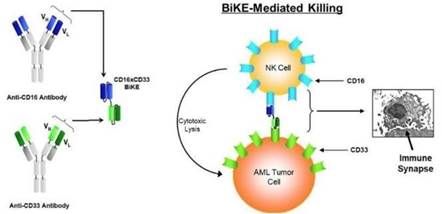

In conjunction with our research agreement with the Masonic Cancer Center at the University of Minnesota, the exploration of targeting NK cells to a variety of tumors initially focused on novel bi-specific killer engagers, or BiKEs, composed of the variable portions of antibodies targeting the CD16 activating receptor on NK cells and CD33 (AML and MDS; see figure below), B7H3 (solid tumors – breast, lung, colon, prostate), Her2 (Breast, Gastric), or CD19/CD22 (B cell lymphomas) on the tumor cells.

| 2 |

Subsequently, a tri-specific (TriKE®) construct that replaced the linker molecule between the CD16 scFv and the CD33 scFv with a modified IL-15 molecule, containing flanking sequences, was generated, and tested. Data indicates that the CD16 x IL-15 x CD33 potently induce proliferation of healthy donor NK cells, possibly greater than that induced by exogenous IL-15, which is absent in the BiKE platform. Targeted delivery of the IL-15 through the TriKE® also resulted in specific expansion of the NK cells without inducing T cell expansion on post-transplant patient samples.

When compared to the CD16 x CD33 BiKE, the CD16 x IL-15 x CD33 TriKE® is also capable of potently restoring killing capacity of post-transplant NK cells against CD33-expressing HL-60 targets and primary AML blasts. These results demonstrated the ability to functionally incorporate an IL-15 cytokine into the BiKE platform and also demonstrated the possibility of targeting a variety of cytokines directly to NK cells while reducing off-target effects and the amount of cytokines needed to obtain biologically relevant function.

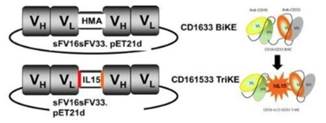

The figure below is a schematic of a BiKE construct (top) and a TriKE® construct (bottom), which has the modified IL-15 linker between the CD16 scFv and the CD33 scFv components.

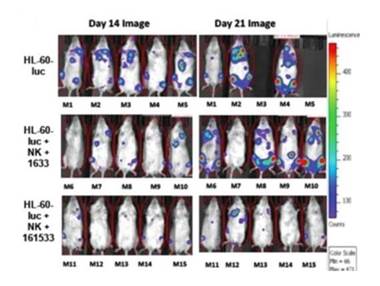

The CD33 -targeting TriKE® constructs was tested against three separate human tumor cell lines to evaluate specificity: CD33+ HL-60 (promyelocitic leukemia) cells, CD33, Raji (Burkitt’s lymphoma), and CD33- HT29 (colorectal adenocarcinoma). TriKE® (GTB-3550) activity was only seen against the CD33+ HL-60 cells containing a Luc reporter to allow for in vivo imaging of the tumors, were used to show in vivo efficacy of BiKE (1633) and TriKE® (GTB-3550) against relevant human tumor targets (HL-60-luc) over an extended period of time. The system consisted of initial conditioning of mice using radiation (250-275 cGy), followed by injection of the tumor cells (I.V. for HL-60-luc, a three-day growth phase, injection of human NK cells, and repeated injection of the drugs of interest, BiKE and TriKE® (three to five times a week). Imaging was carried out at Day 7, 14, and 21, and extended as needed. Subsequent studies were also carried out to evaluate other TriKEs expressing targeting arms against other tumor antigens (B7H3 and HER2 for instance).

| 3 |

The figure below shows the results (tumor burden and mortality) when dosing NK cells alone (top panel), the BiKE version (lacking IL-15) of GTB-3550 (middle panel; called 1633), and the TriKE®, GTB-3550 (bottom panel; then called 161533) in the above human tumor model, HL-60-luc. In the NK-cell-only arm, two out of the five mice were dead by Day 21 with two of the surviving mice having extensive tumor burden as depicted by the colored images. In contrast, all five mice in each of the BiKE and TriKE® arms survived. In addition, the tumor burden in the TriKE®-treated mice was significantly less than in the BiKE-treated mice, demonstrating the improved efficacy from NK cells in the TriKE®-treated mice.

Based on these results, and others, the IND for GTB-3550 was filed in June 2017 by the University of Minnesota. The FDA requested that additional preclinical toxicology, additional information and clarifications on manufacturing, and clinical development plans. The requested additional information and clarifications were completed and incorporated into the IND in eCTD format. We filed the IND amendment in June 2018 and announced on November 1, 2018, that the FDA granted approval of the IND and the Company was authorized to initiate a first-in-human Phase 1 study with GTB-3550 in AML, MDS, and severe mastocytosis. The Phase 1 clinical trial was initiated in September 2019 and closed in September 2021.

Targeting Solid Tumors and Other Potentially Attractive Characteristics

Unlike full-length antibodies, TriKE® is composed of a single-chain fusion protein that binds the CD16 receptor of NK cells directly producing a potentially more potent and lasting response as demonstrated by preclinical studies. An additional benefit due to the smaller size of TriKE® is enhanced biodistribution which we expect to be important in the treatment of solid tumors. In addition to these potential advantages, TriKE® is designed to be non-immunogenic, have appropriate clearance properties and can be engineered quickly to target a variety of tumor antigens. We believe these attributes make them an ideal pharmaceutical platform for potentiated NK cell-based immunotherapies and have the potential to overcome some of the limitations of CAR-T therapy and other antibody therapies.

Examples of our earlier stage solid tumor targeting product candidates are focused on CD33, B7-H3, Her2, CD19, CLEC12A, CD22, and CD133 alone and in combination. We believe these constructs have the potential to target prostate, breast, colon, ovarian, liver, and head and neck cancers. Depending on the availability of drug supply, we hope to initiate human clinical testing for certain of our solid tumor product candidates in 2023.

Efficient Advancement of Potential Future Product Candidates – Production and Scale Up

We are using our TriKE® platform with the intent to bring to market multiple immuno-oncology products that can treat a range of hematologic malignancies and solid tumors. The platforms are scalable, and we are currently working with a third-party product manufacturer investigating the optimal GMP production expression system for TriKE® constructs.

We believe TriKE®s will have the ability, if approved for marketing, to be used as both monotherapy and in combination with standard-of-care therapies.

| 4 |

Immuno-Oncology Product Candidates

GTB-3550

GTB-3550 was our first TriKE® product candidate. It reflected our first-generation TriKE® platform. It is a single-chain, tri-specific scFv recombinant fusion protein conjugate composed of the variable regions of the heavy and light chains of anti-CD16 and anti-CD33 antibodies and a modified form of IL-15. We studied this anti-CD16-IL-15-anti-CD33 TriKE® in CD33 positive leukemias, a marker expressed on tumor cells in acute myelogenous leukemia, or AML, myelodysplastic syndrome, or MDS. CD33 is primarily a myeloid differentiation antigen with endocytic properties broadly expressed on AML blasts and, possibly, some leukemic stem cells. CD33 or Siglec-3 (sialic acid binding Ig-like lectin 3, SIGLEC3, SIGLEC3, gp67, p67) is a transmembrane receptor expressed on cells of myeloid lineage. It is usually considered myeloid-specific, but it can also be found on some lymphoid cells. The anti-CD33 antibody fragment used for these studies was derived from the M195 humanized anti-CD33 scFV and has been used in multiple human clinical studies. It has been exploited as target for therapeutic antibodies for many years. We believe the recent approval of the antibody-drug conjugate gemtuzumab validates this targeted approach.

GTB-3550 is being replaced by a more potent next-generation camelid nanobody TriKE®, GTB-3650, targeting relapsed/refractory Acute Myeloid Leukemia (AML) and high-risk Myelodysplastic Syndromes (MDS).

About High-Risk Myelodysplastic Syndromes

Myelodysplastic Syndromes is a rare form of bone marrow-related cancer caused by irregular blood cell production within the bone marrow. As a result of this irregular production, MDS patients do not have sufficient normal red blood cells, white blood cells and/or platelets in circulation. High-risk MDS is associated with poor prognosis, diminished quality of life, and a higher chance of transformation to acute myeloid leukemia. The goals of therapy are to reduce disease associated symptoms and the risk of disease progression and death, thereby improving both quality and quantity of life. United States incidence of MDS is estimated to be 10,000 cases per year, although the condition is thought to be under diagnosed. The prevalence has been estimated to be from 60,000 to 170,000 in the United States. Approximately 40% of patients with High-Risk MDS transform to AML, another aggressive cancer with poor outcomes.

About Acute Myeloid Leukemia

Acute myeloid leukemia is a type of cancer in which the bone marrow makes abnormal myeloblasts (a type of white blood cell), red blood cells, or platelets. The median age at the time of diagnosis is 65–69 years. AML is an aggressive disease and is fatal without anti-leukemic treatment. Among patients treated with chemotherapy, 65% to 80% achieve complete remission. Despite a plethora of novel agents that have been approved by the U.S. Food and Drug Administration since 2017 for treatment of AML, once complete remission (CR) is achieved, approximately 50% of patients age < 60 years of age and up to 90% of patients ≥ 60 years of age will relapse, despite consolidation strategies. Furthermore, while 10–40% of younger AML patients are primarily refractory to AML induction therapy, the number is considerably higher for patients above 60 years (40–60%). The vast majority of fit AML patients will undergo hematopoietic stem cell transplantation (HSCT) after achieving a CR. However, 40% of these patients relapse after HSCT. Thus, refractory or relapsed (r/r) AML is a very common scenario in AML and despite recent advances and new targeted therapies, the management of AML remains a challenge, particularly in older adults ineligible for intensive therapies. According to the National Cancer Institute (NCI), the five-year survival rate is about 35% in people under 60 years old, and 10% in people over 60 years old. Older people whose health is too poor for intensive chemotherapy have a typical survival of five to ten months. AML accounts for approximately 1.8% of cancer deaths in the United States.

| 5 |

About GTB-3550 TriKE® Clinical Trial

We opened our GTB-3550 Phase 1 clinical trial in September 2019 and enrolled our first patient in January 2020. Patients with CD33+ malignancies (primary induction failure or relapsed AML with failure of one reinduction attempt or high-risk MDS progressed on two lines of therapy) age 18 and older were eligible (ClinicalTrials.gov Identifier NCT03214666). The primary endpoint is to identify the maximum tolerated dose (MTD) of GTB-3550 TriKE®. Correlative objectives include the number, phenotype, activation status and function of NK cells and T cells. From January, 2020 until September, 2021 twelve patients received escalating doses of GTB-3550 in the Phase 1 trial. The results of this trial were presented at several conferences in 2021. To summarize, the therapy was overall well tolerated and safe. There were no serious cases of cytokine release syndrome observed. Four of twelve patients had transient reductions in bone marrow leukemic blast cells. Correlative studies showed activation, proliferation, and persistence of functionally active endogenous NK cells. The results of our first generation GTB-3550 Phase 1 clinical trial support our plans to advance the next generation camelid nanobody into the clinic.

The Next Generation of Camelid Nanobody TriKE®s

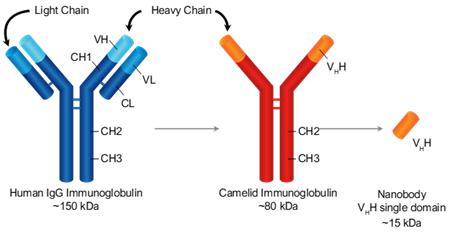

Our goal is to be a leader in immuno-oncology therapies targeting a broad range of indications including hematological malignancies and solid tumors. A key element of our strategy includes introducing a next-generation camelid nanobody platform. Camelid antibodies (often referred as nanobodies) are smaller than human immunoglobulin and consist of two heavy chains. These nanobodies have the potential to have greater affinity to target antigens, potentially resulting in greater potency. GT Biopharma is utilizing this camelid antibody structure for all its new TriKE® product candidates.

Generation of humanized single-domain antibody targeting CD16 for incorporation into the TriKE® platform

To develop second generation TriKE®s, we designed a new humanized CD16 engager derived from a single-domain antibody. While scFvs consist of a heavy and a light variable chain joined by a linker, single-domain antibodies consist of a single variable heavy chain capable of engaging without the need of a light chain counterpart (see figure below).

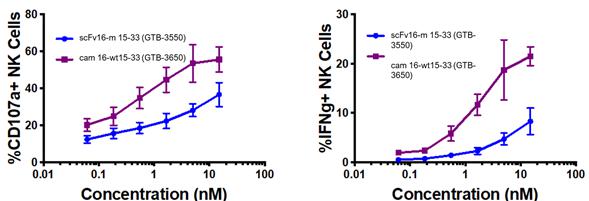

These single-domain antibodies are thought to have certain attractive features for antibody engineering, including physical stability, ability to bind deep grooves, and increased production yields, amongst others. Pre-clinical studies demonstrated increased NK cell activation against CD33+ targets including NK cell degranulation (% CD107a+) and IFNg with the single-domain CD16 TriKE® (cam 16-wt15-33; GTB-3650) compared to the original TriKE® (scFv16-m 15-33; GTB-3550) (see figure below). These data were published by Felices M et al (2020) in Cancer Immunol Res.

| 6 |

CD33+ HL60 Targets

GTB-3650

GTB-3650 is a CD33 targeted TriKE® which targets CD33 on the surface of myeloid leukemias. We are advancing GTB-3650 through preclinical studies and anticipate filing an Investigational New Drug (IND) application in the first half of 2023. We further anticipate starting a study targeting patients with relapsed/refractory AML and high grade MDS by the end of 2023.

GTB-5550

GTB-5550 is a B7-H3 targeted TriKE® which targets B7-H3 on the surface of advanced solid tumors. We are advancing GTB-5550 through preclinical studies and have initiated a GMP manufacturing campaign in anticipation of filing an IND in the late second half of 2023 and starting a study targeting patients with B7-H3 positive solid tumors in the first half of 2024.

Oncology Markets

Acute Myeloid Leukemia and Myelodysplastic Syndromes

AML is a heterogeneous hematologic stem cell malignancy in adults with incidence rate of 4.3% per 100,000 populations. The median age at the time of diagnosis is 68 years. AML is an aggressive disease and is fatal without anti-leukemic treatment. AML is the most common form of adult leukemia in the U.S. These patients will require frontline therapy, usually chemotherapy including cytarabine and an anthracycline, a therapy that has not changed in over 40 years. Myelodysplastic syndromes are a heterogeneous group of myeloid neoplasms characterized by dysplastic features of erythroid/myeloid/megakaryocytic lineages, progressive bone marrow failure, a varying percentage of blast cells, and enhanced risk to evolve into acute myeloid leukemia. It is estimated that over 10,000 new cases of MDS are diagnosed each year and there are minimal treatment options; other estimates have put this number higher. In addition, the incidence of MDS is rising for unknown reasons.

B7-H3 Positive Solid Tumors

The B7-H3 protein, which functions as a checkpoint inhibitor, has been identified in many of the most common solid tumor cancers, including but not limited to bladder, breast, cervical, colorectal, endometrial, esophageal, gastric, glioma, kidney, liver, lung, pancreatic, prostate, head and neck cancer, and melanoma. In recent studies, B7-H3 has been identified as a critical promoter of tumor cell proliferation, migration, invasion, epithelial-to-mesenchymal transition, cancer stemness and drug resistance. Because this protein does not seem to be expressed in normal cells, this makes it an attractive target for therapeutic intervention.

| 7 |

Manufacturing

We do not currently own or operate manufacturing facilities for the production of clinical or commercial quantities of any of our product candidates. We rely on a third-party contract manufacturing operation to produce and/or test our compounds and expect to continue to do so to meet the preclinical and clinical requirements of our potential product candidates as well as for our future commercial needs. We do not have long-term commitments with a third-party product manufacturer. We require in our manufacturing and processing agreements that third-party product manufacturers produce intermediates, active pharmaceutical ingredients, or API, and finished products in accordance with the FDA’s current Good Manufacturing Practices (cGMP), and all other applicable laws and regulations. We maintain confidentiality agreements with potential and existing manufacturers to protect our proprietary rights related to our drug candidates.

Patents and Trademarks

Immuno-oncology platform

TriKE® Patents

On August 24, 2021, two patents were issued by the US Patent Office covering our pipeline of clinical and non-clinical product candidates consisting of tri-specific killer engagers, or TriKE®s, designed to target natural killer, or NK, cells and tumor or virus infected cells forming an immune synapse between the NK cell and the tumor cell thereby inducing NK cell activation at that site. The patents broadly include TriKE®s that target the CD16 receptor, which includes the more potent camelid nanobody sequence, an IL-15 activating domain, and any targeting domain.

University of Minnesota License Agreements

2016 Exclusive Patent License Agreement

We are party to an exclusive worldwide license agreement with the Regents of the University of Minnesota, (“UofMN”) to further develop and commercialize cancer therapies using TriKE® technology developed by researchers at the UofMN to target NK cells to cancer. Under the terms of the 2016 agreement, we received exclusive rights to conduct research and to develop, make, use, sell, and import TriKE® technology worldwide for the treatment of any disease, state or condition in humans. We are responsible for obtaining all permits, licenses, authorizations, registrations and regulatory approvals required or granted by any governmental authority anywhere in the world that is responsible for the regulation of products such as the TriKE® technology, including without limitation the FDA and the European Agency for the Evaluation of Medicinal Products in the European Union. Under the agreement, the University of Minnesota received an upfront payment of $200,000, annual license maintenance fees of $100,000 beginning in 2021, 4% royalty fees (not to exceed 6% under subsequent license agreements or amendments to this agreement), upon sale of a licensed product or a minimum annual royalty payment ranging from $250,000 to $5.0 million. The agreement also includes certain milestone payments totaling $3.1 million, and one-time sales milestone payments of $1.0 million upon reaching $250 million in gross sales and $5.0 million upon reaching $500 million in cumulative gross sales of licensed products.

2021 Exclusive License Agreement

On March 26, 2021, we entered into an agreement with the UofMN specific to the B7H3 targeted TriKE®. Under the agreement, the UofMN received an upfront license fee of $20,000, and will receive annual license maintenance fees of $5,000 beginning in 2022, 2.5% to 5% royalty fees or minimum annual royalty payments of $250,000 beginning in the first year after the first commercial sale of licensed product, and $2.0 million beginning in the fifth year after the first commercial sale of licensed product. The agreement also includes certain milestone payments totaling $3.1 million and one-time sales milestone payments of $1.0 million upon reaching $250 million in gross sales, and $5.0 million upon reaching $500 million in cumulative gross sales of licensed products. There is no double payment intended; if one of the milestone payments has been paid under the 2016 agreement, no further payment is due for the corresponding milestone above.

Employees and Human Capital Resources

At the date of this Annual Report, we have 2 full-time employees and eight consultants to carry on our operations. Many of our activities are outsourced to consultants who provide services to us on a project basis. As business activities require and capital resources permit, we will hire additional employees to fulfill our Company’s needs.

Form and Year of Organization

In 1965, the corporate predecessor of GT Biopharma, Diagnostic Data, Inc., was incorporated in the State of California. Diagnostic Data changed its incorporation to the State of Delaware in 1972, and changed its name to DDI Pharmaceuticals, Inc. in 1985. In 1994, DDI Pharmaceuticals merged with International BioClinical, Inc. and Bioxytech S.A. and changed its name to OXIS International, Inc. On July 17, 2017, we amended our Certificate of Incorporation for the purpose of changing our name from Oxis International, Inc. to GT Biopharma, Inc.

Available Information

We post our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, free of charge, on the Investors section of our public website (www.gtbiopharma.com) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC . In addition, you can read our SEC filings over the Internet at the SEC’s website at www.sec.gov. The contents of these websites are not incorporated into this annual report on Form 10-K. Further, our references to the URLs for these websites are intended to be inactive textual references only.

| 8 |

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information contained in this Annual Report on Form 10-K before deciding whether to invest in shares of our common stock. If any of the following risks actually occur, our business, financial condition or operating results could be harmed. In that case, the trading price of our common stock could decline and you may lose part or all of your investment. In the opinion of management, the risks discussed below represent the material risks known to the company. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business, financial condition and operating results and adversely affect the market price of our common stock.

Risks Related to Our Business

Our business is at an early stage of development and we may not develop therapeutic products that can be commercialized.

Our business is at an early stage of development. We do not have immune-oncology products in late stage clinical trials. We are still in the early stages of identifying and conducting research on potential therapeutic products. Our potential therapeutic products will require significant research and development and pre-clinical and clinical testing prior to regulatory approval in the United States and other countries. We may not be able to obtain regulatory approvals, enter clinical trials for any of our product candidates, or commercialize any products. Our product candidates may prove to have undesirable and unintended side effects or other characteristics adversely affecting their safety, efficacy or cost effectiveness that could prevent or limit their use. Any product using any of our technology may fail to provide the intended therapeutic benefits or achieve therapeutic benefits equal to or better than the standard of treatment at the time of testing or production.

We have a history of operating losses and we expect to continue to incur losses for the foreseeable future and we may never generate revenue or achieve profitability.

During the year ended December 31, 2022, the Company reported a net loss of $20.9 million and as of December 31, 2022 and had an accumulated deficit of $674.5 million. We have not generated any revenue to date and are not profitable, and have incurred losses in each year since our inception. We do not expect to generate any product sales or royalty revenues for the foreseeable future. We expect to incur significant additional operating losses for the foreseeable future as we expand research and development and clinical trial efforts.

Our ability to achieve long-term profitability is dependent upon obtaining regulatory approvals for our products and successfully commercializing our products alone or with third parties. However, our operations may not be profitable even if any of our products under development are successfully developed and produced and thereafter commercialized. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

Even if we succeed in commercializing one or more of our product candidates, we expect to continue to incur substantial research and development and other expenditures to develop and market additional product candidates. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue. Our prior losses and expected future losses have had and will continue to have an adverse effect on our stockholders’ equity and working capital.

We will need additional capital to conduct our operations and develop our products, and our ability to obtain the necessary funding is uncertain.

We have used a significant amount of cash since inception to finance the continued development and testing of our product candidates, and we expect to need substantial additional capital resources to develop our product candidates going forward and launch and commercialize any product candidates for which we receive regulatory approval.

| 9 |

We may not be successful in generating and/or maintaining operating cash flow, and the timing of our capital expenditures and other expenditures may not result in cash sufficient to sustain our operations through the commercialization of our product candidates. If financing is not sufficient and additional financing is not available or available only on terms that are detrimental to our long-term survival, it could have a material adverse effect on our ability to continue to function. The timing and degree of any future capital requirements will depend on many factors, including:

| ● | the accuracy of the assumptions underlying our estimates for capital needs in 2023 and beyond; | |

| ● | scientific and clinical progress in our research and development programs; | |

| ● | the magnitude and scope of our research and development programs and our ability to establish, enforce and maintain strategic arrangements for research, development, clinical testing, manufacturing and marketing; | |

| ● | our progress with pre-clinical development and clinical trials; | |

| ● | the time and costs involved in obtaining regulatory approvals; | |

| ● | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims; and | |

| ● | the number and type of product candidates that we pursue. |

Additional financing through strategic collaborations, public or private equity or debt financings or other financing sources may not be available on acceptable terms, or at all. Additional equity financing could result in significant dilution to our stockholders, and any debt financings will likely involve covenants restricting our business activities. Further, if we obtain additional funds through arrangements with collaborative partners, these arrangements may require us to relinquish rights to some of our technologies, product candidates or products that we would otherwise seek to develop and commercialize on our own.

If sufficient capital is not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or product development initiatives, any of which could have a material adverse effect on our financial condition or business prospects.

Our research and development costs could exceed our projections requiring us to significantly modify our planned operations.

Our currently projected expenditures for 2023 include approximately $10.2 million for research and development. The actual cost of our programs could differ significantly from our current projections if we change our planned development process. In the event that actual costs of our clinical program, or any of our other ongoing research activities, are significantly higher than our current estimates, we may be required to significantly modify our planned level of operations.

The successful development of any product candidate is highly uncertain. It is difficult to reasonably estimate or know the nature, timing and costs of the efforts necessary to complete the development of, or the period in which material net cash inflows are expected to commence from any product candidate, due to the numerous risks and uncertainties associated with developing drugs. Any failure to complete any stage of the development of products in a timely manner could have a material adverse effect on our operations, financial position and liquidity.

We previously identified material weaknesses in our internal controls over financial reporting. While we have worked to remedy these weaknesses, if we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations. Ineffective internal control could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock.

We previously identified material weaknesses in our internal control over financial reporting as a company, which resulted in unauthorized transactions involving our assets and common stock. As defined in Regulation 12b-2 under the Securities Exchange Act of 1934, or the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented, or detected on a timely basis.

We have taken measures to mitigate the issues identified and implement a functional system of internal controls over financial reporting. However, such controls may become inadequate due to changes in conditions, or the degree of compliance with such policies or procedures may deteriorate, which could result in the discovery of additional material weaknesses and deficiencies. In any event, the process of determining whether our existing internal control over financial reporting is compliant with Section 404 of the Sarbanes-Oxley Act, or Section 404, and sufficiently effective requires the investment of substantial time and resources, including by certain members of our senior management.

We are required, pursuant to Section 404, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. However, for as long as we are a “smaller reporting company,” our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. While we could be a smaller reporting company for an indefinite amount of time, and thus relieved of the above-mentioned attestation requirement, an independent assessment of the effectiveness of our internal control over financial reporting could detect problems that our management’s assessment might not. Such undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation.

Our intellectual property may be compromised.

Part of our value going forward depends on the intellectual property rights that we have been and are acquiring. There may have been many persons involved in the development of our intellectual property, and we may not be successful in obtaining the necessary rights from all of them. It is possible that in the future, third parties may challenge our intellectual property rights. We may not be successful in protecting our intellectual property rights. In either event, we may lose the value of our intellectual property, and if so, our business prospects may suffer.

If our efforts to protect the proprietary nature of the intellectual property related to our technologies are not adequate, we may not be able to compete effectively in our market and our business would be harmed.

We rely upon a combination of patents, trade secret protection and confidentiality agreements to protect the intellectual property related to our technologies. Any disclosure to or misappropriation by third parties of our trade secret or other confidential information could enable competitors to quickly duplicate or surpass our technological achievements, thus eroding any competitive advantage we may derive from this information.

| 10 |

The strength of patents in the biotechnology and pharmaceutical field involves complex legal and scientific questions and can be uncertain. The patent applications we own or license may fail to result in issued patents in the United States or in foreign countries. Third parties may challenge the validity, enforceability or scope of any issued patents we own or license or any applications that may be issued as patents in the future, which may result in those patents being narrowed, invalidated or held unenforceable. Even if they are unchallenged, our patents and patent applications may not adequately protect our intellectual property or prevent others from developing similar products that do not fall within the scope of our patents. If the breadth or strength of protection provided by the patents we hold or pursue is threatened, our ability to commercialize any product candidates with technology protected by those patents could be threatened. Further, if we encounter delays in our clinical trials, the time during which we would have patent protection for any covered product candidates that obtain regulatory approval would be reduced. Since patent applications in the United States and most other countries are confidential for a period of time after filing, we cannot be certain at the time of filing that we are the first to file any patent application related to our product candidates.

In addition to the protection afforded by patents, we seek to rely on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable, processes for which patents are difficult to enforce and any other elements of our discovery platform and drug development processes that involve proprietary know-how, information or technology that is not covered by patents or not amenable to patent protection. Although we require all of our employees and certain consultants and advisors to assign inventions to us, and all of our employees, consultants, advisors and any third parties who have access to our proprietary know-how, information or technology to enter into confidentiality agreements, our trade secrets and other proprietary information may be disclosed or competitors may otherwise gain access to such information or independently develop substantially equivalent information. Further, the laws of some foreign countries do not protect proprietary rights to the same extent or in the same manner as the laws of the United States. As a result, we may encounter significant difficulty in protecting and defending our intellectual property both in the United States and abroad. If we are unable to prevent material disclosure of the trade secret intellectual property related to our technologies to third parties, we may not be able to establish or maintain the competitive advantage that we believe is provided by such intellectual property, which could materially adversely affect our market position and business and operational results.

Claims that we infringe the intellectual property rights of others may prevent or delay our drug discovery and development efforts.

Our research, development and commercialization activities, as well as any product candidates or products resulting from those activities, may infringe or be accused of infringing a patent or other form of intellectual property under which we do not hold a license or other rights. Third parties may assert that we are employing their proprietary technology without authorization. There may be third-party patents of which we are currently unaware, with claims that cover the use or manufacture of our product candidates or the practice of our related methods. Because patent applications can take many years to issue, there may be currently pending patent applications that may later result in issued patents that our product candidates may infringe. In addition, third parties may obtain patents in the future and claim that use of our technologies infringes one or more claims of these patents. If our activities or product candidates infringe the patents or other intellectual property rights of third parties, the holders of such intellectual property rights may be able to block our ability to commercialize such product candidates or practice our methods unless we obtain a license under the intellectual property rights or until any applicable patents expire or are determined to be invalid or unenforceable.

Defense of any intellectual property infringement claims against us, regardless of their merit, would involve substantial litigation expense and would be a significant diversion of employee resources from our business. In the event of a successful claim of infringement against us, we may have to pay substantial damages, obtain one or more licenses from third parties, limit our business to avoid the infringing activities, pay royalties and/or redesign our infringing product candidates or methods, any or all of which may be impossible or require substantial time and monetary expenditure. Further, if we were to seek a license from the third-party holder of any applicable intellectual property rights, we may not be able to obtain the applicable license rights when needed or on commercially reasonable terms, or at all. The occurrence of any of the above events could prevent us from continuing to develop and commercialize one or more of our product candidates and our business could materially suffer.

| 11 |

We may desire, or be forced, to seek additional licenses to use intellectual property owned by third parties, and such licenses may not be available on commercially reasonable terms or at all.

A third party may hold intellectual property, including patent rights, that are important or necessary to the development of our product candidates, in which case we would need to obtain a license from that third party or develop a different formulation of the product that does not infringe upon the applicable intellectual property, which may not be possible. Additionally, we may identify product candidates that we believe are promising and whose development and other intellectual property rights are held by third parties. In such a case, we may desire to seek a license to pursue the development of those product candidates. Any license that we may desire to obtain or that we may be forced to pursue may not be available when needed on commercially reasonable terms or at all. Any inability to secure a license that we need or desire could have a material adverse effect on our business, financial condition and prospects.

The patent protection covering some of our product candidates may be dependent on third parties, who may not effectively maintain that protection.

While we expect that we will generally seek to gain the right to fully prosecute any patents covering product candidates we may in-license from third-party owners, there may be instances when platform technology patents that cover our product candidates remain controlled by our licensors. If any of our current or future licensing partners that retain the right to prosecute patents covering the product candidates we license from them fail to appropriately maintain that patent protection, we may not be able to prevent competitors from developing and selling competing products or practicing competing methods and our ability to generate revenue from any commercialization of the affected product candidates may suffer.

We may be involved in lawsuits to protect or enforce our patents or the patents of our licensors, which could be expensive, time-consuming and unsuccessful.

Competitors may infringe our patents or the patents of our current or potential licensors. To attempt to stop infringement or unauthorized use, we may need to enforce one or more of our patents, which can be expensive and time-consuming and distract management. If we pursue any litigation, a court may decide that a patent of ours or our licensor’s is not valid or is unenforceable, or may refuse to stop the other party from using the relevant technology on the grounds that our patents do not cover the technology in question. Further, the legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, which could reduce the likelihood of success of any infringement proceeding we pursue in any such jurisdiction. An adverse result in any infringement litigation or defense proceedings could put one or more of our patents at risk of being invalidated, held unenforceable, or interpreted narrowly and could put our patent applications at risk of not issuing, which could limit our ability to exclude competitors from directly competing with us in the applicable jurisdictions.

Interference proceedings provoked by third parties or brought by the U.S. PTO may be necessary to determine the priority of inventions with respect to our patents or patent applications or those of our licensors. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to use it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms, or at all. Litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees.

If we are unsuccessful in obtaining or maintaining patent protection for intellectual property in development, our business and competitive position would be harmed.

We are seeking patent protection for some of our technology and product candidates. Patent prosecution is a challenging process and is not assured of success. If we are unable to secure patent protection for our technology and product candidates, our business may be adversely impacted.

In addition, issued patents and pending international applications require regular maintenance. Failure to maintain our portfolio may result in loss of rights that may adversely impact our intellectual property rights, for example by rendering issued patents unenforceable or by prematurely terminating pending international applications.

| 12 |

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed.

In addition to seeking patents for some of our technology and product candidates, we also rely on trade secrets, including unpatented know-how, technology and other proprietary information, to maintain our competitive position. We currently, and expect in the future to continue to, seek to protect these trade secrets, in part, by entering into confidentiality agreements with parties who have access to them, such as our employees, collaborators, contract manufacturers, consultants, advisors and other third parties. Despite these efforts, any of these parties may breach the agreements and disclose our proprietary information, including our trade secrets, and we may not be able to obtain adequate remedies for any such disclosure. Enforcing a claim that a party illegally disclosed or misappropriated a trade secret is difficult, expensive and time-consuming, and the outcome is unpredictable. In addition, some courts inside and outside the United States are less willing or unwilling to protect trade secrets. If any of our trade secrets were to be lawfully obtained or independently developed by a competitor, we would have no right to prevent them, or those to whom they disclose the trade secrets, from using that technology or information to compete with us. If any of our trade secrets were to be disclosed to or independently developed by a competitor, our competitive position would be harmed.

If we fail to meet our obligations under our license agreements, we may lose our rights to key technologies on which our business depends.

Our business depends in part on licenses from third parties. These third-party license agreements impose obligations on us, such as payment obligations and obligations to diligently pursue development of commercial products under the licensed patents. If a licensor believes that we have failed to meet our obligations under a license agreement, the licensor could seek to limit or terminate our license rights, which could lead to costly and time-consuming litigation and, potentially, a loss of the licensed rights. During the period of any such litigation, our ability to carry out the development and commercialization of potential products could be significantly and negatively affected. If our license rights were restricted or ultimately lost, our ability to continue our business based on the affected technology platform could be severely adversely affected.

We will have to hire additional employees to carry on our business operations. If we are unable to hire qualified personnel, we may not be able to implement our business strategy.

We currently have two full-time employees and eight consultants to carry on our operations. Our interim Chief Executive Officer and Executive Chairman of the Board provides his services through a consulting arrangement. The loss of the services of any of our employees or consultants could delay our product development programs and our research and development efforts. In order to develop our business in accordance with our business strategy, we will have to hire additional qualified personnel, including in the areas of manufacturing, clinical trials management, regulatory affairs, finance, discovery biology, and business development. We will need to raise sufficient funds to hire and retain the necessary employees and consultants.

Moreover, there is intense competition for a limited number of qualified personnel among biopharmaceutical, biotechnology, pharmaceutical and other businesses. Many of the other pharmaceutical companies against which we compete for qualified personnel have greater financial and other resources, different risk profiles, longer histories in the industry and greater ability to provide valuable cash or stock incentives to potential recruits than we do. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high quality candidates than what we are able to offer as an early-stage company. If we are unable to continue to attract and retain high quality personnel, the rate and success at which we can develop and commercialize product candidates will be limited.

We depend on key personnel for our continued operations and future success, and a loss of certain key personnel could significantly hinder our ability to move forward with our business plan.

Because of the specialized nature of our business, we are highly dependent on our ability to identify, hire, train and retain highly qualified scientific and technical personnel for the research and development activities we conduct or sponsor. The loss of one or more key executive officers, scientific or operational team members would be significantly detrimental to us. In addition, recruiting and retaining qualified scientific personnel to perform research and development work is critical to our success. Our anticipated growth and expansion into areas and activities requiring additional expertise, such as discovery biology, clinical testing, regulatory compliance, manufacturing and compliance, will require the addition of new management personnel and the development of additional expertise by existing management personnel. There is intense competition for qualified personnel in the areas of our present and planned activities. Accordingly, we may not be able to continue to attract and retain the qualified personnel, which would adversely affect the development of our business.

| 13 |

We may be subject to claims by third parties asserting that our employees or we have misappropriated their intellectual property, or claiming ownership of what we regard as our own intellectual property.

Many of our employees were previously employed at universities or other biotechnology or pharmaceutical companies, including our competitors or potential competitors. Although we try to ensure that our employees do not use the proprietary information or know-how of others in their work for us, with contractual provisions and other procedures, we may be subject to claims that these employees or we have used or disclosed intellectual property, including trade secrets or other proprietary information, of any such employee’s former employers. Litigation may be necessary to defend against any such claims.

In addition, while it is our policy to require our employees and contractors who may be involved in the development of intellectual property to execute agreements assigning such intellectual property to us, we may be unsuccessful in executing such an agreement with each party who in fact contributes to the development of intellectual property that we regard as our own. Further, the terms of such assignment agreements may be breached and we may not be able to successfully enforce their terms, which may force us to bring claims against third parties, or defend claims they may bring against us, to determine the ownership of intellectual property rights we may regard and treat as our own.

Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could cause our business to suffer.

We are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with regulations of governmental authorities, such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency, or EMA, to provide accurate information to the FDA or EMA, to comply with manufacturing standards we have established, to comply with federal, state and international healthcare fraud and abuse laws and regulations as they may become applicable to our operations, to report financial information or data accurately or to disclose unauthorized activities to us. Employee misconduct could also involve the improper use of information obtained during clinical trials, which could result in regulatory sanctions and serious harm to our reputation. It is not always possible to identify and deter employee misconduct, and the precautions we currently take and the procedures we may establish in the future as our operations and employee base expand to detect and prevent this type of activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure by our employees to comply with such laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business and results of operations, including the imposition of significant fines or other sanctions.

Our reliance on the activities of our non-employee consultants, research institutions and scientific contractors, whose activities are not wholly within our control, may lead to delays in development of our proposed products.

We rely extensively upon and have relationships with scientific consultants at academic and other institutions, some of whom conduct research at our request, and other consultants with expertise in clinical development strategy or other matters. These consultants are not our employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to us. We have limited control over the activities of these consultants and, except as otherwise required by our collaboration and consulting agreements to the extent they exist, can expect only limited amounts of their time to be dedicated to our activities. These research facilities may have commitments to other commercial and non-commercial entities. We have limited control over the operations of these laboratories and can expect only limited amounts of time to be dedicated to our research goals.

It may take longer to complete our clinical trials than we project, or we may not be able to complete them at all.

For budgeting and planning purposes, we have projected the date for the commencement, continuation and completion of our various clinical trials. However, a number of factors, including scheduling conflicts with participating clinicians and clinical institutions, and difficulties in identifying and enrolling patients who meet trial eligibility criteria, may cause significant delays. We may not commence or complete clinical trials involving any of our products as projected or may not conduct them successfully.

We expect to rely on medical institutions, academic institutions or clinical research organizations to conduct, supervise or monitor some or all aspects of clinical trials involving our products. We will have less control over the timing and other aspects of these clinical trials than if we conducted them entirely on our own. If we fail to commence or complete, or experience delays in, any of our planned clinical trials, our stock price and our ability to conduct our business as currently planned could be harmed.

| 14 |

Clinical drug development is costly, time-consuming and uncertain, and we may suffer setbacks in our clinical development program that could harm our business.

Clinical drug development for our product candidates is costly, time-consuming and uncertain. Our product candidates are in various stages of development and while we expect that clinical trials for these product candidates will continue for several years, such trials may take significantly longer than expected to complete. In addition, we, the FDA, an institutional review board, or IRB, or other regulatory authorities, including state and local agencies and counterpart agencies in foreign countries, may suspend, delay, require modifications to or terminate our clinical trials at any time, for various reasons, including:

| ● | discovery of safety or tolerability concerns, such as serious or unexpected toxicities or side effects or exposure to otherwise unacceptable health risks, with respect to study participants; | |

| ● | lack of effectiveness of any product candidate during clinical trials or the failure of our product candidates to meet specified endpoints; | |

| ● | delays in subject recruitment and enrollment in clinical trials or inability to enroll a sufficient number of patients in clinical trials to ensure adequate statistical ability to detect statistically significant treatment effects; | |

| ● | difficulty in retaining subjects and volunteers in clinical trials; | |

| ● | difficulty in obtaining the Institutional Review Board’s (“IRB”) approval for studies to be conducted at each clinical trial site; | |

| ● | inadequacy of or changes in our manufacturing process or the product formulation or method of delivery; | |

| ● | delays or failure in reaching agreement on acceptable terms in clinical trial contracts or protocols with prospective contract research organizations, (“CROs”), clinical trial sites and other third-party contractors; | |

| ● | inability to add a sufficient number of clinical trial sites; | |

| ● | uncertainty regarding proper formulation and dosing; | |

| ● | failure by us, our employees, our CROs or their employees or other third-party contractors to comply with contractual and applicable regulatory requirements or to perform their services in a timely or acceptable manner; | |

| ● | scheduling conflicts with participating clinicians and clinical institutions; | |

| ● | failure to design appropriate clinical trial protocols; | |

| ● | inability or unwillingness of medical investigators to follow our clinical protocols; | |

| ● | difficulty in maintaining contact with subjects during or after treatment, which may result in incomplete data; or | |

| ● | changes in applicable laws, regulations and regulatory policies. |

| 15 |

If we experience delays or difficulties in the enrollment of patients in clinical trials, those clinical trials could take longer than expected to complete and our receipt of necessary regulatory approvals could be delayed or prevented.

We may not be able to initiate or continue clinical trials for our product candidates if we are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by U.S. Food and Drug Administration, or the FDA, or similar regulatory authorities outside the United States. In particular, because we are focused on patients with molecularly defined cancers, our pool of suitable patients may be smaller and more selective and our ability to enroll a sufficient number of suitable patients may be limited or take longer than anticipated. In addition, some of our competitors have ongoing clinical trials for product candidates that treat the same indications as our product candidates, and patients who would otherwise be eligible for our clinical trials may instead enroll in clinical trials of our competitors’ product candidates.

Patient enrollment for any of our clinical trials may also be affected by other factors, including without limitation:

| ● | the severity of the disease under investigation; | |

| ● | the frequency of the molecular alteration we are seeking to target in the applicable trial; | |

| ● | the eligibility criteria for the study in question; | |

| ● | the perceived risks and benefits of the product candidate under study; | |

| ● | the extent of the efforts to facilitate timely enrollment in clinical trials; | |

| ● | the patient referral practices of physicians; | |

| ● | the ability to monitor patients adequately during and after treatment; and | |

| ● | the proximity and availability of clinical trial sites for prospective patients. |

Our inability to enroll a sufficient number of patients for our clinical trials would result in significant delays and could require us to abandon one or more clinical trials altogether. Enrollment delays in our clinical trials may result in increased development costs for our product candidates, and we may not have or be able to obtain sufficient cash to fund such increased costs when needed, which could result in the further delay or termination of the trial.

Consistent with our general product development strategy, we intend to design future trials for our product candidates to include some patients with the applicable clinical characteristics, stage of therapy, molecular alterations, biomarkers, and/or cell surface antigens that determine therapeutic options, or are indicators of the disease, with a view to assessing possible early evidence of potential therapeutic effect. If we are unable to locate and include such patients in those trials, then our ability to make those early assessments and to seek participation in FDA expedited review and approval programs, including breakthrough therapy and fast track designation, or otherwise to seek to accelerate clinical development and regulatory timelines, could be compromised.

| 16 |

We have limited clinical testing and regulatory capabilities, and human clinical trials are subject to extensive regulatory requirements, which are very expensive, time-consuming and difficult to design and implement. Our products may fail to achieve necessary safety and efficacy endpoints during clinical trials, which may limit our ability to generate revenues from therapeutic products.

We cannot assure you that we will be able to invest or develop resources for clinical trials successfully or as expediently as necessary. In particular, human clinical trials can be very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process is time consuming. We estimate that clinical trials of our product candidates will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be affected by several factors, including:

| ● | unforeseen safety issues; | |

| ● | determination of dosing issues; | |

| ● | inability to demonstrate effectiveness during clinical trials; | |

| ● | slower than expected rates of patient recruitment; | |

| ● | inability to monitor patients adequately during or after treatment; and | |

| ● | inability or unwillingness of medical investigators to follow our clinical protocols. |