Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual report pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 for the fiscal year ended December 31, 2018

Commission File Number 001-15811

MARKEL CORPORATION

(Exact name of registrant as specified in its charter)

A Virginia Corporation

IRS Employer Identification No. 54-1959284

4521 Highwoods Parkway, Glen Allen, Virginia 23060-6148

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (804) 747-0136

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, no par value

New York Stock Exchange, Inc.

(title of each class and name of the exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer x | | Accelerated filer o | | Non-accelerated filer o |

Smaller reporting company o | | Emerging growth company o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the shares of the registrant's Common Stock held by non-affiliates as of June 30, 2018 was approximately $14,686,000,000.

The number of shares of the registrant's Common Stock outstanding at February 5, 2019: 13,874,896.

Documents Incorporated By Reference

The portions of the registrant's Proxy Statement for the Annual Meeting of Shareholders scheduled to be held on May 13, 2019, referred to in Part III.

Index and Cross References-Form 10-K Annual Report

|

| | | | | |

Item No. | | Page |

Part I | | |

1. | Business | |

|

| | |

|

1B. | Unresolved Staff Comments | NONE |

|

2. | | |

|

| | |

|

4. | Mine Safety Disclosures | NONE |

|

| | |

5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

|

| | |

|

| | |

|

| | |

|

8. | Financial Statements and Supplementary Data The response to this item is submitted in Item 15. | |

9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | NONE |

|

9A. | Controls and Procedures | |

|

9B. | Other Information | NONE |

|

Part III | | |

10. | | |

|

| | |

|

11. | Executive Compensation* | |

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | |

13. | Certain Relationships and Related Transactions, and Director Independence* | |

14. | Principal Accounting Fees and Services* | |

*Portions of Item 10 and Items 11, 12, 13 and 14 will be incorporated by reference from the Registrant's Proxy Statement for its 2019 Annual Meeting of Shareholders pursuant to instructions G(1) and G(3) of the General Instructions to Form 10-K. | |

Part IV | | | | |

15. | Exhibits, Financial Statement Schedules | |

| a. | Documents filed as part of this Form 10-K | |

| | (1) | Reports of Independent Registered Public Accounting Firm | 42 |

|

| | | | |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | (2) | Schedules have been omitted since they either are not required or are not applicable, or the information called for is shown in the Consolidated Financial Statements and Notes thereto. | |

| | (3) | | |

|

16. | Form 10-K Summary | NONE |

|

BUSINESS OVERVIEW

We are a diverse financial holding company serving a variety of niche markets. Our principal business markets and underwrites specialty insurance products. We believe that our specialty product focus and niche market strategy enable us to develop expertise and specialized market knowledge. We seek to differentiate ourselves from competitors by our expertise, service, continuity and other value-based considerations. We also own interests in various businesses that operate outside of the specialty insurance marketplace. Our financial goals are to earn consistent underwriting and operating profits and superior investment returns to build shareholder value.

Our business is comprised of the following types of operations:

| |

• | Underwriting - our underwriting operations are comprised of our risk-bearing insurance and reinsurance operations |

| |

• | Investing - our investing activities are primarily related to our underwriting operations |

| |

• | Markel Ventures - our Markel Ventures operations include our controlling interests in a diverse portfolio of businesses that operate outside of the specialty insurance marketplace |

| |

• | Investment management - our investment management operations include investment fund managers that offer a variety of investment products, including insurance-linked securities, catastrophe bonds, insurance swaps and weather derivatives |

| |

• | Program services - our program services business serves as a fronting platform that provides other insurance companies access to the United States (U.S.) property and casualty insurance market |

Underwriting

Specialty Insurance and Reinsurance

The specialty insurance market differs significantly from the standard market. In the standard market, insurance rates and forms are highly regulated, products and coverages are largely uniform with relatively predictable exposures and companies tend to compete for customers on the basis of price. In contrast, the specialty market provides coverage for hard-to-place risks that generally do not fit the underwriting criteria of standard carriers.

Competition in the specialty insurance market tends to focus less on price than in the standard insurance market and more on other value-based considerations, such as availability, service and expertise. While specialty market exposures may have higher perceived insurance risks than their standard market counterparts, we seek to manage these risks to achieve higher financial returns. To reach our financial and operational goals, we must have extensive knowledge and expertise in our chosen markets. Many of our accounts are considered on an individual basis where customized forms and tailored solutions are employed.

By focusing on the distinctive risk characteristics of our insureds, we have been able to identify a variety of niche markets where we can add value with our specialty product offerings. Examples of niche insurance markets that we have targeted include wind and earthquake-exposed commercial properties, liability coverage for highly specialized professionals, equine-related risks, workers' compensation insurance for small businesses, classic cars and marine, energy and environmental-related activities. Our market strategy in each of these areas of specialization is tailored to the unique nature of the loss exposure, coverage and services required by insureds. In each of our niche markets, we assign teams of experienced underwriters and claims specialists who provide a full range of insurance services.

We also participate in the reinsurance market in certain classes of reinsurance product offerings. In the reinsurance market, our clients are other insurance companies, or cedents. We typically write our reinsurance products in the form of treaty reinsurance contracts, which are contractual arrangements that provide for automatic reinsuring of a type or category of risk underwritten by cedents. Generally, we participate on reinsurance treaties with a number of other reinsurers, each with an allocated portion of the treaty, with the terms and conditions of the treaty being substantially the same for each participating reinsurer. With treaty reinsurance contracts, we do not separately evaluate each of the individual risks assumed under the contracts and are largely dependent on the individual underwriting decisions made by the cedent. Accordingly, we review and analyze the cedent's risk management and underwriting practices in deciding whether to provide treaty reinsurance and in pricing of treaty reinsurance contracts.

Our reinsurance products are written on both a quota share and excess of loss basis. Quota share contracts require us to share the losses and expenses in an agreed proportion with the cedent. Excess of loss contracts require us to indemnify the cedent against all or a specified portion of losses and expenses in excess of a specified dollar or percentage amount. In both types of contracts, we may provide a ceding commission to the cedent.

We distinguish ourselves in the reinsurance market by the expertise of our underwriting teams, our access to global reinsurance markets, our ability to offer large lines and our ability to customize reinsurance solutions to fit our client's needs. Our specialty reinsurance product offerings include coverage for general casualty, professional liability, property, workers' compensation and credit and surety risks.

Markets

In the United States, we write business in the excess and surplus lines (E&S) and specialty admitted insurance and reinsurance markets. In 2017, the E&S market represented $45 billion, or 7%, of the $642 billion U.S. property and casualty industry.(1) In 2017, we were the third largest E&S writer in the U.S. as measured by direct premium writings.(1)

Our E&S insurance operations are conducted through Evanston Insurance Company (Evanston), domiciled in Illinois. The majority of our specialty admitted insurance operations are conducted through Markel Insurance Company (MIC), domiciled in Illinois; Markel American Insurance Company (MAIC), domiciled in Virginia; FirstComp Insurance Company (FCIC), domiciled in Nebraska; and Essentia Insurance Company (Essentia), domiciled in Missouri. Beginning in 2017, our specialty admitted operations also include Suretec Insurance Company (SIC), Suretec Indemnity Company (SINC), State National Insurance Company, Inc. (SNIC) and National Specialty Insurance Company (NSIC), all of which are domiciled in Texas. Our U.S. reinsurance operations are conducted through Markel Global Reinsurance Company (Markel Global Re), a Delaware-domiciled reinsurance company.

We participate in the London insurance market primarily through Markel Capital Limited (Markel Capital) and Markel International Insurance Company Limited (MIICL). Markel Capital is the corporate capital provider for Markel Syndicate 3000, through which our Lloyd's of London (Lloyd's) operations are conducted. Markel Syndicate 3000 is managed by Markel Syndicate Management Limited (MSM). Markel Capital and MIICL are headquartered in London, England and have offices across the United Kingdom (U.K.), Europe, Canada, Latin America, Asia Pacific and the Middle East through which we are able to offer insurance and reinsurance. The London insurance market produced approximately $67 billion of gross written premium in 2017.(2) In 2017, the U.K. non-life insurance market was the largest in Europe and fourth largest in the world.(3) In 2017, gross premium written through Lloyd's syndicates generated roughly 65% of the London market's international insurance business,(2) making Lloyd's the world's largest commercial surplus lines insurer and sixth largest reinsurer.(4) Corporate capital providers often provide a majority of a syndicate's capacity and also generally own or control the syndicate's managing agent. This structure permits the capital provider to exert greater influence on, and demand greater accountability for, underwriting results. In 2017, corporate capital providers accounted for approximately 90% of total underwriting capacity in Lloyd's.(5)

In anticipation of the U.K.'s expected exit from the European Union in 2019, which could impact MIICL and Markel Syndicate 3000's ability to transact business in the remaining European Union member states and Switzerland, in 2018, we established Markel Insurance SE (MISE), a regulated insurance carrier located in Munich, Germany. From its offices in Germany, MISE can transact business in all remaining European Union member states and throughout the European Economic Area (EEA). MISE has established branches in Ireland, the Netherlands, Spain and the U.K. For further discussion regarding the U.K.'s expected exit from the European Union, see "Brexit Developments" under Management's Discussion & Analysis of Financial Condition and Results of Operations.

In Latin America, we provide reinsurance through MIICL, using our representative office in Bogota, Colombia and our service company in Buenos Aires, Argentina, and through Markel Resseguradora do Brasil S.A. (Markel Brazil Re), our reinsurance company in Rio de Janeiro, Brazil. MIICL is also able to offer reinsurance in a number of Latin American countries through offices outside of Latin America. We also provide insurance through Markel Seguradora do Brasil S.A. (Markel Brazil), our insurance company in Rio de Janeiro, Brazil.

|

|

(1) Market Segment Report - U.S. Surplus Lines, A.M. Best (September 14, 2018). |

(2) London Company Market Statistics Report, International Underwriting Association (October 2018). |

(3) sigma, Swiss Re Institute (March 2018). |

(4) Market Segment Report - Global Reinsurance, A.M. Best (September 4, 2018). |

(5) Lloyd's Annual Report 2017. |

In Bermuda, we write business in the worldwide insurance and reinsurance markets. The Bermuda property and casualty insurance and reinsurance market produced $66 billion of gross written premium in 2016.(1) We conduct our Bermuda operations through Markel Bermuda Limited (Markel Bermuda), which is registered as a Class 4 insurer and Class C long-term insurer under the insurance laws of Bermuda.

Our reinsurance operations, which include our operations based in the United States, the United Kingdom, Latin America and Bermuda, as described above, made us the 35th largest reinsurer in 2017, as measured by worldwide gross reinsurance premium writings.(2)

In 2018, 21% of gross premium writings from our underwriting segments related to foreign risks (i.e., coverage for risks or cedents located outside of the U.S.), of which 39% were from the U.K. and 11% were from Canada. In 2017, 21% of our premium writings related to foreign risks, of which 34% were from the U.K. and 12% were from Canada. In 2016, 23% of our premium writings related to foreign risks, of which 32% were from the U.K. and 11% were from Canada. In each of these years, there was no other individual foreign country from which premium writings were material. Premium writings are attributed to individual countries based upon location of risk or cedent.

Most of our business is placed through insurance and reinsurance brokers. Some of our insurance business is also placed through managing general agents. We seek to develop and capitalize on relationships with insurance and reinsurance brokers, insurance and reinsurance companies, large global corporations and financial intermediaries to develop and underwrite business. A significant volume of premium for the property and casualty insurance and reinsurance industry is produced through a small number of large insurance and reinsurance brokers. During the years ended December 31, 2018, 2017 and 2016, the top three independent brokers accounted for 25%, 27% and 28%, respectively, of gross premiums written in our underwriting segments.

Competition

We compete with numerous domestic and international insurance companies and reinsurers, Lloyd's syndicates, risk retention groups, insurance buying groups, risk securitization programs, alternative capital sources and alternative self-insurance mechanisms. We also compete with new companies that continue to be formed to enter the insurance and reinsurance markets, particularly companies with new or "disruptive" technologies or business models. Competition may take the form of lower prices, broader coverages, greater product flexibility, higher coverage limits, higher quality services or higher ratings by independent rating agencies. In all of our markets, we compete by developing specialty products to satisfy well-defined market needs and by maintaining relationships with agents, brokers and insureds who rely on our expertise. This expertise is our principal means of competing. We offer a diverse portfolio of products, each with its own distinct competitive environment, which enables us to be responsive to changes in market conditions for individual product lines. With each of our products, we seek to compete with innovative ideas, appropriate pricing, expense control and quality service to policyholders, agents and brokers.

Few barriers exist to prevent insurers and reinsurers from entering our markets of the property and casualty industry. Market conditions and capital capacity influence the degree of competition at any point in time. Periods of intense competition, which typically include broader coverage terms, lower prices and excess underwriting capacity, are referred to as a "soft market." A favorable insurance market is commonly referred to as a "hard market" and is characterized by stricter coverage terms, higher prices and lower underwriting capacity. During soft markets, unfavorable conditions exist due in part to what many perceive as excessive amounts of capital in the industry. In an attempt to use their capital, many insurance companies seek to write additional premiums without appropriate regard for ultimate profitability, and standard insurance companies are more willing to write specialty coverages. The opposite is typically true during hard markets. Historically, the performance of the property and casualty reinsurance and insurance industries has tended to fluctuate in cyclical periods of price competition and excess underwriting capacity, followed by periods of high premium rates and shortages of underwriting capacity. This cyclical market pattern can be more pronounced in the specialty insurance and reinsurance markets in which we compete than the standard insurance market.

|

|

(1) Bermuda Monetary Authority 2017 Annual Report. |

(2) Market Segment Report - Global Reinsurance, A.M. Best (September 4, 2018). |

We experienced soft insurance market conditions across most of our property product lines, as well as on our marine and energy line beginning in 2013 and continuing through 2017. Our large account business has also been subject to more pricing pressure and competition remains strong in the reinsurance market. Following the high level of natural catastrophes that occurred in the third and fourth quarters of 2017, in 2018, we experienced slightly more favorable rates, particularly on our catastrophe exposed and loss affected product lines. However, we also experienced rate decreases on other product lines and the market remains competitive.

We routinely review the pricing of our major product lines and will continue to pursue price increases in 2019, when possible. However, when we believe the prevailing market price will not support our underwriting profit targets, the business is not written. As a result of our underwriting discipline, gross premium volume may vary when we alter our product offerings to maintain or improve underwriting profitability.

Underwriting Philosophy

By focusing on market niches where we have underwriting expertise, we seek to earn consistent underwriting profits, which are a key component of our strategy. The property and casualty insurance industry commonly defines underwriting profit or loss as earned premiums net of losses and loss adjustment expenses and underwriting, acquisition and insurance expenses. We believe that the ability to achieve consistent underwriting profits demonstrates knowledge and expertise, commitment to superior customer service and the ability to manage insurance risk. We use underwriting profit or loss as a basis for evaluating our underwriting performance.

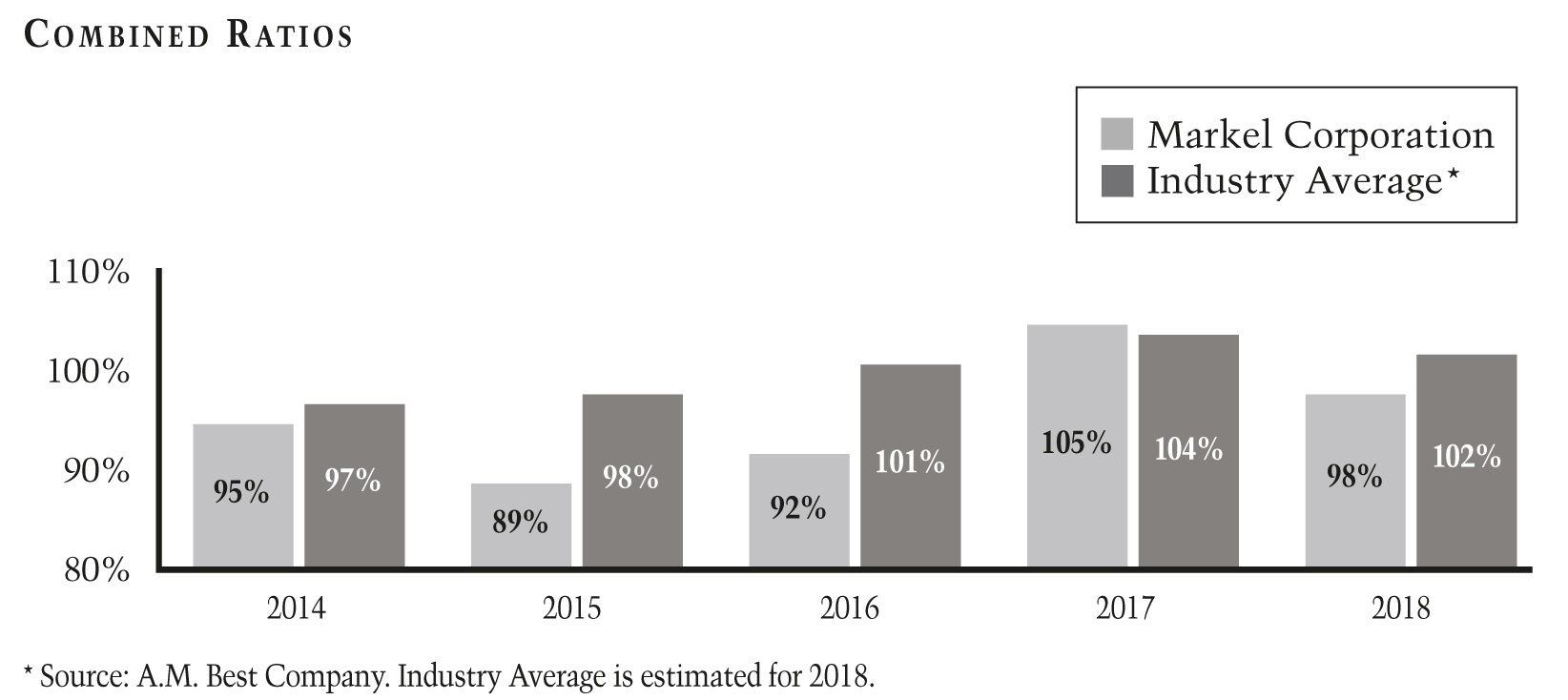

The combined ratio is a measure of underwriting performance and represents the relationship of incurred losses, loss adjustment expenses and underwriting, acquisition and insurance expenses to earned premiums. A combined ratio less than 100% indicates an underwriting profit, while a combined ratio greater than 100% reflects an underwriting loss. In 2018, our combined ratio was 98%. See Management's Discussion & Analysis of Financial Condition and Results of Operations for further discussion of our underwriting results.

The following graph compares our combined ratio to the property and casualty industry's combined ratio for the past five years.

Underwriting Segments

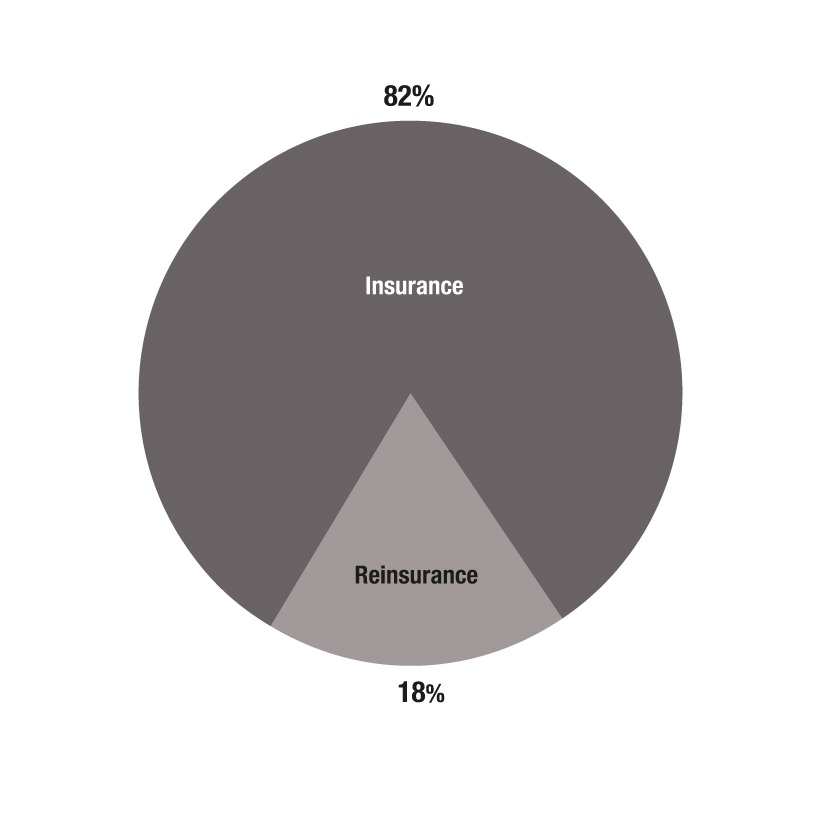

Through December 31, 2017, we monitored and reported our ongoing underwriting operations in the following three segments: U.S. Insurance, International Insurance and Reinsurance. In conjunction with the continued growth and diversification of our business, beginning the first quarter of 2018 we changed the way we review our ongoing underwriting operations. In determining how to monitor our underwriting results, management considers many factors, including the nature of the insurance product sold, the type of account written and the type of customer served. Effective January 1, 2018, our chief operating decision maker allocates resources to and assesses the performance of our ongoing underwriting operations on a global basis in the following two segments: Insurance and Reinsurance. The Insurance segment includes all direct business and facultative placements written across the Company. The Reinsurance segment includes all treaty reinsurance written across the Company. Results for lines of business discontinued prior to, or in conjunction with, acquisitions, including development on asbestos and environmental loss reserves and the results attributable to the run-off of life and annuity reinsurance business, are monitored separately and are not included in a reportable segment.

See note 20 of the notes to consolidated financial statements for additional segment reporting disclosures.

Markel Corporation

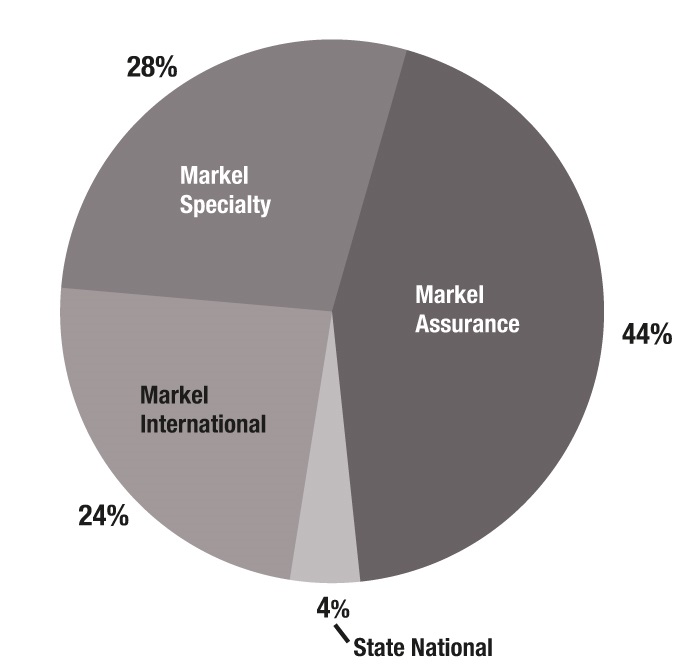

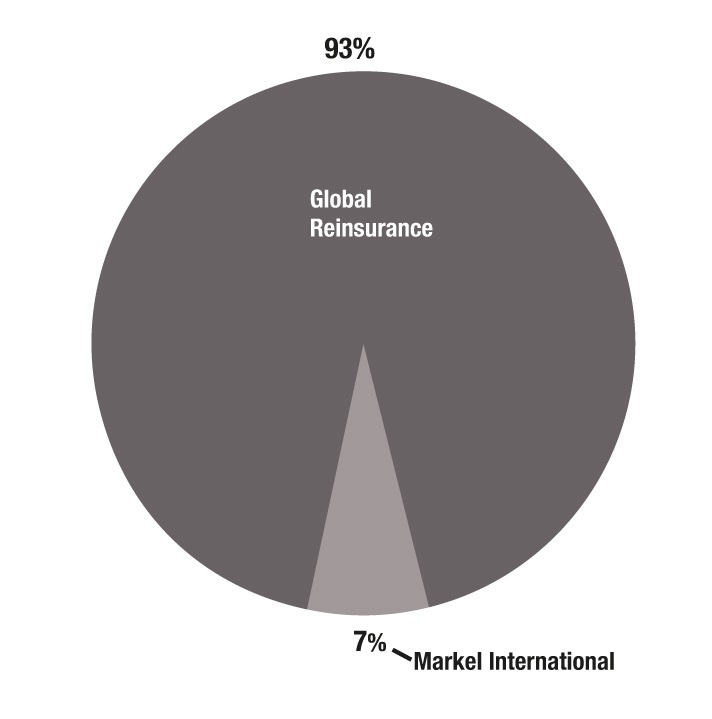

2018 Gross Premium Volume ($5.8 billion)

Insurance Segment

Our Insurance segment includes both hard-to-place risks written outside of the standard market on an E&S basis and unique and hard-to-place risks that must be written on an admitted basis due to marketing and regulatory reasons. Business in this segment is primarily written through our Markel Assurance, Markel Specialty and Markel International divisions. As a result of the acquisition of State National Companies, Inc. (State National), effective November 2017, we created the State National division. The State National division's collateral protection underwriting business is included in the Insurance segment and its program services business is not included in a reportable segment.

Markel Assurance Division

The Markel Assurance division writes commercial and Fortune 1000 accounts for brokers located in the U.S., Bermuda, Ireland and the U.K. In the U.S. accounts are written on an E&S basis and on an admitted basis when a risk must remain with the admitted insurance company for marketing and regulatory reasons. The E&S market focuses on hard-to-place risks and loss exposures that generally cannot be written in the standard market. U.S. insurance regulations generally require an E&S account to be declined by admitted carriers before an E&S company may write the business. E&S eligibility allows our insurance subsidiaries to underwrite unique loss exposures with more flexible policy forms and unregulated premium rates. This typically results in coverages that are more restrictive and more expensive than coverages in the standard market. The Markel Assurance division also writes complex, Fortune 1000 accounts on an admitted and non-admitted basis. Our business that is written in the admitted market is likewise focused on risks that, although unique and hard-to-place, can still be written in the standard market.

Markel Assurance business is primarily written through wholesale brokers, retail brokers and surplus lines general agents who have limited quoting and binding authority. Admitted business produced by this division is written through MAIC, which is authorized to write business in all 50 states and the District of Columbia. Business written on a non-admitted basis and in the E&S market is primarily written through Evanston, which is authorized to write business in all 50 states and the District of Columbia, Guam, Puerto Rico and the U.S. Virgin Islands, as well as MIC, Markel Bermuda and MIICL.

Markel Specialty Division

The Markel Specialty division writes program insurance and other specialty coverages for well-defined niche markets, primarily on an admitted basis in the U.S. Our business written in the admitted market focuses on risks that, although unique and hard-to-place in the standard market, must remain with an admitted insurance company for marketing and regulatory reasons. Hard-to-place risks written in the admitted market cover insureds engaged in similar, but highly specialized, activities that require a total insurance program not otherwise available from standard insurers or insurance products that are overlooked by large admitted carriers. The admitted market is subject to more state regulation than the E&S market, particularly with regard to rate and form filing requirements, restrictions on the ability to exit lines of business, premium tax payments and membership in various state associations, such as state guaranty funds and assigned risk plans.

Business written in the Markel Specialty division is primarily written by retail insurance agents who have very limited or no underwriting authority. We also utilize managing general agents, who have broader underwriting authority, for certain of our product lines. Agents are carefully selected and agency business is controlled through regular audits and pre-approvals. Certain products and programs are marketed directly to consumers or distributed through wholesale producers. Personal lines coverages included in this segment are marketed directly to the consumer using direct mail, internet and telephone promotions, as well as relationships with various motorcycle and boat manufacturers, dealers and associations.

The majority of the business produced by this division is written either through MIC, MAIC, FCIC, Essentia, SIC and SINC. MIC, MAIC and Essentia are licensed to write property and casualty insurance in all 50 states and the District of Columbia. MAIC is also licensed to write property and casualty insurance in Puerto Rico. Essentia specializes in coverage for classic cars and boats. FCIC is currently licensed in 28 states and specializes in workers' compensation coverage. SIC and SINC specialize in surety coverages. SIC is currently licensed in all 50 states and the District of Columbia. SINC is currently licensed in California and Texas.

Markel International Division

The Markel International division writes business worldwide from our London-based platform and branch offices around the world. This includes Markel Syndicate 3000, through which our Lloyd's operations are conducted, and MIICL. Beginning in 2018, the Markel International division also includes business written through MISE, our regulated insurance company in Germany. The London insurance market is known for its ability to provide innovative, tailored coverage and capacity for unique and hard-to-place risks. Hard-to-place risks in the London market are generally distinguishable from standard risks due to the complexity or significant size of the risk. It is primarily a broker market, which means that insurance brokers bring most of the business to the market. Risks written in the Markel International division are written on either a direct basis or a subscription basis, the latter of which means that loss exposures brought into the market are typically insured by more than one insurance company or Lloyd's syndicate, often due to the high limits of insurance coverage required. When we write business in the subscription market, we prefer to participate as lead underwriter in order to control underwriting terms, policy conditions and claims handling.

State National Division

The State National division writes collateral protection insurance (CPI), which insures personal automobiles and other vehicles held as collateral for loans made by credit unions, banks and specialty finance companies through its lender services product line on both an admitted and non-admitted basis. This business is primarily written on SNIC and NSIC, which are licensed to write property and casualty insurance in all 50 states and the District of Columbia.

Our Insurance segment reported gross premium volume of $4.7 billion, earned premiums of $3.8 billion and an underwriting profit of $228.8 million in 2018.

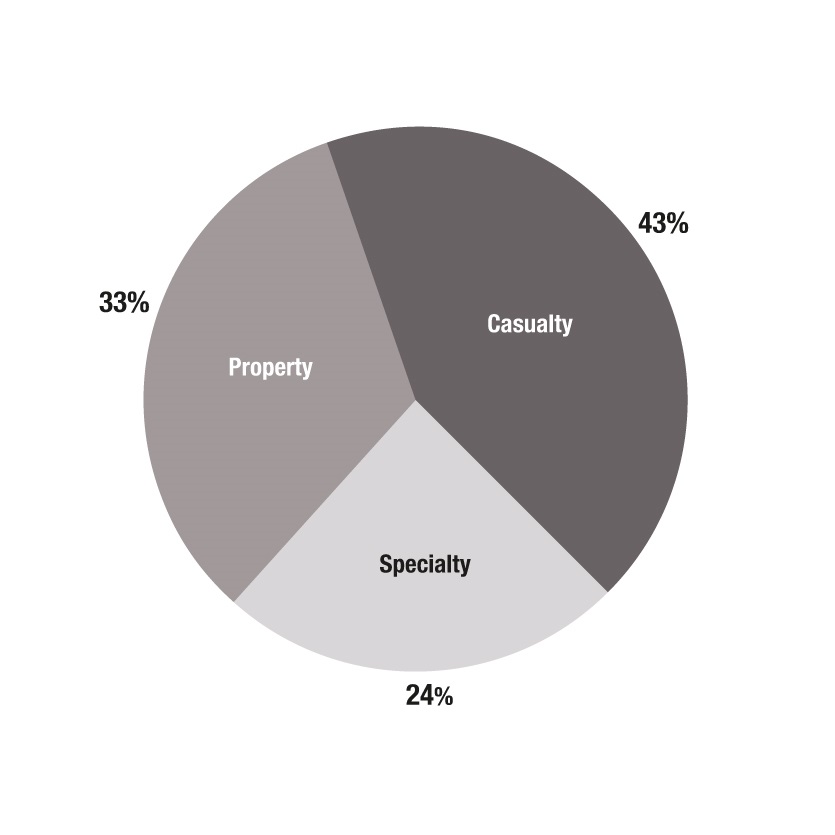

Insurance Segment

2018 Gross Premium Volume ($4.7 billion)

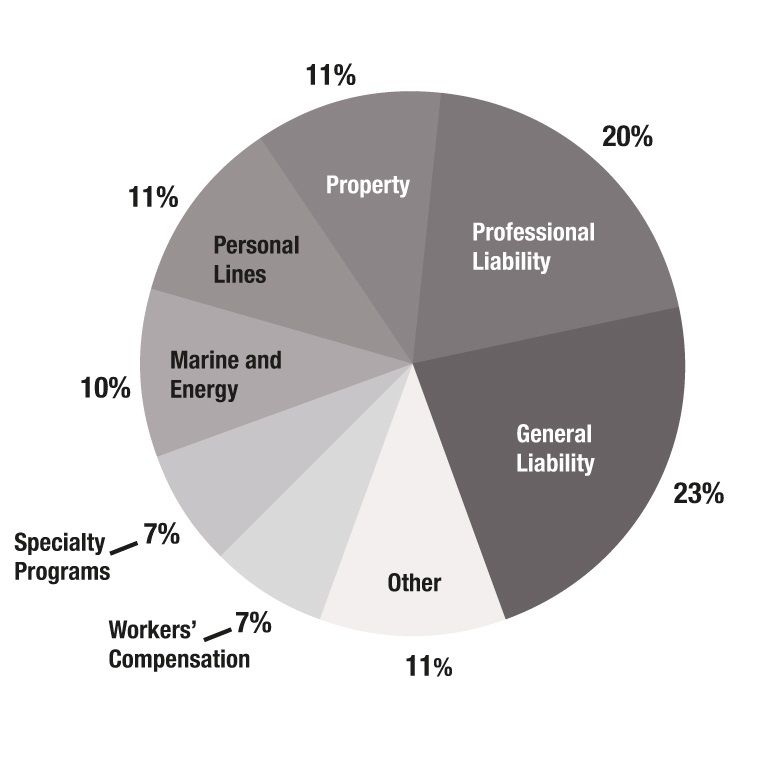

Product offerings within the Insurance segment fall within the following major product groupings:

General Liability product offerings include a variety of primary and excess liability coverages targeting apartments and office buildings, retail stores, contractors, consultants, construction professionals, financial service professionals, professional practices, social welfare organizations and medical products, as well as businesses in the life sciences, energy, medical, healthcare, pharmaceutical, recreational, transportation, heavy industrial and hospitality industries. Specific products include the following:

| |

• | excess and umbrella products, which provide coverage over approved underlying insurance carriers on either an occurrence or claims-made basis; |

| |

• | products liability products, which provide coverage on either an occurrence or claims-made basis to manufacturers, distributors, importers and re-packagers of manufactured products; |

| |

• | environmental products, which provide coverage on either an occurrence or claims-made basis and include environmental consultants' professional liability, contractors' pollution liability and site-specific environmental impairment liability coverages; and |

| |

• | casualty facultative reinsurance written for individual casualty risks focusing on general liability, products liability, automobile liability and certain classes of miscellaneous professional liability and targeting classes which include low frequency, high severity general liability risks. |

Professional liability coverages include unique solutions for highly specialized professions, including architects and engineers, lawyers, accountants, agents and brokers, service technicians and consultants. We offer claims-made medical malpractice coverage for doctors and dentists; claims-made professional liability coverage to individual healthcare providers such as therapists, pharmacists, physician assistants and nurse anesthetists; and coverages for medical facilities and other allied healthcare risks such as clinics, laboratories, medical spas, home health agencies, small hospitals, pharmacies and senior living facilities. Other professional liability coverages include errors and omissions, union liability, professional indemnity, intellectual property, executive liability for financial institutions and Fortune 1000 companies and management liability. Our management liability coverages, which can be bundled with other coverages or written on a standalone basis, include employment practices liability, directors and officers liability and fiduciary liability coverages. Additionally, we offer cyber liability products, which provide coverage primarily for data breach and privacy liability, data breach loss to insureds and electronic media coverage.

Property coverages consist principally of fire, allied lines (including windstorm, hail and water damage) and other specialized property coverages, including catastrophe-exposed property risks such as earthquake and wind on both a primary and excess basis. Catastrophe-exposed property risks are typically lower frequency and higher severity in nature than more standard property risks. Our property coverages are exposed to windstorm losses that, based on the seasonal nature of those events, are more likely to occur in the third and fourth quarters of the year. Our property risks range from small, single-location accounts to large, multi-state, multi-location, multi-national accounts on a worldwide basis. Other types of property products include:

| |

• | inland marine products, which provide a number of specialty coverages for risks such as motor truck cargo coverage for damage to third party cargo while in transit, warehouseman's legal liability coverage for damage to third party goods in storage, contractor's equipment coverage for first party property damage and builder's risk coverage; |

| |

• | railroad-related products, which provide first party coverages for short-line and regional railroads, scenic and tourist railroads, commuter and light rail trains and railroad equipment; and |

| |

• | specie coverage for fine art on exhibition and in private collections, securities, bullion, precious metals, cash in transit and jewelry. |

Personal lines products provide first and third party coverages for classic cars, motorcycles and a variety of personal watercraft, including vintage boats, high performance boats and yachts and recreational vehicles, such as motorcycles, snowmobiles and ATVs. Based on the seasonal nature of much of our personal lines business, we generally will experience higher claims activity during the second and third quarters of the year. Additionally, property coverages are offered for mobile homes, dwellings and homeowners that do not qualify for standard homeowner's coverage. Other products offered include special event protection and pet health coverage.

Marine and energy products include a portfolio of coverages for cargo, energy, hull, liability, war and terrorism risks. The cargo product line is an international transit-based book providing coverage for many types of cargo. Energy coverage includes all aspects of oil and gas activities. Hull coverages consist of coverage for physical damage to ocean-going tonnage, yachts and mortgagees' interests. Liability coverage provides for a broad range of energy liabilities, as well as traditional marine exposures including charterers, terminal operators and ship repairers. War coverage includes protections for the hulls of ships and aircraft, and other related interests, against war and associated perils. Terrorism coverage provides for property damage and business interruption related to political violence including war and civil war.

Specialty programs business included in this segment is offered on a standalone or package basis and generally targets specialized commercial markets and customer groups. Targeted groups include youth and recreation oriented organizations and camps, child care operators, schools, social service organizations, museums and historic homes, performing arts organizations, senior living facilities and wineries. Other specialty programs business written in this segment includes:

| |

• | general agent programs that use managing general agents to offer single source admitted and non-admitted programs for a specific class or line of business; |

| |

• | first and third party coverages for medical transport, small fishing ventures, charters, utility boats and boat rentals; and |

| |

• | property and liability coverages for small to medium-sized commercial risks, including farms, zoos, animal theme parks, safari parks and animal boarding, breeding and training facilities. |

Workers' compensation products provide wage replacement and medical benefits to employees injured in the course of employment and target main-street, service and artisan contractor businesses, retail stores and restaurants.

Other product lines within the Insurance segment include:

| |

• | surety products, which consist primarily of contract, commercial and court bonds; |

| |

• | CPI, which provides coverage on automobiles or other vehicles held as collateral for loans made by credit unions, banks and specialty finance companies; |

| |

• | coverages for equine-related risks, such as horse mortality, theft, infertility, transit and specified perils; |

| |

• | crime coverage primarily targeting financial institutions and providing protection for bankers' blanket bond, computer crime and commercial fidelity; |

| |

• | small business owners policies providing property and liability package coverage to small and medium sized businesses; |

| |

• | accident and health coverage targeting affinity groups and schemes, high value and high risks accounts and sports groups; |

| |

• | coverage for legal expenses including before the event products that protect commercial clients in the event of legal actions and after the event products covering a wide range of litigation; and |

| |

• | short-term trade credit coverage for commercial risks, including insolvency and protracted default as well as political risks coverage in conjunction with commercial risks for currency inconvertibility, government action, import and export license cancellation, public buyer default and war. |

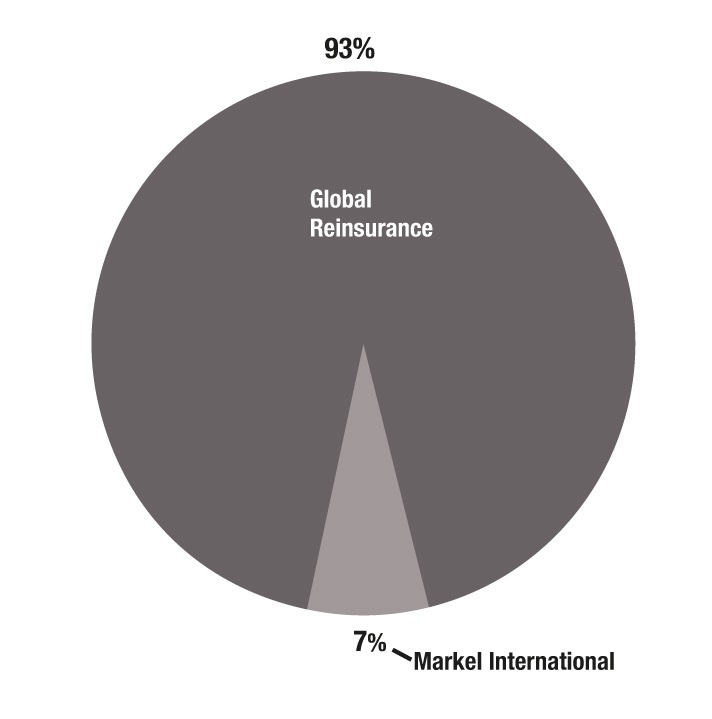

Reinsurance Segment

Our Reinsurance segment includes property and casualty treaty reinsurance products offered to other insurance and reinsurance companies globally through the broker market. Our treaty reinsurance offerings include both quota share and excess of loss reinsurance and are typically written on a participation basis, which means each reinsurer shares proportionally in the business ceded under the reinsurance treaty written. Our reinsurance products may include features such as contractual provisions that require our cedent to share in a portion of losses resulting from ceded risks, may require payment of additional premium amounts if we incur greater losses than those projected at the time of the execution of the contract, may require reinstatement premium to restore the coverage after there has been a loss occurrence or may provide for experience refunds if the losses we incur are less than those projected at the time the contract is executed. Our reinsurance product offerings are underwritten by our Global Reinsurance division and our Markel International division. The Global Reinsurance division operates from platforms in the U.S., Bermuda and the U.K. Business written in the Global Reinsurance division is produced primarily through Markel Global Re, which is licensed or accredited to provide reinsurance in all 50 states and the District of Columbia. The Global Reinsurance division also writes business through Markel Bermuda and beginning in 2018, Markel Syndicate 3000. The Markel International division operates primarily from our London-based platform and business is produced primarily through MIICL. Markel International also conducts reinsurance operations from its platform in Latin America, which includes Markel Brazil Re.

Our Reinsurance segment reported gross premium volume of $1.1 billion, earned premiums of $928.6 million and an underwriting loss of $118.3 million in 2018.

Reinsurance Segment

2018 Gross Premium Volume ($1.1 billion)

Product offerings within the Reinsurance segment fall within the following major product groupings:

Our casualty treaty reinsurance programs are written on a quota share and excess of loss basis and include general liability, professional liability, workers' compensation, medical malpractice, environmental impairment liability and auto liability. General liability reinsurance includes umbrella and excess casualty products that are written worldwide. Our professional liability reinsurance programs are offered worldwide and consist of directors and officers liability, including publicly traded, private, and non-profit companies in both commercial and financial institution arenas; lawyers errors and omissions for small, medium and large-sized law firms; accountants errors and omissions for small and medium-sized firms; technology errors and omissions and cyber liability focusing on network security and privacy exposures. Auto reinsurance treaty products include commercial and non-standard personal auto exposures predominantly in the U.S. Our workers' compensation business includes standard and catastrophe-exposed workers' compensation business. Medical malpractice reinsurance products are offered in the United States and include coverage for physician, surgeon, hospital and long term care medical malpractice writers. Environmental treaty reinsurance provides coverage for pollution legal liability, contractors pollution and professional liability exposures on both a nationwide and regional basis within the U.S.

Property treaty products are offered on an excess of loss and quota share basis for catastrophe, per risk and retrocessional exposures worldwide. Our catastrophe exposures are generally written on an excess of loss basis and target both personal and commercial lines of business providing coverage for losses from natural disasters, including hurricanes, wind storms and earthquakes. We also reinsure individual property risks such as buildings, structures, equipment and contents and provide coverage for both personal lines and commercial property exposures. Our retrocessional products provide coverage for all types of underlying exposures and geographic zones. A significant portion of the property treaty business covers U.S. exposures, with the remainder coming from international property exposures. Our property products are exposed to windstorm losses that, based on the seasonal nature of those events, are more likely to occur in the third and fourth quarters of the year.

Specialty treaty reinsurance products offered in the Reinsurance segment include structured and whole turnover credit, political risk, mortgage and contract and commercial surety reinsurance programs covering worldwide exposures, public entity reinsurance products, aviation, whole account, accident and health coverage, marine and agriculture reinsurance products. Our mortgage products offer coverage for private mortgage insurers in the U.S., Australia and Europe. Our public entity reinsurance products offer customized programs for government risk pools, including counties, municipalities, schools, public housing authorities and special districts (e.g. water, sewer, parks) located in the U.S. Types of coverage for public entities include general liability, environmental impairment liability, cyber and errors and omissions. Our aviation business includes commercial airline hull and liability coverage as well as general aviation for risks worldwide. Our accident and health products cover personal accident, life, medical and workers' compensation coverage, predominately on a per-event basis. Marine reinsurance products include offshore and onshore marine and energy risks on a worldwide basis, including hull, cargo and liability. Agriculture reinsurance covers multi-peril crop insurance, hail and related exposures, for risks located in the U.S. and Canada.

Ceded Reinsurance

Within our underwriting operations, we purchase reinsurance and retrocessional reinsurance to manage our net retention on individual risks and overall exposure to losses, while providing us with the ability to offer policies with sufficient limits to meet policyholder needs. See "Program Services" section below for an overview of ceded reinsurance within our program services business, which is managed separately from our underwriting operations.

In reinsurance and retrocession transactions, an insurance or reinsurance company transfers, or cedes, all or part of its exposure in return for a portion of the premium. We purchase catastrophe reinsurance coverage for our catastrophe-exposed policies to ensure that our net retained catastrophe risk is within our corporate tolerances. Net retention of gross premium volume in our underwriting segments was 83% in 2018 and 84% in 2017. We do not purchase or sell finite reinsurance products or use other structures that would have the effect of discounting loss reserves.

Our ceded reinsurance and retrocessional contracts do not legally discharge us from our primary liability for the full amount of the policies, and we will be required to pay the loss and bear collection risk if the reinsurer fails to meet its obligations under the reinsurance agreement. We attempt to minimize credit exposure to reinsurers through adherence to internal ceded reinsurance guidelines. We manage our exposures so that no exposure to any one reinsurer is material to our ongoing business. To participate in our reinsurance program, prospective companies generally must: (i) maintain an A.M. Best Company (Best) or Standard & Poor's (S&P) rating of "A" (excellent) or better; (ii) maintain minimum capital and surplus of $500 million and (iii) provide collateral for recoverables in excess of an individually established amount. In addition, certain foreign reinsurers for our U.S. insurance operations must provide collateral equal to 100% of recoverables, with the exception of reinsurers who have been granted certified or authorized status by an insurance company's state of domicile. Our credit exposure to Lloyd's syndicates is managed through individual and aggregate exposure thresholds.

When appropriate, we pursue reinsurance commutations that involve the termination of ceded reinsurance and retrocessional contracts. Our commutation strategy related to ceded reinsurance and retrocessional contracts is to reduce credit exposure and eliminate administrative expenses associated with the run-off of ceded reinsurance placed with certain reinsurers.

The following table displays balances recoverable from our ten largest reinsurers by group from our underwriting operations at December 31, 2018. The contractual obligations under reinsurance and retrocessional contracts are typically with individual subsidiaries of the group or syndicates at Lloyd's and are not typically guaranteed by other group members or syndicates at Lloyd's. Reinsurance recoverable balances are shown before consideration of balances owed to reinsurers and any potential rights of offset, any collateral held by us and allowances for bad debts. These ten reinsurance groups represent approximately 61% of our $2.7 billion reinsurance recoverables balance attributed to our underwriting operations, before considering allowances for bad debts.

|

| | | | | |

Reinsurance Group | A.M. Best Rating | | Reinsurance Recoverable |

(dollars in thousands) | | | |

Fairfax Financial Group | A | | $ | 251,692 |

|

AXIS Capital Holdings Limited | A+ | | 195,608 |

|

Munich Re Group | A+ | | 193,690 |

|

Lloyd's of London | A | | 183,033 |

|

RenaissanceRe Holdings Ltd. | A+ | | 159,469 |

|

Alleghany Corporation | A+ | | 143,913 |

|

EXOR S.p.A | A | | 141,452 |

|

Liberty Mutual Holding Company | A | | 133,648 |

|

Swiss Re Group | A+ | | 127,578 |

|

Everest Re Group | A+ | | 107,353 |

|

Reinsurance recoverables for ten largest reinsurers | | 1,637,436 |

|

Total reinsurance recoverables | | $ | 2,691,888 |

|

Reinsurance and retrocessional treaties are generally purchased on an annual or biennial basis and are subject to renegotiations at renewal. In most circumstances, the reinsurer remains responsible for all business produced before termination. Treaties typically contain provisions concerning ceding commissions, required reports to reinsurers, responsibility for taxes, arbitration in the event of a dispute and provisions that allow us to demand that a reinsurer post letters of credit or assets as security if a reinsurer becomes an unauthorized reinsurer under applicable regulations or if its rating falls below an acceptable level.

See note 15 of the notes to consolidated financial statements and Management's Discussion & Analysis of Financial Condition and Results of Operations for additional information about our ceded reinsurance programs and exposures.

Investments

Our business strategy recognizes the importance of both consistent underwriting and operating profits and superior investment returns to build shareholder value. We rely on sound underwriting practices to produce investable funds while minimizing underwriting risk. The majority of our investable assets come from premiums paid by policyholders. Policyholder funds are invested predominantly in high-quality government, municipal and corporate bonds that generally match the duration of our loss reserves. The balance, comprised of shareholder funds, is available to be invested in equity securities, which over the long run, have produced higher returns relative to fixed maturity investments. When purchasing equity securities, we seek to invest in profitable companies, with honest and talented management, that exhibit reinvestment opportunities and capital discipline, at reasonable prices. We intend to hold these investments over the long term. Substantially all of our investment portfolio is managed by company employees.

We evaluate our investment performance by analyzing net investment income and net investment gains (losses) as well as our taxable equivalent total investment return, which is a non-GAAP financial measure. Taxable equivalent total investment return includes items that impact net income, such as coupon interest on fixed maturities, dividends on equity securities and investment gains or losses, as well as changes in unrealized gains or losses on available-for-sale securities, which do not impact net income. Certain items that are included in net investment income have been excluded from the calculation of taxable equivalent total investment return, such as amortization and accretion of premiums and discounts on our fixed maturity portfolio, to provide a comparable basis for measuring our investment return against industry investment returns. The calculation of taxable equivalent total investment return also includes the current tax benefit associated with income on certain investments that is either taxed at a lower rate than the statutory income tax rate or is not fully included in U.S. taxable income.

We believe the taxable equivalent total investment return is a better reflection of the economics of our decision to invest in certain asset classes. We do not lower the quality of our investment portfolio in order to enhance or maintain yields. We focus on long-term total investment return, understanding that the level of investment gains or losses and unrealized gains or losses on available-for-sale securities may vary from one period to the next.

The following table summarizes our investment performance.

|

| | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

(dollars in thousands) | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

Net investment income | $ | 434,215 |

| | $ | 405,709 |

| | $ | 373,230 |

| | $ | 353,213 |

| | $ | 363,230 |

|

Net investment gains (losses) (1) | $ | (437,596 | ) | | $ | (5,303 | ) | | $ | 65,147 |

| | $ | 106,480 |

| | $ | 46,000 |

|

Change in net unrealized investment gains on available-for-sale securities | $ | (299,446 | ) | | $ | 1,125,440 |

| | $ | 342,111 |

| | $ | (457,584 | ) | | $ | 981,035 |

|

Investment yield (2) | 2.7 | % | | 2.6 | % | | 2.4 | % | | 2.3 | % | | 2.4 | % |

| |

(1) | Effective January 1, 2018, we adopted ASU No. 2016-01. As a result, equity securities are no longer classified as available-for-sale with unrealized gains and losses recognized in other comprehensive income; rather, all changes in the fair value of equity securities are now recognized in net income. Prior periods have not been restated to conform to the current presentation. See note 1 of the notes to consolidated financial statements. |

| |

(2) | Investment yield reflects net investment income as a percentage of monthly average invested assets at amortized cost. |

We believe our investment performance is best analyzed from the review of taxable equivalent total investment return over several years. The following table presents taxable equivalent total investment return before and after the effects of foreign currency movements.

Annual Taxable Equivalent Total Investment Returns

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Five-Year Annual Return | | Ten-Year Annual Return |

| Years Ended December 31, | | |

| 2018 | | 2017 | | 2016 | | 2015 | | 2014 | | |

Equities | (3.5 | )% | | 25.5 | % | | 13.5 | % | | (2.5 | )% | | 18.6 | % | | 9.7 | % | | 14.9 | % |

Fixed maturities (1) | 1.3 | % | | 3.4 | % | | 2.4 | % | | 1.6 | % | | 6.5 | % | | 3.0 | % | | 4.3 | % |

Total portfolio, before foreign currency effect | (0.7 | )% | | 9.2 | % | | 5.0 | % | | 0.5 | % | | 8.9 | % | | 4.5 | % | | 6.4 | % |

Total portfolio | (1.0 | )% | | 10.2 | % | | 4.4 | % | | (0.7 | )% | | 7.4 | % | | 3.9 | % | | 6.3 | % |

Invested assets, end of year (in millions) | $ | 19,238 |

| | $ | 20,570 |

| | $ | 19,059 |

| | $ | 18,181 |

| | $ | 18,638 |

| | | | |

| |

(1) | Includes short-term investments, cash and cash equivalents and restricted cash and cash equivalents. |

The following table reconciles investment yield to taxable equivalent total investment return.

|

| | | | | | | | | | | | | | |

| Years Ended December 31, |

| 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

Investment yield (1) | 2.7 | % | | 2.6 | % | | 2.4 | % | | 2.3 | % | | 2.4 | % |

Adjustment of investment yield from amortized cost to fair value | (0.6 | )% | | (0.5 | )% | | (0.4 | )% | | (0.4 | )% | | (0.4 | )% |

Net amortization of net premium on fixed maturities | 0.4 | % | | 0.4 | % | | 0.4 | % | | 0.5 | % | | 0.6 | % |

Net investment gains (losses) and change in net unrealized investment gains on available-for-sale securities | (3.4 | )% | | 5.9 | % | | 2.3 | % | | (2.0 | )% | | 5.9 | % |

Taxable equivalent effect for interest and dividends (2) | 0.1 | % | | 0.4 | % | | 0.4 | % | | 0.4 | % | | 0.4 | % |

Other (3) | (0.2 | )% | | 1.4 | % | | (0.7 | )% | | (1.5 | )% | | (1.5 | )% |

Taxable equivalent total investment return | (1.0 | )% | | 10.2 | % | | 4.4 | % | | (0.7 | )% | | 7.4 | % |

| |

(1) | Investment yield reflects net investment income as a percentage of monthly average invested assets at amortized cost. |

| |

(2) | Adjustment to tax-exempt interest and dividend income to reflect a taxable equivalent basis. |

| |

(3) | Adjustment to reflect the impact of changes in foreign currency exchange rates and time-weighting the inputs to the calculation of taxable equivalent total investment return. |

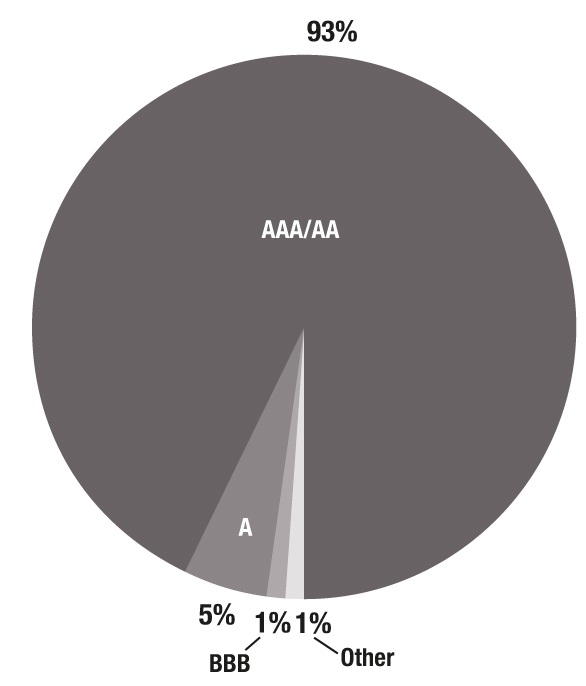

We monitor our investment portfolio to ensure that credit risk does not exceed prudent levels. S&P and Moody's provide corporate and municipal debt ratings based on their assessments of the credit quality of an obligor with respect to a specific obligation. S&P's ratings range from "AAA" (capacity to pay interest and repay principal is extremely strong) to "D" (debt is in payment default). Securities with ratings of "BBB" or higher are referred to as investment grade securities. Debt rated "BB" and below is regarded by S&P as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. Moody's ratings range from "Aaa" to "C" with ratings of "Baa" or higher considered investment grade.

Our fixed maturity portfolio has an average rating of "AA," with 98% rated "A" or better by at least one nationally recognized rating organization. Our policy is to invest in investment grade securities and to minimize investments in fixed maturities that are unrated or rated below investment grade. At December 31, 2018, less than 1% of our fixed maturity portfolio was unrated or rated below investment grade. Our fixed maturity portfolio includes securities issued with financial guaranty insurance. We purchase fixed maturities based on our assessment of the credit quality of the underlying assets without regard to insurance.

The following chart presents our fixed maturity portfolio, at estimated fair value, by rating category at December 31, 2018.

2018 Credit Quality of Fixed Maturity Portfolio ($10.0 billion)

See "Market Risk Disclosures" in Management's Discussion & Analysis of Financial Condition and Results of Operations for additional information about investments.

Markel Ventures

Through our wholly owned subsidiary Markel Ventures, Inc. (Markel Ventures), we own interests in various businesses that operate outside of the specialty insurance marketplace. These businesses are viewed by management as separate and distinct from our insurance operations. Local management teams oversee the day-to-day operations of these companies, while strategic decisions, including investment and capital allocation decisions, are made by our senior management team.

Our strategy in making these investments is similar to our strategy for purchasing equity securities. We seek to invest in profitable companies, with honest and talented management, that exhibit reinvestment opportunities and capital discipline, at reasonable prices. We intend to own the businesses acquired for a long period of time.

We monitor and report our Markel Ventures operations in our Markel Ventures segment. This segment includes a diverse portfolio of businesses from different industries that offer various types of products and services to businesses and consumers. See note 20 of the notes to consolidated financial statements for additional segment reporting disclosures.

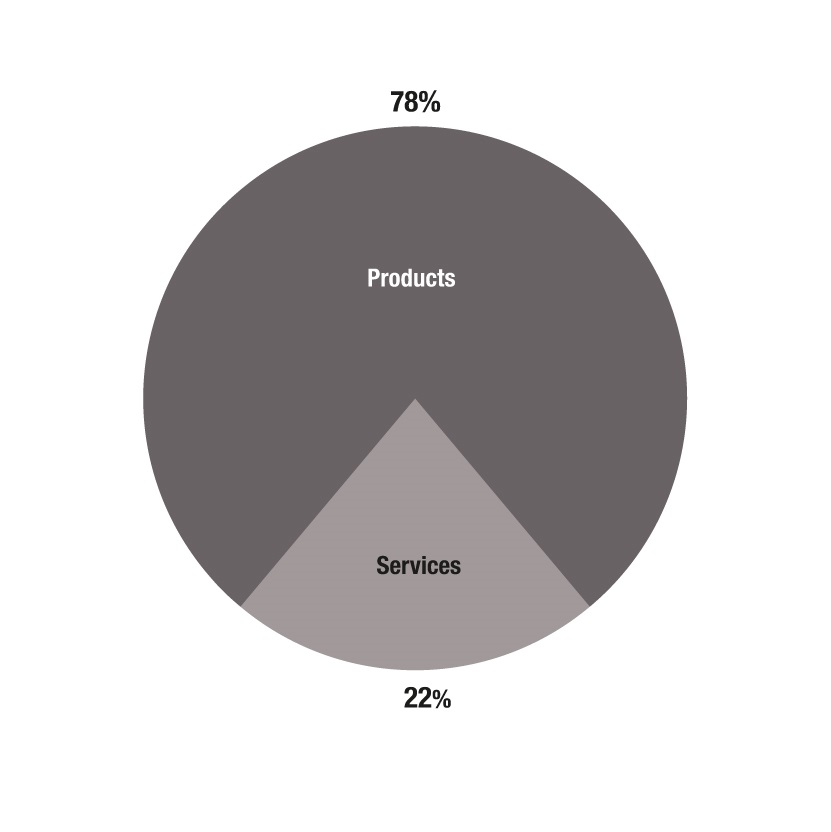

In 2018, our Markel Ventures operations reported revenues of $1.9 billion, net income to shareholders of $35.3 million, operating income of $77.5 million and earnings before interest, income taxes, depreciation and amortization (EBITDA) of $169.9 million. We use Markel Ventures EBITDA as an operating performance measure in conjunction with revenues, operating income and net income. See "Markel Ventures" in Management's Discussion & Analysis of Financial Condition and Results of Operations for more information on EBITDA.

Markel Ventures Segment

2018 Operating Revenues ($1.9 billion)

Our Markel Ventures products include:

| |

• | equipment used in baking systems and food processing; |

| |

• | over-the-road car haulers and equipment; |

| |

• | laminated oak and composite wood flooring used in the trucking industry; |

| |

• | dormitory furniture, wall systems, medical casework and marine panels; |

| |

• | storage and transportation equipment for specialty gas; |

Our Markel Ventures services include:

| |

• | leasing and management of manufactured housing communities; |

| |

• | concierge health programs; |

| |

• | retail intelligence; and |

| |

• | management and technology consulting. |

The majority of our businesses in this segment are headquartered across the United States, with subsidiaries of certain businesses located outside of the United States. This segment offers a wide range of products and services across many markets and encounters a variety of competitors that vary by product line, end market and geographic area. Each business within the segment has several main competitors and numerous smaller ones in most of their end markets and geographic areas. Examples of the end markets are as follows:

| |

• | U.S. consumer markets for residential construction, housing and healthcare; |

| |

• | U.S. and international markets for food service, food production, automobile transporters, governments, miners, marine operators, truck trailers and inter-modal containers and industrial and specialty gas; |

| |

• | U.S. and international retail markets; and |

| |

• | U.S. based businesses in the banking, financial services, energy, utilities, governments, retail and consumer goods, healthcare, travel, and hospitality industries. |

Investment Management

Our investment management operations are comprised of our Markel CATCo operations, and effective November 2018, the operations of Nephila Holdings Ltd.

Markel CATCo

Our Markel CATCo operations are conducted through Markel CATCo Investment Management Ltd. (MCIM). MCIM is an insurance-linked securities investment fund manager headquartered in Bermuda focused on building and managing highly diversified, collateralized retrocession and reinsurance portfolios covering global property catastrophe risks. MCIM serves as the insurance manager for Markel CATCo Re Ltd. (Markel CATCo Re), a Bermuda Class 3 reinsurance company, and as the investment manager for Markel CATCo Reinsurance Fund Ltd., a Bermuda exempted mutual fund company comprised of multiple segregated accounts (Markel CATCo Funds). MCIM also serves as the investment manager to CATCo Reinsurance Opportunities Fund Ltd. (CROF), a limited liability closed-end Bermuda exempted mutual fund company listed on a market operated by the London Stock Exchange and on the Bermuda Stock Exchange. CROF invests substantially all of its assets in Markel CATCo Reinsurance Fund Ltd.

Both Markel CATCo Re and the Markel CATCo Funds are unconsolidated subsidiaries of Markel Corporation. While the voting shares in Markel CATCo Re and Markel CATCo Funds are held by MCIM, the underwriting results of Markel CATCo Re are attributed to Markel CATCo Funds through the issuance of nonvoting preference shares. The performance of the Markel CATCo Funds is attributed to its nonvoting preference shares, which are held by third party investors, including CROF, and by us. As of December 31, 2018, MCIM's net assets under management were $3.4 billion, a portion of which is attributable to our investments in the Markel CATCo Funds. As of December 31, 2018, the fair value of our investments in the Markel CATCo Funds and CROF totaled $58.2 million, which is included in equity securities on our consolidated balance sheet.

MCIM receives management fees for its investment management services based on the net asset value of the accounts managed, as well as incentive fees based on the annual performance of the Markel CATCo Funds. Total revenues attributed to MCIM for the year ended December 31, 2018 were $66.2 million, which are included in services and other revenues in our consolidated statement of income and comprehensive income. See note 16 and note 17 of the notes to consolidated financial statements for further details regarding our Markel CATCo operations.

For further details regarding recent developments within our Markel CATCo operations, see note 18 of the notes to consolidated financial statements.

Nephila

In November 2018, we completed the acquisition of all of the outstanding shares of Nephila Holdings Ltd. (together with its subsidiaries, Nephila). Through its subsidiaries, Nephila primarily serves as an insurance and investment fund manager headquartered in Bermuda that offers a broad range of investment products, including insurance-linked securities, catastrophe bonds, insurance swaps and weather derivatives.

Nephila serves as the investment manager to several Bermuda, Ireland and U.S. based private funds (the Nephila Funds). To provide access for the Nephila Funds to the insurance, reinsurance and weather markets, Nephila also acts as an insurance manager to certain Bermuda Class 3 and 3A reinsurance companies and as both a service company coverholder and agent with binding authority for Lloyd’s Syndicate 2357 (Syndicate 2357) (collectively, the Nephila Reinsurers). The results of the Nephila Reinsurers are attributed to the Nephila Funds primarily through derivative transactions between these entities. Neither the Nephila Funds nor the Nephila Reinsurers are subsidiaries of Markel Corporation, and as such, these entities are not included in our consolidated financial statements. As of December 31, 2018, Nephila's net assets under management were $11.6 billion.

Nephila receives management fees for its investment and insurance management services based on the net asset value of the accounts managed, and for certain funds, incentive fees based on the annual performance of the funds it manages. Total revenues attributed to Nephila from the acquisition date to December 31, 2018 were $25.3 million, which are included in services and other revenues in our consolidated statements of income and other comprehensive income. See note 17 of the notes to consolidated financial statements for further details regarding our Nephila operations.

Program Services

In November 2017, we completed the acquisition of State National. Following the acquisition, our operations expanded to include a program services business, which is provided through our State National division. Our program services business generates fee income, in the form of ceding (program service) fees, by offering issuing carrier capacity to both specialty general agents and other producers who sell, control and administer books of insurance business that are supported by third parties that assume reinsurance risk, including Syndicate 2357. These reinsurers are domestic and foreign insurers and institutional risk investors (capacity providers) that want to access specific lines of U.S. property and casualty insurance business. Fronting refers to business in which we write insurance on behalf of a capacity provider and then cede the risk under these policies to the capacity provider in exchange for program services fees.

Through our program services business, we write a wide variety of insurance products, principally including general liability insurance, commercial liability insurance, commercial multi-peril insurance, property insurance and workers compensation insurance. Program services business written through our State National division is separately managed from our underwriting divisions, which write similar products, in order to protect our program services customers and eliminate internal competition for this business. Our program services business is primarily written through SNIC, NSIC and City National Insurance Company (CNIC), all of which are domiciled in Texas, and United Specialty Insurance Company (USIC) and Independent Specialty Insurance Company (ISIC), which are domiciled in Delaware. SNIC, NSIC, CNIC and ISIC are licensed to write property and casualty insurance in all 50 states and the District of Columbia. USIC is eligible to write business in all 50 states, the District of Columbia and the U.S. Virgin Islands. Many of our programs are arranged with the assistance of brokers that are seeking to provide customized insurance solutions for specialty insurance business that requires an A.M. Best "A" rated carrier. Our specialized business model relies on our producers or capacity providers to provide the infrastructure associated with providing policy administration, claims handling, cash handling, underwriting, or other traditional insurance company services. We believe there are relatively few active competitors in the fronting business. We compete primarily on the basis of price, customer service, geographic coverage, financial strength ratings, licenses, reputation, business model and experience.

Total revenues attributed to our program services business for the year ended December 31, 2018 were $95.7 million. Our program services business generated $2.1 billion of gross written premium volume for the year ended December 31, 2018.

In our program services business, we generally enter into a 100% quota share reinsurance agreement whereby we cede to the capacity provider substantially all of our gross liability under all policies issued by and on behalf of us by the producer. The capacity provider is generally entitled to 100% of the net premiums received on policies reinsured, less the ceding fee to us, the commission paid to the producer and premium taxes on the policies. In connection with writing this business, we also enter into agency agreements with both the producer and the capacity provider whereby the producer and capacity provider are generally required to deal directly with each other to develop business structures and terms to implement and maintain the ongoing contractual relationship. In a number of cases, the producer and capacity provider for a program are part of the same organization or are otherwise affiliated. As a result of our contract design, substantially all of the underwriting risk and operational risk inherent in the arrangement is borne by the capacity provider. The capacity provider assumes and is liable for substantially all losses incurred in connection with the risks under the reinsurance agreement, including judgments and settlements. Our contracts with capacity providers do not legally discharge us from our primary liability for the full amount of the policies, and we will be required to pay the loss and bear collection risk if the capacity provider fails to meet its obligations under the reinsurance agreement. As a result, we remain exposed to the credit risk of capacity providers, or the risk that one of our capacity providers becomes insolvent or otherwise unable or unwilling to pay policyholder claims. We mitigate this credit risk generally by either selecting well capitalized, highly rated authorized capacity providers or requiring that the capacity provider post substantial collateral to secure the reinsured risks.

Although we reinsure substantially all of the risks inherent in our program services business, we have certain programs that contain limits on our reinsurers’ obligations to us, including loss ratio caps, aggregate reinsurance limits or exclusion of the credit risk of producers. Under certain programs, including one program with Syndicate 2357, an unconsolidated affiliate, we also bear underwriting risk for annual aggregate agreement year losses in excess of a limit that we believe is highly unlikely to be exceeded. See note 17 of the notes to consolidated financial statements for further details regarding our program with Syndicate 2357.

The following table displays balances recoverable from our ten largest reinsurers by group for our program services business, based on gross reinsurance recoverable balances at December 31, 2018. The contractual obligations under reinsurance and retrocessional contracts are typically with individual subsidiaries of the group or syndicates at Lloyd's and are not typically guaranteed by other group members or syndicates at Lloyd's. Reinsurance recoverable balances are shown before consideration of balances owed to reinsurers and any potential rights of offset, and allowances for bad debts. These ten reinsurance groups represent 75% of our $2.5 billion reinsurance recoverables balance attributed to our program services business, before considering allowances for bad debts.

|

| | | | | | | | | | | | | |

Reinsurance Group | A.M. Best Rating | | Gross Reinsurance Recoverable | | Collateral Applied (1) | | Net Reinsurance Recoverable |

(dollars in thousands) | | | | | | | |

Fosun International Holdings Ltd. | A- | | $ | 603,140 |

| | $ | 603,140 |

| | $ | — |

|

Knight Insurance Company Ltd. | B++ | | 406,783 |

| | 406,783 |

| | — |

|

Lloyd's of London (2) | A | | 370,874 |

| | — |

| | 370,874 |

|

James River Group Holdings, Ltd. | A | | 170,808 |

| | 170,808 |

| | — |

|

Tokio Marine Holdings, Inc. | A+ | | 123,664 |

| | 815 |

| | 122,849 |

|

Greenlight Capital Re, Ltd. | A- | | 54,892 |

| | 54,892 |

| | — |

|

SOMPO Holdings, Inc. | A+ | | 47,204 |

| | — |

| | 47,204 |

|

Enstar Group Limited | A- | | 45,586 |

| | 28,022 |

| | 17,564 |

|

MS&AD Insurance Group Holdings, Inc. | A | | 39,472 |

| | 39,472 |

| | — |

|

Allianz SE | A+ | | 37,688 |

| | — |

| | 37,688 |

|

Reinsurance recoverables for ten largest gross reinsurers | | 1,900,111 |

| | 1,303,932 |

| | 596,179 |

|

Total reinsurance recoverables | | $ | 2,535,392 |

| | $ | 1,751,098 |

| | $ | 784,294 |

|

| |

(1) | Collateral is applied to each reinsurer, up to the amount of the gross recoverable, to determine the net recoverable for each reinsurer presented in this table. As of December 31, 2018, we were the beneficiary of letters of credit, trust accounts and funds withheld in the aggregate amount of $1.6 billion collateralizing reinsurance recoverable balances from our top 10 reinsurers and $2.2 billion for our total reinsurance recoverables balance. |

| |

(2) | Net reinsurance recoverable from Lloyd’s of London includes $179.8 million attributable to Syndicate 2357, an unconsolidated affiliate. |

Shareholder Value

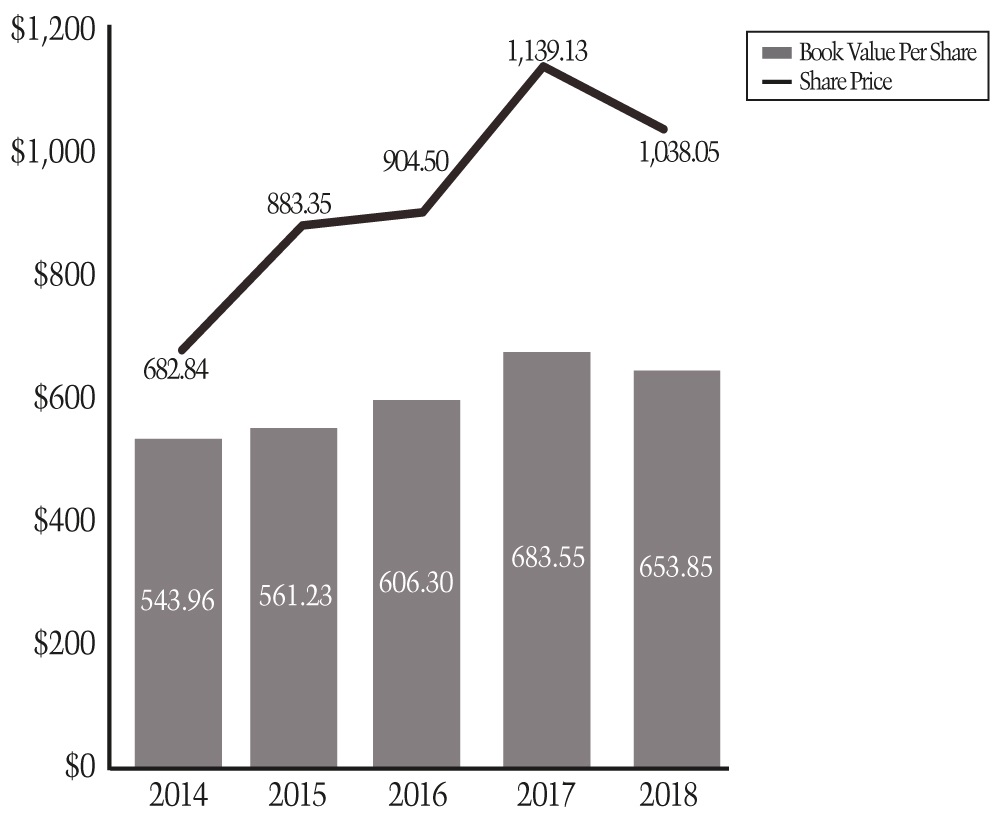

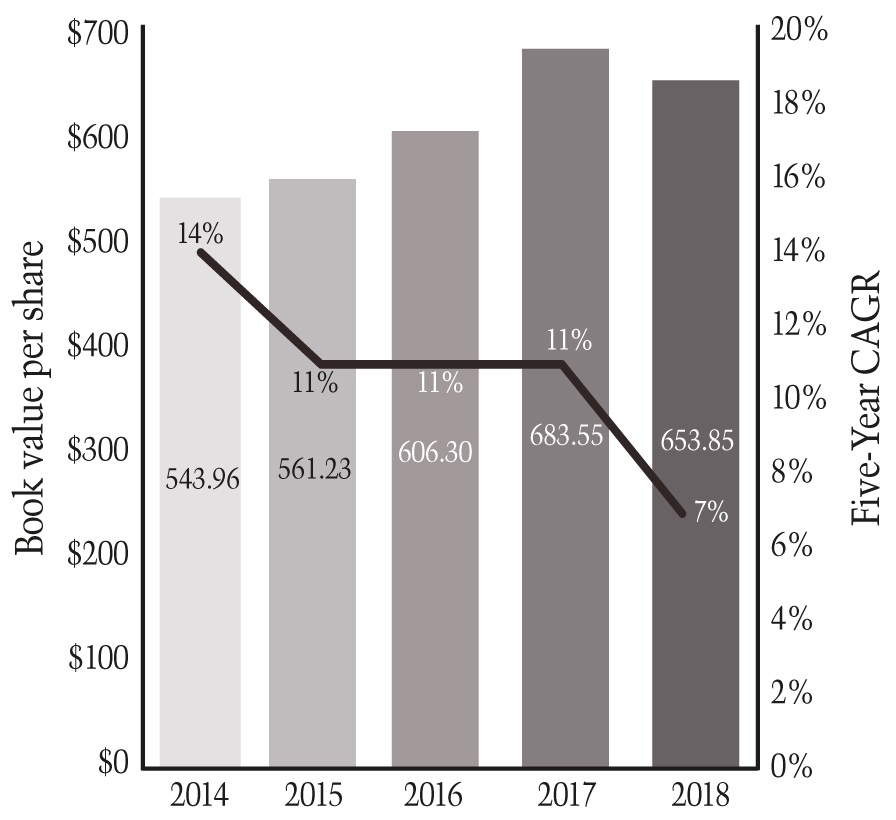

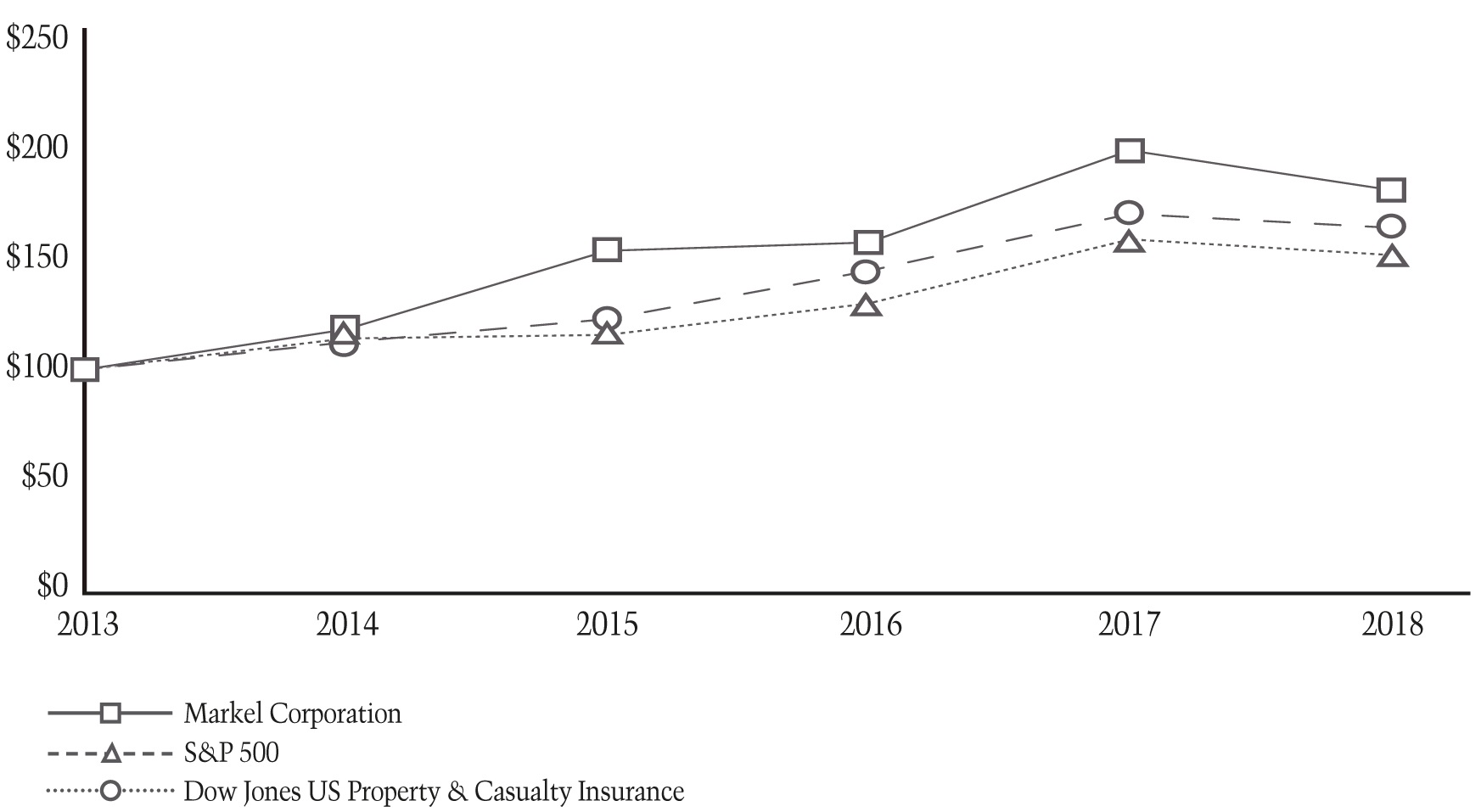

Our financial goals are to earn consistent underwriting and operating profits and superior investment returns to build shareholder value. One of the ways we measure financial success is by our ability to grow book value per share at a high rate of return over a long period of time. To mitigate the effects of short-term volatility, we generally use five-year time periods to measure ourselves. Growth in book value per share is an important measure of our success because it includes all underwriting, operating and investing results. For the year ended December 31, 2018, book value per share decreased 4% primarily due to a $233.5 million decrease in net unrealized gains on investments, net of taxes, and net loss to shareholders of $128.2 million. For the year ended December 31, 2017, book value per share increased 13% primarily due to a $763.0 million increase in net unrealized gains on investments, net of taxes, and net income to shareholders of $395.3 million. Over the past five years, we have grown book value per share at a compound annual rate of 7% to $653.85 per share. As we continue to expand our operations beyond underwriting and investing, we recognize that book value per share does not capture all of the economic value in our business, as a growing portion of our operations are not recorded at fair value or otherwise captured in book value. As a result, we also measure our financial success through the growth in the market price of a share of our stock, or total shareholder return, over a long period of time. For the year ended December 31, 2018, our share price decreased 9%. Over the past five years, our share price increased at a compound annual rate of 12%.

The following graph presents book value per share and share price for the past five years as of December 31.

Regulatory Environment

Our insurance subsidiaries are subject to regulation and supervision by the insurance regulatory authorities of the various jurisdictions in which they conduct business. This regulation is intended for the benefit of policyholders rather than shareholders or holders of debt securities. The jurisdictions of our principal insurance subsidiaries are the United States, the United Kingdom, Germany and Bermuda. Our Markel Ventures, investment fund management and other businesses also are subject to regulation and supervision by regulatory authorities of the various jurisdictions in which they conduct business.

United States Insurance Regulation

Overview. Our U.S. insurance subsidiaries are subject to varying degrees of regulation and supervision in the jurisdictions in which they do business. Each state has its own regulatory authority for insurance that is generally responsible for the direct regulation of the business of insurance conducted in that state. In addition, the National Association of Insurance Commissioners (NAIC), comprised of the insurance commissioners of each U.S. jurisdiction, develops or amends model statutes and regulations that in turn most states adopt. While the U.S. federal government and its regulatory agencies generally do not directly regulate the business of insurance, there have been recent federal initiatives that impact the business of insurance.